Sustainable Transformation: The Impact of Climate Risk Perception on Corporate Operational Resilience in China

Abstract

1. Introduction

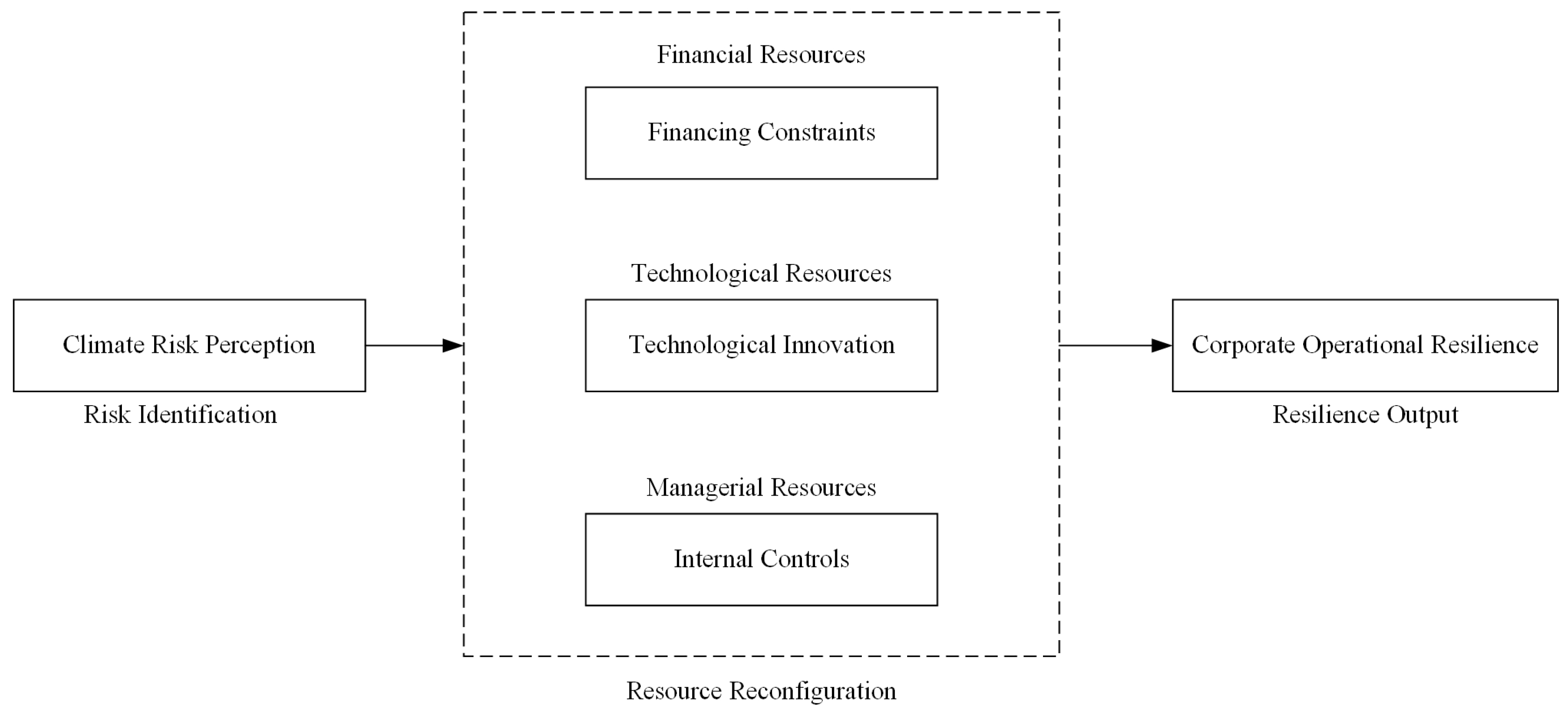

2. Theoretical Analysis and Research Hypotheses

2.1. The Direct Influence of Climate Risk Perception on Corporate Operational Resilience

2.2. The Mechanisms of Climate Risk Perception’s Impact on Corporate Operational Resilience

3. Research Design

3.1. Data and Samples

3.2. Variable Selection

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Mediator Variable

3.2.4. Control Variable

3.3. Model

3.4. Descriptive Statistics

4. Empirical Result

4.1. Correlation Analysis

