1. Introduction

During the past decades, governance of natural resources has emerged as a critical issue, driven by the challenges posed by climate change and urban growth [

1,

2,

3]. With governments often facing limitations in capacity and budget to safeguard resources effectively, the private sector has increasingly participated in shaping policies and initiatives, while civil society advocates for more active involvement in decision-making concerning natural resource conservation and utilization [

4,

5]. Amid this shifting landscape, the development of market-based instruments for managing and valuing of ecosystem services has gained prominence as an alternative or complement to government-led actions, influencing environmental agendas at the state and agency level [

6,

7,

8]. Specifically, payment for ecosystem services (PES) schemes [

9,

10,

11], and their dominant variations such as payments for watershed services (PWS) have experienced rapid proliferation over the past two decades [

12,

13,

14,

15]. These programs aim to tackle water security concerns through voluntary mechanisms, where government or water users invest in nature-based solutions (NbS) within watersheds [

16]. To our best knowledge, as of 2025, the number of such PWS programs worldwide reached 881, with a cumulative transaction value of approximately USD 49 billion [

17]. These numbers show how investment in NbS for water security via PWS and other instrument has doubled over the past decade, if we considered around 387 initiatives as of 2018 with a total investment of USD 24.7 billion [

18].

Latin America has stood out as a global hotspot for PWS [

15,

19] as it has been a pioneer and innovator in developing NbS programs for source water protection, creating enabling policies, institutions, and implementation approaches [

20]. Due to the reliance of its cities on highland and mountain forests for freshwater and energy production, the region is particularly vulnerable to watershed degradation, which poses risks to water resources and other vital goods and services derived from these areas [

21,

22]. Water Funds have emerged as one of the most widely promoted PWS schemes in the region to secure water provision for some of Latin America’s largest cities [

5,

23,

24,

25,

26]. Broadly defined, a Water Fund is a replicable financial and governance model that establishes a link between downstream beneficiaries and upstream land stewards through a sustainable institutional, management and financing mechanism [

27,

28]. Water Funds share three central components: a funding component to collect resources and ensure the mechanism’s financial stability, a governance component responsible for making decisions regarding watershed conservation strategies, and a management component focused on implementing field activities [

28].

Since the establishment of the first Water Fund in the city of Quito in 2000, there has been an intention by different actors to replicate these mechanisms throughout the region. Consequently, the Latin American Water Funds Partnership (LAWFP) emerged in 2011, promoted by The Nature Conservancy (TNC) and other private and public actors, leading to the creation of 26 Water Funds in the region, in particular in Colombia, Ecuador and Brazil. Water Funds, as a subset of PWS have been primarily studied from an economic theory perspective, viewing them as a market solution to the problem of managing water-related ecosystem services as externalities. As a result, several studies have focused on evaluating these schemes based on efficiency, additionality, and conditionality criteria [

15,

29,

30]. However, empirical research on the impacts of Water Funds as institutions that contribute to reshape watershed governance, including actor interactions, roles and responsibilities, and performance of environmental directives, remains limited [

25,

28,

31]. Furthermore, there are few studies comparatively assessing these mechanisms at a national level [

24]. Studying Water Funds from an institutional perspective can provide insights into their impacts on the governance of water ecosystem services, and it can contribute to a deeper understanding of the fundamental challenges related to natural resource management in the region and aid in designing more effective institutions to achieve sustainable development goals [

32].

This study conducts an institutional analysis of Water Funds in Colombia, which are part of the LAWFP. The objective is to understand the key institutional factors enabling and driving the success of Water Funds in Colombia, to grasp their role on development trajectories of Water Funds and understand why some Funds remain active while others dissolve. To achieve this, the study employs Ostrom’s Institutional Analysis and Development Framework (IAD), widely used for examining common-pool resource institutions [

33]. This research argues that the continuity of Water Funds in Colombia depends on the institutional strength of participating stakeholders, the presence of trust among them—often rooted in prior collaboration—and the degree to which environmental authorities perceive the funds as allies rather than competitors. The governance of these funds is weakened when stakeholders lack a consistent agenda, leading to trust erosion and eventual dissolution. The contributions of this paper are twofold: first, we contribute to the literature on water governance by analyzing the factors that influence the continuity of Water Funds as innovative mechanisms for collective action and resource management. Most importantly, we delve into the institutional configuration of specific Water Funds in Colombia, one of the most biodiverse countries in the world, where water ecosystems are vital for sustaining both human populations and the country’s rich biodiversity.

The rest of the paper is organized as follows.

Section 2 outlines the methodology employed, encompassing detailed descriptions of the case studies, the research approach based on concepts of institutions and governance, and the analysis of common-pool resource institutions.

Section 3 presents the results derived from the institutional analysis of Water Funds in Colombia. A discussion of the main findings is covered in

Section 4, while the study’s conclusions are placed in

Section 5.

2. Materials and Methods

This section describes the case studies addressed and the methodological approaches adopted for the aims of the research.

2.1. Case Studies

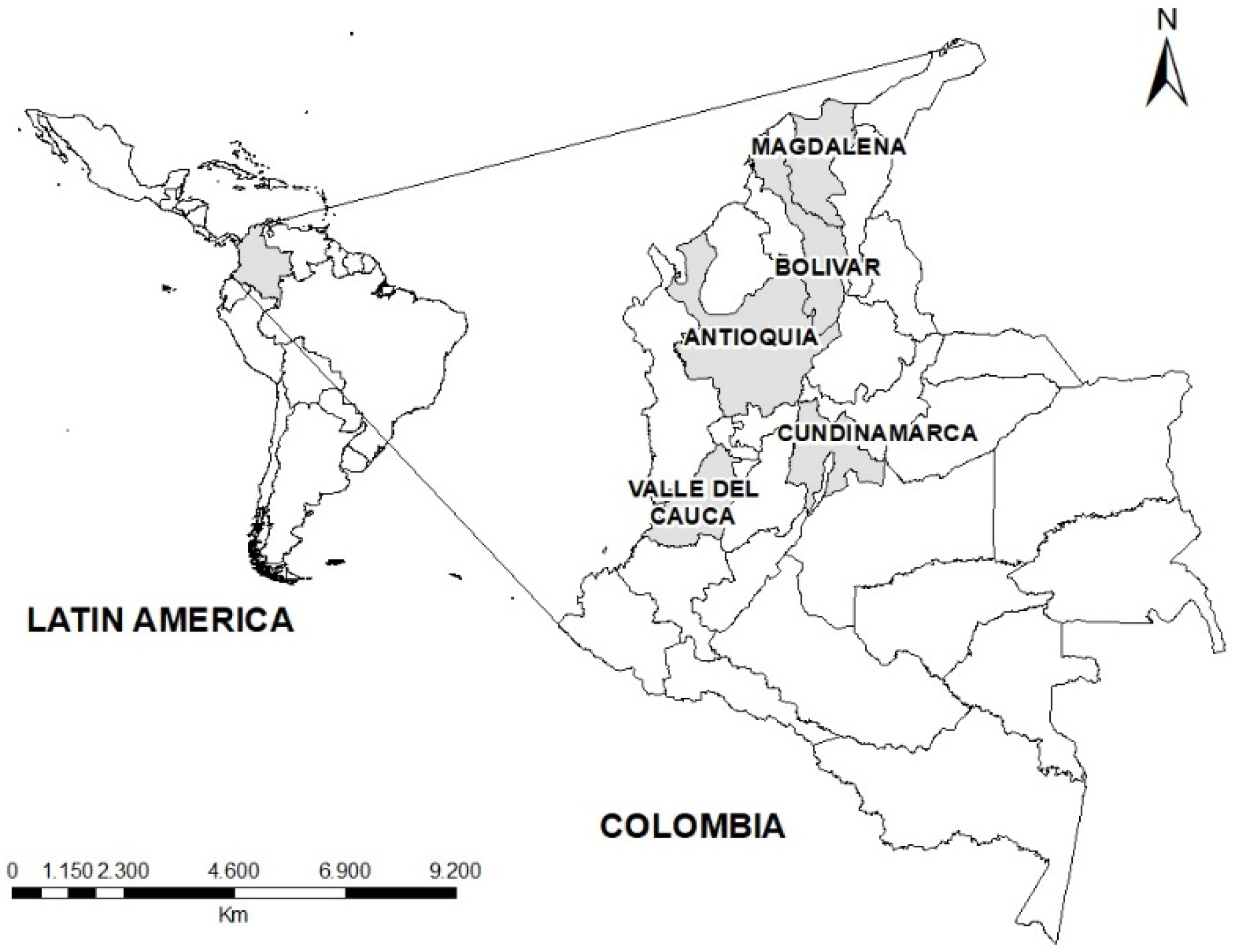

The study focused on the specific case of Colombia, where, as of the date of this study (2020), six Water Funds belonging to the LAWFP have been launched. These funds are in the departments of Antioquia, Bolivar, Cundinamarca, Magdalena, Valle del Cauca, and Norte de Santander. (

Figure 1). The selection of these case studies was based on two key criteria: first, that the Water Fund had already been officially launched (i.e., not still in the planning stage), and second, that the fund was a member of the LAWFP, as we specifically focused on those funds that are part of this partnership. While we attempted to include the Alianza Biocuenca Water Fund from the Norte de Santander region, we were unable to establish contact with them for the purposes of this study.

