Shadows of Uncertainty: Unraveling the Impact of Economic Policy Uncertainty on Tourism-Driven Energy Consumption in Macau

Abstract

1. Introduction

2. Literature Review

2.1. Economic Policy Uncertainty and Its Macroeconomic Effects

2.2. Economic Policy Uncertainty and Energy Consumption

2.3. Uncertainty in Tourism-Dependent Economies

3. Methodology and Empirical Results

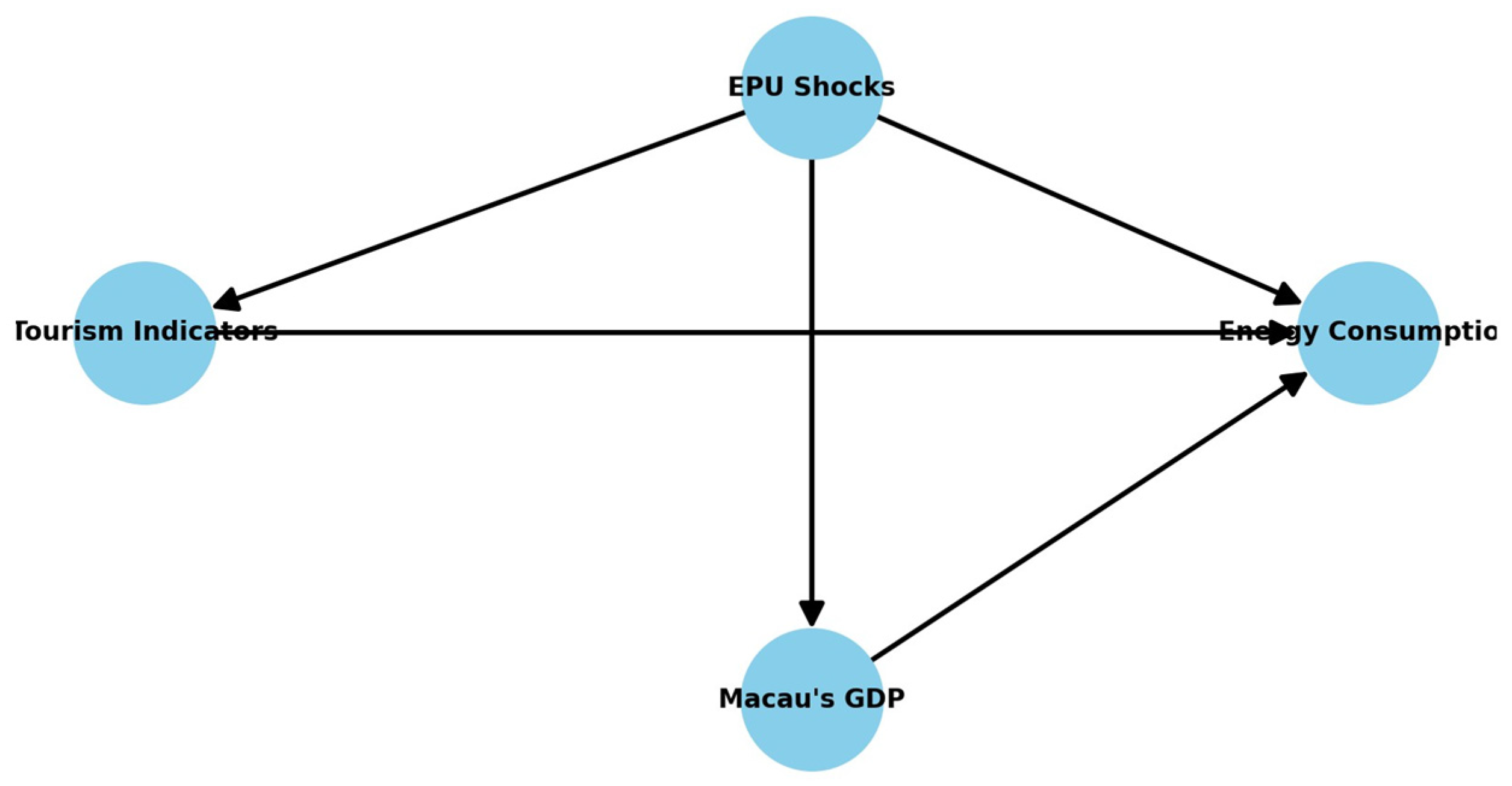

3.1. Methodology

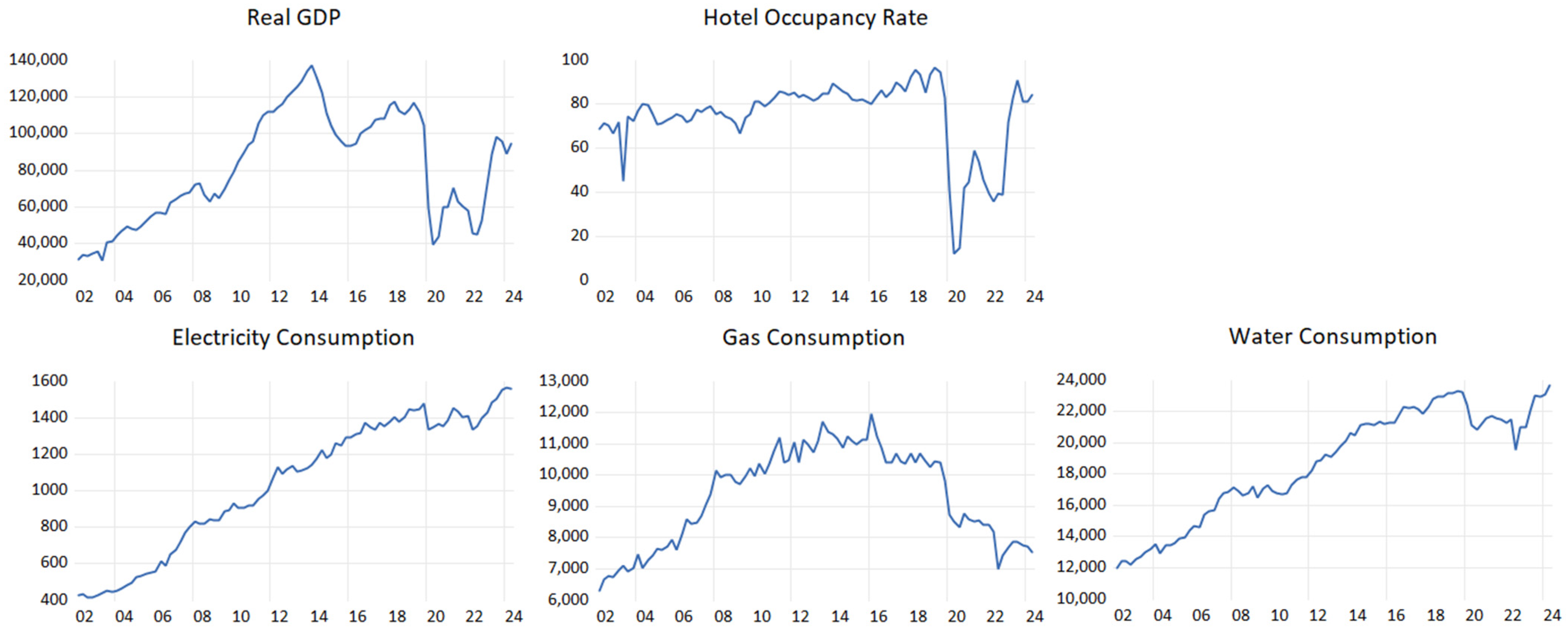

3.2. Data

3.3. Empirical Results

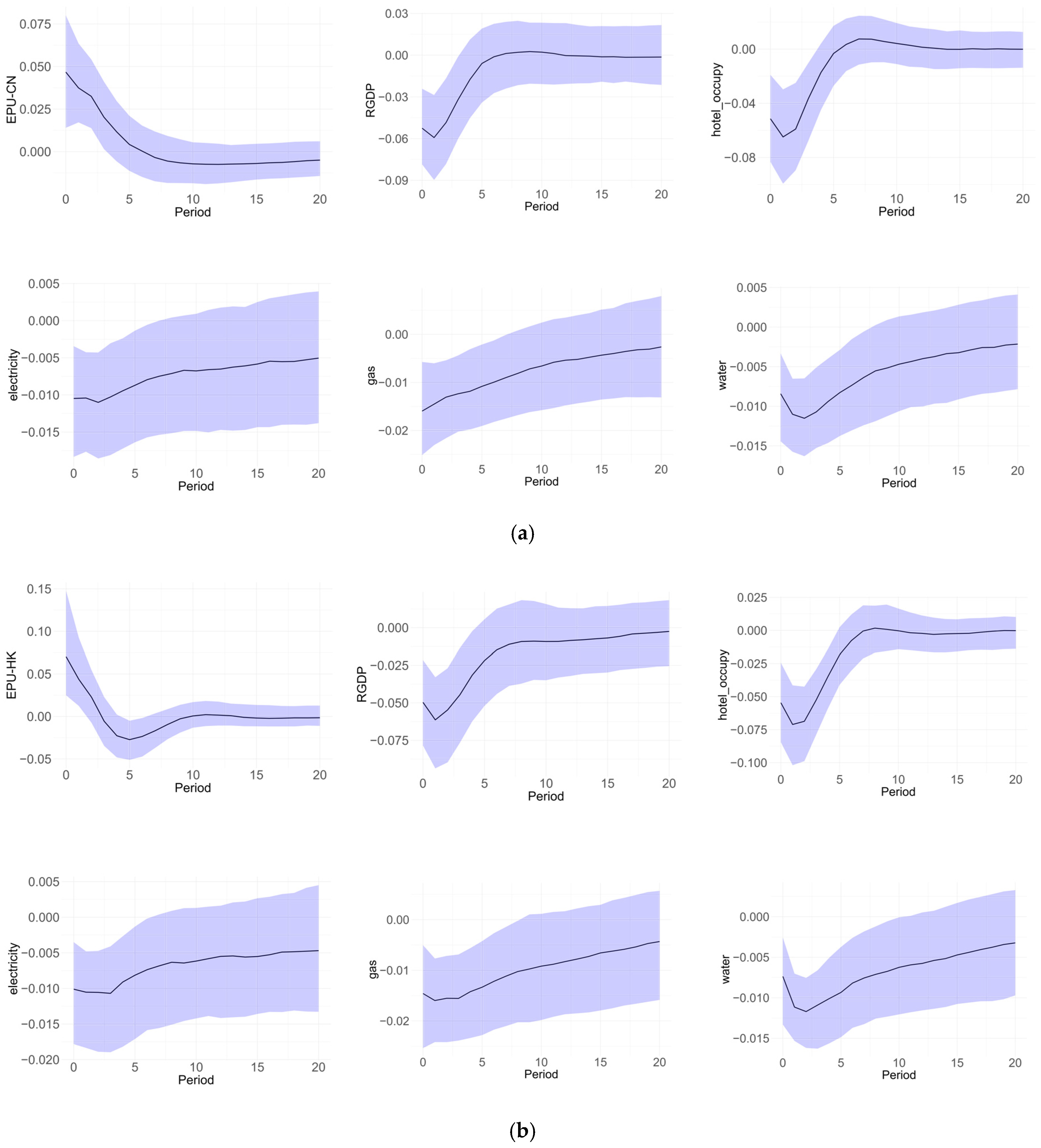

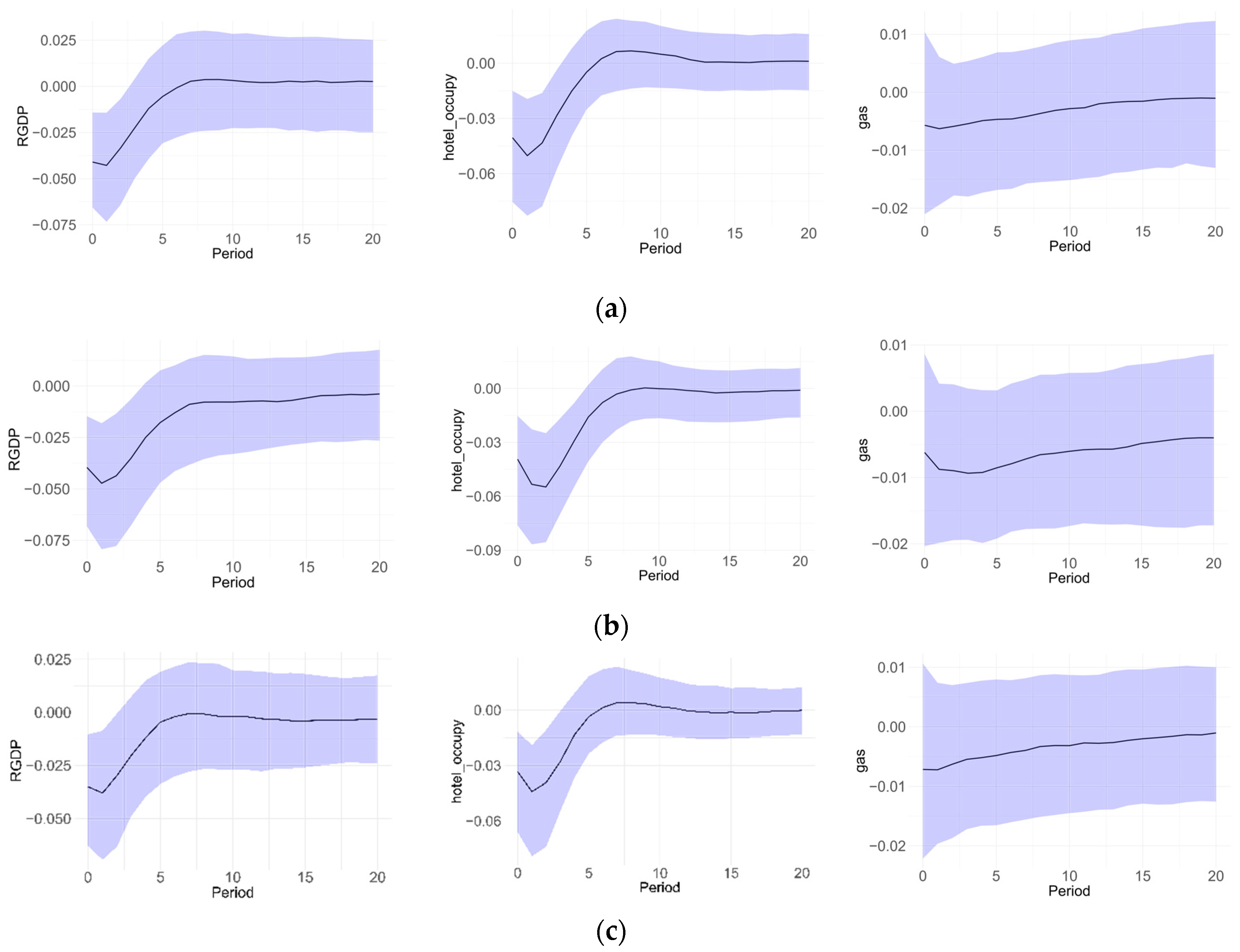

3.3.1. Baseline

3.3.2. Results with an “Agnostic” Approach

3.3.3. Persistent Uncertainty Shock

3.3.4. Robustness Check

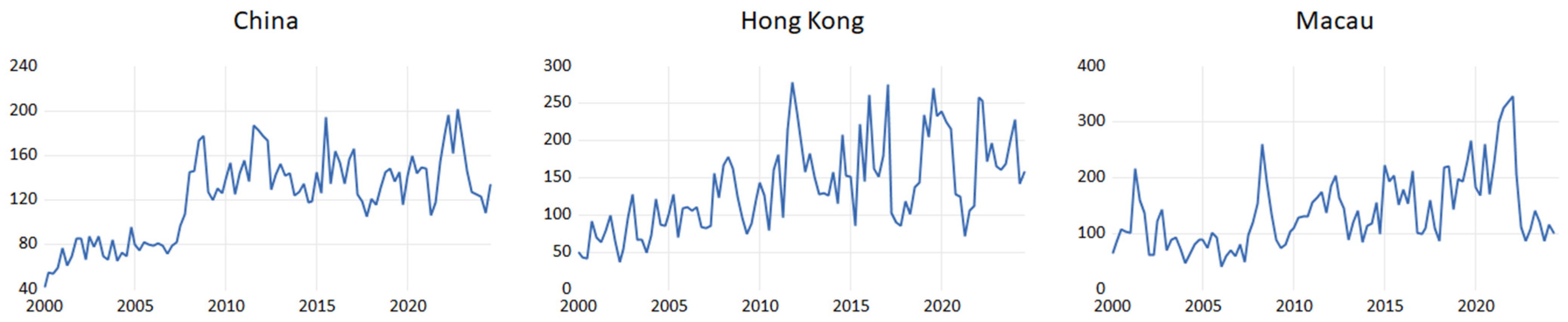

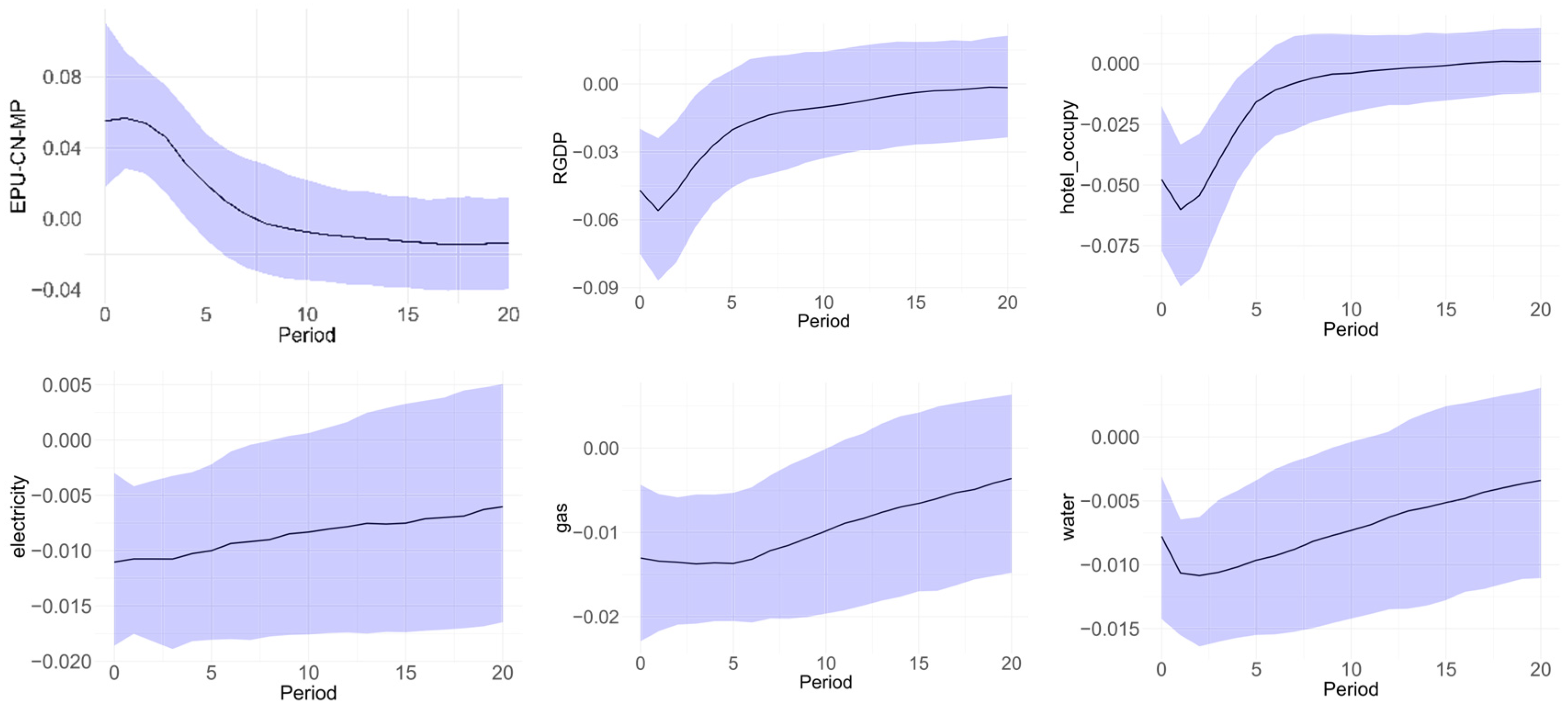

Alternative Uncertainty Measure

Uncertainty Shock Before the COVID-19 Pandemic

4. Discussion

4.1. Policy Implications for Tourism-Driven Small Open Economies

