Hybrid Approaches for Smart Contracts in Land Administration: Lessons from Three Blockchain Proofs-of-Concept

Abstract

1. Introduction

2. Background

2.1. Land Dealings and Conveyance

2.2. Smart Contracts

2.3. Technology Readiness Levels

2.4. Towards Hybrid Solutions

3. Materials and Methods

4. Results

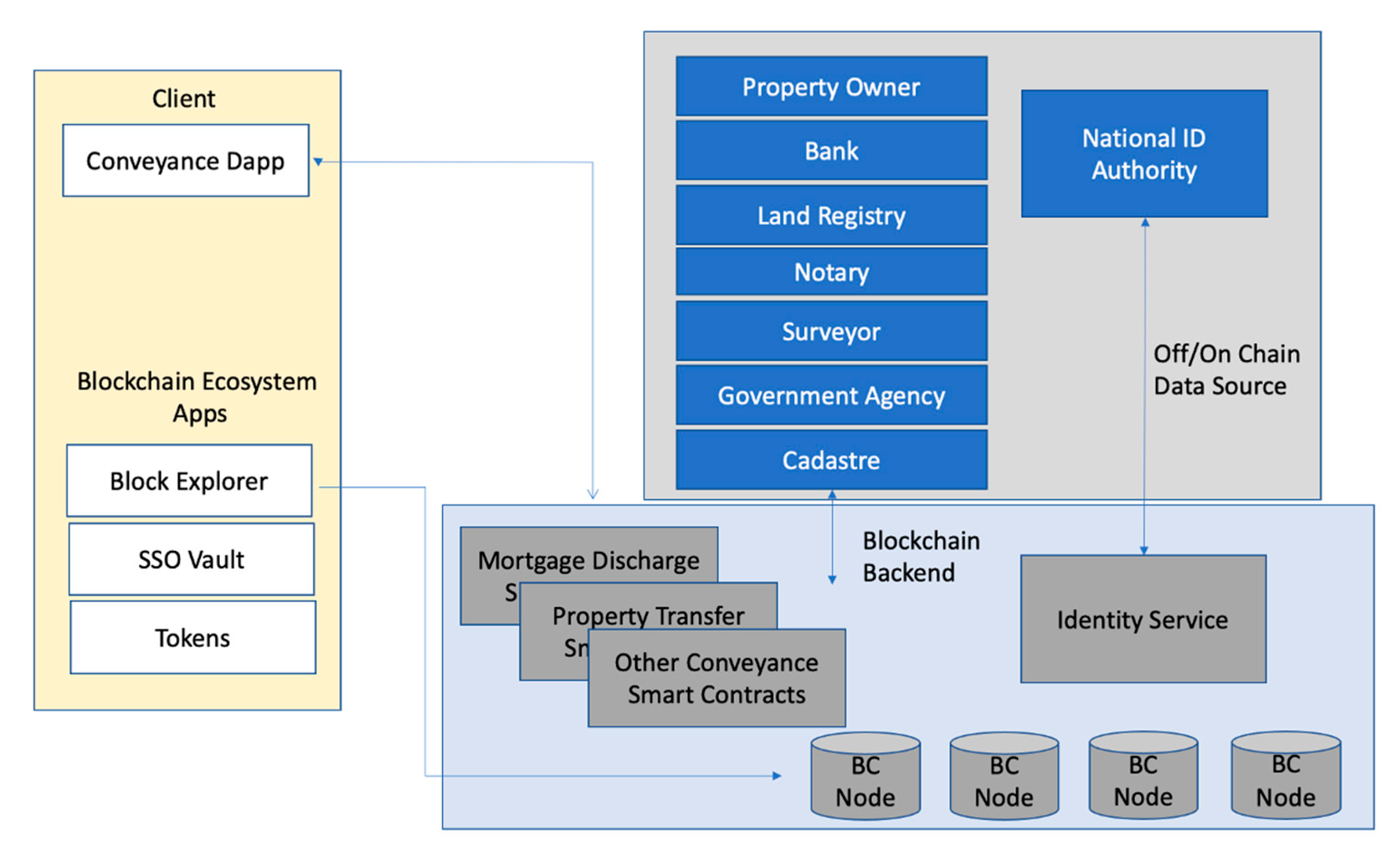

4.1. The Hybrid Approach

