1. Introduction

Companies environmental impact, as well as strategies implemented to minimize or maximize adverse effects on society in general, have become a topic of research worldwide. Society expects companies not only to produce products or provide services but also to play an essential role in improving society; if this obligation is not fulfilled, the company can be criticized for not being sufficiently trustworthy [

1]. Companies’ initiatives and strategies for integrating their actions regarding its performance in environmental, economic, social, and corporate governance aspects, are referred to as ESG strategies [

2]. ESG strategies are essential to companies to increase trustworthiness with stakeholders.

The study of ESG strategies’ performance in companies is linked, among other issues, to understanding the impact on the organization’s financials. The ESG and financial performance relationship has been subject to extensive empirical studies, yet the results are inconclusive; a commonly identified reason for the diverse results is measurement issues [

3]. There is little information and studies on Mexican company ESG and financial performance relationship compared to those in more developed countries. In this regard, the research topic for this study was the ESG and corporate financial performance (CFP) relationship for non-financial listed companies on the Mexican Stock Exchange through BMV.

The problem investigated in this study is that implementing ESG strategies in publicly traded companies in Mexico has not been proven, based on research, to improve financial performance through increased profitability and firm value. Worldwide studies on the ESG and financial performance relationship remain controversial and vary depending on the existence or absence of mandatory regulation in the country, stakeholder expectations, cultural dynamics, industry, or company size. As a significant emerging market, Mexico presents a unique context characterized by evolving regulatory frameworks and stakeholder expectations.

Countries like Mexico have less research on the topic, and CEOs need to consider the benefits of ESG strategies as an investment that leads to better financial performance, not just an expense. According to Zumente and Bistrova [

4], whereas shareholders were previously oriented towards short-term profitability, there is a trend towards acting responsibly and sustainably within the company to ensure its long-term competitive advantage. This study aimed to contribute to the understanding of this trend by examining the evidence from Mexican companies.

This research fills a critical gap by providing robust, quantitative evidence from Mexico, demonstrating that superior ESG practices are not merely a cost but a strategic investment that enhances both market valuation and operational profitability. This study was driven by the need to challenge the perception that Mexican company investments in ESG strategies are a distracting expense that reduces shareholder value, using empirical data to provide local evidence that aligning with broader stakeholder interests can concurrently achieve financial outperformance. This work will present the methodological rigor applied, the key findings, and their practical implications for business strategy in Latin America.

This study makes three important contributions to the literature. First, it develops context-specific evidence for an understudied emerging market; while the global ESG-finance relationship is extensively studied, robust quantitative evidence from Latin America, and Mexico specifically, remains scarce. Second, it is based on a recent and comprehensive four-year dataset (2019, 2021, 2022 and 2023) from the Refinitiv Eikon platform for all non-financial BMV-listed firms with ESG scores. And, third, this study uses a dual performance metric analysis by examining the impact of ESG on both market-based valuation (Tobin’s Q) and accounting-based profitability (ROA), offering a more comprehensive picture of the financial payoff. This dual approach allows for distinguishing between the investor perception of long-term value (captured by Tobin’s Q) and the operational efficiency gains (captured by ROA), providing actionable insights for both executives and investors.

2. Literature Review

2.1. Previous Studies: Mixed Findings and Contextual Dependence of the ESG-Financial Performance Connection

Several researchers have identified benefits for organizations implementing ESG strategies. Implementing ESG practices enables companies to mitigate risk exposure by enhancing their organizations’ social legitimacy and access to new competitive resources, thereby reducing losses when eco-harmful events occur, and minimizing short-term investment risks; all these elements play an insurance-like role [

5]. Mohammad and Wasiuzzaman [

6] found that integrating ESG factors improves market share and access to lower cost of capital, increases customer satisfaction, adds social value to stakeholders, and enhances the company’s competitive advantage. In their review of literature, Ahmad et al. [

2] suggested that positive outcomes result from companies adopting social responsibility as a form of value creation and achieving social responsibility through profitability. However, implementing ESG also brings challenges to organizations.

