Oil Palm Economic Benefit Distribution to Regions for Environmental Sustainability: Indonesia’s Revenue-Sharing Scheme

Abstract

1. Introduction

2. Materials and Methods

2.1. Framework Analysis

2.2. Data Collection

2.3. Data Analysis

3. Results

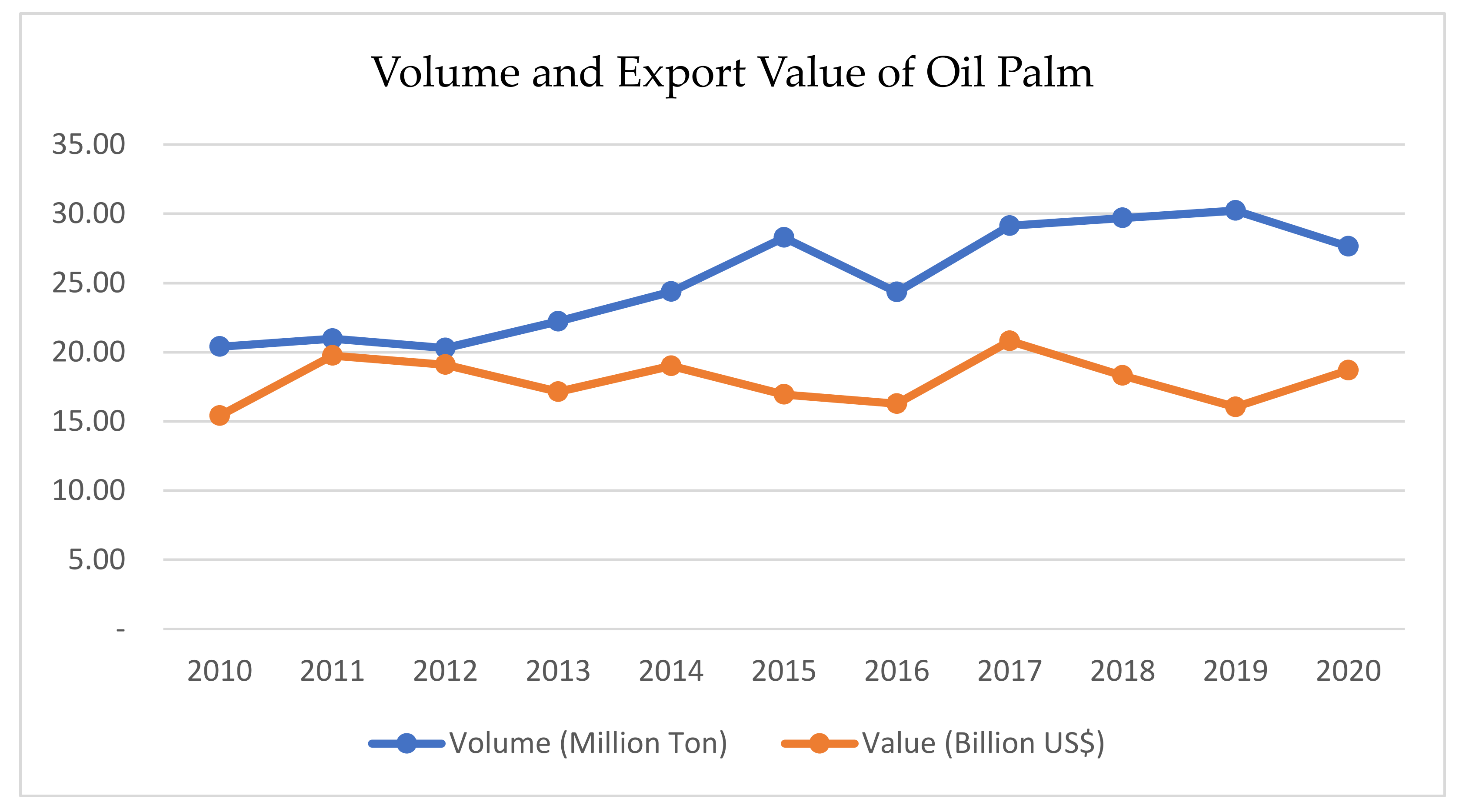

3.1. National Palm Oil Revenues

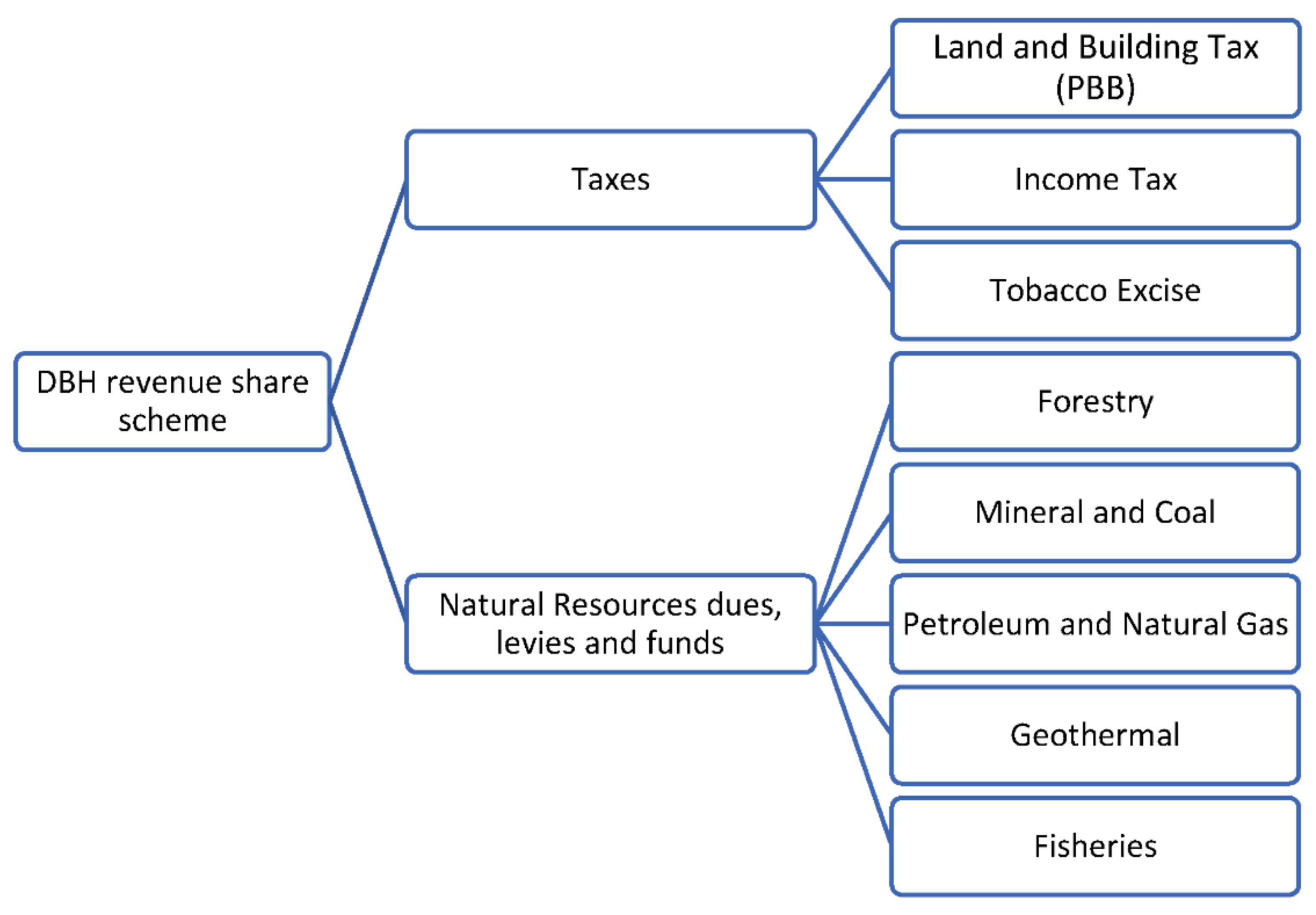

3.2. Fiscal Transfer through DBH Revenue-Sharing Scheme

3.3. DBH Sourcing from Natural Resources

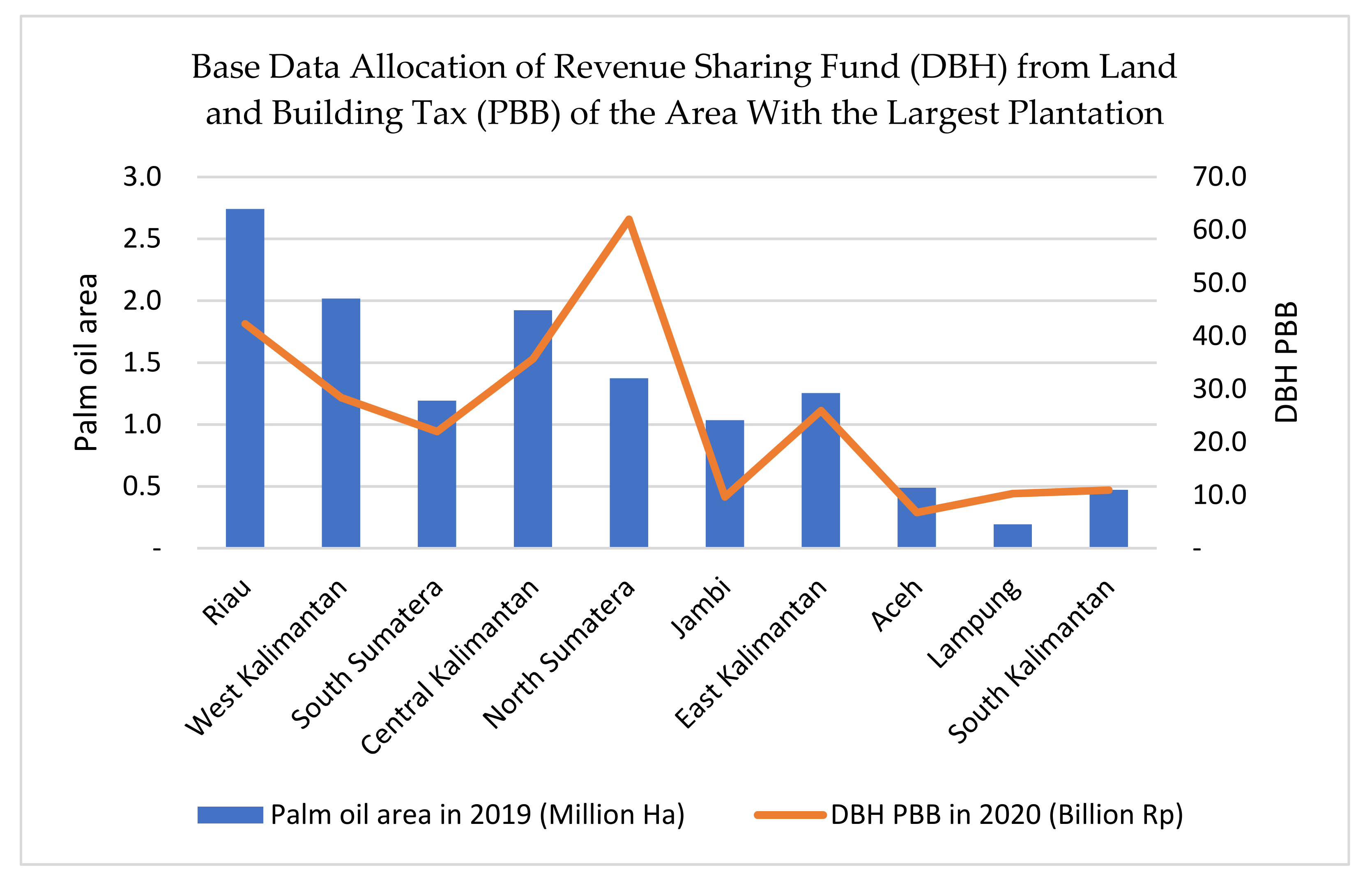

3.4. Potential Sources for DBH Sawit

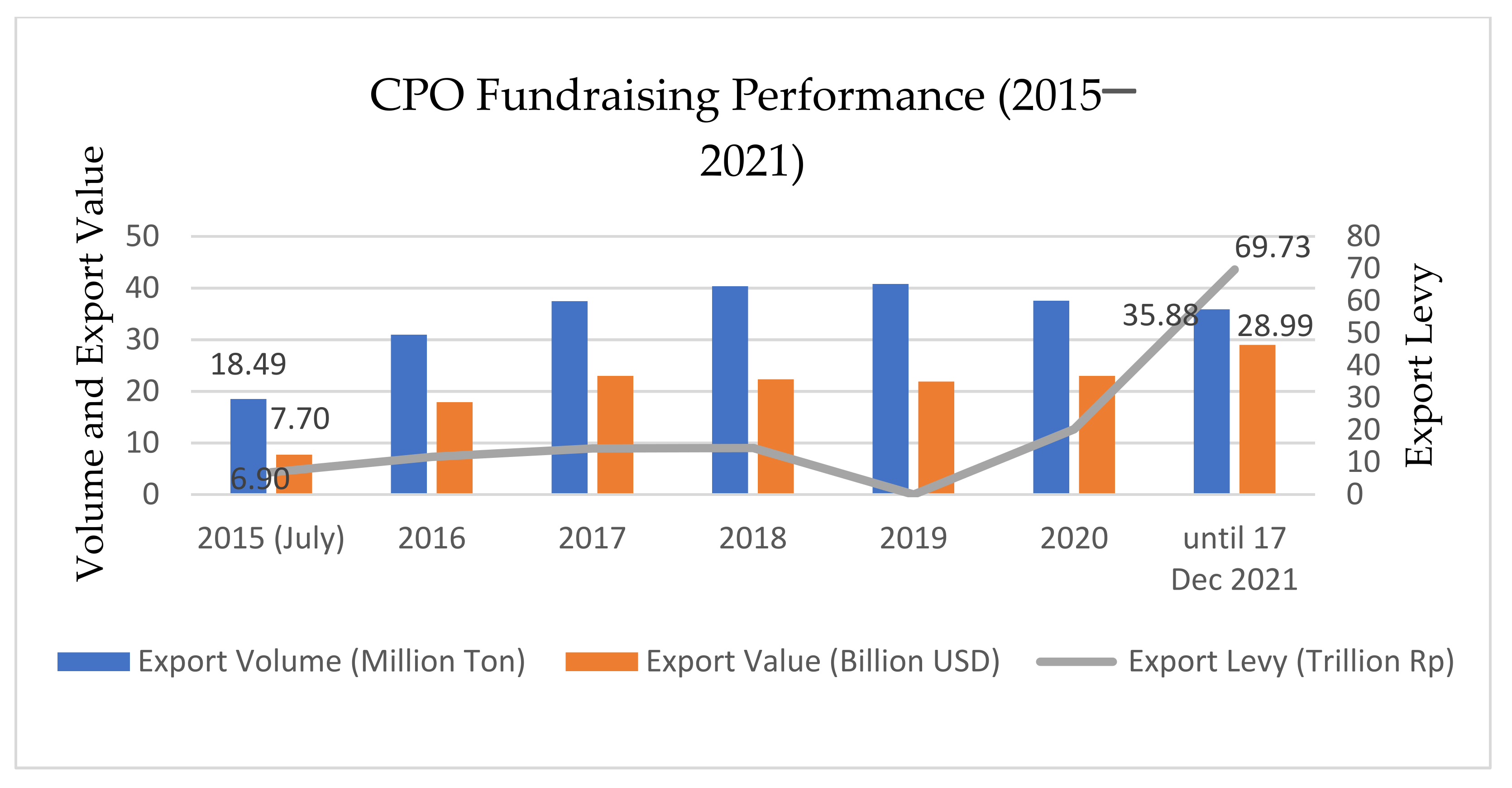

3.4.1. Palm Oil Export Levies

3.4.2. Revenues from Palm Oil Retribution

3.5. Assessing DBH Sawit Using SWOT Analysis

3.5.1. Strength

3.5.2. Weakness

3.5.3. Opportunities

3.5.4. Threat

4. Discussion

DBH Sawit as Fiscal and Incentivizing Instruments for Sustainability

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1. | Indonesia prioritized the development of a green and renewable energy system that increases the renewable energy target to 23% by 2025. It has a mandatory biodiesel programme with 30% palm oil content known as B30. Indonesia to ramp up biodiesel efforts to meet green energy targets, official says | Reuters |

| 2. | https://kabar24.bisnis.com/read/20200112/15/1189181/18-provinsi-penghasil-sawit-rumuskan-dana-bagi-hasil In January 2020, for instance, 20 provincial governments of palm oil producing provinces, 18 of which were represented by governor themselves, gathered in Riau. They made appeals for revisiting the current shared revenue scheme as stipulated in Law 33/2004 to enable them to receive portion of revenues from palm oils. |

| 3. | |

| 4. | See Article 123 of the revised Law No. 33/2004 |

