Abstract

The study of carbon stocks in organic compounds within terrestrial ecosystems allows us to create a pool of potential carbon farming projects. At present, it is essential to assess the economic viability of natural-based solutions in order to develop strategies to encourage small and medium enterprises (SME) and governments to address climate change through specific measures. This article is devoted to the study of the economic efficiency of afforestation projects. The purpose of this study is to evaluate the economic efficiency of the project and, based on NPV sensitivity analysis, to identify the factors affecting economic efficiency. This will make it possible to formulate directions for stimulating the development of afforestation projects using tools to improve their economic efficiency. Based on data on the number of carbon credits issued, their price, and the costs and other revenue associated with the implementation of the afforestation project, a sensitivity analysis of economic efficiency was conducted, highlighting the most significant factors. Given that different tree species are characterized by variable seedling values, planting costs, and sequestration potentials, an afforestation project with the most carbon efficient tree species was selected as a pilot project. Black alder exhibits the most optimal proportion between the volume of carbon units released and the cost of planting trees. A sensitivity analysis of the project’s net present value was conducted in order to ascertain the factors that have the most significant impact on the project’s economic efficiency. These include the discount rate based on the cost of capital and the cost of tree planting. As a result, this article makes recommendations for improving the economic efficiency of afforestation projects for SME. The government’s role in enhancing the economic efficiency of such initiatives entails reducing the cost of capital through a reduction in the key rate or the provision of subsidies for the interest rate on bank credits. An alternative approach involves the granting of subsidies for the cost of tree planting, since the effects can be seen as a series of public goods, such as the creation of recreational areas and increased biodiversity of the ecosystem.

1. Introduction

According to the second report “Global Climate Change Indicators” by the University of Leeds, the Earth’s average surface temperature increased by 1.19 °C from 2014 to 2023. At current CO2 emission levels, the temperature threshold of 1.5 °C established by the Paris Agreement (2015) will be exceeded within 5 years [1]. The energy sector, which relies on fossil fuels, is the primary source of anthropogenic greenhouse gas emissions, accounting for over 70% of emissions [2]. At COP 28 in 2023 (UAE), a decision was made to decarbonize the energy sector in order to limit the global average temperature rise to within 1.5–2 °C. This will primarily involve the development of renewable energy sources (RES) and nuclear energy, alongside a gradual reduction in the role of fossil fuels [3].

However, according to the 2023 UN Production Gap Report, leading fossil fuel producers plan to increase extraction volumes despite their climate commitments. Governments are doubling production levels and planning to produce 110% more fossil fuels by 2030 than what is permitted under the 1.5 °C warming limit and 69% more than what would be feasible within the 2 °C limit [4]. Given the instability, lack of widespread access, and high cost of RES, fossil fuels are expected to remain a primary energy source for many countries worldwide [5]. In this context, offsetting the carbon footprint of the energy sector through the implementation of nature-based climate solutions will play a crucial role in achieving the Paris Agreement targets [6].

According to the target scenario of Russia’s Strategy for Social and Economic Development with Low Greenhouse Gas Emissions until 2050, net emissions of climate-active gases must be reduced by 54% by 2030 compared to 1990 levels [7]. Most of the planned reductions are expected to be achieved through enhancing the absorptive capacity of natural ecosystems. Therefore, nature-based climate solutions implemented by carbon farms hold significant long-term importance. However, current practices demonstrate the inertia of business structures in implementing such projects. As at 8 December 2024, only 4 out of 20 registered climate projects are related to natural ecosystems, with the rest focused on technological solutions [8]. The low interest of businesses in nature-based solutions is due to institutional uncertainty, climate risks, and fluctuating evaluations of the commercial effectiveness of such initiatives [9,10]. This underscores the acute relevance of research that includes analyzing institutional changes in nature-friendly farming, assessing the impact of legislative initiatives on nature-based climate solutions, and evaluating the economic efficiency of long-term projects within the framework of carbon farming.

The challenges of stabilizing carbon pools in terrestrial and aquatic ecosystems are becoming increasingly significant, with the greatest efficiency achieved through interdisciplinary approaches [11]. This necessitates the integration of work in ecology, soil science, green chemistry, atmospheric physics, economics, and environmental management. The formation of carbon stocks in organic compounds of components of terrestrial ecosystems occurs under various substrate-phytocenotic and bioclimatic conditions, including soil formation in chronosequences that occur under natural reclamation (i.e., carbon farming). A comprehensive investigation into the mechanisms underlying these changes, incorporating both natural and anthropogenic factors, is imperative to facilitate the development of effective tools for managing the absorptive capacity of ecosystems. The economic assessment of the effectiveness of implementing carbon farming projects involves a comparison of the project’s sequestration potential and its implementation costs. Consequently, the present study employs the concept of carbon efficiency to evaluate the sequestration potential, incorporating the cost of ecosystem formation. This concept is calculated by dividing the volume of sequestered carbon by the cost of planting trees in the implementation of carbon projects.

Thus, the aim of this study is to evaluate the economic efficiency of the project and, based on NPV sensitivity analysis, to identify the factors affecting economic efficiency. This will make it possible to formulate directions for stimulating the development of afforestation projects using tools to improve their economic efficiency. The object of study is a reforestation project on a one-hectare plot located in the Leningrad Region of the Russian Federation. The subject of the study is the assessment of the carbon and economic efficiency of forest projects in the context of climate mitigation, including the volume of carbon credits generated.

The working scientific hypothesis was that achieving the economic efficiency of afforestation projects depends not only on the natural conditions of the specific site but also on economic factors such as the cost of the resources used and the price of the final product (wood) in light of market demand and institutional conditions.

2. Literature Review

Nature-based climate solutions can be defined as a set of measures aimed at restoring and protecting ecosystems, helping societies adapt to the consequences of climate change, and contributing to the mitigation of global warming. These projects began to gain momentum in the early 2000s. Today, the term encompasses activities in ecosystem-based adaptation and disaster risk reduction; technologies for CO2 sequestration through improved use of terrestrial, marine, and wetland ecosystems; changes in agricultural practices; and more [12,13]. Additionally, nature-based climate solutions provide numerous cobenefits, including environmental, social, and economic advantages [14,15].

It is worth noting that most studies in this area are fundamental in nature, laying the groundwork for the development of nature-based climate solutions, reviewing terminology origins, and identifying best practices for project evaluation [16]. However, empirical research, particularly studies evaluating the economic efficiency of these projects for specific regions, is critical for their broader implementation. While the existing literature provides a strong foundation in the general principles of nature-based solutions, a significant gap remains in the context of afforestation projects tailored to the specific ecological and economic conditions of the North-West Russia geographical region. Specifically, there is a lack of detailed analysis on the optimal choice of tree species for carbon sequestration and economic return in this region, considering factors such as soil type, climate patterns, and market demand for timber. Furthermore, the application and comparison of different economic valuation methods (e.g., market pricing, replacement cost) in the context of afforestation projects in similar boreal forest ecosystems requires further investigation.

Under various international and national carbon standards, more than 100 methodologies have been developed globally for ecosystem-based climate solutions. These include frameworks such as Verra VCS, Gold Standard, Clean Development Mechanism, California Compliance Offset Program, American Carbon Registry, Alberta Emission Offset Program (AEOP), Australian Emissions Reduction Fund, and Korea Offset Program, among others. A study by Roe et al. (2021) summarizes research on climate mitigation measures and concludes that approximately 50% of the economically viable potential for nature-based climate solutions lies in forestry and 35% in agriculture [17]. Researchers also note that a significant portion of this potential is located in developing and least-developed countries. Globally, the area of forest plantations increased by 55.8 million hectares between 1990 and 2020, with the largest surge (21.2 million hectares) occurring from 2000 to 2010. The average annual growth rate rose from 1.98 million hectares per year between 1990 and 2000 to 2.12 million hectares per year from 2000 to 2010 but declined to 1.48 million hectares annually in the past decade [18].

The European Commission has published a study on the potential and costs of climate projects in land use, land-use change, and forestry (LULUCF) [19]. This report formulates methodological approaches for assessing the comparative efficiency of various carbon projects in the LULUCF domain. Based on these assessments, forestry remains a primary source of net carbon uptake. Key factors influencing forestry project efficiency include the increasing demand for wood for energy and materials and a shift in forest age structure toward older forests, which reduces the intensity of carbon accumulation.

Forestry projects are categorized into the following types: expanding forested areas through reforestation and afforestation; conserving existing forests through logging bans, remote monitoring, and special measures to protect against fires and illegal activities; and improving forest management to enhance productivity and sequestration [20]. Research shows that the development of forestry-based climate solutions could increase annual CO2 uptake by 0.2–2.1 gigatons [21,22]. However, scientists caution that imperfections in carbon standards create risks of over-issuance of carbon credits from forestry projects [23].

