Assessing Risk in Chinese Shale Gas Investments Abroad: Modelling and Policy Recommendations

Abstract

:1. Introduction

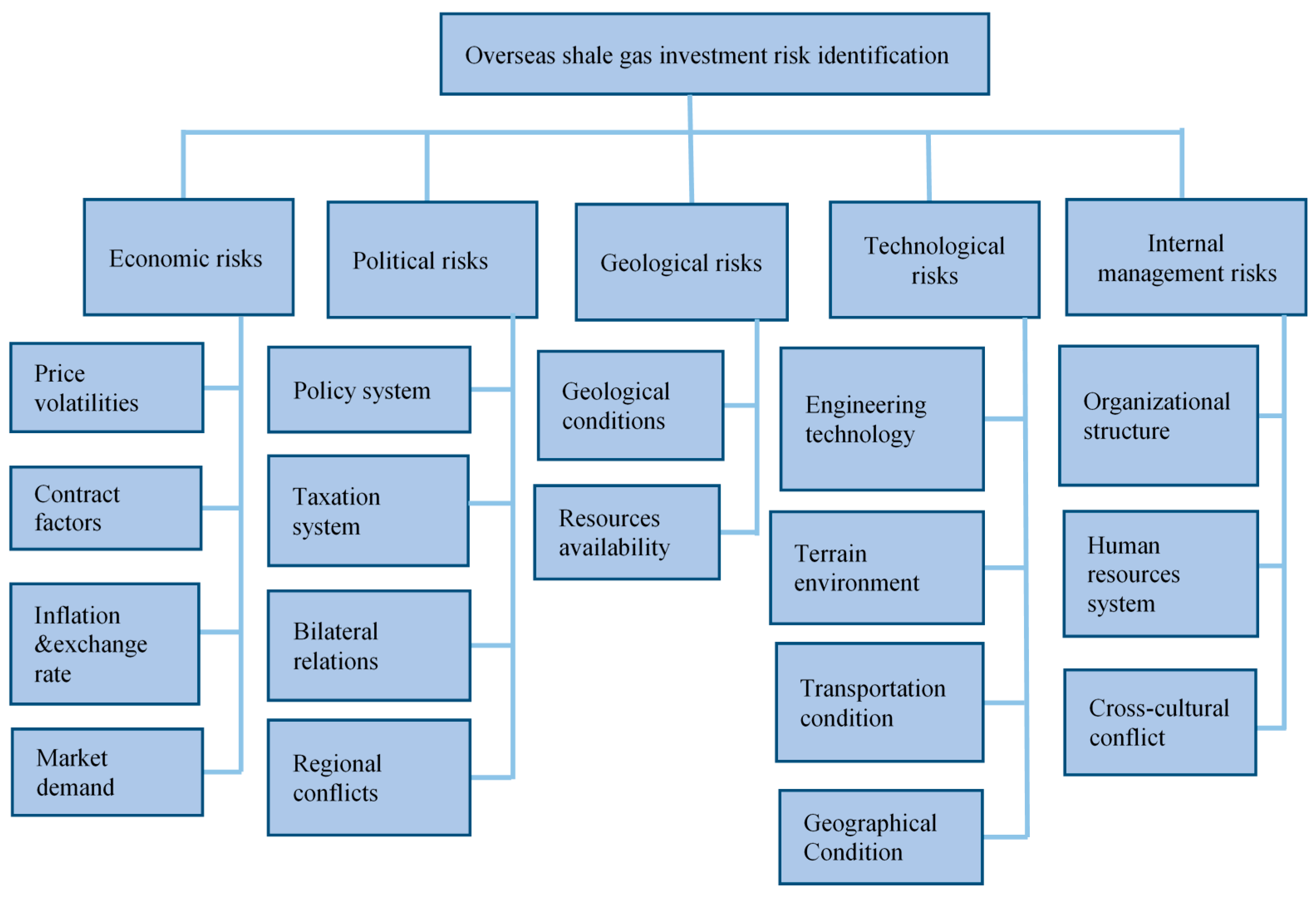

2. Risk Identification

2.1. Economic Risks

- Price volatilities. Shale gas investment is highly sensitive to price changes [52]. Natural gas price shocks may directly decrease investment incentives and profits.

- Contract factors. International shale gas activities are strictly restricted to contracts, which allocate profits between the home and host countries [53]. Potential changes in contract terms make contract risk a high priority for investments.

- Inflation and exchange rate. The uncertainty and fluctuation of inflation and exchange rates can influence the total amount of investment as well as investment returns [54].

- Market demand. The economic competitiveness of shale investment is determined by market factors. Investors are more attracted to the strong demand for natural gas and the subsequent increases in natural gas prices and investment opportunities [55].

2.2. Political Risks

- Taxation system. Taxes on shale gas investment are usually withheld at the shale source country before the investors gain their profits. Changes in tax systems can significantly affect the profitability of shale gas projects [60].

- Bilateral relations. The corporative bilateral relationship between the investor’s home country and the host country provides a stable investment environment and effectively contributes to investment development [61].

- Regional conflicts. Fragile and conflict-affected host countries may be unable to attract the shale gas investors because of damage to the stability of the investment environment [62].

