1. Introduction

The report from the 20th National Congress of the Communist Party of China unequivocally states that high-quality development is the primary task for building a modern socialist country comprehensively. It highlights the necessity to accelerate the green transition of the economic development model, continuously deepen the prevention and control of environmental pollution, and steadily advance carbon peaking and carbon neutrality. This strategic framework has outlined a new direction for China’s economic and social development and also created historical opportunities and broad space for the practice and innovation of the Environmental, Social, and Governance (ESG) concept in China.

Against this macro backdrop, enterprises, as micro-level actors and core drivers in the market economy, see their operation models and management strategies exerting a significant impact on the sustainable development of the economy and society. As a core indicator for evaluating enterprises’ sustainable development capabilities and social responsibilities, ESG performance has garnered increasing attention. Traditional corporate management concepts often prioritize short-term financial performance and the maximization of shareholders’ interests, while neglecting the long-term impacts associated with the environment, society, and governance structure. This tendency can lead to short-sighted behaviors such as infringement of stakeholder rights and ecological environmental damage, which not only contradict the principle of sustainable development but also impede the long-term development of enterprises and the improvement of overall social welfare [

1]. Conversely, strong ESG performance helps enterprises gain consumers’ trust, enhance brand image and market competitiveness, and attract more investors and partners, thereby laying a solid foundation for sustainable operations. Therefore, during the “14th Five-Year Plan” period and beyond, guiding enterprises to shift their development paradigms, enhance their awareness of ESG management, comprehensively improve ESG performance, and achieve transformation, upgrading, and sustainable development has become a crucial and pressing issue.

To actively support the national strategy of carbon peaking and carbon neutrality, the Ministry of Finance issued the Guiding Opinions on Financial Support for the Work of Carbon Peaking and Carbon Neutrality in May 2022, proposing a series of financial support measures. These include guiding the development of green and low-carbon industries, using tax policies to encourage enterprises to reduce emissions, expanding financing channels for green and low-carbon projects, and promoting green products through government procurement. The integration of government procurement into the policy system for carbon peaking and carbon neutrality reflects the characteristics and innovation of China’s fiscal policies. As a significant component of fiscal policies, government procurement undertakes multiple policy functions such as environmental governance, regional economic support, and facilitating enterprises’ green transformation [

2]. In terms of scale, China’s government procurement amount increased from RMB 2.10705 trillion in 2015 (accounting for 12% of national fiscal expenditure) to RMB 3.39296 trillion in 2023 (accounting for 14.82% of general public budget expenditure), demonstrating a continuous growth trend and substantial market influence. Regarding system construction, since the promulgation of the Government Procurement Law of the People’s Republic of China in 2003, the framework of the government procurement system has been progressively refined. Article 9 of this law explicitly defines its policy functions, including environmental protection, poverty alleviation, and support for small and medium-sized enterprises. Subsequent revisions have further enhanced and deepened the relevant content. The second review draft of the Government Procurement Law of the People’s Republic of China (Revised Draft for Comment) released in July 2022 added a dedicated chapter on “government procurement policies”, clarified requirements for supporting innovation, introduced special funds for small and medium-sized enterprises, and refined the content related to green procurement. As the largest buyer in the market, the government can positively influence enterprises’ operations, investment decisions, and fulfillment of social responsibilities through procurement demands, thereby fostering the healthy and stable development of enterprises.

Building upon the above macro background and policy orientation, this paper utilizes micro-data of Chinese listed companies from 2015 to 2023 as the research sample, explores the transmission path and mechanism of how government procurement affects corporate ESG performance from both theoretical and empirical perspectives, and examines whether government procurement influences ESG performance by alleviating corporate financing constraints. Finally, considering the application of new-generation information technology, this paper proposes implementation pathways for strengthening government procurement policies to drive the improvement of corporate ESG levels, offering reference insights for theoretical research and practical exploration in related fields.

Compared with existing literature, this study offers the following marginal contributions. First, it innovatively introduces a comprehensive analytical framework that integrates public policy, resource dependence, and dynamic capability theories, moving beyond the simplistic view of government procurement as an exogenous shock to unravel the “black box” of its impact on ESG. Second, it delves into the heterogeneous effects of government procurement across firm size, profitability, pollution attributes, ownership type, and geographical location, providing a nuanced understanding of the conditional nature of this enabling effect. Third, it theoretically expands and empirically verifies the mediating role of financing constraints, offering novel insights into the “policy-finance-ESG” linkage mechanism and providing direct evidence for policy combinations like “green procurement + supply chain finance”.

2. Literature Review

Based on the context of existing literature, relevant studies primarily focus on the following dimensions:

2.1. Government Procurement: Policy Functions and Measurement

Government procurement has evolved from a mere administrative function into a strategic instrument of fiscal policy. Beyond its primary role of acquiring public goods and services, it is increasingly leveraged to achieve overarching socio-economic objectives, such as fostering innovation, supporting small and medium-sized enterprises (SMEs), and, crucially, promoting environmental sustainability and green transition [

3,

4,

5]. This policy-oriented function is embedded in China’s institutional framework. Article 9 of the Government Procurement Law of the People’s Republic of China explicitly stipulates its role in environmental protection, a principle further refined in subsequent revisions and drafts.

The measurement of corporate exposure to government procurement, however, presents a significant empirical challenge and has evolved considerably. Early studies often relied on broad proxies. Some utilized World Bank enterprise surveys or inferred government patronage from a firm’s disclosure of its top five customers [

6]. Others identified government-related customers through enterprise registration information [

7]. While these methods provided initial insights, they are often hampered by insufficient detail, sample coverage bias, and an inability to capture the precise scale of procurement engagement.

In response to these limitations, a new strand of literature has emerged, capitalizing on enhanced data availability. Scholars have begun to manually collect and collate data from official sources like the China Government Procurement Network [

8,

9]. By matching the names of winning suppliers with listed companies and their subsidiaries, researchers can construct precise, firm-year-level measures of government procurement, typically operationalized as the log-transformed total value or the number of contracts won. This approach offers a more direct, accurate, and granular measure, which our study adopts to mitigate measurement error and enhance the validity of our findings.

2.2. Corporate ESG Performance: Connotation and Evaluation

Corporate ESG performance has transitioned from a niche concern to a central indicator of a firm’s long-term viability, risk management, and commitment to sustainable development. It represents a holistic framework that moves beyond short-term financial metrics to encompass environmental stewardship (E), social responsibility (S), and governance quality (G).

The evaluation and measurement of ESG, however, are fraught with complexity due to the absence of a global standard. Major rating agencies (e.g., MSCI, Sustainalytics, CSI, SynTao) employ distinct methodologies, leading to notoriously low correlation between their ratings [

10]. These divergences stem from differing judgments on material issues across industries, varying weights assigned to E, S, and G pillars, and disparate data sources. For instance, the Dow Jones Sustainability Index (DJSI) heavily weights environmental factors for energy firms, while FTSE Russell might emphasize social metrics. This “rater disagreement” poses a challenge for academic research, as it can influence investor perceptions and the cost of capital.

Despite these challenges, a consensus is forming on the determinants and outcomes of strong ESG performance. Studies show that firms with superior ESG ratings can enjoy lower financing costs, enhanced brand reputation, and greater resilience to crises [

11,

12]. In the Chinese context, the ESG rating system developed by China Securities Index (CSI) has become a widely referenced benchmark due to its comprehensive coverage of all A-share companies since 2009 and its methodologically sound framework. The CSI system employs a dual “negative screening + positive incentive” mechanism and industry-specific materiality analysis, offering a balanced and comparable metric. Its systematic nature and contextual relevance make it a suitable choice for this study.

