Corporate ESG Performance and Supply Chain Financing: Evidence from China

Abstract

1. Introduction

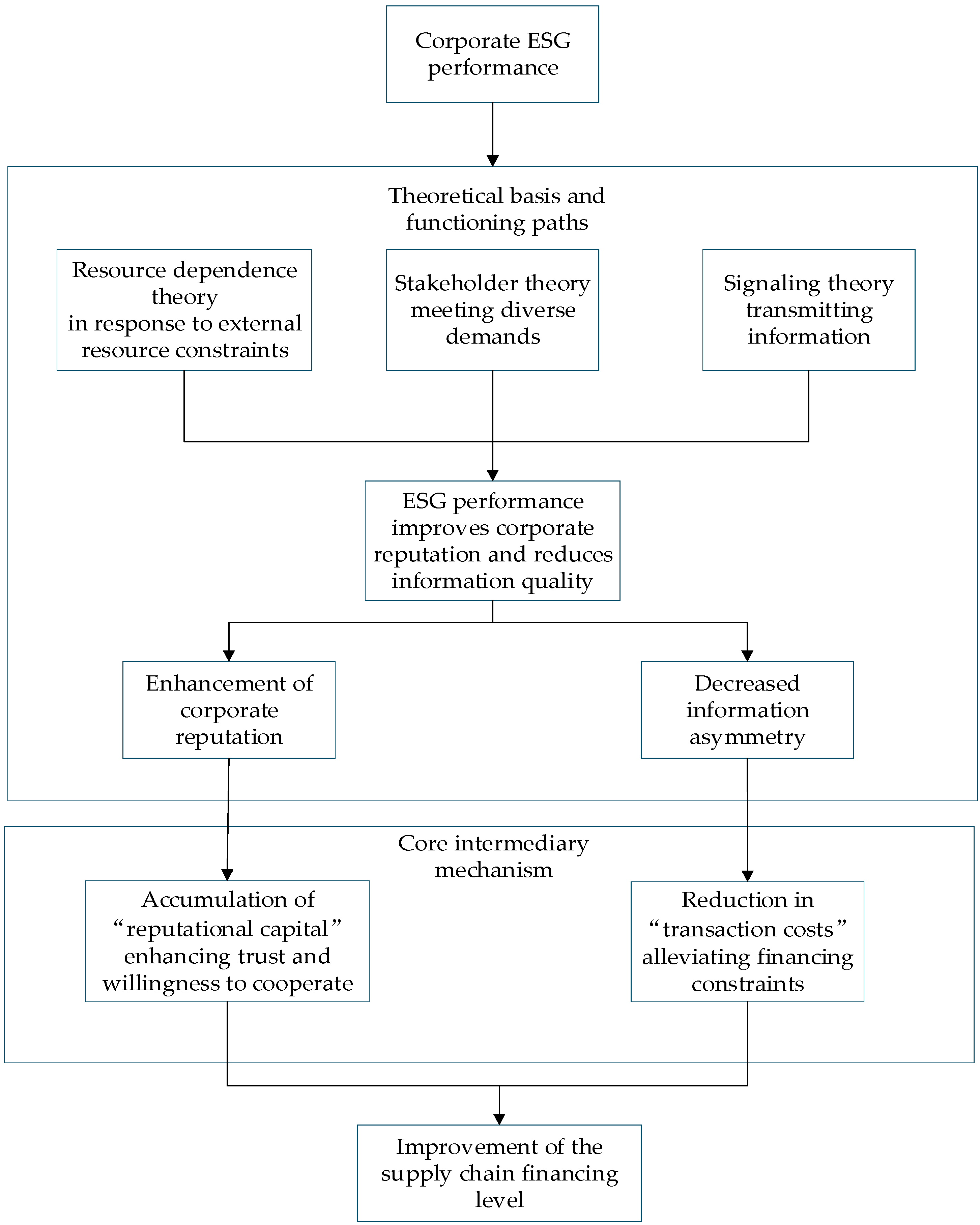

2. Theoretical Analysis and Research Hypotheses

2.1. ESG Performance and Corporate Supply Chain Financing

2.2. Corporate Reputation and Information Asymmetry

2.2.1. ESG Performance and Corporate Reputation

2.2.2. ESG Performance and Information Asymmetry

3. Empirical Strategies and Descriptive Statistics of the Sample

3.1. Data Sources and Sample Selection

3.2. Variable Selection

3.2.1. Dependent Variable: Supply Chain Finance

3.2.2. Independent Variable: ESG Performance

3.2.3. Mediating Variables

- (1)

