Analyzing Economic Effects with Energy Mix Changes: A Hybrid CGE Model Approach

Abstract

:1. Introduction

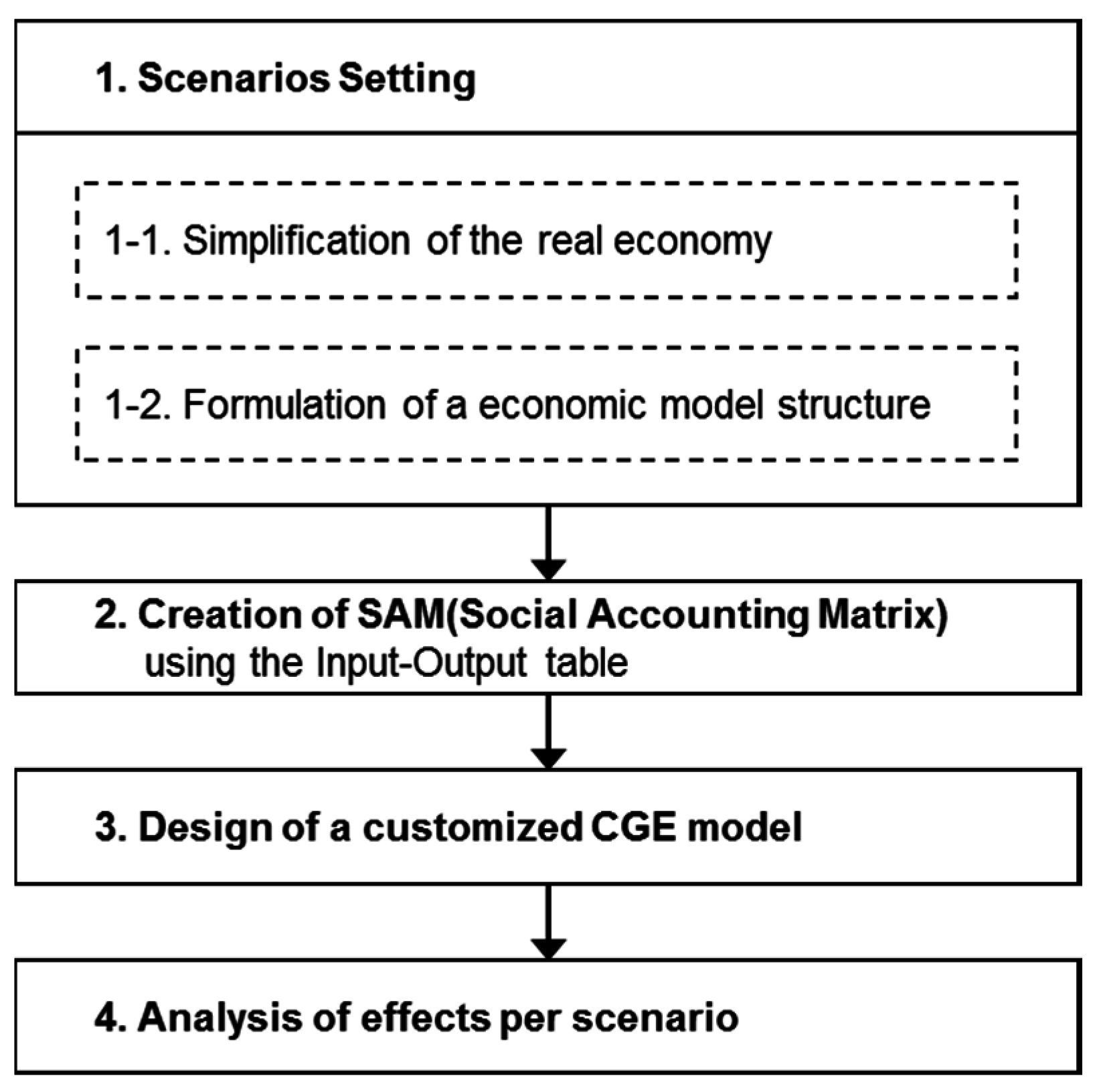

2. CGE Model for the Electricity Industry

2.1. Computable General Equilibrium (CGE)

2.2. Unique Features of the Korean Electricity Industry

2.3. Model Overview

2.4. Model Structure

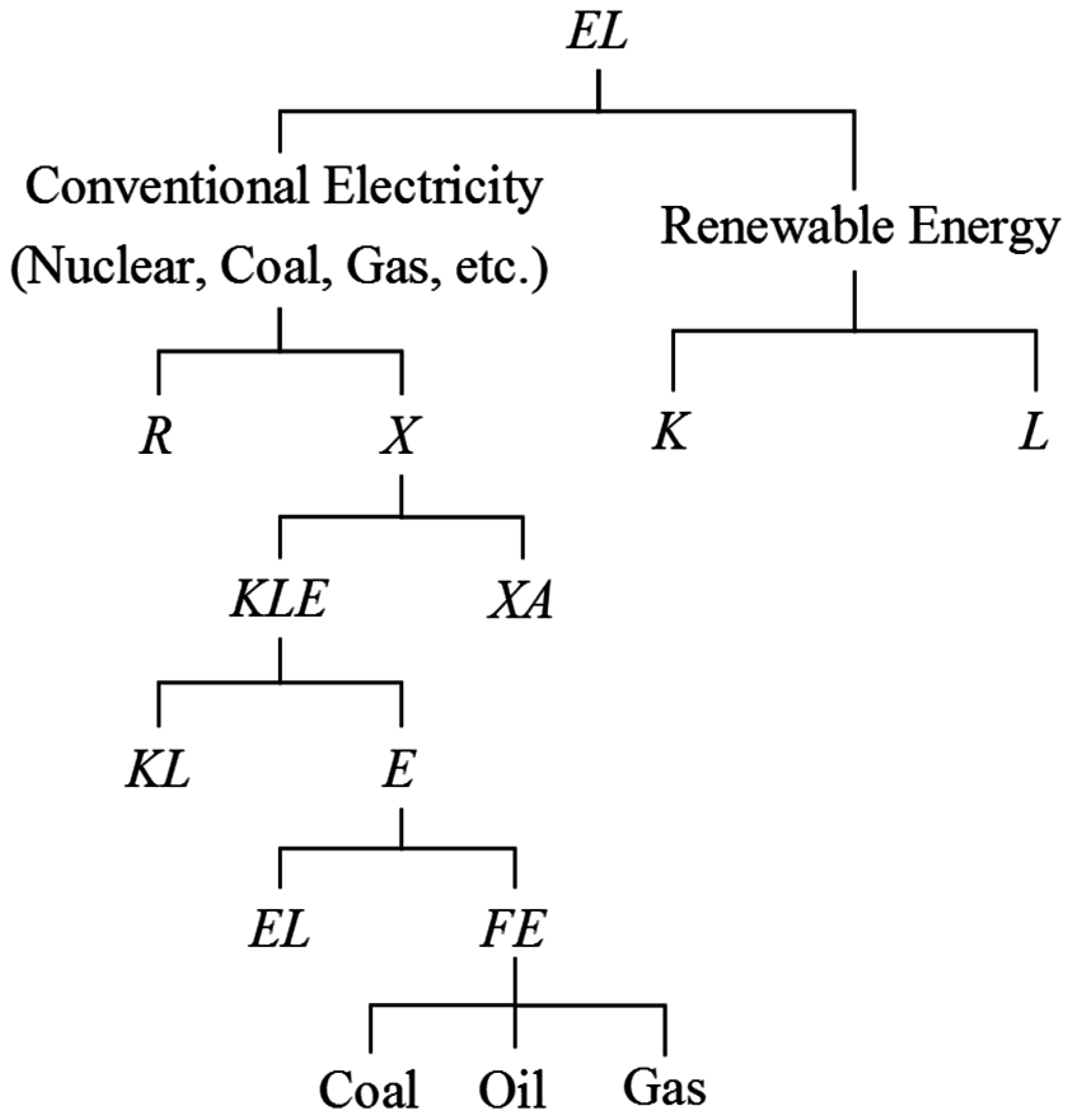

