1. Introduction

Urban areas are now home to the majority of the global population, reflecting an ongoing global trend toward urbanization [

1]. Urban areas globally are expanding in size and complexity, with concurrent transformations in population composition, social dynamics, built environments, mobility networks, and living standards. In the European Union (EU-27), more than 317 million people (70.6%) reside in urban clusters [

2], of which approximately 40 million live in large housing estates. Most of these estates were constructed during the post-WWII industrial boom, a time characterized by economic growth and rising living conditions [

3]. The post-WWII period, marked by rapid economic growth in cities, also led to significant demographic shifts across Europe. Population growth and rural-urban migration led to rapid urbanization [

4,

5,

6]. As part of the economic and housing policy reforms introduced in the late 1950s, especially in Central and Eastern European countries, and in response to the rapidly growing urban population, the concept of modern housing estates emerged [

3,

7,

8,

9,

10]. Post-WWII urban planning, guided by functionalist principles, sought to address housing shortages through the large-scale, efficient construction of residential blocks aimed at enhancing urban livability [

11]. In contrast to socially and occupationally homogeneous neighborhoods, these housing estates were designed to be inclusive environments where people from diverse professions, social classes, ages, and backgrounds could live [

12].

The development of large housing estates in Central and Eastern European countries has been shaped by a combination of political, cultural, spatial, socio-economic, and transnational factors [

13,

14]. In many Central and Eastern European countries, large housing estates commonly exhibit signs of structural degradation and social exclusion, with elevated levels of crime and antisocial behavior reported in several studies [

15,

16]. These challenges contribute to resident dissatisfaction, reinforce negative societal perceptions of such neighborhoods, and can negatively impact local property markets. Since the early 1990s, the housing estates studied have exhibited a relatively high degree of residential mobility. According to Draksler [

17], several issues affect these estates, including traffic congestion, ambiguous land use in public areas, insufficient recreational infrastructure, and unresolved property management concerns. However, in a more recent study of post-WWII large housing estates, residents expressed that they are generally satisfied with their dwellings and neighborhoods, with the vast majority expressing no intention to relocate—highlighting the importance of incorporating psychological and social dimensions into housing research to ensure the long-term sustainability of such estates [

18].

Since their inception, large-scale housing developments have shaped economic, political, and social dynamics within European urban environments. They are a vital component of the urban housing stock in many European cities. According to Dekker et al. [

19], these estates accommodate over 40% of the urban population in Central and Eastern Europe, highlighting their substantial role in the region’s residential landscape. Nonetheless, these estates are often viewed as a fragile part of the housing sector, particularly in terms of maintenance, social cohesion, and long-term sustainability [

20]. Scholars and policymakers increasingly examine the living conditions, design attributes, and long-term viability of large housing estates constructed between the late 1940s and early 1990s. Numerous studies and policy discussions focus on the current state and future development of these estates. Increasing attention is also being paid to their role and importance in the evolving real estate market.

This study investigates the determinants of residential property prices within post-WWII housing estates constructed between the early 1950s and late 1980s in Ljubljana, Slovenia’s largest and most dynamic urban housing market. Focusing on transaction data from 2020 to 2025, the analysis assesses a comprehensive set of spatial, environmental, structural, and accessibility-related variables to understand their influence on apartment price formation. The central research objective is to evaluate the extent to which spatial and market-related factors outperform traditional structural and socio-environmental attributes in explaining price variation. Methodologically, the study combines a hedonic pricing model with advanced machine learning algorithms—including Random Forest, XGBoost, and Gradient Boosting Machines—enabling both interpretable and highly predictive analyses. In parallel, three clustering approaches (Ward’s method, k-means, and HDBSCAN) are used to classify housing estates into typologies based on morphological, structural, and environmental similarities. This integrated, multi-method framework not only enhances understanding of local market dynamics but also provides an empirical foundation for targeted housing policy, valuation practices, and spatial planning in legacy urban environments.

2. Literature Review

As real estate markets across Central and Eastern Europe have evolved, the analysis of pricing trends and market behavior has emerged as a key focus in both academic research and professional practice. Gaining a clearer insight into the dynamics of the residential property market has become increasingly important, particularly in response to the economic downturns triggered by market volatility [

21]. Residential real estate also influences a wide range of other economic sectors through spillover effects. Consequently, tracking price movements and examining the macroeconomic and localized factors that shape property values is vital not only for economic stability but also for broader societal well-being [

22].

At the micro level, growing scholarly attention has been devoted to identifying the specific variables that drive property valuation. For example, Cui [

23] explores how residential investment impacts adjacent land values, while Bardos et al. [

24] and Mihaescu et al. [

25] investigate the depreciation effects of urban decay. Xu [

26] focuses on how different transaction types, housing characteristics, and location-specific socio-economic conditions influence price outcomes.

Research by Glaeser et al. [

27], Kok et al. [

28], and Dantas et al. [

29] explores how regulatory frameworks, particularly land use controls and limitations on building height, influence real estate pricing. Bonnafous et al. [

30] focus on spatial determinants of housing values in Lyon between 1997 and 2008, providing empirical insights into location-driven price variability. The increasing complexity of urban transport systems reflects their expanding role in supporting sustainable development, improving access and mobility, and shaping economic growth. For example, proximity to bus stops has similarly been identified as a key price driver by Calvo [

31] and Deng et al. [

32].

According to Chen et al. [

33], spatial location remains a central component in determining real estate values. City centers, as focal points for social, economic, and civic activity, tend to enhance quality of life through proximity to key services and opportunities for social inclusion. Hamdan et al. [

34] further note that neighborhoods characterized by strong social capital—marked by trust and cohesion—often report higher levels of residential satisfaction. Nonetheless, while centrality brings convenience, residents increasingly value access to green and open spaces. These features contribute not only to environmental health and aesthetic appeal but also to physical activity and psychological well-being.

Green areas are commonly associated with increased residential property values, and various empirical studies support the claim that housing located near green space tends to command higher prices [

35,

36,

37,

38]. However, urban settings also contain environmental and social drawbacks that can negatively influence both perceived quality of life and market value. Kim et al. [

39] point out that neighborhood attractiveness significantly shapes residential location choices. Similarly, Pareja-Eastway et al. [

40] found that many people cite the pursuit of quieter, safer environments as a primary motivation for relocating.