- Corporate reputation

- (2)

- Information asymmetry

3.2.4. Control Variables

3.3. Model Design

3.4. Descriptive Statistics

4. Baseline Regression Results and Robustness Tests

4.1. Analysis of Baseline Regression Results

4.2. Robustness Tests

4.2.1. Two Stage Least Square (2SLS) Instrumental Variable Method

4.2.2. Propensity Score Matching (PSM) Method

4.2.3. Alternative Variable

4.2.4. Controlling for Interaction and Fixed Effects

4.2.5. Shorten Time Window

5. Mechanism Tests

6. Heterogeneity Analysis

6.1. Heterogeneity Analysis Based on Ownership Type

6.2. Heterogeneity Analysis Based on Firm Size

6.3. Heterogeneity Analysis Based on Pollution Level

6.4. Heterogeneity Analysis Based on High-Tech Industry Classification

6.5. Further Analysis of Heterogeneity Through the Introduction of Interaction Terms

7. Conclusions and Implications

8. Research Limitations and Future Research Direction

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Li, T.T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Houston, J.F.; Shan, H. Corporate ESG profiles and banking relationships. Rev. Financ. Stud. 2022, 35, 3373–3417. [Google Scholar] [CrossRef]

- Du, H.; Dai, H. Will the differences in ESG ratings affect the stability of the supply chain? Financ. Theory Pract. 2025, 9, 48–59. [Google Scholar]

- Lai, Z.; Lou, G.; Ma, H.; Chung, S.H.; Wen, X.; Fan, T. Optimal green supply chain financing strategy: Internal collaborative financing and external investments. Int. J. Prod. Econ. 2022, 253, 108598. [Google Scholar] [CrossRef]

- Feng, J.; Tang, J.J.; Qi, Z.; Liu, J. Supply chain finance and innovation investment: Based on financing constraints. Financ. Res. Lett. 2024, 63, 105349. [Google Scholar] [CrossRef]

- Zhang, Z.; Duan, H.; Shan, S.; Liu, Q.; Geng, W. The impact of green credit on the green innovation level of heavy-polluting enterprises—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 650. [Google Scholar] [CrossRef]

- Huang, F.; He, J.; Lei, Q. Coordination in a retailer-dominated supply chain with a risk-averse manufacturer under marketing dependency. Int. Trans. Oper. Res. 2020, 27, 3056–3078. [Google Scholar] [CrossRef]

- Wang, Y.; Xiong, M.; Chen, H.Z. The impact of supply chain finance on enterprises’ capacity utilization: An empirical study based on A-share listed manufacturing companies. Sustainability 2025, 17, 7549. [Google Scholar] [CrossRef]

- Lu, Q.; Deng, Y.; Liu, B.; Chen, J. Promoting supply chain financing performance of SMEs based on the extended resource-based perspective. J. Bus. Ind. Mark. 2023, 38, 1865–1879. [Google Scholar] [CrossRef]

- Agarwal, N.; Modgil, S.; Gupta, S. ESG and supply chain finance to manage risk among value chains. J. Clean. Prod. 2024, 471, 143373. [Google Scholar] [CrossRef]

- Herman, A.; Oplotnik, Ž.J.; Jagrič, T. The impact of ESG on business performance: An empirical analysis of NASDAQ–NYSE-listed companies. Sustainability 2025, 17, 9683. [Google Scholar] [CrossRef]

- Yan, B.; Min, C.; Wang, N. ESG Green Spillover, Supply Chain Transmission, and Corporate Green Innovation. Econ. Res. 2024, 7, 72–91. [Google Scholar]

