3.1. Baseline Model: Structure, Players, and Payoffs

We consider a monopoly or a dominant platform provider that operates two platforms A and B. Without loss of generality, we assume that those platforms A and B are based on the current technology and new emerging technology, respectively. Both platforms connect suppliers and users, thereby exerting the indirect network effect in a two-sided market explained in the previous sections. Even when both platforms share the same ownership, two platforms may virtually compete to achieve the market share in each side. This will happen when a new version of the platform was developed in a different department of the same platform provider. Or, a platform provider (as part of its business strategy) may let different versions of the platform be selected through a competition in the marketplace. Release of new version for OS will be an example of this case.

In this study, we consider the case where the new platform (B) provides all the services that the current platform (A) does. For example, platform B represents a recent version of mobile OS that runs most apps developed for the previous OS version. Another example is a newly deployed fast line Internet connection that guarantees high-resolution video streaming (e.g., UHD Netflix service) as well as traditional Internet services like email and web surfing. Thus, platform B is “backward compatible” in the sense that it may accommodate all the services designed for platform A.

The backward compatibility may be related to the vertical as well as the horizontal differentiation. This study, however, focuses on the latter and postulates the relevant contexts, for example, technically savvy users or early adopters (e.g., children of adolescence) who prefer a new platform version to the old one versus technically insensitive users or followers (e.g., middle-aged parents). In this context, Apple and Samsung are releasing a new version of their smartphones every year while retaining the old versions for a while. Google’s Android version management and telcos’ network infrastructure transition (e.g., 3G to 4G/LTE) can also be understood in the same vein.

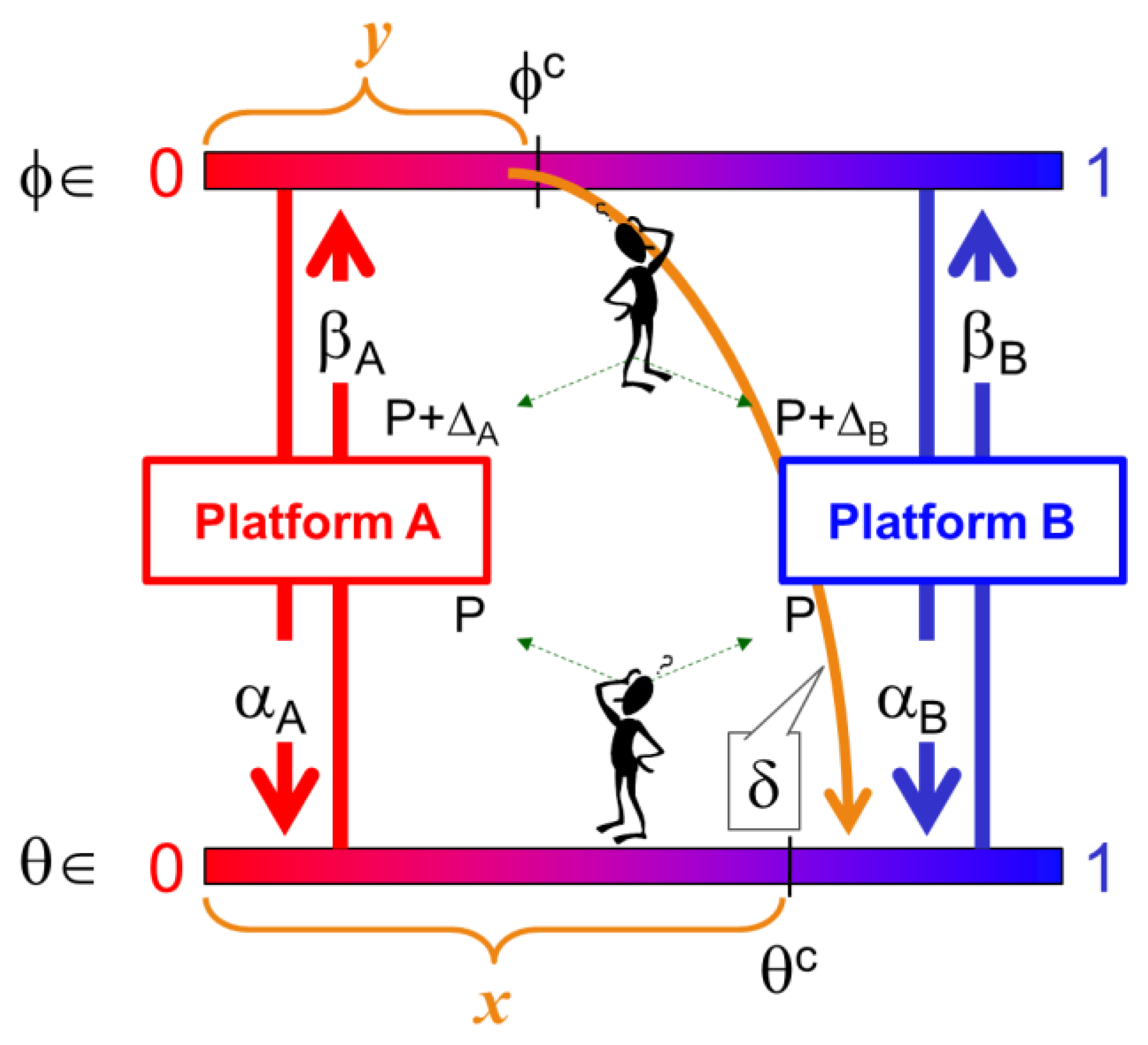

Under the context described above, we develop a stylized model as follows. Our demand model assumes that both users and suppliers are horizontally differentiated based on their preferences for two distinct platform versions a la Hotelling [