Carbon offset processes are implemented through carbon credit registries and offset protocols, which set criteria for project implementation, emission monitoring methods, and greenhouse gas sequestration calculations. Today, there are 46 carbon credit registries globally [24], but 4 major ones—American Carbon Registry (ACR), Climate Action Reserve (CAR), Gold Standard, and Verra (VCS)—account for more than half of all registered climate projects [25]. In addition to international registries, countries like Russia, China, and India are creating internal registries and corresponding carbon credit markets. These vary in terms of project requirements and greenhouse gas assessment methodologies (Table 1), generating risks such as over-issuance of credits, unintended negative impacts outside project boundaries, and carbon leakage.

Table 1.

Comparison of carbon credit registries for forestry climate projects.

Comparative analyses of carbon credit registries reveal differences in baseline establishment, project duration, and other factors, leading to challenges in project acceptance for international trading. For example, Russia’s carbon credit registry differs in implementation timelines, crediting periods, and baseline methodologies compared to international standards.

Meanwhile, international systems also have shortcomings. These include baseline underestimation, which leads to over-crediting, and high economic barriers caused by overestimated baselines. These factors emphasize the need for empirical assessments of sequestration levels and economic efficiency tailored to specific regions to inform decisions about implementing forestry climate projects in business contexts.

The economic analysis of nature-based climate project efficiency faces several challenges. First, assessing the long-term benefits of forestry projects (up to 100 years) is subject to high uncertainty. Second, the complexity of evaluating significant ecosystem and societal cobenefits limits comprehensive economic analysis. Examples include biodiversity conservation and the preservation of traditional livelihoods. Third, evaluating the effects of structural economic shifts and climate adaptation introduces additional challenges. As a result, alongside standard cost–benefit analyses, scientists propose multicriteria approaches, which have their own limitations [22,28,29].

The cost–benefit analysis (CBA) method is widely used in policymaking and in evaluating alternative solutions. Introduced by Atkinson and Mourato [30], this method determines whether the benefits (both tangible and intangible) of a project, practice, or policy outweigh the associated costs—and by how much—over a specified period. Economic evaluation of nature-based climate solutions and their comparison with alternative actions, such as implementing innovative low-carbon technologies or maintaining business-as-usual scenarios with carbon tax payments, is a key step in project assessment. However, real-world case studies for specific territories remain scarce. For example, in Russia, Nazarenko and Krasnoyarova (2018) assessed the unit costs of carbon sequestration in various districts of the Altai Territory [31]. Pomogaev (2021) analyzed climate projects and their potential in the Altai Territory, comparing alternative carbon capture projects in the region [32]. While these studies provide valuable insights, they are not fully applicable to other regions. To further address this gap and provide a more comprehensive context for our study, we acknowledge the work of Sunström E. et al. (1999) who investigated carbon sequestration rates and economic returns of afforestation with different tree species in Southern Sweden [33]. Their findings, while not directly transferable due to differences in specific soil composition and market access for timber products, highlight the importance of considering long-term timber value and species-specific growth rates in the economic assessment of afforestation projects. Similarly, the research by Halldórsson G., Benedikz T., Eggertsson Ó. et al. (2003) provides insights into the impact of government subsidies and tax incentives on afforestation project viability in Iceland [34] and España et al. (2022) in Chile [35]. These studies, alongside the existing literature, inform our methodology by emphasizing the need for a sensitivity analysis that considers various timber prices, carbon credit values, and potential subsidy scenarios. This study aims to address the gap by evaluating the economic efficiency of implementing a nature-based climate solution for afforestation of fallow lands in the north-west region of Russia, specifically the Leningrad Region, as well as territories with similar climatic and ecological conditions.

3. Materials and Methods

3.1. Assessment of Carbon and Economic Efficiency in Implementing a Nature-Based Climate Solution

The primary objective of the cost–benefit analysis (CBA) method is to determine alternative options for implementation and quantitatively evaluate their impact on the subject of study. When assessing various alternatives for using fallow lands, this method formulates potential benefits, both quantitatively and qualitatively, that may be challenging to evaluate using other approaches. The CBA method provides a comprehensive assessment of the costs associated with different alternatives, risk levels, and the potential benefits in both monetary and qualitative terms. Possible alternatives include:

- Reforestation and afforestation of areas in accordance with ecological principles to conserve biodiversity and promote sustainable forest management;

- Agroforestry and other mixed farming practices combining tree vegetation (trees or shrubs) with agricultural and/or livestock production systems on the same land;

- Cultivation of intermediate crops, cover crops, conservation tillage, and improving landscape characteristics (e.g., soil protection, erosion reduction, and increased organic carbon content in degraded arable lands);

- Targeted conversion of fallow or allocated lands into permanent pastures.

The analysis of project efficiency using the CBA method enables the identification of the optimal project. The criteria for optimizing climate projects are the subject of separate research since they may vary depending on the socioeconomic and environmental conditions of the project region. Furthermore, significant additional effects or enhanced public benefits arising during the implementation of a climate project may justify government funding. In this study, we operate under the assumption that there are certain ecological effects associated with the listed alternatives of climate projects. The focal point of this study is the afforestation of fallow lands. A broader study of the economic efficiency of alternative projects of fallow land utilization is a direction for further research.

When business entities consider implementing a climate project, the most appropriate method currently is evaluating the project’s economic efficiency, as climate projects are a particular case of investment projects. The implementation of carbon projects by small and medium-sized enterprises should be incentivized with the objective of ensuring their economic efficiency. The classic method for evaluating investment project efficiency is a sensitivity analysis of the net present value (NPV) to selected quantitative factors. This method is suitable for comparative evaluations of the efficiency of climate projects of the same type. In this case, alternative options involve planting trees of different species and assessing their sequestration capacity and the economic value of the resulting wood.

This study conducted a sensitivity analysis of the economic efficiency of alternative implementation options for an abandoned land afforestation project. The project’s scope does not depend on tree species selection and involves similar types of costs and benefits. Thus, the economic efficiency of afforestation alternatives is assessed using the net present value method (1).

where:

- I—investment expenditures (capital costs)

- t—project implementation period

- CF—operating cash flows, including liquidation expenses

- i—discount rate (cost of capital)

- t—period number

Investment expenditures include the planting cost including the cost of seedlings, as well as its transportation and planting.

where:

- I—investment expenditures (capital costs)

- —cost of seedlings planting,

- —the number of trees planted in the period

- i—discount rate (cost of capital)

- t—period number

The discount rate is calculated based on long-term bank loans by Russian SME (19.9 percent) [36], taking into account the risk premium (3.5 percent) and the forecasted inflation rate (3%). The risk premium is calculated in this study [37].

The inflation rate forecast is based on the forecast of the long-term socioeconomic development of the Russian Federation for the period until 2030, developed by the Ministry of Economic Development of the Russian Federation [38]. The inflation rate by the end of the project implementation period is 3%. Thus, the discount rate is 20.48%.

The operating cash flows include income from the sale of the verified carbon credits and from the sale of wood produced at the end of the project. The number of carbon units as well as the volume of wood are collected on the Ecobase portal [39]. The price of wood is defined as the current market price of roundwood.

where:

- —cash flow generated within the project

- —carbon credit price

- —number of carbon units generated each period

- —price of one m3 of wood produced at the end of the project

- —volume of wood produced at the end of the project (m3)

The fallow land afforestation project can be implemented in various scenarios depending on the tree species planted. The following six options have been selected as alternatives:

- Monoculture afforestation with birch (Betula pendula);

- Monoculture afforestation with black alder (Alnus glutinosa);

- Monoculture afforestation with pine (Pinus sylvestris);

- Monoculture afforestation with spruce (Picea abies);

- Mixed afforestation with birch (Betula pendula) and spruce (Picea abies);

- Mixed afforestation with pine (Pinus sylvestris) and spruce (Picea abies);

- Monoculture afforestation with larch (Larix sibirica).

Reforestation involves planting trees on landscapes that have not recently been covered by forest. The benefits of this project include carbon sequestration from the atmosphere, increased biodiversity in the area, improved soil health, and the cultivation of wood, which can be sold on the market at the end of the project. Among these benefits, some can be quantified in monetary terms, while others cannot and represent public goods.

In natural ecosystems, as a rule, multispecies or oligospecies plant successions develop, where different species of tree species are combined, and, as a rule, the seedlings are of different ages. As a result, mixed groupings of plants of different ages and various productivity are formed, which is difficult to estimate in a mathematical or economic model. From the point of view of primary assessment of the economic and carbon efficiency of the revegetation of antropogenically disturbed areas, it is better to use single-species or oligospecies groups of plants—close to each other in terms of ecology boreal plant species, as they are characterized by a comparable influence on the soil (formation of soil biodiversity, regulation of water regime, and content of nutrition elements). Although the introduction of woody plants from southern regions to northern regions to increase the rate and efficiency of biomass growth is widely known in the world, we do not use this model. First, because the edaphic effect would not be typical for the boreal climatic zone and would not be comparable to that of boreal taiga woody plant species. Secondly, our study is limited to strictly humid cool boreal (taiga) forests in order to achieve comparability of results with each other and to comply with the principle of a single difference.