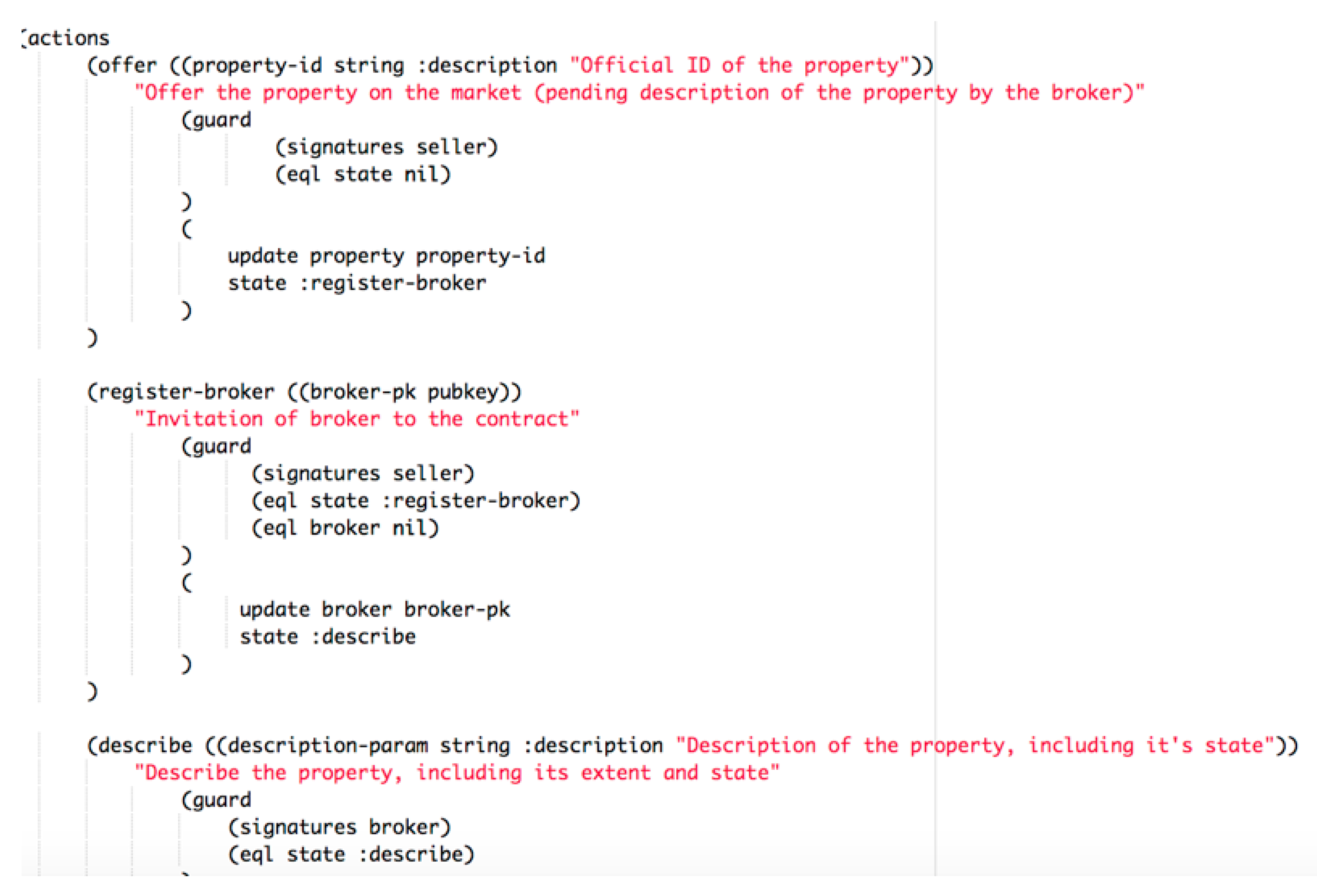

4.2. The Swedish Case—Property Sales

4.3. The Australian Case—Mortgage Discharge

4.4. The Canadian Case—Re-Assignment Reporting in British Columbia

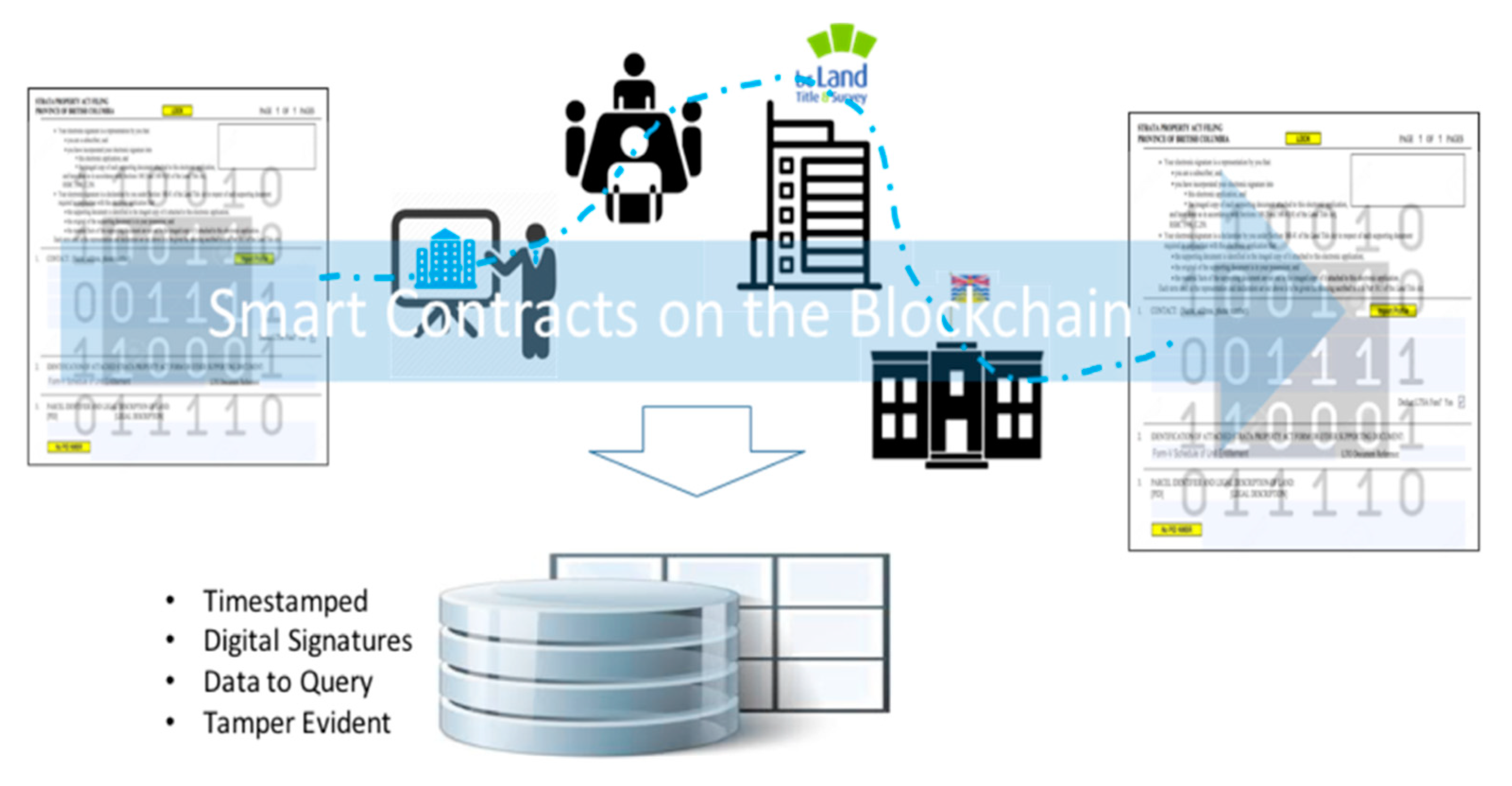

5. Discussion

5.1. Business Requirements Adherence

5.2. Technology Readiness and Maturity Levels

5.3. Strategic Grid Positioning

5.4. Necessity for Sector-Wide Approaches

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bennett, R.M.; Pickering, M.; Sargent, J. Transformations, transitions, or tall tales? A global review of the uptake and impact of NoSQL, blockchain, and big data analytics on the land administration sector. Land Use Policy 2019, 83, 435–448. [Google Scholar] [CrossRef]

