From News to Knowledge: Leveraging AI and Knowledge Graphs for Real-Time ESG Insights

Abstract

1. Introduction

- (1)

- How can AI-driven NLP techniques automate and enrich ESG news data extraction for FTSE 100, FTSE 250, and ASX 200 companies?

- (2)

- Can sentiment and named entity recognition offer timely ESG insights beyond what corporate disclosures provide?

- (3)

- In what ways can knowledge graphs enhance the semantic representation and relationship mapping of ESG information?

- (1)

- To implement pre-trained NLP model utilisation for sentiment analysis, named entity recognition, and topic modelling of ESG-related news articles, terms, and actors within the fetched articles.

- (2)

- To construct and visualise a dynamic knowledge graph representing ESG event relationships among FTSE 350 and ASX 200 companies.

- (3)

- To further dive into the semantic representation of interrelationships between ESG narratives that are not captured through traditional methods of analytics.

- (4)

- Exploration of inferential analytics that may be derived from the output of the proposed framework to be further used for augmenting the decision-making process.

- (1)

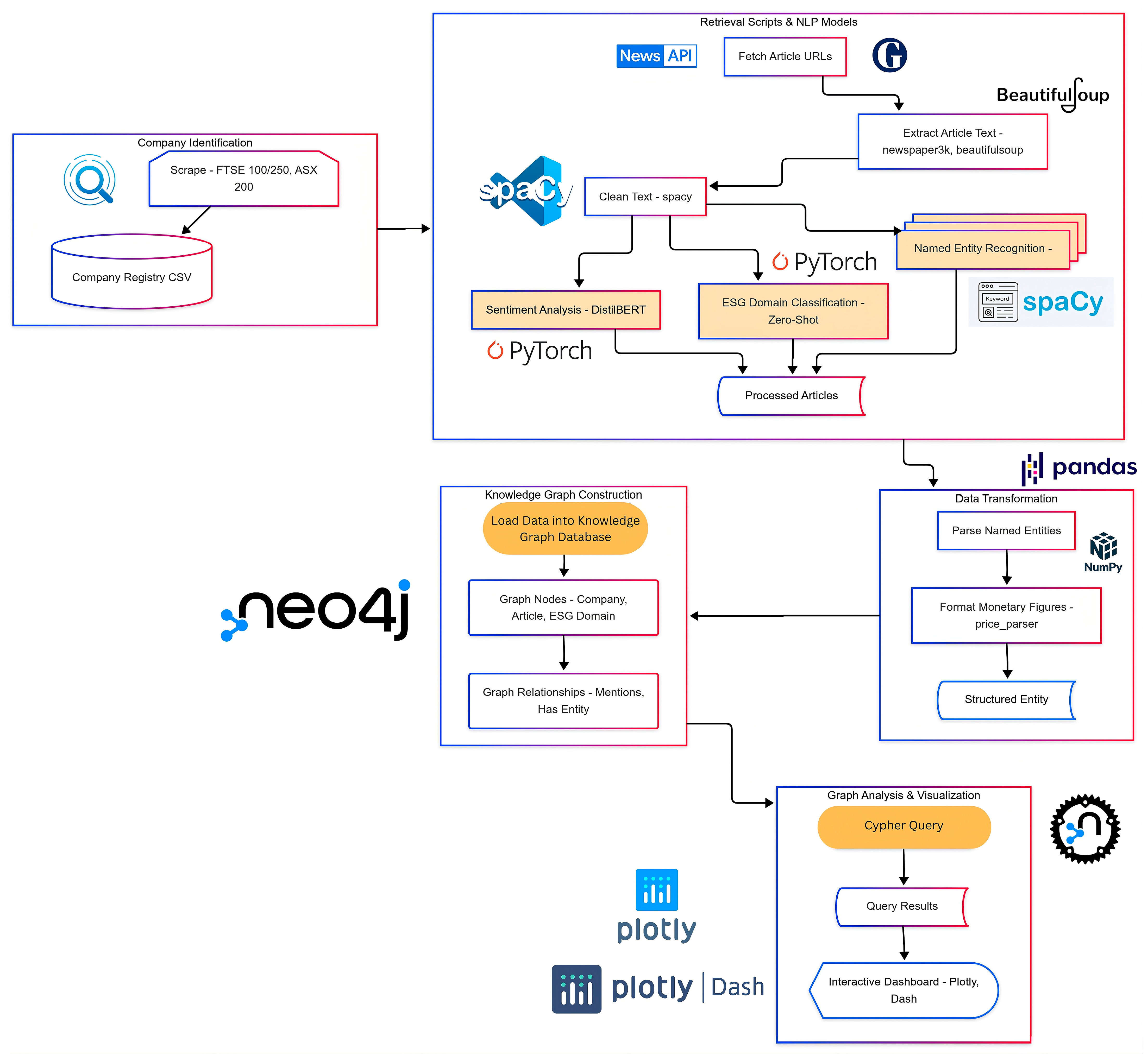

- The development and implementation of a novel, automated framework that integrates NLP and KG technologies for ESG news analysis. This included custom-built scripts for entity collection, news aggregation, and hybrid approaches for ESG domain classification combining a Bag-of-Words and Zero-Shot Classification.

