Type 2 Fuzzy Inference-Based Time Series Model

Abstract

:1. Introduction

2. Methodology

2.1. Collection and Selection of Data

2.2. Proposed Forecasting Model

2.3. Evaluation of the Performance

3. Empirical Analysis

4. Algorithm of the Proposed Method

- Step 1:

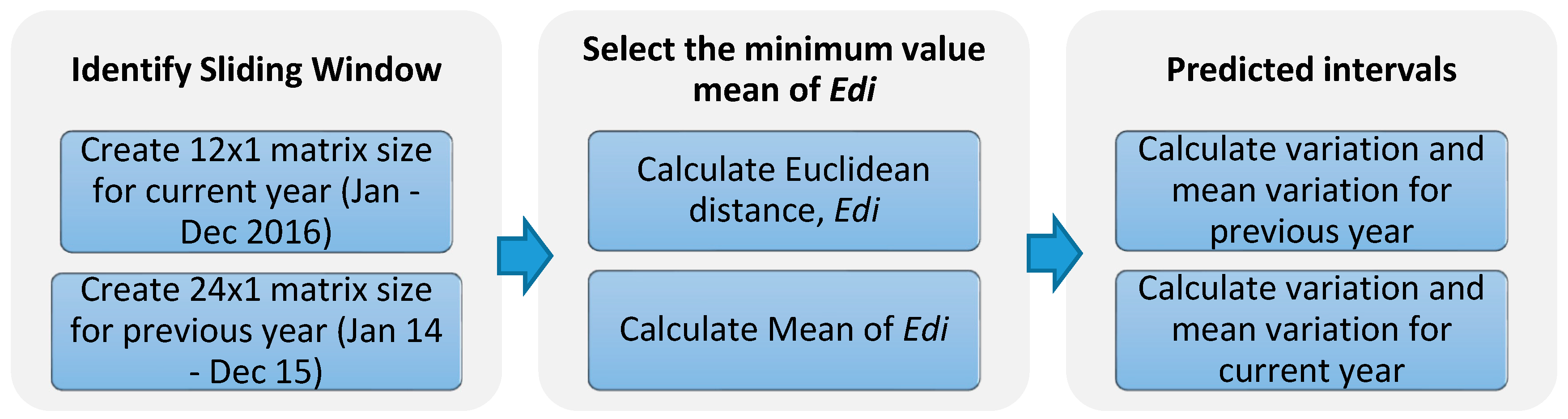

- The class interval of the universe of discourse is determined by using the sliding window method.

- Step 2:

- The observations are fuzzified into corresponding fuzzy sets.

- Step 3:

- Fuzzy logical relationship groups (FLRGs) are obtained.

- Step 4:

- Out-of-sample observations are mapped to FLRGs.

- Step 5:

- Operators and fuzzy rules obtained by using weighted subsethood-based algorithm are applied to the FLRGs for all the observations and obtain forecasts.

- Step 6:

- The forecasts are defuzzified.

- Step 7:

- Forecast values are computed for all data individually.

- Step 8:

- The method is compared with the previous method.