2.3. Geological Risks

- Geological condition. Shale gas reservoirs have complex geomechanical characteristics that pose challenges to exploration. The complexity corresponds to the difficulty of the exploitation [64].

- Resource availability. The amount of available shale gas resources determines the result of the investment. The more shale gas reserves are discovered, the greater the success achieved [44].

2.4. Technological Risks

- Engineering technology. Shale gas extraction relies on core technologies including horizontal drilling and fracking. Difficulties such as equipment failure can hinder production, which is associated with investment cost [66].

- Terrain environment. Difficult terrain such as mountainous regions or swamps will affect the shale gas operations and deserve consideration during risk assessment [67].

- Traffic conditions. Heavy truck traffic can slow operations and requires road condition monitoring [68].

- Geographical condition. Overseas shale gas has a strong dependence on geographical condition, which determine the difficulty of shale gas exploitation associated with the progress of the investment [69].

2.5. Internal Management Risks

- Organizational structure. An effective organizational structure improves operational efficiency by providing clarity to employees and achieving investment objectives for overseas investors [48].

- Human resources management. The global oil and gas industry is facing several human resources deficiencies due to labour flows and an irrational structure, which may result in a loss of competitiveness [49].

- Cross-cultural conflict. Cultural differences among staff can cause misunderstandings between the home country and host country, which present barriers to cooperation [50].

