1. Introduction

Studies show that traveling has become one of the economic boosters for many countries, and research shows that by 2030, the tourism sector is set to increase by USD 15.5 trillion. This includes 11.6% of the global economy, which is an approximately 50% increase from the 2019 statistics that recorded a value of USD 10 trillion and showed that traveling represents about 10.4% of the world’s gross domestic product. In the 2019 report, China was one of the top five countries that were included as a tourism destination that many people traveled to [

1]. Traveling comes with a large number of financial implications, which are required to be able to secure safe accommodation in a foreign country. The need for a direct flight from one country to another makes it easily accessible for one to gain the courage to travel cost-effectively and enhance travel efficiency. There is an increasing need for the BRICS+ countries to make traveling accessible for their member states so that they can access more cooperation programs that can benefit their countries, as one of their mandates is to expand geopolitical implications and grow their economies.

The BRICS+ countries are developing countries, which means that the majority of their citizens are people who are not financially able to travel around the world or participate in programs that may improve their skills or knowledge by traveling to another country to attend a certain program that may be beneficial for them. Therefore, there is a need for direct flights to BRICS+ countries to be prioritized as one of their thematic areas [

2]. International tourism has been growing, especially in the past decades, and it has exceeded USD 1.4 billion, contributing to the global gross domestic product and increasing employment rates by about 10% globally. It has been noted that as much as tourism boosts the global economy, it still consumes a huge amount of fossil fuels and coal from the electricity that is being consumed. Most BRICS countries and the new member states are committed to reducing the use of fossil fuels, and this can be achieved by commitments to minimize frequent long-haul flights. In addition, they can invest in air traffic management [

3]. Studies show that there are currently limited direct flights from the BRICS nations, and they are heavily relying on connecting routes. In particular, after the COVID-19 pandemic, many direct flights have been suspended, and people are left with no choice but to use connecting flights that will allow them to reach their destination. China and India suspended their direct flights from 2020 until the present, and this has also weakened their bilateral relationship, as the number of people traveling to these countries decreased as well [

4]. Flights from Russia to South Africa were also suspended due to the COVID-19 pandemic, and this suspension has affected the tourism sector and prevented people from traveling with convenience.

Research shows that there is a strong relationship between direct flights and the boosting of the tourism sector, as reaching a destination is strongly dependent on the mode of transport one takes and the convenience it offers, which will be a determining factor in attracting more people to use the same route. Those who rely on air transportation also factor in the cost, time, and demand of traveling, and air transport companies also price their tickets based on the demand and supply model. It has been found that many destinations that do not have layovers have approximately 30% more arrivals compared to those that have connecting flights or layovers. This is also based on the preferences and willingness of people to be able to pay for the convenience. Studies show that direct flights have higher costs compared to connecting flights, which are much cheaper; however, it has been found that people are willing to pay for the convenience to save time, especially when it is a long route [

5]. Mighty Travels [

6] argues that the price gap between direct flights and connecting flights has decreased from what it used to be. It also depends on the routes one takes, but many show a 5% to 10% decrease in cost, whereas in Asia and the Middle East, connecting flights seem to have been reduced by 30%.

After the COVID-19 pandemic in 2020, the tourism sector has been negatively impacted, which has affected many people because traveling was not allowed. This has affected domestic and international transportation because executives and entrepreneurs started to meet virtually for business meetings and attend conferences online. There has been a massive increase in flight prices because of the shortage of seats and the increases in the cost of fuel. In South Africa, the prices for flights increased by more than 50% from 2019 prices. The high cost of flights affects the creation of employment due to air travel facilitation and trade [

7]. Many studies have analyzed the impact of COVID-19 and the increase in prices. One study found that there was a price decrease for flights from China to Europe compared to the 2019 and 2020 data, but prices were stable for China’s domestic routes in Asia. Demand allows airlines to increase prices, and this allows demand to change the market conditions. The route also affects pricing due to the consumption of fuel during take-off and landing [

8].

This study looks at the gap that has been caused by the COVID-19 pandemic in the tourism sector after the ban on traveling, which has caused the sector to be in stagnation. This paper analyzes the implications of direct air transportation and collaboration as a strategy plan to improve the tourism sector of BRICS+ countries and increase sustainability in the tourism sector. This paper also discusses challenges that hinder direct transportation within the BRICS+ countries. This paper is organized as follows:

Section 2 provides a theoretical framework;

Section 3 contains a literature review;

Section 4 details the methodology;

Section 5 looks at the impact of tourism on economic development and collaboration in BRICS+ countries;

Section 6 looks at the countries that have a chance to collaborate and benefit from direct airlines; and

Section 7 looks at the challenges for sustainable tourism development in BRICS+ countries and provides an analysis,

Section 8 looks at the BRICS+ summary,

Section 9 looks at the recommendations,

Section 10 looks at the limitations, and conclusions.

2. Theoretical Framework

This paper adopts the Triple Bottom Line (TBL) framework, which aligns with three core sustainability concepts: economic, social, and Environmental, as proposed by John Elkington (1997) [

9]. This theory examines the ever-changing world and emphasizes the importance of continuously seeking balance across these three main sectors. The primary objective of this paper is to investigate the potential of direct transportation links between the BRICS+ nations to generate economic benefit and promote sustainable outcomes, which the TBL theory encourages organizations to consider in terms of economy, social, and environmental sustainability. The BRICS+ nations have been working to identify sustainable solutions for the growth of tourism sectors, recognizing the increasing demand for international travel. This has led the BRICS+ nation to host their first BRICS Tourism Forum in Russia, where they discussed and planned various strategies to boost the sector through cooperation. This collaboration aims to benefit all countries by stimulating their economies, creating jobs, and fostering peace amongst nations [

10]. Many case studies within BRICS+ nations have shown that direct flights significantly boost the tourism sector. For example, Brazil and South Africa witnessed substantial increase in tourist arrivals after resuming direct flights. Similarly, Russian airlines reported a 70% increase in arrivals, benefiting from international tourists, including those from six BRICS nations (Egypt, India, Iran, China, UAE, and Ethiopia), which have direct flights to Russia [

11]. TBL theory also incorporates social sustainability, which includes the creation of jobs in the aviation sector, and environmental sustainability, which involves carbon offset programs and reductions in gas emissions. A study conducted in the United States demonstrate that direct air transport can significantly reduce carbon emission compared to connecting flights, with a 40% decrease in emissions due to shorter routes [

12]. Travel is fundamental to the tourism sector, and air transport is considered one of the most efficient modes of international travel. Therefore, finding ways to reduce gas emissions, promoting a sustainable sector, and ensuring a clean environment within the industry is crucial.

3. Literature Review

Brazil, Russia, India, China, and South Africa (BRICS) countries play a huge role in increasing the world’s gross domestic product (GDP) in comparison to G7 countries when taking into consideration the purchasing power parity (PPP) for 2018. The 2024 statistics showed that BRICS countries hold 35% of the world’s GDP compared to the G7 countries, which are currently at 30% [

13]. The expansion of the BRICS membership has a huge opportunity to control the oil production worldwide, especially countries like Iran, UAE, and Saudi Arabia; the group could amount to 35% of the total oil consumption [

14]. The BRICS+ countries have signed the Paris Agreement for the United Nations Sustainable Development Goals (SDGs). Moreover, the BRICS+ countries have committed to reducing gas emissions while also advocating for clean environments, which will allow these countries to activate their sustainable development goals. The BRICS+ countries encourage collaboration for mutual growth, and they can achieve these sustainable development goals by working together and creating partnerships [

15].

