Abstract

Biodiversity loss poses a threat to corporate performance and social welfare. Biodiversity disclosure enables investors to evaluate firms’ biodiversity status. However, it remains unclear whether and how biodiversity disclosure affects capital market efficiency. In this paper, we employ a binary variable derived from a word-frequency analysis of annual reports to determine whether a firm has disclosed biodiversity information. Using a panel of Chinese listed companies from 2011 to 2022, we provide robust evidence that Companies that disclose biodiversity information have experienced sustained improvements in stock liquidity. Furthermore, the effect is significantly amplified after the 2020 UN Biodiversity Summit, suggesting that investors respond positively to biodiversity disclosure. Channel analysis reveals that higher inventory turnover reinforces this positive effect, while greater financing constraints and higher management ownership weaken it. Heterogeneity analysis further indicates that this effect is more pronounced among firms with higher environmental information asymmetry, lower supply chain transparency, and lower patient capital. This study sheds light on how biodiversity disclosure affects market efficiency and offers important insights for future research and policy.

1. Introduction

Biodiversity loss, a top-three long-term global risk [1], continues to intensify. In response, China released its Biodiversity Conservation Strategy and Action Plan (2023–2030) in 2024. However, the absence of standardized metrics and limited data availability hinders capital markets from accurately pricing biodiversity-related risks [2]. In the same year, the Shanghai Stock Exchange (SSE) also provided preliminary guidance on biodiversity disclosure for listed companies in Article 32 of the “SSE Listed Company Self-Regulatory Guidelines No. 14—Sustainability Reporting (Pilot)”, aiming to improve the standardization and transparency of corporate biodiversity reporting. Biodiversity disclosure differs from other non-financial disclosures. Despite the existence of multiple ESG disclosure frameworks, standardized biodiversity metrics remain in their infancy [2]. Within ESG frameworks, biodiversity issues are often marginalized, their significance overshadowed by topics like climate change and pollution. The environmental dimension is frequently tied to carbon emissions, failing to capture biodiversity’s unique attributes. Consequently, research findings focused on ESG or environmental disclosures cannot be directly applied to biodiversity reporting. Biodiversity warrants separate consideration. Against this backdrop, there is an urgent need to study how biodiversity disclosure affects capital markets, particularly its impact on capital market efficiency.

Stock liquidity is a cornerstone of efficient capital markets, as it facilitates price discovery, information dissemination, and optimal resource allocation. It stands as a critical indicator of corporate operational stability and capital market performance [3,4,5]. Therefore, investigating the impact of biodiversity disclosure on market efficiency from the perspective of stock liquidity is crucial.

The impact of biodiversity disclosure on stock liquidity remains underexplored. Studies related to biodiversity disclosure have focused on its relationships with financial performance [6], firm value [7], analyst forecasts [8], ESG rating divergence [9], and greenwashing behavior [10], but have not explored its impact on stock liquidity. Non-financial disclosures, such as ESG disclosure, CSR disclosure, and climate risk disclosure, are known to impact liquidity [11,12,13], which provides a theoretical basis for exploring the role of biodiversity disclosure. However, from the perspective of the Efficient Market Hypothesis (EMH), existing biodiversity disclosure literature mentions its role in mitigating information asymmetry [6,8] but fails to explicitly link it to market efficiency. As biodiversity information constitutes underpriced non-financial data [2], its disclosure impact on market efficiency remains unexamined. Regarding ESG disclosure, existing research predominantly incorporates biodiversity within a broad ESG framework [11] without isolating its distinct mechanisms.

The impact of biodiversity disclosure on stock liquidity can be interpreted in two directions. First, biodiversity disclosure may positively influence stock liquidity. Such disclosure helps reduce information asymmetry and signals to the market that companies are proactively managing risks. This enables investors to more accurately assess a company’s long-term sustainability risks and value, thereby reducing information friction and enhancing trading willingness. Companies with strong environmental performance gain stakeholder confidence, which in turn boosts market trading activity. Furthermore, the Chinese government currently does not mandate biodiversity-related disclosures, with most companies disclosing voluntarily. Voluntary disclosure often signals a company’s capability and confidence in addressing biodiversity transition risks, thereby attracting support from environmentally conscious investors. Increased investor engagement directly drives trading activity, becoming a key driver of stock liquidity.

Conversely, biodiversity disclosure may also negatively impact stock liquidity. As biodiversity information constitutes environmental risk data, its disclosure may heighten investor concerns about environmental hazards, leading to perceived higher risk and, consequently, reduced stock trading. Furthermore, since companies’ core objective is profit rather than environmental protection, this implies the existence of agency problems. Executives may actively disclose biodiversity information without translating it into management practices. This is detrimental to investors, reducing their willingness to trade and lowering stock liquidity.

In summary, the direction of biodiversity disclosure’s impact on stock liquidity is uncertain, primarily depending on the credibility of the “disclosure equals management” commitment. If companies lack the capability and motivation to manage biodiversity risks, such disclosures may fail to deliver their intended positive effects.

This study focuses on the Chinese market for several reasons. First, most existing biodiversity finance research has focused on the United States, using the 10-K disclosure index to examine returns and risk premiums [2], but neglecting stock liquidity. Similarly, no literature has explored the impact of biodiversity on market liquidity in China. This leaves a research gap in the world’s largest emerging market. Second, China faces significant biodiversity challenges and high industry heterogeneity [14], with manufacturing bearing substantial supply chain-related risks. As noted by Kulionis et al. [15], the financial impact of biodiversity in Asia is second only to that in the Americas. This stems from the interconnectedness of global supply chains, where components of goods sold in one country often originate from other countries. Given China’s pivotal role as an economic and manufacturing hub in Asia, its financial markets are likely to incorporate biodiversity-related information into asset pricing. Third, China’s biodiversity disclosure remains voluntary, unlike that of other nations. The European Union has implemented mandatory biodiversity disclosure at the regional level through the Corporate Sustainability Reporting Directive (CSRD), standardizing corporate practices across member states. France established mandatory biodiversity disclosure through Article 29 of its Energy and Climate Law. The UK enacted legislation mandating Biodiversity Net Gain (BNG) and statutory biodiversity credit requirements, focusing on mandatory disclosure at the development project level. The impact logic of voluntary versus mandatory disclosure differs significantly, making research focused on China particularly valuable for countries that have yet to implement mandatory biodiversity disclosure. Finally, China’s relatively closed market exacerbates information asymmetry between companies and investors [4]. In contrast, stricter disclosure rules and mature analyst coverage in developed economies, such as the United States, mitigate this marginal effect [8]. These unique characteristics make China an ideal testing ground for exploring the impact of biodiversity disclosure on market efficiency, providing insights and experiences that are unavailable from existing research on other emerging economies.

Using data from Chinese-listed companies from 2011 to 2022, we find that biodiversity disclosure has a positive impact on stock liquidity. This result holds across multiple robustness tests. Using the difference-in-differences method, we show that companies disclosing biodiversity information experienced a significant increase in stock liquidity following President Xi Jinping’s keynote speech at the UN Biodiversity Summit on 30 September 2020. Channel and heterogeneity analyses show that this effect is more pronounced in firms with higher inventory turnover rates, lower financing constraints, lower management shareholding ratios, higher environmental information asymmetry, lower supply chain transparency, and lower patient capital. Furthermore, we find that firms disclosing biodiversity information tend to achieve long-term improvements in stock liquidity. Overall, our results suggest that building reputation and reducing information asymmetry enhance stock liquidity, while increased investor risk awareness and potential agency problems may reduce it.

This study makes several contributions to the literature. First, to our knowledge, this is the first study to examine the impact of biodiversity disclosure on stock liquidity among Chinese firms. Prior research on biodiversity has largely overlooked stock liquidity, while studies on stock liquidity have paid little attention to biodiversity [11,16]. By integrating the two into a unified framework, this paper advances both the biodiversity and stock liquidity literature.

Second, we clarify the channels through which voluntary biodiversity disclosure influences stock liquidity. Although we do not propose new mechanisms beyond existing ESG-related research, we broaden the scope of current studies by applying established theories to the perspective of biodiversity disclosure, thereby providing valuable insights into investors’ attitudes toward biodiversity information. Our benchmark results indicate that Chinese investors tend to respond to biodiversity disclosure primarily by recognizing firms’ voluntary disclosures and viewing these firms as proactive in managing biodiversity risks. This investor perspective may vary across firms, suggesting that investors do not evaluate biodiversity information in isolation but rather integrate it with firm characteristics.

Finally, we find that biodiversity-related events are beginning to affect market efficiency in China. This contributes to the event-study literature in biodiversity finance and offers insights for refining future biodiversity policies.

