Abstract

With the accelerated advancement of the global technological revolution and industrial transformation, digitalization and greening are increasingly becoming important trends in the transformation and development of the global economy and society, and the deep integration and collaborative development between the two has become the core issue of current scientific exploration. This study examines the influence and underlying mechanisms of data factors on green innovation among Shanghai and Shenzhen A-share manufacturing listed companies in China, spanning from 2013 to 2023. The empirical analysis reveals a positive correlation between data factors and the enhancement of corporate green innovation. A deeper investigation indicates that this positive effect is more pronounced in eastern enterprises and non-state-owned entities. Additionally, data factors facilitate corporate green innovation by augmenting investment in innovation and intensifying external governance factors, such as analyst attention. Based on these empirical findings, this paper advocates for several measures as follows: enhancing the development of the data factor market; fostering research and development in digital technologies; and fostering integration between digital factors and business applications.

1. Introduction

Encouraging green technological innovation and accelerating the development of a green industrial system are especially important at this time as the green economy has become the commanding height of global industrial competition and green development is a key trend in the latest wave of scientific and technological revolution and industrial transformation [1]. In recent times, China has placed considerable emphasis on green development. “The Implementation Plan for Further Improving the Market-oriented Green Technology Innovation System (2023–2025)” proposes to further improve the market-oriented green technology innovation system and strengthen the support capacity of green technology innovation for green and low-carbon development. In this context, Chinese enterprises are facing the difficult task of creating new economic growth points and improving environmental performance while seeking effective sustainable development strategies of “harmonious coexistence” with the environment [2]. Providing environmentally friendly green products and services has become the key for them to obtain a competitive edge in the market [3], while green innovation serves as a crucial strategic pillar in achieving enterprises’ sustainable development objectives [4]. Green innovation has emerged as a pivotal factor in fostering sustainable development, successfully merging the concepts of green development and innovation-driven progress. It underscores the necessity of achieving green development through innovative means, while innovative development must adhere to green principles. Guided by government policies, Chinese companies are increasingly participating in green innovation activities. As pivotal market participants, enterprises are significant energy consumers and primary drivers of carbon reduction in economic operations. Increasing green R&D innovation with advanced technologies for energy conservation and carbon reduction as the core and their wide application will help establish a long-term mechanism for the green transformation of economic structure [5], thereby fostering the alignment of environmental protection with economic growth. Strengthening enterprises’ commitment to green innovation, enhancing their capabilities in this area, and deepening the breadth and intensity of their green innovation efforts are crucial for elevating the economy’s gold and green standards and propelling China’s social and economic advancement to a new level of green and low-carbon progress.

In the context of contemporary globalization and rapid technological progress, data have become an indispensable and important resource in modern economic society. The digital economy—which is built on a number of emerging information technologies including the Internet, cloud computing, and artificial intelligence—is crucial for industrial transformation, economic development [6], and the improvement and mitigation of environmental degradation [7,8]. From an international perspective, the world has entered the digital age, and data factors are profoundly influencing the development of the world. In 2022, the world’s five largest economies—the US, China, Germany, Japan, and South Korea—digital economy reached USD 31 trillion, accounting for 58% of GDP, an increase of about 11 percentage points compared to 2016. Specifically, nations worldwide are intensifying efforts to advance the digital economy, with a keen emphasis on the realm of data factors, aiming to proactively capitalize on emerging development opportunities. The Chinese government, leveraging its institutional strengths, is actively strategizing the development of the data factor market. The marketization of data factors can better play the enabling role of data factors on traditional factors, accelerate the synergy between production factors within enterprises, improve the ability of data value release, and then drive the businesses’ digital transformation [9]. To further propel the market for data factors, the National Data Administration was one of seventeen departments that jointly released the “Three-Year Action Plan for ‘Data Factor ×’ (2024–2026)” in January 2024, which aims to fully utilize the multiplier effect of data factors and empower economic and social development.

Data, emerging as a novel production factor, constitute the cornerstone of digitization, networking, and intellectual advancement. In the digital economy, data have risen to the position of a key factor of production [10]. Data are a bridge-type production factor that endows capital, labor, technology, and other factors with new characteristics [11], seamlessly integrating with production, distribution, circulation, consumption, social service management, and other aspects, fundamentally changing the mode of production, lifestyle, and social governance structure. The value of data is increasing day by day, and based on data driving, enterprises can realize more efficient production and delivery, more agile industry chain collaboration, more targeted advertising, more precise personalized marketing, and faster and more effective management decisions [12,13,14]. The data factors present fresh avenues for green innovation within corporations. By harnessing and integrating data factors, enterprises can pinpoint market opportunities more accurately, refine resource allocation, enhance resource utilization efficiency, and accelerate the R&D of eco-friendly technologies. Consequently, this paper delves into the micro-level perspective of enterprises, employing empirical analytical methods to comprehensively explore the empowering impact and underlying mechanisms for data factors to foster green innovation in enterprises. The ultimate objective is to propel data-driven green innovation practices forward.

After a systematic review of the existing literature, we found that direct exploration of the relationship between data factors and green innovation is relatively scarce, as well as a lack of studies exploring the underlying mechanisms of their interaction. Because of this, this paper combines data factors and green innovation into a unified research framework with the goal of thoroughly examining the mechanism by which data factors influence green innovation. It also uses empirical analysis to examine the mediating role that innovation input and analyst attention play in this process. This paper’s possible marginal contributions may be summed up as follows: Firstly, it addresses a research void by empirically analyzing the influence of data factors on green innovation employing a two-way fixed effects model. Secondly, through the application of a mediation effect model, we examine the intermediary roles of innovation input and analyst’s attention in the impact of data factors on green innovation, thereby offering more ideas for the green innovation practice route. Thirdly, this paper also examines the diverse effects of data factors on green innovation among regional businesses in various geographic locations, aiming to inject new impetus into the promotion of sustainable development strategies.

2. The Literature Review

2.1. Green Innovation and Its Driving Factors

Originally put forth by Fussler and James (1996), green innovation—also referred to as ecological innovation or environmental innovation—refers to innovative activities that can significantly mitigate adverse environmental effects while creating commercial value for businesses [15]. Specifically, corporate green innovation refers to innovation related to the manufacturing of green products, including designing green products, reducing emissions and energy use, and developing green technologies—all aimed at alleviating environmental burdens and enhancing the ecological environment [16,17]. Compared with traditional innovation models, green innovation requires enterprises to integrate multidimensional information such as production, resource consumption, pollution reduction, and environmental impact and involves the creation, integration, and dissemination of knowledge across various domains both inside and outside the organization [18], which poses a more stringent challenge to enterprises’ capabilities.