| 5. | The Minister of Finance expected that regions can boost their income up to IDR 30.1 trillion through taxes and retribution (Menkeu: RUU HKPD akan dongkrak pendapatan daerah hingga Rp30,1 triliun—ANTARA News) |

| 6. | Indonesia’s palm oil exports down 2 percent in 2016—ANTARA News |

| 7. | This is based on analysis of statistical data issued by Dirjenbun (2020) and the Ministry of Finance’s database portal (http://www.djpk.kemenkeu.go.id/datadasar/dashboard) |

| 8. | Articles 2 and 3 of Finance Minister’s Regulation No. 230/PMK.07/2017 regarding uses, monitoring and evaluation of DBH natural resources (reforestation fund). 230~PMK.07~2017Per.pdf (kemenkeu.go.id) |

| 9. | Finance Minister’s Regulation No. 76/PMK.05/2021 regarding amendment on Minister’s Regulation No. 57/PMK.05/2020 regarding service tariff applicable at BPDPKS |

| 10. | Minister of Finance’s Regulation No. 05/2020 that amends No. 57/PMK.05/2020 concerning service tariffs for the public service agency in charge of managing palm oil funds (BPDPKS) |

| 11. | The overlapping is due both to the failure of plantations to respect concession boundaries, and weak governance of permitting authorities. Despite the overlapping, some plantations continue to operate, while others have stopped pending the outcome of investigations. |

| 12. | Menkeu: RUU HKPD akan dongkrak pendapatan daerah hingga Rp30,1 triliun—ANTARA News |

| 13. | Indonesia imposes mandatory domestic sales for palm oil—Nikkei Asia |

| 14. | Presidential Regulation No. 61/2015 concerning the collection and uses of palm oil plantation funds |

| 15. | Ministry of Environment and Forestry No. SK.01/MENLHK/SETJEN/KUM.1/1/2022 regarding Revocation of Forest Land Concession Licenses, issued on 5 January 2022 |

