1. Introduction

The impact of climate change, one of the most challenging issues of the twenty-first century, has reached all socio-economic levels and poses a major threat to the stability of financial markets and the quality of human life. According to the Intergovernmental Panel on Climate Change’s (IPCC’s) most recent report, global temperatures could rise by 3.2 °C by the end of the century, even with extensive carbon reduction measures [

1]. The pace of industrialization has significantly enriched nations, but it has also contributed to a surge in greenhouse gas emissions. The implications of these emissions, such as rising sea levels and an increase in extreme weather events, as well as ecosystem imbalances, constitute a serious challenge to the global economy and the sustainable development of human communities [

2].

From a socioeconomic standpoint, addressing climate change has emerged as a major issue that nations everywhere must take immediate action to resolve. The market for clean energy is essential to this process because it propels the shift to a low-carbon, sustainable economy [

3]. Changes in global climate risk perceptions are profoundly reshaping the clean energy market landscape. The shift in public and policymaker perceptions of climate risk is a key driver of the clean energy market transformation. Take the bias theory in behavioral economics as an example [

4]. Research shows that individuals may have a variety of cognitive biases, such as representativeness bias or overconfidence when confronted with hazards. These biases typically have a direct impact on investors’ decision making in the clean energy market. Risk perception theory in environmental psychology further explains how individuals perceive climate risk and translate this perception into actual social behaviors, such as adjusting consumption patterns or supporting specific policy directions [

5]. These theories provide solid theoretical underpinnings for understanding how climate risk perceptions influence investment decisions in the clean energy market.

On the other hand, international agreements reflect a global consensus and the commitment of countries around the globe to address climate change. This has been the case since 1992, when the United Nations Framework Convention on Climate Change first established a framework for international cooperation to address global warming [

6]. The 1997 Kyoto Protocol legally bound participating countries to reduce greenhouse gas emissions. To achieve net-zero global emissions in the second half of the century [

7], the 2015 Paris Agreement aimed to reduce global temperatures to below 2 °C above pre-industrial levels by the year 2100 [

8]. In 2018, the implementation guidelines of the Paris Agreement were officially adopted, clarifying corresponding measures from supervision mechanisms, financial support, technological development, and support [

9]. These established international agreements provide a policy framework for this study, which aims to quantify the impact of climate risk perception on the clean energy market, particularly its spillover effects on asset pricing, and explore its potential implications for policymaking and investment strategies.

The existing literature has quantified climate risk perception and explored its relationship with financial markets, underscoring the importance of understanding the economic and financial impacts of climate change on investment decisions and policy formulation in the clean energy industry [

10,

11]. However, there is still a dearth of relevant studies focusing on clean energy markets, and the existing literature often fails to fully analyze the specific mechanisms of spillover dynamics between climate risk perceptions and market returns. As a result, this study investigates the contagion pathways through which shifts in perceptions of climate risk impact the volatility of the clean energy market. It also examines the distinct reactions of various clean energy markets to climate change and the consequences of this heterogeneous relationship for policies about clean energy investments. Our specific research questions include: How do changes in climate risk perceptions affect the contagion pathways of clean energy market volatility? Do different clean energy markets respond differently to climate change? And what does this heterogeneous relationship imply for policies related to clean energy investments?

The present study employs the R2 decomposition framework to capture the multidimensional nature of climate risk perceptions and their spillover effects on clean energy markets. By combining this approach with a spillover network model, we analyze the transmission paths between climate risk perceptions and market dynamics. Specifically, we examine how policy adjustments influence financial flows and market volatility in clean energy sectors across different periods. This methodological approach facilitates the analysis of the immediate and lagged effects of policy changes, thereby providing insights into market responses and the efficacy of interventions. Unlike traditional vector autoregression (VAR) models, R2 decomposition offers a more precise visualization of how climate risk perceptions drive market connectivity over time.

