Research on the Synergistic Development Path of Enterprise Data Asset Trading and New Quality Productive Forces Under the TOE Framework—Empirical Evidence from China

Abstract

1. Introduction

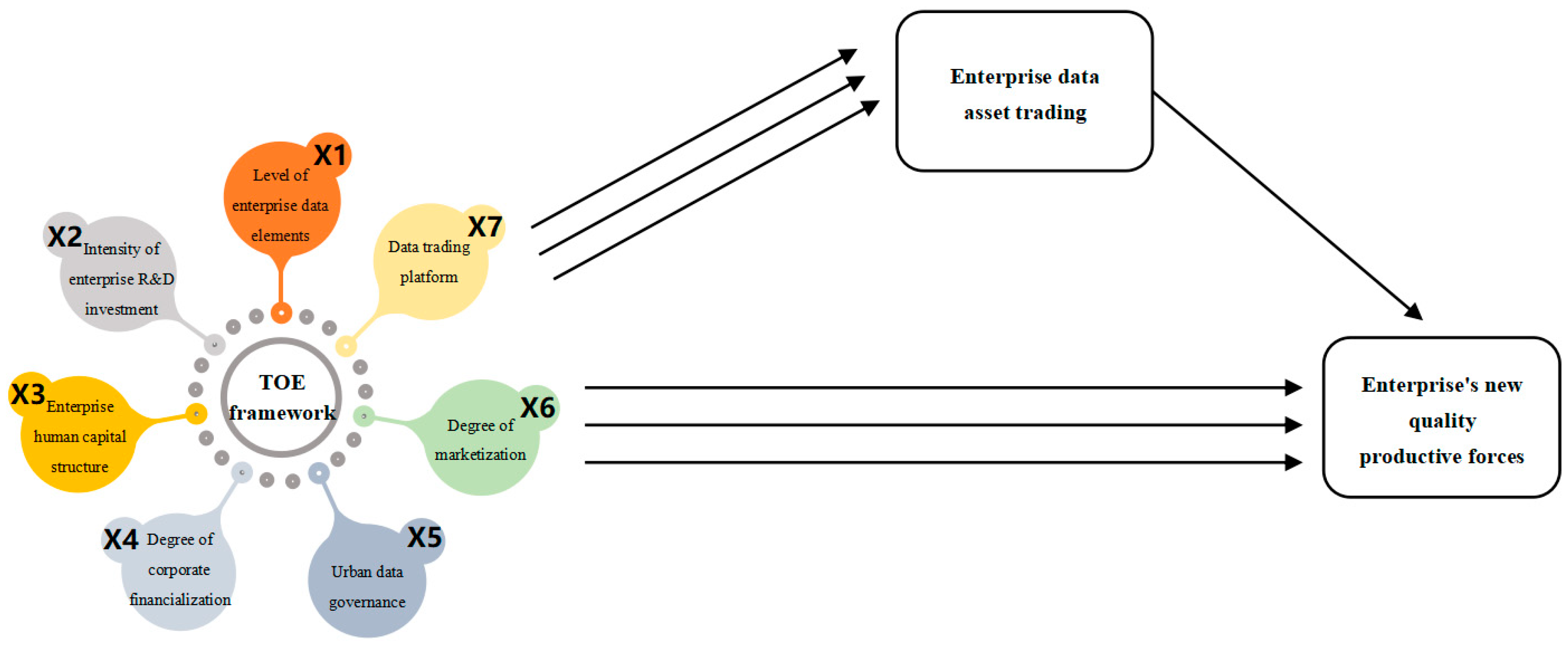

2. Theoretical Foundation and Research Framework

2.1. Driving Factors of Enterprise Data Asset Trading Under the TOE Framework: Complex Influence Mechanisms

2.1.1. Technological Conditions

- (1)

- Level of enterprise data elements

- (2)

- Intensity of enterprise R&D investment

2.1.2. Organizational Conditions

- (1)

- Enterprise human capital structure

- (2)

- Degree of enterprise financialization

2.1.3. Environmental Conditions

- (1)

- Urban data governance

- (2)

- Degree of marketization

- (3)

- Data trading platform

2.2. Diverse Pathways to Promote Enterprise Data Asset Trading and Their Impact on Enterprise’s New Quality Productive Forces Under the TOE Framework: A Complex Mediation Model

3. Research Design

3.1. Data Sources

3.2. Variable Measurement

3.2.1. Conditional Variable

3.2.2. Mediating Variable

3.2.3. Explained Variable

3.2.4. Control Variable

4. Empirical Analysis

4.1. Analysis of the Necessity and Sufficiency of Technological, Organizational, and Environmental Factors for Enterprise Data Asset Trading

