1. Introduction

The examination of how cost–benefit evaluations, executive attitudes, and implementation readiness influence organizational leaders regarding artificial intelligence has become central to contemporary sustainable technology adoption research. Contemporary investigations reveal that cost assessments and managerial viewpoints demonstrate positive correlations with enduring technology utilization and deployment effectiveness [

1,

2]—factors essential for executives navigating intricate digital transformation challenges. Quantitative findings suggest that financial evaluations mediate associations between technology acceptance and continued deployment [

3], while institutional perspectives affect how implementation beliefs influence lasting usage behaviors [

4]. Furthermore, ref. [

5] documented that economic value can strengthen sustainable utilization through flexible management approaches, and [

6] indicated that monetary considerations affect both perspectives and deployment outcomes.

Existing scholarly research exposes notable conceptual and procedural limitations that constrain comprehension of AI adoption processes, especially concerning the synthesis of financial and cognitive elements in enduring implementation frameworks. While earlier studies have established separate linkages between financial assessments and technology acceptance [

7], these investigations encounter three primary limitations constituting the central theoretical gap this research examines. Initially, academic research lacks integrated frameworks that concurrently analyze how financial considerations (price–value) and cognitive factors (attitudes) combine to affect behavioral intentions and sustained usage results. Most investigations study these constructs separately, missing the intricate relationships that define actual executive decision-making processes.

Subsequently, the temporal aspect of enduring AI utilization remains conceptually underdeveloped. Refs. [

8,

9] recognize that economic value considerations forecast implementation success, yet their framework approaches sustainability as a fixed result rather than a fluid process shaped by changing executive perceptions and perspectives. This represents a fundamental theoretical limitation, as sustainable technology implementation requires understanding how initial adoption intentions translate into long-term usage patterns through mediating psychological mechanisms.

Finally, organizational management scholarship exhibits conflicting theoretical models when investigating AI implementation. Refs. [

10,

11] present divergent results concerning financial-adoption associations, indicating that current theoretical frameworks may be insufficiently defined for modern AI deployment contexts. The absence of theoretically integrated frameworks that account for both economic rationality and psychological factors creates a significant knowledge gap that limits our ability to predict and explain sustainable AI adoption among business managers.

These conceptual constraints collectively indicate the necessity for a unified model that connects financial and cognitive perspectives while addressing the evolving nature of sustainable technology deployment. This research fills this void by developing and evaluating an inclusive framework that investigates how economic value perceptions affect attitudes, which subsequently form behavioral intentions and finally establish sustainable AI usage patterns among business executives.

The psychological dimension of sustainable technology implementation has developed as a fundamental framework for comprehending cognitive factors that enhance executives’ effectiveness and sustained utilization [

12]. This perspective acknowledges that organizational managers must cultivate not only technical skills but also suitable perspectives and value assessments to tackle complex deployment challenges [

13]. Investigations in this domain indicate that economic value assessments and favorable perspectives are especially crucial for executives, as they frequently encounter implementation apprehension, deployment obstacles, and institutional pressures of promoting sustainable AI utilization [

14,

15,

16].