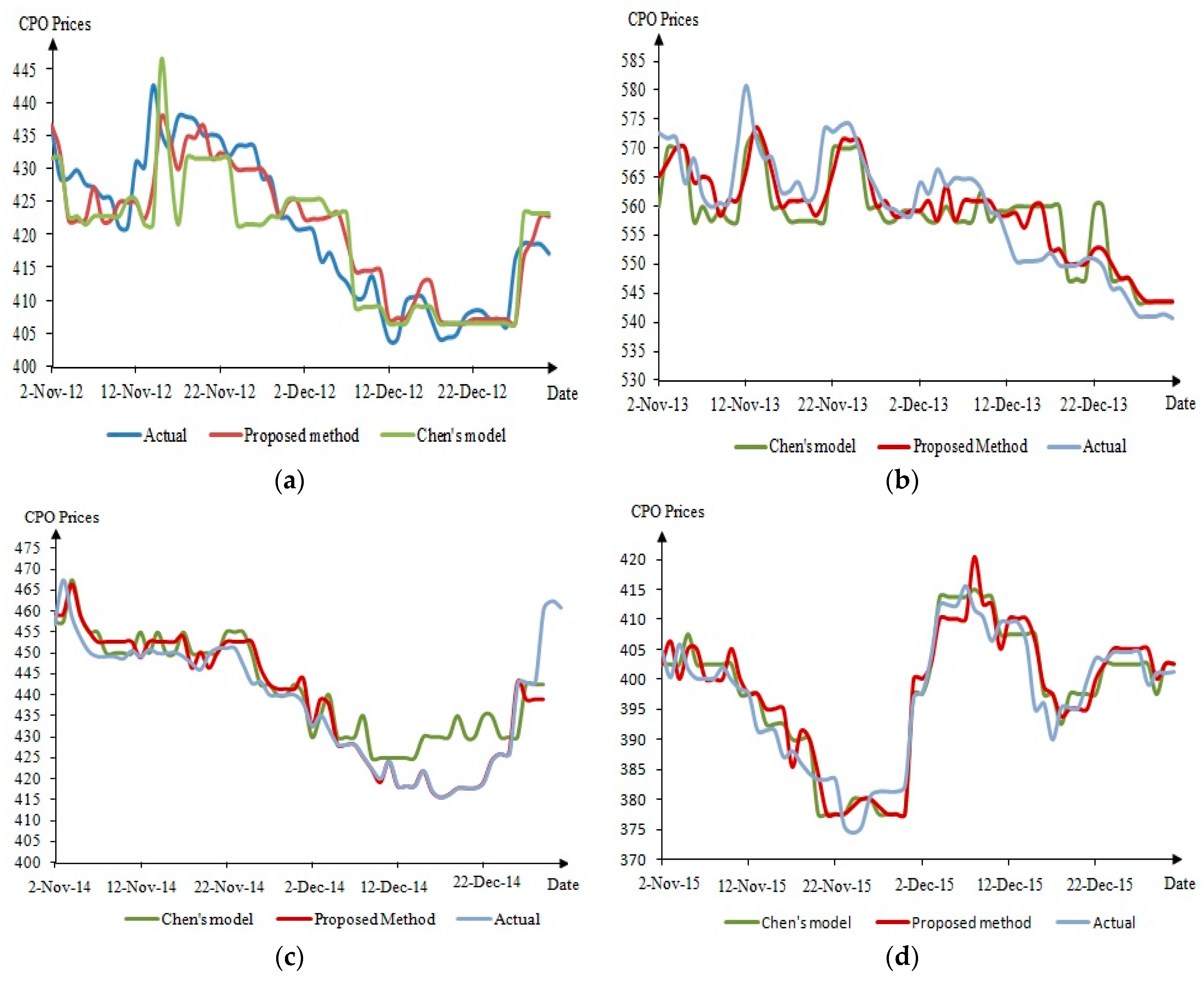

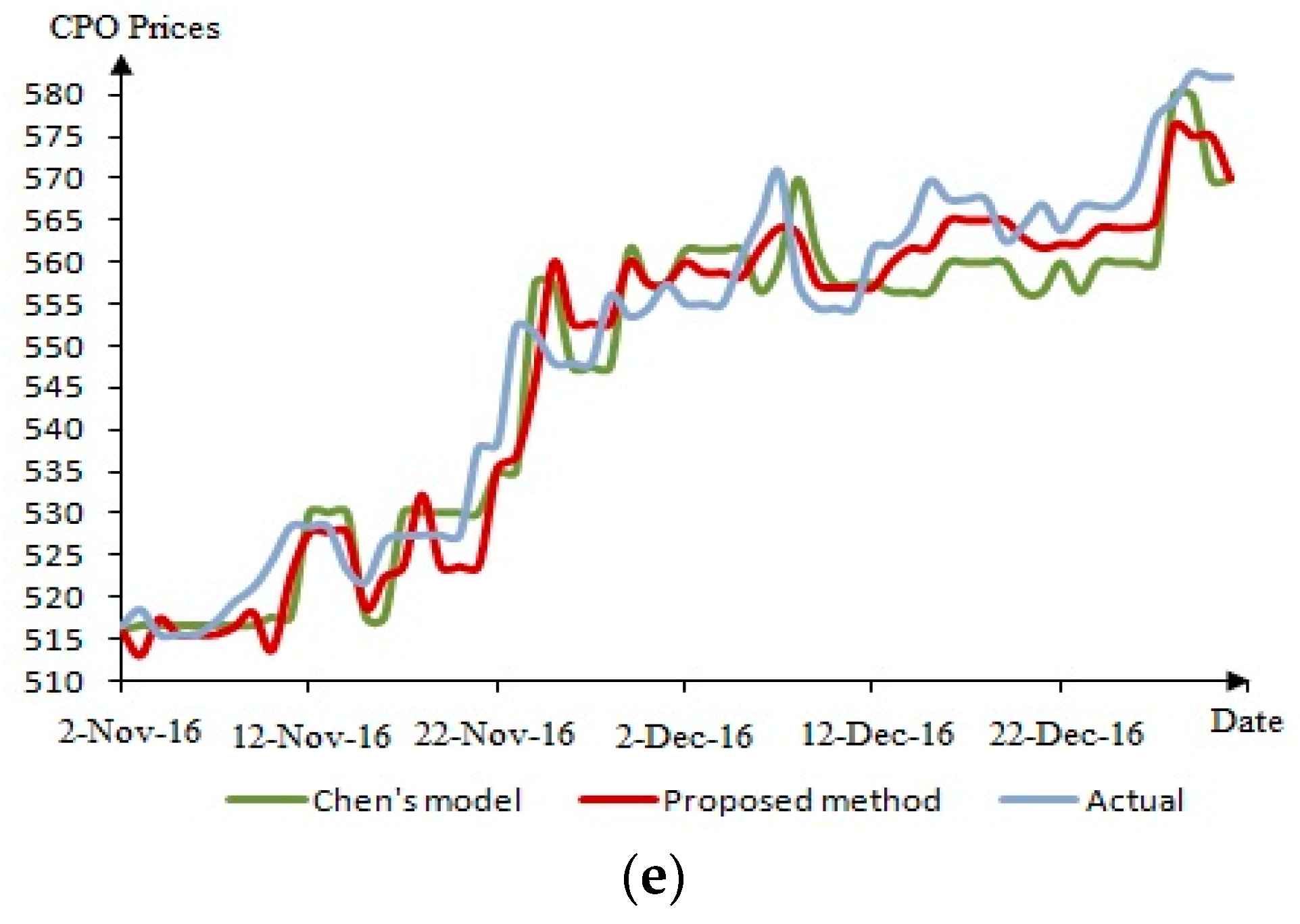

5. Results and Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ahmad, M.H.; Ping, P.Y.; Mahamed, N. Volatility modelling and forecasting of Malaysian crude palm oil prices. Appl. Math. Sci. 2014, 8, 6159–6169. [Google Scholar] [CrossRef] [Green Version]

- Karia, A.A.; Bujang, I.; Ahmad, I. Forecasting on crude palm oil prices using artificial intelligence approaches. Am. J. Oper. Res. 2013, 3, 259–267. [Google Scholar] [CrossRef]

- Luk, K.C.; Ball, J.E.; Sharma, A. An application of artificial neural networks for rainfall forecasting. Math. Comput. Model. 2001, 33, 683–693. [Google Scholar] [CrossRef]

- Hung, N.Q.; Babel, M.S.; Weesakul, S.; Tripathi, N.K. An artificial neural network model for rainfall forecasting in Bangkok, Thailand. Hydrol. Earth Syst. Sci. 2008, 13, 1413–1425. [Google Scholar] [CrossRef]

- Fatimah, M.A.; Hameed, A. Crude oil, palm oil stock and prices: How they link. Rev. Econ. Financ. 2013, 3, 48–57. [Google Scholar]

