Extending UTAUT Theory to Compare South Korean and Chinese Institutional Investors’ Investment Decision Behavior in Cambodia: A Risk and Asset Model

Abstract

1. Introduction

2. Theoretical Background

2.1. Prior Research on Transnational Investment Behavior

2.2. Prior Research on Investment Behavior in Cambodia

2.3. Extended Unified Theory of Acceptance and Use of Technology (UTAUT2)

3. Hypotheses and Research Model

3.1. Perceived Asset Value and Perceived Asset Quality

3.2. Perceived Asset Value and Perceived Asset Price

3.3. Perceived Asset Value and Investment Decision

3.4. Perceived Financial Risk Moderating Effect between Perceived Asset Value and Investment Decision

3.5. Facilitating Conditions and Investment Decision

3.6. Social Influence and Investment Decision

3.7. Performance Expectancy and Investment Decision

4. Methodology, Measurement and Analysis

4.1. Data Analysis

4.2. Data Gathering

4.3. Descriptive Statistics

4.4. Measurement Model

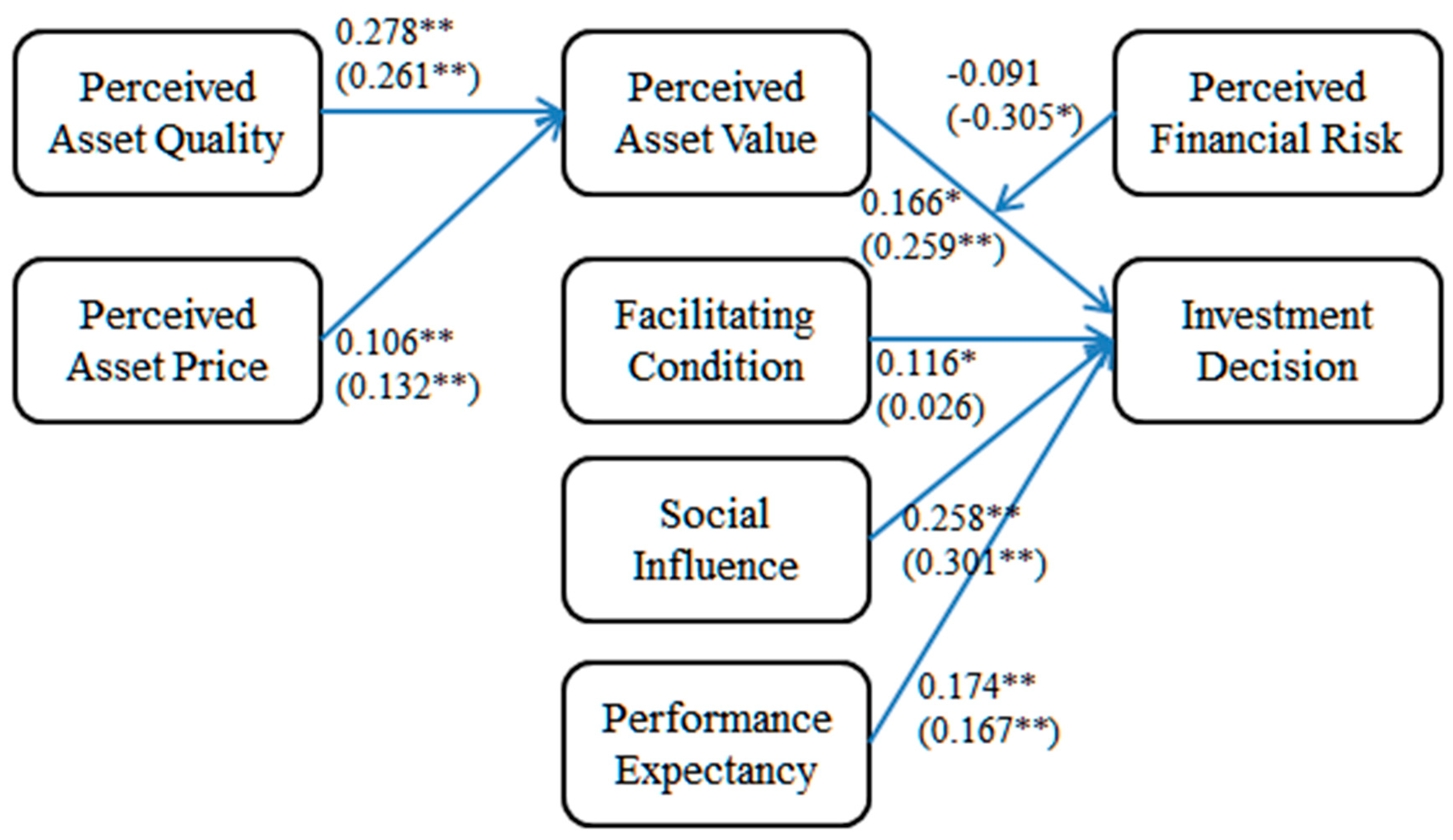

4.5. Structural Model

5. Discussion

6. Conclusions and Contributions

7. Managerial Implications

8. Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Shim, G.Y.; Lee, S.H.; Kim, Y.M. How investor behavioral factors influence investment satisfaction, trust in Investment Company, and reinvestment intention. J. Bus. Res. 2008, 61, 47–55. [Google Scholar] [CrossRef]

- Chen, C.J.; Lin, Y.H. Managing the foreign investment portfolio: How industry and governance diversity influence firm performance. Int. Bus. Rev. 2016, 25, 1235–1245. [Google Scholar] [CrossRef]

- Knill, A.M. Does Foreign Portfolio Investment Reach Small Listed Firms? Eur. Financ. Manag. 2010, 19, 251–303. [Google Scholar] [CrossRef]

- Cumming, D.; Haß, L.H.; Schweizer, D. Strategic Asset Allocation and the Role of Alternative Investments. Eur. Financ. Manag. 2014, 3, 20–547. [Google Scholar] [CrossRef]

- Sa-Aadu, J.; Shilling, J.; Tiwari, A. On the Portfolio Properties of Real Estate in Good Times and Bad Times. Real Estate Econ. 2010, 38, 529–565. [Google Scholar] [CrossRef]