2.2. Measuring Financial Performance: Tobin’s Q and ROA

Several studies address the challenges of ESG implementation. According to Luganskaya and Sukhareva [

7], implementing an ESG strategy, complying with ESG metrics, and tracking ESG performance indicators are challenging due to the continuous nature of these trends. A company reorganization is necessary, along with increased resource utilization and the use of ESG metrics [

7]. Investors in ESG companies are likely to have a lower return than those in companies that do not implement ESG actions due to the moderate level of risk [

8]. Both perspectives—benefits versus challenges or disadvantages—have been explored in studies worldwide, yielding varying results.

Studies have measured the financial impact on companies using various variables. Researchers have conducted empirical studies to analyze financial performance measured through profitability, operational ability, and development ability [

9]. Shaw et al. [

10] studied the relationship between ESG and public company valuation using operating cash flows. However, some researchers have used the share price or the company’s MV, while others have used Tobin’s Q, a stable index [

9]. Qureshi et al. [

11] stated that research has yet to examine all issues and use individual components of the ESG pillars as well as companies’ accounting and market performance methods. Li et al. [

5] concluded that there is a lack of a measurement standard, which leads to various study results. Therefore, non-standardization of financial performance measures does not facilitate conclusive results.

A survey of the existing research literature on the relationship between investment in ESG strategies and financial performance for the Latin American region revealed little research focused in this region. In Mexico, there is a lack of empirical analysis on the relationship between ESG and financial performance relationship [

12]. According to Naeem et al. [

13], investment in ESG strategies is not guaranteed to be profitable. The literature indicates that research results have been diverse and mixed due to the definition of the ESG, the omission of some control variables, the sample used, and the timing of the measurements, among many other variables.

A substantial task in ESG research is the deficiency of measurement standardization, which contributes to the mixed findings in the literature. This is aggravated by the phenomenon of ESG rating divergence, where different rating agencies give significantly dissimilar scores to the same company, grounded on varying methodologies, weightings, and scope [

14,

15]. This “aggregate confusion” [

14] means that a firm’s perceived ESG performance can depend heavily on the agency rater chosen. Studies also explore how this divergence affects real economic outcomes, such as stakeholder engagement models and supply chain financing [

15,

16]. This study uses ESG scores from the Refinitiv Eikon database. While recognizing the limitations of relying on a single rater, Refinitiv provides a comprehensive, consistent, and widely used metric that allows for longitudinal analysis within our sample.

2.3. Theoretical Background: Stakeholder Theory

This study employed stakeholder theory to explain and understand the company ESG and the financial performance relationship. Stakeholder theory posits that long-term corporate success depends on effectively managing relationships with all entities that affect or are affected by the firm, not just the shareholders [

17,

18]. Freeman and Dmytriyev [

19] believed that stakeholder theory and corporate social responsibility (CSR) were aligned when both are oriented toward incorporating societal interests into a company’s operations. Research projects related to CSR and ESG frequently use stakeholder theory when studying their relationship with a company’s financial performance [

3,

20,

21,

22]. Particularly, this study employs the stakeholder theory to explain the ESG—financial performance relationship within the specific context of Mexican publicly traded companies.

Stakeholder theory has been a key concept in several previous studies. According to Velte [

3], when all stakeholders’ interests are aligned, this determines the success of the company’s products or services. Freeman’s 1984 theory posits that ESG-related actions lead to improved market performance by resolving conflicts between the management team and each stakeholder [

21]. Tarmuji et al. [

22], asserted that the company has obligations not only to its shareholders but also to other groups (stakeholders) and, therefore, has become a way of analyzing corporate governance and ethics in companies. In this regard, a greater integration of stakeholder interests into the company’s strategy is perceived.

