Beyond Opacity: Distributed Ledger Technology as a Catalyst for Carbon Credit Market Integrity

Abstract

1. Introduction

2. Background

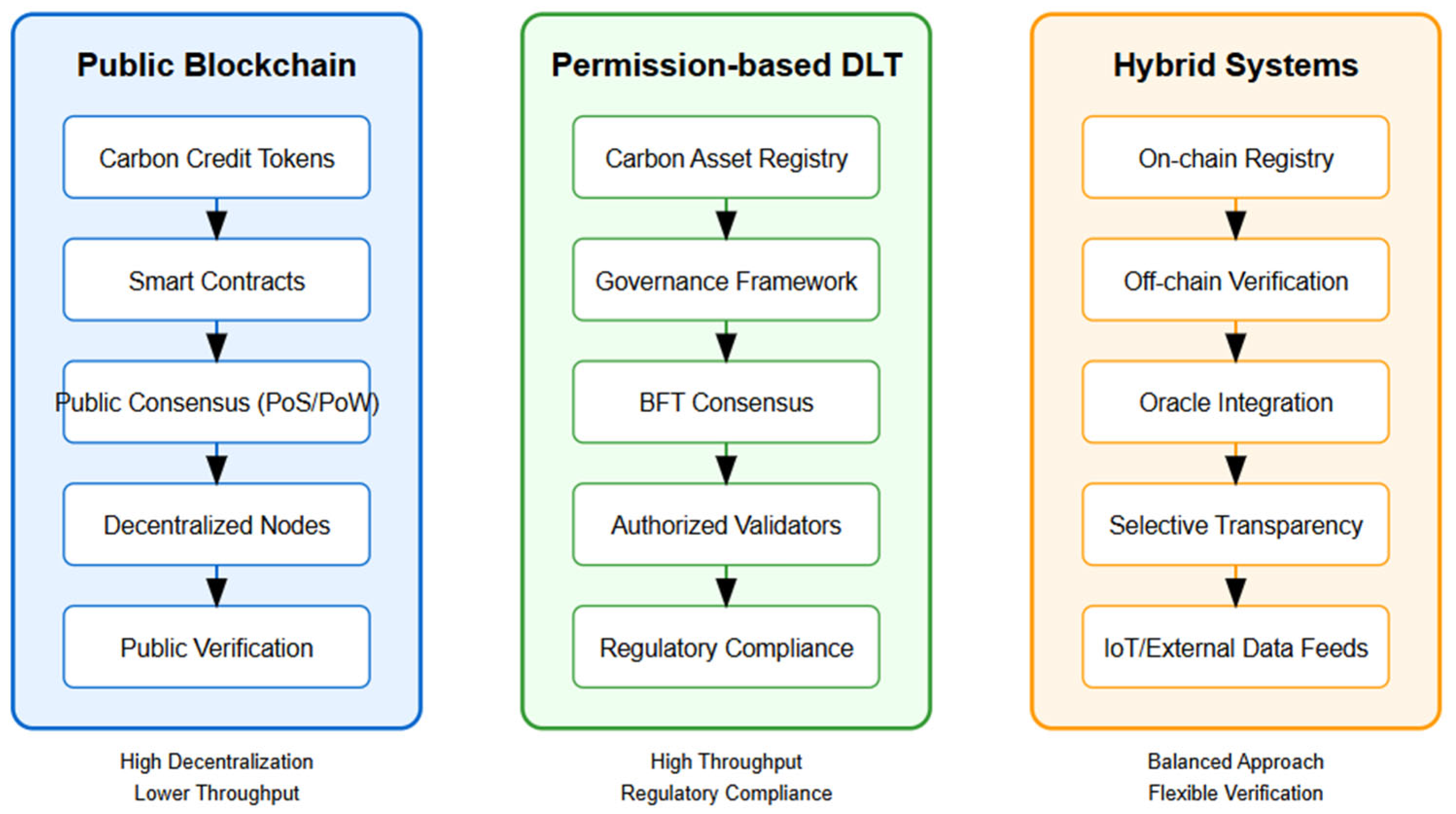

2.1. DLT Architectures for Carbon Credit Trade and Registration

2.2. Key Parameters for Carbon Credit Trade and Registration Architectures Applicability

2.2.1. Market Efficiency Gains

2.2.2. Stakeholder Perspectives

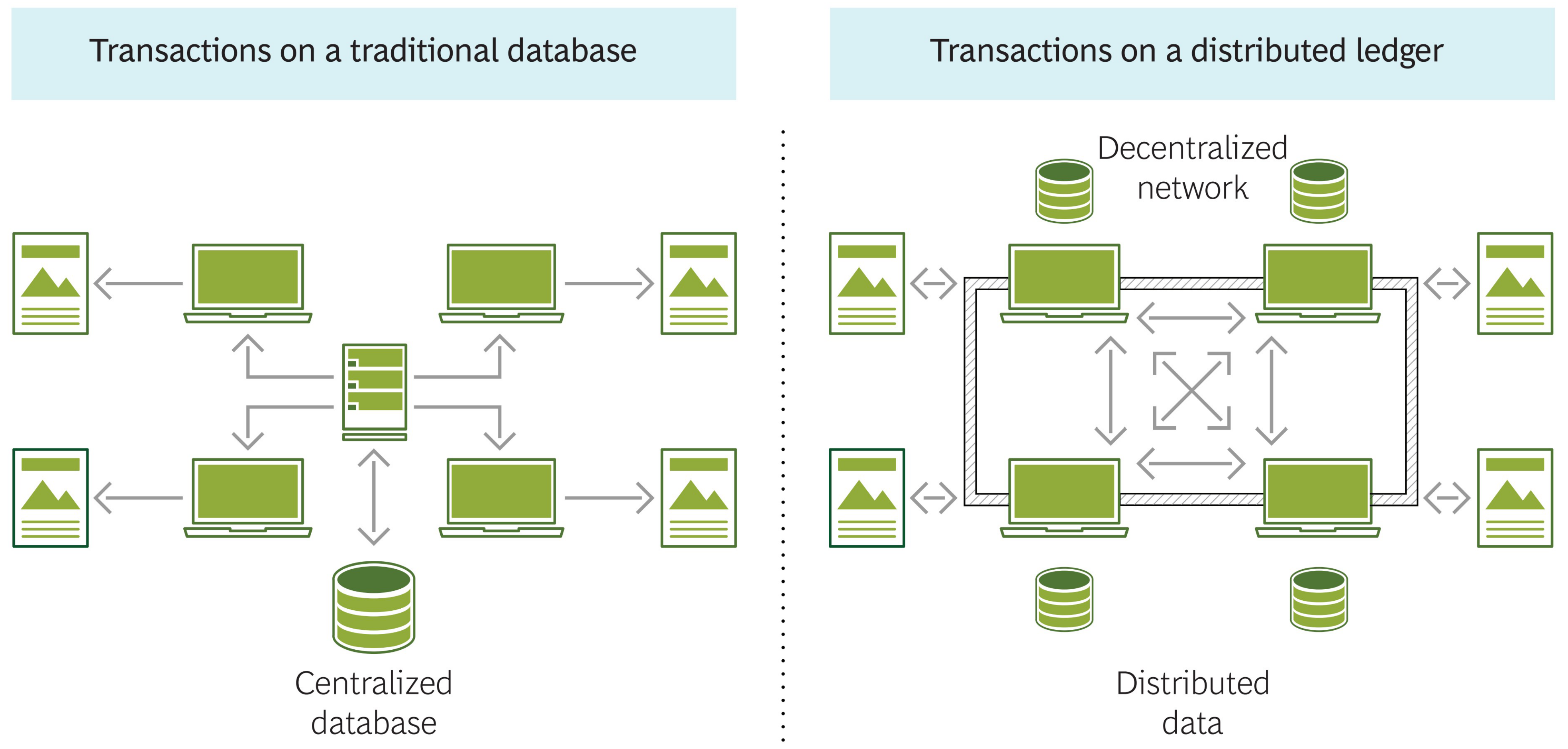

2.2.3. DLT Application in Carbon Trading Market

2.2.4. Transparency and Market Integrity

- Create a record;

- Read a record;

- Update a record;

- Delete a record.

2.3. Potential Carbon Credit Platform Infrastructures

- CarbonChain: A permission-based platform focusing on compliance markets in the EU and Canada, which has processed over 8.2 million carbon credits representing 8.2 MtCO2e. The platform reduces verification times by 80% and decreases transaction costs by 58% [30].

- CarbonBlocks: A public blockchain implementation on Ethereum focused on voluntary carbon markets with an emphasis on nature-based solutions. The platform has tokenized 3.4 million carbon credits but faces scalability challenges during high-demand periods.

- Distributed Carbon Ledger (DCL): A hybrid system combining on-chain record-keeping with off-chain Measurement, Reporting, and Verification (MRV). DCL demonstrated superior scalability and regulatory compliance but requires greater centralization.