4.1.1. Analysis of the Necessity of Individual Conditions

4.1.2. Sufficiency Analysis of Conditional Configurations

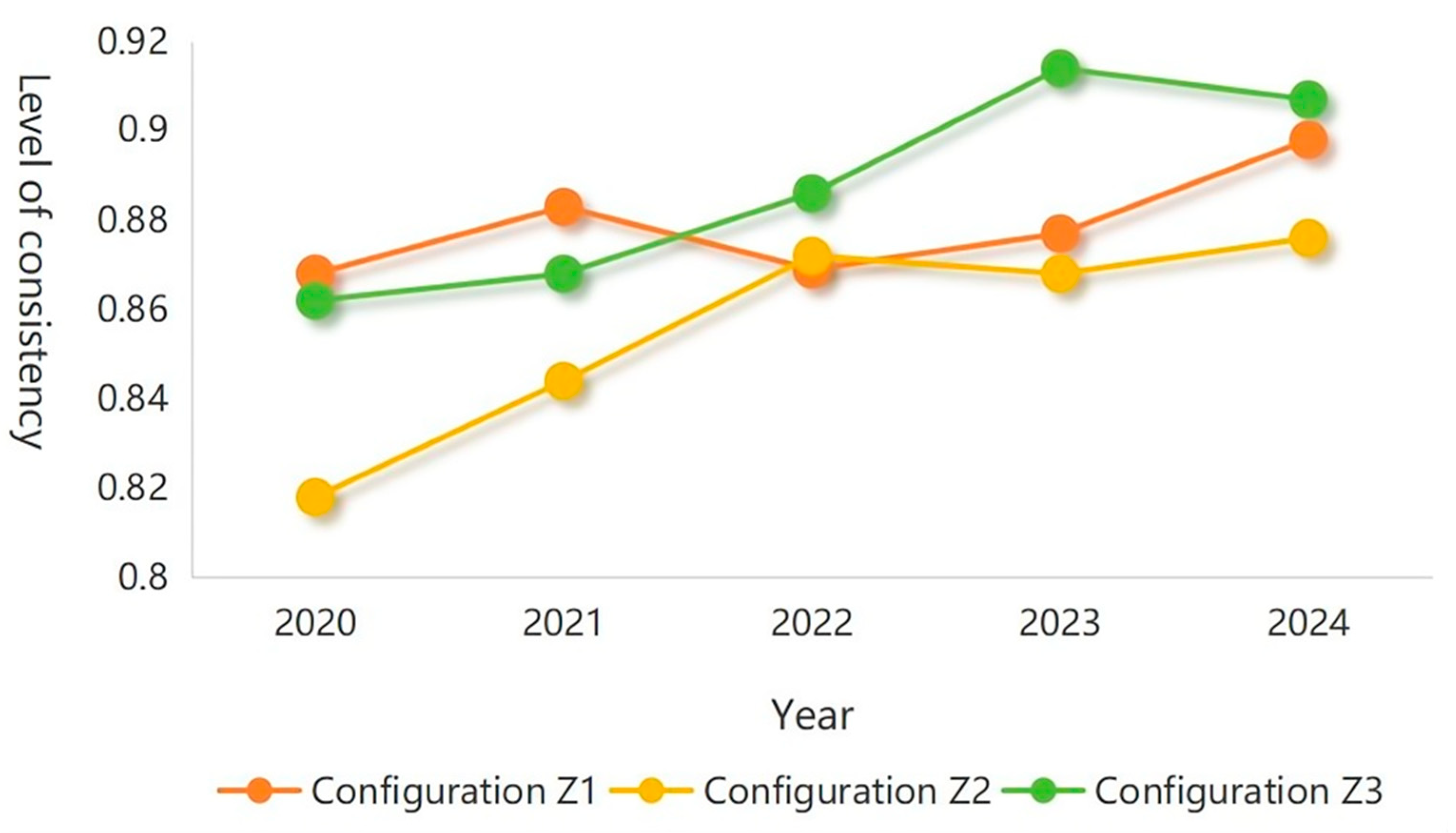

4.1.3. Robustness Test for Configuration Analysis

4.2. Regression Analysis on the Impact of Technological, Organizational, Environmental Factors and Enterprise Data Asset Trading on Enterprise’s New Quality Productive Forces

4.2.1. Descriptive Analysis

4.2.2. Regression Analysis Results

4.2.3. Robustness Test for Regression Analysis

4.2.4. Mechanism Analysis

5. Conclusions

5.1. Research Conclusions

5.2. Theoretical Contributions

5.3. Practical Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Huang, Q.H.; Sheng, F.F. New Quality Productive Forces System: Element Characteristics, Structural Bearing, and Functional Orientation. Reform 2024, 2, 15–24. [Google Scholar]

- Diao, H. Corporate Basic Research and the Cultivation of New-Quality Productive Forces. J. Quant. Tech. Econ. 2025, 42, 91–110. [Google Scholar]

- Xie, D.; Wang, R.; He, C. Market-Oriented Allocation of Data Elements Empowers the Development of New-Quality Productive Forces in Enterprises. Econ. Perspect. 2025, 5, 19–37. [Google Scholar]

