Economic Growth, Innovation, and CO2 Emissions: Analyzing the Environmental Kuznets Curve and the Innovation Claudia Curve in BRICS Countries

Abstract

:1. Introduction

- ➢

- RQ1: Does economic growth in BRICS countries follow the EKC hypothesis, and if so, what shape does it take (inverted-U, N, or W)?

- ➢

- RQ2: How does technological innovation, measured through patent applications, influence emissions in BRICS countries?

- ➢

- RQ3: What role do foreign direct investment, renewable energy consumption, and urbanization play in influencing environmental sustainability in BRICS economies?

2. Literature Review

2.1. Economic and Environmental Factors

2.2. Technology Innovation

3. Methodology

3.1. Theoretical Framework: Environmental Kuznets Curve

- (i)

- Case 1—inverted U-shape with no secondary rise (simple U-shape): . When the cubic term is not statistically significant or is omitted, the EKC is an inverted U-shaped curve. If the linear coefficient is positive, it shows that economic growth drives emissions up. If the quadratic coefficient is negative, it shows that emissions start to slow and eventually decrease as the economies mature, possibly due to TI, more efficient production processes, or environmental policies;

- (ii)

- Case 2—N-shaped curve (multiple U-shapes with two turning points): . This case depicts a situation where emissions first increase, then decrease, and increase again after a second turning point. The EKC has an N-shape. This happens because economic growth leads to both increases and decreases in emissions over time. The positive coefficient for the cubic term implies that after an initial decline in emissions, a rebound effect may take place when emissions increase due to higher energy consumption and the industrialization of resource-intensive growth. This situation may occur in countries where the transition to greener technologies and policies is slow, and economic growth at higher levels leads to increased consumption and industrial activity that temporarily raise emissions before they eventually decline again [48].The secondary rise in emissions at higher income levels, observed in the N-shaped EKC, can be explained by several structural and behavioral mechanisms. As economies reach advanced stages of development, consumption patterns shift toward energy-intensive lifestyles, high-tech products, and expansive infrastructure. The marginal environmental benefits of early innovations and regulations may begin to decline, leading to a saturation effect. Rebound effects, where efficiency gains lower energy costs and stimulate increased consumption, further contribute to the reintensification of emissions. In the BRICS context, this pattern is particularly relevant due to rapid urbanization, increasing vehicle ownership, growing digital infrastructure, and energy demands from expanding service sectors. Without continuous green innovation and stringent environmental policies, economic maturity alone may not be sufficient to sustain emission reductions beyond the first turning point. Thus, the final upward slope of the N-shaped EKC highlights the need for sustained and adaptive sustainability strategies even in high-income phases;

- (iii)

- Case 3—W-shaped curve (multiple turning points with fluctuating emissions): and potentially higher-order terms . A W-shaped EKC is an extension of the N-shaped EKC. A W-shaped EKC suggests that emissions rise and fall twice during economic development. This scenario occurs as a cyclical pattern of environmental degradation and recovery. This pattern can be driven by factors causing fluctuations in emissions over time, such as increased consumption patterns or the limitations of the previous pollution control strategies [55]. For example, periods of rapid industrialization may cause emissions to rise, followed by a decline as cleaner technologies are adopted. Then, emissions may rise again as consumption or industrial activity increases before they eventually stabilize or decline due to sustainability initiatives;

- (iv)

- Case 4—inverted N-shaped curve (after initial rise, emissions consistently decrease): . In this case, emissions first increase, then continuously decrease without a second rise, indicating a consistent and sustained decline after the turning point. The negative cubic term indicates that after reaching a peak, emissions do not rise again but instead keep decreasing as the economy develops further. Although this pattern is less frequent, it may indicate certain policy changes or technology breakthroughs at different phases of economic growth [55]. This situation can arise when an economy shifts to a sustainable development path, in which TI and regulations continuously lower emissions while maintaining economic growth;

- (v)

- Case 5—constant growth (no turning point): . In the constant growth case, the relationship between economic growth and emissions is linear or monotonically increasing. There are no turning points, and emissions continuously rise as the economy grows. This might occur in economies where environmental degradation is tightly linked to economic activities, such as heavy reliance on fossil fuels, high industrial activity, or unsustainable consumption patterns [55].

3.2. Theoretical Framework for the Innovation Claudia Curve

4. Results

5. Integration of Circular Economy Concepts into the Theoretical Framework

6. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| EKC | Environmental Kuznets Curve |

| ICC | Innovation Claudia Curve |

| ARDL | Autoregressive Distributed Lag |

| GDP | Gross Domestic Product |

| RENC | Renewable Energy Consumption |

| FDI | Foreign Direct Investment |

| URB | Urbanization |

| Pas | Patent Applications |

| Carbon Dioxide Emissions Per Capita | |

| TI | Technological Innovation |

| FMOLS | Fully Modified Ordinary Least Squares |

| DOLS | Dynamic Ordinary Least Squares |

| VAR | Vector Autoregressive |

| ADF | Augmented Dickey–Fuller |

| ECT | Error Correction Term |

| LLC | Levin–Lin–Chu (Unit Root Test) |

| IPS | Im–Pesaran–Shin (Test) |

| R&D | Research and Development Technology |

| CE | Circular Economy |

Appendix A

Appendix B

Appendix C

References

- Gbadeyan, O.J.; Muthivhi, J.; Linganiso, L.Z.; Deenadayalu, N. Decoupling Economic Growth from Carbon Emissions: A Transition toward Low-Carbon Energy Systems—A Critical Review. Clean Technol. 2024, 6, 1076–1113. [Google Scholar] [CrossRef]

