Blockchain-Enabled Closed-Loop Supply Chain Optimization for Power Battery Recycling and Cascading Utilization

Abstract

1. Introduction

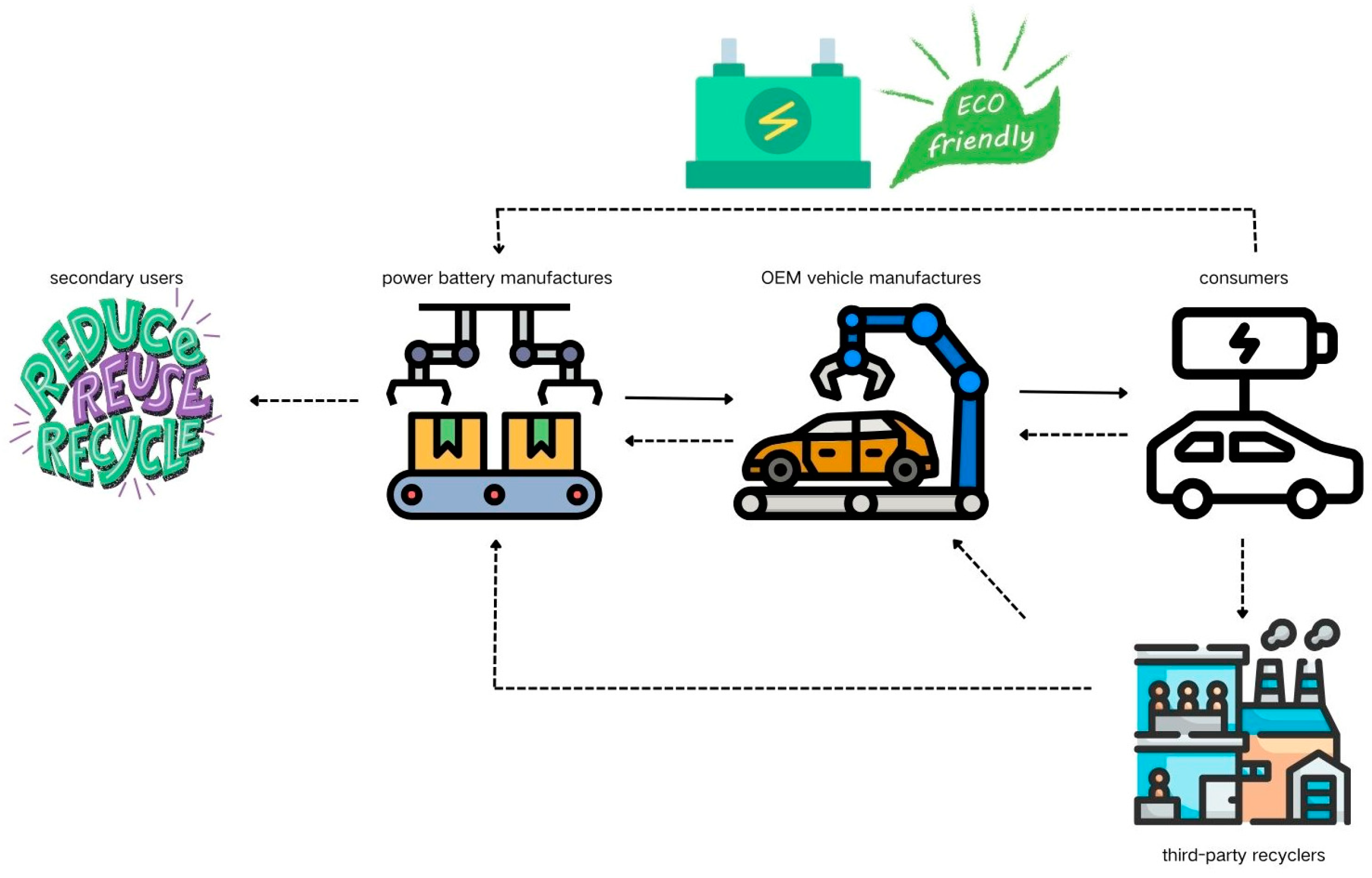

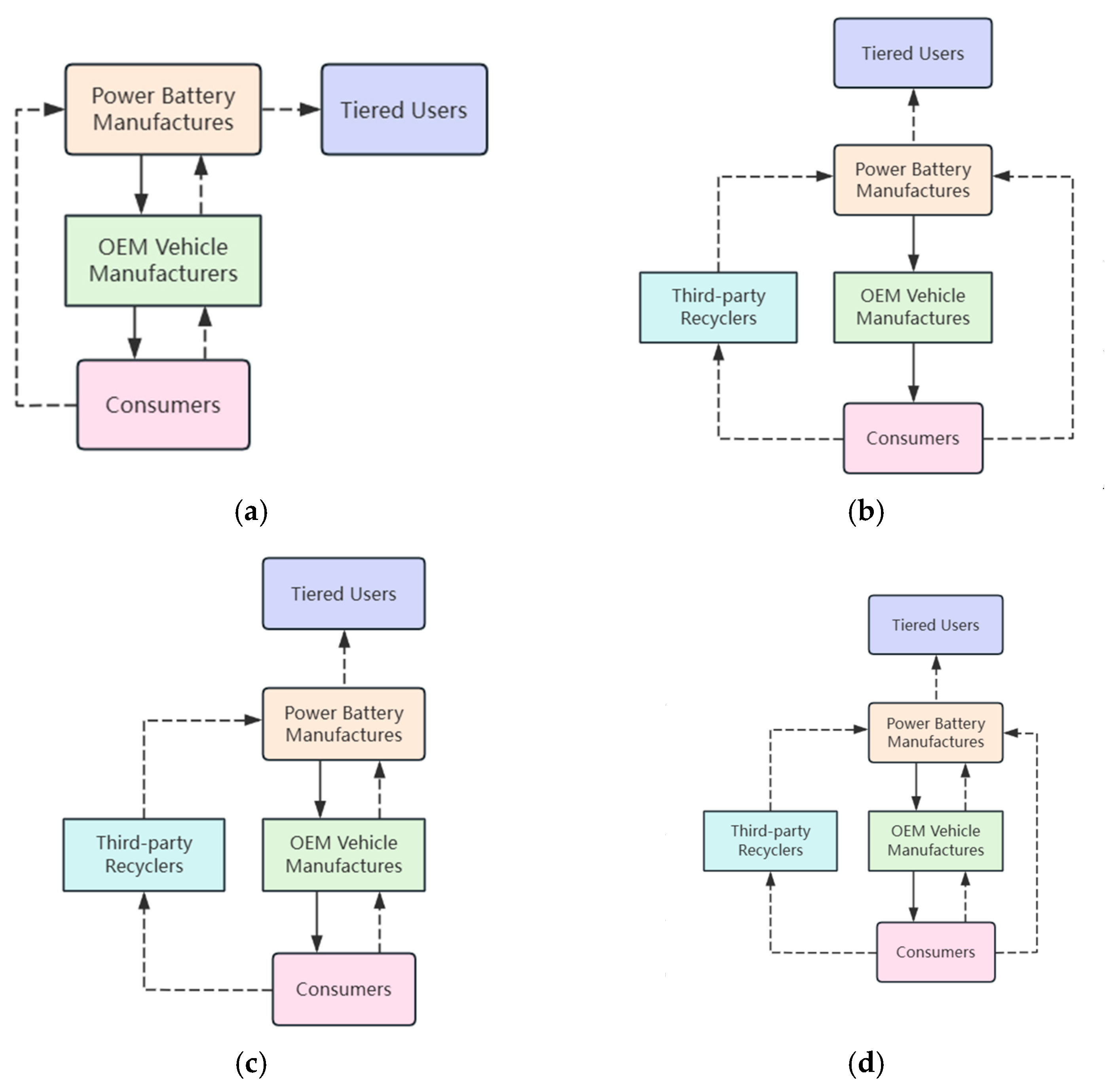

- (1)

- MOR Model: This model represents a hybrid recycling collaboration between power battery manufacturers and original equipment manufacturer (OEM) vehicle manufacturers.

- (2)

- MTR Model: This model involves a hybrid recycling approach between power battery manufacturers and third-party recyclers.

- (3)

- OTR Model: In this model, the collaboration is between OEM vehicle manufacturers and third-party recyclers.

- (4)

- MOTR Model: This model encompasses a hybrid recycling approach among power battery manufacturers, OEM vehicle manufacturers, and third-party recyclers.

2. Literature Review

2.1. Battery Recycling

2.2. Blockchain Application in Supply Chain

2.3. Recycling Supply Chain

2.4. The Interrelationships Among Members in Supply Chain

2.5. Related Work Review and Analysis

3. Methods

3.1. Model Descriptions

3.2. Model Assumptions

3.3. Basic Assumption

- (1)

- The members of the closed-loop supply chain for power batteries are all completely rational, and, in the decision-making process, there is a sequence of actions between power battery manufacturers and OEM vehicle manufacturers. In the case of incomplete information symmetry, the power battery manufacturer is the leader, and the OEM vehicle manufacturer is the follower, determining their own behavior based on the leader’s behavior.