- Li, Z.; Liao, X.D. The Triple Logic of Theory, History, and Reality in Developing ‘New Quality Productive Forces’. Rev. Political Econ. 2023, 14, 146–159. [Google Scholar]

- Xu, Z.; Zheng, H. Data Elements Empowering New-Quality Productive Forces: Intrinsic Mechanisms, Practical Obstacles, and Legal Approaches. Shanghai Econ. Rev. 2024, 5, 37–52. [Google Scholar]

- Li, S.; Zhao, C.; Xie, Y. Data Assets and Corporate Financialization: Data Governance or Conceptual Hype? Foreign Econ. Manag. 2025, 47, 21–38. [Google Scholar]

- Zhu, Z.; Huang, X.; Chen, H. Foreign Investment Openness in Producer Services and Manufacturing Innovation: Concurrent Discussion on the Institutional Openness Optimization Path for the Development of New-Quality Productive Forces. J. Financ. Res. 2024, 2, 76–93. [Google Scholar]

- Shang, L.; Li, D.; Han, S.; Jia, N. How Industry-University-Research Collaboration Stimulates the Development of New-Quality Productive Forces in Digital Native Enterprises: An Exploratory Single-Case Study from the Perspective of Knowledge Orchestration. China Ind. Econ. 2025, 1, 174–192. [Google Scholar]

- Liang, X.; Lü, K.; Chen, S. Research on the Impact of Market-Oriented Data Elements on the Level of New-Quality Productive Forces in Enterprises. Sci. Res. Manag. 2025, 46, 12–21. [Google Scholar]

- Chen, Y.; Hou, Y.; Ma, X.; Xu, B. Research on the Paths and Mechanisms of Intelligent Transformation Empowering High-Quality Development in Enterprises: From the Perspective of Developing New-Quality Productive Forces. Sci. Res. Manag. 2025, 46, 32–42. [Google Scholar]

- Guo, Y.; Chen, Y.; Chi, R. Research on the Systemic Structure of Industrial Platforms Empowering Traditional Industrial Clusters to Develop New-Quality Productive Forces. Sci. Res. Manag. 2025, 46, 22–31. [Google Scholar]

- Ouyang, Y.; Hu, M. The Impact of Data Elements Marketization on Corporate Financing Constraints: Quasi-Experimental Evidence from the Establishment of Data Trading Platforms in China. Financ. Res. Lett. 2024, 69, 106132. [Google Scholar] [CrossRef]

- Dai, K.; Wang, S.; Huang, Z. How Does the Construction of Data Trading Platforms Affect Corporate Total Factor Productivity? Econ. Perspect. 2023, 12, 58–75. [Google Scholar]

- Ge, S.; Tu, Z.; Chen, Y.; Chong, H.-Y. Data-Driven Sustainability: The Impact of Data Trading Platforms on Corporate ESG Performance. Int. Rev. Financ. Anal. 2025, 105, 104371. [Google Scholar] [CrossRef]

- Shen, N.; Zhou, J.; Zhang, G.; Wu, L.; Zhang, L. How Does Data Factor Marketization Influence Urban Carbon Emission Efficiency? A New Method Based on Double Machine Learning. Sustain. Cities Soc. 2025, 119, 106106. [Google Scholar] [CrossRef]

- Yang, Y.; Li, Y.; Liang, X. The Role of Data Trading Platforms (DTPs) in Digital Technology Innovation: Mechanisms & Evidence from China. J. Policy Model. 2025, 47, 1372–1396. [Google Scholar] [CrossRef]

- Dong, L.; Zhu, X.; Yang, L.; Jiang, J. Unleashing the Power of Data Element Markets: Driving Urban Green Growth through Marketization, Innovation, and Digital Finance. Int. Rev. Econ. Financ. 2025, 99, 104070. [Google Scholar] [CrossRef]

- Xu, Y.; Wang, Z. Market-Oriented Construction of Data Elements and Corporate Digital Transformation: A Quasi-Natural Experiment Based on Data Trading Platforms. Soft Sci. 2024, 38, 24–29+39. [Google Scholar]

- Chen, Z.; Zheng, Q.; Wu, Z. The Practical Dilemmas and Solutions for the Construction of Data Trading Platforms in China. Reform 2022, 2, 76–87. [Google Scholar]

- Chatterjee, S.; Rana, N.P.; Dwivedi, Y.K.; Baabdullah, A.M. Understanding AI Adoption in Manufacturing and Production Firms Using an Integrated TAM-TOE Model. Technol. Forecast. Soc. Change 2021, 170, 1–12. [Google Scholar] [CrossRef]

- Liu, C.; Sun, M. Analysis of Influencing Factors and Improvement Paths of the Level of Open Utilization of Public Data Based on the TOE Framework. J. Mod. Inf. 2024, 44, 105–119. [Google Scholar]

