The Impact and Spatiotemporal Heterogeneity of Differentiated Industrial Land Supply Regarding Industrial Total Factor Productivity

Abstract

1. Introduction

2. Characteristics and Theoretical Analysis

2.1. Characteristics of DILS

2.2. Theoretical Analysis

2.2.1. Theoretical Framework

- (1)

- Positive impacts: With scale effects, differentiated supply spatially concentrates firms, reducing inter-firm transaction costs and logistics expenses, thereby enabling specialization and economies of scale [45]. Market competition further refines firm selection, reallocating resources toward high-productivity sectors [46,47]. With technological effects, reduced land costs free up capital for R&D investment in high-tech firms, accelerating technology spillovers and diffusion within agglomerated spaces [48]. Concurrently, competitive pressure compels traditional firms to undertake technological upgrades. With structural effects, differentiated pricing promotes industrial upgrading toward higher value-added activities, optimizes cross-sector resource allocation efficiency, and fosters a synergistic development pattern integrating traditional industry enhancement with emerging industry expansion [39]. Market mechanisms dynamically steer resources toward high-return fields.

- (2)

- Negative impacts: With scale effects, excessive administrative intervention may divert land resources toward connected yet inefficient relationship firms, distorting price signals and undermining the market’s screening function [49]. Subsidy-dependent zombie firms occupy land quotas, eroding potential scale economies from agglomeration. With technological effects, market distortions may distort technological upgrade pathways. Traditional firms facing elevated land costs curtail R&D expenditures, dampening innovation incentives [50]. High-tech firms, incentivized to retain policy benefits, may prioritize short-term imitative projects over fundamental innovation to secure subsidies or preferential land [51]. Over-suppression of traditional industries risks supply chain fragmentation, increasing production costs for high-tech firms and diminishing technology-driven TFP contributions. With structural effects, adverse selection may emerge where inefficient emerging firms acquire low-cost land through rent-seeking, while efficient traditional firms exit [40]. This not only directly lowers aggregate TFP but also disrupts regional industrial chain integrity, heightening vulnerability and industrial hollowing. Prolonged policy support for inefficient firms further diverts resources toward regulatory compliance rather than substantive innovation, reinforcing path dependency and creating structural bubbles [38].