Behsudi [

16] discusses the tourism sector and how it has been the backbone of global economic development for years. In the 1950s, individuals utilized jets to travel internationally for various purposes, which generated employment for approximately 320 million people worldwide. International travelers reached 25 million in number. However, between 2019 and 2020, the world experienced a global COVID-19 pandemic, which significantly disrupted the tourism sector, placing numerous jobs at risk and destabilizing the global economy. Skare, Soriano, and Porada-Rochon [

17] concur that the COVID-19 pandemic jeopardized 75 million workers, putting them at risk of unemployment. Studies indicate that in 2020, the tourism sector’s GDP was projected to sustain a loss of USD 2.1 trillion. The overall impact on the tourism sector was severe, and each country needed to develop a strategy to revitalize economy to its pre-pandemic levels. Before COVID-19, BRICS tourism held a strong position in global tourism, with international tourist arrivals ranking these countries as follows: Brazil at the 48th place, Russia at the 15th place, India at the 19th place, China at the 4th place, and South Africa at the 36th place [

18].

As many countries continue to seek ways to revive their tourism sector, an increasing paradox has merged between tourism sector and climate change sustainability. While tourism undeniably fosters economic growth, it also poses significant environmental challenges, primary due to the large influx of visitors, which places substantial pressure on country’s natural resources and infrastructure. Lenthang [

19] explains how citizens of Barcelona, Spain, protested against tourists who constantly visit their country and urged the government to intervene in decreasing the number of tourists who visit their country. The citizens mention several concerns that come with tourists visiting their country, such as the fact that they, as poor citizens, are not gaining anything from this. Instead, it is the tourism sector and hotels that benefit from tourists, while normal citizens face an increase in rent and the price of housing. Normal rent for residents has shown a 70% increase over a decade, and this is caused by the high number of tourists who constantly visit Spain. In 2023, the number of tourists who visited Barcelona was recorded at 26 million, and they collectively spent about USD 10.4 billion. In 2024, Spain was the second most-visited country. The issue of imbalance in the tourism sector is slowly creating environmental issues that need to be addressed. Greentumble [

20] concurs that tourism is one of the industries that creates economic development, and is also one of the fast-growing sectors. However, one cannot overlook the negative impact it has, such as the damage seen in the depletion of natural resources, the scarcity of clean water, and the pollution. Many of the countries that are ranked high for tourism destinations also suffer from environmental issues. Countries like Spain, Zanzibar, India, Greece, and Bali still have residents who do not have access to clean water.

These environmental issues also affect tourists who come and visit these countries, and controlling water consumption has become a challenge in luxurious hotels and guest houses for tourists.

Franciscone, Zou, and Fernandes [

21] explain that the expansion of the BRICS+ nations will increase the demand for foreign travelers between these countries, and this will in turn increase the demand for connectivity but may also be limited by ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) scheme, which aims to minimize carbon credit payments. Therefore, the BRICS+ countries need to implement and invest in carbon-reduction projects, such as sustainable technological and operational measures, as they help improve international tourism and air transport while still contributing immensely toward economic growth and gross domestic product (GDP). Research shows that tourism creates jobs, and air transport plays a fundamental role in ensuring people reach their destination and enables effective moving of goods for trade, hence the importance of having measures and strategies for achieving sustainable development goals (SDGs).

Hotels’ operations depend on the arrival of people; numbers show that it is tourists who are determining factors for profits in hotels, sightseeing tours, and all cultural activities. Some tourists often prioritize or prefer easy access to reaching their destination. Therefore, if there is a better way of utilizing a quick and easy route that will take them to their destination, chances are high that the place will gain more attraction and obtain more guests [

22]. China is one of the BRICS countries and serves as an example of how direct flights have had a great impact on boosting the tourism sector in this country. It has been ranked as the 8th top country (list of top 10) for travel and tourism.

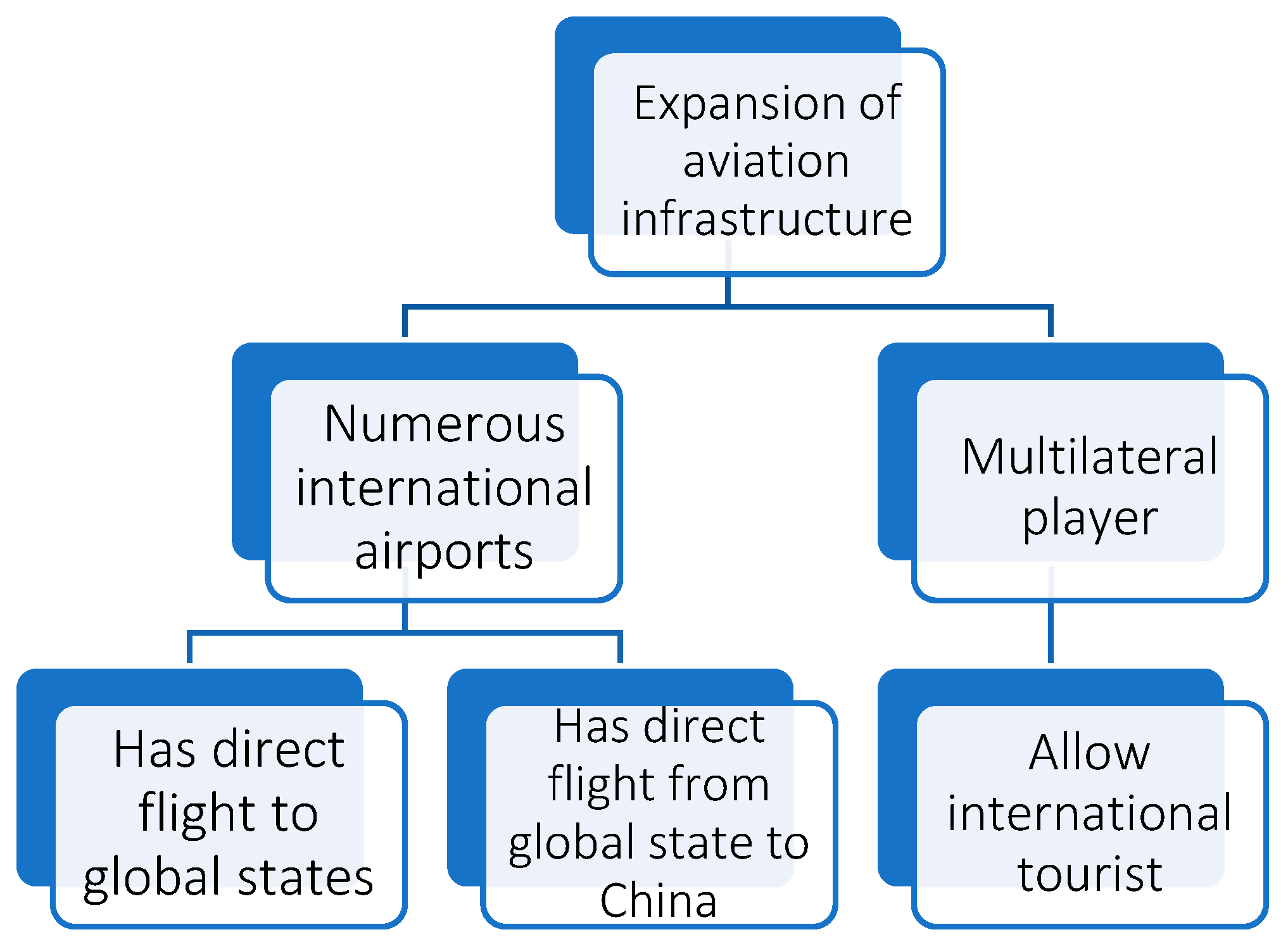

Figure 1 shows the key elements that have led to direct flights increasing the number of tourists in China.

