1. Introduction

As the effects of ongoing climate change challenges become more pressing and the societal and political pressure to decarbonize the economy increases, hydrogen technology has gained significant attention as a stepping stone to a sustainable energy future [

1]. Especially in Germany, a country with ambitious climate targets, supported by the National Hydrogen Strategy [

2], hydrogen is seen as one essential technology to realize the energy transition. It is particularly relevant for sectors where electrification is either technically or economically challenging, such as heavy industry, large-scale transportation, and production [

3].

The topic of transformation is not a future challenge but one of current relevance. First, an energy transformation (innovation plus diffusion) takes several decades [

4] and hence needs to be started with a lead time. Second, especially in Germany, time is pressing, as the country wants to position itself as a frontrunner in hydrogen [

2].

From an academic perspective, research on how organizations organize such transformations is limited, as existing studies focus on either the technical side of hydrogen technology, such as production (e.g., [

5]), storage (e.g., [

6,

7]), transportation (e.g., [

6,

8]) or utilization processes (e.g., [

9]), or on international, national and regional policies and strategies (e.g., [

10]). The focus on this particular area of the energy system in Germany, combined with the use of the dynamic-capability perspective, is a novel approach that has not been taken in the literature so far. Unlike previous studies, it illustrates the early-stage adaptation processes and iterative learning in a high-uncertainty, infrastructure-heavy context. This is even more true when we focus our scope on regional energy suppliers, an important backbone for Germany’s energy sector [

11]. This leads to the central research question of this work: How do German energy sector companies adapt their strategy in response to the increasing importance of hydrogen technology? We will apply the theory of dynamic capabilities to answer this research question.

2. Theoretical Background and State of Research

The transformation of the energy sector, particularly in industrialized economies such as Germany, is characterized by heightened complexity, uncertainty, and interdependence. In this rapidly evolving context, companies can no longer rely solely on their existing competencies or historically successful business practices to maintain competitiveness. Instead, continuous development and renewal of strategic and operational capabilities are essential to respond effectively to shifting market dynamics, regulatory landscapes, and technological advancements [

12].

To address these challenges, the dynamic capabilities framework, initially proposed by David Teece and colleagues, has emerged as a critical theoretical lens. This approach underscores the importance of organizational processes, routines, and managerial decision-making mechanisms that enable companies to sense environmental changes, seize emerging opportunities, and reconfigure internal resources accordingly [

13,

14]. Unlike traditional operational capabilities, which prioritize efficiency and performance in stable environments, dynamic capabilities emphasize adaptability and resilience in the face of uncertainty and volatility.

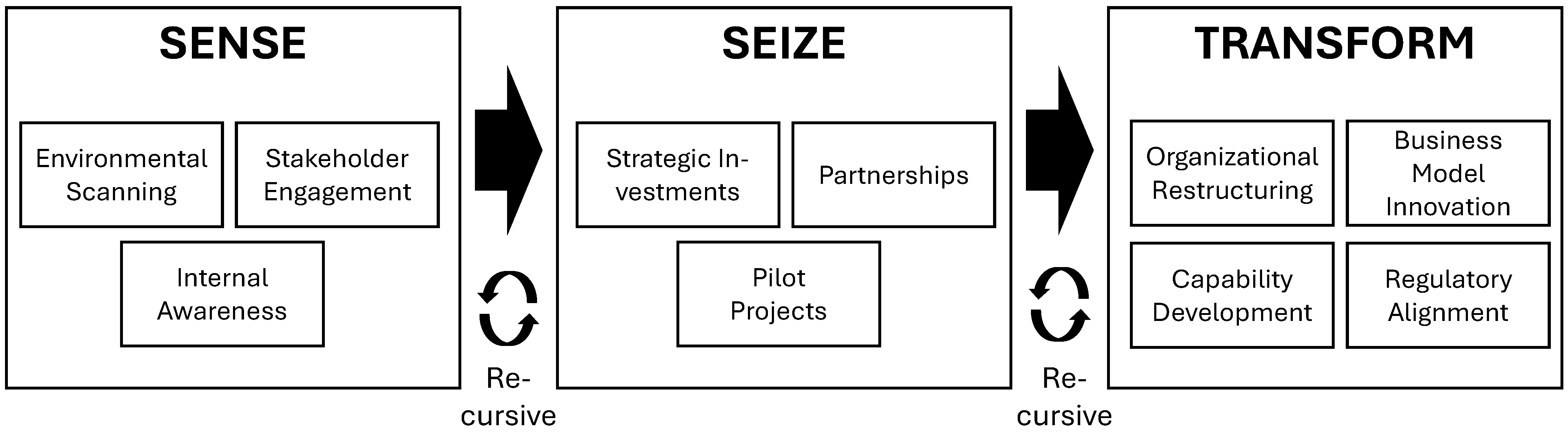

At the core of the dynamic capabilities framework are three main functions: sensing, seizing, and transforming.