When discussing the driving factors behind green innovation in enterprises, scholars mainly conduct in-depth analysis from two dimensions: external environmental pressure and internal governance [19]. From the perspective of external environmental regulation, the “weak Porter hypothesis” theory suggests that environmental regulation can induce green innovation in enterprises through an “innovation compensation” effect to cope with policy costs [20]. However, the influence of different environmental regulatory measures on green innovation in enterprises exhibits heterogeneity—while the pollution charging mechanism can incentivize enterprises to bolster their green innovation capabilities, forming a “forcing” effect, in contrast, environmental subsidies may have a “crowding out” effect [21] and environmental administrative penalties may lead to a synchronous decline in both the amount and caliber of green innovation [22]. At the internal governance level, the characteristics of managers have become a key point in studying green innovation. Based on the theories of senior management hierarchy [23], branding [24], and principal-agent theory [25], scholars have found that the educational background, public environmental experience, and political connections of management have a significant positive impact on corporate green innovation. On the contrary, the short-sighted behavior of managers can seriously hinder green innovation and negatively impact the financial performance of firms [26]. In addition, innovation networks and shareholder relationship networks are important governance features that influence the quality of green innovation within organizations [27,28].

2.2. Data Factors

As the digital economy continues to advance, extensive research on data factors is emerging, and the pervasive utilization of these factors is propelling economic growth and societal transformations [29]. Jones and Tonetti (2020) analyzed the relationship between information, data, and ideas (or knowledge) [30]. They first defined information as the collection of all non-competitive economic goods and pointed out that both data and ideas (or knowledge) are types of information. Ideas (or knowledge) are considered “instructions” that can directly direct the production of economic goods, while data are the parts of information that do not belong to ideas (or knowledge). Farboodi and Veldkamp (2021) emphasize that data are a by-product of economic activity and are predictive information in the binary form of “0–1” [31]. Data have become an economic resource after processing and analysis, which can help customers make decisions and provide them with certain economic value [32]. Therefore, data factors are a means of production, just like labor and capital factors [33]. It is worth noting that—as the central production factor in the digital economy—data have transcended the limitations of traditional production inputs found in labor-intensive and resource-intensive economic models, emerging as a vital driver of sustained economic growth [34].

The data production factor is a virtual resource that exists in database and Internet space. Therefore, most existing studies regard the virtuality of data as a core feature of this factor of production [30]. In addition, the data also have the characteristics of non-competitiveness [35], privacy externality [36], exclusivity [37], increasing returns to scale [30], and strong positive externality [38]. Li et al. (2019) pointed out in their research that data have the characteristic of integrating with other factors, which makes the value of data surge [39]. Blayne Haggart (2018) indicates that only when data flow can they exert their capacity, and the source of their capacity is the collection, induction, and use of these flows [40].

2.3. The Relationship Between Data Factors and Green Innovation

Although research on the factors driving green innovation in enterprises has significantly advanced, the exploration of the interplay between data factors and green innovation remains insufficient and lacks a unified consensus. Some researchers concentrate on the domains of digital economy and digital finance, examining their connections to green innovation. Within the framework of the digital economy, findings indicate that it can stimulate enterprises’ green innovation willingness [41], ease financing constraints [42], and thus improve green innovation performance. Scholars in the field of digital finance highlight how it promotes green innovation by improving residents’ income and accelerating the accumulation of human capital [43,44]. However, some scholars have raised doubts from the perspectives of pollution transfer and energy pressure indirectly caused by data factors and believe that digital factors may have negative effects on green economic development [45]. For example, advances in digital technology may lead enterprises to increase resource extraction and energy consumption during the transitional phase of digital transformation and reduce green innovation activities [46]. Furthermore, although the progress of information technology has broken the geographical space limitation and promoted the exchange of innovative information, it may also lead to a lack of close connection between industries, hindering the advancement of the green innovation chain [47]. Additional studies have indicated that the proliferation of big data may negatively impact enterprises’ innovation efficiency [48], and in the fierce market competition, enterprises strive to maintain their competitive advantage; moreover, influenced by the shifting signals of green technology innovation strategies in the process of digital transformation, peer group enterprises will make similar imitative responses [49,50].

2.4. The Literature Gaps

To sum up, relevant studies at home and abroad provide useful references for this paper but there are still research gaps. The details of these gaps are as follows: First, from the perspective of research, the micro-evidence of the impact of data factors on the green innovation of manufacturing enterprises needs to be improved. The majority of the literature currently in publication uses macro-level indicators to assess the influence of data factors on green innovation, and only a few measure from the micro-level; therefore, it is difficult to fully reveal whether data factors are conducive to green innovation of manufacturing firms. Second, from the standpoint of the effect mechanism, existing research has failed to agree on the enabling relationship and action mechanism between data factors and green innovation. Some scholars have also discussed pollution transfer and energy pressure indirectly caused by data factors, pointing out that data factors have certain negative effects on green economic development. Third, from the perspective of individual differences, it ignores the variations in the degree of digitization and the differences in the characteristics of enterprises. Some of the existing literature ignores the heterogeneous effects of enterprise characteristics—such as regional characteristics—and ownership characteristics on data factors affecting the green innovation of manufacturing enterprises; therefore, it is difficult to provide directional policy tools for the government to implement the strategy of digitization and green transformation of the manufacturing industry to vigorously develop digital economy and sustainable development policies. In light of the aforementioned issues, this article focuses on the micro-focused topic of enterprise, with the goal of thoroughly examining the impact of data elements on enterprise green innovation and the internal mechanism using the empirical analysis approach.

3. Theoretical Mechanism Analysis

3.1. The Impact of Data Factors on Enterprise Green Innovation

A key strategy for addressing environmental issues and achieving sustainable development is green innovation, which emphasizes that while enterprises innovate in technology, they must also pay attention to environmental protection and efficient resource utilization. According to the theory of technological innovation and industrial upgrading, data factors are essential for fostering green innovation. Within the framework of technological innovation and industrial upgrading, data factors emerge as indispensable facilitators of green innovation. By harnessing data-driven technological innovation and industrial transformation, enterprises can facilitate a shift in production methods toward greener and low-carbon practices, augment resource utilization efficiency, and mitigate environmental pollution.

The open characteristics of data factors reduce the difficulty for enterprises to obtain public data, help enterprises grasp the market dynamics and the green strategies of competitors, reduce the unpredictability of green innovation activities, and strengthen enterprises’ willingness and resolve toward green transformation. Simultaneously, the low input of data factors and low pollution emission can form a virtuous circle of “improving economic benefits—increasing input of data factors”, and constantly advance the green transformation of enterprises [51]. Leveraging their digital technology attributes, data factors enable the innovative application of traditional production factors; promote manufacturing enterprises to extend toward the high-end links of the value chain [52]; increase the efficiency of utilizing production factors; cut carbon emissions; and realize the green transformation of cost reduction and efficiency increase. The circulation and sharing of data factors also promote the specialization of refined and networked green R&D; establish a diversified network relationship; effectively integrate green innovation resources and apply them in research and development; and encourage green innovation in businesses. Specifically, the data factor reduces input costs and boosts the effectiveness of green R&D. On the demand side, we can accurately grasp the characteristics of consumer behavior through data mining, and carry out targeted green R&D innovation. On the supply side, high-quality data factors are combined with deep learning, artificial intelligence, and other technologies to accurately predict experimental results and improve screening efficiency; they are combined with digital twin and simulation technologies; and new technology performance testing and new product predictive analysis are completed in virtual space, promoting enterprise green innovation. Consequently, this article posits the following hypothesis:

H1.