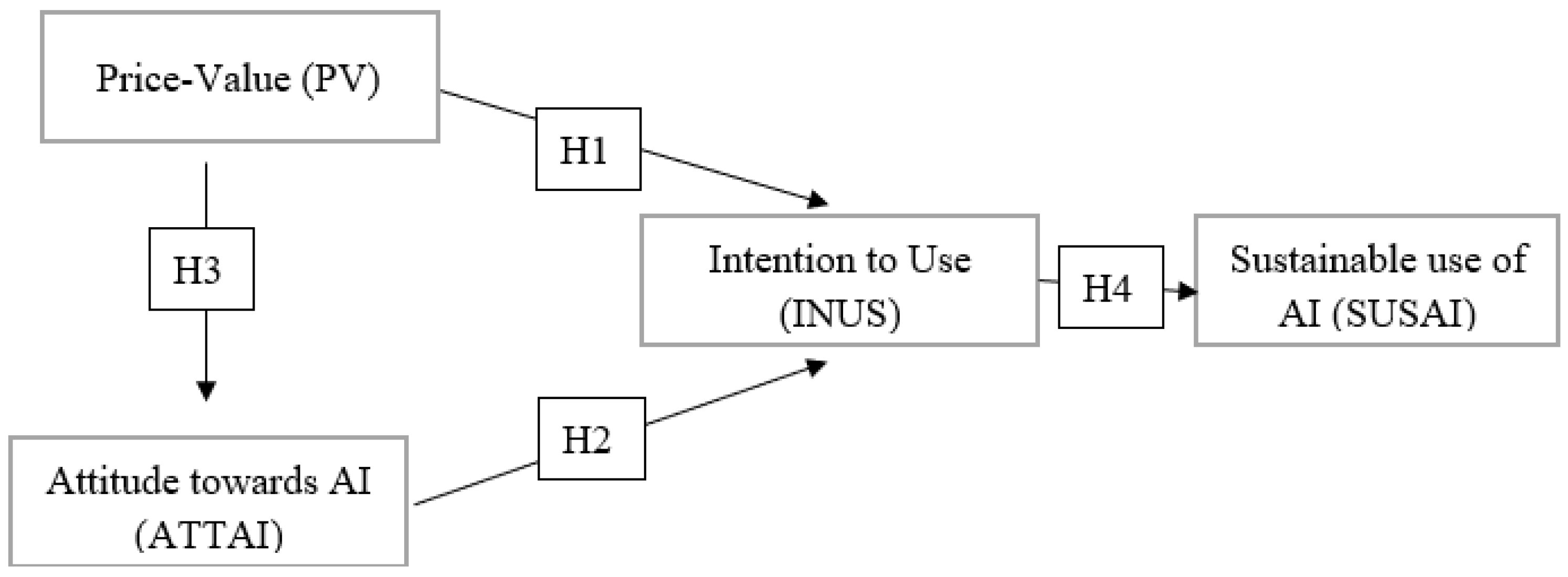

The main goal of this investigation is to examine associations between economic value, perspectives, and adoption willingness within sustainable AI implementation among organizational managers. This research develops four core hypotheses: the effect of economic value on adoption willingness, the impact of perspectives on adoption willingness, the influence of economic value on perspectives, and the role of adoption willingness on sustainable AI deployment. Its innovation resides in emphasizing organizational executives and the concurrent examination of both financial and cognitive factors, elements previously unexplored in sustainable AI implementation scholarship.

The conceptual rationale for this investigation rests in its contribution to comprehending how economic value perceptions and perspectives may affect sustainable AI utilization in organizational contexts, building upon [

17] research on the role of financial beliefs in technology implementation. From an applied standpoint, the results could guide the creation of more efficient strategies to foster sustainable AI utilization among organizational executives, consistent with [

18,

19]. As recommended by [

20,

21] incorporating both financial and cognitive considerations into organizational deployment is essential for strengthening sustainable utilization, especially in AI-centered initiatives. Moreover, refs. [

22,

23] emphasized the importance of understanding how price–value perceptions and managerial attitudes influence sustainable AI adoption throughout implementation journeys in business settings.

3. Materials and Methods

The hypotheses were tested through an empirical, quantitative study with a correlational design and explanatory orientation, applying systematic procedures to examine causal relationships among the variables. This approach was chosen to permit rigorous statistical evaluation of the proposed links between economic value, perspectives, adoption willingness, and sustainable AI use among organizational managers [

80,

81].

3.1. Details of Study Participants

The sample size of 390 organizational executives was established using non-probabilistic accessibility sampling, an approach chosen based on participant availability and the investigative nature of the research examining AI implementation relationships in organizational contexts. As indicated by [

82], accessibility sampling is suitable for studies exploring associations between technological implementation variables in business contexts where availability and voluntary participation are fundamental. Sample size determination adhered to structural equation modeling requirements, as ref. [

83] recommends 10–15 participants minimum per observed variable. Considering the 26 observed variables in the measurement model, the target sample surpassed the minimum requirement of 260 participants, finally achieving 390 participants to guarantee sufficient statistical power for PLS-SEM analysis.