- TransparenTerra: A consortium-based DLT platform focused on land-use change and forestry credits in tropical regions. The system’s smart contract-based verification reduced fraudulent credits by an estimated 92% compared to previous registry systems [31].

- Carbonex: This enterprise uses blockchain to create a transparent and efficient global market for trading carbon credits. The platform aims to simplify the carbon credit lifecycle, ensure compliance, and integrate with existing Emissions Trading Systems (ETSs). It plans to have nodes in all countries that ratified the Paris Agreement, with limited write access for entities like the UNFCCC and local governments while maintaining open read access for public accountability.

- IBM Energy Blockchain Labs: IBM, in partnership with Energy Blockchain Labs, has developed a carbon asset development platform using blockchain technology. This platform automates carbon quota calculations through smart contracts, enhancing transparency, information sharing, and regulatory monitoring. It uses Hyperledger Fabric to securely store environmental data and facilitate emissions tracking for participants.

- ClimateTrade: This online service provider uses DLT to track and sell carbon credits, ensuring that all transactions are visible to platform users. ClimateTrade links to projects verified by major standards like CDM, VCS, and the Gold Standard, allowing users to offset emissions, calculate carbon footprints, and prepare sustainability reports.

- Nori: Nori focuses on carbon removal through regenerative farming practices. It uses blockchain to create a market for carbon removals, issuing Ethereum-based tokens representing one ton of CO2 removed from the atmosphere for at least ten years. The process involves farmers, independent verifiers, and buyers, with all data stored on a blockchain to prevent double-counting.

- Moss.Earth: Moss is an environmental fintech company that sells carbon credits linked to projects in the Amazon rainforest, such as the Ituxi and Juma projects. Using Ethereum, Moss provides a digital platform for individuals and companies to buy, store, and use carbon credits, aiming to combat deforestation and climate change.

2.4. Regulatory Frameworks and Standards

2.5. Conflicts Between Decentralized Systems and Decentralized Systems

- Notable potential conflicts include the following:

- Control over issuance and authenticity in the MRV processes;

- Governance;

- Double-counting or fraud.

- Control over issuance and authenticity in the MRV Processes

- Centralized systems require projects to make use of strict methodologies in order to issue credits, and central registries and people within those entities control the issuance and certification of credits. In these systems, third-party audits and manual field inspections are often necessary, which can create credibility questions.

- Decentralized systems make use of tokenization and smart contracts to auto-issue credits in the system. Consortia members, rather than a central entity, create the rules and establish the methodology for verifying transactions in the system.

- Governance

3. Methodology

Case Study Design

- EU ETS Study: European Union Emissions Trading System: As the world’s largest and most mature market, this case provides insight into DLT integration within an established regulatory framework.

- Australian Study: Australia’s Emissions Reduction Fund (ERF): This case represents a developed economy with an evolving carbon market, offering perspectives on transitioning to DLT-based systems.

- China, Shanghai Study: Shanghai Environment and Energy Exchange (SHEE): As part of China’s emerging national carbon market. This case illustrates the DLT application in a rapidly developing economy with significant emission reduction targets.

- EU ETS: Centralized vs. decentralized system comparison;

- Australian: Traditional carbon market vs. blockchain-enabled market;

- Shanghai: Pre-blockchain vs. post-blockchain market performance.

4. Comparative Analysis Results

4.1. EU Carbon Market Case Study

Benefits of Distributed Ledger for Carbon Trading

- Interoperability: DL can facilitate connections between different carbon markets without requiring complete legal and regulatory standardization [45].

- Transparency and Trust: The distributed database with public/private key encryption provides a transparent and secure environment for transactions.

- Decentralized Infrastructure: This aligns well with the prosumer model, allowing for more direct participation in carbon trading.

- Innovative Data Sharing: DL enables novel approaches to managing and sharing data, crucial for accurate carbon accounting across different markets.

- Flexible Transaction Management: This feature is particularly beneficial for prosumers who may engage in smaller, more frequent transactions.

4.2. Australian Carbon Market Case Study

- Market Access: DLT can lower barriers to entry, allowing smaller-scale prosumers to participate more easily in carbon markets.

- Accurate Accounting: The transparent and immutable nature of DLT addresses the challenge of accurately tracking emissions and credits for decentralized energy producers.

- Cross-Market Participation: As prosumers may operate across different jurisdictions or markets, the interoperability offered by DLT systems is particularly valuable.

