Construction and Measurement of the Transition Finance Evaluation Indicator System for China’s Power Sector

Abstract

1. Introduction

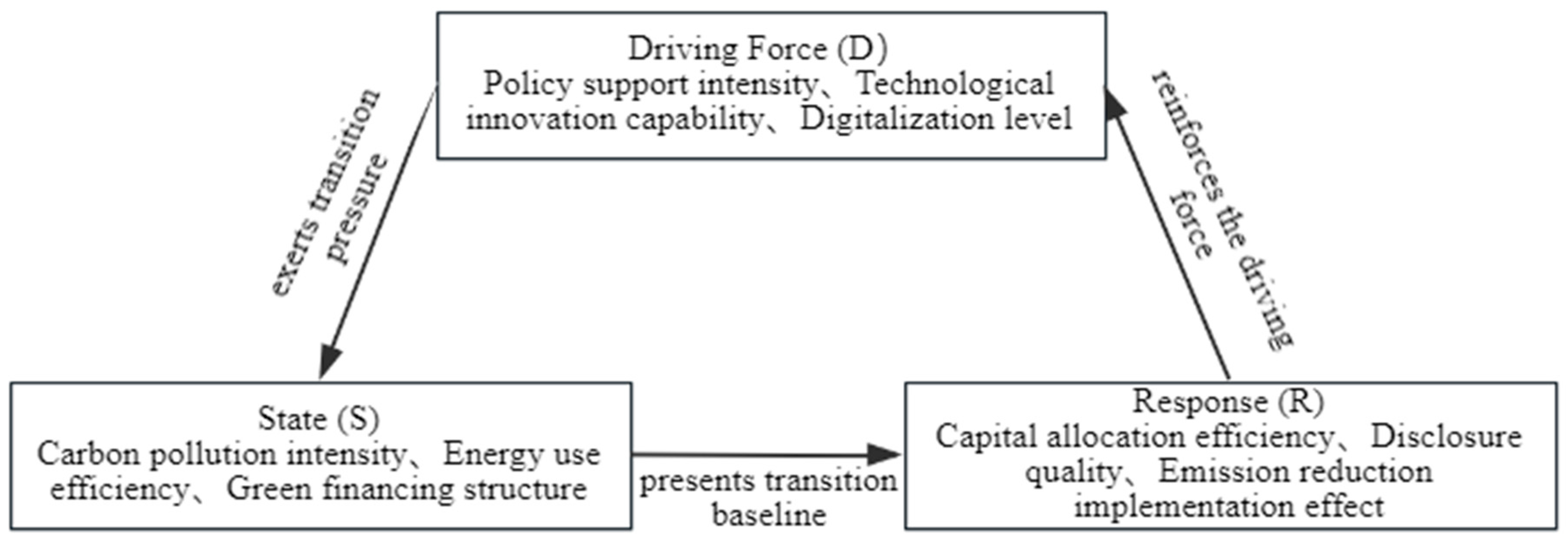

2. Construction of the Transition Finance Evaluation Indicator System and Research Methodology

2.1. Indicator Construction

2.2. Research Methodology

2.2.1. Entropy Weight-TOPSIS Method

2.2.2. Theil Index

2.3. Data Sources

3. Analysis of Transition Finance Development Levels

3.1. Indicator Weight Analysis

3.2. Analysis of Transition Finance Development Level

3.2.1. Comprehensive Evaluation of Transition Finance Development Level

3.2.2. Itemized Evaluation of Transition Finance Development Level

3.3. Disparities in Transition Finance Development Level

4. Research Conclusions and Discussion

4.1. Research Conclusions

- (1)

- Improve the accuracy and equity of policy-driven measures. It is advisable to require enterprises to participate in the carbon trading market as a precondition for receiving transition finance support. Additionally, a dedicated “Just Transition Support Fund” should be established to assist small and medium-sized enterprises, thereby mitigating potential structural financing barriers that may result from policy implementation.

- (2)

- Optimize the management mechanisms governing capital allocation and performance evaluation. Financial institutions should develop financing instruments explicitly linked to key performance indicators (KPIs) for the sustainability transition. These KPIs must be tailored to enterprise types and respective stages of transition so as to align incentives effectively. Meanwhile, stringent financial constraints should be imposed on enterprises that fail to achieve the agreed-upon targets.