4.2. Policy Implications for Energy Consumption

4.3. Modeling Limitations

4.4. Expanding the Research Agenda

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. The Construction of Economic Policy Uncertainty (EPU) Indices

- (1)

- Counting: For each month and each newspaper , the number of articles containing relevant uncertainty-related terms is counted. This count is then scaled by the total number of articles in the same newspaper and month that meet specific criteria. The resulting value is referred to as the monthly scaled EPU count for each newspaper, denoted as .

- (2)

- Standardization: For each newspaper , the sample standard deviation of is calculated using data prior to December 2024. Each monthly scaled count for the newspaper is then standardized by dividing it by the computed standard deviation. This gives the standardized value for each newspaper and month, expressed as follows:

- (3)

- Aggregation: For each month , the standardized values across all newspapers are averaged. This provides the aggregated monthly EPU count for the period, represented as follows:

- (4)

- Normalization: The aggregated monthly index is then normalized to have a mean of 100 for the period from January 2002 to December 2024. This ensures consistency over time, and the resulting EPU index can then be converted into a quarterly index for further analysis, as used in the paper.

Appendix A.2. Alternative Economic Policy Uncertainty (EPU) Index in Mainland China

References

- Rosselló, J.; Becken, S.; Santana-Gallego, M. The Effects of Natural Disasters on International Tourism: A Global Analysis. Tour. Manag. 2020, 79, 104080. [Google Scholar] [CrossRef]

- Mertzanis, C.; Papastathopoulos, A. Epidemiological Susceptibility Risk and Tourist Flows around the World. Ann. Tour. Res. 2021, 86, 103095. [Google Scholar] [CrossRef]

