1. Introduction

Shale gas, a clean-burning and high-efficiency unconventional resource, is a rapidly expanding industry as a result of the shale gas revolution in the United States [

1]. In China, the government is implementing a wide range of policies to support its development [

2]. It has been confirmed to be an independent mineral and is regarded as a promising energy resource [

3]. Chinese shale gas is playing a significant role in energy security and structure as well as in environmental protection and energy diplomacy [

4]. In the domestic market, the abundant shale gas reserves and the commercial production at the Fu-Ling Field have attracted the interest of and cooperation agreements with many international oil companies such as BP, Shell, Eni, Conoco Phillips, Total, and Chevron [

5]. Simultaneously, China’s National Oil Company has expanded its investment activities in global shale gas under the encouragement of the “going out” policy [

6]. China has invested in four overseas gas fields that are, mainly, located in North America [

7,

8,

9,

10,

11]. Participation in overseas mergers and acquisitions provide a stable supply to ease pressure on Chinese domestic shale gas production and generate opportunities for innovation [

12]. It is known that shale gas production involves high investment as well as high risk, which may deter investments [

13]. For overseas shale gas fields, the situation is even more complex due to uncertainties stemming from investment environments, tax terms, legislation and other factors [

14,

15,

16]. Therefore, the overseas risks for shale gas investments should be identified and assessed to reduce potential economic loss, especially when oil prices are low.

By searching the relevant literature, the methods used in risk assessments can be classified into three types: qualitative method, quantitative method, and comprehensive method [

17]. Each method has advantages and disadvantages (see

Table 1) [

18,

19,

20,

21,

22,

23,

24,

25,

26,

27,

28,

29], and there is significant controversy over which method is superior. For example, Expert Judgement, a valuable qualitative method, is frequently used for soliciting informed judgements based on the training and experience of the experts [

22]. However, numerous studies have documented the subjective limitation of the experts [

30]. The quantitative methods, such as Monte Carlo and Fuzzy Evaluation, are limited by the inconvenient implementation and the requirements of abundance data [

31]. Due to the limited usefulness, few risk assessments apply a purely qualitative or quantitative method [

32]. The comprehensive method effectively incorporates the benefits of qualitative and quantitative methods and is becoming an important risk assessment tool [

33].

Considering the methods of overseas oil and gas risk assessment, there are two main groups: expert grading and mathematical statistics [

34,

35]. Companies use many risk tools to assess overseas shale gas fields, but these are not publicly available, and the published literature does not present methods to evaluate the risk associated with overseas shale gas. Therefore, it is imperative to develop a publicly available and acceptable method to assess the risk of overseas shale gas investment for the sake of practical applications and academic contribution. This paper proposes an integrated risk assessment method that is applied in the case of China. Based on empirical results, we provide risk ranking information for the Chinese Oil Company to make investment decisions and policy recommendations for overseas shale gas development.

The innovations are as follows: (1) In terms of the index system, we identify five types of risks for overseas shale gas investments and choose ten representative indices to measure the foreign shale investments risk, which fully considers the potential risk abroad and reduces the repetition and tedium of excessive indices; (2) Considering the risk assessment method, we built an integrated model based on the AHP, Entropy weight and TOPSIS methods, which not only provide a feasible and publicly available method for assessing the global shale gas investment risk but also compensates for the academic shortage of overseas shale risk analysis; (3) Based on the empirical results, our findings optimize the overseas shale gas investment for China with policy recommendations from the perspectives of both the government and investors.

