Reveal or Conceal? Signaling Strategies for Building Legitimacy in Cleantech Firms

Abstract

1. Introduction

2. Theoretical Background

2.1. Building Legitimacy in Cleantech Firms

2.2. Signaling as a Strategy for Building Legitimacy

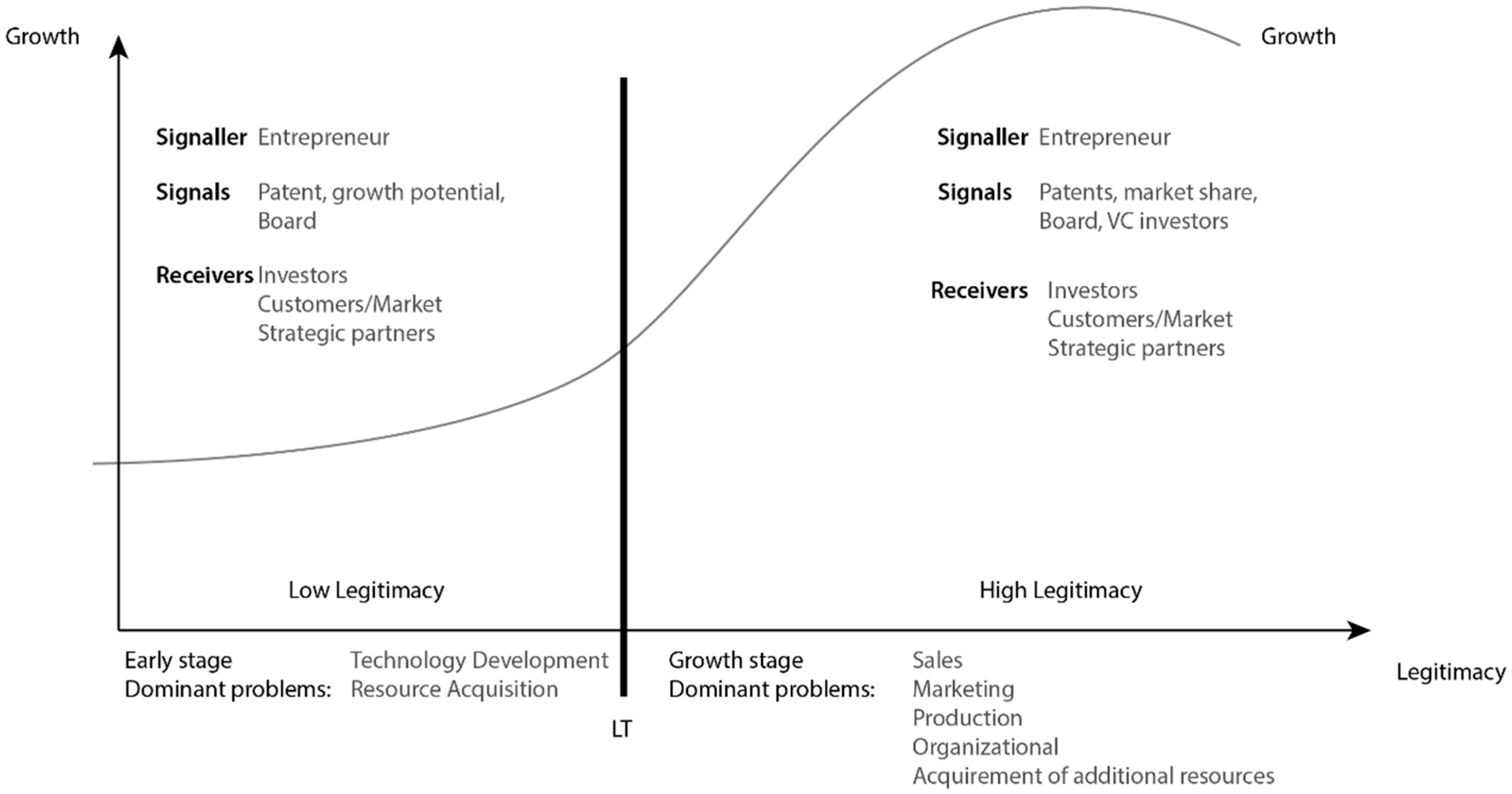

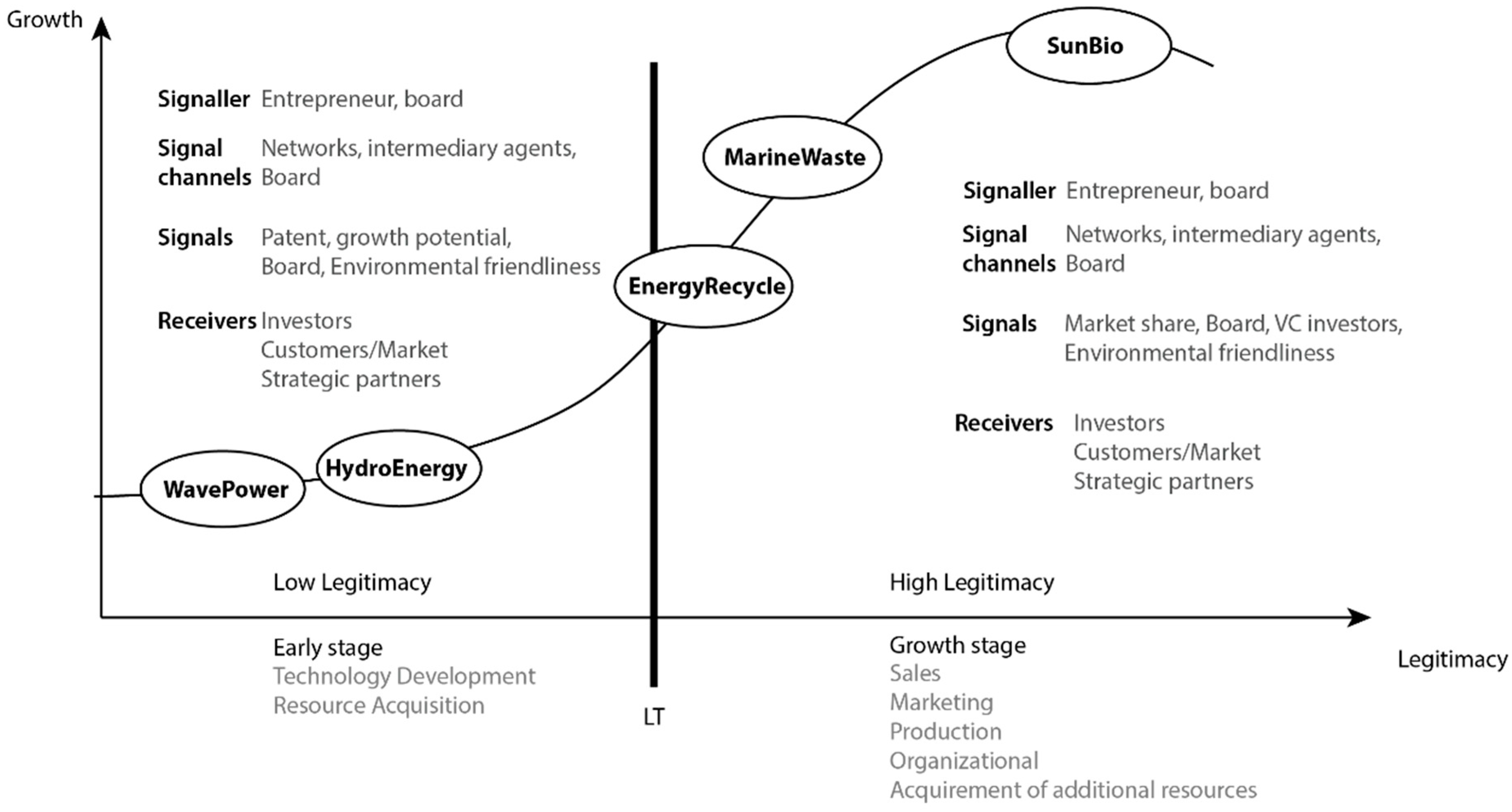

2.3. Signaling at the Early and Growth Development Stages

3. Method and Data

3.1. Research Context

3.2. Selected Cases

3.3. Data Collection

3.4. Data Analysis

4. Results and Discussion

4.1. Why Do Cleantech Firms Signal?

4.2. What Signals Do Cleantech Firms Convey?

4.3. How Do Cleantech Firms Signal?

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Case Study Codes Describing the Dominant Themes

- (1)

- EARLY STAGE DOMINANT PROBLEMS

- Technology development

- Resource Acquisition

- (2)

- GROWTH STAGE DOMINANT PROBLEMS

- Sales

- Marketing

- Production

- Organizational

- Acquirement of additional resources

- (3)

- SIGNALS

- Social capital

- Market

- Technology

- (4)