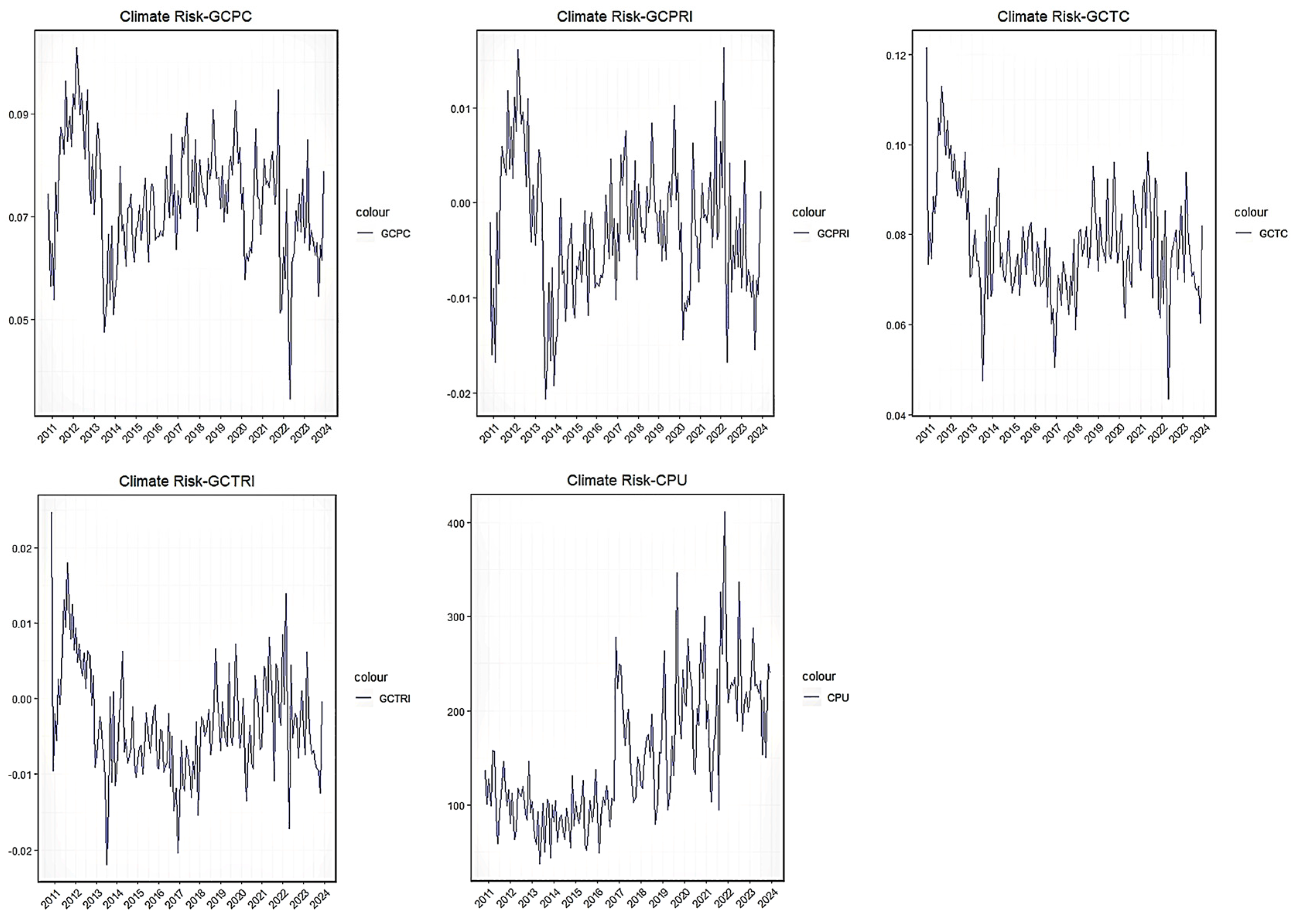

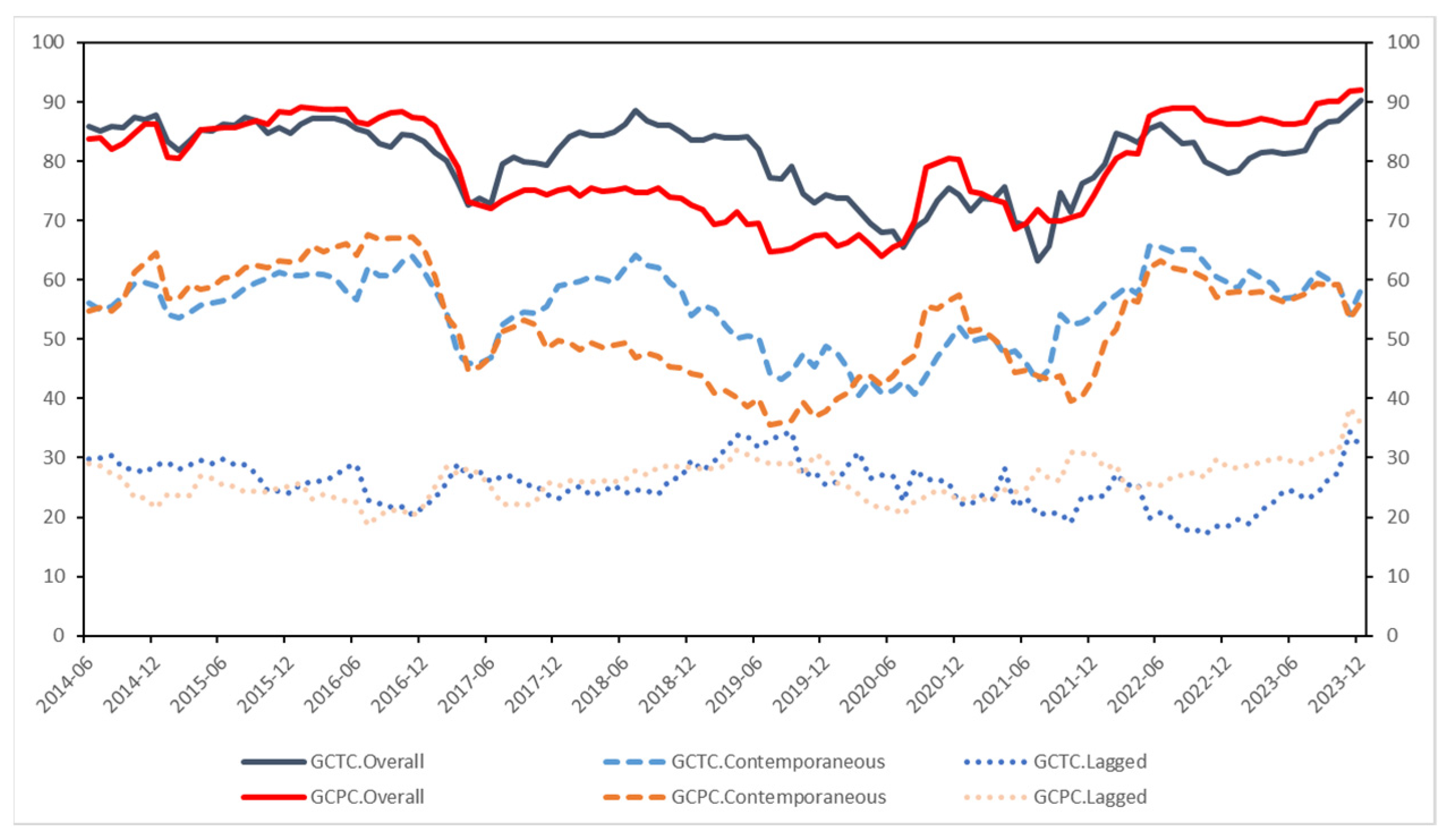

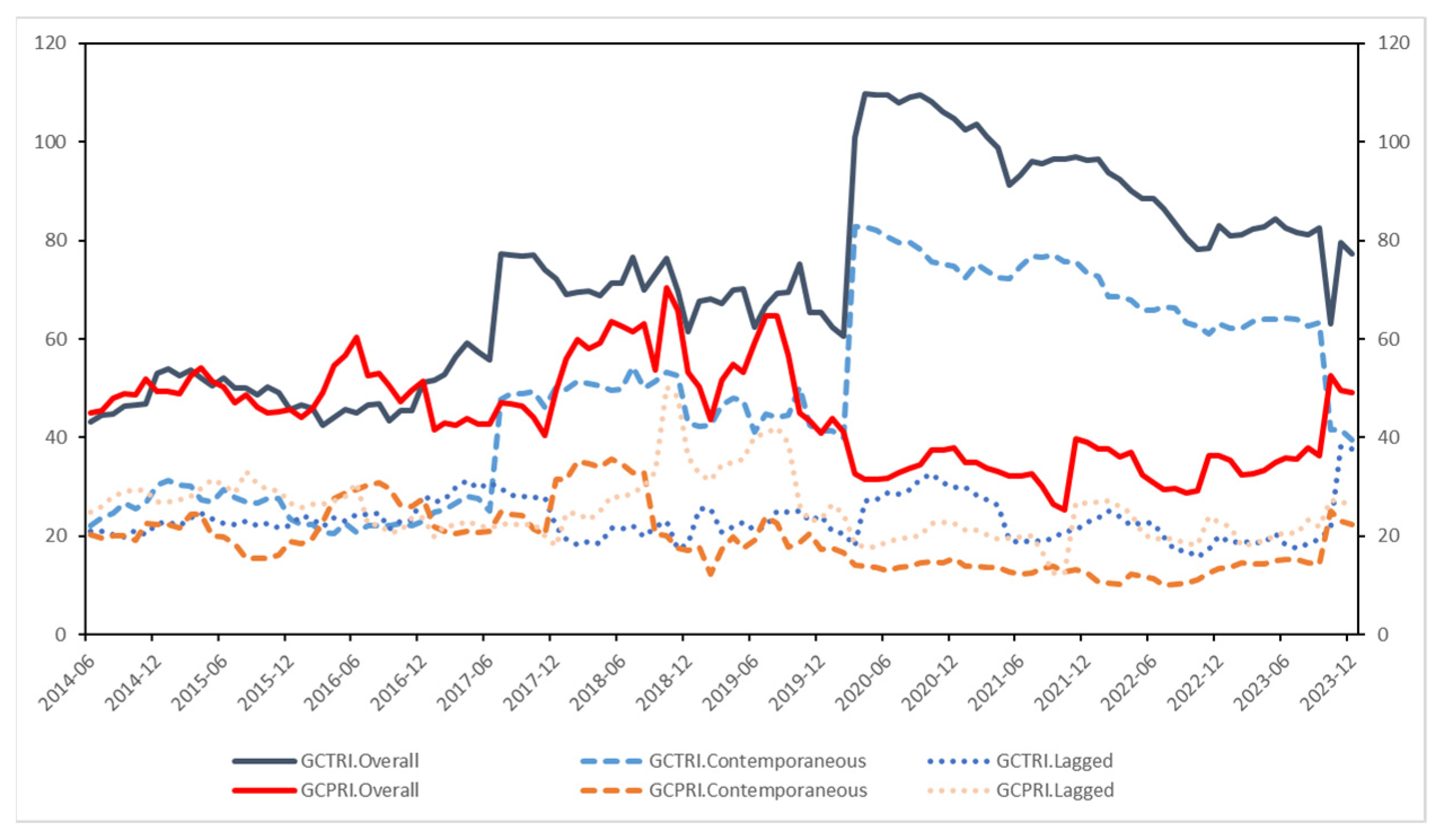

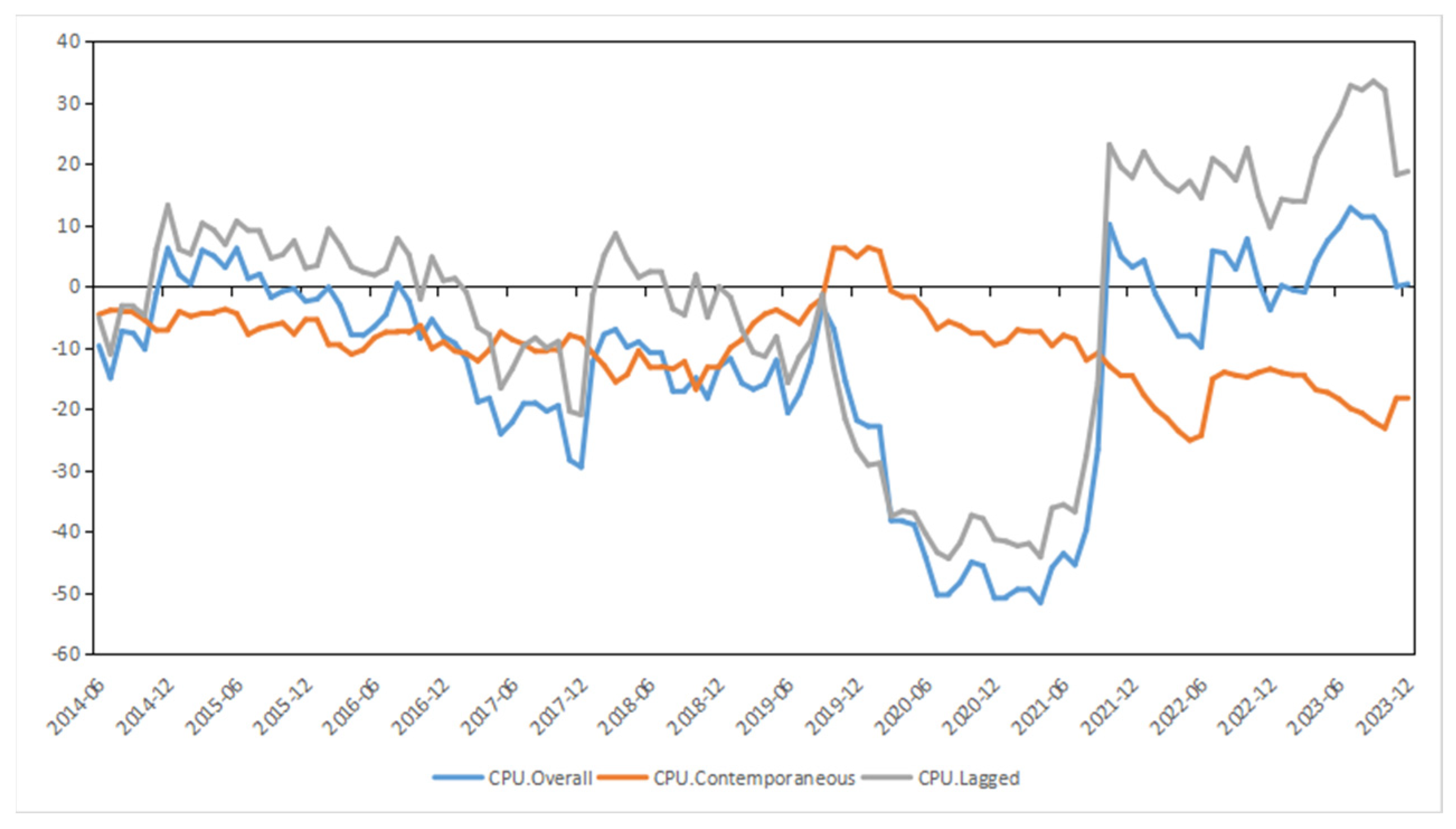

This study demonstrates the clean energy market’s susceptibility to abrupt climate change, suggesting that market dynamics are more responsive to the impacts of the present than the past. The Energy Management Index (EMI), Advanced Materials Index (AMI), and Developer Index (DOI), as primary transmitters of spillovers, and the Global Climate Physical Risk Index (GCPRI), Fuel cell Index (FCI), Climate Policy Uncertainty Index (CPU), and Global Climate Transition Risk Index (GCTRI), as primary recipients, highlight the asymmetry in