The remainder of the paper is organized as follows. Section 2 reviews the literature on biodiversity finance and develops the research hypotheses. Section 3 describes the variables, the baseline model, the data sources, and the descriptive statistics. Section 4 reports the empirical results. Section 5 provides the results of further analysis. Section 6 concludes with key insights, policy implications, and limitations.

2. Literature Review and Hypothesis Development

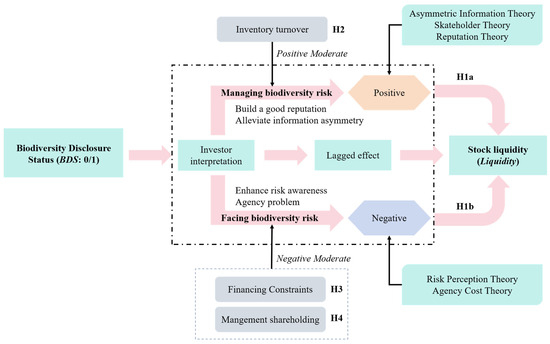

This section reviews the literature on biodiversity finance and presents our hypotheses. Figure 1 shows the logic diagram.

Figure 1.

Logic diagram.

2.1. The Impact of Biodiversity on the Financial Market

Biodiversity and ecosystems support approximately half of global GDP [17], playing a crucial economic role. Biodiversity risks are gaining attention in financial markets. Karolyi and Tobin-de la Puente [18] highlighted the growing importance of biodiversity finance, prompting a surge of academic studies. We have categorized research related to biodiversity and finance and presented it in Table 1. These studies demonstrate that biodiversity risks significantly influence equity pricing, debt financing, and investor decision-making.

Table 1.

Literature on biodiversity and financial markets.

Biodiversity loss alters corporate future cash flows and discount rates through dual risk channels—physical and transition risks—thereby influencing asset prices. Early literature focused on stock returns. Giglio et al. [2] found that biodiversity risks are priced in, yielding negative returns and positive premiums [19,20,21]; subsequent studies further concretised this risk as an increased probability of stock price crashes [28]. Kalhoro and Ahmed [22] found a negative correlation between biodiversity risk and the performance of Socially Responsible Investment (SRI) stocks and commodity indices. Furthermore, firms with strong biodiversity performance tend to face a lower likelihood of stock price crashes, probably because stakeholders support effective biodiversity management [29]. Additionally, major policy events provide quasi-experimental settings for this logic. Following the Kunming Declaration and COP15 in 2022, companies with high biodiversity exposure exhibited significant negative abnormal returns [23,24], while heightened public attention yielded positive returns [25,26]. In fixed-income markets, bank loan spreads and bond credit spreads monotonically widened with corporate biodiversity exposure [30,31]. Investor behavior studies indicate that biodiversity-themed investing imposes no additional costs [27]. Stakeholders also seem to favor firms that actively manage environmental risks, contributing to improved stock liquidity [33,34]. Furthermore, Flammer et al. [32] showed that private and blended capital financing models offer effective tools for managing biodiversity-related risks. Future research is expected to explore these financing solutions in greater depth [35].

Existing literature exhibits the following unrecognized contradictions in its conclusions. First, the relationship between biodiversity risk and stock returns reveals latent market differences. While biodiversity risk correlates with negative returns and positive premiums in U.S. markets [2,24], authors studying multiple countries report significant negative abnormal returns. However, research focusing on China’s explicit markets fails to explicitly mention positive premium phenomena, merely validating the risk-return linkage. This reveals inconsistencies between studies in developed and emerging markets. Second, public attention to biodiversity exhibits an indirect conflict with stock returns. While existing research indicates heightened public concern over biodiversity boosts stock returns [25,26], it fails to address the potential conflict where excessive attention may trigger short-term speculative trading, leading to return volatility.

Existing literature also exhibits certain methodological limitations. For instance, samples have primarily covered institutional investors in developed markets, such as Europe and the United States [27], excluding retail investors in emerging markets. When examining financing instruments, samples have concentrated on companies with high environmental ratings, omitting highly polluting industries [32]. These sample selection biases limit the generalizability of conclusions. This paper, therefore, supplements the research by investigating the economic impact of biodiversity disclosure in emerging markets.

In summary, existing studies confirm that biodiversity has a substantial impact on asset pricing. However, the current literature primarily focuses on returns and risk premiums, overlooking stock liquidity—a key indicator of market efficiency that is equally critical to asset pricing [36]. This omission highlights a notable research gap. Given the fundamental role of liquidity in market efficiency, its relationship with biodiversity warrants closer examination. Additionally, the bond market’s liquidity has not been examined in the literature. This study focuses solely on the impact of biodiversity disclosures on stock market liquidity; future research could concentrate on the impact on the bond market.

2.2. The Relationship Between Biodiversity and Firms

Firms’ financial fundamentals, behaviors, and non-financial performance influence investors’ decisions, thereby affecting stock liquidity. Consequently, the relationship between biodiversity and corporations warrants significant attention. Previous studies on biodiversity and firm behavior are summarized in Table 2. They are generally categorized into six key aspects: financial performance, efficiency, risk, firm governance and ownership structure, behavior, and the environment.

Table 2.

Literature on biodiversity and firms.

In terms of financial performance, exposure to biodiversity risks significantly reduces ROA, dividend payouts, and operational efficiency [6,37,38,39,40,41], while increasing bankruptcy probability [44], thereby introducing uncertainty that impairs stock liquidity [52]. Cash holdings rise due to precautionary motives [41]. These risks also affect internal governance and ownership structures. For example, they are linked to fewer opportunistic stock sales by executives [46] and a decrease in institutional ownership [45]. A greater proportion of management shareholding may lessen these effects, which can deteriorate stock performance [53]. In terms of financing behavior, high-risk firms tend to rely more on short-term debt [42,43] and favor seasoned equity offerings [42]. On the environmental and strategic dimensions, improved biodiversity management is associated with reduced managerial myopia [50]. Furthermore, biodiversity risk has been positively related to ecological innovation [47], and a broader product-market scope has been shown to increase biodiversity risk [51]. Innovation in the green sector may also enhance the connection between biodiversity risk and ESG performance [48]. At the same time, exogenous policies, such as national park pilot programs, directly boost regional corporate environmental disclosure [49].

The above research reveals potential contradictions. First, a disclosure-risk paradox exists between biodiversity and corporate financial performance. Biodiversity disclosure has been shown to positively enhance financial performance [6], while biodiversity risks have been found to negatively impact it [37]. However, a key contradiction remains unexplored: whether companies disclosing high-quality information can offset the negative impact of risks on performance (e.g., some high-risk yet highly disclosing firms show no significant decline in performance). Additionally, the timing at which investors recognize companies disclosing biodiversity information as capable of managing related risks remains unexplored. This is precisely the focus of this paper. Second, existing literature suggests that companies with high biodiversity risks are more inclined to issue additional shares [42] and rely on short-term debt [43]. Yet, it fails to address the contradictory relationship between SEO and short-term debt substitution. Some companies simultaneously increase both SEO and short-term debt, resulting in a deterioration of their financing structure.

Existing research also faces limitations in causal identification. The authors of [46] used executive stock sales as a response to risk, failing to control for confounding factors related to personal wealth planning (e.g., executives may sell shares due to retirement rather than risk aversion). Other studies rely on indirect proxy variables to explain the impact of short-termism on biodiversity performance without establishing direct metrics for measuring the degree of short-termism [50].

In summary, biodiversity risks permeate the entire corporate value chain—spanning finance, governance, financing, and innovation—with informational value sufficient to alter investors’ assessments of long-term corporate value. However, how this information ultimately impacts market microstructure—specifically stock liquidity—remains to be verified.

2.3. Biodiversity Disclosure and Stock Liquidity

Stock liquidity is a key indicator of the development level of capital markets [54,55] and plays a crucial role in asset pricing [36]. Several factors influence stock liquidity, including investor-related variables [56,57], the strength of lending relationships between firms and banks [58], and the anonymity of traders [59]. From a macroeconomic perspective, broader factors such as a sluggish stock market [60], increased market volatility [61], heightened uncertainty [52,62,63], greater risk perception [64], and weak national governance [65] have been shown to negatively affect stock liquidity. Overall, existing literature has predominantly explored stock liquidity through the lens of firm behavior and the relationship between firms and their stakeholders. However, there is currently no literature that directly examines the relationship between biodiversity disclosure and stock liquidity.