- (2)

- Referring to relevant research, the demand function for power batteries is set to , and the amount of retired batteries recovered is (d, optional m, v, t, and n). When using blockchain, it indicates that consumers are sensitive to traceability levels; when blockchain is not used, it indicates that consumers have zero sensitivity to traceability levels.

- (3)

- To optimize the recycling process of the power battery supply chain, power battery manufacturers adopt blockchain technology for management, with an investment cost of .

- (4)

- OEM vehicle manufacturers sell power batteries at retail price p, which only considers the retail price of the power battery and does not include other additional products, related spare parts costs, and labor costs.

- (5)

- For the hierarchical utilization process, this article adheres to the principle that if the battery capacity is below 80% and cannot be used for new energy vehicles, it will be recycled and used for other scenarios, with a single profit of R; for power batteries that cannot be reused, the batteries are tested and reassembled, and usable raw materials are extracted for regeneration and recycling. As the amount of regeneration and recycling cannot be determined, the total profit is set as F. Since the recycling of batteries is relatively small for OEM vehicle manufacturers and third-party recyclers, and the selling price is low, assuming it is ignored, transportation costs and other expenses are borne by the power battery manufacturer.

- (6)

- With the development of new energy vehicles, the types of batteries are becoming more diverse. To ensure research rigor, it is set that all power batteries are of the same model and capacity.

- (7)

- Using blockchain technology, the proportion of retired batteries that can be used for cascading utilization will be quickly identified through information technology.

- (8)

- In reality, it is rare to purchase power batteries separately. To ensure the reliability of the research, it is set that power batteries have independent wholesale prices, retail prices, and recycling prices, which can be independently accounted for.

3.4. Methodology

4. Results

4.1. Hybrid Recycling Mode (MOR Mode) Between Power Battery Manufacturers and OEM Vehicle Manufacturers

4.2. Hybrid Recycling Mode Between Power Battery Manufacturers and Third-Party Recyclers (MTR Mode)

4.3. Hybrid Recycling Mode (OTR Mode) Between OEM Vehicle Manufacturers and Third-Party Recyclers

4.4. Hybrid Recycling Mode (MOTR Mode) for Power Battery Manufacturers, OEM Vehicle Manufacturers, and Third-Party Recyclers

- (1)

- Using Formula (38) to calculate the first partial derivative of its decision variable, we obtain

- (2)

- Using Formula (39) to calculate the first partial derivative of its decision variable, we obtain

- (3)

- Using Formula (40) to calculate the first partial derivative of its decision variable, we obtain

- (1)

- Using Formula (38) to calculate the first partial derivative of its decision variable, we obtain

- (2)

- Using Formula (39) to calculate the first partial derivative of its decision variable, we obtain

- (3)

- Using Formula (40) to calculate the first partial derivative of its decision variable, we obtain

