Abstract

The market-based allocation of rural construction land is conducive to the revitalization of rural land resources, influences urban and rural land planning, and facilitates urbanization. The rural collective operating construction land entering the market (COCLEM) is a key measure for China’s rural construction land marketization reform, while its impacts on the existing land supply pattern have received little attention. Taking Huzhou City as an example, this paper investigates the impacts of COCLEM on state-owned industrial land (SIL) transactions with Difference-in-Differences (DID) regression models. The results show the following: (1) Given the natural conditions, enterprises’ preferences, and government forces, COCLEM has failed to inhibit the SIL transaction scale. (2) COCLEM contributes to industrial agglomeration and significantly increases the value of SIL. These findings altogether imply that currently, in China, market-based rural construction land transfer is the complement of land administrative allocation. Policy implications are drawn from this analysis to advance further reforms for China’s urban–rural integrated construction land market.

1. Introduction

In China, land allocation is characterized by a government-intervention mode, including land acquisition and the monopoly of the primary land market. For many years, China has adopted an urban–rural dual land system framework, where rural land is only made available for urban development following land acquisition and conveyance by local governments [1]. Since the tax system reform in 1994, China has implemented a development model of “political centralization and economic decentralization,” and land finance has been the main source of local public revenue and has fueled urbanization and industrialization [2]. Local governments are highly motivated to gain revenue from profit-oriented land transfer, to support urban infrastructure and public provision, attract investment, and facilitate economic assessment [3,4,5]. Local government is the de facto manager and only de jure supplier of land in the primary land market. The government, through its monopoly of the primary land market, plays multiple roles in decision making concerning land-use zoning regulation [6], land transaction price, land supply structure [7], and land conveyance methods.

Governmental intervention in land resource allocation has proven essential for spatial plan implementation and urbanization development [8,9,10,11]. However, the rapid urban expansion has caused the extensive use of land resources as well as the reduction in arable land. In China, 1.83 million hectares of cultivated land was expropriated for urban construction between 1997 and 20051. The land supply regulation for land expropriation prohibits rural collectives from exercising their land transfer right and violates their right to land development [9]. Meanwhile, the government implements a long-term dual development strategy, namely, an urban-based development strategy, in which factors of production such as land, labor, and capital flow from rural areas to urban areas. As a result of the government’s dual economic and social system, rural development gives way to urban development, further leading to “urban progress and rural decline” [12,13]. Therefore, government intervention in the land market results in unreasonable land resource allocation and welfare loss in the rural sector.

In recent years, China has introduced changes in collective operating construction land (COCL) as a key element of the rural land marketization reform to form the integrated urban–rural land market. COCL refers to the collectively owned construction land used for profit-making purposes, including industry, mining storage, and commercial services, according to the plan for land utilization and urban–rural planning in China [14]. Earlier, in the 1980s, local governments in China’s eastern coastal areas, such as Zhejiang Province, encouraged the development of township and village enterprises (TVEs) by taking advantage of their geographical location and opening-up policies. There were a large number of factories built on rural land there, which stimulated rural collectives to convert arable land to non-agricultural uses. Due to inappropriate management and weak competitiveness, some TVEs went bankrupt after a boom period, leaving a large number of scattered COCL stocks. In rural China, most COCL has been unused or inefficiently utilized since TVEs experienced bankruptcy at the end of the 1990s [15]. To activate the idle rural land assets and promote the rational and effective allocation of land resources, in recent years, the Chinese state government has started to reform the laws of the rural land market. In 2013, the government proposed establishing an integrated market of urban–rural construction land [16], which is a strong signal that the Chinese government intends to liberalize rural–urban land transfers [17]. At the start of 2015, 15 counties (cities, districts) across China were chosen as the first trial for COCL entering the land market. In pilot areas, rural collectives have been given the right to lease out their COCL use rights to urban developers. As one of the pilot projects for the market-oriented reform of rural land, COCL entering the market (COCLEM) broke the pattern that held the government as a monopoly supplier of the primary land market. As of 2019, 12,644 plots of COCL, covering an area of more than 83 km2, had been traded in the rural land market in 33 pilot regions across China2.

A sizeable body of literature has demonstrated that COCLEM is an essential trial for protecting farmers’ land development rights and releasing the government intervention in rural land reallocation [14,17,18]. Some scholars worry that COCL transactions challenge the existing state-owned construction land market and threaten land finance, which has fueled the rapid urbanization and economic growth miracle in China [19,20], stating that transferred COCL shares the quota of newly added construction land, that is, the more COCL is transferred, the less state-owned construction land can be leased out. Some studies have analyzed the impacts of COCLEM on state-owned construction land supply based on the roles and interactions of stakeholders (i.e., local governments and rural households) in land conveyance. In specific, local officials tend to capture a windfall of land value through land acquisition and land supply [21]. Rural households’ willingness to allow their land to be expropriated relies on land compensation, which affects local governments’ expenses for land acquisition [11]. In general, local government is the primary beneficiary of land acquisition and land sales, whereas the rural households’ share of the land increment revenue from compensation is relatively small [22]. Compared with land compensation from land acquisition, rural households can obtain much more income from COCLEM [17]3, and their expectations for land income are rising [14]. Therefore, the conflict that “local governments tend to land acquisition, whereas farmers prefer COCL entering the market directly” would increase land compensation costs and hinder the land acquisition progress, thereby influencing the progress of state-owned construction land supply in the primary land market.

Given that COCL is located on the urban fringes and commonly transferred for industrial use [14], the influence of COCLEM on state-owned industrial land (SIL) transactions should be of concern; however, few empirical studies have been conducted to examine the impacts of the reform of COCLEM on the SIL market. In addition, there is little literature analyzing the relationship between COCL and SIL from the perspectives of both the supply side and demand side, as studies mostly solely focus on the supply side. This study aims to assess the effects of rural construction land marketization on the existing SIL market. The specific question addressed is reported below.