The existing literature provides several channels through which ESG-related factors influence stock liquidity, offering a basis for understanding how biodiversity disclosure may also affect liquidity. First, firm-level ESG performance has been shown to improve investor confidence and reduce information asymmetry, thereby enhancing stock liquidity [11]. Similarly, higher ESG ratings associated with better governance and transparency have been found to correlate with narrower bid-ask spreads and higher trading volumes [16]. Disclosure practices also play a key role. Corporate Social Responsibility (CSR), closely aligned with ESG, has likewise been identified as a determinant of stock liquidity. CSR activities may signal lower firm risk and improve firm reputation, thereby attracting more investors and enhancing trading activity [12]. Climate-related risks, particularly those associated with physical and transition risks, have also been shown to increase the commonality in stock liquidity, potentially by amplifying market-wide uncertainty or investor herding behavior [66]. Biodiversity risks differ from climate risks in their nature and measurement [2]. The authors of [67] highlighted that ESG evaluations at both national and firm levels tend to prioritize climate change while overlooking biodiversity. Emerging evidence suggests that financial markets are starting to incorporate biodiversity risks into their pricing [20,24]. Biodiversity may influence stock liquidity through similar mechanisms, such as altering perceived firm risk, affecting information asymmetry, or shaping investor preferences. Yet this link remains empirically underexplored.

The impact of biodiversity disclosure on a firm’s stock liquidity is complex and multifaceted. On the one hand, Lin et al. [65] highlighted the negative effects of information asymmetry on stock liquidity. According to the theory of information asymmetry, disclosing more biodiversity information can reduce information asymmetry, increase the informational content of stock prices, and enable investors to better assess a firm’s risks and value, ultimately influencing stock prices and liquidity [68]. Additionally, according to stakeholder theory [69], firms must consider the needs and interests of stakeholders, as their survival and growth depend on the acceptance and recognition by both internal and external parties [70]. As biodiversity values become more widely recognized, an increasing number of investors favor firms with strong biodiversity performance [24]. Voluntary biodiversity disclosure may enhance investor confidence and garner stakeholder support [71], which, in turn, can increase a company’s stock liquidity [33,34]. Furthermore, according to reputation theory, a strong reputation for biodiversity management can help firms make better production decisions, reduce costs, enhance market competitiveness, and increase market valuation [68,72], thereby helping firms navigate economic challenges [73,74,75]. In summary, when firms voluntarily disclose biodiversity information in their annual reports, they provide valuable new insights to the capital market and signal to stakeholders that they are fulfilling their social responsibilities and facing lower compliance costs. This can generate positive expectations about the company’s future performance and stock value. Therefore, biodiversity disclosure may positively impact a firm’s stock liquidity.

On the other hand, risk is a key factor in determining asset pricing. If the market perceives that firms face high biodiversity risks, stock liquidity may decrease [64]. As [76] argued, firm-specific risk is inherently tied to future uncertainties. As mentioned in the previous section, biodiversity-related issues can impact multiple aspects of a firm’s performance. These uncertainties may reduce investor confidence and negatively affect stock liquidity [52,62,63]. Additionally, investors tend to be less willing to trade the stocks of high-risk firms [77], further contributing to a decline in stock liquidity. Pi et al. [48] found a significant positive correlation between biodiversity risk and firm ESG performance. However, firm ESG behavior may lead to agency problems [78,79]. Management may prioritize biodiversity protection to enhance its own reputation, potentially at the expense of shareholder interests and value. As a result, investing in firms committed to managing biodiversity risks may not align with shareholder interests [79], thereby suppressing stock liquidity [54,80]. It is essential to note that reducing such agency costs does not necessarily benefit investors, a point that will be discussed in greater detail later in the development of H4. Therefore, biodiversity disclosure may negatively affect stock liquidity.

In summary, biodiversity disclosure can enhance stock liquidity by mitigating information asymmetry, building a positive reputation, and gaining investor trust. Conversely, it may also reduce stock liquidity by heightening investors’ risk awareness and exacerbating agency issues stemming from concentrated ownership of management. Therefore, this paper proposes the following competitive hypotheses:

H1a.

Biodiversity disclosure has a positive impact on a firm’s stock liquidity.

H1b.

Biodiversity disclosure has a negative impact on a firm’s stock liquidity.

We argue that firms with higher inventory turnover rates and lower financing constraints are more likely to be recognized as proactively managing biodiversity risks. These firms are generally perceived as having greater capacity to handle such risks and are better equipped to navigate challenges [73,74,75]. Additionally, such firms are more likely to establish a strong reputation for biodiversity performance and gain stakeholder favor, thereby enhancing their stock liquidity [33,34]. On the one hand, inventory turnover is a direct indicator of supply chain operational efficiency. Given the close relationship between biodiversity and corporate supply chains [2], companies with higher inventory turnover are more likely to be perceived as capable of managing biodiversity issues. Consequently, biodiversity disclosures exert a more substantial positive influence on stock liquidity. On the other hand, firms with higher biodiversity risks often rely more on short-term debt [43], reflecting their greater financial constraints. Investors may perceive firms exposed to high biodiversity risks as more vulnerable, particularly those facing significant financing constraints, which can lead to reduced trading activity and, consequently, diminished stock liquidity.

Based on these considerations, the following hypotheses are proposed in this paper:

H2.

A higher inventory turnover strengthens the positive effect of biodiversity disclosure on a firm’s stock liquidity.

H3.

Higher financing constraints weaken the positive effect of biodiversity disclosure on a firm’s stock liquidity.

The reduction in agency costs is not always beneficial to investors. Du et al. [46] found that biodiversity risks, particularly regulatory risks, significantly curb executives’ opportunistic stock-selling behavior. However, this inhibitory effect weakens when the proportion of management ownership is high, suggesting a nuanced relationship between biodiversity risk and agency costs. Although high management holdings reduce traditional agency conflicts [81], they may also foster excessive conservatism among managers, who are more inclined toward short-term interests [53], thereby offsetting the governance benefits associated with biodiversity disclosure. Additionally, Bessler et al. [82] found that when external shocks reduce agency costs, firms tend to decrease their dividend payments further, highlighting the impact of agency costs on dividend policy decisions. When management holdings are high, excessive concentration of power can lead to excessively low agency costs, resulting in adverse outcomes for shareholders and negatively affecting stock performance. Moreover, suppose managers fail to take appropriate biodiversity management actions. In that case, the increase in biodiversity risks may further reduce dividend payments [39], thereby harming shareholder rights and diminishing stock liquidity.

Based on these considerations, the following hypothesis is proposed in this paper:

H4.

A higher management shareholding ratio weakens the positive effect of biodiversity disclosure on a firm’s stock liquidity.

3. Data and Empirical Design

3.1. Sample Selection and Data Source

Due to data availability, this paper covers only A-share listed companies from 2011 to 2022. Listed companies are typically larger in scale, face fewer financing constraints, and possess more robust disclosure infrastructure. Consequently, the average biodiversity disclosure levels may overestimate the overall level across all enterprises. Therefore, caution is warranted when extrapolating the paper’s conclusions to China’s unlisted enterprises, particularly small, medium, and micro-sized businesses. During the data cleaning process, all samples belonging to the financial industry are excluded, as well as all junk stocks and delisted stocks (stock names containing ST, *ST, or PT). To reduce the bias caused by extreme values, all continuous variables are winsorized at the top and bottom one percentiles. The biodiversity disclosure status index (BDS) is obtained from the link (http://www.cnefn.com/data/download/climate-attention-database/ (accessed on 29 Octorber 2024)) provided by [14]. Per capita green space area in prefecture-level cities is sourced from the China Urban Construction Statistical Yearbook. The intensity of environmental governance in each province is derived from government reports, measured as the proportion of words related to the environment relative to the total number of words. Other data mainly come from the China Stock Market and Accounting Research Database (CSMAR).

3.2. Variables and Baseline Model

3.2.1. Biodiversity Disclosure Status

This paper adopts the biodiversity disclosure status index, referred to herein as BDS, developed by [14]. The construction of the index draws on the 10-K text analysis methodology proposed by [2], which involves creating a biodiversity-related dictionary for keyword identification. The terms in the dictionary include biodiversity, ecosystem(s), ecology/ecological, habitat(s), species, (rain)forest(s), deforestation, fauna, flora, marine, tropical, freshwater, wetland, wildlife, coral, aquatic, desertification, carbon sink(s), ecosphere, and biosphere. A firm is assigned a BDS value of 1 if biodiversity-related terms appear more than twice in its annual report; otherwise, the value is 0. A BDS value of 1 indicates that the company is disclosing biodiversity information. This binary indicator not only reflects the potential biodiversity risks of a firm but also reflects its awareness and management of biodiversity risks, offering market participants a lens through which to evaluate a firm’s long-term sustainability potential. However, this indicator only indicates whether biodiversity information is disclosed—that is, a shift from 0 to 1—and does not capture the quantity or quality of the disclosures.