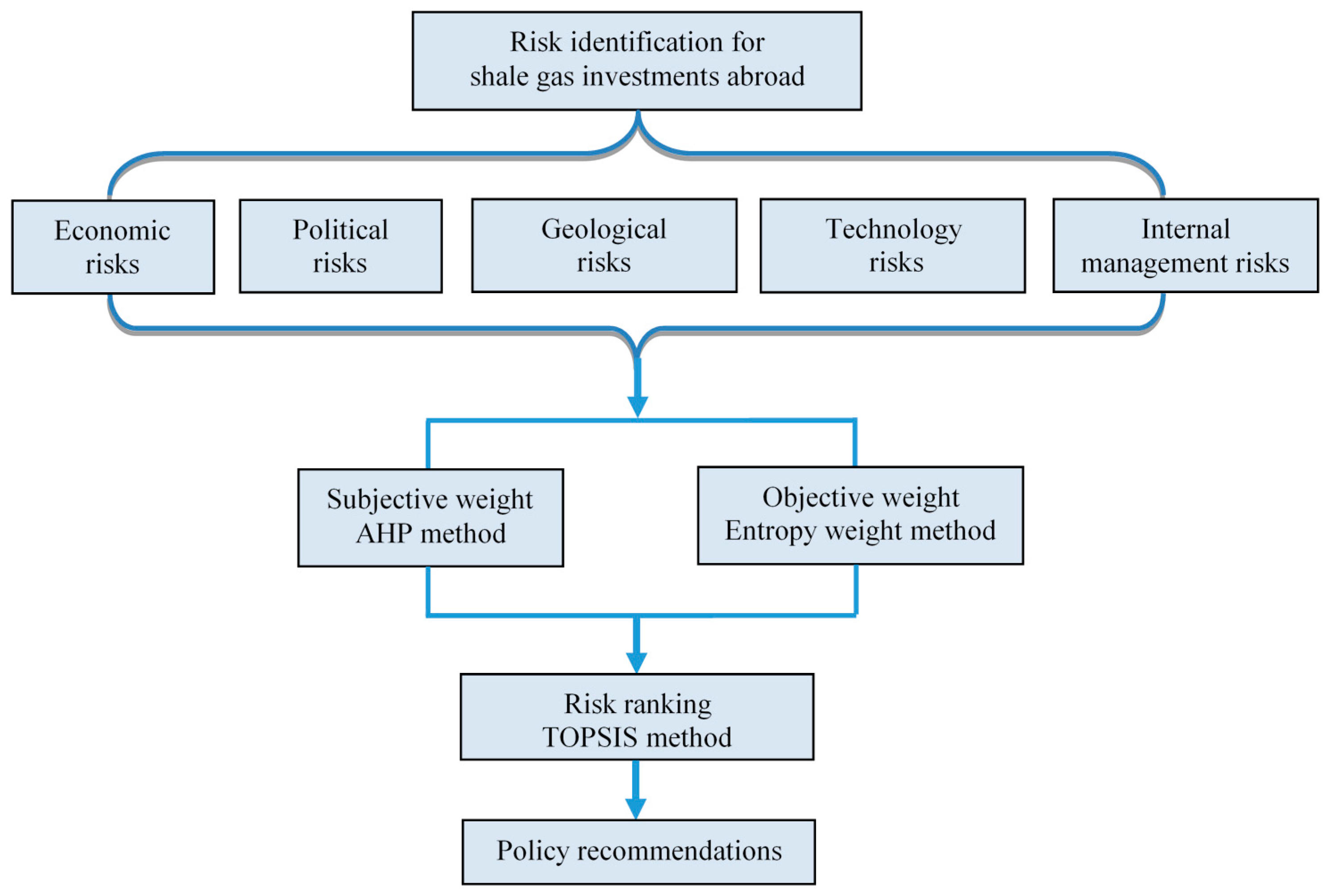

3. Methodology

3.1. AHP Method

3.2. Entropy Weight Method

3.3. TOPSIS Method

4. Risk Assessment of China’s Overseas Shale Gas Investments

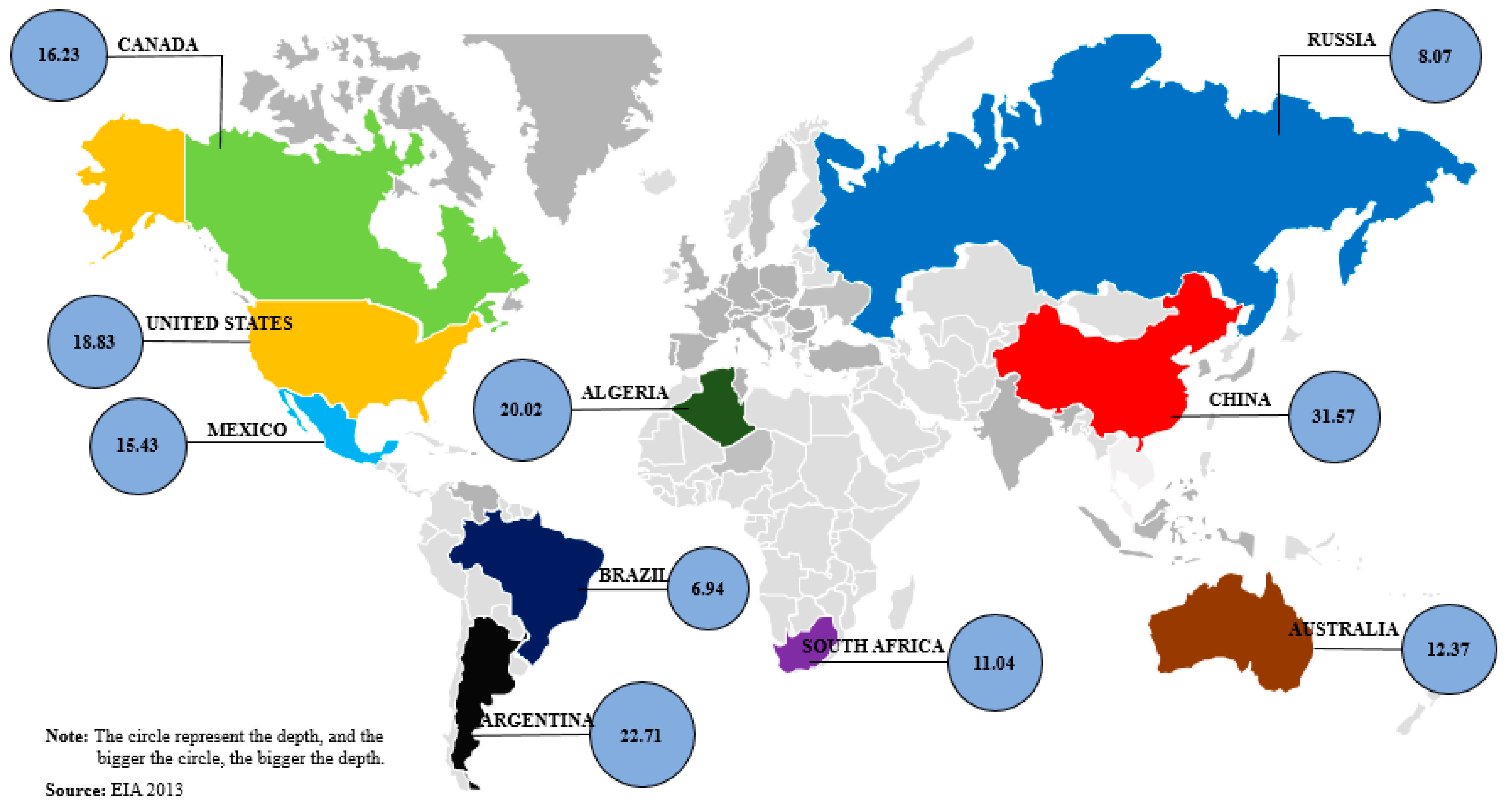

4.1. Country Selection

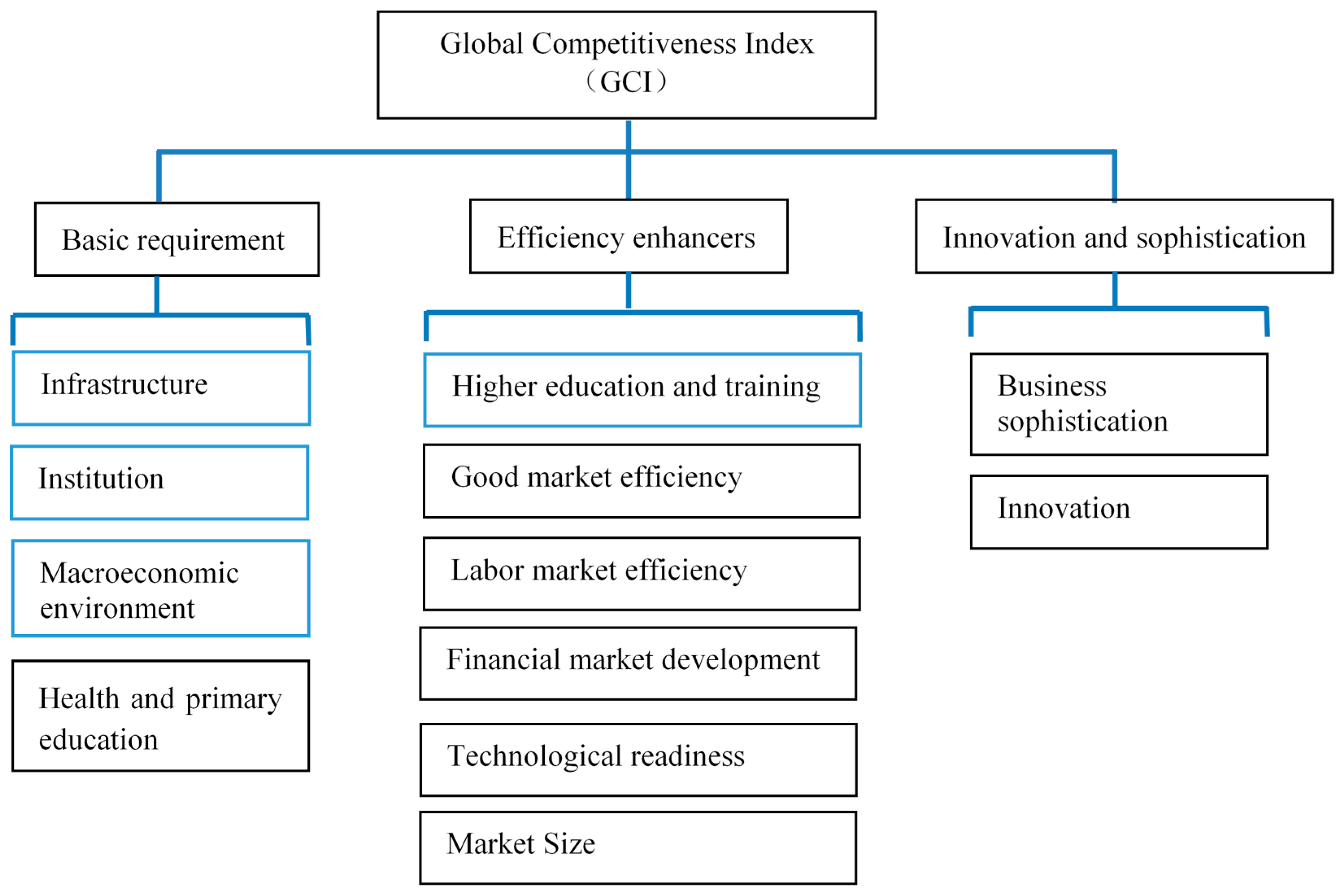

4.2. Index Selection

4.3. Data Collection

4.4. Results and Discussions

4.4.1. Results

4.4.2. Discussions

5. Conclusions and Policy Recommendations

5.1. Conclusions

5.2. Policy Recommendations

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Hughes, J.D. Energy: A reality check on the shale revolution. Nature 2013, 494, 307–308. [Google Scholar] [CrossRef] [PubMed]

- Zhao, J.Z.; Yang, H.; Li, Y.M.; Liao, T. China accelerates shale gas development. J. Oil Gas 2014, 112, 70. (In Chinese) [Google Scholar]

- Zhao, X.G.; Kang, J.L.; Lan, B. Focus on the development of shale gas in China—Based on SWOT analysis. Renew. Sust. Energy Rev. 2013, 21, 603–613. [Google Scholar]

- Zhang, D.W. Important measures for promoting the shale gas exploration and development in China: An explanation of The Shale Gas Development Programming from 2011 to 2015. Nat. Gas Ind. 2012, 32, 1–5. (In Chinese) [Google Scholar] [CrossRef]