- Trust in Decentralized Systems: DLT’s ability to establish trust without centralized authorities aligns well with the decentralized nature of prosumer energy production and consumption.

- Policy Adaptation: As demonstrated in the Australian case, DLT can help existing markets adapt to the changing landscape brought about by prosumers.

4.3. Shanghai Energy Exchange Case Study

5. Discussion

5.1. Integration with Global Compliance Markets

5.2. Challenges and Limitations

5.3. Prosumers in Blockchain-Based Carbon Trading

- Decentralization and Market Dynamics: Prosumers contribute to the decentralization of energy production and carbon management. This shift aligns well with blockchain’s decentralized nature, potentially creating more dynamic and responsive carbon markets.

- Accurate Emissions Tracking: As both producers and consumers of energy, prosumers present unique challenges in accurately tracking carbon emissions. Blockchain technology can offer a solution by providing a transparent and reliable Measurement, Reporting, and Verification (MRV) system [64].

- Equitable Pricing Mechanisms: The dual role of prosumers necessitates the development of fair and equitable pricing mechanisms in carbon trading. Blockchain-based platforms can facilitate peer-to-peer (P2P) trading of carbon allowances [63].

- Enhanced Participation in Carbon Markets: By enabling more accurate tracking and trading of carbon credits, blockchain technology can help the building sector and individual prosumers participate more effectively in carbon credit markets [64].

- Regulatory Challenges: The prosumer model introduces new regulatory challenges in carbon trading. Blockchain’s transparency and immutability can aid in creating more effective regulatory frameworks.

- Data Management and Privacy: Prosumers generate significant amounts of data related to energy production and consumption. Blockchain can provide secure and transparent management of this data while addressing privacy concerns.

- Market Access and Democratization: Blockchain-based systems can potentially democratize access to carbon markets, allowing smaller-scale prosumers to participate alongside larger entities.

- It drives innovation in energy management and carbon trading systems.

- It encourages more widespread adoption of renewable energy sources.

- It necessitates the development of more sophisticated and flexible carbon trading platforms.

- It challenges traditional market structures, potentially leading to more efficient and responsive carbon markets.

6. Implications and Future Directions

Future Research

- Social Impact: As more data begins to emerge regarding cost savings, accuracy, and transparency of recording and tracing tokenized carbon credits, automated features through the use of smart contracts, etc., researchers could begin to assess how these advantages and others affect local and regional communities and parts of the world. If positive results are revealed, this could add momentum to the carbon capture and credit industry as a whole and have a positive impact on global sustainability.

- Governance Strategies: Traditional governance in the carbon credit industry typically makes use of centralized entities like Verra, Gold Standard, UN Clean Development, etc., for decision-making and regulation. This approach can result in picking winners and losers (unfair assessments), clouded or confused or slow decision-making processes, a lack of public trust, and high administrative and transaction costs [65]. Blockchain systems allow for the creation of Decentralized Autonomous Organizations (DAOs), which are digital governance models whereby the DAO operates via the use of smart contracts (computer programs and logic) that drive governance decisions and actions. These automated systems can offset or mitigate many of the aforementioned concerns or limitations of traditional models of governance. If designed and implemented successfully, these governance systems can improve speed, reduce cost, increase transparency, reduce unfair decision-making, and thereby increase public confidence. Researchers should be able to conduct longer-range studies that assess improvements or risks, potentially enhancing these systems in the future.

- Impact Assessments: As industries begin the digitization of processes, decision-making procedures, and administrative functions, researchers have an opportunity to verify the effectiveness of the change in quantitative terms. Industry studies from reputable sources such as the World Economic Forum or The Organization for Economic Co-operation and Development (OECD) make broad statements regarding improved efficiencies, reduced administrative costs, faster decision-making but the reports by in large, avoid citing concreate or specific quantitative results perhaps due to the lack of time production systems have been in place or a simple lack of successful cases to study. Future research should be able to uncover accurate statistics, which can lead to more confidence in those in the process of using a DLT approach to improve their carbon reporting systems.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hasselknippe, H. Systems for Carbon Trading: An Overview. Clim. Policy 2003, 3, S43–S57. [Google Scholar] [CrossRef]

- Saraji, S.; Borowczak, M. A Blockchain-Based Carbon Credit Ecosystem. arXiv 2021, arXiv:2107.00185. [Google Scholar] [CrossRef]

- Zhang, G.; Chen, S.C.I.; Yue, X. Blockchain Technology in Carbon Trading Markets: Impacts, Benefits, and Challenges—A Case Study of the Shanghai Environment and Energy Exchange. Energies 2024, 17, 3296. [Google Scholar] [CrossRef]