2.2.2. Spatiotemporal Heterogeneity

3. Methodology and Data

3.1. Research Methodology

3.2. Variable Description and Data Sources

3.2.1. Variable Description

3.2.2. Data Sources

3.2.3. Research Sample

4. Results and Analysis

4.1. Spatiotemporal Evolution of Core Variables

4.1.1. Temporal Characteristic Analysis

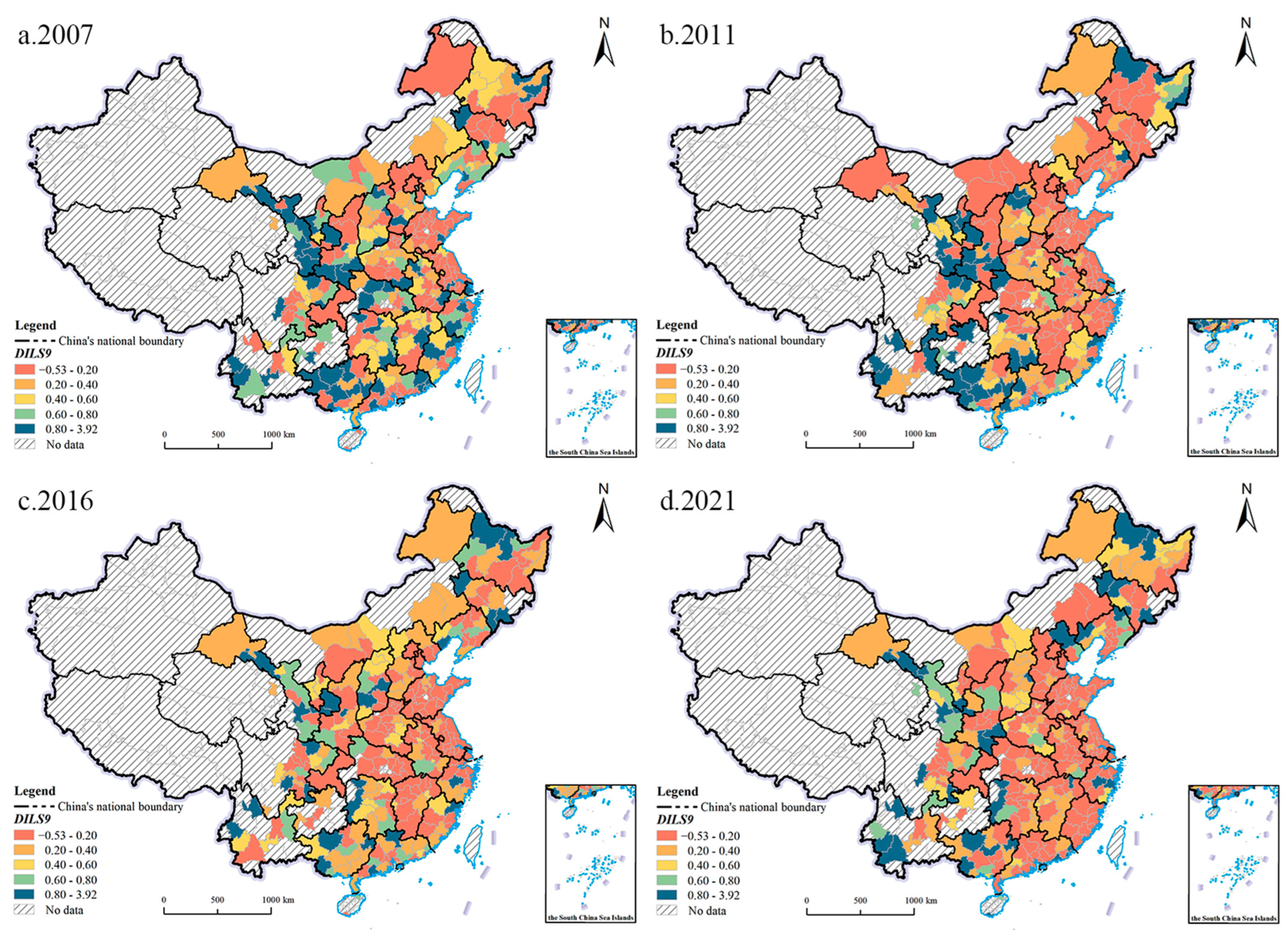

4.1.2. Spatial Characteristics Analysis

4.2. National-Level Effects

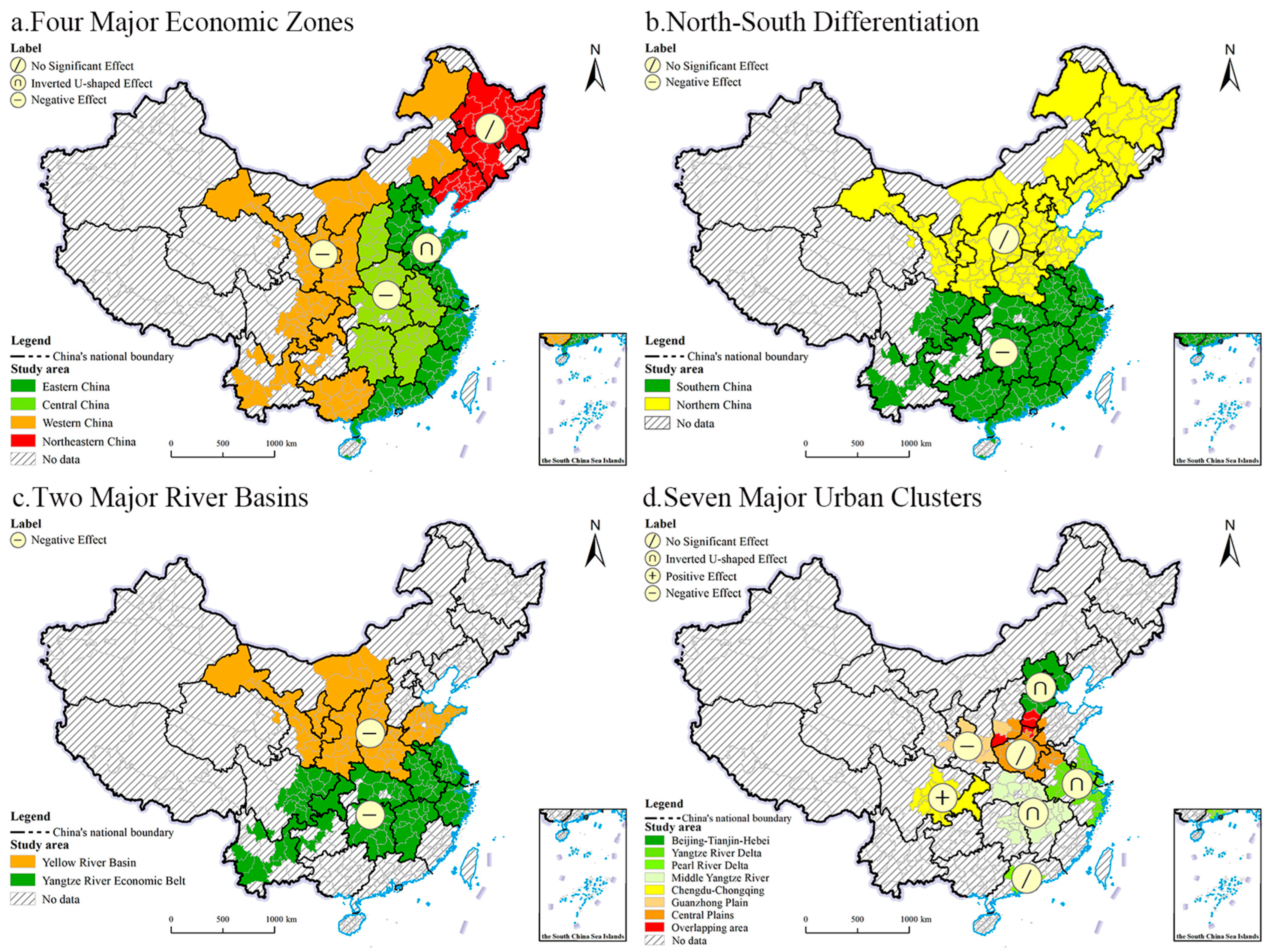

4.3. Spatiotemporal Heterogeneity Effects

5. Conclusions and Recommendations

5.1. Conclusions

5.2. Recommendations

5.3. Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Luckstead, J.; Choi, S.M.; Devadoss, S.; Mittelhammer, R.C. China’s catch-up to the US economy: Decomposing TFP through investment-specific technology and human capital. Appl. Econ. 2014, 46, 3995–4007. [Google Scholar] [CrossRef]

- Calcagnini, G.; Giombini, G.; Travaglini, G. The productivity gap among major european countries, USA and japan. Ital. Econ. J. 2021, 7, 59–78. [Google Scholar] [CrossRef]

- Yao, S.; Li, H.; Deng, Z. The impact of land leasing strategies on industrial green total factor productivity: Insights from Chinese cities. Land Use Policy 2025, 156, 107607. [Google Scholar] [CrossRef]

- Xie, R.; Yao, S.; Han, F.; Zhang, Q. Does misallocation of land resources reduce urban green total factor productivity? An analysis of city-level panel data in China. Land Use Policy 2022, 122, 106353. [Google Scholar] [CrossRef]

- Song, M.; Peng, C.; Liu, G.; Du, A.M.; Boateng, A. The impact of industrial land prices and regional strategical interactions on environmental pollution in China. Int. Rev. Financ. Anal. 2025, 98, 103921. [Google Scholar] [CrossRef]

- Du, W.; Li, M. The impact of land resource mismatch and land marketization on pollution emissions of industrial enterprises in China. J. Environ. Manag. 2021, 299, 113565. [Google Scholar] [CrossRef]

- Wang, C.; Huang, J. Research on the competition strategy of local governments’ differentiated land leasing for investment attraction: Evidence from micro-level land transactions. J. China Univ. Geosci. Soc. Sci. Ed. 2021, 21, 124–136. (In Chinese) [Google Scholar]

- Wang, C.; Huang, J.; Zou, W. Selective land supply, industrial structure adjustment and urban innovation. China Land Sci. 2021, 35, 24–32. (In Chinese) [Google Scholar]

- Yang, Y.; Wu, Q.; Wang, J. Impact of local governments’ differentiated land pricing on industrial green development in the Yangtze River Delta: From both global and local perspectives. China Land Sci. 2023, 37, 51–61. (In Chinese) [Google Scholar]

