2.1. Expected Benefits from Bank Cards

According to Reference [

1], at present, the banking industry is facing strong regulatory and customer needs that are constantly evolving. Ten years ago, Reference [

7] conducted a study in which clients of banks and credit unions were investigated in relation to the quality of services specific to these branches of activity. At that time, credit unions were leading in competition with banks regarding the perception of the quality of services by customers. However, half of the customers who used financial services stopped using them because of the poor performance of the services. Research has shown that there is still no perfect bank in customer perception; this result unequivocally suggests that there is an obvious potential for improvements and the improvement of this perception.

According to Reference [

23], banks and bank card providers can build and adapt their marketing position and marketing strategies, develop communication strategies and brand-management for the target audience represented by the younger generation. In this way, a basis for policies related to credit cards can be systematically developed, depending on the purchasing preferences of young people.

Also, the use of bank cards can be a real incentive for the economies of developing or emerging countries, contributing to the fluidization of national and international monetary flows [

12]. Depending on the degree of bank card adoption in a developing country, refined investors may make certain decisions regarding future investments in that region.

The long-term relationship between a bank and its customers is ensured through a mix of services and products [

15], and the bank card is one of the most important components because the client actually uses the bank’s services every time it uses the card. A research study [

8] shows that the bank card is part of a mix that includes people, technology, telephone banking, internet banking, automatic money transfers. In the same line of ideas, Reference [

24] suggests that a solid relationship between banks and their customers can be achieved through awareness campaigns of bank cards through social networks.

On the other hand, Reference [

15] show that in some cases, more than half of the customer satisfaction in the relationship with banks is determined by receptivity, competence, secure transactions, competitive services. Regarding consumer behavior, Reference [

25] showed that the use of credit cards of a particular type (e.g., platinum) helps customers improve their social image and self-esteem. Statistical data show that platinum cards are more likely to be used in social contexts, implying motivations related to social image.

At the same time, some customers are very sensitive to the merchants’ acceptance of bank cards. Studies [

16] show that the degree of card use may depend on the degree of acceptance by merchants. By analyzing the methods of obtaining new clients, Reference [

26] shows that banks can form a stable customer base if young customers (students) purchase a bank card early; later they will be tempted to continue to use other services of the same bank from which they purchased the credit card.

As for costs, Reference [

27] shows that the widespread use of debit cards will lead to a significant decrease in the costs of the operations performed with these payment instruments, taking place the phenomenon of economies of scale.

In a study about the adoption of the bank cards by different categories of people, Reference [

28] demonstrates that cardholders in the elderly category can be encouraged to adopt new payment technologies and modernize themselves through adoption incentives. According to Reference [

9], the users in all categories except the bank card to bring them added value in terms of financial transactions, and this added value can have various connotations: Comfort, security, processing speed. It was pointed out by Reference [

24] that the overdraft or credit card facility can boost lending at the individual level, increasing financial flows. As for strengthening customer relationships, Reference [

3] shows that the adoption of new technologies by banks can generate new channels of credit card distribution, and thus, strengthen the relationship with their consumers.

In terms of comfort, Reference [

29] shows that from a technical point of view, customers also expect any claims regarding card payments to be resolved fluently by banks, so that future payment processes can run without incidents.

Research conducted by Reference [

5] reveals that access to bank cards with credit facilities generated encouraged spending, in many families, on medical treatment, which would have remained untreated if the patients had not had access to such of financial instruments. This can be considered as a positive result of the financial inclusion that has manifested globally in recent years.

The conclusions obtained by Reference [

30] show that scientific analysis of consumer behavior towards credit cards can lead to important implications for public decision-makers when it comes to over-indebtedness, due to unrealistic optimism from customers. In this way, certain financial slippages which could have adverse consequences on the consumer can be corrected. Moreover, of the same opinion regarding credit cards is [

31] who believes that the effects of the expenditures made through such type of credit are not a neutral one. Credit cards have an effect on the level of welfare and the degree of individual happiness, allowing individuals to access a higher level of satisfaction in the short term by using money from the future. In time, however, the use of the credit card has an erosion effect on the individual subjective welfare because it generates additional needs once the current needs are met. It is considered that a thorough analysis of the impact of credit cards will help the regulatory authorities in taking decisions that will calm the possible excesses, due to consumer credit.