The goal of this analysis is to determine the economic efficiency of the carbon project using different tree species and their combinations as well as to rank the factors of effectiveness based on the NPV sensitivity analysis.

The monetary benefits of afforestation projects include the sale of carbon units in the case of the project being registered as a climate project and the sale of the wood produced at the end of the project. Carbon units, which are obtained during the project’s implementation, are sold upon certification of the project. The maximum amount of CO2 that can be removed from the atmosphere through reforestation depends on the species of the trees planted and the area of the land. For example, the annual carbon binding rate on 1 hectare of land with pine forest can reach 1–1.5 tons of CO2 per year, and with poplars, 5–7 tons of CO2 per year. A tree like Paulownia absorbs up to 30 tons of CO2 per year. Data on carbon sequestration volumes are collected on the Ecobase portal [39].

Wood sales provide additional income and ultimately increase the economic efficiency of the climate project. Depending on the tree species, the volume of the wood grown and its cost will differ.

Benefits that are difficult or impossible to quantify in monetary terms are public goods that are formed or improved as a result of the project’s implementation. An increase in biodiversity in the project area is a public good that can benefit local residents. The increase in plant, animal, and bird diversity not only has a positive impact on the region’s ecological parameters but also shapes favorable recreational conditions.

Another type of public good improved as a result of the project’s implementation is the growth of wild plants and mushrooms. Berries, medicinal plants, and mushrooms are valuable products for both local residents and regional markets. Certification of the designated area according to organic farming standards will allow wild plants and mushrooms to be marketed as organic, with a premium markup, including for export. For example, in Finland, the area of certified organic land used for wild plant collection is 6.9 million hectares, and the country is a leader in the area of organic wild plants (mainly berries) [40]. In Finland, 95% of certified organic land is occupied by wild plants and covers about 20% of the country’s total area [41]. These public goods are not included in the economic efficiency evaluation of the reforestation project, but when presenting the project to regional authorities, the presence of such external effects may play a significant role.

To assess the economic efficiency, costs for seedling planting, the monetary evaluation of carbon credits, and the price of wood sold at the end of the project were modeled. The costs of seedling planting include the cost of seedlings as well as transportation and planting. The costs are distributed over time, as tree planting is carried out with an annual lag of 5 years to create a multilevel forest.

To determine the amount of absorbed carbon from different tree species, data from the Ecobase portal were used. This portal provides a carbon calculator that allows the economic effect of a reforestation carbon project to be calculated for an area of any size in various EU countries. For this study, the authors gathered data on the number of carbon credits generated by reforestation with different tree species. Among EU countries, Estonia was chosen as the most geographically and soil-wise similar country. The ecosystems of the Leningrad Region and Estonia belong to the Baltic region, represented by boreal taiga forest that is comparable to each other for both regions [42]. The same could be stated for soil cover and landforms of both regions [43]. Climatic and soil conditions of these regions are strongly affected by the influence of huge water reservoirs, which provide soft winters, a long period of biological activity, and high productivity of zonal benchmark ecosystems.

Cost–benefit analysis allows us to analyze the benefits and costs of afforestation of fallow land with alternative tree species. The value of benefits from planting different tree species for afforestation is expressed in terms of the ecological effects on the ecosystem. It is considered that all given variants of tree species have positive ecological efficiency, expressed in the improvement of qualitative indicators of the environment, such as biodiversity of the ecosystem, absorption of carbon dioxide, and increasing the level of oxygen in the atmosphere. In the present study, among the environmental effects that have been quantified, the sequestration potential of different tree species is highlighted. For the purpose of this study, the volume of carbon units released is considered as the benefit of planting alternative tree species for the afforestation of fallow land. The value of the cost of planting trees of different tree species, taking into account the cost of seedlings and planting costs, is used as the cost in implementing the cost–benefit analysis. A comparison of alternative options for afforestation with different species of trees is carried out on the basis of the carbon efficiency indicator, calculated by the ratio of the volume of released carbon units to the cost of planting costs of different species of trees.

The cost of birch and spruce seedlings, including transportation and planting costs, was determined based on data from the government procurement portal [44]. The lack of data on the cost of seedlings of other tree species was overcome by using indirect estimates. The market relation of the price of larch, pine, and black alder to the price of birch was used to determine the cost of these seedlings, taking into account planting and transport costs. Detailed calculations are presented in Appendix A.

The original data for the comparative analysis are presented in Table 2.

Table 2.

Original data for the comparative analysis of reforestation carbon projects.

To assess the carbon and economic efficiency of implementing the nature-based climate project for the afforestation of fallow lands, the following steps were undertaken:

- Defining the spatial and temporal scope of the study: The Leningrad Region was chosen as the study area, with a land plot size of 1 hectare. The project implementation horizon was set at 40 years. The location was Russia (RU), at 59°54′00.00′′ N and 31°36′00.00′′ E.

- Determining alternative tree planting scenarios: several tree species and combinations, as listed in Table 3, were selected for evaluation.

Table 3. Carbon efficiency of afforestation projects.

Table 3. Carbon efficiency of afforestation projects. - Comparative assessment of carbon efficiency: The amount of carbon units produced by each alternative tree planting scenario is divided by the discounted value of planting costs. As a result, the most carbon-efficient tree planting scenario is chosen.

- NPV sensitivity analysis of project factors: the impact of key economic parameters—such as discount rate, the price of carbon units, seedling costs (including planting), and wood value—on the net present value (NPV) of the project was evaluated.

To compare the alternatives listed in Table 3, the carbon efficiency indicator was calculated. This metric evaluates the total number of carbon credits generated over the project’s lifespan relative to the discounted costs of seedling planting. The resulting measure is expressed as the number of carbon units per RUR 1000 of investment.

Since the future price of carbon credits and wood cannot be precisely forecasted over the project’s lifecycle, the comparison primarily relied on quantitative measures. Carbon efficiency is calculated using the following Formula (2):

where:

- —carbon efficiency;

- —number of carbon units generated in period t

- —cost of seedlings planting

- —discount rate.

The number of carbon units generated in this project is collected on the Ecobase portal [39]. The cost of seedlings, including transportation and planting, was determined based on data from the government procurement portal [44]. The discount rate is calculated based on long-term bank loans by Russian SME [36], taking into account the risk premium of 3.5% and the forecasted inflation rate of 3%. To account for inflation in cash flows, we used the inflation rate forecast.

3.2. Study Area

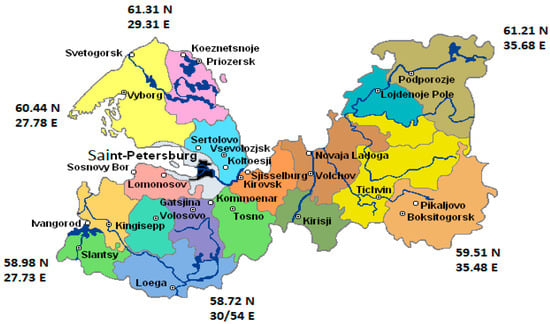

The project site is located in the western districts of the Leningrad Region (Kingisepp and Slantsy districts) (Figure 1). The north-west region of Russia primarily belongs to the southern taiga zone. Ecosystems in this zone are characterized by a high regenerative potential for soil and vegetation recovery. The region also exhibits a wide variety of soil types, exposed due to various processes, which may be of interest for carbon farming development [45]. Soil recovery occurs most rapidly through natural overgrowth of quarry dumps and fallow fields [46]. Consequently, evaluating the natural carbon sequestration mechanisms of the soils and vegetation is particularly efficient in this region.

Figure 1.

Location of the study area. Source: compiled by the authors.

4. Results

Table 3 presents the initial data for the analyzed projects as well as the carbon efficiency indicators. Different tree rotation periods necessitate aligning the project timelines for comparability. Projects involving pine trees extend the rotation period to 80 years. To obtain comparable data, project durations must be standardized. This can be achieved in two ways:

- By reducing the rotation period for pine trees from 80 years to 40 years, thereby standardizing all projects to a shorter duration.

- By extending the rotation periods of all tree species to 80 years, which would require replanting trees after 40 years.

Due to the lack of forecasted seedling costs 40 years into the future and the high risks of long-term projects, the first approach is more appropriate.