- Heresi, R. Reallocation and productivity in resource-rich economies. J. Int. Econ. 2023, 145, 103843. [Google Scholar] [CrossRef]

- Aoki, S. A simple accounting framework for the effect of resource misallocation on aggregate productivity. J. Jpn. Int. Econ. 2012, 26, 473–494. [Google Scholar] [CrossRef]

- Vollrath, D. How important are dual economy effects for aggregate productivity? J. Dev. Econ. 2009, 88, 325–334. [Google Scholar] [CrossRef] [PubMed]

- Britos, B.; Hernandez, M.A.; Robles, M.; Trupkin, D.R. Land market distortions and aggregate agricultural productivity: Evidence from Guatemala. J. Dev. Econ. 2022, 155, 102787. [Google Scholar] [CrossRef]

- Espinoza, M.; Escobal, J. The impact of Peru’s land reform on national agricultural productivity: A synthetic control study. Land Use Policy 2025, 157, 107619. [Google Scholar] [CrossRef]

- Ryzhenkov, M. Resource misallocation and manufacturing productivity: The case of Ukraine. J. Comp. Econ. 2016, 44, 41–55. [Google Scholar] [CrossRef]

- Hsieh, C.T.; Klenow, P.J. Misallocation and manufacturing TFP in China and India. Q. J. Econ. 2009, 124, 1403–1448. [Google Scholar] [CrossRef]

- Wang, Y.; Lei, X.; Yang, F.; Zhao, N. Financial friction, resource misallocation and total factor productivity: Theory and evidence from China. J. Appl. Econ. 2021, 24, 393–408. [Google Scholar] [CrossRef]

- Shi, G.; Li, H. Government-led resource allocation and firm productivity: Evidence from a quasi-natural experiment. Pac.-Basin Financ. J. 2025, 90, 102638. [Google Scholar]

- Dheera-Aumpon, S. Misallocation and manufacturing TFP in ThaiLand. Asian-Pac. Econ. Lit. 2014, 28, 63–76. [Google Scholar] [CrossRef]

- Tang, B.-S.; Ho, W.K. Land-use planning and market adjustment under de-industrialization: Restructuring of industrial space in Hong Kong. Land Use Policy 2015, 43, 28–36. [Google Scholar]

- Adams, C.; Russell, L.; Taylor-Russell, C. Market Activity and Industrial Development. Urban Stud. 1995, 32, 471–489. [Google Scholar] [CrossRef]

- Adams, D.; Russell, L.; Taylor-Russell, C. Land for Industrial Development; Taylor & Francis: Abingdon, UK, 2021. [Google Scholar]

- Kim, K.S.; Gallent, N. Industrial land planning and development in South Korea: Current problems and future directions. Third World Plan. Rev. 2000, 22, 289. [Google Scholar] [CrossRef]

- Howland, M. Planning for industry in a post-industrial world: Assessing industrial land in a suburban economy. J. Am. Plan. Assoc. 2010, 77, 39–53. [Google Scholar] [CrossRef]

- Leigh, N.G.; Hoelzel, N.Z. Smart growth’s blind side: Sustainable cities need productive urban industrial Land. J. Am. Plan. Assoc. 2012, 78, 87–103. [Google Scholar] [CrossRef]

- Feng, Y.; Wang, J.; Shao, Z.; Yang, L.; Zhu, Q.; Wu, Q. Impact of urban industrial land spatial misallocation on industrial total factor productivity in China. Resour. Sci. 2022, 44, 2511–2524. (In Chinese) [Google Scholar]

- Sun, H.; Guo, G.; Peng, S.; Wang, J. Impact and mechanism of the standard land supply model on urban green total factor productivity: Empirical evidence from a PSM-DID approach. China Land Sci. 2023, 37, 56–66. (In Chinese) [Google Scholar]

- Sun, H.; Chen, J.; Wu, Y.; Wu, Y. Land use tournaments and urban green total factor productivity: Evidence from the reform in China. Econ. Anal. Policy 2025, 86, 794–811. [Google Scholar] [CrossRef]

- Nie, L.; Ren, Z.; Wu, Y.; Luo, Q. Urban industrial land misallocation and green total factor productivity: Evidence from China’s Yellow River Basin regions. Aust. Econ. Pap. 2024, 63, 646–666. [Google Scholar] [CrossRef]

- Hu, J.; Liang, J.; Fang, J.; He, H.; Chen, F. How do industrial land price and environmental regulations affect spatiotemporal variations of pollution-intensive industries? Regional analysis in China. J. Clean. Prod. 2022, 333, 130035. [Google Scholar] [CrossRef]

- Zhou, L.; Tian, L.; Cao, Y.; Yang, L. Industrial land supply at different technological intensities and its contribution to economic growth in China: A case study of the Beijing-Tianjin-Hebei region. Land Use Policy 2021, 101, 105087. [Google Scholar] [CrossRef]

- Huang, Z.; Du, X. Strategic interaction in local governments’ industrial land supply: Evidence from China. Urban. Stud. 2016, 54, 1328–1346. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, X.; Skitmore, M.; Song, Y.; Hui, E.C.M. Industrial land price and its impact on urban growth: A Chinese case study. Land Use Policy 2014, 36, 199–209. [Google Scholar] [CrossRef]

- Liu, H. Policy evolution, key problems and reform path of market-oriented allocation of industrial land. Reform Econ. Syst. 2023, 3, 99–107. (In Chinese) [Google Scholar]

- Li, Z.; Lv, B. Total factor productivity of Chinese industrial firms: Evidence from 2007 to 2017. Appl. Econ. 2021, 53, 6910–6926. [Google Scholar] [CrossRef]

- Liu, Z.; He, Y.; Gong, Y. How regional urban land misallocation impedes green technological progress: Cost effects and spatial strategic interaction. Sustain. Futures 2025, 10, 101471. [Google Scholar] [CrossRef]

- Xi, Q.; Mei, L. How did development zones affect China’s land transfers? The scale, marketization, and resource allocation effect. Land Use Policy 2022, 119, 106181. [Google Scholar] [CrossRef]

- Huang, Z.; Li, H.; Song, M.; Ma, L. Intersecting sustainability and governance: The impact of industrial land price distortion on carbon emission efficiency in China. Appl. Geogr. 2025, 176, 103510. [Google Scholar] [CrossRef]