- Kang, K.; Gao, S.; Gao, T.; Zhang, J. Pricing and financing strategies for a green supply chain with a risk-averse supplier. IEEE Access 2021, 9, 9250–9261. [Google Scholar] [CrossRef]

- Su, Y.M.; Zhang, B.B. ESG performance and corporate supply chain financing: From the perspective of trade credit. Sci. Technol. Entrep. J. 2025, 38, 190–199. [Google Scholar]

- Xin, C.; Zhu, R.; Guo, F. Corporate sustainability and supply chain financing: An analysis of environmental, social, and governance (ESG) consistency. J. Environ. Manag. 2025, 377, 124688. [Google Scholar] [CrossRef]

- Judijanto, L.; Utami, E.Y.; Harsono, I. Green Supply Chain Finance: A Bibliometric Review of Financing Instruments, Challenges, and Opportunities. West Sci. Interdiscip. Stud. 2024, 2, 647–655. [Google Scholar] [CrossRef]

- Li, Q.; Li, T.; Zhang, Y. ESG performance, heterogeneous creditors, and bond financing costs: Firm-level evidence. Financ. Res. Lett. 2024, 66, 105527. [Google Scholar] [CrossRef]

- Gao, J.; Hua, G.; Huo, B. Green finance policies, financing constraints and corporate ESG performance: Insights from supply chain management. Oper. Manag. Res. 2024, 17, 1345–1359. [Google Scholar] [CrossRef]

- Ren, L.; Gao, S.; Yang, F. ESG performance, supply chain relationship stability and enterprise technology innovation. Ind. Manag. Data Syst. 2025, 125, 1892–1914. [Google Scholar] [CrossRef]

- Burcă, V.; Bogdan, O.; Bunget, O.C.; Dumitrescu, A.C.; Imbrescu, C.M. Financial Implications of Supply Chains Transition to ESG Models. Explor. ESG Chall. Oppor. Navig. Towards A Better Future 2024, 116, 127–143. [Google Scholar]

- Hillman, A.J.; Withers, M.C.; Collins, B.J. Resource dependence theory: A review. J. Manag. 2009, 35, 1404–1427. [Google Scholar] [CrossRef]

- Kulkarni, P.M.; Nayak, G. Applying the Resource Dependence Theory to Enhance Supply Chain Management of Small and Medium Scale Enterprises (SMEs) in the Context of COVID-19. Asia-Pac. Manag. Account. J. 2023, 18, 179–214. [Google Scholar] [CrossRef]

- Yin, M.; Ji, R.; Zhu, R.; Xu, S.; Sun, K.; Zhang, J.; Zhang, Y.; Reabroy, R. Performance and wake prediction of a ducted tidal stream turbine in yaw misalignment using the lattice Boltzmann method. Energy Convers. Manag. 2026, 347, 120574. [Google Scholar] [CrossRef]

- Co, H.C.; Barro, F. Stakeholder theory and dynamics in supply chain collaboration. Int. J. Oper. Prod. Manag. 2009, 29, 591–611. [Google Scholar] [CrossRef]

- Di Giuli, A.; Kostovetsky, L. Are red or blue companies more likely to go green? Politics and corporate social responsibility. J. Financ. Econ. 2014, 111, 158–180. [Google Scholar] [CrossRef]

- Barnett, M.L.; Jermier, J.M.; Lafferty, B.A. Corporate reputation: The definitional landscape. Corp. Reput. Rev. 2006, 9, 26–38. [Google Scholar] [CrossRef]

- Chen, X.; Lakkanawanit, P.; Suttipun, M.; Swatdikun, T.; Huang, S.-Z. Green technology innovation and corporate reputation: Key drivers of ESG and firm performance. Emerg. Sci. J. 2024, 8, 2501–2518. [Google Scholar] [CrossRef]

- Maaloul, A.; Zéghal, D.; Ben Amar, W.; Mansour, S. The effect of environmental, social, and governance (ESG) performance and disclosure on cost of debt: The mediating effect of corporate reputation. Corp. Reput. Rev. 2023, 26, 1–18. [Google Scholar] [CrossRef]