Data factors have a significant positive impact on enterprises to improve green innovation.

3.2. The Mechanism by Which Data Factors Affect Enterprises Green Innovation

In the current social development setting, data—as an emerging factor of production—not only broaden the scope of means of production but also profoundly change the combination mode of traditional factors of production. The profound integration of data factors with other production factors has formed a powerful synergistic effect, giving rise to new points of productivity growth. The massive amount of data in the digital economy era contain rich potential value. Through data mining and analysis, enterprises can reveal these yet-to-be-revealed values, thereby gaining insights into market trends, optimizing production processes, improving product quality, and promoting technological innovation. The addition of data factors enables enterprises to more effectively utilize existing resources, discover potential innovation opportunities, increase investment in innovation activities, and thereby establish a firm foundation for green innovation. The increasing marginal utility of data factors provides a continuous driving force for innovation investment in enterprises. With the continuous accumulation of data volume and the increasing maturity of data analysis technology, enterprises can continuously explore new value points in data and promote innovation activities to develop in depth. In this process, enterprises can not only accurately grasp the overall market demand, production status, and resource distribution but also achieve optimized allocation and efficient utilization of innovative resources through the precise guidance of data analysis, ensuring that innovation investment is accurately focused on key areas and core links. More importantly, data factors play an irreplaceable role in driving enterprises toward green, low-carbon, and sustainable development. Through data analysis, enterprises can clearly identify environmental bottlenecks and green innovation potential in their operations, and then develop targeted improvement strategies and action plans. Data-driven innovation decision-making not only increases enterprise innovation investment efficiency but also ensures the green attributes and sustainable development value of innovation investment. Consequently, this article puts forward the following hypothesis:

H2.

Data factors enhance green innovation by augmenting enterprise innovation investment. Data-analysis-driven innovation decision-making can improve the efficiency, green attributes, and sustainable development value of enterprise innovation investment.

The emergence of data factors makes the information disclosure of enterprises in the capital market more timely and transparent, attracting more attention from financial media and analysts [53,54]. The theory of information asymmetry holds that in an enterprise, insiders possess more information than outsiders, which may lead to moral hazards and opportunistic behavior, resulting in inefficient corporate governance. The application of data factors effectively improves the availability of enterprise information and enhances the ability of external stakeholders to supervise the development of enterprises. The supervision of external stakeholders such as media, investors, and analysts has formed an external governance role, and thus provided an exogenous driving force for corporate green innovation. Analysts are enthusiastic about mining corporate information from disclosure reports and private channels to form analytical reports, which influence corporate decision-making. On the one hand, analysts’ attention has played a “regulatory effect”, forcing companies to innovate green. In recent years, environmental sustainability has become one of the focuses of attention in the capital market. Corporate green investment and other related information have become the focus of analysts’ attention, affecting the market value of enterprises. To avoid negative evaluations from analysts, management will restrain their opportunistic behavior and maintain or even expand the company’s green innovation investment scale. Additionally, analysts’ attention can play a “guiding effect” and promote green innovation in enterprises. Analysts’ research reports can objectively depict the policy environment and social needs to help businesses recognize the importance of green innovation. Consequently, this article posits the following hypothesis:

H3.

Data factors stimulate green innovation in enterprises by heightening analyst attention.

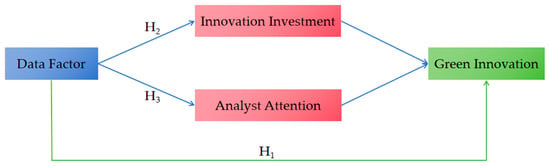

This study developed a theoretical model, as seen in Figure 1, based on the theoretical analysis and research assumptions mentioned above. The relationship between data factors, green innovation, innovation investment, and analyst attention is depicted in this model. The three research hypotheses put forward in this article also indicate the model’s particular course. Subsequent research will examine these three hypotheses’ validity in more detail.

Figure 1.

Research model.

4. Materials and Methods

4.1. Variable Selection

4.1.1. Explained Variable

The dependent variable in this article is corporate green innovation. Enterprise green innovation refers to the innovative activities involving energy saving, pollution prevention, waste recycling, and other aspects taken by enterprises in the process of production and operation in order to cope with environmental problems and achieve sustainable development, reflecting the efforts of enterprises to promote technology or products in an environmentally friendly way and balance environmental benefits and economic benefits.

Generally, the characterization of green innovation within enterprises falls into two main categories: one type utilizes the count of green patent authorizations as a metric, while the other employs the number of green patent applications. Considering that the number of patent authorizations can be significantly impacted by a company’s operating foundation and the intellectual property administrative management system—and that green patent authorizations require annual fees and longer waiting times for testing—this article utilizes the number of green patent applications from listed companies to characterize the company’s green innovation (GI). Specifically, we adopt the methodologies outlined by Wang Xin and Wang Ying (2021) and Li Qingyuan and Xiao Zehua (2020) to quantify green innovation activity (GIA) by summing the number of green invention patent applications and green utility model patent applications [21,55]. Furthermore, the quantity of green invention patent applications is the metric used to assess the quality of green innovation (GIQ). To address the issue of right-skewed patent data distribution, we apply a natural logarithmic transformation to all green patent data after adding 1 to each count.

4.1.2. Core Explanatory Variables

The primary explanatory variable of this article is the data factor measured using the logarithmic scale (Dig). Data resources that engage in social production and management activities and provide owners or consumers with financial gains are referred to as data factors. The original datasets used in production, standardized datasets, different data products, data-based systems, information, and knowledge are all examples of data factors, in addition to computer data and their derivative forms that are collected, sorted, and processed in accordance with particular production needs.

Due to the difficulty in quantifying enterprise data factors, there is currently no suitable method in academia to measure them. Therefore, this article quantifies the key explanatory variables from the perspective of technological application, combined with the five-indicator framework established by Wu Fei et al. (2021) [53]. This system includes five major categories of indicators, namely “cloud computing technology level”, “artificial intelligence capability”, “big data expertise”, “blockchain sophistication”, and “digital technology adoption”, as well as their sub-indicators. These keywords not only cover various aspects of data gathering, storage, cleaning, and interpretation but also mirror enterprises’ capacity to leverage data factors for decision-making in practical scenarios.