Q: Does COCLEM inhibit SIL transactions?

First, this paper discusses the relationship between the COCL reform and SIL transactions from both the supply side and the demand side. Then, the effects of COCLEM on the SIL transaction area and the SIL price are separately assessed. Deqing County, located in Huzhou City, Zhejiang Province, Eastern China, was one of the pioneers, making possible some quasi-experimental research. This paper takes Huzhou City as an example, with a town-level sample, comparing the SIL transaction indicators of towns implementing COCLEM in Deqing County to those without COCLEM in Huzhou City, both before and after the reform of COCL. With statistical data and land parcel data relative to the period of 2010–2019, this paper adopts the Difference-in-Differences (DID) method to investigate the relationship between COCLEM and SIL transactions. This paper contributes to the literature on rural construction land marketization reform and its relationship with land administrative allocation; it is hoped that the findings presented here can provide a useful reference for the smooth implementation of COCLEM in China, as well as the balance of government–market forces to improve rural land allocation efficiency in developing countries.

The remainder of this paper is organized as follows: In Section 2, we outline the analysis framework. In Section 3, we introduce the description of the study area, data, and variables. The research method is presented in Section 4. Section 5 presents the research findings, and Section 6 concludes the paper and discusses policy implications.

2. Analysis Framework

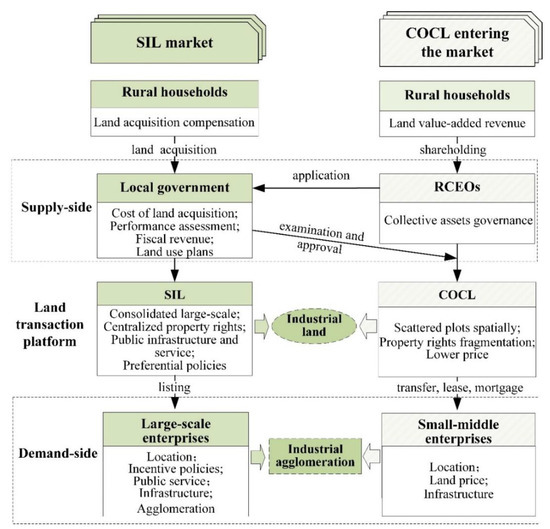

Under competitive market conditions, land transactions and land price depend on the trade-off between the supply of and demand for land resources [23], which are decided by stakeholders’ decision making [6]. The stakeholders, in this study, are the participants of land transactions in the Chinese context, including rural landowners (i.e., rural collectives and rural households), rural collective economic organizations (RCEOs), local governments, and enterprises. A theoretical framework (Figure 1) was developed to analyze the relationship between COCLEM and SIL transactions, including perspectives from both the supply side and demand side.

Figure 1.

Relationship between SIL market and COCL entering the market.

2.1. From the Supply Side

In China, rural land belongs to rural collectives, while urban land is under state ownership and is administered by local officials. China’s Land Management Law (revision 2004) stipulates that rural land is banned from being traded unless local governments had requested that it be transferred from collective ownership to state ownership. From 2004 to 20194, except for pioneers of the COCL reform, land acquisition was the unique legal way to transfer land from agricultural sectors to non-agricultural sectors across China. Local governments’ main concern is GDP-oriented political performance [24,25]. Local governments devise and implement land-use plans that regulate both the quantity and spatial distribution of rural land allowed to be converted to new urban construction land [26], and they expropriate rural land based on the zoning maps. The newly added urban construction land supply is monopolized by local governments, to pursue outside investment and economic growth, and 40% to 50% of the acquired land is transferred for industrial use [27]. By means of listing (guapai), local governments continuously lease out the use right of large-scale SIL to manufacturing enterprises under long-term (50 years) contracts.

The entry of COCL into the market broke the local government’s monopoly on the primary land market. RCEOs and local governments have become co-suppliers of industrial land. In pilot regions of the COCL reform, such as Deqing County, rural collectives can transfer their COCL use rights for industrial use by not changing the ownership. Rural households convert their land assets into shares of the rural collective economic organizations (RCEOs)5 [28]. RCEOs, working on behalf of rural households, apply to the county and upper government for COCLEM. With local governments’ examination and approval, RCEOs negotiate with land demanders (i.e., enterprises) on the transfer price and contract term; then, by means of transfer (Churang), lease (Chuzu), and mortgage (Rugu), they transfer the COCL use rights to enterprises. Local governments, playing the roles of the manager and supervisor of land transfer, are in a strong position to lead the implementation of COCLEM [14]. Local governments establish market entry thresholds and decide whether the scope and conditions of COCL are satisfied. To maximize their own interests, local governments can take full advantage of their power to determine the range and quantity of COCL transferred.

2.2. From the Demand Side

For industrial enterprises, the location preference lies in transportation accessibility, land prices, public infrastructures, and agglomeration degree [11,29,30]. In the mature industrial development system, the division and collaboration among enterprises depend on the high-level supply of public facilities [13]. In practice, large-scale enterprises are attracted by development zones and industrial parks set up by local governments, which are equipped with superior infrastructure and exclusive preferential policies [6]. Compared with SIL, the size of each COCL plot is smaller, and plots are usually scattered throughout villages that lack adequate infrastructure; meanwhile, the COCL mortgage rights remain constrained, leading to low credit accessibility for land developers [17]. Therefore, industrial enterprises have a stronger preference for SIL than COCL. The following hypothesis is proposed based on the above.

H1.

COCL Entering the Land Market Has an Insignificant Effect on the SIL Transaction Area.