3.2.2. Stock Liquidity

To quantify stock liquidity, this paper follows the authors of [83]. Specifically, the illiquidity indicator is calculated in this paper as follows:

where Illiquidity is the illiquidity indicator, representing the absolute value of the return rate of stock i on the dth trading day of year t, indicating the trading volume of stock i on the dth trading day of year t, and is the total number of trading days of stock i in year t. Therefore, / is the change in the unit turnover return rate of stock i on the dth trading day of year t. To reduce the skewness and kurtosis of the illiquidity index, this paper takes the logarithm of the illiquidity index. Then it takes the opposite number to construct the stock liquidity indicator Liquidity, as shown below [84]:

The larger the liquidity index, the lower the impact of the unit trading amount on the stock price, the lower the transaction cost for investors, and the higher the stock liquidity.

3.2.3. Baseline Model

This paper constructs the following baseline regression model to assess the impact of biodiversity disclosure on stock liquidity:

We assume a linear and additive partial-effects structure; the firm fixed-effect absorbs all time-invariant unobservables, and common year shocks are captured by . Standard errors are clustered at the firm level to allow for arbitrary within-firm serial correlation. is the random error term. Following the practices of [11,16,85], the control variables include Size (the logarithm of total assets), ROA (return on total assets), TobinQ, Indep (the proportion of independent directors), Dual (whether the same person holds the chairman and CEO positions), FirmAge (the logarithm of the establishment period of listed company plus 1), Top10 (the shareholding ratio of the top ten shareholders), Lev (leverage ratio), and Cash (the ratio of cash to total capital). For specific explanations of the control variables, please refer to the variable definitions in Appendix A.

3.3. Descriptive Statistics

Table 3 reports the descriptive statistics of the variables. The average value of BDS is 0.487, suggesting that approximately 48.7% of firm years disclose biodiversity information, indicating increasing awareness of biodiversity issues among Chinese listed firms. The mean value and standard deviation of Liquidity are 3.335 and 1.284, respectively, reflecting substantial variation in stock liquidity across firms. The results of the control variables are similar to those in related Chinese studies.

Table 3.

The results of descriptive statistics.

4. Empirical Results

4.1. Baseline Results

Table 4 presents the baseline regression results. As shown in Columns (1) and (2), regardless of whether control variables are included, the coefficients of BDS remain significantly positive, indicating that biodiversity disclosure positively affects stock liquidity. Columns (3) and (4) report results from the random effects model and ordinary least squares regression, respectively, both confirming the positive and significant impact of BDS. Taking the benchmark regression results in Column (2) as an example, whenever a company discloses biodiversity information (i.e., BDS changes from 0 to 1), its stock liquidity increases by 0.85% relative to the mean value. These findings lend support to H1a.

Table 4.

Baseline regression results.

4.2. Robustness Tests

4.2.1. Instrumental Variable Method

This study employs the instrumental variable method to address potential endogeneity issues. Following [9], we select the per capita green space area at the prefecture-level city as one of the instrumental variables to resolve endogeneity stemming from self-selection and regional omitted variables. First, from an environmental economics perspective, regional green space constitutes a vital component of local ecosystems [17]. It provides stable habitats and ecological corridors for biodiversity, while its distribution density is inherently highly correlated with regional biodiversity levels. Simultaneously, local governments often prioritize green space preservation in urban planning and ecological development. This regional ecological layout tendency may indirectly influence enterprises’ perception and assessment logic regarding biodiversity risks in their operating regions. Thus, it can be inferred that per capita regional green space area exhibits a strong correlation with corporate biodiversity disclosure, satisfying the required relationship for instrumental variables. Secondly, the level of per capita regional green space is primarily determined by geographic endowment and natural conditions—factors with significant exogeneity that enterprises cannot directly influence or manipulate. This implies that per capita regional green space area meets the exogeneity assumption for instrumental variables. Given the potential estimation bias introduced by using regional data, we employ the Bartik IV methodology to construct instrumental variables [86]. Specifically, we employ the interaction term between the average industry biodiversity disclosure level (excluding the firm itself) and per capita green space area (Bartik_Green) as our final instrumental variable. While industry-level biodiversity disclosure is significantly correlated with individual firm disclosures, it does not directly influence stock liquidity, thereby enhancing the relevance and exogeneity of the instrumental variable.

Additionally, we employed provincial environmental regulation levels (Govern) as a second instrumental variable to address endogeneity stemming from policy omission. First, according to Porter’s hypothesis, environmental regulatory pressures drive biodiversity disclosure, satisfying the correlation requirement. Second, the intensity of provincial ecological regulation, as a macro-level policy variable, has no direct impact on stock liquidity. Stock liquidity is determined by micro-level factors such as information transparency and the structure of investors. Thus, exogeneity is also satisfied.

Table 5 presents the results of the instrumental variable method. In Column (1), both Bartik_Green and Govern are significantly positive, consistent with the expected signs discussed above. Column (2) indicates that our instrumental variables pass the underidentification test (KP rk LM statistic is significant), the weak identification test (Cragg-Donald Wald statistic > 10; KP rk WF statistic > 10% Stock-Yogo threshold of 19.93), and the overidentification test (Hansen-J statistic is insignificant), confirming the validity of our instrumental variables. BDS remains significantly positive, indicating that our findings are robust and reliable.

Table 5.

The results of the instrumental variable method.

4.2.2. Difference-in-Differences Method

This paper employs the difference-in-differences method to create an exogenous shock, thereby addressing endogeneity issues. Specifically, firms with BDS = 1 are classified as the treatment group, namely the treatment dummy variable Treat equals 1 [40]. A significant policy event, President Xi Jinping’s keynote speech at the UN Biodiversity Summit on 30 September 2020, is used as the cutoff point, with the time dummy variable Post equals 1 for years after 2020 and 0 otherwise. The interaction term DID equals Treat × Post. We use Model (4) to estimate the impact of this event on stock liquidity.

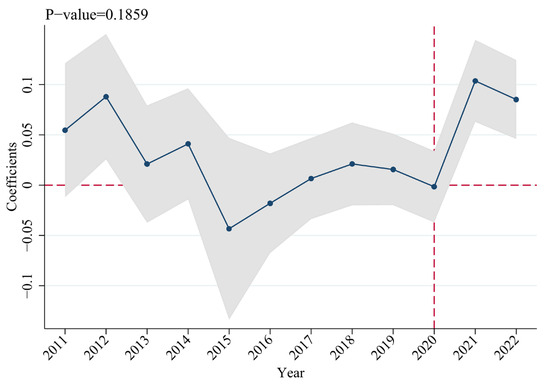

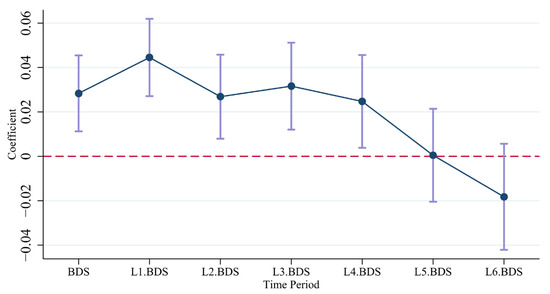

The estimated results for DID are shown in Column (1) of Table 6. The findings indicate that following the biodiversity summit, companies disclosing biodiversity information experienced a significant increase in stock liquidity. Furthermore, following the event, companies that disclosed biodiversity information saw their stock liquidity increase by 2.75%, with an economic effect approximately 3.2 times that of the benchmark regression. A key prerequisite for effective causal identification using DID is passing the parallel trends test. Therefore, we employed an event study approach to visualize the results of the parallel trends test. As shown in Figure 2, before 2020, the confidence intervals for nearly all coefficients included zero. Post-2020, the coefficients rapidly increased and became significantly positive. Additionally, the upper-left corner of Figure 2 shows the p-value for the joint significance test of the prior coefficients, which exceeds 0.1. Collectively, these results indicate that the parallel trend test is satisfied.

Table 6.

The results of DID, PSM, entropy balancing, and adding control variables.

Figure 2.

Event-study test of parallel trends. Note: This figure presents the results of a parallel trend test, where the gray shaded area represents the 95% confidence interval. The p-value of the pre-specified joint significance test is labeled in the upper left corner.