- Anglin, P.M.; Gao, Y. Integrating Illiquid Assets into the Portfolio Decision Process. Real Estate Econ. 2011, 39, 277–311. [Google Scholar] [CrossRef]

- Btartram Sohnke, M. Gunter Dufey. International Portfolio Investment: Theory, Evidence, and Institutional Framework. Financial Markets. Inst. Instrum. 2001, 10, 85–155. [Google Scholar] [CrossRef]

- Wu, J.; Ma, Z.; Liu, Z. The moderated mediating effect of international diversification, technological capability, and market orientation on emerging market firms′ new product performance. J. Bus. Res. 2019, 99, 524–533. [Google Scholar] [CrossRef]

- Verbeke, A.; Liena, K. An internalization theory perspective on the global and regional strategies of multinational enterprises. J. World Bus. 2016, 51, 83–92. [Google Scholar] [CrossRef]

- Hitt, M.; Dan, L.; Kai, Xu. International strategy: From local to global and beyond. J. World Bus. 2016, 51, 58–73. [Google Scholar] [CrossRef]

- Casson, M.; Nigel, W. Emerging market multinationals and internalization theory. Int. Bus. Rev. 2018, 27, 1150–1160. [Google Scholar] [CrossRef]

- Wu, J.; Ma, Z.; Zhou, S. Enhancing national innovative capacity: The impact of high-tech international trade and inward foreign direct investment. Int. Bus. Rev. 2017, 26, 502–514. [Google Scholar] [CrossRef]

- Chen, K.Y.; Elder, R.J.; Hung, S. The Investment Opportunity Set and Earnings Management: Evidence from the Role of Controlling Shareholders. Corp. Gov. 2012, 18, 193–211. [Google Scholar] [CrossRef]

- Brandon, J.; Yook, Y. Political Uncertainty and Corporate Investment Cycles. J. Financ. 2012, 67, 45–83. [Google Scholar]

- Walter, I.; Sisli, E. The Asset Management Industry in Asia: Dynamics of Growth, Structure, and Performance. Financ. Mark. Inst. Instrum. 2007, 16, 1–77. [Google Scholar] [CrossRef]

- Sokang, K. The Impact of Foreign Direct Investment on the Economic Growth in Cambodia: Empirical Evidence. Int. J. Innov. Econ. Dev. 2018, 4, 31–38. [Google Scholar] [CrossRef]

