1. Introduction

The contemporary global economic landscape is characterized by unprecedented uncertainty and heightened volatility in international financial markets [

1]. Recent years have witnessed a succession of financial crises—from the 2008 subprime mortgage crisis and European sovereign debt crisis to the COVID-19 liquidity shock and 2023 Credit Suisse collapse—underscoring the intensifying contagion effects of credit risks that threaten global financial stability. As core financial intermediaries [

2], banks can transmit systemic risk once credit risk accumulates through channels such as credit contraction and deteriorating asset quality [

3]. Consequently, establishing robust credit risk management frameworks and enhancing banks’ risk resilience are imperative.

The United Nations Sustainable Development Goals call on financial institutions to integrate sustainability into risk management and to align economic performance with social value. In 2023, China’s Central Financial Work Conference emphasized preventing and resolving financial risks, strengthening the financial stability framework, and advancing financial sustainability, while under the dual-carbon agenda directing financial resources toward green and low-carbon sectors. These policies provide a clear context for studying bank credit risk governance.

Fintech, as a paradigm of technology-driven innovation, has fundamentally transformed credit risk management in the banking sector [

4]. Big data, blockchain, and artificial intelligence enable more accurate credit scoring, dynamic post-lending monitoring, and lower operating costs, and partnerships with technology firms support differentiated transformation [

5,

6,

7,

8]. Technology adoption also brings vulnerabilities: model and data limitations can bias risk assessment, and competition from third-party platforms compresses bank margins [

9]. Chinese regulators have responded with the FinTech Development Plan (2022–2025), which gives equal weight to prudent fintech development and robust risk controls and signals a coordinated stance on safety and growth. It is therefore necessary, within China’s institutional setting, to evaluate the effect of fintech on bank credit risk and to situate it within a sustainability framework to inform bank risk governance.

This study addresses three core research questions: whether fintech reduces credit risk, the mechanisms by which this effect operates, and under what conditions fintech proves more effective. Utilizing data from 135 Chinese commercial banks spanning the period from 2013 to 2023, we empirically investigate the impact of fintech on credit risk. This study contributes to literature in three key dimensions: (1) We advance measurement methodology by constructing a comprehensive fintech index through textual analysis of bank annual reports. We develop a multi-stage PDF-to-Markdown-to-TXT conversion pipeline that addresses common parsing challenges, including encryption barriers and optical character recognition (OCR) errors. Furthermore, we refine our keyword lexicon by incorporating terminology from recent policy documents, encompassing emerging domains such as intelligent risk control, robo-advisory services, open banking platforms, and innovative business models. This approach yields a more granular measure of fintech penetration depth in banking operations. (2) We make a mechanistic approach by explicitly incorporating financial sustainability into our analytical framework and modelling it through two mediating channels: operational efficiency and asset efficiency. We demonstrate that fintech enables both cost reduction and revenue generation, thereby strengthening banks’ financial resilience. This dual-mediation framework not only enriches the literature on fintech and bank risk management but also enhances our understanding of how sustainability principles underpin technology-driven banking. (3) We introduce the reciprocal of urban carbon intensity as a moderating variable to assess how local environmental conditions shape the fintech–credit risk relationship. Our findings indicate that the risk-reduction effect of fintech is significantly more pronounced in cities with higher levels of green development. This finding addresses the growing importance of green finance and provides novel empirical evidence on the context-dependent nature of fintech’s effectiveness.

2. Literature Review and Hypothesis Development

2.1. Literature Review

Existing research on the impact of fintech on bank credit risk broadly presents three perspectives. First, technology empowerment. Fintech significantly enhances banks’ risk management capabilities by improving information processing efficiency and mitigating information asymmetry [

10,

11]. In practice, banks deploy data analytics and credit-scoring models to predict default probabilities more accurately [

12] and to screen borrowers more effectively [

13], which enhances institutional resilience. Moreover, fintech applications in payment settlement not only expand the coverage of financial services but also facilitate credit cooperation between banks and small-sized enterprises [

14,

15], helping to reduce costs and improve liquidity, which in turn enhances banks’ capacity to withstand credit risks [

16,

17]. Empirical studies based on data from 135 Chinese commercial banks demonstrate that the application of digital risk-control significantly reduces banks’ non-performing loan losses [

18]. Similarly, analyses by Banna and colleagues examining banking data from 24 member countries of the OIC corroborate that fintech effectively curbs banks’ risk-taking behavior, thereby providing safeguards for sustainable economic growth [

19].

Second, competitive pressure. Fintech intensifies competition in the banking industry and compresses traditional profit margins, threatening the financial sustainability of banks. Examining liability structures, Hu et al. argue that fintech undermines the stability of conventional deposits [

20]. In response, banks find themselves compelled to lend to micro and small enterprises with limited repayment capacity, leading to asset quality deterioration and exposing them—either voluntarily or involuntarily—to heightened credit risks [

21]. Guellec et al.’s empirical evidence indicates that this competitive pressure is particularly acute among small and medium-sized banks, accounting for the “Matthew effect” under fintech disruption [

22]. Additionally, new technology applications may trigger regulatory arbitrage and accelerate shadow banking growth, thereby intensifying fragilities in credit risk management [

23].

Third, nonlinear effects. Rather than a simple linear relationship, the impact follows a threshold pattern that shifts across different stages of technological development. In the early adoption phase, fintech primarily intensifies industry competition by compressing interest margins, leading to rapid short-term risk accumulation among banks. However, as technology matures and achieves economies of scale, its advantages in risk management and operational efficiency become evident. In the later phases, fintech can effectively curb the rise in non-performing loan ratios [

24,

25]. Additionally, timely regulatory intervention has proven to be a critical factor in offsetting early negative effects and triggering this inflection point [

26].

In summary, the existing literature has explored fintech’s impact on bank credit risk from multiple perspectives. However, several important gaps remain. First, most studies focus on the direct effects of technology. Few examine how fintech influences risk through improving banks’ internal financial sustainability. Second, while some scholars have recognized the importance of heterogeneity and contextual factors, external sustainability conditions are rarely incorporated into the analysis. Against the backdrop of carbon neutrality goals and the rapid expansion of green finance, regional green development levels may moderate fintech’s risk governance effects by shaping the financial ecosystem and influencing client quality. This question warrants further investigation. Accordingly, this study draws on data from 135 Chinese commercial banks to examine the underlying mechanisms through which fintech affects credit risk, approaching the question from both internal and external sustainability perspectives.