The analysis yields the following conclusions:

- Highest carbon efficiency: With a 40-year tree rotation period, the black alder project demonstrates the highest carbon efficiency, generating 10.79 carbon units per RUR 1000 of investment. This is attributed to the relatively low market cost of black alder seedlings compared to other tree species.

- Maximum carbon units: Over the 40-year project duration, birch afforestation generates the highest total number of carbon units—8089. However, its carbon efficiency is lower than that of black alder due to the higher cost of birch seedlings.

- Lowest carbon units: Pine afforestation yields the lowest total carbon units—3517—over the same period. Combining deciduous and coniferous species significantly reduces the number of carbon units due to the inclusion of coniferous trees.

The next stage of the study involves NPV sensitivity analysis to evaluate how changes in economic factors affect the project’s viability. To this end, the net present value (NPV) of the black alder afforestation project will be modeled under varying parameters as follows:

- Discount rate,

- Carbon credit price,

- Seedling cost (including planting),

- Wood price.

The NPV model is a deterministic model where all parameters are varied in a precise range. The NPV rate of change in the model indicates how the NPV changes by varying parameters.

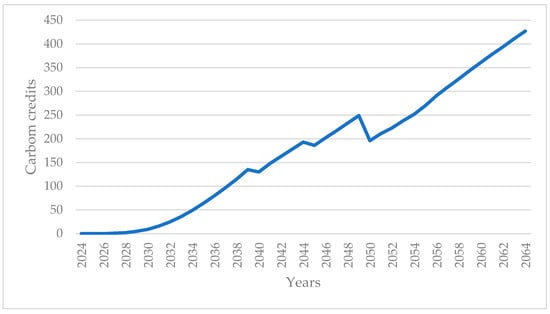

The baseline scenario assumes black alder afforestation with a 40-year rotation period and wood sale in the form of raw logs at the end of the project. The dynamics of carbon unit generation are illustrated in Figure 2.

Figure 2.

The number of carbon units issued during the implementation of the black alder afforestation project. Source: compiled by the authors.

The decrease in carbon sequestration observed in 2050 (Figure 2) is associated with nonhomogeneous biomass growth. Nonhomogeneous growth of carbon credits corresponds to the course of ecogenetic succession, in which there are stages of deceleration of biomass growth as well as a transition from biomass growth to some decrease [45].

The data on the dynamics of the number of carbon units issued, as well as the volume of wood grown and its current value, allow for the calculation of the discounted cash flows from the project implementation.

The initial data for calculating the net present value are presented in Table 4.

Table 4.

Technical and economic parameters of the hanging black alder planting project.

The carbon price data are collected from public sources on the transaction of purchase of carbon units on the platform of the electronic trading system of the over-the-counter market [47]. The discount rate for calculating cash flow accounts for the long term, as abovementioned, is 20.48%. The NPV (net present value) of the black alder afforestation project, based on the initial data, is RUR −644,335. We can conclude that the project’s effectiveness is negative in the present conditions. The reluctance of businesses to engage in carbon project implementation is attributable to this factor.

The NPV sensitivity analysis allows us to determine which parameter of this model has the most impact. Despite the fact that the NPV model does not take into account the risks of changes in the main parameters, such as the inflation rate, the cost of capital, and the price of carbon credit, sensitivity analysis will determine the dependence of the economic efficiency of the project on these parameters. As outlined by [48], sensitivity analysis occupies a pivotal role in the domain of model-based decision support. This is due to the fact that it effectively identifies the interdependencies among variables within a system or model. Graphical representation of the results of the sensitivity analysis in the form of a diagram allows us to show how the NPV value changes when the variables change [49]. Furthermore, it is important to note that graphical representations facilitate the estimation of the variable NPV’s value at which it will be zero; that is to say, they allow for the determination of the limits of economic efficiency of the project when the variable undergoes change. The standardized regression coefficient calculated for NPV dependence on variables measures the sensitivity of the result from a unit change in a variable.

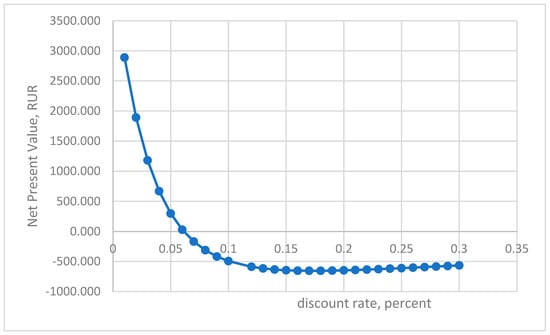

The first parameter we take into account is the discount rate. The discount rate is explained as the cost of capital used in the afforestation project. The sensitivity analysis of the project’s NPV to changes in the discount rate allows us to determine the range of discount rates under which the project could be profitable, assuming other conditions remain unchanged. For the sensitivity analysis, the base values were taken as follows:

- carbon unit price = RUR 1050

- cost of a seedling (including planting costs) = RUR 5600

- price of the wood to be sold = RUR 1200/m3

The discount rate varies from 0% to 30%. The visualization of the project’s net present value dependency on changes in the discount rate is shown in Figure 3.

Figure 3.

Sensitivity of the project to changes in the discount rate within the range of 1% to 30%. Source: calculated by the authors.

The internal rate of return (IRR) is approximately 8%. Therefore, it can be deduced that, in the event the discount rate is less than 8%, the net present value of the project becomes positive. The discount rate of 20.48% is too high for the realization of long-term projects. In conditions of geopolitical instability, this is due to the high key interest rate of the Bank of Russia. The achievement of the minimum discount rate is possible by using financing sources with a lower interest rate, including government subsidies, green bonds, etc. More stable economic conditions, accompanied by a low key rate, would improve project efficiency.

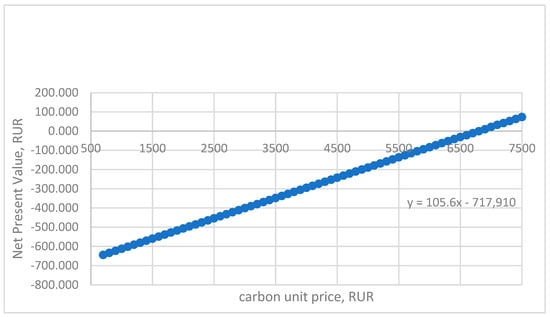

The second parameter of the sensitivity analysis is the cost of a carbon unit. Sensitivity analysis of the NPV of the project to changes in the cost of a carbon credit allows the determination of the range of carbon unit costs at which the project can have a positive NPV as well as the cost of a carbon unit at which the project has a zero NPV, i.e., zero efficiency. For the sensitivity analysis of the project’s efficiency, the following baseline values were used:

- discount rate of 20.48%,

- planting cost = RUR 5600

- price of the wood to be sold = RUR 1200/m3

The analysis covered the range of carbon unit costs from RUR 1050 to RUR 7500. The visualization of the dependency is presented in Figure 4. As shown, the project has a negative economic efficiency with the carbon unit price in this range. The NPV rate of change of 105.6 means that the increase in the carbon unit price leads to an increase in the NPV of RUR 105.6. The zero efficiency is achieved at a price of RUR 6798.

Figure 4.

Sensitivity of the NPV of the black alder afforestation project on the change in the one carbon unit price. Source: calculated by the authors.

The conducted sensitivity analysis allows us to assert that within the existing range of the carbon unit price, the afforestation project cannot become profitable. The project’s NPV becomes positive only when the cost of one carbon unit reaches above RUR 6798. The current carbon unit price in Russia on the platform of the electronic trading system of the over-the-counter market is variable and ranges from RUR 70 to 1050. Concurrently, the possibility of an escalating carbon price could result in an increased appeal of carbon projects. Consequently, a tightening of carbon policy in the context of carbon market development and the mitigation of climate challenges would result in an increased attractiveness of carbon projects for business.

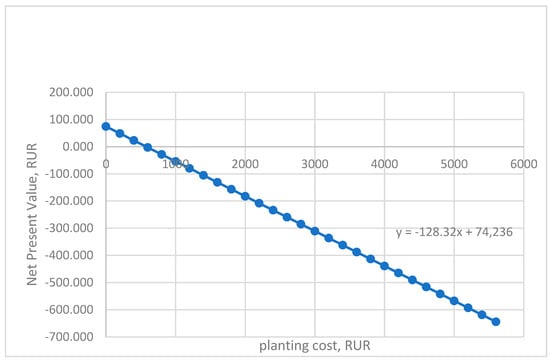

The third factor in the NPV model is the planting cost. The NPV sensitivity analysis of the project’s NPV to changes in planting cost allows the determination of the range of planting costs at which the project’s NPV becomes positive. For the sensitivity analysis of the project’s efficiency, the following baseline values were used:

- discount rate is 20.48%,

- carbon unit price is RUR 1050,

- marketable wood price of RUR 1200/m3.