The first Water Fund established and named as such in Colombia, known as Agua Somos, was introduced in 2009. This fund’s primary objective was to safeguard water quality in Bogotá, the nation’s capital, particularly in the face of climate change and mounting pressures on the natural areas surrounding the city [

34]. As LAWFP grew and witnessed the launch of additional Water Funds across the region, new funds emerged in Colombia, while existing initiatives that align with the Water Fund concept also joined the partnership. Such were the cases of the Fundación Fondo Agua por la Vida y la Sostenibilidad (FAVS) in Valle del Cauca and Cuenca Verde in Antioquia. FAVS, created as an independent organization, has been engaged in watershed protection activities funded by the sugar cane sector and executed by its union, Asocaña, since the early 1990s [

35]. On the other hand, Cuenca Verde originated from joint efforts by TNC and the Medellín water utility (Empresas Públicas de Medellín) with the aim of ensuring the implementation of sustainable land practices in watersheds that supply water to the city of Medellín [

36]. Additionally, two more recent funds, Cartagena and Santa Marta, received funding and technical support from the LAWFP to conduct viability studies before being launched.

The selection of case studies reflects the diversity of ecosystems and social contexts across Colombia. For example, Cuenca Verde, Agua Somos, FAVS, and the Fondo de Agua de Santa Marta y Ciénaga were established in mountainous regions, spanning diverse ecosystems from tropical forests in the lowlands to cloud forests and, in some cases, the páramo. In contrast, the Fondo de Agua Cartagena was created to manage fluvial-marine ecosystems in coastal zones with distinct ecological attributes, land-use patterns, and local actors. Socially, the case studies also represent varied socioeconomic contexts. In Valle del Cauca, the fertile lowlands are predominantly occupied by sugar mills and sugarcane crops, with these industries being the region’s major water users. In areas like Cuenca Verde and Agua Somos, land-use includes both livestock farming and agriculture, practised by a mix of small- and large-scale landowners with varying socioeconomic backgrounds and dependence on the land.

Table 1 provides an overview of the Colombian Water Funds analyzed within this research.

2.2. Institutional Framework for the Analysis of Water Funds

To analyze Water Funds from an institutional perspective, we draw upon the IAD proposed by Ostrom [

33], which has been widely employed in research aimed at studying management of common-pool resources including water resources (e.g., [

37]). For the scope of this research, we have integrated the IAD framework with insights from other authors’ work on the institutional analysis of PES schemes [

31,

38,

39,

40]. This complementary work connects the IAD with PWS literature and operationalizes some of the components of the original IAD framework via guiding questions and analytical variables.

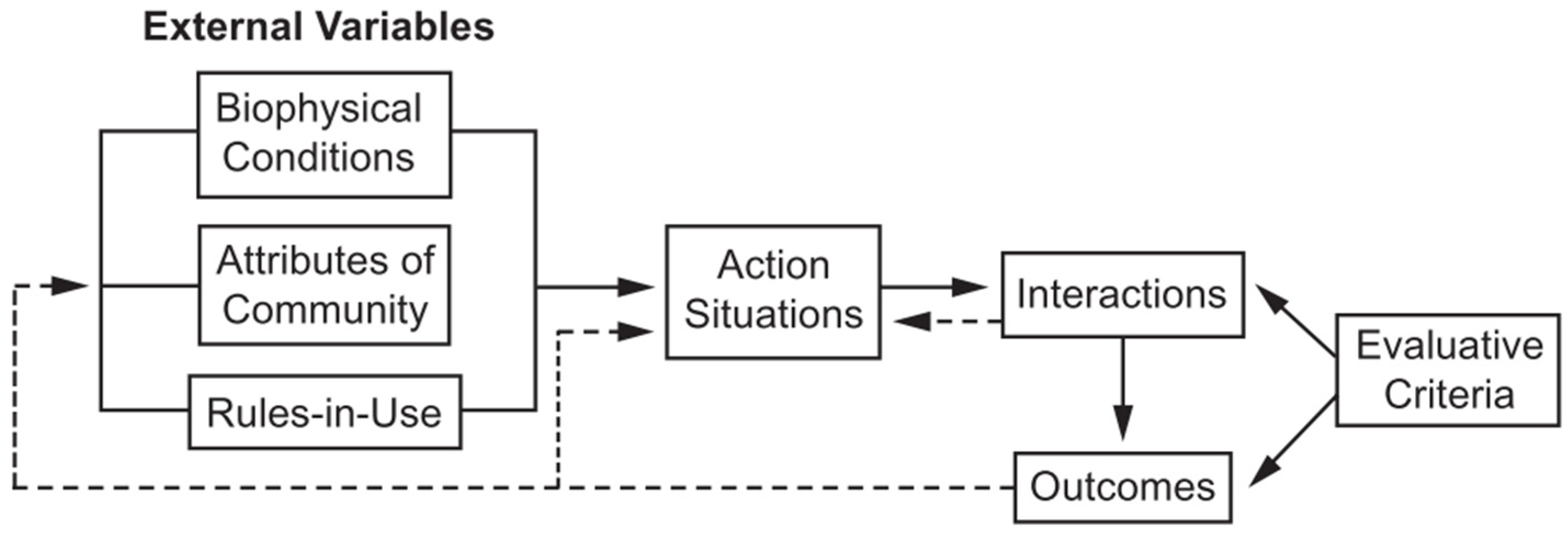

The IAD framework helps highlight key variables of institutional, technical, and participatory aspects of common-pool resource problems and their resulting effects (

Figure 2). In this sense, the framework should represent the main structural variables that are present to some extent in all institutional arrangements, but whose values differ between institutional arrangements [

33].