2.2. Research Hypotheses

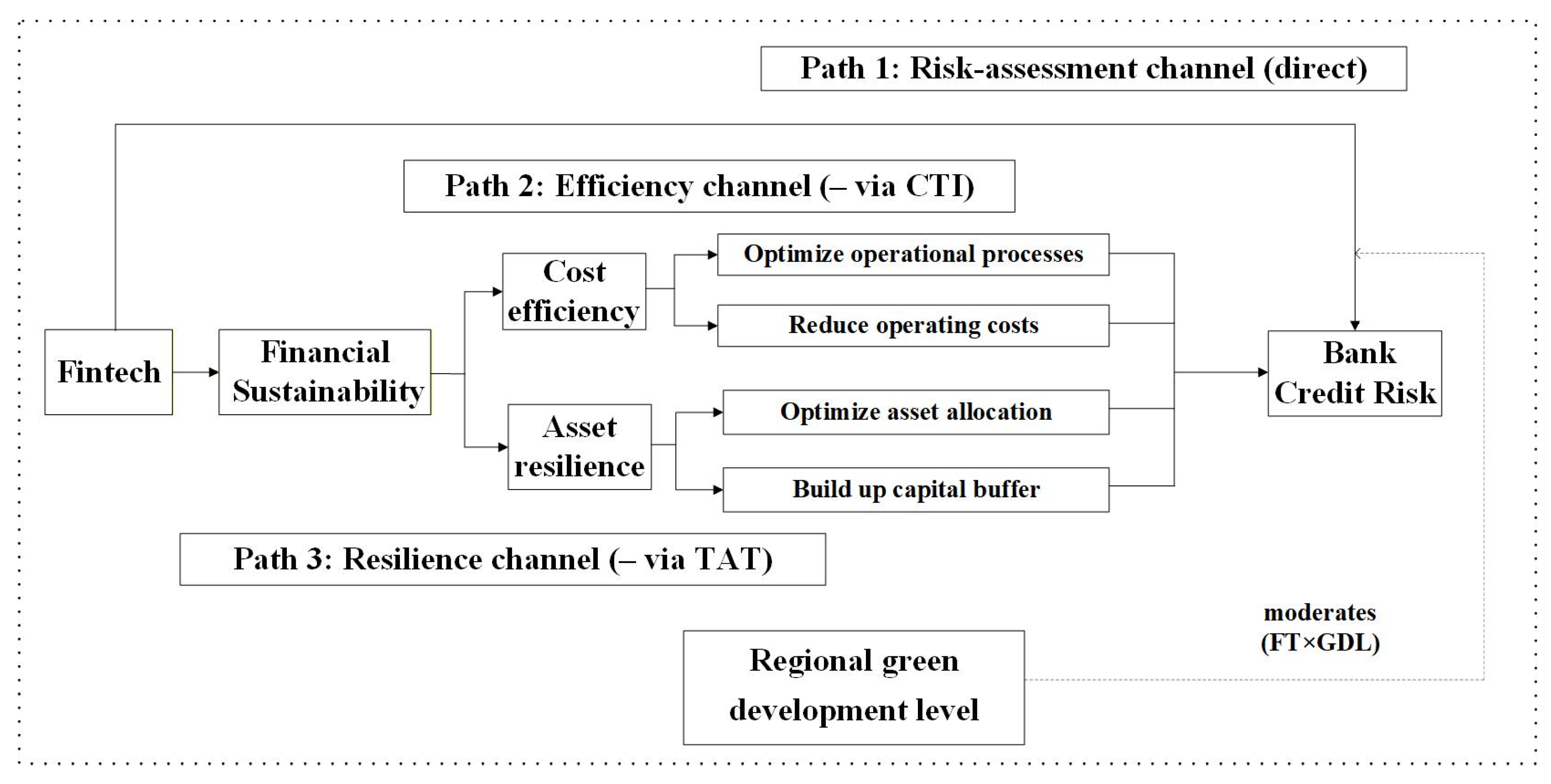

Fintech influences bank credit risk through multiple pathways consistent with a technology enabled risk-governance logic. We organize these mechanisms into three core channels, as shown in the conceptual framework: a risk assessment channel, an operational efficiency channel, and a resilience channel. The theoretical framework of this article is shown in

Figure 1.

2.2.1. Direct Impact: Fintech and Bank Credit Risks

Fintech influences bank credit risk through risk assessment channels. On the one hand, fintech enhances the accuracy of risk identification and assessment. In traditional lending, banks rely on financial statements, collateral, and manual background checks. Information is costly to obtain and often incomplete, making it difficult to form a holistic view of borrower creditworthiness [

27]. Fintech leverages big data to integrate unstructured information such as transaction records, consumption patterns, and social behaviors. Combined with artificial intelligence algorithms, banks can develop dynamic credit scoring models that provide a more comprehensive assessment of borrower risk [

28]. This enables more accurate default probability predictions, reduces adverse selection and moral hazard, and helps prevent the formation of non-performing loans. On the other hand, fintech enables real-time and automated risk monitoring. Banks can continuously track borrower accounts and detect anomalies such as unusual transactions or fund misappropriation. When warning signs emerge, the system can automatically trigger alerts and implement risk mitigation measures, such as credit limit reductions. This approach contains risk spillovers and minimizes credit losses. Based on this analysis, we propose the first hypothesis:

H1. Fintech reduces commercial banks’ credit risk, demonstrating a negative relationship.

2.2.2. Mediating Effect of Financial Sustainability

The United Nations Brundtland Commission defines sustainable development as “meeting the needs of the present without compromising the ability of future generations to meet their own needs.” This idea provides a core framework for understanding an organization’s long-term survivability. At the micro level, Barney and colleagues argue that financial sustainability is a multi-dimensional indicator [

29]. Some scholars contend that its essence lies in whether the resources underpinning current value creation can continue to generate value over time, highlighting improvements in cost efficiency as a key pathway to this end [

30]. Related research further emphasizes that financial sustainability entails maintaining stability amid sustainable expansion, for which effective working-capital management is critical [

31].

Synthesizing these insights, we define financial sustainability as a bank’s capacity to generate risk-adjusted returns and maintain operational resilience in a dynamic environment. This concept encompasses not only current profitability but, more importantly, the long-term viability and resilience derived from operational efficiency and resource allocation [

32].

Accordingly, we measure financial sustainability in two dimensions. Cost efficiency, which captures the bank’s discipline and optimization in resource use during operations, forming the foundation of financial soundness and sustained development. Asset resilience, which reflects the bank’s ability, through asset allocation, to withstand internal and external shocks and to enhance survival and recovery.

Fintech mitigates credit risk through an efficient channel. Traditional lending processes are labor-intensive, costly, and error prone. Automation streamlines workflows by collecting customer data digitally and enabling near-instant approvals, which lowers labor, time, and administrative costs. The resulting savings expand risk-management budgets and reduce the need to raise lending rates, improving borrower selection and lowering portfolio risk. Collaboration with technology firms to access risk-modeling capabilities further allows especially smaller banks to enhance risk control at lower cost.