The visualization of the project’s NPV dependency on planting cost changes is presented in Figure 5. As shown, the project has a negative economic efficiency with a planting cost of more than RUR 579. The NPV rate of change of 0,128.32 means that the increase in the planting cost leads to a decrease in the NPV of RUR 128.32. The zero efficiency is achieved at a planting cost of RUR 579. This amount constitutes 10% of the current planting costs, that is, RUR 5600.

Figure 5.

Sensitivity of the project’s NPV on the planting cost. Source: calculated by the authors.

It is important to note that the cash flows associated with the initial planting of trees are distributed over a five-year period. Consequently, the cash flow associated with this initiative exhibits a reduced dependency on the discount rate in comparison to cash flows derived from the realization of carbon units. The determination of the minimum value of planting costs per plant suggests that state subsidies for these costs could enhance the project’s efficiency.

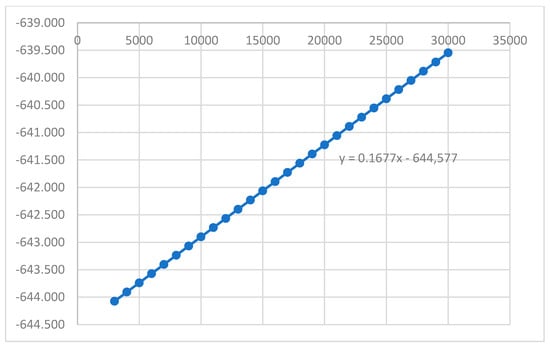

The sensitivity analysis of the project’s NPV from the price of wood, to be sold in the 42nd period, estimates the impact of revenue from the sale of 420 m3 of wood in the 41st year. For the sensitivity analysis of the project’s efficiency, the following baseline values were used:

- a discount rate of 20.48%,

- planting cost of RUR 5600,

- carbon unit price of RUR 1050.

The range of wood cost changes varies from RUR 1200 to RUR 100,000.

Figure 6 demonstrates that the project has a negative economic efficiency with the price of wood within the varying range. The NPV rate of change of 0.1677 means that the increase in the price of wood leads to an increase in the NPV of RUR 0.1677. The zero efficiency is achieved at a wood price of RUR 3,843,631/m3. Nevertheless, the present value of this price of wood, calculated by the discount rate of 20.48%, is RUR 1850/m3. Thus, we could argue that a more accurate estimate of the predicted price of wood in period 41 would allow for more accurate calculations.

Figure 6.

Sensitivity of the project’s NPV on the price of wood, to be sold in the 41st year of the project’s implementation. Source: calculated by the authors.

The analyzed sensitivity of the effectiveness of the alder reforestation project allows us to identify the degree of influence of the changing factors, which is assessed using the NPV rate of change of the corresponding dependencies.

Thus, the identified factors of the carbon project efficiency allow us to determine the following NPV rate of change:

- The impact of a carbon unit price is 105.6;

- The impact of planting cost is −128.32;

- The impact of wood cost is 0.1677.

In order to improve the economic efficiency of the alder reforestation project, an increase in the cost of a carbon unit has a greater influence than a decrease in planting cost and an increase in the price of wood produced at the end of the project’s term. According to our calculations, the minimum cost of one carbon unit should be RUR 6798. A more accurate estimate of the carbon unit price could improve the accuracy of the calculations. The present study results show the main trend of the dependence of the NPV on the carbon unit price.

The results of this study indicate that black alder afforestation demonstrates the highest carbon sequestration potential among the considered options in the Leningrad Region. This finding aligns with [50], which also highlights the significant carbon capture capabilities of alder species in boreal ecosystems. However, economic analysis shows that the financial viability of the project depends primarily on the price of carbon units; this conclusion is consistent with the research [51]. Forecasted estimates of prices for carbon units over a long-term time interval [52] give reason to believe that it is possible to achieve economic efficiency in the implementation of afforestation projects. In the short- and medium-term planning horizon, the cost of new public goods must be taken into account to justify the implementation of the project. This conclusion echoes [53], which emphasizes the importance of taking into account the nonmarket advantages of natural climate solutions.

5. Discussion

The utilization of equal certainty conditions for alterations in the discount rate, carbon unit price, planting costs, and wood price constitutes a methodological limitation of the NPV sensitivity model employed. To achieve a more precise sensitivity analysis, it is imperative to assess the statistical probability of occurrence of specific changes in the analyzed parameters. For instance, the statistical probability of an increase in the carbon unit price remains uncalculated. Consequently, the cash flows from the realization of carbon units cannot be accurately estimated at this time. This has become the most salient factor in the NPV sensitivity analysis.

The long-term nature of the carbon project necessitates a more precise forecast of changes in the discount rate over the span of 40 years as well as the potential for incorporating its volatility throughout the entire life cycle of the project.

The most significant constraint in evaluating economic and carbon efficiency is the utilization of secondary data concerning the magnitude of discharged carbon units. The reliance on secondary data for estimating greenhouse gas emissions, coupled with the limited development of models for quantifying carbon sequestration, results in the utilization of approximations, thereby compromising the analytical precision.

The potential risks associated with the occurrence of forest fires and other natural disasters must be considered through the application of the scenario method. This approach enables the prediction of the net present value (NPV) parameters, accounting for varying scenarios of the probability of certain adverse events transpiring. However, it is imperative to acknowledge that the occurrence of the aforementioned negative events will exert a deleterious effect not only on the number of carbon units but also on the volume of wood, which in turn will adversely impact the economic and carbon efficiency of the project.

The dependence of carbon sequestration on climatic dynamics needs further investigation. The potential for global warming to exert a positive influence on the biomass levels within the studied region is high.

The issue of utilizing fallow land represents an interdisciplinary task that requires considering not only ecological and carbon effects but also the economic feasibility of various options, taking into account the size of the public goods created. Alternative options should include using reclaimed soil for agricultural production in accordance with organic farming requirements or growing corn or alfalfa as feed crops. In this case, we are talking about carbon farming, aimed at maximizing the volume of carbon sequestration.

The analysis of alternative investment project options for developing fallow land is a complex multicriteria procedure, which must take into account the groups of stakeholders involved. Stakeholders include the local population, business structures, and the government. From the perspective of the identified stakeholders, the results of the project will differ [54]. For instance, the population is interested in the recreational functions of the area and access to the land for leisure or the gathering of wild plants, berries, and mushrooms.

Business structures are interested in the economic efficiency of the corresponding investment project. Moreover, for SME, the planning horizon is significantly shorter than for large businesses. Small and medium-sized enterprises are interested in short-term and medium-term effects [55]. The implementation of a forty-year reforestation project with the cutting of the obtained forest at the end of the project does not, from our point of view, interest private entrepreneurs. The implementation of carbon units should lead to an efficiency comparable to alternative capital investment methods. The profitability of alternative investments can be taken into account when calculating the discount rate.

The government, as a stakeholder in the implementation of carbon projects, must, on the one hand, evaluate all types of effects that arise, including the creation or improvement of public goods, and, on the other hand, form regulatory frameworks to stimulate the development of this sector. The conducted research showed that under current conditions, with the available data on costs and benefits, the reforestation project with black alder does not have economic efficiency. It is worth noting that the carbon efficiency of reforestation with this tree species is the highest among the analyzed options (birch, black alder, larch, birch/pine, birch/spruce, spruce, pine). Among the analyzed alternatives, for every thousand RUR invested in reforestation, a total of from 1.92 carbon units (when reforesting with pine) to 10.57 carbon units (when reforesting with black alder) will be obtained. A comparative assessment of the additional external effects from implementing the carbon project, as well as additional costs, including nonfinancial ones, will allow for a fuller assessment of the project’s efficiency [56].

The negative economic efficiency of carbon projects, along with the emergence of environmental and social externalities, determines the role of the government in implementing climate policy [57,58]. In order to reduce the discount rate, it is advisable to subsidize interest rates on bank loans as a source of funding. The elevated discount rate, which is predicated on the Bank of Russia’s elevated key rate in the 2024–2025 period, is substantiated by the considerable volatility of the Russian economy. It can be posited that in the future, the key rate will undergo a decline, which will result in a reduction in the cost of capital and an enhancement in the economic efficiency of carbon projects. The study posits the utilization of a long-term bank loan as a financial resource. Traditional funding models, such as direct government subsidies and corporate social responsibility initiatives, often prove insufficient to cover the long-term investment horizons and inherent risks associated with afforestation. Therefore, it is imperative to explore alternative financing models that can unlock private capital and incentivize sustainable land management practices.

Several alternative financing models have emerged in recent years, offering promising avenues for scaling up afforestation efforts. These include:

- Green bonds: Issuing bonds specifically earmarked for environmentally beneficial projects, including afforestation. Green bonds can attract institutional investors seeking to align their portfolios with sustainability goals. The European Investment Bank has been a prominent issuer of green bonds for forestry projects [59]. However, the eligibility criteria for green bonds can be stringent, requiring robust monitoring and reporting mechanisms [60].