Specifically, this article measures the application of data factors in the annual financial reports of manufacturing enterprises by calculating the number of disclosures of sub-indicators and summing up the disclosures of all indicators. These disclosure frequencies not only directly reflect the importance that companies attach to data factors but also indirectly reflect the effectiveness of their data factor application. If a company successfully applies data factors to its actual business and achieves results, it is likely to elaborate on the implementation and effectiveness in its annual report.

4.1.3. Control Variables

To mitigate the impact of pertinent enterprise-level factors, this paper adopts a methodology similar to that of Wu Fei and colleagues (2021) by incorporating a comprehensive set of control variables [53]. These include the following: (1) the enterprise’s age (age), measured using the logarithmic scale; (2) TobinQ, reflecting the market-to-book value of the company’s assets; (3) the asset–liability ratio (LEV), calculated as total liabilities divided by total assets; (4) share, the shareholding percentage of the largest shareholder; and (5) the operating cost ratio (OCR), representing the ratio of operating costs to operating revenue.

4.1.4. Mediator Variable

The mediating variables are innovation investment and analyst attention. In terms of measuring innovation investment, this article refers to existing research and selects enterprise research and development intensity (RDS) as a substitute variable, specifically measured by the proportion of research and experimental development (R&D) investment in operating income [56].

In terms of analyst attention, this article draws on existing research and measures it by taking the natural logarithm of the number of analyst teams tracking and analyzing a company plus one. Specifically, it considers the number of analysts (teams) that have performed tracking analysis on the company within a year, with one team having a quantity of one, without separately listing the number of its members.

4.1.5. Data Sources

The data utilized in this study consist primarily of three components: enterprise patent information, data factor records, and financial statements. Specifically, the enterprise patent application records were obtained from the China Research Data Service Platform (CNRDS), whereas the data factors and additional financial information were procured from the CSMAR and Wind databases.

The focus of this article is on manufacturing firms listed on the Shanghai and Shenzhen A-share markets, spanning the years from 2013 to 2023. The data preprocessing steps involve excluding samples from the financial and real-estate sectors initially; secondly, we excluded companies with a single year of observation, companies that underwent ST, * ST, or PT processing, or companies that were delisted or went through initial public offerings (IPOs) during the sample collection period; thirdly, we excluded sample businesses that had primary variable observations missing; fourthly, a 1% truncation was applied to the upper and lower ends of the continuous variables in the dataset to reduce the influence of extreme values. After these adjustments, a total of 14,318 samples of 2637 listed companies were finally obtained.

4.2. Model Construction

To verify hypothesis H1, a bidirectional fixed-effects model is established as follows:

where the dependent variable represents the green innovation capability of manufacturing enterprise i in the period t, including two dimensions of green innovation quantity and quality; the explanatory variable is the application indicator of data factors at the enterprise level, representing the level of data factors of manufacturing enterprise i in period t; is a set of control variables; represents a time dummy variable, used to reflect fixed effects at the time level; represents industry dummy variables, used to reflect fixed effects at the industry level; and is a random perturbation term.

This article assumes that data factors could impact a firm’s green innovation by enhancing both investment in innovation and the focus of analysts. To test this proposed mechanism, this article employs a mediation effect model and constructs models (2) and (3) based on model (1):

Among them, is the mechanism variable, and in the article, they are innovation investment and analyst attention, respectively. Model (2) is employed to investigate how data factors affect the mechanism variables, whereas Model (3) explores the impact of data factors on green innovation after integrating the mechanism variables.

5. Results

5.1. Descriptive Statistics

Table 1 outlines the fundamental statistical characteristics of the key variables. Overall, manufacturing enterprises have a certain level of green innovation capability. Specifically, the mean value of data factor Dig is 1.4743 and the median is 1.39. The data reveal a standard deviation of 1.284, and there is a significant difference between the maximum and minimum values, which is 4.80, suggesting a relatively low level of data factor application across enterprises and notable disparities among them. Concerning green innovation at the firm level, the average quantity of enterprise green innovation is 0.4802, with a standard deviation of 0.902. The mean and standard deviation for green innovation quality are 0.3318 and 0.743, pointing to disparities in green innovation capabilities among enterprises. Furthermore, all Variance Inflation Factor (VIF) values stay below 10 according to the multicollinearity test results, rendering the data suitable for regression analysis.

Table 1.

Summary statistics.

5.2. Benchmark Regression Test

The regression findings analyzing the influence of data factors on business green innovation benchmarks are shown in Table 2. Specifically, columns (1) to (3) detail the impact on green innovation quantity, while columns (4) to (6) focus on green innovation quality. In benchmark regression, this article adopts a progressive regression strategy. Among them, the first and fourth columns did not incorporate control variables and fixed effects; columns (2) and (5) introduce control variables but exclude fixed effects; and control variables and fixed effects are simultaneously incorporated into columns (3) and (6). Among them, in the benchmark regression with green innovation quantity and quality as dependent variables, the calculated coefficients of the explanatory variable Dig are all positive at the 1% significance level. It is suggested that data factors foster both an increase in quantity and an improvement in green innovation quality among enterprises, thereby exerting a beneficial impact on overall green innovation. Consequently, hypothesis H1 in this article is supported by the empirical evidence; in addition, looking at its coefficient, the impact of increasing the number of green innovations in businesses is particularly pronounced.

Table 2.

Benchmark regression.

5.3. Robustness Test

5.3.1. Replace the Dependent Variable

To bolster the credibility of the conclusions presented in this paper, an array of robustness checks are conducted, and one is to replace the explained variables. In the baseline regression, the number of patent applications filed by enterprises is utilized as an indicator of their green innovation, while the number of green patent grants awarded to manufacturing firms is employed for the robustness test. The outcomes are shown in columns (1) and (2) of Table 3, and the data factor coefficient is still significant at 1%, indicating that the baseline regression results have strong robustness.

Table 3.

Robustness test.

5.3.2. Replace Explanatory Variables

The method of constructing indicators through word frequency statistics may have certain errors due to the noise of the text data. For example, some keywords appearing in annual reports may be used to describe industry trends or the company’s expectations and prospects for future development. To minimize the impact of such errors, this article replaces the core explanatory variable data factor Dig in the benchmark model with the dummy variable Dig dum. That is, if keywords associated with data factors appear in the annual report, Dig dum is set to 1; if no relevant keywords appear, Dig dum is set to 0. The benchmark model is re-estimated once the explanatory variable is substituted, and Table 3’s columns (3) and (4) display the regression results. The trustworthiness of the benchmark results is further supported by the estimated coefficient for the substituted core explanatory variable Dig dum, which continues to be significantly positive.

5.4. Heterogeneity Test

Various categories of businesses can exert different levels of influence on green innovation due to differences in the application and cost of data factors. This study looks at the various ways that data elements affect green innovation in manufacturing companies from the viewpoints of firm ownership and regional heterogeneity. Table 4 and Table 5 display the results of the heterogeneity analysis.

Table 4.

Heterogeneity test—region.

Table 5.