- Peng, S.; Wang, J.; Sun, H.; Guo, Z. How does the spatial misallocation of land resources affect urban industrial transformation and upgrading? Evidence from China. Land 2022, 11, 1630. [Google Scholar] [CrossRef]

- Acemoglu, D.; Golosov, M.; Tsyvinski, A. Markets Versus Governments: Political Economy of Mechanisms; National Bureau of Economic Research, Inc.: Cambridge, UK, 2006; p. 12224. [Google Scholar]

- Evans, A.W. Chapter 42 the land market and government intervention. In Handbook of Regional and Urban Economics; Elsevier: Amsterdam, The Netherlands, 1999; Volume 3, pp. 1637–1669. [Google Scholar]

- Tian, W.; Wang, Z.; Zhang, Q. Land allocation and industrial agglomeration: Evidence from the 2007 reform in China. J. Dev. Econ. 2024, 171, 103351. [Google Scholar] [CrossRef]

- Datta-Chaudhuri, M. Market failure and government failure. J. Econ. Perspect. 1990, 4, 25–39. [Google Scholar] [CrossRef]

- Kumari, R.D.T.S.; Chen, S.X.; Li, B.; Tang, S.H.K. Can land misallocation be a greater barrier to development than capital? Evidence from manufacturing firms in Sri Lanka. Econ. Model. 2023, 126, 106368. [Google Scholar] [CrossRef]

- Lin, S.; Ben, T. Impact of government and industrial agglomeration on industrial land prices: A Taiwanese case study. Habitat. Int. 2009, 33, 412–418. [Google Scholar] [CrossRef]

- Zhang, L.; Zhao, Y.; Liu, Y.; Qian, J. Does the land price subsidy still exist against the background of market reform of industrial land? Land 2021, 10, 963. [Google Scholar] [CrossRef]

- Lin, Y.; Qin, Y.; Yang, Y.; Zhu, H. Can price regulation increase land-use intensity? Evidence from China’s industrial land market. Reg. Sci. Urban. Econ. 2020, 81, 103501. [Google Scholar] [CrossRef]

- Guo, L.; Liu, Y.; Jiang, Z.; Yuan, X.; Jing, Q. Impact of land prices on corporate carbon emission intensity. Sci. Rep. 2025, 15, 3632. [Google Scholar] [CrossRef] [PubMed]

- Tian, L.; Ma, W. Government intervention in city development of China: A tool of land supply. Land Use Policy 2009, 26, 599–609. [Google Scholar] [CrossRef]

- Wang, J.; Peng, S.; Yan, S.; Guo, G.; Wu, Q. Impact of chinese local government-led construction land supply strategies on urban innovation and its spatiotemporal differences. China World Econ. 2023, 31, 161–189. [Google Scholar] [CrossRef]

- Qi, Y.; Lin, R.; Zhu, D. Impact of rising industrial land prices on land-use efficiency in China: A study of underpriced land price. Land Use Policy 2025, 151, 107490. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, Y.; Chen, W.; Zhou, X.; Zhao, M.; Zhang, B. Do land price variation and environmental regulation improve chemical industrial agglomeration? A regional analysis in China. Land Use Policy 2020, 94, 104568. [Google Scholar] [CrossRef]

- Cheng, J.; Zhao, J.; Zhu, D.; Jiang, X.; Zhang, H.; Zhang, Y. Land marketization and urban innovation capability: Evidence from China. Habitat. Int. 2022, 122, 102540. [Google Scholar]

- Yang, H.; Chen, C.; Li, J.; Li, M.; Sieber, S.; Long, K. How does the concentration of spatial allocation of urban construction land across cities affect carbon emission intensity in China? Ecol. Indic. 2025, 170, 113136. [Google Scholar] [CrossRef]

- Elhorst, J.P. Matlab software for spatial panels. Int. Reg. Sci. Rev. 2014, 37, 389–405. [Google Scholar] [CrossRef]

- Lampe, H.W.; Hilgers, D. Trajectories of efficiency measurement: A bibliometric analysis of DEA and SFA. Eur. J. Oper. Res. 2015, 240, 1–21. [Google Scholar] [CrossRef]

- Tian, X.; Yu, X. The Enigmas of TFP in China: A meta-analysis. China Econ. Rev. 2012, 23, 396–414. [Google Scholar] [CrossRef]

- Lu, X.; Jiang, X.; Gong, M. How land transfer marketization influence on green total factor productivity from the approach of industrial structure? Evidence from China. Land Use Policy 2020, 95, 104610. [Google Scholar] [CrossRef]

- Wang, M.; Shen, H.; Xin, Z.; Pan, Y. Trust and land Lease: The role of informal institutions in land market in rural China. Habitat. Int. 2025, 164, 103521. [Google Scholar] [CrossRef]

- Liu, L.; Yang, Y.; Liu, S.; Gong, X.; Zhao, Y.; Jin, R.; Duan, H.; Jiang, P. A comparative study of green growth efficiency in Yangtze River Economic Belt and Yellow River Basin between 2010 and 2020. Ecol. Indic. 2023, 150, 110214. [Google Scholar] [CrossRef]

- Chen, Q.; Zheng, L.; Wang, Y.; Wu, D.; Li, J. A comparative study on urban land use eco-efficiency of Yangtze and Yellow rivers in China: From the perspective of spatiotemporal heterogeneity, spatial transition and driving factors. Ecol. Indic. 2023, 151, 110331. [Google Scholar] [CrossRef]

- Li, L.; Ma, S.; Zheng, Y.; Xiao, X. Integrated regional development: Comparison of urban agglomeration policies in China. Land Use Policy 2022, 114, 105939. [Google Scholar] [CrossRef]