According to the stakeholder theory, the relationship between ESG and CFP is positive. Galant and Cadez’s [

23] update on the stakeholder theory mentioned that the better an organization manages its relationships with its stakeholders, the more successful it will be. Although all stakeholders can potentially influence the organization, the mechanisms by which they do so differ, as a customer or supplier has different interests from those of a shareholder [

23]. Hence, the company’s strategy is enhanced by considering the stakeholder theory.

Stakeholder theory embodies a shift from a narrow, profit-maximization view of management [

24] to a model where value creation is multi-dimensional and endures the business’s license to operate. Current explanations, such as those connecting stakeholder management to the Sustainable Development Goals (SDGs) or “Net Positive” impact, highlight that value creation must be shared and systemic [

25,

26]. This evolution underscores that ESG is not a marginal consideration, but rather central to contemporary strategic management and long-term resilience [

27]. Whereas stakeholder theory predicts a positive relationship between ESG and financial performance, the empirical evidence—particularly in emerging markets—is inconsistent. This study tests the theory’s fundamental principle in the specific institutional context of Mexico. A positive finding does not simply support the theory; it validates its clarifying influence in a setting with evolving regulations and stakeholder pressures

2.4. Theoretical Perspective and Hypothesis Formulation

This study used two dependent variables to measure firm value and profitability: Tobin’s Q and ROA. ROA and Tobin’s Q were used by Naeem et al. [

13] with Turkish companies using Refinitiv Eikon’s database, and by Aydoğmuş et al. [

28] with a sample of 5000 companies worldwide using Bloomberg’s database. Firm’s ESG combined score was used as the independent variable. The Firm size, industry, leverage, being recognized by Cemefi, and being part of the S&P/BMV Total Mexico ESG Index were used as control variables.

Table 1 lists the variables used in this research, describing each variable, identifying whether it is dependent and criterion or independent and predictor, or whether it is a control variable, along with the meaning of its measurement: profitability, company value, and growth.