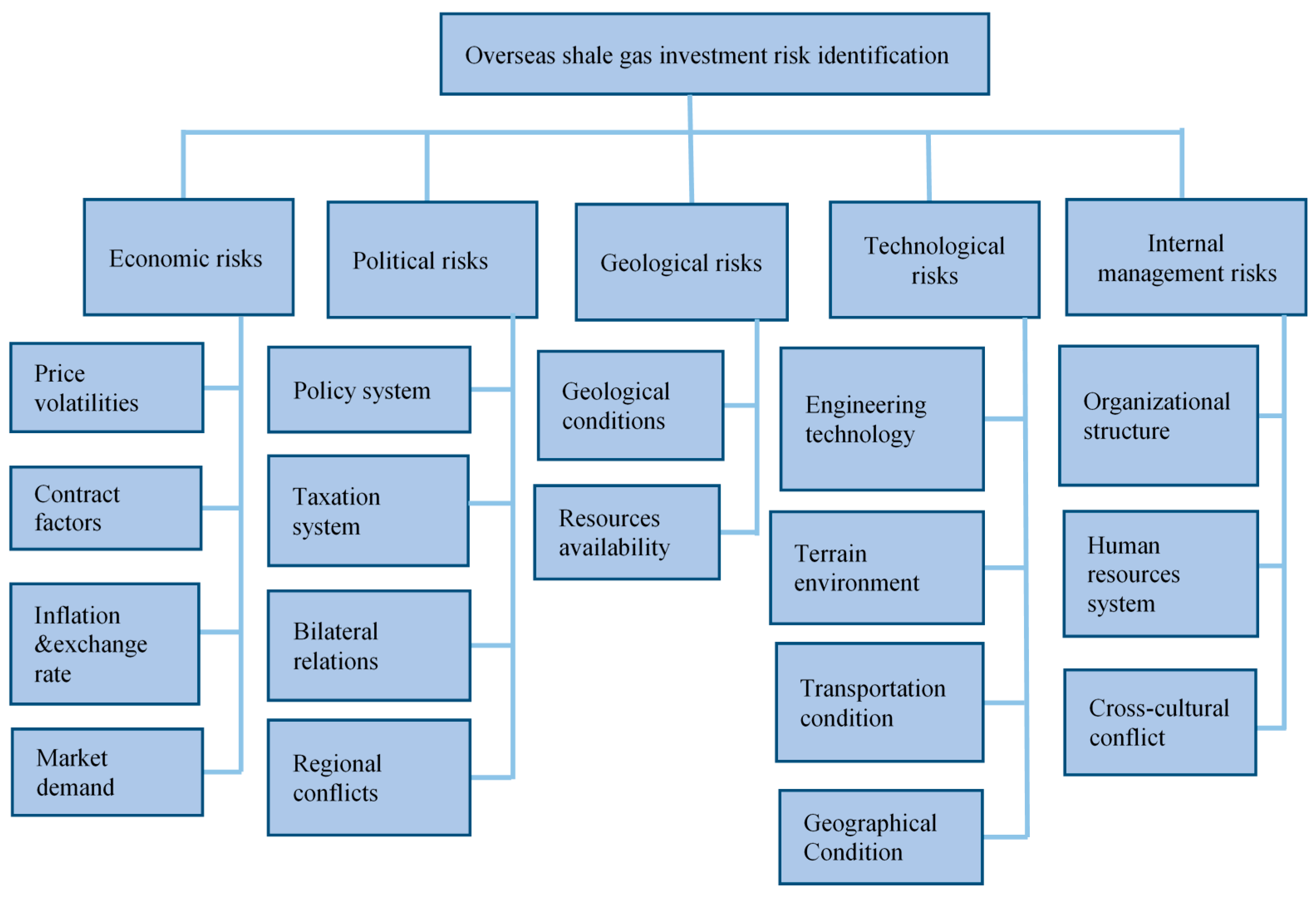

2. Risk Identification

As is well known, international investments in shale gas are surrounded by complexity and uncertainty [

36]. The various risk factors should be identified and ascertained prior to any risk assessment to reveal the basic characteristics of these risk factors and how they affect investments [

37]. According to different criteria, however, there are multiple risk classification categories for global investments. In this paper, we explored five categories of global shale gas investment risks based on the empirical results [

38,

39,

40,

41,

42,

43,

44,

45] and characteristics of shale gas development [

46]. Four categories involving economic, political, geological and technological aspects come directly from Zhang et al. and Xi [

42,

45]. The fifth refers to internal management risk, which plays an increasingly significant role in affecting overseas oil and gas projects [

47,

48,

49,

50]. Therefore, the global shale gas investment risk can be divided into: economic risk, political risk, geological risk, technology risk and internal management risk. The specific categories are shown in

Figure 1.

2.1. Economic Risks

Economic risk is the risk due to unexpected changes caused by economic factors, such as prices, exchange rates, and market demand [

51]. In particular, today’s low oil prices not only reduce investment projects in upstream oil and gas but also pose more risk than the past, which warrants more careful attention. Generally, the economic risk of global shale gas investment is reflected in four aspects:

Price volatilities. Shale gas investment is highly sensitive to price changes [

52]. Natural gas price shocks may directly decrease investment incentives and profits.

Contract factors. International shale gas activities are strictly restricted to contracts, which allocate profits between the home and host countries [

53]. Potential changes in contract terms make contract risk a high priority for investments.

Inflation and exchange rate. The uncertainty and fluctuation of inflation and exchange rates can influence the total amount of investment as well as investment returns [

54].