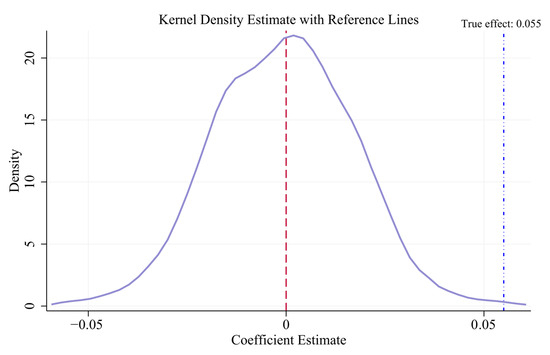

To verify the robustness of the results and rule out spurious causality, we constructed a dummy policy time and conducted a placebo test, with results shown in Appendix B. The kernel density plots from the placebo test reveal that the kernel density curves for the estimated coefficients under the dummy policy time are broadly symmetric about the dotted line at coefficient = 0, with most spurious effects clustered near zero. Meanwhile, the estimated genuine policy effect coefficient in the core regression of this paper is far from zero and does not fall within the main distribution range of spurious effects. The placebo test results strongly support the robustness of the DID estimation results.

Finally, given the policy overlap between the biodiversity summit and the COVID-19 pandemic, we controlled for the pandemic variable to isolate its effects. Specifically, we constructed the variable COVID using daily pandemic data, assigning a value of 1 to cities ranking in the top 20% for cumulative confirmed cases among all cities in 2020 and subsequent years, and 0 otherwise, matching it with the original corporate data. The results in Column (2) of Table 6 indicate that the DID remains significantly positive after controlling for pandemic effects. The magnitude of the coefficient remains relatively stable.

4.2.3. PSM and Entropy Balancing

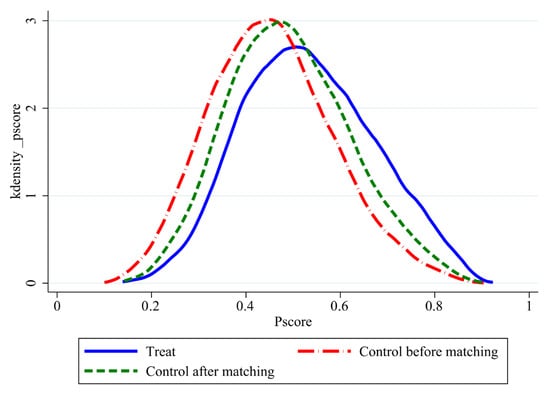

Since companies may selectively disclose biodiversity information based on their circumstances, there is a potential for covariate imbalance. To address the possible sample bias, this paper employs PSM and entropy balancing. Specifically, we treated BDS as a grouping variable for both methods and estimated the PSM results using a 1:1 nearest neighbor matching method with a caliper of 0.01. Figure A2 in Appendix C reports the PSM matching results. It can be observed that the distributions of the matched control group and treatment group are similar, indicating that the model’s matching results are satisfactory and effectively address self-selection bias. Furthermore, we used entropy balancing [87,88] to match firms on the control variables of the benchmark regression and generate corresponding weights, with each company’s mean weight serving as its weight. The results are shown in Columns (3) and (4) of Table 6. All BDS coefficients remain significantly positive.

4.2.4. Add More Control Variables

To mitigate omitted variable bias, this paper includes additional control variables, such as audit opinion (Audit), institutional ownership ratio (IOR), and tangible asset ratio (TAR). An audit opinion reflects the quality of corporate governance and the effectiveness of external monitoring. Firms with poor governance may exhibit weaker capability to manage biodiversity risks and suffer from liquidity shortages stemming from governance issues. Institutional investors possess stronger information collection and analytical capabilities, and their ownership proportion reflects market recognition of a firm’s value. Controlling for institutional ownership mitigates the influence of investor sophistication on liquidity. The tangible asset ratio affects a firm’s financing capacity, which in turn shapes its financial flexibility and risk-bearing capacity. Neglecting this variable could lead to the conflation of the effect of biodiversity risks with that of asset financing capacity. Column (5) of Table 6 indicates that our findings are robust.

4.2.5. Other Robustness Tests

In this section, a series of robustness tests is conducted.

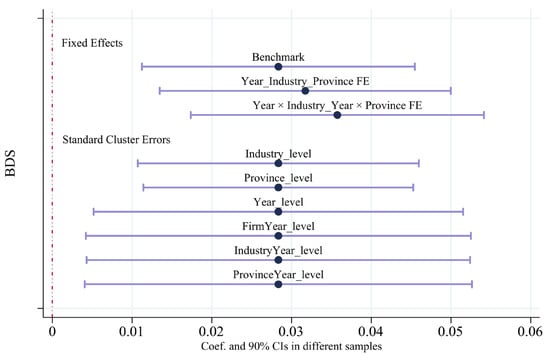

First, we control for unobserved heterogeneity to address omitted variable bias and measurement error. As different industries have varying sensitivities to biodiversity issues, and the biodiversity conditions in other provinces are also distinct, we replaced the firm-level fixed effects with industry-level and provincial-level fixed effects, as shown in Model (3). Additionally, as biodiversity risks may change over time, we also controlled for the interaction between industry and year as well as the interaction between province and year (i.e., Industry FE × Year FE and Province FE × Year FE).

Second, we change the clustering level to address the potential correlation problem among error terms. The regression results, with changing fixed effects and clustered standard errors, are shown in Figure 3. The coefficients of BDS are all significantly positive, indicating that our results are robust.

Figure 3.

Changes in the fixed effects and cluster levels. Note: This figure is a visualization of changes in the fixed effects and cluster levels results, where the horizontal lines represent the 90% confidence intervals. The x-axis is the regression coefficient of BDS.

Third, we conduct a subsample regression. Given the pandemic in 2020, this paper, based on the entropy-balanced weights, excluded samples from 2020 and 2021. The results are shown in Column (1) in Table 7. The coefficient of BDS is positive at the 1% significance level, indicating that our results are robust.

Table 7.

The results of other robustness tests.

Fourth, we replaced the independent variable. We assigned a value of 1 to companies with at least one occurrence of biodiversity-related terminology in their annual reports, and 0 otherwise, yielding BDS1 to test the sensitivity of the benchmark regression model. The results in Column (2) of Table 7 indicate that our findings are robust.

Finally, we employed model averaging to address model uncertainty. The results in Columns (3) to (5) of Table 7 indicate that our findings remain robust regardless of the information criterion selected.

4.3. Channel Analysis

This section will examine the potential channels. We believe that the inventory turnover rate (Inventurn), the reliance on financing constraints (FC), and the proportion of management shareholding (ManageRatio) play a moderating role. All the results are shown in Table 8.

Table 8.

The results of the channel analysis.

4.3.1. Inventory Turnover

In Table 8, Column (1) shows that both the main effect of BDS and the interaction term BDS × Inventurn are positive at the 5% significance level. This indicates that firms with a high inventory turnover rate exhibit better stock liquidity. Firms with a high inventory turnover rate are often highly efficient and can convey to the public a signal of stable supply chains. Therefore, for firms with a high inventory turnover rate, investors are more likely to perceive that firms are actively managing biodiversity risks rather than facing higher biodiversity risk issues. On the other hand, efficient firms are more likely to establish a good reputation for biodiversity because they are perceived as having a greater ability to manage biodiversity risks actively. When biodiversity disclosure is regarded as a signal of active management, other positive signals are needed to make this commitment credible. This paper argues that the inventory turnover rate is one of the reasons. Therefore, H2 is supported.

4.3.2. Financing Constraints

This paper argues that financing constraints (FC) will regulate the impact of biodiversity disclosure on stock liquidity. Firms with higher biodiversity risks tend to rely on short-term debt for a longer period [43], reflecting high financing constraints. These firms typically do not allocate scarce funds to enhance non-financial performance. Investors can identify firms with higher biodiversity risks through this relationship in reverse, making it more challenging for these firms to establish a reputation by mitigating biodiversity risk exposure. Investing in such firms often involves additional risks, which further reduces the confidence of stakeholders and thereby lowers stock liquidity. As can be seen from Column (2) of Table 8, the coefficient of BDS remains significantly positive, and BDS × FC is negative at the 1% significance level. Additionally, the absolute value of the interaction effect is 0.151, which exceeds the coefficient of BDS (0.0991). Our results indicate that high financing constraints can even reverse the positive impact of disclosure. This means that firms with high financing constraints will make investors more vigilant when viewing information on biodiversity disclosure. They are more likely to interpret biodiversity information as a signal of potential risk. Therefore, H3 is supported.

4.3.3. Management Shareholding Ratio

In Table 8, the coefficient of BDS × ManageRatio is significantly negative. The higher the proportion of management shareholding, although the agency cost problem will be less, it will bring new challenges. A highly centralized management may take overly conservative actions, focusing more on short-term interests [53] than long-term issues such as managing biodiversity risk. Therefore, H4 is verified.