2.3. The Nexus Between Government Procurement and Corporate ESG

The theoretical and empirical exploration of the direct link between government procurement and corporate ESG is a relatively nascent but rapidly growing area of inquiry. The broader literature has well-established that government procurement can influence firm behavior through channels such as boosting technological innovation, improving investment efficiency, and fostering specialization [

13,

14,

15].

A smaller, more focused stream of research has begun to connect procurement with corporate non-financial performance, particularly environmental and social practices. This literature suggests that government demand can serve as a powerful signal and incentive. Zhang (2019) argues that procurement acts as a demand-side policy that can guide market acceptance and encourage firms to invest in environmental governance, even at the expense of short-term profits [

16].

However, a critical limitation persists. Many of these studies treat government procurement as an exogenous policy shock and focus on a direct “compliance” or “reputation incentive” narrative. They largely overlook the fundamental resource reallocation mechanisms that underpin a firm’s ability to respond to these incentives. Specifically, the role of financing constraints—a major hurdle for long-cycle, high-externality ESG investments, especially for non-State-Owned Enterprises (non-SOEs) in China’s credit market—has been conspicuously absent from the analysis. Understanding whether and how government procurement alleviates this key financial friction is essential to unpacking the full causal pathway.

2.4. International Perspectives on Sustainable Procurement and ESG Development

While China’s institutional context provides a unique setting, the interplay between public procurement and corporate sustainability is a subject of growing global interest and policy innovation. Internationally, Green Public Procurement has been a cornerstone of the European Union’s environmental policy for years, explicitly leveraging the public sector’s purchasing power to drive markets towards greener products and services. This policy push is now being reinforced by mandatory disclosure frameworks. The EU’s Corporate Sustainability Reporting Directive significantly expands the number of companies required to report on sustainability and introduces more detailed standards, directly affecting how corporate ESG performance is measured and communicated.

Similarly, in the United States, regulatory efforts are evolving. The Securities and Exchange Commission has proposed rules to enhance and standardize climate-related disclosures for investors, which would profoundly influence how companies manage and report their environmental risks and performance. Beyond regional regulations, global standard-setters are working towards convergence. The International Sustainability Standards Board has developed a comprehensive global baseline of sustainability disclosure standards, aiming to provide investors with consistent and comparable ESG information worldwide.

These international developments highlight a global trend towards mandating and standardizing ESG disclosure. Our study, situated in China’s specific policy context, contributes to this global conversation by empirically demonstrating how government procurement—a key demand-side policy tool—can actively improve ESG performance, complementing the disclosure-oriented approaches dominant in other regions. This comparative perspective underscores the potential for policy mix designs that combine procurement incentives with robust disclosure requirements.

2.5. Research Gaps

A critical synthesis of the extant literature reveals three interconnected gaps that this study is designed to address:

The mechanism black box: The intermediary channel, especially the role of financial resources, remains under-explored. The dominant “policy-behavior” paradigm needs supplementation with a “policy-finance-behavior” perspective. We posit that financing constraints are a pivotal mediating variable that explains how procurement orders translate into tangible ESG investments.

The heterogeneity oversight: Existing research frequently searches for an “average effect,” masking the potentially divergent impacts across different types of firms. The effectiveness of government procurement is likely contingent on a firm’s resource endowment and institutional context (e.g., size, profitability, pollution attribute, ownership structure, geographic location). A failure to account for this heterogeneity can lead to biased estimates and misguided, one-size-fits-all policy implications.

Methodological and measurement Constraints: Reliance on indirect procurement proxies and limited sample scopes (e.g., single industries, short periods) have restricted the generalizability and robustness of prior findings.

In direct response to these gaps, our study is strategically positioned to contribute. First, we introduce an integrated theoretical framework that blends resource dependence and signaling theories to explicitly model and test financing constraints as a core mediating mechanism. Second, we conduct a systematic multi-dimensional heterogeneity analysis to delineate the boundary conditions of the procurement-ESG relationship, moving beyond the average effect to provide a more nuanced understanding. Finally, methodologically, we employ a direct, hand-collected measure of government procurement contracts across a broad sample of Chinese listed firms over a nine-year period (2015–2023), thereby enhancing the accuracy, generalizability, and causal credibility of our empirical analysis. The following section formally develops these ideas into testable hypotheses.

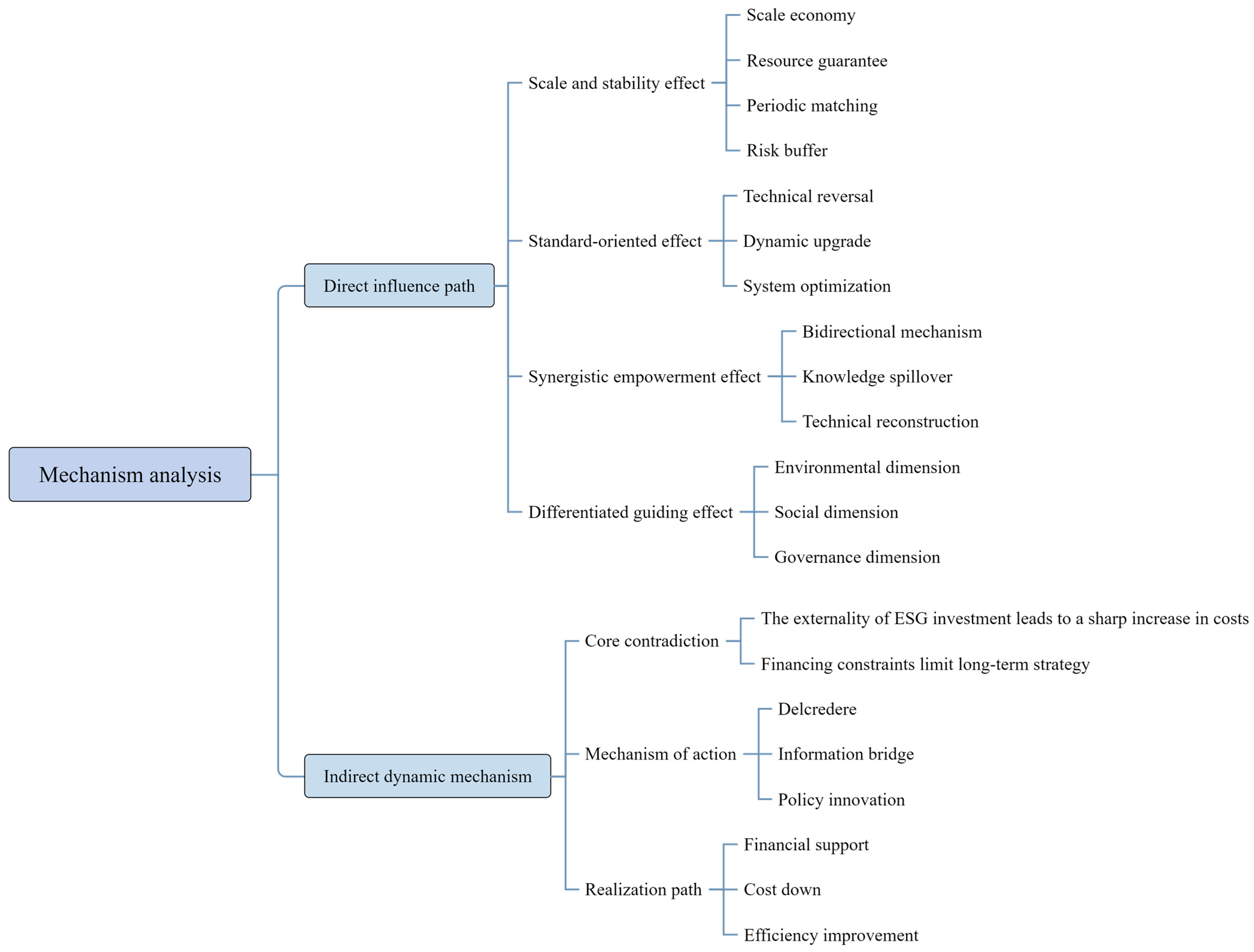

3. Mechanism Analysis of Government Procurement Empowering ESG Performance of Enterprises

This study’s analytical framework is grounded in the economic theory of market failure and the strategic management concepts of resource dependence and signaling. The inherent externalities of ESG investments often lead to underinvestment by firms focused on short-term financial performance. In this context, government procurement emerges as a strategic policy tool to correct this market failure, providing both the resources and the incentives for firms to enhance their ESG performance.