Market demand. The economic competitiveness of shale investment is determined by market factors. Investors are more attracted to the strong demand for natural gas and the subsequent increases in natural gas prices and investment opportunities [

55].

2.2. Political Risks

Political risk is defined as the ways in which changes in the host government’s systems, policies and political environment affect investment [

56]. With regard to the long-term and capital-intensive investments in overseas shale gas, political risk is the most unpredictable factor and includes unexpected nationalism, religious extremism and terrorism [

57]. The political risk in global shale gas investment comprises four aspects.

Policy system. Investor horizons prefer consistent policies and corporate behaviour [

58]. If the policy of the host country is changed, it could potentially result in a loss of investment. For example, Belco Petroleum Corporation failed and lost investments when Peru’s policy was changed [

59].

Taxation system. Taxes on shale gas investment are usually withheld at the shale source country before the investors gain their profits. Changes in tax systems can significantly affect the profitability of shale gas projects [

60].

Bilateral relations. The corporative bilateral relationship between the investor’s home country and the host country provides a stable investment environment and effectively contributes to investment development [

61].

Regional conflicts. Fragile and conflict-affected host countries may be unable to attract the shale gas investors because of damage to the stability of the investment environment [

62].

2.3. Geological Risks

Geological risk encompasses natural hazards caused by geological conditions that pose a potential threat to the investment [

63]. As is well known, specific risks are reflected in the fault structure, reservoirs and other characteristics, which affect the amount of recoverable shale gas and investor’s expected profits.

Geological condition. Shale gas reservoirs have complex geomechanical characteristics that pose challenges to exploration. The complexity corresponds to the difficulty of the exploitation [

64].

Resource availability. The amount of available shale gas resources determines the result of the investment. The more shale gas reserves are discovered, the greater the success achieved [

44].

2.4. Technological Risks

Technological risks are usually caused by technical design, construction, operation and other factors in oil and gas development [

45,

65], and are mainly reflected in the following four aspects.

Engineering technology. Shale gas extraction relies on core technologies including horizontal drilling and fracking. Difficulties such as equipment failure can hinder production, which is associated with investment cost [

66].

Terrain environment. Difficult terrain such as mountainous regions or swamps will affect the shale gas operations and deserve consideration during risk assessment [

67].

Traffic conditions. Heavy truck traffic can slow operations and requires road condition monitoring [

68].

Geographical condition. Overseas shale gas has a strong dependence on geographical condition, which determine the difficulty of shale gas exploitation associated with the progress of the investment [

69].

2.5. Internal Management Risks

Internal management risks contain the uncertainty in the staff, management system, organization structure and other risks related to the enterprise itself. For international business operations, poor management may result in a fatal policy mistake [

70].

Organizational structure. An effective organizational structure improves operational efficiency by providing clarity to employees and achieving investment objectives for overseas investors [

48].

Human resources management. The global oil and gas industry is facing several human resources deficiencies due to labour flows and an irrational structure, which may result in a loss of competitiveness [

49].

Cross-cultural conflict. Cultural differences among staff can cause misunderstandings between the home country and host country, which present barriers to cooperation [

50].