- (2)

- The construction of a dynamic, property knowledge graph using Neo4j version 5.26.6 to structure semantically and link extracted ESG entities, sentiments, and thematic domain classifications from unstructured news data.

- (3)

- A scalable and adaptable framework for transforming unstructured public news into interconnected, queryable knowledge, offering an alternative to traditional, often static, ESG reporting inferential analysis.

- (4)

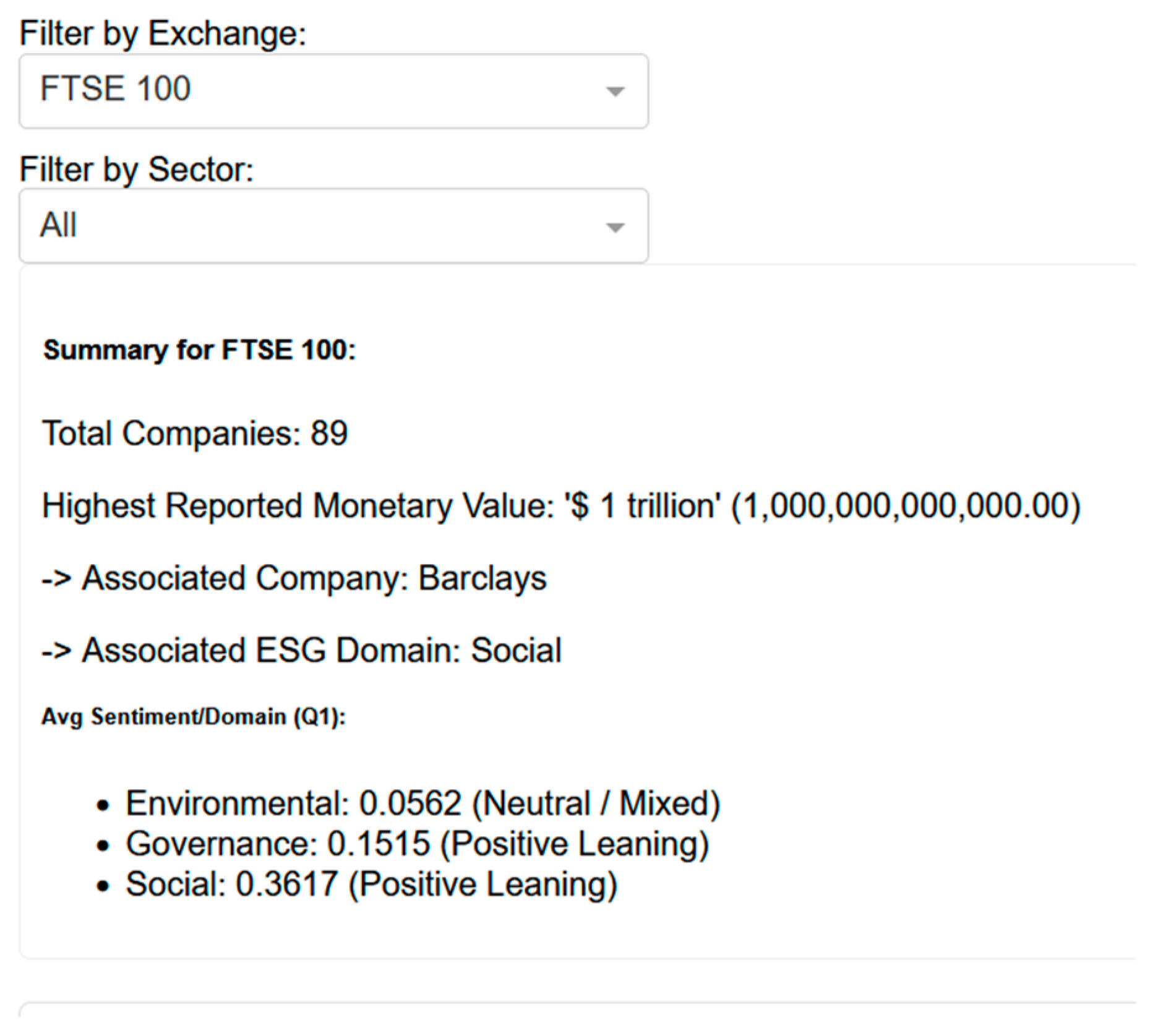

- An interactive dashboard for visualising and exploring the KG, enabling stakeholders to identify sentiment trends, ESG focus areas of market directionalities, and relational dynamics across different companies and sectors within the FTSE 100, FTSE 250, and ASX 200 indices.

- (5)

- Demonstration of how AI-driven analysis of news data can provide timely, sentiment-aware, and context-rich insights often missing from corporate disclosures, aiding financial analysts, policymakers, and researchers.

2. Relevant Literature Review

3. Methodology

- Entity Collection:

- B.

- ESG News Article Collection

- C.

- NLP: NER, Sentiment Analysis, and ESG Domain Classification

- (a)

- Named Entity Recognition:

- (b)

- Sentiment Analysis:

- (c)

- ESG Domain Classification:

- D.