| 16. | See Article 123 of Law No. 1/2022 concerning Fiscal Decentralization between Central and Local Governments |

| 17. | Peraturan Menteri Pertanian No. 38/2020 regarding Indonesia Sustainable Palm Oil Certification |

References

- Dirjenbun. Statistik Perkebunan Unggulan Nasional 2019–2021; Direktorat Jenderal Perkebunan, Kementerian Pertanian: Jakarta, Indonesia, 2020. [Google Scholar]

- GoI. Peraturan Presiden No. 18 Tahun 2020 Tentang Rencana Pembangunan Jangka Menengah Nasional Tahun 2020–2024; Direktorat Jenderal Perkebunan, Kementerian Pertanian: Jakarta, Indonesia, 2020. [Google Scholar]

- DJPK Kemenkeu. Portal Data 2021. Available online: http://www.djpk.kemenkeu.go.id/datadasar/dashboard (accessed on 28 December 2021).

- Dirjenbun. Keragaan Data Kelapa Sawit Indonesia; Direktorat Jenderal Perkebunan, Kementerian Pertanian: Jakarta, Indonesia, 2021. [Google Scholar]

- Coordinating Ministry for Economic Affairs. Roadmap Hilirisasi Produk Kelapa Sawit Untuk Menjadikan Indonesia Sebagai Price Center Bagi CPO Global. In Proceedings of the Pers Conference, Jakarta, Indonesia, 12 November 2021. [Google Scholar]

- Norjani. Kotim Berharap Dapat Dana Bagi Hasil Sawit 2017. Available online: https://kalteng.antaranews.com/berita/269843/kotim-berharap-dapat-dana-bagi-hasil-sawit (accessed on 5 October 2021).

- Media Indonesia. Daerah Minta Ada Pembagian Dana Bagi Hasil Sawit. 2020. Available online: https://mediaindonesia.com/ekonomi/282877/daerah-minta-ada-pembagian-dana-bagi-hasil-sawit (accessed on 28 December 2021).

- Nurhayati, F. Menakar Kontribusi Sawit Pada Daerah. 2021. Available online: https://madaniberkelanjutan.id/2021/01/29/menakar-kontribusi-sawit-pada-daerah (accessed on 5 February 2022).