- Zhang, Y.; Ouyang, Z. Doing Well By Doing Good: How Corporate Environmental Responsibility Influences Corporate Financial Performance. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 54–63. [Google Scholar] [CrossRef]

- Quintana-García, C.; Benavides-Chicón, C.G.; Marchante-Lara, M. Does a green supply chain improve corporate reputation? Empirical evidence from European manufacturing sectors. Ind. Mark. Manag. 2021, 92, 344–353. [Google Scholar] [CrossRef]

- Bilyay-Erdogan, S.; Danisman, G.O.; Demir, E. ESG performance and investment efficiency: The impact of information asymmetry. J. Int. Financ. Mark. Inst. Money 2024, 91, 101919. [Google Scholar] [CrossRef]

- Kim, J.W.; Park, C.K. Can ESG performance mitigate information asymmetry? Moderating effect of assurance services. Appl. Econ. 2023, 55, 2993–3007. [Google Scholar] [CrossRef]

- Ji, Y.; Xu, W.; Zhao, Q.; Jia, Z. ESG disclosure and investor welfare under asymmetric information and imperfect competition. Pac.-Basin Financ. J. 2023, 78, 101982. [Google Scholar] [CrossRef]

- Chod, J.; Lyandres, E. A theory of ICOs: Diversification, agency, and information asymmetry. Manag. Sci. 2021, 67, 5969–5989. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, H.; Zhao, Z. SME investment and financing under asymmetric information. Eur. Financ. Manag. 2022, 28, 1347–1375. [Google Scholar] [CrossRef]

- Vosooghidizaji, M.; Taghipour, A.; Canel-Depitre, B. Supply chain coordination under information asymmetry: A review. Int. J. Prod. Res. 2020, 58, 1805–1834. [Google Scholar] [CrossRef]

- Qiao, R.; Zhao, L. Reduce supply chain financing risks through supply chain integration: Dual approaches of alleviating information asymmetry and mitigating supply chain risks. J. Enterp. Inf. Manag. 2023, 36, 1533–1555. [Google Scholar] [CrossRef]

- Wang, C.; Yu, D. The effect of corporate digitalization on supply chain financing: From the perspective of trade credit. Econ. Manag. Res. 2023, 44, 109–128. [Google Scholar]

- Love, I.; Preve, L.A.; Sarria-Allende, V. Trade credit and bank credit: Evidence from recent financial crises. J. Financ. Econ. 2007, 83, 453–469. [Google Scholar] [CrossRef]

- Li, Y.; Wu, Y.C.; Tian, X.Y. Enterprise ESG performance and supply chain discourse power. J. Financ. Res. 2023, 49, 153–168. [Google Scholar]

- Liu, Y.B.; Geng, X.L. Research on the relationship between marketing input, corporate social responsibility and corporate reputation under environmental uncertainty. Manag. Rev. 2021, 10, 159–170. [Google Scholar]

- Guan, K.; Zhang, R. Corporate reputation and earnings management: Efficient contracting or rent-seeking? Account. Res. 2019, 1, 59–64. [Google Scholar]

- Kaiser, H.F. The application of electronic computers to factor analysis. Educ. Psychol. Meas. 1960, 20, 141–151. [Google Scholar] [CrossRef]

- Li, J.; Ren, G.; Zhao, M.; Wang, M. Investor esg information dissemination and corporate esg performance: Empirical evidence based on online interactive platform. J. Financ. Econ. 2025, 51, 34–49. [Google Scholar]

- Yu, W.; Wang, M.; Jin, X. Political connections and financing constraints: Information effect versus resource effect. Econ. Res. J. 2012, 47, 125–139. [Google Scholar]

- Fang, X.; Hu, D. Corporate ESG performance and innovation: Evidence from A-share listed companies. Econ. Res. J. 2023, 58, 91–106. [Google Scholar]

- Liu, Z.; Wang, Y.; Hu, D. An empirical study on the impact of ESG ratings on supply chain value upgrading. Friends Account. 2025, 3, 91–99. [Google Scholar]