In older residential buildings, resident dissatisfaction is often tied to persistent noise, limited privacy, and strained neighbor relations, as identified by Rebernik [

41]. Moreover, noise pollution has been consistently linked to declines in property prices [

42,

43], while air pollution remains a major concern influencing real estate valuation, as demonstrated by several recent studies [

44,

45,

46].

Given their significance for housing supply, urban design, and policy-making, large-scale residential estates continue to attract scholarly interest. More targeted investigations have focused on the drivers of house price trends and valuation patterns in large housing estate neighborhoods [

47,

48]. A growing body of scholarship has explored the specific characteristics and challenges of housing estates in Ljubljana. Historical and developmental aspects are addressed by Petelin [

49], who examines housing conditions during the early phase of large housing estate construction, and Brezar [

50], who provides a broader analysis of Slovenia’s housing stock with a focus on the capital. Rebernik [

41] considers the spatial and planning dimensions of housing estates within the framework of urban geography. Several studies focus on the relationship between public space and residential experience. Jurkovič [

51] investigates how residents perceive and interact with public open areas, while Lestan et al. [

52] explore the role of open space design in shaping the quality of the urban environment. In terms of market analysis, Friškovec et al. [

53] identify factors influencing second-hand housing prices in Ljubljana and its suburbs. Zakrajšek et al. [

54] and Čeh et al. [

55] develop a location value ratio model to better estimate real estate prices in the city. Dolenec [

56] finds that location stigma—specifically, the perception of an “undesirable location”—significantly impacts both advertised and actual sales prices. Market performance is further assessed by Cirman et al. [

21], who analyze property time-on-market between 2000 and 2010, highlighting the role of both market conditions and macroeconomic indicators. Pirč [

57], examining apartment blocks, evaluates five location-based variables but concludes that none have a statistically significant effect on average price per square meter.

3. Large Housing Estate Neighborhoods in Ljubljana Built Between the Early 1950s and Late 1980s

The post-WWII urban expansion of Slovenian cities, particularly during the 1960s through the 1980s, was largely shaped by state-driven efforts to build large-scale residential neighborhoods. These housing estates quickly became the dominant typology of urban development and a defining feature of city life across Slovenia. Influenced by architectural and planning models from Scandinavian countries, many of these developments were organized around principles of functionalist urbanism. In Ljubljana, rapid population growth—fueled by migration from rural areas, surrounding suburbs, and other parts of the former Yugoslavia—created intense demand for housing [

17]. The early estates constructed in the 1960s were characterized by specific spatial layouts and social goals. As Malešič [

58] explains, the “soseska” or neighborhood unit was intended to provide both a physical and social structure for fostering community life.

Today, more than half of Ljubljana’s housing units are located in apartment blocks constructed after 1945, accommodating roughly half the city’s residents [

41]. These developments reflected modernist planning ideals, prioritizing access to daylight, integration of green spaces, traffic safety, and the economic benefits of prefabricated building methods. Particular focus was placed on open areas, designed to serve recreational, ecological, and microclimatic functions within the urban fabric.

One of the central goals of the post-WWII housing estate model was to cultivate social cohesion by providing shared infrastructure tailored to residents’ daily needs. These multi-family residential developments were designed around a defined spatial, functional, and social framework that emphasized community autonomy and diversity of use. Conceptually grounded in the idea of a “city within the city,” the layout of each estate typically featured a core area comprising essential amenities—including retail spaces, kindergartens, schools, and transit access points. In some cases, these were supplemented with additional services such as healthcare centers, postal offices, and banks [

58,

59]. Architecturally, the estates included a range of building forms, from mid-rise blocks of four to five stories to high-rise towers exceeding ten floors. Housing units were varied in type and size to accommodate a range of household needs.