3.1. The Direct Impact Paths of Government Procurement on Corporate ESG Performance

As an upgraded paradigm of corporate social responsibility, the ESG concept essentially aims to achieve the alignment of enterprises’ sustainable development capabilities with public value through the construction of a three-dimensional governance framework. Theoretically, the Environmental (E) dimension focuses on enterprises’ fulfillment of environmental responsibilities, covering carbon emission reduction, energy efficiency improvement, and green technology iteration; the Social (S) dimension emphasizes the creation of social benefits, involving poverty alleviation, labor rights protection, product quality and safety, and consumer welfare; the Governance (G) dimension centers on governance modernization, including the optimization of equity structure, improvement of internal control mechanisms, establishment of compliance systems, and risk hedging capabilities [

17]. These three dimensions collectively form the endogenous driving force for high-quality corporate development and achieve policy synergy with the government’s sustainable development goals.

However, the ambiguity of public resource property rights leads to dual market failures in the ESG field: on the one hand, environmental externalities and positive social externalities are difficult to internalize through the price mechanism; on the other hand, conflicts between enterprises’ short-term interests and long-term value weaken their willingness to invest in ESG [

18,

19]. Against this backdrop, government procurement, as a strategic policy tool, breaks through the “resource curse” effect of traditional fiscal subsidies through demand-side reforms and forces the upgrading of enterprises’ supply structures via procurement standards, thereby forming a market-oriented incentive mechanism for ESG performance. This paper summarizes the impact paths of government procurement driving the improvement of corporate ESG performance as follows (see

Figure 1 for the mechanism framework):

3.1.1. Stable Demand-Driven Effect of Government Procurement

This path follows the logic: Stable government procurement demand → Alleviation of short-term profit pressure → Increased investment in long-cycle ESG projects. Specifically, as the largest buyer in the market, the government’s order volume often far exceeds ordinary commercial demand [

20]. The stable revenue stream generated by large-scale centralized procurement enables enterprises to break free from the constraints of short-term profit pressure and allocate more resources to long-cycle ESG projects, such as R&D of environmental governance technologies, improvement of employee welfare systems, and establishment of compliance management systems.

For instance, in the field of environmental protection equipment procurement, the economies of scale from government bulk orders significantly reduce the unit green certification cost of enterprises’ products, resolving the dilemma of “high investment and low return”. This resource reallocation mechanism not only eases enterprises’ cash flow pressure but also guides them to transform ESG investment from passive expenditure to strategic investment through market demand signals.

Furthermore, the stability of government procurement cycles creates a certainty framework for corporate ESG practices. Government procurement contracts typically have an implementation cycle of 3–5 years, and this inter-temporal commitment provides enterprises with a clear ESG planning timeline. Compared with the volatile market demand, the government’s long-term and stable cooperation significantly reduces the uncertainty risk of corporate ESG investment. In the field of green technology innovation, the sustainability of government projects is precisely aligned with the R&D cycle—for example, the transition of clean energy technology from laboratory to industrialization often requires 5–8 years of continuous investment, and the stability of government procurement provides a risk buffer for such long-cycle projects [

21,

22]. At the same time, the government’s extremely low default rate effectively avoids the sunk cost risk of ESG investment, forming a positive cycle of “investment-application-benefit”.

3.1.2. Standard-Oriented Effect of Government Procurement

This path follows the logic: Procurement standard orientation → Forced corporate technology upgrading → Improved ESG performance. Specifically, the formulation of government procurement standards forms a technology-forcing mechanism [

23,

24]. By establishing an ESG procurement standard system, the government embeds requirements for environmental performance, social responsibility fulfillment, and governance capabilities into technical access conditions, forming both rigid constraints and flexible incentives for enterprises’ sustainable behaviors.

On the procurement demand side, green policy tools such as green list management and environmental labeling certification create market access barriers. For example, the Government Procurement List for Environmental Labeling Products explicitly requires suppliers to pass the verification of environmental indicators such as energy-saving certification and carbon footprint audits. Therefore, to meet the environmental constraints in procurement standards, enterprises must restructure their production processes, promote the R&D of clean technologies, and update low-carbon equipment. Similarly, requirements for transparent disclosure of social responsibility force enterprises to establish digital labor management and supply chain tracing systems. Compliance standards in the governance dimension drive enterprises to optimize decision-making mechanisms and risk prevention systems.

This standard-driven pressure for technological upgrading urges enterprises to shift from passive adaptation to active innovation. Moreover, by setting dynamically improved technical thresholds, government procurement standards guide enterprises to build sustainable competitiveness: in the environmental dimension, the iteration of clean production technologies reduces resource consumption intensity and promotes the marginal reduction of carbon and pollutant emissions; in the social dimension, the application of digital management systems improves supply chain transparency, making labor rights protection and community relationship maintenance more traceable; in the governance dimension, the introduction of intelligent decision-making tools and compliance control modules enhances enterprises’ response efficiency to environmental risks and social disputes.

Thus, the corporate technology upgrading driven by government procurement standards not only optimizes individual production links but also forms an ESG capability network covering the entire process of R&D, production, and management through the coordinated optimization of technical systems, ultimately achieving the synergistic value enhancement of environmental benefits, social value, and governance efficiency.

3.1.3. Collaborative Empowerment Effect of Government Procurement

This path follows the logic: Government–enterprise cooperation built by government procurement → Accumulation of environmental technology knowledge → Improved ESG performance. Specifically, government departments form a two-way empowerment mechanism by building a long-term and stable government–enterprise cooperation ecosystem [

25]. The government prioritizes selecting suppliers with outstanding environmental technology capabilities and establishes strategic cooperative relationships. While ensuring the stability of procurement demand, it disseminates environmental governance experience and professional standards to enterprises.

In this process, to maintain cooperative ties, enterprises need to systematically enhance their reserve of environmental technology knowledge, including core capabilities such as clean production process innovation, carbon asset management system construction, and R&D of intelligent environmental risk monitoring technologies. This collaborative effect drives enterprises to expand the accumulation of environmental knowledge from single technology application to strategic planning, promoting the in-depth integration of environmental governance capabilities and ESG management systems [

26].

Furthermore, the government–enterprise collaboration effect reconstructs the corporate ESG capability network through knowledge spillovers and resource integration: in the environmental dimension, the accumulation of green technology patents and optimization of low-carbon production processes significantly reduce environmental compliance costs and improve resource utilization efficiency; in the social dimension, government projects’ requirements for supply chain transparency force enterprises to establish digital tracing systems for labor rights, enhancing the verifiability of social responsibility fulfillment; in the governance dimension, the anti-corruption compliance audit mechanism embedded in government cooperation drives enterprises to improve internal control systems and ESG information disclosure systems. This multi-dimensional capability improvement not only breaks the boundary limitations of traditional environmental governance but also forms an ESG capability matrix covering the entire chain of R&D innovation, production operations, and risk prevention through the coordinated evolution of technology, management, and strategy.