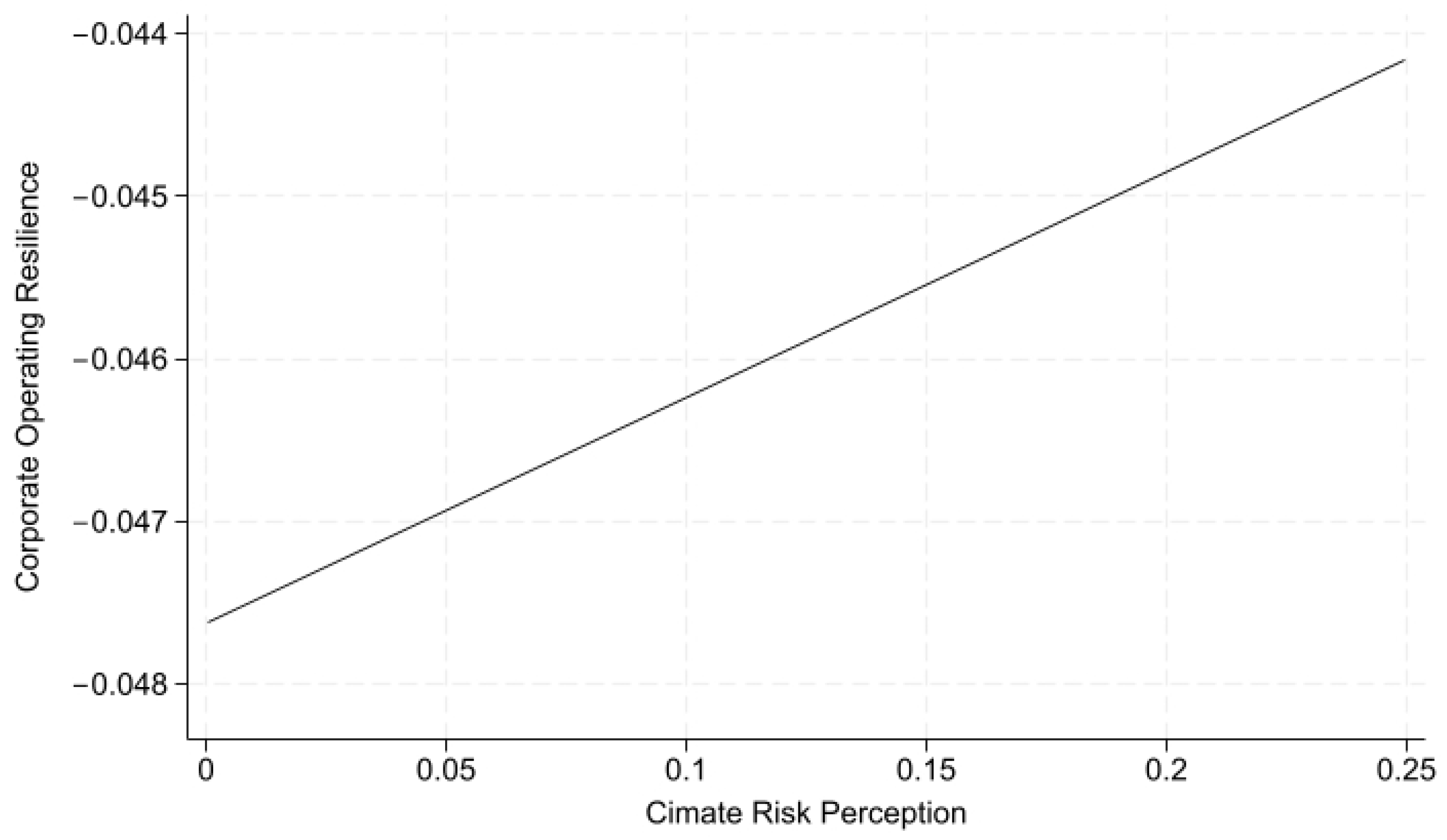

4.2. Baseline Regression Result

4.3. Robustness Check and Endogeneity Discussion

4.3.1. Robustness Check

4.3.2. Endogeneity Discussion

4.4. Mechanism Analysis

4.4.1. Mechanism Effect of Financing Constraints

4.4.2. Mechanism Effect of Technological Innovation

4.4.3. Mechanism Effect of Internal Control

4.5. Heterogeneous Analysis

4.5.1. Regional Heterogeneity

4.5.2. Ownership Heterogeneity

4.5.3. Industry Pollution Heterogeneity

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

5.3. Limitations of the Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Category Code | Industry Code | Industry Name |