- Olsen, B.L. Beyond the Hype: Exploring Blockchain Technology in Land Administration—A Case Study of Ghana and Property Rights. Masters’s Thesis, Copenhagen Business School, Copenhagen, Denmark, 17 September 2020. [Google Scholar]

- Pisa, M.; Juden, M. Blockchain and Economic Development: Hype vs. Reality; Center for Global Development: Washington, DC, USA, 2017; Volume 107, p. 150. [Google Scholar]

- Thomas, R.; Huang, C. Blockchain, the Borg collective and digitalisation of land registries. Convey. Prop. Lawyer 2017, 81. [Google Scholar] [CrossRef]

- Martyn, A. The Concept of Land Plot as a Combination of Smart Contracts: A Vision for Creating Blockchain Cadastre. Balt. Surv. 2018, 8, 68–73. [Google Scholar] [CrossRef]

- Karamitsos, I.; Papadaki, M.; Al Barghuthi, N.B. Design of the blockchain smart contract: A use case for real estate. J. Inf. Secur. 2018, 9, 177–190. [Google Scholar] [CrossRef]

- Ameyaw, P.D.; de Vries, W.T. Transparency of Land Administration and the Role of Blockchain Technology, a Four-Dimensional Framework Analysis from the Ghanaian Land Perspective. Land 2020, 9, 491. [Google Scholar] [CrossRef]

- Zevenbergen, J.; Frank, A.; Stubjkaer, E. Real Property Transactions. Procedures, Transaction Costs and Models; IOS Press: Amsterdam, The Netherlands, 2008. [Google Scholar]

- Szabo, N. Formalizing and Securing Relationships on Public Networks. First Monday 1997, 2. [Google Scholar] [CrossRef]

- Lauslahti, K.; Mattila, J.; Seppala, T. Smart Contracts How Will Blockchain Technology Affect Contractual Practices? SSRN Electron. J. 2017. [Google Scholar] [CrossRef]

- Vos, J.A.; Lemmen, C.H.; Beentjes, B.E. Blockchain based land administration feasible, illusory or a panacea. In Proceedings of the 2017 World Bank Conference on Land and Poverty, Washington, DC, USA, 20–24 March 2017. [Google Scholar]

- Lemmen, C.; Vos, J.; Beentjes, B. Ongoing Development of Land Administration Standards: Blockchain in Transaction Management. Eur. Prop. Law J. 2017, 6, 478–502. [Google Scholar]

- Larsson, G. Land Registration and Cadastral Systems; Tools for Land Information and Management; Longman Scientific and Technical: Norfolk, UK, 1991. [Google Scholar]

- Zevenbergen, J. Systems of Land Registration Aspects and Effects; Publications on Geodesy: Delft, The Netherlands, 2002. [Google Scholar]

- Simpson, S.R. Land Law and Registration; Cambridge University Press: Cambridge, UK, 1976. [Google Scholar]

- Williamson, I.; Ting, L. Land administration and cadastral trends—A framework for re-engineering. Comput. Environ. Urban Syst. 2001, 25, 339–366. [Google Scholar] [CrossRef]

- Griffith-Charles, C. The application of the social tenure domain model (STDM) to family land in Trinidad and Tobago. Land Use Policy 2011, 28, 514–522. [Google Scholar] [CrossRef]

- Henssen, J. Land Registration and Cadastre Systems: Principles and Related Issues; Technische Universität München: Munich, Germany, 2010. [Google Scholar]

- Barry, M.; Augustinus, C. Property theory, metaphors and the continuum of land rights. In Securing Land and Property Rights for All; UN-Habitat/Global Land Tools Network Nairobi: Nairobi, Kenya, 2015. [Google Scholar]

- Lemmen, C.; Van Oosterom, P.; Bennett, R. The land administration domain model. Land Use Policy 2015, 49, 535–545. [Google Scholar] [CrossRef]

- Zevenbergen, J.; Augustinus, C.; Antonio, D.; Bennett, R. Pro-poor land administration: Principles for recording the land rights of the underrepresented. Land Use Policy 2013, 31, 595–604. [Google Scholar] [CrossRef]

