Dynamic Impacts of Rail Transit Investment on Regional Economic Development: A Spatial-System Dynamics Analysis of the Jiangsu Yangtze River City Cluster

Abstract

1. Introduction

2. Method

2.1. Experimental Design and Evaluation Criteria

- (1)

- Data Preprocessing: Collect economic, transportation, and population-related data of 8 core cities from the “Jiangsu Statistical Yearbook” and complete data preprocessing.

- (2)

- Spatial Correlation Verification: Use Moran’s I index to test the spatial autocorrelation of economic development among cities, clarify the rationality of the city cluster as an overall analysis unit, and provide a theoretical basis for subsequent system dynamics model construction.

- (3)

- Model Construction: Based on system dynamics principles, construct a “Rail Transit System—Economic System” dual subsystem model, draw Causal Loop Diagrams (CLDs) and Stock-Flow Diagrams (SFDs), and set functional relationships and initial parameters between variables (calibrate coefficients through regression analysis).

- (4)

- Model Calibration and Validation (2016–2023): Based on historical data, simulate model outputs using Vensim10.3.2 software, compare with actual data for error analysis, and ensure the model fit meets research requirements.

- (5)

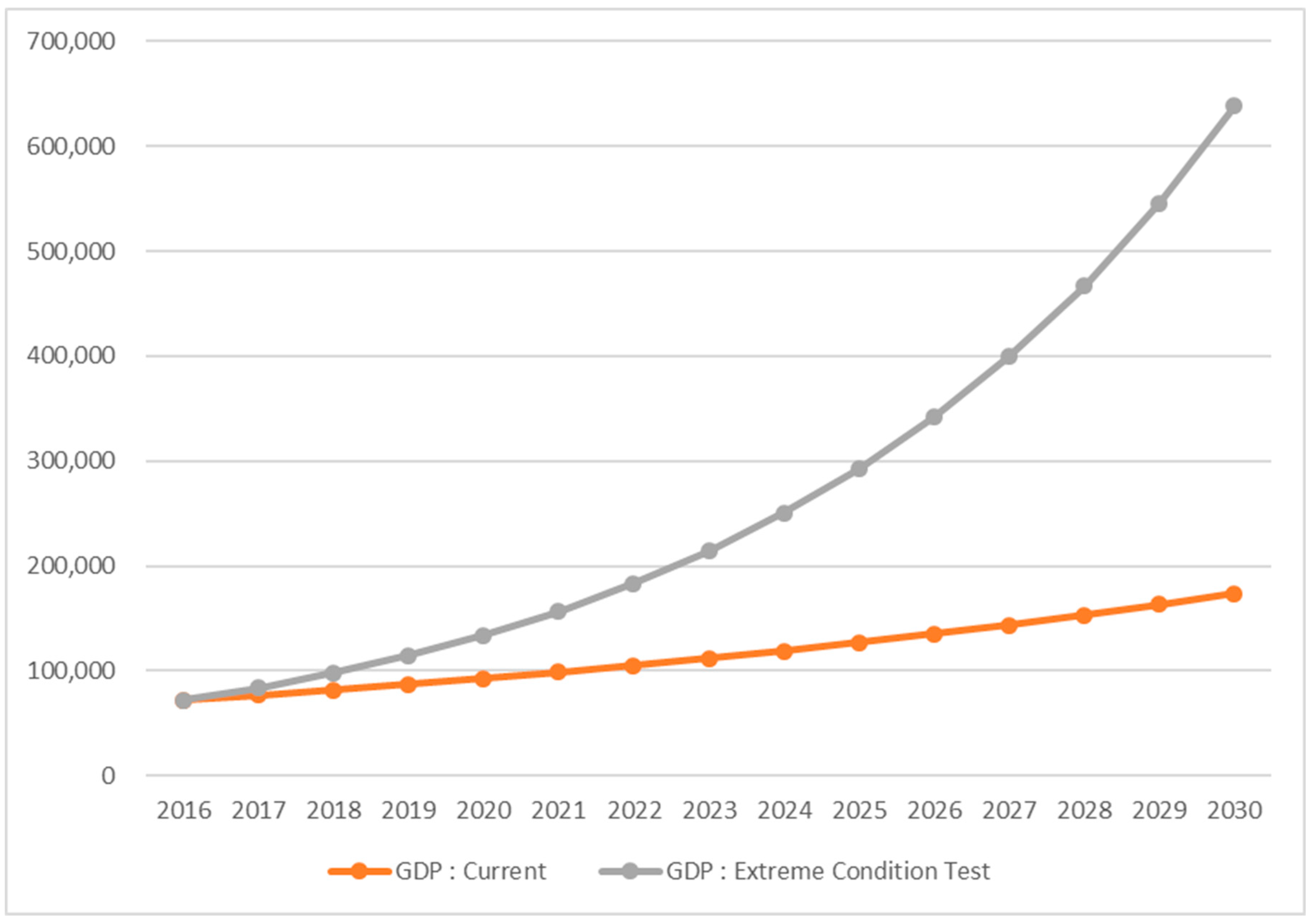

- Scenario Simulation and Comparative Analysis (2024–2030): Set a baseline scenario (maintain existing rail investment ratio) and a high-investment scenario (increase rail investment ratio to 0.02), simulate the dynamic change trends of dependent variables under the two scenarios, and quantify the economic multiplier effect of rail investment.