- SIGNALLER

- Entrepreneur

- Network

- (5)

- RECEIVER

- Investor

- Customer

- Market

- Strategic partners

References

- Bjørnåli, E.S.; Ellingsen, A. Factors Affecting the Development of Clean-tech Start-ups: A Literature Review. Energy Procedia 2014, 58, 43–50. [Google Scholar] [CrossRef]

- Zhang, W.; White, S. Overcoming the liability of newness: Entrepreneurial action and the emergence of China’s private solar photovoltaic firms. Res. Policy 2016, 45, 604–617. [Google Scholar] [CrossRef]

- Rivas Hermann, R.; Wigger, K. Eco-Innovation Drivers in Value-Creating Networks: A Case Study of Ship Retrofitting Services. Sustainability 2017, 9, 733. [Google Scholar] [CrossRef]

- Malek, K.; Maine, E.; McCarthy, I.P. A typology of clean technology commercialization accelerators. J. Eng. Technol. Manag. 2014, 32, 26–39. [Google Scholar] [CrossRef]

- Faems, D.; Van Looy, B.; Janssens, M.; Vlaar, P.W.L. The process of value realization in asymmetric new venture development alliances: Governing the transition from exploration to exploitation. J. Eng. Technol. Manag. 2012, 29, 508–527. [Google Scholar] [CrossRef]

- Ge, B.; Jiang, D.; Gao, Y.; Tsai, S.-B. The Influence of Legitimacy on a Proactive Green Orientation and Green Performance: A Study Based on Transitional Economy Scenarios in China. Sustainability 2016, 8, 1344. [Google Scholar] [CrossRef]

- Bjørgum, Ø.; Moen, Ø.; Madsen, T.K. New ventures in an emerging industry: Access to and use of international resources. Int. J. Entrep. Small Bus. 2013, 20, 233. [Google Scholar] [CrossRef]

- Hyytinen, A.; Pajarinen, M.; Rouvinen, P. Does innovativeness reduce startup survival rates? J. Bus. Ventur. 2015, 30, 564–581. [Google Scholar] [CrossRef]

- York, J.G.; Venkataraman, S. The entrepreneur-environment nexus: Uncertainty, innovation, and allocation. J. Bus. Ventur. 2010, 25, 449–463. [Google Scholar] [CrossRef]

- Giones, F.; Miralles, F. Do Actions Matter More than Resources? A Signalling Theory Perspective on the Technology Entrepreneurship Process. Technol. Innov. Manag. Rev. 2015, 39–45. [Google Scholar]

- Scott, W.R. Institutions and Organizations: Foundations for Organizational Science; A Sage Publication Serie: London, UK, 1995. [Google Scholar]

- Greenwood, R.; Suddaby, R. Institutional entrepreneurship in mature fields: The big five accounting firms. Acad. Manag. J. 2006, 49, 27–48. [Google Scholar] [CrossRef]

- Sine, W.D.; Lee, B.H. Tilting at Windmills? The Environmental Movement and the Emergence of the U.S. Wind Energy Sector. Adm. Sci. Q. 2009, 54, 123–155. [Google Scholar] [CrossRef]

- Battilana, J.; Leca, B.; Boxenbaum, E. 2 How Actors Change Institutions: Towards a Theory of Institutional Entrepreneurship. Acad. Manag. Ann. 2009, 3, 65–107. [Google Scholar] [CrossRef]

- Erikson, T.; Løvdal, N.; Aspelund, A. Entrepreneurial Judgment and Value Capture, the Case of the Nascent Offshore Renewable Industry. Sustainability 2015, 7, 14859–14872. [Google Scholar] [CrossRef]

- Stinchcombe, A.L. Social Structure and Organizations. In Handbook of Organizations; March, J.G., Ed.; Rand-McNally: Chicago, IL, USA, 1965; pp. 142–193. [Google Scholar]

- Zimmerman, M.A.; Zeitz, G.J. Beyond Survival: Achieving New Venture Growth by Building Legitimacy. Acad. Manag. Rev. 2002, 27, 414. [Google Scholar]

- Vohora, A.; Wright, M.; Lockett, A. Critical junctures in the development of university high-tech spinout companies. Res. Policy 2004, 33, 147–175. [Google Scholar] [CrossRef]

- Fisher, G.; Kotha, S.; Lahiri, A. Changing with the Times: An Integrated View of Identity, Legitimacy, and New Venture Life Cycles. Acad. Manag. Rev. 2016, 41, 383–409. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling Theory: A Review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Garud, R.; Kumaraswamy, A.; Karnøe, P. Path Dependence or Path Creation? J. Manag. Stud. 2010, 47, 760–774. [Google Scholar] [CrossRef]