- Zakout, W.; Wehrmann, B.; Torhonen, M.P. Good Governance in Land Administration; World Bank: Washington, DC, USA, 2006. [Google Scholar]

- Dale, P.; McLaughlin, J. Land Administration; Oxford University Press: Oxford, UK, 2000. [Google Scholar]

- Burns, T.; Grant, C.; Nettle, K.; Brits, A.M.; Dalrymple, K. Land Administration Reform: Indicators of Success and Future Challenges. Agric. Rural Dev. Discuss. Pap. 2007, 37, 1–227. [Google Scholar]

- Bennett, R.; Wallace, J.; Williamson, I. Organising land information for sustainable land administration. Land Use Policy 2008, 25, 126–138. [Google Scholar] [CrossRef]

- Griggs, L.; Thomas, R.; Low, R.; Scheibner, J. Blockchains, Trust and Land Administration—The Return of Historical Provenance. Prop. Law Rev. 2017, 6, 180. [Google Scholar]

- Zevenbergen, J.; De Vries, W.; Bennett, R.M. (Eds.) Advances in Responsible Land Administration; CRC Press: Boca Raton, FL, USA, 2015. [Google Scholar]

- The Law Handbook 2020. Available online: https://www.lawhandbook.org.au/2020_00_00_05_glossary/ (accessed on 20 January 2020).

- Ryan, F. Round Hall Nutshells Contract Law; Thomson Round Hall: Dublin, Ireland, 2006. [Google Scholar]

- Hemmo, M.; Sopimusoikeus, I. Uudistettu Painos; Talentum Media Oy: Helsinki, Finland, 2003. [Google Scholar]

- Hemmo, M. Sopimusoikeuden Oppikirja; Talentum Media Oy: Helsinki, Finland, 2006. [Google Scholar]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. Manubot. (From 2008). Available online: https://nakamotoinstitute.org/bitcoin/ (accessed on 20 November 2019).

- Buterin, V. A Next-Generation Smart Contract and Decentralized Application Platform. White Paper. Available online: https://cryptorating.eu/whitepapers/Ethereum/Ethereum_white_paper.pdf (accessed on 3 January 2014).

- Christidis, K.; Devetsikiotis, M. Blockchains and smart contracts for the internet of things. IEEE Access 2016, 4, 2292–2303. [Google Scholar] [CrossRef]

- Wang, S.; Ouyang, L.; Yuan, Y.; Ni, X.; Han, X.; Wang, F.Y. Blockchain-enabled smart contracts: Architecture, applications, and future trends. IEEE Trans. Syst. Man Cybern. Syst. 2019, 49, 2266–2277. [Google Scholar] [CrossRef]

- Webster, A.; Gardner, J. Aligning technology and institutional readiness: The adoption of innovation. Technol. Anal. Strateg. Manag. 2019, 31, 1229–1241. [Google Scholar] [CrossRef]

- Sauser, B.J.; Ramirez-Marquez, J.E.; Henry, D.; Di Marzio, D. A system maturity index for the systems engineering life cycle. Int. J. Ind. Syst. Eng. 2008, 3, 673–691. [Google Scholar]

- Hicks, B.; Larsson, A.; Culley, S.; Larsson, T. A methodology for evaluating technology readiness during product development. In Proceedings of the 17th International Conference on Engineering Design (ICED’09) Design Has Never Been This Cool, Stanford University, Stanford, CA, USA, 24–27 August 2009. [Google Scholar]

- Janssen, M.; Weerakkody, V.; Ismagilova, E.; Sivarajah, U.; Irani, Z. A framework for analysing blockchain technology adoption: Integrating institutional, market and technical factors. Int. J. Inf. Manag. 2020, 50, 302–309. [Google Scholar] [CrossRef]

- Ammous, S.H. Blockchain Technology: What is it Good for? SSRN Electron. J. 2016, 2832751. [Google Scholar] [CrossRef]

- Ølnes, S.; Ubacht, J.; Janssen, M. Blockchain in government: Benefits and implications of distributed ledger technology for information sharing. Gov. Inf. Q. 2017, 34, 355–364. [Google Scholar] [CrossRef]

- Depietro, R.; Wiarda, E.; Fleischer, M. The context for change: Organization, technology and environment. Process. Technol. Innov. 1990, 199, 151–175. [Google Scholar]

