Conceptual Framework for a Machine Learning-Based Algorithmic Model for Early-Stage Business Idea Evaluation

Abstract

1. Introduction

2. Materials and Methods

2.1. Methodological Approach

2.2. Framework Construction Procedure

2.3. Proposed Framework

2.4. Concept Validation

2.5. Reproducibility and Transparency

3. Analysis of the Business Success Prediction Algorithm Using Machine Learning

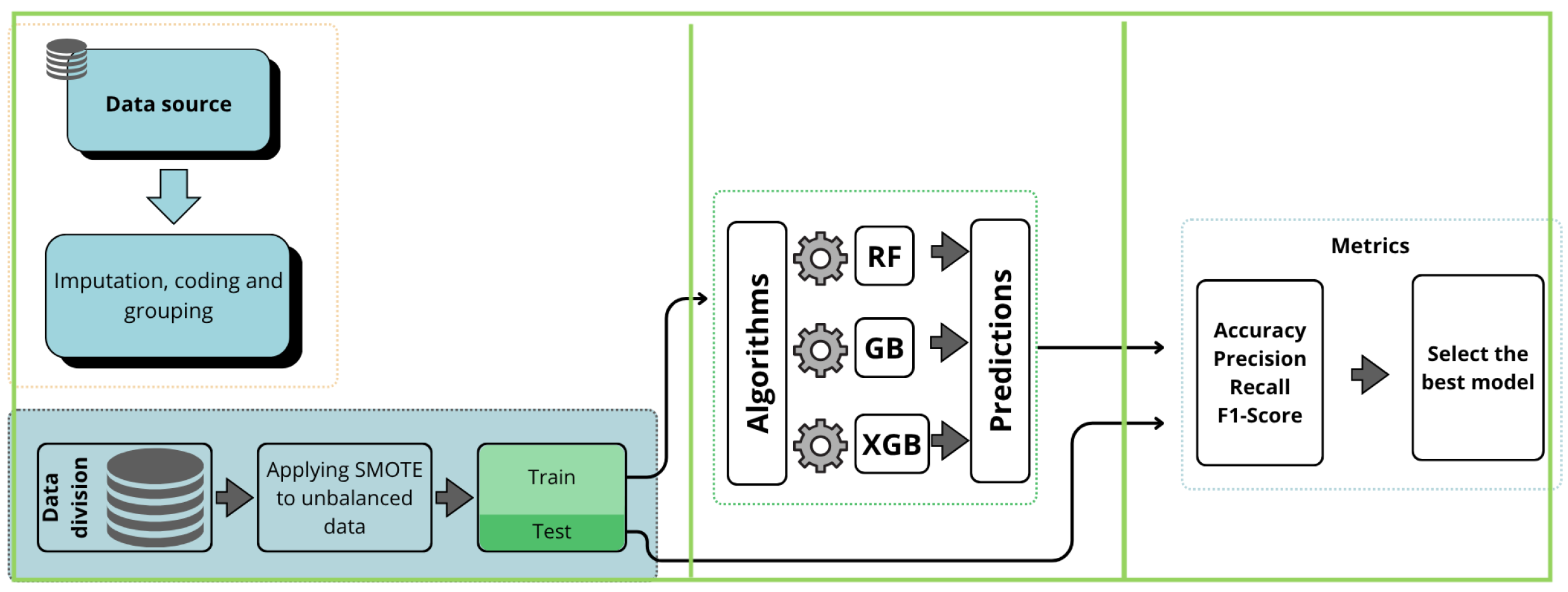

3.1. System Architecture

3.1.1. Data Acquisition and Preprocessing Phase

3.1.2. Division Strategy and Data Balance

3.2. Algorithm Pseudocode

3.2.1. Training and Optimization Center

| Algorithm 1 Business Success Prediction Algorithm using Machine Learning |

|