Sensing is a key part of dynamic capabilities, which help companies stay competitive in fast-changing markets [

13]. It refers to a company’s ability to recognize and understand changes, opportunities, and risks in the environment around it [

14]. Sensing requires ongoing efforts to look out for new technologies, customer needs, competitor actions, and changes in laws or regulations [

15]. It is more than just gathering information; companies must also make sense of what they find so they can make better decisions [

13]. Companies that are good at sensing can spot new opportunities earlier than others and adjust their resources and strategies to take advantage of them, which helps them innovate and perform better over time [

16]. Without strong sensing skills, companies tend to react slowly and may lose their advantage. Therefore, sensing is essential for companies to remain flexible and successful in uncertain and changing markets [

13].

After sensing opportunities or threats in the environment, the organization then seizes them through timely and effective action. Seizing is therefore the second key element in the dynamic capabilities framework and follows sensing [

14]. Once a company has identified opportunities or threats through sensing, seizing refers to its ability to act on them effectively by mobilizing resources and making decisions that capture value [

13]. Companies must often commit significant resources and align internal processes to make the most of the opportunities they have sensed [

15]. Seizing also requires leadership and organizational flexibility, as companies may need to take risks, innovate, or even abandon existing practices to adapt successfully [

13].

First, companies sense opportunities, then seize them by acting fast, and finally transform their organization to maintain long-term success and adaptability. Transforming is the third key element in the dynamic capabilities framework and completes the cycle after sensing and seizing [

14]. It refers to a company’s ability to continuously renew and reconfigure its resources, processes, and organizational structure to remain competitive in changing environments [

13]. Transforming involves changing routines, reallocating resources, building up new competencies, and sometimes reshaping the company’s culture to adapt to new conditions or to prepare for future changes [

16]. For example, a company might reorganize its production system or develop new capabilities to support innovation and growth. This might also involve changing the business model of the organization. This capability is vital because markets and technologies evolve constantly. Without ongoing transformation, companies risk becoming rigid and unable to respond effectively to new challenges or opportunities [

14].

Adapting a business model depends on ongoing development and the ability to innovate within the company. Managers play an important role in promoting organizational flexibility and responsiveness to new developments. When companies are able to respond swiftly and effectively to shifting customer preferences, technological advances, or competitor actions, their business models evolve accordingly. This evolution is necessary to sustain a competitive advantage in markets characterized by uncertainty and rapid change [

17].

The existing literature on business model adaptation is extensive, frequently examining how companies modify their approaches to value creation and capture in response to technological advancements or regulatory shifts. Early research highlighted the necessity for companies to restructure their operations and processes in uncertain environments to maintain competitiveness [

15]. A central argument in this field is that adaptation occurs through specific high-level activities, such as identifying new opportunities, allocating resources, and reorganizing the company, that enable change [

14].

In the energy sector, studies of established utilities demonstrate that companies often respond to change by incrementally adjusting their portfolios, forming strategic partnerships, and expanding into adjacent service areas [

18]. Given the asset-intensive and highly regulated nature of the energy sector, such adaptations tend to unfold gradually and in a sequenced manner. A study in Norway reveals that the general transition from fossil to renewable energy can be supported by dynamic capabilities, specifically having a broad search window, exploring initiatives, fostering new business, seeking partnerships, and changing the organization. However, the study does not specifically deal with hydrogen or municipal companies; it offers valuable insights into which dynamic capabilities might be beneficial [

19]. Another study with a similar generic focus analyzes the Dutch energy sector, equally illustrating activities that fall under dynamic capabilities to realize the transition towards renewable energy [

20]. Yet, these studies do not reflect the situation in Germany or the specific capabilities for hydrogen.

Research on prosumer energy models, particularly in Germany, reveals that new services and market roles emerge as companies integrate decentralized technologies [

21]. While these studies provide valuable insights into the mechanisms of change, they rarely address how companies develop and deploy the capabilities required to adapt when technology, infrastructure, and regulation evolve simultaneously, as is currently the case with hydrogen in Germany.