38]. That is, a user (a supplier) is situated on an interval

, and this location reveals his/her preferences for both platforms. Here, we employ

(

) for the user index (the supplier index) representing his/her preference to the platforms. Without loss of generality, the left end point of the interval (

) is supposed to represent the user (the supplier) who most prefers A to B, while the right end point (

) represents the index of the player who most prefers B to A: that is,

for the extreme platform-A-lover and

for the extreme platform-B-lover. Following the convention of the Hotelling model, users are uniformly populated over the line segment. This normalization of the horizontal differentiation implies that our model focuses on the market share in each side. The same configuration is applied to the supplier side (refer to

Figure 1).

Now, we incorporate the traditional features of the two-sided markets: indirect network effects. First, represents the indirect network effect in the user side for platform k (k = either A or B). That is, represents how users in platform k benefit from the supplier side on the same platform. Similarly, let denote the indirect network effect in the supplier side for platform k (k = A, B). We set the network effects in platform A— and —at , and focus on the relative effects of network effects between the platforms. In this way, we can save the subscripts, and let and respectively represent the corresponding indirect network effects for the users and the supplier in platform B.

We also introduce the cross-platform network effect

, which, by definition, measures users’ benefits from the backward compatibility in the new platform (B). Users subscribing to platform B enjoy not only the services that suppliers in platform B provide but also the ones provided by suppliers in platform A. For example, users of a fast Internet connection (e.g., Google fiber) are able to access premium services (e.g., UHD video streaming) as well as traditional services that are insensitive to delay (e.g., email). Those who update their iPhone OS, say to iOS 11.x, are also able to use most apps developed for iOS 10.x. Note that, however, this effect is “asymmetric”.

works only for platform B thanks to the backward compatibility, and it directly benefits users, not suppliers.

2 Furthermore,

means that there is no benefit from the directional interactions between the users in the new platform and the suppliers in the legacy platform: that is, no backward compatibility.

The backward compatibility of platform B may come at the cost of congestion, or negative network externality in the new platform, especially when this platform is in the early phase of the life cycle. We consider this kind of congestion effect on the suppliers, and employ to denote the degree of congestion (or the negative network externality) in the supplier side of platform B. However, we also consider a countermeasure that the platform provider carries out in order to alleviate this negative externality. As the platform provider makes investment in the new platform, it enhances its capability to accommodate more suppliers and provides better quality of service through this platform. Thus, the congestion factor is a decreasing function of the amount of investment in platform B: i.e., and ≡ < 0.

In an environment where the state variables change dynamically, consider a given time period (in the following description, however, the symbol for time lapse will be omitted). The state variables (e.g., the market shares) at a given time may change over the next period since they interact with each other under the conditions determined by other variables and parameters. We will first define static (i.e., at an arbitrary time) relationships among the variables and parameters, then introduce the adjustment dynamics that lead the system states to the next period.

Let

and

represent the

current market shares of platform

k (

k = A, B) in the user side and the supplier side, respectively. We assume that each market is saturated so that

and

. Therefore, any user or supplier must join exactly one platform, which makes us simply denote

and

as the market shares of platform A in the user side and in the supplier side, respectively.

3We now define the payoffs of users and suppliers as follows. Here, means the payoff of the user who is situated at on and chooses platform k (k = A, B). is similarly defined as the payoff imputed to the supplier with index in platform k (k = A, B). The dominant platform provider charges the users and the suppliers for their platform usage. is the service fee charged upon the players in side t (t = U (user), S (supplier)) with platform s (s = A, B).

- ◾

Payoffs for User

(users’ utilities):

- ◾

Payoffs for Supplier

(suppliers’ profits):

Let’s suppose that

(fixed) due to the reasons below. First, policy or regulatory requirement where price differentiation in the user side should not be allowed. For example, the net neutrality legislation prohibits the network providers from discriminating subscribers of different types of networks. Furthermore, many real-world cases support the strategic utility of our approach despite its simplification on

. Indeed, this setting naturally arises from the competition on the user side. As a result, the prices fixed at a negligible or even zero level are frequently observed on many user-facing platforms whose primary concerns are to attract eyeballs.

4 For example, the price paid to Google for a search is zero, as is the price paid to Twitter or Facebook for joining and using their social networks. Adobe’s free distribution of the pdf reader is another representative example [

1,

3]. Reference [

34] also assumes a fixed royalty rate for the user side in the e-book platforms on the basis of the agency pricing model. In this circumstance, the platform provider controls only the price margin between the user side and the supplier side in each platform; that is,

≡

and

≡

.

Each side market is normalized; that is, the entire demand in each market is set to one. We also consider operating costs incurred from improving the advanced platform (B). Given (under regulation or competition pressure that makes price differentiation in the user side across the platforms impossible), the dominant platform provider that owns and operates both platforms, decides the price margins ≡ (k = A, B) as well as the scale of investment so that it can maximize its total profits from both platforms.

- ◾

Payoff of the Platform Provider:

where

is positive.