It should be recognized that convenience sampling does not permit the calculation of traditional sampling error or the construction of confidence intervals, as would be possible with probabilistic designs. The non-probabilistic nature of the sample constitutes a salient limitation that restricts the generalizability of the results beyond the studied population of business managers in northern Peru. Although the sample size is adequate for the analytical techniques employed and provides sufficient statistical power for hypothesis testing [

84], interpretation should remain bounded by this methodological constraint. The convenience-based approach limits the capacity to draw population-level inferences or to specify precise confidence levels, representing a key limitation to consider when assessing the study’s findings and their applicability to broader managerial populations.

As detailed in

Table 1, the gender distribution showed a predominance of male participants at 58.72% (229 participants) compared to 41.28% (161 participants) female. Regarding age distribution, the largest group was 30–39 years (45.13%, 176 participants), followed by 40–49 years (28.21%, 110 participants), and 25–29 years (15.38%, 60 participants). In terms of management experience, most participants had 5–10 years of experience (38.97%, 152 participants), followed by those with 11–15 years (25.64%, 100 participants), and those with less than 5 years (20.51%, 80 participants).

3.2. Instruments Used in the Study

Data gathering utilized a structured digital survey comprising four validated instruments, employing exclusively closed-ended questions with single-response alternatives to guarantee standardized measurement and enable statistical analysis. The survey structure contained three primary sections: informed consent (1 item), sociodemographic characteristics (3 items), and construct measurement scales (26 items).

Four established measurement instruments enabled information collection:

Price–Value Scale (PV): The empirically confirmed instrument developed by ref. [

24] was employed to evaluate managerial perspectives regarding AI value propositions in relation to financial requirements. This four-indicator instrument demonstrates solid statistical properties within technology acceptance research, including components addressing cost–benefit evaluation, value justification, investment returns, and institutional benefit delivery.

Attitude towards AI Scale (ATTAI): The adapted version by ref. [

80] was employed to evaluate executive personnel’s comprehensive evaluative viewpoints regarding AI implementation. This nine-indicator scale exhibits excellent reliability within institutional contexts, encompassing dimensions including perceived benefits, AI utilization ease, professional efficiency improvement, and trust in AI capabilities.

Intention to Use Scale (INUS): The version confirmed by ref. [

78] was utilized to assess executives’ behavioral intentions concerning AI implementation. This 6-item instrument has shown high internal consistency, examining planning to employ AI, deployment intentions, integration objectives, adoption readiness, and productivity improvement goals.

Sustainable Use of AI Scale (SUSAI): The modification by ref. [

85] was employed to evaluate enduring, responsible AI deployment. This 7-item scale has exhibited solid psychometric properties in organizational settings, assessing responsible utilization commitment, long-term impact evaluation, institutional benefit integration, balanced usage preservation, sustainable value creation, and consistency in beneficial implementation.

All instruments used a 5-point Likert scale ranging from (1) “strongly disagree” to (5) “strongly agree.” The questionnaire was distributed via a secure digital platform (SurveyMonkey), ensuring data privacy and accessibility across different organizational contexts.

Pilot Testing and Validation: Prior to main data collection, a pilot study was conducted with 25 business managers from 5 organizations not included in the final sample. The pilot testing revealed high internal consistency (Cronbach’s α > 0.80 for all scales) and identified minor wording adjustments to enhance clarity in the Peruvian business context. Participants in the pilot study suggested simplifying technical terminology in two items, which were subsequently modified while maintaining construct validity.

Sampling Strategy: Organizations were selected through purposive sampling based on three criteria: (1) active AI implementation or consideration, (2) willingness to participate in research, and (3) availability of middle to senior management personnel. Initial contact was established through professional networks and chamber of commerce databases in northern Peru. From 45 organizations contacted, 28 agreed to participate, representing a 62% organizational response rate. The sample size calculation was based on structural equation modeling requirements, with a minimum of 15 participants per observed variable, resulting in a target sample of 390 participants across participating organizations.