- Hasaniarto. Analisis Perimbangan Keuangan Pusat Dan Daerah: Studi Kasus Tuntutan Provinsi Riau Terhadap Dana Bagi Hasil Sub Sektor Perkebunan Kelapa Sawit. Jom FISIP 2015, 2, 1–11. [Google Scholar]

- Meijaard, E.; Brooks, T.M.; Carlson, K.M.; Slade, E.M.; Garcia-Ulloa, J.; Gaveau, D.L.A.; Lee, J.S.H.; Santika, T.; Juffe-Bignoli, D.; Struebig, M.J.; et al. The environmental impacts of palm oil in context. Nat. Plants 2020, 6, 1418–1426. [Google Scholar] [CrossRef] [PubMed]

- Petrenko, C.; Paltseva, J.; Searle, S. Ecological Impacts of Palm Oil Expansion in Indonesia; International Council on Clean Transportation: Washington, DC, USA, 2016. [Google Scholar]

- Mukherjee, I.; Sovacool, B.K. Palm oil-based biofuels and sustainability in southeast Asia: A review of Indonesia, Malaysia, and Thailand. Renew. Sustain. Energy Rev. 2014, 37, 1–12. [Google Scholar] [CrossRef]

- Manik, Y.; Leahy, J.; Halog, A. Social life cycle assessment of palm oil biodiesel: A case study in Jambi Province of Indonesia. Int. J. Life Cycle Assess. 2013, 18, 1386–1392. [Google Scholar] [CrossRef]

- Wicke, B.; Sikkema, R.; Dornburg, V.; Faaij, A. Exploring land use changes and the role of palm oil production in Indonesia and Malaysia. Land Use Policy 2011, 28, 193–206. [Google Scholar] [CrossRef]

- Savitri, M.D. Kebijakan Dana Bagi Hasil. 2021. Available online: https://auriga.or.id/resource/reference/mariana%20djpk%20kemenkeu%20-%20auriga%2026042021.pdf (accessed on 16 December 2021).

- DPR. Naskah Akademik Rancangan Undang-Undanga Tentang Hubungan Keuangan Antra Pemerintah Pusat Dan Pemerintah Daerah. 2021. Available online: https://www.dpr.go.id/uu/detail/id/355 (accessed on 16 December 2021).

- Saputra, W.; Halimatussadiah, A.; Haryanto, J.T.; Nurfatriani, F.; Salminah, M. Designing Policy of Ecological Fiscal Transfer in Indonesia: Regional Incentive Funds (DID), Specific Purpose Funds (DAK) for Environment and Forestry Sector and Village Funds (DD); Kemitraan Supported USAID BIJAK: Jakarta, Indonesia, 2020. [Google Scholar]

- Elida, S.W.R. The Effect of Regional Fiscal Policy on Regional Economic Growth (Study Case: Provinces in Kalimantan, Indonesia); International Institute of Social Studies: Den Haag, The Netherlands, 2013. [Google Scholar]

- Anggono, P. The Effect of Fiscal Balance Funds on Local Economic Growth in Indonesia. J. Ilm. Adm. Publik 2020, 006, 297–304. [Google Scholar] [CrossRef]

- Soejoto, A.; Subroto, W.T.; Suyanto, Y. Fiscal Decentralization Policy in Promoting Indonesia Human Development. Int. J. Econ. Financ. Issues 2015, 5, 763–771. [Google Scholar]

- Nursini, N.; Tawakkal, T. Poverty alleviation in the contex of fiscal decentralization in Indonesia. Econ. Sociol. 2019, 12, 270–285. [Google Scholar] [CrossRef]

- Nurfatriani, F.; Ramawati; Sari, G.K.; Komarudin, H. Optimalisasi Dana Sawit Dan Pengaturan Instrumen Fiskal Penggunaan Lahan Hutan Untuk Perkebunan Dalam Upaya Mengurangi Deforestasi; Working paper 238; CIFOR: Bogor, Indonesia, 2018. [Google Scholar]

- Manor, J. The Political Economy of Democratic Decentralisation; World Bank, IBRDm: Washington, DC, USA, 1999. [Google Scholar]

- Bahl, R. Intergovernmental Transfers in Developing and Transition Countries: Principles and Practice. In Urban and Local Government Background Series No 2; Municipal Finance; The World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Bahl, R. Implementation Rules for Fiscal Decentralization. In International Studies Program Working Paper 99–1; Andrew Young School of Policy Studies Georgia State University: Atlanta, GA, USA, 1999. [Google Scholar]

- Oates, W.E. An Essay on Fiscal Federalism. J. Econ. Lit. 1999, 37, 1120–1149. [Google Scholar] [CrossRef]

- Shah, R.; Ward, T. Defining and Developing Measures of Lean Production. J. Oper. Manag. 2007, 25, 785–805. [Google Scholar] [CrossRef]

- Ring, I.; May, P.H.; Loureiro, W.; dos Santos, R.F. Ecological Fiscal Transfer. In Instrument Mixes for Biodiversity Policies; Ring, I., Shlaack, C.S., Eds.; POLICYMIX Report No. 2/2011; Helmholtz Centre for Environmental Research-UFZ: Leipzig, Germany, 2011; pp. 98–118. Available online: Http://Policymix.Nina.No (accessed on 13 October 2021).

- GoI. Undang Undang No. 1 Tahun 2022 Tentang Hubungan Keuangan Antara Pemerintah Pusat Dan Pemerintah Daerah; Sekretariat Kabinet Republik Indonesia: Jakarta, Indonesia, 2022. [Google Scholar]

- GoI. Undang Undang No. 33 Tahun 2004 Tentang Perimbangan Keuangan Antara Pemerintah Pusat Dan Pemerintah Daerah; Sekretariat Kabinet Republik Indonesia: Jakarta, Indonesia, 2004. [Google Scholar]

- BPDPKS. BPDPKS Terus Menjaga Sawit Berkelanjutan Melewati Masa Pandemi 2021; Badan Pengelola Dana Perkebunan Kelapa Sawit: Jakarta, Indonesia, 2021. [Google Scholar]

- Bonnici, T.S.; Galea, D. SWOT Analysis. In Wiley Encyclopedia of Management; Cooper, C.L., Ed.; John Wiley&Sons, Ltd.: London, UK, 2014. [Google Scholar]

- Scolozzi, R.; Schirpke, U.; Morri, E.; D’Amato, D.; Santolini, R. Ecosystem services-based SWOT analysis of protected areas for conservation strategies. J. Environ. Manag. 2014, 146, 543–551. [Google Scholar] [CrossRef] [PubMed]

- Kazana, V.; Kazaklis, S.; Stamatiou, C.; Koutsona, P.; Boutsimea, A.; Fotakis, D. SWOT analysis for sustainable forest policy and management: A Greek case study. Int. J. Inf. Decis. Sci. 2015, 7, 32. [Google Scholar] [CrossRef]

- Nikolaou, E.I.; Ierapetritis, D.; Tsagarakis, K.P. An evaluation of the prospects of green entrepreneurship development using a SWOT analysis. Int. J. Sustain. Dev. World Ecol. 2011, 18, 1–16. [Google Scholar] [CrossRef]

- David, F.; David, F. Strategic Management: A Competitive Advantage Approach, Concepts and Cases, 16th ed.; Pearson Education Limited: Harlow, UK, 2015. [Google Scholar]

- Marino, E.; Hernando, C.; Planelles, R.; Madrigal, J.; Guijarro, M.; Sebastián, A. Forest fuel management for wildfire prevention in Spain: A quantitative SWOT analysis. Int. J. Wildland Fire 2014, 23, 373–384. [Google Scholar] [CrossRef]