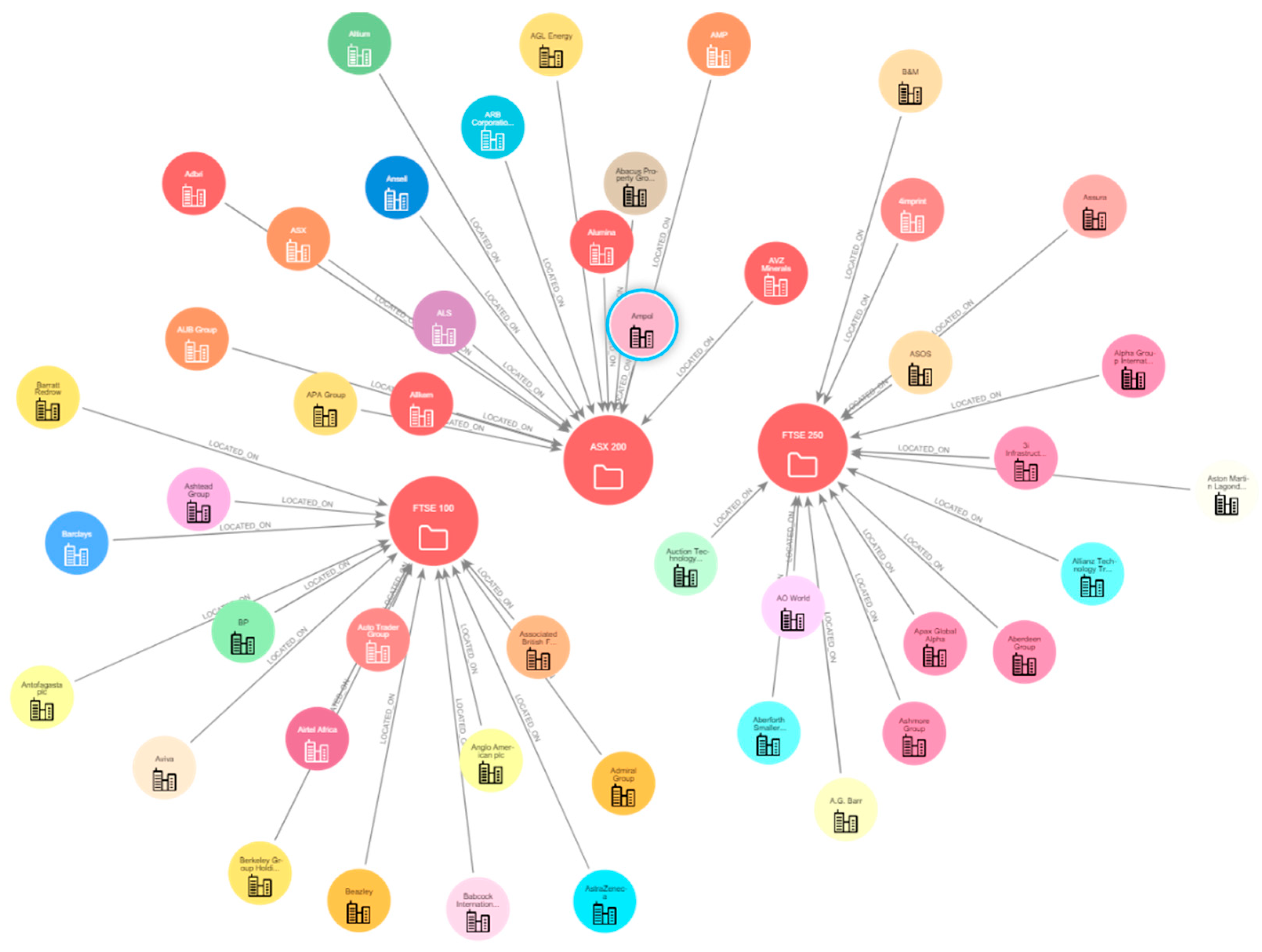

- Knowledge Graph Construction and Linkage

- E.

- Data Normalisation and Pre-Processing

- Company Entity Normalisation: News mentions of companies were mapped to the canonical names and tickers stored within the “Company Registry.” This process ensured that varied references to the same company in different articles were resolved to a single, consistent entity in the knowledge graph.

- Parsing Complex NER Outputs: The outputs from Named Entity Recognition (NER) were parsed to extract and structure relevant information.

- Standardising Data Types: Specific data types were standardised to ensure uniformity across the dataset.

- Conversion of Monetary Values into Numerical: Textual monetary values, such as ‘USD 5 million’ or ‘7 cents’, were converted into uniform numerical formats. This was achieved using data manipulation libraries like pandas, numpy, and price_parser.

- Normalising Sector Names: Sector names were normalised across the dataset to ensure consistency.

- F.