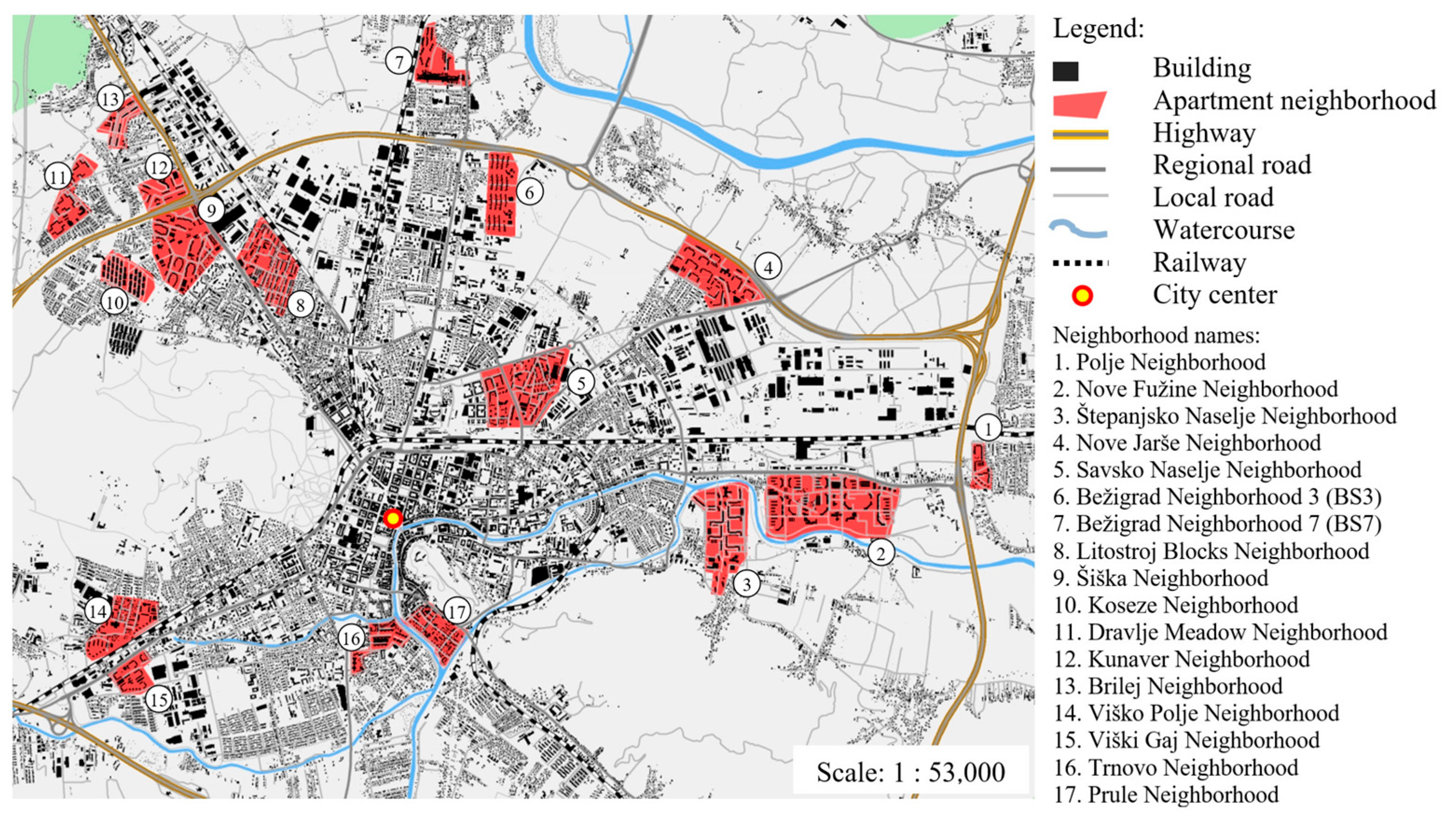

This study focuses on 17 housing estates across the Municipality of Ljubljana constructed between 1947 and 1986 (see

Figure 1).

Table 1 summarizes the key characteristics of each selected neighborhood.

4. Empirical Research

4.1. Methodology

The real estate market possesses distinctive characteristics that set it apart from standard goods markets, particularly in terms of asset heterogeneity, immobility, and localized demand conditions. Beyond traditional economic indicators such as household income, employment rates, and credit accessibility, housing supply and demand are shaped by an array of broader forces. Price dynamics in the housing market are driven by factors operating at multiple scales. At the micro level, property-specific attributes—such as size, age, and condition—play a significant role, while macroeconomic conditions tend to influence broader pricing trends over time. Accordingly, analyzing real estate values requires an integrative approach that accounts for both local and systemic determinants [

61].

A holistic approach to real estate analysis requires examining large housing estate environments in their full spatial, social, and functional complexity [

62]. This study focuses on apartment price determinants within selected housing blocks in the Municipality of Ljubljana, constructed between 1947 and 1986. Apartments constitute the dominant residential form in Slovenia, particularly in Ljubljana, where they account for approximately 13% of the nation’s total housing area and nearly 30% of its overall housing value [

60]. The analysis draws on data from 1973 residential transactions recorded between 2020 and 2025 across 17 multi-family housing districts. To ensure price comparability, unit prices (expressed in EUR/m

2) were standardized based on transaction timing and apartment size. The study adopts a spatially explicit methodology, examining patterns at both the building and neighborhood levels. Two statistical techniques were employed to assess the influence of spatial, environmental, structural, and accessibility-related factors on property values: multivariate regression analysis (OLS) and three machine learning techniques: random forest, XGBoost, and Gradient Boosting Machines. In the subsequent phase, the research applied three complementary clustering methods, Ward’s hierarchical clustering, the non-hierarchical

k-means algorithm, and HDBSCAN, to categorize neighborhoods based on shared characteristics. Identifying patterns within these clusters supports multiple objectives, such as monitoring demographic trends, guiding neighborhood renewal initiatives, and improving valuation practices for residential properties.

Only those real estate transactions that met predefined criteria for data reliability and completeness were included in the analysis. Eligible sales had to be verified and involve entire apartment units, and include key information such as the contract date, total sale price, and net usable floor area [

60]. Each transaction was required to refer to a distinct residential unit, including associated elements like storage spaces or balconies. To maintain analytical precision, sales of units with a net floor area below 20 m

2 were excluded, as these often represent ancillary units. Similarly, records showing unusually high or low unit prices (EUR/m

2) were removed as statistical outliers. The spatial boundaries of the analyzed multi-family neighborhoods were defined using municipal planning documentation, further refined through orthophoto image interpretation [

60,

63].

4.2. Data Sources

Apartment transaction data for the period 2020–2025 (

Figure 2) were obtained from the Real Estate Market Register [

64], managed by the Slovenian Surveying and Mapping Authority (GURS). These data provided verified sale prices and related property characteristics for geolocated housing units across Ljubljana. Spatial analysis relied on georeferenced datasets, including cadastral parcels, building footprints, orthophotos, and road infrastructure layers used for proximity and accessibility indicators [

60]. Noise pollution data were sourced from the City Municipality of Ljubljana and cover long-term average exposure levels to road, rail, and industrial noise [

65]. These were used to construct a standardized index of environmental noise conditions at the neighborhood level.

Land use data, particularly regarding green areas and forested zones, were taken from the Municipal Spatial Plan of the City of Ljubljana [

63]. The Index of Urban Amenities Accessibility was constructed using location data on various services: the locations of post offices were gathered from Pošta Slovenije [

66]; grocery stores and bakeries from publicly available service provider platforms; pharmacies from Lekarna Ljubljana [

67]; health centers from Zdravstveni dom Ljubljana [

67,

68]; ATMs from Bankart d.o.o. [

69]; and petrol station locations from GURS [

60]. All datasets were harmonized, standardized, and spatially aligned to support consistent multivariate and machine learning analysis.

4.3. Multivariate Regression Analysis (OLS) Model Specification

The selection of explanatory variables was based on an in-depth review of previous studies on the determinants of housing prices in urban areas, research on the quality of life in residential areas, and studies focusing specifically on large housing estate neighborhoods in Ljubljana [

22,

55,

70,

71]. Particular attention was paid to the heterogeneous structure of the selected neighborhoods. In this context, the appropriateness of the explanatory variables is of particular importance, as they are intended to serve as representative indicators for the selected dependent variable

y, the average housing price per square meter adjusted for year of sale and surface area. It is assumed that all other factors have less influence on this variable.

For the purposes of this study, we estimated a semi-logarithmic (log-linear) model, where the natural logarithm of the dependent variable—apartment price per m

2—was regressed on a set of spatial, structural, and environmental predictors to address skewness in price distribution and to facilitate elasticity-based interpretation of the coefficients:

Table 2 contains the notation and description of the explanatory variables x

i that were included in the regression model.