- Fourie, J.; Rosselló-Nadal, J.; Santana-Gallego, M. Fatal Attraction: How Security Threats Hurt Tourism. J. Travel Res. 2019, 59, 209–219. [Google Scholar] [CrossRef]

- Khalid, U.; Okafor, L.E.; Shafiullah, M. The Effects of Economic and Financial Crises on International Tourist Flows: A Cross-Country Analysis. J. Travel Res. 2019, 59, 315–334. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Bloom, N. The Impact of Uncertainty Shocks. Econometrica 2009, 77, 623–685. [Google Scholar]

- Caldara, D.; Fuentes-Albero, C.; Gilchrist, S.; Zakrajšek, E. The Macroeconomic Impact of Financial and Uncertainty Shocks. Eur. Econ. Rev. 2016, 88, 185–207. [Google Scholar] [CrossRef]

- Jurado, K.; Ludvigson, S.C.; Ng, S. Measuring Uncertainty. Am. Econ. Rev. 2015, 105, 1177–1216. [Google Scholar] [CrossRef]

- Duro, J.A.; Osório, A.; Perez-Laborda, A. Modeling Uncertainty in Tourism Markets. Ann. Tour. Res. 2024, 107, 103795. [Google Scholar] [CrossRef]

- Hailemariam, A.; Ivanovski, K. The Effect of Economic Policy Uncertainty on Us Tourism Net Exports. Tour. Econ. 2021, 28, 2219–2227. [Google Scholar] [CrossRef]

- Kuok, R.U.K.; Koo, T.T.; Lim, C. Economic Policy Uncertainty and International Tourism Demand: A Global Vector Autoregressive Approach. J. Travel Res. 2022, 62, 540–562. [Google Scholar] [CrossRef]

- Adams, S.; Adedoyin, F.; Olaniran, E.; Bekun, F.V. Energy consumption, economic policy uncertainty and carbon emissions; causality evidence from resource rich economies. Econ. Anal. Policy 2020, 68, 179–190. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Zakari, A. Energy Consumption, Economic Expansion, and Co2 Emission in the Uk: The Role of Economic Policy Uncertainty. Sci. Total Environ. 2020, 738, 140014. [Google Scholar] [CrossRef]

- Wang, Q.; Xiao, K.; Lu, Z. Does Economic Policy Uncertainty Affect CO2 Emissions? Empirical Evidence from the United States. Sustainability 2020, 12, 9108. [Google Scholar] [CrossRef]