- (3)

- Establish a transformation ecosystem spearheaded by leading enterprises to facilitate cross-industry collaboration. It is advisable for energy management authorities to take the lead in creating a “Transformation Technology and Funding Collaboration Platform”. This platform would promote the transfer of mature energy-saving and carbon-reduction technologies from large corporations to small and medium-sized enterprises within the same industry. Meanwhile, it also offers complementary financing channels to address structural bottlenecks.

4.2. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Mariani, M.; D’eRcole, F.; Frascati, D.; Fraccalvieri, G. Sustainability-linked bonds, corporate commitment and the cost of debt. Res. Int. Bus. Financ. 2025, 74, 102658. [Google Scholar] [CrossRef]

- Liu, Y.; Gao, C.; Yang, X.; Yuan, J.; Ren, Y. Credible transition plans for coal power sector: Current disclosure framework and considerations for transition finance. Carbon Footpr. 2023, 3, 1. [Google Scholar] [CrossRef]

- Tandon, A. Transition Finance: Investigating the State of Play: A Stocktake of Emerging Approaches and Financial Instruments; OECD Environment Working Papers; OECD: Paris, France, 2021. [Google Scholar]

- Wang, Y.; Zhang, G. Transition Finance: Connotation, Framework and Future Prospects. Contemp. Econ. Sci. 2024, 46, 1–17. [Google Scholar]

- Xiao, H. Cultivation of new quality productivity and risk management of stranded assets: A dual-effect mechanism of transition finance. Reg. Financ. Res. 2024, 46, 32–39. [Google Scholar]

- Wei, T.; Wang, H. Theoretical basis, practical experience and countermeasures of transition finance. Enterp. Econ. 2023, 42, 141–149. [Google Scholar]

- Gao, J.; Hua, G.; Mahamane, F.; Li, Z. Can green transformation finance contribute to urban carbon emission performance? An empirical analysis based on a spatiotemporal bi-fixed SPDM model. Environ. Sci. Pollut. Res. Int. 2023, 30, 102947–102971. [Google Scholar] [CrossRef]

- Fan, S.; Wang, C. Transition finance facilitates lower-cost achievement of climate targets: A case study of China. Struct. Change Econ. Dyn. 2024, 71, 617–629. [Google Scholar] [CrossRef]

- Wang, B.; Lin, L. Progress and Lessons from Domestic and International Practices in Managing Financial Risks during Transformation. Mod. Financ. 2024, 9, 2722–2734. [Google Scholar]

- Kang, J. Theoretical Research and Mechanism Analysis of Financial Risks in Transformation. West. Financ. 2024, 27–32, 37. [Google Scholar]

- Wei, H.; Liao, Y. Financial risk transmission mechanism and empirical simulation of transition finance. Heilongjiang Financ. 2023, 8, 33–40. [Google Scholar]

- Hao, S.; Ping, W.; Ao, B. The impact of stranded asset risk on corporate value in the context of transition finance. Financ. Econ. Res. 2023, 38, 66–81. [Google Scholar]

- Feng, A.; Chen, Y. Quantile time–frequency connectedness between green finance and shipping markets: The role of climate transition and physical risks. Int. Rev. Econ. Financ. 2025, 104, 104704. [Google Scholar] [CrossRef]

- Li, R.; Can, W. Research on the challenges and countermeasures of linked transition financial instruments to support the low-carbon transformation of enterprises. China Environ. Manag. 2024, 16, 57–62. [Google Scholar]

- Xu, H.; Yi, L. Innovation, comparative analysis and development suggestions of transition financial products at home and abroad. Southwest Financ. 2023, 9, 15–31. [Google Scholar]

- Liu, C.; Yang, Y.; Chen, S. How does transition finance influence green innovation of high-polluting and high-energy-consuming enterprises? Evidence from China. Environ. Sci. Pollut. Res. Int. 2024, 31, 8026–8045. [Google Scholar] [CrossRef] [PubMed]

- Khan, S.; Pinglu, C.; Ullah, A.; Qian, N. Facilitating sustainable corporate growth in China: Examining the role of transition finance, green technology innovation, and ESG strategies in the path to sustainability. J. Environ. Manag. 2025, 389, 126085. [Google Scholar] [CrossRef]

- Khan, S.; Ullah, A.; Pinglu, C.; Kashif, M. Impact of financial technology innovation on sustainable transition finance: The moderating role of globalization in BRI, advanced and emerging economies. Clean Technol. Environ. Policy 2024, 27, 1479–1503. [Google Scholar] [CrossRef]