For small and medium enterprises (SMEs), particularly township and village enterprises, that cannot satisfy the various entry thresholds imposed by local governments (i.e., land-use scale, investment intensity, output value, and tax income), barriers may exist to permissions to enter well-equipped SIL [30]. However, COCL with low entry barriers can satisfy the development of SMEs, and its price is acceptable. Local governments supply SIL equipped with public goods needed for industrial development to large-scale enterprises, while rural collectives attract SMEs by leasing COCL; this facilitates the formation of upstream- and downstream-related industry chains and promotes regional industrial agglomeration effects [31]. Industrial agglomeration can enhance the overall competitive advantage of the region and further bring about an appreciation of land value [32]. Therefore, COCLEM contributes to promoting regional industrial development and further promoting the increase in the price of SIL. Based on the above analysis, this paper proposes hypothesis 2.

H2.

The Entry of COCL into the Land Market Can Promote the Increase in the Price of SIL through the Effect of Industrial Agglomeration.

3. Study Area, Data Sources and Variables

3.1. Study Area

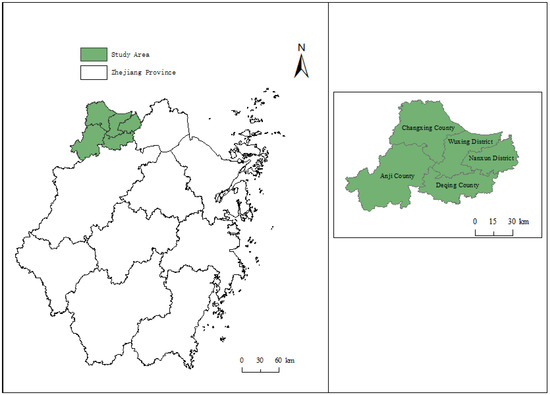

Huzhou City (30°22′−31°11′ N, 119°14′−120°29′ E) is situated in Zhejiang Province. The study area (Figure 2), which covers 5818 km2, is composed of Wuxing District, Nanxun District, Deqing County, Changxing County, and Anji County. In 2019, the regional per capita GDP was 116.81 thousand CNY, which was 1.7 times that of the entirety of China, and the population was 2.68 million people.

Figure 2.

Sketch map of study area.

In this paper, we chose Huzhou City as our research area for two reasons. First, Deqing County was one of 15 of China’s earliest pioneers relatively to the reform of “COCL entering the market” in 2015; moreover, the volume of COCL transactions in Deqing County is larger than that in most pioneer regions [33]. Meanwhile, the other four counties and districts in Huzhou City lack COCLEM, which means they can be treated as control units and make possible quasi-experimental research. Second, Deqing has set up a public transaction platform, that is, the “Public Resource Trading Center,” where information about SIL and COCL can be published to list bids, which means that COCL and SIL can compete fairly. As of December 2020, 255 plots of COCL in 7 towns of Deqing County, with an area of 136.18 hectares, were traded in Deqing Public Recourse Trading Center.

3.2. Data Sources

Variables including SIL transaction area, SIL transaction price, the allowed floor area ratio, and plot address were calculated using land transaction data, which were acquired from the database of the micro transaction records of land parcels. The land parcel data were from China Land Market Webpage (CLMW)6, sponsored by the Ministry of Nature Resources. As the largest nationwide land information platform in China, CLMW gathers and publishes land supply data from the primary market. Thus, Python program was used to collect 2010–2019 land transaction data from CLMW.

In this study, we used the records for SIL parcels identified derived from the proposed usage of each land parcel. We removed the records with incomplete information and winsorized it at the 1st and 99th percentile to reduce the impact of outliers [34]. As a result, 3644 SIL transaction records were left from 2010 to 2019 in Huzhou City. To obtain the balanced panel data, the transaction records were matched with 35 towns in Huzhou City; then, the data of transaction records were averaged at the town level. At the town level, land parcels in the town scope shared a similar geographical environment, economic development, and traffic accessibility. Furthermore, using town-level data, we could control the effects of location on land transactions, eliminating the influence of unobservable spatial factors and better identifying the temporal trends of SIL transaction area and price.

3.3. Variable Selection and Description

3.3.1. Dependent Variables

SIL transaction area (Area): We matched the land transaction parcels at the town level and calculated the average SIL transaction area (Area) as the final value for each town.

SIL transaction price (Price): We matched the land transaction parcels at the town level and calculated the average SIL transaction price (Price) as the final value for each town.

3.3.2. Explanatory Variables

COCL entering the market (COCLEM): The key independent variable in this study was the dummy variable. Since the trials of COCLEM in Deqing County were legalized and went into effect in January 2015, for towns in Huzhou City exposed to the intervention of COCL transactions, COCLEM equaled 1; otherwise, COCLEM equaled 0.

3.3.3. Control Variables

The land transaction area is often affected by many other factors. In this paper, variables including floor area ratio, land fragment degree, land location, and town-level economy were selected.

Floor area ratio: Referring to [35], the allowed floor area ratio (FAR), which reflects a city’s land-use regulation—regarded as one of the most crucial means of macro-control of urban growth—has a significantly positive effect on the land price.

Land fragment degree: In general, large square parcels provide sufficient space for enterprises to design the site of their factories and manufacturing facilities, and it is convenient for their expansion of the production scale [32]. According to [15], the fragmentation of land plots and property results in higher transaction costs and lower work efficiency if the land scale is smaller than optimal. Each town has a different scale and number of collective economic organizations, so we used the area of the land parcel as a proportion of the town’s area to measure the relative fragmentation of the land parcel. Then, we defined it as the land fragment degree (LFD).

Land location: Land location, using distance to the government center or main road as a proxy, is an effective way to capture the social environment where the land parcel is located [36]. In this paper, the Application Programming Interface (API) of AutoNavi Map was first used to extract the latitude and longitude of each land parcel center, highway entrance and exit, county center, and city center; then, we calculated the distance from one parcel to the nearest highway (D_highway, in km), the distance to the county center (D_county, in km), and the distance to the city government (D_city, in km).