Heterogeneity test—enterprise ownership.

Owing to the considerable disparities in resource availability and industrial development among different regions and economic belts, the degree of use of data factors in manufacturing enterprises may also vary. Therefore, this article categorizes the sample into three distinct regions: the eastern region, which encompasses 11 provinces including Beijing, Tianjin, and Shanghai; the central region, comprising 9 provinces such as Shanxi, Anhui, and Jiangxi; and the western region, which includes 11 provinces like Inner Mongolia, Guangxi, Chongqing, and Sichuan. The regression findings are presented in Table 4, indicating that data factors can improve both the quantity and quality of green innovation in businesses located in the eastern region. In contrast, data factors do not significantly contribute to improving green innovation within manufacturing firms in the central and western regions. Firstly, talent is the foundation of enterprise innovation, and highly qualified individuals have greater advantages in big data analysis and digital technology applications, providing technical support and solutions for green innovation in enterprises. Therefore, regions with a higher concentration of talent experience a more pronounced positive impact from data factors on enterprise green innovation. With a higher degree of intelligence and digitalization than its central and western equivalents, the eastern area is better positioned to attract talent, especially high-quality talent with innovative capabilities. This dynamic undoubtedly enhances the beneficial influence of data factors on fostering green innovation in businesses. Secondly, the green innovation of enterprises requires sustained financial support. The eastern region, compared to its central and western counterparts, exhibits a greater level of digitization and intelligence, which can more effectively absorb and accumulate the monetary capital and financial support needed for innovation. Financial technology supported by data factors and digital technology can enhance the efficiency of allocating financial resources, facilitate the spread and implementation of green technologies, and further stimulate the advancement of green innovation activities within enterprises.

The characteristics of enterprise ownership can influence the connection between data factors and green innovation. To examine the differences in ownership types—based on the property rights of the actual controller—this study divides the sample companies into state-owned and non-state-owned businesses. The findings of the regression analysis are presented in detail in Table 5. The effect of data elements on the amount and caliber of green innovation in non-state-owned businesses is statistically significant at the 1% level, as shown in columns (1) and (3). The quality of green innovation, on the other hand, only achieves significance at the 10% level for state-owned businesses, indicating that data factors have a stronger impact on green innovation in non-state-owned businesses. Despite state-owned enterprises having advantages such as established systems, capital resources, and larger scales, their performance in green innovation is lagging behind that of non-state-owned enterprises. Several factors may contribute to this discrepancy: First, because the government participates in decision-making, the state-owned enterprises have more decision-making links, and the efficiency loss is more serious; second, when facing new challenges and significant changes, state-owned enterprises—due to their own principal-agent problems—show risk avoidance behavior decision-making bias, hindering the realization of the positive effects of data factors on green innovation; third, non-state-owned enterprises themselves face hard financing constraints and a lack of market resources, face more market competition, have a relatively strong willingness to leverage data factors for green innovation, and are more able to respond to the market quickly.

5.5. Mediation Effect Analysis

Table 6 reports the findings from the mechanism test. The coefficient of Dig in column (1) is 0.025, which is significant at the 1% level, indicating that the improvement in the application level of data factors promotes the innovation input of enterprises. The RDS coefficient in columns (2) and (3) is likewise positive and reaches significance at the 1% level, indicating that increased innovation investment has a favorable effect on the advancement of green innovation. At the 1% level, the Dig coefficient is still positive and significant and shows a decrease, implying that innovation investment contributes to part of the mechanism effect. This suggests that data factors indirectly support green innovation by increasing innovation input and not only have a direct impact on it. Thus, hypothesis H2 is verified.

Table 6.

Mediating effects.

In column (4), the coefficient for Dig is 0.034, which is statistically significant at the 1% level, suggesting that the introduction of data factors has heightened analysts’ focus on the company. The coefficient for the analyst in column (5) is positive and meets the 10% significance level, indicating that greater analyst attention positively influences the volume of green innovation. However, in column (6), the analyst coefficient does not reach statistical significance, implying that analyst attention does not substantially enhance the quality of green innovation. This may be attributed to the fact that analyst attention represents only one form of external scrutiny, and its impact on the organization may be restricted. Enhancing the quality of green innovation typically necessitates extensive and ongoing investment, and relying solely on analyst attention may not be sufficient for companies to determine whether to elevate the quality of their green innovations. The findings presented in Table 6, columns (4)–(6), demonstrate that although data variables have helped to raise the amount of green innovation by increasing analyst attention, they have not significantly improved the quality of green innovation in businesses. Thus, hypothesis H3 is confirmed.

6. Discussion

(1) The baseline effect of the research model is significant, indicating that data factors have a positive impact on the promotion of green innovation. This finding builds on the findings of EI-Kassar and Singh, who found that corporate green innovation activities are affected by the use of big data but did not further explore the mechanism affecting corporate green innovation [57]. In 2021, Mubarak et al. further improved the mechanism test of this influence based on the study and found that Industry 4.0 technology can stimulate technological innovation of enterprises through knowledge accumulation and information transmission, which is conducive to further stimulating enterprises to carry out green technological innovation activities [18]. Based on this, this study investigates the influence of data elements on enterprise green innovation by fusing theoretical and empirical analysis. Simultaneously, data factors facilitate the intelligent modernization of conventional industries [58], encourage the rapid growth of green emerging industries, support the development and application of green technologies, spearhead the emergence of the green consumption trend, efficiently increase resource utilization efficiency, and hasten the social economy’s transition to a sustainable green development path overall [59]. Actually, by enhancing the use of data factors, the Chinese government hopes to support sustainable development and green innovation. The 2035 vision-goals outline and the “14th Five-Year Plan” both explicitly call for advancing the digital economy as the primary pillar to reach carbon neutrality, deepen the digital application of production and manufacturing processes, and enable green manufacturing;

(2) The mediating role of innovation input in the research model is confirmed. Innovation input is a positive partial mediator of the relationship between data factors and green innovation. This finding aligns with the results presented by Wang (2024), who discussed that under the new quality productivity, data factors can improve the quality of green innovation by increasing the innovation input of enterprises, thus improving the validity of our conclusions [60]. In the context of the rapidly evolving digital economy, businesses that actively seek out new developments and make efficient use of data factors are more likely to enhance innovation investment and pursue green innovation. Furthermore, the Chinese Government’s “Opinions on Building a more perfect Market-oriented Allocation System and Mechanism of Factors” proposed to accelerate the cultivation of the data factor market; this is because the marketization of data factors not only helps enterprises reshape the allocation mode of innovation factors but also can better enhance the “multiplier effect” of data factors and bring about the extension of the application boundary of innovation factors and functional changes to better foster the development of green innovation initiatives within enterprises [61];

(3) The mediating role of analyst concern in the research model is confirmed. As shown in Table 6, data factors contribute to an increase in the number of green innovations by increasing analyst attention. These findings build on the work of Yu Zhao et al. (2024), who argue that external supervision and attention pressure from the firm will increase the willingness of the firm to make a green transformation and prompt the company to adopt environmental measures [62]. In other words, the supervision pressure from outside the enterprise will force the enterprise to speed up the green transformation. As the product of the deep integration of enterprise innovation and environmental protection, green innovation is also an important dimension of investors’ trading decisions, which will encourage enterprises to actively promote green innovation strategy and practice [63]. Additionally, investors can take measures such as complaints and Internet exposure to put pressure on enterprises to carry out green innovation [64]. Consequently, the external environment is crucial, which not only forms the external governance role but also provides the exogenous driving force for enterprises’ green innovation. In fact, China is improving the external environment’s attention and supervision of enterprises through various policies, creating a good business environment to improve the green innovation capabilities of enterprises.