- Wang, Y. Greenwashing or green evolution: Can transition finance empower green innovation in carbon-intensive enterprise? Int. Rev. Financ. Anal. 2025, 97, 103826. [Google Scholar] [CrossRef]

- Yang, T.; Zhou, B. Does transition finance policies persistently fuel green innovation in brown firms? Investigating the roles of ESG rating and bank connection. Pac. Basin Financ. J. 2025, 90, 102674. [Google Scholar] [CrossRef]

- Chen, P.; Yao, X.; Li, J.; Wang, Y. Does the transition finance policy facilitate lending for heavy polluters? Insights from China. Financ. Res. Lett. 2025, 83, 107625. [Google Scholar] [CrossRef]

- Xuan, Z. Research on the Impact of Real Estate Tax Policy on Housing Prices Based on DFSR Model: A Case Study of Shanghai. China Real Estate 2014, 10, 33–40. [Google Scholar]

- Ma, J.; Guo, J.; Zhao, G. Key Performance Indicators of Transition Financial Instruments. China Financ. 2023, 15, 27–29. [Google Scholar]

- Kasdan, M.; Kuhl, L.; Kurukulasuriya, P. The evolution of transformational change in multilateral funds dedicated to financing adaptation to climate change. Clim. Dev. 2021, 13, 427–442. [Google Scholar] [CrossRef]

- Liu, H.; Liu, Z.; Zhang, C.; Li, T. Transformational insurance and green credit incentive policies as financial mechanisms for green energy transitions and low-carbon economic development. Energy Econ. 2023, 126, 107016. [Google Scholar] [CrossRef]

- Li, C.; Bao, Y.; Li, Y.; Yue, M.; Wu, L.; Mao, Y.; Yang, T. Assessment of the coupling coordination relationship between the green financial system and the sustainable development system across China. Sci. Rep. 2024, 14, 11534. [Google Scholar] [CrossRef]

- Bai, X. Exploring the Sustainable Development Path of a Green Financial System in the Context of Carbon Neutrality and Carbon Peaking: Evidence from China. Sustainability 2022, 14, 15710. [Google Scholar] [CrossRef]

- Xie, N.; Hu, H.; Fang, D.; Shi, X.; Luo, S.; Burns, K. An empirical analysis of financial markets and instruments influencing the low-carbon electricity production transition. J. Clean. Prod. 2021, 280, 2. [Google Scholar] [CrossRef]

- Zhou, D.; Zhao, S.; Ding, H.; Wang, Q. Optimal transition pathways toward carbon neutrality in Chinese power sector: Considering regional heterogeneity and technological change. Comput. Ind. Eng. 2023, 183, 109553. [Google Scholar] [CrossRef]

- Jin, S.; Deng, F. Research on Sustainable Economic Dynamics: Digital Technology Development and Relative Poverty of Urban Households. Sustainability 2024, 16, 3407. [Google Scholar] [CrossRef]

- Qi, Y.; Han, M.; Zhang, C. The Synergistic Effects of Digital Technology Application and ESG Performance on Corporate Performance. Financ. Res. Lett. 2024, 61, 105007. [Google Scholar] [CrossRef]

- Xiao, R.; Chen, X.; Qian, L. Heterogeneous Environmental Regulation, Government Support and Enterprise Green Innovation Efficiency: Based on the Perspective of Two-stage Value Chain. Financ. Trade Res. 2022, 33, 79–93. [Google Scholar]

- Kong, D.; Wei, Y.; Ji, M. Research on the impact of environmental protection fee tax reform on enterprise green information disclosure. Secur. Mark. Herald. 2021, 8, 2–14. [Google Scholar]

| First-Level Indicator | Second-Level Indicator | Third-Level Indicator | Indicator Description |

|---|---|---|---|

| Driving Force (D) | Policy Support Intensity | Carbon Trading Market Participation (+) | Whether the enterprise’s registered location has launched a carbon trading market in the current year |

| Green Subsidy Intensity per Unit of Power Generated (+) | Annual green subsidy received/Total power generation | ||

| Technological Innovation Capability | Carbon Performance (+) | The reciprocal of total carbon emissions per million yuan of net sales | |

| Clean Technology R&D Expenditure Ratio (+) | Annual R&D expenditure/Total operating revenue | ||