- Subagiana, I.G.M.; Suryaniadi, S.M.; Wijayati, N.L.M. New Hope of Creative Industry for Reducing the Poverty of Fisherman in Pengambengan Village of Bali Province. In Proceedings of the 2nd International Conference on Applied Science and Technology 2019-Social Sciences Track (ICASTSS 2019), Bali, Indonesia, 24–25 October 2019; Volume 354. [Google Scholar]

- Reihanian, A.; Mahmood, N.Z.B.; Kahrom, E.; Hin, T.W. Sustainable tourism development strategy by SWOT analysis: Boujagh National Park, Iran. Tour. Manag. Perspect. 2012, 4, 223–228. [Google Scholar] [CrossRef]

- Rachid, G.; El Fadel, M. Comparative SWOT analysis of strategic environmental assessment systems in the Middle East and North Africa region. J. Environ. Manag. 2013, 125, 85–93. [Google Scholar] [CrossRef] [PubMed]

- Purwanto, H. Indonesia’s Palm Oil Exports Down 2 Percent in 2016. Antara Indonesia News Agency 2017. Available online: https://en.antaranews.com/news/108864/indonesias-palm-oil-exports-down-2-percent-in-2016#:~:text=Indonesia%60s%20palm%20oil%20exports%20down%202%20percent%20in,from%20after-effects%20of%20the%20El%20Nino%20weather%20phenomenon (accessed on 24 July 2021).

- PASPI. Analisis Ekspor CPO Indonesia Ke Uni Eropa: Faktor Apa Yang Mendorong Trend Positif. GAPKI, 2017. Available online: https://gapki.id/news/4268/analisis-ekspor-cpo-indonesia-ke-uni-eropa-faktor-apa-yang-mendorong-trend-positif (accessed on 28 December 2021).

- Uly, Y.A. Terdampak Pandemi, Volume Ekspor CPO Turun Jadi 34 Juta Ton Di 2020 2021. Available online: https://money.kompas.com/read/2021/02/04/192730726/terdampak-pandemi-volume-ekspor-cpo-turun-jadi-34-juta-ton-di-2020 (accessed on 28 December 2021).

- BPS. Statistik Kelapa Sawit Indonesia (Indonesian Oil Palm Statistics); BPS: Jakarta, Indonesia, 2021. [Google Scholar]

- Soedomo, S.; Kartodihardjo, V.; Hendrayanto; Wibowo, A.B.; Adinugraha, A.G.; Hadijah, S.; Prihatmaja, H.; Lewenussa, A.; Prasetyo, A.R. Tata Kelola Perkebunan Sawit di Indonesia: Studi Kasus Di Provinsi Riau Dan Kalimantan Barat; Forci Development: Bogor, Indonesia, 2018. [Google Scholar]

- Syaid, N.A.J.; Afifah, N.; Burhan, I. Penerapan pbb p3 Sektor Perkebunan Pada pt Madinra Inti Sawit. J. Anal. Akunt. dan Perpajak. 2020, 4, 99–116. [Google Scholar] [CrossRef]

- Wulandari, Y. Pengaruh Dana Bagi Hasil Terhadap Belanja Daerah Pada Kabupaten Dan Kota di Indonesia. J. Akut. 2014, 2, 1–20. [Google Scholar]

- Mulyati, S.; Yusriadi. Dana Bagi Hasil Dan Dana Alokasi Umum Terhadap Belanja Daerah Di Provinsi Aceh. J. Ekon. Dan Bisnis 2018, 2, 55–66. [Google Scholar] [CrossRef]

- Fauzi, T.; Darwanis; Abdulla, S. Pengaruh Pendapatan Asli Daerah, Dana Bagi Hasil, Dana Alokasi Umum, Dan Sisa Lebih Perhitungan Anggaran Terhadap Belanja Bantuan Sosial Pemerintah Daerah Di Aceh. J. Telaah Dan Ris. Akunt. 2014, 7, 76–92. [Google Scholar]

- Mafira, T.; Muluk, S. From Digging to Planting: A Sustainable Economic Transition for Berau, East Kalimantan; Global S&T Development Trend Analysis Platform of Resources and Environment. 2019. Available online: https://www.greengrowthknowledge.org/case-studies/digging-planting-sustainable-economic-transition-berau-east-kalimantan (accessed on 26 July 2021).

- KPK. Kajian Sistem Pengelolaan Komoditas Kelapa Sawit; Direktorat Penelitian dan Pengembangan, Kedeputian Pencegahan Komisi Pemberantasan Korupsi: Jakarta, Indonesia, 2016. [Google Scholar]

- Directorate General of Forestry Planning and Environmental Management. Proceedings of the Settlement of Oil Palm Plantations in Forest Area. Presented at FGD on Roadmap for Sustainable Indonesian Palm Oil Development (2022–2029), Bogor, Indonesia, 28–30 October 2021.

- Rahmawati, R.; Juniar, A.; Wardhana, A. Penerimaan Pajak Bumi Dan Bangunan Sektor Perkebunan, Perhutanan Dan Pertambangan (PBB P3) Di Kanwil Dirjen Pajak Kalselteng. Pros. Semin. Nas. AIMI 2017, 450–458. [Google Scholar]

- Muna, N.; Anggraeni, A.T.; Nisaa, C.; Faradila, F. Analisa Dampak Pungutan Ekspor Terhadap Kinerja Ekspor Sawit Dan Produk Turunannya; Pusat Pengkajian Perdagangan Luar Negeri, Badan Pengkajian dan Pengembangan Perdagangan, Ministry of Trade: Jakarta, Indonesia, 2020. [Google Scholar]

- Sukmananto, B. Dampak Kebijakan Perdagangan Terhadap Kinerja Ekspor Produk Industri Pengolahan Kayu Primer di Indonesia. Ph.D. Thesis, Sekolah Pascasarjana, Institut Pertanian Bogor, Bogor, Indonesia, 2007. [Google Scholar]

- BPDPKS. 2020 Annual Report: Optimizing Opportunities, Achieving Prime Performance for Sustainable Indonesian Palm Oil; Badan Pengelola Dana Perkebunan Kelapa Sawit: Jakarta, Indonesia, 2021. [Google Scholar]

- Hidayati, M.; Luthfi; Husaini, M. Kontribusi Perkebunan Kelapa Sawit Terhadap Ketahanan Pangan Rumah Tangga Dan Perekonomian Daerah Kabupaten Tanah Laut. Front. Agribisnis 2019, 3(4), 31–36. [Google Scholar]

- PDSI. Expor Impor Indonesia: Neraca Perdagangan Indonesia Total Periode 2016–2021. 2019. Available online: Https://Statistik.Kemendag.Go.Id/Indonesia-Trade-Balance (accessed on 24 June 2021).