- Stevens, S.H.; Moodhe, K.D.; Kuuskraa, V.A. China Shale Gas and Shale Oil Resource Evaluation and Technical Challenges. SPE Asia Pacific Oil and Gas Conference and Exhibition; Society of Petroleum Engineers: Jakarta, Indonesia, 2013. [Google Scholar]

- Li, N.; Wang, Y.G.; Xiang, Y.C. Thought on Implementing “Going Global” Strategy for Shale Gas Development of China. Nat. Resour. Econ. China 2012, 25, 37–39. (In Chinese) [Google Scholar]

- Chesapeake Energy Corporation and CNOOC Limited Announce Eagle Ford Shale Project Cooperation Agreement, 2010. Available online: http://www.businesswire.com/news/home (accessed on 11 October 2010).

- Gonzalez, A.; Dezember, R. Sinopec Enter U.S. Shale. Wall St. J. 2012. Available online: http://www.wsj.com/articles/ (accessed on 4 January 2012).

- Jones, J. Encana, PetroChina Take $2.2 Billion Stab at Join Venture. Reuters. Available online: http://www.reuters.com/article/ (accessed on 13 December 2012).

- Pioneer Natural Resources Company. Pioneer Natural Resources Announces Closing of $1.7 Billion Horizontal Wolfcamp Shale Transaction with Sinochem, 2013. Available online: http://investors.pxd.com/phoenix.zhtml?c=90959&p=irol-newsArticle&ID=1825928 (accessed on 31 May 2013).

- China’s Haimo Seals US Shale Gas Stake. China Daily. 2012. Available online: http://usa.chinadaily.com.cn/business/2012–10/26/content_15849981.htm (accessed on 26 October 2012).