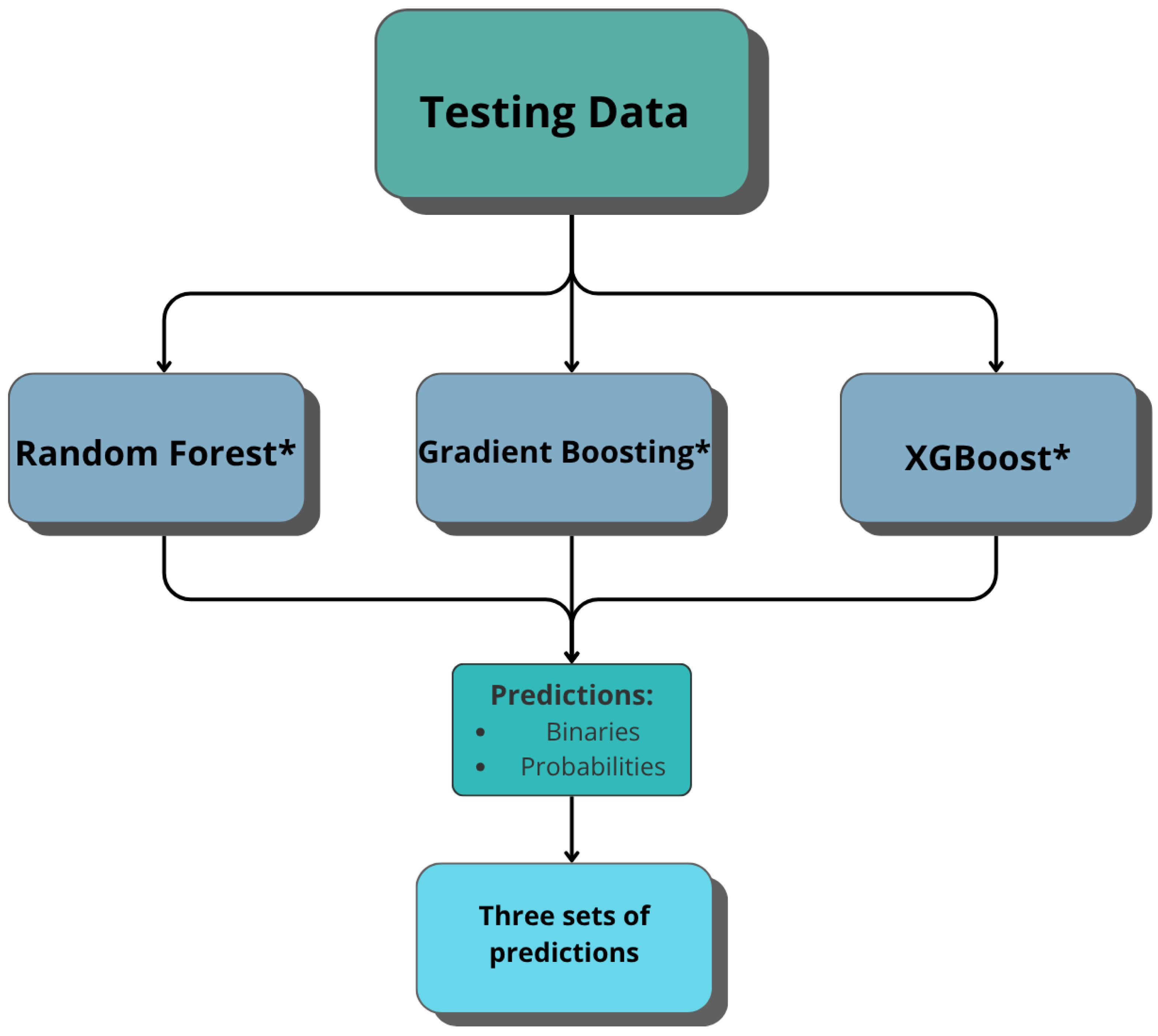

3.2.2. Evaluation and Selection System

3.3. Methodology Flowchart

Importance and Interpretability Analysis

3.4. Methodological Innovation

- ≥0.70: High potential

- 0.50–0.69: Medium potential

- <0.50: Requires reformulation

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Audretsch, D.B.; Belitski, M. Knowledge spillover entrepreneurship and economic growth. Technol. Forecast. Soc. Change 2021, 166, 120650. [Google Scholar] [CrossRef]

- Urbano, D.; Audretsch, D.; Aparicio, S.; Noguera, M. Does entrepreneurial activity matter for economic growth in developing countries? The role of the institutional environment. Int. Entrep. Manag. J. 2019, 16, 1065–1099. [Google Scholar] [CrossRef]