7. Conclusions, Policy Recommendations, and Research Limitations

7.1. Conclusions

This research investigates how data factors influence green innovation within manufacturing firms and examines the underlying mechanisms involved. It empirically analyzes manufacturing businesses listed on the Shanghai and Shenzhen A-shares from 2013 to 2023, leading to the following conclusions:

Firstly, data factors can enhance green innovation within manufacturing enterprises. Specifically, they can lead to improvements in both the quantity and quality of green innovation in enterprises. After robustness testing, this finding is still valid. Secondly, under different regional and ownership characteristics, this effect exhibits significant asymmetry, meaning that their positive impact on green innovation is more pronounced in the eastern regions and among non-state-owned enterprises. Thirdly, mechanism testing shows that data factors can increase enterprise innovation investment and analyst attention, thereby promoting improvement in the quantity and quality of green innovation in manufacturing enterprises. However, while the effect of analyst attention is significant on the quantity of green innovation in manufacturing enterprises, its influence on the quality aspect has not been fully reflected.

7.2. Policy Recommendations

Drawing from the aforementioned research findings, this paper presents several policy implications:

First, strengthen the government–enterprise coordination mechanism and jointly draw a new blueprint for enabling data factors. The government needs to further deepen cooperation with enterprises through the establishment of special support funds, build bridges for scientific research and innovation cooperation and other measures, encourage enterprises to delve deeper into the frontiers of research and development, as well as encourage the practical applications of data technology. This strategy seeks to accelerate the integration of data factors with real-world scenarios and explore more paths to realize green innovation driven by data factors. In addition, the government should continue to improve the standard system and regulatory framework for data use, accelerate the process of open sharing of data resources, help enterprises reduce the threshold and cost of data acquisition, and lay a solid institutional foundation for the efficient circulation of data factors and the release of value.

Second, attention should be directed toward enhancing the quality of human capital to create a hub for green innovation talent. Skilled individuals are the fundamental driving force behind green innovation. To nurture this talent, the government ought to boost investments in educational resources and focus on developing and attracting professionals in critical areas. Simultaneously, businesses should be encouraged to build an internal training system, improve employees’ data thinking and innovation skills, and cultivate a composite and high-quality talent team for green innovation projects. In addition, it is vital to promote the collaborative development of industry, academia, and research institutions, facilitating close partnerships among companies, universities, and research organizations. This collaboration will accelerate the research and development of green innovation technologies and their practical application, thereby strengthening the green innovation capacity and market competitiveness of enterprises, ultimately driving the robust growth of the green economy.

Third, enterprises should expedite the process of enterprise digital transformation and promote data factors to enable green innovation. Establishing a cohesive data management system is crucial for the timely integration of both internal and external data resources, enabling better data-driven decision-making and optimization of business processes. By continuously exploring data factors, enterprises can generate new momentum for green innovation and development. Moreover, it is important for companies to improve the corporate green information disclosure mechanism and make good use of external supervision. From an internal point of view, enterprises should—in accordance with relevant laws, regulations, and industry standards—clarify the specific content, key indicators, and requirements of green information disclosure; set up a special green information disclosure team, responsible for collecting, sorting, analyzing, and releasing matters, ensuring the timeliness and integrity of information; and strengthening the internal management and audit mechanism of green information disclosure. This can ensure the standardization of disclosure processes and the accuracy of their content. From the external perspective, enterprises should actively establish communication mechanisms with external stakeholders such as analysts and the media to better understand their demands and respond to market needs and concerns in a timely manner; this could include using network technology and social media to improve the efficiency and transparency of information disclosure, expand the scope of green information dissemination, and enhance corporate credibility and reputation.

7.3. Practical Implication

Currently, there exists a considerable disparity between the green innovation capabilities of Chinese enterprises and the standards required for high-quality economic development. Data factors, as the core production factors in the information age, rely on the profound integration of digital technology with the real economy. Exploring how these data factors can drive manufacturing firms to innovate in a sustainable and environmentally friendly manner is a crucial strategy for enhancing their green innovation capabilities. This strategy fosters ecological development within the industry and addresses challenges such as environmental pollution. Such efforts hold significant practical importance for the transformation and advancement of China’s manufacturing sector and for achieving high-quality economic growth. Secondly, this paper provides some theoretical references and suggestions for the government to create effective policies and has certain practical guiding significance. At the same time, many enterprises also have more urgent needs for how to implement sustainable development and how to find ways and methods to promote green innovation. This paper offers new perspectives for businesses to comprehensively promote green transformation—taking into account the balanced development of economic benefits, natural environment, and social ecology—and provides possibilities for meeting the above needs.

7.4. Research Limitations and Future Research Directions

Based on the practical problems faced by Chinese manufacturing enterprises and the gaps in relevant theories, this study discusses the influence mechanism and action mechanism of data factors on green innovation on the basis of strictly following scientific research logic and using scientific research methods to build models, which has made certain contributions to green innovation research and enriched relevant theoretical research. However, due to various restrictive factors, this study also has some limitations, which need to be further perfected and improved in the follow-up research. First of all, limited by the availability of data, only listed companies have complete and reliable information disclosure in recent years so only relevant data of listed companies can be collected. Although small and micro-enterprises are also an important part of the overall Chinese enterprises, due to the unavailability of data, there are still certain limitations in this study of the impact of data factors on the green innovation of manufacturing enterprises. Second, this study was conducted in the context of a developing country with a special cultural and economic background, which may limit the generality of the findings, resulting in conclusions that are not applicable to other developing or developed countries. Therefore, more sample data from multinational enterprises can be used in future studies to verify the relationship between the variables studied in this paper. At the same time, a comparative analysis of enterprises from various countries could be conducted to further validate the findings of this research to deepen the understanding of the study findings presented. This study could be broadened to include different types of businesses, such as service companies and financial institutions, to assess the applicability and variability of the results across different situations. This will facilitate a more comprehensive investigation of how data factors can drive green innovation in enterprises. Finally, only two mediating variables are studied in this paper, and future studies should include additional mediating variables and moderating variables such as redundant resources, management style, corporate green culture, and other factors to obtain more abundant and detailed research conclusions.