- Visualisation and Analysis

4. Results and Discussion

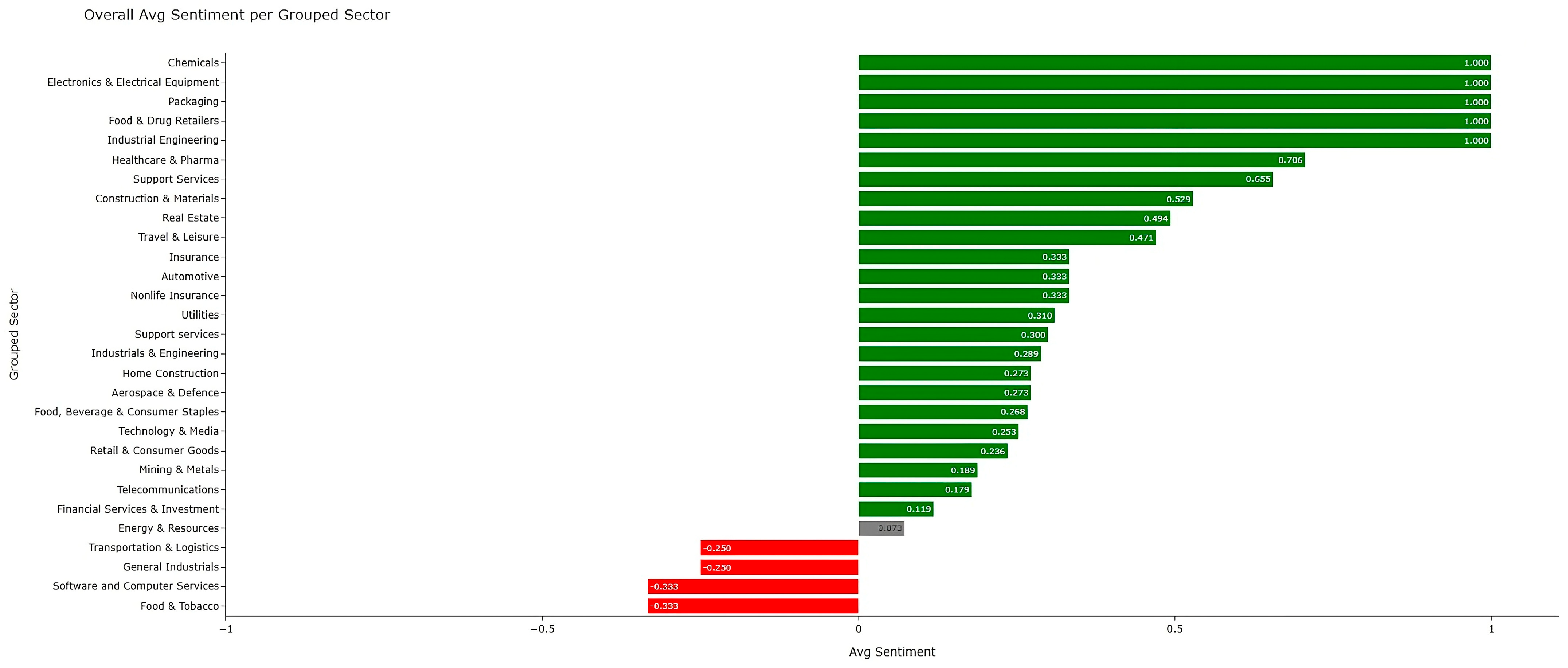

4.1. Environmental, Social, and Governance Insights Across Indices

4.2. Average Sentiment Across Indices for Technology & Media Grouped Sector

4.3. Regulatory Context & Implications

4.4. Inferential Analytics Discussion Through Dashboards

5. Limitations and Future Work

- ▪

- Entity Collection: Reliance on Wikipedia for company registries is pragmatic due to its accessibility and frequent updates, but it could be augmented with official exchange data feeds in the future for enhanced canonical accuracy and to mitigate lag in reflecting index composition changes. The initial scope, limited to FTSE 350 (FTSE 100 and FTSE 250 combined) and ASX 200 for their economic influence and geographic diversity, could be expanded to other global indices or sectors to provide richer cross-market ESG comparisons and improve the generalizability of insights.

- ▪

- Article Retrieval and Relevance: Public APIs present limitations such as rate restrictions, potentially impacting data volume and recency, and variable search result relevance from general keyword queries, which can introduce noise. Refining ESG relevance filtering beyond current keyword-based approaches (e.g., “ESG,” “Sustainability Reports”) using fine-tuned classification models, trained on a dedicated ESG news corpus, would significantly improve precision in identifying truly pertinent articles and reduce the manual effort needed for verification.

- ▪

- News Coverage & External Validity: Our corpus (~1098 articles retrieved across 450/550 firms) is sufficient for prototyping but not for exhaustive coverage. Future work should explore different language representativeness for better context on regional differences; commit to extending the time window for article collection, also to enable time-series analysis; incorporate additional news APIs and local outlets; and add other indices (e.g., STOXX, S&P 500 /ASX extensions) to strengthen cross-market generalisability.

- ▪

- NLP—Sentiment Analysis: DistilBERT provides a good balance of performance and computational efficiency, crucial for processing large article volumes; however, larger or domain-specific models like FinBERT could capture more ESG-specific sentiment nuances and contextual subtleties often missed by general-purpose transformers. Addressing mixed sentiments within articles, perhaps through aspect-based sentiment analysis, and mitigating the impacts of text truncation on capturing comprehensive sentiment from lengthy reports remain key areas for future improvement and model refinement.

- ▪

- NLP—Topic Modelling: The hybrid BoW and zero-shot classification (using models like facebook/bart-large-mnli) was effective for initial ESG domain categorisation without requiring task-specific training data, but this approach could be enhanced for greater depth. Future work should explore multi-label classification to accurately capture articles spanning multiple ESG domains simultaneously and develop more granular ESG sub-theme models (e.g., distinguishing “water scarcity” from “carbon emissions”), likely requiring dedicated, expertly annotated ESG news datasets and defined taxonomies.

