Panel Cointegration and Causality Among Socioeconomic Indicators in CEE Regions: Insights for Regional Economic Resilience and Sustainable Development

Abstract

1. Introduction

2. Literature Review

2.1. Socioeconomic Development Highlighting Regional Differentiation

2.2. Regional Disparities in CEE Countries

2.3. Research Gap

3. Methodology

3.1. Cross-Sectional Dependence

3.2. Panel Unit Root Tests

3.2.1. LLC Panel Unit Root Test

3.2.2. IPS Panel Unit Root Test

3.2.3. ADF Panel Unit Root Test

3.3. Panel Cointegration Tests

3.4. Panel ARDL

3.5. Granger Panel Causality Test

4. Results

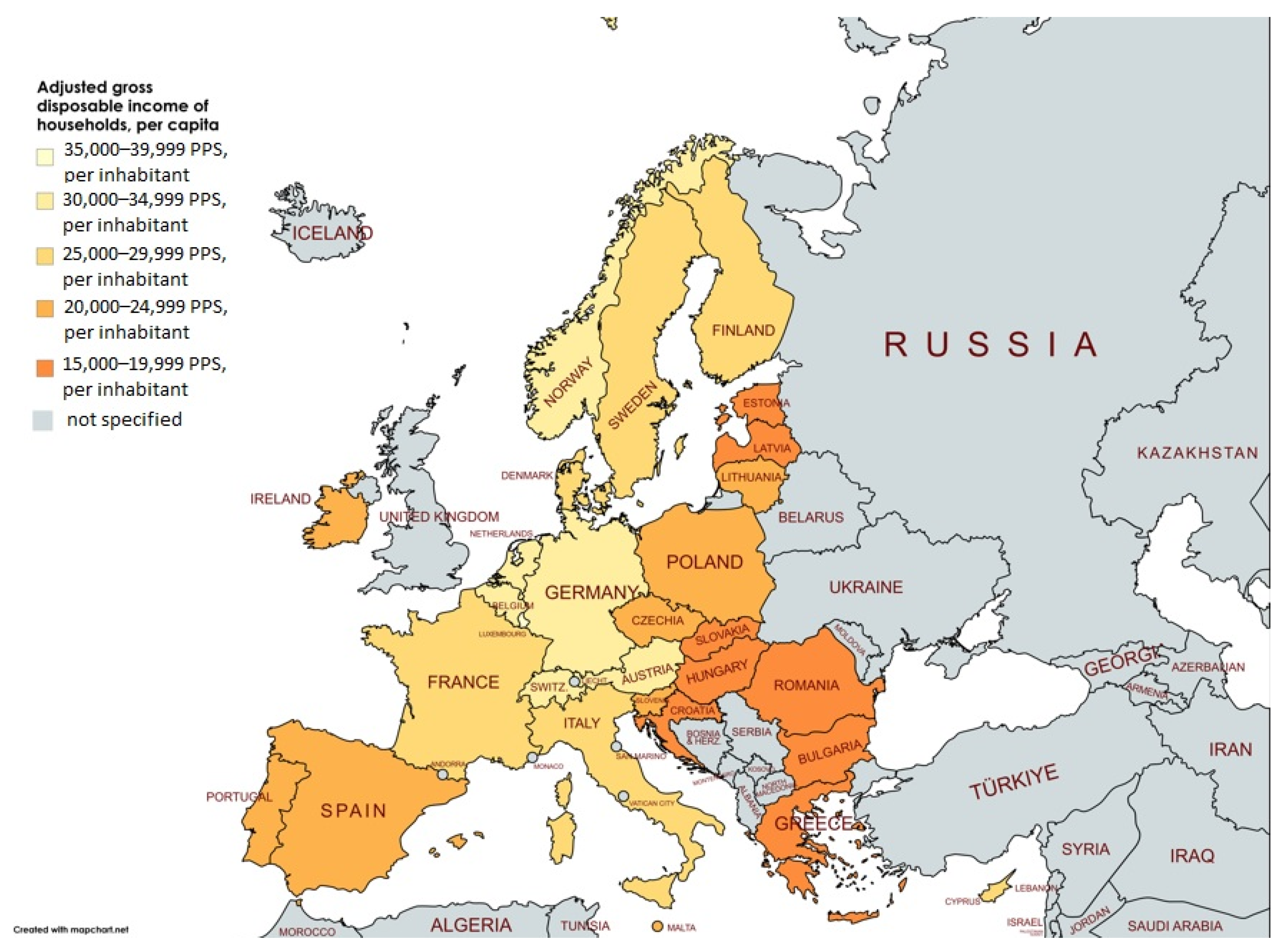

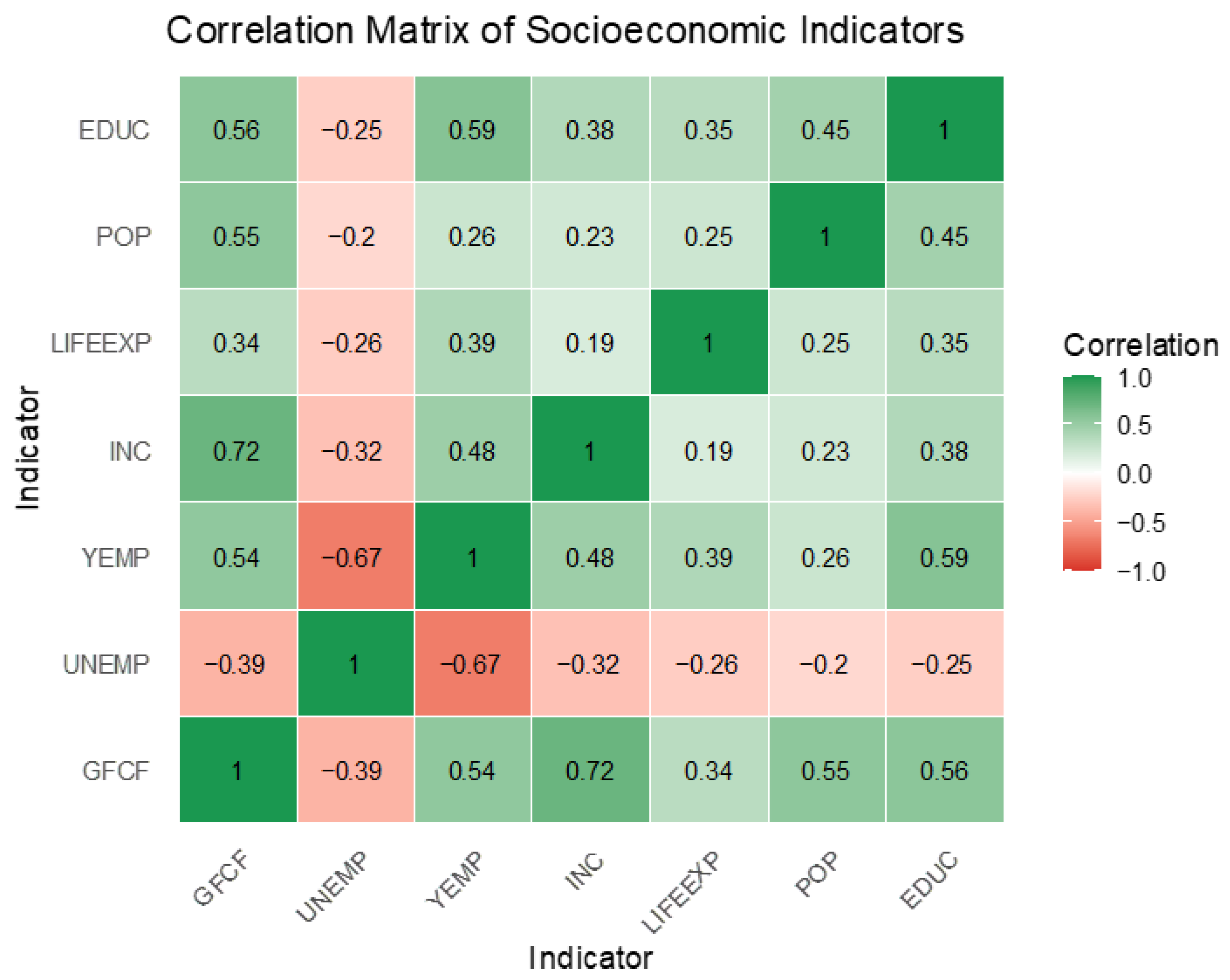

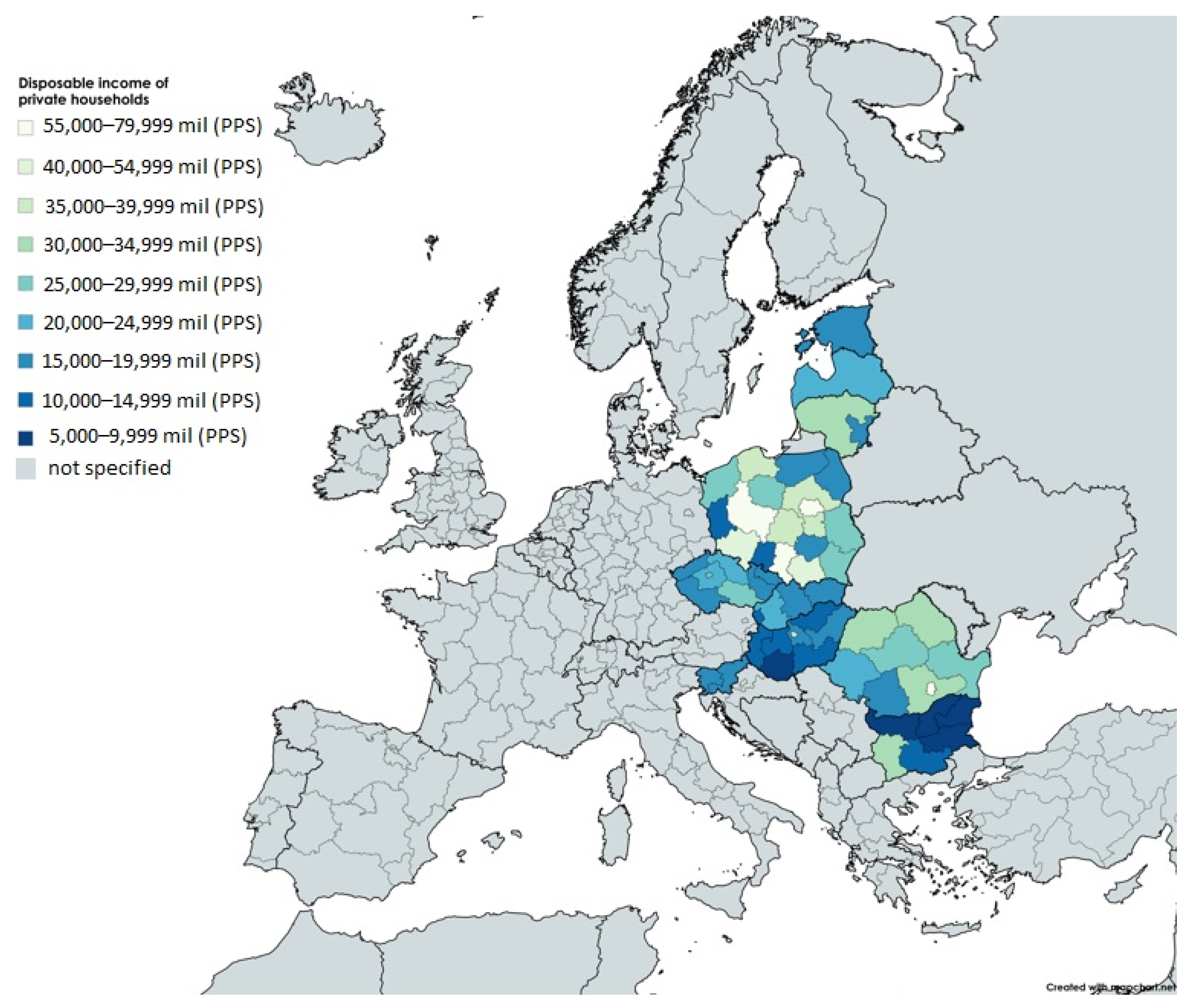

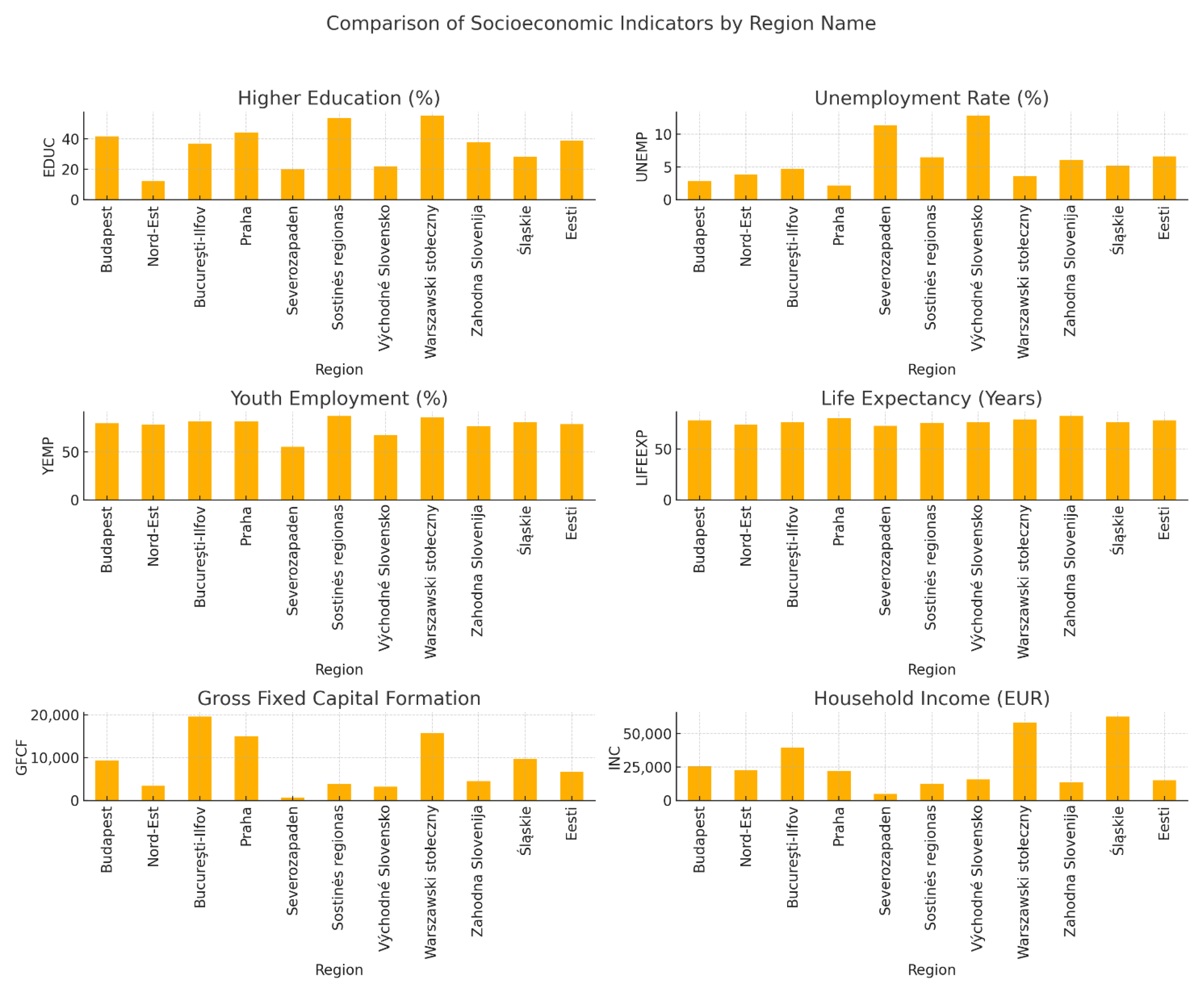

4.1. Input Data

4.2. Empirical Results

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| At Levels | |||||

|---|---|---|---|---|---|

| INC | GCFC | UNEMP | LIFEEXP | POP | |

| Unit root (Common Unit Root Process) | |||||

| LLC | 13.17 (0.99) | 5.88 (0.99) | −19.48 (0.000) * | −31.19 (0.000) * | −548.41 (0.000) * |

| Unit root (Individual Unit Root Process) | |||||

| IPS | 14.81 (0.99) | 7.83 (0.99) | −6.09 (0.000) * | −14.96 (0.000) * | −741.02 (0.000) * |

| ADF-Fisher Chi-square | 3.19 (0.99) | 57.39 (0.999) | 230.75 (0.000) * | 257.99 (0.000) * | 72.52 (0.000) * |