The whole situation is modeled as a two-stage game, which proceeds as follows. In the first stage, the dominant platform provider determines the price margins (

and

) and the amount of investment (

) in platform B. This leads us to the next stage that we named “subscription game”, where both users and suppliers simultaneously respond to the price margins and the quality of platform B and choose the platform they join. In this stage, their payoffs depend on the current reference players whose positions (

and

) respectively represent the market share of platform A in the corresponding side. Thus, the market share of each platform in each side of a two-sided market here is “endogenously” determined through the interrelated platform subscription game. If the current status is out of equilibrium, then there will be an incentive for some players to change their decisions in the next period. In our approach, the subscription game will be governed by dynamics

5 to be described in the next section.

3.2. Equilibrium and Stability Analysis of Subscription Game

This section elaborates the notions of the reference players and the dynamics of players’ behaviors between the consecutive periods. We start with defining some notions that will play a fundamental role in our approach. A “critical” user

in the user side indicates the user (also the location of the user) whose payoff is indifferent across the platforms given the current market shares

and

. Accordingly, we can express

. Similarly, we define the “critical” supplier

(

). Thus, critical players should satisfy the following relationships at the same time:

Since we are dealing with the situation where both markets are saturated, we allow either (=) or (=) to have a negative value. Given , (k = A, B), and (thereby , too), we derive the equations for and in terms of and from Equations (5) and (6) as follows.

- ◾

Equations identifying critical participants:

If there is an interior equilibrium , it will occur at the point where the market share of each platform coincides with the corresponding critical participant in both markets: that is, and . If the current market share and in the user side and in the supplier side) do not coincide, then there exist users (suppliers) whose payoffs can be raised by changing their choices: that is, switching to the other platform. If ), then users (suppliers) between and ( and ), who currently reside in platform B, would have been better off by switching to platform A. On the other hand, if (), then users (suppliers) between and ( and ) would have been better off by moving from A to B. Accordingly, it is natural to define the system dynamics as follows.

- ◾

subject to , ,

where ( = , ) controls the speed of the adjustment process.

We first consider the “interior” equilibrium, where both platforms coexist on both sides. This type of equilibrium corresponds to the traditional notion of the Nash equilibrium in most economics literature. At an interior equilibrium (if exists), the adjustment process should halt; that is, both and vanish. Thus, one can find an interior Nash equilibrium by solving the simultaneous linear equation system and , where (Equation (9)) and (Equation (10)). With given and (price margins determined by the dominant platform provider at the upper stage) and (platform provider’s investment on platform B), one can derive not only the trivial solution but also as identified in Proposition 1, which provides more detailed analysis about the interior equilibrium in the subscription game. Hereafter, we fix the adjustment speed for simplifying expressions without significantly affecting the qualitative characteristics of the analytical results.

Proposition 1 (Interior Equilibrium). Suppose that , , and are determined by the platform provider at the upper stage. We assume that one of the following sets of inequalities hold, where :

- Set I:

and if ,

- Set II:

and if .

Let us define the following matrix and vectors for ease of reference and future use:Then the interior (Nash) equilibrium in the subscription game (if exists) is unique. Specifically, at the interior equilibrium , the critical players and coincide with and , respectively, and they are determined as follows:where . If the interior equilibrium exists, then it is stable if(i.e., under Set I). Otherwise (i.e., under Set II), it is unstable (a saddle point).