Research on hydrogen in Germany has expanded rapidly in recent years. International reports confirm that the majority of global hydrogen production still relies on fossil sources, with low-emission hydrogen accounting for less than one percent of total output [

22]. In Germany, hydrogen is positioned as a critical component of the energy transition, especially in sectors such as steel, chemicals, and other hard-to-abate industries [

2]. The updated National Hydrogen Strategy sets a target of at least 10 GW of electrolysis capacity by 2030 while also recognizing the necessity for substantial imports.

When looking at the German setting, three themes in the literature are relevant for understanding adaptation. The first focuses on the electricity sector, where incumbents have adjusted to the growth of renewables by rebalancing portfolios, investing in flexibility, and creating new service-based revenue streams. Studies here highlight gradual, regulated adaptation and offer indirect lessons on capability building in infrastructure-heavy sectors [

18]. The second theme covers industrial pathways for hydrogen use, such as direct reduced iron in steelmaking or renewable ammonia in chemicals. These studies give cost estimates, technological readiness levels, and required policy support [

22], but rarely detail the organizational skills and decision-making routines needed to move from pilot to large-scale deployment. The third theme analyzes policy and regulation, especially the role of EU certification rules and infrastructure planning in enabling or constraining projects [

23]. While valuable, those works tend to describe the system context rather than examining company-level adaptation processes. Dynamic capabilities were developed to explain how established companies in mature industries can transform and adapt to new market requirements, ensuring their long-term success even under heavily changing conditions [

13]. German municipal companies are typically well-established companies in a long-established local energy supply industry. These established companies have to deal with a new energy form to be included in their portfolio that has different requirements for production, storage, and infrastructure than existing products. We therefore argue that those companies need to transform to include this energy form in their future portfolio, as well as push and actively develop the hydrogen transition in Germany.

This absence of detailed capability-focused research on hydrogen transition matters because hydrogen in Germany is developing under unusual conditions. Unlike previous energy transitions, where companies could adapt to technologies and policies that were already relatively stable, here companies must act while rules, infrastructure, and technologies are still being defined. This calls for repeated cycles of sensing opportunities, seizing them through strategic commitments, and reconfiguring assets and partnerships as conditions change. Capturing these processes empirically will help to connect the established theory of dynamic capabilities with the specific challenges and opportunities that hydrogen presents to organizations in the energy sector.

3. Materials and Methods

This study uses a qualitative research design to explore how German energy companies adapt their business models when adopting hydrogen technologies. The approach enables the identification of common strategies and challenges in adapting business models to hydrogen technologies, while also accounting for company-specific contexts.

In qualitative research, various types of interviews are used to collect firsthand data. Depending on the research objectives, different interview types can be used. Most studies categorize single-respondent interviews into three main types: structured interviews, semi-structured interviews, and unstructured interviews [

24]. For this study, semi-structured interviews were chosen. This type of interview follows a structured format with prepared questions, providing a degree of uniformity while allowing flexibility based on the conversation flow. This approach enables the probing of relevant parts of answers to collect sufficient in-depth data in order to address the research questions. Semi-structured interviews can include both open and closed questions. This approach allows the answers of participants to be explored in depth with open questions and ensures their answers are understood correctly by asking a yes or no question as a follow-up. Therefore, semi-structured interviews are most suited for this study. The interviews were conducted in German, and all quotes and information derived from them have been translated into English to make this research accessible to a larger audience. The aim was not to test hypotheses but to explore patterns that could contribute to theory formation. For this study, a mixture of deductive and inductive codes was used based on the research questions and theoretical background. First, initial codes were deducted while reading the interviews. Then, these open codes were sorted into broader categories that appeared while going through the text line by line. Additionally, all the coded segments were analyzed during this process, and relationships between codes were crystallized.

Three companies were chosen for the study. All of them operate in the German energy sector and are already working with hydrogen in some way, but they are not identical. They are typical examples of regional medium-sized energy providers. The companies had to be active in hydrogen adoption, operate mainly in Germany, supply energy to customers, and differ enough from one another to allow for meaningful comparisons. For the analysis and presentation of this study, the data were anonymized.

The final sample consisted of three organizations:

Company A: This organization is a regional city-based energy provider, a much older municipal utility located in Northern Bavaria. With under 100 employees and over 13,000 customers, the company is deeply committed to renewable energy. The company is also highly involved in future energy projects around smart grids, energy storage, and digital technology. The interview was conducted with a senior expert of this organization.

Company B: This limited liability company is a municipal utility with under 100 employees, also based in Northern Bavaria. It provides a broad range of services, including electricity, water, heating, gas, internet, telephone, e-mobility, and leisure facilities to several thousand customers. The interview was conducted with the managing director of this organization.

