5.1. Econometric Results for Main Models

The dataset employed in this study covers ten countries over a 32-year period, forming a balanced panel that integrates both cross-sectional and time-series dimensions. To mitigate potential serial correlation, first-order autoregressive dynamics were eliminated prior to estimation, and the models were analyzed under both RE and FE frameworks. Following the relevant literature, autoregressive patterns tend to intensify in long-span macro panels [

58]. The estimation results for RE and FE specifications using Driscoll–Kraay robust errors are presented in

Table 9.

In the baseline specification (Model 1), LOPs were found to be statistically insignificant, whereas both LCO2 emissions and real income exhibited strong statistical significance. A 1% increase in real income led to an approximate 0.53% rise in LREC, while a 1% increase in LCO2 emissions resulted in a comparable decrease in LREC. The FE estimator confirmed these relationships with slightly larger coefficients and higher precision compared with the RE model.

In Model 2, LFD was introduced as an additional determinant. Similarly to the baseline results, LOPs and LFD remained statistically insignificant in both the RE and FE estimations, while income and LCO2 continued to exert strong effects on LREC in the expected directions. Although LFD’s sign was negative under FE, the effect was small and statistically weak, indicating that the financial sector’s contribution to renewable deployment may be limited in the short run within E-10 economies.

Model 3 incorporated the LPOP variable to capture demographic effects. Under the RE specification, population growth significantly enhanced LREC, whereas in the FE estimation, the coefficient became negative and statistically significant. This reversal suggests that, after controlling for country-specific heterogeneity, population growth may exert downward pressure on renewable energy adoption due to infrastructure constraints or energy-demand surges that disproportionately favor fossil fuels.

Model 4 replaced LPOP with LURB to mitigate the multicollinearity arising from their joint inclusion. The results show that LURB is statistically insignificant in both the FE and RE estimations, while income and LCO2 emissions remained highly significant. This implies that, in the short run, the level of urbanization per se does not directly promote renewable energy expansion once structural effects are absorbed by fixed effects.

Finally, Model 5 combined both population and urbanization to examine their joint influence. In this model, population retained its negative and significant coefficient under both estimators, while LURB remained statistically insignificant. Thus, demographic expansion appears to hinder the renewable transition, whereas urban concentration has no clear short-term effect.

The Hausman specification test was conducted for all five models to determine the appropriate estimator between FE and RE. The test statistics ranged between χ2(4) = 27.48 (p = 0.001) and χ2(5) = 44.11 (p = 0.0000), consistently rejecting the null hypothesis of no systematic difference between the two estimators. These results confirm that the FE estimator provides consistent and efficient estimates across all model specifications, whereas the RE model would yield biased coefficients due to the correlation between the unobserved individual effects and the regressors. The overall findings, therefore, rely on FE estimates, which indicate that oil prices and financial development do not exhibit statistically significant relationships with renewable energy consumption, whereas income and LCO2 emissions remain robust and significant determinants of LREC across specifications.

To capture potential persistence and address endogeneity among regressors, a dynamic specification was subsequently estimated using the two-step System GMM developed by Arellano and Bover [

60] and Blundell and Bond [

61]. Motivated by the assumption that LREC in the previous period influences current consumption. This persistence can be attributed to two channels: (i) once households and firms adopt renewable energy, they are more likely to continue its use in subsequent periods, and (ii) past investments in renewable energy infrastructure create momentum for future production and consumption. The results of the dynamic panel estimations are presented in

Table 10.

Table 10 displays the estimation outcomes for the five dynamic panel models. With coefficients ranging from 0.61 to 0.80, the results show that the lagged LREC variable is highly statistically significant across all model specifications. This finding demonstrates that past consumption has a significant positive impact on current levels and supports the strong persistence of renewable energy use. With the exception of Model 1, where significance is noted at the 5% level, the coefficients for the LOP variable are statistically significant at the 1% level in accordance with the static panel estimates. Every coefficient has a negative sign, indicating that rising oil prices discourage the use of renewable energy. This negative relationship likely reflects the structural dependence of E-10 economies on fossil fuel–based energy systems and the inertia associated with transitioning to cleaner energy sources.