3.1.4. Differentiated Guidance Effect of Government Procurement Objects

This path follows the logic: Classification of object characteristics → Targeted driving of ESG dimensions → Construction of a sustainable development ecosystem. Specifically, the diversity of government procurement objects forms a differentiated guidance mechanism for the environmental, social, and governance dimensions through refined design on the demand side. Based on the strategic attributes of different procurement categories, the government deeply embeds ESG requirements into bidding standards and contract performance clauses, guiding enterprises to allocate resources to specific fields in a targeted manner and achieving precise alignment between policy goals and corporate capability building [

27].

In the environmental dimension, green procurement projects such as clean energy equipment and pollution governance services force enterprises to restructure production processes through binding indicators such as full-life-cycle carbon emission limits and renewable energy usage ratios. For example, mandatory requirements for suppliers to provide product carbon footprint tracing system certification drive enterprises to implement full-process green transformation from raw material selection to waste disposal, prompting environmental management to shift from passive compliance to active innovation.

In the social dimension, public service procurement such as education and medical facilities, and indemnificatory housing incorporates quantifiable social responsibility indicators (e.g., labor rights protection, community benefit-sharing) into the bid evaluation system. By setting hard thresholds such as minimum wage guarantees and disabled employment rates, enterprises are driven to establish standardized management systems covering employment norms and occupational health monitoring, enhancing the measurability and sustainability of social value creation.

In the governance dimension, technology procurement projects such as government cloud platforms and data security services force enterprises to optimize internal control processes by mandating the disclosure of corporate governance structure transparency and anti-corruption mechanism effectiveness.

Drawing on the above conceptual analysis of how government procurement directly addresses market failures and creates a market-oriented incentive mechanism through stable demand, standard setting, collaborative empowerment, and differentiated guidance, we formally propose, this paper proposes research hypothesis 1:

Hypothesis 1: Under the condition that other factors remain unchanged, government procurement can significantly improve corporate ESG performance.

3.2. The Role of Financing Constraints and the Indirect Impact Mechanism of Government Procurement

Financing constraints play a crucial role in the complex relationship between government procurement and corporate ESG development. From the in-depth perspective of production and operation, compared with traditional business activities, corporate investment in the ESG field exhibits significantly more prominent externality characteristics. This externality is not only reflected in enterprises’ fulfillment of environmental and social responsibilities but also directly leads to an increase in production costs, thereby causing a sharp rise in enterprises’ demand for funds [

28,

29]. Against the severe reality of imperfect competition and information asymmetry in the capital market, financing constraints often become a major obstacle for enterprises to formulate long-term strategic decisions and pursue high-quality development. Faced with the limitations of financing constraints, enterprises, out of precautionary motives, tend to adopt conservative development strategies and reduce capital investment in ESG development to ensure the stability and sustainability of short-term operating income [

30,

31]. While other paths (e.g., standard orientation) are theoretically plausible, the financing channel represents the most direct and fundamental resource-enabling mechanism.

However, as an important policy tool, government procurement can not only directly provide enterprises with long-term and sustainable cash flow support but also serve as an indirect channel to alleviate corporate financing constraints and incentivize enterprises to improve ESG performance. Specifically, in the process of government procurement, procurement departments can give full play to their policy-oriented role and provide credit guarantees for suppliers by virtue of government procurement contracts. This measure effectively improves the information asymmetry between enterprises and financial institutions, reduces the difficulty for financial institutions to assess corporate credit risks, and thus establishes a new type of “government-bank-enterprise” cooperative relationship. Under this cooperative relationship, winning enterprises can rely on government procurement contracts as strong evidence to obtain credit financing support from the external market more conveniently and effectively. This credit financing support is of great significance for alleviating the contradiction faced by enterprises in their operations between the need to increase investment in ESG-related fields and the need to ensure continuous production and operation. It enables enterprises to allocate more funds and resources to ESG development while ensuring the stability of production and operation, thereby optimizing their environmental performance and social responsibility performance.

From a practical perspective, in recent years, Chinese governments at all levels have made many useful attempts and explorations in continuously improving and formulating procurement credit policies. For example, the implementation of the advance payment system allows suppliers to obtain part of the funds before performing the contract, effectively alleviating their capital pressure; the clarification of credit financing policies provides suppliers with more financing options and channels; financial institutions are encouraged to optimize the “government procurement loan” service model, which improves the convenience and economy of suppliers’ access to financing by simplifying loan procedures and reducing loan interest rates. The implementation of these policies not only provides strong financial support for suppliers but also reduces their financing costs and improves their financing efficiency. At the same time, government procurement departments have also established close cooperative relationships with financial institutions to jointly promote the innovation and improvement of procurement credit policies. This cooperation not only helps alleviate corporate financing constraints but also provides strong policy support and institutional guarantees for enterprises to improve their ESG performance.

Therefore, we posit that the alleviation of financing constraints constitutes a key indirect pathway, or mediating mechanism, through which government procurement empowers corporate ESG performance.

Based on the above analysis, this paper proposes Research Hypothesis 2:

Hypothesis 2: Under the condition that other factors remain unchanged, government procurement can improve corporate ESG performance by alleviating corporate financing constraints.

4. Research Design

4.1. Variable Setting

4.1.1. Explained Variable

As the attention from all sectors of society to corporate ESG performance continues to rise, numerous domestic and international rating agencies have stepped up their efforts in compiling and evaluating ESG indices for listed companies. Among them, institutions such as China Securities Index (CSI), Wind, SynTao Green Finance, and Alliance Green have been active in this field. Given the differences in target applicants, evaluation dimensions, coverage scope, and time horizons across various ESG rating systems, this study chooses to adopt the ESG rating indicators developed by CSI as the main basis for measuring corporate ESG performance. We acknowledge the well-documented issue of low correlation across different ESG rating providers. The rationality of choosing the CSI rating despite this limitation is based on the following considerations specific to our research context:

Systematic evaluation dimensions: The CSI ESG rating system comprises 12 categories of secondary indicators and 34 tertiary indicators. It not only includes traditional environmental topics such as greenhouse gas emissions and energy management but also incorporates emerging social indicators like employee rights protection and supply chain social responsibility, forming a multi-dimensional and comprehensive evaluation framework.

Scientific methodology: It adopts a dual evaluation mechanism of “negative screening + positive incentive”, combined with the industry benchmark adjustment method and material issue analysis method. This not only avoids biases caused by industry-specific characteristics but also highlights the differentiated practical performance of enterprises, ensuring that the rating results are both horizontally comparable and retain vertical dynamic characteristics.

Wide application: Since 2009, CSI has been conducting systematic ESG performance evaluations on securities issuers such as entities in the A-share market and bond-issuing bodies. Its evaluation scope now fully covers all A-share listed companies, providing valuable data support and decision-making references for investors, regulatory authorities, and the academic community [

32]. Its established methodology and comprehensive coverage make it a leading and reliable metric in the Chinese context.

In addition, this rating indicator consists of nine grades: C, CC, CCC, B, BB, BBB, A, AA, and AAA, which are assigned values from 1 to 9, respectively.

4.1.2. Explanatory Variable

In January 2015, the Ministry of Finance issued the Notice of the Ministry of Finance on Promoting the Disclosure of Government Procurement Information, which clearly stipulated that both central and local budget units must publicly disclose information related to their government procurement on official government procurement websites. In March of the same year, the State Council released the Regulations on the Implementation of the Government Procurement Law of the People’s Republic of China, requiring that “procurement institutions shall, within 2 working days after the signing of a government procurement contract, publish an announcement of the contract content on official media designated by the finance department of a provincial or higher-level people’s government”.