- Dunkel, S. How a Blockchain Network Can Ensure Compliance with Clean Development Mechanism Methodology and Reduce Uncertainty About Achieving Intended Nationally Determined Contributions; Elsevier Inc.: Amsterdam, The Netherlands, 2018; ISBN 9780128144480. [Google Scholar]

- Xu, Z. Research on The Path of China’s Green Finance to Support the Development of Low-Carbon Economy. Front. Bus. Econ. Manag. 2022, 5, 133–136. [Google Scholar] [CrossRef]

- Kim, S.K.; Huh, J.H. Blockchain of Carbon Trading for UN Sustainable Development Goals. Sustainability 2020, 12, 4021. [Google Scholar] [CrossRef]

- Yao, X.; Broca, S. Sustainable Development—17 Goals to Transform Our World; FAO: Rome, Italy; United Nations: New York, NY, USA, 2015. [Google Scholar]

- Martinez, R.; Gregorie, J.; Val, S. The World Needs Carbon Markets. Here’s How to Make Them Work Better. Deloitte Insights. 2023. Available online: https://www.deloitte.com/us/en/insights/industry/financial-services/future-of-carbon-market.html (accessed on 11 September 2025).

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon Pricing in Practice: A Review of Existing Emissions Trading Systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef]

- Swan, M. Blockchain Blueprint for A New Economy; McGovern, T., Ed.; O’Reilly: Sebastopol, CA, USA, 2015; ISBN 9781491920497. [Google Scholar]

- Manarte, B.M.C. Challenges and Opportunities in the Voluntary Carbon Market: How Can Emerging Regulatory Frameworks and Blockchain Technology Enhance Transparency and Credibility in the Market. Master’s Thesis, Nova School of Business and Economics, Carcavelos, Portugal, 2022. Volume 4. [Google Scholar]

- Scott, N.; Nellore, S.; Marke, A. DLT and the Voluntary Carbon Markets. In Governing Carbon Markets with Distributed Ledger Technology; Marke, A., Mehling, M.A., Correa, F.d.A., Eds.; Cambridge University Press: Cambridge, UK, 2022; pp. 115–136. ISBN 9781108919166. [Google Scholar]

- Heister, S. Enterprise Blockchain Explained. Pathw. Res.-Bus. 2022, 1–11. Available online: https://about.ebsco.com/sites/default/files/acquiadam-assets/Pathways-to-Research-Business-Sample-Enterprise-Blockchain-Explained.pdf (accessed on 11 September 2025).

- Volpicelli, G.M. As Kazakhstan Descends Into Chaos, Crypto Miners Are at a Loss. Available online: https://www.wired.com/story/kazakhstan-cryptocurrency-mining-unrest-energy/ (accessed on 14 April 2025).

- Sriman, B.; Ganesh Kumar, S.; Shamili, P. Blockchain Technology: Consensus Protocol Proof of Work and Proof of Stake. In Intelligent Computing and Applications (Advances in Intelligent Systems and Computing); Dash, S.S., Das, S., Panigrahi, B.K., Eds.; Springer Nature: Singapore, 2020; pp. 395–406. [Google Scholar]

- Coinmetro Gas Fees Explained: Why Ethereum Transactions Can Be Expensive. Available online: https://www.coinmetro.com/learning-lab/gas-fees-explained (accessed on 14 April 2025).

- Zhang, S.; Lee, J.H. Analysis of the Main Consensus Protocols of Blockchain. ICT Express 2020, 6, 93–97. [Google Scholar] [CrossRef]

- Chainlink Hybrid Smart Contracts Explained|Chainlink. Available online: https://chain.link/education-hub/hybrid-smart-contracts (accessed on 14 April 2025).

- Khan, D.; Jung, L.T.; Hashmani, M.A.; Cheong, M.K. Empirical Performance Analysis of Hyperledger LTS for Small. Sensors 2022, 22, 915. [Google Scholar] [CrossRef]

- World Bank. State and Trends of Carbon Pricing 2023; World Bank: Washington, DC, USA, 2023. [Google Scholar]

- Choudhury, R.; Jhanji, K.; Samd, H.; Gleeson, S.; Bennett, S.; Nirgudkar, N.; Boston Consulting Group (New York). Impact of Distributed Ledger Technology in Global Capital Markets; AFME: London, UK, 2023. [Google Scholar]