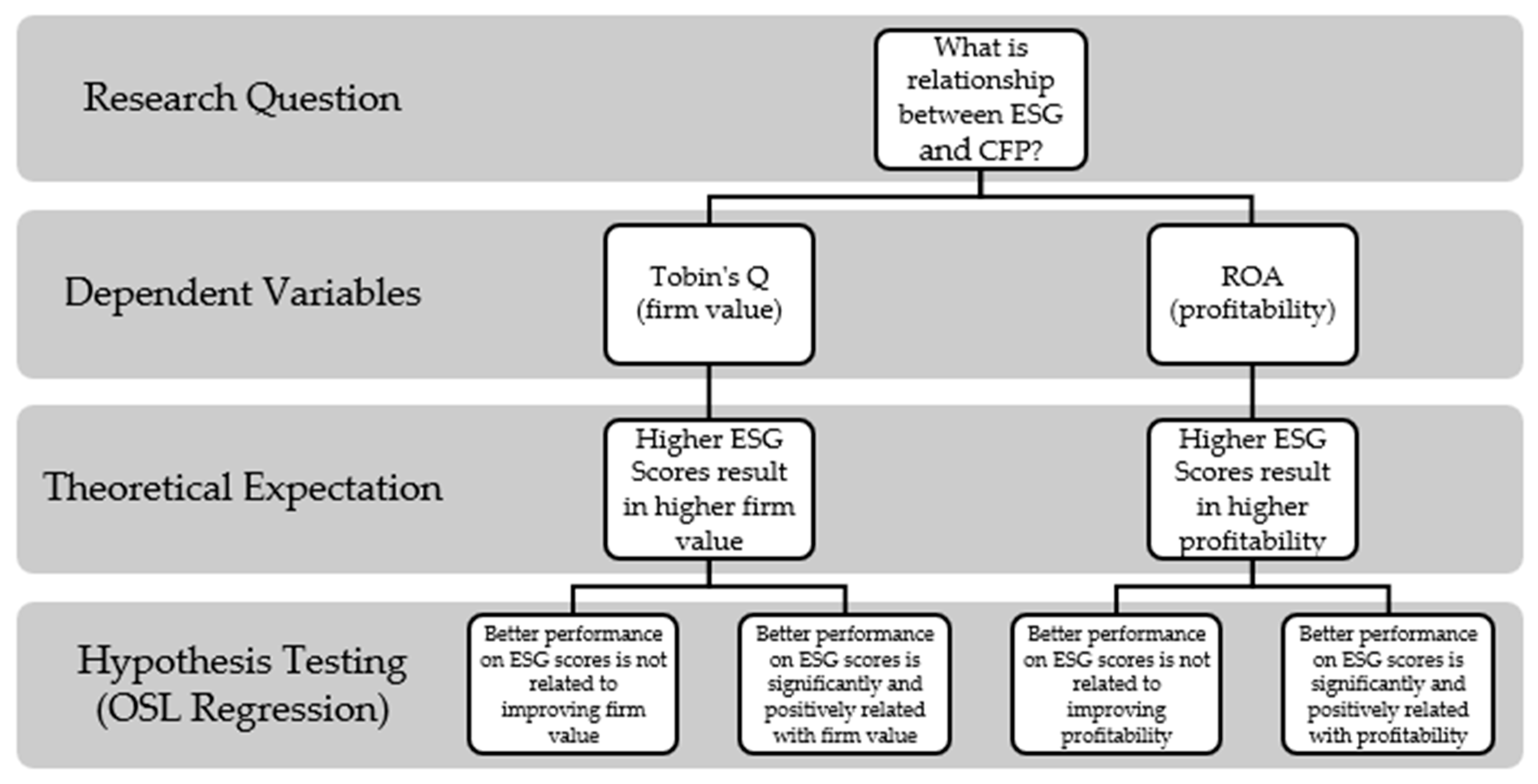

The study explored the question of how strongly related CFP is to the ESG score. The expectation was that the ESG score, which reflects the firm’s level of investments into environmental, social, and governance initiatives, would be positively and significantly related to firm value and profitability.

Two hypotheses were used to examine this research question:

H01: (Null Hypothesis) Better performance on Refinitiv ESG scores is not related to improving firm value.

H11: (Alternative Hypothesis) Better performance on Refinitiv ESG scores is significantly and positively associated with firm value.

H02: (Null Hypothesis) Better performance on Refinitiv ESG scores is not related to improving profitability.

H12: (Alternative Hypothesis) Better performance on Refinitiv ESG scores is significantly and positively associated with improving profitability.

Figure 1 is a flowchart to visualize the hypothesis formulation of the study including the null and alternative hypothesis and relationship to the dependent variables.

3. Materials and Methods

A quantitative, correlational research design using secondary data from 2019, 2021, 2022, and 2023 was used in this study. The years 2019–2023 were initially considered, but 2020 was excluded due to the COVID-19 pandemic economic effects that violated statistical assumptions. Archival data was sourced from the Refinitiv Eikon database 2024, a leading provider of ESG and financial metrics.

3.1. Sample Selection

All companies listed on the BMV Mexican Stock Exchange with an ESG score were considered part of the population. The study period spanned from 2019 to 2023, during which a population of 103 companies across 37 industries was analyzed.

3.2. Data Analysis

The data analysis followed these steps: information collected in Excel was loaded into the R software 4.5.2; information was transformed using the Yeo-Johnson model, a statistical method that helps stabilize the variance and normalize the data [

29]; outliers were identified through the Mahalanobis test [

30],

Table S1 in the

supplementary material shows the outliers; and a value imputation was performed through the K-Nearest Neighbors method [

31],

Table S2 in the

supplementary material shows the observations for each year after value imputation. A total of 73 companies were identified. Having the observations ready in the database and verifying that the database complied with the assumptions required for an OLS regression were essential. In this sense, it is important to comply with normality, independence of errors, homoscedasticity for OLS, and linearity. Both the ESG–Return to assets relationship and the ESG-Tobin’s Q relationship meet the assumptions to develop an OLS regression. The

supplementary material shows the methods used to validate the fulfillment of the assumptions for the variables selected in

Figures S1–S6, with a summary shown in

Table S3. Once the data met the assumptions, two separate OLS regression models were used to analyze ESG score relationship to each dependent variable, both with and without control variables.