- Zhang, W.; Wang, B.; Wang, J.; Wu, Q.; Wei, Y.D. How does industrial agglomeration affect urban land use efficiency? A spatial analysis of Chinese cities. Land Use Policy 2022, 119, 106178. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Measurement | Mean | Std. Dev. | Min | Max | Obs. | |

|---|---|---|---|---|---|---|---|---|

| Dependent Variable | ITFP (ITFP) | Estimated via Stochastic Frontier Analysis (SFA) | 0.875 | 0.314 | 0.134 | 1.937 | 4230 | |

| Core Explanatory Variable | Differentiated Industrial Land Supply (DILS) | Industry-specific land price gap per unit area divided by regional GDP | DILS3 | 0.672 | 0.753 | −0.580 | 3.916 | 4230 |

| DILS9 | 0.410 | 0.643 | −0.539 | 3.421 | 4230 | |||

| Control Variables | Economic Development Level (EDL) | GDP per capita (10 k CNY/person) | 10.542 | 0.675 | 8.599 | 11.979 | 4230 | |

| Industrial Structure (IS) | Secondary industry output/tertiary industry output | 1.266 | 0.589 | 0.308 | 3.817 | 4230 | ||

| Population Density (PD) | Year-end resident population/administrative area (km2) | 0.043 | 0.031 | 0.000 | 0.153 | 4230 | ||

| Fiscal Self-Sufficiency Rate (FSR) | Local general public budget revenue/expenditure | 0.458 | 0.223 | 0.090 | 1.024 | 4230 | ||

| Science and Technology Expenditure (STE) | Urban science expenditure/total local general public budget expenditure (%) | 0.016 | 0.014 | 0.001 | 0.076 | 4230 | ||

| Financial Development Level (FD) | Year-end financial institution loan balances/regional GDP | 9.018 | 0.519 | 0.000 | 10.346 | 4230 | ||

| Informatization Level (IL) | Number of broadband internet subscribers (10 k households/city) | 3.855 | 1.110 | 0.833 | 6.469 | 4230 | ||

| Spatial Weight Matrix | Variables | Moran’s I | E(I) | sd(I) | z | p-Value |

|---|---|---|---|---|---|---|

| Adjacency Matrix | ITFP | 0.644 | −0.004 | 0.040 | 16.215 | 0.000 |

| DILS3 | 0.248 | −0.004 | 0.040 | 6.327 | 0.000 | |

| Geographic Distance Matrix | ITFP | −0.051 | −0.004 | 0.002 | −21.390 | 0.000 |

| DILS3 | −0.047 | −0.004 | 0.002 | −19.865 | 0.000 | |

| Economic Distance Matrix | ITFP | 0.041 | −0.004 | 0.032 | 1.372 | 0.085 |

| DILS3 | 0.137 | −0.004 | 0.032 | 4.376 | 0.000 | |

| Nested Geo-Economic Matrix | ITFP | 0.147 | −0.004 | 0.027 | 5.623 | 0.000 |

| DILS3 | 0.265 | −0.004 | 0.027 | 10.052 | 0.000 |

| Variable | Dep. Var: ITFP (ITFP) | |||||||

|---|---|---|---|---|---|---|---|---|

| Adjacency | Geog. Dist. | Econ. Dist. | Nested | Adjacency | Geog. Dist. | Econ. Dist. | Nested | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| DILS3 | −0.0120 ** | −0.0127 *** | −0.0124 ** | −0.0126 *** | ||||

| (0.0048) | (0.0049) | (0.0048) | (0.0048) | |||||

| DILS9 | −0.0186 *** | −0.0197 *** | −0.0184 *** | −0.0188 *** | ||||

| (0.0057) | (0.0058) | (0.0058) | (0.0058) | |||||

| EDL | −0.0212 | −0.0173 | −0.0179 | −0.0094 | −0.0218 | −0.0176 | −0.0174 | −0.0093 |

| (0.0209) | (0.0190) | (0.0177) | (0.0202) | (0.0209) | (0.0190) | (0.0177) | (0.0202) | |

| IS | 0.0047 | 0.0072 | 0.0094 | 0.0072 | 0.0040 | 0.0066 | 0.0086 | 0.0064 |

| (0.0096) | (0.0092) | (0.0089) | (0.0092) | (0.0096) | (0.0092) | (0.0089) | (0.0092) | |

| PD | 1.4293 * | 1.7568 ** | 1.9690 *** | 1.9056 ** | 1.4411 * | 1.7657 ** | 1.9718 *** | 1.9113 ** |

| (0.7974) | (0.7814) | (0.7433) | (0.7786) | (0.7970) | (0.7809) | (0.7427) | (0.7782) | |

| FSR | 0.0180 | −0.0028 | −0.0120 | −0.0037 | 0.0169 | −0.0047 | −0.0131 | −0.0051 |

| (0.0403) | (0.0385) | (0.0369) | (0.0374) | (0.0403) | (0.0386) | (0.0369) | (0.0373) | |

| STE | 0.2530 | 0.4091 | 0.5558 # | 0.5057 | 0.2478 | 0.4011 | 0.5472 # | 0.4950 |

| (0.3927) | (0.3852) | (0.3627) | (0.3714) | (0.3926) | (0.3849) | (0.3625) | (0.3712) | |

| FD | −0.0021 | −0.0021 | −0.0013 | −0.0002 | −0.0024 | −0.0027 | −0.0017 | −0.0007 |

| (0.0104) | (0.0104) | (0.0103) | (0.0105) | (0.0104) | (0.0104) | (0.0103) | (0.0105) | |

| IL | −0.0035 | −0.0034 | −0.0025 | −0.0015 | −0.0036 | −0.0034 | −0.0024 | −0.0016 |

| (0.0060) | (0.0060) | (0.0057) | (0.0058) | (0.0060) | (0.0060) | (0.0057) | (0.0058) | |

| W × DILS3 | −0.0010 | −0.0164 | 0.0029 | 0.0063 | ||||

| (0.0094) | (0.1567) | (0.0132) | (0.0141) | |||||

| W × DILS9 | 0.0071 | −0.1271 | −0.0062 | −0.0075 | ||||

| (0.0114) | (0.2122) | (0.0152) | (0.0175) | |||||

| W × Control Variables | YES | YES | YES | YES | YES | YES | YES | YES |

| Spatial-rho | −0.0148 | −0.7444 ** | 0.0016 | −0.0072 | −0.0141 | −0.7331 ** | 0.0006 | −0.0093 |

| (0.0233) | (0.3006) | (0.0280) | (0.0334) | (0.0233) | (0.3018) | (0.0280) | (0.0334) | |

| Variance-sigma2_e | 0.0205 *** | 0.0205 *** | 0.0205 *** | 0.0205 *** | 0.0205 *** | 0.0204 *** | 0.0205 *** | 0.0205 *** |

| (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | |

| N | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 |

| R2 | 0.0426 | 0.0656 | 0.0033 | 0.0016 | 0.0415 | 0.0676 | 0.0045 | 0.0027 |

| Loglikelihood | 2221.5921 | 2220.3373 | 2218.0504 | 2217.2880 | 2223.9089 | 2222.7190 | 2220.0130 | 2219.4047 |