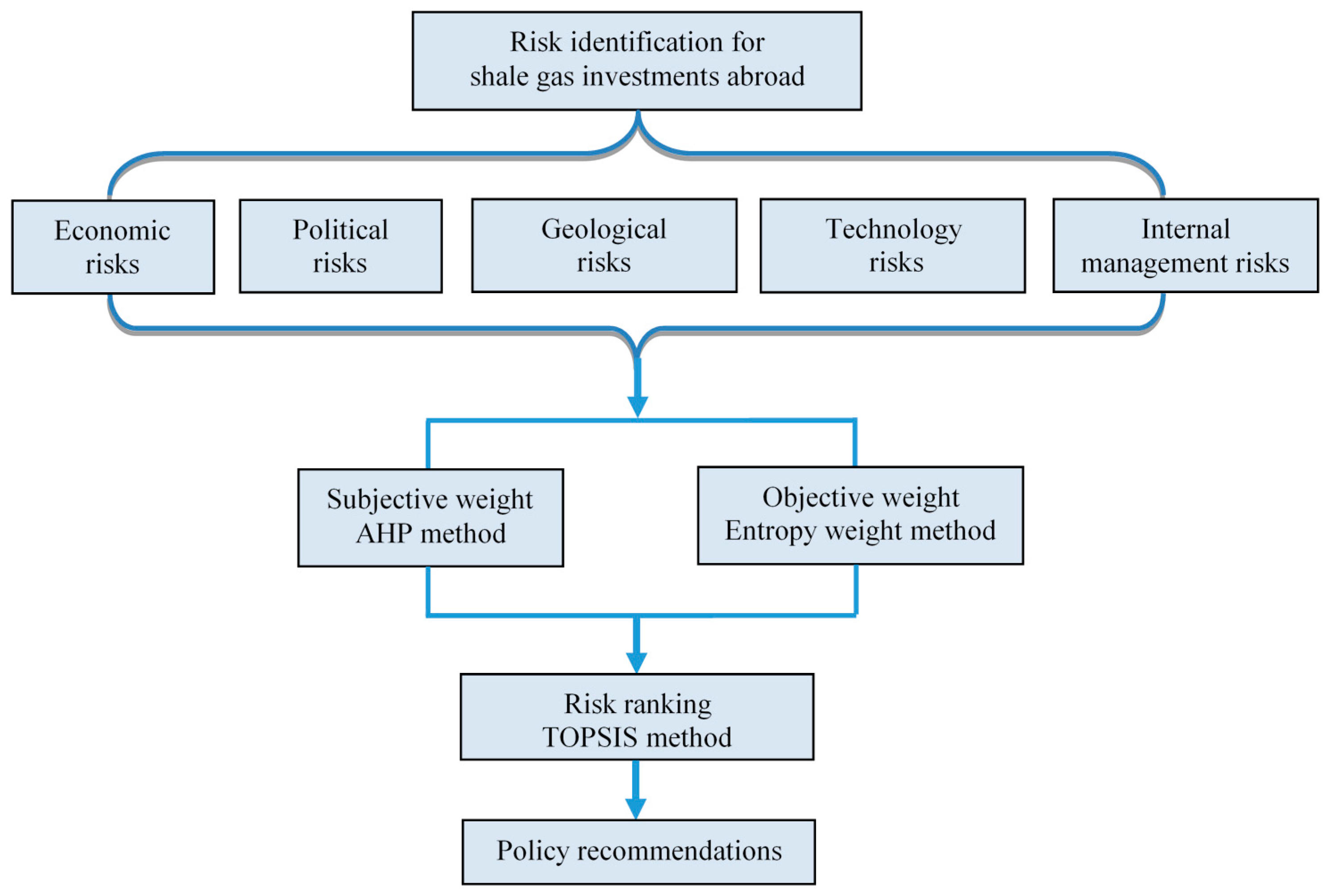

3. Methodology

In this paper, an integrated model for assessing risk of overseas shale gas investments is proposed. The aim of this model is to address the index calculation and risk ranking, which can be illustrated in the following steps: First, both AHP and Entropy methods are applied to determine index weights. AHP produces a subjective weight and the Entropy method generates an objective weight. Second, the results are combined to form comprehensive weights. Third, the TOPSIS method is performed to rank each option based on the AHP-Entropy weighting results. Finally, according to the preferential rankings, we can determine the risk level of investing in shale gas exploration by providing useful investment information for global shale gas investors. The risk assessment flowchart is briefly described in

Figure 2.

The prominent advantages of the AHP-Entropy-TOPSIS model not only takes full consideration of the expertise judgement but also contains the objective information provided by the data itself, which can assess the risk more scientifically and reasonably. In addition, as a practical and useful risk assessment tool, it can be easily accepted and applied by the shale investors.

3.1. AHP Method

AHP, which stands for Analytical Hierarchy Process, was first proposed by Saaty (1997 and 1994) [

71]. It is a subjective weighting method that combines qualitative and quantitative analysis. AHP is attractive due to its high reliability, good practicability and robust mathematical properties [

72]. AHP starts with a hierarchical structure construction, which generally contains three layers from, top to bottom: the object layer, the criterion layer and the scheme layer. Then, pairwise compared judge matrices are established to obtain the priorities of every element based on the expert judgements. Finally, based on the comparison priorities, the relative weights and overall weights are calculated and tested for consistency.

3.2. Entropy Weight Method

Entropy is known to be a useful tool for obtaining objective weights [

73]. It is widely adopted in the index system and is applied to determine the criteria weight of risk index in this paper. Consider an initial decision matrix

with m alternatives and n indicators. The standardized format is expressed as

. Generally, there are two types of evaluation criteria: benefit type and cost type. When evaluating benefit criteria, larger values are considered more valuable, whereas the reverse holds for cost criteria. The two types can be described as follows:

The above calculations not only eliminate the incommensurability influence of index dimension, but also help to create a positive index. Based on the entropy method, the entropy and entropy weight of the index j are defined, respectively, in Equations (3) and (4):

where

,

,

,

.