In compliance with the requirements of the aforementioned laws and regulations, this study draws on the data collection and processing approaches of Huang et al. (2023) and Tang et al. (2025) to crawl and manually organize the information of concluded government procurement contracts published in the “Government Procurement Contract Announcement Query System” on the China Government Procurement Network, covering the time range from 2015 to 2023 [

33,

34]. The above-mentioned contract information includes multiple indicators such as contract number, project number, specific contract name, contract signing date, full name of the purchaser, list of winning suppliers, name of the agency, name of the main procurement objects, specific quantity of the objects, unit price of each object, and total contract amount.

Subsequently, to match the government procurement orders of China’s listed companies, this study matched the names of suppliers with the full names of listed companies. Based on the calendar year, it counted and organized the quantity and amount of government procurement orders obtained by each listed company every year, which served as the data basis for the subsequent regression analysis.

In the benchmark regression analysis, considering that some enterprises have a government procurement order amount of zero (resulting in a “left-skewed distribution”), this study uses the logarithm of the government procurement order amount of listed companies plus 1 as the core explanatory variable of focus. This measure is chosen over alternatives such as the share of procurement in total revenue for two primary reasons. First, the absolute value of procurement orders directly captures the scale and economic significance of the government’s demand-pull effect, which is the core of our theoretical mechanism. Second, using a revenue share introduces denominator-driven endogeneity, as a firm’s total revenue can be influenced by a wide array of factors unrelated to government procurement, potentially biasing our estimates. The log transformation is applied to mitigate skewness and better approximate a normal distribution. Besides, in the robustness test, the logarithm of the quantity of government procurement orders of listed companies plus 1 is used as the measurement indicator to verify the reliability of the core conclusions of this study.

4.1.3. Mechanism Variable

Corporate ESG investment exhibits distinct external characteristics, often requiring substantial capital input and long-term time costs. However, financing constraints tend to be the biggest constraint for enterprises when choosing high-quality development in their long-term strategic decisions. Under the constraints of financing limitations, enterprises may be more inclined to adopt conservative development strategies and reduce capital investment related to ESG development to ensure the stability of short-term operating income.

Drawing on the research methods of Hadlock et al. (2010), Vereshchagina (2023), and Hajivassiliou et al. (2024), this study constructs the SA index as a proxy indicator for corporate financing constraints [

35,

36,

37]. This index has strong exogeneity and is more capable of depicting the inherent characteristics of corporate financing constraints from a long-term perspective. The specific calculation formula is as follows:

Among them, refers to the financing constraint index; represents firm size, which is measured by the logarithm of the firm’s total assets at the end of the year in this study; denotes the firm’s operating lifespan, calculated as the difference between the sample observation year of the firm and its registration year. It should be noted that the SA index is a reverse indicator—specifically, a larger value of the index indicates lower financing constraints faced by the firm.

4.1.4. Control Variable

Given the numerous macro and micro factors influencing government procurement and corporate ESG performance, this study selects the following 7 control variables based on the perspectives of existing literature to minimize biases in the model’s causal inference caused by omitting important variables [

38]. These variables include the proportion of independent directors, the shareholding ratio of the top five shareholders, Tobin’s Q, return on assets (ROA), cash flow ratio, management shareholding ratio, and asset-liability ratio. For specific measurement methods, please refer to

Table 1.

4.2. Model Setting

To accurately identify the impact relationship between government procurement and corporate ESG performance, this study establishes the following panel model:

Among them, and represent corporate ESG performance and government procurement, respectively; is the intercept term; is the to-be-estimated coefficient of the core explanatory variable—if the value is positive, it indicates that government procurement is conducive to improving corporate ESG performance; refers to the control variables selected above; and represent the fixed effects of industry and year, respectively; is the random error term; and represent the sample enterprise and time, respectively.

Meanwhile, to further unpack the “black box” of how government procurement affects corporate ESG performance, this study incorporates financing constraints as a mediating variable into a unified analytical framework. Drawing on the research paradigm of Wen et al. (2014), the following regression equation system is constructed [

39]:

Among them, the symbol setting of variables in the above equations is consistent with that in the benchmark regression model. Moreover, this study examines the influence of government procurement on ESG performance of enterprises through Formula (3). If the coefficient is significant, model (4) is used to examine the influence of government procurement on financing constraint index. If the coefficient is significant, model (5) is used to test the influence of adding intermediary variables and explanatory variables on the ESG performance of enterprises. If the coefficients and pass the significance test, it shows that there is some intermediary effect. If the coefficient is significant, but is not significant, it indicates that there is a complete mediation effect. Otherwise, the intermediary effect is not established. Finally, Sobel test and 500 Bootstrap sampling tests are used in this study to reflect the results of mediation effect more accurately, thus enhancing the robustness and reliability of the study.

4.3. Data Source

Due to data availability constraints, this study selects data of Chinese listed companies from 2015 to 2023 as the initial research sample set. To ensure the validity and reliability of the samples, a series of rigorous data preprocessing procedures are implemented, with specific steps as follows:

Excluding samples of ST (Special Treatment) and *ST (Delisting Risk Warning) enterprises with special financial data;

Eliminating samples of enterprises that conducted IPOs (Initial Public Offerings) during the research period to avoid the potential impact of new stock issuances on data analysis;

Removing enterprise samples with missing key variables, and only retaining samples with complete and non-missing data for more than five consecutive years to ensure data continuity and integrity;

To control for biases that outliers may introduce to the estimation results, all continuous variables are subjected to 1% winsorization on both the upper and lower tails.

After screening through the above steps, this study finally obtains 5252 valid sample observations. In addition, the enterprise-level data required for this study are mainly sourced from authoritative databases such as CSMAR (China Stock Market & Accounting Research Database), WIND (Wind Information Terminal), and CNRDS (China National Research Data Service Platform). For the descriptive statistics of variables, see

Table 2 for details.

5. Analysis of Empirical Results

5.1. Multicollinearity Test

In the in-depth exploration of the mechanism through which government procurement affects corporate ESG performance, this study incorporates a relatively large number of control variables to strive for more accurate and unbiased estimates. To avoid potential multicollinearity issues—which could interfere with the statistical significance of variables and the reliability of parameter estimates—a multicollinearity test was conducted, with the results presented in

Table 3. It is evident that the largest Variance Inflation Factor (VIF) corresponds to ROA, with a value of 1.340, while the second largest VIF is for Lev, at 1.290. The VIF reflects the extent to which the estimated variance of a given independent variable’s regression coefficient increases due to linear correlations among independent variables. A larger VIF value indicates more severe multicollinearity, which may render regression results unreliable. Typically, a VIF value greater than 10 is considered to indicate a serious multicollinearity problem.

Overall, the average VIF value of the model is 1.150, and the VIF values of all variables do not exceed the commonly recognized threshold of 10. This finding strongly demonstrates that the econometric model constructed in this study effectively avoids the potential threat of multicollinearity, laying a solid and reliable foundation for the subsequent regression analysis.

5.2. Analysis of Benchmark Regression

For the sake of model robustness, this study conducts fitting by gradually incorporating control variables, ensuring that each step of fitting can accurately reflect the relationships between variables. Moreover, during the fitting process, this study strictly controls for year-fixed effects and industry-fixed effects to eliminate potential interference from time trends and industry differences on the results, thus ensuring the accuracy and purity of the estimation results. The specific estimation results are presented in

Table 4.

As shown in Column (1), when no control variables are included, the estimated coefficient of government procurement’s impact on corporate ESG performance is 0.0089, which passes the significance test at the 5% level. This initially reveals that government procurement has a significant “enabling effect” on corporate ESG performance. On this basis, Columns (2) to (8) gradually add the control variables selected in this study, aiming to capture other important factors that may affect corporate ESG performance and thereby more accurately assess the role of government procurement. It is evident that with the gradual inclusion of control variables, the promotional effect of government procurement on corporate ESG performance persists, and the final impact coefficient stabilizes at 0.0098 (see Column (7)).