- Pi, G.L.; Dong, X.C.; Dong, C.; Guo, J.; Ma, Z.W. The status, obstacles and policy recommendations of shale gas development in China. Sustainability 2015, 7, 2353–2372. [Google Scholar] [CrossRef]

- Ma, X.; Philip, A.S. The overseas activities of China’s national oil companies: Rationale and outlook. Miner. Energy Raw Mater. Rep. 2006, 21, 17–30. [Google Scholar] [CrossRef]

- Fan, Y.; Zhu, L. A real options based model and its application to China’s overseas oil investment decisions. Energy Econ. 2010, 32, 627–637. [Google Scholar] [CrossRef]

- Wagner, J.; Armstrong, K. Managing environmental and social risks in international oil and gas projects: Perspectives on compliance. J. World Energy Law Bus. 2010, 3, 140–165. [Google Scholar] [CrossRef]

- Berends, K. Engineering and construction projects for oil and gas processing facilities: Contracting, uncertainty and the economics of information. Energy Policy 2007, 35, 4260–4270. [Google Scholar] [CrossRef]

- Felder, F.A. Risk Modeling, Assessment, and Management. IIE Trans. 2005, 37, 586–587. [Google Scholar]

- Hora, S.C. Acquisition of expert judgment: Examples from risk assessment. J. Energy Eng. 1992, 118, 136–148. [Google Scholar] [CrossRef]

- Tixier, J.; Dusserre, G.; Salvi, O.; Gaston, S. Review of 62 risk analysis methodologies of industrial plants. J. Loss Prevent. Proc. 2002, 15, 291–303. [Google Scholar] [CrossRef] [Green Version]

- Liu, H.C.; Liu, L.; Liu, N. Risk evaluation approaches in failure mode and effects analysis: A literature review. Expert Syst. Appl. 2013, 40, 828–838. [Google Scholar] [CrossRef]

- Li, P.; Chen, B.; Li, Z.; Zheng, X.; Wu, H.J.; Jing, L.; Lee, K. A Monte Carlo simulation based two-stage adaptive resonance theory mapping approach for offshore oil spill vulnerability index classification. Mar. Pollut. Bull. 2014, 86, 434–442. [Google Scholar] [CrossRef] [PubMed]

- Zheng, Q.C.; Yao, A.L.; Guan, H.P.; Jiang, H.Y.; Gu, D.M. Safety evaluation on flood damage at slope of oil and gas pipelines based on cloud model. J. Saf. Environ. 2013, 4, 233–238. [Google Scholar]

- Volkanovski, A.; Čepin, M.; Mavko, B. Application of the fault tree analysis for assessment of power system reliability. Reliab. Eng. Syst. Saf. 2009, 94, 1116–1127. [Google Scholar] [CrossRef]

- Ferdous, R.; Khan, F.; Sadiq, R.; Amyotte, P.; Veitch, B. Handling data uncertainties in event tree analysis. Process. Saf. Environ. Prot. 2009, 87, 283–292. [Google Scholar] [CrossRef]

- Zou, Q.; Zhou, J.Z.; Zhou, C.; Song, L.X.; Guo, J. Comprehensive flood risk assessment based on set pair analysis-variable fuzzy sets model and fuzzy AHP. Stoch. Env. Res. Risk Assess. 2013, 27, 525–546. [Google Scholar] [CrossRef]

- Luzon, B.; El-Sayegh, S.M. Evaluating supplier selection criteria for oil and gas projects in the UAE using AHP and Delphi. Int. J. Constr. Manag. 2016, 16, 1–9. [Google Scholar] [CrossRef]

- Xu, X.M.; Niu, D.X.; Qiu, J.P.; Wu, M.Q.; Wang, P.; Qian, W.Y.; Jin, X. Comprehensive Evaluation of Coordination Development for Regional Power Grid and Renewable Energy Power Supply Based on Improved Matter Element Extension and TOPSIS Method for Sustainability. Sustainability 2016, 8, 143. [Google Scholar] [CrossRef]

- Wooldridge, M.; Schaffner, D.W. Microbial Risk Analysis of Foods; ASM Press: Washington, DC, USA, 2008. [Google Scholar]

- Van Ryzin, J. Quantitative risk assessment. J. Occup. Environ. Med. 1980, 22, 321. [Google Scholar] [CrossRef]

- Cox, L.A.T.; Babayev, D.; Huber, W. Some limitations of qualitative risk rating systems. Risk Anal. 2005, 25, 651–662. [Google Scholar] [CrossRef] [PubMed]

- Kaplan, S.; Garrick, B.J. On the quantitative definition of risk. Risk Anal. 1981, 1, 11–27. [Google Scholar] [CrossRef]

- Ramona, S.E. Advantages and Disadvantages of Quantitative and Qualitative Information Risk Approaches. Chin. Bus. Rev. 2011, 10, 1106–1110. [Google Scholar]

- Guo, R.; Luo, D.K.; Zhao, X.; Wang, J.L. Integrated Evaluation Method-Based Technical and Economic Factors for International Oil Exploration Projects. Sustainability 2016, 8, 188. [Google Scholar] [CrossRef]