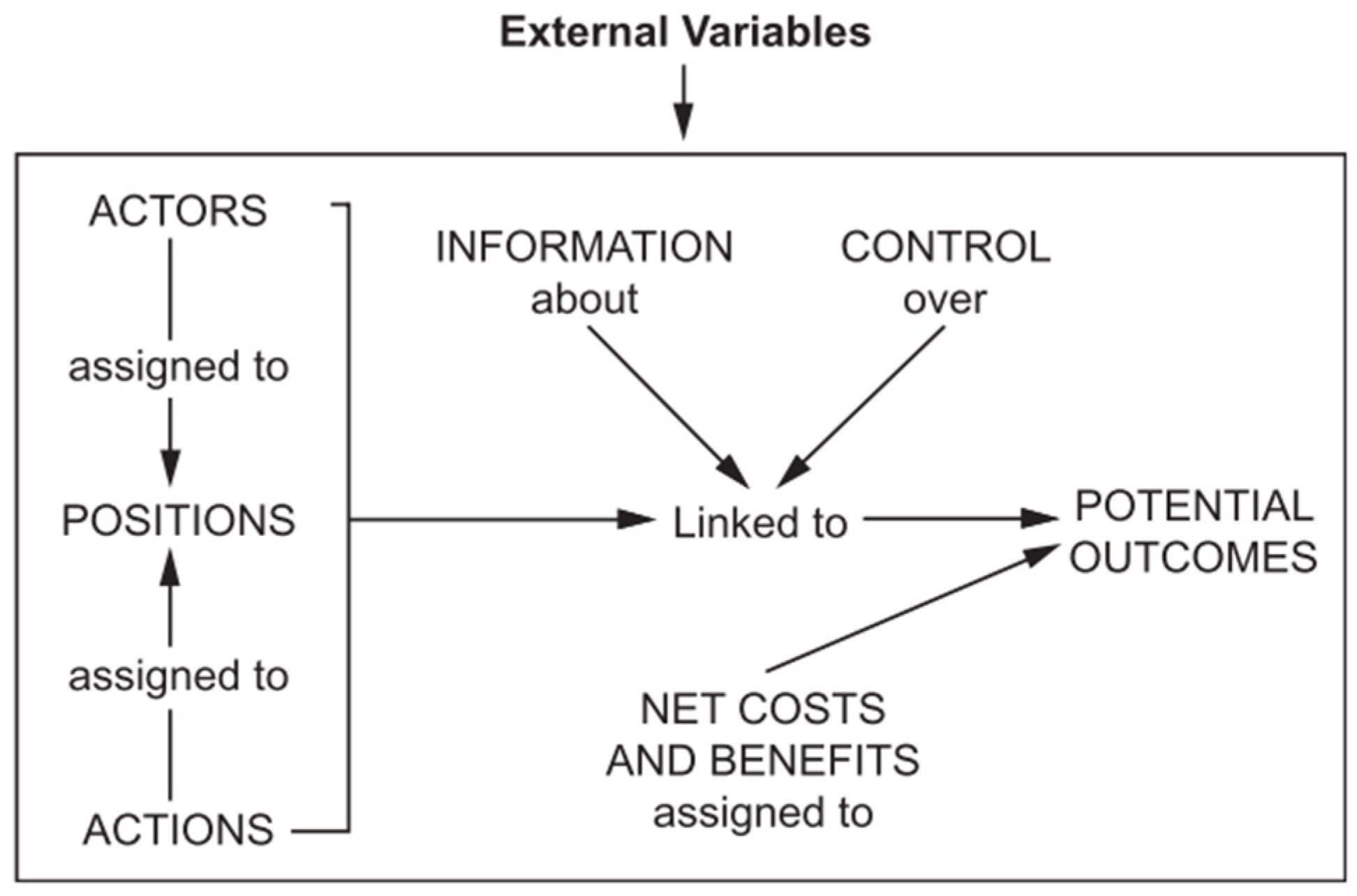

At the heart of the IAD framework there is the concept of action situation, which refers to asocial space of a minimum of two actors, phasing a series of potential actions that produce outcomes [

41]. Actions situations have become a central unit of analysis in social-ecological systems research and are shaped by key variables such as (i) the kind of actors involved in them, which at the same time belong to a community with certain attributes; (ii) the rules that allow specific choices and determines actors participation, (iii) the outcomes from those action situations, which feedback in a loop [

42] (

Figure 3). For this study, our unit of analysis is the rule-making process within a Water Fund (i.e., the action situation of governing a Water Fund), to understand why some Water Funds remained active while others dissolved. The IAD framework informs our data collection and analysis by focusing on key variables in this action situation, including the actors involved, the rules governing their participation, and the outcomes of their interactions. These categories of the IAD framework and the action situation structure were broken down into guiding questions and analytical variables for data collection purposes (

Table 2), directly informing the literature review and qualitative interview process presented below.

2.3. Data Collection and Analysis

The data for this study was collected from two primary sources. The first source involved a comprehensive three-step literature review on Water Funds in Colombia, conducted between March and July 2021, encompassing scientific and gray sources (e.g., reports, non-published studies, and press releases). The search process was structured around the analytical dimensions of the IAD framework, including the roles of actors (e.g., directors, landowners, environmental authorities) and the types of interactions (e.g., synergies, conflicts) that influenced the design and performance of the funds. In the initial step, we conducted a general search within the scientific literature on water funds in Latin America using the search string “Water fund * AND Latin America”. The search was conducted on Web of Science, a university library resource (SOEG at The Danish Royal Library), and Google Scholar. Subsequently, we explored the LAWFP website to access gray literature, including summaries, strategic plans, technical documents, press releases, official videos, and other available websites for each Water Fund. Additionally, we consulted relevant sections on the TNC website, namely “Toolbox”, “Regions”, and “Library”, to gather related information on Latin American Water Funds. The final step involved specific searches for scientific and gray literature on each of the five selected Water Funds using Google Scholar and Google, both in English and Spanish. This review encompassed web pages of municipalities, companies, LAWFP partners, other organizations, press releases, and various other documents.

The second data source comprised qualitative interviews with relevant actors associated with each Colombian Water Fund, conducted in Spanish via Zoom between May and July 2021. In total, 15 semi-structured interviews were conducted—i.e., three for each Water Fund—guided by the IAD framework’s analytical dimensions presented in

Section 2.2. The interview structure and analysis focused on understanding the key actors, their motivations, the rules-in-use, and the outcomes of each Water Fund’s operation. The interviews were fully recorded with the consent of the interviewees and subsequently transcribed.

The stakeholders interviewed included the director and at least one developer from each Water Fund, as well as additional actors occupying various positions and roles, such as board members, representatives of landowners, and environmental authorities (

Table 3). The directors were contacted first via e-mail, with the support from the TNC team in Water Security for Latin America. To conduct a minimum of three interviews per Water Fund, a snowball sampling approach was followed by asking the Water Funds directors for potential next interviewees. The expected profiles for the interviews included other stakeholders such as program/project coordinators, Water Fund developers, board members, representatives of landowners and environmental authorities.

The interviews were analyzed from a qualitative perspective to explore the main categories of the IAD framework shaping the action situation of rule-making. To achieve this, an ‘editing approach’ [

43] was adopted, using the analyzed dimensions of the framework as guiding themes to conduct a thematic analysis [

44,

45,

46] of the interview data. The analysis followed the six-step approach defined by Lincoln & Guba [

47] and revised by Braun & Clarke [

44]. We first reviewed interviews and deductively identified text segments and patterns/themes that aligned with each of IAD dimensions. These segments were then coded deductively, with the codes corresponding to the predefined dimensions. Subsequently, patterns and themes within each dimension were extracted and analyzed, allowing us to make interpretative statements about them [

48]. To ensure reliability, two coders independently reviewed the interview data and compared results to identify inconsistencies or divergences in coding. Throughout the analysis, information collected during the interviews was summarized and organized into matrixes to compare findings across the targeted case studies, finally distilling general considerations and discussing them vis-à-vis existing literature. Discrepancies or subjective judgments in the analysis were resolved through discussions between the coders, based on the coding process’s documentation.

3. Results

The status of continuity and dissolution of the Water Funds in Colombia varies across the different schemes. Three out of the five Funds were either in a stand-by or a dissolution phase, namely Agua Somos, Cartagena, and Santa Marta y Ciénaga water funds, while Cuenca Verde and FAVS were currently operational. This section examines the Water Funds rule-making process considering the analytical categories that influence it according to the IAD framework. Results from the literature review and the interviews show how institutional strength, stakeholder trust, and collaboration with environmental authorities affect the different actors’ interactions with implications for the Water Funds continuity.

3.1. Actors and Positions

We identified three recurring types of actors participating from the rule-making processes within the Water Funds, as partners or financiers: (i) private sector organizations, (ii) non-governmental organizations (NGOs), and (iii) public organizations, including city water utilities and environmental authorities (

Table 4). Private sector organizations, such as beverage companies and other large water users, as well as NGOs, primarily contribute to the Water Funds through donations or resources for seed capital or specific conservation projects. Notable examples include TNC and Bavaria’s involvement in supporting Agua Somos and Postobon and Nutresa’s contributions to Cuenca Verde. Public services companies, specifically city water utilities like Medellín’s public service company (EPM) and Bogota Aqueduct and Sewerage Company (EAAB) also play a significant role in financing the Water Funds. Additionally, regional environmental authorities serve as technical supervisors, validators and, in certain cases, as contributors of the Water Funds. For example, FAVS benefits from co-financing conservation projects facilitated by the regional environmental authorities. A fourth type of actor, (iv) landowners, was found only on the board of directors of FAVS, having limited representation in the Funds’ decision-making bodies across cases. This is because for the case of FAVS, the fund has been working with organizations existing in the watersheds for more than 20 years, called Water Users Associations (WUAs). This provided the fund a strong social capital in the watersheds where it operates, through processes of acceptance and trust building that are often complex and require time. The other four funds did not report such community-based processes. Across the various Water Funds, the roles and relationships of the different actors can significantly vary. For instance, the interaction between FAVS and the environmental authority of its jurisdiction, Valle del Cauca Regional Autonomous Corporation (CVC) has existed since before the fund was officially established, mainly through previous collaboration with Asocaña and the WUAs, nowadays integrating members of this Water Fund. This situation differs from that of the Santa Marta y Ciénaga and Cartagena Water Funds with their respective environmental authorities, where none of the funds’ integrating members had a collaboration record with CORPAMAG or CARDIQUE, respectively. Moreover, in the cases of Cuenca Verde and FAVS some interviewees explained that specific board members of these water funds had previously held roles that made them interact with the environmental authorities, such as CORNARE in the case of Cuenca Verde or CVC for FAVS. This background influenced the trust between actors and the involvement of Environmental authorities in the funds’ management and financing. As a consequence, CVC is reported as actively engaged as a partner in the case of FAVS, providing co-financing for conservation initiatives and validating the Water Fund’s presence in the watersheds, whereas the Santa Marta y Ciénaga and Cartagena Water Funds did not establish a significant partnership with the local environmental authorities. The collaboration did not go beyond signing the agreement for their establishment, with no subsequent financial contributions from the environmental authorities.