|---|---|---|

| Mining industry (B) | B06 | Coal mining and washing industry |

| B07 | Oil and gas extraction industry | |

| B08 | Ferrous metal mining and processing industry | |

| B09 | Non-ferrous metal mining and processing industry | |

| Manufacturing (C) | C17 | Textile industry |

| C19 | Leather, fur, feathers, and their products and footwear industry | |

| C22 | Paper and paper products industry | |

| C25 | Petroleum processing, coking, and nuclear fuel processing industry | |

| C26 | Chemical raw materials and chemical products manufacturing industry | |

| C27 | Pharmaceutical manufacturing industry | |

| C28 | Chemical fiber manufacturing | |

| C30 | Non-metallic mineral products industry | |

| C31 | Ferrous metal smelting and rolling processing industry | |

| C32 | Non-ferrous metal smelting and rolling processing industry | |

| C33 | Metal products industry | |

| Electricity, heat, gas, and water production and supply industry (D) | D44 | Electricity and heat production and supply industry |

References

- Lee, S.H.; Choi, D.J.; Han, S.H. Corporate cash holdings in response to climate risk and policies. Financ. Res. Lett. 2023, 55, 103910. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Z. Corporate climate risk exposure and capital structure: Evidence from Chinese listed companies. Financ. Res. Lett. 2023, 51, 103488. [Google Scholar] [CrossRef]

- IPCC. Climate Change 2023: Synthesis Report; Core Writing Team, Lee, H., Romero, J., Eds.; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2023. [Google Scholar] [CrossRef]

- Zhou, K.; Li, Y. Carbon finance and carbon market in China: Progress and challenges. J. Clean. Prod. 2019, 214, 536–549. [Google Scholar] [CrossRef]

- Li, Y.; Wang, X.; Gong, T.; Wang, H. Breaking out of the pandemic: How can firms match internal competence with external resources to shape operational resilience? J. Oper. Manag. 2023, 69, 384–403. [Google Scholar] [CrossRef]

- Essuman, D.; Boso, N.; Annan, J. Operational resilience, disruption, and efficiency: Conceptual and empirical analyses. Int. J. Prod. Econ. 2020, 229, 107762. [Google Scholar] [CrossRef]

- Liu, X.; Tse, Y.K.; Wang, S.; Sun, R. Unleashing the power of supply chain learning: An empirical investigation. Int. J. Oper. Prod. Manag. 2023, 43, 1250–1276. [Google Scholar] [CrossRef]

- Chen, Y.; Li, B.; Huo, B. Building operational resilience through digitalization: The roles of supply chain network position. Technol. Forecast. Soc. Change 2025, 211, 123918. [Google Scholar] [CrossRef]

- Pankratz, N.M.C.; Schiller, C.M. Climate Change and Adaptation in Global Supply-Chain Networks. Rev. Financ. Stud. 2024, 37, 1729–1777. [Google Scholar] [CrossRef]

- Mehling, M.A.; Van Asselt, H.; Das, K.; Droege, S.; Verkuijl, C. Designing Border Carbon Adjustments for Enhanced Climate Action. Am. J. Int. Law 2019, 113, 433–481. [Google Scholar] [CrossRef]

- Hu, S.; Cao, L.; Shi, Y.; Wang, H. Green manufacturing pioneers: Unveiling the carbon dioxide reduction effect of China’s green factories. Econ. Anal. Policy 2025, 85, 1645–1662. [Google Scholar] [CrossRef]

- Conway, D.; Nicholls, R.J.; Brown, S.; Tebboth, M.G.L.; Adger, W.N.; Ahmad, B.; Biemans, H.; Crick, F.; Lutz, A.F.; De Campos, R.S.; et al. The need for bottom-up assessments of climate risks and adaptation in climate-sensitive regions. Nat. Clim. Change 2019, 9, 503–511. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Kolk, A.; Pinkse, J. Market Strategies for Climate Change. Eur. Manag. J. 2004, 22, 304–314. [Google Scholar] [CrossRef]