- Wittwer, A.; Nasdala, L.; Wanthanachaisaeng, B.; Bunnag, N.; Škoda, R.; Balmer, W.A.; Giester, G.; Zeug, M. Mineralogical characterisation of gem zircon from Ratanakiri, Cambodia. In Proceedings of the Conference on Raman and Luminescence Spectroscopy in the Earth Sciences, Vienna, Austria, 3 July 2013. [Google Scholar]

- Zeug, M.; Nasdala, L.; Wanthanachaisaeng, B.; Balmer, W.A.; Corfu, F.; Wildner, M. Blue Zircon from Ratanakiri Cambodia. J. Gemmol. 2018, 36, 112–132. [Google Scholar] [CrossRef]

- Aiba, D.; Ken, O.; Vouthy, K. Foreign currency borrowing and risk-hedging behavior: Evidence from Cambodian households. J. Asian Econ. 2018, 58, 19–35. [Google Scholar] [CrossRef]

- Samreth, S. An empirical study on the hysteresis of currency substitution in Cambodia. J. Asian Econ. 2011, 22, 518–527. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 278–425. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Shareef, M.; Simintiras, A.C.; Lal, B.; Weerakkody, V. A generalised adoption model for services: A cross-country comparison of mobile health (m-health). Gov. Inf. Q. 2016, 33, 174–187. [Google Scholar] [CrossRef]

- Shaw, N.; Ksenia, S. The non-monetary benefits of mobile commerce: Extending UTAUT2 with perceived value. Int. J. Inf. Manag. 2019, 45, 44–55. [Google Scholar] [CrossRef]

- Chang, H.H.; Wong, K.H.; Li, S.Y. Applying push-pull-mooring to investigate channel switching behaviors: M-shopping self-efficacy and switching costs as moderators. Electron. Commer. Res. Appl. 2017, 24, 50–67. [Google Scholar] [CrossRef]

- Jiang, L.; Jun, M.; Yang, Z. Customer-perceived value and loyalty: How do key service quality dimensions matter in the context of B2C e-commerce? Serv. Bus. 2016, 10, 301–317. [Google Scholar] [CrossRef]

- Kuo, Y.-F.; Wu, C.-M.; Deng, W.-J. The relationships among service quality, perceived value, customer satisfaction, and post-purchase intention in mobile value-added services. Comput. Hum. Behav. 2009, 25, 887–896. [Google Scholar] [CrossRef]

- Goode, S.; Lin, C.; Tsai, J.C.; Jiang, J.J. Rethinking the role of security in client satisfaction with Software-as-a-Service (SaaS) providers. Decis. Support Syst. 2015, 70, 73–85. [Google Scholar] [CrossRef]

- Lu, Y.; Zhang, L.; Wang, B. A multidimensional and hierarchical model of mobile service quality. Electron. Commer. Res. Appl. 2009, 8, 228–240. [Google Scholar] [CrossRef]

- Fang, J.; Wen, C.; George, B.; Prybutok, V.R. Consumer heterogeneity, perceived value, and repurchase decision-making in online shopping: The role of gender, age, and shopping motives. J. Electron. Commer. Res. 2016, 17, 116. [Google Scholar]

- Cocosila, M.; Trabelsi, H. An integrated value-risk investigation of contactless mobile payments adoption. Electron. Commer. Res. Appl. 2016, 20, 159–170. [Google Scholar] [CrossRef]

- Hsu, C.L.; Lin, J.C.C. What drives purchase intention for paid mobile apps?—An expectation confirmation model with perceived value. J. Electron. Commer. Res. Appl. 2015, 14, 46–57. [Google Scholar] [CrossRef]

- Dowling, G.R.; Staelin, R. A model of perceived risk and intended risk-handling activity. J. Consum. Res. 1994, 21, 119–134. [Google Scholar] [CrossRef]

- Forsythe, S.; Liu, C.; Shannon, D.; Gardner, L.C. Development of a scale to measure the perceived benefits and risks of online shopping. J. Interact. Mark. 2006, 20, 55–75. [Google Scholar] [CrossRef]

- Lim, N. Consumers′ perceived risk: Sources versus consequences. Electron. Commer. Res. Appl. 2003, 2, 216–228. [Google Scholar] [CrossRef]