3.2. Attributes of Community

Actors’ characteristics such as their institutional stability vary considerably across Water Funds. In the case of Cuenca Verde, the Fund was created as an initiative of EPM with the support of TNC and some private companies. However, the Fund grounded, especially at the beginning, on EPM’s social capital, and institutional and financial strength, which allowed the fund to quickly incorporate critical actors (e.g., the environmental authority and private sector companies) on its board of members. Cuenca Verde benefitted from EPM’s existing experience and territorial recognition, gained partially for implementing conservation projects in its area of influence for several decades. Conversely, in the cases of Cartagena and Santa Marta, the funds were born from the initiative of some members of the LAWFP, who provided the seed capital for the feasibility studies and launching of the Funds. This seed capital helped initial engagement with private foundations, the water utilities and environmental authorities to constitute these Funds decision-making bodies. But beyond this enthusiastic start, these funds did not achieve a de facto collaboration with the public authorities in general, and their interactions were mainly with the private organizations.

The institutional strength of the actors constituting a Water Fund was mentioned through the interviews as a relevant factor to facilitate these processes of trust and collaboration among private and public actors. In the case of the Cartagena Water Fund, the institutional instability of the city started eroding the communication channels between the fund’s actors, especially between the public and private. Between the five years after the launch of the Water Fund and the time of this study, the city of Cartagena had four different Mayors. At the same time, Cartagena’s Water Utility had undergone continuous restructuring processes, which caused an intermittent involvement of the public actors in the funds management and funding. As an ultimate consequence, it was not possible to define a long-term commitment from these public institutions, which provoked skepticism within the private actors regarding their potential investments in the Fund. This dynamic generated a progressive abandonment of the scheme from private actors, who continued to develop their water conservation activities independently. Another example can be described regarding the city water utilities’ involvement in the funds’ management and funding, where the size and the frequency of contributions varied considerably. On the one hand, EPM’s participation is notable in Cuenca Verde, with active representation on the board of directors, the fund’s planning, and dedicated annual budgets. Conversely, EAAB’s support is not prominent nor stable in Agua Somos, and technical and budgetary participation has been unsteady over the years. In the latter case, Bogotá’s public administration experienced political instability during the 2013–2017 period, resulting in the mayor being removed from office. After that, the aqueduct and sewerage company also had a series of internal institutional problems, causing the Water Fund not to have a constant interlocutor with these critical partners. Funding and support from these actors were reduced, and the contributions of the private actors were not enough to support the scheme’s operation.

The Water Funds in Colombia also exhibit varying degrees of collaboration with other institutions involved in watershed management. For example, FAVS has developed a solid relationship with CVC in the Cauca Valley, reaching roles coordination for different projects in the area. Similarly, Cuenca Verde has engaged with public sector bodies, including the environmental authority CORNARE, achieving varying levels of success in coordination. The Fund acts in compliance with the environmental directives and the authority, in turn, sees the fund as a powerful partner to strengthen watershed governance. On the other hand, Agua Somos and the Santa Marta y Cartagena water fund have not achieved significant engagement with environmental authorities, municipalities, and local public authorities. Their interactions primarily revolve around private organizations. For these cases, public institutions and the environmental authorities did not provide the resources to finance the funds over time. For example, the municipalities of Santa Marta and Ciénaga and the Magdalena Government, all from the same region but administered by leaders of different political parties, did not show a genuine willingness to jointly invest in the scheme. The investment budgets of these institutions for environmental projects were invested in other activities.

3.3. Rules-in-Use

The type of commitment and the rules for the agreements on how the Funds would be funded by the actors also varies across cases. As mentioned before, Cuenca Verde relies strongly on EPM’s annual funding, which was set within the statutes of the fund when first established. This contribution is complemented by voluntary contribution from private sector companies. For the cases of Cartagena and Santa Marta, a critical source of funding identified was the mandatory investment of 1% of the yearly budget of municipalities and regional government for environmental protection. However, it was not clearly defined how these resources were to be transferred and this process was not mentioned within the funds’ statutes. Neither was there an assessment of the political will of public institutions to contribute this money to these funds, which created difficulties in the proper collection and management of financial resources. Notably, beyond clear funding commitments, a recurring factor mentioned by interviewees to ease processes of governance and financing within the funds was the importance of non-formal arrangements. An example is the process of financing FAVS projects, where the fund provides about 60% of the resources and the CVC the remaining 40%. No agreement states how often the parties are committed to promoting these projects. However, these projects have been conducted and continue to be performed based on the informal agreements and the existing social capital between the two organizations.

Another key aspect that varies across the Funds is their institutional arrangement, namely the constitutive processes. This difference in how the Water Funds were established and through which arrangement they became operational directly impacted their rule-making processes and their interactions with the actors that constitute them and finance them. (

Table 5). Cuenca Verde was created as an independent corporation, mostly supported technical and financially by EPM. FAVS was established as a foundation with participation from Asocaña, the Water Users Associations, TNC, and other private companies, built upon Asocaña’s previous projects with the Water Users Associations dating back to the 1990s. Agua Somos was initiated as a joint effort of the Bogota Aqueduct and Sewerage Company (EAAB), TNC, Bavaria brewing company, and the foundation Fondo Patrimonio Natural. The Cartagena Water Fund was established through a five-year framework association agreement signed by eight public and private stakeholders. The main promoters included TNC and three private foundations, with Canal del Dique Foundation (FCD) chosen as the Fund’s operator and resource administrator. This founding block included in the agreement the local water utility, the district of Cartagena, and the regional environmental authority (Cardique). Similarly, the Santa Marta y Ciénaga Water Fund received seed capital from the LAWFP, led by the Inter-American Development Bank (IDB) and TNC. Within a year, several private actors joined the Fund’s development, among which the Prosierra foundation was later designated as the Fund’s operator.

In contrast, the five Water Funds shared one aspect of the rules-in-use, which is that all the schemes were oriented towards working with landowners. The most common way to formalize the relationship is through voluntary conservation agreements (e.g., some of these agreements have a standard duration, while other funds agree these periods directly with the landowners). However, all the funds shared a low representation of landowners in their decision-making bodies. Except for FAVS, where landowners do have representation through delegates from the WUA, the funds’ boards were typically made up of representatives of the water utilities, the environmental authorities, and the private sector.

3.4. Outcomes

Three out of the five Funds were either dissolved (Cartagena and Santa Marta y Ciénaga) or in a stand-by phase (Agua Somos) during the time of this study, while two were operational (Cuenca Verde and FAVS). Agua Somos was undergoing a redesign process, which included changing the institutional arrangement, planning to shift from being operated by an existing foundation to establishing an independent organization for better functionality. On the other hand, the Cartagena and Santa Marta y Ciénaga funds did not advanced beyond the pilot phase and were in a “latency” stage until the framework agreements end. In contrast, Cuenca Verde and FAVS were fully operational and implementing various conservation projects and initiatives in their respective impact areas (