Company C: This is a mid-sized limited liability utility company, also based in South Germany. With a workforce of between 201 and 500 employees, the utility company delivers to more than 35,000 customers, both residential and commercial. Following the foundation of a hydrogen hub, the company produces up to 1200 tons of green hydrogen annually. The interview was conducted with the head of the business development and innovation department.

The main source of information came from semi-structured interviews with experts from each company. These took place between late July and early August 2025. Each conversation lasted about 20–30 min. All interviews were recorded with permission and later transcribed, but the recordings were only used to make sure the written transcripts were accurate. The interview guide was based on the dynamic capabilities framework [

14]. It included open questions designed to uncover how the companies sense opportunities or risks, how they seize them through action, and how they transform their structures to stay competitive. Interviewees were encouraged to share specific examples from their work, rather than just general views, so the answers would be concrete and practical.

After the interviews were transcribed, they were analyzed using qualitative content analysis [

25]. This analysis followed a deductive approach, meaning the main categories—sensing, seizing, and transforming—were taken from existing theory rather than developed from scratch. Each interview was examined on its own before being compared to the others. To make the results more reliable, several loops were taken. To reduce bias, interview transcripts were double-checked against audio recordings. While coding was performed by a single researcher, it was cross-checked by the other researchers. Every step of the process, from finding the companies to analyzing the data, was documented in detail. All three companies in this study are operating in this unsettled environment. Each is adapting its business model to meet both the pressures and the opportunities that come with the growth of hydrogen.

4. Results

The presentation of results will be documented in three sections. In the first section, we will describe the approach of hydrogen adoption and relevant background information, such as the organizational structure for each company. In a second step, we will systematically link and compare the activities of each company following the dynamic capabilities logic. Finally, we will draw conclusions from our comparative analysis, illustrating similarities and differences as well as highlighting good practices.

4.1. Company A

Company A approaches hydrogen not as a distant possibility but as an integral part of the future energy system. The company’s interest is grounded in concrete developments: through constant monitoring of industry trends and close cooperation with associations, it ensures that technological and regulatory changes are recognized early. Engagement with external organizations serves not only to stay informed but also to position the utility within a network that can provide both expertise and practical experience. Networking is an important element to stay updated “via the associations, i.e., the DVGW [German association for gas and water industry] for, and the latest newsletters from the various organizations, for example ‘Zukunftsgas’ [translated Futues Gas] or ‘Gas und Wasserstoff’ [translated gas and hydrogen], of which we are also a member, which always deal with projects related to hydrogen.”

Inside the company, a small but focused research group takes responsibility for gas and hydrogen projects. This concentration of knowledge ensures that innovations are developed in-house and adapted to the existing infrastructure. The team functions as a link between traditional gas operations and the emerging hydrogen sector, enabling a gradual and controlled shift. Organizationally, the company has adapted its structure to meet the demands of hydrogen technology. A gas and water engineer has been given oversight of hydrogen operations, ensuring that technical execution and compliance go hand in hand. Business model adjustments have also been made. For example, customers can choose to pay a premium for water and hydrogen products that align with sustainability goals. This not only supports financing but also creates a direct link between customer behavior and environmental benefits.

Pilot projects form another pillar of the strategy. One such initiative examines the storage and supply of hydrogen. These small-scale experiments are essential for testing concepts under real conditions, identifying challenges, and developing solutions before scaling up.

Market positioning is shaped by early adoption. Company A has leveraged its first-mover advantage to present itself as an experienced actor in the hydrogen field. However, the company is aware of the risks associated with this position: Safety compliance, including technical safety certification, and technical resilience are therefore treated as priorities. Customer and societal impacts are central to the concept. By offering sustainable products at a premium, the utility allows the public to participate actively in the energy transition. This strengthens local acceptance and fosters a sense of shared responsibility.

Despite the progress made, challenges remain. Safety concerns and regulatory requirements are not merely formalities but factors that can slow implementation. Navigating these safety and regulatory hurdles means aligning project design with frameworks like the EU Hydrogen and Decarbonized Gas Market Package and Germany’s National Hydrogen Strategy, which embed strict technical standards, certification systems, and regulated cost-recovery mechanisms into hydrogen infrastructure development.

4.2. Company B

Company B directs its environmental scanning towards the stabilization of the energy system and places hydrogen at the center of this task. It is not treated as a secondary innovation but as a structural component for maintaining grid balance in an increasingly decentralized energy landscape. This perspective is technically grounded and links hydrogen directly to infrastructural resilience rather than focusing solely on market opportunities.

Collaboration is an important element of the company’s approach, which works closely with universities and research institutions, creating a cycle in which academic insights influence practical applications, and operational experience is fed back into scientific work. This not only strengthens the quality of hydrogen projects but also allows the company to contribute to policy development through credible, research-based examples.