The BMV-listed population was chosen for its transparency and mandate for the availability of public data. Refinitiv was selected for its comprehensive coverage, transparent methodology, and widespread use in prior academic research. OLS regression was chosen for its suitability in modeling linear relationships between a continuous independent and dependent variable, allowing for precise interpretation of the effect size and direction.

4. Results and Analysis

The OLS regression analysis results supported the positive and significant relationship between ESG score and financial performance in Mexican firms listed on the BMV. Specifically, higher ESG scores were strongly associated with increased firm market value (Tobin’s Q) and enhanced ROA.

4.1. Findings on Hypothesis 1 (ESG Relationship to Tobin’s Q)

Regarding Hypothesis 1, whether better performance in Refinitiv’s ESG scores is related to firm value (Tobin’s Q), the OLS regression analysis revealed a statistically significant relationship between ESG score and Tobin’s Q (F = 46.18,

p < 0.001, highly significant). In R, the

p result is expressed as 1.082 × 10

–10 in scientific notation. However, its explanatory power is limited (R

2 = 0.1757).

Table 2 shows the residuals, coefficients, and results of the least squares model. In R, the asterisks indicate the level of statistical significance of the

p-values; it is an easy way to identify which predictors are statistically significant and to what degree, as shown in the significance column:

p < 0.001 was highly significant,

p < 0.001 was very significant,

p < 0.05 was significant, and

p < 0.1 was marginally significant.

As shown in

Table 2, the regression model for Tobin’s Q was statistically significant (F = 46.18,

p < 0.001). The ESG coefficient was 0.445 (

p < 0.001); for every one-point increase in the ESG score, a firm’s Tobin’s Q is expected to increase by approximately 0.445 units, holding all else constant. The model explains 17.96% of the variance in Tobin’s Q. Although this may seem modest, it is substantial in financial performance studies, where numerous factors (macroeconomic conditions, investor sentiment, and industry disruptions) influence market value. This confirms that ESG is a material driver of value perception in the Mexican market.

This positive relationship strongly supports stakeholder theory. Investors are not penalizing firms for ESG investments; they reward them with a higher valuation. The market may interpret an improved ESG score as a signal of superior long-term management, lower risk exposure, and enhanced brand equity, leading to a higher market value relative to the firm’s asset base.

After conducting an OLS regression, the control variables for this study were included. For this purpose, the variables of leverage, industry (whether they produce goods [IndustryGoods]), provide services (IndustryServices), or both (IndustryGoods and Services), whether the companies belong to the S&P IPC ESG Mexico (S.P_IPC_ESG_MexicoSI), and whether Cemefi recognized them as socially responsible (CemefiSI) were added. The regression results are presented in

Table 3, which includes the intercept, ESG, and control variables.

The OLS regression results indicate that there is a positive and statistically significant relationship between the ESG score and Tobin’s Q is positively and statistically significant. However, most control variables are not significant, indicating that they do not have a significant impact Tobin’s Q in this model. The R-squared (R2) indicates that the variables in the model explain a moderate portion of the variability in Tobin’s Q, suggesting that other factors not included in the model may also influence Tobin’s Q. The only variable with a moderate level of influence is Cemefi. Formal, external validation of social responsibility practices may further amplify the market’s positive valuation, acting as a reinforcing signal for investors.

4.2. Findings on Hypothesis 2 (ESG Relationship to ROA)

Regarding Hypothesis 2, whether better performance in Refinitiv ESG scores is related to firm profitability measured through ROA, the OLS regression showed the ESG score relationship to ROA is statistically significant (F = 69.03,

p < 0.001, highly significant). In R, the result is expressed as 1.174 × 10

−14 in scientific notation. However, its explanatory power is limited (R

2 = 0.2429). Although the ESG score is a valid predictor of ROA, the model does not account for other factors that may explain the variability in ROA.