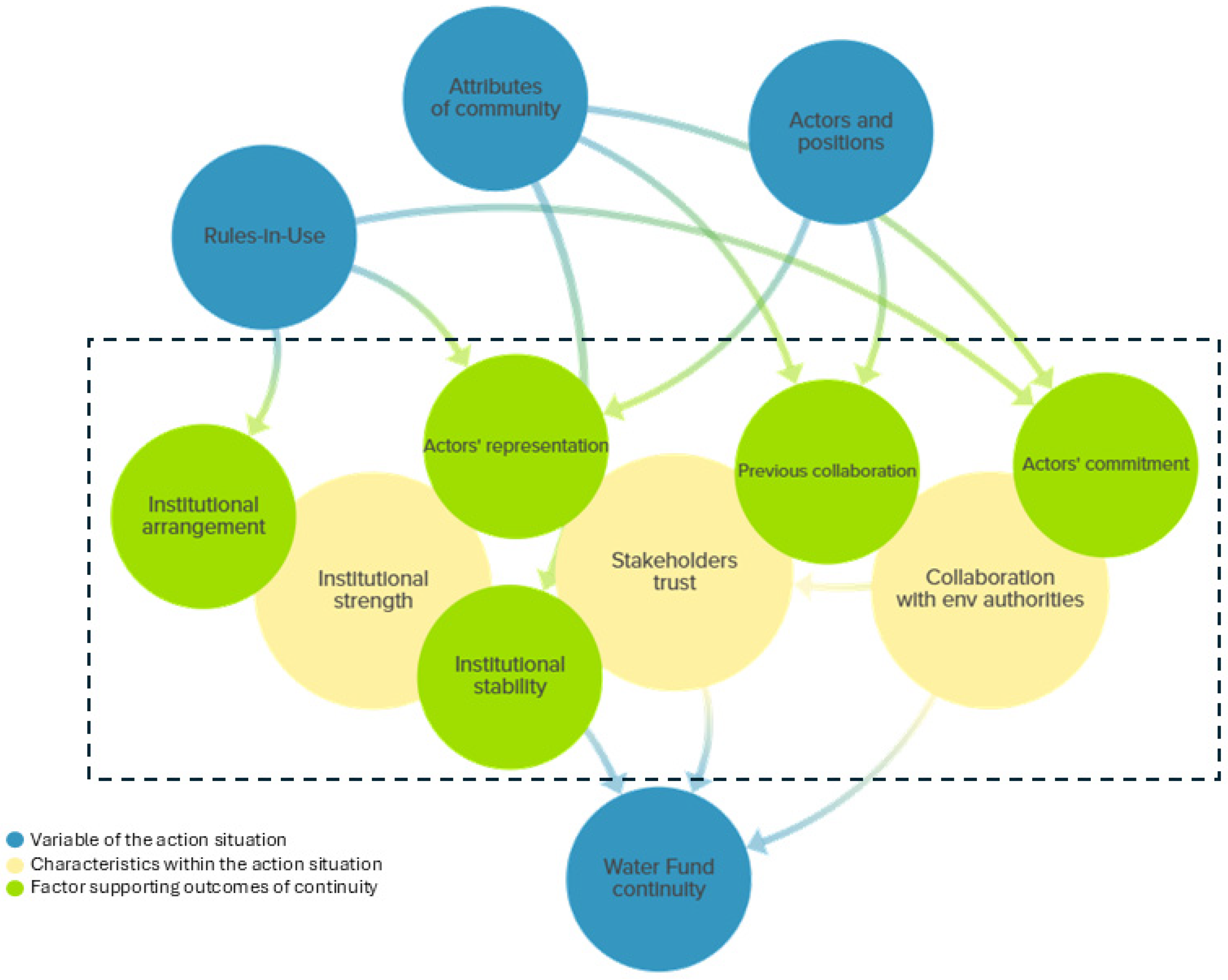

Table 5). Across interviews, specific characteristics of the actors and their roles, the attributes of Water Fund members, and the rules-in-use in the design and governance of these schemes were identified as elements influencing their continuity (

Figure 4). In particular, strong institutional structures, stakeholder trust, and collaboration with environmental authorities emerged as central institutional factors supporting the long-term continuity of the Water Funds.

In the cases of Cuenca Verde and FAVS, characteristics of the actors and their positions, such as prior working relationships among specific board members, facilitated the establishment of environments of trust and collaboration. Cuenca Verde benefited from prior work by specific individuals from EPM and CORNARE to align the fund’s planning with that of the environmental authority. Similarly, the previous collaboration between the water utility and private-sector companies eased lobbying activities to attract financing for the fund. In the case of FAVS, the landowners’ representation on the board of members via the Water Users Association provided legitimacy and institutional strength to the fund in the watershed where the actions were implemented.

Characteristics of the Water Funds’ members (i.e., the attributes of the community governing the scheme), such as their institutional stability, were also identified as impacting trust among them and the schemes’ strength. For the funds that remained at the design or pilot stages, institutional instability among public actors impeded the establishment of clear commitments to the schemes and appropriate communication channels with other members. This is illustrated by examples from Bogotá’s period of political instability during 2013–2017 and the continuous restructuring of Cartagena’s water utility, which made it difficult to maintain continuous financing for these funds or to establish relationships with other board members. Finally, characteristics such as the type of institutional arrangement used to establish a fund and the involvement of specific actor categories within their boards, were identified as part of the rules-in-use that affect the funds’ continuity. In the cases of Agua Somos, Cartagena, and Santa Marta y Ciénaga Water Funds, the chosen arrangement was to host the funds’ management and secretariat within existing organizations (i.e., private foundations). Landowners were identified as the primary beneficiary type, but no landowner association was included in the funds’ constitution or planning processes. In contrast, both FAVS and Cuenca Verde were established as independent organizations (an association and a corporation, respectively). In FAVS, landowners were represented on the fund’s board and in its planning processes.

This representation characteristic was not exempt from shortcomings whatsoever. Some respondents raised concerns about these Water Funds being associated with a predominant actor, which could influence how other stakeholders perceive them. For example, Cuenca Verde was seen as closely linked to EPM, FAVS was perceived as primarily driven by sugar mills’ interests, and Agua Somos was identified as a program of Bogotá’s public services company. Some respondents expressed concerns that the Funds could be viewed as mere extensions of these dominant actors, potentially leading to skepticism about the allocation and management of resources. In any case, landowners’ representation was generally perceived as a positive characteristic among interviewees, since it can provide the funds with a good reputation and confidence even before starting activities in the watersheds.

4. Discussion

Water Funds have been largely promoted in Latin America during the last 20 years as promising governance mechanisms. Still, there has been little empirical research on their impacts as institutions that reshape watershed governance. In this paper, we aimed to fill that gap by exploring the institutional factors that explain the continuity and dissolution of Water Funds in Colombia. Through the conducted institutional analysis, we identified key factors that impact the action situation of rule-making, ultimately conditioning outcomes of continuity. These encompass the institutional strength of the Funds’ constituting actors, the trust between actors based on previous relationships, and successful engagement with environmental authorities. The main contributions of this paper rely on the empirical insights for understanding the institutional conditions required for the success of collaborative governance mechanisms in watershed management and the provision of context-specific insights about how governance mechanisms operate in the Colombian socio-environmental landscape.

4.1. Stakeholder Trust Sourcing from Rules-in-Use and Actors

According to our results, landowners were consistently underrepresented in their interactions with the Water Funds [

25]. Except for FAVS, none of the other schemes incorporated landowners or owner associations into decision-making mechanisms, such as boards of directors. These findings are in line with [

28], who reported a limited representation of upstream landowners in Water Funds at the board level in Latin America, with only Tungurahua (Ecuador) and FAVS (Colombia) standing as exceptions. The lack of representation of landowners could affect the development of social capital—such as networks, shared norms, values, and understandings—that facilitates cooperation among actors, potentially enhancing the legitimacy of these mechanisms at the watershed level. It may also affect distribution dynamics and outcomes regarding how benefits from the Funds are transferred back to landowners and managers who implement management practices that ensure the provision of the targeted ecosystem services and associated co-benefits (see, e.g., [

49]). According to [

33,

50], enduring common-pool resource institutions share certain design principles that underpin their success despite their diverse contexts. One such principle concerns collective choice arrangements, which advocate for the inclusion of actors affected by the institution in the group responsible for modifying its rules. Embracing this principle could enhance the participation of key actors, including landowners, who directly influence watershed services through their activities and choices. Consequently, a more inclusive approach might lead to stronger trusts dynamics and the achievement of the schemes’ continuity.

Beyond formal representation, our findings suggest that prior collaboration among actors is critical to promote stakeholder trust and facilitate coordination within Water Funds. Prior interactions between public and private actors—such as those observed between Cuenca Verde’s board members and the environmental authority CORNARE—helped establish shared norms and expectations, reducing transaction costs and uncertainty in collective action. This aligns with [

51], which states that repeated interactions and reciprocity are essential for building trust and sustaining cooperation in common-pool resource governance. Similarly, refs. [

24,

52] emphasize that pre-existing networks and institutional memory among actors enhance perceived legitimacy and lower barriers to joint decision-making. Strengthening these relational foundations may be as critical as formal inclusion mechanisms for ensuring long-term collaboration and continuity.

Our evidence suggests that fragile stakeholder trust, rooted in the characteristics of the actors and the rules in place, hampered the continuation of Agua, Somos, Cartagena, Santa Marta y Ciénaga funds. Limited landowner representation and weak prior collaboration with environmental authorities undermined reciprocity and shared norms; unclear or non-binding funding rules (e.g., the unresolved operationalization of the 1% public investment) heightened uncertainty and transaction costs; and frequent turnover in key public institutions disrupted communication and continuity. In [

50] terms, these conditions compromised collective choice arrangements and reliable rule enforcement, eroding confidence in long-term commitments.

4.2. Institutional Strength Influencing Water Funds’ Continuity

The strength of a certain institution can be influenced by its construction of social capital, which, depending on the characteristics of the actors, often take time and has a large impact on the characteristics of different communities. Let us get back to the example of FAVS, where the WUA that receive the resources collected by the Fund to implement the projects have existed since the 1990s. This implies that they have been established in the watersheds for more than 20 years through mechanisms of trust, reciprocity and reputation [

53]. These processes have also allowed a progressive concordance of values between different landowners and water users in the watershed, articulated by the WUAs. One of these actors was also the CVC, which is one of the fundamental partners of FAVS. In contrast, cases such as the Cartagena and Santa Marta Water Funds did not have significant processes of previous interactions between actors. The lack of funding and political will from public partners, such as water utilities, municipalities, and environmental authorities who had initially signed the launch agreements, ultimately hindered the progression of these Funds toward a continuous operational phase. Our findings also suggest that Water Funds structured as independent organizations (e.g., Cuenca Verde and FAVS) exhibit greater stability over time and continue to operate without having undergone significant changes in their structure. One plausible explanation for this trend is that, from an institutional standpoint, establishing the mechanism as an independent organization is preferable to delegating its functions to one of the funding partners. Such an arrangement could help avoid conflicts of interest or “judge and jury” situations when defining strategies, using resources, or managing conflicts. It could be argued that funds embedded within a partner organization or governed by short-term framework agreements (as in the case of Cartagena) were more exposed to the internal turnover from the funds’ members, budget cycles, and shifting priorities, which translated into discontinuous funding and unclear accountability lines. By contrast, independent legal entities (e.g., Cuenca Verde, FAVS) could buffer shocks by maintaining dedicated governance routines, stable secretariats, and clearer fiduciary responsibilities. Under the IAD lens, these differences map onto more reliable ‘rules-in-use’ for resource mobilization, decision authority, and conflict resolution, which could have promoted reciprocity and commitment among actors.