4.5. Summary

5. Simulation Analysis

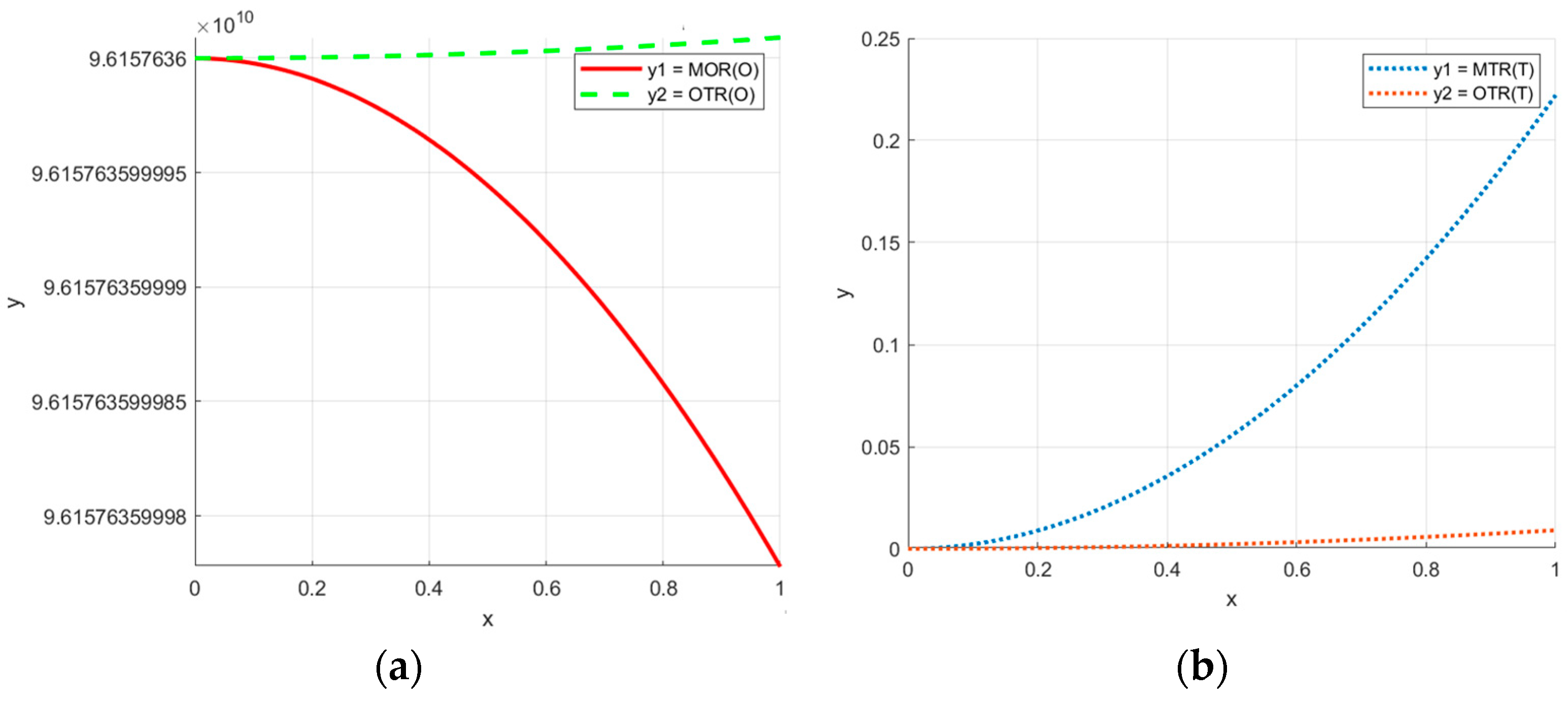

5.1. The Impact of the Hierarchical Utilization Ratio θ on the Supply Chain

5.1.1. The Variation of Recycling Prices pm, pv, pn, and pt with the Hierarchical Utilization Ratio θ

5.1.2. The Profit of Power Battery Manufacturers Varies with the Hierarchical Utilization Ratio θ

5.1.3. The Profit of OEM Vehicle Manufacturers and Third-Party Recyclers Varies with the Hierarchical Utilization Ratio θ