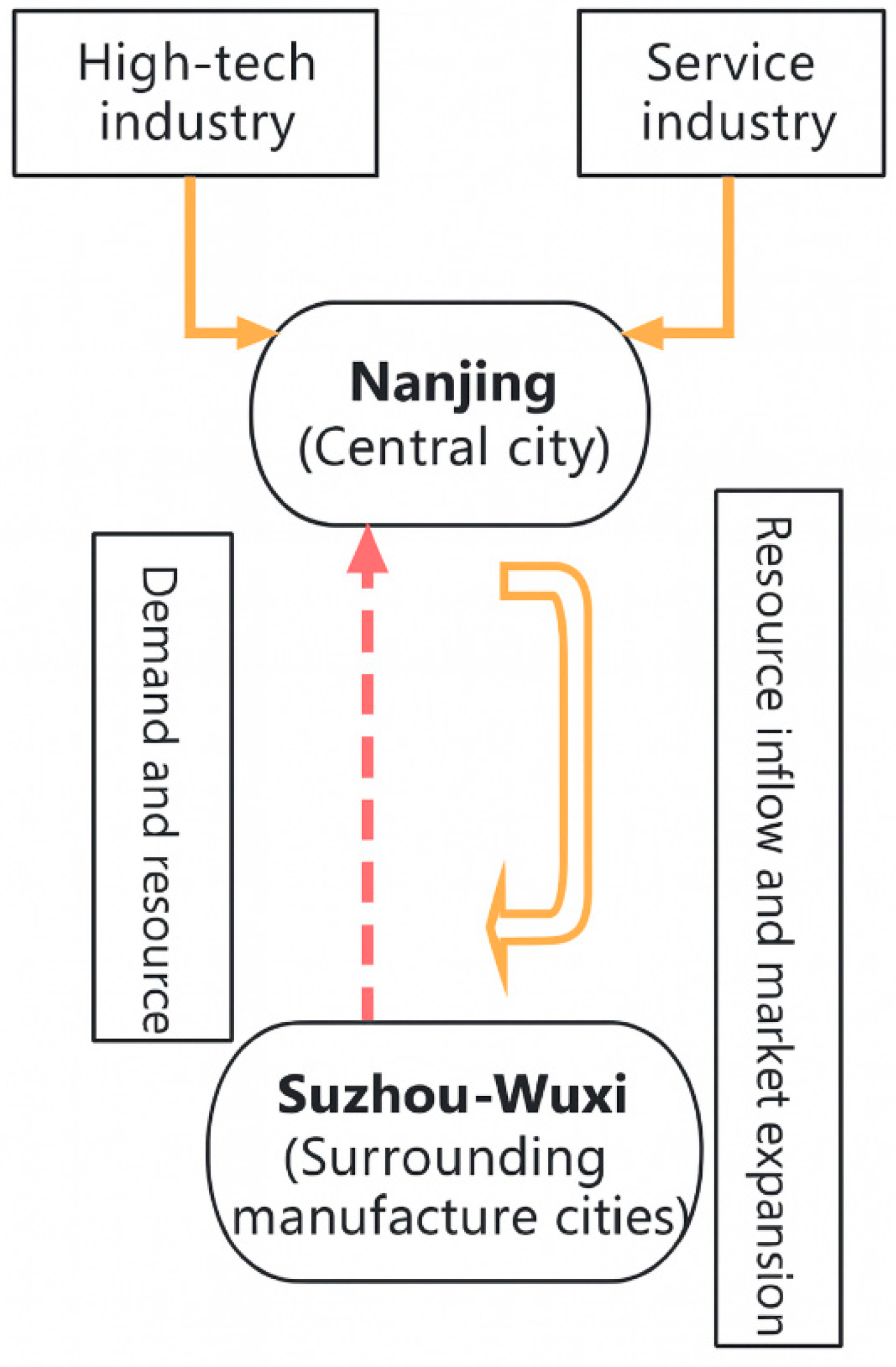

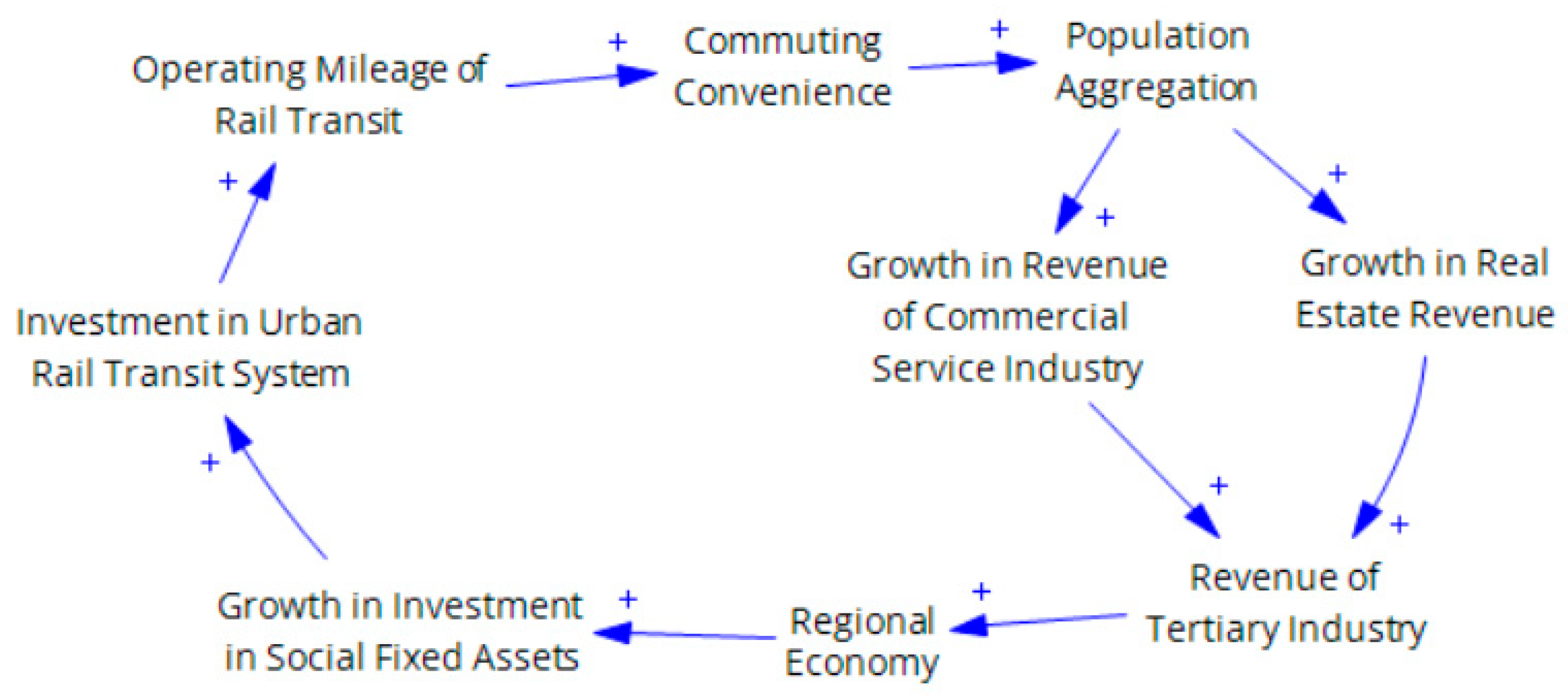

2.2. Causal Relationship Analysis

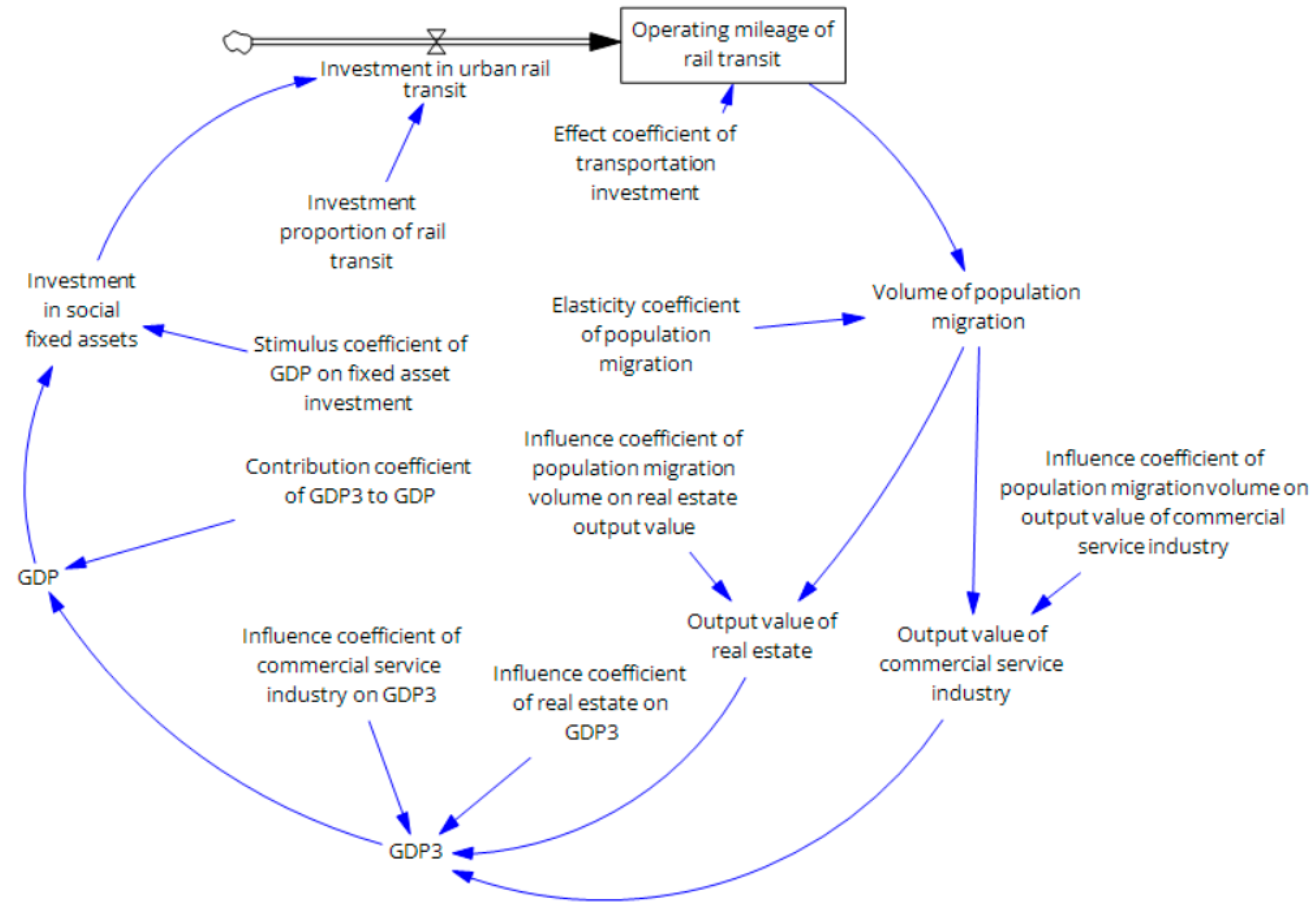

2.3. Stock-Flow Diagram

2.4. System Dynamic Equations

2.5. Spatial Autocorrelation Test

3. Result

3.1. Model Validity Verification

- (1)

- Some data were missing, and part of the data generated by fitting had a certain error compared with the real situation.

- (2)

- In some years, the impact of the epidemic caused large fluctuations in the volume of population migration.

- (3)

- Parameters are estimated using linear regression, which has certain errors.

- (4)

- Simplified selection of dependent variables leads to hidden structural errors.