- Kane, L.T.; Fang, T.; Galetta, M.S.; Goyal Dhruv, K.C.; Nicholson Kristen, J.; Kepler Christopher, K.; Vaccaro Alexander, R.; Schroeder Gregory, D. Propensity score matching: A statistical method. Clin. Spine Surg. 2020, 33, 120–122. [Google Scholar] [CrossRef] [PubMed]

- Chen, S.; Liu, X. Economic policy uncertainty and corporate trade credit supply. J. Financ. Res. 2018, 5, 172–190. [Google Scholar]

- Jiang, T. Mediation and moderation effects in empirical research on causal inference. China Ind. Econ. 2022, 5, 100–120. [Google Scholar]

- He, G.; Wang, S.; Zhang, B. Watering down environmental regulation in China. Q. J. Econ. 2020, 135, 2135–2185. [Google Scholar] [CrossRef]

| Dimension | Index | Calculation Method/Definition |

|---|---|---|

| Consumers and society | Industry ranking by assets | The relative ranking of the company’s total assets within the same industry for that year. |

| Industry ranking by income | The relative ranking of the company’s total operating revenue within the same industry for that year. | |

| Industry ranking by net profit | The relative ranking of the company’s net profit within the same industry for that year. | |

| Industry ranking by market capitalization | The relative ranking of the company’s market value within the same industry for that year. | |

| Creditor | Liabilities-to-Assets ratio | Total liabilities/Total assets |

| Long-term debt ratio | Total long-term liabilities/Total assets | |

| Liquidity ratio | Directly obtained from the financial statements. | |

| Shareholder | Earnings per share | Directly obtained from the financial statements. |

| Pre-tax cash dividend per share | Directly obtained from the financial statements. | |

| Are the audits conducted by the big four accounting firms? | If the audit is conducted by one of the big four international accounting firms, it is assigned a value of 1; otherwise, it is assigned a value of 0. | |

| Corporation | The proportion of independent directors | Number of independent directors/Total number of board members. |

| Sustainable growth rate | Directly obtained from the financial statements. |

| Factor | Eigenvalue | Variance | Variance Explained | Cumulative Variance Explained |

|---|---|---|---|---|

| Factor 1 | 3.962 | 1.651 | 0.33 | 0.33 |

| Factor 2 | 2.311 | 1.211 | 0.193 | 0.523 |

| Factor 3 | 1.1 | 0.08 | 0.092 | 0.614 |

| Factor 4 | 1.021 | 0.116 | 0.085 | 0.7 |

| Factor 5 | 0.905 | 0.091 | 0.075 | 0.775 |

| Factor 6 | 0.813 | 0.075 | 0.068 | 0.843 |

| Factor 7 | 0.739 | 0.321 | 0.062 | 0.904 |

| Factor 8 | 0.418 | 0.134 | 0.035 | 0.939 |

| Factor 9 | 0.284 | 0.068 | 0.024 | 0.963 |

| Factor 10 | 0.216 | 0.052 | 0.018 | 0.981 |

| Factor 11 | 0.163 | 0.094 | 0.014 | 0.994 |

| Factor 12 | 0.069 | - | 0.006 | 1 |

| Principal Component | Eigenvalue | Variance | Variance Explained | Cumulative Variance Explained |

|---|---|---|---|---|

| Comp1 | 1.395 | 0.413 | 0.465 | 0.465 |

| Comp2 | 0.983 | 0.361 | 0.328 | 0.793 |

| Comp3 | 0.622 | - | 0.207 | 1 |

| Variable | Comp1 | Comp2 | Comp3 |

|---|---|---|---|

| LR | 0.431 | 0.806 | 0.406 |

| ILL | 0.699 | −0.014 | −0.715 |

| GAM | 0.571 | −0.592 | 0.57 |

| Type | Name | Symbol | Definition |

|---|---|---|---|

| Dependent variable | Supply chain financing | SCF | (Accounts receivable + notes receivable + prepayments − advances from customers − accounts payable − notes payable)/total asset |

| Independent variable | ESG performance | ESG | Comprehensive scores obtained from the CNRDs database |

| Mediating variables | Corporate reputation | REP | Based on 12 selected indicators, combined into a composite index through factor analysis |