| Variable | Dep. Var: ITFP (ITFP) | |||||||

|---|---|---|---|---|---|---|---|---|

| Adjacency | Geog. Dist. | Econ. Dist. | Nested | Adjacency | Geog. Dist. | Econ. Dist. | Nested | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| L.DILS3 | −0.0111 # | −0.0112 # | −0.0117 * | −0.0120 * | ||||

| (0.0068) | (0.0069) | (0.0068) | (0.0068) | |||||

| L.DILS9 | −0.0136 ** | −0.0128 ** | −0.0143 ** | −0.0145 ** | ||||

| (0.0063) | (0.0064) | (0.0063) | (0.0063) | |||||

| EDL | −0.0215 | −0.0174 | −0.0179 | −0.0089 | −0.0166 | −0.0200 | −0.0257 # | −0.0315 * |

| (0.0210) | (0.0190) | (0.0177) | (0.0202) | (0.0185) | (0.0168) | (0.0164) | (0.0190) | |

| IS | 0.0046 | 0.0068 | 0.0091 | 0.0067 | 0.0037 | 0.0050 | 0.0097 | 0.0110 |

| (0.0096) | (0.0092) | (0.0089) | (0.0092) | (0.0102) | (0.0097) | (0.0095) | (0.0100) | |

| PD | 1.4275 * | 1.7520 ** | 1.9637 *** | 1.8969 ** | 0.7930 | 0.6453 | 1.2598 | 1.3422 # |

| (0.7974) | (0.7815) | (0.7433) | (0.7786) | (0.9482) | (0.9517) | (0.9064) | (0.9323) | |

| FSR | 0.0182 | −0.0030 | −0.0122 | −0.0044 | 0.0171 | 0.0101 | −0.0028 | 0.0041 |

| (0.0403) | (0.0386) | (0.0369) | (0.0374) | (0.0381) | (0.0363) | (0.0347) | (0.0352) | |

| STE | 0.2567 | 0.4215 | 0.5592 # | 0.5119 | 0.2869 | 0.3515 | 0.6399 # | 0.6646 * |

| (0.3930) | (0.3854) | (0.3633) | (0.3719) | (0.4260) | (0.4204) | (0.3926) | (0.4004) | |

| FD | −0.0021 | −0.0017 | −0.0012 | −0.0001 | −0.0010 | −0.0006 | −0.0028 | −0.0030 |

| (0.0104) | (0.0104) | (0.0103) | (0.0105) | (0.0098) | (0.0097) | (0.0096) | (0.0099) | |

| IL | −0.0035 | −0.0037 | −0.0025 | −0.0016 | −0.0018 | −0.0017 | −0.0011 | 0.0000 |

| (0.0060) | (0.0060) | (0.0057) | (0.0058) | (0.0058) | (0.0058) | (0.0054) | (0.0055) | |

| W × L.DLPS3 | −0.0063 | 0.1853 | 0.0097 | 0.0193 | ||||

| (0.0136) | (0.2804) | (0.0183) | (0.0205) | |||||

| W × L.DLPS9 | −0.0059 | 0.2798 | 0.0014 | 0.0064 | ||||

| (0.0126) | (0.2501) | (0.0167) | (0.0189) | |||||

| W × Control Variables | YES | YES | YES | YES | YES | YES | YES | YES |

| Spatial-rho | −0.0150 | −0.7327 ** | 0.0012 | −0.0071 | −0.0103 | −0.7353 ** | 0.0024 | −0.0063 |

| (0.0233) | (0.3009) | (0.0280) | (0.0334) | (0.0231) | (0.2995) | (0.0281) | (0.0337) | |

| Variance-sigma2_e | 0.0205 *** | 0.0205 *** | 0.0205 *** | 0.0205 *** | 0.0171 *** | 0.0170 *** | 0.0171 *** | 0.0171 *** |

| (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | |

| N | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 |

| R2 | 0.0424 | 0.0581 | 0.0035 | 0.0016 | 0.0339 | 0.0288 | 0.0062 | 0.0069 |

| Loglikelihood | 2221.7481 | 2220.7353 | 2218.1984 | 2217.6730 | 2603.8868 | 2607.9854 | 2605.5752 | 2604.8284 |

| Variable | Dep. Var: ITFP (ITFP) | |||||||

|---|---|---|---|---|---|---|---|---|

| Adjacency | Geog. Dist. | Econ. Dist. | Nested | Adjacency | Geog. Dist. | Econ. Dist. | Nested | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| DILS3 | −0.0103 # | −0.0098 | −0.0110 # | −0.0110 # | ||||

| (0.0071) | (0.0072) | (0.0071) | (0.0071) | |||||

| DILS32 | −0.0073 # | −0.0079 * | −0.0068 # | −0.0070 # | ||||

| (0.0045) | (0.0045) | (0.0045) | (0.0045) | |||||

| DILS9 | −0.0126 * | −0.0118 # | −0.0134 * | −0.0135 * | ||||

| (0.0072) | (0.0073) | (0.0072) | (0.0072) | |||||

| DILS92 | −0.0051 * | −0.0058 * | −0.0047 # | −0.0049 # | ||||

| (0.0030) | (0.0030) | (0.0030) | (0.0030) | |||||

| EDL | −0.0175 | −0.0200 | −0.0258 # | −0.0308 # | −0.0172 | −0.0205 | −0.0260 # | −0.0312 # |

| (0.0185) | (0.0168) | (0.0164) | (0.0190) | (0.0185) | (0.0168) | (0.0164) | (0.0190) | |

| IS | 0.0040 | 0.0056 | 0.0093 | 0.0103 | 0.0037 | 0.0054 | 0.0092 | 0.0104 |

| (0.0102) | (0.0097) | (0.0095) | (0.0100) | (0.0102) | (0.0097) | (0.0095) | (0.0100) | |

| PD | 0.8094 | 0.6399 | 1.2380 | 1.3221 | 0.8007 | 0.6464 | 1.2516 | 1.3325 |

| (0.9480) | (0.9520) | (0.9062) | (0.9320) | (0.9480) | (0.9518) | (0.9063) | (0.9321) | |