An obvious characteristic of entropy weight indicates the relative degree of competition among the index, rather than referring to the significant factor of the index. Thus we combine the significant weight and entropy weight, which overcomes the disadvantages of each weight method. Supposing that the weight result is

based on the expert judgement, then the comprehensive weight of the index

j is expressed as follows:

3.3. TOPSIS Method

The TOPSIS method (technique for order preference by similarity to an ideal solution) is presented to rank all alternative solutions according to their closeness to the ideal solution [

74] and find the best alternatives. Before the TOPSIS process, the decision matrix must be normalized.

is the normalized decision matrix. The main procedure of TOPSIS consists of four steps:

Step 1. Construct the weighted normalized decision matrix named

.

Step 2. Define the ideal solution

and the negative ideal solution

Step 3. Calculate the distance between alternatives and the ideal solution,

and

Step 4. Calculate the relative degree and rank the order of alternatives

4. Risk Assessment of China’s Overseas Shale Gas Investments

China’s global shale gas development promotes national energy security and is an indispensable component of the “going out” strategy [

6]. The risk of global shale gas projects should be assessed to better inform Chinese oil and gas companies before investing. This assessment can be taken as an example of an integrated model applied to overseas shale gas investments.

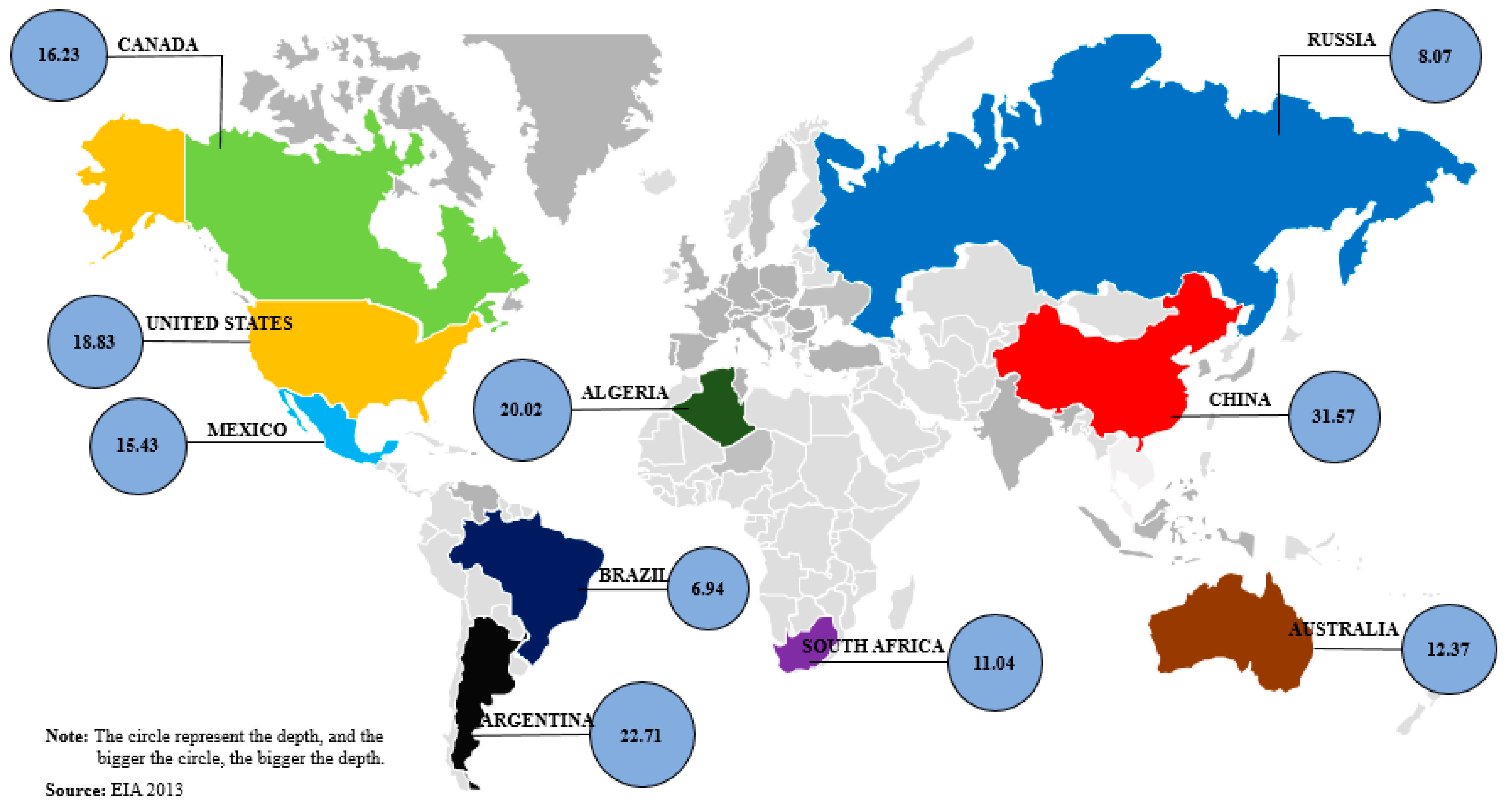

4.1. Country Selection

The selection criteria of shale gas target countries are similar to the selection criteria for overseas oil investments [

14]. According to the IEA’s world shale resource assessments, we chose the top 10 countries (excluding China) as potential investment targets, as shown in