The variable x1 (AAP500) represents the average adjusted apartment selling price, calculated within a 500 m radius of each housing unit, based on transactions from the 2020–2025 period. It serves as a spatial market reference indicator that captures local pricing dynamics and neighborhood-level valuation trends. The variable x2 (BGFA) denotes the gross floor area of the building in square meters. It reflects the scale of the building structure and may influence price perceptions due to shared maintenance burdens or building typology. Variable x3 (NApFL) captures the apartment’s vertical position, measured as the number of floors above ground level. Higher floor levels may affect price through improved views, reduced exposure to street-level noise, or constrained accessibility in buildings without elevators.

Variable

x4 (

INEL) represents the neighborhood noise exposure level, measured as an index based on long-term daily averages from road, rail, and industrial sources. The index was formed by summing standardized, unweighted indicators. Prior to aggregation, the values were standardized into

z-scores to ensure comparability across different units of measurement [

72,

73]. The final index values were categorized into nine ordinal levels, ranging from 1 (lowest) to 9 (highest), capturing environmental externalities relevant to housing desirability.

Variable x5 (YWR) indicates the year of window renovation for each apartment unit. This variable serves as a proxy for recent building upgrades, energy efficiency improvements, and the overall maintenance status of the dwelling. The ratio of green space within a neighborhood is captured by variable x6 (RGS), expressed as the percentage of unbuilt, vegetated land relative to the estate’s total area. It reflects the environmental quality of the residential setting and may influence preferences for health, aesthetics, or recreation. Variable x7 (NTF) records the total number of floors in the apartment building. This attribute is used to differentiate between low-rise and high-rise typologies, which may have implications for building maintenance, service accessibility, and resident preferences.

Travel time to BTC City, Ljubljana’s largest shopping and business complex, is measured by variable x8 (tBTC), expressed in minutes from the geometric center of each neighborhood. It serves as an indicator of commercial accessibility and broader connectivity within the urban structure. The variable x9 (NPS) represents the number of petrol stations within each housing estate. While often overlooked in housing studies, proximity to such infrastructure may influence perceived environmental quality and affect price through associated nuisances or service convenience. Variable x10 (IUA) is the Index of Urban Amenities Accessibility. It is a composite measure based on pedestrian access to daily services (e.g., shops, health care, schools), green spaces, and leisure or cultural facilities. It reflects functional accessibility and the availability of essential services within walking distance.

Variable x11 (CLHE) defines the location of the housing estate in relation to the inner urban motorway ring. This spatial position serves as a binary indicator (inside or outside the ring road), reflecting locational advantages such as proximity to the city center or major infrastructure. Lastly, variable x12 (CBT) denotes the building type category, classifying the architectural form or typology of the structure. It distinguishes between different post-WWII construction formats and is used to examine how built form influences price patterns in the housing market.

4.4. Machine Learning (ML) Models

Machine learning (ML) offers substantial advantages over traditional hedonic OLS models in housing price prediction by effectively capturing complex, non-linear relationships between variables. Unlike OLS, which assumes linearity and often underperforms in heterogeneous housing markets, ML models—particularly supervised learning algorithms like Random Forest, XGBoost, and different gradient boosting—can model intricate interactions and deliver higher predictive accuracy. Numerous studies have shown that ML models consistently outperform linear regression in housing price prediction, typically achieving higher accuracy [

74,

75].

In this study, we compare the predictive performance of the multivariate regression (OLS) model with a suite of ML algorithms designed to capture complex, non-linear relationships in housing data. The models include Random Forest (RF), standard XGBoost, and Gradient Boosting Machines (GBMs). For XGBoost and GBMs, we also implement two hyperparameter tuning strategies—Grid Search Cross-Validation (CV) and Randomized Search CV—resulting in three configurations for each: standard, Grid Search-tuned, and Randomized Search-tuned. This approach allows us to evaluate both baseline model performance and the effects of systematic and randomized optimization on predictive accuracy.

Random Forest (RF) is applied to predict apartment prices based on spatial, structural, and environmental attributes. The method builds an ensemble of decision trees, each trained on a bootstrap sample drawn with replacement from the original dataset. For regression tasks, each tree outputs a numerical prediction, and the final output is computed as the average across all trees. To enhance model diversity and reduce overfitting, RF introduces randomness at the node level by selecting the best split from a random subset of predictors [

76]. This reduces inter-tree correlation and improves generalization.

In this study, we evaluate the predictive performance of the Extreme Gradient Boosting (XGBoost) algorithm, a highly efficient and scalable implementation of gradient-boosted decision trees [

75]. XGBoost constructs an additive model by sequentially fitting trees to the residuals of previous iterations, while incorporating regularization to reduce overfitting and improve generalization. Its ability to capture complex, non-linear relationships makes it particularly suitable for structured data such as housing attributes.

Gradient Boosting Machines (GBMs) are applied as a baseline boosting method for predicting apartment prices. A GBM builds an ensemble of shallow decision trees, each sequentially trained to correct the residuals of the previous model using gradient descent. While a GBM is flexible and effective in capturing complex patterns, it is sensitive to hyperparameters and prone to overfitting without proper tuning.

To improve model stability and performance, we apply two hyperparameter optimization strategies [

77]. Grid Search CV conducts an exhaustive search over a predefined parameter grid (e.g., learning rate, tree depth, number of iterations), ensuring a systematic and reproducible tuning process. Randomized Search CV, in contrast, samples from specified parameter distributions, enabling a more efficient search across a broader space. Although it does not guarantee a global optimum, it often identifies high-performing configurations with significantly lower computational cost—making it well-suited for larger or more complex modeling tasks.

All variables used in the ML models are consistent with those described in

Section 4.3, Multivariate Regression Analysis (OLS) Model Specification.

4.5. Clustering of Large Housing Estate Neighborhoods

As part of the analysis, we examined which neighborhoods are most similar in terms of their morphological and structural characteristics derived from explanatory variables known to influence housing prices. The clustering procedure aimed to group neighborhoods based on similarity, such that units within the same cluster are as similar as possible, while those in different clusters are as dissimilar as possible [

78,

79]. To ensure robustness and enable cross-validation of results, we applied three complementary clustering methods: Ward’s hierarchical agglomerative clustering,

k-means, and HDBSCAN (Hierarchical Density-Based Spatial Clustering of Applications with Noise). The first approach employed the Ward method [

80], which minimizes within-group variance using Euclidean distance as the dissimilarity measure. The second method used was

k-means clustering [

81], a non-hierarchical, iterative partitioning algorithm widely used in empirical research [

82,

83]. Both of these approaches require the number of clusters to be defined in advance, and all input variables were standardized before analysis to ensure comparability across measurement scales.