2.4.1. Electricity Industry

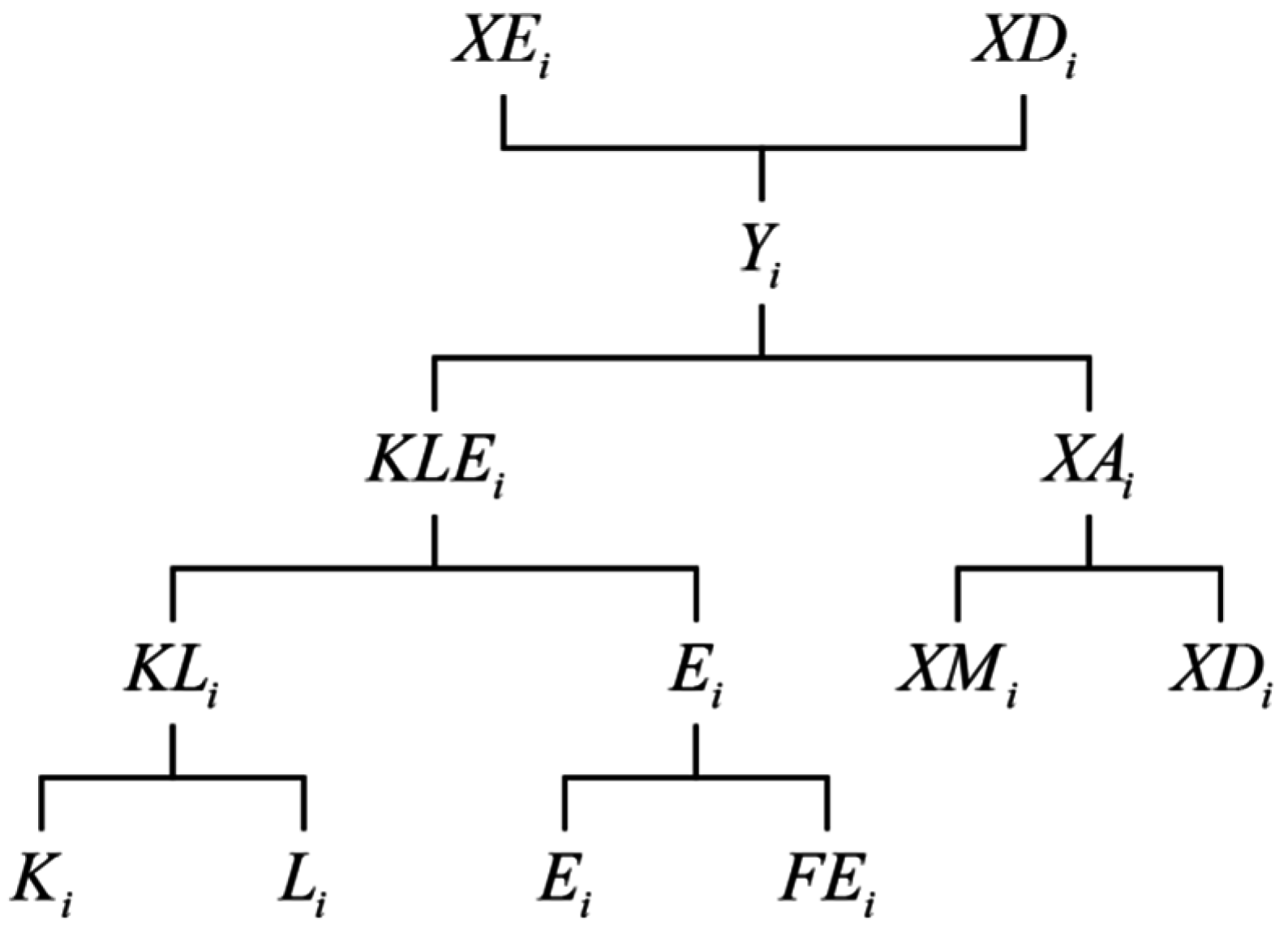

2.4.2. Non-Electricity Industry

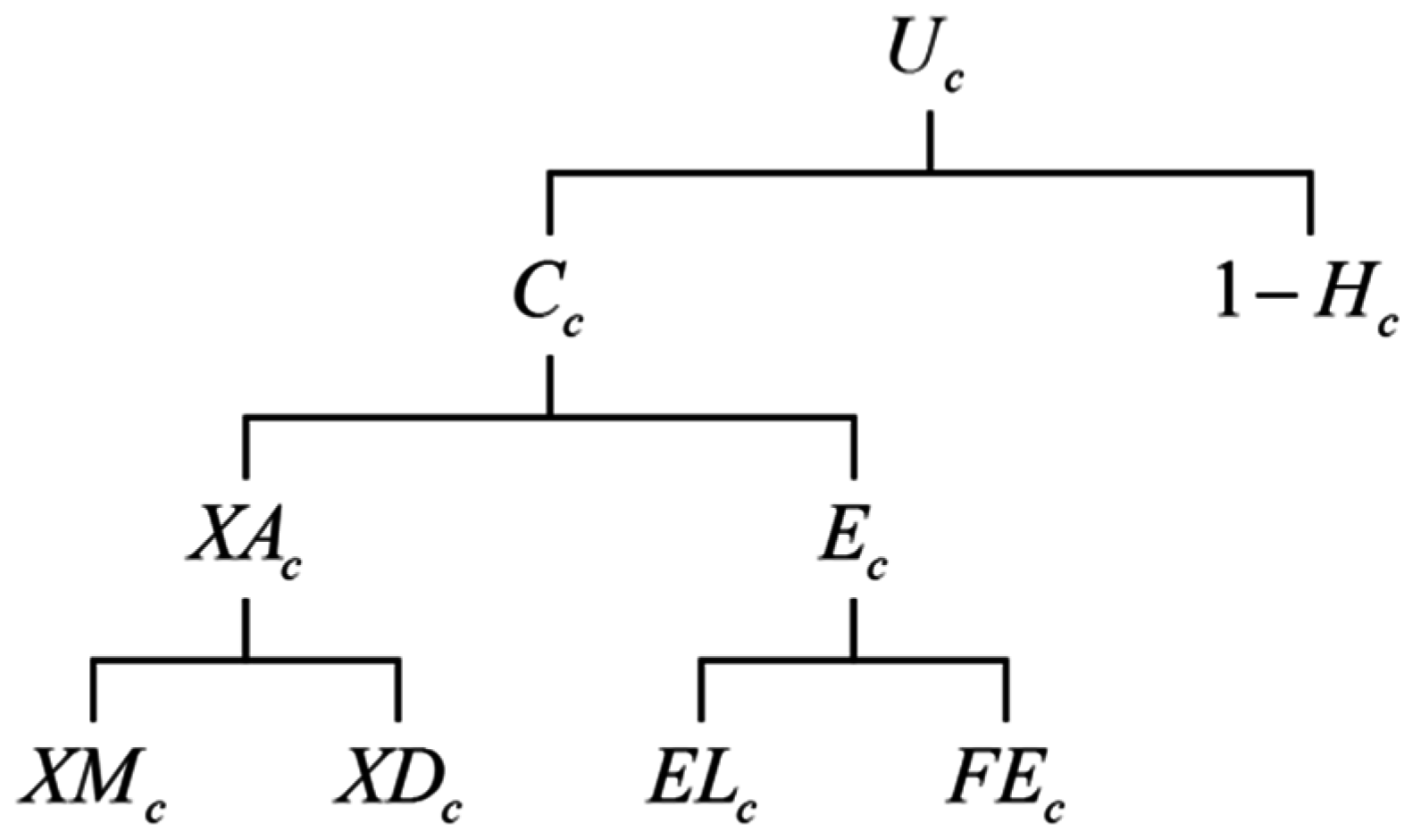

2.4.3. Household

2.4.4. Government

2.4.5. International Trade

3. Input Data

3.1. Social Accounting Matrix (SAM)

3.1.1. Input-Output Table of the Electricity Industry

3.1.2. Parameters and Calibration