| At first difference | |||||

| Unit root (Common Unit Root Process) | |||||

| LLC | −6.51 (0.000) * | −20.31 (0.000) * | −4.26 (0.000) * | −61.77 (0.000) * | −2598.32 (0.000) * |

| Unit root (Individual Unit Root Process) | |||||

| IPS | −3.80 (0.000) * | −7.69 (0.000) ** | −1.87 (0.030) ** | −21.44 (0.000) * | −809.26 (0.000) * |

| ADF-Fisher Chi-square | 188.64 (0.000) * | 285.13 (0.000) * | 137.65 (0.083) * | 348.21 (0.000) * | 165.329 (0.000) * |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. * |

|---|---|---|---|---|

| Long-Run Equation | ||||

| GFCF | 2.83 | 0.20 | 13.99 | 0.000 * |

| UNEMP | −213.99 | 35.83 | −5.97 | 0.000 * |

| LIFEEXP | 112.24 | 10.52 | 10.66 | 0.000 * |

| POP | −6.72 | 3.23 | −2.07 | 0.038 ** |

| Short-Run Equation | ||||

| COINTEQ01 | −0.01 | 0.02 | −0.46 | 0.638 |

| D(GFCF) | 0.39 | 0.11 | 3.35 | 0.000 * |

| D(UNEMP) | −213.33 | 57.35 | −1.97 | 0.048 ** |

| D(LIFEEXP) | 43.15 | 79.92 | 0.53 | 0.589 |

| D(POP) | −227.97 | 173.01 | −1.31 | 0.188 |

References

- Davies, S. Regional resilience in the 2008–2010 downturn: Comparative evidence from European countries. Camb. J. Reg. Econ. Soc. 2011, 4, 369–382. [Google Scholar] [CrossRef]

- Boschma, R. Towards an evolutionary perspective on regional resilience. Reg. Stud. 2015, 49, 733–751. [Google Scholar] [CrossRef]

- Prodi, E.; Ghinoi, S.; Rubini, L.; Silvestri, F. Do informal institutions matter for the economic resilience of European regions? A study of the post-2008 shock. Econ. Polit. 2023, 40, 189–223. [Google Scholar] [CrossRef]

- Mantas, R.; Mindaugas, B. From adversity to advantage: A systematic literature review on regional economic resilience. Urb. Sci. 2025, 9, 118. [Google Scholar]

- Cellini, R.; Di Caro, P.; Torrisi, G. Regional resilience in Italy: Do employment and income tell the same story? In Handbook of Regions and Competitiveness; MPRA Paper No. 59660; University Library of Munich: Munich, Germany, 2014. [Google Scholar]

- Nijkamp, P.; Ţigănaşu, R.; Bănică, A.; Pascariu, G.C. Institutional adaptability: Its relevance for enhancing resilience and smart specialization capacity of the European Union’s lagging regions. Eurasian Geogr. Econ. 2022, 65, 1–33. [Google Scholar] [CrossRef]

- Peng, A. Sustainable regional development from the perspective of economic resilience: Based on the impact of COVID-19. PLoS ONE 2025, 20, 0314663. [Google Scholar] [CrossRef] [PubMed]

- Tian, S.; He, Y. The impact of digital industry development on regional economic resilience: Evidence from China. PLoS ONE 2025, 20, 0315203. [Google Scholar] [CrossRef]

- Gu, J.; Liu, Z. A study of the coupling between the digital economy and regional economic resilience: Evidence from China. PLoS ONE 2024, 19, 0296890. [Google Scholar] [CrossRef]

- Drobniak, A. Economic resilience and hybridization of development—A case of the central European regions. Reg. Stat. 2017, 7, 43–62. [Google Scholar] [CrossRef]

- Goldin, I. Why Do Some Countries Develop and Others Not? In Development in Turbulent Times: The Many Faces of Inequality Within Europe, 1st ed.; Dobrescu, P., Ed.; Springer: Berlin/Heidelberg, Germany, 2019; pp. 13–30. [Google Scholar]

- European Parliament. Regional Inequalities in the EU. Briefing 2019. Available online: https://www.europarl.europa.eu/RegData/etudes/BRIE/2019/637951/EPRS_BRI(2019)637951_EN.pdf (accessed on 19 May 2025).

- European Commission. Competitiveness in Low-Income and Low-Growth Regions. The Lagging Regions Report. 2017. Available online: https://ec.europa.eu/regional_policy/sources/studies/lagging_regions%20report_en.pdf (accessed on 19 May 2025).