- Blended finance: Combining public and philanthropic funding with private investment to reduce the risk profile of afforestation projects and attract commercial capital. Blended finance approaches can leverage the strengths of different actors and overcome market barriers [61]. However, structuring blended finance deals can be complex and time-consuming [62].

- Supply chain finance can play a critical role in supporting firms that depend on forestry biomass by providing low-cost financial incentives to promote sustainable forestry development. This approach leverages funding mechanisms tied to the product market and supply chain dynamics, ensuring both economic and environmental benefits. Collaboration among stakeholders (farmers, middlemen, enterprises) is essential for stabilizing supply and reducing costs. Securing long-term agreements with landowners or timber dealers is crucial for bioenergy firms to ensure a stable feedstock supply. These agreements also help mitigate risks associated with fluctuating spot markets. The approach can align supply chain sustainability with the need to develop nature-based climate solutions [63].

The selection of the most appropriate financing model depends on the specific context of the afforestation project, including the geographic location, project scale, regulatory framework, and investor preferences. In conditions of significant ecosystem effects, state cofinancing of climate projects is advisable [64]. Further research is needed to evaluate the effectiveness and scalability of different financing models in promoting sustainable afforestation practices and achieving both environmental and economic objectives.

The government, through forest activity regulation, can significantly reduce the risks associated with implementing carbon reforestation projects. Risks are primarily related to the preservation of trees. If forests are damaged or destroyed by people or natural forces, all accumulated carbon will be released. Carbon release also occurs when the forest soil is disturbed. Furthermore, when the forest reaches maturity, the carbon absorption capacity of the trees decreases, which necessitates reforestation work. The greatest danger comes from forest fires. According to Faostat data, in Russia, greenhouse gases are released from forest fires in an amount ranging from three to seven thousand tons of CO2 equivalent annually [65]. As a result of forest fires, carbon dioxide is released, the volume of which in some cases exceeds the amount of carbon sequestered. This issue is examined in more detail in the work of Nadporozhskaya and colleagues [66].

The sensitivity analysis allows us to identify areas of support for such reforestation projects. First of all, reducing the cost of capital will significantly increase the economic efficiency of the project. According to the forecasts of the Bank of Russia, the key rate is expected to decrease to a range of 7.5–8.5% for the period until 2027. This projection is outlined in the medium-term forecast of the Bank of Russia [67]. Moreover, the utilization of subsidized interest rates and the issuance of green bonds for the implementation of such projects can increase their attractiveness. The probability that the cost of capital will decrease in Russia is quite high, so we can talk about the future prospects for the development of afforestation projects.

Moreover, reducing the cost of planting trees through cofinancing with environmental NGOs, as well as public–private partnerships in forestry, will lead to lower capital costs and the spread of such projects across the country. The importance of reforestation on abandoned land is increasing not only because of the development of the carbon market but also because of the large amount of abandoned land resulting from mining.

Finally, the economic efficiency of carbon projects can be increased by expanding the access of national projects to international markets for carbon units. In this case, the price of carbon units could be higher than in the domestic market. Besides payment for ecosystem services (PES), establishing mechanisms to compensate landowners and communities for the ecosystem services provided by forests, such as carbon sequestration, water purification, and biodiversity conservation, can create direct economic incentives for sustainable forest management [68]. However, the valuation of ecosystem services can be challenging and the long-term sustainability of PES schemes depends on secure funding sources [69].

6. Conclusions

The carbon project for the afforestation of fallow lands is evaluated from the perspectives of carbon and economic efficiency. The concept of carbon efficiency allows for comparing the amount of carbon absorbed with the cost of afforestation. Different tree species vary in planting density, carbon absorption capacity, seedling costs, and the value obtained from wood at the end of the project’s duration. The ratio of the total absorbed carbon over the project’s entire duration to the discounted cost of seedlings, including planting costs, helped to identify the most carbon-efficient species, which include birch and black alder. Additionally, deciduous trees have significantly lower flammability, which is an additional factor contributing to carbon efficiency.

International experience in implementing afforestation projects with certification on voluntary carbon markets, summarized in the Forest Trends’ Ecosystem Marketplace report [70], allows for determining the range of carbon unit costs. In forestry and land-use projects, the cost of one carbon unit was USD 11.21 (Voluntary Carbon Market), with the cost increasing almost twofold from USD 5.78 to USD 11.21 between 2021 and 2023.

The presented analysis of carbon and economic efficiency requires further refinements. For example, the discount rate for an actual project should be adjusted based on the capital structure of the specific investor and funding source. Moreover, nonfinancial benefits and costs need to be considered. For medium and small businesses, participation in forest climate projects demonstrates a commitment to sustainability, improving the business’s image among customers, investors, and partners, but also comes with operational and administrative challenges. For MSBs, success in these initiatives often depends on leveraging external support from governments or NGOs while adopting robust strategies for sustainability.

Thus, it can be concluded that the methodology for assessing the economic efficiency of carbon vs., applied in this article, on the one hand, is widely accepted for evaluating investment projects, and, on the other hand, requires refinement due to the specific characteristics that distinguish such projects from ordinary investments, particularly due to the significant role of public goods resulting from these projects.

The present discussion concerns the potential risks of natural disasters, including forest fires and hurricanes. The occurrence of such events can lead to various adverse effects, including environmental disruption and the emission of bound carbon. Furthermore, there is a possibility of economic damage resulting from these occurrences. Moreover, forest fires pose a threat not only to the environment and economy but also to the lives, health, and well-being of the local population. Consequently, it is imperative to incorporate the assessment of these risks into investment analyses and to implement comprehensive mitigation strategies to enhance the probability of their avoidance.

In order to account for the inherent uncertainty in assessing the economic efficiency of carbon projects, further research is necessary. Presently, risks are addressed by adjusting the discount rate (risk premium of 3.5%). A more comprehensive evaluation of risk and its probability of materialization can be achieved by developing multiple scenarios for the implementation of the carbon project, namely the optimistic, most probable, and pessimistic scenarios. This approach enables not only the assessment of risk likelihood but also the development of effective adaptation strategies to mitigate potential adverse effects.

Author Contributions

Methodology, N.N. and M.V.; Validation, M.V.; Investigation, N.N. and M.V.; Data curation, E.A.; Writing—original draft, N.N. and E.A.; Writing—review & editing, E.A. All authors have read and agreed to the published version of the manuscript.

Funding

The research was conducted under the support of Saint-Petersburg University, project No 123042000071-8.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Acknowledgments

This work was supported by the project № 123042000071-8. “From carbon polygon to carbon regulation: potential and ways of development of sequestration carbon industry on the territory of the Leningrad Region and St. Petersburg”.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

| The Market Price of a Tree Species Seedling, RUR (1) | The Market Price of a Birch Seedling, RUR (2) | The Market Price Relation. (3) = (1)/(2) | The Birch Seedling Cost, Incl. Planting and Transport, RUR (4) | The Tree Species Seedling Cost, Incl. Planting and Transport, RUR (5) = (3) × (4) | |

|---|---|---|---|---|---|

| Birch | 6720 | 6720 | 1 | 7800 | 7800 |

| Spruce | 4766 | 6720 | 1.41 | 7800 | 11,000 |

| Pine | 6519 | 6720 | 0.97 | 7800 | 7600 |

| Larch | 3897 | 6720 | 0.58 | 7800 | 4500 |

| Black Alder | 4838 | 6720 | 0.72 | 7800 | 5600 |

References

- Forster, P.M.; Smith, C.; Walsh, T.; Lamb, W.F.; Lamboll, R.; Hall, B.; Hauser, M.; Ribes, A.; Rosen, D.; Gillett, N.P.; et al. Indicators of Global Climate Change 2023: Annual update of key indicators of the state of the climate system and human influence. Earth Syst. Sci. Data 2024, 16, 2625–2658. [Google Scholar] [CrossRef]

- OWD. Greenhouse Gas Emissions by Sector, World. Our World in Data. 2021. Available online: https://ourworldindata.org/grapher/ghg-emissions-by-sector (accessed on 15 January 2025).

- UNCC. COP28 UAE: The Highest Ambition. United Nation Climate Change. 2023. Available online: https://unfccc.int/cop28 (accessed on 15 January 2025).