Table 4 presents the residuals, coefficients, and results of the least squares model results.

The results for profitability were even more pronounced. The model for ROA was highly significant (F = 69.03, p < 0.001). The coefficient for the ESG score was 0.040 (p < 0.001); a one-point increase in the ESG score corresponds to an expected 0.04 percent ROA increase. The model explained 24.65% of the variance in ROA, a strong explanatory power for a single predictor. This suggests that ESG performance is a key differentiator in the operational efficiency and profit generation of Mexican firms.

This finding offers a compelling operational dimension to stakeholder theory. Higher profitability suggests that ESG practices translate into tangible business benefits that improve the bottom line. This can occur through various channels: improved employee productivity and retention (Social), reduced energy and material costs (Environmental), better risk management and reduced fines (Governance), and enhanced customer loyalty. It moves the conversation beyond reputation to concrete operational advantage.

After the OLS regression of ESG on ROA, the control variables for this study were included. For this purpose, the variables of leverage, industry (whether they produce goods [IndustryGoods]), provide services (IndustryServices), or both (IndustryGoods and Services), whether the companies belong to the S&P IPC ESG Mexico (S.P_IPC_ESG_MexicoSI), and whether Cemefi recognized them as socially responsible (CemefiSI) were added.

Table 5 presents the regression results, which include the intercept, ESG, and control variables.

The inclusion of control variables (

Table 5) confirmed the robustness of the ESG-ROA relationship (β = 0.037,

p < 0.001). The control variables of leverage and industry did not have a significant effect. The consistency of the ESG coefficient across both models, with and without controls, underscores that its positive impact is independent of firm size, debt levels, or sector. This supports that ESG is a factor in improving asset efficiency and profitability, universally applicable across the non-financial listed landscape in Mexico.

5. Discussion and Conclusions

In Mexican firms, the implementation of ESG strategies is associated with higher profitability (ROA) and firm value, as supported by the results of this study. It is worth noting that the study focused on companies listed on the BMV, typically large companies with a higher level of governance maturity. Therefore, it does not necessarily generalize to Mexican companies of all sizes, although it provides some information on the ESG-CFP relationship. This study highlights the impact of ESG strategies on various dimensions of financial performance.

A significant finding is the positive relationship between Tobin’s Q and ROA. It demonstrates that ESG strategies in emerging markets, such as Mexico, can have a positive impact on CFP. A stronger explanatory power for ROA (24.65%) compared to Tobin’s Q (17.96%) suggests that the operational benefits of ESG (e.g., cost savings, efficiency gains) are more immediately quantifiable and consistent. While positive, the market valuation (Tobin’s Q) may be impacted by other external and speculative factors, yet still clearly incorporates a significant ESG premium.

By demonstrating that Mexican firms with high ESG scores achieve higher ROA and Tobin’s Q, this study validates that even in environments with less mandatory regulation, ESG strategies can generate tangible financial advantages. These results provide practical evidence for CEOs in Mexico that strategies that strengthen ESG issues can generate financial value. Overall, this research makes key contributions to emerging markets, such as providing quantitative data that demystifies the perception of ESG as an expense in resource-constrained contexts.

The findings of this study demonstrate a statistically significant, positive relationship between ESG performance and financial performance (as measured by Tobin’s Q and ROA) for large, non-financial companies listed on the BMV. It is critical to define the scope of these results. Primarily, they offer robust, contextual evidence for the Mexican emerging market, a location characterized by the development of ESG regulations and evolving stakeholder expectations. Although the results may not be directly generalized to all international settings, they provide a powerful basis for comparative data and a confirmed benchmark for other countries at a similar stage of economic and market development within Latin America or among emerging economies. The mechanisms recommended by our outcomes—where ESG relates to both operational efficiency (ROA) and firm valuation (Tobin’s Q)—are probably most pertinent for large corporations in markets where formal ESG practices are changing from voluntary to expected norms. Consequently, these results call for testing in analogous institutional environments rather than claiming general validity.