- Capello, R.; Perucca, G. Industrial restructuring in CEE regions: Determinants of regional growth in the accession and in the crisis period. J. Balt. Stud. 2016, 48, 309–329. [Google Scholar] [CrossRef]

- Lang, T. Socio-economic and political responses to regional polarisation and socio-spatial peripheralisation in central and eastern Europe: A research agenda. Hung. Geogr. Bull. 2015, 64, 171–185. [Google Scholar] [CrossRef]

- Tichit, A. The Optimal Speed of Transition Revisited. Eur. J. Political Econ. 2006, 22, 349–369. [Google Scholar] [CrossRef]

- Svejnar, J. Transition Economies: Performance and Challenges. J. Econ. Perspect. 2002, 16, 3–28. [Google Scholar] [CrossRef]

- Csomós, G.; Derudder, B. European cities as command-and-control centres 2006–11. Eur. Urban Reg. Stud. 2013, 21, 345–352. [Google Scholar] [CrossRef]

- Smith, A.; Timár, J. Uneven transformations: Space, economy and society 20 years after the collapse of state socialism. Eur. Urban Reg. Stud. 2010, 21, 115–125. [Google Scholar] [CrossRef]

- Steinführer, A.; Haase, A. Demographic Change as Future Challenge for Cities in East Central Europe. Geogr. Ann. B 2007, 89, 183–195. [Google Scholar] [CrossRef]

- Stec, M.; Filip, P.; Grzebyk, M.; Pierscieniak, A. Socio-economic development in EU member states—Concept and classification. Eng. Econ. 2014, 25, 504–512. [Google Scholar] [CrossRef]

- Wu, L.; Kim, S.K. Does socioeconomic development lead to more equal distribution of green space? Evidence from Chinese cities. Sci. Total Environ. 2021, 757, 143780. [Google Scholar] [CrossRef] [PubMed]

- Vorontsov, D.; Shikhalev, A.; Semushina, K. Using of cultural heritage in the socio-economic development strategy of the EU regions. Procedia Soc. Behav. Sci. 2015, 188, 163–169. [Google Scholar] [CrossRef][Green Version]

- Jie, H.; Khan, I.; Alharthi, M.; Zafar, M.W.; Saeed, A. Sustainable energy policy, socio-economic development, and ecological footprint: The economic significance of natural resources, population growth, and industrial development. Util. Policy 2023, 81, 101490. [Google Scholar] [CrossRef]

- Herodowicz, T.; Konecka-Szydlowska, B.; Churski, P.; Perdal, R. Political Divisions and Socio-Economic Disparities in Poland: A Geographical Approach. Sustainability 2021, 13, 13604. [Google Scholar] [CrossRef]

- Compagnucci, F.; Gentili, A.; Valentini, E.; Gallegati, M. Asymmetric responses to shocks: The role of structural change on resilience of the Euro area regions. Appl. Econ. 2022, 53, 4324–4355. [Google Scholar] [CrossRef]

- OECD. It Together: Why Less Inequality Benefits All; OECD Publishing: Paris, France, 2015. [Google Scholar] [CrossRef]

- Pastuszka, S.; Pastuszka, K. The level and dynamics of socio-economic development of Great Britain regions in 2012-2020. Eur. Res. Stud. 2024, 27, 3–19. [Google Scholar] [CrossRef]

- Savoia, F. Income Inequality Convergence Across EU Regions. Available online: http://www.lisdatacenter.org/wps/liswps/760.pdf (accessed on 15 May 2025).

- Carrera, E.J.S.; Rombaldoni, R.; Pozzi, R. Socioeconomic inequalities in Europe. Econ. Anal. Policy 2021, 71, 307–320. [Google Scholar] [CrossRef]

- Georgescu, I.; Nica, I.; Delcea, C.; Chiriță, N.; Ionescu, Ș. Assessing regional economic performance in Romania through panel ARDL and panel quantile regression models. Sustainability 2024, 16, 9287. [Google Scholar] [CrossRef]

- Artelaris, P.; Kallioras, D.; Petrakos, G. Regional inequalities and convergence clubs in the European Union New Member States. East. J. Eur. Stud. 2010, 1, 113–133. [Google Scholar]

- Petrakos, G.; Kallioras, D.; Anagnostou, A. Regional Convergence and Growth in Europe: Understanding Patterns and Determinants. Eur. Res. Stud. 2011, 18, 375–391. [Google Scholar] [CrossRef]

- Eller, M.; Haiss, P.; Steiner, K. Foreign Direct Investment in the Financial Sector and Economic Growth in Central and Eastern Europe: The Crucial Role of the Efficiency Channel. Emerg. Mark. Rev. 2006, 7, 300–319. [Google Scholar] [CrossRef]

- Nicolini, M.; Resmini, L. FDI Spillovers in New EU Member States. Econ. Transit. 2010, 18, 487–511. [Google Scholar] [CrossRef]

- Radosevic, S. Regional Innovation Systems in Central and Eastern Europe: Determinants, Organizers and Alignments. J. Technol. Transf. 2002, 27, 87–96. [Google Scholar] [CrossRef]

- Bandelj, N.; Mahutga, M.C. How socio-economic change shapes income inequality in post-socialist Europe. Soc. Forces 2010, 88, 2133–2161. [Google Scholar] [CrossRef]

- Growiec, K.; Growiec, J. Trusting only whom you know, knowing only whom you trust: The joint impact of social capital and trust on happiness in CEE countries. J. Happiness Stud. 2014, 15, 1015–1040. [Google Scholar] [CrossRef]