- Applanaidu, S.D.; Fatimah, M.A.; Shamsudin, M.N.; Abdel Hameed, A.A. An econometric analysis of the link between biodiesel demand and malaysian palm oil market. Int. J. Bus. Manag. 2011, 6, 35–45. [Google Scholar] [CrossRef]

- Tanuwijaya, K.; Chen, S.M. A new method to forecast enrollments using fuzzy time series and clustering techniques. In Proceedings of the 2009 international conference on machine learning and cybernetics, Hebei, China, 12–15 July 2009. [Google Scholar]

- Wang, Y.N.; Lei, Y.; Fan, X.; Wang, Y. Intuitionistic fuzzy time series forecasting model based on intuitionistic fuzzy reasoning. Math. Probl. Eng. 2016, 38, 1332–1338. [Google Scholar] [CrossRef]

- Uslu, V.R.; Bas, E.; Yolcu, U.; Egrioglu, E. A new fuzzy time series analysis approach by using differential evolution algorithm and chronologically-determined weights. J. Soc. Econ. Stat. 2013, 2, 18–30. [Google Scholar]

- Rajaram, S.; Vamitha, V. A modified approach on fuzzy time series forecasting. Ann. Pure Appl. Math. 2012, 2, 96–106. [Google Scholar]

- Chen, S.M.; Hsu, C.C. A new method to forecast enrollments using fuzzy time series. Int. J. Appl. Sci.& Eng. 2004, 2, 234–244. [Google Scholar]

