Climate Risk in Supply Chains and Corporate Cash Holdings: Mechanisms and Mitigation Strategies

Abstract

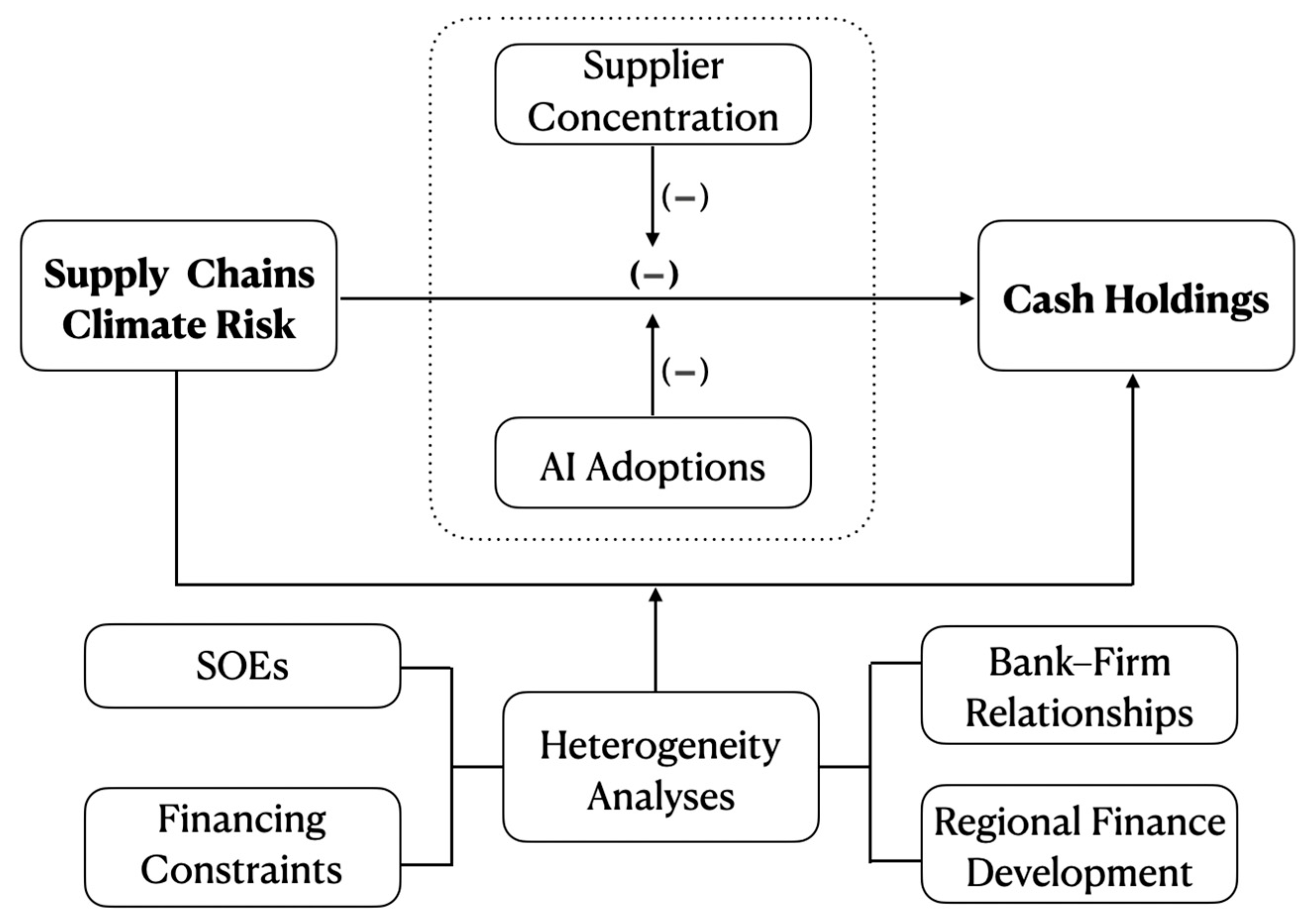

1. Introduction

2. Literature Review and Theoretical Hypotheses

2.1. Literature Review

2.1.1. Climate Risk and Corporate Financial Decision-Making

2.1.2. Supply Chain Climate Risk and Corporate Resilience

2.1.3. Artificial Intelligence, Risk Management and Financial Decision-Making

2.2. Theoretical Analysis and Research Hypotheses

3. Data and Methodology

3.1. Sample

3.2. Variables

3.3. Model Specification

4. Empirical Results

4.1. Descriptive Statistics

4.2. Climate Change and Corporate Cash Holdings

4.3. Robustness Check

4.4. Mechanism Analysis-Based on the Predictive Capabilities of Enterprises

4.5. Mitigation Effect—Analysis Based on Artificial Intelligence Applications

5. Heterogeneity Analyses

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Construction Methods of Artificial Intelligence Application Indicators

- (1)

- Constructing the text database for prediction

- (2)

- Construct the sentence database to be manually labeled

- (3)

- Artificial labeling

- (4)

- Model Training

- (5)

- Generate Indicators

| 1. General Artificial Intelligence Technologies | |

| Classification | Keywords |

| 1A Machine learning | Machine learning, Deep learning, Reinforcement learning, Supervised learning, Unsupervised learning, Evolutionary learning, Transfer learning, Imitation learning, Enhanced learning, Self-learning, Ensemble learning, Intelligent learning; Neural network (Deep neural network, Multilayer neural network, Deep Q-network, Recurrent neural network, Generative adversarial network, Convolutional neural network); Large-scale model, Model validation, Model performance, Model training, Model serving, Generative model, Markov model, Predictive model, Algorithmic model, Recommendation model, Brain-inspired model; Intelligent algorithm, Asynchronous Advantage Actor-Critic (A3C) algorithm, Privacy-preserving computing, Affective computing, K-Nearest Neighbors (KNN) algorithm, Neural computing, Intelligent computing, Cognitive computing; Feature extraction, Intent classification, Support Vector Machine (SVM), Deep Belief Network (DBN), Decision tree, Particle Swarm Optimization (PSO), Restricted Boltzmann Machine (RBM), Multimodal fusion, Brain simulation, Policy optimization, Search engine algorithm, Multi-agent system, Multi-objective evolution, Adaptive system, Clustering, Pooling, Caffe-MPI framework. |