- Fry, R.; Pagan, A. Sign Restrictions in Structural Vector Autoregressions: A Critical Review. J. Econ. Lit. 2011, 49, 938–960. [Google Scholar] [CrossRef]

- Huang, Y.; Luk, P. Measuring Economic Policy Uncertainty in China. China Econ. Rev. 2020, 59, 101367. [Google Scholar] [CrossRef]

- Anzuini, A.; Rossi, L.; Tommasino, P. Fiscal Policy Uncertainty and the Business Cycle: Time Series Evidence from Italy. J. Macroecon. 2020, 65, 103238. [Google Scholar] [CrossRef]

- Adjei, A.N.K.; Tweneboah, G.; Junior, P.O. Interdependence of Economic Policy Uncertainty and Business Cycles in Selected Emerging Market Economies. J. Financ. Econ. Policy 2022, 14, 601–632. [Google Scholar] [CrossRef]

- Popp, A.; Zhang, F. A Note on International Spillovers of Economic Policy Uncertainty across Business Cycles: Evidence from Oecd Countries. Macroecon. Dyn. 2023, 28, 99–111. [Google Scholar] [CrossRef]

- Dejuan-Bitria, D.; Ghirelli, C. Economic Policy Uncertainty and Investment in Spain. SERIEs 2021, 12, 351–388. [Google Scholar] [CrossRef]

- Bernanke, B.S. Irreversibility, Uncertainty, and Cyclical Investment. Q. J. Econ. 1983, 98, 85–106. [Google Scholar] [CrossRef]

- McDonald, R.; Siegel, D. The Value of Waiting to Invest. Q. J. Econ. 1986, 101, 707–727. [Google Scholar] [CrossRef]

- Ingersoll, J.E., Jr.; Ross, S.A. Waiting to Invest: Investment and Uncertainty. J. Bus. 1992, 65, 1–29. [Google Scholar] [CrossRef]

- Meng, X.; Guo, H.; Li, J. Economic Policy Uncertainty and Corporate Investment: Evidence from China. Econ. Change Restruct. 2023, 56, 4491–4529. [Google Scholar] [CrossRef]

- Dreyer, C.; Schulz, O. Policy Uncertainty and Corporate Investment: Public Versus Private Firms. Rev. Manag. Sci. 2022, 17, 1863–1898. [Google Scholar] [CrossRef]

- Akron, S.; Demir, E.; Díez-Esteban, J.M.; García-Gómez, C.D. Economic Policy Uncertainty and Corporate Investment: Evidence from the U.S. Hospitality Industry. Tour. Manag. 2020, 77, 104019. [Google Scholar] [CrossRef]

- Wu, W.; Zhao, J. Economic Policy Uncertainty and Household Consumption: Evidence from Chinese Households. J. Asian Econ. 2022, 79, 101436. [Google Scholar] [CrossRef]

- Gu, Y.; Jiang, G.; Liang, X. The Transmission Mechanism Analysis of the Impact of Economic Policy Uncertainty on Household Consumption. Int. Stud. Econ. 2022, 17, 371–393. [Google Scholar] [CrossRef]

- Coibion, O.; Georgarakos, D.; Gorodnichenko, Y.; Kenny, G.; Weber, M. The Effect of Macroeconomic Uncertainty on Household Spending. Am. Econ. Rev. 2024, 114, 645–677. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Iyke, B.N.; Sharma, S.S.; Affandi, Y. Economic Policy Uncertainty and Financial Stability–Is There a Relation? Econ. Model. 2021, 94, 1018–1029. [Google Scholar] [CrossRef]

- Aman, A.; Anwar, S.; Khan, M.A.; Haddad, H.; Al-Ramahi, N.M.; Khan, M.A. Economic Policy Uncertainty and Financial System Efficiency. Heliyon 2024, 10, e31384. [Google Scholar] [CrossRef]

- Carballo, J.; Handley, K.; Limão, N. Economic and Policy Uncertainty: Aggregate Export Dynamics and the Value of Agreements. J. Int. Econ. 2022, 139, 1036601. [Google Scholar] [CrossRef]

- Yayi, C.L. Economic Policy Uncertainty and Trade: Does Export Sophistication Matter? Appl. Econ. 2023, 56, 169–185. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M.; Molligo, P.; Prestipino, A.; Raffo, A. The Economic Effects of Trade Policy Uncertainty. J. Monet. Econ. 2020, 109, 38–59. [Google Scholar] [CrossRef]

- Wang, C.-W.; Lee, C.-C.; Chen, M.-C. The Effects of Economic Policy Uncertainty and Country Governance on Banks’ Liquidity Creation: International Evidence. Pac. -Basin Financ. J. 2022, 71, 101708. [Google Scholar] [CrossRef]

- Ali, K.; Hongbing, H.; Liew, C.Y.; Jianguo, D. Governance Perspective and the Effect of Economic Policy Uncertainty on Financial Stability: Evidence from Developed and Developing Economies. Econ. Change Restruct. 2023, 56, 1971–2002. [Google Scholar] [CrossRef]