- Stam, E.; van de Ven, A. Entrepreneurial ecosystem elements. Small Bus. Econ. 2021, 56, 809–832. [Google Scholar] [CrossRef]

- Martín-Peña, M.L.; Lorenzo, P.C.; Meyer, N. Digital platforms and business ecosystems: A multidisciplinary approach for new and sustainable business models. Rev. Manag. Sci. 2024, 18, 2465–2482. [Google Scholar] [CrossRef]

- Rubilar-Torrealba, R.; Chahuán-Jiménez, K.; De La Fuente-Mella, H.; Marzo-Navarro, M. Econometric modeling to measure the social and economic factors in the success of entrepreneurship. Sustainability 2022, 14, 7573. [Google Scholar] [CrossRef]

- Estrada-Lavilla, R.; Ruiz-Navarro, J. Method for and Analysis of Early-Stage Firm Growth Patterns Using World Bank Data. Sustainability 2024, 16, 1450. [Google Scholar] [CrossRef]

- Kim, J.; Kim, H.; Geum, Y. How to succeed in the market? Predicting startup success using a machine learning approach. Technol. Forecast. Soc. Change 2023, 193, 122614. [Google Scholar] [CrossRef]

- González, M.A.M.; Terzidis, O.; Lütz, P.; Heblich, B. Critical decisions at the early stage of start-ups: A systematic literature review. J. Innov. Entrep. 2024, 13, 83. [Google Scholar] [CrossRef]

- Ahmad, M.; Zheng, J. The Cyclical and Nonlinear Impact of R&D and Innovation Activities on Economic Growth in OECD Economies: A New Perspective. J. Knowl. Econ. 2022, 14, 544–593. [Google Scholar] [CrossRef]

- Kostis, P.C. Culture, innovation, and economic development. J. Innov. Entrep. 2021, 10, 22. [Google Scholar] [CrossRef]

- Skare, M.; Porada-Rochon, M. The role of innovation in sustainable growth: A dynamic panel study on micro and macro levels 1990–2019. Technol. Forecast. Soc. Change 2022, 175, 121337. [Google Scholar] [CrossRef]

- Baden-Fuller, C.; Teece, D.J. Market sensing, dynamic capability, and competitive dynamics. Ind. Mark. Manag. 2020, 89, 105–106. [Google Scholar] [CrossRef]

- Carbonell Garcia, D.; Van Klyton, A.; Tavera-Mesias, J.F. The moderating effect of digital transformation on environmental turbulence in emerging economies-advancing business model innovation research. Benchmarking Int. J. 2025, 1–31. [Google Scholar] [CrossRef]

- Gangwani, D.; Zhu, X. Modeling and prediction of business success: A survey. Artif. Intell. Rev. 2024, 57, 44. [Google Scholar] [CrossRef]

- Park, J.; Choi, S.; Feng, Y. Predicting startup success using two bias-free machine learning: Resolving data imbalance using generative adversarial networks. J. Big Data 2024, 11, 122. [Google Scholar] [CrossRef]

- Zhang, Z.; Lau, R.Y. Exploiting Multimodal Features and Deep Learning for Predicting Crowdfunding Successes. In Proceedings of the 2024 IEEE International Conference on Omni-layer Intelligent Systems (COINS), London, UK, 29–31 July 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Sadia, R.T.; Cheng, Q. CrunchLLM: Multitask LLMs for Structured Business Reasoning and Outcome Prediction. arXiv 2025. [Google Scholar] [CrossRef]

- Bonaventura, M.; Ciotti, V.; Panzarasa, P.; Liverani, S.; Lacasa, L.; Latora, V. Predicting success in the worldwide start-up network. Sci. Rep. 2020, 10, 345. [Google Scholar] [CrossRef] [PubMed]

- Argaw, Y.M.; Liu, Y. The Pathway to Startup Success: A Comprehensive Systematic Review of Critical Factors and the Future Research Agenda in Developed and Emerging Markets. Systems 2024, 12, 541. [Google Scholar] [CrossRef]

- Ningrum, I.W.K.; Ridho, F.; Wijayanto, A.W. Predicting Startup Success Using Machine Learning Approach. J. Appl. Inform. Comput. 2024, 8, 280–290. [Google Scholar] [CrossRef]