- Song, Q.; Chissom, B.S. Fuzzy time series and its models. Fuzzy Sets Syst. 1993, 54, 269–277. [Google Scholar] [CrossRef]

- Song, Q.; Chissom, B.S. Forecasting enrollments with fuzzy time series—Part I. Fuzzy Sets Syst. 1993, 54, 1–9. [Google Scholar] [CrossRef]

- Song, Q.; Chissom, B.S. Forecasting enrollments with fuzzy time series—Part II. Fuzzy Sets Syst. 1994, 62, 1–8. [Google Scholar] [CrossRef]

- Chen, S. Forecasting enrollments based on fuzzy time series. Fuzzy Sets Syst. 1996, 81, 311–319. [Google Scholar] [CrossRef]

- Saxena, P. Forecasting enrollments based on fuzzy time series with Higher Forecast Accuracy Rate. Int. J. Comput. Technol. Appl. 2012, 3, 957–961. [Google Scholar]

- Datar, M.; Gionis, A.; Indyk, P.; Motwani, R. Maintaining stream statistics over sliding windows: (extended abstract). In Proceedings of the Thirteenth Annual {ACM-SIAM} Symposium on Discrete Algorithms, San Francisco, CA, USA, 6–8 January 2002; pp. 635–644. [Google Scholar]

- BenYahmed, Y.; Abu, B.A.; Razak, H.A.; Ahmed, A.; Abdullah, S.M.S. Adaptive sliding window algorithm for weather data segmentation. J. Theor. Appl. Inf. Technol. 2015, 80, 322–333. [Google Scholar]

- D’Arcy, J.A.; Collins, D.J.; Rowland, I.J.; Padhani, A.R.; Leach, M.O. Applications of sliding window reconstruction with cartesian sampling for dynamic contrast enhanced MRI. NMR Biomed. 2002, 15, 174–183. [Google Scholar] [CrossRef]

- Kapoor, P.; Bedi, S.S. Weather forecasting using sliding window algorithm. ISRN Signal. Process. 2013, 2013, 1–5. [Google Scholar] [CrossRef]

- Arasu, A.; Manku, G.S. Approximate counts and quantiles over sliding windows. In Proceedings of the twenty-third ACM SIGMOD-SIGACT-SIGART symposium on Principles of database systems, Paris, France, 14–16 June 2004; pp. 286–296. [Google Scholar]

- Huarng, K. Effective lengths of intervals to improve forecasting in fuzzy time series. Fuzzy Sets Syst. 2001, 123, 387–394. [Google Scholar] [CrossRef]

- Huarng, K.; Yu, T.H. Ratio-based lengths of intervals to improve fuzzy time series forecasting. IEEE Trans. Syst. Man. Cybern. B Cybern. 2006, 36, 328–340. [Google Scholar] [CrossRef]

- Rasmani, K.A.; Shen, Q. Subsethood-based fuzzy modelling and classification. In Proceedings of the 14th IEEE International Conference On Fuzzy Systems, Reno, NV, USA, 25 May 2005. [Google Scholar]

- Rasmani, K.A.; Shen, Q. Data-driven fuzzy rule generation and its application for student academic performance evaluation. Appl. Intell. 2006, 25, 305–319. [Google Scholar] [CrossRef] [Green Version]

- Cordón, O.; Herrera, F.; Zwir, I. Linguistic modeling by hierarchical systems of linguistic rules. IEEE Trans. Fuzzy Syst. 2002, 10, 2–20. [Google Scholar] [CrossRef]

- Dubois, D.; Prade, H. Handbook of fuzzy computation. Fuzzy Sets Syst. Dep. Comput. Sci. Artif. Intell. 2001, 123, 397–398. [Google Scholar] [CrossRef]

- Khaliq, A.; Ahmad, A. Fuzzy Logic and Approximate Reasoning; Blekinge Institute of Technology: Karlskrona, Sweeden, 2010. [Google Scholar]

- Huarng, K.; Yu, H.K. A Type 2 fuzzy time series model for stock index forecasting. Phys. Stat. Mech. Appl. 2005, 353, 445–462. [Google Scholar] [CrossRef]

- Zhang, E.; Wang, D.; Li, H. A comprehensive high order Type 2 fuzzy time series forecasting model. In Proceedings of the 28th Chinese control and decision conference, Shenyang, China, 28–30 May 2016; pp. 6681–6686. [Google Scholar]

- Maleki, A.; Pasha, E.; Razzaghnia, T. Possibility linear regression analysis with trapezoidal fuzzy data. World Appl. Sci. J. 2012, 18, 37–42. [Google Scholar]