- Jiang, W.N.; Ju, B.S.; Di, G.H.; Chen, Y.Q.; Jiang, H.N.; Wei, L. Risk evaluation of overseas oil-gas development projects. Resour. Ind. 2015, 17, 62. (In Chinese) [Google Scholar]

- Harbaugh, J.W.; Doveton, J.H.; Davis, J.C. Probability Methods in Oil Exploration; John Wiley and Sons: New York, NY, USA, 1977. [Google Scholar]

- Xie, G.; Yue, W.Y.; Wang, S.Y.; Lai, K.K. Dynamic risk management in petroleum project investment based on a variable precision rough set model. Technol. Forecast. Soc. 2010, 77, 891–901. [Google Scholar] [CrossRef]

- Kendrick, T. Identifying and Managing Project Risk: Essential Tools for Failure-Proofing Your Project; American Management Association: New York, NY, USA, 2015. [Google Scholar]

- Pandian, S. The political economy of trans-Pakistan gas pipeline project: Assessing the political and economic risks for India. Energy Policy 2005, 33, 659–670. [Google Scholar] [CrossRef]

- Stephens, J.C.; Wilson, E.J.; Peterson, T.R. Socio-Political Evaluation of Energy Deployment (SPEED): An integrated research framework analyzing energy technology deployment. Technol. Forecast. Soc. 2008, 75, 1224–1246. [Google Scholar] [CrossRef]

- Chorn, L.G.; Shokhor, S. Real options for risk management in petroleum development investments. Energy Econ. 2006, 28, 489–505. [Google Scholar] [CrossRef]

- Asrilhant, B.; Dyson, R.G.; Meadows, M. On the strategic project management process in the UK upstream oil and gas sector. Omega 2007, 35, 89–103. [Google Scholar] [CrossRef]

- Zhang, B.S.; Wang, Q.; Wang, Y.J. Model of risk-benefit co-analysis on oversea oil and gas projects and its application. Syst. Eng. Theory Pract. 2012, 32, 246–256. (In Chinese) [Google Scholar]

- Shang, M.M.; Zhang, B.S.; Wang, L.J. Risk evaluation and decision support systems on international oil and gas exploration projects. Technol. Econ. 2012, 31, 72–76. (In Chinese) [Google Scholar]

- Stauffer, T.R. Political Risk and Overseas Oil Investment. Symposium on Energy, Finance, and Taxation Policies; Society of Petroleum Engineers: Washington, DC, USA, 1988. [Google Scholar]

- Xi, W.D.; Jin, Q.F. Overseas Investment in Oil Industry and the Risk Management System; Orient Academic Forum: Beijing, China, 2010. [Google Scholar]

- Horsfield, B.; Schulz, H.M. Shale gas exploration and exploitation. Mar. Petrol. Geol. 2012, 31, 1–2. [Google Scholar] [CrossRef]

- Mehdizadeh, Y. Internal Controls are critical in oil and gas application systems. Oil Gas. Financ. J. 2008, 27, 35–66. [Google Scholar]

- Latif, K.I.; Baloch, Q.B.; Khan, M.N. Structure, Corporate strategy and the overall effectiveness of the organisation. Abasyn J. Soc. Sci. 2012, 5, 1–13. [Google Scholar]

- Tsang, E.W. Human resource management problems in Sino-foreign joint ventures. Int. J. Manpower 1994, 15, 4–21. [Google Scholar] [CrossRef]

- Xie, Y. Cross-cultural communication barriers between staff in overseas-funded enterprises and management strategies for overcoming them. J. Lang. Cult. 2013, 4, 44–48. [Google Scholar]

- Zhu, L.; Zhang, Z.X.; Fan, Y. Overseas oil investment projects under uncertainty: How to make informed decisions? J. Policy Model. 2015, 37, 742–762. [Google Scholar] [CrossRef]

- EIA. Today in Energy September 2015, Sustained Low Oil Prices Could Reduce Exploration and Production Investment. Available online: https://www.eia.gov/todayinenergy/detail.cfm?id=23072 (accessed on 24 September 2015).

- Zhao, X.; Luo, D.; Xia, L. Modelling optimal production rate with contract effects for international oil development projects. Energy 2012, 45, 662–668. [Google Scholar] [CrossRef]

- Sadorsky, P. Risk factors in stock returns of Canadian oil and gas companies. Energy Econ. 2001, 23, 17–28. [Google Scholar] [CrossRef]

- Ramos, S.B.; Veiga, H. Risk factors in oil and gas industry returns: International evidence. Energy Econ. 2011, 33, 525–542. [Google Scholar] [CrossRef]

- Schmidt, D.A. Analyzing political risk. Bus. Horiz. 1986, 29, 43–50. [Google Scholar] [CrossRef]

- Busse, M.; Hefeker, C. Political risk, institutions and foreign direct investment. Eur. J. Political Econ. 2007, 23, 397–415. [Google Scholar] [CrossRef]

- Derrien, F.; Kecskés, A.; Thesmar, D. Investor horizons and corporate policies. J. Financ. Quant. Anal. 2013, 48, 1755–1780. [Google Scholar] [CrossRef]

- Modarress, B.; Ansari, A. The economic, technological, and national security risks of offshore outsourcing. J. Glob. Bus. Issue 2007, 1, 165. [Google Scholar]