Town-level economy: Due to a lack of economy information concerning the town where the land parcels are located, an alternative solution is to use the land grade (Grade). In China, the Ministry of Natural Resources has assigned grades to land based on their natural and economic attributes. The benchmark land price is determined by relatively standardized land grading standards. Each land parcel published and sold on the CLMW is assigned a land level. The land grades are classified from 1 to 157, with lower numbers standing for a higher land grade and a better economy level; this proves an important reference in relation to the land price system.

The description of the variables is shown in Table 1, and the comparison between Deqing County and counties without COCLEM is shown in Table 2.

Table 1.

Summary statistics of variables in the study area.

Table 2.

Comparison between Deqing County and Counties without COCLEM.

4. Research Design

This section describes the estimation strategy for assessing the effects of COCL entering the market on SIL transactions. First, with the general Difference-in-Differences (DID) method, Model 1 was built to estimate the effect of COCLEM on the SIL transaction area. Then, Model 2, Model 3, and Model 4, based on general DID, Spatial Difference-in-Differences (SDID), and DID with mediator variables, respectively, were used to assess how the entry of COCL into the market affected the SIL transaction price.

The DID method is a widely used quasi-experimental research design to estimate the effects of social events or policy interventions [37]; it adopts an identification strategy that is implemented using an interaction term between group and time indicators whose coefficient represents the difference in the outcome variable of the differences between units across time [38].

Estimating the effects of COCLEM requires a strategy that can isolate the impact of COCL transactions on the SIL transactions of treated towns from contemporaneous policies implemented in Huzhou City. The entry of COCL into the market was legally implemented in towns of Deqing County in 2015; the identification strategy of this study was to design a control group composed of other towns in Huzhou City. This strategy, along with the DID method, square up other time-varying indicators that would have led the treatment group to experience different changes in SIL transactions post-reform. In this study, we utilized the DID method to estimate the treatment effects of COCLEM, and the effects were estimated using the observed Area and Price controlled by the potential outcome without COCLEM.

4.1. Measuring Impacts of COCLEM on SIL Transaction Area

The impact of COCLEM on the SIL transaction area could be estimated using DID estimation expressed as Model 1.

where represents the SIL transaction area (Area) in town in year and represents the trial of COCL entering the market. Both and are dummy variables, since Deqing County has been one of the trials for COCL entering the market since 2015; we suppose in towns that conducted COCLEM in Deqing County and in towns without COCL transactions. Meanwhile, in 2009–2014, , and otherwise. The effect on the average of COCLEM on Area is associated with parameter . Vector refers to control variables influencing Area; and represent individual effects and time-specific effects, respectively; and the remainder error term is [39].

4.2. Measuring Impacts of COCLEM on SIL Transaction Price

The impact of COCLEM on SIL transaction price based on the DID method could be expressed as Model 2.

where represents the logarithm of the SIL transaction price (Price) in town in year and the effect on the average of COCLEM on is associated with parameter . Vector contains control variables influencing Price, and the remainder error term is .

A sizable body of studies have suggested that neighborhood effects, which are considered as an essential determinant of land price, extend over multiple spatial levels [40,41]. Specifically, the land leasing prices in a town are a function not only of the policy implementation in that town but also of the implementation in all the other towns in the system, in the form of a spatial multiplier effect [42]. Therefore, Model 3, described by Equation (3), refers to the spatial DID model built by [43], where a spatially lagged SIL transaction price captures the contemporaneous outcomes in adjacent towns.

where is the spatial weight matrix (constant over time) composed by ; in this paper, we chose the widely used binary continuity matrix, which is defined by whether two regions are neighbors—that is, if town and town are adjacent, ; else, . The spatial autoregressive coefficient is , given the spillover effect, and the estimated effect on the average of COCLEM on is donated by .

As mentioned in Section 2, we are interested in assessing the effect of COCLEM on the SIL transaction price as well as on the potential channel, that is, industrial agglomeration. Equation (3) shows the total effect of COCL transactions on the land transaction price. Further, in Model 4, we added industrial agglomeration as a mediator based on Model 2; then, we tested the mediation effect with the estimate strategy conducted by Baron and Kenny (1986) [44].

The direct and indirect effects of the entry of COCL into the market on the land transaction price could be defined as shown below.

where is the mediation variable representing the industrial agglomeration effect in town in year ; in this paper, industrial agglomeration is measured by the ratio of the number of enterprises to the town area. represents the average effect of COCLEM on the industrial agglomeration effect, while is the direct effect of COCLEM on the SIL transaction price after controlling for the mediator and other control variables.

5. Empirical Results

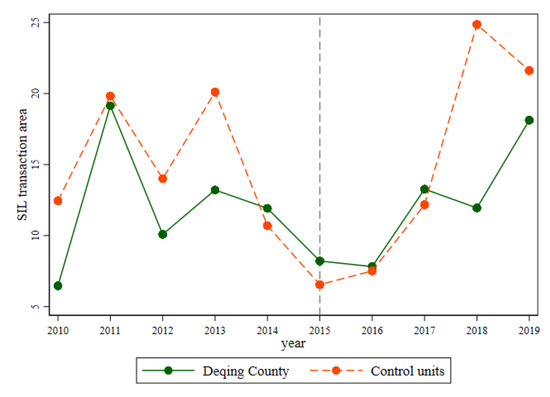

5.1. Changes in SIL Transaction Area

Figure 3 visually reports the annual SIL transaction area in Huzhou City from the years prior to 2015 and 2015–2019; notably, differential trends of the SIL transaction area in Deqing County were not obvious. In Deqing County, the transaction area of newly added SIL was 54.1 hectares (36 plots), 41.8 hectares (26 plots), and 81.44 hectares (51 plots) in 2013, 2015, and 2019, respectively. This indicates that in towns where COCL entering the market was implemented, the newly added SIL supply was not decreased. The empirical results of Model 1 presented in Table 3 showed that the coefficient of COCLEM was insignificantly distant from zero; that is, COCLEM showed no significant impacts on the SIL transaction area. Hence, the findings support hypothesis 1.