| 1B Knowledge engineering | Knowledge engineering, Expert system, Cognitive computing, Knowledge reasoning, Knowledge processing, Knowledge extraction, Knowledge representation, Knowledge graph, Knowledge fusion. |

| 1C Other general AI technologies. | Pattern recognition, Pattern classification, Pattern clustering, Quantum algorithm, Quantum programming, Qubit, Quantum mechanics, Quantum computing, Basic computing power, Virtual biology, Virtual world, Social simulation. |

| 2. Key Artificial Intelligence Technologies | |

| 2D Natural language processing | Natural language, Natural language processing, Language model, Semantic analysis, Semantic processing, Semantic understanding, Semantic fusion, Semantic network, Semantic segmentation, Word frequency statistics, Word segmentation, Text analysis, Sentiment analysis, Syntax analysis; Speech recognition, Named entity recognition, Character recognition, Semantic recognition, Semantic retrieval, Semantic search, Natural language query, Semantic classification; Natural language generation, Natural language question answering, Machine question answering, Automatic translation, Machine translation, Intelligent translation, Language converter, Neural machine translation, Question-answering system. |

| 2E Speech recognition | Speech recognition, Speaker recognition, Speech synthesis, Speech enhancement, Speech sensing, Speech retrieval, Speech control, Voice navigation, Speech coding and decoding, Speech classification, Neural vocoder, Text-to-speech synthesis, Speech evaluation, Speech interaction, Waveform concatenation, Sound analysis. |

| 2F Biometric identification | Biometrics, Object recognition, Object identification, Item recognition, Fingerprint recognition, Face recognition, Iris recognition, Behavioral feature recognition, Vein recognition, Liveness detection, Fingerprint classification, Fingerprint verification, Face capture, Face extraction, Facial recognition, Expression recognition, Face verification, Iris detection, Retina detection, Iris verification, Voice recognition, Speaker recognition, Voice identification, Voice concatenation, Voice waveform, Motion capture, Action recognition, Biometric recognition, Finger-vein recognition, Gait recognition, Palmprint recognition, Sensitive-person identification. |