- Busch, T.; Hoffmann, V.H. How Hot Is Your Bottom Line? Linking Carbon and Financial Performance. Bus. Soc. 2011, 50, 233–265. [Google Scholar] [CrossRef]

- Slawinski, N.; Bansal, P. A Matter of Time: The Temporal Perspectives of Organizational Responses to Climate Change. Organ. Stud. 2012, 33, 1537–1563. [Google Scholar] [CrossRef]

- Bernstein, A.; Gustafson, M.T.; Lewis, R. Disaster on the horizon: The price effect of sea level rise. J. Financ. Econ. 2019, 134, 253–272. [Google Scholar] [CrossRef]

- Balvers, R.; Du, D.; Zhao, X. Temperature shocks and the cost of equity capital: Implications for climate change perceptions. J. Bank. Financ. 2017, 77, 18–34. [Google Scholar] [CrossRef]

- Sun, G.; Fang, J.; Li, T.; Ai, Y. Effects of climate policy uncertainty on green innovation in Chinese enterprises. Int. Rev. Financ. Anal. 2024, 91, 102960. [Google Scholar] [CrossRef]

- Heo, Y. Climate Change Exposure and Firm Cash Holdings; SSRN Scholarly Paper 3795298; Social Science Research Network: Rochester, NY, USA, 2021; p. 3795298. [Google Scholar] [CrossRef]

- Chen, X.; Chen, X.; Xu, L.; Wen, F. Attention to climate change and downside risk: Evidence from China. Risk Anal. 2023, 43, 1011–1031. [Google Scholar] [CrossRef]

- Javadi, S.; Masum, A.-A. The impact of climate change on the cost of bank loans. J. Corp. Financ. 2021, 69, 102019. [Google Scholar] [CrossRef]

- Nguyen, D.D.; Ongena, S.; Qi, S.; Sila, V. Climate Change Risk and the Cost of Mortgage Credit*. Rev. Financ. 2022, 26, 1509–1549. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic Capabilities and Strategic Management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Er-Kara, M.; Ghadge, A.; Bititci, U. Modelling the Impact of Climate Change Risk on Supply Chain Performance. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Mao, Y.; Li, P.; Li, Y. The relationship between slack resources and organizational resilience: The moderating role of dual learning. Heliyon 2023, 9, e14044. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Ricciardi, G.; Callegari, G. Digital Twins for Climate-Neutral and Resilient Cities. State of the Art and Future Development as Tools to Support Urban Decision-Making. In Technological Imagination in the Green and Digital Transition; Arbizzani, E., Cangelli, E., Clemente, C., Cumo, F., Giofrè, F., Giovenale, A.M., Palme, M., Paris, S., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 617–626. [Google Scholar]

- Wieland, A.; Durach, C.F. Two perspectives on supply chain resilience. J. Bus. Logist. 2021, 42, 315–322. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit rationing in markets with imperfect information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Task Force on Climate-related Financial Disclosures. Recommendations of the Task Force on Climate-Related Financial Disclosures; Financial Stability Board: Basel, Switzerland, 2017; Available online: https://www.fsb.org/uploads/P290617-5.pdf (accessed on 10 January 2025).

- Zhang, W.; Zhao, Y.; Meng, F. ESG performance and green innovation of Chinese enterprises: Based on the perspective of financing constraints. J. Environ. Manag. 2024, 370, 122955. [Google Scholar] [CrossRef]

- Li, Y.; Ju, G.; Miao, H.; Zhou, J.; Liu, Y.; Ullah, I. Analyzing the Effect of Carbon Emission Regulations and Policy Tools in China on Reducing Emissions. Sustainability 2024, 16, 10016. [Google Scholar] [CrossRef]

- Dikau, S.; Volz, U. Central bank mandates, sustainability objectives and the promotion of green finance. Ecol. Econ. 2021, 184, 107022. [Google Scholar] [CrossRef]

- Al Janabi, M.A.M. Insights into Liquidity Dynamics: Optimizing Asset Allocation and Portfolio Risk Management with Machine Learning Algorithms. In Liquidity Dynamics and Risk Modeling: Navigating Trading and Investment Portfolios Frontiers with Machine Learning Algorithms; Al Janabi, M.A.M., Ed.; Springer Nature: Cham, Switzerland, 2024; pp. 257–303. [Google Scholar] [CrossRef]