- Szczubełek, G.; Rzeczkowski, D. Impact of GDP and RES Share on CO2 Emissions, Energy Efficiency and Economic Growth in European Union Member States. Olszt. Econ. J. 2024, 19, 201–221. [Google Scholar] [CrossRef]

- Saba, C.S. CO2 Emissions-Energy Consumption-Militarisation-Growth Nexus in South Africa: Evidence from Novel Dynamic ARDL Simulations. Environ. Sci. Pollut. Res. 2022, 30, 18123–18155. [Google Scholar] [CrossRef] [PubMed]

- Onofrei, M.; Vatamanu, A.F.; Cigu, E. The Relationship Between Economic Growth and CO2 Emissions in EU Countries: A Cointegration Analysis. Front. Environ. Sci. 2022, 10, 934885. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Almeida, D.; Carvalho, L.; Ferreira, P.; Dionísio, A.; Haq, I.U. Global Dynamics of Environmental Kuznets Curve: A Cross-Correlation Analysis of Income and CO2 Emissions. Sustainability 2024, 16, 9089. [Google Scholar] [CrossRef]

- Htike, M.M.; Shrestha, A.; Kakinaka, M. Investigating Whether the Environmental Kuznets Curve Hypothesis Holds for Sectoral CO2 Emissions: Evidence from Developed and Developing Countries. Environ. Dev. Sustain. 2022, 24, 12712–12739. [Google Scholar] [CrossRef] [PubMed]

- Liu, W. EKC Test Study on the Relationship between Carbon Dioxide Emission and Regional Economic Growth. Carbon Manag. 2020, 11, 415–425. [Google Scholar] [CrossRef]

- Alaganthiran, J.R.; Anaba, M.I. The Effects of Economic Growth on Carbon Dioxide Emissions in Selected Sub-Saharan African (SSA) Countries. Heliyon 2022, 8, e11193. [Google Scholar] [CrossRef]

- Osobajo, O.A.; Otitoju, A.; Otitoju, M.A.; Oke, A. The Impact of Energy Consumption and Economic Growth on Carbon Dioxide Emissions. Sustainability 2020, 12, 7965. [Google Scholar] [CrossRef]

- Li, J.; Irfan, M.; Samad, S.; Ali, B.; Zhang, Y.; Badulescu, D.; Badulescu, A. The Relationship between Energy Consumption, CO2 Emissions, Economic Growth, and Health Indicators. Int. J. Environ. Res. Public Health 2023, 20, 2325. [Google Scholar] [CrossRef]

- Sikder, M.; Wang, C.; Yao, X.; Huai, X.; Wu, L.; KwameYeboah, F.; Wood, J.; Zhao, Y.; Dou, X. The Integrated Impact of GDP Growth, Industrialization, Energy Use, and Urbanization on CO2 Emissions in Developing Countries: Evidence from the Panel ARDL Approach. Sci. Total Environ. 2022, 837, 155795. [Google Scholar] [CrossRef] [PubMed]

- Behera, B.; Behera, P.; Sucharita, S.; Sethi, N. Mitigating Ecological Footprint in BRICS Countries: Unveiling the Role of Disaggregated Clean Energy, Green Technology Innovation and Political Stability. Discov. Sustain. 2024, 5, 165. [Google Scholar] [CrossRef]

- Gebert, I.M.; De Mello-Sampayo, F. Efficiency of BRICS Countries in Sustainable Development: A Comparative Data Envelopment Analysis. Int. J. Dev. Issues 2025, 24, 38–54. [Google Scholar] [CrossRef]

- Chandra Voumik, L.; Sultana, T. Impact of Urbanization, Industrialization, Electrification and Renewable Energy on the Environment in BRICS: Fresh Evidence from Novel CS-ARDL Model. Heliyon 2022, 8, e11457. [Google Scholar] [CrossRef] [PubMed]

- Zhang, J.; Yasin, I. Greening the BRICS: How Green Innovation Mitigates Ecological Footprints in Energy-Hungry Economies. Sustainability 2024, 16, 3980. [Google Scholar] [CrossRef]

- Zhang, H. Technology Innovation, Economic Growth and Carbon Emissions in the Context of Carbon Neutrality: Evidence from BRICS. Sustainability 2021, 13, 11138. [Google Scholar] [CrossRef]

- Khan, H.; Khan, I.; BiBi, R. The Role of Innovations and Renewable Energy Consumption in Reducing Environmental Degradation in OECD Countries: An Investigation for Innovation Claudia Curve. Environ. Sci. Pollut. Res. 2022, 29, 43800–43813. [Google Scholar] [CrossRef]