Within the organization, there is a clear understanding that hydrogen plays a decisive role in system stability, and this awareness is embedded in decision-making and daily operations. Hydrogen is integrated into a broader multi-energy strategy that links gas, electricity, and storage solutions. Such integration prevents the creation of isolated projects and ensures that innovation is supported across departments.

The company’s strategic investments show a willingness to develop new business models, particularly in the area of sector coupling. Funds are directed towards ventures that expand the organization’s role from that of a traditional utility to an energy producer and service provider within hydrogen value chains. When selecting partners, shared objectives are prioritized over short-term profits, making cooperation more stable over the long-term timeframes typical of hydrogen infrastructure projects.

Pilot projects form an essential part of this strategy. Hydrogen is incorporated into trials that examine its role in energy storage, grid balancing, and integration of renewables under real operating conditions. These projects serve both as technical experiments and as a means of building trust among stakeholders. A significant organizational change was the creation of a separate company for hydrogen activities, which enables a more focused and flexible management approach as well as targeted investment.

Alongside this, the business model has been adapted to offer hydrogen as part of broader service packages rather than as a stand-alone product. This allows the company to add value through integration and reliability. The company has also expanded its capabilities in gas processing, electrolysis operation, and multi-energy system management while strengthening project management and regulatory expertise. The new business models were co-created with new partners, which also played an important role in the implementation of these business models. Company B states that these new partnerships had to be developed, illustrating that this is not a short-term activity.

“So, we actually developed new partnerships, of course we developed a business model and then implemented it with partners. In other words, we didn’t implement it within the company alone, but looked for partners with similar interests or partial interests and then rounded off the business case accordingly” (Company B).

The greatest challenges for company B remain technical integration, regulatory complexity, and organizational adaptation. These require persistence and adaptability, qualities the company continues to develop as it advances its role in the German hydrogen transition.

4.3. Company C

This mid-sized utility company, as presented in the interview with the head of business development and innovation, clearly identifies hydrogen as an essential element of the future energy landscape. It is not described as a supplementary option but as a key driver for Germany’s energy transition and its long-term environmental objectives. This assessment is based not only on a vision for the future but also on a realistic understanding of current market developments and national policy priorities.

Partnerships are a central part of this strategy. The company views external cooperation as crucial for gaining access to the expertise and practical experience needed in the hydrogen sector. These partnerships are not limited to sharing resources; they are also a way to integrate knowledge into the organization so that it can respond to rapid technological and regulatory changes.

Within the company, responsibility for hydrogen projects lies with the business development and innovation team. This ensures that hydrogen-related initiatives are strategically embedded in the company’s operations rather than being treated as separate trials. Such a structure allows for quick adjustments when conditions in the market or in policy shift.

One defining characteristic of the company’s approach has been the early mobilization of resources. Funding and partnerships were secured at an early stage, which reduced the risks connected with entering a developing market. Once again, cooperation plays a decisive role, as it can not only open doors to additional funding and enhance the credibility of projects but also reduce the number of unknown variables. Good networking with partners, such as universities, is considered a promising strategy.

The company’s engagement with hydrogen began in 2020 with the development of a formal adoption concept. This step was part of a deliberate strategy to prepare for upcoming technological changes and to move gradually from planning to actual implementation. In parallel with these technological steps, the organization has also expanded. The creation of a multicultural business environment shows that innovation is not limited to technology alone. A diverse workforce can encourage creativity, improve problem-solving, and increase adaptability in a constantly changing sector.

Hydrogen is also a completely new business area for the company. This development makes targeted recruitment and the training of technical specialists essential. Such investment in human capital demonstrates the company’s understanding that technical change must be accompanied by skill development. However, there are still challenges. The speed of hydrogen adoption is strongly influenced by operational readiness, quickly changing regulations such as the EU Hydrogen and Decarbonized Gas Market Package and Germany’s National Hydrogen Strategy, and questions of economic viability. The company seems to address these factors by combining ambition with caution, advancing where possible but avoiding overextension in uncertain conditions.

The company is also aware of the social and political aspects of the energy transition. Alongside financial risks, social acceptance and public perception are recognized as critical factors for success. Public communication is therefore used to prevent misunderstandings and to build trust in hydrogen projects. This strengthens the organization’s legitimacy and can help secure long-term support.

4.4. Activities Linked to Dynamic Capabilities

The transcribed interviews were systematically analyzed to identify activities that refer to one of the three dynamic capabilities: sensing, seizing, and transforming. The results are presented in a comprehensive overview, showing which activities are taken by each organization (see

Table 1).