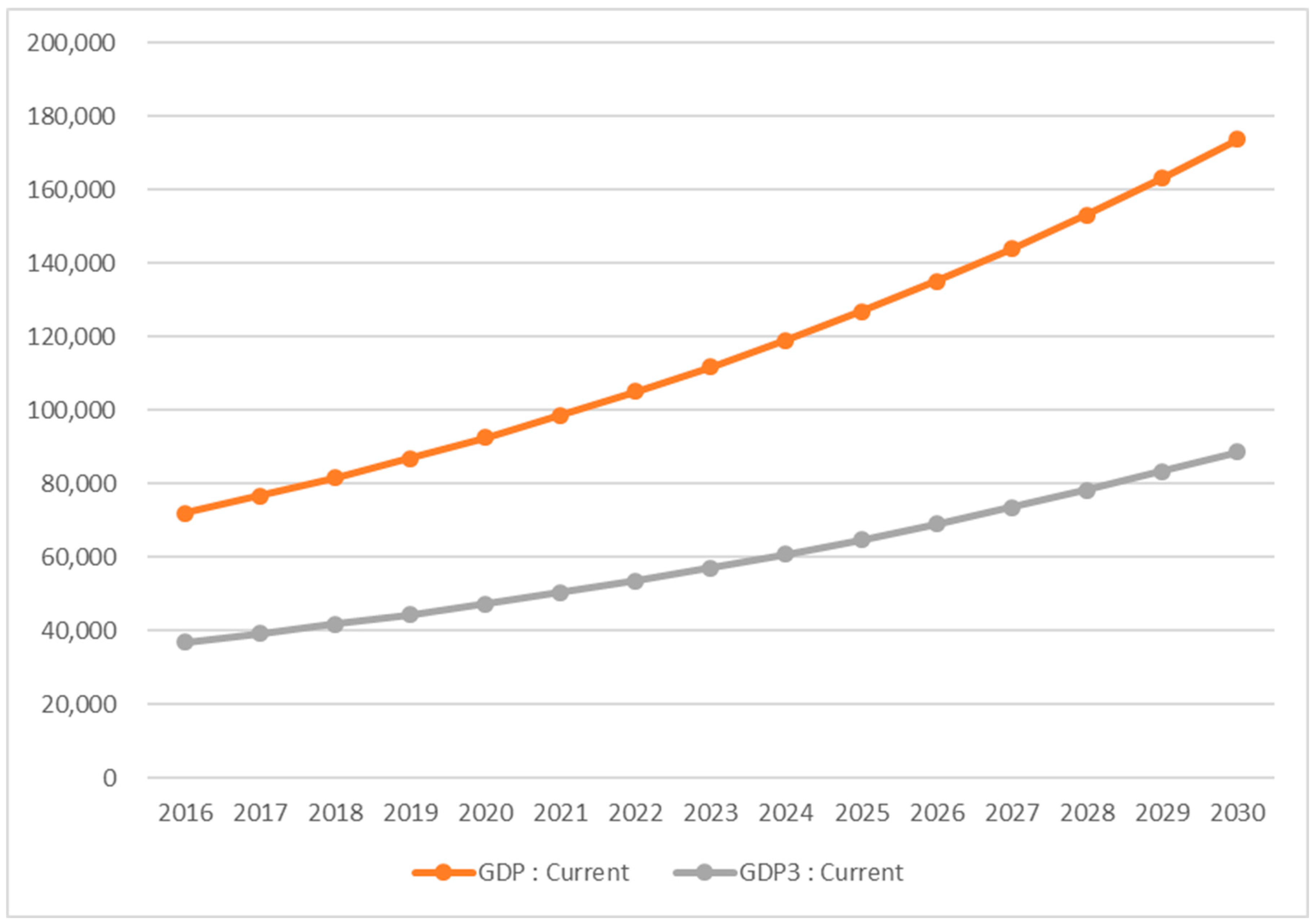

3.2. Model Simulation Prediction

3.3. Model Comparative Analysis

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhao, L.Y.; Shen, L. The impacts of rail transit on future urban land use development: A case study in Wuhan, China. Transp. Policy 2019, 81, 396–405. [Google Scholar] [CrossRef]

- Wang, Y.Y.; Peng, B.H.; Wei, G.; Elahi, E. Comprehensive evaluation and spatial difference analysis of regional ecological carrying capacity: A case study of the Yangtze River urban agglomeration. Int. J. Environ. Res. Public Health 2019, 16, 3499. [Google Scholar] [CrossRef]