- Mohan, P. DLT in Securities Settlement, Potential Impact and Challenges of Implementation. Master’s Thesis, Johann Wolfgang Goethe-Universität Frankfurt, Frankfurt am Main, Germany, 2020. Volume i. [Google Scholar]

- BJÖRN FONDÉN. Making Net Zero Possible; BJÖRN FONDÉN: Genève, Switzerland, 2023. [Google Scholar]

- Pons, J.R.D. Trust Creation with Blockchain and Distributed Ledger Technology (DLT) for Carbon and Biodiversity Credit Management. 2025. Available online: https://www.researchgate.net/publication/390466525_Trust_Creation_with_Blockchain_and_Distributed_Ledger_Technology_DLT_for_Carbon_and_Biodiversity_Credit_Management (accessed on 11 September 2025).

- Parhamfar, M.; Sadeghkhani, I.; Adeli, A.M. Towards the Net Zero Carbon Future A Review of Blockchain-enabled peer-to-peer carbon trading. Energy Sci. Eng. 2024, 12, 1242–1264. [Google Scholar] [CrossRef]

- Abiodun, T.P.; Nwulu, N.I.; Olukanmi, P.O. Application of Blockchain Technology in Carbon Trading Market: A Systematic Review. IEEE Access 2025, 13, 5446–5470. [Google Scholar] [CrossRef]

- Tian, H.; Zhao, T.; Wu, X.; Wang, P. The Impact of Digital Economy Development on Carbon Emissions-Based on the Perspective of Carbon Trading Market. J. Clean. Prod. 2024, 434, 140126. [Google Scholar] [CrossRef]

- Kaufman, M.; Heister, S.; Yuthas, K. Consortium Capabilities for Enterprise Blockchain Success. J. Br. Blockchain Assoc. 2021, 4, 34–42. [Google Scholar] [CrossRef] [PubMed]

- Fuessler, J.; Braden, S.; Owen Hewlett, M.G.I. Navigating Blockchain and Climate Action; Climate Ledger Initiative (CLI): Zurich, Switzerland, 2020. [Google Scholar]

- CarbonChain. Carbon Accounting Software for Manufacturers, Commodity Traders and Their Banks. Available online: https://www.carbonchain.com/ (accessed on 20 September 2025).

- TransparenTerra. Available online: https://transparenterra.com/ (accessed on 21 March 2025).

- Michaelowa, A.; Ahonen, H.-M.; Juliana Keßler, A.S.D. Carbon Market Mechanism Working Group; Perspectives Climate Group: Freiburg, Germany, 2023. [Google Scholar]

- Interwork Alliance. V2 Digital Measurement, Reporting & Verification Framework-Interwork Alliance; Interwork Alliance: Washhington, DC, USA; Geneva, Switzerland, 2023. [Google Scholar]

- Global Blockchain Business Council. Token Taxonomy Framework (TTF). 2025. Available online: https://www.gbbc.io/interwork-alliance/token-taxonomy-framework (accessed on 11 September 2025).

- Greenfield, P. Revealed: More than 90% of Rainforest Carbon Offsets by Biggest Certifier Are Worthless, Analysis Shows. Guardian 2023, 18, 2023. [Google Scholar]

- Kessler, J.; Ahonen, H.-M.; Schmid, A.; Frey, C. Analysis of the ICVCM’s Core Carbon Principles and Assessment Framework Analysis of the ICVCM’s CCPs and Assessment Framework; Integrity Council for the Voluntary Carbon Market (ICVCM): Freiburg, Germany, 2024. [Google Scholar]

- Flourentzou, P. Decentralised Sustainability: Integrating Climate Action into Digital Asset Management on Distributed Ledger Technology (DLT); Blockchain & Climate Institute: London, UK, 2025. [Google Scholar]

- Mandaroux, R.; Dong, C.; Li, G. A European Emissions Trading System Powered by Distributed Ledger Technology: An Evaluation Framework. Sustainability 2021, 13, 2106. [Google Scholar] [CrossRef]

- ISO/TS 23635:2022; ISO Blockchain and Distributed Ledger Technologies—Guidelines for Governance. ISO: Geneva, Switzerland, 2022; Volume 2022.