- Najie, M.; Sofian, A.A.; Sidabutar, R.J.; Untoro, M.C. Optimizing Startup Success Prediction Through SMOTE Oversampling and Classification. J. Intell. Syst. Inf. Technol. 2024, 1, 57–65. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Belitski, M.; Guerrero, M. Sustainable orientation management and institutional quality: Looking into European entrepreneurial innovation ecosystems. Technovation 2023, 124, 102742. [Google Scholar] [CrossRef]

- Takas, N.; Kouloumpris, E.; Moutsianas, K.; Liapis, G.; Vlahavas, I.; Kousenidis, D. Startup Sustainability Forecasting with Artificial Intelligence. Appl. Sci. 2024, 14, 8925. [Google Scholar] [CrossRef]

- Wei, C.P.; Fang, E.S.H.; Yang, C.S.; Liu, P.J. To shine or not to shine: Startup success prediction by exploiting technological and venture-capital-related features. Inf. Manag. 2025, 62, 104152. [Google Scholar] [CrossRef]

- Truant, E.; Giordino, D.; Borlatto, E.; Bhatia, M. Drivers and barriers of smart technologies for circular economy: Leveraging smart circular economy implementation to nurture companies’ performance. Technol. Forecast. Soc. Change 2024, 198, 122954. [Google Scholar] [CrossRef]

- Liu, Y.; Tian, G.; Sheng, H.; Zhang, X.; Yuan, G.; Zhang, C. Batch Eol Products Human-Robot Collaborative Remanufacturing Process Planning and Scheduling for Industry 5.0. Robot. Comput.-Integr. Manuf. 2026, 97, 103098. [Google Scholar] [CrossRef]

- Delmar, F. Measuring growth: Methodological considerations and empirical results. In Entrepreneurship and SME Research; Routledge: Oxfordshire, UK, 2019; pp. 199–215. [Google Scholar]

- Davila, A.; Foster, G.; Gupta, M. Venture capital financing and the growth of startup firms. J. Bus. Ventur. 2003, 18, 689–708. [Google Scholar] [CrossRef]

- Levie, J.; Lichtenstein, B.B. A terminal assessment of stages theory: Introducing a dynamic states approach to entrepreneurship. Entrep. Theory Pract. 2010, 34, 317–350. [Google Scholar] [CrossRef]

- Pryor, C.; Webb, J.W.; Ireland, R.D.; Ketchen, D.J., Jr. Toward an integration of the behavioral and cognitive influences on the entrepreneurship process. Strateg. Entrep. J. 2016, 10, 21–42. [Google Scholar] [CrossRef]

- Cohen, B.; Winn, M.I. Market imperfections, opportunity and sustainable entrepreneurship. J. Bus. Ventur. 2007, 22, 29–49. [Google Scholar] [CrossRef]

- Cohen, B.; Almirall, E.; Chesbrough, H. The emergence of the urban entrepreneurship ecosystem: Ecosystem dynamics in an urban context. Calif. Manag. Rev. 2017, 59, 5–25. [Google Scholar] [CrossRef]

- Schade, P.; Schuhmacher, M.C. Predicting entrepreneurial activity using machine learning. J. Bus. Ventur. Insights 2023, 19, e00357. [Google Scholar] [CrossRef]

- Li, Y.; Zadehnoori, I.; Jowhar, A.; Wise, S.; Laplume, A.; Zihayat, M. Learning from Yesterday: Predicting early-stage startup success for accelerators through content and cohort dynamics. J. Bus. Ventur. Insights 2024, 22, e00490. [Google Scholar] [CrossRef]

- McCarthy, P.X.; Gong, X.; Braesemann, F.; Stephany, F.; Rizoiu, M.A.; Kern, M.L. The impact of founder personalities on startup success. Sci. Rep. 2023, 13, 17200. [Google Scholar] [CrossRef]

- Kaiser, U.; Kuhn, J. The value of publicly available, textual and non-textual information for startup performance prediction. J. Bus. Ventur. Insights 2020, 14, e00179. [Google Scholar] [CrossRef]