- Ren, M.; Geng, C.; Wu, Y. Driving Factors and Configuration Paths of Policy Formulation for Authorized Operation of Public Data: An Empirical Analysis Based on fsQCA. Library 2025, 11, 1–10. [Google Scholar]

- Lian, T.; Yang, S.; Wang, X. Research on Influencing Factors of Digital Transformation of Cultural and Tourism Enterprises in the Context of the Digital Economy: Based on the “TOE” Framework. J. Soochow Univ. (Philos. Soc. Sci. Ed.) 2025, 46, 116–129. [Google Scholar]

- Zhao, S.; Xu, H.; Gao, W.; Xu, Y. The Utilization Level of Corporate Data Elements, Digital Innovation, and the Modernization of Industrial Structure. China Soft Sci. 2024, S2, 398–407. [Google Scholar]

- Su, W.; Yu, S.; Ge, J. Research on the Configurational Effects of Motivational Factors for Corporate Data Element Supply. Sci. Technol. Prog. Policy 2024, 41, 89–98. [Google Scholar]

- Yu, X.; Niu, B.; Yuan, Z. Research on the Impact of “Human-Data” Synergy on High-Quality Development of Enterprises from the Perspective of the Value Chain. Sci. Res. Manag. 2025, 46, 60–68. [Google Scholar]

- Huo, C.; Yang, Y.; He, D.; Jing, S. The Generative Logic and Mechanism of Action of Lean Digitalization Empowering Organizational Resilience in Manufacturing Enterprises: A Multi-Case Study Based on Dissipative Structure. Sci. Technol. Prog. Policy 2025, 1–13. [Google Scholar]

- Yuan, Z.; Yu, X.; Li, M. Data Asset Information Disclosure, Heterogeneity of Institutional Investors, and Corporate Value. Mod. Financ. Econ. (J. Tianjin Univ. Financ. Econ.) 2022, 42, 32–47. [Google Scholar]

- Yuan, Q.; Zheng, L. Authorized Operation or Data Trading? Research on the Market-Oriented Circulation and Utilization Channels of Public Data: From the Perspectives of Asset Specificity and Descriptive Complexity. E-Government 2024, 10, 14–21. [Google Scholar]

- Yu, X.; Niu, B. Research on the Value Creation Effect of the Interaction Between Corporate Data Resources and Human Capital. Contemp. Financ. Econ. 2025, 6, 139–149. [Google Scholar]

- Mao, C.; Yan, Y.; Niu, J.; Wang, Q. How Data Assets Enhance Corporate Green Innovation Capability: Causal Inference Based on a Double Machine Learning Model. Sci. Technol. Prog. Policy 2025, 42, 1–10. [Google Scholar]

- Tang, M. Data Element Utilization and Firm Value. Int. Rev. Financ. Anal. 2025, 102, 104004. [Google Scholar] [CrossRef]

- Niu, B.; Du, Y.; Yu, X.; Zhao, N. Data Asset Information Disclosure and Bond Financing Costs. J. Guangdong Univ. Financ. Econ. 2024, 39, 88–101. [Google Scholar]

- Ouyang, R.; Sun, Y. The Theoretical Mechanism and Implementation Path of “Data Elements ×” Financial Services. Mod. Financ. Res. 2024, 29, 48–58+69. [Google Scholar]

- Bernardo, B.M.V.; São Mamede, H.; Barroso, J.M.P.; Santos, V.D.d. Data Governance & Quality Management—Innovation and Breakthroughs Across Different Fields. J. Innov. Knowl. 2024, 9, 100598. [Google Scholar] [CrossRef]

- Wang, X.; Liu, D.; Wang, S. Riding the “Wave of Data”: Government Data Governance Empowers the Integration of Digital and Real Economies. J. Hainan Univ. (Humanit. Soc. Sci. Ed.) 2025, 1–11. [Google Scholar]

- Liu, Y.; Zhang, Y. Restrictive Factors and Breakthrough Paths in the Cultivation of the Data Elements Market. Reform 2023, 9, 21–33. [Google Scholar]

- Yang, F.; Ai, Y.; Li, J. The Dual Improvement of Data Assetization on Pricing Efficiency and Stability in the Capital Market: An Empirical Test Based on Corporate Stock Price Synchronicity and Volatility. West. Forum 2025, 35, 17–31. [Google Scholar]

- Yao, H.; Zhang, J. Research on the Impact of Corporate Data Assets on Total Factor Productivity. Econ. Surv. 2024, 41, 107–119. [Google Scholar]

- Chen, L.; Dong, H. Can Transactional Data Assets Promote Corporate Breakthrough Innovation? Evidence from A-Share Listed Companies. J. Hubei Univ. (Philos. Soc. Sci. Ed.) 2025, 52, 147–156+196. [Google Scholar]

- Li, C.; Zhang, S.; Wang, M. Research on the Impact of Data Elements Market Construction on Corporate Innovation. Sci. Res. Manag. 2025, 1–17. [Google Scholar]