- Chen, Z.; Dubinsky, AJ. A conceptual model of perceived customer value in E-commerce: A preliminary investigation. Psychol. Mark. 2003, 20, 323–347. [Google Scholar] [CrossRef]

- Forsythe, S.M.; Shi, B. Consumer patronage and risk perceptions in Internet shopping. J. Bus. Res. 2003, 56, 867–875. [Google Scholar] [CrossRef]

- Chang, E.C.; Tseng, Y.F. Research note: E-store image, perceived value and perceived risk. J. Bus. Res. 2013, 66, 864–870. [Google Scholar] [CrossRef]

- Bhatnagar, A.; Ghose, S. Segmenting consumers based on the benefits and risks of internet shopping. J. Bus. Res. 2004, 57, 1352–1360. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.; Xu, X. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef]

- Hossain, M.A.; Hasan, M.I.; Chan, C.; Ahmed, J.U. Predicting user acceptance and continuance behavior towards location-based services: The moderating effect of facilitating conditions on behavioral intention and actual use. Australas. J. Inf. Syst. 2017, 21. [Google Scholar] [CrossRef]

- Oliveira, T.; Thomas, M.; Baptista, G.; Campos, F. Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Comput. Hum. Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Patnasingam, P.; Gefen, D.; Pavlou, P.A. The role of facilitating conditions and institutional trust in electronic marketplaces. J. Electron. Commer. Organ. (JECO) 2005, 3, 69–82. [Google Scholar] [CrossRef][Green Version]

- Gonzalez, F. Bank Equity Investments: Reducing Agency Costs or Buying Undervalued Firms? The Information Effects. J. Bus. Financ. Account. 2006, 33, 284–304. [Google Scholar] [CrossRef]

- Sun, J. How risky are services? An empirical investigation on the antecedents and consequences of perceived risk for hotel service. Int. J. Hosp. Manag. 2014, 37, 171–179. [Google Scholar] [CrossRef]

- Tsao, W.C.; Chang, H.R. Exploring the impact of personality traits on online shopping behavior. Afr. J. Bus. Manag. 2010, 4, 1800–1812. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–151. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. Adv. Int. Mark. 2009, 20, 277–319. [Google Scholar]

- Bagozzi, R.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Fornell, C.; Bookstein, F.L. Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. J. Mark. Res. 1982, 19, 440–452. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D. A practical guide to factorial validity using PLS-Graph: Tutorial and annotated example. Commun. Assoc. Inf. Syst. 2005, 16, 5. [Google Scholar] [CrossRef]

| Variable | Measurement |

|---|---|

| Perceived asset quality [24] | 1. Assets of Cambodia are financially appealing. 2. Assets of Cambodia make it easy for investors to find what they need. 3. Quality of assets in Cambodia is relatively high. |

| Perceived asset price [24] | 1. The current price of assets in Cambodia is reasonable. 2. The current price of assets in Cambodia is inexpensive. 3. I would be pleased to invest in assets of Cambodia at the current price. |

| Perceived asset value [23] | 1. I consider the present assets in Cambodia to be good value. 2. Present assets in Cambodia have a good level of investment potential. 3. Present assets in Cambodia appear to be beneficial to me. |

| Perceived financial risk ([44] | 1. There is a chance that I will lose money because of the high cost to maintain assets in Cambodia. 2. Investing in Cambodia is risky in terms of long-term costs. 3. Investing in Cambodia will lead to a loss of money because of spending a lot of time and effort to sell them out. |

| Facilitating conditions [41] | 1. I have the resources necessary to invest in the assets of Cambodia. 2. I have the knowledge necessary to invest in the assets of Cambodia. 3. Investing in Cambodia is compatible with other financial systems I use. |

| Social influence [41] | 1. People who influence my behavior think that I should invest in the assets of Cambodia. 2. People who are important to me think that I should invest in the assets of Cambodia. 3. People whose opinions that I value prefer that I should invest in the assets of Cambodia. |

| Performance expectancy [41] | 1. I think that investing in the assets of Cambodia would enable me to make profits more quickly. 2. I think that investing in the assets of Cambodia would increase my productivity. 3. I think that investing in the assets of Cambodia would improve my performance. |

| Investment decision [45] | 1. I am likely to invest in the assets of Cambodia. 2. I desire to invest in the assets of Cambodia. 3. I plan to invest in the assets of Cambodia. |