Author Contributions

Writing—original draft preparation, Y.C.; Writing—review and editing, K.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data utilized in this study consist primarily of three components: enterprise patent information, data factor records, and financial statements. Specifically, the enterprise patent application records were sourced from the China Research Data Service Platform (CNRDS), whereas the data factors and additional financial information were procured from the CSMAR and Wind databases.

Acknowledgments

First of all, I would like to give my heartfelt thanks to all the people who have ever helped me in this research. Furthermore, my sincere and hearty thanks and appreciations to my tutor, Professor Ji Chengjun. He provided the initial ideas and train of thought for this study and it has been a great privilege and joy to study under his guidance and supervision. Finally, I am really grateful to all those who devote much time to reading this thesis and give me much advice, Which will benefit me in my later study.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Peng, L.; Yan, X.; Jiang, Z.; Yan, Z.; Xu, J. From pilots to demonstrations: The green economic development effect of low-carbon city pilot policies. Environ. Sci. Pollut. Res. 2023, 30, 62376–62396. [Google Scholar] [CrossRef] [PubMed]

- Li, W.; Zhang, Y.; Zheng, M.; Li, X.; Cui, G.; Li, H. Research on green governance of Chinese listed companies and its evaluation. J. Manag. World 2019, 35, 126–133. [Google Scholar]

- Arroyave, J.J.; Sáez-Martínez, F.J.; González-Moreno, Á. Cooperation with universities in the development of eco-innovations and firms’ performance. Front. Psychol. 2020, 11, 612465. [Google Scholar] [CrossRef] [PubMed]

- Huang, J.-W.; Li, Y.-H. Green innovation and performance: The view of organizational capability and social reciprocity. J. Bus. Ethics 2017, 145, 309–324. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The environment and directed technical change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Zixun, Q.; Yahong, Z. Development of digital economy and regional total factor productivity: An analysis based on national big data comprehensive pilot zone. J. Financ. Econ. 2021, 47, 4–17. [Google Scholar]

- Xiao, X.; Qi, Y. Value dimension and theoretical logic of industrial digital transformation. Reform 2019, 8, 61–70. [Google Scholar]

- Deng, R.; Zhang, A. Research on the impact of urban digital economy development on environmental pollution and its mechanism. South China J. Econ 2022, 2, 18–37. [Google Scholar]

- Lv, T.; Li, R. Digital Transformation of Manufacturing Enterprises: The Perspective of Data Elements Empowering Traditional Elements. Study Explor. 2022, 9, 108–117. [Google Scholar]

- Yu, L.; Wang, J. New theory on production factors-commonness and characteristics of data factor. Res. Econ. Manag. 2020, 41, 62–73. [Google Scholar]

- Yang, J.; Li, X.; Huang, S. Impacts on environmental quality and required environmental regulation adjustments: A perspective of directed technical change driven by big data. J. Clean. Prod. 2020, 275, 124126. [Google Scholar] [CrossRef]

- McAfee, A.; Brynjolfsson, E.; Davenport, T.H.; Patil, D.; Barton, D. Big data: The management revolution. Harv. Bus. Rev. 2012, 90, 60–68. [Google Scholar] [PubMed]

- Grover, V.; Chiang, R.H.; Liang, T.-P.; Zhang, D. Creating strategic business value from big data analytics: A research framework. J. Manag. Inf. Syst. 2018, 35, 388–423. [Google Scholar] [CrossRef]

- Hagiu, A.; Wright, J. When data creates competititve advantage, and when it doesn’t. Harv. Bus. Rev. 2020, 98, 94–101. [Google Scholar]

- Fussler, C.; James, P. Driving Eco-Innovation: A Breakthrough Discipline for Innovation and Sustainability; Pitman Publishing: London, UK, 1996. [Google Scholar]

- Jorgenson, D.W.; Wilcoxen, P.J. Environmental regulation and US economic growth. RAND J. Econ. 1990, 21, 314–340. [Google Scholar] [CrossRef]

- Tietenberg, T.; Lewis, L. Environmental and Natural Resource Economics; Routledge: London, UK, 2023. [Google Scholar]

- Mubarak, M.F.; Tiwari, S.; Petraite, M.; Mubarik, M.; Raja Mohd Rasi, R.Z. How Industry 4.0 technologies and open innovation can improve green innovation performance? Manag. Environ. Qual. Int. J. 2021, 32, 1007–1022. [Google Scholar] [CrossRef]

- Sterner, T.; Coria, J. Policy Instruments for Environmental and Natural Resource Management; Routledge: London, UK, 2013. [Google Scholar]

- Chen, Y. Retesting of “Strong Potter Hypothesis” under Fiscal Decentralization: From the Perspectives of Enterprise Environmental Protection Innovation and Non-environmental Protection Innovation. Commer. Res. 2018, 60, 143. [Google Scholar]

- Li, Q.; Xiao, Z. Heterogeneous environmental regulation tools and green innovation incentives: Evidence from green patents of listed companies. Econ. Res. J 2020, 55, 192–208. [Google Scholar]

- Wang, A.; Si, L.; Hu, S. Can the penalty mechanism of mandatory environmental regulations promote green innovation? Evidence from China’s enterprise data. Energy Econ. 2023, 125, 106856. [Google Scholar] [CrossRef]

- Zhou, M.; Chen, F.; Chen, Z. Can CEO education promote environmental innovation: Evidence from Chinese enterprises. J. Clean. Prod. 2021, 297, 126725. [Google Scholar] [CrossRef]

- Liao, Z.; Chen, J.; Weng, C.; Zhu, C. The effects of external supervision on firm-level environmental innovation in China: Are they substantive or strategic? Econ. Anal. Policy 2023, 80, 267–277. [Google Scholar] [CrossRef]

- Ling, H.; Yang, Z.; Xu, R.; Chen, J. Green Effect of Public Experience:CEO Public Environmental Protection Experience Diversity and Enterprise Green Technology Innovation. Sci. Sci. Manag. S. T. 2024, 45, 189–210. [Google Scholar]

- Wang, L.; Zhou, X.; Chen, M. From “cultivator” to “influencer”:How does digital transformation drive green innovation:Longitudinal case study based on Inspur. China Soft Sci. 2023, 10, 146–163. [Google Scholar]

- Feng, X.; Wang, J.; Na, X. Impact of green innovation network embedding and resources access to green innovation quality of enterprises. China Soft Sci. 2023, 11, 175–188. [Google Scholar]

- Gu, W.; Yuan, W. Research on the influence of chain shareholder network on enterprise green innovation. J. Bus. Res. 2024, 172, 114416. [Google Scholar] [CrossRef]

- Cong, L.W.; Xie, D.; Zhang, L. Knowledge accumulation, privacy, and growth in a data economy. Manag. Sci. 2021, 67, 6480–6492. [Google Scholar] [CrossRef]