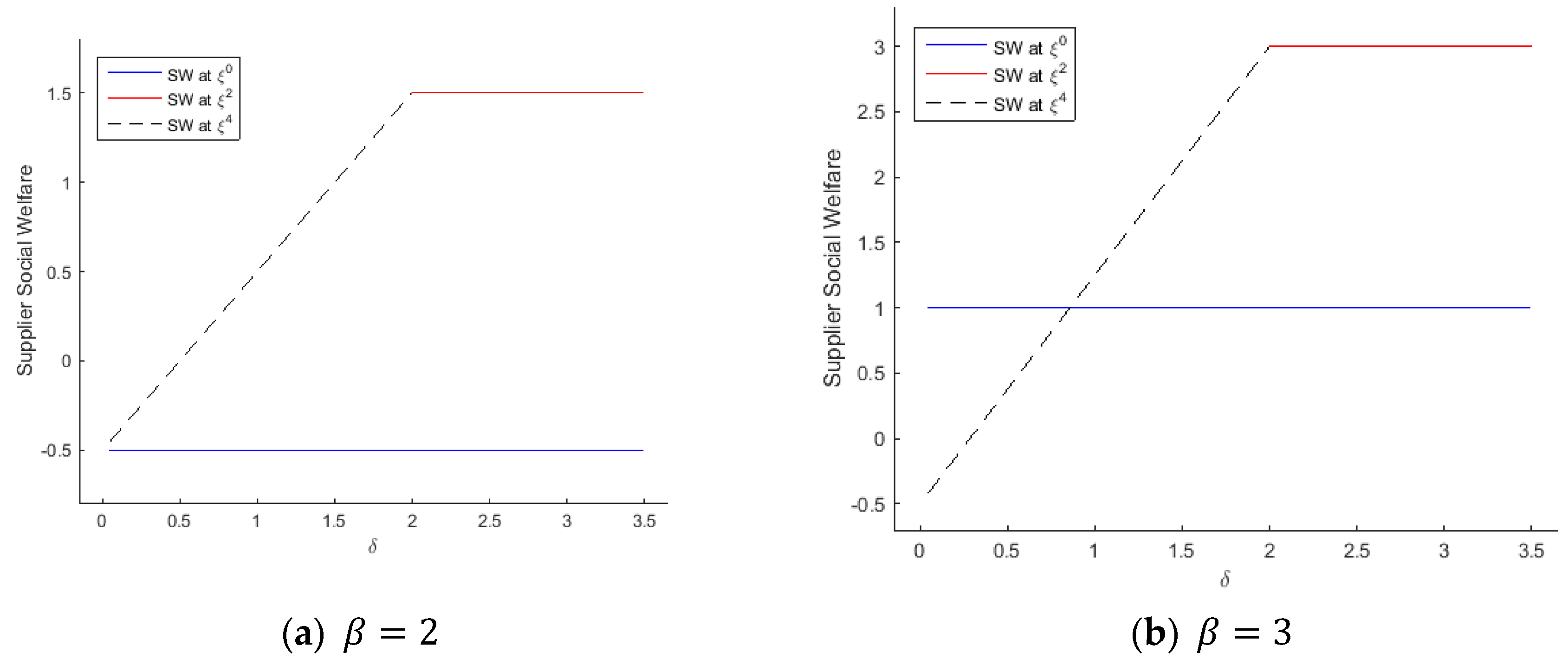

First, note that , which determines the dynamics nature, is composed of key parameters such as , , , and . Furthermore, each set of inequality conditions represents quite a different context. Set I includes , which implies a large congestion effect (); on the other hand, in Set II requires that should not be too strong to overwhelm the indirect network effects. However, the chance to attain a positive determinant of (thereby, the interior equilibrium being stable if exists) seems limited since neither nor is allowed to exhibit a proper scale for . For example, with and 1, at least one of and should be smaller than one, which does not fit well with the conventional premise of the two-sided markets. Indeed, a stable interior equilibrium (i.e., stable coexistence of both platforms on both sides) is less likely to be sustained within most ranges of the indirect network effects when the backward compatibility prevails.

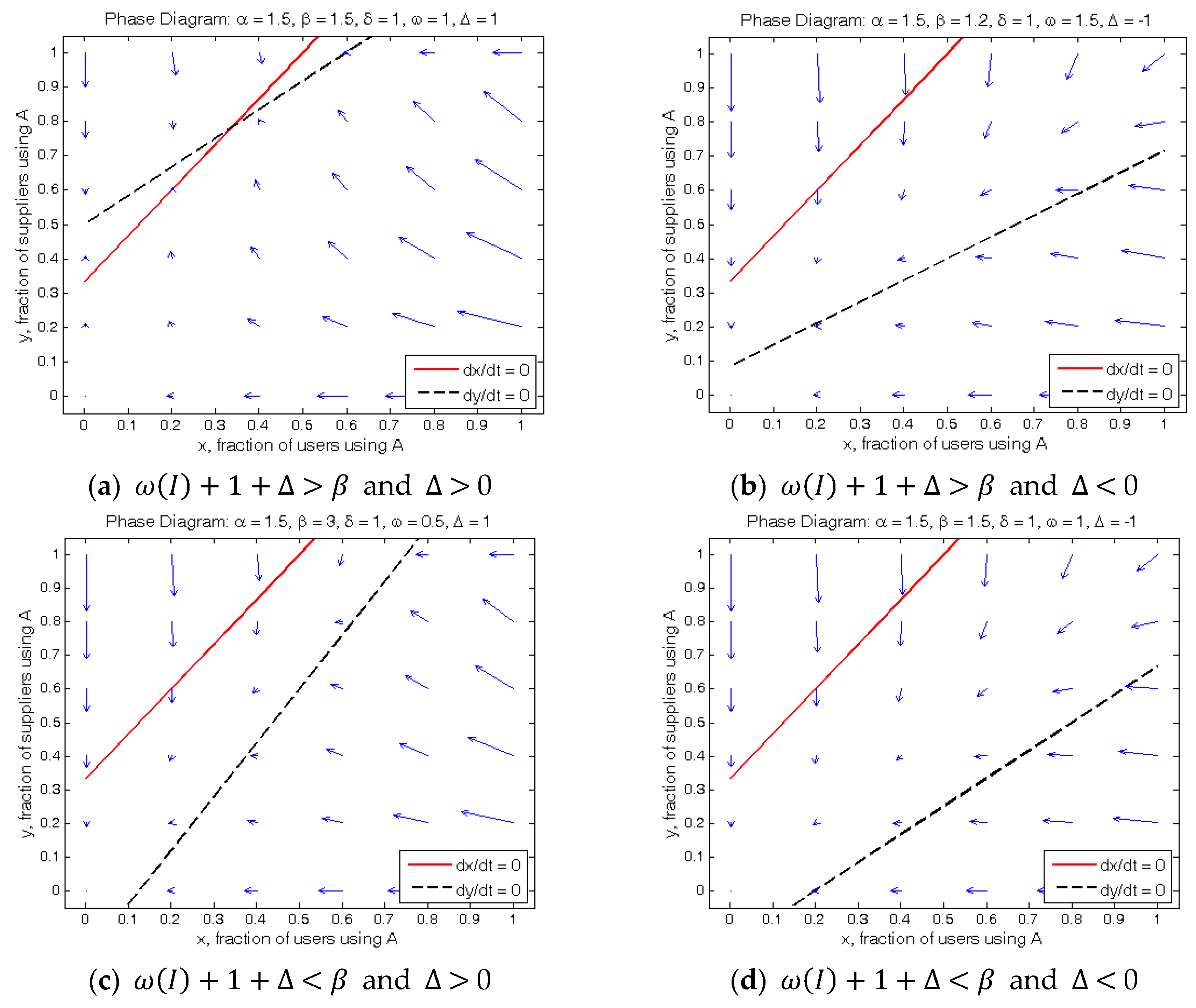

Figure 2 shows sample instances, each of which corresponds to its unique dynamics. Note that two null-clines or demarcation curves (each is a trace of two-tuples on either

in Equation (9) or

in Equation (10)) have positive slopes if

, or

, which implies that the strength of the backward compatibility should not be too strong to overwhelm the indirect network effects. One can also see the state