To further explore firm-level heterogeneity related to managerial ownership, this paper conducts a grouped regression based on the level of the management shareholding ratio. The results in Table 9 indicate that the BDS coefficient is smaller and less significant in companies with higher management ownership ratios. These findings further support H4.

Table 9.

Grouped management shareholding ratio channel test.

4.4. Heterogeneity Analysis

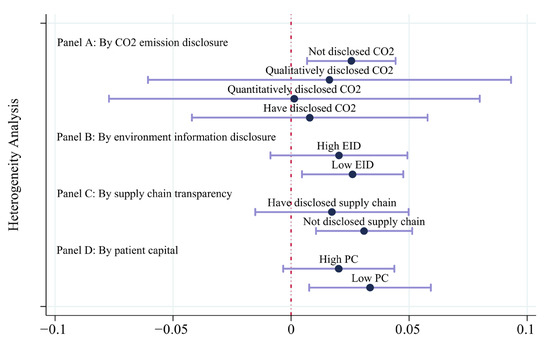

Given that the impact of biodiversity disclosure on stock liquidity may differ across firms with varying degrees of environmental information asymmetry, supply chain transparency, and patient capital, this section conducts a heterogeneity analysis. It is worth noting that the heterogeneity analysis differs from the channel analysis. While the channel analysis examines the moderating effects of firm-level characteristics that appear relatively independent of biodiversity disclosure, the heterogeneity analysis investigates how variables more closely related to biodiversity disclosure modify this impact. All heterogeneity results are visualized in Figure 4. For more detailed regression results, see Appendix D. For the specific definition of heterogeneous grouping variables, see Appendix A.

Figure 4.

Heterogeneity results visualization. Note: This figure illustrates heterogeneity, where the horizontal lines represent the 90% confidence intervals. The x-axis is the regression coefficient of BDS. Panel A is based on the disclosure of carbon dioxide emissions information, Panel B is based on environmental information disclosure, Panel C is based on supply chain transparency, and Panel D is based on patient capital.

4.4.1. Environmental Information Asymmetry

Panel A of Figure 4 reports the regression results based on firms’ disclosure of carbon dioxide emissions (CO2Emission). The coefficient of BDS is significantly positive only among firms that do not disclose carbon emission information. This suggests that biodiversity disclosure plays a greater role in reducing environmental information gaps [65], thereby improving stock liquidity. In contrast, for firms with lower information asymmetry, the marginal effect of biodiversity disclosure on alleviating such asymmetry is diminished.

Panel B of Figure 4 presents the results based on a more direct indicator, EID, for measuring the environmental information disclosure of firms. We grouped using the upper third quartile of EID. The results show that BDS is only significant among firms with high levels of environmental information disclosure. This result further strengthens our confidence in the above conclusion.

4.4.2. Supply Chain Transparency

Panel C of Figure 4 presents the results based on supply chain information transparency (STC_Num). Specifically, companies are divided into those that disclose supply chain information and those that do not. The findings reveal that the positive impact of biodiversity disclosure on stock liquidity is more substantial only among companies with lower supply chain transparency. This occurs because biodiversity is intrinsically linked to supply chain operations [2]. Thus, biodiversity disclosures may partially serve as a substitute for supply chain information disclosure. Among companies that have disclosed supply chain information, the marginal effect of biodiversity disclosures on stock liquidity diminishes.

4.4.3. Patient Capital

Panel D of Figure 4 reports the results for patient capital (PC). We grouped firms based on the median level of patient capital. The results indicate that the positive impact of biodiversity disclosure on stock liquidity exists only among firms with low patient capital. Patient capital refers to forms of capital characterized by a commitment to long-term value creation, extended time horizons, and a higher risk tolerance. Managing biodiversity risks aligns with companies’ objectives of pursuing long-term sustainable development. In firms with higher patient capital, investors anticipate the company’s pursuit of long-term growth, thereby diminishing the marginal effect of biodiversity disclosure on stock liquidity.

5. Further Analysis

To examine whether the effect of biodiversity disclosure on stock liquidity evolves, this paper incorporates lagged terms of biodiversity disclosure and conducts a series of regression analyses. On the one hand, as a form of signal transmission, biodiversity disclosure may require time to exert a more pronounced influence on stock liquidity. On the other hand, investors’ interpretation of biodiversity information may be shaped by a firm’s prior disclosure. Firms that consistently and voluntarily disclose biodiversity-related information are more likely to build a strong reputation, thereby attracting greater investor participation and enhancing stock liquidity. The regression model is shown in Model (5):

where k takes 0 to 6, respectively. The rest of the structure is the same as Model (3). The lagged BDS can also mitigate the bidirectional causality issue to a certain extent.

The results in Figure 5 indicate that BDS is significantly positive, lasting up to four years. Moreover, the coefficient for the one-period lag is larger. These results suggest that biodiversity information exerts a long-term influence, with its effects becoming more pronounced through a one-year signaling process.

Figure 5.

Lagged effect of BDS on stock liquidity. Note: The vertical lines in this figure represent the 90% confidence intervals. The x-axis indicates the periods of BDS and its lagged terms, while the y-axis shows the coefficients of BDS after running Model (5). All the points are connected by straight lines to facilitate a more precise observation of the changing trend.

The lag effect reflects the time required for two critical processes: information verification and reputation building, both central to this study’s theoretical framework. First, from the perspective of reducing information asymmetry, biodiversity disclosure serves as a voluntary signal of a company’s commitment to managing nature-related risks. However, investors do not immediately accept this signal as credible. They require time to verify whether a company’s disclosures are accompanied by tangible risk management actions (e.g., supply chain adjustments or environmental investments). A company disclosing biodiversity information in year t may only demonstrate concrete progress in year t + 1. This verification process explains why the effect intensifies after a one-period lag—as investors gain confidence in the company’s credibility upon observing consistent behavior. Second, consistent with reputation theory, biodiversity disclosure contributes to building long-term reputation rather than short-term market reactions. Companies that continuously disclose biodiversity information demonstrate sustained commitment to sustainability, gradually attracting environmentally conscious investors and reducing stakeholder skepticism. This cumulative reputation effect explains why positive impacts persist for four years.

By examining the dynamic evolution of lag effects, we identify another mechanism through which continuous disclosure makes biodiversity disclosures credible in shaping management practices. This differs from the moderating effect that enables credibility through commitment.

6. Conclusions

6.1. Empirical Conclusions

As global biodiversity loss accelerates, the impacts of biodiversity risks have increasingly permeated the economic sphere. Against this backdrop, this paper uses data from Chinese-listed companies from 2011 to 2022 to examine the influence of biodiversity disclosure on stock liquidity. The baseline regression results indicate that biodiversity disclosure has a positive impact on stock liquidity. Using the difference-in-differences method, we found that following the 2020 biodiversity summit, companies that disclosed biodiversity information experienced a more pronounced increase in stock liquidity. The channel analysis results show that this effect is weakened for firms with lower inventory turnover rates, higher financing constraints, and a higher proportion of managerial ownership. The results of the heterogeneity analysis reveal that firms with higher environmental information asymmetry, lower supply chain transparency, and lower patient capital receive a greater impact. Furthermore, this paper finds that biodiversity disclosure has long-term implications for market efficiency, indicating that companies should build long-term reputation by enhancing transparency in biodiversity information.

6.2. Practical Implications

As China increasingly prioritizes biodiversity conservation, the frequency of related policy events continues to rise. This study suggests that such events have begun to impact stock liquidity, creating opportunities for investors seeking short-term arbitrage through liquidity. Investors must gain a deep understanding of a company’s fundamentals and its exposure to biodiversity-related risks to assess its capacity and motivation for managing biodiversity risks. Companies should tailor their biodiversity disclosure strategies to their unique contexts, as investor reactions may vary based on their fundamental conditions and influence stock prices. Specifically, companies must address issues such as excessive management shareholdings, which might undermine the positive impact of biodiversity disclosures on stock liquidity. Heterogeneity analysis reveals that biodiversity information can partially substitute for other environmental and supply chain disclosures. It also sends signals about a company’s commitment to long-term development—a message that patient capital can interpret—highlighting the multidimensional importance of biodiversity information for investors. Therefore, integrating biodiversity considerations into risk management frameworks is essential for companies. Lag effect studies suggest that companies can build investor trust through consistent biodiversity disclosure, which also improves secondary market trading efficiency and provides insights for refining disclosure practices. Given that information quality underpins price discovery and market efficiency [89], governments should strengthen disclosure requirements and regulations to maximize the role of biodiversity disclosure in promoting market efficiency. Research shows that companies in countries with strong governance systems are more likely to provide comprehensive biodiversity disclosures [90]. Increased transparency helps in more accurately identifying corporate biodiversity profiles, speeds up the dissemination of information, and ultimately boosts market efficiency. However, mandating biodiversity disclosures for financially distressed companies that are unable to manage biodiversity risks could negatively affect market liquidity. This necessitates careful policy design to avoid unintended consequences.