Fintech also operates through a resilience channel. Fee-based businesses such as robo-advisory and wealth management generate stable, low-capital-intensity income, improving asset utilization and strengthening capital buffers so that banks can provision in downturns and absorb shocks. Data-driven forecasting and liquidity management help match funds to demand in real time, reducing mismatches and idle balances and lowering the likelihood that liquidity stress will trigger a credit crunch. Based on the foregoing analysis, this study proposes the following hypotheses:

H2a. Fintech reduces bank credit risk through cost efficiency improvements.

H2b. Fintech reduces bank credit risk through asset efficiency enhancements.

2.2.3. Moderating Effect of Regional Green Development Level

The risk-mitigating effects of fintech on bank credit extend beyond internal efficiency gains to encompass synergies with the broader macroeconomic environment. First, in regions with higher levels of green development, stricter environmental regulations and disclosure requirements compel firms to release richer environmental information. Using big-data models, banks can integrate unstructured indicators—such as ESG performance, energy consumption and emissions, and records of environmental penalties—into their credit-assessment systems [

33], thereby identifying borrowers’ environmental-compliance risk and long-term transition risk with greater precision. Second, a higher green-development level generally signals a successful regional economic transition, which improves the overall quality of banks’ borrower pools and lowers the likelihood of clustered defaults among highly polluting firms. In this environment, the risk-mitigating effect of fintech is amplified. Third, green transition generates substantial demand for green credit. Fintech creates strategic complementarities with this demand by enabling lower-cost, data-driven services for SMEs in emerging green industries, helping to reclassify clients once viewed as “high-risk” into borrowers with strong growth prospects and, ultimately, into higher-quality assets. Building on this mechanism, we hypothesize:

H3. Regional green development positively moderates the mitigating effect of fintech on bank credit risk.

3. Research Design

3.1. Data

For sample construction, we exclude bank–year observations with substantial missing annual reports or financial information. The resulting dataset is an unbalanced panel covering 135 banks from 2013 to 2023, including 42 A-share listed banks and 93 unlisted institutions. Unstructured text is taken from publicly disclosed annual reports; bank-level micro data come from the CSMAR and Wind databases; and macroeconomic variables are sourced from the National Bureau of Statistics of China.

3.2. Variable Selection and Definition

3.2.1. Explained Variable: Credit Risk

Common measures include the Z-score, expected default probability, the non-performing loan (NPL) ratio, and the ratio of risk-weighted assets. We use the natural logarithm of the NPL ratio as the main outcome because it directly reflects the quality of the loan portfolio. For robustness, we employ the loan-loss provision coverage ratio as an alternative proxy, since it captures a bank’s capacity to absorb potential credit losses.

3.2.2. Core Explanatory Variable: Fintech

Two approaches are commonly used to measure fintech development. The first is a text-mining approach, which counts the frequency of relevant keywords in news releases to construct a technology index [

34]. The second uses the Peking University Digital Inclusive Finance Index as a proxy [

35]. That index spans the provincial, municipal, and county levels and captures regional trends in digital inclusive finance, but it does not accurately reflect heterogeneity in fintech adoption across individual banks. Accordingly, we build a bank-level fintech index by processing the annual reports of 135 commercial banks and applying text mining to compute keyword frequencies. We then aggregate these signals into an index for each bank–year. The specific methods are as follows.

First, we build a fintech keyword dictionary. Drawing on the Financial Stability Board’s (FSB) definition and authoritative policy documents—including the People’s Bank of China’s Fintech Development Plan (2022–2025) and McKinsey’s Global Banking Digitalization White Paper—we develop a dictionary spanning five dimensions: payment and settlement, resource allocation, risk management, digital service channels, and technological infrastructure. The final dictionary contains 121 keywords (see

Table 1).

Second, we collect and process annual reports. Using web-scraping techniques, we obtain banks’ annual reports from 2013 to 2023 and employ a multi-stage conversion process (PDF → Markdown → TXT) to ensure data quality. We remove tables of contents, headers, and footers, and construct a negation word list (e.g., “not,” “no,” “without”) to identify negative contexts that would invalidate keyword matches.

Third, we apply the entropy weighting method to construct the index through the following steps:

Step 1: To account for variations in report length, we calculate standardized term frequency:

where

denotes the frequency of keyword

in bank

’s year

annual report, and

represents the total word count.

Step 2: We aggregate keywords within each dimension:

where

denotes the set of keywords belonging to dimension

.

Step 3: We employ entropy weighting to determine dimension weights. Based on each dimension’s degree of dispersion, we calculate the information entropy

and derive weights as:

The resulting weights are payment and settlement (0.369), resource allocation (0.167), risk management (0.150), digital services (0.188), and technological infrastructure (0.126).

Step 4: We construct the composite index:

where

represents the normalized dimension indicator. Higher values of

indicate greater fintech development.