Expansion of the aviation infrastructure—Zhao, Li, and Chen [

23] explain that infrastructure is a foundation for boosting the tourism sector. It allows flexible accessibility of destinations, which draws in more tourists and leads to an increase in traveling demand and promotes a high-quality tourist sector. New technology investments that are made in the aviation infrastructure, such as high-speed Wi-Fi, allow tourists to be able to navigate their travel easily and do things online. Prioritizing accessibility and having high-quality technology becomes essential when wanting to attract international tourists [

24].

Numerous international airports—These airports have allowed thousands of international tourists to arrive via their inbound and outbound flights to different cities in China, and they were also utilizing the 144-h visa-free policy that was recently established, which has led to a massive increase in the tourism sector. In a space of three days, China has exceeded 2.2 million trips from different airports that accommodated international tourists [

25].

Multilateral players—China has built and maintained good bilateral relationships with other global states through the Association of Southern Asian Nations (ASEAN), which makes it easy for other nations to become tourists in China. The introduction of easy visa access was a major factor in allowing foreigners to travel across different states in China. These traditional bilateral cooperations seem to have worked in favor of growing China’s tourism sector by participating in various cultural exchange activities [

26]. China has a bilateral respectful relationship with ASEAN, the China–ASEAN Free Trade Agreement, which was formally signed in 2015. The new visa policy agreement, which includes the 144-hour free visa, covers some of the ASEAN countries such as Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. All of these policy changes favor and boost China’s tourism sector.

In short, the expanding role of BRICS and its BRICS+ members in the global economy highlights their potentials and challenges, particularly in sectors like tourism and air transport. While these countries show promise in driving GDP growth and promoting sustainable development, the impacts of the COVID-19 pandemic have underscored the need for strategic recovery. The ongoing efforts to balance economic growth with environmental sustainability, particularly through carbon reduction initiatives and international cooperation, will be critical to the region’s continued influence on the world stage.

4. Methodology

This paper used a mixed methodology to derive findings. To determine if there was any recovery after the COVID-19 pandemic, we used secondary data from case studies regarding tourism sectors in the BRICS+ countries. This helped us gain an understanding of why people were not traveling again or to investigate why trips were not picking up after COVID-19. We also analyzed government policies, such as visa policies, to see if there were any changes that were made that might have contributed to the shift in the tourism sector. We analyzed and compared statistics from previous years to see if there was any growth. This paper also examined the BRICS+ countries that have direct flights and if there have been any improvements in their tourism sectors after the COVID-19 pandemic in comparison to countries that do not have direct flights. We also looked at each BRICS country and assessed what they have implemented to try and boost the sectors individually. This method helped us extract lessons from each country, and, to support our findings, we analyzed graphs and reports from each government, tourism sector, and airline.

5. The Impact of Tourism on Economic Development and Collaboration in BRICS+

This section covers the BRICS+ countries that have bilateral and cooperative relationships. We discuss some of the impacts that come with such collaborations and consider whether they have any impact on the growth and economic development of these relationships. We also look at the role that is played by the tourism sector in growing the country’s economy and analyze the effect of how the COVID-19 pandemic caused a shift in the tourism sector and how it destabilized the BRICS nations. In this section, we also look at the ASEAN countries and how they bounced back in their tourism sector, boosting their countries’ economies.

Alcalá-Ordóñez, Brida, and Cárdenas-García [

27] explain that international travel has shown to be the biggest contributor to the country’s economic growth; this is achieved by different channels within the tourism sector, such as foreign investment, increased competition, improvement of infrastructure, and the creation of jobs. The BRICS countries’ GDP has been on the rise constantly when compared with G7 countries. The 2024 stats recorded BRICS GDP at 35% and G7 GDP at 30% [

13]. A study by Rasool, Maqbool, and Tarique [

28] shows that there is a positive direct causal relationship built by inbound tourism, which has a positive effect on increasing the country’s GDP and allows the economy of the country to grow. Ventura, Fernandes, Tshikovhi, and Sucheran [

29] concur that the rise in the arrival of tourists contributes to the international trade in BRICS nations and enhances their economic progress.

In previous years, like 2016 stats, the tourism sector showed a good performance regarding international arrivals into BRICS countries, with a constant increase being observed each year. China has always been the leading country among the BRICS nations when it comes to international tourism. Moreover, China has been improving its infrastructure, hotels, and local businesses. The tourism sector in South Africa contributed about 9.5% of the GDP in 2019, but there was a shortfall in 2020 due to the COVID-19 pandemic. In 2023, the GDP recorded was 8.2%.

Figure 2 shows the frequency of international arrivals for BRICS nations before the COVID-19 pandemic. We analyzed the data from 2016 to 2020. Brazil has always shown steady progress in international arrivals compared to other years. Brazil was not making significant growth, but each year the numbers would grow. They started to see a decrease in arrivals in 2019. In 2018, the country recorded 6,621,000 tourists; in 2019, the numbers decreased by 268,000 tourists, equating to 6,353,000 tourists, which is the lowest count compared to 2016 and 2017 stats, indicating that there was a loss arising within the country. China and South Africa also experienced a drastic loss in international tourists. From 2016 to 2019, China was on a constant growth trajectory until 2020, where they received 30,404,000 international tourists. There was a difference of 132,134,000 international tourists in a span of a year between 2019 and 2020 [

30].

The tourism sector has a significant impact on the country’s economy, encompassing areas such as air transportation, hospitality, accommodation, and job creation. In

Table 1, we analyzed the statistics for Brazil, China, India, and South Africa from 2019 to 2023 to identify which tourism sectors were most affected in each country and how that affected each country’s economy. In 2020, BRICS nations were negatively affected across different sectors of tourism. For instance, China experienced a loss in its hotel and accommodation bookings. In 2019, approximately 55.18% of accommodations were booked, indicating a healthy number of tourists utilizing hotels and contributing financially to the country. However, there was an abrupt change in 2020, with only 38.98% of accommodations booked, resulting in the industry being impacted as a whole, including those employed in these establishments. Although 2021 was still marked by the COVID-19 pandemic in China, so this country began implementing new strategies to revitalize its hospitality sector. This resulted in a gradual increase in numbers from 2021 to 2023, culminating in a 2023 booking rate of 50.69%. While these figures may not surpass the 2019 stats, they do indicate a recovering sector [

31].

In South Africa, on the other hand, Stats SA [

32] shows a decrease in the employment sector, specifically in hotels, motels, and B&Bs. The numbers of people employed has been slowly decreasing since 2018, which may be attributed to the COVID-19 pandemic. In 2018, the tourism sector employed approximately 104,105 people; however, according to 2022 statistics, this number decreased by 20,236, with only 83,869 people employed.

In Brazil, we examined the luxury hotel industry to determine if tourists are still willing to book luxury suites in hotels. López [

33] states that in 2019, people were willing to book luxurious hotels because the country had about 52.5% of tourists booking them. In 2020, there was evidence of the damage that was caused by the pandemic, as booking dropped to 24.2%. However, from 2021 to 2023, statistics show a positive trend with luxurious hotel being bookings. This time, it appears that bookings are surpassing the 2019 figures and demonstrating the resilience of the tourism sector.

In India, we examined job creation within the tourism sector to assess the impact of COVID-19 on it. Keelery [

34] states that, although India is working toward recovering from the setback caused by the pandemic, statistics show that the country is still struggling to rebuild its tourism workforce. In 2019 and 2020, the percentage of indirect and direct jobs created by the sector was recorded at 79.89%, the highest level so far. However, no statistics were recorded in 2021, which could indicate that no new hires were made due to the pandemic. It was impossible to hire new employees during these crises. From 2022 to 2024, the employment rate has been sitting at 40% to 45%, showing a sign of slow recovery. It is evident that employment in the tourism sector suffered significantly.