- Clohessy, T.; Treiblmaier, H.; Acton, T.; Rogers, N. Antecedents of blockchain adoption: An integrative framework. Strateg. Chang. 2020, 29, 501–515. [Google Scholar] [CrossRef]

- Humphrey, W.S. Managing the Software Process; Addison-Wesley Longman Publishing Co., Inc.: Boston, MA, USA, 3 January 1989. [Google Scholar]

- Paulk, M.C.; Curtis, B.; Chrissis, M.B.; Weber, C.V. Capability Maturity Model for Software, Version 1.1; Software Engineering Institute: Pittsburgh, PA, USA, February 1993; CMU/SEI-93-TR-24, DTIC Number ADA263403.

- Osterland, T.; Rose, T. From a Use Case Categorization Scheme Towards a Maturity Model for Engineering Distributed Ledgers. In Blockchain and Distributed Ledger Technology Use Cases; Springer: Cham, Switzerland, 2020; pp. 33–50. [Google Scholar]

- Kaczorowska, M. Blockchain-based Land Registration: Possibilities and Challenges. Masaryk. Univ. J. Law Technol. 2019, 13, 339–360. [Google Scholar] [CrossRef]

- Tashakkori, A.; Teddlie, C.; Teddlie, C.B. Mixed Methodology: Combining Qualitative and Quantitative Approaches; Sage: Thousand Oaks, CA, USA, 24 June 1998. [Google Scholar]

- Steudler, D.; Rajabifard, A.; Williamson, I.P. Evaluation of land administration systems. Land Use Policy 2004, 21, 371–380. [Google Scholar] [CrossRef]

- Çağdas, V.; Stubkjaer, E. Design Research for Cadastral Systems. Comput. Environ. Urban Syst. 2011, 35, 77–87. [Google Scholar] [CrossRef]

- Mitchell, D.; Clarke, M.; Baxter, J. Evaluating land administration projects in developing countries. Land Use Policy 2008, 25, 464–473. [Google Scholar] [CrossRef]

- Cete, M.; Yomralioglu, T. Re-engineering of Turkish land administration. Surv. Rev. 2013, 45, 197–205. [Google Scholar] [CrossRef]

- Ramadhani, S.A.; Bennett, R.M.; Nex, F.C. Exploring UAV in Indonesian cadastral boundary data acquisition. Earth Sci. Inform. 2018, 11, 129–146. [Google Scholar] [CrossRef]

- Polat, Z.A.; Alkan, M. Design and Implementation of A LADM-Based External Archive Data Model for Land Registry and Cadastre Transactions in Turkey: A Case Study of Municipality. Land Use Policy 2018, 77, 249–266. [Google Scholar] [CrossRef]

- Asiama, K.O.; Bennett, R.M.; Zevenbergen, J.A. Participatory Land Administration on Customary Lands: A Practical VGI Experiment in Nanton, Ghana. ISPRS Int. J. Geo-Inf. 2017, 6, 186. [Google Scholar] [CrossRef]

- Unger, E.M.; Bennett, R.M.; Lemmen, C.; de Zeeuw, K.; Zevenbergen, J.; Teo, C.; Crompvoets, J. Global policy transfer for land administration and disaster risk management. Land Use Policy 2020, 99, 104834. [Google Scholar] [CrossRef]

- Mehar, M.I.; Shier, C.L.; Giambattista, A.; Gong, E.; Fletcher, G.; Sanayhie, R.; Kim, H.M.; Laskowski, M. Understanding a revolutionary and flawed grand experiment in blockchain: The DAO attack. J. Cases Inf. Technol. 2019, 21, 19–32. [Google Scholar] [CrossRef]

- Jobin, C.; Le Masson, P.; Hooge, S. What does the proof-of-concept (POC) really prove? A historical perspective and a cross-domain analytical study. In Proceedings of the XXIXth Conference of the International Association of Strategic Management (AIMS), Baku, Azerbaijan, 11–13 June 2020. [Google Scholar]

- Applegate, L.M.; Austin, R.D.; McFarlan, F.W. Corporate Information Strategy and Management: Txct and Cases; McGraw-Hill: New York, NY, USA; Irwin Custom Publishing: New York, NY, USA, 2006. [Google Scholar]