| FSR | 0.0170 | 0.0088 | −0.0042 | 0.0027 | 0.0173 | 0.0092 | −0.0039 | 0.0027 |

| (0.0381) | (0.0363) | (0.0347) | (0.0351) | (0.0381) | (0.0363) | (0.0347) | (0.0352) | |

| STE | 0.2802 | 0.3468 | 0.6609 * | 0.6926 * | 0.2777 | 0.3408 | 0.6502 * | 0.6800 * |

| (0.4257) | (0.4206) | (0.3922) | (0.4001) | (0.4257) | (0.4204) | (0.3923) | (0.4002) | |

| FD | −0.0011 | −0.0004 | −0.0025 | −0.0026 | −0.0013 | −0.0005 | −0.0027 | −0.0028 |

| (0.0098) | (0.0097) | (0.0096) | (0.0099) | (0.0098) | (0.0097) | (0.0096) | (0.0099) | |

| IL | −0.0020 | −0.0012 | −0.0011 | −0.0001 | −0.0019 | −0.0012 | −0.0011 | −0.0000 |

| (0.0058) | (0.0058) | (0.0054) | (0.0055) | (0.0058) | (0.0058) | (0.0054) | (0.0055) | |

| W × DILS3 | −0.0144 | 0.2048 | 0.0209 | 0.0342 # | ||||

| (0.0148) | (0.3547) | (0.0189) | (0.0219) | |||||

| W × DILS32 | 0.0105 | −0.1240 | −0.0180 # | −0.0237 * | ||||

| (0.0093) | (0.1776) | (0.0121) | (0.0136) | |||||

| W × DILS9 | −0.0112 | 0.2706 | 0.0129 | 0.0239 | ||||

| (0.0148) | (0.3227) | (0.0191) | (0.0221) | |||||

| W × DILS92 | 0.0046 | −0.1211 | −0.0077 | −0.0096 | ||||

| (0.0060) | (0.1157) | (0.0083) | (0.0089) | |||||

| W × Control Variables | YES | YES | YES | YES | YES | YES | YES | YES |

| Spatial-rho | −0.0101 | −0.7879 *** | 0.0010 | −0.0079 | −0.0103 | −0.7760 *** | 0.0014 | −0.0074 |

| (0.0231) | (0.2992) | (0.0281) | (0.0337) | (0.0231) | (0.2997) | (0.0281) | (0.0337) | |

| Variance-sigma2_e | 0.0171 *** | 0.0170 *** | 0.0171 *** | 0.0171 *** | 0.0171 *** | 0.0170 *** | 0.0171 *** | 0.0171 *** |

| (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0004) | |

| N | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 | 4230.0000 |

| R2 | 0.0337 | 0.0498 | 0.0066 | 0.0075 | 0.0339 | 0.0456 | 0.0069 | 0.0078 |

| Loglikelihood | 2604.8464 | 2607.3459 | 2607.0360 | 2606.6422 | 2604.8302 | 2607.9924 | 2606.6250 | 2606.0215 |

| Variables | Linear Model | Quadratic Model | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Adjacency | Geog. Dist. | Econ. Dist. | Nested | Adjacency | Geog. Dist. | Econ. Dist. | Nested | ||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | ||

| Eastern China | DILS3 | −0.0044 | 0.0014 | −0.0031 | −0.0021 | 0.0212 | 0.0305 ** | 0.0241 # | 0.0253 * |

| (0.0118) | (0.0122) | (0.0118) | (0.0118) | (0.0147) | (0.0151) | (0.0147) | (0.0148) | ||

| DILS32 | −0.0200 *** | −0.0229 *** | −0.0211 *** | −0.0214 *** | |||||

| (0.0070) | (0.0072) | (0.0070) | (0.0070) | ||||||

| Central China | DILS3 | −0.0204 ** | −0.0139 # | −0.0220 ** | −0.0205 ** | −0.0186 * | −0.0135 | −0.0183 * | −0.0173 # |

| (0.0090) | (0.0092) | (0.0090) | (0.0090) | (0.0110) | (0.0113) | (0.0109) | (0.0110) | ||

| DILS32 | −0.0011 | −0.0003 | −0.0033 | −0.0027 | |||||

| (0.0054) | (0.0055) | (0.0053) | (0.0054) | ||||||

| Western China | DILS3 | −0.0127 * | −0.0152 ** | −0.0132 ** | −0.0141 ** | −0.0128 # | −0.0132 # | −0.0147 # | −0.0145 # |

| (0.0067) | (0.0068) | (0.0067) | (0.0067) | (0.0087) | (0.0089) | (0.0097) | (0.0096) | ||

| DILS32 | −0.0001 | −0.0008 | 0.0008 | 0.0003 | |||||

| (0.0022) | (0.0023) | (0.0037) | (0.0037) | ||||||

| Northeastern China | DILS3 | −0.0010 | 0.0037 | −0.0092 | −0.0068 | 0.0034 | 0.0148 | −0.0065 | −0.0030 |

| (0.0131) | (0.0134) | (0.0129) | (0.0128) | (0.0168) | (0.0173) | (0.0169) | (0.0167) | ||

| DILS32 | −0.0014 | −0.0090 | −0.0019 | −0.0027 | |||||

| (0.0078) | (0.0081) | (0.0079) | (0.0078) | ||||||

| Northern China | DILS3 | −0.0069 | −0.0094 | −0.0065 | −0.0078 | −0.0085 | −0.0090 | −0.0042 | −0.0068 |

| (0.0066) | (0.0067) | (0.0066) | (0.0066) | (0.0084) | (0.0085) | (0.0085) | (0.0084) | ||

| DILS32 | 0.0013 | −0.0002 | −0.0006 | 0.0001 | |||||

| (0.0036) | (0.0036) | (0.0036) | (0.0036) | ||||||

| Southern China | DILS3 | −0.0162 ** | −0.0162 ** | −0.0164 ** | −0.0169 ** | −0.0018 | −0.0020 | −0.0023 | −0.0030 |

| (0.0067) | (0.0068) | (0.0067) | (0.0068) | (0.0093) | (0.0094) | (0.0093) | (0.0093) | ||

| DILS32 | −0.0093 ** | −0.0092 ** | −0.0092 ** | −0.0089 ** | |||||

| (0.0042) | (0.0042) | (0.0042) | (0.0042) | ||||||

| Variables | Linear Model (DILS3) | Quadratic Model (DILS3 + DILS32) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Adjacency | Geog. Dist. | Econ. Dist. | Nested | Adjacency | Geog. Dist. | Econ. Dist. | Nested | ||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | ||