First, some interviews confirmed that the transition towards hydrogen goes along with a clear change in competencies in the companies. As Company B states, “hydrogen expertise, gas production is of course completely different from dealing with natural gas. […] It’s about rebuilding production processes, i.e., understanding them, accompanying the production processes—we had to completely rebuild that.” One interviewee, however, also stated some similarities between the competences needed for natural gas and hydrogen.

Sensing—The companies showed a strong awareness of their external environment in their hydrogen activities. They monitored new policy developments, funding programs, and regional initiatives. Several companies actively participated in working groups and maintained a regular dialogue with universities and technology providers to stay updated. Rather than relying on internal research, they drew on partnerships and networks to navigate a field still full of uncertainty. Specific examples include participation in networks like HyExperts or initiatives like H2P, as well as the use of dedicated trend databases like TrendOne.

Seizing—After identifying opportunities, the companies seized this opportunity—sometimes faster than one might expect from public utilities. In one case, a utility quickly applied for government funding and co-financed a pilot plant. Another company joined forces with local partners to launch a feasibility study for hydrogen in a new use case. These steps often required convincing internal stakeholders and a willingness to experiment. Despite limited resources, the utilities showed they were willing to take calculated risks at an early stage. Examples include co-creation workshops with partners to develop new business models or pilot projects in specific applications, yet with an uncertain business perspective. However, not all activities lead to new projects, as Company C states, “Many projects get stuck in the concept phase. It is only in practice that you see the real problems.” This also illustrates the importance of specific projects in the learning process.

Transforming—Engaging with hydrogen also triggered deeper changes inside the organizations. Some utilities set up dedicated teams to coordinate hydrogen-related work or the founding of new entities, while others adapted their planning and investment strategies to reflect long-term hydrogen goals. Staff training sessions and knowledge-sharing are specific examples of how companies ensured and drove transformation. As Company C states, “[…] hydrogen was not established in our organization: processes, expertise, and dependencies had to be built from scratch.” In many cases, lessons learned from pilot initiatives were fed back into strategy discussions, helping the companies reorient themselves in a changing energy landscape. The formation of dedicated teams and the founding of new entities clearly show the organizational impact: “We have a small research group here that accompanies various research projects here, i.e., European and also German and Bavarian projects” (Company A).

Dynamic Capabilities—Rather than proceeding linearly, the dynamic capabilities observed in the cases evolved in overlapping and iterative cycles. For instance, early sensing activities (e.g., workshops or monitoring) directly influenced seizing actions (e.g., joint project applications), which in turn prompted organizational transformation (e.g., creating new teams). Knowledge from transformations was input for new sensing cycles—e.g., lessons from pilot projects raised awareness of further opportunity spaces. This illustrates the intertwined nature of dynamic capabilities in an emerging, high-uncertainty environment such as hydrogen.

4.5. Similarities and Differences

Our third section will focus on the comparative analysis of the three companies, illustrating common practices but also differences in their approaches. All researched companies have a number of important similarities that explain why all three have been able to make progress in the field of hydrogen projects. Each of them relies on internal teams that are responsible for research and development, underlining the importance they attach to having in-house expertise rather than depending entirely on external input. This internal capacity is complemented by steady investment in new technologies and in the skills of the workforce. The companies treat training as an essential part of remaining competitive in an evolving energy market and have all integrated it into their operations.

Furthermore, partnerships play a key role for all three, as cooperation is viewed as essential for accessing resources, sharing knowledge, and accelerating progress. They work within the necessary regulatory frameworks and agree on the importance of sustainability and communication with stakeholders. For each company, economic feasibility is a crucial consideration, as projects must not only contribute to environmental goals but also be financially viable.

Although these similarities provide common ground, their approaches reveal notable differences. Company A maintains a strong focus on associations and political engagement, using networks to keep track of policy developments and to position itself strategically. Company B takes a different route, prioritizing collaboration with universities and research institutions while paying less attention to broad external stakeholder groups. Company C places its emphasis on strategic partnerships, carefully selecting collaborators that can contribute funding, technical expertise, and market access. The degree of external orientation also varies: Company B is more inward-looking, concentrating on internal system stability and academic connections, while Company A and Company C cultivate wider and more diverse networks. The partnerships observed include (1) public–private partnerships, (2) firm–university collaboration, and (3) firm–firm alliances.