4. Empirical Results

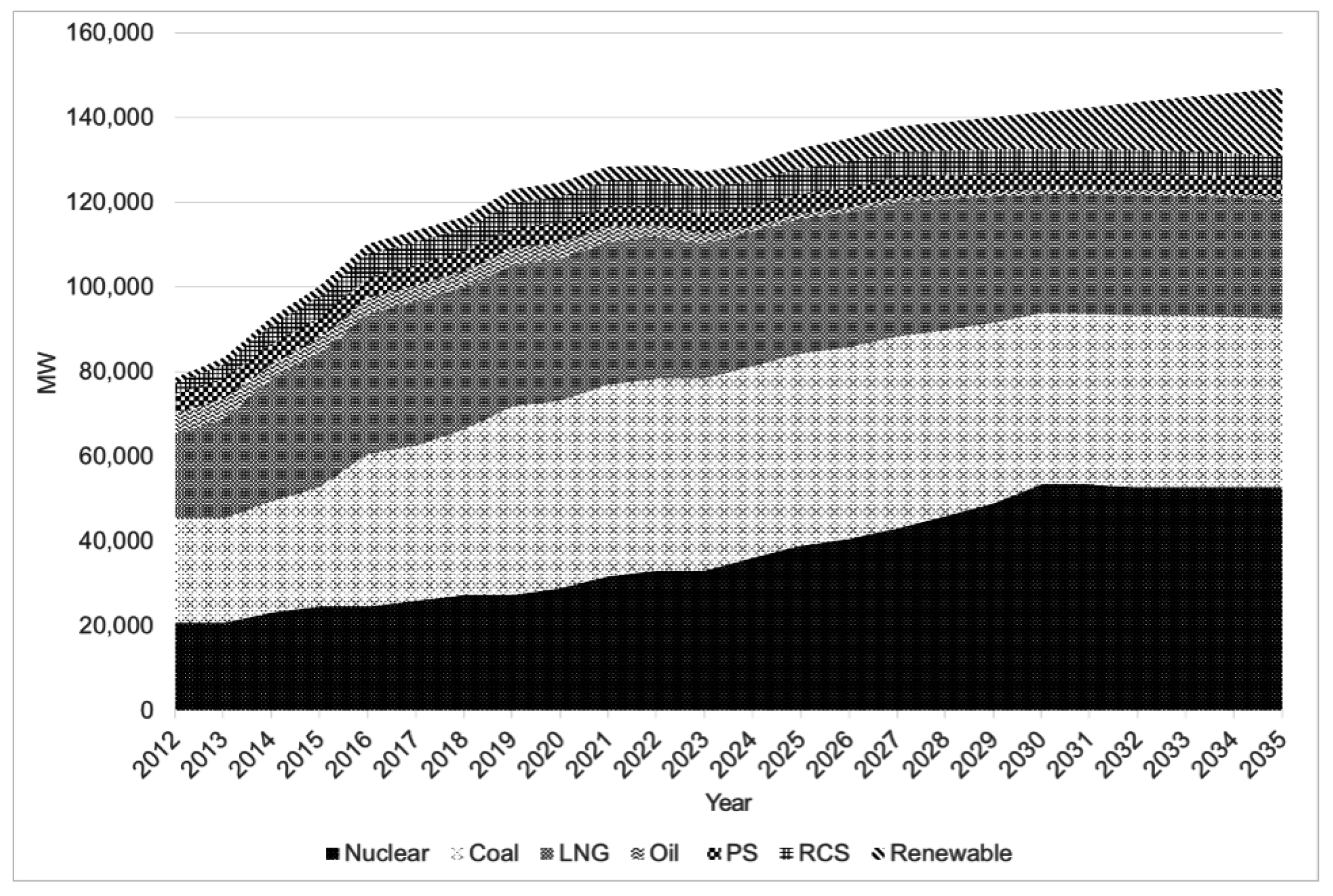

4.1. Bench Mark Data

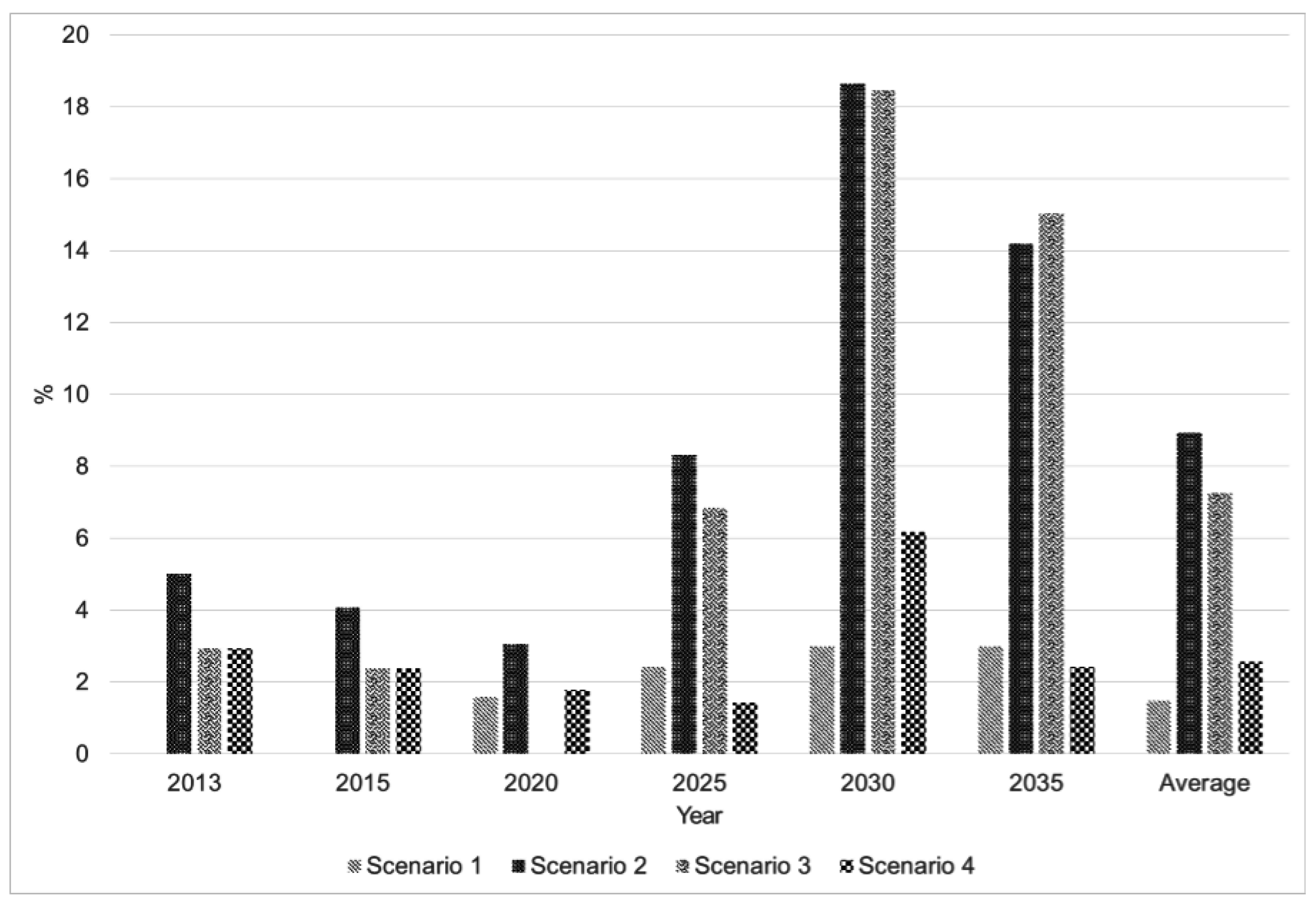

4.2. Scenario: Reduction of Nuclear Capacities

4.3. Analytical Results

4.3.1. Electricity Industry

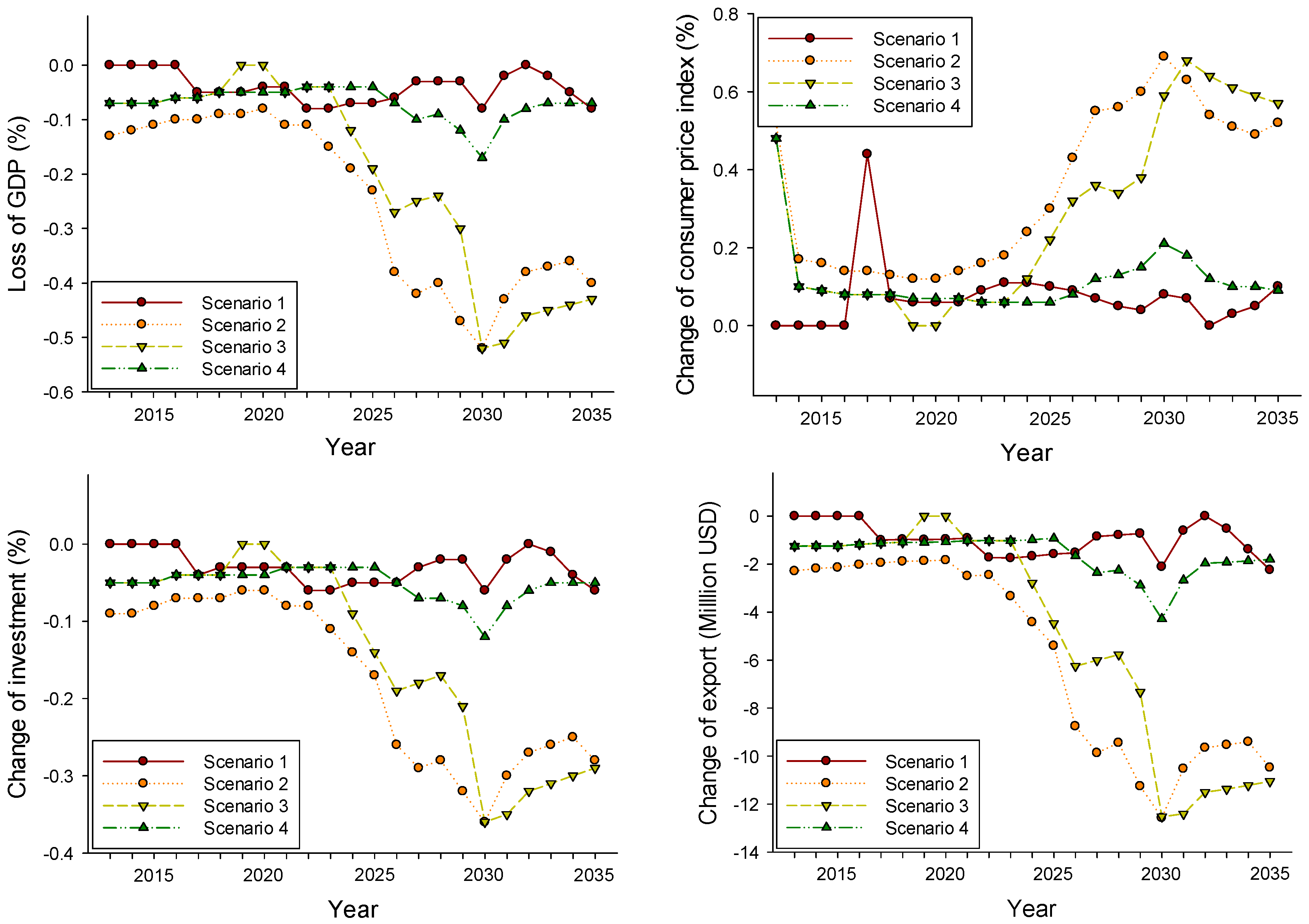

4.3.2. National Economic Effects

4.3.3. Production Change of Industrial Sectors

5. Conclusions and Policy Implications

Author Contributions

Conflicts of Interest

References

- International Energy Agency (IEA). World Energy Outlook 2013; IEA: Paris, France, 2013. [Google Scholar]

- International Energy Agency (IEA). Energy Balances of OECD Countries; IEA: Paris, France, 2015. [Google Scholar]

- Bohringer, C.; Rutherford, T.F. Integrated assessment of energy policies: Decomposing top-down and bottom-up. J. Econ. Dyn. Control 2009, 33, 1648–1661. [Google Scholar] [CrossRef]

- Johansen, L. A Multi-Sectoral Study of Economic Growth; North-Holland: Amsterdam, The Netherlands, 1960. [Google Scholar]

- Harberger, A.C. The Incidence of the Corporation Income Tax. J. Political Econ. 1962, 70, 215–240. [Google Scholar] [CrossRef]