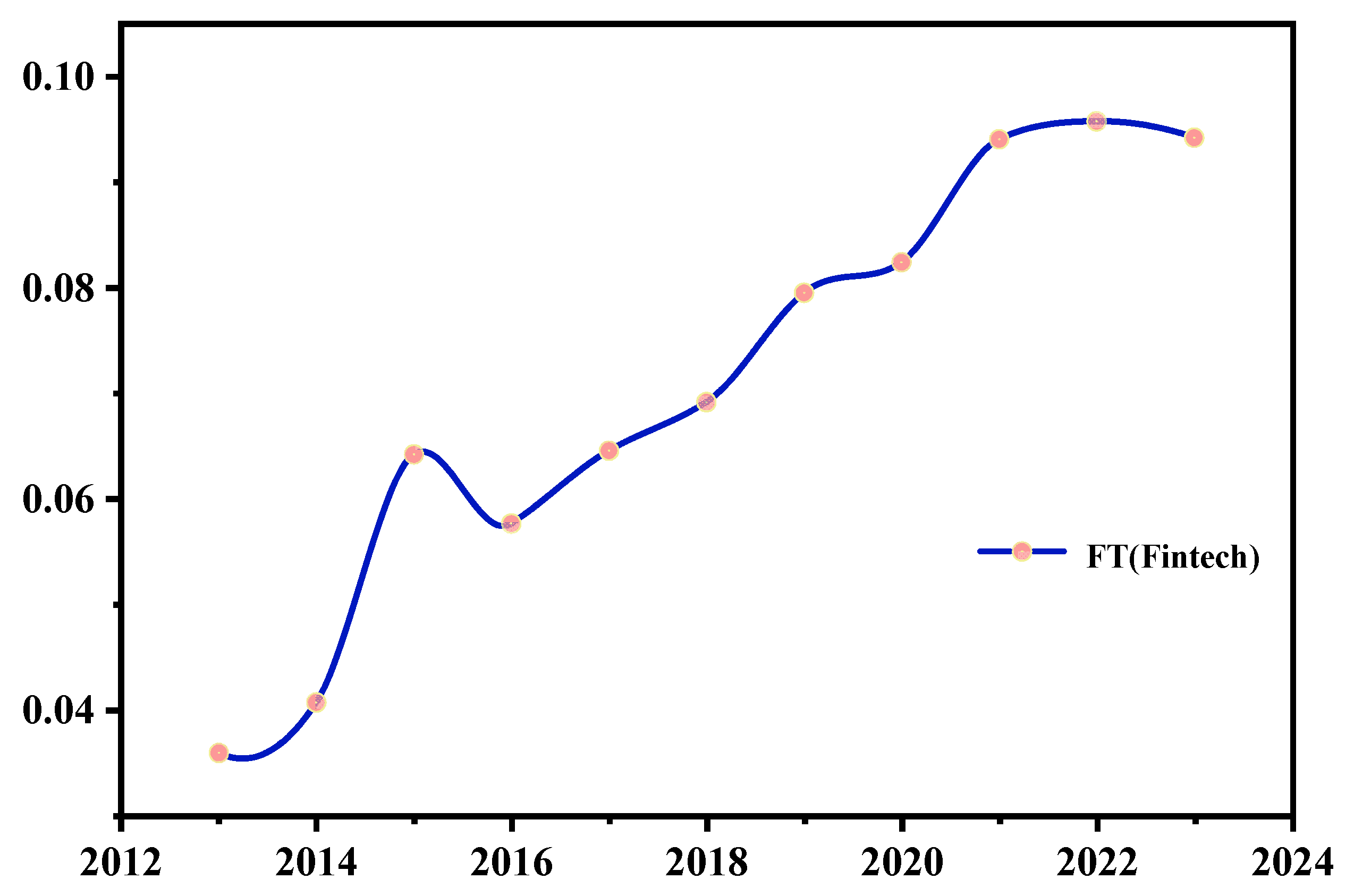

Figure 2 shows the development trend.

3.2.3. Core Explanatory Variable Validity Test

To validate the effectiveness of our fintech index and its policy identification capability, we introduce a policy benchmark mechanism. We compile policies related to the regulatory sandbox pilot program and the banking information technology application pilot program, categorizing sample banks into “pilot banks” and “non-pilot banks” (constructing a dummy variable Pilot_i, which equals 1 if bank

i is a pilot bank and 0 otherwise). We conduct an independent samples

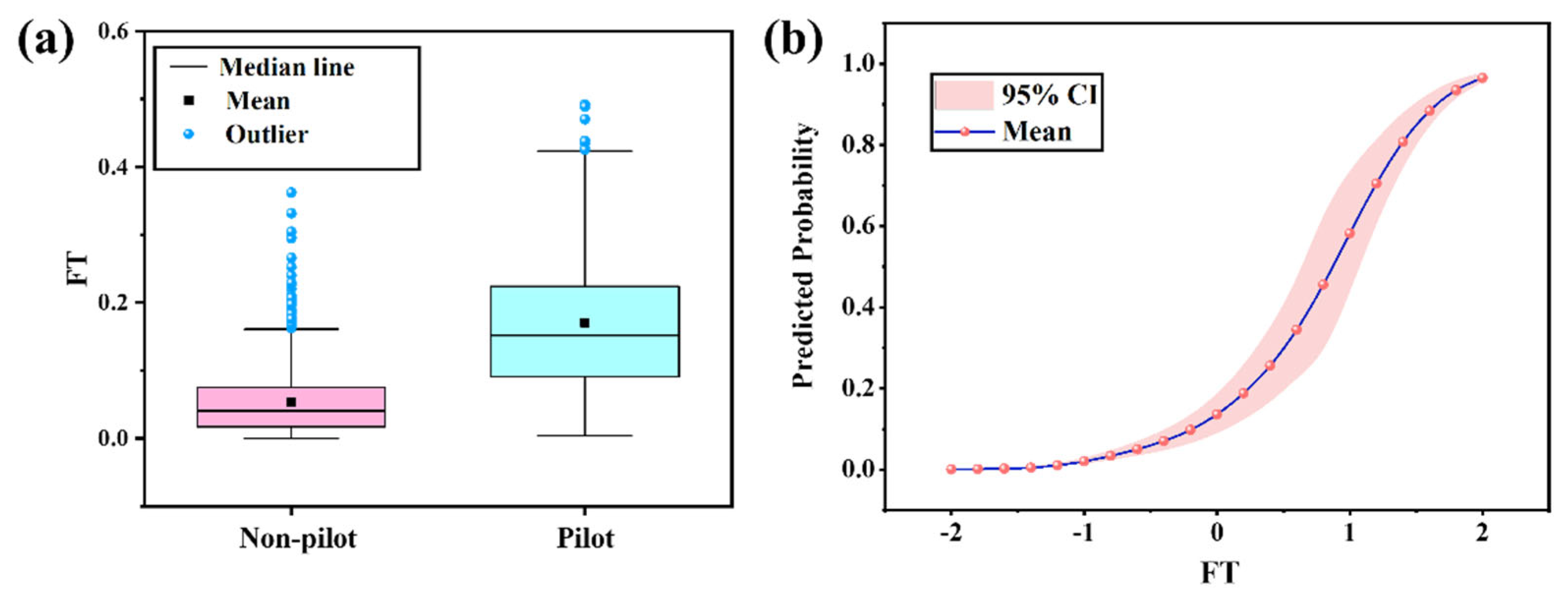

t-test. As illustrated in the box plots presented in

Figure 3, pilot banks exhibit significantly higher fintech index values than non-pilot banks. The mean FT for the pilot group is 0.17, compared to 0.05 for the non-pilot group, yielding a mean difference of 0.12 (t = −24.58,

p < 0.001). This demonstrates that our index effectively distinguishes banks with “high fintech development levels” as designated by policy authorities.

Building on the visual evidence from

Figure 3a, we further estimate a logit model that incorporates a comprehensive set of control variables (consistent with those used in subsequent analyses) and year fixed effects, with standard errors clustered at the bank level.

Figure 3b presents the predicted probability curve from this logit model, revealing that FT exerts a significantly positive effect on the probability of a bank being selected for the pilot program. The average marginal effect of FT is 0.242, indicating that a one-unit increase in fintech development raises the probability of being included in the pilot program by approximately 24.2 percentage points. The effect is statistically significant at the 5% level (

p = 0.021). These findings, from multiple dimensions, confirm the validity and policy identification capability of our fintech index FT, demonstrating that it accurately captures banks’ actual level of fintech development.