- ▪

- NLP—Named Entity Recognition: SpaCy’s en_core_web_lg model is robust for familiar entities, but fine-tuning with an ESG-specific annotated corpus would improve precision for specialised terms (e.g., “carbon offsetting initiative,” “green bonds”) not well-represented in general training data; this includes enhancing the parsing of complex monetary values beyond the current price_parser capabilities if needed. Advanced entity disambiguation, linked to canonical databases like Wikidata or bespoke ESG entity repositories, is a complex but valuable future addition for enhancing knowledge graph accuracy and resolving entity ambiguities.

- ▪

- Knowledge Graph Construction: The current property graph schema effectively models core relationships between companies, articles, and ESG domains, but it could be significantly enriched by integrating external structured datasets, such as official company-reported emissions figures or third-party ESG ratings, for cross-validation. Linking entities and concepts to established ontologies like DBpedia or financial ontologies (e.g., FIBO) would also provide greater semantic depth, facilitate more sophisticated reasoning, and improve interoperability with other ESG data systems.

- ▪

- Knowledge Graph Enhancements & Explainable AI: While the KG provides a rich semantic structure, the complex web of relationships can sometimes make it challenging to trace the exact reasoning behind emergent patterns or inferential conclusions. To enhance user trust and facilitate easier validation of insights, future work should explore the integration of explainable AI (XAI) techniques. Methods such as generating textual explanations for paths within the graph or adapting principles from tools like SHAP or LIME to graph-based queries could help clarify how specific ESG assessments or sentiment trends are derived from the underlying data and relationships within the KG.

- ▪

- Inclusion of Financial Data: Integrating quantitative financial metrics such as company revenue, market capitalisation, stock price volatility, credit ratings, or specific reported ESG performance indicators alongside news-derived insights could enable robust correlational analyses. This would bridge qualitative ESG news narratives with quantitative market realities, offering a more holistic assessment and allowing for the investigation of potential links between ESG news sentiment, subsequent stock movements, or overall corporate financial health.

- ▪

- Ethical Considerations and Model Bias: The insights derived from this framework are contingent on the news data processed and the inherent characteristics of the AI models used. News media itself can reflect various biases, including market sentiment, political leanings, or selective reporting, which can influence the textual data fed into the framework itself. Consequently, the sentiment and topics identified by the NLP models may, to some extent, mirror these existing biases from the source material. Future work should incorporate systematic approaches for bias detection and mitigation within the NLP framework. This could involve using fairness toolkits, carefully curating and balancing training data if models are fine-tuned for ESG tasks, and conducting fairness audits to understand how the framework performs across different types of ESG narratives and company profiles. Furthermore, as AI-driven ESG analysis becomes more prevalent, establishing clear lines of accountability for automated outputs is crucial. Overreliance on these tools without understanding their limitations (including inherent biases from data and models) could lead to flawed decision-making by investors, regulators, or companies themselves. Future frameworks should aim for greater transparency in how conclusions are drawn.

- ▪

- NLP Model Bias: Because news sources embed editorial and regional norms as mentioned before, modelled sentiment and topics can partially inherit those biases. Going forward, we will integrate a formal bias-detection and mitigation pipeline: data curation with stratified sampling, reweighting, and counterfactual data augmentation (e.g., entity/region swaps; negation injection) to balance ESG narratives; fairness auditing using slice-based performance by sector, region, firm size, calibration metrics, and reporting via model cards. To reduce NLP misinterpretations, we will deploy negation and hedging detectors, co-reference and entity disambiguation, contradiction and stance checks (NLI), sarcasm and modality cues, topic-to-entity disentanglement, and KG consistency rules; add uncertainty quantification with abstention or human-in-the-loop review for low-confidence, high-materiality events; and perform domain adaptation and multilingual normalisation to stabilise performance across regions. These measures aim to prevent overreliance on purely automated outputs, foreground model limitations, and make downstream decisions more robust and auditable.

- ▪

- News Media Bias: As researchers, we need to concur that news-driven ESG signals inherit editorial agendas and regional journalistic norms, producing systematic selection and framing effects. Classic agenda-setting research shows that media emphasis shapes public salience, implying coverage ≠ ground truth; thus, indicator intensity can reflect editorial priorities as much as event magnitude. We mitigate by aggregating across diversified outlets/APIs, de-duplicating, recording outlet/region provenance in the KG, normalising for time-varying source coverage, and enabling region-weighted analyses; nevertheless, residual selection effects persist and are explicitly acknowledged and stress-tested via sensitivity analyses. Further research should be expanded thoroughly.

- ▪

- Financial Linkage to Market Outcomes: While this study primarily focuses on developing and implementing the framework structure, a full econometric validation remains beyond the current scope. Future work will explicitly extend the analysis toward quantitative benchmarking and validation against third-party ESG rating datasets (e.g., MSCI, Refinitiv, or Sustainalytics). This will involve comparing company-level graph-based indicators with existing ESG scores using rank concordance, correlation, and sector-level benchmarking metrics. Additionally, we plan to integrate financial datasets to enable a comprehensive econometric evaluation—transforming time-stamped ESG sentiment intensity, topic salience, and controversy signals into investable indicators. These will be examined through event studies, time-fixed panel regressions, and Granger or VAR-based lead–lag analyses, with appropriate confounder controls, multiple-testing corrections, and robustness checks. This next stage will provide a systematic pathway to assess how the graph-derived ESG indicators correspond to financial performance and market behaviour.