- CME Group. An Overview of the Edible Oil Markets: Crude Palm Oil vs Soybean Oil; CME Group: Chicago, IL, USA, 2020. [Google Scholar]

- OECD; Food and Agriculture Organization of the United Nations. OECD-FAO Agricultural Outlook, 2021 ed.; OECD: Rome, Italy, 2022. [Google Scholar] [CrossRef]

- OECD; Food and Agriculture Organization of the United Nations. OECD-FAO Agricultural Outlook 2021-2030; OECD: Rome, Italy, 2021. [Google Scholar] [CrossRef]

- CPOPC. Palm Oil Supply and Demand Outlook Report 2021; Council of Palm Oil Producing Countries: Jakarta, Indonesia, 2021. [Google Scholar]

- Sari, D.W.; Hidayat, F.N.; Abdul, I. Efficiency of Land Use in Smallholder Palm Oil Plantations in Indonesia: A Stochastic Frontier Approach. For. Soc. 2021, 5, 75–89. [Google Scholar] [CrossRef]

- Grassini, P.; Edreira, J.I.R.; Andrade, J.F.; Van de Ven, G.W.J.; Hekman, W.; Van de Buken, R.; Van Lttersum, M.K.; Rahutomo, S.; Sutarta, E.S.; Agus, F.; et al. Developing an Atlas of Yield Potential and Yield Gaps for Current Oil Palm Plantation Area in Indonesia. In Proceedings of the International Oil Palm Conference (IOPC), Medan, Indonesia, 17–19 July 2018. [Google Scholar]

- Jelsma, I.; Woittiez, L.S.; Ollivier, J.; Dharmawan, A.H. Do wealthy farmers implement better agricultural practices? An assessment of implementation of Good Agricultural Practices among different types of independent oil palm smallholders in Riau, Indonesia. Agric. Syst. 2019, 170, 63–76. [Google Scholar] [CrossRef]

- Woittiez, L.S. On Yield Gaps and Better Management Practices in Indonesian Smallholder Oil Palm Plantations. Ph.D. Thesis, Wageningen University, Wageningen, The Netherlands, 2019. [Google Scholar] [CrossRef][Green Version]

- GAPKI. CPO Production Predicted to Rise by 3.5% Next Year. 2020. Available online: https://gapki.id/en/news/19589/cpo-production-predicted-to-rise-by-3-5-next-year#:~:text=Jakarta%20%E2%80%93%20The%20Indonesian%20Palm%20Oil%20Association%20%28GAPKI%29,from%20the%20expected%2047.4%20million%20tons%20this%20year (accessed on 12 October 2021).

- Wibowo, L.R.; Lestari, N.S.; Rochmayanto, Y. Kebijakan Pengembangan Biodiesel Berbasis Sawit: Mungkinkah Tanpa Peningkatan Konversi Kawasan Hutan? Policy Paper; Pusat Litbang Sosial Ekonomi Kebijakan dan Perubahan Iklim (P3SEKPI): Bogor, Indonesia, 2020. [Google Scholar]

- The Ministry of Energy and Mineral Resources. Peraturan Menteri Energi Dan Sumber Daya Mineral No. 24 Tahun 2021 Tentang Penyediaan Dan Pemanfaatan Bahan Bakar Nabati Jenis Biodiesel Dalam Kerangka Pembiayaan Oleh Badan Pengelola Dana Perkebunan Kelapa Sawit; Kementerian Energi dan Sumberdaya Mineral: Jakarta, Indonesia, 2021. [Google Scholar]

- EU. Stepping Up EU Action to Protect and Restore the World’s Forests; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- EU. Commission Delegated Regulation (EU) Supplementing Directive (EU) 2018/2001 as Regards the Determination of High Indirect Land-Use Change-Risk Feedstock for which A Significant Expansion of the Production Area into Land with High Carbon Stock Is Observed and the Certification of Low Indirect Landuse Change-Risk Biofuels, Bioliquids and Biomass Fuels; European Union: Brussel, Belgium, 2019. [Google Scholar]

- Eurostat. Key Figures on the European Food Chain: 2021 Edition, 2021 ed.; European Union: Brussel, Belgium, 2021. [Google Scholar]

- Rifin, A.; Feryanto; Herawati; Harianto. Assessing the impact of limiting Indonesian palm oil exports to the European Union. J. Econ. Struct. 2020, 9, 26. [Google Scholar] [CrossRef]

- Wicaksono, T.A. Indonesia’s Fight Against EU Palm Oil Ban—Analysis. Eurasia Review. 2021. Available online: https://www.geopoliticalmonitor.com/indonesias-fight-against-the-eu-palm-oil-ban/ (accessed on 28 December 2021).

- Christia, A.M.; Ispriyarso, B. Desentralisasi Fiskal dan Otonomi Daerah di Indonesia. LAW Reform 2019, 15, 149–163. [Google Scholar] [CrossRef]

- Ring, I.; Drechsler, M.; van Teeffelen, A.J.; Irawan, S.; Venter, O. Biodiversity conservation and climate mitigation: What role can economic instruments play? Curr. Opin. Environ. Sustain. 2010, 2, 50–58. [Google Scholar] [CrossRef]

- Irawan, S.; Tacconi, L.; Ring, I. Designing intergovernmental fiscal transfers for conservation: The case of REDD+ revenue distribution to local governments in Indonesia. Land Use Policy 2014, 36, 47–59. [Google Scholar] [CrossRef]

- Rao, M.G. Redesigning the Fiscal Transfer System in India. Econ. Political Wkly. 2019, IV, 52–60. [Google Scholar]

- Apresian, S.R.; Tyson, A.; Varkkey, H.; Choiruzzad, A.A.B.; Indraswari, R. Palm Oil Development in Riau, Indonesia: Balancing Economic Growth and Environmental Protection. Nusant. Int. J. Humanit. Soc. Sci. 2020, 2, 1–29. [Google Scholar] [CrossRef]

- Mumbunan, S.; Wahyudi, R. Assessing Revenue Loss from Legal Timber in Indonesia. For. Policy Econ. 2016, 71, 115–123. [Google Scholar] [CrossRef]

- Mumbunan, S.; Ring, I.; Lenk, T. Ecological Fiscal Transfers at the Provincial Level in Indonesia; Working Paper. No.6; Helmholtz Centre for Environmental Research (UFZ): Leipzig, Germany, 2012. [Google Scholar]

- Article 33 Indonesia. Transparansi Dan Penautan Rantai Perizinan Dalam Prakarsa Satu Informasi Perizinan (SIP) Dengan Rantai Penerimaan Negara Untuk Sektor-Sektor Berbasis Lahan. Laporan Untuk Unit Kerja Presiden Bidang Pengawasan Dan Pengendalian Pembangunan (UKP4). 2014. Available online: https://www.menpan.go.id/site/berita-terkini/kementerian-panrb-ukp4-kelola-lapor (accessed on 12 December 2021).