| Category | Subject | South Korea | China | ||

|---|---|---|---|---|---|

| N | % | N | % | ||

| Education Level | High school | 12 | 6.9% | 108 | 42.9% |

| Bachelor | 124 | 72.1% | 114 | 44.9% | |

| Master | 30 | 17.5% | 28 | 11.0% | |

| Ph.D | 6 | 3.5% | 3 | 1.2% | |

| Age | 23–30 | 24 | 14.5% | 81 | 32.3% |

| 30–40 | 97 | 56.0% | 137 | 53.9% | |

| 40–50 | 36 | 20.8% | 29 | 11.4% | |

| Over 50 | 15 | 8.7% | 6 | 2.4% | |

| Investment Working Years in Cambodia | 1–3 years | 50 | 29.5% | 142 | 56.3% |

| 3–6 years | 95 | 54.9% | 81 | 31.9% | |

| Over 6 years | 27 | 15.6% | 30 | 11.8% | |

| Focus of Investment | Real estate | 37 | 21.9% | 73 | 29.2% |

| Financial industry | 36 | 20.9% | 19 | 7.5% | |

| Entertainment | 12 | 6.9% | 81 | 31.9% | |

| Retail | 25 | 14.5% | 31 | 12.2% | |

| Restaurant & hotels | 16 | 9.2% | 18 | 7.1% | |

| Mining | 15 | 8.7% | 19 | 7.5% | |

| Manufacturing | 21 | 12.1% | 5 | 1.9% | |

| Others | 10 | 5.8% | 7 | 2.7% | |

| Fund Size | Under 10 million $ | 104 | 60.7% | 148 | 58.6% |

| 10–20 million $ | 39 | 22.5% | 82 | 32.3% | |

| 20–50 million $ | 21 | 12.2% | 6 | 2.4% | |

| Above 50 million $ | 8 | 4.6% | 17 | 6.7% | |

| Variables | South Korea | China | Mean Gap | ||

|---|---|---|---|---|---|

| Mean | Standard Deviation | Mean | Standard Deviation | ||

| Perceived Asset Quality | 4.949 | 1.407 | 5.387 | 1.160 | −0.438 |

| Perceived Asset Price | 4.917 | 1.221 | 4.885 | 1.244 | 0.032 |

| Perceived Asset Value | 4.763 | 1.462 | 4.674 | 1.020 | 0.089 |

| Perceived Financial Risk | 4.162 | 1.415 | 4.863 | 1.540 | −0.701 |

| Facilitating Condition | 5.459 | 1.069 | 4.471 | 1.355 | −0.988 |

| Social Influence | 4.707 | 1.205 | 4.894 | 1.162 | −0.187 |

| Performance Expectancy | 4.380 | 1.365 | 4.553 | 1.235 | −0.173 |

| Investment Decision | 4.878 | 1.247 | 5.135 | 1.464 | −0.257 |

| Variables | Item | Standardized Loading | AVE | Composite Reliability |

|---|---|---|---|---|

| Perceived Asset Quality | PQ1 | 0.936 (0.893) | 0.915 (0.908) | 0.970 (0.934) |

| PQ2 | 0.985 (0.950) | |||

| PQ3 | 0.948 (0.878) | |||

| Perceived Asset Price | PP1 | 0.934 (0.933) | 0.824 (0.813) | 0.933 (0.941) |

| PP2 | 0.897 (0.868) | |||

| PP3 | 0.890 (0.924) | |||

| Perceived Asset Value | PV1 | 0.933 (0.949) | 0.889 (0.875) | 0.970 (0.953) |

| PV2 | 0.969 (0.973) | |||

| PV3 | 0.909 (0.925) | |||

| Perceived Financial Risk | PR1 | 0.942 (0.949) | 0.877 (0.894) | 0.966 (0.912) |