While this study focuses on China, its implications extend to global capital markets. Emerging markets can accelerate capital market efficiency by adopting TNFD-aligned disclosure templates, mandating biodiversity risk assessments, and integrating biodiversity into green finance taxonomies. As China refines its SSE Sustainability Reporting Guidelines, it has a strategic opportunity to pilot TNFD-compliant disclosures in key biodiversity-exposed sectors such as agriculture, mining, and textiles. Moreover, China’s experience offers a replicable policy model for other emerging economies, such as India, Brazil, and Indonesia, where biodiversity risks are high but disclosure remains voluntary. By harmonizing domestic rules with global standards, these markets can attract long-term ESG capital, reduce informational frictions, and build resilience against nature-related shocks. In the field of biodiversity finance, biodiversity disclosure directs funds to environmentally friendly companies, thereby promoting long-term harmony between conserving biodiversity and achieving carbon-neutrality goals, ultimately aiding sustainable societal development.

6.3. Limitations and Future Research

Although the conclusions of this paper offer valuable insights for future research and policy practice, several limitations warrant further exploration. First, this paper only examines whether disclosing biodiversity information affects stock liquidity, without exploring the quantity and quality of such disclosures. Text-based indicators may offer forward-looking advantages, but they often lack scientific rigor. One of the fundamental challenges preventing broader engagement from economists and financial researchers with biodiversity risks lies in their inherent complexity and the difficulty of quantifying them [2]. Existing literature typically relies on either quantitative metrics or text-mining approaches, drawing on sources such as corporate disclosure reports, media coverage, search engine data, and biodiversity-related databases. Some studies separate physical and transition risks, while others employ a single composite indicator to assess economic impacts. Future research could enhance measurement by using TF-IDF weighting, sentiment analysis, or manual scoring frameworks aligned with TNFD or EU CSRD standards to further examine their influence on stock liquidity. Second, while this paper’s findings may not be directly generalizable to other countries, they nonetheless offer meaningful insights. Future research may continue to explore how the impact of biodiversity disclosure on market efficiency varies across countries. Our study provides such an analytical perspective. Finally, although this paper employs multiple endogeneity treatment methods to achieve robust causal identification, the causal relationship may still be overstated. Future research could utilize high-frequency data to explore the impact of biodiversity disclosure on market efficiency or conduct further causal identification using other biodiversity-related policies.

Author Contributions

Conceptualization, H.L. and Y.Y.; methodology, H.L.; validation, H.L.; formal analysis, H.L.; resources, Y.Y.; data curation, H.L.; writing—original draft preparation, H.L.; writing—review and editing, all authors; visualization, H.L.; supervision, Y.Y. and M.Q.; project administration, H.L. and Y.Y.; funding acquisition, Y.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National College Students’ Innovative Entrepreneurial Training Program of China (202510338060), the National Statistical Science Research Project (2024LY081) and the Social Science Foundation of Zhejiang Province (Grant Number 25NDJC054YBMS).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Appendix A

Table A1.

Variable definitions.

Table A1.

Variable definitions.

| Variables | Definitions |

|---|---|

| Independent Variable | |

| BDS | 1 for the frequency of biodiversity-related terms in the annual report exceeds two occurrences, otherwise 0. |

| Dependent Variable | |

| Liquidity | The opposite of the illiquidity logarithm. |

| Control Variables | |

| Size | Logarithm of the total assets of the company at the end of the year. |

| ROA | Net profit divided by total assets. |

| TobinQ | The ratio of shares held by the largest shareholder to outstanding shares. |

| Indep | The ratio of the number of independent directors on the board. |

| Dual | 1 for the dual role of the board chairman, otherwise 0. |

| FirmAge | Logarithm of the establishment period of the listed company plus 1. |

| Top10 | The shareholding proportion of the top ten shareholders. |

| Lev | Liabilities divided by total assets. |

| Cash | The ratio of cash and its cash equivalents to total assets. |

| Audit | 1 for types of audit opinions other than standard unqualified opinions issued by accounting firms, otherwise 0. |

| IOR | The number of shares held by institutional investors is divided by the company’s total share capital. |

| TAR | Total tangible assets divided by total assets. |

| Mechanism Variables | |

| Inventurn | Cost of goods divided by average inventory balance. |

| FC | Financing constraints. It is constructed by this equation: |

| ManageRatio | The number of shares held by the management is divided by the total share capital. |

| Heterogeneity Variables | |

| CO2Emission | Firm CO2 emissions are coded as 0 for no description, 1 for qualitative description, and 2 for quantitative description. |

| EID | The environmental information disclosure situation of listed firms (sourced from the CSMAR database). |

| STC_Num | It represents the number of major suppliers and customers whose names a company explicitly discloses. We divided the sample into companies that disclosed relevant information (STC_Num > 0) and those that did not (STC_Num = 0). |

| PC | Using institutional investor stability as a proxy variable for patient capital. Obtained using the following formula: where INVH represents the institutional ownership ratio. |

| Other Variables | |

| Bartik_Green | The interaction term between the average industry biodiversity disclosure level (excluding the firm itself) and per capita green space area |

| Govern | The intensity of environmental governance in each province is derived from government reports, which is the proportion of words related to the environment in the total number of words. |

| DID | See Section 4.2.2. |

Appendix B

Figure A1.

Placebo test for DID. Note: This figure shows the kernel density distribution of the DID placebo test. The data was resampled 1000 times. The red dashed line represents the position where the coefficient is 0, while the blue dotted line indicates the position of the actual coefficient.

Appendix C

Figure A2.

Propensity score distributions. Note: This figure presents a kernel density plot visualizing the PSM matching results. The blue line represents the treatment group, the red line denotes the control group before matching, and the green line indicates the control group after matching. The distribution of the matched control group aligns more closely with that of the treatment group, indicating that the model achieves effective matching and effectively addresses self-selection bias.

Appendix D

Table A2.

Environmental information asymmetry heterogeneity.

Table A2.

Environmental information asymmetry heterogeneity.

| Variable | Liquidity | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Not Disclosed | Qualitatively Disclosed | Quantitatively Disclosed | Have Disclosed | High EID | Low EID | |

| BDS | 0.0255 ** | 0.0163 | 0.0014 | 0.0079 | 0.0203 | 0.0261 ** |

| (0.0114) | (0.0467) | (0.0477) | (0.0303) | (0.0176) | (0.0130) | |

| Constant | −9.3883 *** | −5.5443 *** | −9.4321 *** | −8.4979 *** | −8.8369 *** | −8.8389 *** |

| (0.4591) | (2.0089) | (2.6331) | (1.8205) | (0.8346) | (0.5211) | |

| Observations | 24141 | 2443 | 1669 | 4112 | 8612 | 19641 |

| Adjusted R2 | 0.5532 | 0.4441 | 0.5727 | 0.4745 | 0.5493 | 0.5450 |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

Note: This table shows the regression results based on environmental information asymmetry. Column (1) represents firms that have never disclosed carbon dioxide emissions information, Column (2) represents firms that have disclosed qualitative carbon dioxide emissions information, Column (3) represents firms that have disclosed quantitative carbon dioxide emissions information, Column (4) represents firms that have disclosed carbon dioxide emissions information (including both qualitative and quantitative), Column (5) represents firms with more environmental information disclosure, that is, firms with a lower degree of environmental information asymmetry, and Column (6) represents firms with a higher degree of environmental information asymmetry. Standard errors are reported in parentheses. ***, ** indicate significance at the 1%, 5% levels, respectively.

Table A3.

Supply chain transparency and patient capital heterogeneity.

Table A3.

Supply chain transparency and patient capital heterogeneity.

| Variable | Liquidity | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Have Disclosed | Not Disclosed | High PC | Low PC | |

| BDS | 0.0173 | 0.0309 ** | 0.0202 | 0.0334 ** |

| (0.0197) | (0.0124) | (0.0143) | (0.0157) | |

| Constant | −9.9648 *** | −8.8520 *** | −8.2188 *** | −11.0952 *** |

| (1.0147) | (0.4987) | (0.5618) | (0.6129) | |

| Observations | 8097 | 20156 | 16264 | 11989 |

| Adjusted R2 | 0.4131 | 0.5774 | 0.5428 | 0.5451 |

| Controls | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

Note: This table shows the regression results based on supply chain transparency and patient capital. Column (1) represents firms that have disclosed supply chain information, Column (2) represents firms that do not disclose supply chain information, Column (3) represents firms with high patient capital, and Column (4) represents firms with low patient capital. Standard errors are reported in parentheses. ***, ** indicate significance at the 1%, 5% levels, respectively.