This result indicates that even after controlling for other influencing factors, government procurement can still significantly improve corporate ESG performance, which verifies Research Hypothesis 1 of this study. Relying on market purchasing behavior, government procurement effectively complements the limitations of traditional “one-way funding”-based fiscal support methods. Through a precise market demand-oriented mechanism, it stimulates enterprises’ supply potential, promotes enterprises to improve their ESG (Environmental, Social, and Governance) performance, and thus drives enterprises toward a path of high-quality development.

5.3. Robustness Test

The results of the benchmark regression show that government procurement can significantly improve corporate ESG performance. To verify the robustness of this conclusion, the study uses the following four methods for confirmation:

Considering that measurement bias of variables caused by indicator setting may affect the core research conclusions of this study, based on the crawled government procurement contract information of listed companies, this study selects the natural logarithm of the number of government procurement orders of listed companies plus 1 (NGP) as the measurement indicator for government procurement behavior, and re-conducts regression estimation using the two-way fixed effects model. It should be additionally noted that the number and amount of government procurement orders essentially jointly reflect the transaction scale intensity between enterprises and the government. The government tends to achieve economies of scale through bulk procurement agreements or framework contracts, which means an increase in the number of orders is usually accompanied by a rise in the amount of a single transaction. Therefore, both can serve as effective proxy variables for the scale of government procurement. As shown in Column (1) of

Table 5, after replacing the measurement standard of the explanatory variable, government procurement still has a significant positive promoting effect on corporate ESG performance, with the impact coefficient increasing to 0.0611, which strongly reinforces the core argument of this study.

- 2.

Introduction of Provincial Fixed Effects

In the above benchmark regression model, this study has incorporated enterprise characteristic variables to reduce the problems caused by omitted variables, but there may still be important variables affecting corporate ESG performance that are omitted. In view of this, drawing on the research method of Wang et al. (2023), this study introduces provincial fixed effects to effectively control the time-varying macro-environmental factors at the provincial level [

40]. The adjusted regression results are presented in Column (2) of

Table 5. The results show that after incorporating provincial fixed effects, the impact coefficient of government procurement is 0.0080, which passes the 10% significance test. This further confirms the important role of government procurement in improving corporate ESG performance and strengthens the robustness of the benchmark conclusion.

- 3.

Firm-Level Clustering

To further address the issue of serial correlation within and between groups, this study adopts a firm-level clustering adjustment method to re-verify the benchmark regression results. This method can effectively account for potential heterogeneity among enterprises and the correlation of data points within an enterprise, thereby improving the accuracy and robustness of regression estimation. Column (3) of

Table 5 shows the empirical results of the impact of government procurement on corporate ESG performance after applying firm-level clustering adjustment. The estimation results indicate that the regression coefficient of government procurement is 0.0098, which is significant at the 5% significance level. This is consistent with the estimation results of the benchmark regression, further verifying the reliability of the regression results.

- 4.

Lag Effect

It is considered that the impact of government procurement on corporate ESG performance may have a time lag. For example, after an enterprise obtains a government procurement contract, it may take a certain period of time to adjust resource allocation, take measures such as increasing environmental protection investment and optimizing governance structure, before these efforts can be reflected in the improvement of ESG scores. At the same time, although the two-way fixed effects model has controlled for industry fixed effects and time fixed effects, it cannot rule out the interference of short-term accidental factors (such as policy pilots and emergency events) on the results. Based on this, this study replaces the core explanatory variable with the lagged term of government procurement for the robustness test to enhance the credibility of the results. As shown in Column (4) of

Table 5, the impact coefficient of the lagged term of government procurement is 0.0157, which passes the 5% significance test and is higher than the impact coefficient (0.0098) in the benchmark regression analysis. This result indicates that the promoting effect of government procurement on corporate ESG is cumulative and sustainable, rather than a short-term “flash in the pan”. Enterprises need time to absorb the resources brought by government procurement, adjust internal governance processes, or implement social responsibility projects.

In summary, the above robustness tests exclude the interference of factors such as measurement errors and external shocks from different dimensions. Although there are differences in the magnitude of the estimated coefficients among different methods, all results pass the economic significance test, and the direction and intensity of the standardized effects are consistent with the benchmark regression. It is worth noting that the impact direction of the core explanatory variable is completely consistent in all tests, the statistical significance is stable, and the coefficient differences do not show systematic deviation characteristics. Therefore, although the absolute values of the coefficients fluctuate reasonably due to the different measurement perspectives of various methods, the positive effect of government procurement on improving corporate ESG performance is robust in terms of statistical significance and economic logic, which strengthens the reliability of the core conclusions of this study.

5.4. Endogeneity Treatment

Although the previous analysis of the relationship between government procurement and corporate ESG performance incorporated a comprehensive set of control variables—aimed at mitigating endogeneity issues arising from omitted key variables or measurement errors—the model setup still inevitably faces complex endogeneity due to potential reverse causality between the two variables. On one hand, government procurement encourages enterprises to increase investments in environmental, social, and governance (ESG) areas through multiple channels (e.g., providing financial support, setting procurement standards, and enhancing market attention), thereby improving their ESG performance. On the other hand, enterprises with strong ESG performance are often more favored by the government, as they better align with the government’s sustainable development goals and policy orientations, enabling them to “stand out” when participating in government procurement activities.

In light of this, following methods for causal inference in econometrics, this study constructs instrumental variables (IVs) from the two dimensions below and uses two-stage least squares (2SLS) for verification:

First Instrumental Variable: Drawing on the approach of Tan et al. (2024), the first IV is defined as the ratio of a firm’s annual government procurement amount to the total government procurement amount received by all firms in the same industry that year [

41]. This ratio directly reflects the firm’s relative position in terms of government procurement within its industry. Since firms in the same industry typically face similar policy environments, market demands, and competitive conditions regarding government procurement, this ratio exhibits a strong correlation with the firm’s own government procurement amount—satisfying the core prerequisite for a valid IV. Detailed estimation results are presented in Column (1) of

Table 6.

Second Instrumental Variable: Referring to the method of Jiang et al. (2024), the second IV is calculated as the annual average government procurement amount of all firms in the same industry and year [

42]. For firms in the same industry and year, their government procurement amounts are influenced by industry-specific characteristics and macroeconomic conditions, leading to a certain degree of commonality—thus satisfying the correlation condition for IVs. Meanwhile, this variable reflects industry- and year-level aggregate conditions rather than firm-specific factors. No existing research has demonstrated a direct correlation between this variable and firm-specific confounding factors affecting ESG performance (e.g., a firm’s unique management style, geographic location, or corporate culture), so it meets the exogeneity condition for IVs. Detailed estimation results are shown in Column (2) of

Table 6.

Additionally, considering the widespread presence of heteroskedasticity and serial auto-correlation in economic variables, this study further employs the two-step feasible generalized method of moments (GMM) for verification to obtain more accurate parameter estimates. By leveraging orthogonality conditions, GMM effectively addresses heteroskedasticity and serial auto-correlation in panel data—i.e., the IV matrix satisfies orthogonality constraints with the model’s error term. Furthermore, GMM’s orthogonality conditions allow flexible adjustment of the correlation structure between IVs and error terms. For example, if the error term follows a moving average process, restricting the maximum lag order of IVs can avoid potential correlations between distant lagged variables and the current error term, thereby ensuring the validity of moment conditions while controlling for serial auto-correlation.