| 2G Computer vision | Computer vision, Machine vision, Intelligent vision, Entity recognition, Image sensing, Image recognition, Image understanding, Image retrieval, Image detection, Image extraction, Image discrimination, Image correction, Image filtering, Image classification, Image generation, Image synthesis, Image reconstruction, Image matching, Image clustering, Object detection, Handwriting recognition, Computational imaging, 3D vision, Dynamic vision, Multimodal recognition, Automatic video tagging, Complex scene recognition, Optical character recognition (OCR), Image enhancement, Image normalization. |

| 2H Human–computer interaction | Human–computer interaction, Motion interaction, Eye tracking, Gaze tracking, Visual trajectory tracking, Head trajectory tracking, Data glove, Speech interaction, Voice activation, Human-computer dialog, Voice input, Motion sensing, Pose capture, Pose sensing, Haptic feedback, Gesture tracking, Gesture recognition, Brain–computer interface (BCI), Implantable BCI, Non-implantable BCI, Affective interaction, Somatosensory interaction, Brain-machine interaction, Natural human–computer interaction technology. |

| 2J Augmented Reality (AR)/Virtual Reality (VR) | Virtual reality, Virtual interaction, Virtual environment, Augmented intelligence, Intelligent simulation, Augmented reality, Mixed reality. |

References

- Pankratz, N.M.; Schiller, C.M. Climate change and adaptation in global supply-chain networks. Rev. Financ. Stud. 2024, 37, 1729–1777. [Google Scholar] [CrossRef]

- Opler, T.; Pinkowitz, L.; Stulz, R.; Williamson, R. The determinants and implications of corporate cash holdings. J. Financ. Econ. 1999, 52, 3–46. [Google Scholar] [CrossRef]

- Wagner, S.M.; Bode, C. An empirical examination of supply chain performance along several dimensions of risk. J. Bus. Logist. 2008, 29, 307–325. [Google Scholar] [CrossRef]

- Pankratz, N.; Bauer, R.; Derwall, J. Climate change, firm performance, and investor surprises. Manag. Sci. 2023, 69, 7352–7398. [Google Scholar] [CrossRef]

- Harford, J.; Mansi, S.A.; Maxwell, W.F. Corporate governance and firm cash holdings in the US. J. Financ. Econ. 2008, 87, 535–555. [Google Scholar] [CrossRef]

- Denis, D.J.; Sibilkov, V. Financial constraints, investment, and the value of cash holdings. Rev. Financ. Stud. 2010, 23, 247–269. [Google Scholar] [CrossRef]

- Anand, L.; Thenmozhi, M.; Varaiya, N.; Bhadhuri, S. Impact of macroeconomic factors on cash holdings?: A dynamic panel model. J. Emerg. Mark. Financ. 2018, 17 (Suppl. S1), S27–S53. [Google Scholar] [CrossRef]

- Orlova, S.V. Cultural and macroeconomic determinants of cash holdings management. J. Int. Financ. Manag. Account. 2020, 31, 270–294. [Google Scholar] [CrossRef]

- Ciccarelli, M.; Marotta, F. Demand or supply? An empirical exploration of the effects of climate change on the macroeconomy. Energy Econ. 2024, 129, 107163. [Google Scholar] [CrossRef]

- Javadi, S.; Masum, A.-A. The impact of climate change on the cost of bank loans. J. Corp. Financ. 2021, 69, 102019. [Google Scholar] [CrossRef]

- Kabir, M.N.; Rahman, S.; Rahman, M.A.; Anwar, M. Carbon emissions and default risk: International evidence from firm-level data. Econ. Model. 2021, 103, 105617. [Google Scholar] [CrossRef]

- Cai, Y.; Lontzek, T.S. The social cost of carbon with economic and climate risks. J. Political Econ. 2019, 127, 2684–2734. [Google Scholar] [CrossRef]

- Ginglinger, E.; Moreau, Q. Climate risk and capital structure. Manag. Sci. 2023, 69, 7492–7516. [Google Scholar] [CrossRef]