- Nakhle, C. Petroleum Taxation: Sharing the Oil Wealth: A Study of Petroleum Taxation Yesterday, Today and Tomorrow; Routledge: New York, NY, USA, 2008. [Google Scholar]

- Knill, A.; Lee, B.S.; Mauck, N. Bilateral political relations and sovereign wealth fund investment. J. Corp. Financ. 2012, 18, 108–123. [Google Scholar] [CrossRef]

- Mills, R.; Fan, Q. The Investment Climate in Post-Conflict Situations; World Bank Publications: Washington, DC, USA, 2006. [Google Scholar]

- Bentley, R.W. Global oil & gas depletion: An overview. Energy Policy 2002, 30, 189–205. [Google Scholar]

- Speight, J.G. Shale Gas Production Processes; Gulf Professional Publishing: Laramie, WY, USA, 2013. [Google Scholar]

- Small, M.J.; Stern, P.C.; Bomberg, E.; Christopherson, S.M.; Goldstein, B.D.; Israel, A.L.; Jackson, R.B.; Krupnick, A.; Mauter, M.S.; Nash, J.; et al. Risks and risk governance in unconventional shale gas development. Environ. Sci. Technol. 2014, 48, 8289–8297. [Google Scholar] [CrossRef] [PubMed]

- Zhang, B.S.; Xia, L.Y.; Zheng, Y.H. Risk-benefit on oversea oil and gas projects and its application. China Soc. Sci. Daily 2012, 11, 7. (In Chinese) [Google Scholar]

- Lei, T.; Wang, Z.M.; Alan, K.; Liu, X.L. Stimulating Shale Gas Development in China: A comparison with the US Experience. Energy Policy 2014, 75, 109–116. [Google Scholar]

- Lendel, I. Social impacts of shale development on municipalities. Bridge 2014, 44, 47–51. [Google Scholar]

- Bigliani, R. Reducing Risk in Oil and Gas Operations; White Paper; IDC Energy Insights: Framingham, MA, USA, 2013. [Google Scholar]

- Muralidhar, K. Enterprise risk management in the Middle East oil industry: An empirical investigation across GCC countries. Int. J. Energy Sector Manag. 2010, 4, 59–86. [Google Scholar] [CrossRef]

- Saaty, T.L. A scaling method for priorities in hierarchical structures. J. Math. Psychol. 1977, 15, 234–281. [Google Scholar] [CrossRef]

- Xie, C.S.; Dong, D.P.; Hua, S.P.; Xu, X.; Chen, Y.J. Safety evaluation of smart grid based on AHP-entropy method. Syst. Eng. Procedia 2012, 4, 203–209. [Google Scholar]

- Guiaşu, S. Weighted entropy. Rep. Math. Phys. 1971, 2, 165–179. [Google Scholar] [CrossRef]

- Hwang, C.L.; Yoon, K. Lecture Notes in Economics and Mathematical Systems. Multiple Objective Decision Making. Methods and Applications: A State-of-the-Art Survey; Spring-Verlag: New York, NY, USA, 1981. [Google Scholar]

- IEA. World Shale Resource Assessments, September 2015. Available online: https://www.eia.gov/analysis/studies/worldshalegas/ (accessed on 24 September 2015).

- Planning Department of China National Petroleum Corporation & Engineering pricing management center of China petroleum. Petroleum Engineering Construction and Investment Reference Index; China National Petroleum Corporation: Beijing, China, 2009. [Google Scholar]

- Iledare, O.O. Analyzing the Impact of Petroleum Fiscal Arrangements and Contract Terms on Petroleum E&P Economics and the Host Government Take. In Proceedings of the Nigeria Annual International Conference and Exhibition, Society of Petroleum Engineers, Abuja, Nigeria, 2–5 August 2004.

- Schwab, K. World Economic Forum. The Global Competitiveness Report 2014–2015, 2014. Available online: http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2014–15.pdf (accessed on 2 September 2014).

| Methods | Typical Examples | Advantages | Disadvantages |

|---|---|---|---|

| Qualitative method |

|

|

|

| Quantitative method |

|

|

|

| Comprehensive method |

|

|

|

| Topography | Adjustment Coefficient |

|---|---|

| Plain, Hill | 1 |

| Gobi | 0.92–0.96 |

| Desert | 1.05–1.08 |

| Swamp | 1.15–1.25 |

| Heavy hills, Low mountain | 1.02–1.06 |

| Mountain | 1.2–1.3 |

| Countries | Reserves | Depth | Recovery Ratio | Terrain Environment | Infrastructure | Macroeconomic Environment | Contract Factors | Political System | Bilateral Relation | Staff Quality |