the propagation of market shocks. The market’s dynamic reaction to the perception of climate risk highlights the substantial impact of geopolitical and economic events on market behavior and demonstrates the time-varying nature of spillover effects. Moreover, climate risk perception plays a key role in the risk spillover mechanism; in particular, the Global Climate Transition Concern Index (GCTC) and the Global Climate Physical Concern Index (GCPC) significantly influence the pathways through which market risks are transmitted.

This study makes the following novel contributions to the body of literature. First, it offers a methodical examination of the dynamic influence of perceived climate risk on the clean energy market, exposing the relative insensitivity of the market to past events and its sensitivity to current events. Second, methodologically, it employs the contemporaneous and lagged R2 decomposition connectivity method, an advanced analytical tool for uncovering significant spillover effects and highlighting the importance of considering climate risk in policy and investment decisions between climate risk perception indices and clean energy sub-sectors, thereby enhancing the precision of the research findings and overcoming the limitations of traditional index methods. Based on empirical analyses, these findings not only offer a fresh viewpoint on the complexities of climate risk perception in the financial sector but also provide policymakers and market regulators with useful references and insights. In conclusion, the findings of this study not only contribute to the body of knowledge in academia but also serve as a guide in the real world, especially with regard to creating effective risk management plans and promoting the sustainable expansion of the clean energy sector.

This article has the following structure.

Section 2 examines pertinent literature;

Section 3 introduces the research methodology;

Section 4 explains the creation of the data and index;

Section 5 presents the empirical findings; and

Section 6 summarizes the findings and suggestions of the study.