- Liu, W.; Lin, G.; He, Q. Enhanced management information disclosure responsibilities and corporate risk-taking: Evidence from the accountability system for errors in China. Int. Rev. Econ. Financ. 2024, 89, 511–531. [Google Scholar] [CrossRef]

- Teece, D.J. Dynamic capabilities as (workable) management systems theory. J. Manag. Organ. 2018, 24, 359–368. [Google Scholar] [CrossRef]

- Zhou, X.; Zhu, Q.; Xu, L.; Wang, K.; Yin, X.; Mangla, S.K. The effect of carbon tariffs and the associated coping strategies: A global supply chain perspective. Omega 2024, 122, 102960. [Google Scholar] [CrossRef]

- Al-Sammak, K.A.; Al-Gburi, S.H.; Marghescu, I.; Drăgulinescu, A.-M.C.; Marghescu, C.; Martian, A.; Al-Sammak, N.A.H.; Suciu, G.; Alheeti, K.M.A. Optimizing IoT Energy Efficiency: Real-Time Adaptive Algorithms for Smart Meters with LoRaWAN and NB-IoT. Energies 2025, 18, 987. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, M.; Zang, H. Renewable energy technology innovation, climate risk, and carbon emission reduction: A Cross-Country Analysis. Renew. Energy 2025, 240, 122136. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Zhang, Y.; Yuan, L.; Ibrahim, I.; Omar, R. Sustainability in Question: Climate Risk, Environment, Social and Governance Performance, and Tax Avoidance. Sustainability 2025, 17, 1400. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Cao, X. How enterprise climate risk perception affects organizational resilience: A green technology innovation perspective. Stoch. Environ. Res. Risk Assess. 2024, 38, 4369–4391. [Google Scholar] [CrossRef]

- DesJardine, M.; Bansal, P.; Yang, Y. Bouncing Back: Building Resilience Through Social and Environmental Practices in the Context of the 2008 Global Financial Crisis. J. Manag. 2019, 45, 1434–1460. [Google Scholar] [CrossRef]

- John, K.; Litov, L.; Yeung, B. Corporate Governance and Risk-Taking. J. Financ. 2008, 63, 1679–1728. [Google Scholar] [CrossRef]

- Acharya, V.V.; Amihud, Y.; Litov, L. Creditor rights and corporate risk-taking. J. Financ. Econ. 2011, 102, 150–166. [Google Scholar] [CrossRef]

- Lei, L.; Zhang, D.; Ji, Q.; Guo, K.; Wu, F. A text-based managerial climate attention index of listed firms in China. Financ. Res. Lett. 2023, 55, 103911. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Deeds, D.L. Alliance type, alliance experience and alliance management capability in high-technology ventures. J. Bus. Ventur. 2006, 21, 429–460. [Google Scholar] [CrossRef]

- Hoang, H.; Rothaermel, F.T. Leveraging internal and external experience: Exploration, exploitation, and R&D project performance. Strateg. Manag. J. 2010, 31, 734–758. [Google Scholar] [CrossRef]

- Lee, H. Does ESG Performance Drive Firm-Level Innovation? Evidence from South Korea. Sustainability 2025, 17, 1727. [Google Scholar] [CrossRef]

- Petersen, M.A. Estimating Standard Errors in Finance Panel Data Sets: Comparing Approaches. Rev. Financ. Stud. 2009, 22, 435–480. [Google Scholar] [CrossRef]

- Sun, G.; Li, T.; Ai, Y.; Li, Q. Digital finance and corporate financial fraud. Int. Rev. Financ. Anal. 2023, 87, 102566. [Google Scholar] [CrossRef]

- Keller, K.; Helgeson, C.; Srikrishnan, V. Climate risk management. Annu. Rev. Earth Planet. Sci. 2021, 49, 95–116. [Google Scholar] [CrossRef]

- Wu, H.; Chen, J.; Jiao, H. Dynamic capabilities as a mediator linking international diversification and innovation performance of firms in an emerging economy. J. Bus. Res. 2016, 69, 2678–2686. [Google Scholar] [CrossRef]

- Zhang, C.; Zhou, X.; Zhou, B.; Zhao, Z. Impacts of a mega sporting event on local carbon emissions: A case of the 2014 Nanjing Youth Olympics. China Econ. Rev. 2022, 73, 101782. [Google Scholar] [CrossRef]