| Yellow River Basin | DILS3 | −0.0099 | −0.0104 | −0.0081 | −0.0099 | −0.0178 * | −0.0168 # | −0.0120 | −0.0178 * |

| (0.0078) | (0.0080) | (0.0078) | (0.0078) | (0.0101) | (0.0104) | (0.0102) | (0.0101) | ||

| DILS32 | 0.0050 | 0.0041 | 0.0032 | 0.0050 | |||||

| (0.0041) | (0.0042) | (0.0041) | (0.0041) | ||||||

| Yangtze River Economic Belt | DILS3 | −0.0141 * | −0.0148 * | −0.0144 * | −0.0148 * | −0.0027 | −0.0017 | −0.0013 | −0.0017 |

| (0.0079) | (0.0080) | (0.0079) | (0.0080) | (0.0108) | (0.0108) | (0.0108) | (0.0108) | ||

| DILS32 | −0.0072 # | −0.0079 * | −0.0080 * | −0.0079 * | |||||

| (0.0048) | (0.0048) | (0.0048) | (0.0048) | ||||||

| Variables | Linear Model (DILS3) | Quadratic Model (DILS3 + DILS32) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Adjacency | Geog. Dist. | Econ. Dist. | Nested | Adjacency | Geog. Dist. | Econ. Dist. | Nested | ||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | ||

| Beijing–Tianjin–Hebei (BTH) | DILS3 | 0.0030 | 0.0130 | 0.0008 | −0.0013 | 0.0156 | 0.0226 | 0.0007 | 0.0035 |

| (0.0332) | (0.0409) | (0.0339) | (0.0329) | (0.0396) | (0.0425) | (0.0362) | (0.0354) | ||

| DILS32 | −0.0647 * | −0.1307 *** | −0.0839 ** | −0.0832 ** | |||||

| (0.0377) | (0.0354) | (0.0334) | (0.0333) | ||||||

| Yangtze River Delta (YRD) | DILS3 | 0.0174 | 0.0248 | 0.0123 | 0.0133 | 0.0488 * | 0.0624 ** | 0.0419 # | 0.0418 # |

| (0.0251) | (0.0274) | (0.0253) | (0.0254) | (0.0264) | (0.0291) | (0.0266) | (0.0266) | ||

| DILS32 | −0.0357 ** | −0.0412 ** | −0.0339 ** | −0.0348 ** | |||||

| (0.0155) | (0.0166) | (0.0154) | (0.0154) | ||||||

| Pearl River Delta (PRD) | DILS3 | 0.0269 | 0.0837 | −0.0156 | 0.0041 | 0.0450 | 0.0596 | −0.0060 | 0.0084 |

| (0.0598) | (0.0678) | (0.0666) | (0.0625) | (0.0617) | (0.0721) | (0.0698) | (0.0661) | ||

| DILS32 | 0.0206 | 0.0839 | −0.0331 | −0.0109 | |||||

| (0.0510) | (0.0634) | (0.0591) | (0.0585) | ||||||

| Chengdu–Chongqing (CC) | DILS3 | 0.0430 * | 0.0536 * | 0.0679 *** | 0.0632 ** | 0.0358 | 0.0550 # | 0.0635 ** | 0.0569 * |

| (0.0256) | (0.0277) | (0.0251) | (0.0250) | (0.0307) | (0.0347) | (0.0307) | (0.0309) | ||

| DILS32 | 0.0056 | −0.0008 | 0.0048 | 0.0068 | |||||

| (0.0151) | (0.0183) | (0.0152) | (0.0154) | ||||||

| Middle Yangtze River (MYR) | DILS3 | −0.0144 | −0.0035 | −0.0150 | −0.0126 | 0.0358 | 0.0263 | 0.0272 | 0.0297 |

| (0.0176) | (0.0189) | (0.0174) | (0.0175) | (0.0285) | (0.0294) | (0.0276) | (0.0276) | ||

| DILS32 | −0.0148 # | −0.0090 | −0.0155 * | −0.0152 # | |||||

| (0.0093) | (0.0105) | (0.0093) | (0.0093) | ||||||

| Guanzhong Plain (GZP) | DILS3 | −0.0580 *** | −0.0355 * | −0.0547 *** | −0.0517 *** | −0.0510 ** | −0.0243 | −0.0623 *** | −0.0558 ** |

| (0.0196) | (0.0213) | (0.0189) | (0.0191) | (0.0234) | (0.0270) | (0.0225) | (0.0225) | ||

| DILS32 | −0.0053 | −0.0084 | 0.0073 | 0.0057 | |||||

| (0.0086) | (0.0102) | (0.0089) | (0.0087) | ||||||

| Central Plains (CP) | DILS3 | −0.0018 | 0.0005 | 0.0023 | 0.0012 | −0.0021 | 0.0064 | 0.0045 | 0.0027 |

| (0.0151) | (0.0161) | (0.0154) | (0.0155) | (0.0179) | (0.0193) | (0.0181) | (0.0183) | ||

| DILS32 | −0.0003 | −0.0062 | −0.0020 | −0.0014 | |||||

| (0.0105) | (0.0114) | (0.0104) | (0.0105) | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.; Li, Y.; Wei, H.; Wu, Q. The Impact and Spatiotemporal Heterogeneity of Differentiated Industrial Land Supply Regarding Industrial Total Factor Productivity. Land 2025, 14, 2435. https://doi.org/10.3390/land14122435

Wang J, Li Y, Wei H, Wu Q. The Impact and Spatiotemporal Heterogeneity of Differentiated Industrial Land Supply Regarding Industrial Total Factor Productivity. Land. 2025; 14(12):2435. https://doi.org/10.3390/land14122435

Chicago/Turabian StyleWang, Jian, Yun Li, Haixia Wei, and Qun Wu. 2025. "The Impact and Spatiotemporal Heterogeneity of Differentiated Industrial Land Supply Regarding Industrial Total Factor Productivity" Land 14, no. 12: 2435. https://doi.org/10.3390/land14122435

APA StyleWang, J., Li, Y., Wei, H., & Wu, Q. (2025). The Impact and Spatiotemporal Heterogeneity of Differentiated Industrial Land Supply Regarding Industrial Total Factor Productivity. Land, 14(12), 2435. https://doi.org/10.3390/land14122435