, where all the markets are stuck at the legacy platform, lies below the

null-cline. Furthermore, for

, the

null-cline has a positive

-intercept. Since these two inequalities—

and

—seem quite natural and fit well with the two-sided market context presumed in this study, and they will be maintained, hereafter.

On the other hand, the

null-cline may take different forms based on the sign of the

-intercept as well as the relative location of the state

. Thus, we now distinguish four types together with their dynamics as drawn in the respective panels in

Figure 2.

The relative magnitudes of those slopes define the sign of

, thereby determining the stability of the corresponding case.

Figure 2a shows a typical stable interior equilibrium, which occurs around (0.35, 0.80) (i.e., 35% of users and 80% of suppliers in the legacy platform; 65% of users and 20% of suppliers in the new one). If the slopes of two null-clines are interchanged (not depicted in

Figure 2), however, the interior equilibrium (if exists) becomes a saddle point, which cannot be stable. The coexistence of both platforms (on both sides) may be maintained near the saddle point for a certain period of time if the current states happen to locate in the converging areas of the state space. Once the adjustment process reaches the saddle point, however, this temporary coexistence will eventually collapse down to a degenerate state with at least one side tipped into a single platform. It may be the temporary coexistence that we observe in practice (e.g., iOS and Windows examples in the Introduction). In the other types displayed in the panels (b), (c), and (d) in

Figure 2, the interior equilibrium seldom occurs in the feasible region of the state space. Indeed, for a wide range of reasonable parameters, the dynamics for these types produce similar patterns.

As indicated by sample instances above, the interior equilibrium is probably uncommon in a two-sided market. Furthermore, a stable interior equilibrium appears as an extraordinary case in our framework of the two-sided market. In sum, Proposition 1 and the examples in

Figure 2 suggest that a stable interior equilibrium will not be guaranteed in the competing platforms with asymmetric backward compatibility. Accordingly, those results give a reason why we should investigate “boundary” equilibria, where at least one of the sides tips to a specific platform; for example, all users prefer platform B to platform A and choose B in a boundary equilibrium where

.

However, the boundary equilibrium on one side will be highly likely to affect the other side through the reinforcing feedback loops due to the indirect network effects, thereby pushing the other side toward the same platform. Accordingly, it may not seem plausible that one side (say, the user side) is locked in the one platform (say, platform A), while the other side (say, the supplier side) is locked in the other (say, platform B). Instead, one may naturally put top priority on checking out the possibilities and conditions that both markets tip to the same platform. However, the backward compatibility and the congestion factor make it possible for both platforms to coexist at least on the user side while all suppliers stick to the legacy platform. Instead, we may observe various types of the boundary equilibrium. The following proposition presents the conditions under which these plausible status as a boundary equilibrium, at least one side locked in a specific platform, can or cannot occur.