To complement these traditional methods, we also applied HDBSCAN, which is particularly well-suited for identifying clusters of varying densities and shapes—an important consideration when analyzing urban areas with unevenly distributed spatial features. Unlike

k-means, HDBSCAN determines the number of clusters automatically, reducing subjectivity in the classification process [

84,

85]. Moreover, it explicitly distinguishes noise points from core clusters, enabling more precise identification of atypical or outlier housing estates. The inclusion of HDBSCAN thus allowed for a more nuanced and context-sensitive classification of post-WWII apartment neighborhoods in Ljubljana.

5. Results and Discussion

5.1. Results of the Multivariate Regression (OLS) Analysis

The regression model exhibits a moderate linear relationship between the selected explanatory variables and apartment selling prices, as indicated by the correlation coefficient (R = 0.413). Based on the results, we find that the selected location-related, environmental, and socio-demographic variables have a statistically significant impact on the average house price in the period 2020–2025. However, the model’s explanatory power is limited, with an R2 value of 0.171, meaning that only approximately 17.1% of the variability in apartment selling prices is explained by the included variables. The adjusted R2 value (0.159) closely aligns with R2, further underscoring that introducing additional explanatory variables has provided minimal improvement and that the model’s limitations stem from omitted influential factors rather than overfitting. The standard error of the estimate (0.08427) indicates moderate predictive accuracy, reflecting reasonable but not optimal reliability in estimating actual selling prices from the chosen predictors.

Table 3 shows the results of the analysis of variance (ANOVA). The results confirm the statistical significance of the regression model (

F = 15.036,

p < 0.001), indicating that at least one explanatory variable significantly contributes to predicting apartment selling prices. However, the regression accounts for only a small portion (1.281) of the total variance (7.503), leaving a substantial residual variance unexplained (6.221). Although the model’s overall statistical significance is robust, the low proportion of explained variance underscores limitations in its practical explanatory effectiveness, suggesting the presence of influential factors not captured by the current set of variables.

The regression analysis identified several statistically significant predictors of apartment selling prices in post-WWII housing estates in Ljubljana (

Table 4). The most influential determinant is the average adjusted selling price within the same estate over the 2020–2025 period (

x1:

AAP500), which exhibits a standardized regression coefficient (

β) of +0.338 and a highly significant

t-value (

t = 10.028,

p < 0.001). This variable captures local market dynamics and price anchoring effects, reflecting how prevailing transaction values in the immediate vicinity shape buyer expectations and appraised unit value. Its strong positive association confirms that local reference prices serve as a key benchmark in housing valuation, particularly in homogenous urban estates with limited architectural diversity.

Apartment floor level (x3: NApFL) also exerts a positive and statistically significant influence on selling prices (β = +0.079, t = 2.060, p = 0.040). This effect, though modest in magnitude, suggests that higher-floor apartments are associated with a price premium, likely due to improved views, reduced street-level noise, greater privacy, or better sunlight exposure. Conversely, noise exposure level (x4: INEL) displays a significant negative effect on price (β = −0.111, t = −3.071, p = 0.002), confirming that environmental disamenities—especially traffic- or railway-related noise—lower market valuation. This aligns with findings from environmental economics, where noise pollution is consistently associated with reduced housing desirability, particularly in residential zones with limited sound mitigation infrastructure.

Window renovation year (x5: YWR) is another positively signed and statistically significant variable (β = +0.096, t = 2.992, p = 0.003). This suggests that apartments in buildings with recently replaced windows command higher prices, likely due to improved energy efficiency, thermal comfort, and a perceived signal of proactive maintenance. Window replacement may serve as a proxy for broader building quality or modernization efforts, thus enhancing buyer willingness to pay.

On the other hand, several variables did not show statistically significant effects. The gross floor area of the building (x2: BGFA) had a negligible and non-significant influence on price (β = −0.002, t = −0.051, p = 0.960). This may suggest that buyers do not assign added value to larger buildings—particularly those constructed during the socialist post-WWII era—which often involve higher maintenance costs for underutilized shared spaces, such as oversized corridors or non-operational elevators, thereby reducing the perceived desirability of individual units. Similarly, the ratio of green space within the estate (x6: RGS) did not significantly influence price (β = +0.028, t = 0.630, p = 0.529), despite expectations that greener environments enhance housing attractiveness.

Importantly, multicollinearity diagnostics revealed no serious concerns. All variance inflation factors (VIFs) were below 2.2, and tolerance values were comfortably above 0.1, indicating stable and interpretable coefficient estimates.

In sum, while several explanatory variables align with theoretical expectations—particularly those reflecting local market conditions, environmental quality, and maintenance status—others show limited or no statistical relevance, highlighting the complexity and context-dependence of housing price formation in Ljubljana’s post-WWII estates. In

Section 5.2, Results of Machine Learning Models, we evaluate the performance of seven machine learning algorithms. We anticipate a meaningful comparison by examining whether the OLS model identifies similar key predictors—such as apartment condition, access to amenities, and micro-location indicators—which are critical for enhancing the model’s explanatory power.

5.2. Results of Machine Learning Models

Table 5 presents the comparative performance of seven ML models—including RF, XGBoost, and GBMs with their corresponding hyperparameter optimizations—applied to predict apartment selling prices using a consistent set of explanatory variables. Across all models, predictive accuracy substantially outperforms the baseline OLS regression model (R

2 = 0.171), confirming the ability of non-linear algorithms to capture more complex interactions between housing determinants.

The Gradient Boosting Machine (GBM) with Randomized Search CV yielded the highest R2 value of 0.5957, indicating that approximately 59.6% of the variance in apartment prices is explained by the model. This performance is closely followed by XGBoost Randomized Search CV (R2 = 0.5951) and XGBoost Grid Search CV (R2 = 0.588), confirming the robustness of ensemble-based gradient boosting methods when hyperparameters are optimized. The standard GBM model (R2 = 0.5612) and the RF model (R2 = 0.5712) also demonstrate strong performance, suggesting that both bagging and boosting techniques are well-suited for housing price prediction in this context. In contrast, the baseline XGBoost model (R2 = 0.4531) performs the weakest among the ensemble models, underscoring the importance of hyperparameter tuning.