- Arroyo, J.; Corea, F.; Jimenez-Diaz, G.; Recio-Garcia, J.A. Assessment of Machine Learning Performance for Decision Support in Venture Capital Investments. IEEE Access 2019, 7, 124233–124243. [Google Scholar] [CrossRef]

- Kaminski, J.; Hopp, C. Predicting outcomes in crowdfunding campaigns with textual, visual, and linguistic signals. Small Bus. Econ. 2020, 55, 627–649. [Google Scholar] [CrossRef]

- Ralcheva, A.; Roosenboom, P. Forecasting success in equity crowdfunding. Small Bus. Econ. 2020, 55, 39–56. [Google Scholar] [CrossRef]

- Qiu, Y.; Chen, P.; Huang, W. Enhancing Startup Financing Success Prediction Based on Social Media Sentiment. Systems 2025, 13, 520. [Google Scholar] [CrossRef]

- Soto-Simeone, A.; Sirén, C.; Antretter, T. New Venture Survival: A Review and Extension. Int. J. Manag. Rev. 2020, 22, 378–407. [Google Scholar] [CrossRef]

- Zhao, X.; Xu, Y.; Vasa, L.; Shahzad, U. Entrepreneurial ecosystem and urban innovation: Contextual findings in the lens of sustainable development from China. Technol. Forecast. Soc. Change 2023, 191, 122526. [Google Scholar] [CrossRef]

- Gilsing, R.; Türetken, O.; Grefen, P.; Ozkan, B.; Adali, O.E. Business model evaluation: A systematic review of methods. Pac. Asia J. Assoc. Inf. Syst. 2022, 14, 26–61. [Google Scholar] [CrossRef]

- Razaghzadeh Bidgoli, M.; Raeesi Vanani, I.; Goodarzi, M. Predicting the success of startups using a machine learning approach. J. Innov. Entrep. 2024, 13, 80. [Google Scholar] [CrossRef]

- Lee, K.; Roh, T.; Kim, J.; Park, S.; Bae, Y. Unpacking sustainability in start-ups: A systematic review and research agenda. Environ. Dev. Sustain. 2025, 6, 218. [Google Scholar] [CrossRef]

- Ross, G.; Das, S.; Sciro, D.; Raza, H. CapitalVX: A machine learning model for startup selection and exit prediction. J. Financ. Data Sci. 2021, 7, 94–114. [Google Scholar] [CrossRef]

- Teece, D. Hand in glove: Open innovation and the dynamic capabilities framework. Strateg. Manag. Rev. 2020, 1, 233–253. [Google Scholar] [CrossRef]

- Carle, P.É.; Rayna, T. Where to start? Exploring how sustainable startups integrate sustainability impact assessment within their entrepreneurial process. J. Manag. Organ. 2023, 30, 148–164. [Google Scholar] [CrossRef]

- Chawla, N.V.; Bowyer, K.W.; Hall, L.O.; Kegelmeyer, W.P. SMOTE: Synthetic Minority Over-sampling Technique. J. Artif. Intell. Res. 2002, 16, 321–357. [Google Scholar] [CrossRef]

- Fernández, A.; García, S.; Herrera, F.; Chawla, N.V. SMOTE for learning from imbalanced data: Progress and challenges, marking the 15-year anniversary. J. Artif. Intell. Res. 2018, 61, 863–905. [Google Scholar] [CrossRef]

| Author | Method/Approach | Main Finding (Brief) | Reinforced Dimension |

|---|---|---|---|

| [33] | Comparison between ML and regression (DT, RF, ANN, k-NN, XGBoost, Naïve Bayes; logistic baseline) | XGBoost outperforms regression; high accuracy under imbalanced scenarios | Algorithmic/Metric methodology |

| [34] | Two-phase framework; textual/team and cohort features; supervised ML | Cohort-level features enhance prediction in accelerator contexts | Scalability/Environment (network or cohort) |

| [35] | Interpretable ML based on Big Five personality traits | Traits such as openness and activity, along with team diversity, correlate with startup success | Entrepreneurial team |

| [36] | Text-as-data combined with administrative data; classification models (AUC) | Public textual information improves prediction of survival and innovation | Innovation/Early signals |

| [37] | Multiple ML models on >120,000 startups, 3-year horizon | ML supports VC decisions, predicting funding rounds and shutdown risk through multiple signals | Early finance/Risk |