5.1. Brazil and South Africa Collaboration on Direct Flights

Travel2latam [

35] states that South African Airways (SAA) announced that a deal has been finalized between the SA Airways and the Brazilian airline for direct flights from Johannesburg and Cape Town. These flights are intended to promote tourism and Brazilian destinations across the African continents. They have established an effective schedule to accommodate entrepreneurs, executives, and leisure travelers. These planes will land in São Paulo, which is known as the country’s financial center. This move aims to promote tourist attractions in São Paulo, such as culture centers, museums, and first-class cinemas. This connectivity is based on diplomatic relations between Brazil and South Africa. The partnership was established so that both countries could benefit from cultural exchange, business collaboration, event facilitation, and the organization of meaningful meetings and events, ultimately boosting both countries’ economies. Statistics indicate potential for positive growth in this partnership since, in 2019, Brazil received 25,000 tourists from South Africa, despite the absence of direct flights. However, in 2022, this number decreased to 5400 South African tourists, likely due to the financial impact of COVID-19, which affected many people and reduced travel. Roy [

36] states that with the direct flight partnership, there will be an increase in the number of tourists traveling to Brazil. Additionally, the airline is expected to offer approximately 46,000 new seats for travelers from South Africa to Brazil.

5.2. China and Russia Collaboration on Direct Flights

The bilateral relationship between Russia and China has continued to grow ever since it began in the 1950s, even though there have been challenges related to political issues in Russia. China remains supportive of the country and continues to cooperate. Global Times [

37] mentioned that even after the terror attack at a concert hall in Russia, China did not suspend any of its direct flights to Moscow. Instead, there was a surge in airline ticket prices, and while other airlines refunded their customers or rescheduled their flights, China maintained its routes. Wong [

38] states that despite these political challenges, Rusia and China have continued to build good cooperation. A Russia airport executive mentioned that they will be adding another direct flight route to China, connecting St. Petersburg with Beijing and Shanghai. Additionally, another route from Hainan province is set to launch in 2025 due to the growing demand for flights between the two countries for business and tourism.

Lecca [

39] explains that traveling to Russia has become challenging for many countries due to the war between Russia and Ukraine, which is negatively affecting both countries’ economies. Many Western tourists and cargo carriers are now forced to take longer routes to avoid flying through Russia, as it has been designated as a “no-fly zone”. This leads to increased fuel consumption and higher costs for passengers. However, this situation has benefited the Chinese airlines by boosting their economy, as they have significantly increased their direct flights between Asian and European cities. Girard [

40] argues that although China remains loyal to the Russian government, this relationship is also creating economic challenges for China. Many international flights have been pulled from Beijing due to the Russia–Ukraine war, which began in 2022 and continues to this day. This has impacted China’s tourism industry, as European tourists are now required to take longer and more expensive routes to travel to China. For example, the Virgin Atlantic Airline has announced that its last flight from Shanghai, mainland China, to London will be on the 26 of October 2024. Despite the political interference in Russia’s tourism sector, China’s support for the Russian government has significantly helped boost Russian tourism. Statistics show that there have been 55 direct flights weekly between capital cities such as Moscow and Beijing. Official data recorded that approximately 244,000 Chinese tourists visited Moscow in 2023 [

41]. The China–Russia relationship continues to strengthen as both countries are planning to use the tourism sector to boost their economies by hosting conferences, meetings, and tourism exhibitions. They have also signed a cooperation program aimed at the enhancing their tourism sectors alongside other industries, which leads to growth in GDP. This initiative aligns with the SDG Goal 8 for decent work and economic development, as it will create employment opportunities. Additionally, it supports SDG Goal 16 by promoting cultural identities, fostering understanding and tolerance, and helping prevent conflict.

5.3. India and Iran Collaboration on Direct Flights

TravelWorld [

42] explains that India and Iran are in the planning stages of signing a tourism Memorandum of Understanding (MoU) for cooperation to help both countries boost their tourism sectors. This development follows Iran’s decision to waive the visa application requirement for Indians traveling to Iran, which has led to an increase in the number of Indian tourists visiting Iran, leading to a positive impact on economic growth. This impact is also evident in the number of direct flights between the two countries, as it takes only four hours to travel from India to Iran. The MoU aims to revive the shared historical and cultural heritage of both countries, which can be strengthened through increased tourism and cultural exchange. Following the decision to waive visas, Iran has recorded a 39% increase in the number of Indian tourists within four months of its implementation. In 2023, the numbers of Indian visitors to Iran was significantly lower than in 2024 as it reached 58,000 visitors. This initiative was expected to further expand the tourism sector in both Iran and India and contribute to the economic growth of both countries.

Policy reform in visa applications appeared to be an effective strategy for attracting more tourists. For example, when examining ASEAN member countries, Vietnam and Thailand visa strategies have significantly boosted tourism and increased employment. Muthuta and Laoswatchaikul [

43] elaborate on how the Thailand government recognized the need to revise international tourist visa policies after seeing economic improvements. Between 2017 and 2019, Thailand’s GDP increased to 18.13%, while job creation in the tourism sector rose by 11.58%. These policy change have positioned Thailand among the top 10 most-visited countries in 2024 [

44]. Similarity, Vietnam has extended visa-free stays for eligible travellers from 15 days to 45 days, encouraging longer visits and contributing to economic growth. These changes have helped Vietnam in expanding its international tourism sector [

45].

5.4. South Africa and United Arab Emirates (UAE) Collaboration on Direct Flights

Philipot [

46] explains that South Africa and the United Arab Emirates started a direct airline partnership in 1995, which has led to multiple additional collaborations, including partnerships with smaller, cost-effective airlines such as South African Airways, Airlink, Cemair, and FlySafair, which offer budget-friendly travel options. Over the years, this partnership has evolved, with both countries expanding their operations and exploring innovative ways to strengthen their collaboration. A stronger foundation of trust has been built, leading to an extended partnership with the South African tourism sector, where Emirates actively promote and showcase South African culture, history, heritage, diverse tourist attractions, and natural beauty.

Emirates [

47] confirm that they have signed an MoU with the South African Tourism Board. This collaboration aims to boost and promote tourist attraction in both countries and increase inbound and outbound travel. It also seeks to restore travel demand, which declined due to COVID-19, by providing high quality services. Through this partnership, both countries hope to recover financially by supporting each other through marketing strategies that enhance access to key tourist destinations. One such destination is the Kruger Nation Park, renowned for its natural beauty. A direct flight from Dubai to Kruger National Park provides passengers with a cost-effective and convenient travel option. This partnership offers different tourist packages and incentives designed to enhance the travel experience. Additionally, there are giveaways that encourage travellers to read magazines featuring Emirates and South African tourism sectors, allowing them to learn more and participate promotional campaigns. This initiative is a part of a broader strategy implemented by both countries to attract more travellers.

5.5. South African and Ethiopian Airlines

In 2010, Ethiopian Airlines and South Africa Airways signed a cooperation agreement for a code-share partnership covering different routes in South Africa and Ethiopia for both domestic and regional flights. This partnership aims to provide travellers with more options and greater traveling flexibility, including flying on the weekends. Additionally, this cooperation boosts tourism in both countries by attracting more visitors and increasing airlines activity [

48].

Grover [

49] explains that South African and Ethiopian Airlines have launched another partnership called “Explore More & More For Less”, which provides tourists from India with direct flights from Mumbai, Delhi, Bengaluru, and Chennai to Cape Town and Johannesburg. This short-term campaign is carefully designed to accommodate tourists that travel between India and South Africa during the major holidays such as Diwali and Christmas. Passengers can travel between 1 October and 31 December 2024, with a 10% discount available for them. This partnership seeks to increase the number of tourists traveling between the two countries and to strengthen bilateral relations between them.