- Eisenhardt, K.M. What Is the Eisenhardt Method, Really? Strateg. Organ. 2021, 19, 147–160. [Google Scholar] [CrossRef]

- Kubler, S.; Renard, M.; Ghatpande, S.; Georges, J.P.; Le Traon, Y. Decision Support System for Blockchain (DLT) Platform Selection Based on ITU Recommendations: A Systematic Literature Review Approach. Expert Syst. Appl. 2023, 211, 118704. [Google Scholar] [CrossRef]

- Zolla, M.; Marke, A.; Mehling, M.A. DLT and the European Union Emissions Trading System. In Governing Carbon Markets with Distributed Ledger Technology; Cambridge University Press: Cambridge, UK, 2022; pp. 98–114. [Google Scholar] [CrossRef]

- Hartmann, S.; Thomas, S. Applying Blockchain to the Australian Carbon Market. Econ. Pap. 2020, 39, 133–151. [Google Scholar] [CrossRef]

- Jackson, R.B.; Friedlingstein, P.; Andrew, R.M.; Canadell, J.G.; Le Quéré, C.; Peters, G.P. Persistent Fossil Fuel Growth Threatens the Paris Agreement and Planetary Health. Environ. Res. Lett. 2019, 14, 121001. [Google Scholar] [CrossRef]

- Jackson, A.; Lloyd, A.; Macinante, J.; Hüwener, M. Networked Carbon Markets: Permissionless Innovation With Distributed Ledgers? Permissionless Innovation With Distributed Ledgers? In Transforming Climate Finance and Green Investment with Blockchains; Academic Press: Cambridge, MA, USA, 2018; pp. 255–268. [Google Scholar] [CrossRef]

- EU Login-European Commission Authentication Service-Erasmus+ & European Solidarity Corps Guides-EC Public Wiki. Available online: https://wikis.ec.europa.eu/spaces/NAITDOC/pages/33529367/EU+Login+-+European+Commission+Authentication+Service (accessed on 22 August 2025).

- EU Emissions Trading System (EU ETS)-European Commission. Available online: https://climate.ec.europa.eu/eu-action/carbon-markets/eu-emissions-trading-system-eu-ets_en (accessed on 22 August 2025).

- Yang, Y.; Xu, X.; Pan, L.; Liu, J.; Liu, J.; Hu, W. Distributed Prosumer Trading in the Electricity and Carbon Markets Considering User Utility. Renew. Energy 2024, 228, 120669. [Google Scholar] [CrossRef]

- CMI. A National Carbon Market Strategy for Australia; CMI: Singapore, 2024. [Google Scholar]

- DeGrandpré, J.; Zhang, N.; Marquardt, M. Navigating CBAM in China: Exploring Policy Pathways for Guangdong Province; NewClimate Institute: Cologne, Germany; Berlin, Germany, 2025. [Google Scholar]

- UN. The Paris Agreement; United Nations Framework Convention on Climate Change (UNFCCC): Bonn, Germany, 2016; p. 60. [Google Scholar]

- Sedlmeir, J.; Buhl, H.U.; Fridgen, G.; Keller, R. The Energy Consumption of Blockchain Technology: Beyond Myth. Bus. Inf. Syst. Eng. 2020, 62, 599–608. [Google Scholar] [CrossRef]

- World Bank. Blockchain and Emerging Digital Technologies for Enhancing Post-2020 Climate Markets; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Hastig, G.M.; Sodhi, M.M.S. Blockchain for Supply Chain Traceability: Business Requirements and Critical Success Factors. Prod. Oper. Manag. 2020, 29, 935–954. [Google Scholar] [CrossRef]

- Groenfeldt, T. IBM and Maersk Apply Blockchain to Container Shipping. Forbes. 2017. Available online: https://www.forbes.com/sites/tomgroenfeldt/2017/03/05/ibm-and-maersk-apply-blockchain-to-container-shipping/ (accessed on 11 September 2025).

- Pun, H.; Swaminathan, J.M.; Hou, P. Blockchain Adoption for Combating Deceptive Counterfeits. Prod. Oper. Manag. 2021, 30, 864–882. [Google Scholar] [CrossRef]

- Yavaprabhas, K.; Pournader, M.; Seuring, S. Blockchain and Trust in Supply Chains: A Bibliometric Analysis and Trust Transfer Perspective. Int. J. Prod. Res. 2024, 63, 5071–5098. [Google Scholar] [CrossRef]

- UNFCCC. Draft CMA Decision on Guidance on Cooperative Approaches Referred to in Article 6, Paragraph 2, of the Paris Agreement; Proposal by the President; DT.DD.CMA3.i12a.v4; UNFCCC: New York, NY, USA, 2021; Volume 15, pp. 1–13. [Google Scholar]

- Maya Zaynetdinova Dentzel. The Future of Climate Finance: Analysis of the Regenerative Finance Community at the Intersection of Web3 and Climate. Master’s Thesis, University of California, Los Angeles, CA, USA, 2023. Volume 13.