| Information asymmetry | ASY | Constructed based on three stock liquidity indicators: liquidity ratio (LR), illiquidity ratio (ILL), and return reversal indicator (GAM), with principal component analysis applied | |

| Control variables | Firm size | Size | In (total assets) |

| Return on assets | Roa | Net profit at the end of the period/total assets | |

| Return on equity | Roe | Net profit/average balance of owners’ equity | |

| Net cash flow from operating activities | Cashflow | Net cash flow from operating activities/total assets | |

| Bank loans | Bank | (Long-term borrowings + short-term borrowings)/total assets | |

| Capital intensity | Cap | Total assets/operating revenue | |

| Financial leverage | DFl | EBIT/(EBIT − interest expenses − pre-tax preferred dividends) | |

| Ownership nature | Soe | Dummy variable: 1 if the firm is state-owned, 0 otherwise |

| Variable | Observations | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| SCF | 3619 | −0.027 | 0.126 | −0.593 | 0.515 |

| ESG | 3619 | 28.480 | 10.300 | 6.092 | 79.320 |

| Rep | 3619 | 0.193 | 0.552 | −1.808 | 1.991 |

| Asy | 3619 | −0.394 | 0.577 | −5.420 | 0.634 |

| Size | 3619 | 22.970 | 1.297 | 19.590 | 26.440 |

| Roa | 3619 | 0.036 | 0.054 | −0.358 | 0.255 |

| Roe | 3619 | 0.066 | 0.110 | −0.787 | 0.415 |

| Cashflow | 3619 | 0.051 | 0.068 | −0.196 | 0.267 |

| Bank | 3619 | 0.158 | 0.132 | 0 | 0.757 |

| Cap | 3619 | 2.747 | 2.514 | 0.378 | 18.560 |

| Fl | 3619 | 1.616 | 1.634 | −5.549 | 26.570 |

| Soe | 3619 | 0.618 | 0.486 | 0 | 1 |

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| SCF | SCF | SCF | SCF | SCF | |

| ESG | 0.001 *** (4.76) | 0.001 *** (5.23) | 0.001 *** (2.91) | 0.001 * (1.94) | |

| ESG2 | 0.000 ** (2.37) | ||||

| Size | −0.016 *** (−9.43) | −0.016 *** (−8.98) | −0.016 *** (−3.79) | −0.015 *** (−8.87) | |

| Roa | 1.496 *** (16.35) | 1.197 *** (13.92) | 1.197 *** (7.56) | 1.196 *** (13.89) | |

| Roe | −0.611 *** (−14.19) | −0.451 *** (−11.19) | −0.451 *** (−6.31) | −0.450 *** (−11.18) | |

| Cashflow | −0.231 *** (−6.98) | −0.284 *** (−9.36) | −0.284 *** (−6.35) | −0.284 *** (−9.36) | |

| Bank | 0.152 *** (8.53) | 0.143 *** (7.85) | 0.143 *** (4.04) | 0.143 *** (7.86) | |

| Cap | −0.001 * (−1.83) | 0.003 *** (3.31) | 0.003 ** (2.10) | 0.003 *** (3.29) | |

| Fl | 0.000 (0.31) | −0.001 (−0.66) | −0.001 (−0.46) | −0.001 (−0.69) | |

| Soe | −0.013 *** (−3.24) | −0.016 *** (−4.00) | −0.016 (−1.61) | −0.016 *** (−3.94) | |

| _cons | −0.054 *** (−8.83) | 0.295 *** (7.93) | 0.296 *** (7.69) | 0.282 *** (3.19) | 0.301 *** (7.81) |

| Ind FE | NO | NO | YES | YES | YES |

| Year FE | NO | NO | YES | YES | YES |

| N | 3619 | 3619 | 3619 | 3619 | 3619 |

| R2 | 0.01 | 0.12 | 0.33 | 0.33 | 0.33 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| ESG | SCF | ESG | SCF | |