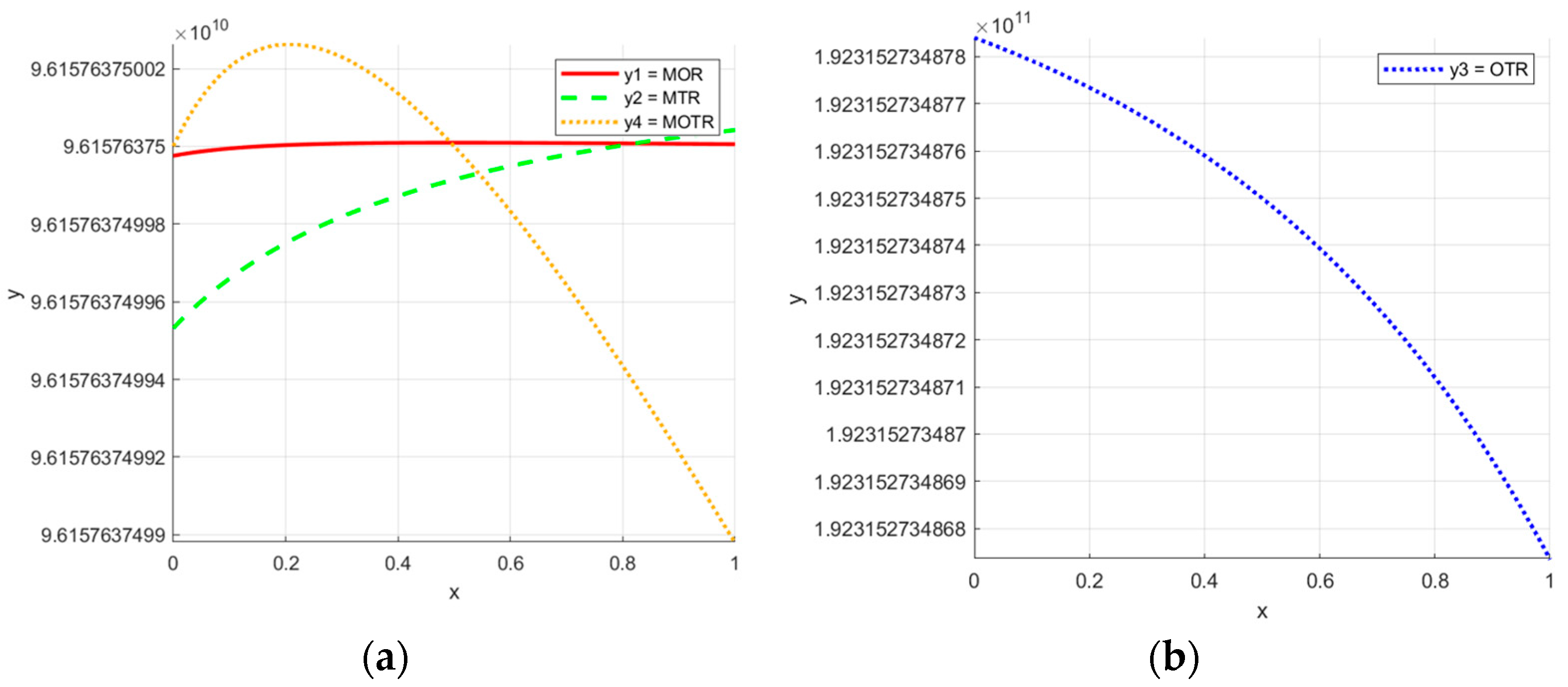

5.2. The Impact of Different Recycler Competition Coefficients h on the Supply Chain

5.2.1. The Variation of Recycling Prices pm, pv, pn, and pt with h

5.2.2. The Profit of Power Battery Manufacturers Changes with h

5.2.3. The Profit Changes of OEM Vehicle Manufacturers and Third-Party Recyclers with h

6. Conclusions

7. Discussion and Policy Implication

- Improve the hierarchical utilization rate of power batteries.

- 2.

- Promote healthy competition and ensure market order.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Daily Economic News. GEM: The Company Has Fully Imported the Supply Chain of World-Renowned Battery Manufacturers’ Eastern Fortune Network. Available online: http://www.nbd.com.cn/articles/2021-12-04/2025146.html (accessed on 22 May 2024).

- The Beijing News. Green Beauty Collaborates with Mercedes Benz China, CATL and Others to Build a Battery Closed-Loop Recycling Project. Available online: http://m.bjnews.com.cn/detail/1677560544168530.html (accessed on 28 February 2023).

- Majumder, P.; Groenevelt, H. Competition in remanufacturing. Prod. Oper. Manag. 2001, 10, 125–141. [Google Scholar] [CrossRef]

- Dobó, Z.; Dinh, T.; Kulcsár, T. A review on recycling of spent lithium-ion batteries. Energy Rep. 2023, 9, 6362–6395. [Google Scholar] [CrossRef]

- Wang, M.; Liu, K.; Dutta, S.; Alessi, D.S.; Rinklebe, J.; Ok, Y.S.; Tsang, D.C. Recycling of lithium iron phosphate batteries: Status, technologies, challenges, and prospects. Renew. Sustain. Energy Rev. 2022, 163, 112515. [Google Scholar] [CrossRef]

- Rettenmeier, M.; Möller, M.; Sauer, A. Disassembly technologies of end-of-life automotive battery packs as the cornerstone for a circular battery value chain: A process-oriented analysis. Resour. Conserv. Recycl. 2024, 209, 107786. [Google Scholar] [CrossRef]

- Sathya, S.; Soosaimanickam, C.; Bella, F.; Yoo, D.J.; Stephan, A.M. Cycling performance of SiOx-Si-C composite anode with different blend ratios of PAA-CMC as binder for lithium sulfur batteries. J. Polym. Res. 2024, 31, 205. [Google Scholar] [CrossRef]

- Versaci, D.; Colombo, R.; Montinaro, G.; Buga, M.; Felix, N.C.; Evans, G.; Bella, F.; Amici, J.; Francia, C.; Bodoardo, S. Tailoring cathode materials: A comprehensive study on LNMO/LFP blending for next generation lithium-ion batteries. J. Power Sources 2024, 613, 234955. [Google Scholar] [CrossRef]

- Fagiolari, L.; Versaci, D.; Di Berardino, F.; Amici, J.; Francia, C.; Bodoardo, S.; Bella, F. An exploratory study of MoS2 as anode material for potassium batteries. Batteries 2022, 8, 242. [Google Scholar] [CrossRef]

- Yi, X.; Lu, T.; Li, Y.; Ai, Q.; Hao, R. Collaborative planning of multi-energy systems integrating complete hydrogen energy chain. Renew. Sustain. Energy Rev. 2025, 210, 115147. [Google Scholar] [CrossRef]