- Harberger, A.C. Efficiency Effects of Taxes on Income from Capital. In Effects of Corporation Income Tax; Krzyzaniak, M., Ed.; Wayne State University Press: Detroit, MI, USA, 1966; pp. 107–117. [Google Scholar]

- Scarf, H. On the Computation of Equilibrium Prices. In Ten Economic Studies in the Tradition from Irving Fischer; Fellner, W.J., Ed.; Wiley Press: New York, NY, USA, 1967. [Google Scholar]

- Scarf, H. The Computation of Economic Equilibria; Yale University Press: New Haven, CT, USA; London, UK, 1973. [Google Scholar]

- Fullerton, D.; Rogers, D.L. Who Bears the Lifetime Tax Burden? The Brooking Institution: Washington, DC, USA, 1993. [Google Scholar]

- Lau, A.P.; Rutherford, T.F. Approximation Infinite Horizon Models in a Complementarity Format: A Primer in Dynamic General Equilibrium Analysis. J. Econ. Dyn. Control 2002, 26, 577–609. [Google Scholar] [CrossRef]

- Uwe, R. Capacity Building through Energy Modelling and System Analysis; IEA: Paris, France, 2012. [Google Scholar]

- Hoffman, K.; Jorgenson, D. Economic and technological models for evaluation of energy policy. Bell J. Econ. 1976, 8, 444–466. [Google Scholar] [CrossRef]

- Hogan, W.W.; Weyant, J.P. Combined energy models. In Advances in the Economics of Energy and Resources; Moroney, J.R., Ed.; Emerald Group Publishing Limited: Bingley, UK, 1982; pp. 117–150. [Google Scholar]

- Drouet, L.; Haurie, A.; Labriet, M.; Thalmann, P.; Vielle, M.; Viguier, L. A Coupled Bottom-Up/Top-Down Model for GHG Abatement Scenarios in the Swiss Housing Sector; Energy and Environment; Springer: New York, NY, USA, 2005; pp. 27–61. [Google Scholar]

- Schäfer, A.; Jacoby, H. Experiments with a Hybrid CGE-MARKAL Model. Energy J. 2006, 27, 171–178. [Google Scholar] [CrossRef]

- Bahn, O.; Kypreos, S.; Bueller, B.; Luethi, H.J. Modelling an international market of CO2 emission permits. Int. J. Glob. Energy Issues 1999, 12, 283–291. [Google Scholar] [CrossRef]

- Messener, S.; Schrattenholzer, L. Message-Macro: Linking an energy supply model with a macroeconomic module and solving iteratively. Energy 2000, 25, 144–163. [Google Scholar] [CrossRef]

- Manne, A.S.; Mendelsohn, R.; Richels, R.G. MERGE: A model for evaluating regional and global effects of GHG reduction policies. Energy Policy 2006, 23, 17–34. [Google Scholar] [CrossRef]

- Boccanfuso, D.; Estache, A.; Savard, L. Electricity reforms in Mali: A macro-micro analysis of the effects on poverty and distribution. S. Afr. J. Econ. 2009, 77, 127–147. [Google Scholar] [CrossRef]

- Bosetti, V.; Carraro, C.; Galeotti, M.; Massetti, E.; Tavoni, M. WITCH—A World Induced Technical Change Hybrid Model; University Ca’Foscari of Venice Economic Research Paper, No.46/06; Social Science Electronic Publishing, Inc.: London, UK, 2006. [Google Scholar]

- Varian, H.R. Microeconomic Analysis, 3rd ed.; Norton: New York, NY, USA, 1992. [Google Scholar]

- Kim, M.K.; Kim, S.T. An Analysis on the Economic Effect of Corporate Income Tax Reduction in Korea Using Dynamic Computable General Equilibrium Model. Korean Econ. Rev. 2010, 58, 75–119. [Google Scholar]

- Armington, P.S. A theory of demand for products distinguished by place of production. IMF Staff Pap. 1969, 16, 159–178. [Google Scholar] [CrossRef]

- Pyatt, G.; Round, J.I. Social Accounting Matrix: A Basis for Planning; The World Bank: Washington, DC, USA, 1985. [Google Scholar]

- Reinert, K.A.; Roland-Holst, D.W. Social Accounting Matrices, Applied Method for Trade Policy: A Handbook; Cambridge University Press: Cambridge, UK, 1997; pp. 94–121. [Google Scholar]

- Sohn, Y.H.; Shin, D.C. The Effects of a Change in Exchange Rate on the Energy Sector in Korea. Korean Econ. Res. 1997, 45, 123–139. [Google Scholar]

- Bernstein, P.M.; Montgomery, W.O.; Rutherford, T.F. Global Impacts of the Kyoto Agreement: Results from MS-MRT Model. Resour. Energy Econ. 1999, 219, 375–413. [Google Scholar] [CrossRef]