Beyond R2, the Mean Absolute Error (MAE) and Root Mean Squared Error (RMSE) provide complementary insights into prediction accuracy. The lowest MAE was achieved by GBM Randomized Search CV (MAE = 0.03), meaning the model’s average prediction deviates from actual prices by just 0.03 in the normalized price units. Most other models—including XGBoost variants and RF—exhibited MAE values between 0.04 and 0.05, which reflects high consistency in performance. The RMSE values, which penalize larger errors more heavily, consistently range from 0.06 to 0.07, indicating that no model exhibits extreme error outliers in prediction. The tight clustering of RMSE values reinforces the models’ reliability across different optimization strategies.

These results suggest that machine learning models—particularly gradient-boosted frameworks—are markedly more effective than linear regression in capturing the complex, potentially non-linear relationships between price and apartment characteristics in Ljubljana’s post-WWII housing estates. Importantly, while R2 values are not exceptionally high in absolute terms, they represent a substantial improvement relative to traditional econometric approaches using the same feature set. This improvement suggests that price formation in these heterogeneous estates involves interaction effects and non-linearities that ML models are better suited to detect.

The feature importance analysis across the seven machine learning models reveals consistent patterns in the predictors influencing apartment prices (

Table 6). Among all explanatory variables, the average adjusted selling price within a 500 m radius (

x1:

AAP500) emerges as the most influential determinant across all models. It carries the highest importance in RF (0.514), GBM (0.5807), and GBM Randomized Search CV (0.5255), and remains among the top contributors in all XGBoost configurations. This confirms that local market comparables are a primary anchor for price estimation, reflecting prevailing neighborhood price levels. The result underscores the relevance of spatial price anchoring in urban housing markets and validates the use of localized average prices as a robust reference in price modelling.

Gross floor area of the building (x2: BGFA) consistently ranks among the top three features in all models, though with a more moderate impact. Importance scores range from 0.059 (XGBoost Grid Search CV) to 0.1484 (GBM). This suggests that while building size does influence price—possibly as a proxy for architectural scale or maintenance intensity—it is secondary to micro-location and historical pricing factors. Larger buildings may signal lower perceived exclusivity or higher shared maintenance costs, especially in post-WWII estates with less efficient layouts.

Apartment floor level (x3: NApFL) shows modest but consistent importance across models (e.g., 0.0885 in RF, 0.0793 in GBM Randomized Search CV). Its role may relate to views, privacy, or noise insulation, with buyers valuing mid- or higher-level units slightly more. The year of window renovation (x5: YWR) also contributes meaningfully (ranging from 0.0543 to 0.1018), reinforcing the importance of recent investments in thermal efficiency and comfort. Renovation signals proactive maintenance and improved energy performance, both of which influence buyer preferences.

Several environmental and contextual variables contribute non-trivially, although with less consistency across models. For instance, noise exposure level (x4: INEL) has a moderate and stable influence (0.0327–0.0611), confirming its negative externality effect on perceived housing quality. Green space ratio (x6: RGS) holds relatively low importance overall, possibly due to uniform availability across estates or poor green infrastructure quality, though its contribution peaks in XGBoost models (up to 0.0879). Interestingly, the number of petrol stations in the estate (x9: NPS) shows high importance in tuned XGBoost models (e.g., 0.2224 in Grid Search CV), suggesting a latent correlation with spatial intensity, traffic, or perceived environmental degradation—factors which may lower desirability in dense or mixed-use areas.

Variables capturing location and accessibility—notably the index of urban accessibility (x10: IUA) and location category of the estate (x11: CLHE)—show moderate importance in XGBoost configurations (up to 0.1185), though their relevance diminishes in other models. This reflects how location-related heterogeneity is partially captured by historical price levels (AAP500), which may already embed multiple spatial factors. Travel time to BTC City (x8: tBTC) and building type (x12: CBT) play minor roles in most models, except in standard XGBoost where CBT achieves a surprisingly high importance (0.1738), potentially due to model sensitivity to categorical variables when not smoothed through optimization.

Overall, the most robust predictors across algorithms are local historical price levels (x1), building size (x2), floor level (x3), noise exposure (x4), and window renovation year (x5). These findings confirm that both physical dwelling attributes and local market signals are essential in price formation, while more abstract contextual factors (e.g., proximity to retail centers or urban accessibility indices) play a secondary, model-dependent role.