Figure 3. These nations have large technically recoverable shale gas resources and corporate relationships with Chinese oil and gas companies. The ranking was as follows: United States, Argentina, Mexico, South Africa, Australia, Canada, Russia, Algeria, and Brazil [

75].

4.2. Index Selection

Based on the risk identification results and the available and operable data, we consulted shale gas experts and selected five index layers with 10 indicators to evaluate the investment risk, including reserves (MMbbl), depth (m), recovery ratio (%), terrain environment (coefficient), infrastructure (score), macroeconomic environment (score), contract factor (%), political system (score), bilateral relations (coefficient), and staff quality (score).

First, the economic risk is assessed using two indicators: macroeconomic environment and contract factors. Second, the political system and bilateral relations indicators are used to evaluate political risk. Third, geological risk is reflected by shale gas reserves and recovery ratio indicators. Technological risk is then determined by the depth, terrain environment and infrastructure indicators. Finally, the staff quality indicator is used to measure internal management risk.

4.3. Data Collection

Shale gas reserves, depth and recovery ration data were obtained from the potential assessment report of each of the reserve areas. Differences in terrain environment will affect the overseas oil and gas projects. Therefore, the terrain environment should be adjusted in advance based on [

76], as shown in

Table 2.

The various models and specific terms of the contract factor indicator will have an effect on the economic benefit of overseas projects [

77]. The calculation for different contract modes is described below.

where

is the contractor’s portion,

is the cost recovery of one barrel,

is the value of one barrel,

is the service cost per barrel,

is the mining royalty,

is sharing profit oil of the government,

is the duty of domestic market, and

is income tax.