- Huang, H.H.; Kerstein, J.; Wang, C. The impact of climate risk on firm performance and financing choices: An international comparison. In Crises and Disruptions in International Business: How Multinational Enterprises Respond to Crises; Springer International Publishing: Cham, Switzerland, 2022; pp. 305–349. [Google Scholar]

- Krueger, P.; Sautner, Z.; Starks, L.T. The importance of climate risks for institutional investors. Rev. Financ. Stud. 2020, 33, 1067–1111. [Google Scholar] [CrossRef]

- Javadi, S.; Masum, A.A.; Aram, M.; Rao, R.P. Climate change and corporate cash holdings: Global evidence. Financ. Manag. 2023, 52, 253–295. [Google Scholar] [CrossRef]

- Addoum, J.M.; Ng, D.T.; Ortiz-Bobea, A. Temperature shocks and establishment sales. Rev. Financ. Stud. 2020, 33, 1331–1366. [Google Scholar] [CrossRef]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Almaazmi, G.; Al-Shboul, M.; Barood, G. How Does Climate Policy Uncertainty Impact Corporate Cash Holdings? Evidence from UAE. Int. J. Econ. Financ. Issues 2025, 15, 408. [Google Scholar] [CrossRef]

- Flammer, C.; Hong, B.; Minor, D. Corporate governance and the rise of integrating corporate social responsibility criteria in executive compensation: Effectiveness and implications for firm outcomes. Strateg. Manag. J. 2019, 40, 1097–1122. [Google Scholar] [CrossRef]

- Ghadge, A.; Wurtmann, H.; Seuring, S. Managing climate change risks in global supply chains: A review and research agenda. Int. J. Prod. Res. 2020, 58, 44–64. [Google Scholar] [CrossRef]

- Kim, Y.; Chen, Y.-S.; Linderman, K. Supply network disruption and resilience: A network structural perspective. J. Oper. Manag. 2015, 33, 43–59. [Google Scholar] [CrossRef]

- Patatoukas, P.N. Customer-base concentration: Implications for firm performance and capital markets: 2011 American accounting association competitive manuscript award winner. Account. Rev. 2012, 87, 363–392. [Google Scholar] [CrossRef]

- Yu, Y.; Wu, H.; Tan, Y. Does digitalizing supply chains enhance corporate financial stability? Int. Rev. Financ. Anal. 2025, 107, 104603. [Google Scholar] [CrossRef]

- Carvalho, V.M. From micro to macro via production networks. J. Econ. Perspect. 2014, 28, 23–48. [Google Scholar] [CrossRef]

- Freudenreich, B.; Lüdeke-Freund, F.; Schaltegger, S. A stakeholder theory perspective on business models: Value creation for sustainability. J. Bus. Ethics 2020, 166, 3–18. [Google Scholar] [CrossRef]

- Tang, C.; Tomlin, B. The power of flexibility for mitigating supply chain risks. Int. J. Prod. Econ. 2008, 116, 12–27. [Google Scholar] [CrossRef]

- Baryannis, G.; Dani, S.; Antoniou, G. Predictive analytics and artificial intelligence in supply chain management: Review and implications for the future. Comput. Ind. Eng. 2019, 137, 106024. [Google Scholar]

- Farboodi, M.; Mihet, R.; Philippon, T.; Veldkamp, L. Big data and firm dynamics. AEA Pap. Proc. 2019, 109, 38–42. [Google Scholar] [CrossRef]

- Duan, Y.; Edwards, J.S.; Dwivedi, Y.K. Artificial intelligence for decision making in the era of Big Data–evolution, challenges and research agenda. Int. J. Inf. Manag. 2019, 48, 63–71. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; McElheran, K. The rapid adoption of data-driven decision-making. Am. Econ. Rev. 2016, 106, 133–139. [Google Scholar] [CrossRef]

- Agrawal, A.; Gans, J.; Goldfarb, A. The Economics of Artificial Intelligence: An Agenda; University of Chicago Press: Chicago, IL, USA, 2019. [Google Scholar]

- Boh, W.; Constantinides, P.; Padmanabhan, B.; Viswanathan, S. Building Digital Resilience Against Major Shocks; Management Information Systems Research Center, University of Minnesota: Minneapolis, MN, USA, 2023; Volume 47, pp. 343–360. [Google Scholar]