The way they perceive hydrogen’s role in their operations further differentiates them. For Company A, hydrogen is seen as an expansion of its existing business, opening new revenue streams through private investments and customer premiums for green gas. Company B and Company C, however, regard it as a completely new business field, representing a diversification into emerging markets rather than an extension of their current services. This difference in perspective is reflected in their staffing approaches. Company B and Company C both needed to hire new qualified workers to meet the specific demands of hydrogen projects, whereas Company A has integrated the technology into its existing team without major changes in personnel.

The pace of adoption also sets them apart. Company A and Company B are early adopters, willing to commit to hydrogen technologies at an early stage and take on the associated risks, such as developing safety regulations, underdeveloped technical standards, and technical uncertainties in general. Key triggers of adoption include regulatory updates, funding availability, and customer expectations. Company C has chosen a more cautious path, acting as a follower that enters the field after uncertainties have been reduced and successful models have been demonstrated elsewhere. Differences can also be found in their business models. Company A’s approach connects hydrogen activities directly to consumer revenue, with products such as green gas premiums embedded in its established service offering. Company B and Company C adopt a broader view, incorporating hydrogen into a wider portfolio of innovative projects with long-term potential, rather than relying on immediate consumer sales. Company B illustrates that its early business focus and comprehensive strategic plan have led to the systematic development of new business models incorporating hydrogen technology and knowledge.

In summary, the three companies are united by their commitment to building internal expertise, investing in technology and skills, forming partnerships, running active projects, and ensuring that economic and environmental goals are met. We identified these activities as dynamic capabilities (see

Figure 1). At the same time, they differ in how they engage with external actors, how they define hydrogen’s place within their strategies, how they handle staffing requirements, and how quickly they move to adopt new technologies. Company A is politically well-connected and oriented toward direct consumer monetization, Company B relies on academic collaboration and internal stability, and Company C focuses on carefully chosen strategic alliances combined with a deliberate entry into the market. These similarities and differences reflect each company’s specific environment, priorities, and market position, while showing that they share the common aim of making hydrogen a key element of a sustainable energy future.

5. Discussion

The empirical results show how three German energy companies are reshaping their business models in response to the emerging hydrogen economy. Using Teece’s dynamic capabilities framework, which links the processes of sensing, seizing, and transforming, these cases show how companies can remain competitive in volatile environments. The findings also connect with the wider literature on business model adaptation [

17,

26], where organizations must constantly reconfigure the way they create and capture value to cope with external disruptions. The strategies of the three companies both support and, in some areas, challenge the dynamic capabilities framework. Policy and technical constraints appear throughout as important forces shaping these adaptations [

10,

27].

Sensing, the ability to spot and interpret changes in the external environment [

14], is the essential first step when adapting to disruptive technologies like hydrogen. Each company approaches sensing differently, shaped by its priorities and resources. However, for all companies, partnerships are important, which is in line with existing literature on dynamic capabilities in the renewable energy sector [

19]. They are rooted in networks of partners, drawing on industry associations, along with manufacturer information and industry updates. This fits Teece’s view that scanning through partnerships and stakeholder engagement is key. Further collaborations include partnerships with universities. This reflects the exploratory learning described by Eisenhardt and Martin, where organizations invest in knowledge creation to anticipate future needs [

15]. Academic partnerships can help to understand and evaluate opportunities before making large investments. This is especially relevant in technologically uncertain situations [

28]. Partnerships can help to obtain news and insights from the industry, which might be further enhanced by a systematic scanning for industry updates. This can be achieved pragmatically (newsletters) or in a structured way with tools like Trend One. A structured approach fits Teece’s recommendation of integrating sensing into core business processes, which supports faster decisions and better resource allocation [

12]. These contrasting approaches underline that sensing is always shaped by context [

13].

Once opportunities are identified, the seizing stage comes next. The three companies take noticeably different paths, making our findings more ambiguous in this area. Company A pursues a high-commitment strategy with its Power-to-Gas plant, developed alongside Green Planet Energy. This fits Zollo and Winter’s idea of experimental seizing, where pilot projects test business models before scaling [

16]. It is also market-focused, directly tying sustainability to profitability [

17]. Company B’s seizing strategy is narrower but highly targeted. It concentrates on system integration, particularly using hydrogen for grid stability and sector coupling. This reflects strategic niche management [

29], where companies specialize in high-value niche applications to build credibility and expertise. By running hydrogen pilots with partners, Company B limits its risk while proving viability in real-world settings. Company C takes a more cautious route, leaning heavily on partnerships. It secures external funding and technical know-how before committing to major market moves, making heavy use of external resources.