| Technology | Production (MW) | Share (%) |

|---|---|---|

| Hydro with Pumped Storage | 4700 | 5.65 |

| Coal thermal | 24,534 | 29.49 |

| Gas thermal | 23,574 | 28.33 |

| Oil thermal | 4780 | 5.74 |

| Nuclear | 20,716 | 24.90 |

| Steam and Water Supply | 3306 | 5.65 |

| Wind | 643 | 0.77 |

| Solar | 534 | 0.64 |

| Fuel cell | 418 | 0.50 |

| Scope of Industry | |

|---|---|

| S01 Agriculture forestry and fishing | S21 Hydro power |

| S02 Anthracite and flaming Coal product | S22 Coal thermal power |

| S03 Other oil Product including crude oil | S23 Gas thermal power |

| S04 Heavy and light oil products | S24 Oil thermal power |

| S05 Gas products | S25 Nuclear power |

| S06 Mining | S26 Steam and water supply |

| S07 Food and beverage | S27 Construction |

| S08 Textile and leather | S28 Wholesale and retails |

| S09 Wood | S29 Accommodation and food service |

| S10 Paper and printing | S30 Transportation and storage |

| S11 Coal products | S31 Communications and broadcasting |

| S12 Chemical products | S32 Financial and insurance |

| S13 Non-metallic products | S33 Real estate |

| S14 Basic metal products | S34 Public administration and national defense |

| S15 Metal products | S35 Education and human health |

| S16 Machinery | S36 Social services |

| S17 Electrical and electronic instruments | S37 Others service |

| S18 Precision machinery | S38 Wind power |

| S19 Automobile and ship building | S39 Solar power |

| S20 Other manufacturing products | S40 Fuel cell power |

| Hydro | Coal | Gas | Oil | Nuclear | RCS * | Renewable | ||

|---|---|---|---|---|---|---|---|---|

| Domestic goods | Coal | 0 | 1221 | 0 | 0 | 0 | 0 | 0 |

| Oil | 3 | 0 | 0 | 818 | 45 | 215 | 0 | |

| Gas | 0 | 0 | 9196 | 0 | 0 | 419 | 0 | |

| Electricity | 16 | 162 | 29 | 11 | 192 | 561 | 0 | |

| Other goods | 89 | 1952 | 356 | 135 | 3518 | 211 | 0 | |

| Import goods | Coal | 0 | 5989 | 0 | 0 | 0 | 489 | 0 |

| Oil | 0 | 0 | 0 | 1016 | 8 | 169 | 0 | |

| Gas | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Electricity | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Other goods | 11 | 222 | 40 | 15 | 354 | 8 | 0 | |

| Value added | Labour | 131 | 0 | 229 | 87 | 2066 | 230 | 252 |

| Capital | 150 | 1253 | 339 | 129 | 3739 | 550 | 427 | |

| Tax | Indirect tax | 25 | 1858 | 117 | 44 | 572 | 86 | 0 |

| Labour tax | 10 | 640 | 18 | 7 | 158 | 18 | 0 | |

| Corporate tax | 23 | 96 | 51 | 20 | 568 | 84 | 0 | |

| Tariff | 0 | 282 | 0 | 0 | 0 | 0 | 0 | |

| Cross subsidy | Mark-up | 23 | −630 | 321 | 260 | −207 | −1784 | 0 |

| Total output | 2499 | 13,045 | 10,696 | 2540 | 11,015 | 1256 | 679 | |

| Solar | Wind | Fuel Cell | |

|---|---|---|---|

| Labor | 97 | 109 | 46 |

| Capital | 164 | 185 | 77 |

| Total Output | 261 | 295 | 123 |

| Hydro | Coal | Gas | Oil | Nuclear | RCS | Renewable | |

|---|---|---|---|---|---|---|---|

| 2010 IO (%) | 1.1 | 33.3 | 25.3 | 5.6 | 27.3 | 7.4 | - |

| Reference (%) | 6 | 31.3 | 25.6 | 6.1 | 26.4 | 3 | 1.6 |

| Cross-subsidy (Million USD) | 23 | −630 | 321 | 260 | −207 | −1784 | - |

| Classification | Industry | Final Consumer | Export | Total Selling |

|---|---|---|---|---|

| Revenue (Million USD) | 32,994 | 8735 | 0 | 41,729 |

| % | 79.1 | 20.9 | - | - |

| Classification | Electricity (Million USD) | Total Output (Million USD) | Electricity Consumption/Total Output (%) |

|---|---|---|---|

| Agricultural and marine | 330 | 48,083 | 0.69 |

| Coal | 5 | 226 | 2.29 |

| Petroleum | 722 | 65,928 | 1.1 |

| Heavy and light oil | 804 | 51,040 | 1.58 |

| LNG and LPG | 24 | 25,371 | 0.09 |

| Mineral products | 60 | 2880 | 2.09 |

| Food products and beverages | 524 | 85,983 | 0.61 |

| Textile and leather products | 990 | 46,344 | 2.14 |

| Wood and paper products | 823 | 25,386 | 3.24 |

| Printing and publishing | 61 | 7630 | 0.8 |

| Coal products | 147 | 6947 | 2.12 |

| Chemical products | 2842 | 203,443 | 1.4 |

| Non-metallic mineral products | 585 | 31,134 | 1.88 |

| Basic metal products | 3551 | 154,526 | 2.3 |

| Metal products | 1644 | 111,350 | 1.48 |

| General machinery | 471 | 103,548 | 0.45 |

| Electrical and electronic | 2154 | 309,476 | 0.7 |

| Precise instruments | 71 | 16,140 | 0.44 |

| Transport equipment | 923 | 207,239 | 0.45 |

| Other manufacturing products | 35 | 1235 | 2.8 |

| Construction | 314 | 171,220 | 0.18 |

| Whole sale and retail trade | 2815 | 145,399 | 1.94 |

| Restaurant and accommodation | 943 | 72,969 | 1.29 |

| Transport and storage | 556 | 105,964 | 0.52 |

| Telecom and broadcasting | 831 | 53,998 | 1.54 |

| Financial and insurance | 796 | 120,911 | 0.66 |

| Real estate | 3855 | 250,368 | 1.54 |

| Public administration | 853 | 86,633 | 0.98 |

| Education and health | 2890 | 162,088 | 1.78 |

| Social and other service | 979 | 72,225 | 1.36 |

| Others | 422 | 53,797 | 0.78 |

| Households | 8735 | 559,137 | 1.56 |

| Goods | Elasticity of Substitution [σ] |

|---|---|

| Export goods vs. Domestic goods | 2.5 |

| Armington goods vs. General goods | 2.5 |

| Between non electricity energies | 0.25 |

| Non electricity vs. electricity | 0.5 |

| Inter-electricity industry | 0.25–0.5 (assuming increase with time) |

| Consumption vs. leisure | 0.8 |

| Elasticity vs. VA and energy | 0.7 |

| Intra-fossil fuel substitution in final demand | 0.5 |

| Elasticity of substitution vs. oil and gas | 2.0 |

| Classification | Description |

|---|---|

| Reference Scenario | phase-out of 2-plants, 2 times life extension of 20 years (total 44 plants operation) Keeping 41% peak capacity of nuclear facility on the basis of the first national energy plan 8-plants of 1400 MW under construction and one 1000 MW PHWR 14-plants of 1500 MW in planning from 2024 35.8% peak capacity in 2035 |