| [38] | NLP and network analysis; 20,188 campaigns | Textual and visual signals outperform firm-level determinants in early-stage pitches | Innovation/Communication |

| [39] | Parsimonious model with 3-year moving window | Equity retention, founder experience, and accelerator participation predict success | Finance/Team |

| [40] | DSS with DNN; Crunchbase + Twitter; BERTweet for sentiment analysis | Incorporating social sentiment enhances prediction accuracy of funding outcomes | Environment/Market (external signals) |

| Dimension | Variable | Type | Indicator/Question | Encoding |

|---|---|---|---|---|

| Innovation | Novelty of the solution | Ordinal | Level of technical or commercial novelty | Likert 1–5 |

| Intellectual property protection | Categorical | Is there an IP registration or application? | 1 = Yes, 0 = No | |

| Business model differentiation | Ordinal | Degree of differentiation from the market | Likert scale: 1–5 | |

| Sustainability | Environmental impact | Ordinal | Estimated level of environmental impact | 1 = Low, 2 = Medium, 3 = High |

| Circular economy | Ordinal | Proportion of reusable/recyclable inputs | 0 = None, 1 = Partial, 2 = Total | |

| Social inclusion | Categorical | Does it consider historically excluded groups? | 1 = Yes, 0 = No | |

| Entrepreneurial team | Sector experience | Numerical | Average years of experience in the sector | Scale: 0–1 |

| Functional diversity | Ordinal | Coverage of critical roles (technical, business, etc.) | Likert 1–5 | |

| Dedication to the project | Numerical | Percentage of dedication to the project | 0–100% | |

| Scalability | Market Size (TAM/SAM/SOM) | Numerical | Documented estimate of the target market | Scale 0–1 |

| Scaling Potential | Ordinal | Ability to expand geographically/sectorally | Likert 1–5 | |

| Early Traction | Numerical | Initial signs of interest (leads, pre-sales) | Scale 0–1 | |

| Initial Financing | Capital Intensity (CAPEX/OPEX) | Numerical | Initial investment vs. opportunity ratio | Scale 0–1 (inverted) |

| Time to Break-even | Numerical | Estimated months to reach breakeven | Scale 0–1 (inverted) | |

| Initial funding sources | Categorical | Do you have seed capital or investors? | 1 = Yes, 0 = No |

| Appearance | Traditional Approaches | Proposed Framework |

|---|---|---|

| Dimensions | Financial dominance; marginal innovation and sustainability | 15 variables in 5 dimensions (innovation, sustainability, team, scalability, finance) |

| Non-linearity | Restrictive linear assumptions | Ensemble algorithms that capture interactions and non-linearities |

| Imbalance | Generally not addressed | SMOTE and balanced metrics (F1, balanced accuracy) |

| Validation | Limited cross-validation; low replicability | Systematic validation and replication- ready design |

| Generalization | Sensitive to concept drift and survival bias | Scalable pipeline oriented towards early decisions |

| Interpretability | Global coefficients | Importance of variables and dimensions; model-agnostic explainability |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chahuán-Jiménez, K.; Garrido-Araya, D.; Román, C.E. Conceptual Framework for a Machine Learning-Based Algorithmic Model for Early-Stage Business Idea Evaluation. Sustainability 2025, 17, 10124. https://doi.org/10.3390/su172210124

Chahuán-Jiménez K, Garrido-Araya D, Román CE. Conceptual Framework for a Machine Learning-Based Algorithmic Model for Early-Stage Business Idea Evaluation. Sustainability. 2025; 17(22):10124. https://doi.org/10.3390/su172210124

Chicago/Turabian StyleChahuán-Jiménez, Karime, Dominique Garrido-Araya, and Carlos Escobedo Román. 2025. "Conceptual Framework for a Machine Learning-Based Algorithmic Model for Early-Stage Business Idea Evaluation" Sustainability 17, no. 22: 10124. https://doi.org/10.3390/su172210124

APA StyleChahuán-Jiménez, K., Garrido-Araya, D., & Román, C. E. (2025). Conceptual Framework for a Machine Learning-Based Algorithmic Model for Early-Stage Business Idea Evaluation. Sustainability, 17(22), 10124. https://doi.org/10.3390/su172210124