4. Methodology

We measure the impact of climate risk perceptions on clean energy markets using Balli’s R

2 decomposition connectivity analysis framework [

36]. This strategy is used because it expands on Diebold and Yilmaz’s fundamental technique by differentiating between contemporaneous and lagged spillovers, enabling a more sophisticated comprehension of market dynamics [

28]. A Vector Autoregression (VAR (

p)) model is used in this framework to determine the connection measures and clarify the connection between the goodness-of-fit indicator and the Generalized Forecast Error Variance Decomposition (GFEVD). Leveraging the insights from Koop, Pesaran and Shin, this approach facilitates a more nuanced interpretation of connectivity beyond the confines of model-based assumptions [

46,

47]. Finding the optimal lag length (

p) using information criteria such as the Bayesian Information Criterion (BIC) or the Akaike Information Criterion (AIC) ensures the parsimony and predictive accuracy of the VAR model. The goodness-of-fit of the model is evaluated and refined to improve the model’s explanatory power. The robustness of the model is rigorously tested using cross-validation techniques and by incorporating potential confounding variables to account for omitted variable bias.

This study uses the Vector Autoregression (VAR (

p)) model, with the number of lags set to

, due to the dynamic interaction between climate risk perception and the clean energy market, which may involve the interdependence of various time series variables. An analysis of the dynamic interaction between renewable energy markets and climate risk perceptions is made possible when using this approach. We are able to analyze the direction and strength of interactions in depth without imposing structural constraints, thus identifying the specific impacts of policy changes on market connectivity and financial flows, and providing an empirical basis for policymakers:

In this model, , , and represent a dimensional vector of demeaned variables at time . The matrices and are dimensional, with the diagonal elements of constrained to zero, ensuring that the variable on the left is not included in the predictors on the right. It is crucial to emphasize that the VAR model reduces to the contemporaneous R2 decomposed connectedness framework when its order () reaches zero, as proposed by Balli. The model can also be expressed in a matrix form as follows: . In this formula, and are vectors with dimensions and dimensions and zero on the position, respectively.

The goodness-of-fit measure of R

2 from multiple linear regression (MLR) is frequently consistent with the sum of R

2 contributions from binary linear regressions (BLRs), provided that all of the right-hand-side variables (RHS) are uncorrelated with one another. The key to addressing this problem is figuring out a transformation that converts the correlated series—where

is similar to

but lacks the left-hand side (LHS) variable—into a set of orthogonal series. Principal component analysis (PCA) is an effective tool for achieving this transformation since it uses several latent factors corresponding to the count of RHS variables. Consequently, the R

2 decomposition of an MLR is calculated as follows:

In this framework, and illustrate the eigenvector, eigenvalue and the Pearson correlation matrices of , respectively. Additionally, and denote the Pearson correlation and R2 contribution vectors of , respectively.

Specifically, denotes the Pearson correlation coefficients between variables on the left-hand side (LHS), while denotes the Pearson correlation coefficient between variables on the right-hand side (RHS) and those placed on the LHS. The initial values of at the beginning indicate the contemporaneous R2 contribution, while the subsequent values at the end emphasize the lagged R2 contribution.

Because of this, the goodness-of-fit of the multiple linear regression (MLR) R2 is equal to the sum of the vector . To create the dimensional decomposition matrix, we combine the contributions from the total of the KMLRs. Here, Whereas the lagged spillovers are represented by the cumulative lagged values , can be seen as contemporaneous spillovers, represented by .

In Diebold and Yilmaz’s connectedness approach, the scaled GFEVD matrix is substituted with

and

[

28,

29]. According to this calculation, the total connectedness index (TCI) implies that the average R

2 of the

multivariate linear regressions (MLRs) is equal to:

TCI also lies within the same range as

, which means that the connectivity normalization issue is avoided [

32]. With the help of our suggested methodology, we can look at the contemporaneous and lagged TCI:

where

and

represent the contemporaneous and lagged

, respectively.

Ultimately, this conceptual framework can be extended to assess gross directed connectivity, both emanating

TO and directed

FROM other entities, and to quantify gross net directed connectivity. This extension allows for a comprehensive assessment of the systemic influences and interdependencies in the network of variables under investigation:

In this study, total directional connectedness ((∕)) expresses how much of the change in the variables on the left-hand side (LHS) that is contemporaneous or lagged can be explained by series . Conversely, the degree to which series explains the overall (contemporaneous/lagged) variation in the variables on the right-hand side (RHS) is indicated by the total directional connectedness of (∕), which is equivalent to the R2 of the multivariate linear regression (MLR). Series is classified as a net transmitter (receiver) when the , meaning that it can explain more (fewer) changes in other series than other series, and vice versa. The idea aligns with how both contemporaneous and lagged association degrees are interpreted.