In contrast to the excess consumption associated with credit cards, debit cards were studied by Reference [

32], and it was found that consumers who received a debit card as a result of financial transfer operations, tended to voluntarily reduce their consumer spending, and thus, managed to save money. Thus, a part of the population that is included in the category of the population affected by poverty has a chance to change their consumption style in order to improve their own financial situation. In the same vein [

33] shows that owning a credit card in times of prosperity has the role of making its owner responsible in times of recession; a concrete example is a fact that if credit cardholders temporarily lose their jobs, during the unemployment period, they tend to use the credit card much less.

S. Agarwal, et al. [

34] found that if credit cards are related to other accounts or services provided by the bank, then customers tend to perform more transactions than in cases that there are no such relationships. Due to the existence of relationships between credit cards and other accounts, products or banking services, banks can have significant potential benefits: The information that the credit institution has about the customer can be used to reduce the credit risk associated with the credit card account. In this way, customer scoring is much better grounded, and the decision to grant the credit limit is much less risky.

At the merchant level, studies by Reference [

13] show that using debit cards brings at least two immediate benefits: (1) Customers are tempted to spend more when using the card instead of cash; and (2) the costs of card transactions are much lower than the costs of managing cash.

At the state level, Reference [

35] considers that the fiscal component is very important, and the widespread use of bank cards determines an increased efficiency of the fiscal operations and the reduction of the tax evasion phenomenon

2.2. The Importance of Bank Cards in Romania

Romania is a member country of the European Union in which the banking system is very strongly regulated by the National Bank of Romania. At the level of 2018–2019, 34 commercial and investment banks are authorized in Romania, with a total of approximately 100-billion-euro bank assets [

36].

There are seven banks with an individual market share greater than 5%, nine banks with an individual market share between 1%–5% and 18 banks with a market share of less than 1%. The first seven banks in the system hold together over 76% of the banking assets in Romania, but we can say that there is a real and strong competition between banks, due to their relatively large number. From the point of view of capital structure, the market share of credit institutions with domestic private majority capital is 16.90%, and the market share of credit institutions with foreign majority capital (Austrian, Dutch, German, Greek, Cypriot, Polish) is 63.60%.

According to the official report by Reference [

37], at the level of the entire banking system, the number of branches and banking agencies is about 4,500 units, which means a good market penetration from this point of view. Reference [

38] shows that the Romanian banks have more than 53,000 employees and this number has been decreasing in the last five years as a result of investments in alternative communication channels, such as e-banking, mobile banking and self-banking.

According to the official information provided by the National Bank of Romania [

39], at the level of 2019, the analytical situation of the bank cards in Romania is presented according to

Table 1.

Although the number of the population in Romania has decreased, due to the demographic decline, the values of the indicators in

Table 1 have steadily increased in recent years, which means that the percentage of banking population in Romania is on an upward trend.

According to the official reports issued by the National Bank of Romania [

40], the quarterly analytical situation for the last three fiscal years (2016–2018) regarding the number of payments, transactions and cash withdrawals from the ATM with the cards issued by the banks in Romania are presented according to the data in

Table 2.

For the period of the last three fiscal years (2016–2018), the quarterly value of the payments, transactions and cash operations performed with the cards issued by the commercial banks in Romania is presented according to the

Table 3.

According to the analytical data available from the official reports of the banking system in Romania, we conclude that in Romania there is a very strong competition between banks, due to their number (34 accredited banks to an official population of about 20 million Romanians). This conclusion is also confirmed by the total number of cards (over 17 million cards) issued. The evolution of the impact of the cards on the economic and social life of the Romanians is clearly evidenced by the fact that in the last 12 quarters (3 fiscal years), there was an increase of the number and the value of the transactions carried out by means of bank cards, both on the electronic payments component or constantly increased at the POS, as well as at the cash component at the ATM.