- ▪

- Evaluation and KG Governance: The project primarily focused on implementation success, demonstrating a functional framework and qualitative insight generation via the dashboard. Future work should incorporate formal evaluation metrics for each NLP task and the KG itself; this would necessitate the development or availability of suitable, expertly annotated ESG benchmark datasets to establish ground truth for entities, sentiments, topics, and relations, allowing for rigorous quantitative performance assessment. As entities and relations evolve, we will maintain versioned graph snapshots with timestamped provenance, periodic schema reviews, and scheduled model refreshes; we will log all ingestion and inference settings to ensure longitudinal comparability.

6. Conclusions & Real-World Application Retrospectives

Potential Real-World Applications of This Framework

- ▪

- Investors and financial analysts can utilise the framework to gain timely insights into ESG-related risks and opportunities potentially not yet reflected in formal company disclosures or lagging third-party ratings. Tracking ESG domain focus (e.g., Figure 9) and sentiment shifts (e.g., Figure 5 and Figure 7) for specific companies or sectors can inform investment decisions, due diligence, and portfolio management, particularly for Socially Responsible Investing (SRI) strategies. Further, hedge funds and asset managers could employ the framework as an early-warning mechanism for reputational or regulatory shocks, incorporating ESG sentiment indicators into trading algorithms and risk assessment models.

- ▪

- Regulators and policymakers could leverage the framework to monitor corporate ESG discourse in near real-time, identify emerging areas of concern (e.g., widespread negative sentiment in a sector), or detect patterns indicative of potential ‘greenwashing’ across industries or indices. This can support evidence-based policy making and market oversight activities. For example, securities commissions could use ESG sentiment graphs to detect discrepancies between corporate sustainability disclosures and external narratives, informing targeted audits or compliance investigations.

- ▪

- ESG auditors and consultants might employ the tool to complement their traditional audit processes by providing an external, media-based perspective on a company’s ESG performance and stakeholder perception, helping to identify discrepancies or areas requiring deeper investigation beyond company-provided data. Consultancies could also use the knowledge graph to benchmark ESG practices across peers, generating comparative analytics for advisory reports and assisting clients in preparing for regulatory disclosure mandates.

- ▪

- Corporations could utilise the framework for proactive reputation management, understanding public sentiment regarding their ESG initiatives (positive or negative), benchmarking their media portrayal against peers, and identifying shifts in ESG focus within their sector. Additionally, corporate boards could incorporate these insights into strategic decision-making, such as tailoring sustainability campaigns, anticipating activist shareholder concerns, or aligning ESG communication strategies with investor and societal expectations.

- ▪

- Insurance and Risk Management Firms: The framework can support insurers in evaluating ESG-related risks (e.g., climate litigation, governance scandals, or labour disputes) by monitoring media sentiment and thematic focus across industries. This could inform underwriting, risk-adjusted pricing, and exposure monitoring.

- ▪

- Academia and Research: Researchers in sustainable finance, computational linguistics, and policy studies could leverage the framework as an open data resource for analysing ESG narratives, studying cross-cultural discourse on sustainability, and developing advanced explainable AI techniques for graph-based inference.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Wang, M.P.M.; Casey, B. ESG-FTSE: A Corpus of News Articles with ESG Relevance Labels and Use Cases. Available online: https://www.londonstockexchange.com/ (accessed on 28 April 2025).

- Kim, M.; Kang, J.; Jeon, I.; Lee, J.; Park, J.; Youm, S.; Jeong, J.; Woo, J.; Moon, J. Differential Impacts of Environmental, Social, and Governance News Sentiment on Corporate Financial Performance in the Global Market: An Analysis of Dynamic Industries Using Advanced Natural Language Processing Models. Electronics 2024, 13, 4507. [Google Scholar] [CrossRef]

- Sanh, V.; Debut, L.; Chaumond, J.; Wolf, T. DistilBERT, a Distilled Version of BERT: Smaller, Faster, Cheaper and Lighter. Available online: https://www.researchgate.net/publication/336230729_DistilBERT_a_distilled_version_of_BERT_smaller_faster_cheaper_and_lighter (accessed on 27 April 2025).

- Yin, W.; Hay, J.; Roth, D. Benchmarking Zero-shot Text Classification: Datasets, Evaluation and Entailment Approach. Available online: https://www.researchgate.net/publication/335599580_Benchmarking_Zero-shot_Text_Classification_Datasets_Evaluation_and_Entailment_Approach (accessed on 2 May 2025).

- Schimanski, T.; Reding, A.; Reding, N.; Bingler, J.; Kraus, M.; Leippold, M. Bridging the gap in ESG measurement: Using NLP to quantify environmental, social, and governance communication. Financ. Res. Lett. 2024, 61, 104979. [Google Scholar] [CrossRef]

- Girerd-Potin, I.; Taramasco, O.; Shahrour, M.H. Corporate social responsibility and firm default risk in the Eurozone: A market-based approach. Manag. Financ. 2021, 47, 975–997. [Google Scholar] [CrossRef]

- Berg, F.; Kölbel, J.F.; Rigobon, R. Aggregate Confusion: The Divergence of ESG Ratings. Rev. Financ. 2022, 26, 1315–1344. [Google Scholar] [CrossRef]

- Jones, H. EU Watchdogs See Greenwashing Across the Bloc’s Financial Sector. Reuters, 1 June 2023. Available online: https://www.reuters.com/world/europe/eu-watchdogs-see-greenwashing-across-blocs-financial-sector-2023-06-01/ (accessed on 28 April 2025).

- Poiriazi, E.; Zournatzidou, G.; Konteos, G.; Sariannidis, N. Analyzing the Interconnection Between Environmental, Social, and Governance (ESG) Criteria and Corporate Corruption: Revealing the Significant Impact of Greenwashing. Adm. Sci. 2025, 15, 100. [Google Scholar] [CrossRef]

- Tahtinen, J.; Clements, G. Insights from the Reporting Exchange: ESG Reporting Trends. Available online: https://www.cdsb.net/sites/default/files/cdsb_report_1_esg.pdf (accessed on 16 September 2025).

- Dia, H.; Pettersson, N. Evaluating the Accuracy of Sentiment Analysis Models When Applied to Social Media Texts. Ph.D. Thesis, School of Electrical Engineering and Computer Science (EECS), Stockholm, Sweden, 2024. [Google Scholar]

- Koroteev, M.V. BERT: A Review of Applications in Natural Language Processing and Understanding. arXiv 2021, arXiv:2103.11943. [Google Scholar] [CrossRef]

- Mehra, S.; Louka, R.; Zhang, Y. ESGBERT: Language Model to Help with Classification Tasks Related to Companies Environmental, Social, and Governance Practices. arXiv 2022, arXiv:2203.16788. [Google Scholar] [CrossRef]

- Shahrour, M.H.; Dekmak, M. Intelligent stock prediction: A neural network approach. Int. J. Financ. Eng. 2023, 10, 2250016. [Google Scholar] [CrossRef]

- Araci, D.T. FinBERT: Financial Sentiment Analysis with Pre-trained Language Models. arXiv 2025, arXiv:1908.10063. [Google Scholar]

- Qader, W.A.; Ameen, M.M.; Ahmed, B.I. An overview of bag of words; importance, implementation, applications, and challenges. In Proceedings of the 5th International Engineering Conference, Erbil, Iraq, 23–25 June 2019; pp. 200–204. [Google Scholar] [CrossRef]

- Driller, J.; Trang, S.T.-N. Unlocking sustainable reporting: Leveraging knowledge graphs for ESG metrics extraction the role of knowledge graphs in sustainability reporting. In Informatik 2024; Gesellschaft für Informatik e.V.: Bonn, Germany, 2024. [Google Scholar] [CrossRef]

- Angioni, S.; Consoli, S.; Dessì, D.; Osborne, F.; Recupero, D.R.; Salatino, A. Exploring Environmental, Social, and Governance (ESG) Discourse in News: An AI-Powered Investigation Through Knowledge Graph Analysis. IEEE Access 2024, 12, 77269–77283. [Google Scholar] [CrossRef]

- FTSE 100 Dips as Tariff Worries Hit Sentiment. Available online: https://www.sharesmagazine.co.uk/news/shares/ftse-100-dips-as-tariff-worries-hit-sentiment (accessed on 7 May 2025).

- LSEG FTSE UK Index Series. Available online: https://www.lseg.com/en/ftse-russell/indices/uk (accessed on 7 May 2025).

- Lamont, D.; Mccarthy, H. Sustainability Stock Market League Table: Which Rank Best and Worst? Available online: https://www.schroders.com/en/global/individual/insights/sustainability-stock-market-league-table-which-rank-best-and-worst-/ (accessed on 7 May 2025).

- Barnes, C.; Brien, J.; Zhu, S.; Abdul, M. Paying for Sustainable Growth. Available online: https://assets.kpmg.com/content/dam/kpmgsites/uk/pdf/2021/11/paying-for-sustainable-growth.pdf (accessed on 7 May 2025).

| Company Name | Ticker | Sector | Exchange |

|---|---|---|---|

| 3i | III | Financial Services | FTSE 100 |

| Admiral Group | ADM | Insurance | FTSE 100 |

| Allianz Technology Trust | ATT | Investment Trusts | FTSE 250 |

| Alpha Group International | ALPH | Financial Services | FTSE 250 |

| Pro Medicus | PME | Healthcare | ASX 200 |

| Tyro Payments | TYR | Information Technology | ASX 200 |

Total News Articles Distribution:

| News Article Distribution by Exchange:

| News Article Distribution by ESG Domain:

|

| Total Character Count: 1,961,454 | Total Characters with Spaces; 1,055,018 | Total Characters without Spaces; 906,436 |

| Corpus: 436 Pages of Content | Corpus Total Lines: 20,866 | Corpus Total Words: 131,161 |

| Stock Index | ESG Domain | Total Count | Positive Articles Count | Negative Articles Count |

|---|---|---|---|---|

| FTSE 250 | Environmental | 159 | 122 | 37 |

| FTSE 250 | Governance | 102 | 44 | 58 |

| FTSE 250 | Social | 224 | 146 | 78 |

| ASX 200 | Environmental | 156 | 100 | 56 |

| ASX 200 | Governance | 77 | 49 | 28 |

| ASX 200 | Social | 166 | 111 | 55 |

| FTSE 100 | Environmental | 88 | 46 | 42 |

| FTSE 100 | Governance | 32 | 18 | 14 |

| FTSE 100 | Social | 94 | 64 | 30 |

| Company | Sector | Content of Article | Sentiment of Article | ESG Domain | Named Entities Extracted | Exchange |

|---|---|---|---|---|---|---|

| Admiral Group | Insurance | Content Deprecated 500+ Words | Negative | Governance | Admiral Group Plc (ORG); 31 March 2025 (DATE); Justine Roberts (PERSON) | FTSE 100 |

| ASOS | Retailers | Content Deprecated 500+ Words | Negative | Social | LONDON (GPE); Tuesday 16th November 2024 (DATE); Centre Sustainable Fashion CSF (ORG) | FTSE 250 |

| BHP | Materials | Content Deprecated 500+ Words | Positive | Social | Chile (GPE); BHP (ORG); USD 797 million (MONEY) | ASX 200 |

| Element Type | Label | Attributes | Description |

|---|---|---|---|

| Node | Company | Ticker (string, unique), Company (string), Sector (string), Exchange (string), | Represents a company from the input company registry file. |

| Node | Article | URL (string, unique), Source (string), Content (string), Sentiment (string), ESG tags (string), | Represents a processed news article that is retrieved in the article retrieval stage. |

| Node | ESG Domain | Domain(string) | Represents a primary ESG category for each article (Environmental, Social, Governance), derived from the topic modelling procedure. |

| Node | Named Entity | Entity (string, unique), Entity Label(string), Context(string), Numerical Value (float) | Represents an extracted entity from each article; a single article may contain multiple entities (person, org, money, etc.) Numerical Value only holds the money entities. |

| Node | Exchange | Exchange (string, unique) | Represents a stock exchange or index out of the pre-defined ones (FTSE 100, FTSE 250, ASX 200). Can be customised to accept other exchanges. |

| Node | Grouped Sector | Normalised Sector (string, unique) | Represents a grouping of sectors to ease relating the sectors that closely align with a broader one, to summarise how major market sectors relate to the other nodes. |

| Node | Sector | Sector (string, unique) | Represents an industry section that businesses deal in (Finance, Technology, Investments, etc.) Sectors are derived from the company registry file. |

| Element Type | Label | Description |

|---|---|---|

| Relationship | Has Named Entity | Links (Article) → (Named Entity) |

| Relationship | Has ESG Domain | Links (Article) → (ESG Domain) → (Company) |

| Relationship | Mentions | Links (Article) → (Company) → (Named Entity) |

| Relationship | Located On | Links (Company) → (Exchange) |

| Relationship | Belongs To | Links (Company) → (Sector) |

| Relationship | Belongs To Group Sector | Links (Sector) → (Grouped Sector) → (Company) |

| Exchange | Environmental Domain | Governance Domain | Social Domain |

|---|---|---|---|

| FTSE 250 | Positive Leaning (0.53%) | Negative Leaning (0.14%) | Positive Leaning (0.30%) |

| FTSE 100 | Neutral / Mixed (0.05%) | Positive Leaning (0.15%) | Positive Leaning (0.36%) |

| ASX 200 | Positive Leaning (0.28%) | Positive Leaning (0.27%) | Positive Leaning (0.34%) |

| Prediction Class | Model Used (Pre-Trained) | Metric | Value of Metric |

|---|---|---|---|

| Sentiment Analysis | DistilBERT | Overall Accuracy F1-Score (Positive) F1-Score (Negative) | 66.00% 0.81% 0.30% (Recall: 0.75; Precision: 0.19) |

| ESG Domain | Zero-Shot Classification | Overall Accuracy F1-Score (Environmental) F1-Score (Social) F1-Score (Governance) | 60.00% 0.68% 0.69% 0.67% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hassan Nassar, O.M.; Jafari, F.; Jain, C. From News to Knowledge: Leveraging AI and Knowledge Graphs for Real-Time ESG Insights. Sustainability 2025, 17, 11128. https://doi.org/10.3390/su172411128

Hassan Nassar OM, Jafari F, Jain C. From News to Knowledge: Leveraging AI and Knowledge Graphs for Real-Time ESG Insights. Sustainability. 2025; 17(24):11128. https://doi.org/10.3390/su172411128

Chicago/Turabian StyleHassan Nassar, Omar Mohmmed, Fahimeh Jafari, and Chanchal Jain. 2025. "From News to Knowledge: Leveraging AI and Knowledge Graphs for Real-Time ESG Insights" Sustainability 17, no. 24: 11128. https://doi.org/10.3390/su172411128

APA StyleHassan Nassar, O. M., Jafari, F., & Jain, C. (2025). From News to Knowledge: Leveraging AI and Knowledge Graphs for Real-Time ESG Insights. Sustainability, 17(24), 11128. https://doi.org/10.3390/su172411128