3.2.4. Mediating Variables and Moderating Variables

Bank financial sustainability encompasses two dimensions: cost reduction and revenue generation. For cost efficiency, we employ the cost-to-income ratio (CTI) as a proxy variable to directly examine whether banks effectively reduce operating costs. For asset efficiency, we use the total asset turnover ratio (TAT) as a proxy to measure banks’ efficiency in converting assets into revenue and profits.

Green development fundamentally entails the relative decoupling of economic growth from carbon emissions. Given that State Council policies explicitly require enhanced carbon intensity management with staged reduction targets, carbon intensity serves as a directly policy-aligned metric for assessing regional green development. We therefore adopt carbon intensity as our proxy for regional green development levels. Since carbon intensity (carbon emissions/GDP) is a negative indicator—with higher values reflecting poorer environmental performance—we take its reciprocal value to construct our regional green development level indicator (GDL). This transformation ensures that higher GDL values intuitively represent superior green development outcomes, facilitating straightforward interpretation of our empirical findings.

3.2.5. Control Variable

At the bank level, we control for asset size (SIZE), capital adequacy ratio (CAR), leverage (LEV), loan-to-deposit ratio (LDR), and net interest margin (NIM). At the macroeconomic level, we include GDP growth and CPI growth. For national banks, we use national averages; for local banks, we use data for the prefecture-level city in which the bank is headquartered.

Table 2 reports variable definitions.

3.3. Model Construction

To examine the effect of fintech on banks’ credit risk, we estimate the following benchmark regression model:

where

denotes bank

’s credit risk in year

,

is the bank-level fintech index, and

is a vector of control variables.

and

capture bank and year fixed effects, respectively, and

is the idiosyncratic error term. A negative and statistically significant

indicates that fintech reduces banks’ credit risk.

4. Empirical Results and Analysis

4.1. Descriptive Statistics

To enhance model reliability, we first test for multicollinearity. The average variance inflation factor (VIF) is 1.55, and the maximum VIF is 2.52, both well below the conventional threshold of 10, indicating that multicollinearity is not a concern. Descriptive statistics are reported in

Table 3. The key explanatory variable, the fintech index (FT), has a standard deviation of 0.076. Its minimum and maximum values are 0.000 and 0.492, respectively, indicating substantial dispersion. This pattern suggests that some leading banks have substantially scaled up fintech adoption, whereas others remain at an early stage, resulting in marked heterogeneity across institutions.

4.2. Baseline Regression Results

Prior to estimation, we conducted a Hausman test (

p = 0.000), which rejects the null under the random-effects model that unit effects are uncorrelated with the regressors. This indicates that unobserved bank-specific characteristics are likely correlated with the key explanatory variables, implying that a random-effects estimator would yield biased and inconsistent estimates. We therefore adopt a fixed-effects specification for the subsequent analysis.

Table 4 presents the baseline estimates with bank and year fixed effects and bank-clustered standard errors. In column (1), the coefficient on FT is negative and significant at the 1% level. Column (2) adds the full set of controls, and the FT coefficient remains negative and significant, indicating that higher fintech development is associated with lower credit risk, consistent with H1. In particular, a one-unit increase in FT is associated with a 0.904-percentage-point reduction in credit risk. Based on the average non-performing loan ratio in the sample (1.506%), this decline is equivalent to 60% of the industry’s average risk level.

The control variables behave as expected. The coefficient on the capital adequacy ratio (CAR) is significantly negative, indicating that better-capitalized banks bear less risk. This finding underscores the critical role of capital buffers in absorbing unexpected losses. Specifically, banks with adequate capital reserves can withstand loan default shocks without being forced to contract their lending portfolios or engage in fire sales of assets, thereby preventing the amplification of risk. Bank size (SIZE) is also significantly negative, suggesting that larger banks demonstrate superior risk management capabilities stemming from economies of scale. Larger institutions maintain more diversified asset portfolios, effectively hedging against sector-specific or idiosyncratic risks through strategic portfolio allocation. By contrast, the loan-to-deposit ratio (LDR) is significantly positive. A higher LDR signals tighter liquidity buffers; under sudden withdrawal pressure or payment shocks, banks with thin buffers are more prone to liquidity stress, which can spill over into asset-quality deterioration.

4.3. Endogenous Inspection

4.3.1. Instrumental Variable Estimation

Reverse causality may exist between Fintech adoption and bank credit risk. Rising risk can prompt banks to expand fintech investment to strengthen risk management. Moreover, unobserved factors affecting both variables could introduce omitted variable bias into the estimation results. To identify the effect of fintech on credit risk, we use an instrumental variables strategy.

Guided by Bartik and Nunn [

36,

37], we employ the interaction term between the postal and telecommunications business volume in 1984 at the bank’s headquarters location and the national internet penetration rate in the previous year. This instrument satisfies both relevance and exogeneity requirements. First, historical communication infrastructure serves as a foundation for fintech development. Cities with better postal and telecommunications infrastructure in the pre-internet era were better positioned to capitalize on the digital economy, establishing relevance. Second, the 1984 data predates our sample period (2013–2023) by nearly three decades, making it largely exogenous to contemporary credit risk.

Table 5 presents the two-stage least squares (2SLS) results with the same controls and fixed effects as our baseline specification. Panel B reports the first-stage regression, where the instrument (IV) exhibits a significantly positive coefficient. The F-statistic equals 35.149, well above the conventional threshold of 10, ruling out weak instrument concerns. Panel A presents the second-stage estimates. In column (2), the coefficient on fintech (FT) is −2.448 and significant at the 5% level, consistent with our baseline OLS results. This confirms that fintech development reduces banks’ non-performing loan ratios, even after addressing endogeneity concerns.

4.3.2. GMM Dynamic Model

While our baseline results show that fintech (FT) significantly reduces non-performing loans (NPL), bank credit risk typically exhibits persistence over time. Ignoring this dynamic structure may lead to biased estimates. We therefore estimate a dynamic panel model using system GMM, incorporating the lagged dependent variable L.NPL. We treat L.NPL and FT as endogenous variables, while other bank characteristics (SIZE, CAR, NIM, LDR, LEV) and macroeconomic variables (CPI, GDP) are treated as predetermined. To mitigate instrument proliferation, we collapse the instrument matrix and limit instruments for endogenous variables to lags 2–3.

Column (3) of

Table 5 reports the results. The coefficient on L.NPL is 0.594 (significant at 1%), confirming substantial persistence in credit risk. Importantly, the FT coefficient remains negative and significant at −0.692, indicating that fintech development continues to reduce credit risk even after accounting for dynamics. Panel C presents diagnostic tests. The AR (1) test rejects the null (

p = 0.001) while AR (2) does not (

p = 0.144), suggesting no second-order autocorrelation in differenced residuals. The Hansen J-statistic yields

p = 0.226, indicating that instrument exogeneity cannot be rejected and overidentification is not a concern. These diagnostics validate our GMM specification and reinforce our core finding that fintech reduces bank credit risk.