- Dee, N.; Ford, S.; Garnsey, E. Obstacles to Commercialization of Clean Technology Innovations from UK Ventures. In Sustainable Innovation and Entrepreneurship; Edward Elgar Publishing: Cheltenham, UK, 2008. [Google Scholar]

- Franzitta, V.; Curto, D.; Milone, D.; Trapanese, M. Energy Saving in Public Transport Using Renewable Energy. Sustainability 2017, 9, 106. [Google Scholar] [CrossRef]

- Naty, S.; Viviano, A.; Foti, E. Wave Energy Exploitation System Integrated in the Coastal Structure of a Mediterranean Port. Sustainability 2016, 8, 1342. [Google Scholar] [CrossRef]

- Stuart, T.; Hoang, H.; Hybels, R. Interorganizational endorsements and the performance of entrepreneurial ventures. Adm. Sci. Q. 1999, 44, 315–349. [Google Scholar] [CrossRef]

- Gulati, R.; Higgins, M.C. Which ties matter when? the contingent effects of interorganizational partnerships on IPO success. Strateg. Manag. J. 2003, 24, 127–144. [Google Scholar] [CrossRef]

- Hsu, D.H.; Ziedonis, R.H. Resources as dual sources of advantage: Implications for valuing entrepreneurial-firm patents. Strateg. Manag. J. 2013, 34, 761–781. [Google Scholar] [CrossRef]

- Solberg-Hjorth, S.; Brem, A. How to Assess Market Readiness for an Innovative Solution: The Case of Heat Recovery Technologies for SMEs. Sustainability 2016, 8, 1152. [Google Scholar] [CrossRef]

- Jakobsen, S.; Clausen, T.H. Innovating for a greener future: The direct and indirect effects of firms’ environmental objectives on the innovation process. J. Clean. Prod. 2016, 128, 131–141. [Google Scholar] [CrossRef]

- Spence, M. Job Market Signaling. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Basuroy, S.; Desai, K.K.; Talukdar, D. An Empirical Investigation of Signaling in the Motion Picture Industry. J. Mark. Res. 2006, 43, 287–295. [Google Scholar] [CrossRef]

- Rao, A.R.; Qu, L.; Ruekert, R.W. Signaling Unobservable Product Quality through a Brand Ally. J. Mark. Res. 1999, 36, 258. [Google Scholar] [CrossRef]

- Dyer, J.; Chu, W. The determinants of trust in supplier? automaker relations in the US, Japan, and Korea: A retrospective. J. Int. Bus. Stud. 2011, 42, 28–34. [Google Scholar] [CrossRef]

- Elitzur, R.; Gavious, A. Contracting, signaling, and moral hazard: A model of entrepreneurs, “angels,” and venture capitalists. J. Bus. Ventur. 2003, 18, 709–725. [Google Scholar] [CrossRef]

- Stiglitz, J.E. Information and Economic Analysis: A Perspective. Econ. J. 1985, 95, 21–41. [Google Scholar] [CrossRef]

- Bruton, G.D.; Chahine, S.; Filatotchev, I. Founders, Private Equity Investors, and Underpricing in Entrepreneurial IPOs. Entrep. Theory Pract. 2009, 33, 909–928. [Google Scholar] [CrossRef]

- Lester, R.H.; Certo, S.T.; Dalton, C.M.; Dalton, D.R.; Cannella, A.A. Initial Public Offering Investor Valuations: An Examination of Top Management Team Prestige and Environmental Uncertainty. J. Small Bus. Manag. 2006, 44, 1–26. [Google Scholar] [CrossRef]

- Alsos, G.A.; Ljunggren, E. The Role of Gender in Entrepreneur-Investor Relationships: A Signaling Theory Approach. Entrep. Theory Pract. 2017, 41, 567–590. [Google Scholar] [CrossRef]

- Baum, J.A.C.; Silverman, B.S. Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. J. Bus. Ventur. 2004, 19, 411–436. [Google Scholar] [CrossRef]

- Hoenig, D.; Henkel, J. Quality signals? The role of patents, alliances, and team experience in venture capital financing. Res. Policy 2015, 44, 1049–1064. [Google Scholar] [CrossRef]

- Hsu, D.H. Experienced entrepreneurial founders, organizational capital, and venture capital funding. Res. Policy 2007, 36, 722–741. [Google Scholar] [CrossRef]