- Prayitno, H.; Taufik, A.; Fitriani, R.; Ramdan, D.; Gunawan; Putra, R.A.S. Mengukur Komitmen: Analisis Kebijakan Perencanaan Dan Anggaran Nasional Terhadap Pengelolaan Hutan Dan Lahan di Indonesia; FITRA: Jakarta, Indonesia, 2013. [Google Scholar]

- Adrison, V. Deforestation in Decentralized and Democratic Indonesia; Working Paper; LPEM FEUI: Jakarta, Indonesia, 2013. [Google Scholar]

- Oka, N.P. Dilema Kebijakan Perimbangan Dana Reboisasi; CIFOR: Bogor, Indonesia, 2004. [Google Scholar]

- Subarudi; Dwiprabowo, H. Otonomi Daerah Bidang Kehutanan Implementasi Dan Tantangan Kebijakan Perimbangan Keuangan; CIFOR: Bogor, Indonesia, 2007. [Google Scholar]

- Barr, C.; Resosudarmo, I.A.P.; Dermawan, A.; McCarthy, J.; Moeliono, M.; Setiono, B. Decentralization of Forest Administration in Indonesia: Implications for Forest Sustainability, Economic Development and Community Livelihood; Centre for International Research: Bogor, Indonesia, 2006. [Google Scholar]

- Barr, C.; Dermawan, A.; Purnomo, H.; Komarudin, H. Financial Governance and Indonesia’s Reforestation Fund During the Soeharto and Postsoeharto Periods, 1989–2009. A Political Economic Analysis of Lessons for REDD+; Centre for International Forestry Research: Bogor, Indonesia, 2010. [Google Scholar]

- Irawan, S.; Tacconi, L.; Ring, I. Stakeholders’ incentives for land-use change and REDD+: The case of Indonesia. Ecol. Econ. 2013, 87, 75–83. [Google Scholar] [CrossRef]

- Greenomics Indonesia; Indonesian Corruption Watch. Pungutan Usaha Kayu-Evolusi Terhadap Mekanisme Perhitungan, Pemungutan, Dan Penggunaan Pungutan Usaha Kayu; Greenomics Indonesia and Indonesian Corruption Watch: Jakarta, Indonesia, 2004. [Google Scholar]

- Pradiptyo, R.; Saputra, W.; Nugroho, A.; Hutami, A. Ketika Kekayaan Alam Tidak Menyejahterakan: Pembelajaran Dari Pencegahan Korupsi Sektor Sumber Daya Alam. J. Antikorupsi Integritas 2019, 5, 49–63. [Google Scholar] [CrossRef]

- Hudori, M. Perbandingan Kinerja Perkebunan Kelapa Sawit Indonesia dan Malaysia. J. Citra Widya Edukasi 2017, IX, 93–112. [Google Scholar]

- Ebarcelos, E.; Rios, S.D.A.; Cunha, R.N.V.; lopes, R.; Motoike, S.Y.; Ebabiychuk, E.; Eskirycz, A.; Kushnir, S. Oil palm natural diversity and the potential for yield improvement. Front. Plant. Sci. 2015, 6, 190. [Google Scholar] [CrossRef]

- Afriyanti, D.; Kroeze, C.; Saad, A. Indonesia palm oil production without deforestation and peat conversion by 2050. Sci. Total Environ. 2016, 557–558, 562–570. [Google Scholar] [CrossRef] [PubMed]

- Taheripour, F.; Zhao, X.; Tyner, W.E. The impact of considering land intensification and updated data on biofuels land use change and emissions estimates. Biotechnol. Biofuels 2017, 10, 1–16. [Google Scholar] [CrossRef] [PubMed]

- Pacheco, P.; Dermawan, A.; Komarudin, H.; Okarda, B. The Palm Oil Global Value Chain: Implications for Economic Growth and Social and Environmental Sustainability; Working Paper 220; CIFOR: Bogor, Indonesia, 2017. [Google Scholar]

- Schoneveld, G.C.; van der Haar, S.; Ekowati, D.; Andrianto, A.; Komarudin, H.; Okarda, B.; Jelsma, I.; Pacheco, P. Certification, good agricultural practice and smallholder heterogeneity: Differentiated pathways for resolving compliance gaps in the Indonesian oil palm sector. Glob. Environ. Chang. 2019, 57, 101933. [Google Scholar] [CrossRef]

- Piñeiro, V.; Arias, J.; Dürr, J.; Elverdin, P.; Ibáñez, A.M.; Kinengyere, A.; Opazo, C.M.; Owoo, N.; Page, J.R.; Prager, S.D.; et al. A scoping review on incentives for adoption of sustainable agricultural practices and their outcomes. Nat. Sustain. 2020, 3, 809–820 . [Google Scholar] [CrossRef]

- Kadarusman, Y.B.; Herabadi, A.G. Improving Sustainable Development within Indonesian Palm Oil: The Importance of the Reward System. Sustain. Dev. 2018, 26, 422–434. [Google Scholar] [CrossRef]

- Oates, W.E. Fiscal and Regulatory Competition: Theory and Evidence. Perspekt. Wirtsch. 2002, 3, 377–390. [Google Scholar] [CrossRef]

- Kitchen, H.; McMillan, M.; Shah, A. Local Public Finance and Economics. An International Perspective; Palgrave Macmillan: London, UK, 2019. [Google Scholar]

- Andersson, K.; Ostrom, E. Analyzing Decentralized Natural Resource Governance from A Polycentric Perspective. Policy Sci. 2008, 41, 1–23. [Google Scholar] [CrossRef]

- Ring, I. Integrating local ecological services into intergovernmental fiscal transfers: The case of the ecological ICMS in Brazil. Land Use Policy 2008, 25, 485–497. [Google Scholar] [CrossRef]

- Nurfatriani, F.; Rochmayanto, Y.; Salminah, M.; Sari, G.K.; Kurniasari, D.R. Konsep Kebijakan Transfer Fiskal Berbasis Ekologi; IPB Press: Bogor, Indonesia, 2020. [Google Scholar]

- Cao, H.; Qi, Y.; Chen, J.; Shao, S.; Lin, S. Incentive and coordination: Ecological fiscal transfers’ effects on eco-environmental quality. Environ. Impact Assess. Rev. 2020, 87, 106518. [Google Scholar] [CrossRef]

- Lyons-White, J.; Knight, A.T. Palm oil supply chain complexity impedes implementation of corporate no-deforestation commitments. Glob. Environ. Chang. 2018, 50, 303–313. [Google Scholar] [CrossRef]

- van Duijn, G. Traceability of the palm oil supply chain. Lipid Technol. 2013, 25, 15–18. [Google Scholar] [CrossRef]

- RSPO. Palm Oil Traceability Protocol. 2016. Available online: https://www.rspo.org/acop/2016/pepsico/M-Practice-Guidelines.pdf (accessed on 5 February 2022).

- Hirbli, T. Palm Oil Traceability: Blockchain Meets Supply Chain; Supply Chain Management Program, Massachusetts Institute of Technology: Cambridge, MA, USA, 2018. [Google Scholar]

- MoEF. The State of Indonesia’s Forests 2020; Ministry of Environment and Forestry: Jakarta, Indonesia, 2021. [Google Scholar]

- Seymour, F.J.; Aurora, L.; Arif, J. The Jurisdictional Approach in Indonesia: Incentives, Actions, and Facilitating Connections. Front. For. Glob. Chang. 2020, 3, 503326. [Google Scholar] [CrossRef]

- Dawid, H.; Harting, P.; Neugart, M. Fiscal transfers and regional economic growth. Rev. Int. Econ. 2017, 26, 651–671. [Google Scholar] [CrossRef]

- Ward, P.S.; Bell, A.R.; Parkhurst, G.M.; Droppelmann, K.; Mapemba, L. Heterogeneous preferences and the effects of incentives in promoting conservation agriculture in Malawi. Agric. Ecosyst. Environ. 2016, 222, 67–79. [Google Scholar] [CrossRef]

- Suich, H. The effectiveness of economic incentives for sustaining community based natural resource management. Land Use Policy 2013, 31, 441–449. [Google Scholar] [CrossRef]