The study offers several business applications. One of them involves decision making and resource allocation. These findings can be used to prioritize ESG initiatives that generate financial value. ESG strategies developed by each company can be communicated through annual reports and other documents, highlighting how their practices contribute to improving environmental conditions of their environment, reducing the environmental impact of their operations, and operating transparently and compliantly while generating financial value. Companies’ ESG strategies can become a key differentiator, enabling customers to perceive their brand more positively, fostering greater loyalty, and mitigating potential reputational crises.

Author Contributions

Conceptualization, P.O.-M. and C.J.G.; methodology, P.O.-M.; validation, P.O.-M.; formal analysis, P.O.-M.; investigation, P.O.-M.; resources, P.O.-M.; data curation, P.O.-M.; writing—original draft preparation, P.O.-M. and C.J.G.; writing—review and editing, P.O.-M. and C.J.G.; supervision, C.J.G.; project administration, P.O.-M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data supporting the findings of this study are available from the Refinitiv Eikon Platform, however restrictions apply to the availability of these data, which were used under a UPAEP subscription for the current study and are therefore not publicly available. The data are, however, available from the corresponding author upon reasonable request, as per UPAEP consent.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Cho, S.J.; Chung, C.Y.; Young, J. Study on the relationship between CSR and financial performance. Sustainability 2019, 11, 343. [Google Scholar] [CrossRef]

- Ahmad, N.; Mobarek, A.; Roni, N.N. Revisiting the impact of ESG on financial performance of FTSE350 UK firms: Static and dynamic panel data analysis. Cogent Bus. Manag. 2021, 8, 1900500. [Google Scholar] [CrossRef]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Zumente, I.; Bistrova, J. ESG importance for long-term shareholder value creation: Literature vs. practice. J. Open Innov. Technol. Mark. Complex. 2021, 7, 127. [Google Scholar] [CrossRef]

- Li, T.T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Mohammad, W.M.W.; Wasiuzzaman, S. Environmental, social and governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Clean. Environ. Syst. 2021, 2, 100015. [Google Scholar] [CrossRef]

- Luganskaya, E.; Sukhareva, M. Integrating the ESG approach in business. Bus. Educ. Knowl. Econ. 2024, 338, 1727. [Google Scholar]

- Huang, J. Assessing the effectiveness and limitations of ESG in portfolio Investment. Highlights Bus. Econ. Manag. 2023, 19, 177–182. [Google Scholar]

- Zhou, G.; Liu, L.; Luo, S. Sustainable development, ESG performance, and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 2022, 31, 3371–3387. [Google Scholar] [CrossRef]

- Shaw, W.H.; Nelson, S.L.; Gehrke, C.J.; Jones, C. Environmental, social and governance score correlation to valuation of public companies: Evidence from 2012 to 2021. Int. J. Bus. Manag. Stud. 2025, 6468–6510. [Google Scholar]

- Qureshi, M.A.; Akbar, M.; Akbar, A.; Poulova, P. Do ESG endeavors assist firms in achieving superior financial performance? A case of 100 best corporate citizens. Sage Open 2021, 11, 21582440211021598. [Google Scholar] [CrossRef]

- Gabriel, M.; Lenain, P.; Mehrez, M.; Reynaud, J.; Soneja, P. Doing Well by Doing Good: The Role of Mexico’s Firms in Achieving Sustainable and Inclusive Growth; Economics Department Working Papers; OECD Publishing: Paris, France, 2017. [Google Scholar]

- Naeem, N.; Cankaya, S.; Bildik, R. Does ESG performance affect the financial performance of environmentally sensitive industries? A comparison between emerging and developed markets. Borsa Istanb. Rev. 2022, 22, S128–S140. [Google Scholar] [CrossRef]