- Ma, Y.-R.; Liu, Z.; Ma, D.; Zhai, P.; Guo, K.; Zhang, D.; Ji, Q. A news-based climate policy uncertainty index for China. Sci. Data 2023, 10, 881. [Google Scholar] [CrossRef]

- Wang, Z.; Sun, X.; Li, W. Cultural diversity and green innovation: Evidence from China. Financ. Res. Lett. 2023, 58, 104379. [Google Scholar] [CrossRef]

- Jiang, C.; Li, Y.; Zhang, X.; Zhao, Y. Climate risk and corporate debt decision. J. Int. Money Financ. 2025, 151, 103261. [Google Scholar] [CrossRef]

- Huang, S.; Wang, X.; Xue, Y.; Zhang, X. CEOS’climate risk perception bias and corporate debt structure. J. Int. Money Financ. 2025, 151, 103254. [Google Scholar] [CrossRef]

- Wang, T.; Liu, X.; Wang, H. Green bonds, financing constraints, and green innovation. J. Clean. Prod. 2022, 381, 135134. [Google Scholar] [CrossRef]

- Wu, Y. The impact of climate risks on green technology innovation: An empirical study based on panel data of 269 cities in China. Front. Environ. Sci. 2025, 12, 1510883. [Google Scholar] [CrossRef]

- Xia, H.; Liu, M.; Wang, P.; Tan, X. Strategies to enhance the corporate innovation resilience in digital era: A cross-organizational collaboration perspective. Heliyon 2024, 10, e39132. [Google Scholar] [CrossRef]

- Huang, H.H.; Kerstein, J.; Wang, C. The impact of climate risk on firm performance and financing choices: An international comparison. J. Int. Bus. Stud. 2018, 49, 633–656. [Google Scholar] [CrossRef]

- Lee, K.-H.; Min, B.; Yook, K.-H. The impacts of carbon (CO2) emissions and environmental research and development (R&D) investment on firm performance. Int. J. Prod. Econ. 2015, 167, 1–11. [Google Scholar] [CrossRef]

- Huo, M.; Li, C.; Liu, R. Climate policy uncertainty and corporate green innovation performance: From the perspectives of organizational inertia and management internal characteristics. Manag. Decis. Econ. 2024, 45, 34–53. [Google Scholar] [CrossRef]

- Al Balushi, M. How internal transparency impacts organizational resilience. Int. J. Qual. Reliab. Manag. 2021, 38, 1246–1263. [Google Scholar] [CrossRef]

- Weber, M.M.; Pedell, B.; Rötzel, P.G. Resilience-oriented management control systems: A systematic review of the relationships between organizational resilience and management control systems. J. Manag. Control 2024, 563–620. [Google Scholar] [CrossRef]

- Li, H.; Chang, Y.; Wang, X.; Zhang, N. Institutional Complexity and Corporate Environmental Investments: Evidence from China’s Mixed-Ownership Reform of State-Owned Enterprises. Manag. Organ. Rev. 2024, 20, 716–747. [Google Scholar] [CrossRef]

- Liu, X.; Huang, N.; Su, W.; Zhou, H. Green innovation and corporate ESG performance: Evidence from Chinese listed companies. Int. Rev. Econ. Financ. 2024, 95, 103461. [Google Scholar] [CrossRef]

- Ng, S.H.; Yang, Y.; Lee, C.C.; Ong, C.Z. Nexus of financing constraints and supply chain finance: Evidence from listed SMEs in China. Int. J. Financ. Stud. 2023, 11, 102. [Google Scholar] [CrossRef]

- Cuervo-Cazurra, A.; Li, C. State ownership and internationalization: The advantage and disadvantage of stateness. J. World Bus. 2021, 56, 101112. [Google Scholar] [CrossRef]

- Xu, S.; Chen, S.; Jiao, W.; Chen, M. State-owned enterprises shareholders and innovation of private enterprises: Evidence from China. Technovation 2025, 140, 103144. [Google Scholar] [CrossRef]

- Li, J.; Wang, K.; Mei, Y. State-Owned Capital Participation and Corporate Environmental, Social, and Governance Performance: Evidence from Chinese Private Firms. J. Knowl. Econ. 2024, 1–28. [Google Scholar] [CrossRef]