It is evident that in the first-stage regression, both types of IVs selected in this study exhibit a significant positive correlation with government procurement, consistent with the expected sign direction. Meanwhile, in the underidentification test for IVs, the Kleibergen-Paap rk LM statistics for the two IVs are 1360.34 and 624.39, respectively—both significantly rejecting the null hypothesis (indicating no underidentification issue). In the weak identification test for IVs, the Kleibergen-Paap rk Wald F statistics for the two IVs are 1805.08 and 756.04, respectively—both greater than the critical value of 16.38 at the 10% significance level in the Stock-Yogo weak identification test (confirming no weak IV problem).

Thus, both types of IVs selected in this study are reasonable and valid. In the second-stage regression, after addressing endogeneity, the positive promoting effect of government procurement on corporate ESG performance remains significant and passes the 1% significance test. This result indicates that endogeneity caused by omitted key variables or reverse causality has no significant impact on the core conclusion; in fact, the estimated coefficient slightly increases.

In addition, from the regression results of GMM, government procurement has a significant positive effect on ESG performance of enterprises, and the influence coefficients are 0.0339 and 0.0831, respectively, which are close to the regression coefficients of the second stage, which once again demonstrates the reliability of the core conclusions of this paper.

5.5. Analysis of Heterogeneity

5.5.1. Heterogeneity Analysis Based on Enterprise Scale

Considering the differences in capital strength, technical resources, and market networks among enterprises of varying sizes, this study, following the approach of Tian et al. (2023) [

43], classifies sample enterprises into large-scale and small-scale groups based on the average value (22.5419) of their asset sizes and conducts grouped regression analyses. The specific results are presented in

Table 7 [

43].

The empirical findings indicate that the promotional effect of government procurement on corporate ESG performance is more prominent in large-scale enterprises, with the impact coefficient reaching 0.0100. This result can be attributed to the following aspects:

First, differences in government contract accessibility; government procurement projects typically impose high requirements on supplier qualifications, including technical standards, historical performance, and credit ratings. Benefiting from their scale advantages, large-scale enterprises are more likely to meet these criteria, thereby securing more high-value-added orders. In contrast, small-scale enterprises may only participate in low-threshold procurement; such contracts impose weaker ESG constraints, resulting in a limited driving effect of government procurement on their ESG performance.

Second, differences in resource endowments. Large-scale enterprises generally possess stronger capital strength, technical capabilities, and management teams, enabling them to quickly respond to the implicit ESG requirements in government procurement contracts (e.g., upgrading environmental protection technologies, investing in employee welfare).

Third, effectiveness of policy transmission mechanisms. ESG clauses in government procurement (such as green procurement and fair trade requirements) are often designed for mature enterprises. Large-scale enterprises already have established ESG management frameworks, allowing them to more efficiently internalize policy requirements into operational standards. Small-scale enterprises, however, may lack ESG management experience, and policy requirements may be perceived as a “compliance burden” rather than a motivation for improvement.

5.5.2. Heterogeneity Analysis Based on Enterprise Management Status

With the growing attention of global investors to sustainable development and corporate social responsibility, corporate ESG performance has become a crucial indicator for measuring enterprises’ long-term value and development potential. However, excellent ESG performance requires enterprises to inject long-term and sustainable funds for support—such as investing in environment-friendly projects, supporting social responsibility initiatives (e.g., education and public health), and improving internal corporate governance structures. Therefore, based on the net profit disclosed in corporate financial information, this study classifies the sample into profitable enterprises and loss-making enterprises according to whether the net profit is greater than zero, and conducts grouped regression analysis again. The estimation results are presented in

Table 8.

In terms of numerical values alone, regardless of whether an enterprise is profitable or not, government procurement still exerts a positive promoting effect on the corporate ESG coefficient; in fact, the impact coefficient for loss-making enterprises is slightly higher than that for profitable ones. However, from a statistical perspective, the effect for loss-making enterprises fails to pass the significance test. This seemingly contradictory phenomenon may stem from the following logical and economic mechanisms:

First, due to tight cash flow, loss-making enterprises are more dependent on external financial support from government procurement. Government procurement may become a key source of funds for them to maintain ESG investment in the short term, leading to a higher absolute value of the coefficient. Nevertheless, loss-making enterprises may prioritize the use of government procurement funds for “survival protection” rather than long-term ESG development, resulting in unstable ESG improvement effects, which is reflected in the lack of statistical significance.

Second, profitable enterprises have stable profit accumulation and can combine government procurement funds with their own resources to systematically invest in ESG-related fields, forming observable long-term effects. Hence, although the coefficient is lower, it is statistically significant. At the same time, profitable enterprises are usually larger in scale or more mature in operation, and their ESG improvement measures are more likely to generate economies of scale, making the marginal promoting effect of government procurement relatively smaller but stable in impact.

5.5.3. Heterogeneity Analysis Based on Enterprise Pollution Discharge

With the growing global emphasis on sustainable development and environmental protection, government procurement policies are increasingly inclined to prioritize eco-friendly, energy-efficient, and low-carbon products and services. Consequently, the pollution intensity of enterprises has become a key consideration in government procurement decision-making. Drawing on the research paradigm of Li et al. (2020) and adhering to the 2012 classification standards of the China Securities Regulatory Commission (CSRC), this study classifies sample enterprises into heavily polluting enterprises and non-heavily polluting enterprises [

44]. Among them, the industry codes for heavily polluting industries are B06–B12, C17–C19, C22, C25–C29, C31, C32, and D44. Detailed estimation results are presented in

Table 9.

The results show that government procurement can only significantly improve the ESG performance of non-heavily polluting enterprises, with an influence coefficient of 0.0106. However, for heavily polluting enterprises, the effect is negative, with a value of −0.0033, and it fails the significance test. Enhancing ESG performance in heavily polluting industries requires substantial investments (such as the replacement of clean technologies and the construction of pollution control facilities), yet the financial support provided by government procurement may be far lower than their transformation costs. Enterprises face a dilemma: “insufficient investment makes it difficult to improve ESG scores, while excessive investment leads to short-term financial pressure.” In some cases, resource misallocation may even cause an overall decline in ESG performance. Furthermore, government procurement may impose stricter ESG requirements on heavily polluting enterprises. To meet the minimum environmental compliance standards, these enterprises may be forced to cut investments in social responsibility or corporate governance, resulting in a structural imbalance in ESG scores.

In contrast, ESG investments by non-heavily polluting enterprises are more likely to be recognized by the market as “value-adding behaviors.” Government procurement further strengthens their ESG reputation, forming a positive cycle of “policy support—market recognition—resource acquisition.”

5.5.4. Heterogeneity Analysis Based on Enterprise Subject Situation

It is considered that enterprises that typically share technical resources, R&D facilities, and talent reserves with academic institutions can more efficiently convert government procurement funds into green technological innovation or social responsibility practices, thereby directly improving their ESG performance. Moreover, enterprises affiliated with universities or research institutes, having long-term access to cutting-edge scientific research achievements, possess a stronger ability to understand and apply the implicit ESG technical requirements in government procurement (such as low-carbon standards and data governance norms), forming an “accelerator” for policy effects.

To verify this hypothesis, this study groups the samples according to whether the enterprise entity is a university or research institute, and then conducts regression analysis again. The results are presented in

Table 10. The empirical results show that government procurement significantly promotes the improvement of ESG performance for enterprises affiliated with universities or research institutes, with an impact coefficient of 0.0107, which verifies the above hypothesis. Therefore, relying on the data analysis capabilities of academic institutions, such enterprises are more likely to meet the governance requirements in government procurement (e.g., algorithm compliance review and privacy protection) and improve their ESG ratings. At the same time, when ESG investment faces uncertainty, academic institutions can provide technical support or reputation guarantees, reduce negative market feedback, and enhance the sustainability of policy effects.