5.6. Cooperation Between China and Africa (South Africa, Ethiopia, and Egypt)

Over the years, there has been significant growth in the China–Africa cooperation, as evidenced by the numerous partnerships China has established with African countries. China has expanded its collaboration through direct flights from South Africa to China, Ethiopian Airline to China, and China to Egypt. These direct flight routes are convenient for passengers and save time in reaching their destination. This development has also created many business opportunities between African nations and China, while simultaneously their boosting tourism.

Business Tech Africa [

50] explains why direct flights between Africa and China have resumed. The Gauteng MEC has stated for the economic development that the cancelation of flights between these countries had a devastating impact on the tourism sector, negatively affecting trade and investment. Before the COVID-19 pandemic, China was a major contributor to the Gauteng market trade, increasing investments and bringing approximately 120,000 tourists to the region annually. Around 9.7% of South Africa’s exports go to China, and this sector suffered due to the suspension of air travel. The tourism and airport services alone create approximately 3000 jobs and contribute 2% to the country’s economic growth. The decision to resume direct flights is expected to bring positive economic result for South Africa, as it will restore business operations and create employment opportunities, particularly for the youth, given the country’s high unemployment rate. Something that should not be overlooked is the fact that China and South Africa share a long-standing relationship, which strengthens cooperation in various sectors, including education, health, tourism, and art and culture.

Lei [

51] explains that the direct airline collaboration between China and Ethiopia has continued to grow each year. Between January and June 2024, more than 330,000 passengers traveled from China to Ethiopia via the Ethiopian Airline, marking a strong recovery since the COVID-19 pandemic. The Shanghai–Addis Ababa route has been operating for approximately 10 years, and the number of tourists using this route continues to rise. Additional routes also connect passengers to other airports in China, including Beijing. This partnership has contributed to the growth of tourism infrastructure across Africa.

China and Egypt have maintained a bilateral relationship for years, with China actively participating in various projects in Egypt. Salah [

52] states that Egypt’s Minister of Tourism, Antiquities Ahmed Issa, is currently in discussion with the Chinese government to increase the number of direct flights between China and Egypt. This initiative aims to attract more Chinese tourists to Egypt and promote the country’s rich history and culture. The minister also revealed that a marketing study was conducted to assess the demand for tourism in Egypt, and the results were surprising—a significant number of Chinese travelers expressed interest in visiting Egypt. In response, a workshop was held to enhance cooperation between Cairo and Beijing, with Chinese delegates exploring ways to further boost tourism between the two nations.

Si [

53] states that the tourism industry is expanding rapidly, particularly among Chinese travelers who seek to explore more African countries. Chinese tourists often spend their summer holidays visiting multiple African nations; various travel portals indicate that the most booked flights by Chinese tourists in July and August 2024 were to the top five African destinations: Egypt, Tanzania, Kenya, Morocco, and South Africa. The number of Chinese tourists traveling to these destination has increased 1.2 times annually. When asked about their favorite experience in Africa, many Chinese highlighted the local culture, wildlife, natural attraction, and pyramids as the most enjoyable aspects of their trips.

The direct flight collaboration between the BRICS+ countries has experienced significant growth.

Figure 3 presents statistics from 2020 to 2024, illustrating the steady improvement in international travel among these nations [

54,

55]. The number of direct flights between China and Russia has shown substantial growth. In 2023, 477,000 tourist traveled between the two countries, and within 12 months, this figure increased to 254,900, further reaching 731,900 tourist in 2024. Similarly, the direct flight partnership between Brazil and South Africa has demonstrated remarkable improvement. In 2023, 21,414 international tourists were recorded, while in 2024, the number increased to 44,637, reflecting a growth of 23,223 tourists within a year. These figures suggest that the tourism sector is recovering; however, further efforts are needed by BRICS+ nations to sustain and accelerate this progress.

6. Countries with a Chance for Collaboration

In this section, we analyze the BRICS+ countries that still have the opportunity to collaborate and enhance each country’s economy. Strategic collaboration has been demonstrated as an effective approach to stimulate growth in the tourism sector. Expanding partnerships among BRICS countries through various collaborations will enable them to foster economic development. Several successful international alliances have employed this strategy. A study conducted by Wong, Mistilis, and Dwyer [

56] examines how the ASEAN members implemented a collaboration as a key strategy for strengthening their tourism sectors. They stablished an agreement that facilitated economic stability and mutual reliance. Furthermore, the ASEAN members have introduced various targeted campaigns that have significantly contributed to the growth and promotion of their tourism sectors.

6.1. India and South Africa Collaboration on Direct Flights

Philpot [

57] explains that India and South Africa previously maintained a direct flight route from Mumbai to Johannesburg through South African Airways. This collaboration lasted for 19 years until the route was discontinued in 2015. The termination of this route has raised concerns, given both countries are members of BRICS and are expected to facilitate direct flights to enhance and strengthen their bilateral relationship and cooperation. South Africa’s Travel News [

58] have also reported that at the Africa Travel Indaba conference, the Airports Company South Africa (ACSA) CEO Mpumi Mpofu attributed the cancelation of direct flights to the diplomatic challenges between the two countries. Mpofu further highlighted difficulties in securing a dedicated airline to operate the routes efficiently. South African Airways is currently in the negotiation with an Indian airline to explore the possibility of reinstating the partnership. South and East African Tourism update [

59] states that the South African Minister of Tourism, Patricia de Lille, recently visited India. A key objective of her visit was to engage in discussions regarding the resuming of direct flights between the two countries, emphasizing that India is a crucial partner for South Africa. Reinstating this collaboration is regarded as essential for boosting the tourism sector, as well as fostering trade and business relations between these countries.

6.2. Russia and South Africa Collaboration on Direct Flights

Russia and South Africa have maintained a strong bilateral relationship for years; however, there have been challenges concerning the establishment of a direct flight route between these two countries. TV BRICS [

60] reports that there are plans for South Africa and Russia’s to resume direct flights. This was announced by the ambassador of the Russian Ministry of Foreign Affairs, who has stated that South Africa is collaborating with Nordwind Airlines to launch a direct airline service between the two countries, with flights planned to land in Moscow and/or Tambo International Airport in Johannesburg. Birns [

61] concurs that South Africa has been engaged in discussions with Nordwind Airlines to establish a direct flight service between South Africa and Russia. However, the carrier is subjected to political sanctions by the US and Europe due the ongoing war between Russia and Ukraine, and it must comply with the international aviation safety regulations. Nevertheless, there have been conflicting reports regarding the potential resumption of direct flights.

Tozer-Pennington [

62] states that the Russian Minister of Transport has denied any plans for a direct flight service between South Africa and Russia. This denial was followed an announcement by the Federal Air Transport Agency, which had previously stated that direct flight routes will be launched between these two countries. Additionally, several government departments, including the Russian Ministry of Foreign Affairs, have also made statements that contradict the claims regarding the establishment of direct flights.

7. Challenges for Sustainable Tourism Development in BRICS+ Countries and Analysis

Many challenges persist in the tourism sector, hindering its growth and impending the creation of a sustainable economy for each country. Political conflicts can cause significant harm to the country’s growth, employment, and economy. Some of the key challenges that countries face within the tourism sector include the following:

7.1. Political Wars (Sanctions)

Hall and Seyfi [

63] explain that the tourism sector has been significantly impacted by sanctions, which hinder its growth. When sanctions are imposed on a country, fewer flight operate to and from this country, leading to a decline in tourism, hospitality services, employment opportunities, and restricted business environment, ultimately stagnating the economic growth. Political conflicts have been the greatest factor affecting the tourism sector. For example, countries like Iran are affected by sanctions, which prevent Iran from achieving peaceful cooperation and partnership with other countries such as India. One example is the delayed launch of direct flights between India and Iran. The Economic Times [

64] explains that Air India has deferred its plan to launch a direct flight to Tehran because of the uncertainties regarding the US administration and the potential sanctions that could hinder cooperation. The uncertainty surrounding the sanctions was a key factor, as it would determine whether India and Iran could establish direct flights without financial repercussions. This also relates to fact that some of the Indian airlines receive financial support from a US loan bank, Exim Bank. The consequences of these sanctions continue to increase poverty rates in Iran because people are losing their jobs, and no new employment opportunities are being created until the sanctions are lifted.