In addition to contributing to the trust between institutions, the funds’ institutional arrangement can provide flexibility aspects to the mechanisms, playing a pivotal role in ensuring their sustainability amidst a constantly changing environment [

54,

55]. In this context, it could be argued that the Funds that have remained over time and engaged with key institutions are those that have adapted to the rules of the game rather than those that have imposed the rules. By being receptive to change, these Funds have facilitated stakeholders to reach actual agreements, charting a clear course of action and methods for implementation. This sheds light on the importance of negotiations and agreement processes in defining the interests of various actors, establishing robust rules of engagement, and formulating effective conflict resolution mechanisms.

Finally, the characteristics and interactions of the different actors in the rule-making situation cannot be seen entirely independently of other action situations. Exogenous shifts such as changes in political regimes within the public actors that conformed Agua Somos and the Cartagena Water Funds might have had a large impact on the agenda of these institutions. Electoral turnover, administrative restructuring in the case of the Cartagena water utility, or macro-fiscal constraints ultimately repercussed in the Funds’ continuity. The Water Funds governance might weaken without actors with recognized institutional strength, since this situation could erode trust between actors. Nevertheless, contentious watershed agendas or regional governance crises can depress trust formation across actors irrespective of internal design, biasing our inferences about the effects of organizational arrangements.

4.3. Collaboration with Environmental Authorities as a Prerequisite for Viable Water Funds

The involvement of local water utilities and private companies emerged as a common trend across all five Water Funds. These findings align with [

28], who similarly identified water utilities, private companies, multilateral organizations, and NGOs as the primary actors in Water Funds across Latin America. However, our study highlights a distinctive aspect in the Colombian context, where environmental authorities play a significant role within the Water Funds rule-making. This discrepancy may be attributed to Colombia’s decentralized system of environmental governance [

56], which comprises regional environmental authorities instead of a centralized national body. Consequently, environmental authorities hold considerable influence in watershed-level governance. The level of interaction between a Water Fund and the environmental authority in its operating area may play a pivotal role in determining the Fund’s capacity and overall continuity. The experiences of the Santa Marta y Ciénaga and Cartagena Water Funds, where environmental authorities did not fulfill their initial commitment to contribute economic resources, highlight the relevance of environmental authorities not only for the Water Funds’ financing but also for coordination aspects around watershed Governance. These examples also showcase how the Water Funds could disrupt existing power dynamics and discomfort key actors by challenging the status quo. Contrastingly, the cases of Cuenca Verde and FAVS exemplify how Water Funds can foster synergistic relationships with other institutions, even when funding commitments from specific actors (e.g., the environmental authorities) were equally unclear across the five schemes. This might be because interactions and achievements between two or more institutions are not exclusively the product of the official rules and agreements defined between them but also of informal arrangements (i.e., informal institutions).

Unlike Colombia’s decentralized environmental governance, where regional environmental authorities play a significant role in watershed governance, Ecuador’s FONAG (i.e., the Quito Water Fund) was established within a more centralized national water administration [

57]. The fund is the product of a public–private trust anchored by the municipal utility and TNC, with strong municipal leadership. This anchoring has enabled stable co-governance routines and durable funding commitments, making FONAG one of the “success stories” in Water Funds. In the case of Aquafondo in Peru, a nationally enabled, utility-linked financing framework (MERESE, Law 30215) allows utilities to allocate portions of tariffs to natural infrastructure, with sector regulators operationalizing the mechanism [

58]. This centralized legal framework clarifies funding rules, thereby strengthening continuity even as local relationships are still maturing [

59]. Compared with these two countries, where centralized utility mandates or municipally anchored trusts formalize the role of key public actors, Colombia’s decentralized water governance makes the environmental authority pivotal but also exposes funds to uneven regional capacities and political turnover.

The varying interactions between different Water Funds and other institutional actors can be attributed, in part, to their unique origins and development processes. Cuenca Verde and FAVS were products of social processes at the local level, which facilitated the establishment of agreements and informal institutions through trust-building [

40,

53]. Moreover, the conceptual distancing of Water Funds from traditional PES schemes, as highlighted by [

25] signifies a shift towards a more complex and evolved institutional model. While Water Funds were initially inspired by the PES rationale, they developed into distinct entities with their own unique characteristics and objectives. As such, Water Funds cannot be solely viewed through the lens of a PES scheme without considering the broader political consequences they entail. Their interactions with existing institutions have significant implications, as they can reshape the traditional interplay among actors involved in watershed governance.

5. Conclusions

In this research, we analyzed the Water Funds in Colombia within the Latin American Water Funds Partnership from an institutional perspective. By using the Ostrom’s IAD Framework, we analyzed the factors that contribute to explain continuity and dissolution, as outcomes of the rule-making process for Water Funds in Colombia. The findings refer specifically to the Colombian context and should be interpreted with caution, given the country’s distinctive environmental governance model based on regional autonomous environmental authorities and its broader political dynamics. These contextual features shape institutional interactions and actor configurations differently than in more centralized governance systems, limiting the generalizability of the results to other countries.

The findings revealed how the institutional strength of the actors that compose a Water Fund governing body and partake of their constitutive process largely impact the Fund continuity. This institutional strength might be influenced by the attributes of the community, such as previous collaboration experiences that built social capital and trust between actors, and the impact of adjacent action situations such as the political regime changes, especially in public institutions such as the cities’ water utilities. Such changes might affect the Funds’ agenda and objectives, easily eroding the trust between actors, particularly the private ones.

Stakeholders trust proves to be another influential factor regarding the Fund’s continuity or dissolution. A limited representation of upstream landholders in decision-making, indicating a marginal role for beneficiaries in participation created limited legitimacy of the Funds in the implementation areas. In the same line, not all the Water Funds were backed up by the environmental authorities, which posed critical challenges to some of the Funds’ financing and viability. When comparing Colombia with countries like Peru and Ecuador, the influence of governance structures becomes evident: Peru’s centralized regulatory framework and Ecuador’s trust model provide clearer funding rules and institutional mandates, whereas Colombia’s decentralized governance exposes Water Funds to uneven institutional capacities and political turnover. However, positive examples of collaboration with environmental authorities in Colombia, such as the cases of FAVS and Cuenca Verde, demonstrated the potential synergies between funds and authorities, and highlights the importance of trust and social capital as enablers of these relationships over time. Including principles of greater involvement for stakeholders could enhance cooperation and legitimacy.

Finally, our study reveals that Water Funds should not be seen as institutions that replace public entities with similar functions, since, at least in Colombia, there are instruments for watershed planning and public bodies to implement it. Instead, they can complement the role of environmental authorities in environmental conservation to enhance private sector and civil society engagement around watershed governance mechanisms and benefit–cost sharing.

Several reform recommendations can be derived from this study. Strengthening Water Funds in Colombia may require formalizing collaboration mechanisms with regional environmental authorities to stabilize financing and clarify mandates; ensuring landowner and community representation in decision-making bodies to improve legitimacy and local buy-in; and promoting hybrid institutional arrangements that combine independence with strong public sector anchoring. Moreover, establishing more precise and more binding funding rules, like tariff-based or trust models adopted in other countries, could reduce uncertainty and enhance long-term continuity.

Despite all our efforts, the present work has some limitations that should be acknowledged. The first is the small sample size—only 15 interviews were conducted—which may restrict the analysis and the level of detail in describing each mechanism. Secondly, the uneven stakeholder representation throughout the interviews, particularly the low number of landowners, could introduce bias by over-representing certain perspectives, such as those of Water Fund directors and developers and overlook the opinions of key groups such as upstream farmers and communities. A third limitation of this study is the reliance on a limited data set, primarily based on interviews and a literature review, without support from field observations, questionnaires, or other quantitative data. While we consulted scientific reviews whenever available to contrast and discuss our findings, the academic literature on Latin American Water Funds was still scarce as of 2020, particularly concerning the funds’ activities and results. Consequently, we had to supplement our analysis with gray literature sources. Finally, the use of the institutional analysis approach in analyzing the Water Funds may lead to context-specific reasoning and notions, making it challenging to generalize results or draw broad conclusions about the subject. To address these limitations and expand the understanding of Water Funds, future research could explore comparative exercises at the regional level or in other countries. Additionally, further investigation could encompass other schemes beyond those within the LAWFP that operate as Water Funds.