- Wang, C.; Wang, X. The Relationship and Impact Between the Development of New-Quality Productive Forces and Data Elements Exploitation. Library 2025, 8, 49–55+90. [Google Scholar]

- Chen, H.; Wei, S.; Xie, W. The Effect and Mechanism of Innovation-Incentive Tax Reductions in Promoting the Development of New-Quality Productive Forces in Enterprises: Evidence from A-Share Listed Companies from 2015 to 2022. Tax. Res. 2025, 5, 104–113. [Google Scholar]

- Han, W.; Tang, X. The Theoretical Logic and Practical Path of New Finance in Promoting the Development of New-Quality Productive Forces. J. Lanzhou Univ. (Soc. Sci. Ed.) 2025, 53, 15–26. [Google Scholar]

- Wang, X.; Yang, Y.; Chen, Y.; Li, H. Can Digital Government Construction Improve Corporate Breakthrough Innovation Performance? Based on the Mediating Effect of New-Quality Productive Forces. Sci. Technol. Prog. Policy 2025, 42, 84–93. [Google Scholar]

- Wang, W.J.; Chen, Y.X. Research on the Synergistic Effect of Data Elements on Enterprise Carbon Emission Reduction. J. Northeast. Norm. Univ. (Philos. Soc. Sci. Ed.) 2025, 6, 1–10. [Google Scholar]

- Ren, S.; Du, M.; Cao, Y. Managerial Short-Termism Fluctuations, Diversification Strategies, and Corporate Input. Manag. Rev. 2025, 37, 200–213. [Google Scholar]

- Cheng, B.; Xu, Y.; Liu, Z. State-Owned Enterprise Reform and Human Capital Structure Optimization. Collect. Essays Financ. Econ. 2025, 1, 106–117. [Google Scholar]

- Yu, N.; Zhang, H.; Liu, H. Non-Controlling Major Shareholders and Corporate Financialization: A Reservoir or an Arbitrage Tool? Nankai Bus. Rev. 2023, 26, 96–107. [Google Scholar]

- Shen, Z.; Zhu, S.; Wen, Q.; Tang, C. Empowering an Efficient Market with a Proactive Government: Government Digital Governance and Corporate Investment Efficiency. World Econ. 2025, 48, 166–195. [Google Scholar]

- Wu, Z.; Li, Q.; Zhao, R. Provincial Unified Management of Personnel, Finances, and Assets in Local Courts Promotes Cross-Regional Investment. China Econ. Q. 2024, 24, 1308–1324. [Google Scholar]

- He, Y.; Chen, L.; Du, Y. Can Data Assetization Alleviate Financing Constraints for “Specialized, Sophisticated, Unique, and Innovative” Small and Medium-Sized Enterprises? China Ind. Econ. 2024, 8, 154–173. [Google Scholar]

- Li, X.R.; Tian, Z.R.; Chang, B.Q. New Quality Productive Forces, Resource Utilization, and Enterprise Organizational Resilience. West. Forum 2024, 34, 35–49. [Google Scholar]

- Zhang, M.; Du, Y. The Application of QCA Method in Organizational and Management Research: Positioning, Strategies, and Directions. Chin. J. Manag. 2019, 16, 1312–1323. [Google Scholar]

- Peng, Z.; Hao, Y.; Bao, F. Research on the Value Creation Path Driven by the Innovation Ecosystem of Industrial Internet Platforms Derived from Manufacturing Enterprises: A Configurational Analysis Based on fsQCA. J. Guizhou Univ. Financ. Econ. 2024, 3, 11–20. [Google Scholar]

- Zhang, E.; Li, Z. The Path and Mechanism of Digital Technology Innovation Driving the Growth of Corporate Data Assets. China Bus. Mark. 2025, 39, 100–114. [Google Scholar]

| Keywords | Lexicon |

|---|---|

| Digital | Digital platform; Digital trade; Digital consumption; Digital currency; Digital product security; Digital certification; Digital products |

| Data | Data platform; Data cooperation; Data trading; Data circulation and sharing; Data application services; Data hosting; Data usage rights; Data security; Data service provider; Data disclosure; Data exchange. |

| Information | Information platform; sharing; services; consumption Resource sharing; interconnection; interoperability; system; exchange; level; platform |

| Network | Online transaction; online sales; network data security; information security; security performance; risks; provision of networks; service provision; network interconnection; network convergence; interoperability; network service provider; cyberspace sovereignty |

| Primary Indicator | Secondary Indicator | Tertiary Indicator | Calculation Method |

|---|---|---|---|

| New Quality Laborers | Employee Quality | Proportion of R&D Personnel | Number of R&D personnel/Total number of employees |

| Proportion of Highly Educated Personnel | Number of employees with postgraduate degrees or above/Total number of employees | ||