- SEI; Climate Analytics; E3G; IISD; UNEP. The Production Gap: Phasing Down or Phasing Up? Top Fossil Fuel Producers Plan Even More Extraction Despite Climate Promises; International Institute for Sustainable Development and United Nations Environment Programme: Nairobi, Kenya, 2023. [Google Scholar] [CrossRef]

- Vetrova, M.; Pakhomova, N.; Richter, K.K. Strategies for the Development of Russian Energy in the Context of Climate Challenges and Geopolitical Instability. Bull. St. Petersburg Univ. Econ. 2023, 39, 439–469. [Google Scholar] [CrossRef]

- Brezgin, V.S.; Glazyrina, I.P. Carbon Balance of the Region and Climate Policy. ECO 2023, 11, 25–42. [Google Scholar] [CrossRef]

- The Government of the Russian Federation. Order No. 3052-r Dated October 29, 2021. Available online: http://government.ru/docs/43708/ (accessed on 7 March 2025).

- Registry Carbon Units. Registry Publications. 2025. Available online: https://carbonreg.ru/en/registry-infos/?tab=projects (accessed on 7 March 2025).

- Castelo, S.; Amado, M.; Ferreira, F. Challenges and Opportunities in the Use of Nature-Based Solutions for Urban Adaptation. Sustainability 2023, 15, 7243. [Google Scholar] [CrossRef]

- Martín, E.G.; Costa, M.M.; Egerer, S.; Schneider, U. Assessing the long-term effectiveness of Nature-Based Solutions under different climate change scenarios. Sci. Total Environ. 2020, 794, 148515. [Google Scholar] [CrossRef]

- Hou, D.; Bolan, N.S.; Tsang, D.C.W.; Kirkham, M.B.; O’Connor, D. Sustainable soil use and management: An interdisciplinary and systematic approach. Sci. Total Environ. 2020, 729, 138961. [Google Scholar] [CrossRef]

- Romanovskaya, A.A. Approaches to the Implementation of Ecosystem Climate Projects in Russia. News of the Russian Academy of Sciences. Geogr. Ser. 2023, 87, 463–478. [Google Scholar] [CrossRef]

- Nesterienko, N. International Experience in State Regulation of the Carbon Footprint of the Agro-Food System. Econ. Agric. Bus. 2022, 11, 88–103. [Google Scholar] [CrossRef]

- European Commission. Directorate General for Research and Innovation. Nature-Based Solutions: State of the Art in EU Funded Projects; Publications Office: Luxembourg, 2020. Available online: https://research-and-innovation.ec.europa.eu/knowledge-publications-tools-and-data/publications/all-publications/nature-based-solutions-state-art-eu-funded-projects_en (accessed on 15 January 2025).

- Vanino, S.; Baratella, V.; Pirelli, T.; Ferrari, D.; Di Fonzo, A.; Pucci, F.; Nikolaidis, N.P.; Lilli, M.A.; Doğan, Z.A.; Topdemir, T.; et al. Nature-Based Solutions for Optimizing the Water–Ecosystem–Food Nexus in Mediterranean Countries. Sustainability 2024, 16, 4064. [Google Scholar] [CrossRef]

- Coletta, V.R.; Pagano, A.; Pluchinotta, I.; Fratino, U.; Scrieciu, A.; Nanu, F.; Giordano, R. Causal Loop Diagrams for Supporting Nature-Based Solutions Participatory Design and Performance Assessment. J. Environ. Manag. 2021, 280, 111668. [Google Scholar] [CrossRef]

- Roe, S.; Streck, C.; Beach, R.; Busch, J.; Chapman, M.; Daioglou, V.; Deppermann, A.; Doelman, J.; Emmet-Booth, J.; Engelmann, J.; et al. Land-Based Measures to Mitigate Climate Change: Potential and Feasibility by Country. Glob. Change Biol. 2021, 27, 6025–6058. [Google Scholar] [CrossRef] [PubMed]

- FAO. Global Forest Resources Assessment 2020; Food and Agriculture Organization of the United Nations: Rome, Italy, 2020. [Google Scholar] [CrossRef]

- Böttcher, H.; Verkerk, H.; Gusti, M.; Havlik, P.; Schneider, U. Analysis of Potential and Costs of LULUCF Use by EU Member States. Final Report. IIASA, Laxenburg, May 2011. Available online: https://pure.iiasa.ac.at/id/eprint/9754/1/XO-11-055.pdf (accessed on 15 January 2025).

- Griscom, B.W.; Adams, J.; Ellis, P.W.; Houghton, R.A.; Miteva, D.A.; Schlesinger, W.H.; Shoch, D.; Siikamäki, J.V.; Smith, P.; Woodbury, P.; et al. Natural Climate Solutions. Proc. Natl. Acad. Sci. USA 2017, 114, 11645–11650. [Google Scholar] [CrossRef] [PubMed]

- Roe, S.; Streck, C.; Obersteiner, M.; Frank, S.; Griscom, B.; Drouet, L.; Fricko, O.; Gusti, M.; Harris, N.; Hasegawa, T.; et al. Contribution of the Land Sector to a 1.5 °C World. Nat. Clim. Change 2019, 9, 817–828. [Google Scholar] [CrossRef]

- Austin, K.G.; Baker, J.S.; Sohngen, B.L.; Wade, C.M.; Daigneault, A.; Ohrel, S.B.; Ragnauth, S.; Bean, A. The Economic Costs of Planting, Preserving, and Managing the World’s Forests to Mitigate Climate Change. Nat. Commun. 2020, 11, 5946. [Google Scholar] [CrossRef] [PubMed]

- Haya, B.K.; Evans, S.; Brown, L.; Bukoski, J.; Butsic, V.; Cabiyo, B.; Jacobson, R.; Kerr, A.; Potts, M.; Sanchez, D.L. Comprehensive Review of Carbon Quantification by Improved Forest Management Offset Protocols. For. Carbon Credit. A Nat.-Based Solut. Clim. Change 2023, 6, 958879. [Google Scholar] [CrossRef]

- The World Bank Group. State and Trends of Carbon Pricing Dashboard. 2024. Available online: https://carbonpricingdashboard.worldbank.org/ (accessed on 15 January 2025).

- Berkeley Carbon Trading Project. Voluntary Registry Offsets Database. 2024. Available online: https://gspp.berkeley.edu/research-and-impact/centers/cepp/projects/berkeley-carbon-trading-project/offsets-database (accessed on 15 January 2025).

- Herbert, C.; Haya, B.; Stephens, S.L.; Butsic, V. Managing Nature-Based Solutions in Fire-Prone Ecosystems: Competing Management Objectives in California Forests Evaluated at a Landscape Scale. For. Carbon Credit. A Nat.-Based Solut. Clim. Change 2022, 5, 957189. [Google Scholar] [CrossRef]

- Registry Carbon Units. Climate Project Registration. 2024. Available online: https://carbonreg.ru/en/ (accessed on 15 January 2025).

- Phan, D.T.H.; Brouwer, R.; Davidson, M.D. A Global Survey and Review of the Determinants of Transaction Costs of Forestry Carbon Projects. Ecol. Econ. 2017, 133, 1–10. [Google Scholar] [CrossRef]

- Veerkamp, C.; Ramieri, E.; Romanovska, L.; Zandersen, M.; Förster, J.; Rogger, M.; Martinsen, L. Assessment Frameworks of Nature-Based Solutions for Climate Change Adaptation and Disaster Risk Reduction. 2021. Available online: https://www.eionet.europa.eu/etcs/etc-cca/products/etc-cca-reports/tp_3-2021 (accessed on 21 April 2025).

- Atkinson, G.; Mourato, S. Cost-Benefit Analysis and the Environment; OECD Environment Working Papers, 97; OECD Publishing: Paris, France, 2015. [Google Scholar] [CrossRef]

- Nazarenko, A.E.; Krasnoyarova, B.A. Cost Valuation of Ecosystem Services for Carbon Deposition by the Ecosystems of the Altai Territory as Part of the Transition to Sustainable Development; Institute of Water and Environmental Problems of the Siberian Branch of the Russian Academy of Sciences, Russian Federation, Barnaul—Geopolitics and Ecogeodynamics of Regions: Barnaul, Russia, 2018; Volume 4, pp. 89–99. [Google Scholar]

- Pomogaev, V. Carbon Market and Climate Projects: Perspectives and Opportunities for the Altai Territory; Federal State Budgetary Educational Institution of Higher Education Omsk State Agrarian University: Omsk, Russia, 2022. [Google Scholar]

- Sunström, E.; Hånell, B. Afforestation of low-productivity peatlands in Sweden—the potential of natural seeding. New For. 1999, 18, 113–129. [Google Scholar] [CrossRef]

- Halldórsson, G.; Benedikz, T.; Eggertsson, Ó.; Oddsdóttir, E.S.; Óskarsson, H. The impact of the green spruce aphid Elatobium abietinum (Walker) on long-term growth of Sitka spruce in Iceland. For. Ecol. Manag. 2003, 181, 281–287. [Google Scholar] [CrossRef]

- España, F.; Arriagada, R.; Melo, O.; Foster, W. Forest plantation subsidies: Impact evaluation of the Chilean case. For. Policy Econ. 2022, 137, 102696. [Google Scholar] [CrossRef]

- The Central Bank of the Russian Federation. Interest Rates on Credit and Deposit Operations of Credit Institutions in Rubles. 2025. Available online: https://www.cbr.ru/statistics/bank_sector/int_rat/1224/ (accessed on 7 March 2025).