- Bennett, R.M.; Wallace, J.; Williamson, I. Integrated Land Administration in Australia: The need to align ICT strategies and operations. In Proceedings of the Annual SSSI Conference, Melbourne, Australia, 25 August–1 September 2005. [Google Scholar]

- UNGGIM. The Framework for Effective Land Administration. In Proceedings of the United Nations Global Geospatial Information Management—Expert Committee, New York, NY, USA, 26–27 August 2020. [Google Scholar]

| 1 | It should be noted that it is usually Anglophone literature that makes these distinctions, with preference for title registration perhaps being transferred to the subsequent terminology. |

| 2 | The registration principle also supports value capture via land taxation by government agencies. |

| 3 | Torrens and other titling systems add to the four above mentioned principles, including the insurance principle, whereby the authority responsible for the book (i.e., often government) will provide compensation to parties judged to have been defrauded of property, due to inadequate checks by the registry, at the time of registration. |

| 4 | Rent seeking, enabled by manual processes, for example, is recognised as another reason for land sector inertia. |

| 5 | It should be noted that the transaction cost to property price ratio, in developing contexts, may make the technology more economically viable. This helps explain the numerous blockchain property starts-ups observed in those contexts. |

| 6 | Again, in this regard, land sector smart contract solutions may come from outside the existing institutional frameworks, as demonstrated in [1], with start-ups offering alternative registration approaches. |

| Criteria | Conventional Contracts | Smart Contracts |

|---|---|---|

| Specification | Natural language and legal prose | Code |

| Identity and Consent | “wet” signatures | Digital Signatures |

| Dispute Resolution | Judges, adjudicators, arbitrators | Consensus via blockchain |

| Nullification | Parties via legal enforcement Process of breached terms | Parties via Agreed Upon Digital Nullification workflow and block consensus |

| Payment | Independent third-party Process | Automatic, based on executed terms (Built into Contract) |

| Escrow | Independent third-party Process | Automatic, based on executed terms (Built into Contract), or not even required |

| Maturity Phase | Intention | Artifact | Scope |

|---|---|---|---|

| 1. Initial | Discovery of the potential benefits and how the replacement of intermediaries may impact process and governance structures | Development of Minimum Viable Product (MVP) blockchain prototypes | Selection of blockchain platforms is not systematic and the roles of the blockchain and existing database technology are indistinct |

| 2. Structured | Use a structured technology-selection process to identify appropriate platform | An appropriate platform selected and the design of a partner network and governance frameworks | Specific criteria have been used to select blockchain use cases and to distinguish the solution from existing database technology |

| 3. Automation | Moves toward process automation based on smart contracts | Smart Contracts—use the platform to go beyond distributed transaction management | The scope of smart contracts is limited to “single dependencies between data or business processes” |

| 4. Business Collaboration | Distributed autonomous organisation | Complex relationships and automated processes across | A network of visible partners is expressed by inter-linked smart contracts. |

| 5. Verification | Formally proven automation | Correctness of smart contracts and DAOs checked | Verification by known model checkers |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bennett, R.; Miller, T.; Pickering, M.; Kara, A.-K. Hybrid Approaches for Smart Contracts in Land Administration: Lessons from Three Blockchain Proofs-of-Concept. Land 2021, 10, 220. https://doi.org/10.3390/land10020220

Bennett R, Miller T, Pickering M, Kara A-K. Hybrid Approaches for Smart Contracts in Land Administration: Lessons from Three Blockchain Proofs-of-Concept. Land. 2021; 10(2):220. https://doi.org/10.3390/land10020220

Chicago/Turabian StyleBennett, Rohan, Todd Miller, Mark Pickering, and Al-Karim Kara. 2021. "Hybrid Approaches for Smart Contracts in Land Administration: Lessons from Three Blockchain Proofs-of-Concept" Land 10, no. 2: 220. https://doi.org/10.3390/land10020220

APA StyleBennett, R., Miller, T., Pickering, M., & Kara, A.-K. (2021). Hybrid Approaches for Smart Contracts in Land Administration: Lessons from Three Blockchain Proofs-of-Concept. Land, 10(2), 220. https://doi.org/10.3390/land10020220