4.4. Robustness Test

The non-performing loan (NPL) ratio captures realized credit deterioration and a bank’s current risk exposure. By contrast, the provision coverage ratio (PCR) focuses on preparedness for future losses. We re-estimate the model using PCR as the dependent variable. As reported in column (1) of

Table 6, the coefficient on FT is positive and statistically significant, indicating that fintech development raises provision coverage and strengthens banks’ loss-absorbing capacity. This implies that the conclusion of Hypothesis 1 is robust to the choice of risk measure.

Then, we use the prefecture-level Peking University Digital Inclusive Finance Index (Fintech) as an alternative proxy for regional fintech development. Column (2) of

Table 6 reports the estimates. The coefficient on Fintech is negative and statistically significant. This result indicates that the main conclusion of Hypothesis 1 does not depend on a specific metric.

Finally, we exclude observations from 2020 as a robustness check. The COVID-19 pandemic generated exceptional spikes in NPLs and accelerated emergency digitalization efforts by banks. These crisis-driven responses may distort the underlying relationship between strategic fintech adoption and credit risk. Column (3) of

Table 6 reports the results: the coefficient on (FT) remains negative and statistically significant. The consistency in sign and significance indicates that sample selection does not affect the conclusion of Hypothesis 1. In particular, a one-unit increase in fintech is associated with a ** 0.835-percentage-point ** decline in the non-performing loan (NPL) ratio. Using the optimized-sample mean NPL of 1.50% as the benchmark, this reduction amounts to 55.7% of the average risk level, indicating a sizable improvement.

5. Further Analysis

5.1. Mediating Effect Test

The baseline regression results demonstrate that fintech development effectively reduces banks’ credit risk exposure. However, the underlying mechanisms through which fintech influences credit risk warrant further investigation. Building upon the theoretical framework established earlier, this study posits that fintech may enhance banks’ financial sustainability through two distinct channels—cost reduction and improved asset efficiency—thereby mitigating credit risk. To test Hypotheses 2a and 2b, we further develop the following mediation models for empirical examination.

where

and

represent the mediating variables—cost-to-income ratio and asset turnover ratio, respectively—while all other variables retain the same definitions as in Equation (1). The coefficient

captures the relationship between the mediating variables and credit risk. If

is statistically significant, we further examine the change in the coefficient of the core explanatory variable before and after incorporating the mediator. A reduction in the absolute value of the coefficient (

) indicates that the proposed mechanism holds and exerts a positive mediating effect, meaning the mediating variable partially accounts for the impact of fintech on credit risk. Conversely, if the absolute value of the coefficient increases (

), this suggests a negative mediating effect, whereby the mediator partially suppresses the overall effect of fintech on credit risk reduction.

Table 7 presents the mediation analysis. Column (1) replicates the baseline regression from

Table 3. Columns (2) and (3) introduce the mediating variables TAT and CTI, respectively. The coefficient on TAT is negative and significant at the 1% level, indicating that higher asset utilization efficiency corresponds to lower credit risk exposure. In contrast, CTI exhibits a positive and significant coefficient at the 1% level, suggesting that banks with weaker operational efficiency face greater credit risk. Notably, the estimated coefficient on fintech development (FT) declines in both columns relative to the baseline, confirming that operational efficiency and asset efficiency serve as underlying mechanisms through which fintech reduces banks’ credit risk. This confirms the hypotheses H2a and H2b. Column (4) incorporates both mediators simultaneously. The FT coefficient decreases by 0.058 compared to the baseline, implying that CTI and TAT jointly account for approximately 6.42% of fintech’s total effect on credit risk.

5.2. Moderating Effect Test

To examine the moderating role of regional green development (Hypothesis 3), we estimate the following interaction model:

where

denotes the moderating variable—regional green development level—and

represents the interaction term between fintech and green development. Our primary focus is on the coefficient

of the interaction term. A significantly positive

would indicate that regional green development amplifies fintech’s risk-reducing effect, whereas a significantly negative

would suggest that green development attenuates the risk-mitigating impact of fintech.

The results reveal that the interaction term is negative and statistically significant at the 5% level, indicating that higher regional green development levels amplify fintech’s risk-reducing effect on non-performing loan ratios. This finding supports Hypothesis 3 regarding the moderating role of green development. Specifically, a one-unit increase in regional green development intensity strengthens fintech’s negative impact on NPL ratios by an additional 0.710 units, beyond the baseline effect of −0.993. In other words, green development amplifies fintech’s credit risk mitigation by enhancing its risk management effectiveness.

To present the moderation more clearly, we stratify the sample by the regional green development level (GDL) using quantile splits. Regressions within each stratum control for bank characteristics and year fixed effects, with standard errors clustered at the bank level. We report results for the low (10th percentile), middle (50th percentile), and high (90th percentile) GDL groups. As illustrated in

Figure 4, the horizontal axis displays the demeaned fintech variable (FT), while the vertical axis shows the model-predicted non-performing loan ratio (NPL). The three curves correspond to low, moderate, and high levels of GDL, respectively. The figure reveals that NPL decreases across all groups as FT increases, though the magnitude of decline varies considerably. Specifically, the relationship between FT and NPL exhibits the flattest slope in the low GDL group, begins to display a notably negative slope in the moderate GDL group, and demonstrates the steepest slope in the high GDL group. These patterns indicate that the mitigating effect of fintech on bank credit risk intensifies with higher regional green development levels. This graphical evidence corroborates the regression results presented in

Table 8, providing robust support for the moderating mechanism proposed in Hypothesis 3.

5.3. Heterogeneity Test

5.3.1. Heterogeneity of Property Rights Nature

State-owned banks in China play a policy-execution role. Their lending is more policy-oriented and, as a result, tends to be less sensitive to risk. Non–state-owned banks compete on a market basis and serve a client base dominated by SMEs. These borrowers often face information opacity and limited collateral, which makes traditional risk control more challenging. In this setting, fintech tools are especially valuable for breaking information barriers, improving credit scoring, and sharpening risk-based pricing. We therefore split the sample by ownership. Columns (1) and (2) of

Table 9 report the results. In the non–non-state-owned group, the coefficient on FT is −1.171 and significant at the 1% level, indicating that higher fintech development is associated with lower credit risk. In the state-owned group, the FT coefficient is statistically insignificant. These findings suggest that fintech delivers a stronger risk-mitigation effect for non–non-state-owned banks, consistent with the greater marginal value of data-driven screening where borrower information is scarce.