| Z1 | 0.478 *** (26.25) | |||

| Z2 | 0.686 *** (20.38) | |||

| ESG | 0.001 *** (3.97) | 0.003 *** (4.22) | ||

| LM Statistic | 383.142 | 269.657 | ||

| Wald F Statistic | 904.051 | 501.346 | ||

| Control Variables | YES | YES | YES | YES |

| Industry/Year | YES | YES | YES | YES |

| Sample Size | 3289 | 3289 | 3611 | 3611 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| PSM | Alternative Variable | Interaction Fixed Effects | Shorten Time Window | |

| ESG | 0.001 *** (2.74) | 0.000 * (1.94) | 0.001 *** (3.21) | 0.001 ** (2.28) |

| Controls | YES | YES | YES | YES |

| _cons | 0.258 *** (3.88) | 0.275 *** (7.82) | 0.285 *** (7.10) | 0.293 *** (6.43) |

| Ind FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| N | 1699 | 3619 | 3619 | 2631 |

| R2 | 0.33 | 0.43 | 0.17 | 0.34 |

| Variable | (1) | (2) |

|---|---|---|

| REP | ASY | |

| ESG | 0.001 ** (2.44) | −0.004 *** (−4.70) |

| Control | YES | YES |

| _cons | −7.607 *** (−76.91) | 5.497 *** (−29.98) |

| Ind FE | YES | YES |

| Yea FE | YES | YES |

| N | 3619 | 3619 |

| R2 | 0.86 | 0.55 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| SOE | Non-SOE | Large Enterprise | Small and Medium-Sized Enterprise | Non-Heavy-Polluting Enterprise | Heavy- Polluting Enterprise | High-Tech Enterprise | Non- High-Tech Enterprise | |

| ESG | 0.001 ** (2.39) | 0.000 (0.72) | 0.001 ** (2.26) | 0.001 (1.58) | 0.001 *** (3.01) | 0.000 (1.15) | 0.001 *** (2.60) | 0.000 (1.18) |

| Control | YES | YES | YES | YES | YES | YES | YES | YES |

| _cons | 0.198 *** (3.78) | 0.419 *** (6.89) | 0.270 *** (4.60) | 0.622 *** (4.83) | 0.289 *** (5.64) | 0.241 *** (4.50) | 0.074 (1.40) | 0.551 *** (10.08) |

| Ind FE | YES | YES | YES | YES | YES | YES | YES | YES |

| Yea FE | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 2234 | 1382 | 2497 | 1116 | 2335 | 1283 | 2023 | 1595 |

| R2 | 0.34 | 0.40 | 0.34 | 0.41 | 0.32 | 0.32 | 0.33 | 0.32 |

| Coefficient Difference Value | 0.000 | 0.000 | 0.000 | 0.000 | ||||

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Firm Nature | Firm Size | Pollution Level | High-Tech Level | |

| ESG × SOE | 0.001 * (1.94) | |||

| ESG × Size | −0.001 ** (−2.17) | |||

| ESG × Pollute | −0.001 ** (−2.02) | |||

| ESG × High-tech | −0.002 *** (−4.13) | |||

| _cons | YES | YES | YES | YES |

| Ind FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| N | 3619 | 3619 | 3619 | 3619 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, F.; Wang, Y.; Su, X.; Yang, J.; Yu, H.; Ock, Y.-S. Corporate ESG Performance and Supply Chain Financing: Evidence from China. Sustainability 2025, 17, 10551. https://doi.org/10.3390/su172310551

Wu F, Wang Y, Su X, Yang J, Yu H, Ock Y-S. Corporate ESG Performance and Supply Chain Financing: Evidence from China. Sustainability. 2025; 17(23):10551. https://doi.org/10.3390/su172310551

Chicago/Turabian StyleWu, Fengpei, Yijing Wang, Xiang Su, Jing Yang, Hongjuan Yu, and Young-Seok Ock. 2025. "Corporate ESG Performance and Supply Chain Financing: Evidence from China" Sustainability 17, no. 23: 10551. https://doi.org/10.3390/su172310551

APA StyleWu, F., Wang, Y., Su, X., Yang, J., Yu, H., & Ock, Y.-S. (2025). Corporate ESG Performance and Supply Chain Financing: Evidence from China. Sustainability, 17(23), 10551. https://doi.org/10.3390/su172310551