| Management Quality | Green Awareness of Executives | ln (Frequency of green development keywords in annual reports + 1) | |

| Overseas Background of Management | Assigned a value of 1 if any executives have an overseas background; otherwise, 0 | ||

| New Quality Objects of Labor | Ecological Environment | Environmental Governance Score | E indicator from Huazheng ESG ratings, with 9 levels assigned values from 1 to 9 respectively |

| Future Development | Proportion of Fixed Assets | Fixed assets/Total assets | |

| Capital Accumulation Rate | Growth in owner’s equity for the current year/Owner’s equity at the beginning of the year | ||

| New Quality Means of Labor | Technological Means of Labor | Innovation Level | ln (Number of patent grants + 1) |

| Digital Means of Labor | Degree of Digitalization | ln (Frequency of digital keywords in annual reports + 1) | |

| Proportion of Intangible Assets | Intangible assets/Total assets | ||

| Green Means of Labor | Green Technology Level | ln (Number of green patent grants + 1) | |

| Proportion of Green Patents | Number of green patent grants/Total number of patent grants |

| Conditional Variable | High-Level Enterprise Data Asset Trading | Low-Level Enterprise Data Asset Trading | ||||||

|---|---|---|---|---|---|---|---|---|

| Aggregated Consistency | Aggregated Coverage | Inter-Group Consistency Adjustment Distance | Intra-Group Consistency Adjustment Distance | Aggregated Consistency | Aggregated Coverage | Inter-Group Consistency Adjustment Distance | Intra-Group Consistency Adjustment Distance | |

| X1 | 0.641 | 0.562 | 0.046 | 0.487 | 0.564 | 0.644 | 0.043 | 0.037 |

| ~X1 | 0.594 | 0.511 | 0.055 | 0.454 | 0.616 | 0.691 | 0.043 | 0.033 |

| X2 | 0.684 | 0.641 | 0.058 | 0.422 | 0.487 | 0.596 | 0.101 | 0.043 |

| ~X2 | 0.569 | 0.460 | 0.055 | 0.487 | 0.707 | 0.744 | 0.058 | 0.027 |

| X3 | 0.758 | 0.676 | 0.017 | 0.389 | 0.463 | 0.538 | 0.041 | 0.051 |

| ~X3 | 0.482 | 0.408 | 0.032 | 0.552 | 0.721 | 0.795 | 0.023 | 0.025 |

| X4 | 0.568 | 0.559 | 0.026 | 0.487 | 0.514 | 0.659 | 0.038 | 0.035 |

| ~X4 | 0.653 | 0.507 | 0.020 | 0.422 | 0.656 | 0.664 | 0.035 | 0.033 |

| X5 | 0.852 | 0.473 | 0.020 | 0.519 | 0.729 | 0.527 | 0.014 | 0.031 |

| ~X5 | 0.148 | 0.295 | 0.116 | 1.850 | 0.271 | 0.705 | 0.038 | 0.029 |

| X6 | 0.578 | 0.493 | 0.296 | 0.487 | 0.638 | 0.708 | 0.290 | 0.031 |

| ~X6 | 0.657 | 0.582 | 0.293 | 0.454 | 0.543 | 0.627 | 0.351 | 0.037 |

| X7 | 0.748 | 0.487 | 0.046 | 0.681 | 0.605 | 0.513 | 0.084 | 0.031 |

| ~X7 | 0.252 | 0.328 | 0.136 | 1.330 | 0.395 | 0.672 | 0.128 | 0.030 |

| Causal Combination Scenario | Indicator | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| X6/Y | Inter-group Consistency | 0.366 | 0.476 | 0.572 | 0.658 | 0.726 |

| Inter-group Coverage | 0.559 | 0.514 | 0.484 | 0.459 | 0.498 | |

| ~X6/Y | Inter-group Consistency | 0.890 | 0.796 | 0.681 | 0.565 | 0.466 |

| Inter-group Coverage | 0.523 | 0.566 | 0.592 | 0.597 | 0.666 | |

| X6/~Y | Inter-group Consistency | 0.401 | 0.542 | 0.647 | 0.724 | 0.798 |

| Inter-group Coverage | 0.832 | 0.780 | 0.730 | 0.697 | 0.633 | |

| ~X6/~Y | Inter-group Consistency | 0.788 | 0.662 | 0.542 | 0.437 | 0.367 |

| Inter-group Coverage | 0.628 | 0.628 | 0.628 | 0.638 | 0.608 |

| Conditional Variable | Configuration Analysis—High-Level Enterprise Data Asset Trading | ||