The complete questionnaire, including all items and their psychometric properties, is provided in

Table A1 and

Table A2 (

Appendix A) for transparency and replication purposes.

Table A1 presents the complete item inventory with factor loadings and validation results, while

Table A2 summarizes construct validation and item retention rates.

3.3. Procedure and Data Analysis

Data collection took place from June to September 2024 in multiple business organizations across northern Peru. After securing the requisite institutional authorizations, the instrument was disseminated via corporate email and professional networks to organizational managers, accompanied by a detailed description of the study’s objectives regarding AI implementation and the voluntary nature of participation.

To promote consistency across organizational contexts, a unified data-collection protocol was implemented, incorporating standardized participant instructions and explicit guidelines to uphold data quality in virtual business settings.

The analytical sequence comprised: (1) data cleaning and preparation in Microsoft Excel; (2) descriptive statistics to characterize the sample; and (3) confirmatory factor analysis (CFA) to assess convergent validity through factor loadings and average variance extracted (AVE), with thresholds of 0.70 and 0.50, respectively. During CFA, items ATTAI4, INUS3, and SUSAI4 were removed due to insufficient loadings (<0.50). Reliability was evaluated using Cronbach’s alpha and composite reliability (CR), while discriminant validity was examined with the [

86] criterion and the heterotrait–monotrait (HTMT) ratio.

Finally, hypothesis testing was conducted via partial least squares structural equation modeling (PLS-SEM) in SMART-PLS v.4.0, estimating relationships among price–value, attitudes, intention to use, and sustainable AI implementation in business contexts.

5. Discussion

The results provide substantial empirical support for the relationships among cost–benefit evaluations, attitudes, implementation intentions, and sustained AI use among business executives. Testing of the proposed hypotheses yielded notable outcomes that deepen understanding of these constructs within corporate technology-implementation contexts.

For the first hypothesis, the evidence confirms that economic value has a significant positive effect on willingness to adopt artificial intelligence among organizational managers (β = 0.662,

p < 0.001). This strong association indicates that when AI deployment is perceived to offer a favorable cost–benefit balance, managers are more likely to develop robust intentions to implement the technology. This aligns with [

49], which reported that positive economic-value perceptions predict higher implementation intentions (β = 0.45,

p < 0.001). Similarly, ref. [

50] found that price–value considerations significantly influence implementation intentions across varied organizational settings (β = 0.52,

p < 0.01). The magnitude of this relationship is consistent with [

78], identifying price–value as a core economic driver of managerial adoption decisions. Moreover, ref. [

6] demonstrated that the impact of price–value on intention to use is mediated by perceived benefits in organizational environments (β = 0.48,

p < 0.001), further corroborating these findings. These results are reinforced by [

79], who established that organizational readiness—including economic considerations—significantly influences the AI adoption journey, with technology readiness levels serving as critical benchmarks for successful implementation across different organizational phases.

For the second hypothesis, the findings illustrate that perspectives toward AI substantially affect adoption willingness (β = 0.456,

p < 0.001). This influence indicates that positive executive perspectives toward AI technology serve a vital function in forming deployment intentions. This result is aligned with [

56] research demonstrating that executive perspectives strongly predict technology implementation intentions (β = 0.43,

p < 0.001). Reference [

57] similarly found that positive attitudes towards AI significantly influence implementation decisions (β = 0.39,

p < 0.01). Our results also align with [

58] identification of attitudinal factors as significant predictors of AI adoption intentions. Furthermore, ref. [

48] demonstrated that positive attitudes reduce adoption resistance and enhance implementation intentions (β = 0.51,

p < 0.001), supporting the importance of attitudinal factors in technology adoption. This finding gains additional support from [

80], who documented that computer skills training—which shapes technological attitudes—demonstrates significant positive effects on organizational performance and digital transformation readiness in Eastern European companies, suggesting that attitude formation through skill development constitutes a critical pathway for sustainable technology adoption.