- Bolton, P.; Kacperczyk, M. Do investors care about carbon risk? J. Financ. Econ. 2021, 142, 517–549. [Google Scholar] [CrossRef]

- Singh, N.P. Managing environmental uncertainty for improved firm financial performance: The moderating role of supply chain risk management practices on managerial decision making. Int. J. Logist. Res. Appl. 2020, 23, 270–290. [Google Scholar] [CrossRef]

- Keynes, J.M. The general theory of employment. Q. J. Econ. 1937, 51, 209–223. [Google Scholar] [CrossRef]

- Bates, T.W.; Kahle, K.M.; Stulz, R.M. Why do US firms hold so much more cash than they used to? J. Financ. 2009, 64, 1985–2021. [Google Scholar] [CrossRef]

- Han, S.; Qiu, J. Corporate precautionary cash holdings. J. Corp. Financ. 2007, 13, 43–57. [Google Scholar] [CrossRef]

- Krüger, P. Corporate goodness and shareholder wealth. J. Financ. Econ. 2015, 115, 304–329. [Google Scholar] [CrossRef]

- Lins, K.V.; Servaes, H.; Tufano, P. What drives corporate liquidity? An international survey of cash holdings and lines of credit. J. Financ. Econ. 2010, 98, 160–176. [Google Scholar] [CrossRef]

- Wu, H.; Deng, H.; Gao, X. Firm’s supply chain resilience under climate change: Evidence from China. In Environment, Development and Sustainability; Springer: Berlin/Heidelberg, Germany, 2025; pp. 1–32. [Google Scholar]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institutions of Capitalism: Firms, Markets, Relational Contracting. University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship. Available online: https://ssrn.com/abstract=1496720 (accessed on 15 November 2025).

- Ivanov, D. Viable supply chain model: Integrating agility, resilience and sustainability perspectives—Lessons from and thinking beyond the COVID-19 pandemic. Ann. Oper. Res. 2022, 319, 1411–1431. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Brandon-Jones, E.; Squire, B.; Autry, C.W.; Petersen, K.J. A contingent resource-based perspective of supply chain resilience and robustness. J. Supply Chain. Manag. 2014, 50, 55–73. [Google Scholar]

- Christopher, M.; Peck, H. Building the resilient supply chain. Int. J. Logist. Manag. 2004, 15, 1–13. [Google Scholar] [CrossRef]

- Knemeyer, A.M.; Zinn, W.; Eroglu, C. Proactive planning for catastrophic events in supply chains. J. Oper. Manag. 2009, 27, 141–153. [Google Scholar]

- Wieland, A.; Wallenburg, C.M. The influence of relational competencies on supply chain resilience: A relational view. Int. J. Phys. Distrib. Logist. Manag. 2013, 43, 300–320. [Google Scholar] [CrossRef]

- Bhamra, R.; Dani, S.; Burnard, K. Resilience: The concept, a literature review and future directions. Int. J. Prod. Res. 2011, 49, 5375–5393. [Google Scholar] [CrossRef]

- Sheffi, Y.; Rice, J.B., Jr. A supply chain view of the resilient enterprise. MIT Sloan Manag. Rev. 2005, 47. Available online: https://web.mit.edu/sheffi/www/academicPublications.html (accessed on 15 November 2025).

- Ambulkar, S.; Blackhurst, J.; Grawe, S. Firm’s resilience to supply chain disruptions: Scale development and empirical examination. J. Oper. Manag. 2015, 33, 111–122. [Google Scholar] [CrossRef]

- Sarkis, J. Supply chain sustainability: Learning from the COVID-19 pandemic. Int. J. Oper. Prod. Manag. 2020, 41, 63–73. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A. Viability of intertwined supply networks: Extending the supply chain resilience angles towards survivability. A position paper motivated by COVID-19 outbreak. Int. J. Prod. Res. 2020, 58, 2904–2915. [Google Scholar] [CrossRef]

- Alazab, M.; Alhyari, S.; Awajan, A.; Abdallah, A.B. Blockchain technology in supply chain management: An empirical study of the factors affecting user adoption/acceptance. Clust. Comput. 2021, 24, 83–101. [Google Scholar]