Figure 3.

Trend of the SIL transaction area in Deqing County and Counties without COCLEM from 2010 to 2019.

Table 3.

Estimations of the effect of COCLEM on the SIL transaction area.

Notes: The vertical line represents the year when the trial of COCLEM was implemented. The red dotted line represents the average SIL transaction area for counties that did not implement COCLEM in Huzhou City.

This finding is inconsistent from the conclusion of [25] and the analysis of [20]. A possible explanation for those results can be found in Table 4, which compares the average area of land parcels and the transaction price of SIL and COCL in Deqing County. From 2015 to 2019, the average area of leasing SIL parcels was 2.68 hectares, which was 4.25 times that of COCL. COCL plots are scattered and usually small, and even though COCL is cheaper than SIL, the latter is more attractive for developers who, for large-scale enterprises, prefer large-scale and contiguous land to meet the requirements of industrial development [15]. Local governments establish development zones with preferential policies to attract manufacturing enterprises; moreover, they design and implement land-use plans so they can delimit areas where land acquisition is the sole legal path that rural land can be transferred for un-agricultural use. Deqing County has adopted a land acquisition strategy based on its land-use plan [45]. That is, if the land is within the urban construction scope designed by the land-use plan, it can be expropriated and converted to SIL, and only COCL outside the scope is allowed to enter the market. Therefore, given the natural conditions, enterprises’ location preference, and government force, COCL has failed to compete with SIL.

Table 4.

Comparison between SIL and COCL.

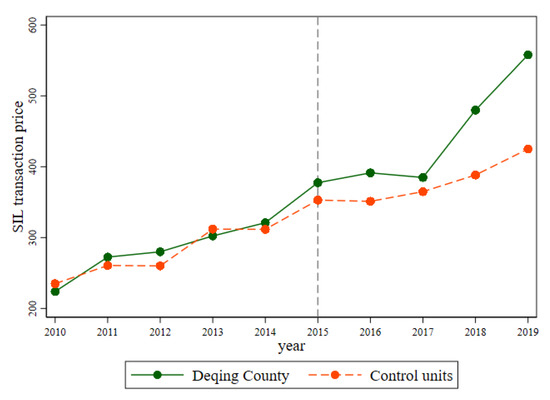

5.2. Changes in SIL Transaction Price

Figure 4 plots the trends of the SIL transaction price in towns implementing COCLEM and that in control towns. As the figure suggests, before the passage of COCL entering the market, the series of SIL transaction prices in Deqing County and the other towns of Huzhou City were close and showed similar trends. State-owned industrial land transaction prices increased in 2015 but saw larger increases in the towns of Deqing County than in the rest of Huzhou City. In 2019, the land transaction price gap was CNY 132.89.

Figure 4.

Trends of land transaction price: towns in Deqing County vs. the other towns of Huzhou City. Notes: The vertical line denotes the year when the trial of COCLEM was implemented.

The empirical results of Model 2 and Model 3 are presented in Table 5, showing that the coefficient of COCLEM was significantly positive at the level of 1%, indicating that the COCL reform increased the SIL transaction price. Specifically, the estimated value of 0.145 indicated that on average, the implementation of COCLEM in Deqing County contributed to a 14.5% increase in the SIL transaction price per year. By adopting COCLEM, rural collectives retain ownership of COCL and receive higher value-added benefits, thus hindering land acquisition. Meanwhile, large companies prefer SIL equipped with public goods and infrastructure, so SIL is traded at a higher price. The land grade, land fragmentation degree, and plot ratio had a significantly positive impact on the price of industrial land at the levels of 1%, 5%, and 1%, respectively. The transaction of land parcels was highly relative to the location. In specific, industrial land prices were negatively affected by the distance between the plot and the city center. The closer it was to the county center, the higher the price of industrial land, but the difference was not significant. In contrast, a plot’s distance from an expressway had a significant negative impact on the price of industrial land, suggesting that industrial land was more expensive the closer it was to the expressway; this suggests that transportation is an important factor in enhancing industry development and land prices. There was, however, little radiation effect caused by the administrative center.

Table 5.

Estimations of the effect of COCLEM on the SIL transaction price.

The empirical result of Model 3 shows that there exists a spatial spillover effect, that is, the SIL value in a focal town is significantly and positively affected by neighboring towns. On one hand, by enhancing local industrial vitality and economic development potential, COCLEM can boost the price of industrial land in surrounding towns; on the other hand, the COCLEM of a town affects the expectations of landowners in the surrounding towns regarding land prices, resulting in them believing their land is more valuable. Thus, the government could have a harder time acquiring land, which would increase the cost of land use and the price of industrial land. If the effects of neighboring SIL transaction prices are ignored, the estimated contribution of the COCL reform to SIL transaction prices could be overestimated.

Table 6 reports the presence of the mediation effect of industrial agglomeration. Column (1) of Table 6 indicates that COCLEM significantly increased the number of firms at the level of 10%, accelerating local industrial agglomeration. A plausible reason could be that the local government attracted large-scale enterprises by supplying SIL with well-equipped infrastructure provisions, while small-to-medium factories and garages were built in COCL parcels. Column (3) shows that the implementation of COCLEM per year through the agglomeration effect increased the SIL transaction price by about 12.6%. Thus, the above empirical findings support hypothesis 2.