2.3. Indicators and Expected Benefits from the Use of Bank Cards

A. Rona-Tas and A. Guseva [

4] point out that the problem of the adoption of cards by the population is a chicken-and-egg type because a balance point was needed for both banks and card processors, as well as for consumers regarding the efficiency of the card transactions.

S. Dauda and J. Lee [

41] show that banks should focus very strongly on the following four issues: Significantly reducing trading errors, reducing unit transaction cost, waiting time and time required for online learning for card-related online services. Of these four attributes, the most significant impact on customer satisfaction is the waiting time and the transaction cost. In relation to card costs, Reference [

14] pointed out that in the United States, low-income customers lose proportionately more than high-income customers when debit cards become more expensive, while in the case of credit cards the situation is exactly the opposite.

The importance of the cost factor is also confirmed by Reference [

42] along with the personal attitude towards modern means of payment.

In China, one of the largest markets in terms of the potential for the development of banking products and services, the results obtained by Reference [

43] show that having a credit card is influenced by several factors, such as

the level of interest rate associated with the card, the card approval process, the number of persons in the household, the size of the credit limit, the rewards programs. Moreover, research has shown that the level of education influences the size of the credit limit that customers can obtain from banks.

The study conducted by Reference [

44] on a sample of urban consumers demonstrates that the order of the independent variables that determine the decision to adopt bank cards is as follows: Usefulness, ease of use, satisfaction, compulsion, network externality and norms.

C. Blankson, A. Paswan, and K. Boakye [

23] scientifically identify the following four key elements regarding the adoption of bank cards by young people:

Customer service, incentives, need for credit and buying power. References [

45] and [

35] show that there is a positive relationship between the quality of the services attached to the plastic cards (data confidentiality, quick answers, the competence of the bank staff) and the degree of customer satisfaction. Regarding credit cards, research [

11] revealed that there are four factors influencing the consumption decision: The insurance offered by the credit card issuer, the costs associated with the credit card, the programs of rewards that are attached to the credit card and the convenience offered. Of these, the most significant are those related to

the attached costs, the rewards programs and the comfort offered. Regarding the costs and exchange rates related to the card transactions, Reference [

16] showed that the number and volume of the transactions carried out by credit cards are influenced by the variation of the attached costs. A decrease in the attached costs results in an increase in the number of transactions made through cards. Having a similar concern, Reference [

24] shows that the perception of financial costs has a negative impact on the decision to select and adopt credit cards. In terms of costs, Reference [

32] shows that debit cards are preferred when the costs are low enough to allow monitoring and checking of bank account balances, thus, generating customer confidence in the bank.

Based on scientific research, Reference [

6] consider the following important factors in consumer decision regarding bank cards in developing countries: Relative advantage, compatibility, customer awareness. The study made by Reference [

12] has shown that in transition economies, the factors that determine the decision to adopt credit cards are

perceived usefulness, perceived ease of use, subjective norm, self-efficacy and

anxiety. In these countries, it appears that the financial costs attached are not a significant factor of influence. Regarding the contactless technology, Reference [

9] determined several predictors for the process of adopting contactless cards: Perceived usefulness, ease of use, perceived risk, availability of infrastructure. However, Reference [

10] discusses the ease of use has a direct effect on the decision to adopt contactless credit cards, while the perceived risk has an insignificant effect.

As shown by Reference [

46], it was found that a person’s preference for a particular method of payment depends largely on a set of personal characteristics. Customer satisfaction is determined by both the attitude and expectations and the intrinsic performance of the financial payment instrument. As customer satisfaction increases, it is expected that they will recommend these payment instruments to other potential users.

An interesting study [

47] has developed an extended model of TAM (Technology Acceptance Model) and found that for mobile credit cards, a very important factor is

the amount of information on the mobile credit card. As for credit cards using NFC (Near Field Communication) technology, Reference [

48] found that their adoption rate is still quite low, although at first glance the advantages are obvious: The possibility of paying only by approaching the phone with the card reading device, mobility, reducing the trading time. The main influencing factors regarding the use of the cards that have attached the NFC technology refer to

the security risk in the mobile environment, the perceived trust in the transactions made through the mobile phone, the compatibility of the devices and the costs related to the mobile equipment.