- Deng, Y.M.; Li, X.M.; Zhu, J.M. Effect of planning and construction of intercity railways on the economic development of the Pearl River Delta Urban Agglomeration: An analysis based on the spatial durbin model. Sustainability 2024, 16, 738. [Google Scholar] [CrossRef]

- Zhang, D.; Jiao, J. How Does Urban Rail Transit Influence Residential Property Values? Evidence from An Emerging Chinese Megacity. Sustainability 2019, 11, 534. [Google Scholar] [CrossRef]

- Nilsson, I.; Delmelle, E.C. On the link between rail transit and spatial income segregation. Appl. Geogr. 2020, 125, 102364. [Google Scholar] [CrossRef]

- Ren, P.; Li, Z.; Cai, W.; Ran, L.; Gan, L. Heterogeneity Analysis of Urban Rail Transit on Housing with Different Price Levels: A Case Study of Chengdu, China. Land 2021, 10, 1330. [Google Scholar] [CrossRef]

- Shi, D.; Fu, M. How Does Rail Transit Affect the Spatial Differentiation of Urban Residential Prices? A Case Study of Beijing Subway. Land 2022, 11, 1729. [Google Scholar] [CrossRef]

- Wen, H.; Gui, Z.; Tian, C.; Xiao, Y.; Fang, L. Subway Opening, Traffic Accessibility, and Housing Prices: A Quantile Hedonic Analysis in Hangzhou, China. Sustainability 2018, 10, 2254. [Google Scholar] [CrossRef]

- Vichiensan, V.; Wasuntarasook, V.; Hayashi, Y.; Kii, M.; Prakayaphun, T. Urban Rail Transit in Bangkok: Chronological Development Review and Impact on Residential Property Value. Sustainability 2021, 14, 284. [Google Scholar] [CrossRef]

- Tyndall, J. The local labour market effects of light rail transit. J. Urban Econ. 2021, 124, 103350. [Google Scholar] [CrossRef]

- Qin, C.; Yang, C.; Zhang, M.; Zhu, B. Does high-speed rail improve green development? Evidence from a quasi-natural experiment. J. Clean. Prod. 2023, 407, 137174. [Google Scholar] [CrossRef]

- Liu, Y.H.; Tang, D.S.; Wang, F.Y. Research on the spatial spillover effect of high-speed railway on the income of urban residents in China. Humanit. Soc. Sci. Commun. 2024, 11, 236. [Google Scholar] [CrossRef]

- Shi, K.H.; Wang, J.F. The influence and spatial effects of high-speed railway construction on urban industrial upgrading: Based on an industrial transfer perspective. Socio-Econ. Plan. Sci. 2024, 93, 101886. [Google Scholar] [CrossRef]

- Yang, X.H.; Zhang, H.R.; Lin, S.L.; Zhang, J.P.; Zeng, J.L. Does high-speed railway promote regional innovation growth or innovation convergence? Technol. Soc. 2021, 64, 101472. [Google Scholar] [CrossRef]

- Hu, M.Y.; Xu, J. How does high-speed rail impact the industry structure? Evidence from China. Urban Rail Transit 2022, 8, 296–317. [Google Scholar] [CrossRef]

- Zhang, P.; Zhao, Y.; Zhu, X.; Cai, Z.; Xu, J.; Shi, S. Spatial structure of urban agglomeration under the impact of high-speed railway construction: Based on the social network analysis. Sustain. Cities Soc. 2020, 62, 102404. [Google Scholar] [CrossRef]

- An, Y.; Wei, Y.D.; Yuan, F.; Chen, W. Impacts of high-speed rails on urban networks and regional development: A study of the Yangtze River Delta, China. Int. J. Sustain. Transp. 2022, 16, 483–495. [Google Scholar] [CrossRef]

- Pokharel, R.; Bertolini, L.; te Brömmelstroet, M. How does transportation facilitate regional economic development? A heuristic mapping of the literature. Transp. Res. Interdiscip. Perspect. 2023, 19, 100817. [Google Scholar] [CrossRef]

- He, Y.; Liu, M. System dynamics analysis on the regional transport infrastructure and socio-economic development. In Proceedings of the First International Conference on Transportation Engineering, Chengdu, China, 22–24 July 2007; pp. 642–648. [Google Scholar]