Table 6.

Estimation effects of industrial agglomeration’s mediation effect on SIL transaction price.

To test whether the mediation effect existed, the bias-corrected bootstrap approach [46] was chosen to test the indirect effect of industrial agglomeration on the SIL transaction price. For comparison, statistics obtained using the Sobel (1982) method are also reported [47]. The decomposition of the effects of COCLEM on land transaction price, which is divided into total effect (TE), direct effect (DE), and the indirect effect (ID), is shown in Table 7. The TE of COCLEM on land price was about 0.16, indicating that the transaction price of SIL increased by about 16% after the implementation of COCLEM. The coefficient of the ID was 0.031 at the significance level of 5%, showing that an ID significantly existed, and industrial agglomeration indirectly improved the SIL price by about 3.1%. While local governments provide SIL with public goods needed to industrial development to large-scale enterprises, COCLEM meets the land requirements of SMEs that cannot meet entry thresholds for SIL; in addition to increasing the number of enterprises in Deqing County, it facilitates the formation of downstream and upstream industry chains and promotes regional industrial agglomeration. The agglomeration of industrial activities then boosts competitiveness and increases land value in Deqing County.

Table 7.

Decomposition of effects of COCLEM on SIL transaction price.

In summary, the empirical analysis suggested that the COCLEM policy had a significant impact on SIL transactions, since COCL transactions contributed to rural industrial development and land value growth. The results suggested, however, that local governments still played a dominant role in rural construction land transactions, while the market played a lesser role.

5.3. Robustness Checks

To check the robustness of our findings, we estimated three additional models.

First, since the DID design requires a strong underlying assumption, that is, in the absence of policy implementation, (average) outcomes for treatment and control units follow parallel paths over time [42,48]. The assumption of parallel trends of the SIL transaction price of towns implementing COCLEM and towns without COCLEM in Huzhou City were tested. Table 8 displays the test results. Table 8 reveals that the estimated coefficients were insignificant from 2010 to 2013, which meant that from 2010 to 2013, the difference in Price between towns implementing COCLEM and control towns was similar to that of 2014. Therefore, the Price of towns implementing COCLEM and control towns followed a parallel trend in the absence of COCL transactions. Thus, the DID method was appropriated to estimate the causal relationship between the COCL reform and SIL transaction.

Table 8.

Assumption of parallel trends of SIL transaction price.

Second, we estimated models in which we falsely assumed that the trial of COCLEM took place in different years prior to 2015 using data from the period. Table 9 shows that the results of placebo tests were close to zero and were relatively distant from the estimators in Table 5. Only the estimators in 2014 were statistically significantly different from zero at the 5% level. In November 2013, China’s state government proposed to establish an integrated urban–rural construction land market and to allow COCL to enter the market [16]. Both farmers’ willingness and local governments’ choice to convert a parcel of land is jointly determined with the expected utility or returns from the parcel [49]. Therefore, due to the expected revenue from COCL reform, the SIL transaction price increased in 2014. The placebo test demonstrated that the empirical results were not obtained by chance.

Table 9.

Placebo test results: randomly selected years between 2011 and 2014.

Finally, a natural concern is whether the land price increase resulted from a land-use plan, such as the setup of development zones. Therefore, we conducted the robustness test by removing the towns located in development zones and repeated the regression analysis. The empirical results are shown in Table 10, which shows that similar results were obtained.

Table 10.

Estimations of the effect of COCLEM on SIL price without samples in development zones.

6. Conclusions and Policy Implications

There are two basic means for land resource allocation—the government force and the market force. In China, the government monopolizes land resources allocation from agricultural to non-agricultural sectors. This paper illustrates the impacts of COCLEM on the SIL market from both the supply side and the demand side, enriching both the theoretical and empirical literature on the relationship between rural land marketization and the existing land administrative allocation. This paper analyzes the changes in SIL transactions in China spanning from 2010 to 2019 using a micro database of state-owned land transactions. Our estimates from DID models compare outcomes of towns implementing COCLEM to towns without COCLEM in Huzhou City, across different year intervals. Compared with SIL, COCL has disadvantages in terms of natural conditions, enterprises preference, as well as government support; thus, the COCL reform has failed to affect the SIL transaction scale, whereas it has significantly increased the transaction price of SIL through industrial agglomeration. Therefore, the rural construction land marketization has not hindered administrative allocation, which continues unabated and has opened new market-based avenues of land supply, spurring innovative ways of combining the two.

The findings of this paper yield two policy implications.

First, there are considerable differences in the parcel scale and transaction price between SIL and COCL; the results suggest that COCL fails to compete with SIL. The users of SIL can use their certificates to mortgage loans and support their business operations, while the mortgages are constrained for COCL under Land Administration Law. Even with mediation from local governments, the loan size is much smaller than loans that can be obtained using SIL as collateral. To establish an integrated urban–rural construction land market, COCL should be equipped with complete property rights to guarantee and optimize the profits of landowners and developers.

Second, government forces still play the driving role in the process of COCLEM, and collective economic organizations have to obey the laws designed by local government. In this case, the overlapping functions induce local governments to maximize economic interests and ignore the benefits of rural collectives. To enhance the allocation efficiency of rural land resources and smooth the implementation of rural construction land marketization, local governments should transition from a leading role to being assistants and supervisors of the rural construction market. The performance assessment of local officials should not only increase in terms of fiscal revenue and GDP but should also adopt incentive regulation policies, such as those regarding the outcomes of integrated development between urban and rural areas.

Author Contributions

Conceptualization, M.J.; methodology, M.J.; software, M.J.; validation, M.J.; formal analysis, M.J.; data curation, M.J.; writing—original draft preparation, M.J.; writing—review and editing, H.X.; supervision, H.X.; funding acquisition, H.X. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by National Natural Science Foundation of China grant number [41971249]. And The APC was funded by [41971249].