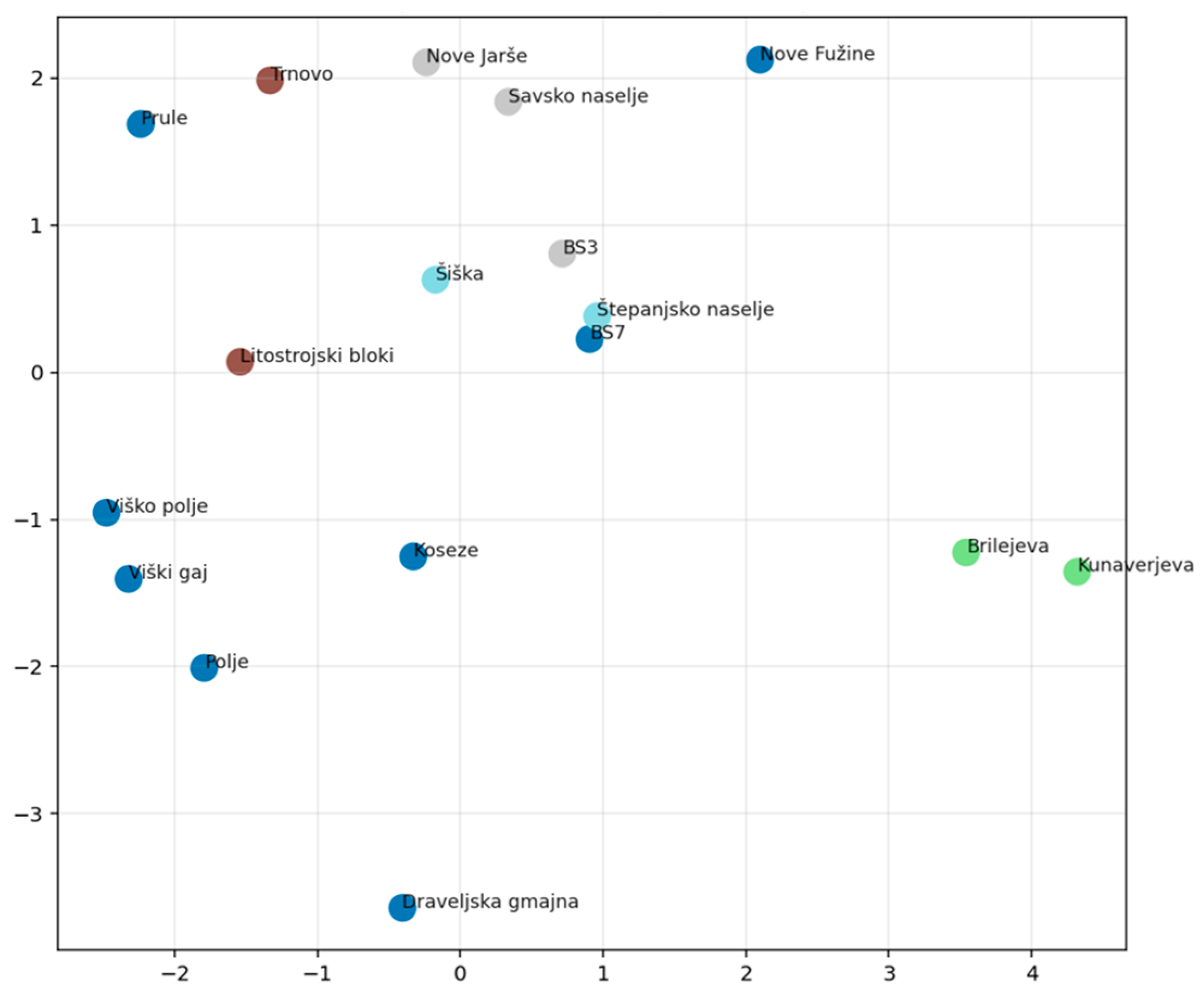

5.3. Results of Neighborhood Clustering

The analysis aimed to identify which neighborhoods are most similar in terms of their morphological characteristics and key explanatory variables influencing average apartment prices. Clustering was performed using three complementary methods: Ward’s hierarchical clustering, the non-hierarchical

k-means algorithm, and HDBSCAN. The results from Ward’s method and

k-means yielded a consistent classification into four distinct groups (see

Table 7), confirming the structural robustness of the clustering regardless of the chosen technique. The inclusion of HDBSCAN further enhanced the analysis by enabling the identification of clusters with varying densities and shapes, as well as the explicit detection of noise points—i.e., atypical or outlier neighborhoods. The convergence of results across these methods strengthens the validity of the identified typologies and supports their use in subsequent interpretation.

The neighborhood clustering results obtained with both methods indicate a comparable yet not identical classification structure. The first group, identified using Ward’s method, includes housing estates with the highest total number of dwellings and the most recorded sales during the observation period. Despite their size, these estates have the second-lowest average apartment prices among all groups. On average, this group features the shortest travel time to BTC City shopping center (x8: tBTC = 11.3 min), with most housing estates located within the motorway ring of Ljubljana (x11: CLHE = 1). The urban amenities accessibility index averages 4.0, slightly above the overall group mean (x10: IUA = 3.9). These housing estates also report the lowest average noise exposure (x4: INEL = 4.9). The group is characterized by predominantly high-rise buildings (x7: NTF = 2; six or more floors), with apartments typically sold on the sixth floor, and in relatively newer buildings (average age at sale: 47.2 years).

The second group contains housing estates with the second-largest dwelling stock and the second-highest number of transactions. It also has the second-highest average selling price. Travel time to BTC City is the longest among all groups (x8: tBTC = 17.5 min), although all housing estates are still located within the motorway ring (x11: CLHE = 1). This group records the highest accessibility to urban amenities (x10: IUA = 4.2) and the second-lowest average noise exposure (x4: INEL = 5.9). While building types vary, low-rise blocks (x7: NTF = 1; up to five floors) dominate, reflected in the average transaction floor of 4.5. These apartments were sold in the oldest buildings among all groups, with an average age of 50.7 years (overall average: 47.1).

The third group consists of smaller housing estates in terms of dwelling stock but with the largest average gross floor area of buildings. It ranks second-lowest in both total number of dwellings and sales. This group reports the lowest average apartment prices. With an average BTC City travel time of 13.5 min (x8: tBTC), all housing estates are located within the motorway ring (x11: CLHE = 1). The amenities accessibility index is relatively low (x10: IUA = 3.8), and it records the highest average noise exposure (x4: INEL = 8.1). These housing estates consist exclusively of high-rise buildings (x7: NTF = 2; six or more floors), with units sold on average on the eighth floor, and in the newest buildings among all groups (average age at sale: 41.9 years).

The fourth group includes housing estates with the fewest dwellings and transactions, but the highest average apartment prices. The average travel time to BTC City is 13.5 min (x8: tBTC), and all housing estates lie within the motorway ring (x11: CLHE = 1). However, this group has the lowest amenities accessibility (x10: IUA = 3.0) and relatively high noise exposure (x4: INEL = 6.1). It is characterized by a dominance of low-rise buildings (x7: NTF = 1; up to five floors), with transactions typically occurring on the fourth floor. The average building age at sale is 48.6 years.

Results of one-way ANOVA confirm that the groups differ significantly across several key variables, including gross floor area (p = 0.005), travel time to shopping center (p = 0.016), location within or outside the motorway ring (p < 0.001), urban amenities accessibility (p < 0.001), noise exposure (p = 0.020), transaction floor level (p < 0.001), number of building floors (p = 0.002), window renovation (p = 0.026), and green space ratio (p = 0.005). These findings confirm the internal validity of the identified clusters and highlight that they reflect distinct spatial, physical, and environmental conditions. Despite minor reclassifications, both clustering methods produced structurally coherent groups, reinforcing the robustness of the identified typologies. The only discrepancy involves two housing estates—BS7 and Šiška—which were assigned to Group 2 by k-means, but to Group 1 using Ward’s method.

The results of the HDBSCAN analysis (

Table 7) are broadly consistent with the previous two methods but demonstrate greater precision in distinguishing more complex cases, as the technique identified five clusters instead of four. Some neighborhoods that were grouped by Ward’s method and

k-means were classified into separate clusters by HDBSCAN—for example, Šiška and Štepanjsko naselje formed independent clusters, as did Trnovo and the Litostroj blocks (

Figure 3). This suggests that HDBSCAN is better at capturing internal heterogeneity and allows for more flexible classification, particularly in areas with more complex urban structures.

HDBSCAN confirmed the core structure revealed by the other two methods, while also highlighting potential thematic subgroups within existing classifications. This contributes to higher resolution and validity of the typology. The combination of all three methods enabled a comprehensive analysis of housing estate structures. While Ward’s method and k-means provide a stable foundation for general typology, HDBSCAN adds further depth by identifying specific subgroups that are relevant for more precise housing policy planning. Together, the results from all three methods offer a strong empirical basis for the study’s conclusions.

Overall, despite some variation in cluster membership across methods, the results consistently demonstrate that factors such as neighborhood scale, housing stock size, accessibility to urban amenities, environmental quality, and perceived safety play a central role in the spatial differentiation of apartment prices in Ljubljana. While Ward’s method and k-means provided a stable typological foundation, HDBSCAN contributed additional analytical depth by identifying more nuanced subgroupings, particularly in neighborhoods with complex or heterogeneous characteristics. This methodological complementarity reinforces the robustness of the classification framework and confirms its validity in capturing both structural and market-relevant patterns across the city’s post-WWII housing estates.

6. Conclusions

This study investigated determinants of housing prices in 17 post-WWII multi-family housing estates in the Municipality of Ljubljana, built between 1947 and 1986. The research combined multiple analytical approaches to better understand the spatial, structural, and socio-environmental drivers of housing prices within a specific segment of the urban fabric. The analysis included a hedonic pricing model using ordinary least squares (OLS), a series of advanced machine learning (ML) models—most notably Random Forest (RF), XGBoost, and Gradient Boosting Machines (GBMs) with two different hyperparameter optimization methods—and three clustering algorithms to classify the estates into typological groups.

The hedonic OLS model confirmed the statistical significance of several location-based, structural, and environmental variables, though it explained only a modest share of the total price variance (R2 = 0.171). Among all predictors, the average apartment price within a 500 m radius (x1: AAP500) emerged as the most important determinant, highlighting the strong influence of localized market conditions. Other relevant factors included apartment floor level (x3: NApFL), noise exposure level (x4: INEL), year of window renovation (x5: YWR), and proximity to green space (x6: RGS). Despite limited explanatory power due to variable homogeneity across neighborhoods, the OLS model offered valuable insight into the direction and magnitude of specific effects, reinforcing its role in interpretable and policy-relevant urban analysis.

To address the limitations of the linear regression model and better capture complex, non-linear relationships, the study employed seven supervised ML algorithms: RF, standard XGBoost, XGBoost with Grid Search Cross-Validation (CV), XGBoost with Randomized Search CV, and three equivalent configurations of GBMs. All ML models demonstrated substantially stronger predictive accuracy than the OLS model. Among them, the GBM with Randomized Search CV performed best, reaching the highest R2 value of 0.5957, followed closely by XGBoost with Randomized Search CV (R2 = 0.5951) and XGBoost with Grid Search CV (R2 = 0.588). The RF model also performed well (R2 = 0.5712), providing a strong baseline without hyperparameter tuning. In contrast, the standard XGBoost and GBM models without tuning exhibited moderately lower performance, with R2 values of 0.4531 and 0.5612, respectively.

In terms of prediction error, the lowest mean absolute error (MAE) was achieved by GBM with Randomized Search CV (MAE = 0.03), indicating high precision in estimating apartment prices. Most other tuned models also maintained low MAE values of 0.04, while the untuned XGBoost performed less favorably (MAE = 0.05). These results confirm that hyperparameter tuning meaningfully improves model performance, particularly for boosting algorithms. Overall, the GBM and XGBoost models with randomized tuning showed the best balance of accuracy, robustness, and efficiency, making them well-suited for real-world housing price prediction tasks. RF models, while slightly less accurate, remains a highly interpretable and stable alternative.

In parallel, three clustering approaches—Ward’s hierarchical method, k-means, and HDBSCAN—were employed to identify typological groupings among the neighborhoods based on shared morphological, structural, and environmental attributes. Both Ward’s method and k-means produced a stable four-cluster classification, with high internal consistency and interpretable group profiles, while the clusters differed significantly across multiple key variables. These significant differences, confirmed through one-way ANOVA, validate the structural robustness of the clusters and demonstrate that the classification reflects meaningful variation in spatial and physical housing estate characteristics.

HDBSCAN offered a more flexible and nuanced alternative by identifying five clusters instead of four, while also distinguishing noise points—outlier neighborhoods not clearly belonging to any group. This method proved especially effective in detecting internal heterogeneity among complex urban areas. For example, neighborhoods such as Šiška and Štepanjsko naselje, grouped together by Ward’s method, were confirmed as distinct yet similar cases under HDBSCAN, reinforcing their shared market and structural profiles. While k-means and Ward’s method are effective in establishing general typologies and are suitable for replicable, policy-oriented analyses, HDBSCAN is better suited for exploratory analysis and the identification of edge cases and substructures. The convergence of results across all three methods, despite methodological differences, supports the overall validity and applicability of the classification framework and suggests that combining hierarchical and density-based clustering can enhance resolution in spatial housing analysis.

Taken together, the findings underscore the value of integrating spatial, structural, and environmental variables in analyzing apartment price dynamics within post-WWII housing estates. By combining a traditional hedonic price (OLS) model with advanced ML techniques and multiple clustering methods, the study offers a multi-dimensional framework for understanding the determinants of housing prices in Ljubljana. The approach not only improves predictive accuracy but also enhances interpretability and policy relevance. The use of RF, XGBoost, and GBM models revealed complex, non-linear relationships often overlooked in linear (OLS) models. At the same time, clustering methods—particularly HDBSCAN—uncovered hidden typologies and subgroups among neighborhoods. While the study is context-specific—focusing on relatively homogeneous post-WWII multi-family estates in Ljubljana—the analytical framework is transferable to similar urban environments across Central and Eastern Europe that share comparable housing legacies and planning histories. The methodology can support comparative studies in cities where large-scale estates form a significant part of the residential fabric, offering a replicable tool for data-driven policy, valuation, and regeneration strategies.