Tiwari [

65] argues that the Iran–Israel conflict does not create a favorable environment for other countries to pursue a bilateral relationship; constant political wars ultimately affect many people, leading to delays of planes mid-air, which causes disruptions for passengers and increases financial costs of plane fuel. No country desires to be in any cooperative relationship with a country that experiences constant financial loss. Dzulhisham [

66] explains that Iran sanctions do not benefit the country at all, since the Iranian economy is underperforming and they could use all the support that they can receive from other BRICS+ countries to help them boost their economy. Statistics show that there are significant chances that the Iranian economy will continue to struggle because of the inflation rate (recorded at 34%), which has caused the price of bread to rise by 200%, making it harder for unemployed people to afford basic needs like food. This means that Goal 2 of the Sustainable Development Goals (SDGs), Zero Hunger, will not be achieved any time soon, since the standard of living in Iran seems to be becoming more challenging and sanctions are only making the situation worse.

Khatinoglu [

67] states that the gas shortage, which Iran is currently facing, poses an additional challenge that increases the country’s inflation. It is noted that if the gas shortage is not quickly resolved, it might escalate and worsen the inflation rate in Iran. The country faced a similar shortage during summer of approximately 14,000 megawatts (MW) in electricity supply, and in winter, the shortage increased to approximately 250 million cubic meters, costing the country approximately USD 8 billion annually across different industries. The lack of implementing and growing renewable energy is another factor that has a significant impact on electricity and gas shortages in Iran. Statistics show that the demand for domestic gas will double by 2040; however, the sanctions have caused companies and projects to withdraw from Iran, such as the Joint Comprehensive Plan of Action (JCPOA) in 2018 and China National Petroleum Corporation (CNPC).

7.2. Traveling Expenses (Flight Prices)

Rebecca Kesby [

68] explains some of the challenges that are faced by African countries in the aviation space, particularly the cost of their flights, especially on Africa-to-Africa destinations, which are often too expensive for an average person to explore due to tight budgets. The aviation sector also contributes to the country’s GDP and supports job creation as well. The more demand the flights generate, the greater the need for new employment to keep the service running effectively. Collaboration is key in the aviation sector because when more African countries collaborate and sign partnership agreements, it enhances connectivity and creates a larger market that could generate significant number of jobs and boost the country’s GDP.

Tolcha, Bråthen, and Holmgren [

69] explain that African countries have poor land infrastructure that should also be considered. They mention that the cost of traveling can be reduced if efforts are made to improve transportation and shorten traveling distance by prioritizing network expansion and managing capacity. This can be achieved by building partnerships so that the demand is shared, potentially reducing traveling costs. The availability of planes also increases the price demand. Therefore, there is a need for the extension of new flight routes that are cost-effective for passengers. Fuyane, Xaba, and Sikwela [

70] argues that some of the challenges relate to preferences of passengers when choosing flights, such as the comfort of the flight, the cleanliness, and the services offered onboard. All these factors influence the pricing of flights. The more comfortable the plane is, i.e., with large leg space and better onboard services, the more these elements become priorities for passengers when they are traveling.

7.3. Visas

UN Tourism [

71] has come up with new rules after the COVID-19 pandemic that need to be followed globally. In this report, they introduce many changes that allow people to travel smoothly while still being guided. This report indicates that there has been an easing of traditional visa requirements, with statistics showing a decrease from 77% in 2008 to 59% in 2018, and further down to 47% in 2023. This allows most countries to have e-visas, which have increased from 3% in 2013 to 7% in 2018. Visa-on-arrival options have also grown, with the percentage increasing from 14% to 16% in 2008, although it slightly decreased to 15% in 2018.

The application for a visa in some of the BRICS+ countries can be a cause of challenges that travelers are experiencing. For instance, the lack of direct flights between India and South Africa has been attributed to the fact that Indian passport holders need a visa to enter South Africa, which creates obstacles for establishing a South African Airways (SAA) direct flight [

57]. The challenging part about visas is their cost-effectiveness, which makes it difficult for those who wish to travel but lack the extra funds to pay for the visa. This indicates that people who are allowed to travel are those who have financial capacity. This further limits the flow of travelers internationally [

72].

UN Tourism [

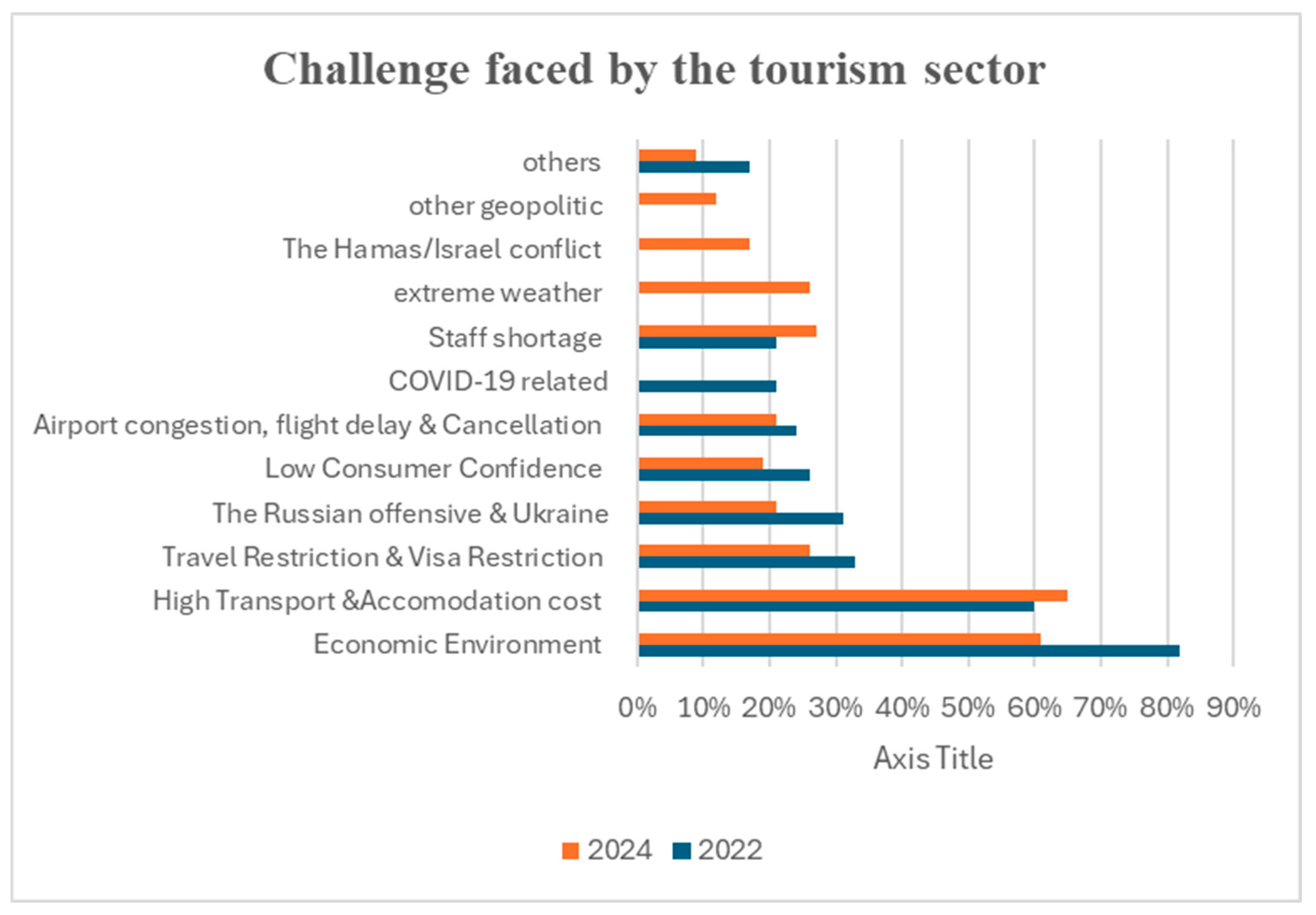

73] highlights some of the factors that are holding back the tourism sector from recovering quickly internationally.