- Ma, H.; Hao, D. Economic Policy Uncertainty, Financial Development, and Financial Constraints: Evidence from China. Int. Rev. Econ. Financ. 2022, 79, 368–386. [Google Scholar] [CrossRef]

- Yang, J.Y. Policy Uncertainty and Substitution between External Financing and Internal Funds: International Evidence. Res. Int. Bus. Financ. 2023, 66, 102083. [Google Scholar] [CrossRef]

- Lu, J.; Lv, L.; Wang, Y.; Zhu, Y. The Real Effect of Monetary Policy under Uncertainty: Evidence from the Change in Corporate Financing Purposes. J. Bank. Financ. 2025, 172, 107381. [Google Scholar] [CrossRef]

- Wang, X.; Li, J.; Ren, X.; Bu, R.; Jawadi, F. Economic Policy Uncertainty and Dynamic Correlations in Energy Markets: Assessment and Solutions. Energy Econ. 2023, 117, 106475. [Google Scholar] [CrossRef]

- Liu, R.; He, L.; Liang, X.; Yang, X.; Xia, Y. Is There Any Difference in the Impact of Economic Policy Uncertainty on the Investment of Traditional and Renewable Energy Enterprises?—A Comparative Study Based on Regulatory Effects. J. Clean. Prod. 2020, 255, 120102. [Google Scholar] [CrossRef]

- Alberini, A.; Ščasný, M.; Czajkowski, M.; Bigano, A. Volatile Energy Markets, Consumers and Energy Price Expectations. Energy Econ. 2023, 126, 107039. [Google Scholar] [CrossRef]

- Klayme, T.; Gokmenoglu, K.K.; Rustamov, B. Economic Policy Uncertainty, Covid-19 and Corporate Investment: Evidence from the Gold Mining Industry. Resour. Policy 2023, 85, 103787. [Google Scholar] [CrossRef]

- Shafiullah, M.; Miah, M.D.; Alam, M.S.; Atif, M. Does Economic Policy Uncertainty Affect Renewable Energy Consumption? Renew. Energy 2021, 179, 1500–1521. [Google Scholar] [CrossRef]

- Jiao, Y.; Xiao, X.; Bao, X. Economic Policy Uncertainty, Geopolitical Risks, Energy Output and Ecological Footprint—Empirical Evidence from China. Energy Rep. 2022, 8, 324–334. [Google Scholar] [CrossRef]

- Zhang, M.; Abbasi, K.R.; Inuwa, N.; Sinisi, C.I.; Alvarado, R.; Ozturk, I. Does Economic Policy Uncertainty, Energy Transition and Ecological Innovation Affect Environmental Degradation in the United States? Econ. Res. -Ekon. Istraživanja 2023, 36, 2177698. [Google Scholar] [CrossRef]

- Jens, C.E.; Page, T.B. Uncertainty, Precautionary Saving, and Investment: Evidence from Prescheduled Election Cycles. Financ. Manag. 2024, 53, 431–470. [Google Scholar] [CrossRef]

- Benito, A. Does Job Insecurity Affect Household Consumption? Oxf. Econ. Pap. 2006, 58, 157–181. [Google Scholar] [CrossRef]

- Jiang, P.; Van Fan, Y.; Klemeš, J.J. Impacts of Covid-19 on Energy Demand and Consumption: Challenges, Lessons and Emerging Opportunities. Appl. Energy 2021, 285, 116441. [Google Scholar] [CrossRef]

- Gu, X.; Sheng, L.; Lei, C. Specialization or Diversification: A Theoretical Analysis for Tourist Cities. Cities 2022, 122, 103517. [Google Scholar] [CrossRef]

- Akdağ, S.; Kılıç, İ.; Gürlek, M.; Alola, A.A. Does Economic Policy Uncertainty Drive Outbound Tourism Expenditures in 20 Selected Destinations? Qual. Quant. 2022, 57, 4327–4337. [Google Scholar] [CrossRef] [PubMed]

- Demir, E.; Gozgor, G.; Paramati, S.R. To What Extend Economic Uncertainty Effects Tourism Investments? Evidence from Oecd and Non-Oecd Economies. Tour. Manag. Perspect. 2020, 36, 100758. [Google Scholar] [CrossRef]

- Shang, Y.; Yang, Q.; Pu, Y. Role of Foreign Direct Investment and Political Openness in Boosting the Eco-Tourism Sector for Achieving Sustainability. Humanit. Soc. Sci. Commun. 2024, 11, 72. [Google Scholar] [CrossRef]

- Luk, P.; Cheng, M.; Ng, P.; Wong, K. Economic Policy Uncertainty Spillovers in Small Open Economies: The Case of Hong Kong. Pac. Econ. Rev. 2020, 25, 21–46. [Google Scholar] [CrossRef]

- Luk, P. Economic Policy Uncertainty Index for Macao. Macao Monet. Res. Bull. 2019, 50, 75–88. [Google Scholar]