Transforming, which means reconfiguring structures, processes, and culture for sustained competitiveness [

13], is the third and last capability. Here too, strategies differ. Company A takes an incremental route, folding hydrogen into its existing organization, if possible, without new hires developing existing staff. This avoids major disruption and builds capacity gradually, though it may limit rapid scaling if demand rises quickly. For SMEs, such a resource-conscious transformation is common [

26], and in Company A’s case, it expands on existing gas assets. Company B takes a bigger leap, creating a dedicated hydrogen subsidiary. This allows focused investment and faster decisions, in line with Teece’s [

12] argument that transformation often needs organizational ambidexterity, exploiting current strengths while exploring new ones. A promising strategy that might lead to higher innovation performance [

30]. The company also invests in internal and external training, highlighting how skill-building is central to transformation. Company C blends the two approaches. It sets up a multicultural business unit and hires specialists in engineering, sales, and marketing. All three approaches confirm that transformation is not a one-off event but an ongoing process [

12].

In summary, several points stand out. First of all, sensing varies with context, external networks, research partnerships, and hybrid scanning; each of them suits different needs. Second of all, seizing is about balancing risk and collaboration, whether through bold moves like Company A’s Power-to-Gas plant or more cautious partnerships. Third, transformation is ongoing and works best when aligned with sensing and seizing. Finally, business model adaptation is an iterative process, requiring constant adjustment of value creation and capture to meet external challenges.

6. Conclusions, Limitations, and Further Research

Teece’s dynamic capacities framework served as the foundation for this thesis, which looked at how German energy businesses modified their business plans in response to the growing significance of hydrogen technology.

Taken together, the findings illustrate that the processes of sensing, seizing, and transforming are not isolated but closely intertwined in the context of hydrogen adoption. Business models are being adapted dynamically in response to shifting technological trajectories, changing market demands, and regulatory developments. Strategic partnerships—whether with firms, government bodies, or research institutions—play an important role in bridging capability and resource gaps, enabling organizations to pursue innovation pathways. Although the study focuses on three municipal utilities, it provides a detailed and empirically grounded perspective on organizational adaptation in a highly uncertain sector. This paper adds to the literature by showing how iterative learning cycles, e.g., in pilot projects, help to develop new knowledge, where sensing and seizing are not linear but recursive. It differs from earlier work by emphasizing the role of co-created capabilities through partnerships, e.g., the co-development of new business models and experimental pilots.

Policy implications include the need to support regional utilities with long-term funding instruments, as business cases are challenging. Furthermore, the access to technical expertise, e.g., by fostering cross-regional exchange, might accelerate the buildup of competencies. Lastly, reliable regulatory pathways for hydrogen projects would increase planning security. The diversity of municipal companies can also be understood as an opportunity to learn from different approaches and identify good practices for hydrogen rollout.

The conclusions drawn from this study must be interpreted with consideration of its limitations. Most notably, the small sample size—limited to three companies—constrains the generalizability of the findings. While the insights offer valuable depth into specific organizational practices and strategies, they do not allow for broad conclusions about the entire German energy sector. The prerequisites for renewable energy are very different in Germany, with the north offering better conditions for the exploitation of wind energy but with less industrial energy demand. The South, on the other hand, has a very high industrial energy demand but is limited when it comes to renewable energy exploitation. This might lead to specific circumstances in each region. As we only interviewed organizations in the South, we have to take into account these limitations. Future research might expand the research base and might explore differences in the hydrogen transition in North and South Germany. Furthermore, the unique characteristics of the selected companies may not reflect the diversity of actors within the sector, such as municipal utilities, start-ups, or multinational corporations. Extrapolating the results to other firms or applying them to international contexts would be inappropriate without further empirical validation on a broader basis. Given the rapid development of hydrogen technologies and policies, the findings represent a snapshot in 2025. Longitudinal research is needed to track dynamic capability development over time. Geographic reach is also limited, as all cases are located within Southern Germany; the results may not fully account for the different policy, market, and cultural contexts found elsewhere. Furthermore, the qualitative, interview-based approach, while rich in detail, leaves open questions about the quantitative performance in the context of dynamic capabilities. Regional policy diversity suggests that comparative studies across several German federal states would enrich generalizability. Future research should aim to include a larger and more diverse sample to enhance the robustness and external validity of the findings. These factors create limits on how widely the results can be applied and show that more research is needed to cover a wider range of situations.

This thesis contributes to filling a research gap by offering empirical insights into the early-stage application of dynamic capabilities in the hydrogen sector, a setting where uncertainty is high and industry structures are still emerging. While much of the existing literature addresses adaptation in more mature industries, this study sheds light on how companies navigate ambiguity through iterative learning and strategic adjustment.