- Jones, C.I.; Tonetti, C. Nonrivalry and the Economics of Data. Am. Econ. Rev. 2020, 110, 2819–2858. [Google Scholar] [CrossRef]

- Farboodi, M.; Veldkamp, L. A model of the Data Economy; National Bureau of Economic Research: Cambridge, MA, USA, 2021. [Google Scholar]

- Niyato, D.; Alsheikh, M.A.; Wang, P.; Kim, D.I.; Han, Z. Market model and optimal pricing scheme of big data and Internet of Things (IoT). In Proceedings of the 2016 IEEE International Conference on Communications (ICC), Kuala Lumpur, Malaysia, 22–27 May 2016; pp. 1–6. [Google Scholar]

- Chadefaux, T. Early warning signals for war in the news. J. Peace Res. 2014, 51, 5–18. [Google Scholar] [CrossRef]

- Farboodi, M.; Mihet, R.; Philippon, T.; Veldkamp, L. Big data and firm dynamics. In AEA Papers and Proceedings; American Economic Association: Nashville, TN, USA, 2019; pp. 38–42. [Google Scholar]

- Acquisti, A.; Taylor, C.; Wagman, L. The economics of privacy. J. Econ. Lit. 2016, 54, 442–492. [Google Scholar] [CrossRef]

- Carrière-Swallow, Y.; Haksar, V. The Economics and Implications of Data; IMF: Washington, DC, USA, 2019. [Google Scholar]

- Gaessler, F.; Wagner, S. Patents, data exclusivity, and the development of new drugs. Rev. Econ. Stat. 2022, 104, 571–586. [Google Scholar] [CrossRef]

- Schaefer, M.; Sapi, G. Learning from Data and Network Effects: The Example of Internet Search. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3688819 (accessed on 13 October 2024).

- Li, W.C.; Nirei, M.; Yamana, K. Value of Data: There’s No Such Thing as a Free Lunch in the Digital Economy; RIETI: Tokyo, Japan, 2019. [Google Scholar]

- Haggart, B. The government’s role in constructing the data-driven economy. In Data Governance in the Digital Age; Centre for International Governance Innovation: Waterloo, ON, Canada, 2018; pp. 20–25. [Google Scholar]

- Li, X.; Dong, H.; Chan, W. Digital Economy, Green Innovation Willingness and Green Innovation Performance: An Theoretical Framework on the Endogenization of Data as Production Factors and Empirical Study. J. Zhongnan Univ. Econ. Law 2024, 134–147. [Google Scholar] [CrossRef]

- Yang, L.; Jia, R. Can Digital Transformation Boost Green Innovation Performance?: Based on the Data of Chinese A-Share Listed Companies. Ecol. Econ. 2024, 40, 64–74. [Google Scholar]

- Han, X.; Chen, L.; Li, B.; Song, W. Why Can Digital Finance Induce Regional Green Innovation? Sci. Sci. Manag. S.& T. 2023, 44, 114–130. [Google Scholar]

- Jianlin, L.; Tianying, J.; Mengyu, F. The impact Path of digital finance on green innovation efficiency. Econ. Geogr. 2023, 43, 141–147. [Google Scholar]

- Lange, S.; Pohl, J.; Santarius, T. Digitalization and energy consumption. Does ICT reduce energy demand? Ecol. Econ. 2020, 176, 106760. [Google Scholar] [CrossRef]

- Li, X.; Liu, J.; Ni, P. The impact of the digital economy on CO2 emissions: A theoretical and empirical analysis. Sustainability 2021, 13, 7267. [Google Scholar] [CrossRef]

- Quah, D. ICT clusters in development: Theory and evidence. EIB Pap. 2001, 6, 85–100. [Google Scholar]

- Ghasemaghaei, M.; Calic, G. Assessing the impact of big data on firm innovation performance: Big data is not always better data. J. Bus. Res. 2020, 108, 147–162. [Google Scholar] [CrossRef]

- Pacheco, D.F.; Dean, T.J. Firm responses to social movement pressures: A competitive dynamics perspective. Strateg. Manag. J. 2015, 36, 1093–1104. [Google Scholar] [CrossRef]

- Matray, A. The local innovation spillovers of listed firms. J. Financ. Econ. 2021, 141, 395–412. [Google Scholar] [CrossRef]

- Basu, S.; Fernald, J. Information and communications technology as a general-purpose technology: Evidence from US industry data. Ger. Econ. Rev. 2007, 8, 146–173. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How smart, connected products are transforming companies. Harv. Bus. Rev. 2015, 93, 96–114. [Google Scholar]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance: Empirical evidence from stock liquidity. Manag. World 2021, 37, 130–144. [Google Scholar]

- Chen, W.; Zhang, L.; Jiang, P.; Meng, F.; Sun, Q. Can digital transformation improve the information environment of the capital market? Evidence from the analysts’ prediction behaviour. Account. Financ. 2022, 62, 2543–2578. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Y. Research on the green innovation promoted by green credit policies. J. Manag. World 2021, 37, 173–188. [Google Scholar]

- Ying, Q.; He, S. Corporate innovation strategies under the government’s R&D subsidies:“making up the number” or “Strive for excellence”. Nankai Bus. Rev. 2022, 25, 57–69. [Google Scholar]

- El-Kassar, A.-N.; Singh, S.K. Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Change 2019, 144, 483–498. [Google Scholar] [CrossRef]

- Xu, X.; Ren, X.; Chang, Z. Big Data and Green Development. China Ind. Econ. 2019, 4, 5–22. [Google Scholar]

- Cao, Y.; Li, X.; Hu, H.; Wan, G.; Wang, S. How does digitalization drive the green transformation in manufacturing companies? An exploratory case study from the perspective of resource orchestration theory. J. Manag. World 2023, 39, 96–112. [Google Scholar]

- Wang, K.; Liu, Y.; Wang, S. Data Factors and Green Innovation: A Perspective of New Quality Productive Forces. Res. Financ. Econ. Issues 2024, 9, 18–33. [Google Scholar]

- Chuanming, L.; Liang, C.; Xiaomin, W. Impact of Data Element Agglomeration on Scientific and Technological Innovation: A Quasi-natural Experiment Based on Big Data Comprehensive Pilot Areas. J. Shanghai Univ. Financ. Econ. 2023, 25, 107–121. [Google Scholar]

- Yu, Z.; Linbo, C.; Kun, Z. Does Digital Transformation Promote Corporate Green Innovation? Enterp. Econ. 2024, 43, 107–117. [Google Scholar]

- Siemroth, C.; Hornuf, L. Why do retail investors pick green investments? A lab-in-the-field experiment with crowdfunders. J. Econ. Behav. Organ. 2023, 209, 74–90. [Google Scholar] [CrossRef]

- Wang, J. The impact of investor communication on enterprise green innovation. Financ. Res. Lett. 2023, 57, 104158. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).