- Chen, H.; Chiang, R.H.; Storey, V.C. Business intelligence and analytics: From big data to big impact. MIS Q. 2012, 36, 1165–1188. [Google Scholar] [CrossRef]

- Di, L.; Luo, Y.; Jiang, W.; Chen, C. Does the tone of customer annual reports have a contagion effect along the supply chain? Evidence from corporate cash holdings. Manag. World 2020, 36, 148–163. [Google Scholar] [CrossRef]

- Barrot, J.N.; Sauvagnat, J. Input specificity and the propagation of idiosyncratic shocks in production networks. Q. J. Econ. 2016, 131, 1543–1592. [Google Scholar] [CrossRef]

| Obs | Mean | SD | Min | Max | |

|---|---|---|---|---|---|

| CashHolding | 14,609 | 0.0028 | 0.2117 | −0.0898 | 14.3372 |

| CR | 14,609 | 0.0002 | 0.0010 | 0.0000 | 0.0403 |

| Size | 14,609 | 21.9673 | 1.2611 | 15.5773 | 28.1092 |

| Lev | 14,609 | 0.4434 | 0.3372 | 0.0080 | 10.0822 |

| EM | 14,609 | 2.1708 | 3.5889 | −1.5 × 102 | 90.5706 |

| DLCR | 14,609 | 0.1494 | 0.1906 | −1.1752 | 3.0305 |

| ROA | 14,609 | 0.0367 | 0.1471 | −1.5613 | 7.2493 |

| NetProfit | 14,609 | 0.0541 | 0.7033 | −11.4355 | 34.2699 |

| Quick | 14,609 | 2.1557 | 4.2091 | 0.0524 | 90.5148 |

| INV | 14,609 | 0.1413 | 0.1405 | 0.0000 | 0.9150 |

| Mshare | 14,609 | 12.3961 | 19.3260 | 0.0000 | 89.1771 |

| FinInst | 14,609 | 0.0711 | 0.2569 | 0.0000 | 1.0000 |

| ChairHoldR | 14,609 | 7.8504 | 13.7875 | 0.0000 | 67.3200 |

| (1) | (2) | (3) | |

|---|---|---|---|

| CashHolding | CashHolding | CashHolding | |

| CR | −0.7354 *** | −0.7426 *** | −0.7411 *** |

| (0.2723) | (0.2689) | (0.2662) | |

| _cons | 0.0029 *** | −0.0696 | −0.0714 |

| (0.0000) | (0.0450) | (0.0453) | |

| Controls | No | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Industry FE | No | No | Yes |

| N | 14,560 | 14,560 | 14,559 |

| R2 | 0.3288 | 0.3291 | 0.3291 |

| (1) | (2) | |

|---|---|---|

| First-stage | Second-stage | |

| CR | CashHolding | |

| CR | −0.7530 *** | |

| (0.2713) | ||

| IV | 1.0005 *** | |

| (0.0008) | ||

| Controls | Yes | Yes |

| Firm FE | Yes | Yes |

| Year FE | Yes | Yes |

| Industry FE | Yes | Yes |

| Kleibergen-Paap rk LM | 33.3384 | |

| F | 1,579,697.5452 | |

| N | 14,559 | 14,559 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CashHolding | CashHolding | CashHolding | CashHolding | |

| CR | −7.42 × 103 *** | −0.8027 *** | −0.5711 *** | |

| (2.7 × 103) | (0.2816) | (0.2183) | ||

| L.CR | −0.6533 * | |||

| (0.3410) | ||||

| HHI | −0.0254 ** | |||

| (0.0121) | ||||

| SA | −0.0133 ** | |||

| (0.0054) | ||||

| Occupy | 0.0049 | |||

| (0.0045) | ||||

| INST | −0.0000 | |||

| (0.0000) | ||||

| _cons | −713.0008 | −0.0883 | −0.0922 | −0.0972 *** |

| (451.7518) | (0.0639) | (0.0582) | (0.0324) | |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes |

| N | 14,558 | 10,432 | 11,556 | 13,043 |

| R2 | 0.3291 | 0.4397 | 0.3291 | 0.2504 |

| (1) | (2) | (3) | |

|---|---|---|---|

| CashHolding | CashHolding | CashHolding | |

| Supplier concentration * CR | 2.5761 * | 2.4997 * | 2.1723 ** |

| (1.3811) | (1.3624) | (1.0671) | |

| CR | −1.9664 ** | −1.9330 ** | −1.7809 ** |

| (0.8297) | (0.8301) | (0.6969) | |

| Supplier concentration | 0.0073 | 0.0094 | 0.0158 |

| (0.0084) | (0.0107) | (0.0168) | |

| _cons | 0.0009 | −0.0835 | −0.0865 |

| (0.0023) | (0.0576) | (0.0594) | |

| Controls | No | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Industry FE | No | No | Yes |

| N | 14,508 | 14,508 | 14,507 |

| R2 | 0.3288 | 0.3291 | 0.3291 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| CashHolding (General AI) | CashHolding (NO General AI) | CashHolding (General-purpose AI) | CashHolding (No General-purpose AI) | CashHolding (Key AI) | CashHolding (No Key AI) | |

| CR | −0.4302 | −0.5847 ** | −0.0028 *** | −0.7450 *** | 0.0102 | −0.6537 *** |

| (0.3855) | (0.2604) | (0.0009) | (0.2679) | (0.0072) | (0.2487) | |

| _cons | −0.1756 *** | −0.0434 | −0.0001 | −0.0723 | −0.0004 | −0.0694 |

| (0.0542) | (0.0477) | (0.0007) | (0.0464) | (0.0003) | (0.0446) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 2455 | 12,038 | 412 | 14,083 | 520 | 13,980 |

| R2 | 0.7961 | 0.3292 | 0.9450 | 0.3291 | 1.0000 | 0.3293 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CashHolding (SOEs) | CashHolding (Non-SOEs) | CashHolding (High financing constraints) | CashHolding (Low financing constraints) | |

| CR | −0.2423 | −1.0305 ** | −1.0920 ** | −0.0084 |

| (0.1783) | (0.5017) | (0.4732) | (0.0137) | |

| _cons | −0.0166 | −0.1225 | −0.2201 | −0.0082 |

| (0.0146) | (0.0778) | (0.1799) | (0.0082) | |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes |

| N | 5547 | 8777 | 7503 | 7041 |

| R2 | 0.5615 | 0.3301 | 0.3306 | 0.7878 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CashHolding (Without bank–firm relationships) | CashHolding With bank–firm relationships | CashHolding (Regional finance developing) | CashHolding (Regional finance developed) | |

| CR | −0.7823 * | −0.2895 | −0.8887 ** | −0.2719 |

| (0.4401) | (0.2112) | (0.3446) | (0.3245) | |

| _cons | −0.2735 | −0.0398 ** | −0.0667 *** | −0.0541 |

| (0.2573) | (0.0157) | (0.0250) | (0.1065) | |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes |

| N | 5509 | 9036 | 6630 | 6594 |

| R2 | 0.4931 | 0.5093 | 0.5784 | 0.3315 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sheng, X.; Shao, J.; Ju, Z. Climate Risk in Supply Chains and Corporate Cash Holdings: Mechanisms and Mitigation Strategies. Sustainability 2025, 17, 10390. https://doi.org/10.3390/su172210390

Sheng X, Shao J, Ju Z. Climate Risk in Supply Chains and Corporate Cash Holdings: Mechanisms and Mitigation Strategies. Sustainability. 2025; 17(22):10390. https://doi.org/10.3390/su172210390

Chicago/Turabian StyleSheng, Xiaoqi, Jun Shao, and Zhen Ju. 2025. "Climate Risk in Supply Chains and Corporate Cash Holdings: Mechanisms and Mitigation Strategies" Sustainability 17, no. 22: 10390. https://doi.org/10.3390/su172210390

APA StyleSheng, X., Shao, J., & Ju, Z. (2025). Climate Risk in Supply Chains and Corporate Cash Holdings: Mechanisms and Mitigation Strategies. Sustainability, 17(22), 10390. https://doi.org/10.3390/su172210390