- Bliege Bird, R.; Smith, E.A. Signaling Theory, Strategic Interaction, and Symbolic Capital. Curr. Anthropol. 2005, 46, 221–248. [Google Scholar] [CrossRef]

- Busenitz, L.W.; Fiet, J.O.; Moesel, D.D. Signaling in Venture Capitalist-New Venture Team Funding Decisions: Does It Indicate Long-Term Venture Outcomes? Entrep. Theory Pract. 2005, 29, 1–12. [Google Scholar] [CrossRef]

- Daily, C.M.; Certo, S.T.; Dalton, D.R. Investment bankers and IPO pricing: Does prospectus information matter? J. Bus. Ventur. 2005, 20, 93–111. [Google Scholar] [CrossRef]

- Cohen, B.D.; Dean, T.J. Information asymmetry and investor valuation of IPOs: Top management team legitimacy as a capital market signal. Strateg. Manag. J. 2005, 26, 683–690. [Google Scholar] [CrossRef]

- Janney, J.J.; Folta, T.B. Moderating effects of investor experience on the signaling value of private equity placements. J. Bus. Ventur. 2006, 21, 27–44. [Google Scholar] [CrossRef]

- Certo, S.T.; Covin, J.G.; Daily, C.M.; Dalton, D.R. Wealth and the effects of founder management among IPO-stage new ventures. Strateg. Manag. J. 2001, 22, 641–658. [Google Scholar] [CrossRef]

- Arthurs, J.D.; Hoskisson, R.E.; Busenitz, L.W.; Johnson, R.A. Managerial Agents Watching other Agents: Multiple Agency Conflicts Regarding Underpricing in IPO Firms. Acad. Manag. J. 2008, 51, 277–294. [Google Scholar] [CrossRef]

- Ndofor, H.A.; Levitas, E. Signaling the Strategic Value of Knowledge. J. Manag. 2004, 30, 685–702. [Google Scholar] [CrossRef]

- Srivastava, J. The Role of Inferences in Sequential Bargaining with One-Sided Incomplete Information: Some Experimental Evidence. Organ. Behav. Hum. Decis. Process. 2001, 85, 166–187. [Google Scholar] [CrossRef] [PubMed]

- Loock, M. Going beyond best technology and lowest price: On renewable energy investors’ preference for service-driven business models. Energy Policy 2012, 40, 21–27. [Google Scholar] [CrossRef]

- Masini, A.; Menichetti, E. The impact of behavioural factors in the renewable energy investment decision making process: Conceptual framework and empirical findings. Energy Policy 2012, 40, 28–38. [Google Scholar] [CrossRef]

- Van de Ven, A.H.; Poole, M.S. Explaining Development and Change in Organizations. Acad. Manag. Rev. 1995, 20, 510–540. [Google Scholar] [CrossRef]

- Stubbart, C.I.; Smalley, R.D. The Deceptive Allure of Stage Models of Strategic Processes. J. Manag. Inq. 1999, 8, 273–286. [Google Scholar] [CrossRef]

- Phelps, R.; Adams, R.; Bessant, J. Life cycles of growing organizations: A review with implications for knowledge and learning. Int. J. Manag. Rev. 2007, 9, 1–30. [Google Scholar] [CrossRef]

- Kazanjian, R.K. Relation of Dominant Problems to Stages of Growth in Technology-Based New Ventures. Acad. Manag. J. 1988, 31, 257–279. [Google Scholar] [CrossRef]

- Miles, M.B.; Huberman, A.M. Qualitative data analysis: An expanded sourcebook, 2nd ed.; Sage Publications: Thousand Oaks, CA, USA, 1994. [Google Scholar]

- Eisenhardt, K.M.; Graebner, M. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Grünfeld, L.A.; Espelien, A. En kunnskapsbasert Fornybar Energi- og Miljønæring. Et Kunnskapsbasert Norge; Menon Business Economics: Oslo, Norway, 2011. [Google Scholar]

- Spilling, O.R. (Ed.) Innovasjonspoilitikk - Problemstillinger og Utfordringer; Fagbokforlaget: Bergen, Norway, 2010. [Google Scholar]

- Pernick, R.; Wilder, C. The Clean Tech Revolution: The Next Big Growth and Investment Opportunity; Harper Collins Publishers: New York, USA, 2007. [Google Scholar]