- Tapscott, D.; Tapscott, A.; Tapscott, D.; Tapscott, A. Blockchain Revolution; Portfolio/Penquin: New York, NY, USA, 2016; pp. 1–368. [Google Scholar]

- Basu, P.; Deb, P.; Singh, A. Blockchain and the Carbon Credit Ecosystem: Sustainable Management of the Supply Chain. J. Bus. Strategy 2024, 45, 33–40. [Google Scholar] [CrossRef]

- Carson, B.; Romanelli, G.; Walsh, P.; Zhumaev, A. Blockchain beyond the Hype: What Is the Strategic Business Value? McKinsey Q. 2018, 2018, 118–127. [Google Scholar]

- Boumaiza, A.; Maher, K. Leveraging Blockchain Technology to Enhance Transparency and Efficiency in Carbon Trading Markets. Int. J. Electr. Power Energy Syst. 2024, 162, 110225. [Google Scholar] [CrossRef]

- Woo, J.; Fatima, R.; Kibert, C.J.; Newman, R.E.; Tian, Y.; Srinivasan, R.S. Applying Blockchain Technology for Building Energy Performance Measurement, Reporting, and Verification (MRV) and the Carbon Credit Market: A Review of the Literature. Build. Environ. 2021, 205, 108199. [Google Scholar] [CrossRef]

- Hoopes, J., IV; Lerner, A.; Mezzatesta, M.; Anna, H.; Cheikosman, E.; Dentzel, M.; Llyr, B. Blockchain for Scaling Climate Action; World Economic Forum (WEF): Geneva, Switzerland, 2023. [Google Scholar]

| STUDY | EFFICIENCY GAINS | COST REDUCTIONS | PROCESSING SPEED |

|---|---|---|---|

| EU ETS | Automated compliance, reduced admin burden | >EUR 5 billion fraud prevention | Smart contract automation |

| AUSTRALIA | Reduced CSP reliance, automated MRV | Lower transaction costs | Instant vs. 6-week ACCU issuance |

| CHINA | 15% transaction cost reduction | Lower regulatory costs | 40% transaction speed increase |

| PARAMETER | CHINA (DLT-BASED) | AUSTRALIA (DLT-ENABLED) | EUROPEAN UNION (ESTABLISHED DLT) |

|---|---|---|---|

| USER AUTHENTICATION | Focused on legal entities, potential for future offshore access; emphasis on data quality and security measures | Advocates for secure API access and robust security measures like multi-factor authentication | Robust two-factor authentication system with a central authentication service |

| SYSTEM STABILITY | Younger market, increasing stability, but still more volatile compared to the EU ETS; fewer price stabilization mechanisms | Evolving market with reforms to enhance transparency and integrity; rising ACCU prices indicate increasing stability | Mature and stable market with a proven track record; Market Stability Reserve (MSR) effectively manages supply and demand |

| ECONOMIC DESIGN | Mandatory ETS and voluntary CCER scheme; initially, intensity-based allocation with free allowances; aiming to incentivize low-carbon practices | Combines ACCU projects with the Safeguard Mechanism; ACCUs treated as financial products; emphasis on broad economic coverage and sectoral linkages | Mature cap-and-trade system with wide sectoral coverage; allowances classified as financial instruments; effective in driving emission reductions and generating revenue for green transition |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Heister, S.; Hui, F.K.P.; Wilson, D.I.; Anker, Y. Beyond Opacity: Distributed Ledger Technology as a Catalyst for Carbon Credit Market Integrity. Computers 2025, 14, 403. https://doi.org/10.3390/computers14090403

Heister S, Hui FKP, Wilson DI, Anker Y. Beyond Opacity: Distributed Ledger Technology as a Catalyst for Carbon Credit Market Integrity. Computers. 2025; 14(9):403. https://doi.org/10.3390/computers14090403

Chicago/Turabian StyleHeister, Stanton, Felix Kin Peng Hui, David Ian Wilson, and Yaakov Anker. 2025. "Beyond Opacity: Distributed Ledger Technology as a Catalyst for Carbon Credit Market Integrity" Computers 14, no. 9: 403. https://doi.org/10.3390/computers14090403

APA StyleHeister, S., Hui, F. K. P., Wilson, D. I., & Anker, Y. (2025). Beyond Opacity: Distributed Ledger Technology as a Catalyst for Carbon Credit Market Integrity. Computers, 14(9), 403. https://doi.org/10.3390/computers14090403