- Alnafisah, N.; Alsmari, E.; Alshehri, A.; Binsuwadan, J. Assessing the Impacts of Technological Innovation on Carbon Emissions in MENA Countries: Application of the Innovation Curve Theory. Energies 2024, 17, 904. [Google Scholar] [CrossRef]

- Sun, P.; Nisar, U.; Qiao, Z.; Ahmad, S.; Kathuria, K.; Al Bahir, A.; Ahmad, M. Digital Economy, Technology, and Urban Carbon Emissions Nexus: An Investigation Using the Threshold Effects and Mediation Effects Tests. Front. Environ. Sci. 2024, 12, 1454256. [Google Scholar] [CrossRef]

- Xuan, V.N. Determinants of Carbon Dioxide Emissions in Technology Revolution 5.0: New Insights in Vietnam. Environ. Sustain. Indic. 2025, 26, 100636. [Google Scholar] [CrossRef]

- Grossman, G.M.; Helpman, E. Endogenous Innovation in the Theory of Growth. J. Econ. Perspect. 1994, 8, 23–44. [Google Scholar] [CrossRef]

- Klewitz, J.; Hansen, E.G. Sustainability-Oriented Innovation of SMEs: A Systematic Review. J. Clean. Prod. 2014, 65, 57–75. [Google Scholar] [CrossRef]

- Ali Bekhet, H. Highlighting Innovation Policies and Sustainable Growth in Malaysia. Int. J. Innov. Manag. Technol. 2017, 8, 228–239. [Google Scholar] [CrossRef]

- Sadiq, M.; Hassan, S.T.; Khan, I.; Rahman, M.M. Policy Uncertainty, Renewable Energy, Corruption and CO2 Emissions Nexus in BRICS-1 Countries: A Panel CS-ARDL Approach. Environ. Dev. Sustain. 2023, 26, 21595–21621. [Google Scholar] [CrossRef]

- Vo, D.H.; Vo, A.T. Renewable Energy and Population Growth for Sustainable Development in the Southeast Asian Countries. Energy Sustain. Soc. 2021, 11, 30. [Google Scholar] [CrossRef]

- Hasan, M.B.; Wieloch, J.; Ali, M.S.; Zikovic, S.; Uddin, G.S. A New Answer to the Old Question of the Environmental Kuznets Curve (EKC). Does It Work for BRICS Countries? Resour. Policy 2023, 87, 104332. [Google Scholar] [CrossRef]

- Georgescu, I.A.; Bâra, A.; Oprea, S.-V. Challenges for Low-Carbon Economies in Latin America. Testing Pollution Haven Hypothesis in Developing Countries. Energy Rep. 2024, 12, 5280–5299. [Google Scholar] [CrossRef]

- Agozie, D.Q.; Akwasi Gyamfi, B.; Victor Bekun, F.; Ozturk, I.; Taha, A. Environmental Kuznets Curve Hypothesis from Lens of Economic Complexity Index for BRICS: Evidence from Second Generation Panel Analysis. Sustain. Energy Technol. Assess. 2022, 53, 102597. [Google Scholar] [CrossRef]

- Kartal, M.T.; Mukhtarov, S.; Depren, Ö.; Ayhan, F.; Ulussever, T. Uncovering the Role of Stringent Environmental Policies and Energy Transition in the Achievement of SDG-13: Evidence from BRICS Countries by WLMC Model. Energy Environ. 2025, 0958305X241293737. [Google Scholar] [CrossRef]

- Nica, I.; Georgescu, I.; Kinnunen, J. An Autoregressive Distributed Lag and Environmental Kuznets Curve Approach: Linking CO2 Emissions and Electricity Access in India. Sustainability 2024, 16, 11278. [Google Scholar] [CrossRef]

- Yilanci, V.; Bozoklu, S.; Gorus, M.S. Are BRICS Countries Pollution Havens? Evidence from a Bootstrap ARDL Bounds Testing Approach with a Fourier Function. Sustain. Cities Soc. 2020, 55, 102035. [Google Scholar] [CrossRef]

- Li, F.; Chang, T.; Wang, M.-C.; Zhou, J. The Relationship between Health Expenditure, CO2 Emissions, and Economic Growth in the BRICS Countries—Based on the Fourier ARDL Model. Environ. Sci. Pollut. Res. 2022, 29, 10908–10927. [Google Scholar] [CrossRef] [PubMed]

- Joo, B.A.; Shawl, S. Understanding the Relationship Between Foreign Direct Investment and Economic Growth in BRICS: Panel ARDL Approach. Vikalpa J. Decis. Mak. 2023, 48, 100–113. [Google Scholar] [CrossRef]

- Xu, X.; Gou, X.; Zhang, W.; Zhao, Y.; Xu, Z. A Bibliometric Analysis of Carbon Neutrality: Research Hotspots and Future Directions. Heliyon 2023, 9, e18763. [Google Scholar] [CrossRef] [PubMed]

- Gou, X.; Xu, X.; Xu, Z.; Skare, M. Circular Economy and Fuzzy Set Theory: A Bibliometric and Systematic Review Based on Industry 4.0 Technologies Perspective. Technol. Econ. Dev. Econ. 2024, 30, 489–526. [Google Scholar] [CrossRef]