Across the majority of models, the real income (LRGDP) variable continues to have a positive and statistically significant correlation with the use of renewable energy, albeit with a relatively small effect size. Similarly, all models show consistently negative and statistically significant coefficients for LCO2 emissions, which range from −0.35 to −0.19. This suggests that a decrease in the use of renewable energy is linked to an increase in LCO2 emissions. These coefficients imply that, in comparison to other explanatory variables, environmental degradation has a greater dampening effect on the use of renewable energy.

LFD, introduced in Model 2, exhibits a positive and statistically significant impact on renewable energy consumption, indicating that an expansion of the financial sector contributes—albeit moderately—to the growth of renewable energy utilization in the E-10 countries. In Model 3, the inclusion of LPOP yields an insignificant coefficient; however, in Model 5, where all variables are incorporated, the population variable becomes highly significant and negative, suggesting that population growth tends to constrain renewable energy consumption. The LURB variable is statistically significant and negative in Model 4, implying that urban growth currently undermines renewable energy use in the E-10 context, possibly due to inadequate urban energy policies or insufficient integration of renewable infrastructure in urban planning. When both LURB and LPOP are included in Model 5, the LURB variable loses significance—a likely consequence of multicollinearity between the two variables, as confirmed by the VIF analysis.

Table 11 displays the dynamic model’s diagnostic results. The Arellano-Bond tests, which determine whether serial correlation exists, are represented by the AR(1) and AR(2) statistics. AR(2) shouldn’t exhibit significance, but AR(1) usually should. While AR(2) consistently produces

p-values well above 0.05 across the five specifications, the AR(1) statistic in the current analysis is significant at the 10% level for all models but the first. These results imply that the models do not contain second-order autocorrelation. The Sargan chi-square tests evaluate the validity of the instruments, with nine instruments employed in some models and ten in others. Both the Sargan and Hansen test results support instrument validity, as their associated probabilities are comfortably above the 0.05 threshold. Finally, the Hansen difference-in-Hansen tests, which examine the exogeneity of instrument subsets, indicate that the instruments are exogenous and thus consistent with the theoretical framework of the models. Additionally, the Pesaran–Yamagata [

77] (HAC-adjusted Δ) test results indicate that the null hypothesis of slope homogeneity cannot be rejected (

p > 0.05) across all model specifications. This implies that the estimated coefficients are statistically similar across countries once dynamic effects are included, confirming that the System GMM estimations capture average relationships representative of the overall panel.

In summary, the dynamic panel estimations confirm the persistence of LREC, as past usage exerts a strong and positive effect on current levels. This inertia indicates that renewable adoption in the E-10 countries follows a path-dependent process shaped by prior investments and institutional learning. The negative impact of rising LOPs on renewable energy adoption, consistent with previous studies [

15,

31,

39,

41,

48,

78], can be explained by the fact that many E-10 economies are net oil importers that maintain fossil-fuel subsidies to stabilize domestic prices. These policy distortions weaken market incentives to invest in renewables—a mechanism also emphasized by [

31,

41]. Conversely, in high-income or diversified economies, rising LOPs tend to accelerate renewable investment, suggesting that structural and policy heterogeneity may underline the observed regional differences. Real income consistently promotes LREC across specifications, corroborating the growth–energy nexus established in [

30,

36]. This finding implies that higher income levels not only raise energy demand but also enhance fiscal and technological capacity for renewable deployment. LFD also emerges as a significant driver, reinforcing evidence from [

11,

35], who emphasize that deeper financial systems reduce financing constraints and mobilize capital toward clean-energy projects. In contrast, carbon dioxide emissions and population growth exert negative effects on LREC, consistent with the environmental degradation hypothesis and earlier findings [

39,

79,

80]. This pattern suggests that rapid population expansion and emissions-intensive development place additional pressure on energy infrastructure, delaying the transition toward sustainable sources. Finally, LURB negatively influences LREC, supporting the conclusions of [

14,

49]. The negative LURB–LREC link indicates that politicians should revise urban centers, infrastructure modernization, and sustainable-city policies, which may lead to turning LURB effects from negative to positive. Taken together, these results highlight the interplay between income, finance, urban structure, and fossil-fuel dependence in shaping the renewable energy transition in the E-10 region. Cross-country heterogeneity exemplified by Brazil’s hydro- and biofuel-based system and Poland’s rapid post-accession progress illustrates how different policy regimes and resource endowments modulate these relationships.