- Fontoura, W.B.; Ribeiro, G.M.; Chaves, G.D.L.D. A framework for evaluating the dynamic impacts of the Brazilian Urban Mobility Policy for transportation socioeconomic systems: A case study in Rio de Janeiro. J. Simul. 2020, 14, 316–331. [Google Scholar] [CrossRef]

- Wang, J.; Lu, H.; Peng, H. System dynamics model of urban transportation system and its application. J. Transp. Syst. Eng. Inf. Technol. 2008, 8, 83–89. [Google Scholar] [CrossRef]

- Suryani, E.; Hendrawan, R.A.; Adipraja, P.F.E.; Indraswari, R. System dynamics simulation model for urban transportation planning: A case study. Int. J. Simul. Model. 2020, 19, 5–16. [Google Scholar] [CrossRef]

- Li, X.; Zhang, Y.; Cao, Y. Impact of port trade on regional economic development based on system dynamics. J. Coast. Res. 2020, 110, 38–42. [Google Scholar] [CrossRef]

- Zhao, S.; Xue, L.; Li, J. Modelling and simulation of the urban rail transit operation system based on system dynamics. Int. J. Simul. Process Model. 2021, 17, 284–302. [Google Scholar]

- Papageorgiou, G.; Tsappi, E. A system dynamics model promoting active transportation modes for urban sustainability. IFAC-PapersOnLine 2024, 58, 255–260. [Google Scholar] [CrossRef]

- Mylonakou, M.; Chassiakos, A.; Karatzas, S. System dynamics analysis of the relationship between urban transportation and overall citizen satisfaction: A case study of Patras city, Greece. Systems 2023, 11, 112. [Google Scholar] [CrossRef]

- Donaldson, D. Railroads of the Raj: Estimating the impact of transportation infrastructure. Am. Econ. Rev. 2018, 108, 899–934. [Google Scholar] [CrossRef]

| Evaluation Indicator | Statistical Indicator | Unit | Indicator Connotation |

|---|---|---|---|

| Commuting convenience | Operating mileage of rail transit | Kilometer | The operating mileage of rail transit can actually reflect the current situation of commuting convenience. |

| Revenue of tertiary industry | GDP3 | 100 million yuan | The external economic benefits during the operation of rail transit are mainly reflected in the output value of the regional tertiary industry. |

| Growth in real estate revenue | Output value of real estate | 100 million yuan | The output value of real estate can reflect the development status of the regional real estate industry. |

| Growth in revenue of commercial service industry | Output value of commercial service industry | 100 million yuan | The output value of the business service industry can reflect the development of other industries in the region except the real estate industry. |

| Population aggregation | Volume of population migration | Person | The volume of population migration can reflect the degree of population aggregation. |

| Growth in investment in social fixed assets | Investment in social fixed assets | 100 million yuan | The total amount of social fixed asset investment reflects the situation of fixed asset input in the region |

| Regional economy | GDP | 100 million yuan | GDP is the most direct indicator for measuring the development of the regional economy. |

| Investment in urban rail transit system | Investment in urban rail transit | 100 million yuan | The investment in rail transit directly reflects the input intensity of the region in rail transit construction. |

| Year | GDP (100 Million Yuan) | Output Value of Real Estate (100 Million Yuan) | Output Value of Commercial Service Industry (100 Million Yuan) | GDP3 (100 Million Yuan) |

| 2016 | 77,350.85 | 5792.01 | 29,612.5 | 38,269.57 |

| 2017 | 85,869.76 | 6907.75 | 32,818.24 | 42,700.49 |

| 2018 | 93,207.55 | 7467.17 | 35,472.62 | 46,936.41 |

| 2019 | 98,656.82 | 7925.85 | 37,672.51 | 50,852.05 |

| 2020 | 102,807.7 | 88,383.85 | 37,086.06 | 53,638.85 |

| 2021 | 117,392.4 | 8626.94 | 42,702.65 | 59,992.65 |

| 2022 | 122,089.3 | 7931.08 | 42,752.12 | 62,239.04 |

| 2023 | 128,222.2 | 7783.68 | 45,547.5 | 66,236.7 |

| Year | Investment in Social Fixed Assets (100 Million Yuan) | Operating Mileage of Rail Transit (Kilometer) | Rail Transit Passenger Volume (10,000 Person-Times) | Investment in Urban Rail Transit |