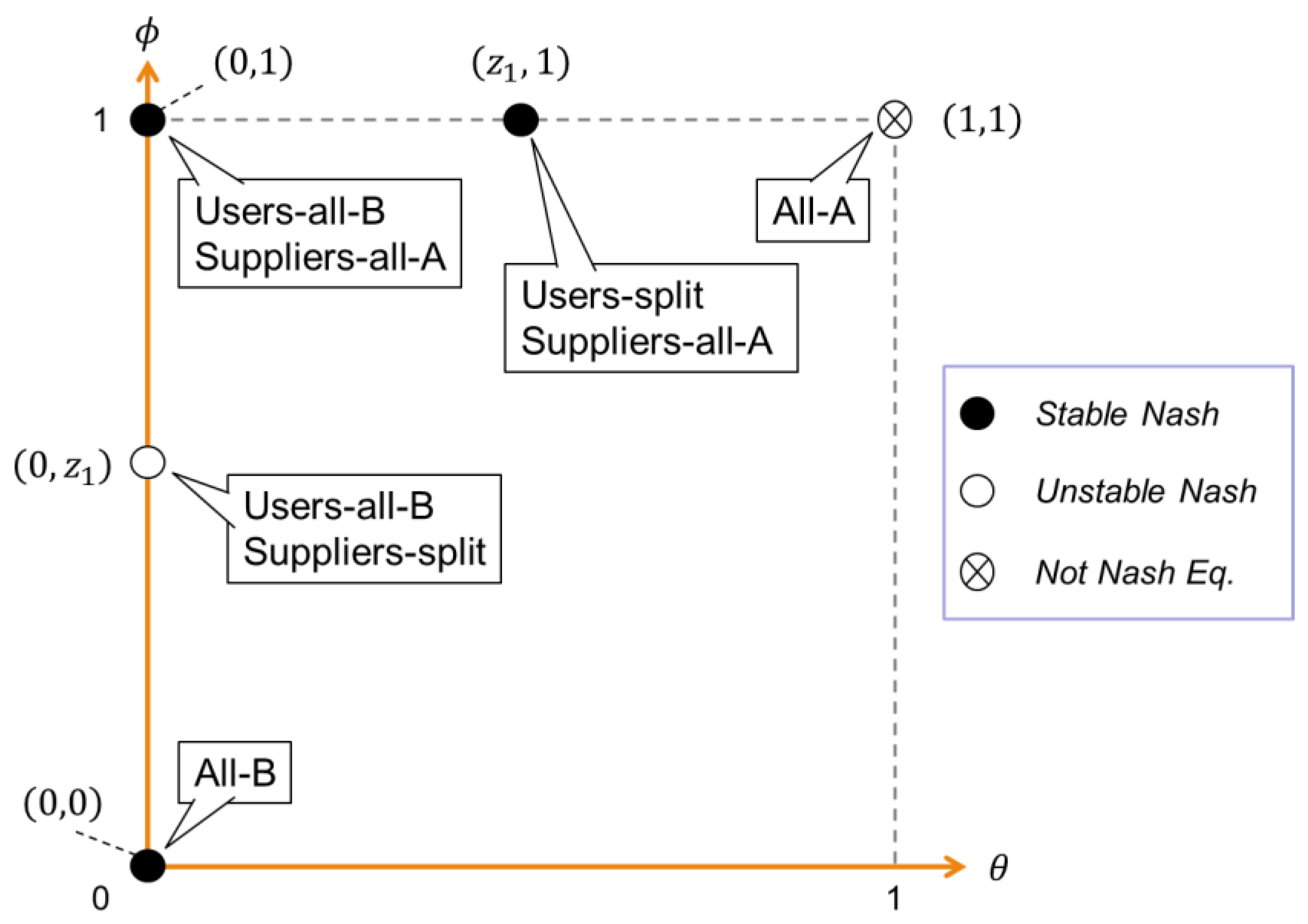

Proposition 2 (Boundary Equilibria). Suppose that , , and are determined by the platform provider at the upper stage. Let us consider the following candidate boundary states: (0, 0), (1, 1), (0, 1), (0, ), and (, 1), where and . The following statements assert whether the respective candidates become a stable equilibrium or not:

- ①

≡ (0, 0) becomes a stable Nash equilibrium if and ,

- ②

≡ (1, 1) cannot be a Nash equilibrium if ,

- ③

≡ (0, 1) becomes a stable Nash equilibrium if and ,

- ④

≡ (0, ) becomes a Nash equilibrium if and ; but, is unstable,

- ⑤

≡ (, 1) becomes a stable Nash equilibrium if , , and .

Proposition 2 suggests that we do not need to focus on all the possible boundary equilibria. Instead, it would be better to delve into only the stable equilibria for further consideration. The candidates are

,

, and

. At the boundary equilibrium

, all users and suppliers tip to the new platform B (see “All-B equilibrium” in

Figure 3). On the other hand, at

and

, the two sides split into different platforms. In the former case, the user side tips to the advanced platform, while the supplier side remains at the legacy one. Thus, users use the new platform only for the legacy services at

. In the latter, while the supplier side sticks to the legacy platform, the user side splits into two platforms. That is, there still remains some users (

) who are loyal and dedicated to the legacy platform. The context of horizontal differentiation in our demand model seems to play an important role in stabilizing the seemingly unreasonable equilibria—

and

—since there should remain a portion of users who prefer the new platform to the legacy one. If we had developed the demand model on the basis of the vertical differentiation, then these equilibria would have been unstable.

Figure 3 summarizes the results of Proposition 2. First of all, we cannot expect that both sides tip to the relatively inferior platform. In other words,

cannot be a Nash equilibrium without negative backward compatibility

. However,

should be positive since we assume that the emerging platform has a certain degree of the backward compatibility, at least in the user side. Accordingly, the backward compatibility plays the role of reinforcing the relative advantage of platform B.

However, the backward compatibility

works as a double-edged sword as in Reference [

36]. In fact, the size of

is the key factor that determines the equilibrium type. In other words, the stable equilibrium is distinguished based on

. With a relatively large

(see the conditions in ③ and

), all the suppliers may remain in the old platform since all the users can use the advanced platform to access the legacy services. On the other hand, for the backward compatibility, which is smaller than one but quite comparable with the indirect network effect