Author Contributions

Conceptualization, J.D.R.; methodology, A.L.; formal analysis, J.D.R.; investigation, J.D.R.; data curation, M.M.; writing—original draft preparation, J.D.R.; writing—review and editing, M.M.; supervision, A.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Ethical review and approval were waived for this study through a specific vote by the Ethical Committee for the Research at the Department of Land, Environment, Agriculture and Forestry based on its current regulation.

Informed Consent Statement

Informed consent has been obtained from the respondents for their participation in this research and the potential publication of its results.

Data Availability Statement

The original contributions presented in the study are included in the article; further inquiries can be directed to the corresponding author.

Acknowledgments

We thank The Nature Conservancy’s Latin American Water Security team for helping us contact the five Water Funds in Colombia and the interviewees for their collaboration.

Conflicts of Interest

Author Alessandro Leonardi was employed by the company Etifor|Valuing Nature. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| ACUACAR | Cartagena’s Water Utility |

| CAR | Regional Autonomous Corporation of Cundinamarca |

| CARDIQUE | Regional Autonomous Corporation of the Dique Canal |

| CORNARE | Regional Autonomous Corporation of the Negro and Nare River Basins |

| CORPAMAG | Magdalena Regional Autonomous Corporation |

| CVC | Regional Autonomous Corporation of Valle del Cauca |

| EAAB | Bogotá Aqueduct and Sewerage Company |

| EPM | Medellín’s public service company |

| FAVS | Water Fund for Life and Sustainability Foundation |

| FCD | Canal del Dique Foundation |

| IAD | Institutional Analysis and Development Framework |

| IDB | Inter-American Development |

| LAWFP | Latin American Water Funds Partnership |

| NbS | Nature-based solutions |

| NGO | Non-governmental organization |

| PES | Payment for Ecosystem Services |

| PWS | Payment for Watershed Services |

| TNC | The Nature Conservancy |

| WUA | Water Users Association |

References

- Chakraborty, R.; Sherpa, P.Y. From climate adaptation to climate justice: Critical reflections on the IPCC and Himalayan climate knowledges. Clim. Change 2021, 167, 49. [Google Scholar] [CrossRef]

- Deere-Birkbeck, C. Global governance in the context of climate change: The challenges of increasingly complex risk parameters. Int. Aff. 2009, 85, 1173–1194. [Google Scholar] [CrossRef]

- Rashidi, P.; Lyons, K. Democratizing global climate governance? The case of indigenous representation in the Intergovernmental Panel on Climate Change (IPCC). Globalizations 2021, 20, 1312–1327. [Google Scholar] [CrossRef]

- Bardsley, D.K.; Rogers, G.P. Prioritizing Engagement for Sustainable Adaptation to Climate Change: An Example from Natural Resource Management in South Australia. Soc. Nat. Resour. 2010, 24, 1–17. [Google Scholar] [CrossRef]

- Vogl, A.L.; Goldstein, J.H.; Daily, G.C.; Vira, B.; Bremer, L.; McDonald, R.I.; Shemie, D.; Tellman, B.; Cassin, J. Mainstreaming investments in watershed services to enhance water security: Barriers and opportunities. Environ. Sci. Policy 2017, 75, 19–27. [Google Scholar] [CrossRef]

- Gómez-Baggethun, E.; Muradian, R. In markets we trust? Setting the boundaries of Market-Based Instruments in ecosystem services governance. Environ. Sci. Policy 2015, 75, 19–27. [Google Scholar] [CrossRef]

- Hrabanski, M. Private Sector Involvement in the Millennium Ecosystem Assessment: Using a UN platform to promote market-based instruments for ecosystem services. Environ. Policy Gov. 2017, 27, 605–618. [Google Scholar] [CrossRef]

- Pirard, R.; Lapeyre, R. Classifying market-based instruments for ecosystem services: A guide to the literature jungle. Ecosyst. Serv. 2014, 9, 106–114. [Google Scholar] [CrossRef]

- Derissen, S.; Latacz-Lohmann, U. What are PES? A review of definitions and an extension. Ecosyst. Serv. 2013, 6, 12–15. [Google Scholar] [CrossRef]

- Kaiser, J.; Haase, D.; Krueger, T. Payments for ecosystem services: A review of definitions, the role of spatial scales, and critique. Ecol. Soc. 2021, 26, 1. [Google Scholar] [CrossRef]

- Wunder, S. Revisiting the concept of payments for environmental services. Ecol. Econ. 2015, 117, 234–243. [Google Scholar] [CrossRef]

- Bellver-Domingo, A.; Hernández-Sancho, F.; Molinos-Senante, M. A review of Payment for Ecosystem Services for the economic internalization of environmental externalities: A water perspective. Geoforum 2016, 70, 115–118. [Google Scholar] [CrossRef]

- Grima, N.; Singh, S.J.; Smetschka, B.; Ringhofer, L. Payment for Ecosystem Services (PES) in Latin America: Analysing the performance of 40 case studies. Ecosyst. Serv. 2016, 17, 24–32. [Google Scholar] [CrossRef]

- Martin-ortega, J.; Ojea, E.; Roux, C. Payments for Water Ecosystem Services in Latin America: Evidence from Reported Experience. 2012. Available online: www.bc3research.org (accessed on 18 February 2021).

- Wang, H.; Meijerink, S.; Van Der Krabben, E. Institutional Design and Performance of Markets for Watershed Ecosystem Services: A Systematic Literature Review. Sustainability 2020, 12, 6382. [Google Scholar] [CrossRef]

- Kang, S.; Kroeger, T.; Shemie, D.; Echavarria, M.; Montalvo, T.; Bremer, L.L.; Bennett, G.; Barreto, S.R.; Bracale, H.; Calero, C.; et al. Investing in nature-based solutions: Cost profiles of collective-action watershed investment programs. Ecosyst. Serv. 2023, 59, 101507. [Google Scholar] [CrossRef]

- Smith, M.M.; Gammie, G.; Song, J.; Atwell, B.; Shemie, D.; Bennett, M.; Adriazola, C.J.; Joubert, J.I.; Tanguy, P. Doubling Down on Nature-State of Investment in Nature-Based Solutions for Water Security 2025. 2025. Available online: https://www.forest-trends.org/publications/doubling-down-on-nature/ (accessed on 16 September 2025).

- Salzman, J.; Bennett, G.; Carroll, N.; Goldstein, A.; Jenkins, M. The global status and trends of Payments for Ecosystem Services. Nat. Sustain. 2018, 1, 136–144. [Google Scholar] [CrossRef]

- Sophie, T.; Atwell, B.; Dominique, K.; Matthews, N.; Becker, M.; Muñoz, R. Funding and financing to scale nature-based solutions for water security. In Nature-Based Solutions and Water Security: An Action Agenda for the 21st Century; Elsevier: Amsterdam, The Netherlands, 2021; pp. 361–398. [Google Scholar] [CrossRef]

- Echavarria, M.; Cassin, J.; Da Rocha, J.B. Protecting source waters in Latin America. In Nature-Based Solutions and Water Security: An Action Agenda for the 21st Century; Elsevier: Amsterdam, The Netherlands, 2021; pp. 215–239. [Google Scholar] [CrossRef]

- Aguilar-Barajas, I.; Mahlknecht, J.; Kaledin, J.; Kjellén, M.; Mejía-Betancourt, A. Water and Cities in Latin America: Challenges for Sustainable Development; Taylor and Francis Inc.: Philadelphia, PA, USA, 2015. [Google Scholar] [CrossRef]

- Hommes, L.; Boelens, R.; Bleeker, S.; Duarte-Abadía, B.; Stoltenborg, D.; Vos, J. Water governmentalities: The shaping of hydrosocial territories, water transfers and rural–urban subjects in Latin America. Environ. Plan. E Nat. Space 2020, 3, 399–422. [Google Scholar] [CrossRef]

- Bremer, L.; Gammie, G.; Maldonado, O. Participatory Social Impact Assessment of Water Funds: A Case Study from Lima, Peru. Forest Trends. 2016. Available online: https://www.forest-trends.org/wp-content/uploads/imported/for183-sia-report-english-16-0701-web-pdf.pdf (accessed on 16 September 2025).