The third hypothesis—stating that price–value significantly influences attitudes toward AI—was supported (β = 0.374,

p < 0.001). This association indicates that favorable price–value perceptions foster more positive attitudes toward AI implementation. Consistent evidence appears in [

9], which found that price–value considerations significantly predict technological attitudes (β = 0.42,

p < 0.001). Similarly, ref. [

64] reported comparable effects for cost–benefit perceptions and technology attitudes (β = 0.38,

p < 0.01). In addition, ref. [

66] showed that price–value assessments shape technological attitudes in business contexts (β = 0.45,

p < 0.001), and ref. [

68] further demonstrated that positive price–value perceptions reduce implementation stress and enhance attitudes toward new technologies (β = 0.47,

p < 0.001). The relationship between economic evaluation and attitude formation is further illuminated by [

79], who argued that successful AI adoption requires alignment between technology readiness and organizational preparedness across people, processes, and data dimensions, with economic considerations serving as foundational elements in this alignment process.

Finally, the fourth hypothesis—assessing the effect of intention to use on sustainable AI implementation—was strongly supported (β = 0.749,

p < 0.001). This robust association indicates that managers’ implementation intentions are pivotal determinants of sustainable AI use. Convergent evidence appears in [

4], which reported that implementation intentions strongly predict sustainable technology adoption (β = 0.56,

p < 0.001); likewise, ref. [

73] documented a significant link between usage intentions and sustainable practices (β = 0.61,

p < 0.001). In the same direction, ref. [

74] found a positive correlation between intention to use and long-term technology adoption (β = 0.53,

p < 0.001), and ref. [

78] showed that implementation intentions account for a substantial share of variance in sustainable AI use across business sectors (β = 0.58,

p < 0.001). This relationship is contextualized by [

93], who emphasized that sustainable AI implementation requires progression through multiple technology readiness levels, with intention serving as the bridge between initial adoption decisions and long-term operational success. Additionally, ref. [

94] demonstrated that organizational investments in digital competencies—reflecting strong implementation intentions—correlate with improved performance outcomes across multiple economic indicators, reinforcing the critical role of intentionality in achieving sustainable technology integration.

The interpretation of these findings must account for contextual factors specific to northern Peru that may influence the observed relationships. The region’s digital infrastructure—characterized by variable internet connectivity, limited cloud computing resources, and nascent AI service ecosystems—likely shapes how business managers evaluate price–value propositions and form implementation intentions. Organizations operating in contexts with underdeveloped technological infrastructure face higher implementation costs and greater uncertainty regarding return on investment, potentially amplifying the importance of clear economic value demonstrations. Additionally, Peru’s economic environment, marked by small and medium enterprise prevalence, resource constraints, and cautious investment cultures, may heighten sensitivity to cost–benefit considerations relative to contexts where capital availability permits more experimental technology adoption. The regional business culture, which emphasizes relationship-based decision-making, hierarchical organizational structures, and collective rather than individual risk assessment, could moderate how attitudes translate into intentions and subsequently into sustained usage. These contextual elements suggest that the particularly strong relationship between price–value and intention observed here (β = 0.662) may reflect situational factors where economic justification assumes paramount importance due to resource scarcity and risk aversion. In more developed markets with mature AI ecosystems, robust digital infrastructure, and risk-tolerant business cultures, the relative influence of economic versus attitudinal factors might differ, with psychological elements potentially assuming greater prominence. Future research examining these relationships across diverse economic and cultural contexts would illuminate the boundary conditions for the patterns identified in this Peruvian sample and advance toward culturally contextualized models of AI adoption.

The credibility of the findings is bolstered by strong psychometric evidence, with model fit indices meeting established thresholds (SRMR = 0.065; NFI = 1.267). Additionally, high reliability and discriminant validity—indicated by HTMT values below 0.85—support the conclusion that the observed relationships represent genuine patterns within the studied population of business managers.