Figure 4 presents a comparative study of the challenges that occurred in 2022 versus 2024. The economic environment was recorded at 82% in 2022, but in 2024, it decreased to 61%. However, transport and accommodation costs increased in 2024, rising to 65% compared to 60% in 2022. Travel restrictions were notably high in 2022, recorded at 33%; however, in 2024 they decreased to 26%. The Russia–Ukraine conflict was recorded at 31% in 2022, but it decreased to 21% in 2024. A new challenge in 2024 is the Hamas–Israel war, which was recorded at 17%. Extreme weather conditions were recorded at 26% for 2024, and geopolitical issues were noted at 17% for the same year. These statistics demonstrate that the tourism sector will always face challenges. In 2022, the primary challenges were related to the economic environment, but in 2024, the emphasis shifted to high price of air transport, which could be because airlines are trying to recover from the COVID-19 pandemic. Additionally, 2024 brought new challenges, including the political issue like the Hamas–Israel conflict and extreme weather challenges, which are part of climate change.

From the case studies about direct flights to BRICS+ countries, it is evident that most of the countries have bilateral relationships, which make it manageable to have direct flights from one country to another (

Table 2 and

Table 3). In some countries, it is easy to have direct flights since they are geographically neighbors.

Table 2 shows the first group of countries that are geographically neighbors and have a direct flight from each country. The first group, which includes India, Russia, and China, are all neighboring countries.

Having a direct flight does not only mean that countries should be neighbors; there is also a need for direct flights because there has been a rise in demand in the tourism sector and an increase in people traveling internationally. The movement of people has been proven to boost the tourism sector, enhance the country’s GDP, increase trade and investment, and create employment opportunities. Direct flights are needed to bring convenience to tourists and assist people who are traveling for emergencies [

74]. The cooperation program in the BRICS+ countries is very important, and it has proven to be empowering for every country involved.

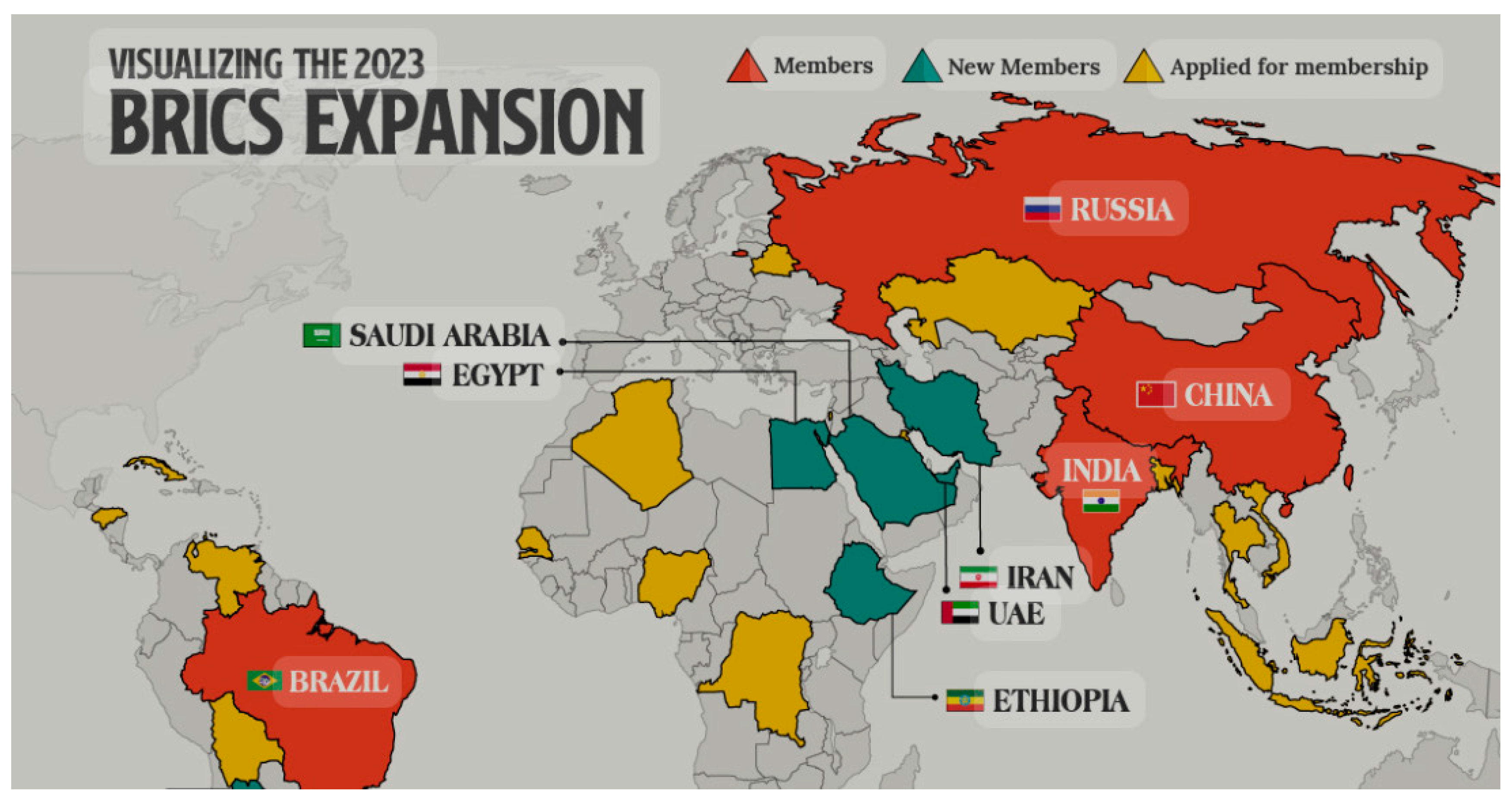

Figure 5 is a map of the BRICS+ countries that illustrate how cooperation programs and partnerships can be established even with countries that are on different continents and still maintain multilateral relationships [

75].

8. Summaries of the BRICS+ Countries

When one looks at the BRICS+ countries and how the tourism sector has grown after the COVID-19 pandemic, a gradual revival can be observed. Many tourists are attracted to BRICS+ countries because of their different cultures and historical backgrounds, as well as their unique experiences. These factors lead to BRICS+ contributing a significant amount of the global tourism market. TV BRICS [

76] gives a summary of how the BRICS+ countries have managed to come back from the COVID-19 pandemic, especially the tourism sector, which was one of the most negatively affected since travel was prohibited.

Brazil—The Brazilian government has announced its plans to boost tourism and arrivals into the country. The program is called the “International Tourism Acceleration Programme (PATI)”. This program aims to foster good collaboration with the public–private partnership between airports and airlines. This project seeks to learn international practices and adapt to new ways of doing things, which will enable the country to attract more tourists.

India—This country initiated a major infrastructure project that was meant to improve the country’s state after the COVID-19 pandemic. India has been investing in transport sectors, spending more than USD 200 billion across various airports over the years. This investment led to a 64% increase in foreign tourists in 2023 compared to 2022, as reported by the India Brand Equity Foundation.