5.3.2. Heterogeneity of Regional Industrial Structure

Regions with different industrial structures typically exhibit varying levels of information infrastructure and data availability. These differences shape both the cost and the quality of fintech adoption, thereby affecting banks’ operational efficiency and risk management. The tertiary sector is a key indicator of a region’s economic structure and stage of development [

38]. In regions with a lower share of tertiary industry, where manufacturing and agriculture prevail, lending relies more heavily on collateral, approval processes are longer, and timely risk assessment is more difficult. In such contexts, fintech tools such as IoT-based real-time monitoring, big-data analytics, and intelligent anti-fraud, integrate fragmented information, improve risk rating accuracy, and streamline procedures, yielding stronger marginal improvements in service efficiency and internal risk control. By contrast, in service-oriented regions with a higher tertiary share, financial institutions often possess mature risk-management systems and data infrastructure, so the incremental risk-mitigating effect of fintech is partially diluted. We split the sample according to the share of the tertiary sector in regional GDP. As reported in columns (3) and (4) of

Table 9, the coefficient on FT is more statistically significant in regions with a lower tertiary-industry share, which corroborates the above analysis.

6. Conclusions and Policy Implications

Drawing on panel data of Chinese commercial banks from 2013 to 2023, this study systematically examines the mechanisms through which FinTech influences bank credit risk, as well as the heterogeneity of its effects across different contexts. The results reveal that FinTech development significantly mitigates credit risk, primarily through two financial sustainability channels. First, the adoption of new technologies promotes automation and intelligent operations, improving cost efficiency and reducing risk exposure. Second, FinTech facilitates asset allocation optimization and liquidity enhancement, strengthening banks’ resilience and long-term financial sustainability. The heterogeneity analysis further indicates that FinTech’s risk-mitigating effect is more pronounced among non-state-owned banks and in regions with a lower share of the tertiary industry. This suggests that FinTech yields higher marginal benefits in areas where financial services are less developed and infrastructure is weaker, while its incremental effect diminishes in regions with mature service sectors and advanced financial systems. In addition, regional green-development levels play a positive moderating role, indicating that external sustainability conditions can amplify technology-enabled risk mitigation.

Placed in a global context, the findings offer a new perspective on fintech’s role across heterogeneous development environments. Compared with advanced economies—where financial infrastructure is generally mature and traditional banking services are widely accessible—fintech in emerging markets tends to exhibit a stronger inclusion function and delivers more pronounced risk-reduction effects. China’s experience further shows that, under a combination of adaptive regulation and proactive policy guidance, fintech functions not only as an effective risk-management tool but also as an engine for advancing financial inclusion and the green transition. Based on these results, we propose the following targeted policy recommendations:

(1) Promote strategic alignment between fintech and sustainability goals. Encourage commercial banks to deepen fintech adoption with a focus on intelligent risk management and green lending, thereby achieving technology-sustainability synergy. Regulators and banks should jointly develop credit-rating models that integrate ESG performance into dynamic risk assessments, incorporating firms’ environmental behavior into ongoing monitoring. In parallel, banks and fintech firms should collaborate to build shared green-data platforms.

(2) Implement differentiated technology strategies to unlock the risk-management potential of non–state-owned banks. Policy resources should be prioritized for small and medium-sized banks, especially those in lagging regions. Using regulatory sandboxes, encourage non–state-owned banks to deploy intelligent risk tools to offset disadvantages in scale, and capital.

(3) Strengthen global fintech governance and collaborative capacity building. While FinTech reduces traditional credit risk, it also introduces new vulnerabilities such as algorithmic bias, technological dependency, and cyber threats. Regulators should establish multi-layered supervisory frameworks, emphasizing algorithm transparency, data security, and real-time monitoring of cross-border risk contagion. Developing flexible, stage-specific regulatory approaches can prevent regulatory arbitrage and mitigate the widening of the global digital divide.

In conclusion, Fintech has emerged as an indispensable tool for credit risk management in commercial banks. Through technological innovation, institutional safeguards, and operational optimization, banks can construct more inclusive and resilient risk management systems that foster sustainable development. Concurrently, regulatory authorities must refine legal and regulatory frameworks to provide the institutional foundation necessary for fintech’s healthy evolution.

7. Research Limitations and Future Research Directions

Although this study provides new evidence for understanding the relationship between fintech and bank risk, several limitations remain.

First, there are limitations related to our variables. The fintech index employed in this paper is primarily constructed through text mining of annual reports. While this approach effectively captures the scale of technology supply and application, it may not fully capture certain nuances of fintech, such as actual user trust levels, data privacy practices, and governance quality. Future research could address this shortcoming by designing survey instruments or developing new indicator systems. Second, there are limitations regarding the research context. The empirical analysis in this study is based on data from China’s banking sector, and our findings are inevitably influenced by China’s unique regulatory environment and market characteristics. To enhance the generalizability of our conclusions, future research could consider conducting cross-country comparative studies.

Author Contributions

Conceptualization, Z.J.; methodology, Z.Q.; software, Z.J.; validation, Z.J.; formal analysis, Z.Q.; resources, Z.Q.; data curation, Z.J.; writing—original draft preparation, Z.J.; writing—review and editing, Z.Q.; supervision, Z.Q. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fund of China (21BZZ028).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available on request from the corresponding author, upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- International Monetary Fund. Global Financial Stability Report, April 2025: Enhancing Resilience amid Uncertainty; International Monetary Fund: Washington, DC, USA, 2025; ISBN 979-8-229-00326-1. [Google Scholar]

- Allen, F.; Carletti, E.; Gu, X. The roles of banks in financial systems. Oxf. Handb. Bank. 2008, 3, 39–61. [Google Scholar]

- Chodorow-Reich, G. The employment effects of credit market disruptions: Firm-level evidence from the 2008–2009 financial crisis. Q. J. Econ. 2014, 129, 1–59. [Google Scholar] [CrossRef]

- Gai, K.; Qiu, M.; Sun, X. A Survey on FinTech. J. Netw. Comput. Appl. 2018, 103, 262–273. [Google Scholar] [CrossRef]

- Hurley, M.; Adebayo, J. Credit scoring in the era of big data. Yale J. Law Technol. 2016, 18, 148. [Google Scholar]

- Vinoth, S.; Vemula, H.L.; Haralayya, B.; Mamgain, P.; Hasan, M.F.; Naved, M. Application of Cloud Computing in Banking and E-Commerce and Related Security Threats. Mater. Today Proc. 2022, 51, 2172–2175. [Google Scholar] [CrossRef]