- Krätke, S. Metropolisation of the European Economic Territory as a Consequence of Increasing Specialisation of Urban Agglomerations in the Knowledge Economy. Eur. Plan. Stud. 2007, 15, 1–27. [Google Scholar] [CrossRef]

- Smolińska-Bryza, K.; Okereke, O.; Anyebe, D. Regional analysis of socio-economic development: The case of Poland. Sustainability 2025, 17, 1877. [Google Scholar] [CrossRef]

- Gergics, T. The Impact of Convergence on Inequalities in the European Union since 2004. Public Financ. Q. 2023, 68, 30–47. [Google Scholar] [CrossRef]

- Antonescu, D.; Florescu, I.C. Spatial Patterns of Regional Inequalities in European Union in Pandemic Time: Empirical Evidence from NUTS 2 Regions. J. Acad. Res. Econ. 2023, 15, 596–615. [Google Scholar]

- Christopoulos, D.K. The relationship between output and unemployment: Evidence from Greek regions. Pap. Reg. Sci. 2004, 83, 611–620. [Google Scholar] [CrossRef]

- Lloyd, S.J.; Quijal-Zamorano, M.; Achebak, H.; Hajat, S.; Muttarak, R.; Striessnig, E.; Ballester, J. The direct and indirect influences of interrelated regional-level sociodemographic factors on heat-attributable mortality in Europe: Insights for adaptation strategies. Environ. Health Perspect. 2023, 131, e084675. [Google Scholar] [CrossRef]

- EUROSTAT. Gross Fixed Capital Formation by Main Asset Type. 2025. Available online: https://ec.europa.eu/eurostat/cache/metadata/en/nama_10_an6_esms.htm (accessed on 23 May 2025).

- Luy, M.; Di Giulio, P.; Di Lego, V.; Lazarevic, P.; Sauerberg, M. Life expectancy: Frequently used, but hardly understood. Gerontology 2020, 66, 95–104. [Google Scholar] [CrossRef]

- Hou, X.; Ma, Q.; Wang, X. Spatial differentiation and elements influencing urban resilience in the middle reaches of the Yangtze river under the COVID-19 pandemic. Discret. Dyn. Nat. Soc. 2021, 2021, 6687869. [Google Scholar] [CrossRef]

- Sarafidis, V.; Wansbeek, T. Cross-Sectional Dependence in Panel Data Analysis. Econom. Rev. 2012, 31, 483–531. [Google Scholar] [CrossRef]

- Breusch, T.S.; Pagan, A.R. The Lagrange Multiplier Test and its Applications to Model Specification in Econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; Cambridge Working Papers in Economics No. 0435; Center for Economic Studies & Ifo Institute for Economic Research CESifo: Munich, Germany, 2004. [Google Scholar]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Barbieri, L. Panel Cointegration Tests: A Survey. Riv. Internazionale Di Sci. Soc. 2008, 1, 3–36. [Google Scholar]

- Hlouskova, J.; Wagner, M. The performance of panel unit root and stationarity tests: Results from a large scale simulation study. Econom. Rev. 2006, 25, 85–116. [Google Scholar] [CrossRef]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Pedroni, P. Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom. Theory 2004, 20, 597–625. [Google Scholar] [CrossRef]

- Neal, T. Panel cointegration analysis with xtpedroni. Stata J. 2014, 14, 684–692. [Google Scholar] [CrossRef]

- Çetintaş, H.; Barişik, S. Export, Import and Economic Growth: The Case of Transition Economies. Transit. Stud. Rev. 2009, 15, 636–649. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y. Cointegration and speed of convergence to equilibrium. J. Econom. 1996, 71, 117–143. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-spectral Models. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- EUROSTAT. Households—Statistics on Income, Saving and Investment. 2025. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?_saving_and_investment&oldid=585444#Gross_household_adjusted_disposable_income (accessed on 23 May 2025).

- Zhu, J.H.; Sun, H.X. Research on Spatial-temporal Evolution and Influencing Factors of Urban Resilience of China’s Three Metropolitan Agglomerations. Soft Sci. 2020, 34, 72–79. [Google Scholar]

- Eurofound. European Foundation for the Improvement of Living and Working Conditions. Convergence: Economic Dimension. 2025. Available online: https://eurofound.europa.eu/en/convergence-economic-dimension (accessed on 30 May 2025).

- Mackenbach, J.P. Health Inequalities: Persistence and Change in European Welfare States, 1st ed.; Oxford University Press: Oxford, UK, 2020. [Google Scholar]

- EUROSTAT. Educational Attainment Statistics. 2025. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Educational_attainment_statistics (accessed on 23 May 2025).

- OECD. Youth Employment and Social Policies. 2025. Available online: https://www.oecd.org/en/topics/youth-employment-and-social-policies.html (accessed on 23 May 2025).