- Wirawan, A.; Sinaga, B.R.P. Fair and Beneficial Tobacco Excise Sharing Funds Regulations for Tobacco Farmers in Indonesia. Adv. Soc. Sci. Educ. Humanit. Res. 2020, 499, 632–639. [Google Scholar] [CrossRef]

- Yuliani, E.L.; de Groot, W.T.; Knippenberg, L.; Bakara, D.O. Forest or oil palm plantation? Interpretation of local responses to the oil palm promises in Kalimantan, Indonesia. Land Use Policy 2020, 96, 104616. [Google Scholar] [CrossRef]

- Gatto, M.; Wollni, M.; Qaim, M. Oil palm boom and land-use dynamics in Indonesia: The role of policies and socioeconomic factors. Land Use Policy 2015, 46, 292–303. [Google Scholar] [CrossRef]

| Strengths | Weaknesses |

|---|---|

| S1: Sizable area of oil palm plantations | W1: Tax revenues from palm oil are not optimal as some plantations are located on state forest lands and not all corporate plantations are on land with business rights (HGU) |

| S2: High production of palm oil | W2: Absence of traceability systems that enable each region to trace all processes from FFB production to CPO exports |

| S3: Palm oil as the largest source of foreign exchange | W3: Absence of databases to calculate portions of shared funds |

| S4: Palm oil’s contribution to regional economic development | W4: Lack of local government capacity to manage and use shared funds from palm oils |

| S5: Supporting regulations for sharing revenue funds | |

| S6: Local government institutions in support of sharing revenue funds | |

| S7: Huge amount of palm oil export levy | |

| Opportunities | Threats |

| O1: Enthusiasm of local governments for the new revenue- sharing scheme of natural resources from palm oil | T1: EU policies on sourcing deforestation-free palm oil products |

| O2: Increased global demand for palm oils | T2: Vegetable oil market competition that affects palm oil production and price fluctuation |

| O3: Potential increased production of CPO and its derivatives | T3: Lack of land intensification (i.e., good agricultural practices, replanting) causing low crop productivity |

| O4: Enhanced systems for IFT, particularly for a shared revenue mechanism | T4: Inappropriate use of DBH funds to support sustainable palm oil |

| O5: Potential use of performance-based accountability system (e.g., ecological fiscal transfer) | T5: Resistance among actors receiving biodiesel incentives from CPO levies |

| T6: Increased domestic demand for palm oils (e.g., biodiesel policies) |

| Revenue Source | Revenue Type | Authority | |

|---|---|---|---|

| Central | Regional | ||

| PNBP | Seeding | 100% | |

| Export levies | 100% | ||

| Pajak | Duty | 100% | |

| Land and building taxes (PBB) | 10% | 90% | |

| Corporate income tax (PPh Badan) | 100% | ||

| Personal income tax (PPh OP) | 80% | 20% | |

| Value added taxes (PPN) | 100% | ||

| SWOT Analysis | |

|---|---|

| Factors | Weighting Score |

| Strength | 1.87 |

| Weakness | 1.15 |

| Opportunity | 1.61 |

| Threat | 1.67 |

| Strength | |

|---|---|

| Internal Factors | Weighting Score |

| S1: Extensive area | 0.02 |

| S2: High production | 0.30 |

| S3: High foreign exchange | 0.33 |

| S4: Regional economic contribution | 0.63 |

| S5: Supporting regulations | 0.18 |

| S6: Institutional support | 0.15 |

| S7: Export levy | 0.24 |

| Weakness | |

|---|---|

| Internal Factors | Weighting Score |

| W1: Non-optimal tax revenues | 0.58 |

| W2: Non-existent traceability of production systems | 0.39 |

| W3: Absence of database of DBH | 0.11 |

| W4: Lack of local government management capacity | 0.07 |

| Opportunity | |

|---|---|

| External Factors | Weighting Score |

| O1: Great local government enthusiasm | 0.06 |

| O2: Increased global demand for palm oils | 0.17 |

| O3: Increased production | 0.28 |

| O4: Enhanced fiscal transfer system | 0.38 |

| O5 Ecological fiscal transfer | 0.72 |

| Threat | |

|---|---|

| External Factors | Weighting Score |

| T1: EU ban | 0.04 |

| T2: Market competition | 0.18 |

| T3: Lack of land intensification | 0.37 |

| T4: Inappropriate use of funds | 0.55 |

| T5: Actor resistance | 0.21 |

| T6: Increased domestic demand | 0.32 |

| Internal—External Factors | Strength |

| S1: Sizable area of oil palm plantations | |

| S2: High production of palm oil | |

| S3: Palm oil as the largest source of foreign exchange | |

| S4: Palm oil’s contribution to regional economic development | |

| S5: Supporting regulations for sharing revenue funds | |

| S6: Local government institutions in support of sharing revenue funds | |

| S7: Huge amount of palm oil export levy | |

| Threat | Diversification strategies |

| T1: EU policies on sourcing deforestation-free palm oil products | 1. Increase palm oil productivity through land intensification to meet high global market demand |

| T2: Vegetable oil market competition resulting in palm oil production and price fluctuation | 2. Accelerate sustainable palm oil certification for all business actors (companies and smallholders) |

| T3: Lack of land intensification (i.e., good agricultural practices, replanting) causing low crop productivity | 3. Revamp sustainable palm oil governance to encourage increased palm oil exports |

| T4: Inappropriate use of DBH funds to support sustainable palm oil | 4. Conduct inventory, tracing, recording of palm oil production with regions’ jurisdictions, the results of which could be the basis for DBH Sawit formula |

| T5: Resistance among actors receiving biodiesel incentive from CPO levies | 5. Formulate sustainability criteria used for allocating funds through revenue-sharing scheme |

| T6: Increased domestic demand for palm oils (e.g., biodiesel policies) | 6. Advocate the adoption of ecological-based fiscal transfer concept for DBH Sawit |

| 7. Expand opportunities to use export levy funds as an incentive for the region by referring to provisions on the use of plantation funds as specified in the Plantation Law (Law No. 39/2014) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nurfatriani, F.; Ramawati; Sari, G.K.; Saputra, W.; Komarudin, H. Oil Palm Economic Benefit Distribution to Regions for Environmental Sustainability: Indonesia’s Revenue-Sharing Scheme. Land 2022, 11, 1452. https://doi.org/10.3390/land11091452

Nurfatriani F, Ramawati, Sari GK, Saputra W, Komarudin H. Oil Palm Economic Benefit Distribution to Regions for Environmental Sustainability: Indonesia’s Revenue-Sharing Scheme. Land. 2022; 11(9):1452. https://doi.org/10.3390/land11091452

Chicago/Turabian StyleNurfatriani, Fitri, Ramawati, Galih Kartika Sari, Wiko Saputra, and Heru Komarudin. 2022. "Oil Palm Economic Benefit Distribution to Regions for Environmental Sustainability: Indonesia’s Revenue-Sharing Scheme" Land 11, no. 9: 1452. https://doi.org/10.3390/land11091452

APA StyleNurfatriani, F., Ramawati, Sari, G. K., Saputra, W., & Komarudin, H. (2022). Oil Palm Economic Benefit Distribution to Regions for Environmental Sustainability: Indonesia’s Revenue-Sharing Scheme. Land, 11(9), 1452. https://doi.org/10.3390/land11091452