References

- WEF. The Global Risk Report. 2024. Available online: https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2024.pdf (accessed on 20 May 2025).

- Giglio, S.; Kuchler, T.; Stroebel, J.; Zeng, X. Biodiversity Risk; NBER Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2023; p. 31137. [Google Scholar] [CrossRef]

- Merton, R.C. A Simple Model of Capital Market Equilibrium with Incomplete Information. J. Financ. 1987, 42, 483–510. [Google Scholar] [CrossRef]

- Cheung, W.M.Y.; Im, H.J.; Selvam, S. Stock liquidity and investment efficiency: Evidence from the split-share structure reform in China. Emerg. Mark. Rev. 2023, 56, 101046. [Google Scholar] [CrossRef]

- Muchenje, L.T. Stock liquidity and corporate climate performance: Evidence from China. J. Financ. Stab. 2025, 77, 101389. [Google Scholar] [CrossRef]

- Elsayed, R.A.A. Exploring the financial consequences of biodiversity disclosure: How does biodiversity disclosure affect firms’ financial performance? Future Bus. J. 2023, 9, 22. [Google Scholar] [CrossRef]

- Ma, C.; Gao, L.; Jiang, Y.; Ren, Y.-S. How biodiversity information disclosures spill the beans on firm value? Financ. Res. Lett. 2025, 85, 108240. [Google Scholar] [CrossRef]

- Sheng, X.; Yang, L. From headlines to earnings: Do biodiversity disclosures tighten analyst forecasts? Financ. Res. Lett. 2025, 85, 108158. [Google Scholar] [CrossRef]

- He, F.; Duan, L.; Lucey, B.; Hao, J. Biodiversity risk or climate risk? Which factor affects corporate ESG rating divergence. Int. Rev. Financ. Anal. 2025, 104, 104302. [Google Scholar] [CrossRef]

- He, F.; Wei, C.; Lucey, B.; Hao, J. Beyond greenwashing: How does firm-level biodiversity disclosure affect corporate sustainability strategy? Pac.-Basin Financ. J. 2025, 92, 102787. [Google Scholar] [CrossRef]

- Wang, K.; Li, T.; San, Z.; Gao, H. How does corporate ESG performance affect stock liquidity? Evidence from China. Pac.-Basin Financ. J. 2023, 80, 102087. [Google Scholar] [CrossRef]

- Li, Z.; Lin, W.; Zhou, S. The effect of mandatory CSR disclosure on stock liquidity. China Econ. Rev. 2024, 87, 102232. [Google Scholar] [CrossRef]

- Lei, S.; Chen, Y.; Xia, D. Does climate risk disclosure affect stock liquidity? Res. Int. Bus. Financ. 2025, 80, 103130. [Google Scholar] [CrossRef]

- He, F.; Chen, L.; Lucey, B.M. Chinese corporate biodiversity exposure. Financ. Res. Lett. 2024, 70, 106275. [Google Scholar] [CrossRef]

- Kulionis, V.; Pfister, S.; Fernandez, J. Biodiversity impact assessment for finance. J. Ind. Ecol. 2024, 28, 1321–1335. [Google Scholar] [CrossRef]

- He, F.; Feng, Y.; Hao, J. Corporate ESG rating and stock market liquidity: Evidence from China. Econ. Model. 2023, 129, 106511. [Google Scholar] [CrossRef]

- WEF. Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy. 2020. Available online: http://www3.weforum.org/docs/WEF_New_Nature_Economy_Report_2020.pdf (accessed on 20 May 2025).

- Karolyi, G.A.; de la Puente, J. Biodiversity finance: A call for research into financing nature. Financ. Manag. 2023, 52, 231–251. [Google Scholar] [CrossRef]

- Carvalho, S.H.C.d.; Cojoianu, T.; Ascui, F. From impacts to dependencies: A first global assessment of corporate biodiversity risk exposure and responses. Bus. Strat. Environ. 2022, 32, 2600–2614. [Google Scholar] [CrossRef]

- Ma, F.; Wu, H.; Zeng, Q. Biodiversity and stock returns. Int. Rev. Financ. Anal. 2024, 95, 103386. [Google Scholar] [CrossRef]

- Coqueret, G.; Giroux, T.; Zerbib, O.D. The biodiversity premium. Ecol. Econ. 2025, 228, 108435. [Google Scholar] [CrossRef]

- Kalhoro, M.R.; Ahmed, K. Dynamic linkages and spillover effects of biodiversity risk in socially responsible investment and commodity markets. J. Environ. Manag. 2025, 374, 124144. [Google Scholar] [CrossRef] [PubMed]

- Kalhoro, M.R.; Kyaw, K. Manage biodiversity risk exposure? Financ. Res. Lett. 2024, 61, 104989. [Google Scholar] [CrossRef]

- Garel, A.; Romec, A.; Sautner, Z.; Wagner, A.F. Do investors care about biodiversity? Rev. Financ. 2024, 28, 1151–1186. [Google Scholar] [CrossRef]

- El Ouadghiri, I.; Kaabia, O.; Peillex, J.; Platania, F.; Toscano Hernandez, C. Attention to biodiversity and stock returns. Int. Rev. Financ. Anal. 2025, 97, 103855. [Google Scholar] [CrossRef]

- Zhou, C.; Chen, Y.; Ji, Q.; Zhang, D. Does public attention to biodiversity matter to stock markets? Int. Rev. Financ. Anal. 2025, 98, 103925. [Google Scholar] [CrossRef]

- Appio, F.P.; Benlemlih, M.; El Ouadghiri, I.; Peillex, J. International evidence on the financial performance of biodiversity investing. J. Environ. Manag. 2025, 377, 124640. [Google Scholar] [CrossRef]

- Liang, C.; Yang, J.; Shen, L.; Dong, D. The role of biodiversity risk in stock price crashes. Financ. Res. Lett. 2024, 67, 105856. [Google Scholar] [CrossRef]

- Bassen, A.; Buchholz, D.; Lopatta, K.; Rudolf, A.R. Biodiversity management and stock price crash risk. Bus. Strat. Environ. 2024, 33, 4788–4805. [Google Scholar] [CrossRef]

- Becker, A.; Di Girolamo, F.E.; Rho, C. Loan pricing and biodiversity exposure: Nature-related spillovers to the financial sector. Res. Int. Bus. Financ. 2025, 75, 102724. [Google Scholar] [CrossRef]

- Cherief, A.; Sekine, T.; Stagnol, L. A novel nature-based risk index: Application to acute risks and their financial materiality on corporate bonds. Ecol. Econ. 2025, 228, 108427. [Google Scholar] [CrossRef]

- Flammer, C.; Giroux, T.; Heal, G.M. Biodiversity finance. J. Financ. Econ. 2025, 164, 103987. [Google Scholar] [CrossRef]

- Gurun, U.G.; Stoffman, N.; Yonker, S.E. Trust Busting: The Effect of Fraud on Investor Behavior. Rev. Financ. Stud. 2017, 31, 1341–1376. [Google Scholar] [CrossRef]

- Lee, J.; Ryu, D. How does FX liquidity affect the relationship between foreign ownership and stock liquidity? Emerg. Mark. Rev. 2019, 39, 101–119. [Google Scholar] [CrossRef]

- Jonäll, K.; Baeckström, Y.; Elliot, V.; Arvidsson, S. The biodiversity–finance nexus: A future research agenda. Curr. Opin. Environ. Sustain. 2025, 72, 101504. [Google Scholar] [CrossRef]

- Keene, M.A.; Peterson, D.R. The Importance Of Liquidity As A Factor In Asset Pricing. J. Financ. Res. 2007, 30, 91–109. [Google Scholar] [CrossRef]

- Bach, T.N.; Hoang, K.; Le, T. Biodiversity risk and firm performance: Evidence from US firms. Bus. Strat. Environ. 2024, 34, 1113–1132. [Google Scholar] [CrossRef]

- Cheong, C.S.; Gao, S.; Lun, P.; Mihaylov, G.; Zurbruegg, R. Biodiversity and the performance of tourism firms. Ann. Tour. Res. 2024, 109, 103842. [Google Scholar] [CrossRef]