| Digitalization Level | Digital Technology Application Level (+) | Frequency of the keyword “digital technology application” in the company’s annual report plus 1, then take the logarithm | |

| State (S) | Carbon Pollution Intensity | Carbon Emission Intensity (−) | Total Carbon Emissions/Total Power Generation |

| Pollutant Emission Intensity (−) | Total Pollutant Emissions/Total Power Generation | ||

| Energy Use Efficiency | Coal Consumption Rate of Power Generation (−) | Standard coal consumption for power generation/Total power generation | |

| Green Financing Structure | Share of Green Credit (+) | Green credit balance/Total credit balance | |

| Response (R) | Capital Allocation Efficiency | Share of Environmental Governance Expenditures (+) | Annual environmental governance expenditures/Total operating revenue |

| Green Outcome Transformation Efficiency (+) | Efficiency of converting green patent indicators into final outputs | ||

| Disclosure Quality | ESG Score (+) | Huazheng Index ESG Score | |

| Green Information Disclosure Quality (+) | ln(Sum of environmental project scores disclosed by 25 enterprises) | ||

| Emission Reduction Implementation Effect | Carbon Intensity Reduction Rate (+) | (1 − Current Period Carbon Intensity/Base Period Carbon Intensity) × 100% | |

| Carbon Asset Efficiency (+) | Total operating revenue/Total carbon emissions |

| First-Level Indicator | Weight | Second-Level Indicator | Weight | Third-Level Indicator | Weight |

|---|---|---|---|---|---|

| Driving Force (D) | 0.5330 | Policy Support Intensity | 0.3064 | Carbon Trading Market Participation | 0.0994 |

| Green Subsidy Intensity per Unit of Power Generation | 0.2070 | ||||

| Technological Innovation Capacity | 0.2173 | Carbon Performance | 0.0988 | ||

| Clean Technology R&D Expenditure Ratio | 0.1186 | ||||

| Digitalization Level | 0.0092 | Digital Technology Application Level | 0.0092 | ||

| State (S) | 0.0318 | Carbon Pollution Intensity | 0.0095 | Carbon Emission Intensity | 0.0023 |

| Pollutant Emission Intensity | 0.0073 | ||||

| Energy Use Efficiency | 0.0095 | Coal Consumption Rate of Power Generation | 0.0095 | ||

| Green Financing Structure | 0.0127 | Share of Green Credit | 0.0127 | ||

| Response (R) | 0.4353 | Capital Allocation Efficiency | 0.3165 | Share of Environmental Governance Expenditures | 0.2942 |

| Green Outcome Transformation Efficiency | 0.0223 | ||||

| Disclosure Quality | 0.0190 | ESG Score | 0.0057 | ||

| Green Information Disclosure Quality | 0.0133 | ||||

| Emission Reduction Implementation Effect | 0.0998 | Carbon Intensity Reduction Rate | 0.0010 | ||

| Carbon Asset Efficiency | 0.0988 |

| Enterprise | 2019 | 2020 | 2021 | 2022 | ||||

|---|---|---|---|---|---|---|---|---|

| Evaluation Index | Ranking | Evaluation Index | Ranking | Evaluation Index | Ranking | Evaluation Index | Ranking | |

| Shenzhen Energy | 0.4071 | 2 | 0.2958 | 2 | 0.3367 | 2 | 0.3326 | 1 |

| Shennan Power | 0.2647 | 3 | 0.2113 | 5 | 0.3287 | 3 | 0.3235 | 2 |

| Jiangxi Ganneng | 0.5009 | 1 | 0.3588 | 1 | 0.3758 | 1 | 0.3187 | 3 |

| Hengyun Enterprises | 0.2148 | 5 | 0.2117 | 4 | 0.2362 | 6 | 0.2969 | 4 |

| Devotion | 0.2461 | 4 | 0.2480 | 3 | 0.2779 | 4 | 0.2903 | 5 |

| Meiyan Jixiang | 0.1988 | 6 | 0.2007 | 6 | 0.2436 | 5 | 0.2850 | 6 |

| … | … | … | … | … | ||||

| Power Sector | 0.1406 | 0.1404 | 0.1489 | 0.1695 | ||||

| First-Level Indicator | Enterprise | 2019 | 2020 | 2021 | 2022 | ||||

|---|---|---|---|---|---|---|---|---|---|

| Evaluation Index | Ranking | Evaluation Index | Ranking | Evaluation Index | Ranking | Evaluation Index | Ranking | ||