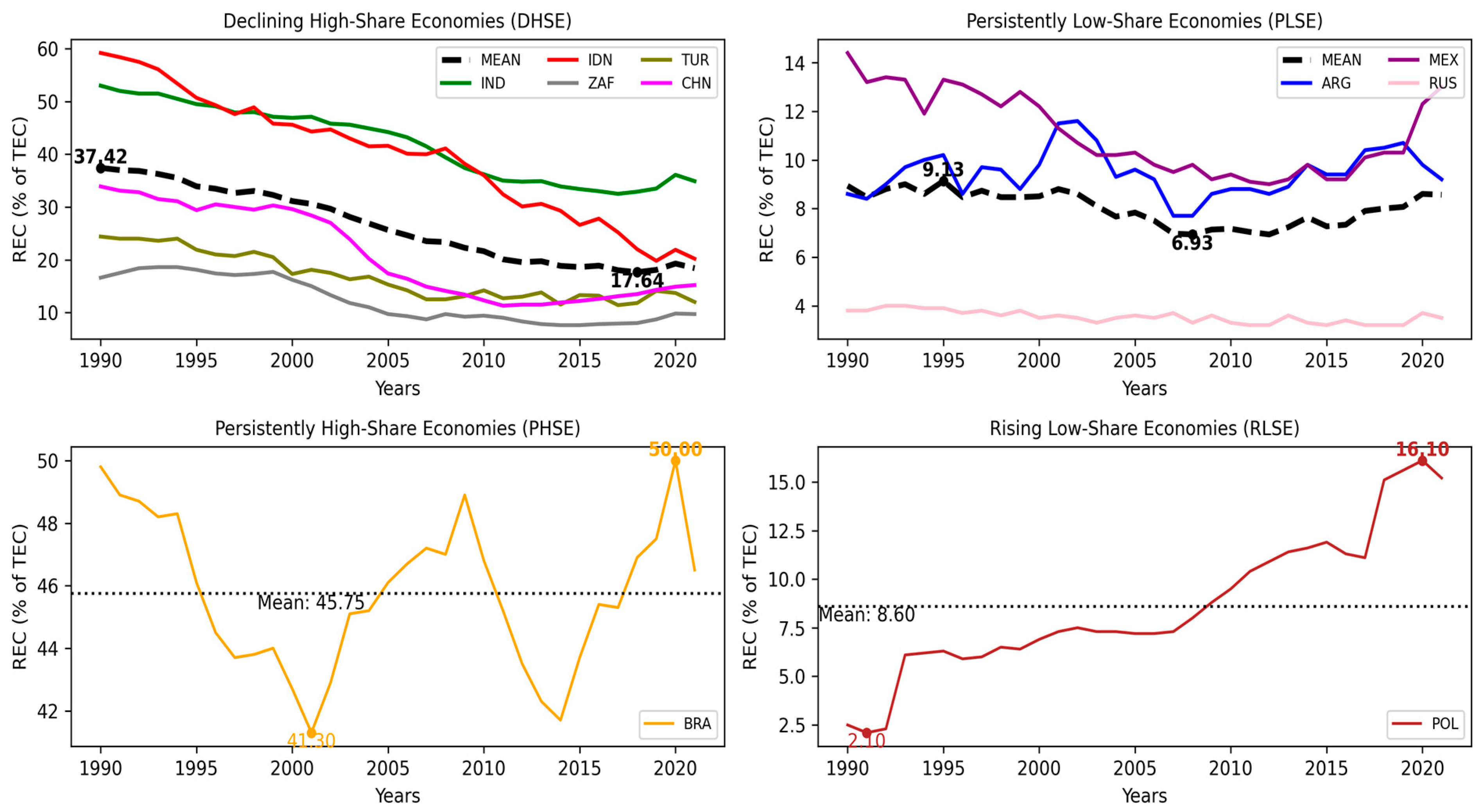

5.2. Econometric Results for Sub-Group Estimations

Firstly, dynamic model estimation was performed for the DSHE group of countries, which includes five countries. The results of the dynamic panel estimation for Models 1 through 5 are presented in

Table 12. Across all specifications, the coefficient of the lagged renewable energy consumption variable is positive and statistically significant at the 1% level, ranging between 0.63 and 0.87. This finding indicates a strong persistence in renewable energy consumption, implying that past consumption patterns exert a substantial influence on current levels. The high magnitude of these coefficients reflects the sluggish adjustment process in renewable energy demand and suggests that renewable energy consumption exhibits a high degree of inertia over time.