6. Conclusions and Policy Recommendations

6.1. Main Conclusions

This study reveals the significant impact of policy adjustments on capital flows and market dynamics in the clean energy market by analyzing changes in market connectivity over different time periods. By employing the contemporaneous and lagged R2 decomposition linkage, we find significant spillover effects and emphasize the importance of considering climate risk in policy and investment decisions, providing an empirical basis for policymakers to develop more targeted policy interventions. This leads to the adoption of a sophisticated network technique to analyze the risk contagion path and build a spillover network model. Our work makes useful suggestions for those involved in the renewable energy industry and adds to the expanding corpus of research on climate finance. The following are the primary findings from the study:

First, the dominance of contemporaneous effects indicates that immediate market dynamics have a significant impact on overall connectivity. Second, we detected asymmetry in shock transmission, with the Advanced Materials Index (AMI), Developer Index (DOI) and Energy Management Index (EMI) being the main shock transmitters and GCPRI, FCI, CPU, and GCTRI being the main receivers. Third, a special and nuanced function for climate risk perception exists in the dynamic process of market shock transmission. Similar spillover effects exist between GCTRI and GCPRI, as well as GCTC and GCPC, and the risk attention indices (GCTC and GCPC) significantly influence the transmission pathways of market risks. Finally, the connection metrics exhibit temporal variability, which is a result of the influence of economic events. This is especially noticeable during moments of global crises and technological progress.

In comparison with extant studies, this study addresses the limitations of existing static models (e.g., VAR) in the analysis of dynamic risk transmission mechanisms by introducing a time-varying network model and the R2 decomposition framework, with a particular emphasis on the interactive effects of climate risk perception and policy uncertainty. In comparison with traditional methods, this study not only distinguishes between simultaneous and lagged effects but also integrates the dynamic interaction of multidimensional risk factors.

However, there are some limitations to this study. It does not fully account for behavioral elements that could affect market behavior, because it mainly employs statistical models and quantitative indices to assess how climate risk perceptions affect renewable energy markets. Future research could incorporate a behavioral economics perspective to further explore the complex interplay between climate risk perceptions and market dynamics. Additionally, the study is limited by the geographic scope and period of the data. Future research could address these limitations by expanding the geographical range, including more diverse markets, and extending the period to encompass long-term trends. In the long run, this would assist in formulating better investment and policy strategies by further confirming the universality and stability of the study’s findings; it would also provide deeper insights into climate risk management and global clean energy investment.

6.2. Policy Recommendations

After a careful analysis of the connection between the clean energy market and climate risk perception, the following policy recommendations are made.

First, the standardization and implementation of climate risk assessment methods in the financial sector should be promoted. It is incumbent upon policymakers to fortify climate risk assessment and incorporate it into financial decision making, risk management practices, and financial information disclosure. This will make the financial system more resilient. The establishment of a unified climate risk assessment framework and a data-sharing platform is imperative to ensuring the consistency and reliability of assessment methodologies.

Second, intervention strategies must target both net transmitters and net receivers. It is imperative to identify and support the main net transmitters (the Advanced Materials Index (AMI), Developer Index (DOI) and Energy Management Index (EMI)) and net receivers (GCPRI, FCI, and CPU). The enhancement of their resilience to market shocks should be facilitated through the implementation of financial incentives, risk sharing mechanisms, or technical support. To this end, the implementation of tax credits for net senders or targeted loans for net receivers, with the aim of enhancing their resilience, is recommended.

Third, investment in clean energy infrastructure and innovative technologies should be encouraged. In order to reduce the adverse consequences of climate change and the risks associated with transition, governments should encourage investment in clean energy infrastructure, research, and development through tax breaks, subsidies, and public–private partnerships. For instance, tax credits and special funding can be made available for research and development of clean energy technologies.

Fourth, the formulation and implementation of adaptive economic policies is imperative. The introduction of flexible pricing mechanisms and long-term stable subsidy policies is recommended to promote the healthy development of the clean energy market. To enhance market efficiency, policymakers should consider the development of differentiated incentives based on the characteristics of different regions and industries. The establishment of a policy environment that encourages sustainable growth and investment in the clean energy sector is especially crucial during times of global crisis and technological transformation. One potential approach involves the establishment of a dedicated fund to support clean energy projects in affected regions, ensuring policy continuity and stability.