- Hintze, J.L.; Nelson, R.D. Violin Plots: A Box Plot-Density Trace Synergism. Am. Stat. 1998, 52, 181–184. [Google Scholar] [CrossRef]

- Di Caro, P. Recessions, recoveries and regional resilience: Evidence on Italy. Camb. J. Reg. Econ. Soc. 2015, 8, 273–291. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson New International Edition: London, UK, 2013. [Google Scholar]

- Hsiao, C. Analysis of Panel Data, 4th ed.; Cambridge University Press: Cambridge, UK, 2022. [Google Scholar]

- Rodríguez-Pose, A.; Crescenzi, R. Research and Development, Spillovers, Innovation Systems, and the Genesis of Regional Growth in Europe. Reg. Stud. 2008, 42, 51–67. [Google Scholar] [CrossRef]

- Bloom, D.E.; Canning, D.; Fink, G. Implications of population aging for economic growth. Oxf. Rev. Econ. Policy 2010, 26, 583–612. [Google Scholar] [CrossRef]

- Androniceanu, A.; Georgescu, I. Regional Policy in Romania: Main Changes and Dilemmas of Practice; London Scientific: London, UK, 2018; ISBN 978-0-9954618-5-7. [Google Scholar]

- Brülhart, M.; Sbergami, F. Agglomeration and Growth: Cross-Country Evidence. J. Urban Econ. 2009, 65, 48–63. [Google Scholar] [CrossRef]

- Adeodato, R.; Pournouri, S. Secure Implementation of E-Governance: A Case Study About Estonia. In Cyber Defence in the Age of AI, Smart Societies and Augmented Humanity; Jahankhani, H., Kendzierskyj, S., Chelvachandran, N., Ibarra, J., Eds.; Advanced Sciences and Technologies for Security Applications; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

| Ref. | Objective | Territory | Time Interval | Results |

|---|---|---|---|---|

| Ref. [37] | Factors that determine changes in income inequality | 10 CEE countries | 1989–2001 | Income inequality is mainly related to the privatization process, the social exclusion of minorities, and foreign capital investments. |

| Ref. [14] | Relationship between industrial restructuring and economic growth | CEE countries | 2004–2012 | Regional growth differences are due to productivity inequalities in higher-value sectors. |

| Ref. [30] | Relationship between spatial and social disparities | 276 EU regions | 2000–2016 | Regional inequalities are related to the geography of production. |

| Ref. [43] | Relationship between output expansion and unemployment | 13 Greek regions | 1971–1993 | A long-run relationship documented between unemployment and output growth. Okun’s law con-firmed for 6 out of the 13 regions examined. |

| Ref. [44] | Influence of sociodemographic predictors and relative income | 147 EU regions | 1998–2012 | More levels of education are associated with lower heat-related mortality, while higher life expectancy and relative income have mixed relations. |

| Ref. [28] | Evaluation of the dynamics of social and economic development | 41 GB regions | 2012–2020 | The leader in socioeconomic development among GB regions is London, which dominates economically over other regions. |

| Ref. [40] | Outline regional disparities in development | NUTS2 regions in Poland | 2010–2012; 2020–2022 | Authors highlighted clear spatial and structural disparities. Mazowieckie, which includes the capital city, importantly diverges in its level of social and economic development from the other regions. |

| Variable | Acronym | Measurement Unit | Source |

|---|---|---|---|

| Disposable income of private households by NUTS2 region | INC | Million purchasing power standards (PPS, EU27 from 2020) | Eurostat |

| Gross fixed capital formation by NUTS2 region | GCFC | Million euro | Eurostat |

| Unemployment rates by NUTS2 region | UNEMP | % of population from 20 to 64 years | Eurostat |

| Population density by NUTS2 region | POP | Persons per square kilometer | Eurostat |

| Life expectancy at birth by NUTS2 region | LIFEEXP | Year | Eurostat |

| Educational attainment level by NUTS2 region | EDUC | % of population with tertiary education | Eurostat |

| Youth employment rate by NUTS2 region | YEMP | % of population from 25 to 29 years | Eurostat |

| EDUC | UNEMP | YEMP | LIFEEXP | POP | GFCF | INC | |

|---|---|---|---|---|---|---|---|

| Mean | 26.09 | 6.17 | 74.63 | 76.57 | 238.05 | 4840.76 | 19,701.63 |

| Median | 23.8 | 5.4 | 75.5 | 76.5 | 89.4 | 3946.35 | 16,415 |

| Maximum | 62.1 | 18.4 | 91.3 | 82.8 | 3448.1 | 31,298.57 | 76,303.39 |

| Minimum | 11.2 | 1.2 | 50.1 | 69.5 | 29.7 | 408.02 | 3981.8 |

| Std. Dev. | 9.88 | 3.36 | 7.05 | 2.06 | 572.99 | 3723.53 | 12,189.21 |

| Skewness | 1.11 | 0.84 | −0.56 | 0.12 | 4.51 | 2.60 | 1.89 |

| Kurtosis | 4.13 | 3.30 | 3.35 | 3.25 | 22.89 | 12.62 | 7.14 |

| Tests | Statistic | p-Value |

|---|---|---|

| Breusch–Pagan LM | 5240.38 | 0.000 |

| Pesaran–scaled LM | 66.67 | 0.000 |

| Pesaran CD | 9.42 | 0.000 |

| At Levels | |||||

|---|---|---|---|---|---|

| INC | GCFC | UNEMP | LIFEEXP | POP | |

| Unit root (Common Unit Root Process) | |||||

| LLC | 12.81 (0.99) | 5.78 (0.99) | 3.07 (0.998) | 49.16 (0.999) | 0.59 (0.723) |

| Unit root (Individual Unit Root Process) | |||||

| IPS | 14.27 (0.99) | 7.64 (0.99) | 1.17 (0.879) | 4.50 (0.999) | 3.39 (0.999) |

| ADF-Fisher Chi-square | 3.19 (0.99) | 57.10 (0.999) | 87.30 (0.959) | 21.68 (0.999) | 115.11 (0.401) |

| At first difference | |||||

| Unit root (Common Unit Root Process) | |||||

| LLC | −6.72 (0.000) * | −20.60 (0.000) * | −3.84 (0.000) * | −14.57 (0.000) * | −10.59 (0.000) * |

| Unit root (Individual Unit Root Process) | |||||

| IPS | −4.11 (0.000) * | −7.66 (0.000) ** | −1.71 (0.043) ** | −9.72 (0.023) ** | −2.40 (0.008) * |

| ADF-Fisher Chi-square | 188.09 (0.000) * | 278.25 (0.000) * | 244.09 (0.000) * | 323.968 (0.000) * | 164.31 (0.009) * |

| Pooled AR Coefficients Within-Dimension | ||

|---|---|---|

| Statistics (Prob.) | Weighted Statistics (Prob.) | |

| Panel v-stat. | 0.90 (0.183) | −3.07 (0.99) |

| Panel ρ-stat. | 4.58 (0.99) | 5.62 (0.99) |

| Panel PP-stat. | −8.40 * (0.000) | −11.52 * (0.000) |

| Panel ADF-stat. | −6.89 * (0.000) | −7.22 * (0.000) |

| Individual AR Coefficients Between-Dimension | ||

| Group ρ-stat. | 8.98 (0.99) | |

| Group PP-stat. | −17.94 * (0.000) | |

| Group ADF-stat. | −6.22 * (0.000) | |

| t-Statistic | Prob | |

|---|---|---|

| Variance ratio 0.001 | −3.34 | 0.000 * |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. * |

|---|---|---|---|---|

| Long-Run Equation | ||||

| GFCF | 1.31 | 0.06 | 19.59 | 0.000 * |

| UNEMP | −755.41 | 15.01 | −50.30 | 0.000 * |

| LIFEEXP | −1111.73 | 54.90 | −20.37 | 0.000 * |

| POP | 1288.86 | 29.87 | 43.13 | 0.000 * |

| Short-Run Equation | ||||

| COINTEQ01 | −0.12 | 0.06 | −2.07 | 0.039 ** |

| D(GFCF) | 0.11 | 0.13 | 0.89 | 0.369 |

| D(UNEMP) | −41.11 | 70.37 | −0.58 | 0.559 |

| D(LIFEEXP) | 196.14 | 72.77 | 2.69 | 0.007 * |

| D(POP) | −265.39 | 252.53 | −1.05 | 0.294 |

| C | −5690.7 | 4838.74 | −1.17 | 0.240 |

| Null Hypothesis (H0) | F-Statistic | p-Value | Conclusion |

|---|---|---|---|

| GCFC nGC INC | 6.12 | 0.002 * | GCFC → INC |

| INC nGC CGFC | 5.83 | 0.003 * | INC → GCFC |

| UNEMP nGC INC | 6.62 | 0.001 * | UNEMP → INC |

| INC nGC UNEMP | 7.26 | 0.008 * | INC → UNEMP |

| LIFEEXP nGC INC | 3.46 | 0.032 ** | LIFEEXP → INC |

| INC nGC LIFEEXP | 4.47 | 0.011 ** | INC → LIFEEXP |

| POP nGC INC | 2.06 | 0.128 | |

| INC nGC POP | 2.25 | 0.105 | |

| UNEMP nGC GCFC | 1.65 | 0.192 | |

| GCFC nGC UNEMP | 2.09 | 0.124 | |

| LIFEEXP nGC GFCF | 7.65 | 0.000 * | LIFEEXP ⟶ GFCF |

| GFCF nGC LIFEEXP | 4.94 | 0.007 * | GFCF → LIFEEXP |

| POP nGC GFCF | 7.56 | 0.000 * | POP → GFCF |

| GFCF nGC POP | 4.94 | 0.007 * | GFCF → POP |

| LIFEEXP nGC UNEMP | 5.50 | 0.004 * | LIFEEXP → UNEMP |

| UNEMP nGC LIFEEXP | 11.16 | 2 × 10−5 * | UNEMP → LIFEEXP |

| POP nGC UNEMP | 2.09 | 0.123 | |

| UNEMP nGC POP | 1.71 | 0.181 | |

| POP nGC LIFEEXP | 1.08 | 0.339 | |

| LIFEEXP nGC POP | 1.29 | 0.275 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Băncescu, M.; Georgescu, I. Panel Cointegration and Causality Among Socioeconomic Indicators in CEE Regions: Insights for Regional Economic Resilience and Sustainable Development. Sustainability 2025, 17, 9947. https://doi.org/10.3390/su17229947

Băncescu M, Georgescu I. Panel Cointegration and Causality Among Socioeconomic Indicators in CEE Regions: Insights for Regional Economic Resilience and Sustainable Development. Sustainability. 2025; 17(22):9947. https://doi.org/10.3390/su17229947

Chicago/Turabian StyleBăncescu, Mioara, and Irina Georgescu. 2025. "Panel Cointegration and Causality Among Socioeconomic Indicators in CEE Regions: Insights for Regional Economic Resilience and Sustainable Development" Sustainability 17, no. 22: 9947. https://doi.org/10.3390/su17229947

APA StyleBăncescu, M., & Georgescu, I. (2025). Panel Cointegration and Causality Among Socioeconomic Indicators in CEE Regions: Insights for Regional Economic Resilience and Sustainable Development. Sustainability, 17(22), 9947. https://doi.org/10.3390/su17229947