In both developed and developing countries, recent studies [

25] have shown that the use of credit cards has a strong connection with the notion of social status or social image. Experiments have shown that customer demand for a platinum card significantly exceeds the demand for an anonymous product with identical benefits, which suggests a clear preference for using the platinum card strictly on the basis of improving the social image and social status. Moerover, the same experiment shows that in the case of credit cards, the request for status is of a psychological nature and that the social image is a substitute for the self-esteem. Reference [

49] highlights that one of the most important factors in choosing a credit card refers to the satisfaction offered by social influence. On roughly the same research idea, Reference [

31] shows that one of the benefits of using credit cards is increasing the subjective level of individual happiness in the short term. Recent studies [

33] have shown that, however, there is self-censorship of the use of credit cards in case the owner loses his job and is unemployed for a longer period of time. Moerover, after the unemployment period, those holders tend to have a lower share of credit card payments in total payments made.

Regarding banking policies related to the use of cards for

ATM withdrawal operations, Reference [

28] shows that the

registration bonuses proposed by banks generate

different behaviors by age segments. Thus, seniors are encouraged by offers and sign-up bonuses indefinitely, while young people tend to postpone the decision of whether the offer is available for an unlimited period. Moreover, Reference [

26] showed that the decision to purchase a bank card is influenced by specific factors for young students compared to other categories of age. Rewards programs are also addressed by Reference [

43], who shows that the increase in the use of bank cards is directly related to the rewards offered to cardholders. Regarding the preference for cash or card payments [

50], it shows that young people with above-average income prefer to make card payments; the demographic effects on the use of the cards vary according to regions, types of housing and status within the family. In addition, Reference [

27] found that customers’ preferences regarding ATM cash use or card payments vary by country, even if those countries are in relatively homogeneous areas from a financial view perspective (such as the area of the European Union, with a developed level of financial intermediation). Reference [

51] shows that in developing countries, bank card users prefer them because they offer almost immediate access to money in the form of cash.

In the same vein, Reference [

52] shows that early adopters of credit cards are typically urban customers who have a prevalence in using this payment instrument when their payment amounts exceed a certain value level.

According to Reference [

24], the clients of the financial institutions are also very interested in

the credit facility through the bank card. Moreover, Reference [

35] shows that in the literature there are many studies on credit cards (those with the possibility of direct credit of consumers), but the specific issue of debit cards is very little analyzed. Subsequently, Reference [

32] found that debit cards are preferred by some consumers, due to the fact that they facilitate the consumer

saving process.

K. Kamalpreet and K. Mandeep [

3] believe that the technological aspects and the

e-banking attached services are closely linked to the decision to adopt credit cards because, at present, the cards can be integrated into complex packages of products and services within the marketing and sales programs from banks.

P. Nakul, D. Swati and D. Sanjay [

1] show that for customers it can be important the way of bank card delivery, especially for the clients from rural areas who had not previously access to modern financial services. Reference [

29] notes that although bank cards are payment instruments that are based on advanced technologies, they can often generate problems among customers that need to be solved by directly calling on bank advisers. According to consumer complaints, banks often blame customers themselves and deny their responsibility, subsequently leading to a decline in confidence in the reliability of card payments. As a result, the way banks handle customer complaints has a significant impact on the decision to continue using the card.