|---|---|---|---|

| Configuration Z1 | Configuration Z2 | Configuration Z3 | |

| Level of enterprise data elements (X1) | ● | ● | ● |

| Intensity of enterprise R&D investment (X2) | ● | ● | |

| Enterprise human capital structure (X3) | ● | ● | ● |

| Degree of corporate financialization (X4) | ● | ● | |

| Urban data governance (X5) | ● | ● | ● |

| Degree of marketization (X6) | ⊗ | ⊗ | |

| Data trading platform (X7) | ● | ||

| Consistency | 0.880 | 0.855 | 0.887 |

| PRI | 0.710 | 0.718 | 0.731 |

| Coverage | 0.206 | 0.283 | 0.168 |

| Unique Coverage | 0.032 | 0.109 | 0.024 |

| Inter-group Consistency Adjustment Distance | 0.017 | 0.032 | 0.029 |

| Intra-group Consistency Adjustment Distance | 0.162 | 0.195 | 0.162 |

| Overall Consistency | 0.846 | ||

| Overall PRI | 0.707 | ||

| Overall Coverage | 0.339 | ||

| The case frequency is 2, the original consistency threshold is 0.8, and the PRI threshold is 0.65. | |||

| Conditional Variable | Configuration Analysis—High-Level Enterprise Data Asset Trading | ||

|---|---|---|---|

| Configuration Z1 | Configuration Z2 | Configuration Z3 | |

| Level of enterprise data elements (X1) | ● | ● | ● |

| Intensity of enterprise R&D investment (X2) | ● | ● | |

| Enterprise human capital structure (X3) | ● | ● | ● |

| Degree of corporate financialization (X4) | ● | ● | |

| Urban data governance (X5) | ● | ● | ● |

| Degree of marketization (X6) | ⊗ | ⊗ | |

| Data trading platform (X7) | ● | ||

| Consistency | 0.880 | 0.859 | 0.887 |

| PRI | 0.710 | 0.726 | 0.731 |

| Coverage | 0.206 | 0.236 | 0.168 |

| Unique Coverage | 0.061 | 0.092 | 0.024 |

| Inter-group Consistency Adjustment Distance | 0.017 | 0.032 | 0.029 |

| Intra-group Consistency Adjustment Distance | 0.162 | 0.195 | 0.162 |

| Overall Consistency | 0.851 | ||

| Overall PRI | 0.712 | ||

| Overall Coverage | 0.322 | ||

| Conditional Variable | Configuration Analysis—High-Level Enterprise Data Asset Trading | ||

|---|---|---|---|

| Configuration Z1 | Configuration Z2 | Configuration Z3 | |

| Level of enterprise data elements (X1) | ● | ● | ● |

| Intensity of enterprise R&D investment (X2) | ● | ● | |

| Enterprise human capital structure (X3) | ● | ● | ● |

| Degree of corporate financialization (X4) | ● | ● | |

| Urban data governance (X5) | ● | ● | ● |

| Degree of marketization (X6) | ⊗ | ⊗ | |

| Data trading platform (X7) | ● | ||

| Consistency | 0.880 | 0.855 | 0.887 |

| PRI | 0.710 | 0.718 | 0.731 |

| Coverage | 0.206 | 0.283 | 0.168 |

| Unique Coverage | 0.032 | 0.109 | 0.024 |

| Inter-group Consistency Adjustment Distance | 0.017 | 0.032 | 0.029 |

| Intra-group Consistency Adjustment Distance | 0.162 | 0.195 | 0.162 |

| Overall Consistency | 0.846 | ||

| Overall PRI | 0.707 | ||

| Overall Coverage | 0.339 | ||

| Conditional Variable | Configuration Analysis—High-Level Enterprise Data Asset Trading | ||

|---|---|---|---|

| Configuration Z1 | Configuration Z2 | Configuration Z3 | |

| Level of enterprise data elements (X1) | ● | ● | ● |

| Intensity of enterprise R&D investment (X2) | ● | ● | |

| Enterprise human capital structure (X3) | ● | ● | ● |

| Degree of corporate financialization (X4) | ● | ● | |

| Urban data governance (X5) | ● | ● | ● |

| Degree of marketization (X6) | ⊗ | ⊗ | |

| Data trading platform (X7) | ⊗ | ● | ● |

| Consistency | 0.901 | 0.859 | 0.887 |

| PRI | 0.738 | 0.726 | 0.731 |

| Coverage | 0.031 | 0.236 | 0.168 |

| Unique Coverage | 0.031 | 0.092 | 0.024 |

| Inter-group Consistency Adjustment Distance | 0.064 | 0.032 | 0.029 |

| Intra-group Consistency Adjustment Distance | 0.065 | 0.195 | 0.162 |

| Overall Consistency | 0.860 | ||

| Overall PRI | 0.725 | ||

| Overall Coverage | 0.291 | ||

| Variable Type | Variable Name | Measurement Method | N | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|---|

| Explained variable | Enterprise’s new quality productive forces | See Table 2 for details. | 4348 | 0.167 | 0.074 | 0.021 | 0.380 |

| Explanatory Variable | Configuration Z1 | The degree of set membership for each enterprise in the corresponding configuration | 4348 | 0.102 | 0.157 | 0.000 | 0.900 |