- Faust, J. The Robustness of Identified Var Conclusions About Money. Carnegie-Rochester Conf. Ser. Public Policy 1998, 49, 207–244. [Google Scholar] [CrossRef]

- Uhlig, H. What Are the Effects of Monetary Policy on Output? Results from an Agnostic Identification Procedure. J. Monet. Econ. 2005, 52, 381–419. [Google Scholar] [CrossRef]

- Canova, F.; De Nicoló, G. Monetary Disturbances Matter for Business Fluctuations in the G-7. J. Monet. Econ. 2002, 49, 1131–1159. [Google Scholar] [CrossRef]

- Sims, C.A.; Stock, J.H.; Watson, M.W. Inference in Linear Time Series Models with Some Unit Roots. Econometrica 1990, 58, 113–144. [Google Scholar] [CrossRef]

- Hailemariam, A.; Dzhumashev, R. The Impact of Pandemic-Induced Uncertainty Shock on Tourism Demand. Curr. Issues Tour. 2022, 26, 2575–2581. [Google Scholar] [CrossRef]

- Wang, Y.; Kong, D. Economic Policy Uncertainty and the Energy Stock Market: Evidence from China. Energy Res. Lett. 2022, 3, 28171. [Google Scholar] [CrossRef]

- Cai, K.; Sun, C.; Wang, H.; Song, Q.; Wang, C.; Wang, P. The Potential Challenge for the Effective Ghg Emissions Mitigation of Urban Energy Consumption: A Case Study of Macau. Environ. Impact Assess. Rev. 2022, 93, 106717. [Google Scholar] [CrossRef]

- Redl, C. Uncertainty Matters: Evidence from Close Elections. J. Int. Econ. 2020, 124, 103296. [Google Scholar] [CrossRef]

- Solarin, S.A.; Gil-Alana, L.A. The Persistence of Economic Policy Uncertainty: Evidence of Long Range Dependence. Phys. A: Stat. Mech. Its Appl. 2021, 568, 125698. [Google Scholar] [CrossRef]

- Albert, J.-F.; Gómez-Fernández, N. The Impact of Economic and Policy Uncertainty Shocks in Spain. J. Econ. Policy Reform 2020, 24, 270–291. [Google Scholar] [CrossRef]

- Redl, C. The Impact of Uncertainty Shocks in the United Kingdom. In Bank of England Staff Working Paper No. 695; Bank of England: London, UK, 2017. [Google Scholar]

- Davis, S.J.; Liu, D.; Sheng, X.S. Economic Policy Uncertainty in China since 1949: The View from Mainland Newspapers. Fourth Annu. IMF-Atlanta Fed Res. Workshop China’s Econ. Atlanta 2019, 19, 1–37. [Google Scholar]

- Rholes, R.; Petersen, L. Should Central Banks Communicate Uncertainty in Their Projections? J. Econ. Behav. Organ. 2021, 183, 320–341. [Google Scholar] [CrossRef]

- Wolf, C.K. What Can We Learn from Sign-Restricted Vars? AEA Pap. Proc. 2022, 112, 471–475. [Google Scholar] [CrossRef]

- Zhou, X.; Xing, S.; Xu, J.; Tian, J.; Niu, A.; Lin, C. Impacts of Climate Change Risk and Economic Policy Uncertainty on Carbon Prices: Configuration Analysis from a Complex System Perspective. J Environ. Manag. 2025, 373, 123622. [Google Scholar] [CrossRef]

- Azqueta-Gavaldón, A.; Hirschbühl, D.; Onorante, L.; Saiz, L. Sources of Economic Policy Uncertainty in the Euro Area. Eur. Econ. Rev. 2023, 152, 104373. [Google Scholar] [CrossRef]

| Model | Baseline Model | Agnostic Model |

|---|---|---|

| Variables | ||

| Uncertainty indices | + | + |

| Gross domestic product | − | − |

| Hotel occupancy rate | − | − |

| Energy consumption: Water | − | NA |

| Electricity | − | NA |

| Gas | − | NA |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, H.; Tian, M. Shadows of Uncertainty: Unraveling the Impact of Economic Policy Uncertainty on Tourism-Driven Energy Consumption in Macau. Sustainability 2025, 17, 3716. https://doi.org/10.3390/su17083716

Zhang H, Tian M. Shadows of Uncertainty: Unraveling the Impact of Economic Policy Uncertainty on Tourism-Driven Energy Consumption in Macau. Sustainability. 2025; 17(8):3716. https://doi.org/10.3390/su17083716

Chicago/Turabian StyleZhang, Hongru, and Maoshan Tian. 2025. "Shadows of Uncertainty: Unraveling the Impact of Economic Policy Uncertainty on Tourism-Driven Energy Consumption in Macau" Sustainability 17, no. 8: 3716. https://doi.org/10.3390/su17083716

APA StyleZhang, H., & Tian, M. (2025). Shadows of Uncertainty: Unraveling the Impact of Economic Policy Uncertainty on Tourism-Driven Energy Consumption in Macau. Sustainability, 17(8), 3716. https://doi.org/10.3390/su17083716