| 2016 | 49,370.85 | 2722 | 17,814 | 380.5266 |

| 2017 | 53,000.21 | 2771 | 19,786 | 408.5 |

| 2018 | 58,403.85 | 3033 | 21,204 | 450.1487 |

| 2019 | 61,818.36 | 3539 | 22,880 | 476.4661 |

| 2020 | 64,419.29 | 3998 | 15,038 | 496.5128 |

| 2021 | 73,558.05 | 4313 | 19,075 | 566.9499 |

| 2022 | 76,501.14 | 4319 | 11,399 | 589.6338 |

| 2023 | 80,344.01 | 4623 | 28,202 | 619.2528 |

| Variable | Equation | Unit |

|---|---|---|

| Operating mileage of rail transit | INTEG(Investment in urban rail transit × Effect coefficient of transportation investment, Initial value of the operating mileage of rail transit) | Kilometer |

| Volume of population migration | Operating mileage of rail transit × Elasticity coefficient of population migration | person |

| Output value of real estate | Volume of population migration × Influence coefficient of population migration volume on real estate output value | 100 million yuan |

| Output value of commercial service industry | Volume of population migration × Influence coefficient of population migration volume on output value of commercial service industry | 100 million yuan |

| GDP3 | Output value of real estate × Influence coefficient of real estate on GDP3 + Output value of commercial service industry × Influence coefficient of commercial service industry on GDP3 | 100 million yuan |

| GDP | GDP3 × Contribution coefficient of GDP3 to GDP | 100 million yuan |

| Investment in social fixed assets | GDP × Stimulus coefficient of GDP on fixed asset investment | 100 million yuan |

| Investment in urban rail transit | Investment in social fixed assets × Investment proportion of rail transit | 100 million yuan |

| Year | 2014 | 2015 | 2016 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|

| 0.264 | 0.247 | 0.248 | 0.264 | 0.260 | 0.245 | 0.250 |

| Year | GDP (100 Million Yuan) | GDP3 (100 Million Yuan) | ||||

|---|---|---|---|---|---|---|

| Simulation | Historical | Relative Error | Simulation | Historical | Relative Error | |

| 2016 | 71,918.6 | 77,350.85 | 7.0% | 36,693.2 | 38,269.57 | 4.1% |

| 2017 | 76,595.8 | 85,869.76 | 10.8% | 39,079.5 | 42,700.49 | 8.5% |

| 2018 | 81,577 | 93,207.55 | 12.5% | 41,620.9 | 46,936.41 | 11.3% |

| 2019 | 86,882.3 | 98,656.82 | 11.9% | 44,327.7 | 50,852.05 | 12.8% |

| 2020 | 92,532.5 | 102,807.7 | 10.0% | 47,210.5 | 53,638.85 | 12.0% |

| 2021 | 98,550.2 | 117,392.4 | 16.1% | 50,280.7 | 59,992.65 | 16.2% |

| 2022 | 104,959 | 122,089.3 | 14.0% | 53,550.7 | 62,239.04 | 14.0% |

| 2023 | 111,785 | 128,222.2 | 12.8% | 57,033.3 | 66,236.7 | 13.9% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Qian, M.; Cheng, L. Dynamic Impacts of Rail Transit Investment on Regional Economic Development: A Spatial-System Dynamics Analysis of the Jiangsu Yangtze River City Cluster. Sustainability 2026, 18, 986. https://doi.org/10.3390/su18020986

Qian M, Cheng L. Dynamic Impacts of Rail Transit Investment on Regional Economic Development: A Spatial-System Dynamics Analysis of the Jiangsu Yangtze River City Cluster. Sustainability. 2026; 18(2):986. https://doi.org/10.3390/su18020986

Chicago/Turabian StyleQian, Minlei, and Lin Cheng. 2026. "Dynamic Impacts of Rail Transit Investment on Regional Economic Development: A Spatial-System Dynamics Analysis of the Jiangsu Yangtze River City Cluster" Sustainability 18, no. 2: 986. https://doi.org/10.3390/su18020986

APA StyleQian, M., & Cheng, L. (2026). Dynamic Impacts of Rail Transit Investment on Regional Economic Development: A Spatial-System Dynamics Analysis of the Jiangsu Yangtze River City Cluster. Sustainability, 18(2), 986. https://doi.org/10.3390/su18020986