|---|---|---|---|---|---|---|---|---|---|---|

| United States | 18.83 | 1700 | 30% | 1 | 4.69 | 4.01 | 39% | 5.15 | 1 | 5.82 |

| Argentina | 22.71 | 2800 | 16% | 0.96 | 3.54 | 4.22 | 51% | 3.79 | 1 | 4.83 |

| Mexico | 15.43 | 2100 | 15% | 1.06 | 3.4 | 5.04 | 41% | 4.59 | 0 | 3.99 |

| South Africa | 11.04 | 2400 | 19% | 1 | 4.5 | 4.45 | 45% | 4.3 | 1 | 4.04 |

| Australia | 12.37 | 1900 | 22% | 1 | 5.6 | 5.61 | 42% | 5.14 | 1 | 5.67 |

| Canada | 16.23 | 2200 | 28% | 0.96 | 5.74 | 5.06 | 48% | 5.43 | 1 | 5.5 |

| Russia | 8.07 | 2300 | 18% | 1 | 3.45 | 5.54 | 50% | 4.94 | 1 | 4.96 |

| Algeria | 20.02 | 2500 | 15% | 1.06 | 3.12 | 6.41 | 40% | 3.41 | 1 | 3.69 |

| Brazil | 6.94 | 2100 | 17% | 1.02 | 3.98 | 4.49 | 45% | 3.47 | 0 | 4.92 |

| Reserves | Depth | Recovery Ratio | Terrain Environment | Infra-Structure | Macro-Economic Environment | Contract Factors | Political System | Bilateral Relation | Staff Quality | |

|---|---|---|---|---|---|---|---|---|---|---|

| Resources | 1 | 3 | 5 | 5 | 5 | 3 | 2 | 3 | 7 | 7 |

| Depth | 1/3 | 1 | 3 | 3 | 3 | 1 | 1/3 | 1 | 5 | 5 |

| Recovery ratio | 1/5 | 1/3 | 1 | 1 | 1 | 1/3 | 1/5 | 1/4 | 3 | 3 |

| Terrain environment | 1/5 | 1/3 | 1 | 1 | 1 | 1/3 | 1/5 | 1/4 | 3 | 3 |

| Infrastructure | 1/5 | 1/3 | 1 | 1 | 1 | 1/3 | 1/5 | 1/4 | 3 | 3 |

| Macroeconomic environment | 1/3 | 3 | 5 | 5 | 5 | 1 | 1/3 | 1/2 | 5 | 5 |

| Contract factor | 1/2 | 3 | 5 | 5 | 5 | 3 | 1 | 1 | 5 | 5 |

| Political system | 1/3 | 1 | 4 | 4 | 4 | 1 | 1/3 | 1 | 4 | 4 |

| Bilateral relations | 1/7 | 1/5 | 1 | 1 | 1 | 1/5 | 1/6 | 1/4 | 1 | 1 |

| Staff quality | 1/7 | 1/5 | 1 | 1 | 1 | 1/5 | 1/6 | 1/4 | 1 | 1 |

| Index | Reserves | Depth | Recovery Ratio | Terrain Environment | Infra-Structure | Macro-Economic Environment | Contract Factor | Political System | Bilateral Relations | Staff Quality |

|---|---|---|---|---|---|---|---|---|---|---|

| Entropy | 0.864 | 0.925 | 0.779 | 0.947 | 0.857 | 0.866 | 0.922 | 0.873 | 0.903 | 0.889 |

| Entropy weight | 0.116 | 0.064 | 0.188 | 0.045 | 0.122 | 0.114 | 0.066 | 0.108 | 0.082 | 0.095 |

| AHP weight | 0.237 | 0.102 | 0.042 | 0.042 | 0.042 | 0.124 | 0.173 | 0.107 | 0.029 | 0.029 |

| Comprehensive weight | 0.302 | 0.072 | 0.086 | 0.021 | 0.056 | 0.156 | 0.125 | 0.126 | 0.026 | 0.030 |

| Positive Ideal Solution (δi *) | Negative Ideal Solution (δi °) | Closeness (ηi) | TOPSIS Arrangement | |

|---|---|---|---|---|

| United States | 0.2389 | 0.2238 | 0.4837 | 3 |

| Argentina | 0.2382 | 0.2284 | 0.4895 | 2 |

| Mexico | 0.2609 | 0.1585 | 0.3779 | 6 |

| South Africa | 0.3094 | 0.1159 | 0.2726 | 8 |

| Australia | 0.2573 | 0.1977 | 0.4345 | 5 |

| Canada | 0.2101 | 0.2475 | 0.5409 | 1 |

| Russia | 0.3123 | 0.1700 | 0.3525 | 7 |

| Algeria | 0.2568 | 0.2260 | 0.4681 | 4 |

| Brazil | 0.3660 | 0.0895 | 0.1964 | 9 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, H.; Sun, R.; Lee, W.-J.; Dong, K.; Guo, R. Assessing Risk in Chinese Shale Gas Investments Abroad: Modelling and Policy Recommendations. Sustainability 2016, 8, 708. https://doi.org/10.3390/su8080708

Li H, Sun R, Lee W-J, Dong K, Guo R. Assessing Risk in Chinese Shale Gas Investments Abroad: Modelling and Policy Recommendations. Sustainability. 2016; 8(8):708. https://doi.org/10.3390/su8080708

Chicago/Turabian StyleLi, Hui, Renjin Sun, Wei-Jen Lee, Kangyin Dong, and Rui Guo. 2016. "Assessing Risk in Chinese Shale Gas Investments Abroad: Modelling and Policy Recommendations" Sustainability 8, no. 8: 708. https://doi.org/10.3390/su8080708

APA StyleLi, H., Sun, R., Lee, W.-J., Dong, K., & Guo, R. (2016). Assessing Risk in Chinese Shale Gas Investments Abroad: Modelling and Policy Recommendations. Sustainability, 8(8), 708. https://doi.org/10.3390/su8080708