- Goldman-Benner, R.L.; Benitez, S.; Boucher, T.; Calvache, A.; Daily, G.; Kareiva, P.; Kroeger, T.; Ramos, A. Water funds and payments for ecosystem services: Practice learns from theory and theory can learn from practice. Oryx 2012, 46, 55–63. [Google Scholar] [CrossRef]

- Nelson, S.H.; Bremer, L.; Prado, K.M.; Brauman, K.A. The Political Life of Natural Infrastructure: Water Funds and Alternative Histories of Payments for Ecosystem Services in Valle del Cauca, Colombia. Dev. Change 2020, 51, 26–50. [Google Scholar] [CrossRef]

- The Nature Conservancy. Water Funds: Field Guide; 2018. Available online: https://www.nature.org/content/dam/tnc/nature/en/documents/Water-Funds-Field-Guide-2018.pdf (accessed on 16 September 2025).

- Brauman, K.A.; Benner, R.; Benitez, S.; Bremer, L.; Vigerstøl, K. Water Funds. In Green Growth That Works; Island Press/Center for Resource Economics: Washington, DC, USA, 2019; pp. 118–140. [Google Scholar] [CrossRef]

- Bremer, L.L.; Auerbach, D.A.; Goldstein, J.H.; Vogl, A.L.; Shemie, D.; Kroeger, T.; Nelson, J.L.; Benítez, S.P.; Calvache, A.; Guimarães, J.; et al. One size does not fit all: Natural infrastructure investments within the Latin American Water Funds Partnership. Ecosyst. Serv. 2016, 17, 217–236. [Google Scholar] [CrossRef]

- Kosoy, N.; Martínez-Tuna, M.; Muradian, R.; Martinez-Alier, J. Payments for environmental services in watersheds: Insights from a comparative study of three cases in Central America. Ecol. Econ. 2007, 61, 446–455. [Google Scholar] [CrossRef]

- Porras, I.; Alyward, B.; Dengel, J. Monitoring Payments for Watershed Services Schemes in Developing Countries. 2013. Available online: http://pubs.iied.org/16525IIED (accessed on 18 February 2021).

- Escobar, M.M.; Hollaender, R.; Weffer, C.P. Institutional durability of payments for watershed ecosystem services: Lessons from two case studies from Colombia and Germany. Ecosyst. Serv. 2013, 6, 46–53. [Google Scholar] [CrossRef]

- Muradian, R.; Cardenas, J.C. From market failures to collective action dilemmas: Reframing environmental governance challenges in Latin America and beyond. Ecol. Econ. 2015, 120, 358–365. [Google Scholar] [CrossRef]

- Ostrom, E. Background on the Institutional Analysis and Development Framework. Policy Stud. J. 2011, 39, 7–27. [Google Scholar] [CrossRef]

- Veiga, F.; Calvache, A.; Benítez, S.; León, J.; Ramos, A. Water funds as a tool for urban water provision and watershed conservation in Latin America. In Water and Cities in Latin America: Challenges for Sustainable Development; Routledge: New York, NY, USA, 2015; p. 235. [Google Scholar]

- Padilla, P.H.M. Fondo Agua por la Vida y la Sostenibilidad: Manejo Integral de Cuencas Hidrográficas en el Valle Geográfico Alto del Río Cauca. 2016. Available online: https://www.asocana.org/documentos/2642016-1637CC45-00FF00,000A000,878787,C3C3C3,0F0F0F,B4B4B4,FF00FF,FFFFFF,2D2D2D,A3C4B5,D2D2D2.pdf (accessed on 25 March 2021).

- Santos de Lima, L. Effectiveness and Uncertainties of Payments for Watershed Services. Ph.D. Thesis, Humboldt University of Berlin, Berlin, Germany, 2018. [CrossRef]

- Nigussie, Z.; Tsunekawa, A.; Haregeweyn, N.; Adgo, E.; Cochrane, L.; Floquet, A.; Abele, S. Applying Ostrom’s institutional analysis and development framework to soil and water conservation activities in north-western Ethiopia. Land Use Policy 2018, 71, 1–10. [Google Scholar] [CrossRef]

- Corbera, E.; Soberanis, C.G.; Brown, K. Institutional dimensions of Payments for Ecosystem Services: An analysis of Mexico’s carbon forestry programme. Ecol. Econ. 2009, 68, 743–761. [Google Scholar] [CrossRef]

- Leonardi, A. Characterizing Governance and Benefits of Payments for Watershed Services in Europe. Ph.D. Thesis, University of Padova, Padova, Italy, 2015. [Google Scholar]

- Prokofieva, I.; Gorriz, E. Institutional analysis of incentives for the provision of forest goods and services: An assessment of incentive schemes in catalonia (north-east spain). For. Policy Econ. 2013, 37, 104–114. [Google Scholar] [CrossRef]

- McGinnis, M.D. Networks of Adjacent Action Situations in Polycentric Governance. Policy Stud. J. 2011, 39, 51–78. [Google Scholar] [CrossRef]

- Kimmich, C.; Baldwin, E.; Kellner, E.; Oberlack, C.; Villamayor-Tomas, S. Networks of action situations: A systematic review of empirical research. Sustain. Sci. 2023, 18, 11–26. [Google Scholar] [CrossRef]

- Miller, W.; Crabtree, B. Clinical research. In Handbook of Qualitative Research, 3rd ed.; Denzin, N., Lincoln, Y., Eds.; Sage: Thousand Oaks, CA, USA, 2005; pp. 605–639. [Google Scholar]

- Braun, V.; Clarke, V. Using thematic analysis in psychology. Qual. Res. Psychol. 2006, 3, 77–101. [Google Scholar] [CrossRef]

- King, N. Using Templates in the Thematic Analysis of Text. In Essential Guide to Qualitative Methods in Organizational Research; Sage: Thousand Oaks, CA, USA, 2014; pp. 256–270. [Google Scholar] [CrossRef]

- Nowell, L.S.; Norris, J.M.; White, D.E.; Moules, N.J. Thematic Analysis: Striving to Meet the Trustworthiness Criteria. Int. J. Qual. Methods 2017, 16, 1609406917733847. [Google Scholar] [CrossRef]

- Lincoln, Y.; Guba, E.G. Naturalistic Inquiry; Sage: Newbury Park, CA, USA, 1985. [Google Scholar]

- DiCicco-Bloom, B.; Crabtree, B.F. The qualitative research interview. Med. Educ. 2006, 40, 314–321. [Google Scholar] [CrossRef]

- Zanella, M.A.; Schleyer, C.; Speelman, S. Why do farmers join Payments for Ecosystem Services (PES) schemes? An Assessment of PES water scheme participation in Brazil. Ecol. Econ. 2014, 105, 166–176. [Google Scholar] [CrossRef]

- Ostrom, E. Governing the Commons: The Evolution of Institutions for Collective Action, Cambridge; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Ostrom, E. Design Principles of Robust Property Rights Institutions: What Have We Learned? In Property Rights and Land Policies; Gregory, K.I., Hong, Y.-H., Eds.; Earthscan: London, UK, 2009. [Google Scholar] [CrossRef]

- Bennett, D.E.; Gosnell, H. Integrating multiple perspectives on payments for ecosystem services through a social–ecological systems framework. Ecol. Econ. 2015, 116, 172–181. [Google Scholar] [CrossRef]

- Ostrom, E. A Behavioral Approach to the Rational Choice Theory of Collective Action: Presidential Address, American Political Science Association, 1997. Am. Political Sci. Rev. 1998, 92, 1–22. [Google Scholar] [CrossRef]

- Baerlein, T.; Kasymov, U.; Zikos, D. Self-Governance and Sustainable Common Pool Resource Management in Kyrgyzstan. Sustainability 2015, 7, 496–521. [Google Scholar] [CrossRef]

- Nunan, F. Governing Renewable Natural Resources: Theories and Frameworks—1st E. 2019. Available online: https://www.routledge.com/Governing-Renewable-Natural-Resources-Theories-and-Frameworks/Nunan/p/book/9780367146702 (accessed on 16 September 2025).

- Hohbein, R.R.; Nibbelink, N.; Cooper, R.J. Impacts of Decentralized Environmental Governance on Andean Bear Conservation in Colombia. Environ. Manag. 2021, 68, 882–899. [Google Scholar] [CrossRef]

- Fondo para la Protección del Agua (FONAG). Plan Estratégico 2021–2025. Available online: https://www.fonag.org.ec/web/plan-estrategico/ (accessed on 19 October 2025).

- MINAM. Ley N° 30215 Mecanismos de Retribución por Servicios Ecosistémicos. Congreso de la República. 2014. Available online: https://www.minam.gob.pe/disposiciones/ley-n-30215/ (accessed on 2 November 2025).

- Fondo de Agua para Lima y Callao (AQUAFONDO). Plan Estratégico—Fondo de Agua de Lima, Aquafondo; Fondo de Agua para Lima y Callao (AQUAFONDO): Lima, Peru, 2019; p. 59. [Google Scholar]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).