- Tang, J.; Sheng, Z.; Zhao, D. Research on the trade-in modes for electric vehicle power batteries under deposit and fund policies. Int. J. Low-Carbon Technol. 2024, 19, 733–746. [Google Scholar] [CrossRef]

- Zhang, W.; Liu, X.; Zhu, L.; Wang, W.; Song, H. Pricing and production R&D decisions in power battery closed-loop supply chain considering government subsidy. Waste Manag. 2024, 190, 409–422. [Google Scholar] [CrossRef]

- Narang, P.; De, P.K.; Lim, C.P.; Kumari, M. Optimal recycling model selection in a closed-loop supply chain for electric vehicle batteries under carbon cap-trade and reward-penalty policies using the Stackelberg game. Comput. Ind. Eng. 2024, 196, 110512. [Google Scholar] [CrossRef]

- Xiao, J.; Jiang, C.; Wang, B. A review on dynamic recycling of electric vehicle battery: Disassembly and echelon utilization. Batteries 2023, 9, 57. [Google Scholar] [CrossRef]

- Wang, N.; Garg, A.; Su, S.; Mou, J.; Gao, L.; Li, W. Echelon utilization of retired power lithium-ion batteries: Challenges and prospects. Batteries 2022, 8, 96. [Google Scholar] [CrossRef]

- Casals, L.C.; Barbero, M.; Corchero, C. Reused second life batteries for aggregated demand response services. J. Clean. Prod. 2019, 212, 99–108. [Google Scholar] [CrossRef]

- Catton, J.W.A.; Walker, S.B.; McInnis, P.; Fowler, M.; Fraser, R.A.; Young, S.B.; Gaffney, B. Design and analysis of the use of re-purposed electric vehicle batteries for stationary energy storage in Canada. Batteries 2019, 5, 14. [Google Scholar] [CrossRef]

- Chen, M.; Ma, X.; Chen, B.; Arsenault, R.; Karlson, P.; Simon, N.; Wang, Y. Recycling end-of-life electric vehicle lithium-ion batteries. Joule 2019, 3, 2622–2646. [Google Scholar] [CrossRef]

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S.; et al. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86. [Google Scholar] [CrossRef]

- Yu, W.; Zheng, Y.; Zhang, Y. Carbon emission reduction by echelon utilization of retired vehicle power batteries in energy storage power stations. World Electr. Veh. J. 2022, 13, 144. [Google Scholar] [CrossRef]

- Morkunas, V.J.; Paschen, J.; Boon, E. How blockchain technologies impact your business model. Bus. Horiz. 2019, 62, 295–306. [Google Scholar] [CrossRef]

- Mulligan, C.; Morsfield, S.; Cheikosman, E. Blockchain for sustainability: A systematic literature review for policy impact. Telecommun. Policy 2024, 48, 102676. [Google Scholar] [CrossRef]

- Belchior, R.; Vasconcelos, A.; Guerreiro, S.; Correia, M. A survey on blockchain interoperability: Past, present, and future trends. ACM Comput. Surv. 2021, 54, 168:1–168:41. [Google Scholar] [CrossRef]

- Park, A.; Li, H. The effect of blockchain technology on supply chain sustainability performances. Sustainability 2021, 13, 1726. [Google Scholar] [CrossRef]

- Luo, H.; Zhang, Q.; Sun, G.; Yu, H.; Niyato, D. Symbiotic blockchain consensus: Cognitive backscatter communications-enabled wireless blockchain consensus. IEEE/ACM Trans. Netw. 2024, 32, 5372–5387. [Google Scholar] [CrossRef]

- Xiao, L.; Ouyang, Y.; Lin, Q.; Guo, Y. Cooperative recycling strategy for electric vehicle batteries considering blockchain technology. Energy 2024, 313, 134062. [Google Scholar] [CrossRef]

- Zhang, X.; Feng, X.; Jiang, Z.; Gong, Q.; Wang, Y. A blockchain-enabled framework for reverse supply chain management of power batteries. J. Clean. Prod. 2023, 415, 137823. [Google Scholar] [CrossRef]

- Florea, B.C.; Taralunga, D.D. Blockchain IoT for smart electric vehicles battery management. Sustainability 2020, 12, 3984. [Google Scholar] [CrossRef]

- Gao, J.; Jiang, S.; Zhang, Y. To adopt blockchain or not? A game theoretic analysis of profit and environmental impact in decommissioned EV lithium-ion battery recycling. Appl. Energy 2024, 367, 123312. [Google Scholar] [CrossRef]