In all models, the coefficient of LOPs is negative and statistically significant, indicating that the use of renewable energy decreases as oil prices rise. In economies with inflexible energy structures or inadequate renewable infrastructure, higher oil prices may reduce overall energy demand, including that from renewables. This inverse relationship may be a reflection of the substitution effect between fossil fuels and renewable energy sources.

Across all model specifications, the consumption of renewable energy is positively and significantly impacted by economic growth. The coefficient’s magnitude ranges from 0.021 to 0.046, suggesting that higher real GDP levels are linked to higher use of renewable energy. The findings lend credence to the idea that economic growth encourages investment in renewable technologies by raising incomes, financial resources, and energy consumption.

In every model, LCO2 has a negative and statistically significant coefficient, suggesting that lower use of renewable energy is linked to higher emissions. This finding might suggest that economies with higher emission intensities are more dependent on fossil fuels, which limits the growth of renewable energy sources. When more control variables are added, the coefficient’s magnitude increases in extended specifications (up to −0.29), indicating a stronger negative relationship.

Every model in which LFD is included shows a positive and statistically significant effect (Models 2–5). This finding indicates that deeper financial systems contribute to the expansion of renewable energy consumption, likely by facilitating access to credit, enhancing investment capacity, and lowering financing costs for renewable projects.

Among the demographic factors, LPOP and LURB yield mixed results. LPOP is positively associated with renewable energy consumption in the models where it appears, with statistical significance in Model 3 and a relatively large coefficient in Model 5, suggesting that larger populations drive higher energy demand, including renewables. LURB, although positive, is statistically insignificant, implying that urban expansion alone does not necessarily lead to greater renewable energy use, possibly due to structural or policy-related constraints in urban energy systems.

Overall, the dynamic panel results confirm that renewable energy consumption exhibits strong persistence and is positively influenced by economic growth and financial development, while it is negatively affected by LOPs and LCO2 emissions. These findings highlight the importance of economic and financial factors in shaping the trajectory of renewable energy adoption.

An eight-country model, which excluded Brazil and Poland from the sample, was estimated as a second subgroup.

Table 13 presents the estimation results for this subgroup, which includes the DHSE and PLSE countries. The highly significant and positive coefficients of the lagged dependent variable, which range from 0.77 to 0.88 across all specifications, show a clear persistence in renewable energy consumption in the dynamic panel estimation results reported in

Table 13. This result emphasizes the path-dependent character of renewable energy use by indicating that past consumption has a significant impact on current levels.

LOPs continuously have a negative and statistically significant impact, suggesting that rising oil prices tend to reduce the use of renewable energy, perhaps as a result of temporary substitution or financial limitations in the energy mix. On the other hand, consumption of renewable energy is positively and significantly correlated with real economic growth (LRGDP) across all models, indicating that rising income levels and economic expansion encourage the use of renewable energy.

In every specification, the coefficient of LCO2 is negative and significant, indicating that economies with higher emission intensities continue to rely more heavily on fossil fuels, thereby impeding the growth of renewable energy. The extended models show that LFD has a positive impact on renewable energy consumption, suggesting that deeper financial systems make it easier to invest in and finance renewable projects.

To sum up, the dynamic GMM results consistently indicate strong persistence in renewable energy consumption, with the lagged dependent variable (LREC (−1)) remaining positive and highly significant across all models LOPs exert a negative and significant effect, suggesting that higher fossil fuel prices reduce renewable energy demand, while real GDP (LRGDP) positively influences renewable energy use, supporting the growth–energy nexus. LCO2 is negatively associated with renewable energy consumption, reflecting continued reliance on fossil fuels. LFD positively and significantly affects renewable energy consumption in the extended models, underscoring the role of financial systems in supporting clean energy investment. Demographic variables show mixed outcomes: LPOP tends to promote renewable energy demand, whereas LURB often has a negative or insignificant effect, especially in sub-country-group estimations.