- Berg, F.; Kölbel, J.F.; Rigobon, R. Aggregate confusion: The divergence of ESG ratings. Rev. Financ. 2022, 26, 1315–1344. [Google Scholar] [CrossRef]

- Sun, G.; Hu, X.; Chen, X.; Xiao, J. Sustainability Uncertainty and Supply Chain Financing: A Perspective Based on Divergent ESG Evaluations in China. Systems 2025, 13, 850. [Google Scholar] [CrossRef]

- Attanasio, G.; Preghenella, N.; De Toni, A.F.; Battistella, C. Stakeholder engagement in business models for sustainability: The stakeholder value flow model for sustainable development. Bus. Strategy Environ. 2022, 31, 860–874. [Google Scholar] [CrossRef]

- Freeman, R.E. Management: Framework and Philosophy. In R. Edward Freeman’s Selected Works on Stakeholder Theory and Business Ethics; Dmytriyev, S.D., Freeman, R.E., Eds.; Springer: Berlin/Heidelberg, Germany, 2023; p. 53. [Google Scholar]

- Freeman, R.E. The stakeholder approach revisited. J. Bus. Corp. Ethics 2004, 5, 228–241. [Google Scholar] [CrossRef]

- Freeman, R.E.; Dmytriyev, S. Corporate social responsibility and stakeholder theory: Learning from each other. Symphonya Emerg. Issues Manag. 2017, 1, 7–15. [Google Scholar] [CrossRef]

- Janah, O.O.; Sassi, H. The ESG impact on corporate financial performance in developing countries: A systematic literature review. Int. J. Account. Financ. Audit. Manag. Econ. 2021, 2, 391–410. [Google Scholar]

- Peng, L.S.; Isa, M. Environmental, social and governance (ESG) practices and performance in Shariah firms: Agency or stakeholder theory. Asian Acad. Manag. J. Account. Financ. 2020, 16, 1–34. [Google Scholar]

- Tarmuji, I.; Maelah, R.; Tarmuji, N.H. The impact of environmental, social and governance practices (ESG) on economic performance: Evidence from ESG score. Int. J. Trade Econ. Financ. 2016, 7, 67–74. [Google Scholar] [CrossRef]

- Galant, A.; Cadez, S. Corporate social responsibility and financial performance relationship: A review of measurement approaches. Econ. Res. 2017, 30, 676–693. [Google Scholar] [CrossRef]

- Friedman, M. The Social Responsibility of Business is to Increase its Profits. In Corporate Ethics and Corporate Governance; Springer: Berlin/Heidelberg, Germany, 2007; pp. 173–178. [Google Scholar]

- Van Tulder, R.; Van Mil, E. Principles of Sustainable Business: Frameworks for Corporate Action on the SDGs; Routledge: London, UK, 2022. [Google Scholar]

- Polman, P.; Winston, A. Net Positive: How Courageous Companies Thrive by Giving More Than They Take; Harvard Business Review Press: Boston, MA, USA, 2021. [Google Scholar]

- Daft, R.L. Management, 12th ed.; South-Western Cengage Learning: Mason, OH, USA, 2015. [Google Scholar]

- Aydoğmuş, M.; Gülay, G.; Ergun, K. Impact of ESG performance on firm value and profitability. Borsa Istanb. Rev. 2022, 22, S119–S127. [Google Scholar] [CrossRef]

- Bao-Hua, L.; Long-Wen, Z.; Yi-Qiang, W.; Chen, C. Dual power transformation and Yeo–Johnson techniques for static and dynamic reliability assessments. Buildings 2024, 14, 3625. [Google Scholar] [CrossRef]

- Field, A. Discovering Statistics Using IBM SPSS Statistics, 6th ed.; Sage Publications: London, UK, 2024. [Google Scholar]

- Halder, R.K.; Uddin, M.N.; Uddin, M.A.; Aryal, S.; Khraisat, A. Enhancing K-nearest neighbor algorithm: A comprehensive review and performance analysis of modification. J. Big Data 2024, 11, 113. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |