Systemic Competitiveness in the EU Cereal Value Chain: A Network Perspective for Policy Alignment

Abstract

1. Introduction

The Conceptual Framework

2. Materials and Methods

3. Results

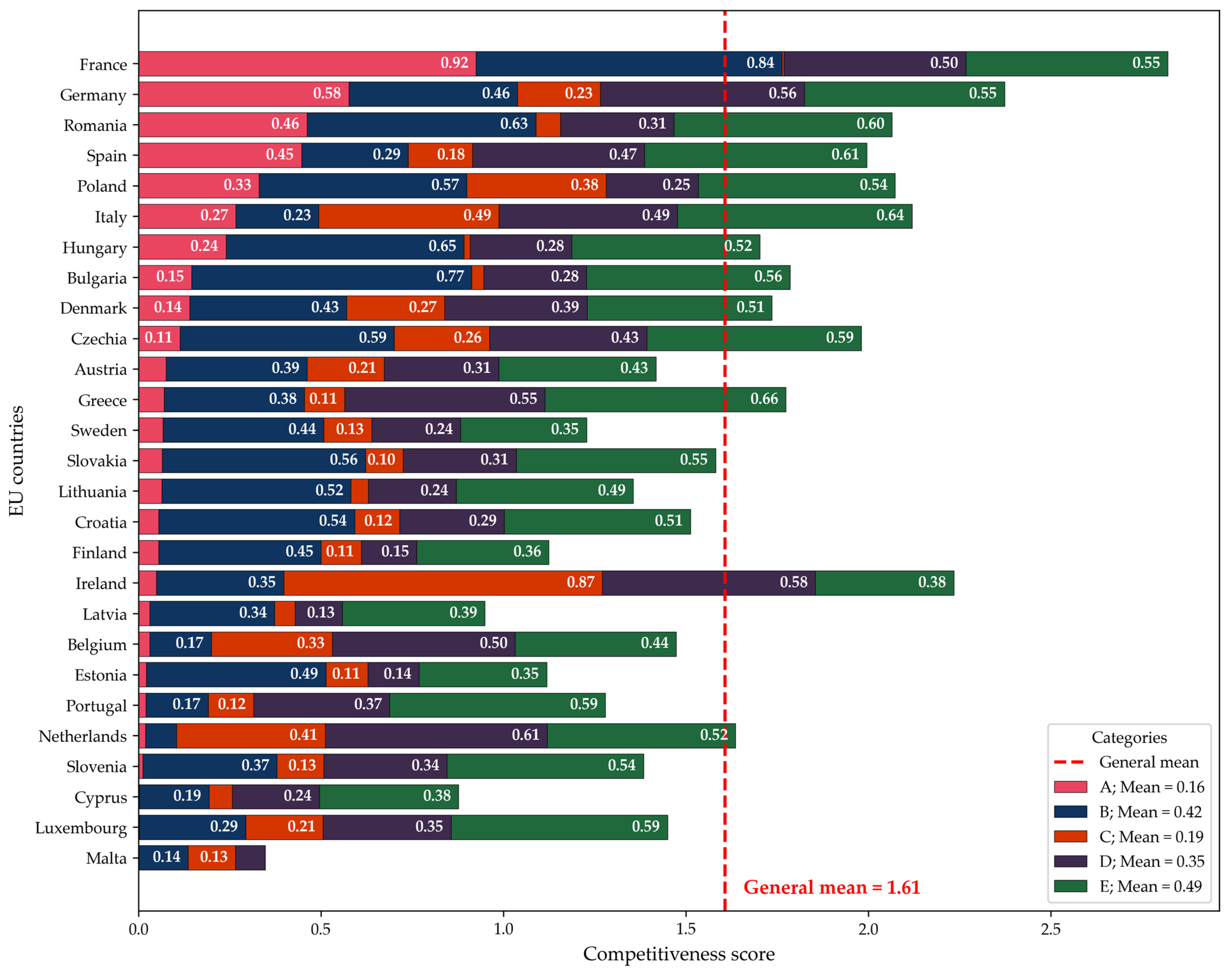

3.1. Overview—Main Competitiveness Results

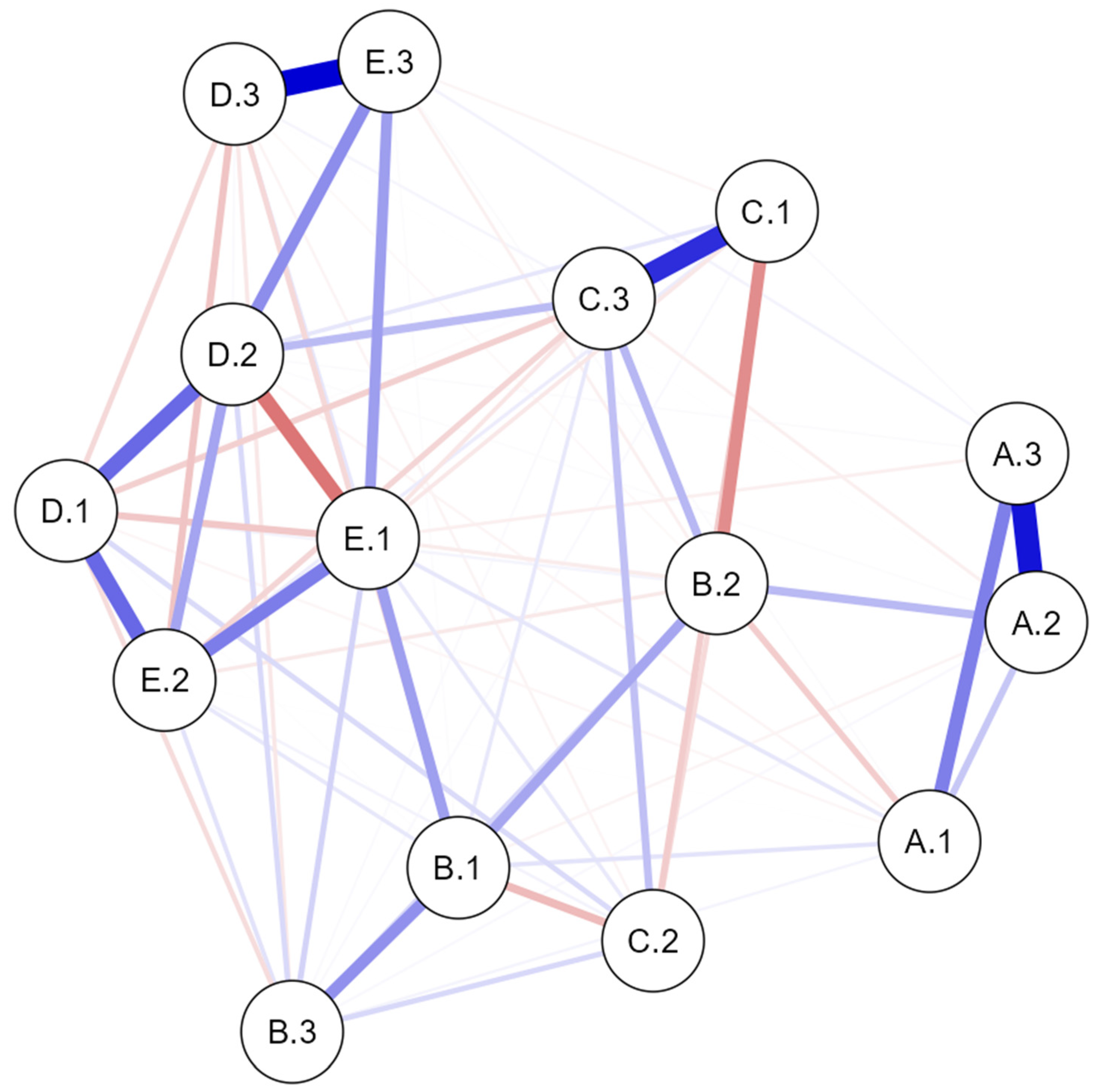

3.2. The Sparse Gaussian Graphical Model

3.3. Revealing Decoupled Competitiveness Drivers Through Asymmetry Analysis

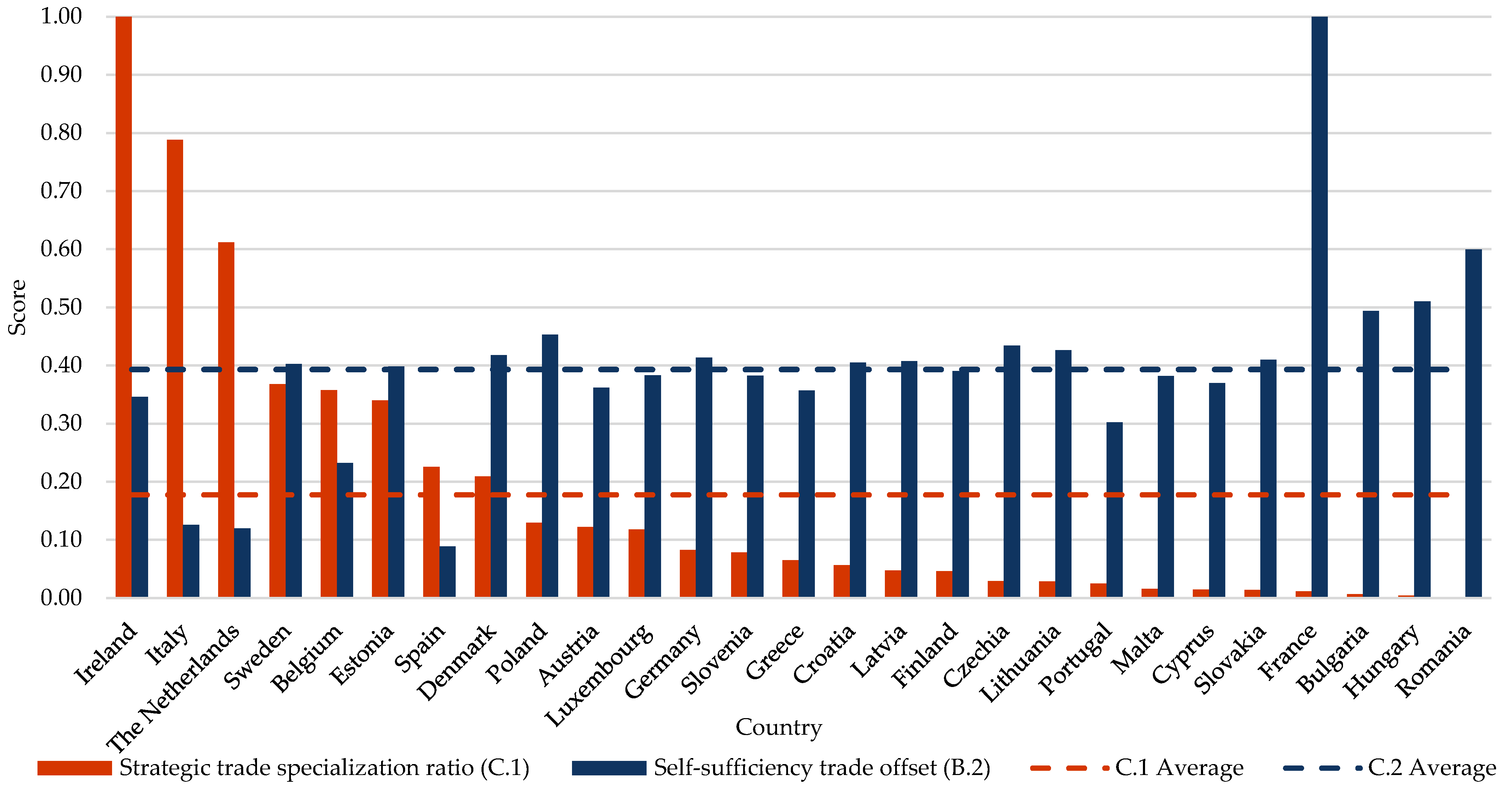

3.3.1. Strategic Trade Specialization (C.1)—Asymmetric with Self-Sufficiency Balance (B.2)

3.3.2. Trade Strategy (C)—Misaligned with Factor Endowments (A)

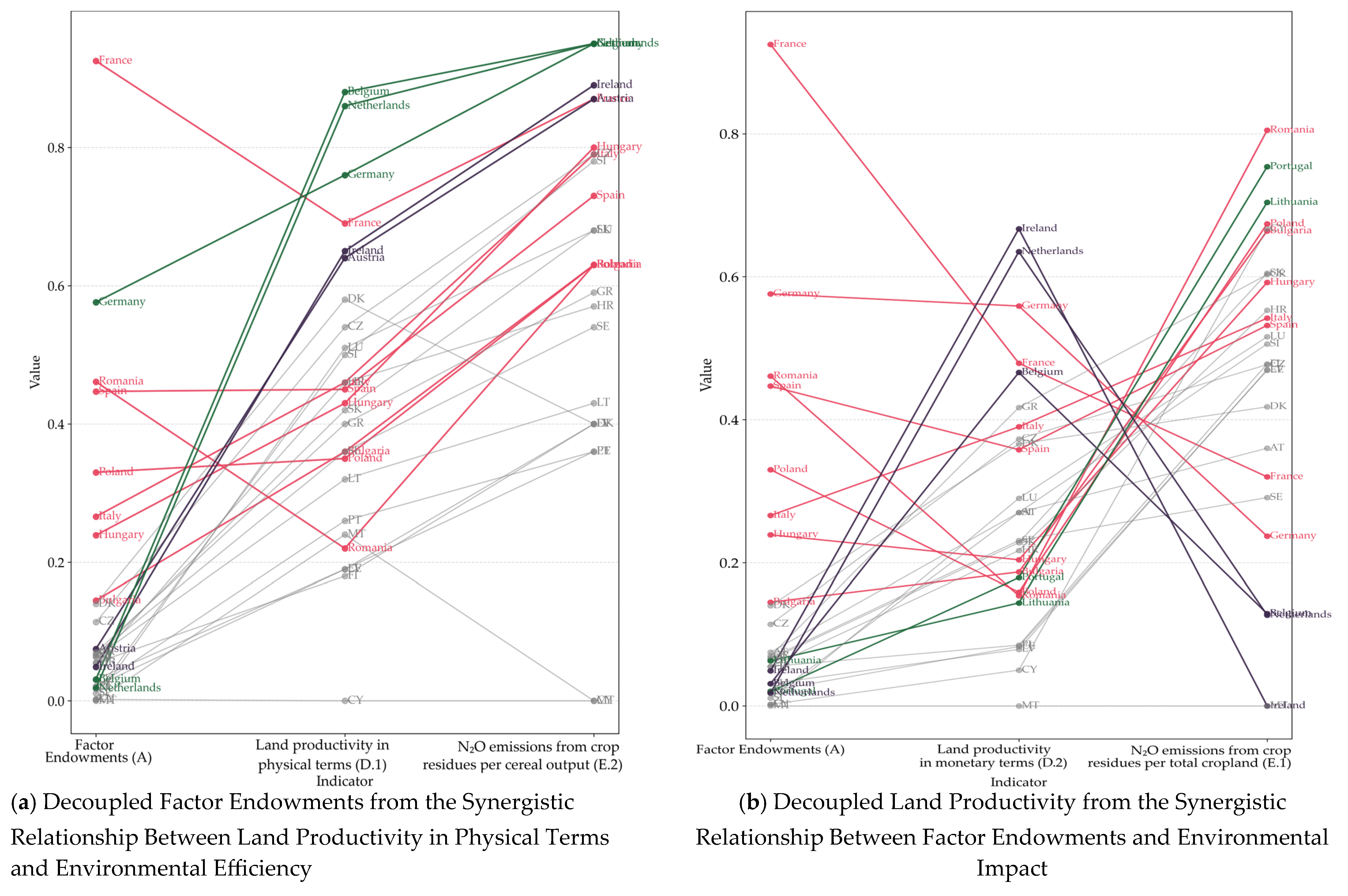

3.3.3. Between Asymmetry and Synergy: Structural Complexity in Factor Endowments (A), Resource Productivity (D), and Environmental Impact (E)