(see the conditions in ⑤ and

(

, 1)), it is possible that some users (the fraction of

) still use the advanced platform for the legacy services. However, the size of

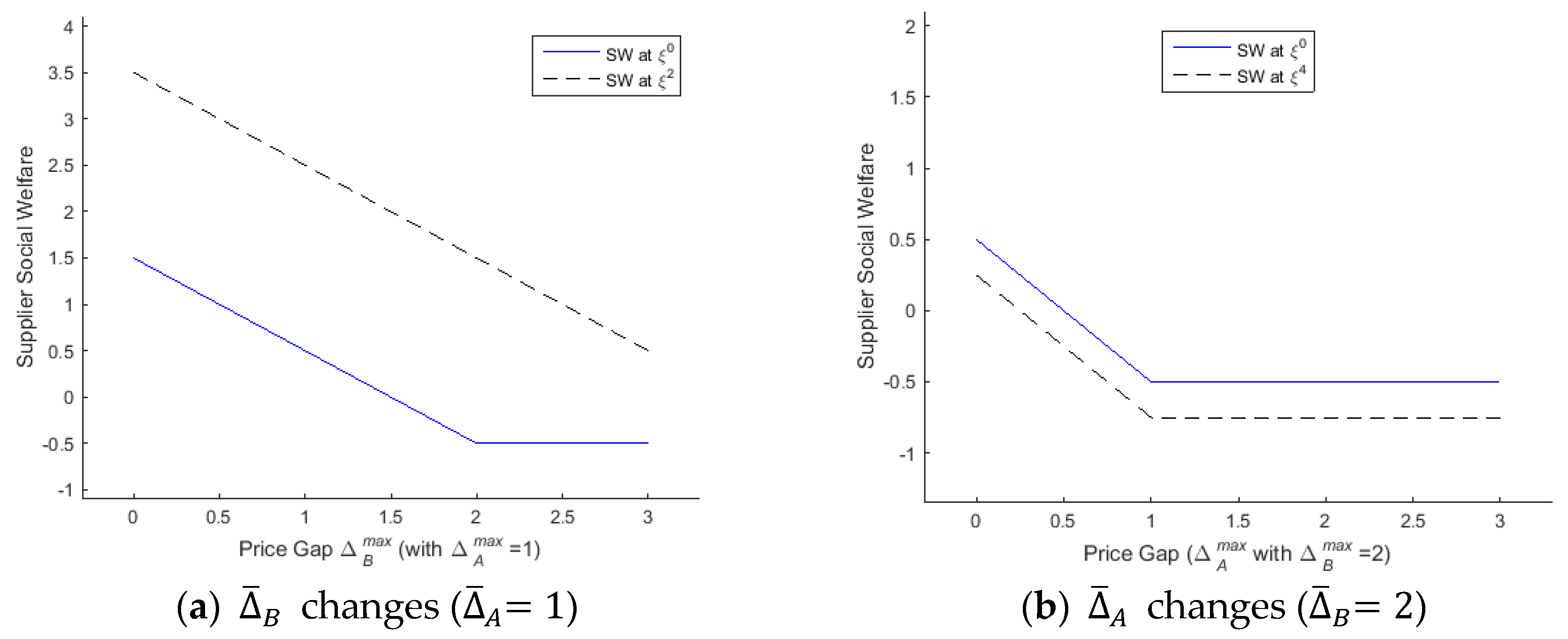

is not the only factor that determines the equilibrium. In both cases, the conditions require that the pricing gap

in the supplier side be relatively big (i.e.,

), which may hinder the suppliers from switching to the advanced (but highly costly) platform.

On the other hand, both sides will tip to the new platform (i.e., ) under milder conditions than those for and . The stability of this equilibrium does not require a specific range on the strength of the backward compatibility. Indeed, what is required for tipping to the new platform is two simple conditions on the indirect network effects and , together with some condition on platform provider’s decisions of investment () and price margins ( and ). The first condition, , means that the indirect network effect in the user side for platform B should be stronger than the one for platform A (note that it is set at 1 in our model), which fits well in the context of this study. The second condition, + 1 + , requires that either the congestion effect or the pricing gap in the supplier side should not be so high as to overwhelm the indirect network effect in the supplier side for platform B.