Institutional Review Board Statement

This study does not involve humans or animals.

Data Availability Statement

Land parcel data can be collected from https://www.landchina.com/#/.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | Data source: http://www.gov.cn/zxft/ft149/content_1144625_2.htm. |

| 2 | Data source: http://gi.mnr.gov.cn/202010/t20201001_2563314.html. |

| 3 | According to Interim Measures for the Administration of the Collection and Use of the Adjustment Fund for the Value-added Revenue of Rural Collective Operating Construction Land, local government can levy 20%–50% of value-added land of COCL, and the rest is shared between rural collective and rural households. |

| 4 | Land Management Law of China (revision 2019) stipulates that it is no longer mandatory for non-agricultural construction land in China to be state-owned, which removes legal barriers to COCL entering land market. |

| 5 | RCEO is a type of organization representing the rural collective exercising its property rights (Chen 2016) and is responsible for collective assets operation and management. |

| 6 | |

| 7 |

References

- Ding, C.; Lichtenberg, E. Land and urban economic growth in China. J. Reg. Sci. 2011, 51, 299–317. [Google Scholar] [CrossRef]

- Xu, C. The Fundamental Institutions of China’s Reforms and Development. J. Econ. Lit. 2011, 49, 1076–1151. [Google Scholar] [CrossRef]

- He, C.F.; Huang, Z.J.; Wang, R. Land use change and economic growth in urban China: A structural equation analysis. Urban. Stud. 2014, 51, 2880–2898. [Google Scholar] [CrossRef]

- Fang, Y.P.; Pal, A. Drivers of urban sprawl in urbanizing China-a political ecology analysis. Environ. Urban. 2016, 28, 599–616. [Google Scholar] [CrossRef]

- Rithmire, M.E. Land Institutions and Chinese Political Economy: Institutional Complementarities and Macroeconomic Management. Politics Soc. 2017, 45, 123–153. [Google Scholar] [CrossRef]

- Shen, M.N.; Lin, S.W.; Ben, T.M. A study of the public services valuation in the industrial park in Taiwan. J. Taiwan Land Res. 2006, 8, 49–72. (In Chinese) [Google Scholar]

- Xiong, C.S.; Tan, R. Will the land supply structure affect the urban expansion form? Habitat Int. 2018, 75, 25–37. [Google Scholar] [CrossRef]

- Moreda, T. Large-scale land acquisitions, state authority and indigenous local communities: Insights from Ethiopia. Third World Q. 2017, 38, 698–716. [Google Scholar] [CrossRef]

- Dell’Angelo, J.; D’Odorico, P.; Rulli, M.C.; Marchand, P. The tragedy of the grabbed commons: Coercion and dispossession in the global land rush. World Dev. 2017, 92, 1–12. [Google Scholar] [CrossRef]

- Qu, Y.B.; Jiang, G.H.; Tian, Y.Y.; Shang, R.; Wei, S.W.; Li, Y.L. Urban-Rural construction land Transition (URCLT) in Shandong Province of China: Features measurement and mechanism exploration. Habitat Int. 2019, 86, 101–115. [Google Scholar]

- Shen, X.Q.; Wang, L.P.; Wang, X.D.; Zhang, Z.; Lu, Z.W. Interpreting non-conforming urban expansion from the perspective of stakeholders’ decision-making behavior. Habitat Int. 2019, 89, 102007. [Google Scholar] [CrossRef]

- Mabe, F.N.; Nashiru, S.; Mummuni, E.; Boateng, V.F. The nexus between land acquisition and household livelihoods in the Northern region of Ghana. Land Use Policy 2019, 85, 357–367. [Google Scholar] [CrossRef]

- Qiu, Y. Rural Industrialization Pattern and Rural Land System Change: A Study on the System of Collective Construction Land in Coastal Areas. Chin. Rural. Econ. 2021, 4, 101–123. (In Chinese) [Google Scholar]

- Yan, L.; Hong, K.R.; Chen, K.Q.; Li, H.; Liao, L.W. Benefit distribution of collectively-owned operating construction land entering the market in rural China: A multiple principal-agent theory-based analysis. Habitat Int. 2021, 109, 102328. [Google Scholar] [CrossRef]

- Xie, X.X.; Zhang, A.L.; Wen, L.J.; Bin, P. How horizontal integration affects transaction costs of rural collective construction land market? An empirical analysis in Nanhai district, Guangdong Province, China. Land Use Policy 2019, 82, 138–146. [Google Scholar] [CrossRef]

- The 18th CCCPC. Decision of the CCCPC on Some Major Issues Concerning Comprehensively Deepening the Reform. 2013. Available online: http://www.gov.cn/gzdt/2013-11/22/content_2532605.htm (accessed on 11 November 2021). (In Chinese)

- Tan, R.; Wang, R.Y.; Heerink, N. Liberalizing rural-to-urban construction land transfers in China: Distribution effects. China Econ. Rev. 2020, 60, 101147. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, X.H.; Liu, Y.S. Rural land system reforms in China: History, issues, measures and prospects. Land Use Policy 2020, 91, 104330. [Google Scholar] [CrossRef]

- Wang, B.; Zhang, Y.; Zhan, C.; Yang, X. Strategic interaction of industrial land conveyance behaviors in China: Based on an asymmetric two-regime Spatial Durbin Model. J. Clean. Prod. 2020, 270, 122598. [Google Scholar] [CrossRef]

- He, X.F.; Gui, H.; Xia, Z.Z. On the direction and some ideas of China’s land system reform. J. Northwest AF Univ. Soc. Sci. Ed. 2019, 19, 1–7. (In Chinese) [Google Scholar]