- Jones, C.I. Sources of U.S. Economic Growth in a World of Ideas. Am. Econ. Rev. 2002, 92, 220–239. [Google Scholar] [CrossRef]

- Kumail, T.; Mandić, A.; Li, H.; Sadiq, F. Uncovering the Interconnectedness of Tourism Growth, Green Technological Advancements and Climate Change in Prominent Asian Tourism Destinations. Tour. Manag. Perspect. 2024, 53, 101284. [Google Scholar] [CrossRef]

- Wang, Z.; Yang, Z.; Zhang, Y.; Yin, J. Energy Technology Patents–CO2 Emissions Nexus: An Empirical Analysis from China. Energy Policy 2012, 42, 248–260. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Kirikkaleli, D. Impact of Renewable Energy Consumption, Globalization, and Technological Innovation on Environmental Degradation in Japan: Application of Wavelet Tools. Environ. Dev. Sustain. 2021, 23, 16057–16082. [Google Scholar] [CrossRef]

- Udeagha, M.C.; Ngepah, N. The Drivers of Environmental Sustainability in BRICS Economies: Do Green Finance and Fintech Matter? World Dev. Sustain. 2023, 3, 100096. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.-F.; James Chu, C.-S. Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for Unit Roots in Heterogeneous Panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Choi, I. Unit Root Tests for Panel Data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.P. Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Samargandi, N.; Fidrmuc, J.; Ghosh, S. Is the Relationship Between Financial Development and Economic Growth Monotonic? Evidence from a Sample of Middle-Income Countries. World Dev. 2015, 68, 66–81. [Google Scholar] [CrossRef]

- Leal, P.H.; Marques, A.C. The Evolution of the Environmental Kuznets Curve Hypothesis Assessment: A Literature Review under a Critical Analysis Perspective. Heliyon 2022, 8, e11521. [Google Scholar] [CrossRef]

- Dasgupta, S.; Laplante, B.; Wang, H.; Wheeler, D. Confronting the Environmental Kuznets Curve. J. Econ. Perspect. 2002, 16, 147–168. [Google Scholar] [CrossRef]

- Dinda, S. Environmental Kuznets Curve Hypothesis: A Survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- Kaufmann, R.K.; Davidsdottir, B.; Garnham, S.; Pauly, P. The Determinants of Atmospheric SO2 Concentrations: Reconsidering the Environmental Kuznets Curve. Ecol. Econ. 1998, 25, 209–220. [Google Scholar] [CrossRef]

- Shafik, N.; Bandyopadhyay, S. Economic Growth and Environmental Quality: Time Series and Cross-Country Evidence; Policy Research Working Paper Series 904; The World Bank: Washington, DC, USA, 1992. [Google Scholar]

- Kijima, M.; Nishide, K.; Ohyama, A. Economic Models for the Environmental Kuznets Curve: A Survey. J. Econ. Dyn. Control. 2010, 34, 1187–1201. [Google Scholar] [CrossRef]

- Mikayilov, J.I.; Galeotti, M.; Hasanov, F.J. The Impact of Economic Growth on CO2 Emissions in Azerbaijan. J. Clean. Prod. 2018, 197, 1558–1572. [Google Scholar] [CrossRef]

- Bulut, A.; Tekdemir, N. Unveiling the Inverted N-Shaped Environmental Kuznets Curve in OECD Nations: An Empirical Analysis. 2024. Available online: https://www.researchsquare.com/article/rs-4356060/latest (accessed on 11 April 2025).

- Porter, M.E.; Linde, C.V.D. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Popp, D. Induced Innovation and Energy Prices. Am. Econ. Rev. 2002, 92, 160–180. [Google Scholar] [CrossRef]

- Costantini, V.; Mazzanti, M. On the Green and Innovative Side of Trade Competitiveness? The Impact of Environmental Policies and Innovation on EU Exports. Res. Policy 2012, 41, 132–153. [Google Scholar] [CrossRef]

- Bauer, D.; Papp, K.; Polimeni, J.; Mayumi, K.; Giampietro, M.; Alcott, B. John Polimeni, Kozo Mayumi, Mario Giampietro & Blake Alcott, The Jevons Paradox and the Myth. of Resource Efficiency Improvements. Sustain. Sci. Pract. Policy 2009, 5, 48–54. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing Returns and Long-Run Growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Lucas, R.E. On the Mechanics of Economic Development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Johnstone, N.; Haščič, I.; Popp, D. Renewable Energy Policies and Technological Innovation: Evidence Based on Patent Counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Herring, H.; Sorrell, S. (Eds.) Energy Efficiency and Sustainable Consumption; Palgrave Macmillan: London, UK, 2009; ISBN 978-1-349-35753-6. [Google Scholar]

- Lütkepohl, H.; Xu, F. The Role of the Log Transformation in Forecasting Economic Variables. Empir. Econ. 2012, 42, 619–638. [Google Scholar] [CrossRef]