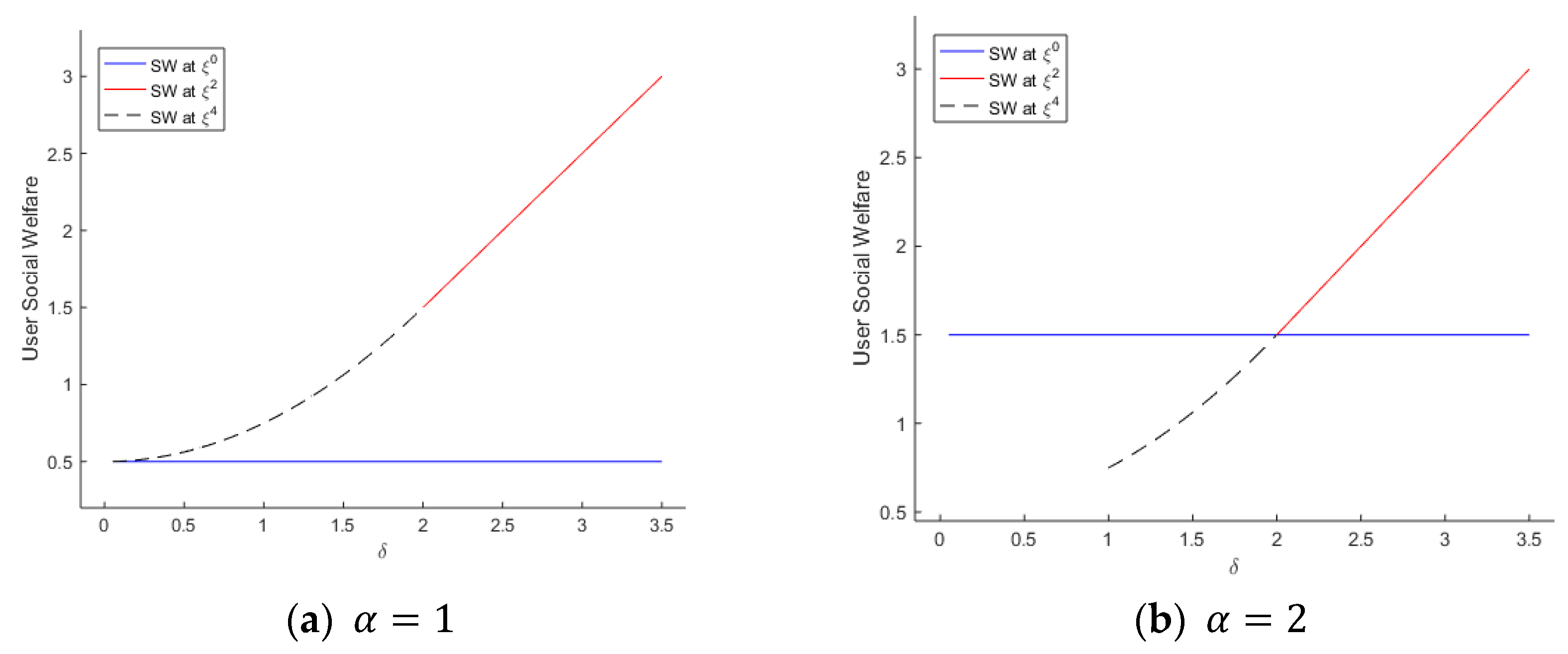

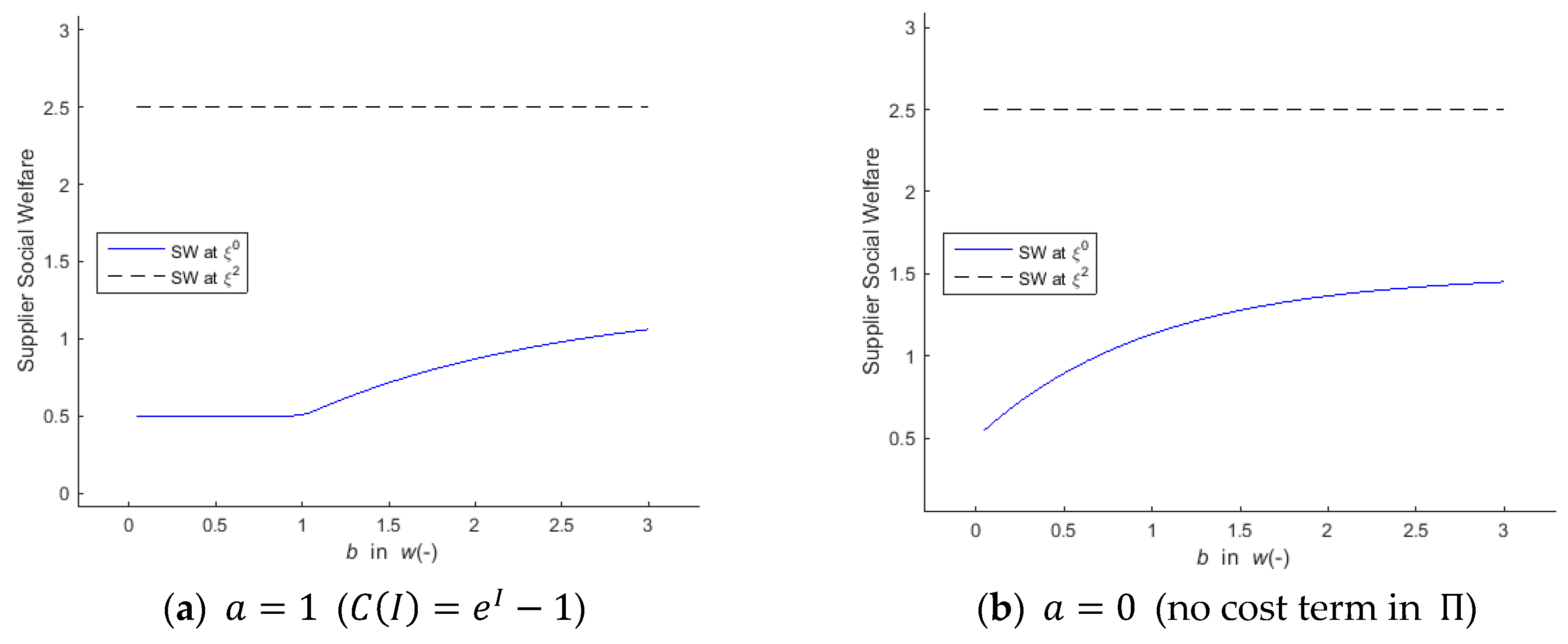

Proposition 3 also implies a clear difference between “All-B equilibrium”, and “separate equilibria”, and in terms of the platform investment. The platform provider’s switching to the advanced platform and its efforts to attract and tie the suppliers to the new platform (i.e., maintaining ) will require a certain amount of investment (). On the other hand, inducing only the user side to the new platform and preventing the suppliers from switching to the new one could go without investment () or with a small investment. We will deal with this issue in the next section.

Since we identify the static equilibria and analyze their stability as a consequence of a dynamic process, the stable equilibria can be thought of as the plausible steady states. Indeed, these are the most promising outcomes in the subscription game played at the lower stage of the entire game model. Accordingly, one may view the equilibrium dynamics here in the perspective of a platform provider’s maneuver toward a stable state with its decision variables as a tool for this purpose. Such an interpretation explains why we put emphasis on the stability of an equilibrium. In other words, an unstable equilibrium presents just a fragile snapshot that could exist only within a short period. In the next section, we deal with the upper stage led by the dominant platform provider and complete our whole model.