- Liu, Y.; Huang, H.; Mbanyele, W.; Li, X.; Balezentis, T. Harnessing supply chain digital innovation for enhanced corporate environmental practices and sustainable growth. Energy Econ. 2025, 142, 108161. [Google Scholar] [CrossRef]

- Deng, Q.; Huang, G.; Li, D.; Yang, S. The impact of climate risk on corporate innovation: An international comparison. J. Multinatl. Financ. Manag. 2024, 75, 100870. [Google Scholar] [CrossRef]

- Dai, L.; Zhang, R. Environmental Regulation and Green Investment Efficiency: Threshold and Spatial Spillover Analysis for China. Sustainability 2025, 17, 2934. [Google Scholar] [CrossRef]

| Dimension | Keywords |

|---|---|

| Climate Physical Threats | Air pollution, air quality, temperature, carbon dioxide, carbon emissions, climate change, extreme weather, flue gas, gas emissions, greenhouse gas emissions, global warming, natural disasters, ozone layer, sea level |

| Policy Responses | Carbon neutrality, carbon price, carbon sink, carbon tax, carbon peak, Kyoto Protocol, Paris Agreement, carbon reduction, electric vehicles |

| Clean Energy | Energy transition, clean energy, forest land, clean water, clean air, carbon energy, low-carbon, zero-carbon, energy environment, environmental sustainability, renewable energy, thermal energy, solar energy, water resources, wave energy, tidal energy, wind energy, biomass energy, new energy, energy efficiency |

| Variable Type | Variable Name | Symbol | Definition |

|---|---|---|---|

| Dependent variable | Corporate operational resilience | The standard deviation of the firm’s EBITDA over a 4-year rolling period. For ease of interpretation, the negative value of this measure is used in the regression analysis. | |

| Independent variable | Climate risk perception | The Climate Risk Manager Attention Index from the GCRID | |

| Mediator variable | Financing constraints | The absolute value of the SA index | |

| Technological innovation | The proportion of R&D personnel | ||

| Internal controls | The presence of internal control deficiencies | ||

| Control variable | Corporate size | The logarithm of the company’s total assets at year end | |

| The proportion of fixed assets | The ratio of fixed assets to total assets at year end | ||

| The fixed assets growth rate | The fixed assets growth rate | ||

| The debt-to-asset ratio | The proportion of total debt to total assets | ||

| The cash growth rate | The growth rate of cash and cash equivalents | ||

| Ownership concentration | The ratio of shares held by the largest shareholder. | ||

| The proportion of independent directors | The ratio of independent directors to the total number of directors | ||

| Chairman–CEO duality | A binary variable, where a value of 1 indicates that the Chairman and CEO are the same person and 0 indicates the roles are filled by separate people. |

| Variable | Sample Size | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| 19,081 | −0.045 | 0.052 | −0.305 | −0.003 | |

| 19,081 | 0.023 | 0.046 | 0 | 0.247 | |

| 19,081 | 22.695 | 1.313 | 20.008 | 26.516 | |

| 19,081 | 0.200 | 0.152 | 0.002 | 0.695 | |

| 19,081 | 0.105 | 0.212 | −0.317 | 1.076 | |

| 19,081 | 0.181 | 0.121 | 0.016 | 0.601 | |

| 19,081 | 0.461 | 0.196 | 0.070 | 0.892 | |

| 19,081 | 0.320 | 0.145 | 0.079 | 0.724 | |

| 19,081 | 0.377 | 0.0540 | 0.333 | 0.571 | |

| 19,081 | 0.260 | 0.439 | 0 | 1 |

| Variables | (1) COR | (2) COR | (3) COR |

|---|---|---|---|

| 0.0426 *** | 0.0589 *** | 0.0577 *** | |

| (0.0103) | (0.0104) | (0.0104) | |

| −0.0035 *** | −0.0032 *** | ||

| (0.0004) | (0.0004) | ||

| 0.0139 *** | 0.0132 *** | ||

| (0.0033) | (0.0033) | ||

| 0.0059 *** | 0.0063 *** | ||

| (0.0020) | (0.0020) | ||

| −0.0029 | −0.0043 | ||

| (0.0039) | (0.0039) | ||

| 0.0050 * | 0.0048 * | ||

| (0.0026) | (0.0026) | ||

| −0.0090 *** | |||

| (0.0030) | |||

| 0.0065 | |||

| (0.0070) | |||

| −0.0022 ** | |||

| (0.0009) | |||

| Year FE | YES | YES | YES |

| Industry FE | YES | YES | YES |

| Observation | 19,081 | 19,081 | 19,081 |

| R-squared | 0.0823 | 0.0891 | 0.0899 |

| Variables | (1) COR1 | (2) COR | (3) COR | (4) COR |

|---|---|---|---|---|

| 0.0295 *** | ||||

| (0.0062) | ||||

| 0.0014 ** | ||||

| (0.0006) | ||||

| 0.0579 *** | ||||

| (0.0120) | ||||

| 0.0577 *** | ||||

| (0.0146) | ||||

| YES | YES | YES | YES | |

| Year FE | YES | No | YES | YES |

| Industry FE | YES | YES | YES | YES |

| Observation | 19,081 | 19,081 | 15,741 | 13,263 |

| R-squared | 0.9811 | 0.0849 | 0.0963 | 0.1110 |

| Variables | (1) COR | (2) COR | (3) CRP | (4) COR |

|---|---|---|---|---|

| 0.0577 *** | 0.0544 *** | 0.3976 ** | ||

| (0.0104) | (0.0114) | (0.1795) | ||

| 0.3828 *** | ||||

| (0.0613) | ||||

| YES | YES | YES | YES | |

| Year FE | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES |

| Observation | 19,081 | 19,081 | 19,081 | 19,081 |

| R-squared | 0.0899 | 0.0930 | 0.3061 | 0.0928 |

| Variables | (1) absSA | (2) COR | (3) RDP | (4) COR | (5) ICD | (6) COR |

|---|---|---|---|---|---|---|

| −0.3760 *** | 0.0577 *** | 0.0633 *** | 0.0531 *** | 0.3740 *** | 0.0568 *** | |

| (0.0430) | (0.0104) | (0.0208) | (0.0109) | (0.0957) | (0.0104) | |

| −0.0029 * | ||||||

| (0.0016) | ||||||

| 0.0076 * | ||||||

| (0.0044) | ||||||

| 0.0022 *** | ||||||

| (0.0007) | ||||||

| YES | YES | YES | YES | YES | YES | |

| Year FE | YES | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES | YES |

| Observation | 19,081 | 19,081 | 12,037 | 12,037 | 19,081 | 19,081 |

| R-squared | 0.2970 | 0.0893 | 0.4534 | 0.0891 | 0.0833 | 0.0904 |

| Variables | (1) COR | (2) COR | (3) COR | (4) COR | (5) COR | (6) COR |

|---|---|---|---|---|---|---|

| 0.0497 *** | 0.0957 *** | 0.0486 *** | 0.0406 *** | 0.0908 *** | 0.0482 *** | |

| (0.0108) | (0.0270) | (0.0123) | (0.0130) | (0.0263) | (0.0110) | |

| YES | YES | YES | YES | YES | YES | |

| Year FE | YES | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES | YES |

| Observation | 14,205 | 4876 | 10,651 | 8430 | 4022 | 15,059 |

| R-squared | 0.1121 | 0.1078 | 0.0920 | 0.0863 | 0.0494 | 0.1052 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Bao, X. Sustainable Transformation: The Impact of Climate Risk Perception on Corporate Operational Resilience in China. Sustainability 2025, 17, 3387. https://doi.org/10.3390/su17083387

Zhang X, Bao X. Sustainable Transformation: The Impact of Climate Risk Perception on Corporate Operational Resilience in China. Sustainability. 2025; 17(8):3387. https://doi.org/10.3390/su17083387

Chicago/Turabian StyleZhang, Xu, and Xing Bao. 2025. "Sustainable Transformation: The Impact of Climate Risk Perception on Corporate Operational Resilience in China" Sustainability 17, no. 8: 3387. https://doi.org/10.3390/su17083387

APA StyleZhang, X., & Bao, X. (2025). Sustainable Transformation: The Impact of Climate Risk Perception on Corporate Operational Resilience in China. Sustainability, 17(8), 3387. https://doi.org/10.3390/su17083387