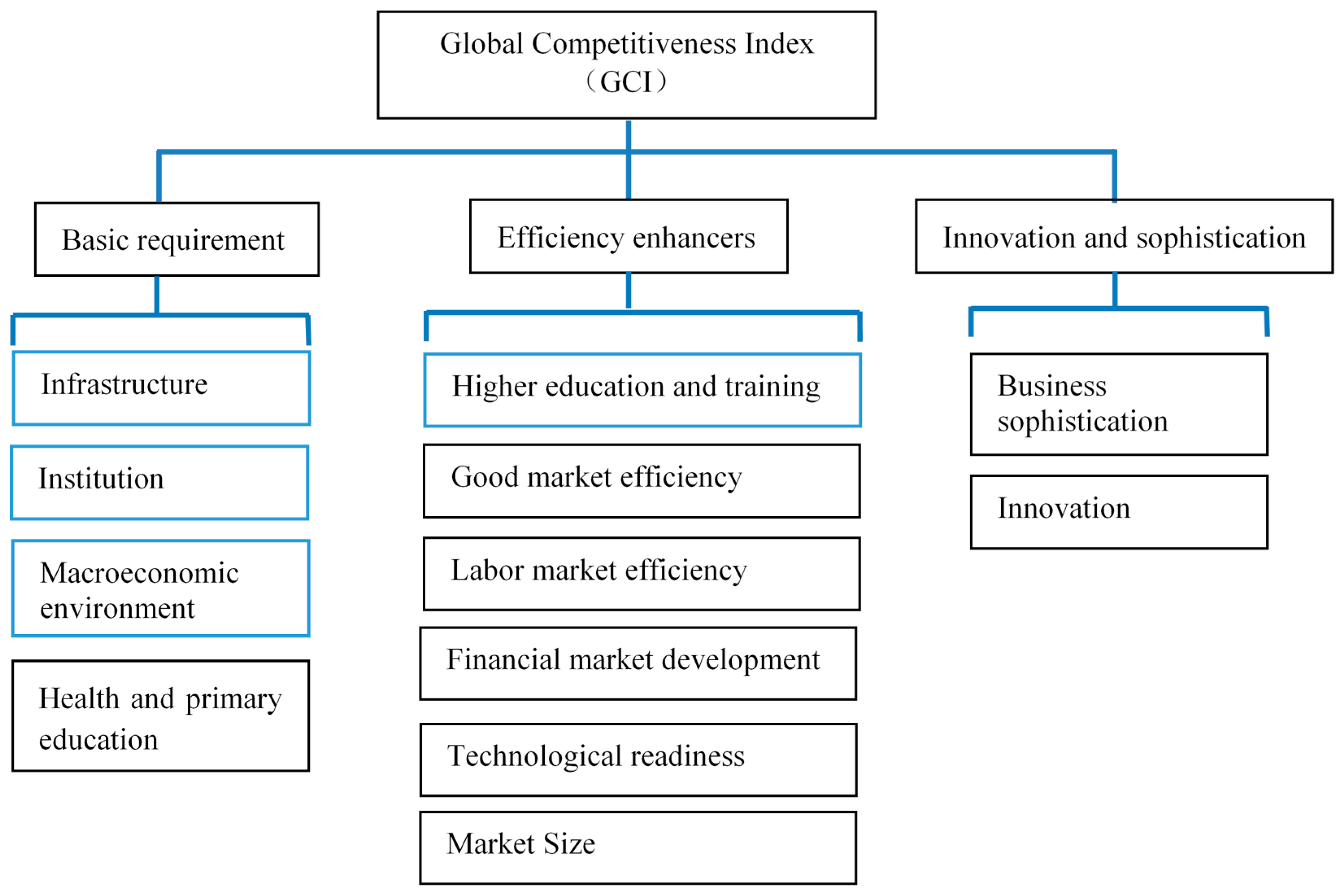

Infrastructure, macroeconomic environment and staff quality data come from the World Economic Forum’s annual Global Competitiveness Report [

78]. In this report, the Global Competitiveness Index (GCI) evaluation system is divided into three subsides with 12 index pillars, as illustrated in

Figure 4; however, only the four indicators that correspond to the GCI system (highlighted in blue) are used in this paper.

Finally, the quantization of the bilateral relations depends on whether the home country has a bilateral agreement with the resource country. If there is an investment agreement, the value of the bilateral relations is equal to 1. Otherwise the value is 0.

4.4. Results and Discussions

4.4.1. Results

After establishing the risk assessment index system, an initial decision matrix can be generated as shown in

Table 3. The standardized matrix was calculated according to Equations (1) and (2). The entropy weights were obtained from the computations based on Equations (3) and (4). Regarding the significance of the expert judgment weights in the risk assessments, we employed the principles of accountability, neutrality, fairness, and empirical control. Furthermore, we invited 12 experts who came from the enterprises, the universities and the research institutes of gas field. The distribution of the expert group is as follows: five of the experts with certain professional knowledge were selected from the state-owned oil companies because they were the main investors of shale gas in China. Two of them were from the engineering and technical companies such as Schlumberger and Antonoil, which were skilled at shale gas exploration. In addition, we choose three academic professors with outstanding knowledge in oil and gas research fields. Finally, we selected two researchers from Oil and Gas Resources Survey Center of China Geological Survey and China Energy Network. Once the expert group is built, the participants graded weight values through a series of pairwise comparison as we explained in the methodology section. The provided scores by the experts were the inputs of the software, which is converted to the AHP weights (see

Table 4 and

Table 5). Based on comprehensive weight calculating (Equation (5)),

Table 5 presents the comprehensive weights of all indices determined by both Entropy weight and AHP weight. As shown in

Table 6, the risk order from low to high is as follows: Canada, Argentina, United States, Algeria, Australia, Mexico, Russia, South Africa and Brazil.