- Shen, D.; Liu, Q.; Cudjoe, D. Competing Manufacturers Adopt Blockchain for Tracing Power Batteries: Is There a Win-Win Zone? Energies 2024, 17, 2868. [Google Scholar] [CrossRef]

- Li, J.; Liu, F.; Zhang, J.Z.; Li, L.; Ferreira, J. Forward–reverse blockchain traceability: Promoting electric vehicles with battery recycling in the presence of subsidy. Ann. Oper. Res. 2024. [Google Scholar] [CrossRef]

- van Wassenaer, L.; Verdouw, C.; Wolfert, S. What blockchain are we talking about? An analytical framework for understanding blockchain applications in agriculture and food. Front. Blockchain 2021, 4, 653128. [Google Scholar] [CrossRef]

- Rogerson, M.; Parry, G.C. Blockchain: Case studies in food supply chain visibility. Supply Chain Manag. Int. J. 2020, 25, 601–614. [Google Scholar] [CrossRef]

- Pun, H.; Swaminathan, J.M.; Hou, P. Blockchain adoption for combating deceptive counterfeits. Prod. Oper. Manag. 2021, 30, 864–882. [Google Scholar] [CrossRef]

- Agbo, C.C.; Mahmoud, Q.H.; Eklund, J.M. Blockchain technology in healthcare: A systematic review. Healthcare 2019, 7, 56. [Google Scholar] [CrossRef]

- Ghosh, P.K.; Chakraborty, A.; Hasan, M.; Rashid, K.; Siddique, A.H. Blockchain application in healthcare systems: A review. Systems 2023, 11, 38. [Google Scholar] [CrossRef]

- Tanwar, S.; Parekh, K.; Evans, R. Blockchain-based electronic healthcare record system for healthcare 4.0 applications. J. Inf. Secur. Appl. 2020, 50, 102407. [Google Scholar] [CrossRef]

- Yaqoob, I.; Salah, K.; Jayaraman, R.; Al-Hammadi, Y. Blockchain for healthcare data management: Opportunities, challenges, and future recommendations. Neural Comput. Appl. 2021, 34, 11475–11490. [Google Scholar] [CrossRef]

- Tan, K.; Tian, Y.; Xu, F.; Li, C. Research on multi-objective optimal scheduling for power battery reverse supply chain. Mathematics 2023, 11, 901. [Google Scholar] [CrossRef]

- Li, G.; Lu, M.; Lai, S.; Li, Y. Research on power battery recycling in the green closed-loop supply chain: An evolutionary game-theoretic analysis. Sustainability 2023, 15, 10425. [Google Scholar] [CrossRef]

- Gong, B.; Gao, Y.; Li, K.W.; Liu, Z.; Huang, J. Cooperate or compete? A strategic analysis of formal and informal electric vehicle battery recyclers under government intervention. Int. J. Logist. Res. Appl. 2024, 27, 149–169. [Google Scholar] [CrossRef]

- Wu, S.; Cao, J.; Shao, Q. How to select remanufacturing mode: End-of-life or used product? Environ. Dev. Sustain. 2024. [Google Scholar] [CrossRef]

- Tang, T.; Xu, H.; Zhang, Z.; Chen, K. Financing and online recycling channel decisions in a closed-loop supply chain. Electron. Commer. Res. Appl. 2024, 67, 101414. [Google Scholar] [CrossRef]

- Wu, W.; Zhang, M.; Jin, D.; Ma, P.; Wu, W.; Zhang, X. Decision-making analysis of electric vehicle battery recycling under different recycling models and deposit-refund scheme. Comput. Ind. Eng. 2024, 191, 110109. [Google Scholar] [CrossRef]

- Zhao, B.; Tang, W.; Wei, L.; Zhang, J. Price distortion forced by recycling competition under trade-in collaboration. Int. J. Prod. Res. 2024, 62, 7687–7703. [Google Scholar] [CrossRef]

- Feng, Z.; Li, F.; Tan, C. Supplier development or supplier integration? Equilibrium analysis in competing electric vehicle supply chains with power battery recycling. Expert Syst. Appl. 2024, 238, 121519. [Google Scholar] [CrossRef]

- Shao, L.; Peng, Y.; Wang, X. Cooperation and Production Strategy of Power Battery for New Energy Vehicles Under Carbon Cap-and-Trade Policy. Sustainability 2024, 16, 9860. [Google Scholar] [CrossRef]

- Huang, Y.; Peng, N. Manufacturer’s cooperation strategies of closed-loop supply chain considering recycling advertising. RAIRO-Oper. Res. 2024, 58, 1555–1576. [Google Scholar] [CrossRef]