3.4. Robustness Checks

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Jia, N.; Xia, Z.; Li, Y.; Yu, X.; Wu, X.; Li, Y.; Su, R.; Wang, M.; Chen, R.; Liu, J. The Russia-Ukraine War Reduced Food Production and Exports with a Disparate Geographical Impact Worldwide. Commun. Earth Environ. 2024, 5, 765. [Google Scholar] [CrossRef]

- Kacperska, E.M.; Łukasiewicz, K.; Skrzypczyk, M.; Stefańczyk, J. Price Volatility in the European Wheat and Corn Market in the Black Sea Agreement Context. Agriculture 2025, 15, 91. [Google Scholar] [CrossRef]

- Aliu, F.; Kučera, J.; Hašková, S. Agricultural Commodities in the Context of the Russia-Ukraine War: Evidence from Corn, Wheat, Barley, and Sunflower Oil. Forecasting 2023, 5, 351–373. [Google Scholar] [CrossRef]

- Özocakli, D.; Doğan Başar, B.; Ekşi, İ.H.; Ginn, W. Effect of Grain Corridor Agreement on Grain Prices. Int. Econ. J. 2024, 38, 489–506. [Google Scholar] [CrossRef]

- Center for Strategic and International Studie Fracturing Solidarity: The Grain Trade Dispute Between Ukraine and the European Union. Available online: https://www.csis.org/analysis/fracturing-solidarity-grain-trade-dispute-between-ukraine-and-european-union (accessed on 2 February 2025).

- Nicastro, R.; Papale, M.; Fusco, G.M.; Capone, A.; Morrone, B.; Carillo, P. Legal Barriers in Sustainable Agriculture: Valorization of Agri-Food Waste and Pesticide Use Reduction. Sustainability 2024, 16, 8677. [Google Scholar] [CrossRef]

- Lin, F.; Li, X.; Jia, N.; Feng, F.; Huang, H.; Huang, J.; Fan, S.; Ciais, P.; Song, X.-P. The Impact of Russia-Ukraine Conflict on Global Food Security. Glob. Food Secur. 2023, 36, 100661. [Google Scholar] [CrossRef]

- Hamulczuk, M.; Pawlak, K.; Stefańczyk, J.; Gołębiewski, J. Agri-Food Supply and Retail Food Prices during the Russia–Ukraine Conflict’s Early Stage: Implications for Food Security. Agriculture 2023, 13, 2154. [Google Scholar] [CrossRef]

- Noja, G.G.; Cristea, M.; Pirtea, M.G.; Panait, M.; Drăcea, R.M.; Abrudan, D. Drivers of Firms’ Financial Performance in the Energy Sector: A Comparative Approach between the Conventional and Renewable Energy Fields. Eng. Econ. 2023, 34, 205–222. [Google Scholar] [CrossRef]

- Campbell, R.M.; Anderson, N.M.; Daugaard, D.E.; Naughton, H.T. Financial Viability of Biofuel and Biochar Production from Forest Biomass in the Face of Market Price Volatility and Uncertainty. Appl. Energy 2018, 230, 330–343. [Google Scholar] [CrossRef]

- Kristöfel, C.; Strasser, C.; Morawetz, U.B.; Schmidt, J.; Schmid, E. Analysis of Woody Biomass Commodity Price Volatility in Austria. Biomass Bioenergy 2014, 65, 112–124. [Google Scholar] [CrossRef]

- Gilbert, C.L.; Mugera, H.K. Food Commodity Prices Volatility: The Role of Biofuels. Nat. Resour. 2014, 5, 200–212. [Google Scholar] [CrossRef][Green Version]

- Diaconescu, M.; Marinas, L.E.; Marinoiu, A.M.; Popescu, M.-F.; Diaconescu, M. Towards Renewable Energy Transition: Insights from Bibliometric Analysis on Scholar Discourse to Policy Actions. Energies 2024, 17, 4719. [Google Scholar] [CrossRef]

- Voicu-Dorobanțu, R.; Volintiru, C.; Popescu, M.-F.; Nerău, V.; Ștefan, G. Tackling Complexity of the Just Transition in the EU: Evidence from Romania. Energies 2021, 14, 1509. [Google Scholar] [CrossRef]

- Lupu, I.; Hurduzeu, G.; Lupu, R.; Popescu, M.-F.; Gavrilescu, C. Drivers for Renewable Energy Consumption in European Union Countries. A Panel Data Insight. Amfiteatru Econ. 2023, 25, 380–396. [Google Scholar] [CrossRef]

- Ruzekova, V.; Kittova, Z.; Steinhauser, D. Export Performance as a Measurement of Competitiveness. J. Compet. 2020, 12, 145–160. [Google Scholar] [CrossRef]

- Mizik, T. Agri-Food Trade Competitiveness: A Review of the Literature. Sustainability 2021, 13, 11235. [Google Scholar] [CrossRef]

- Coronado, F.; Charles, V.; Dwyer, R.J. Measuring Regional Competitiveness through Agricultural Indices of Productivity: The Peruvian Case. World J. Entrep. Manag. Sustain. Dev. 2017, 13, 78–95. [Google Scholar] [CrossRef]

- Bezat-Jarzębowska, A.; Rembisz, W. Efficiency-Focused Economic Modeling of Competitiveness in the Agri-Food Sector. Procedia-Soc. Behav. Sci. 2013, 81, 359–365. [Google Scholar] [CrossRef]

- Rousseau, R. Balassa = Revealed Competitive Advantage = Activity. Scientometrics 2019, 121, 1835–1836. [Google Scholar] [CrossRef]

- Sarker, R.; Ratnasena, S. Revealed Comparative Advantage and Half-a-Century Competitiveness of Canadian Agriculture: A Case Study of Wheat, Beef, and Pork Sectors. Can. J. Agric. Econ./Rev. Can. d’Agroeconomie 2014, 62, 519–544. [Google Scholar] [CrossRef]

- Crespo Cuaresma, J.; Hlouskova, J.; Obersteiner, M. Agricultural Commodity Price Dynamics and Their Determinants: A Comprehensive Econometric Approach. J. Forecast. 2021, 40, 1245–1273. [Google Scholar] [CrossRef]

- Mavrommati, A.; Pliakoura, A.; Kontogeorgos, A. Olive Oil Export Competitiveness in Leading Producing Nations: An Econometric Approach. J. Agribus. Dev. Emerg. Econ. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Long, Y. Export Competitiveness of Agricultural Products and Agricultural Sustainability in China. Reg. Sustain. 2021, 2, 203–210. [Google Scholar] [CrossRef]

- Abrhám, J.; Strielkowski, W.; Vošta, M.; Šlajs, J. Factors That Influence the Competitiveness of Czech Rural SMEs. Agric. Econ.—Czech. 2015, 61, 450–460. [Google Scholar] [CrossRef]

- Balogh, J.M.; Jámbor, A. Determinants of Revealed Comparative Advantages: The Case of Cheese Trade in the European Union. Acta Aliment. 2017, 46, 305–311. [Google Scholar] [CrossRef]

- Sharma, R.; Kamble, S.S.; Gunasekaran, A.; Kumar, V.; Kumar, A. A Systematic Literature Review on Machine Learning Applications for Sustainable Agriculture Supply Chain Performance. Comput. Oper. Res. 2020, 119, 104926. [Google Scholar] [CrossRef]

- Zhang, C.; Li, M.; Guo, P. An Interval Multistage Joint-Probabilistic Chance-Constrained Programming Model with Left-Hand-Side Randomness for Crop Area Planning under Uncertainty. J. Clean. Prod. 2017, 167, 1276–1289. [Google Scholar] [CrossRef]

- Balducci, F.; Impedovo, D.; Pirlo, G. Machine Learning Applications on Agricultural Datasets for Smart Farm Enhancement. Machines 2018, 6, 38. [Google Scholar] [CrossRef]

- Mehra, M.; Saxena, S.; Sankaranarayanan, S.; Tom, R.J.; Veeramanikandan, M. IoT Based Hydroponics System Using Deep Neural Networks. Comput. Electron. Agric. 2018, 155, 473–486. [Google Scholar] [CrossRef]

- Ren, J.; Chen, X.; Miao, Z.; Gao, T. How Does High-Standard Farmland Construction Affect Agroecological Efficiency—From the Perspective of Factor Endowment. Land 2024, 13, 1673. [Google Scholar] [CrossRef]

- Porter, M.E. The Competitive Advantage of Nations. Compet. Intell. Rev. 1990, 1, 14. [Google Scholar]

- Engerman, S.L.; Sokoloff, K.L. Factor Endowments, Institutions, and Differential Paths of Growth Among New World Economies: A View from Economic Historians of the United States. In How Latin America Fell Behind: Essays on the Economic Histories of Brazil and Mexico; Haber, S., Ed.; Stanford University Press: Redwood City, CA, USA, 1997; pp. 260–306. ISBN 978-1-5036-2250-0. [Google Scholar]

- Peng, W.; Zheng, H.; Robinson, B.E.; Li, C.; Li, R. Comparing the Importance of Farming Resource Endowments and Agricultural Livelihood Diversification for Agricultural Sustainability from the Perspective of the Food–Energy–Water Nexus. J. Clean. Prod. 2022, 380, 135193. [Google Scholar] [CrossRef]

- Tleuberdinov, A.; Nurlanova, N.; Alzhanova, F.; Salibekova, P. Food Security and Self-Sufficiency as a Factor of Country’s Sustainable Development: Assessment Methods and Solutions. Discov. Sustain. 2025, 6, 50. [Google Scholar] [CrossRef]

- Parrinello, S. The Notion of National Competitiveness in a Global Economy. In Economic Theory and Economic Thought; Vint, J., Metcalfe, S., Heinz, D.K., Salvadori, N., Samuelson, P., Eds.; Routledge: London, UK, 2009; ISBN 978-0-203-86304-6. [Google Scholar]

- Alabi, M.O.; Ngwenyama, O. Food Security and Disruptions of the Global Food Supply Chains during COVID-19: Building Smarter Food Supply Chains for Post COVID-19 Era. Br. Food J. 2022, 125, 167–185. [Google Scholar] [CrossRef]

- Sadłowski, A.; Zając, A. Export of Ukrainian Agricultural Products through Poland—Route Restrictions. Agric. Resour. Econ. Int. Sci. E-J. 2024, 10, 29–46. [Google Scholar] [CrossRef]

- Ben Hassen, T.; El Bilali, H.; Daher, B.; Burkart, S. Sustainable and Resilient Food Systems in Times of Crises. Front. Nutr. 2025, 12, 1564950. [Google Scholar] [CrossRef]

- Redding, S.; Vera-Martin, M. Factor Endowments and Production in European Regions. Rev. World Econ. 2006, 142, 1–32. [Google Scholar] [CrossRef][Green Version]

- Borsellino, V.; Schimmenti, E.; El Bilali, H. Agri-Food Markets towards Sustainable Patterns. Sustainability 2020, 12, 2193. [Google Scholar] [CrossRef]

- Turmunkh, B.-E. The Cereal Production as an Indicator of Agricultural Land Use Efficiency and Economic Growth in Central Asia: Evidence from A Generalized Method of Moments (GMM) Panel Data Analysis of the Environmental Kuznets Curve (EKC). Saudi J. Econ. Financ. 2021, 5, 492–508. [Google Scholar] [CrossRef]

- Ambroziak, Ł.; Szczepaniak, I.; Bułkowska, M. Competitive Position of Polish and Ukrainian Food Producers in the EU Market. Agriculture 2024, 14, 2104. [Google Scholar] [CrossRef]

- Bezat-Jarzębowska, A.; Rembisz, W.; Jarzębowski, S. Maintaining Agricultural Production Profitability—A Simulation Approach to Wheat Market Dynamics. Agriculture 2024, 14, 1910. [Google Scholar] [CrossRef]

- Lădaru, G.R.; Lombardi, M.; Petre, I.L.; Dobrotă, C.E.; Platania, M.; Mocanu, S. Analysis of Export Competitiveness of Agri-Food Products at the EU-27 Level through the Perspective of Technical Complexity. Sustainability 2024, 16, 5807. [Google Scholar] [CrossRef]

- Boboc, D.; Lădaru, G.R.; Diaconeasa, M.C.; Petre, I.L.; Velicu, R. The Influence of Investments on the Technical-Economic Performance of the Agricultural Sector in Romania. Econ. Comput. Econ. Cybern. Stud. Res. 2021, 55, 251–267. [Google Scholar] [CrossRef]

- Ganeshkumar, C.; Jena, S.K.; Sivakumar, A.; Nambirajan, T. Artificial Intelligence in Agricultural Value Chain: Review and Future Directions. J. Agribus. Dev. Emerg. Econ. 2021, 13, 379–398. [Google Scholar] [CrossRef]

- Dimovski, J.; Krstić, B.; Radivojević, V. Ensuring the Improvement of Agricultural Competitiveness Through the Human Resource Development. Ekon. Poljopr. 2022, 69, 1017–1029. [Google Scholar] [CrossRef]

- Rambe, P.; Khaola, P. The Impact of Innovation on Agribusiness Competitiveness: The Mediating Role of Technology Transfer and Productivity. Eur. J. Innov. Manag. 2021, 25, 741–773. [Google Scholar] [CrossRef]

- Mekuria, W.; Mekonnen, K.; Thorne, P.; Bezabih, M.; Tamene, L.; Abera, W. Competition for Land Resources: Driving Forces and Consequences in Crop-Livestock Production Systems of the Ethiopian Highlands. Ecol. Process. 2018, 7, 30. [Google Scholar] [CrossRef]

- Harvey, M.; Pilgrim, S. The New Competition for Land: Food, Energy, and Climate Change. Food Policy 2011, 36, S40–S51. [Google Scholar] [CrossRef]

- Milczarek-Andrzejewska, D.; Zawalińska, K.; Czarnecki, A. Land-Use Conflicts and the Common Agricultural Policy: Evidence from Poland. Land Use Policy 2018, 73, 423–433. [Google Scholar] [CrossRef]

- Wijnands, J.H.M.; Bremmers, H.J.; van der Meulen, B.M.J.; Poppe, K.J. An Economic and Legal Assessment of the EU Food Industry’s Competitiveness. Agribusiness 2008, 24, 417–439. [Google Scholar] [CrossRef]

- Clapp, J. Food Self-Sufficiency: Making Sense of It, and When It Makes Sense. Food Policy 2017, 66, 88–96. [Google Scholar] [CrossRef]

- Kovljenić, M.; Matkovski, B.; Đokić, D. Competitiveness and Cereal Self-Sufficiency in Western Balkan Countries. Agriculture 2024, 14, 1480. [Google Scholar] [CrossRef]

- Erokhin, V. Self-Sufficiency versus Security: How Trade Protectionism Challenges the Sustainability of the Food Supply in Russia. Sustainability 2017, 9, 1939. [Google Scholar] [CrossRef]

- Haji-Rahimi, M. Comparative Advantage, Self-Sufficiency and Food Security in Iran: Case Study of Wheat Commodity. Int. J. Agric. Manag. Dev. (IJAMAD) 2014, 4, 203–210. [Google Scholar]

- Szajner, P.; Szczepaniak, I.; Łopaciuk, W. An Assessment of the Production Potential and Food Self-Sufficiency of Ukraine against the Background of the European Union and Poland. Sustainability 2024, 16, 7735. [Google Scholar] [CrossRef]

- Lazíková, J.; Bandlerová, A.; Rumanovská, Ľ.; Takáč, I.; Lazíková, Z. Crop Diversity and Common Agricultural Policy—The Case of Slovakia. Sustainability 2019, 11, 1416. [Google Scholar] [CrossRef]

- Ismail, M.M.; Yusop, Z. Competitiveness of the Malaysian Food Processing Industry. J. Food Prod. Mark. 2014, 20, 164–178. [Google Scholar] [CrossRef]

- Ignjatijević, S.; Milojević, I.; Cvijanović, G.; Jandrić, M. Balance of Comparative Advantages in the Processed Food Sector of the Danube Countries. Sustainability 2015, 7, 6976–6993. [Google Scholar] [CrossRef]

- Rumankova, L.; Kuzmenko, E.; Benesova, I.; Smutka, L. Selected EU Countries Crop Trade Competitiveness from the Perspective of the Czech Republic. Agriculture 2022, 12, 127. [Google Scholar] [CrossRef]

- Buttinelli, R.; Cortignani, R.; Caracciolo, F. Irrigation Water Economic Value and Productivity: An Econometric Estimation for Maize Grain Production in Italy. Agric. Water Manag. 2024, 295, 108757. [Google Scholar] [CrossRef]

- Constantin, D.M.; Mincu, F.I.; Diaconu, D.C.; Burada, C.D.; Băltățeanu, E. Water Management in Wheat Farming in Romania: Simulating the Irrigation Requirements with the CROPWAT Model. Agronomy 2025, 15, 61. [Google Scholar] [CrossRef]

- Lamb, M.C.; Anderson, W.F.; Strickland, T.C.; Coffin, A.W.; Sorensen, R.B.; Knoll, J.E.; Pisani, O. Economic Competitiveness of Napier Grass in Irrigated and Non-Irrigated Georgia Coastal Plain Cropping Systems. Bioenerg. Res. 2018, 11, 574–582. [Google Scholar] [CrossRef]

- Sadjadi, E.N.; Fernández, R. Challenges and Opportunities of Agriculture Digitalization in Spain. Agronomy 2023, 13, 259. [Google Scholar] [CrossRef]

- Finco, A.; Bucci, G.; Belletti, M.; Bentivoglio, D. The Economic Results of Investing in Precision Agriculture in Durum Wheat Production: A Case Study in Central Italy. Agronomy 2021, 11, 1520. [Google Scholar] [CrossRef]

- Dinu, M.; Mănescu, C.O.; Spiridon, C.E.; Mogoş, L.; Ganea, O. The Competitiveness of Financial Support Measures in the Context of the Pandemic. Proc. Int. Conf. Bus. Excell. 2024, 18, 770–778. [Google Scholar] [CrossRef]

- Maslova, V.; Zaruk, N.; Fuchs, C.; Avdeev, M. Competitiveness of Agricultural Products in the Eurasian Economic Union. Agriculture 2019, 9, 61. [Google Scholar] [CrossRef]

- Turi, A.; Goncalves, G.; Mocan, M. Challenges and Competitiveness Indicators for the Sustainable Development of the Supply Chain in Food Industry. Procedia-Soc. Behav. Sci. 2014, 124, 133–141. [Google Scholar] [CrossRef]

- Remondino, M.; Zanin, A. Logistics and Agri-Food: Digitization to Increase Competitive Advantage and Sustainability. Literature Review and the Case of Italy. Sustainability 2022, 14, 787. [Google Scholar] [CrossRef]

- Andrei, J.V.; Chivu, L.; Constantin, M.; Subić, J. Economic Aspects of International Agricultural Trade and Possible Threats to Food Security in the EU-27: A Systematic Statistical Approach. In Shifting Patterns of Agricultural Trade: The Protectionism Outbreak and Food Security; Erokhin, V., Tianming, G., Andrei, J.V., Eds.; Springer: Singapore, 2021; pp. 229–261. ISBN 9789811632600. [Google Scholar]

- Brenes, E.R.; Ciravegna, L.; Acuña, J. Differentiation Strategies in Agribusiness—A Configurational Approach. J. Bus. Res. 2020, 119, 522–539. [Google Scholar] [CrossRef]

- Dixit, A. Strategic Aspects of Trade Policy. In Advances in Economic Theory: Fifth World Congress; Bewley, T.F., Ed.; Econometric Society Monographs; Cambridge University Press: Cambridge, UK, 1987; pp. 329–362. ISBN 978-0-521-38925-9. [Google Scholar]

- Zhai, L.; Xie, R.; Ma, D.; Liu, G.; Wang, P.; Li, S. Evaluation of Individual Competitiveness and the Relationship Between Competitiveness and Yield in Maize. Crop Sci. 2015, 55, 2307–2318. [Google Scholar] [CrossRef]

- Iqbal, N.; Khan, A.; Gill, A.S.; Abbas, Q. Nexus between Sustainable Entrepreneurship and Environmental Pollution: Evidence from Developing Economy. Environ. Sci. Pollut. Res. 2020, 27, 36242–36253. [Google Scholar] [CrossRef]

- Bennett, A.J.; Bending, G.D.; Chandler, D.; Hilton, S.; Mills, P. Meeting the Demand for Crop Production: The Challenge of Yield Decline in Crops Grown in Short Rotations. Biol. Rev. 2012, 87, 52–71. [Google Scholar] [CrossRef] [PubMed]

- Gutiérrez-Moya, E.; Adenso-Díaz, B.; Lozano, S. Analysis and Vulnerability of the International Wheat Trade Network. Food Sec. 2021, 13, 113–128. [Google Scholar] [CrossRef] [PubMed]

- Patarlageanu, S.R.; Dinu, M.; Diaconu, A.; Negescu, M.D.O. Ecological Agriculture and Its Role in Sustainable Development. Proc. Int. Conf. Bus. Excell. 2022, 16, 390–399. [Google Scholar] [CrossRef]

- Diaconeasa, M.C.; Zaharia, A.; Lădaru, G.R.; Mocanu, S. Bibliometric Analysis of Sustainable Food Systems. Amfiteatru Econ. J. 2024, 26, 1224–1240. [Google Scholar] [CrossRef]

- Gyarmati, G. Transformation of the Three Pillars of Agri-Food Sustainability around the COVID-19 Crisis—A Literature Review. Sustainability 2024, 16, 5616. [Google Scholar] [CrossRef]

- Cristea, M.; Noja, G.G.; Drăcea, R.M.; Iacobuță-Mihăiță, A.-O.; Dorożyński, T. ESG Investment Strategies and the Financial Performance of European Agricultural Companies: A New Modelling Approach. J. Bus. Econ. Manag. 2024, 25, 1283–1307. [Google Scholar] [CrossRef]

- Strat, V.A.; Trică, C.L.; Teodor, C.; Ignat, R.; Drăcea, R.M.; Petrescu, I.E.; Darie, F.C. Different Scenarios for the Development of the Circular Economy Based on the Deposit System—The Case of Romania. Econ. Comput. Econ. Cybern. Stud. Res. 2024, 58, 120–137. [Google Scholar] [CrossRef]

- Baylis, K.; Heckelei, T.; Hertel, T.W. Agricultural Trade and Environmental Sustainability. Annu. Rev. Resour. Econ. 2021, 13, 379–401. [Google Scholar] [CrossRef]

- Nowak, A.; Kasztelan, A. Economic Competitiveness vs. Green Competitiveness of Agriculture in the European Union Countries. Oeconomia Copernic. 2022, 13, 379–405. [Google Scholar] [CrossRef]

- Apetrei, A.; Toró, G.; Deaconu, E.-M. Exploring the Interaction between Energy Use in Agriculture and Food Production. In Geopolitical Perspectives and Technological Challenges for Sustainable Growth in the 21st Century; Sciendo: Bucharest, Romania, 2023; pp. 239–248. ISBN 978-83-67405-54-6. [Google Scholar]

- U.S. Environmental Protection Agency Understanding Global Warming Potentials. Available online: https://www.epa.gov/ghgemissions/understanding-global-warming-potentials (accessed on 20 January 2025).

- FAO. The Share of Agriculture in Total Greenhouse Gas Emissions. Global, Regional and Country Trends. Available online: https://openknowledge.fao.org/server/api/core/bitstreams/7fe33d41-3969-4f87-95c5-4b897229350b/content (accessed on 2 February 2025).

- Wang, X.; Qiang, W.; Niu, S.; Growe, A.; Yan, S.; Tian, N. Multi-Scenario Simulation Analysis of Grain Production and Demand in China during the Peak Population Period. Foods 2022, 11, 1566. [Google Scholar] [CrossRef]

- Mergos, G. Population and Food System Sustainability. In International Handbook of Population Policies; May, J.F., Goldstone, J.A., Eds.; Springer International Publishing: Cham, Switzerland, 2022; pp. 131–155. ISBN 978-3-031-02040-7. [Google Scholar]

- van Beek, C.L.; Meerburg, B.G.; Schils, R.L.M.; Verhagen, J.; Kuikman, P.J. Feeding the World’s Increasing Population While Limiting Climate Change Impacts: Linking N2O and CH4 Emissions from Agriculture to Population Growth. Environ. Sci. Policy 2010, 13, 89–96. [Google Scholar] [CrossRef]

- Deaconu, E.-M.; Pătărlăgeanu, S.R.; Petrescu, I.-E.; Dinu, M.; Sandu, A. An Outline of the Links between the Sustainable Development Goals and the Transformative Elements of Formulating a Fair Agri-Food Trade Policy—A Measurable EU Achievement. Proc. Int. Conf. Bus. Excell. 2023, 17, 1449–1462. [Google Scholar]

- European Commission. The European Green Deal. 2019. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52019DC0640 (accessed on 2 February 2025).

- FAOSTAT Crops and Livestock Products Database 2025. Available online: https://www.fao.org/faostat/ (accessed on 3 February 2025).

- International Trade Center Trade Map: Trade Statistics Database 2025. Available online: https://www.intracen.org/itc/market-info-tools/trade-statistics (accessed on 3 February 2025).

- Balassa, B. Trade Liberalisation and “Revealed” Comparative Advantage. Manch. Sch. 1965, 33, 99–123. [Google Scholar] [CrossRef]

- Min, K.; Mai, Q.; Zhang, X. Fast and Separable Estimation in High-Dimensional Tensor Gaussian Graphical Models. J. Comput. Graph. Stat. 2022, 31, 294–300. [Google Scholar] [CrossRef]

- Li, T.; Qian, C.; Levina, E.; Zhu, J. High-Dimensional Gaussian Graphical Models on Network-Linked Data. J. Mach. Learn. Res. 2020, 21, 1–45. [Google Scholar]

- Qiao, X.; Guo, S.; James, G.M. Functional Graphical Models. J. Am. Stat. Assoc. 2019, 114, 211–222. [Google Scholar] [CrossRef]

- Ngenoh, E.; Kurgat, B.K.; Bett, H.K.; Kebede, S.W.; Bokelmann, W. Determinants of the Competitiveness of Smallholder African Indigenous Vegetable Farmers in High-Value Agro-Food Chains in Kenya: A Multivariate Probit Regression Analysis. Agric. Econ. 2019, 7, 2. [Google Scholar] [CrossRef]

- Schiefer, J.; Hartmann, M. Determinants of Competitive Advantage for German Food Processors. Agribusiness 2008, 24, 306–319. [Google Scholar] [CrossRef]

- Tandra, H.; Suroso, A.I.; Syaukat, Y.; Najib, M. The Determinants of Competitiveness in Global Palm Oil Trade. Economies 2022, 10, 132. [Google Scholar] [CrossRef]

- Narayan, S.; Bhattacharya, P. Relative Export Competitiveness of Agricultural Commodities and Its Determinants: Some Evidence from India. World Dev. 2019, 117, 29–47. [Google Scholar] [CrossRef]

- Bahta, Y.T.; Mbai, S. Competitiveness of Namibia’s Agri-Food Commodities: Implications for Food Security. Resources 2023, 12, 34. [Google Scholar] [CrossRef]

- Vogels, L.; Mohammadi, R.; Schoonhoven, M.; Birbil, Ş.İ. Bayesian Structure Learning in Undirected Gaussian Graphical Models: Literature Review with Empirical Comparison. J. Am. Stat. Assoc. 2024, 119, 3164–3182. [Google Scholar] [CrossRef]

- Williams, D.R.; Mulder, J. Bayesian Hypothesis Testing for Gaussian Graphical Models: Conditional Independence and Order Constraints. J. Math. Psychol. 2020, 99, 102441. [Google Scholar] [CrossRef]

- Banerjee, O.; Ghaoui, L.E.; d’Aspremont, A.; Natsoulis, G. Convex Optimization Techniques for Fitting Sparse Gaussian Graphical Models. In Proceedings of the 23rd international conference on Machine learning—ICML ’06, Pittsburgh, PA, USA, 25–29 June 2006; ACM Press: New York, NY, USA, 2006; pp. 89–96. [Google Scholar]

- JASP Team Version 0.19.1. 2024. Available online: https://jasp-stats.org/faq/how-do-i-cite-jasp/ (accessed on 2 February 2025).

- Freeman, L.C. A Set of Measures of Centrality Based on Betweenness. Sociometry 1977, 40, 35–41. [Google Scholar] [CrossRef]

- Baldoni, E.; Esposti, R. Agricultural Productivity in Space: An Econometric Assessment Based on Farm-Level Data. Am. J. Agric. Econ. 2021, 103, 1525–1544. [Google Scholar] [CrossRef]

- Tran, D.; Vu, H.T.; Goto, D. Agricultural Land Consolidation, Labor Allocation and Land Productivity: A Case Study of Plot Exchange Policy in Vietnam. Econ. Anal. Policy 2022, 73, 455–473. [Google Scholar] [CrossRef]

- Villoria, N.B. Technology Spillovers and Land Use Change: Empirical Evidence from Global Agriculture. Am. J. Agric. Econ. 2019, 101, 870–893. [Google Scholar] [CrossRef]

- Chiarella, C.; Meyfroidt, P.; Abeygunawardane, D.; Conforti, P. Balancing the Trade-Offs between Land Productivity, Labor Productivity and Labor Intensity. Ambio 2023, 52, 1618–1634. [Google Scholar] [CrossRef]

- Khan, Z.; Badeeb, R.A.; Ali, S.; Bilan, Y.; Majewski, S. Land Productivity and Environmental Sustainability for G7 Economies: Does an Inverted U-Shaped Curve Exhibit Green Finance? Land Degrad. Dev. 2025, 36, 706–723. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Hoja, H.; Yu, P. Developing and Enhancing the Competitiveness of the Palestinian National Product: The Leather and Footwear Sector—Analysis and Evaluation of Government Interventions. Sustainability 2022, 14, 7745. [Google Scholar] [CrossRef]

- Fahy, J. A Resource-Based Analysis of Sustainable Competitive Advantage in a Global Environment. Int. Bus. Rev. 2002, 11, 57–77. [Google Scholar] [CrossRef]

- Jambor, A.; Gorton, M. Twenty Years of EU Accession: Learning Lessons from Central and Eastern European Agriculture and Rural Areas. Agric. Food Econ. 2025, 13, 1. [Google Scholar] [CrossRef]

- Radlińska, K. Changes in the Structure of Agriculture in Central and Eastern Europe in the Light of the European Green Deal. Sustainability 2025, 17, 104. [Google Scholar] [CrossRef]

- Georgescu, P.-L.; Barbuta-Misu, N.; Zlati, M.L.; Fortea, C.; Antohi, V.M. Quantifying the Performance of European Agriculture Through the New European Sustainability Model. Agriculture 2025, 15, 210. [Google Scholar] [CrossRef]

- Stephan, J. The Productivity Gap between East and West Europe: What Role for Sectoral Structures during Integration? Acta Oeconomica 2002, 52, 289–305. [Google Scholar] [CrossRef]

- Juchniewicz, M.; Łukiewska, K. Competitive Position of the Food Industry of the European Union on the Global Market. Acta Sci. Polonorum. Oeconomia 2015, 14, 63–72. [Google Scholar]

- Borbély, D. EU Export Specialization Patterns in Selected Accession Countries. In Structural Change and Exchange Rate Dynamics: The Economics of EU Eastern Enlargement; Welfens, P.J.J., Wziątek-Kubiak, A., Eds.; Springer: Berlin/Heidelberg, Germany, 2005; pp. 37–72. ISBN 978-3-540-28526-7. [Google Scholar]

- Matkovski, B.; Zekić, S.; Đokić, D.; Jurjević, Ž.; Đurić, I. Export Competitiveness of Agri-Food Sector during the EU Integration Process: Evidence from the Western Balkans. Foods 2022, 11, 10. [Google Scholar] [CrossRef]

- Zdráhal, I. The Revealed Comparative Advantage of Agri-Food Industries in Selected Countries in the Central and Eastern Europe: Gross-Versus Value-Added Trade Flows. AGRIS -Line Pap. Econ. Inform. 2024, 16, 135–150. [Google Scholar] [CrossRef]

- Doukas, Y.E.; Salvati, L.; Vardopoulos, I. Unraveling the European Agricultural Policy Sustainable Development Trajectory. Land 2023, 12, 1749. [Google Scholar] [CrossRef]

- Dupraz, P.; Guyomard, H. Environment and Climate in the Common Agricultural Policy. EuroChoices 2019, 18, 18–25. [Google Scholar] [CrossRef]

- Barral, S.; Detang-Dessendre, C. Reforming the Common Agricultural Policy (2023–2027): Multidisciplinary Views. Rev. Agric. Food Environ. Stud. 2023, 104, 47–50. [Google Scholar] [CrossRef]

- Pruitt, B.H. Self-Sufficiency and the Agricultural Economy of Eighteenth-Century Massachusetts. William Mary Q. 1984, 41, 334–364. [Google Scholar] [CrossRef]

- Andersén, J. Resource-based Competitiveness: Managerial Implications of the Resource-based View. Strateg. Dir. 2010, 26, 3–5. [Google Scholar] [CrossRef]

- Lockett, A.; Thompson, S.; Morgenstern, U. The Development of the Resource-Based View of the Firm: A Critical Appraisal. Int. J. Manag. Rev. 2009, 11, 9–28. [Google Scholar] [CrossRef]

- Mahoney, J.T.; Pandian, J.R. The Resource-Based View within the Conversation of Strategic Management. Strateg. Manag. J. 1992, 13, 363–380. [Google Scholar] [CrossRef]

- Auty, R.M. Resource-Based Industrialization: Sowing the Oil in Eight Developing Countries; Clarendon: Oxford, UK, 1990; ISBN 978-0-19-823299-5. [Google Scholar]

- Ross, M.L. The Political Economy of the Resource Curse. World Politics 1999, 51, 297–322. [Google Scholar]

- Esser, K.; Hillebrand, W.; Messner, D.; Meyer-Stamer, J. Systemic Competitiveness: New Governance Patterns for Industrial Development; Routledge: London, UK, 2013; ISBN 978-1-315-03646-5. [Google Scholar]

- Rosińska-Bukowska, M. Systemic Competitiveness—New Challenges for Enterprises in the 21st Century. Cent. Eur. Rev. Econ. Financ. 2016, 12, 5–19. [Google Scholar]

- Zhang, T.; Yang, J. Factors Influencing the Global Agricultural Trade: A Network Analysis. Agric. Econ./Zemědělská Ekon. 2023, 69, 343–357. [Google Scholar] [CrossRef]

- Zhou, F.; Wen, C. Research on the Evolution of the Spatial Association Network Structure and Driving Factors of China’s Agricultural Green Development. Agriculture 2024, 14, 683. [Google Scholar] [CrossRef]

- Wang, F.; Wu, L.; Zhang, F. Network Structure and Influencing Factors of Agricultural Science and Technology Innovation Spatial Correlation Network—A Study Based on Data from 30 Provinces in China. Symmetry 2020, 12, 1773. [Google Scholar] [CrossRef]

- Boafowaa Oppong, P.; Tweneboah, G. The Causal Relationship between Global Competitiveness and GVC Participation in Sub-Saharan Africa: A Network Approach. Res. Glob. 2023, 7, 100151. [Google Scholar] [CrossRef]

| Category | Indicators | Technical Notes | |

|---|---|---|---|

| A. | Factor endowments | A.1. Cereal harvested land | Measured in hectares |

| A.2. Cereal production volume | Measured in t (metric tons) | ||

| A.3. Cereal economic output | Measured in gross production value (constant 2014–2016 US$) | ||

| B. | Self-sufficiency and trade dependence | B.1. Self-sufficiency ratio | Computed as the ratio of cereal production (t) to the total domestic supply, defined as the sum of production (t) and imports (t) minus exports (t) |

| B.2. Self-sufficiency trade offset | Computed as the difference between cereal exports (t) and cereal imports (t) | ||

| B.3. Import dependency ratio | Computed as the ratio of cereal imports (t) to total domestic supply, defined as the sum of production (t) and imports (t) minus exports (t) | ||

| C. | Trade strategy | C.1. Strategic trade specialization ratio | Computed as the ratio of the Balassa index (RCA) for processed cereals to the Balassa index (RCA) for raw cereals |

| C.2. Value chain utilization ratio | Computed as the ratio of the export value of processed cereal products to the sum of the gross production value of raw cereals and their imports, minus their exports, all expressed in US$ | ||

| C.3. Value-added trade ratio | Computed as the ratio of the processed cereal exports and raw cereal exports in US$ | ||

| D. | Resource productivity | D.1. Land productivity in physical terms | Computed as the ratio of A.2 to A.1 (t per hectare) |

| D.2. Land productivity in monetary terms | Computed as the ratio of A.3 to A.1 (US$ per hectare) | ||

| D.3. Revenue per unit output | Computed as the ratio of A.3 to A.2 (US$ per t) | ||

| E. | Environmental impact | E.1. N2O emissions from crop residues per total cropland | Measured in kt (kilotons) per total cropland |

| E.2. N2O emissions from crop residues per cereal output | Measured in kt (kilotons) per t | ||

| E.3. N2O emissions from crop residues per economic output | Measured in kt (kilotons) per US$ | ||

| Network Property | Specification |

|---|---|

| Estimation method | EBICglasso |

| Tuning parameter (γ) | 0.1 |

| Number of nodes | 15 |

| Number of non-zero edges | 78/105 (74.2%) |

| Sparsity | 0.257 |

| Variable * | Network | |||

|---|---|---|---|---|

| Betweenness | Closeness | Strength | Expected Influence | |

| A.1 | −0.898 | −1.646 | −1.551 | −0.304 |

| A.2 | 0.125 | −1.011 | −0.637 | 0.83 |

| A.3 | −0.812 | −1.435 | −0.843 | 1.028 |

| B.1 | 1.744 | 1.639 | −0.012 | 0.189 |

| B.2 | 1.915 | 0.903 | 0.336 | −1.55 |

| B.3 | −0.898 | −0.406 | −0.96 | 0.315 |

| C.1 | 0.295 | 0.738 | −0.251 | −1.16 |

| C.2 | −0.898 | −0.688 | −1.358 | −1.565 |

| C.3 | 0.381 | 0.811 | 0.765 | 0.68 |

| D.1 | −0.898 | −0.231 | 0.387 | −0.467 |

| D.2 | 0.466 | 0.777 | 1.343 | 0.901 |

| D.3 | −0.898 | −0.711 | −0.19 | −0.777 |

| E.1 | 1.148 | 1.299 | 2.099 | −0.563 |

| E.2 | −0.898 | 0.081 | 0.735 | 0.755 |

| E.3 | 0.125 | −0.12 | 0.137 | 1.687 |

| Variable * | Network | |||

|---|---|---|---|---|

| Barrat | Onnela | WS | Zhang | |

| A.1 | −1.005 | −1.526 | −0.888 | 1.647 |

| A.2 | −2.08 | −1.805 | −0.202 | −0.415 |

| A.3 | −0.52 | −0.493 | 0.484 | −0.134 |

| B.1 | −0.209 | 0.529 | −1.009 | −0.239 |

| B.2 | 1.137 | 1.53 | 0.764 | 1.206 |

| B.3 | −0.52 | −0.651 | −1.391 | −1.376 |

| C.1 | 1.028 | 0.469 | 0.484 | 1.213 |

| C.2 | 0.098 | 0.527 | −0.919 | 0.712 |

| C.3 | −1.288 | −0.951 | 0.203 | −1.624 |

| D.1 | −0.079 | −0.351 | −1.231 | 0.52 |

| D.2 | 1.486 | 1.462 | 2.285 | 0.695 |

| D.3 | 0.285 | 1.079 | 1.045 | −0.232 |

| E.1 | 1.08 | 0.257 | 0.203 | −1.189 |

| E.2 | −0.167 | 0.298 | −0.358 | −0.917 |

| E.3 | 0.753 | −0.374 | 0.531 | 0.133 |

| Variable * | Network | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A.1 | A.2 | A.3 | B.1 | B.2 | B.3 | C.1 | C.2 | C.3 | D.1 | D.2 | D.3 | E.1 | E.2 | E.3 | |

| A.1 | 0.000 | 0.185 | 0.424 | 0.094 | −0.164 | 0.036 | 0.000 | 0.000 | 0.000 | −0.029 | −0.033 | 0.000 | 0.079 | −0.003 | 0.012 |

| A.2 | 0.185 | 0.000 | 0.776 | −0.035 | 0.233 | 0.023 | 0.000 | 0.000 | −0.052 | 0.036 | 0.010 | −0.002 | −0.046 | 0.000 | 0.000 |

| A.3 | 0.424 | 0.776 | 0.000 | 0.000 | 0.000 | 0.000 | 0.016 | 0.000 | 0.000 | 0.000 | 0.013 | 0.000 | −0.052 | 0.000 | 0.041 |

| B.1 | 0.094 | −0.035 | 0.000 | 0.000 | 0.294 | 0.363 | 0.000 | −0.228 | 0.075 | −0.007 | 0.000 | −0.130 | 0.318 | 0.076 | 0.011 |

| B.2 | −0.164 | 0.233 | 0.000 | 0.294 | 0.000 | 0.130 | −0.376 | −0.124 | 0.237 | 0.000 | 0.000 | −0.020 | −0.063 | −0.072 | −0.048 |

| B.3 | 0.036 | 0.023 | 0.000 | 0.363 | 0.130 | 0.000 | 0.019 | 0.130 | 0.015 | −0.115 | 0.126 | −0.081 | 0.147 | 0.095 | 0.000 |

| C.1 | 0.000 | 0.000 | 0.016 | 0.000 | −0.376 | 0.019 | 0.000 | −0.168 | 0.695 | −0.010 | 0.083 | 0.000 | −0.081 | 0.062 | −0.034 |

| C.2 | 0.000 | 0.000 | 0.000 | −0.228 | −0.124 | 0.130 | −0.168 | 0.000 | 0.209 | 0.123 | 0.000 | −0.036 | 0.073 | 0.040 | 0.000 |

| C.3 | 0.000 | −0.052 | 0.000 | 0.075 | 0.237 | 0.015 | 0.695 | 0.209 | 0.000 | −0.155 | 0.225 | 0.033 | −0.085 | −0.139 | 0.000 |

| D.1 | −0.029 | 0.036 | 0.000 | −0.007 | 0.000 | −0.115 | −0.010 | 0.123 | −0.155 | 0.000 | 0.496 | −0.128 | −0.184 | 0.498 | 0.000 |

| D.2 | −0.033 | 0.010 | 0.013 | 0.000 | 0.000 | 0.126 | 0.083 | 0.000 | 0.225 | 0.496 | 0.000 | 0.016 | −0.455 | 0.301 | 0.376 |

| D.3 | 0.000 | −0.002 | 0.000 | −0.130 | −0.020 | −0.081 | 0.000 | −0.036 | 0.033 | −0.128 | 0.016 | 0.000 | 0.082 | −0.194 | 0.842 |

| E.1 | 0.079 | −0.046 | −0.052 | 0.318 | −0.063 | 0.147 | −0.081 | 0.073 | −0.085 | −0.184 | −0.455 | 0.082 | 0.000 | 0.428 | 0.321 |

| E.2 | −0.003 | 0.000 | 0.000 | 0.076 | −0.072 | 0.095 | 0.062 | 0.040 | −0.139 | 0.498 | 0.301 | −0.194 | 0.428 | 0.000 | 0.000 |

| E.3 | 0.012 | 0.000 | 0.041 | 0.011 | −0.048 | 0.000 | −0.034 | 0.000 | 0.000 | 0.000 | 0.376 | 0.842 | 0.321 | 0.000 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Istudor, N.; Constantin, M.; Privitera, D.; Ignat, R.; Petrescu, I.-E.; Teodor, C. Systemic Competitiveness in the EU Cereal Value Chain: A Network Perspective for Policy Alignment. Land 2025, 14, 731. https://doi.org/10.3390/land14040731

Istudor N, Constantin M, Privitera D, Ignat R, Petrescu I-E, Teodor C. Systemic Competitiveness in the EU Cereal Value Chain: A Network Perspective for Policy Alignment. Land. 2025; 14(4):731. https://doi.org/10.3390/land14040731

Chicago/Turabian StyleIstudor, Nicolae, Marius Constantin, Donatella Privitera, Raluca Ignat, Irina-Elena Petrescu, and Cristian Teodor. 2025. "Systemic Competitiveness in the EU Cereal Value Chain: A Network Perspective for Policy Alignment" Land 14, no. 4: 731. https://doi.org/10.3390/land14040731

APA StyleIstudor, N., Constantin, M., Privitera, D., Ignat, R., Petrescu, I.-E., & Teodor, C. (2025). Systemic Competitiveness in the EU Cereal Value Chain: A Network Perspective for Policy Alignment. Land, 14(4), 731. https://doi.org/10.3390/land14040731