4.4.2. Discussions

Concerning the performance of the index, we find that the significance of each index is determined by its comprehensive weight. Furthermore, there are differences between the entropy weight and AHP weight for the same index. In the case of the Chinese risk index system of overseas shale gas investment, the technically recoverable resources index is confirmed to be the most critical factor due to the maximum comprehensive weight (0.302). Additionally, because of the low expert judgement weight, the recovery ratio with the maximum entropy weight produces a low comprehensive result. Given their low subjective weights, both bilateral relations and staff quality indices have a limited impact on the risk level of global shale gas investment. Macroeconomic environment, contract factors and the political system strongly affect risk levels due to their high comprehensive weight. Therefore, the index related to external risk is more important than that related to internal risk for overseas shale gas risk assessment. The comprehensive weight technique combining both objective and subjective methods is more reasonable and efficient compared to a single measure.

With regard to the ranking orders based on the TOPSIS method, Canada provides a stable and safe environment. Although the volume of technically recoverable shale gas in Canada is not the largest, the good infrastructure and a stable political system help it attain the largest score, which places Canada at the lowest risk ranking. Argentina and United States also present lower risks because Argentina has the best contract factors and the recovery ratio in United States is significantly higher. By contrast, smaller reserves and poor relations make Brazil an uncertain prospect for Chinese shale gas investors. According to the current foreign shale investment situation, there are four overseas shale gas fields dominated by China National Oil Company, with one located in Canada and the other three focused on shale gas in the United States. This information is in accordance with our ranking results and demonstrates the practicality and effectiveness of this integrated method.

Although the risk analysis is taken into consideration based on a risk assessment index system and an integrated method, however, the evaluation of economic and environmental benefits of overseas shale gas investment, the EROI calculation and other factors affecting investment decision are not considered. Investors cannot rely solely on the risk ranking results to make optimal decisions, but they still provide important investment information. Optimal investment decision-making in international shale gas is the result of considering a wide range of factors.

5. Conclusions and Policy Recommendations

5.1. Conclusions

As the shale gas revolution expands globally, the future potential and economic profits around the overseas shale gas reserves have attracted the interest of Chinese investors. Given the high uncertainty and complexity, the risk of overseas shale gas deserves further consideration. Therefore, this paper carries out an integrated method combining AHP, Entropy weight and TOPSIS for the risk assessment of overseas investments, which is available and practicable for the public. Furthermore, China is taken as the example nation to prove the effectiveness of this model and help the investors make wise decisions. The conclusions of this study are as follows:

(1) The risk in overseas shale gas investment is divided into five categories: economic risk, political risk, geological risk, technological risk and internal management risk. Each category is identified by specific risk indices. Based on the risk identification results and specific features of international shale gas development, this paper constructs a risk assessment index system for overseas shale gas investment, and choose ten representative indices for China’s overseas shale gas investment. Furthermore, the integrated method is proposed to assess the risk of overseas shale gas investments, which can be available to public.

(2) Taking China’s overseas shale gas investment as an example, we evaluated the ten countries with the most abundant shale resources (excluding China). The results revealed the significance of different indices, and this paper discussed the main factors affecting the risk level of the target countries. It is suggested that low-risk countries such as Canada, Argentina, the United States, and Algeria can be considered to be key investment targets and investors should be more cautious of high risk countries in the future.

5.2. Policy Recommendations

Although the current low oil price enables Chinese investors to purchase foreign shale gas fields at a low price, the activities around international shale gas investment are reduced due to the impact of economic decline, overseas business transformation, governmental corruption and other factors. In the context of promising prospects and the uncertain shale gas market, Chinese shale gas investors are presented with not only major opportunities but also challenges that warrant serious caution and consideration. Based on the empirical results, the risk of overseas shale gas investment for China refers to aspects of both the external environment and interior conditions. Cooperation between the government and investors is needed to achieve optimal overseas investments with low risk. Some recommendations for China’s overseas shale gas investment policy are proposed as follows:

(1) From a government perspective, it is necessary to actively create conditions for the development of overseas shale gas. Policies should be tailored to individual countries based on their risk assessment. The government should preferentially coordinate with low-risk countries. The policies of the home country involve strategic guidance and coordination, mutual complementarity, financial support, reduced regulation and strong energy diplomacy. In high-risk countries, it necessary to supervise the investment and strengthen the approval of the project while seeking further investment opportunities.

(2) From an investor perspective, it is critical to cultivate risk awareness and make a prudent investment at all risk levels. Before investing, investors must identify the five risk categories and other potential risks in investments abroad. Additionally, every investor should establish a risk management and control system to address uncertainty and reduce potential economic loss. Based on the proposed integrated method, we suggest that the investors adjust their index selection criteria and add useful indices in practice, so that the results provide more risk information for investment decision making.