- Yu, H.; Mi, J.; Xu, N. Recycling, pricing decisions, and coordination in the dual-channel closed-loop supply chain: A dynamic perspective. J. Clean. Prod. 2024, 456, 142297. [Google Scholar] [CrossRef]

- Liu, J.; Li, K.; Zhang, L.; Xu, S. Recycling investment strategies in two-sided competition with diverse vertical structures. Manag. Decis. Econ. 2024, 45, 2968–2987. [Google Scholar] [CrossRef]

| Type | Case | Battery Recyclers |

|---|---|---|

| MOR | CATL collaborate with Xiaomi and BAIC to complete the recycling project | Power Battery Manufacturers OEM Vehicle Manufacturers |

| MTR | GEM cooperate with LGC/CATL/Samsung to promote battery recycling [1] | Power Battery Manufacturers Third-party recyclers |

| OTR | BYD partnered with Shenzhen Pandpower Co., Ltd., to develop battery recycling | OEM Vehicle Manufacturers Third-party recyclers |

| MOTR | Mercedes-Benz signed a contract with CATL and GEM to start a recycling project [2] | Power Battery Manufacturers OEM Vehicle Manufacturers Third-party recyclers |

| References | Power Battery Recycle | Utilization | Blockchain Applications | Recycling Channel Analysis | Member Relationships |

|---|---|---|---|---|---|

| [4,5,6,7,8,9] | √ | × | × | × | × |

| [10,11,12,13,14,15,16,17,18,19,20] | √ | √ | × | × | × |

| [21,22,23,24,25] [32,33,34,35,36,37,38] | × | × | √ | × | × |

| [26,27,28,29,30,31] | √ | × | √ | × | × |

| [39,40,41,42,43,44] | √ | × | × | √ | × |

| [45,46,47,48,49,50] | √ | × | × | √ | √ |

| Our research | √ | √ | √ | √ | √ |

| Parameter | Description |

|---|---|

| C0 | The cost of producing power batteries for power battery manufacturers |

| w | Wholesale price of power batteries |

| D | Demand for power batteries in the market |

| a | Potential demand for power batteries in the market |

| α | Consumer sensitivity to retail prices of power batteries |

| β | Consumer sensitivity to the price of retired battery recycling |

| δ | Cost coefficient of blockchain investment |

| φ | Cost coefficient of battery recycling |

| ε | Consumer sensitivity to the traceability level of power batteries |

| p | Retail price of power battery |

| pm | Retired power battery recycling price (power battery manufacturer → consumer) |

| pv | Retired power battery recycling price (OEM vehicle manufacturer → consumer) |

| pt | Retired power battery recycling price (third-party recyclers → consumers) |

| pn | Retired power battery recycling price (power battery manufacturer → OEM vehicle manufacturer/third-party recycler) |

| Ca | Retired power battery costs (including but not limited to dismantling, evaluation, and transportation expenses) |

| Cb | Cost of blockchain investment |

| e θ R | Level of investment in blockchain The proportion of retired batteries that can be recycled and reused (the hierarchical utilization ratio) Profit per unit of power battery cascading utilization |

| M | Consumers voluntarily return the quantity of power batteries |

| F | Total revenue from dismantling and recycling power batteries |

| Profit function of i under mode j | |

| h | Competition coefficient among members in the process of recycling waste batteries |

| MOR Mode | MTR Mode | OTR Mode | MOTR Mode | |

|---|---|---|---|---|

| p | ||||

| w | ||||

| e | ||||

| pm | ||||

| pv | ||||

| pn | ||||

| pt | ||||

| M Revenue | ||||

| O Revenue | ||||

| T Revenue |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, H.; Wang, S. Blockchain-Enabled Closed-Loop Supply Chain Optimization for Power Battery Recycling and Cascading Utilization. Sustainability 2025, 17, 4192. https://doi.org/10.3390/su17094192

Yu H, Wang S. Blockchain-Enabled Closed-Loop Supply Chain Optimization for Power Battery Recycling and Cascading Utilization. Sustainability. 2025; 17(9):4192. https://doi.org/10.3390/su17094192

Chicago/Turabian StyleYu, Haiyun, and Shuo Wang. 2025. "Blockchain-Enabled Closed-Loop Supply Chain Optimization for Power Battery Recycling and Cascading Utilization" Sustainability 17, no. 9: 4192. https://doi.org/10.3390/su17094192

APA StyleYu, H., & Wang, S. (2025). Blockchain-Enabled Closed-Loop Supply Chain Optimization for Power Battery Recycling and Cascading Utilization. Sustainability, 17(9), 4192. https://doi.org/10.3390/su17094192