5.5.5. Heterogeneity Analysis Based on the Geographical Location of Enterprises

Considering differences in factors such as market operation mechanisms, environmental protection awareness, and policy support intensity across regions, this study classifies enterprises into those in eastern China and those in central and western China based on their geographical locations, and conducts subsample regression analysis. The results are presented in

Table 11.

The empirical findings indicate that government procurement is more effective in driving enterprises in eastern China to improve their ESG performance, while the regression results for enterprises in central and western China fail to pass the significance test. The significant promotional effect of government procurement on the ESG performance of eastern enterprises essentially stems from the combined action of “high marketization level + strong institutional constraints + abundant resource endowments”. Specifically:

First, the marketization process in eastern China started earlier, and enterprise competition relies more on brand reputation and long-term value creation. The ESG requirements in government procurement can be transformed into motivation for substantive corporate improvements through market transmission mechanisms, forming a closed loop of “policy signals—market incentives—behavioral adjustments”.

Second, eastern China has a high level of urbanization, strong public awareness of environmental protection, and close supervision of enterprises’ environmental and social responsibility behaviors by the media and NGOs. If government procurement projects involve high-polluting enterprises, they are likely to trigger public opinion backlash, forcing enterprises to enhance ESG performance to avoid reputation risks.

Third, local governments in eastern China usually issue supporting policies such as special ESG subsidies, green credit interest discounts, and carbon trading pilots, which form a “combined policy package” with government procurement.

However, enterprises in central and western China face rigid constraints such as shortages of ESG technical talents and insufficient green financial services. Even if government procurement provides funds, these enterprises still struggle to access clean technologies or professional teams, resulting in the dilution of policy effects.

5.6. Analysis of Mechanism

To explore the mediating role of financing constraints in the process of government procurement influencing corporate ESG performance, regression estimation was conducted based on the mediating effect model constructed above, and the estimation results are presented in

Table 12.

The regression results in Column (2) show that government procurement has a significant positive promoting effect on easing financing constraints, with an estimated coefficient of 0.0093, which passes the 1% significance test. This result indicates that government procurement typically provides a long-term and stable source of income, improves enterprises’ cash flow expectations, enhances their debt-servicing capacity, and thereby reduces financing costs.

After incorporating both government procurement and the financing constraint index into Column (3), the estimated coefficients of government procurement and the financing constraint index are 0.0267 and 0.3641 respectively, both passing the 1% significance test. The Z-statistic of the Sobel test is 0.0034, which also passes the 1% significance test. The Bootstrap test results show that the 95% confidence interval for the mediating effect is [0.0024, 0.0044], which does not include 0.

Therefore, financing constraints play a partial mediating role in the relationship between government procurement and corporate ESG performance, forming a positive transmission mechanism of “government procurement → easing corporate financing constraints → improving ESG performance”. In other words, government procurement behavior can not only directly inject a large amount of continuous and stable funds into enterprises for production and operation to ease their capital turnover pressure, but also serve as a market signal with positive externalities, enhancing enterprises’ “credit aura” and thereby guiding investments from relevant financial institutions. Ultimately, this helps enterprises meet the ESG requirements they face in the development process.

6. Conclusions and Policy Implications

This study elucidates the theoretical mechanisms through which government procurement affects corporate ESG performance and provides empirical evidence based on panel data from Chinese listed companies between 2015 and 2023. The findings demonstrate that government procurement significantly enhances corporate ESG performance, with the effect particularly evident among large-scale enterprises, profitable firms, non-heavy polluters, university- or research institute-affiliated enterprises, and those located in eastern China. Moreover, the analysis confirms that government procurement facilitates ESG improvement by mitigating corporate financing constraints. In conclusion, Our findings demonstrate that the link between government procurement and ESG performance is neither simple nor universal. It is fundamentally mediated by the alleviation of financing constraints and is contingent upon a firm’s intrinsic characteristics and external environment.

The empirical outcomes offer several policy implications. First, policymakers should strengthen the credit-enhancement function of government procurement and construct a diversified financial support system. This can be achieved through innovating procurement-based financing tools and improving coordination across green financial policies. Second, differentiated procurement policies should be implemented to enhance targeting precision, such as designing tiered support mechanisms tailored to firms of varying sizes and regions. For instance, simplified bidding processes and dedicated quota for SMEs could help include them in the green transition. Third, deeper collaboration among government, enterprises, and academic institutions should be encouraged to strengthen ESG capacity building, for instance, through establishing joint ESG laboratories and developing training and certification systems.

Beyond the Chinese context, our findings hold relevance for the international policy debate on fostering corporate sustainability. The “procurement-finance-ESG” pathway identified in this study offers a complementary approach to the disclosure-dominated strategies seen in regulations like the EU’s CSRD or the SEC’s proposed rules. It suggests that demand-side policy instruments, especially in emerging economies with less mature capital markets, can effectively kick-start corporate ESG investment by directly addressing resource bottlenecks. International bodies and national governments could explore policy mixes that strategically combine the pull of sustainable public procurement with the push of robust disclosure standards to create a synergistic effect on corporate behavior.

Despite these contributions, the study has certain limitations that suggest fruitful avenues for future research. The sample is primarily composed of listed companies, which may not fully represent non-listed firms, small and micro enterprises, or supply-chain partners. Future studies could expand coverage to these entities, possibly through case studies or in-depth interviews, to enhance the generalizability of the findings. Additionally, this paper does not examine the synergistic effects of government procurement with other policy instruments, such as carbon market transactions or green taxation. Subsequent research could employ structural equation models to explore optimal policy mixes that jointly promote corporate ESG performance, thereby providing theoretical support for integrated policy design within the new “dual circulation” development framework.

Author Contributions

Conceptualization, J.Y., X.Z. and X.G.; methodology, J.Y.; software, J.Y.; validation, J.Y. and X.G.; formal analysis, J.Y., X.Z. and X.G.; investigation, J.Y. and X.G.; resources, X.Z.; data curation, J.Y., X.Z. and X.G.; writing—original draft, J.Y. and X.G.; writing—review and editing, J.Y. and X.Z.; visualization, J.Y., X.Z. and X.G.; supervision, X.G.; project administration, J.Y. and X.G.; funding acquisition, X.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Natural Science Foundation of Fujian Province (grant number: 2022J01320) and the Fundamental Research Funds for the Central Universities in Huaqiao University. The APC was funded by X.Z.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

No description in this study involves humans.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Sudhi, S.; Vaibhav, A.; Reepu, R.; Gitanjali, K.M. ESG performance and corporate volatility: An empirical exploration in an emerging economy. Int. J. Soc. Econ. 2024, 52, 467–483. [Google Scholar] [CrossRef]

- Wang, N.N.; Cui, N.X.; Hao, J.L.; Chai, Y.L. The role of government procurement in sustainable industry development—The trends and research agenda. Sustainability 2025, 17, 1319. [Google Scholar] [CrossRef]

- Liu, Y.; Li, R. Government procurement and corporate investment efficiency: Evidence from China. Financ. Res. Lett. 2024, 67, 105934. [Google Scholar] [CrossRef]

- Parker, S.; Liddle, J. Local government procurement in English regions: Organisations, collaborations and mechanisms. Local Gov. Stud. 2024, 1–29. [Google Scholar] [CrossRef]

- Liu, J.Q.; Xue, J.J.; Yang, L.; Shi, B.S. Enhancing green public procurement practices in local governments: Chinese evidence based on a new research framework. J. Clean. Prod. 2019, 211, 842–854. [Google Scholar] [CrossRef]

- Zhang, G.S.; Kuang, H.S.; Liu, Z. How does government procurement affect capacity utilization?—Experience from manufacturing enterprises in China. Econ. Manag. J. 2018, 40, 41–58. [Google Scholar] [CrossRef]