- Chen, S.M.; Wang, N.Y. Fuzzy forecasting based on fuzzy-trend logical relationship groups. IEEE Trans. Syst. Man. Cybern. Part. B Cybern. 2010, 40, 1343–1358. [Google Scholar] [CrossRef]

- Rahim, N.F.; Othman, M.; Sokkalingam, R.; Abdul, K.E. Forecasting crude palm oil prices using fuzzy rule-based time series method. IEEE Access 2018, 6, 32216–32224. [Google Scholar] [CrossRef]

| Date (yyyy/mm/dd) | CPO Price | Fuzzy Sets |

|---|---|---|

| 2012/10/1 | 424.20 | A7 |

| 2012/10/2 | 424.20 | A7 |

| 2012/10/3 | 407.40 | A3 |

| 2012/10/4 | 395.20 | A1 |

| 2012/10/5 | 411.00 | A4 |

| 2012/10/6 | 412.50 | A4 |

| 2012/10/7 | 412.50 | A4 |

| 2012/10/8 | 406.80 | A3 |

| 2012/10/9 | 418.50 | A5 |

| 2012/10/10 | 418.00 | A5 |

| 2012/10/11 | 430.00 | A8 |

| 2012/10/12 | 423.00 | A6 |

| 2012/10/13 | 415.50 | A5 |

| 2012/10/14 | 415.50 | A5 |

| 2012/10/15 | 417.40 | A5 |

| 2012/10/16 | 417.00 | A5 |

| 2012/10/17 | 414.90 | A5 |

| 2012/10/18 | 419.60 | A6 |

| 2012/10/19 | 425.80 | A7 |

| 2012/10/20 | 424.00 | A6 |

| 2012/10/21 | 424.00 | A6 |

| 2012/10/22 | 435.10 | A9 |

| 2012/10/23 | 424.70 | A7 |

| 2012/10/24 | 424.70 | A7 |

| 2012/10/25 | 435.20 | A9 |

| 2012/10/26 | 435.20 | A9 |

| 2012/10/27 | 434.30 | A9 |

| 2012/10/28 | 434.30 | A9 |

| 2012/10/29 | 428.60 | A7 |

| 2012/10/30 | 426.00 | A7 |

| 2012/10/31 | 424.70 | A7 |

| Date (mm/dd) | Closing | High | Low |

|---|---|---|---|

| … | … | … | … |

| 10/11 | 430.00 | 431.10 | 419.20 |

| 10/12 | 423.00 | 428.80 | 412.80 |

| 10/13 | 415.50 | 420.30 | 413.80 |

| … | … | … | … |

| Date (mm/dd) | Forecasts | ||

|---|---|---|---|

| Closing | |||

| 10/12 | High | ||

| Low | |||

| Closing | |||

| 10/13 | High | ||

| Low | |||

| Closing | |||

| 10/14 | High | ||

| Low |

| Date (mm/dd) | Forecasts | ||

|---|---|---|---|

| Closing | |||

| 10/12 | High | ||

| Low | |||

| Closing | |||

| 10/13 | High | ||

| Low | |||

| Closing | |||

| 10/14 | High | ||

| Low |

| Year | Mean Square Error (MSE) | Root Mean Square Error (RMSE) | ||

|---|---|---|---|---|

| Proposed Method | Chen’s model | Proposed Method | Chen’s model | |

| 2012 | 0.0010 | 0.0010 | 0.518 | 0.520 |

| 2013 | 0.00067 | 0.0011 | 0.457 | 0.635 |

| 2014 | 0.0019 | 0.0027 | 0.637 | 0.855 |

| 2015 | 0.00069 | 0.00079 | 0.414 | 0.462 |

| 2016 | 0.0009 | 0.0015 | 0.567 | 0.754 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rahim, N.F.; Othman, M.; Sokkalingam, R.; Abdul Kadir, E. Type 2 Fuzzy Inference-Based Time Series Model. Symmetry 2019, 11, 1340. https://doi.org/10.3390/sym11111340

Rahim NF, Othman M, Sokkalingam R, Abdul Kadir E. Type 2 Fuzzy Inference-Based Time Series Model. Symmetry. 2019; 11(11):1340. https://doi.org/10.3390/sym11111340

Chicago/Turabian StyleRahim, Nur Fazliana, Mahmod Othman, Rajalingam Sokkalingam, and Evizal Abdul Kadir. 2019. "Type 2 Fuzzy Inference-Based Time Series Model" Symmetry 11, no. 11: 1340. https://doi.org/10.3390/sym11111340