| PR2 | 0.924 (0.976) | |||

| PR3 | 0.940 (0.934) | |||

| Facilitating Condition | FC1 | 0.914 (0.808) | 0.839 (0.812) | 0.940 (0.913) |

| FC2 | 0.919 (0.919) | |||

| FC3 | 0.915 (0.816) | |||

| Social Influence | SI1 | 0.934 (0.876) | 0.787 (0.793) | 0.917 (0.908) |

| SI2 | 0.788 (0.826) | |||

| SI3 | 0.932 (0.912) | |||

| Performance Expectancy | PE1 | 0.970 (0.951) | 0.920 (0.925) | 0.972 (0.941) |

| PE2 | 0.944 (0.924) | |||

| PE3 | 0.963 (0.968) | |||

| Investment Decision | II1 | 0.966 (0.970) | 0.917 (0.929) | 0.971 (0.956) |

| II2 | 0.959 (0.985) | |||

| II3 | 0.949 (0.941) |

| Construct | PQ | PP | FC | PE | PV | SI | ID | PR |

|---|---|---|---|---|---|---|---|---|

| PQ | 0.956 (0.953) | |||||||

| PP | 0.256 (0.232) | 0.907 (0.902) | ||||||

| FC | 0.059 (0.047) | −0.048 (−0.109) | 0.916 (0.901) | |||||

| PE | 0.171 (0.193) | −0.195 (−0.145) | 0.264 (0.217) | 0.959 (0.961) | ||||

| PV | 0.462 (0.477) | 0.621 (0.588) | −0.001 (−0.043) | −0.044 (−0.029) | 0.943 (0.935) | |||

| SI | 0.387 (0.399) | 0.159 (0.193) | 0.234 (0.201) | 0.346 (0.308) | 0.301 (0.297) | 0.887 (0.890) | ||

| ID | 0.251 (0.301) | 0.032 (0.085) | 0.437 (0.399) | 0.668 (0.567) | 0.168 (0.195) | 0.555 (0.507) | 0.957 (0.964) | |

| PR | −0.291 (−0.183) | 0.049 (0.107) | −0.045 (−0.021) | −0.268 (−0.221) | −0.050 (−0.099) | −0.223 (−0.301) | −0.291 (−0.336) | 0.936 (0.945) |

| Hypotheses | Paths | Estimate | t-Value | Results |

|---|---|---|---|---|

| H1 | Perceived Asset Quality→Perceived Asset Value | 0.278 (0.261) | 12.488 ** (13.531 **) | Accepted (Accepted) |

| H2 | Perceived Asset Price→Perceived Asset Value | 0.106 (0.132) | 5.030 ** (5.321 **) | Accepted (Accepted) |

| H3 | Perceived Asset Value→Investment Decision | 0.166 (0.259) | 2.078 * (2.849 **) | Accepted (Accepted) |

| H4 | Perceived Financial Risk’s Moderating Effect | −0.091 (−0.305) | 1.207 (2.294 *) | Not Accepted (Accepted) |

| H5 | Facilitation Conditions→Investment Decision | 0.116 (0.026) | 2.378 * (0.880) | Accepted (Not Accepted) |

| H6 | Social Influence→Investment Decision | 0.258 (0.301) | 7.359 ** (7.962 **) | Accepted (Accepted) |

| H7 | Performance Expectancy→Investment Decision | 0.174 (0.167) | 6.325 ** (5.477 **) | Accepted (Accepted) |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, W.; Dedahanov, A.T.; Shin, H.Y.; Kim, K.S. Extending UTAUT Theory to Compare South Korean and Chinese Institutional Investors’ Investment Decision Behavior in Cambodia: A Risk and Asset Model. Symmetry 2019, 11, 1524. https://doi.org/10.3390/sym11121524

Sun W, Dedahanov AT, Shin HY, Kim KS. Extending UTAUT Theory to Compare South Korean and Chinese Institutional Investors’ Investment Decision Behavior in Cambodia: A Risk and Asset Model. Symmetry. 2019; 11(12):1524. https://doi.org/10.3390/sym11121524

Chicago/Turabian StyleSun, Wei, Alisher Tohirovich Dedahanov, Ho Young Shin, and Ki Su Kim. 2019. "Extending UTAUT Theory to Compare South Korean and Chinese Institutional Investors’ Investment Decision Behavior in Cambodia: A Risk and Asset Model" Symmetry 11, no. 12: 1524. https://doi.org/10.3390/sym11121524

APA StyleSun, W., Dedahanov, A. T., Shin, H. Y., & Kim, K. S. (2019). Extending UTAUT Theory to Compare South Korean and Chinese Institutional Investors’ Investment Decision Behavior in Cambodia: A Risk and Asset Model. Symmetry, 11(12), 1524. https://doi.org/10.3390/sym11121524