| Scenario 1 | one time life extension for all nuclear facilities for 10 years, 5-plant phase-out 8-plants of 1400 MW under construction and one 1000 MW PHWR, 14-plants of 1500 MW in planning from 2024 34.1% peak capacity in 2035 |

| Scenario 2 | no permission of life extension to all nuclear facilities (total 13-plant phase-out) 8-plants of 1400 MW under construction and one 1000 MW PHWR, 14-plants of 1500 MW in planning from 2024 29% peak capacity in 2035 |

| Scenario 3 | meeting the second national energy plan(total 2-plant phase-out) 8-plants of 1400 MW under construction and one 1000 MW PHWR 7-plants of 1500 MW in planning from 2024 28.7% peak capacity in 2035 |

| Scenario 4 | no permission of life extension to PHWR, two times life extension for PWR (total 5-plant phase-out) 8-plant under construction, 14-plants of 1500 MW in planning from 2024 34.4% peak capacity in 2035 |

| Agriculture Fishery | Chemical | Steel | Metal | Electricity Electronics | Car Ship | Construction | Finance Insurance | |

|---|---|---|---|---|---|---|---|---|

| 2013 | −0.05 | −0.28 | −0.34 | −0.21 | −0.07 | −0.1 | −0.07 | −0.06 |

| 2014 | −0.04 | −0.27 | −0.33 | −0.2 | −0.07 | −0.09 | −0.07 | −0.06 |

| 2015 | −0.04 | −0.26 | −0.32 | −0.2 | −0.07 | −0.09 | −0.06 | −0.06 |

| 2016 | −0.04 | −0.24 | −0.29 | −0.18 | −0.06 | −0.08 | −0.06 | −0.05 |

| 2017 | −0.04 | −0.22 | −0.27 | −0.17 | −0.06 | −0.08 | −0.05 | −0.05 |

| 2018 | −0.03 | −0.21 | −0.25 | −0.16 | −0.05 | −0.07 | −0.05 | −0.05 |

| 2019 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2021 | −0.03 | −0.18 | −0.22 | −0.14 | −0.04 | −0.06 | −0.04 | −0.04 |

| 2022 | −0.03 | −0.18 | −0.21 | −0.13 | −0.04 | −0.06 | −0.04 | −0.04 |

| 2023 | −0.03 | −0.18 | −0.21 | −0.13 | −0.04 | −0.06 | −0.04 | −0.04 |

| 2024 | −0.08 | −0.47 | −0.57 | −0.35 | −0.11 | −0.15 | −0.11 | −0.1 |

| 2025 | −0.12 | −0.74 | −0.9 | −0.56 | −0.16 | −0.24 | −0.18 | −0.16 |

| 2026 | −0.17 | −1.02 | −1.23 | −0.76 | −0.22 | −0.32 | −0.25 | −0.22 |

| 2027 | −0.16 | −0.97 | −1.17 | −0.72 | −0.2 | −0.3 | −0.24 | −0.21 |

| 2028 | −0.15 | −0.92 | −1.1 | −0.68 | −0.18 | −0.28 | −0.23 | −0.2 |

| 2029 | −0.19 | −1.15 | −1.38 | −0.85 | −0.22 | −0.34 | −0.29 | −0.25 |

| 2030 | −0.33 | −1.94 | −2.33 | −1.43 | −0.36 | −0.57 | −0.49 | −0.42 |

| 2031 | −0.32 | −1.89 | −2.27 | −1.39 | −0.35 | −0.55 | −0.48 | −0.41 |

| 2032 | −0.29 | −1.72 | −2.07 | −1.26 | −0.31 | −0.49 | −0.44 | −0.37 |

| 2033 | −0.28 | −1.68 | −2.01 | −1.23 | −0.29 | −0.47 | −0.43 | −0.36 |

| 2034 | −0.28 | −1.63 | −1.95 | −1.19 | −0.28 | −0.46 | −0.41 | −0.35 |

| 2035 | −0.27 | −1.58 | −1.89 | −1.15 | −0.26 | −0.44 | −0.4 | −0.34 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yun, T.; Cho, G.L.; Kim, J.-Y. Analyzing Economic Effects with Energy Mix Changes: A Hybrid CGE Model Approach. Sustainability 2016, 8, 1048. https://doi.org/10.3390/su8101048

Yun T, Cho GL, Kim J-Y. Analyzing Economic Effects with Energy Mix Changes: A Hybrid CGE Model Approach. Sustainability. 2016; 8(10):1048. https://doi.org/10.3390/su8101048

Chicago/Turabian StyleYun, Taesik, Gyeong Lyeob Cho, and Jang-Yeop Kim. 2016. "Analyzing Economic Effects with Energy Mix Changes: A Hybrid CGE Model Approach" Sustainability 8, no. 10: 1048. https://doi.org/10.3390/su8101048

APA StyleYun, T., Cho, G. L., & Kim, J.-Y. (2016). Analyzing Economic Effects with Energy Mix Changes: A Hybrid CGE Model Approach. Sustainability, 8(10), 1048. https://doi.org/10.3390/su8101048