- Fagerberg, J. Innovation: A guide to the literature. In Oxford Handbooks in Business and Management; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Drasch, B.J.; Schweizer, A.; Urbach, N. Integrating the ‘Troublemakers’: A Taxonomy for Cooperation between Banks and Fintechs. J. Econ. Bus. 2018, 100, 26–42. [Google Scholar] [CrossRef]

- Sampat, B.; Mogaji, E.; Nguyen, N.P. The Dark Side of FinTech in Financial Services: A Qualitative Enquiry into FinTech Developers’ Perspective. Int. J. Bank Mark. 2024, 42, 38–65. [Google Scholar] [CrossRef]

- Deng, L.; Lv, Y.; Liu, Y.; Zhao, Y. Impact of Fintech on Bank Risk-Taking: Evidence from China. Risks 2021, 9, 99. [Google Scholar] [CrossRef]

- Zhu, K.; Guo, L. Financial Technology, Inclusive Finance and Bank Performance. Financ. Res. Lett. 2024, 60, 104872. [Google Scholar] [CrossRef]

- Dobbie, W.; Liberman, A.; Paravisini, D.; Pathania, V. Measuring Bias in Consumer Lending. Rev. Econ. Stud. 2021, 88, 2799–2832. [Google Scholar] [CrossRef]

- Pierri, M.N.; Timmer, M.Y. Tech in Fin Before Fintech: Blessing or Curse for Financial Stability; International Monetary Fund: Washington, DC, USA, 2020. [Google Scholar]

- Boot, A.; Hoffmann, P.; Laeven, L.; Ratnovski, L. Fintech: What’s Old, What’s New? J. Financ. Stab. 2021, 53, 100836. [Google Scholar] [CrossRef]

- Zhao, Y.; Goodell, J.W.; Wang, Y.; Abedin, M.Z. Fintech, macroprudential policies and bank risk: Evidence from China. Int. Rev. Financ. Anal. 2023, 87, 102648. [Google Scholar] [CrossRef]

- Fang, Y.; Wang, Q.; Wang, F.; Zhao, Y. Bank Fintech, Liquidity Creation, and Risk-Taking: Evidence from China. Econ. Model. 2023, 127, 106445. [Google Scholar] [CrossRef]

- D’Andrea, A.; Limodio, N. High-Speed Internet, Financial Technology and Banking in Africa. SSRN J. 2024, 70, 733–798. [Google Scholar] [CrossRef]

- Zhang, Y.; Ye, S.; Liu, J.; Du, L. Impact of the Development of FinTech by Commercial Banks on Bank Credit Risk. Financ. Res. Lett. 2023, 55, 103857. [Google Scholar] [CrossRef]

- Banna, H.; Kabir Hassan, M.; Rashid, M. Fintech-Based Financial Inclusion and Bank Risk-Taking: Evidence from OIC Countries. J. Int. Financ. Mark. Inst. Money 2021, 75, 101447. [Google Scholar] [CrossRef]

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption Intention of Fintech Services for Bank Users: An Empirical Examination with an Extended Technology Acceptance Model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef]

- Dong, J.; Yin, L.; Liu, X.; Hu, M.; Li, X.; Liu, L. Impact of Internet Finance on the Performance of Commercial Banks in China. Int. Rev. Financ. Anal. 2020, 72, 101579. [Google Scholar] [CrossRef]

- Guellec, D.; Paunov, C. Digital Innovation and the Distribution of Income; National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Buchak, G.; Matvos, G.; Piskorski, T.; Seru, A. Fintech, Regulatory Arbitrage, and the Rise of Shadow Banks. J. Financ. Econ. 2018, 130, 453–483. [Google Scholar] [CrossRef]

- Wang, R.; Liu, J.; Luo, H. Fintech Development and Bank Risk Taking in China. Eur. J. Financ. 2021, 27, 397–418. [Google Scholar] [CrossRef]

- Chen, B.; Yang, X.; Ma, Z. Fintech and Financial Risks of Systemically Important Commercial Banks in China: An Inverted U-Shaped Relationship. Sustainability 2022, 14, 5912. [Google Scholar] [CrossRef]

- Ni, Q.; Zhang, L.; Wu, C. Fintech and Commercial Bank Risks—The Moderating Effect of Financial Regulation. Financ. Res. Lett. 2023, 58, 104536. [Google Scholar] [CrossRef]

- Ivashina, V. Asymmetric information effects on loan spreads. J. Financ. Econ. 2009, 92, 300–319. [Google Scholar] [CrossRef]

- Hurlin, C.; Pérignon, C.; Saurin, S. The fairness of credit scoring models. Manag. Sci. 2024. [Google Scholar] [CrossRef]

- Barney, J.B. Purchasing, Supply Chain Management and Sustained Competitive Advantage: The Relevance of Resource-based Theory. J. Supply Chain Manag. 2012, 48, 3–6. [Google Scholar] [CrossRef]

- Banker, D.R.; Mashruwala, R.; Tripathy, A. Does a Differentiation Strategy Lead to More Sustainable Financial Performance than a Cost Leadership Strategy? Manag. Decis. 2014, 52, 872–896. [Google Scholar] [CrossRef]

- Kayani, U.N.; Gan, C.; Rabbani, M.R.; Trichilli, Y. Is Short-Term Firm Performance an Indicator of a Sustainable Financial Performance? Empirical Evidence. Stud. Econ. Financ. 2024, 41, 619–637. [Google Scholar] [CrossRef]

- Gleißner, W.; Günther, T.; Walkshäusl, C. Financial Sustainability: Measurement and Empirical Evidence. J. Bus. Econ. 2022, 92, 467–516. [Google Scholar] [CrossRef]

- Caputo, F.; Pizzi, S.; Ligorio, L.; Leopizzi, R. Enhancing Environmental Information Transparency through Corporate Social Responsibility Reporting Regulation. Bus. Strategy Environ. 2021, 30, 3470–3484. [Google Scholar] [CrossRef]

- Guo, P.; Shen, Y. The impact of internet finance on commercial banks’ risk taking: Theoretical interpretation and empirical test. China Financ. Econ. Rev. 2015, 4, 16. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s digital financial inclusion: Index compilation and spatial characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar] [CrossRef]

- Bartik, T.J. Who Benefits from State and Local Economic Development Policies; W.E. Upjohn Institute: Kalamazoo, MI, USA, 1991. [Google Scholar]

- Nunn, N.; Wantchekon, L. The slave trade and the origins of mistrust in Africa. Am. Econ. Rev. 2011, 101, 3221–3252. [Google Scholar] [CrossRef]

- Muhammad, S.; Pan, Y.; Agha, M.H.; Umar, M.; Chen, S. Industrial Structure, Energy Intensity and Environmental Efficiency across Developed and Developing Economies: The Intermediary Role of Primary, Secondary and Tertiary Industry. Energy 2022, 247, 123576. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).