| Driving Force (D) | Shenzhen Energy | 0.5008 | 1 | 0.3188 | 1 | 0.4015 | 1 | 0.4971 | 2 |

| Shennan Power | 0.1238 | 4 | 0.1191 | 5 | 0.1847 | 3 | 0.4508 | 3 | |

| Jiangxi Ganneng | 0.0416 | 6 | 0.0740 | 6 | 0.1003 | 6 | 0.2912 | 5 | |

| Hengyun Enterprises | 0.1311 | 3 | 0.1314 | 3 | 0.1557 | 5 | 0.2742 | 6 | |

| Devotion | 0.1611 | 2 | 0.1700 | 2 | 0.2056 | 2 | 0.4175 | 4 | |

| Meiyan Jixiang | 0.1060 | 5 | 0.1208 | 4 | 0.1696 | 4 | 0.5405 | 1 | |

| State (S) | Shenzhen Energy | 0.3360 | 5 | 0.5386 | 3 | 0.4110 | 5 | 0.7599 | 2 |

| Shennan Power | 0.4290 | 3 | 0.4366 | 5 | 0.4623 | 4 | 0.4384 | 6 | |

| Jiangxi Ganneng | 0.3758 | 4 | 0.2261 | 6 | 0.3989 | 6 | 0.4531 | 5 | |

| Hengyun Enterprises | 0.4387 | 2 | 0.5500 | 2 | 0.6649 | 1 | 0.4827 | 4 | |

| Devotion | 0.5306 | 1 | 0.5864 | 1 | 0.5843 | 2 | 0.6134 | 3 | |

| Meiyan Jixiang | 0.1874 | 6 | 0.4729 | 4 | 0.5606 | 3 | 0.8099 | 1 | |

| Response (R) | Shenzhen Energy | 0.1057 | 5 | 0.0984 | 5 | 0.0882 | 4 | 0.2650 | 5 |

| Shennan Power | 0.2201 | 2 | 0.0851 | 6 | 0.2597 | 2 | 0.3675 | 3 | |

| Jiangxi Ganneng | 0.5656 | 1 | 0.4011 | 1 | 0.4061 | 1 | 0.4566 | 1 | |

| Hengyun Enterprises | 0.1106 | 4 | 0.1106 | 3 | 0.1625 | 3 | 0.2087 | 6 | |

| Devotion | 0.1586 | 3 | 0.1038 | 4 | 0.0764 | 5 | 0.3427 | 4 | |

| Meiyan Jixiang | 0.0844 | 6 | 0.1156 | 2 | 0.0240 | 6 | 0.4329 | 2 | |

| Year | Within-Group Disparity | Between-Group Disparity | Overall Theil Index | Group Disparity | |

|---|---|---|---|---|---|

| Thermal Power Group | Renewable Energy Group | ||||

| 2019 | 0.2065 | 0.0076 | 0.2142 | 0.2237 | 0.1836 |

| 2020 | 0.1850 | 0.0062 | 0.1912 | 0.1459 | 0.2340 |

| 2021 | 0.1845 | 0.0135 | 0.1980 | 0.1321 | 0.2558 |

| 2022 | 0.1285 | 0.0001 | 0.1285 | 0.1172 | 0.1395 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xiao, Z.; Xin, X.; Li, Y.; He, Q. Construction and Measurement of the Transition Finance Evaluation Indicator System for China’s Power Sector. Sustainability 2025, 17, 11099. https://doi.org/10.3390/su172411099

Xiao Z, Xin X, Li Y, He Q. Construction and Measurement of the Transition Finance Evaluation Indicator System for China’s Power Sector. Sustainability. 2025; 17(24):11099. https://doi.org/10.3390/su172411099

Chicago/Turabian StyleXiao, Zhenyu, Xueling Xin, Yue Li, and Qianshan He. 2025. "Construction and Measurement of the Transition Finance Evaluation Indicator System for China’s Power Sector" Sustainability 17, no. 24: 11099. https://doi.org/10.3390/su172411099

APA StyleXiao, Z., Xin, X., Li, Y., & He, Q. (2025). Construction and Measurement of the Transition Finance Evaluation Indicator System for China’s Power Sector. Sustainability, 17(24), 11099. https://doi.org/10.3390/su172411099