- Vetrova, M.A.; Pakhomova, N.V.; Lvova, N.A.; Lemeshko, N.A. Climate projects of Russian business: Methodology of justification and framework conditions for successful implementation. Vestn. St. Petersburg Univ. Econ. 2025, 41, 65–91. [Google Scholar]

- Ministry of Economic Development of the Russian Federation. Forecasts of Socio-Economic Development. 2024. Available online: https://economy.gov.ru/material/directions/makroec/prognozy_socialno_ekonomicheskogo_razvitiya/ (accessed on 7 March 2025).

- Ecobase. Carbon Calculator. Ecobase Portal. 2024. Available online: https://www.ecobase.earth/ (accessed on 15 January 2025).

- Willer, H.; Trávníček, J.; Schlatter, B. The World of Organic Agriculture. Statistics and Emerging Trends 2024. Research Institute of Organic Agriculture FiBL, Frick, and IFOAM—Organics International, Bonn. 2024. Available online: https://www.fibl.org/en/shop-en/1747-organic-world-2024 (accessed on 15 January 2025).

- The World Bank Group. Forest area (% of land area)—Finland. Food and Agriculture Organization. 2020. Available online: https://data.worldbank.org/indicator/AG.LND.FRST.ZS?view=chart&locations=FI (accessed on 15 January 2025).

- Volkova, E.A.; Galanina, O.V.; Makarova, M.A.; Khramtsov, V.N. Sketch of the vegetation of the Luga Bay area of the Leningrad Region. Bot. J. 1999, 84, 21–38. [Google Scholar]

- Abakumov, E. Rendzinas of the Russian Northwest: Diversity, Genesis, and Ecosystem Functions: A Review. Geosciences 2023, 13, 216. [Google Scholar] [CrossRef]

- EIS. The Cost of Seedlings. Unified Information System in the Field of Procurement. 2024. Available online: https://zakupki.gov.ru/epz/main/public/home.html (accessed on 15 January 2025).

- Abakumov, E.V.; Cajthaml, T.; Brus, J.; Frouz, J. Humus accumulation, humification, and humic acid composition in soils of two post-mining chronosequences after coal mining. J. Soils Sediments 2013, 13, 491–500. [Google Scholar] [CrossRef]

- Polyakov, V.; Abakumov, E. Estimation of Carbon Stocks and Carbon Sequestration Rates in Abandoned Agricultural Soils of Northwest Russia. Atmosphere 2023, 14, 1370. [Google Scholar] [CrossRef]

- SIBUR. SIBUR’s Carbon Unit Deal Has Set a New Price Benchmark in the Market. 2024. Available online: https://www.sibur.ru/ru/press-center/news-and-press/sdelka-sibura-po-prodazhe-uglerodnykh-edinits-ustanovila-novyy-tsenovoy-benchmark-na-rynke/ (accessed on 7 March 2025).

- Borgonovo, E.; Plischke, E. Sensitivity analysis: A review of recent advances. Eur. J. Oper. Res. 2016, 248, 869–887. [Google Scholar] [CrossRef]

- Anas, A.V.; Amalia, R.; Qaidahiyani, N.F.; Herin, S.R.D. Sensitivity Analysis of Net Present Value due to Optimal Pit Limit in PT Ceria Nugraha Indotama, Kolaka Regency, Southeast Sulawesi Province. IOP Conf. Ser. Mater. Sci. Eng. 2020, 875, 012050. [Google Scholar] [CrossRef]

- Seely, B.; Welham, C.; Kimmins, H. Carbon sequestration in a boreal forest ecosystem: Results from the ecosystem simulation model, FORECAST. For. Ecol. Manag. 2002, 169, 123–135. [Google Scholar] [CrossRef]

- Manley, B. Afforestation Economic Modelling—Impact of Carbon Price on Forest Management; Prepared for Ministry for Primary Industries: Wellington, New Zealand, 2022. Available online: https://www.mpi.govt.nz/dmsdocument/53641-Afforestation-Economic-Modelling-Impact-of-carbon-price-on-forest-management (accessed on 7 March 2025).

- Artemenkov, A.; Medvedeva, O.E.; Pavlov, A.N.; Ganiev, O. The Issues of Carbon Pricing in the Russian Federation: The Local and International Perspectives Under the Cost Approach and the Role of Afforestation Projects. Sustainability 2025, 17, 1088. [Google Scholar] [CrossRef]

- Ralph, C.; Fullenkamp, C.; Berzaghi, F.; Español-Jiménez, S.; Marcondes, M.; Palazzo, J. On Valuing Nature-Based Solutions to Climate Change: A Framework with Application to Elephants and Whales. Econ. Res. Initiat. Duke 2020, 297. [Google Scholar] [CrossRef]

- Food and Agriculture Organization of The United Nations. Forestry for a Low-Carbon Future. 2016. Available online: https://openknowledge.fao.org/server/api/core/bitstreams/7d061b3d-e791-48eb-9f77-1bfd1fa6e679/content (accessed on 15 January 2025).

- United Nations Publications. Promoting International Investment by Small and Medium-sized Enterprises. Available online: https://unctad.org/system/files/official-document/diae2023d7_en.pdf (accessed on 15 January 2025).

- Trinks, A.; Machiel Mulder, M.; Bert Scholtens, B. External carbon costs and internal carbon pricing. Renew. Sustain. Energy Rev. 2022, 168, 112780. [Google Scholar] [CrossRef]

- Stern, N. Towards a carbon neutral economy: How government should respond to market failures and market absence. J. Gov. Econ. 2022, 6, 100036. [Google Scholar] [CrossRef]

- Boycko, M.A.; Vishny, R. A Theory of Privatisation. Econ. J. 1996, 106, 309–319. [Google Scholar] [CrossRef]

- EIB. Forest Financing Opportunities from the European Investment Bank. 2023. Available online: https://eu-cap-network.ec.europa.eu/news/forest-financing-opportunities-european-investment-bank_en (accessed on 7 March 2025).

- CBI. Green Bonds & Forestry. 2018. Available online: https://www.climatebonds.net/files/files/standards/Forestry/Forestry%20Summary%20Slides%20for%20Press%20Release%2014Nov.pdf (accessed on 7 March 2025).

- OECD. Blended Finance for Sustainable Development. 2020. Available online: https://www.deval.org/fileadmin/Redaktion/PDF/05-Publikationen/Discussion_Paper/2020_03_EvidenceGapMap_BlendedFInance/DEval_Discussion_Paper_3_2020_Evidence_Gap_Map_of_Blended_Finance.pdf (accessed on 7 March 2025).

- UN Environment. Structuring Blended Finance for Climate. 2019. Available online: https://www.ngfs.net/system/files/import/ngfs/medias/documents/scaling-up-blended-finance-for-climate-mitigation-and-adaptation-in-emdes.pdf (accessed on 7 March 2025).

- FSC. Supply Chain Finance and Sustainable Forestry. 2022. Available online: https://fsc.org/sites/default/files/2023-09/FSC%20Annual%20Report%202022%20-%20English.pdf (accessed on 7 March 2025).

- Borghi, J.; Cuevas, S.; Anton, B.; Iaia, D.; Gasparri, G.; Hanson, M.; Soucat, A.; Bustreo, F.; Langlois, E. Climate and health: A path to strategic co-financing? Health Policy Plan. 2024, 39, 4–18. [Google Scholar] [CrossRef] [PubMed]

- FAOSTAT. Emissions totals. The State of Food Security and Nutrition in the World. 2022. Available online: https://www.fao.org/publications/home/fao-flagship-publications/the-state-of-food-security-and-nutrition-in-the-world/2022 (accessed on 15 January 2025).

- Nadporozhskaya, M.A.; Chertov, O.G.; Bykhovets, S.S.; Shaw, C.H.; Maksimova, E.Y.; Abakumov, E.V. Recurring surface fires cause soil degradation of forest land: A simulation experiment with the EFIMOD model. Land Degrad Dev. 2018, 29, 2222–2232. [Google Scholar] [CrossRef]

- The Central Bank of the Russian Federation. The Bank of Russia’s Medium-Term Forecast. 2025. Available online: https://www.cbr.ru/Content/Document/File/172536/forecast_250214.pdf (accessed on 7 March 2025).

- Wunder, S. PES: A Review of Achievements and Remaining Challenges. Ecol. Econ. 2015, 117, 234–243. [Google Scholar] [CrossRef]