- Hu, A.-G. The Five-Year Plan: A New Tool for Energy Saving and Emissions Reduction in China. Adv. Clim. Change Res. 2016, 7, 222–228. [Google Scholar] [CrossRef]

- Wu, Q.; Chen, Y.; Huang, C.; Zhang, L.; He, C. Carbon Emission Peaks in Countries Worldwide and Their National Drivers. Carbon. Res. 2025, 4, 28. [Google Scholar] [CrossRef]

- Guilhot, L. An Analysis of China’s Energy Policy from 1981 to 2020: Transitioning towards to a Diversified and Low-Carbon Energy System. Energy Policy 2022, 162, 112806. [Google Scholar] [CrossRef]

- Southall, R.J. Economic Imperialism in Theory and Practice: The case of South African gold mining finance, 1886–1914. J. Mod. Afr. Stud. 1981, 19, 337–339. [Google Scholar] [CrossRef]

- Mabeba, M.R. Financialization and Economic Growth Nexus in South Africa. J. Econ. Financ. Anal. 2023, 7, 61–78. [Google Scholar] [CrossRef]

- Karwowski, E.; Fine, B.; Ashman, S. Introduction to the Special Section ‘Financialization in South Africa’. Compet. Change 2018, 22, 383–387. [Google Scholar] [CrossRef]

- Ngcobo, W.A.; Zhou, S.; Pillay, S.S. The Effect of Financial Market Capitalisation on Economic Growth and Unemployment in South Africa. Economies 2025, 13, 57. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhao, Y. Multi-Dimensional Analysis of Urban Growth Characteristics Integrating Remote Sensing Data: A Case Study of the Beijing–Tianjin–Hebei Region. Remote Sens. 2025, 17, 548. [Google Scholar] [CrossRef]

- Anupriya, R.S.; Rubeena, T.A. Spatio-Temporal Urban Land Surface Temperature Variations and Heat Stress Vulnerability Index in Thiruvananthapuram City of Kerala, India. Geol. Ecol. Landsc. 2025, 9, 262–278. [Google Scholar] [CrossRef]

- Xu, Z.; Xu, G.; Lan, T.; Li, X.; Chen, Z.; Cui, H.; Zhou, Z.; Wang, H.; Jiao, L.; Small, C. Global Consistency of Urban Scaling Evidenced by Remote Sensing. PNAS Nexus 2025, 4, pgaf037. [Google Scholar] [CrossRef] [PubMed]

- Wu, J. The Rise of China: A Key Player in the Supply Chain. In Global Trends in Manufacturing Supply Chains; Springer Series in Supply Chain Management; Springer Nature: Singapore, 2025; Volume 26, pp. 29–61. ISBN 978-981-9632-27-5. [Google Scholar]

- Feng, S.; Han, Y.; Lazkano, I.; Vasquez Gonzalez, M.M. Do Ev Adoption Policies Drive Innovation in Energy Storage Technologies? Evid. Chin. Mark. 2025. [Google Scholar]

- Qamruzzaman, M.; Almulhim, A.; Aljughaiman, A. Nexus between Uncertainty, Innovation, and Environmental Sustainability in BRICS: An Analysis under the Environmental Kuznets Curve (EKC) Framework. Front. Environ. Sci. 2025, 13, 1570150. [Google Scholar] [CrossRef]

- Haciimamoglu, T. Investigating the EKC and LCC Hypotheses for BRICS Countries: The Role of Economic Complexity in Environmental Degradation. Nat. Resour. Forum, 2025; early view. [Google Scholar] [CrossRef]

- Padhan, L.; Bhat, S. The Relevance of Renewable Energy and Green Innovation in Environmental Sustainability: Evidence from BRICS Countries. Int. J. Sustain. Econ. 2025, 17, 52–74. [Google Scholar] [CrossRef]

- Yan, C.; Ahmed, S.; Solangi, Y.A.; Alyamani, R.; Khoso, W.M. The Nexus between Foreign Direct Investment, Economic Progress, and Quality of Institutions in Fostering Sustainable Energy Efficiency: Evidence from BRICS Economies. Heliyon 2024, 10, e34222. [Google Scholar] [CrossRef] [PubMed]

- Rauf, A.; Ali, N.; Sadiq, M.N.; Abid, S.; Kayani, S.A.; Hussain, A. Foreign Direct Investment, Technological Innovations, Energy Use, Economic Growth, and Environmental Sustainability Nexus: New Perspectives in BRICS Economies. Sustainability 2023, 15, 14013. [Google Scholar] [CrossRef]

- Wiredu, J.; Yang, Q.; Lu, T.; Sampene, A.K.; Wiredu, L.O. Delving into Environmental Pollution Mitigation: Does Green Finance, Economic Development, Renewable Energy Resource, Life Expectancy, and Urbanization Matter? Environ. Dev. Sustain. 2025. [Google Scholar] [CrossRef]

- Ibrahim, R.L.; Awosusi, A.A.; Ajide, K.B.; Ozdeser, H. Exploring the Renewable Energy-Environmental Sustainability Pathways: What Do the Interplay of Technological Innovation, Structural Change, and Urbanization Portends for BRICS? Environ. Dev. Sustain. 2023, 27, 191–211. [Google Scholar] [CrossRef]