- Lichtenberg, E.; Ding, C. Local officials as land developers: Urban spatial expansion in China. J. Urban Econ. 2009, 66, 57–64. [Google Scholar] [CrossRef]

- Bao, H.; Fang, Y.; Ye, Q.; Peng, Y. Investigating social welfare change in urban village transformation: A rural migrant perspective. Soc. Indic. Res. 2018, 139, 723–743. [Google Scholar] [CrossRef]

- Kheir, N.; Portnov, B.A. Economic, demographic and environment factors affecting urban land prices in the Arab sector Israel. Land Use Policy 2016, 50, 518–527. [Google Scholar] [CrossRef]

- Wang, D.; Ren, C.R.; Zhou, T. Understanding the impact of land finance on industrial structure change in China: Insights from a spatial econometric analysis. Land Use Policy 2021, 103, 105323. [Google Scholar] [CrossRef]

- Wang, R.Y.; Tan, R. Efficiency and distribution of rural construction land marketization in contemporary China. China Econ. Rev. 2020, 60, 101223. [Google Scholar] [CrossRef]

- Wang, H.; Tao, R.; Wang, L.L.; Su, F.B. Farmland preservation and land development rights trading in Zhejiang, China. Habitat Int. 2010, 34, 454–463. [Google Scholar] [CrossRef]

- Zhang, J.P.; Fan, J.Y.; Mo, J.W. Government Intervention, Land Market, and Urban Development: Evidence from Chinese Cities. Econ. Inq. 2017, 55, 115–136. [Google Scholar] [CrossRef]

- Yep, R. Filling the institutional void in rural land markets in southern China: Is there room for spontaneous change from below? Dev. Change 2015, 46, 534–561. [Google Scholar] [CrossRef]

- Fehribach, F.A.; Rutherford, R.C.; Eakin, M.E. An analysis of the determinants of industrial property valuation. J. Real Estate Res. 1993, 8, 365–376. [Google Scholar] [CrossRef]

- Zhang, L.L.; Yue, W.Z.; Liu, Y.; Fan, P.L.; Wei, Y.H.D. Suburban industrial land development in transitional China: Spatial restructuring and determinants. Cities 2018, 78, 96–107. [Google Scholar] [CrossRef]

- Jiang, X.S.; Liu, S.Y. Land capitalization and rural industrialization: An investigation of the economic development in Nanhai, Foshan City, Guangdong Province. Manag. World 2003, 11, 87–97. (In Chinese) [Google Scholar]

- Lin, S.W.; Ben, T.M. Impact of government and industrial agglomeration on industrial land prices: A Taiwanese case study. Habitat Int. 2009, 33, 412–418. [Google Scholar] [CrossRef]

- Yao, R.; Wu, K.N.; Luo, M.; Zhang, X.J.; Feng, Z.; Li, C.X. Market development degree measurement and impact factors of collectively-owned construction land from the perspective of urban-rural integration: Take 30 pilot areas as examples. China Land Sci. 2018, 32, 14–20. (In Chinese) [Google Scholar]

- Durnev, A.; Kim, E.H. To steal or not to steal: Firm attributes, legal environment, and valuation. J. Financ. 2005, 60, 1461–1493. [Google Scholar] [CrossRef]

- Han, W.J.; Zhang, X.L.; Zheng, X. Land use regulation and urban land value: Evidence from China. Land Use Policy 2020, 92, 104432. [Google Scholar] [CrossRef]

- Cervero, R.; Duncan, M. Neighborhood composition and residential land prices: Does exclusion raise or lower values? Urban Stud. 2004, 41, 299–315. [Google Scholar] [CrossRef]

- Lee, M.J.; Sawada, Y. Review on Difference in Differences. Korean Econ. Rev. 2020, 36, 135–173. [Google Scholar]

- Puhani, P.A. The treatment effect, the cross difference, and the interaction term in nonlinear “difference-in-differences” models. Econ. Lett. 2012, 115, 85–87. [Google Scholar] [CrossRef]

- Oreopoulos, P. Estimating average and local average treatment effects of education when compulsory schooling laws really matter. Am. Econ. Rev. 2006, 96, 152–175. [Google Scholar] [CrossRef]

- Owen, G.; Harris, R.; Jones, K. Under examination: Multilevel models, geography and health research. Prog. Hum. Geogr. 2016, 40, 394–412. [Google Scholar] [CrossRef]

- Yuan, F.; Wei, Y.D.; Xiao, W.Y. Land marketization, fiscal decentralization, and the dynamics of urban land prices in transitional China. Land Use Policy 2019, 89, 104208. [Google Scholar] [CrossRef]

- Anselin, L. Spatial Externalities, Spatial Multipliers, and Spatial Econometrics. Int. Reg. Sci. Rev. 2003, 26, 153–166. [Google Scholar] [CrossRef]

- Kolak, M.; Anselin, L. A spatial perspective on the econometrics of program evaluation. Int. Reg. Sci. Rev. 2020, 43, 128–153. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Xu, J.N.; Li, G. How is Rural Land Marketization Possible? Cases Study Based on the Approach of Double Influences. J. Public Manag. 2019, 16, 108–117. (In Chinese) [Google Scholar]

- Taylor, A.B.; Mackinnon, D.P.; Tein, J.Y. Tests of the three-path mediated effect. Organ. Res. Methods 2008, 11, 241–269. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic confidence intervals for indirect effects in structural equation models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Ashenfelter, O.; Card, D. Using the longitudinal structure of earnings to estimate the effect of training programs. Rev. Econ. Stat. 1985, 67, 648–660. [Google Scholar] [CrossRef]

- Felsenstein, D.; Ashbel, E. Simultaneous modeling of developer behavior and land prices in UrbanSim. J. Transp. Land Use 2010, 3, 107–127. [Google Scholar] [CrossRef][Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).