Russia—In March 2024, the Russian government agreed to implement a project designed to boost their tourism and hospitality sectors, with an investment of RUB 400 billion. The planning stage for supporting tourism recovery was initially set during 2023, and to ensure its success, the Russian government permitted foreign nationals to apply for an electronic visa to enter the country starting in August 2023.

China—In 2024, this country experienced a massive 280% increase in the tourism sector, welcoming 190 million visitors compared to 2023 statistics. Notably, 10% of their tourists were Russians.

South Africa—The Department of Tourism implemented a plan to help the country recover their tourism sector by initiating the Tourism Sector Recovery Plan (TSRP). This plan resulted in the country receiving 8.5 million travelers in the period from January to December 2023, representing a 48.9% increase compared to 2022.

Saudi Arabi—International and domestic visitor data from 2023 indicated that Saudi Arabia became more tourist-diverse, with 106.2 million visitors, resulting in a 56% increase compared to 2019. There was also a 12% increase in growth from 2022. In terms of international tourism, there was a 27.4 million increase, reflecting a 56% rise compared to pre-pandemic levels, which has contributed approximately 40% to the GDP.

United Arab Emirates (UAE)— The UAE has consistently been a hub for foreign tourists and, in 2023, the country announced its goal to double its economy with USD 8.7 trillion invested through economic developments. The UAE will allocate USD 27 billion to tourism. This initiative aims to grow the 2024 economy and increase the tourism GDP to USD 1225 billion by 2031.

Iran—The Iranian government decided in December 2023 to ease and cancel visas for citizens of 33 countries. This decision resulted in a 60% increase in foreign tourists within the first quarter of 2024, amounting to 1.398 million visitors.

Ethiopia—This country has attracted significant infrastructure investments from stakeholders aiming to grow the tourism sector. There have been massive construction investments in hotels, resorts, convention centers, duty-free centers, and cultural villages and centers. These investments and partnerships are expected to improve the tourism sector in the upcoming years.

Egypt—The Egyptian government announced that to grow their tourism sector, they needed an environmental and sustainable program. They are promoting an eco-tourism initiative through international cooperation to expand the sector and achieve climate sustainability goals. Significant growth has been observed, when comparing the 2010 and 2023 statistics. In 2023, Egypt received 14.9 million visitors, surpassing the 14.7 million visitors recorded in 2010

9. Recommendation

The challenges that were presented by travellers are something that BRICS+ countries should try and investigate so that they can reduce certain burdens on tourists. Some of the recommendations are as follows:

Ease visa requirements, especially for BRICS+ countries to boost their inbound tourism numbers. It has been proven that waving visa requirement can increase the number of tourists. For example, China’s ease of visa policy for ASEAN countries visiting Xishuangbanna, Yunnan, allows tourists to receive free visas. This has created a massive growth in the Chinese tourism sector. The number of inbounds visitors increased significantly because of this visa update, changes, and exemptions. This policy has helped China become a part of the top 10 most-visited countries worldwide [

77]. The issue of visa payment in some of the BRICS+ nations presents another challenge; some countries have visa exemptions, while others do not. This is an area that needs attention, particularly for BRICS+ member states.

The high transportation cost of traveling needs to be addressed across different dimensions, such as offering discounts for travelers using direct flights between BRICS+ countries. Promotions for the summer/winter holidays could offer discounts for a certain number of travelers who buy tickets in advance. Various studies have shown that direct flights may be slightly more expensive than connecting flights. The issue of finance is crucial in the tourism sector because it directly affects tourism progress. Other scholars argue that direct and connecting flight prices differ in terms of detours. Studies by Lijesen, Rietveld, and Nijkamp [

78] and Stefano de Luca [

79] indicate that direct flights are also dependent on costs and routes. Preferences also play a role in decision-making, including factors like the age of a traveler.

Offering discounts of 5% or 10% for travelers who are visiting any BRICS+- country for purposes such as conferences, education, or long-term employment is a valid strategy. This encourages greater cooperation between the countries while also accommodating those who may not have the financial means to travel.

Extreme weather, caused by climate change, and programs for reducing gas emissions should be the priority of all BRICS+ countries. They must ensure that countries develop effective programs to meet the 2030 sustainability goals. For example, in India, weather conditions caused 3430 flight cancelations due to fog-related disruption in 2023, leaving hundreds of passengers stranded. This disruption affected multiple airlines, including IndiGo, Alliance Air, SpiceJet, and Air India [

80].

There should be better solutions to political conflicts rather than relying on sanctions, which only increase poverty and unemployment. They do not contribute to the global economic growth. Allowing each country to solve its domestic issues would be a more effective solution for future conflicts. Traveling to Russia has become increasingly difficult since the US sanctioned them. Tourists cannot use their Visa/Mastercard cards while in Russia. Sending or transferring money to Russia is nearly impossible due to these sanctions. These sanctions have negatively affected Russia’s tourism sector, but now, with the literature provided, there appear to be solutions for tourists visiting Russia [

81].

10. Limitations and Conclusions

This study focused on the post-COVID-19 pandemic, which was different for each BRICS+ country; China’s post-COVID-19 period was until December 2022 compared to other BRICS countries. The data available for comparison seemed to be unbalanced due to this factor, and there were also limitations in finding more data on air transport. This could be because it is still early for industries to release such data. Perhaps, after five years post-COVID-19, many sectors will be more open to sharing whether there has been any growth or not. These limitations have also opened up opportunities for exploring other sectors through studies that contribute to boosting the tourism sector.

There have been many studies that are trying to test whether the tourism sector is linked to the economic development of a country. In a study that was conducted by Pablo-Romero and Molina [

82], 89 case studies were analyzed to determine if there is any positive relation between tourism and economic growth. These studies showed that a positive relationship between the tourism sector and country’s economic growth. However, four studies indicated that there was no relationship between tourism and economic growth. Another study by Brida, Gómez, and Segarra [

83] investigated whether tourism has any relationship with economic growth. This study analyzed 80 different countries, including both developed and underdeveloped countries. The findings were not conclusive to one answer, but they did acknowledge that tourism positively impacts country’s economic development. A study conducted by Rasool, Maqbool, and Tarique [

28] examined the link between tourism and economic growth in the BRICS countries. The findings showed a strong relationship between international tourism and financial development, identifying them as significant factors in improving economic growth. This study also indicated that if there is a rise in the tourism sector, it directly contributes to the GDP of the BRICS economy. Enhancing air connectivity for the BRICS+ countries is related to boosting their tourism sector, which will allow the countries to grow their GDP.

Table 1 shows how tourism impacts job creation and sustainability in most of the BRICS countries. The post-COVID-19 shift is still evident in some countries that are gradually recovering from it, while others are struggling and need collaboration to help them thrive again.

Policymakers and governments play an important role in assisting the tourism sector in recovering. Infrastructure and technology are significant in enhancing air connectivity. Challenges in air connectivity, such as visa policies, still need to be prioritized and addressed with flexible solutions that do not require a lengthy process, as these tend to discourage tourists. Underdeveloped countries within BRICS+ face different challenges, with their primary concern being the creation of a sustainable economy. This can be supported by increasing the availability of airline choices in order to create competition, which leads to lowering the cost of air travel and allows tourists to choose based on their budget.

The BRICS+ collaboration framework has proven to be effective, with members implementing various programs and projects to stimulate growth in the tourism sector. Even countries without direct flights to other nations often face political challenges unrelated to BRICS+ members. Despite these challenges, countries can find alternative ways to cooperate. In case like India and South Africa, short term campaigns have been introduced to promote Indian tourism and to reach South Africa at lower costs, although political issue persists between the two countries. Multilateral and bilateral relationships remain the foundation of the BRICS+ countries, leading to successful cooperative outcomes.