5.1. Theoretical Implications

This research advances the theoretical understanding of AI adoption in organizational contexts by establishing an integrated framework that bridges economic and psychological perspectives. The model’s substantial explanatory power (R2 = 0.892 for intention to use; R2 = 0.851 for sustainable use) demonstrates that combining price–value perceptions with attitudinal constructs provides a more comprehensive account of technology adoption than models examining these factors in isolation.

The study makes three significant theoretical contributions. First, it validates the mediating role of attitudes in the relationship between economic evaluations and behavioral intentions, confirming that price–value perceptions influence adoption decisions both directly and indirectly through attitude formation. This dual-pathway mechanism enriches technology acceptance frameworks by demonstrating how rational economic assessments interact with psychological factors to shape implementation decisions. Second, the research extends sustainable technology adoption theory by establishing intention to use as a critical antecedent of sustainable AI implementation (β = 0.749, p < 0.001), providing empirical evidence that volitional commitment precedes enduring usage patterns. Third, the framework contributes to business management literature by demonstrating that AI adoption among managers follows distinct patterns characterized by strong economic rationality (β = 0.662 for price–value on intention) combined with attitudinal mediation, suggesting that managerial technology adoption differs from end-user acceptance in emphasizing cost–benefit considerations.

The integration of these constructs addresses a theoretical gap identified in prior research, where economic and psychological factors were examined separately despite their evident interdependence in organizational decision-making. The robust path coefficients and high explanatory variance indicate that this integrated approach captures essential mechanisms underlying sustainable AI adoption in business environments.

5.2. Practical Implications

The findings yield actionable insights for organizational leaders and policymakers seeking to promote sustainable AI implementation. The pronounced effect of price–value on both attitudes (β = 0.374) and intentions (β = 0.662) underscores the necessity of clearly articulating AI’s economic value proposition to management teams. Organizations should develop comprehensive cost–benefit analyses that quantify return on investment, productivity gains, and competitive advantages, presenting these metrics through structured business cases that resonate with managerial decision-making frameworks.

The substantial influence of attitudes on implementation intentions (β = 0.456) suggests that cultivating favorable managerial perspectives toward AI constitutes a strategic priority. Organizations can achieve this through targeted interventions including hands-on demonstration projects, pilot programs that showcase AI capabilities in relevant business contexts, and structured change management initiatives that address concerns while building confidence. Training programs should emphasize not only technical competencies but also strategic understanding of AI’s organizational implications, enabling managers to develop informed, positive attitudes grounded in practical knowledge.

The strong association between intention and sustainable use (β = 0.749) highlights that genuine commitment—rather than superficial compliance—drives lasting implementation success. Organizations should foster authentic engagement through participatory implementation processes, where managers contribute to AI strategy formulation and deployment planning. This approach transforms passive recipients into active stakeholders, strengthening implementation intentions and increasing the likelihood of sustained adoption.

For policymakers and industry associations, these findings suggest that AI adoption initiatives should incorporate economic literacy components alongside technical training, recognizing that managers require clear understanding of both financial implications and technological capabilities. Support mechanisms might include frameworks for assessing AI readiness, industry-specific cost–benefit benchmarks, and knowledge-sharing platforms that facilitate peer learning among business leaders navigating AI implementation.

6. Limitations and Future Research

This study presents several constraints that influence result interpretation and establish directions for future inquiry. The primary limitation concerns geographic scope, as the sample of 390 organizational managers from northern Peru restricts generalizability to other cultural and economic contexts. Northern Peru’s particular business environment—characterized by specific technological infrastructure, regulatory frameworks, and organizational cultures—may shape the relationships observed among price–value perceptions, attitudes, and AI adoption in ways that differ from other regions. The applicability of these findings to managers in developed economies, other Latin American countries, or Asian and African markets remains uncertain and warrants cautious interpretation.

The cross-sectional design constitutes a second significant limitation, precluding definitive causal inferences regarding the relationships among constructs. While structural equation modeling enables assessment of directional relationships, the temporal ordering of variables cannot be conclusively established without longitudinal data. Future research should employ panel designs tracking managers across multiple time points to examine how price–value perceptions, attitudes, and intentions evolve during AI implementation journeys, and to establish temporal precedence among these constructs.