| Configuration Z2 | 4348 | 0.144 | 0.205 | 0.000 | 0.910 | ||

| Configuration Z3 | 4348 | 0.083 | 0.145 | 0.000 | 0.820 | ||

| Mediating variable | Enterprise data asset trading | Construct dictionaries of seed words and similar terms for “digital,” “data,” “information,” and “network,” and measure them using the ratio of the total frequency of these words to the total word frequency in annual reports. | 4348 | 0.434 | 0.340 | 0.050 | 1.000 |

| Control variable | Cashflow | Net cash flow from operating activities/Total assets | 4348 | 0.039 | 0.069 | −0.355 | 0.545 |

| Growth | (Current year’s operating revenue amount—amount from the same period last year)/Amount from the same period last year | 4348 | 0.116 | 0.664 | −1.445 | 27.080 | |

| Firmage | Current year—Establishment year | 4348 | 20.004 | 6.649 | 4.000 | 68.000 | |

| Tobin’s Q | Market capitalization/Total assets | 4348 | 2.444 | 1.689 | 0.641 | 41.081 | |

| HHI | Main business revenue’s market share in the industry | 4348 | 0.074 | 0.107 | 0.023 | 1.000 |

| Variable | Explained Variable: Enterprise’s New Quality Productive Forces | ||

|---|---|---|---|

| Model 1 | Model 2 | Model 3 | |

| Configuration Z1 | 0.0545 *** (7.9361) | ||

| Configuration Z2 | 0.0489 *** (8.6826) | ||

| Configuration Z3 | 0.0394 *** (5.1114) | ||

| Controls | YES | YES | YES |

| Year | YES | YES | YES |

| _cons | 0.1772 *** (37.1180) | 0.1739 *** (35.9362) | 0.1793 *** (37.4782) |

| N | 4348 | 4348 | 4348 |

| adj. R2 | 0.0766 | 0.0809 | 0.0694 |

| Variable | Replace the Dependent Variable; | Remove Extreme Values. | ||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 1 | Model 2 | Model 3 | |

| Configuration Z1 | 0.1439 ** (2.2542) | 0.0556 *** (7.9001) | ||||

| Configuration Z2 | 0.0972 * (1.8965) | 0.0489 *** (8.6096) | ||||

| Configuration Z3 | 0.4627 *** (6.2532) | 0.0401 *** (5.1307) | ||||

| Controls | YES | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES | YES |

| _cons | 6.3686 *** (117.9018) | 6.3666 *** (116.1273) | 6.3442 *** (118.7827) | 0.1771 *** (37.1617) | 0.1740 *** (36.0361) | 0.1793 *** (37.5495) |

| N | 4205 | 4205 | 4205 | 4348 | 4348 | 4348 |

| adj. R2 | 0.0562 | 0.0560 | 0.0625 | 0.0766 | 0.0806 | 0.0694 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Configuration Z1 | 0.0461 *** (6.3701) | |||

| Configuration Z2 | 0.0419 *** (6.9712) | |||

| Configuration Z3 | 0.0294 *** (3.6721) | |||

| Enterprise data asset trading | 0.0207 *** (6.5752) | 0.0152 *** (4.6168) | 0.0121 *** (3.6182) | 0.0176 *** (5.3636) |

| Controls | YES | YES | YES | YES |

| Year | YES | YES | YES | YES |

| _cons | 0.1750 *** (35.5428) | 0.1726 *** (35.2643) | 0.1709 *** (34.6465) | 0.1739 *** (35.4080) |

| N | 4348 | 4348 | 4348 | 4348 |

| adj. R2 | 0.0722 | 0.0808 | 0.0833 | 0.0751 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lai, Y.; Zhang, J.; Zheng, M. Research on the Synergistic Development Path of Enterprise Data Asset Trading and New Quality Productive Forces Under the TOE Framework—Empirical Evidence from China. Sustainability 2025, 17, 11362. https://doi.org/10.3390/su172411362

Lai Y, Zhang J, Zheng M. Research on the Synergistic Development Path of Enterprise Data Asset Trading and New Quality Productive Forces Under the TOE Framework—Empirical Evidence from China. Sustainability. 2025; 17(24):11362. https://doi.org/10.3390/su172411362

Chicago/Turabian StyleLai, Yan, Juan Zhang, and Minggui Zheng. 2025. "Research on the Synergistic Development Path of Enterprise Data Asset Trading and New Quality Productive Forces Under the TOE Framework—Empirical Evidence from China" Sustainability 17, no. 24: 11362. https://doi.org/10.3390/su172411362

APA StyleLai, Y., Zhang, J., & Zheng, M. (2025). Research on the Synergistic Development Path of Enterprise Data Asset Trading and New Quality Productive Forces Under the TOE Framework—Empirical Evidence from China. Sustainability, 17(24), 11362. https://doi.org/10.3390/su172411362

_Li.png)