- Fisher, G.; Kuratko, D.F.; Bloodgood, J.M.; Hornsby, J.S. Legitimate to whom? The challenge of audience diversity and new venture legitimacy. J. Bus. Ventur. 2017, 32, 52–71. [Google Scholar] [CrossRef]

- Gehman, J.; Glaser, V.L.; Eisenhardt, K.M.; Gioia, D.; Langley, A.; Corley, K. Finding Theory-Method Fit: A Comparison of Three Qualitative Approaches To Theory Building. J. Manag. Inq. 2017. [Google Scholar] [CrossRef]

- Yin, R.K. Case study Research: Desing and Methods, 3rd ed.; Sage Publications Ltd.: Thousand Oaks, CA, USA, 2003. [Google Scholar]

- Gibbert, M.; Ruigrok, W. The What and How of Case Study Rigor: Three Strategies Based on Published Work. Organ. Res. Methods 2010, 13, 710–737. [Google Scholar] [CrossRef]

- Gioia, D.A.; Thomas, J.B. Identity, Image, and Issue Interpretation: Sensemaking During Strategic Change in Academia. Adm. Sci. Q. 1996, 41, 370. [Google Scholar] [CrossRef]

- Aldrich, H.E.; Kim, P.H. Small worlds, infinite possibilities? How social networks affect entrepreneurial team formation and search. Strateg. Entrep. J. 2007, 1, 147–165. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building Theories from Case Study Research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar]

- Rasmussen, E.; Moen, Ø.; Gulbrandsen, M. Initiatives to promote commercialization of university knowledge. Technovation 2006, 26, 518–533. [Google Scholar] [CrossRef]

- Mowery, D.C.; Nelson, R.R.; Sampat, B.N.; Ziedonis, A.A. The growth of patenting and licensing by U.S. universities: An assessment of the effects of the Bayh–Dole act of 1980. Res. Policy 2001, 30, 99–119. [Google Scholar] [CrossRef]

| WavePower | HydroEnergy | EnergyRecycle | MarineWaste | SunBio | |

|---|---|---|---|---|---|

| Stage | Early | Early | Growth | Growth | Growth |

| Incorp. year | 2009 | 2000 | 2006 | 2007 | 2006 |

| No. employees | 1 | 2 | 11 | 38 | 26 |

| Board members | 4, all with industry background | 4, two VC * investors and two with industry background | 4, two VC investors and two with industry background | 4, with backgrounds in economics, law and ship brokering | 3, with backgrounds in law and business and administration |

| Key activities | Technology development, searching for funding | Product development, nearly ready for sale | Sales and continuation of growth | Sales and continuation of growth | Sales and expansion to neighboring countries |

| Key milestones achieved | First patent application in 2007 Soft funding in 2007 First full scale prototype test in 2014 | First patent application in 2004 Proof of concept in 2009 Acquired by Investor B in 2014 | First patent application in 2004 First full scale prototype in 2011 First sale abroad in 2015 | First customer in 2000 IPO in 2014 | Product in sale Grown from 100 million to 1 billion in sales during the three last years |

| Partner firms | - | Investor B | Investor A | - | Customer A |

| Incorp. year | - | 2008 | 2005 | - | 2011 |

| Signal Categories | Signal Characteristics |

|---|---|

| Technology | Technology, patents, product |

| Social Capital | Team, board, investors, strategic partners, networks |

| Market | Growth potential, market position, business potential, price, service, long-term cooperation, customer references, history, achievements |

| Sustainability | Renewability, environmental sustainability |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bjornali, E.S.; Giones, F.; Billstrom, A. Reveal or Conceal? Signaling Strategies for Building Legitimacy in Cleantech Firms. Sustainability 2017, 9, 1815. https://doi.org/10.3390/su9101815

Bjornali ES, Giones F, Billstrom A. Reveal or Conceal? Signaling Strategies for Building Legitimacy in Cleantech Firms. Sustainability. 2017; 9(10):1815. https://doi.org/10.3390/su9101815

Chicago/Turabian StyleBjornali, Ekaterina S., Ferran Giones, and Anders Billstrom. 2017. "Reveal or Conceal? Signaling Strategies for Building Legitimacy in Cleantech Firms" Sustainability 9, no. 10: 1815. https://doi.org/10.3390/su9101815

APA StyleBjornali, E. S., Giones, F., & Billstrom, A. (2017). Reveal or Conceal? Signaling Strategies for Building Legitimacy in Cleantech Firms. Sustainability, 9(10), 1815. https://doi.org/10.3390/su9101815