- Kumari, D.; Shashwat, S.; Verma, P.K.; Giri, A.K. Examining the Nexus between Carbon Dioxide Emissions, Economic Growth, Fossil Fuel Energy Use, Urbanization and Renewable Energy towards Achieving Environmental Sustainability in India. Int. J. Energy Sect. Manag. 2025, 19, 731–746. [Google Scholar] [CrossRef]

- Zhang, T.; Tan, Y.; Robinson, G.M.; Bai, W. China’s New-Style Urbanization and Its Impact on the Green Efficiency of Urban Land Use. Sustainability 2025, 17, 2299. [Google Scholar] [CrossRef]

- Latif, N.; Rafeeq, R.; Safdar, N.; Liaquat, M.; Younas, K.; Ahmad, S. Investigating the Role of Economic Integration and Financial Development: Rebound Effect and Green ICT in BRICS. Sustain. Futures 2023, 6, 100126. [Google Scholar] [CrossRef]

- Dilanchiev, A.; Urinov, B.; Humbatova, S.; Panahova, G. Catalyzing Climate Change Mitigation: Investigating the Influence of Renewable Energy Investments across BRICS. Econ. Change Restruct. 2024, 57, 113. [Google Scholar] [CrossRef]

- Zhang, M.; Imran, M.; Juanatas, R.A. Innovate, Conserve, Grow: A Comprehensive Analysis of Technological Innovation, Energy Utilization, and Carbon Emission in BRICS. Nat. Resour. Forum, 2024; early view. [Google Scholar] [CrossRef]

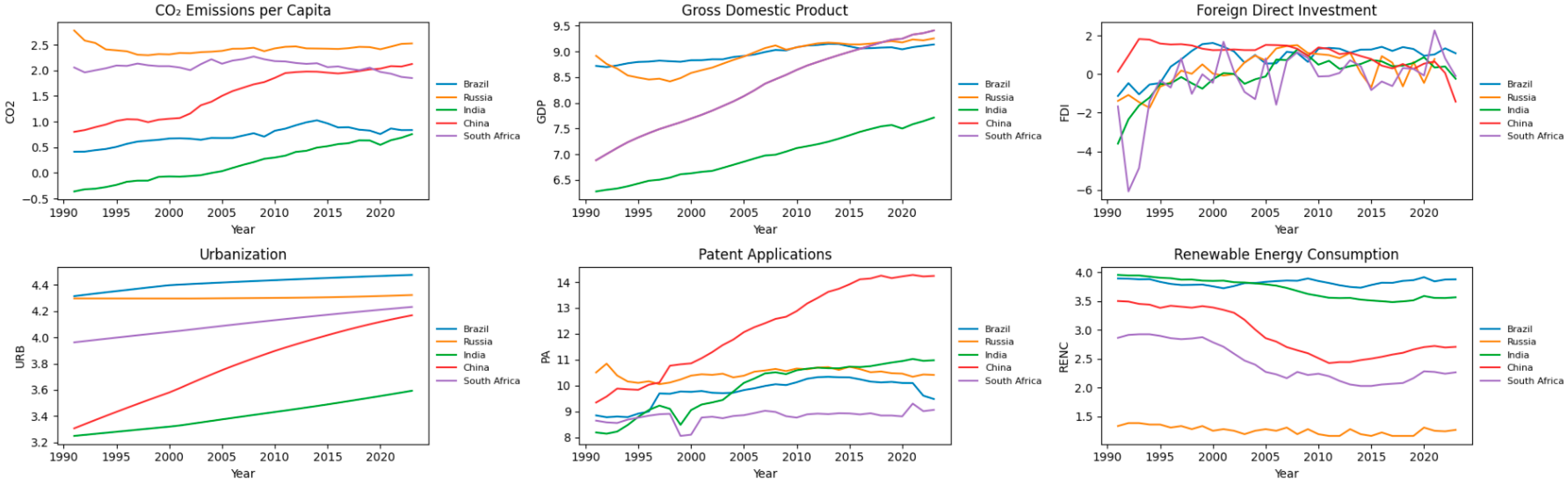

| Variable | Acronym | Measurement Unit | Source |

|---|---|---|---|

| emissions per capita | Tonnes per person | Our World in Data | |

| Patent applications | Pas | Number | World Bank |

| Gross domestic product | GDP | Constant 2015 USD | World Bank |

| Renewable energy consumption | RENC | % of total final energy | World Bank |

| Urban population | URB | % of total population | World Bank |

| Foreign direct investment | FDI | % of GDP | World Bank |

| Statistics | GDP | FDI | URB | PAs | RENC | |

|---|---|---|---|---|---|---|

| Mean | 1.37 | 8.26 | 0.33 | 3.99 | 10.23 | 2.84 |

| Median | 1.59 | 8.66 | 0.59 | 4.12 | 10.12 | 2.92 |

| Maximum | 2.77 | 9.40 | 2.26 | 4.47 | 14.27 | 3.95 |

| Minimum | 0.36 | 6.27 | 6.08 | 3.24 | 8.05 | 1.16 |

| Std. dev. | 0.87 | 0.90 | 1.14 | 0.39 | 1.45 | 0.96 |

| Skewness | 0.27 | 0.65 | 0.20 | 0.60 | 1.22 | 0.52 |

| Kurtosis | 1.68 | 2.05 | 10.44 | 1.88 | 4.31 | 1.87 |

| At Levels | ||||||||

| GDP | GDP2 | GDP3 | FDI | URB | PA | RENC | ||

| Unit root (common unit root process) | ||||||||

| LLC | (0.38) | 2.57 *** (0.00) | 1.73 *** (0.04) | (0.38) | * (0.05) | 1.60 * (0.05) | 0.72 (0.78) | 1.77 (0.96) |

| Unit root (individual unit root process) | ||||||||

| IPS | 0.96 (0.83) | 0.87 (0.80) | 1.64 (0.95) | 2.71 (0.99) | 1.99 ** (0.02) | 1.97 (0.97) | 1.66 (0.95) | 1.96 (0.99) |

| ADF–Fisher Chi-square | 6.29 (0.79) | 6.15 (0.80) | 3.76 (0.95) | 2.07 (0.99) | 26.58 *** (0.00) | 5.46 (0.85) | 1.54 (0.31) | 8.42 (0.58) |

| At first difference | ||||||||

| Unit root (common unit root process) | ||||||||

| LLC | 2.53 *** (0.00) | 1.90 ** (0.02) | 1.78 ** (0.03) | 1.90 ** (0.02) | 3.68 *** (0.00) | 3.52 *** (0.00) | 11.61 *** (0.00) | 8.54 *** (0.00) |

| Unit Root (individual unit root process) | ||||||||

| IPS | 4.36 *** (0.00) | 2.83 *** (0.00) | 2.72 *** (0.00) | 2.71 *** (0.00) | 6.72 *** (0.00) | 8.15 *** (0.00) | 9.59 *** (0.00) | 7.58 *** (0.00) |

| ADF–Fisher Chi-square | 38.22 *** (0.00) | 27.17 *** (0.00) | 26.37 *** (0.00) | 25.81 *** (0.00) | 61.39 *** (0.00) | 281.72 *** (0.00) | 82.57 *** (0.00) | 78.69 *** (0.00) |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| Long run equation | ||||

| GDP | 58.14 | 7.52 | 7.73 | 0.00 *** |

| GDP2 | 7.53 | 0.95 | 7.88 | 0.00 *** |

| GDP3 | 0.32 | 0.04 | 8.07 | 0.00 *** |

| FDI | 0.02 | 0.01 | 2.06 | 0.04 ** |

| URB | 1.03 | 0.19 | 5.33 | 0.00 *** |

| PAs | 0.09 | 0.01 | 6.21 | 0.00 *** |

| RENC | 0.96 | 0.05 | 16.97 | 0.00 *** |

| Short-run equation | ||||

| Cointeq01 | 0.43 | 0.17 | 2.45 | 0.01 ** |

| 1)) | 0.38 | 0.17 | 2.28 | 0.02 ** |

| 2)) | 0.20 | 0.09 | 2.11 | 0.01 ** |

| D(GDP) | 279.03 | 293.58 | 0.95 | 0.02 ** |

| )) | 71.00 | 93.06 | 0.76 | 0.03 ** |

| D(GDP2) | 30.07 | 33.37 | 0.90 | 0.34 |

| 1)) | 7.41 | 11.43 | 0.64 | 0.44 |

| D(GDP3) | 1.06 | 1.27 | 0.84 | 0.37 |

| 1)) | 0.24 | 0.47 | 0.51 | 0.51 |

| D(FDI) | 0.02 | 0.003 | 7.59 | 0.40 |

| 1)) | 0.01 | 0.005 | 2.76 | 0.60 |

| D(URB) | 6.33 | 20.43 | 0.31 | 0.00 *** |

| 1)) | 40.94 | 22.62 | 1.81 | 0.00 *** |

| D(PA) | 0.05 | 0.03 | 1.68 | 0.75 |

| 1)) | 0.05 | 0.00 | 11.21 | 0.07 * |

| D(RENC) | 0.12 | 0.07 | 1.65 | 0.09 * |

| 1)) | 0.02 | 0.08 | 0.29 | 0.00 *** |

| C | 65.61 | 26.48 | 2.47 | 0.10 |

| Validation metrics | ||||

| Root MSE | 0.02 | Mean dependent variable | 0.01 | |

| S.D. dependent var. | 0.04 | S.E. of regression | 0.01 | |

| Akaike information criterion | 4.38 | Sum squared residuals | 0.03 | |

| Schwarz criterion | 2.54 | Log likelihood | 454.37 | |

| Hannan–Quinn criterion | 3.64 | |||

| Hypothesized No. of CE(s) | Fisher Stat. (Trace Test) | Prob. (Trace Test) | Fisher Stat. (Max-Eigen Test) | Prob. (Max-Eigen Test) |

|---|---|---|---|---|

| None | 446.3 | 0 | 160.6 | 0 |

| At most 1 | 239.2 | 0 | 97.99 | 0 |

| At most 2 | 169.7 | 0 | 59.54 | 0 |

| At most 3 | 119.5 | 0 | 48.79 | 0 |

| At most 4 | 80.46 | 0 | 29.73 | 0.0009 |

| At most 5 | 62.25 | 0 | 37.29 | 0 |

| At most 6 | 40.03 | 0 | 28.85 | 0.0013 |

| At most 7 | 24.94 | 0 | 24.94 | 0.0055 |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| Long-run equation | ||||

| GDP | 0.27 | 0.05 | 4.96 | 0.00 *** |

| FDI | 0.04 | 0.01 | 4.20 | 0.00 *** |

| URB | 1.16 | 0.32 | 3.63 | 0.00 *** |

| PAs | 32.72 | 5.89 | 5.55 | 0.00 *** |

| PA2 | 3.64 | 0.62 | 5.84 | 0.00 *** |

| PA3 | 0.14 | 0.02 | 6.15 | 0.00 *** |

| RENC | 0.29 | 0.04 | 6.76 | 0.00 *** |

| Short-run equation | ||||

| Cointeq01 | 0.42 | 0.21 | 2.00 | 0.04 * |

| 1)) | 0.14 | 0.18 | 0.79 | 0.43 |

| 2)) | 0.00 | 0.11 | 0.01 | 0.98 |

| D(GDP) | 0.12 | 0.51 | 0.23 | 0.81 |

| )) | 0.61 | 0.62 | 0.98 | 0.33 |

| D(FDI) | 0.00 | 0.01 | 0.10 | 0.92 |

| 1)) | 0.01 | 0.00 | 1.59 | 0.11 |

| D(URB) | 25.98 | 17.80 | 1.46 | 0.14 |

| 1)) | 39.84 | 31.24 | 1.28 | 0.20 |

| D(PA) | 30.22 | 40.52 | 0.75 | 0.45 |

| 1)) | 20.41 | 53.78 | 0.38 | 0.70 |

| D(PA2) | 3.41 | 4.55 | 0.75 | 0.45 |

| 1)) | 1.52 | 5.53 | 0.27 | 0.78 |

| D(PA3) | 0.13 | 0.17 | 0.75 | 0.45 |

| 1)) | 0.03 | 0.19 | 0.17 | 0.86 |

| D(RENC) | 0.22 | 0.16 | 1.35 | 0.18 |

| 1)) | 0.11 | 0.06 | 1.99 | 0.05 * |

| C | 40.98 | 20.44 | 2.00 | 0.04 ** |

| Validation metrics | ||||

| Root MSE | 0.01 | Mean dependent variable | 0.02 | |

| S.D. dependent var. | 0.05 | S.E. of regression | 0.02 | |

| Akaike information criterion | 4.28 | Sum squared residuals | 0.03 | |

| Schwarz criterion | 2.44 | Log likelihood | 445.78 | |

| Hannan–Quinn criterion | 3.53 | |||

| Hypothesized No. of CE(s) | Fisher Stat. (Trace Test) | Prob. (Trace Test) | Fisher Stat. (Max-Eigen Test) | Prob. (Max-Eigen Test) |

|---|---|---|---|---|

| None | 303.7 | 0 | 124.3 | 0 |

| At most 1 | 164.9 | 0 | 65.2 | 0 |

| At most 2 | 109.6 | 0 | 43.9 | 0 |

| At most 3 | 70.7 | 0 | 29.9 | 0.0009 |

| At most 4 | 46.8 | 0 | 17.6 | 0.0616 |

| At most 5 | 35.8 | 0.0001 | 19.7 | 0.0296 |

| At most 6 | 25.5 | 0.0045 | 21.9 | 0.0158 |

| At most 7 | 17 | 0.0756 | 17 | 0.0756 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nica, I.; Georgescu, I.; Kinnunen, J. Economic Growth, Innovation, and CO2 Emissions: Analyzing the Environmental Kuznets Curve and the Innovation Claudia Curve in BRICS Countries. Sustainability 2025, 17, 3507. https://doi.org/10.3390/su17083507

Nica I, Georgescu I, Kinnunen J. Economic Growth, Innovation, and CO2 Emissions: Analyzing the Environmental Kuznets Curve and the Innovation Claudia Curve in BRICS Countries. Sustainability. 2025; 17(8):3507. https://doi.org/10.3390/su17083507

Chicago/Turabian StyleNica, Ionuț, Irina Georgescu, and Jani Kinnunen. 2025. "Economic Growth, Innovation, and CO2 Emissions: Analyzing the Environmental Kuznets Curve and the Innovation Claudia Curve in BRICS Countries" Sustainability 17, no. 8: 3507. https://doi.org/10.3390/su17083507

APA StyleNica, I., Georgescu, I., & Kinnunen, J. (2025). Economic Growth, Innovation, and CO2 Emissions: Analyzing the Environmental Kuznets Curve and the Innovation Claudia Curve in BRICS Countries. Sustainability, 17(8), 3507. https://doi.org/10.3390/su17083507