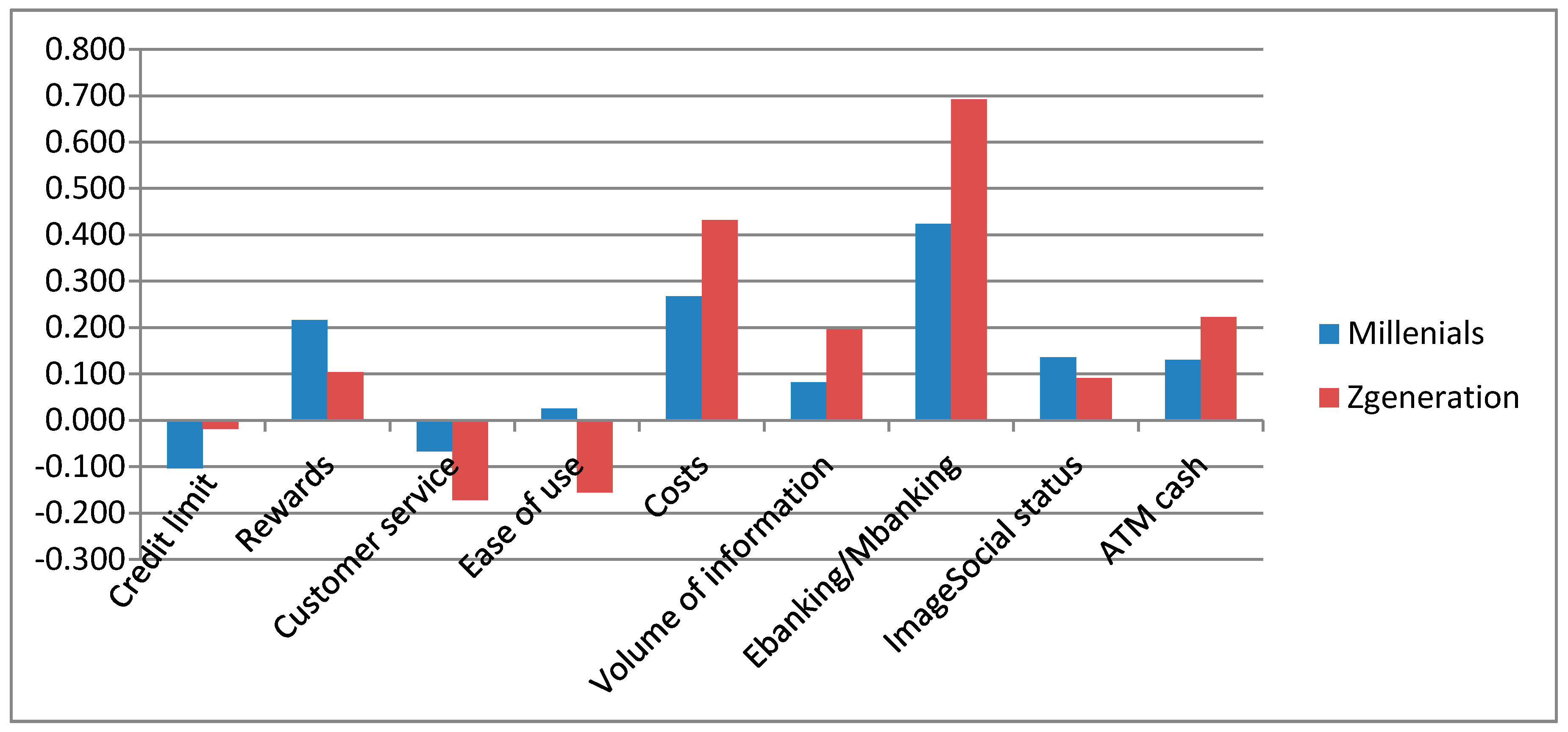

In view of the above mentioned researches in the field, we conclude that the most relevant factors regarding the influence on the level of satisfaction and the adoption rate of the bank cards are the following: The costs associated with the bank cards (insurance costs, subscription costs, the size of the interest rate for credit or overdraft), the size of the credit limit offered by the bank, the rewards programs (sign-up bonuses, cashback, bonus points, special offers, etc.), customer service (the card approval process by the bank, how to deliver the card, how to resolve complaints, confidentiality of data), the convenience offered by the use of the card, the ease of use, the volume of information available for the mobile card, the existence of e-banking/m-banking services attached to the card, the social image and the social status offered by the use of the card, the possibility to perform operations with ATM cash (withdrawals and cash deposits).