Methodologically, exclusive reliance on self-report measures introduces potential common method bias, despite statistical controls. Managers may overestimate their implementation intentions or provide socially desirable responses regarding attitudes toward emerging technologies. Future studies should incorporate multi-method approaches combining self-reports with objective behavioral indicators such as actual AI adoption rates, implementation timelines, and resource allocation decisions. Additionally, collecting data from multiple organizational stakeholders—including IT personnel, frontline employees, and senior executives—would provide triangulated perspectives on AI implementation processes.

The non-probabilistic sampling approach, while appropriate for this exploratory investigation, limits statistical generalization to broader managerial populations. Future research should employ probability sampling methods across diverse organizational types, industry sectors, and geographic regions to enhance external validity. Comparative studies examining AI adoption patterns across cultural contexts would illuminate whether the relationships identified here represent universal patterns or context-specific phenomena.

Several theoretical constructs potentially relevant to sustainable AI adoption were not examined in this study. Organizational culture, leadership support, technological infrastructure readiness, and regulatory environments likely moderate or mediate the relationships identified here. Future investigations should develop more comprehensive models incorporating these organizational and contextual factors. Additionally, examining potential curvilinear relationships—such as whether extremely high price–value perceptions produce diminishing returns on attitudes or intentions—would refine theoretical understanding.

The brief Likert scales employed, while psychometrically sound, may not capture the full complexity of constructs such as ethical considerations in AI use, long-term sustainability commitment, or organizational change readiness. Future research might employ mixed methods designs combining quantitative surveys with qualitative interviews to explore nuanced aspects of managerial AI adoption that standardized scales cannot adequately assess. Longitudinal case studies tracking organizations through complete AI implementation cycles would provide rich insights into temporal dynamics and implementation challenges.

Finally, the model does not address implementation outcomes beyond sustainable use intentions. Future research should examine relationships between sustainable AI use and organizational performance indicators such as productivity gains, competitive advantage, innovation capacity, and financial returns. Understanding these downstream consequences would complete the causal chain from initial price–value perceptions through sustainable implementation to organizational outcomes, providing a more complete account of AI adoption’s organizational impact.

7. Conclusions

This investigation establishes that sustainable AI implementation among business managers emerges from the coordinated influence of economic value perceptions, favorable attitudes, and strong implementation intentions. The research demonstrates that these factors operate as an integrated system rather than isolated variables, with economic evaluations shaping psychological responses that subsequently influence behavioral commitments leading to sustained usage patterns.

Three principal findings merit emphasis. First, price–value perceptions exert both direct influence on implementation intentions and indirect effects mediated by attitudinal formation, challenging simplistic models that treat cost–benefit analysis and psychological acceptance as separate processes. Second, the robust relationship between implementation intentions and sustained use patterns confirms that volitional engagement, rather than mandated compliance, drives lasting technology integration. Third, the model’s substantial explanatory power validates the theoretical premise that managerial technology adoption reflects complex interplay between rational calculation and affective response.

These findings yield actionable implications for organizational practice. Successful AI implementation strategies must simultaneously address economic justification through comprehensive cost–benefit analyses and psychological readiness through experiential learning and participatory decision-making. Organizations that invest substantial effort in building authentic intentions during pre-implementation phases establish stronger foundations for sustained adoption than those emphasizing post-implementation support alone.

The study acknowledges contextual specificity as both a limitation and opportunity for future research. While the patterns observed among Peruvian business managers align with the literature on broader technology acceptance, cultural, economic, and institutional factors specific to emerging economies may influence the relative weight of economic versus psychological determinants. Comparative research examining these relationships across diverse contexts would illuminate boundary conditions and advance toward more nuanced, context-sensitive models of organizational technology adoption. Future investigations should also employ longitudinal designs to establish temporal precedence among constructs and incorporate objective behavioral indicators alongside self-report measures to strengthen causal inferences.