Exploring Sustainable Agricultural Supply Chain Financing: Risk Sharing in Three-Party Game Theory

Abstract

1. Introduction

2. Literature Review

3. Problem Description and Model Framework

3.1. Problem Description

3.2. Model Assumptions and Parameter Definitions

3.3. Model Analysis

3.3.1. Payoff Matrix

3.3.2. Replicator Dynamic Equations

3.4. Steady-State Equilibrium Analysis

4. Simulation Analysis

4.1. Simulation Parameter Settings

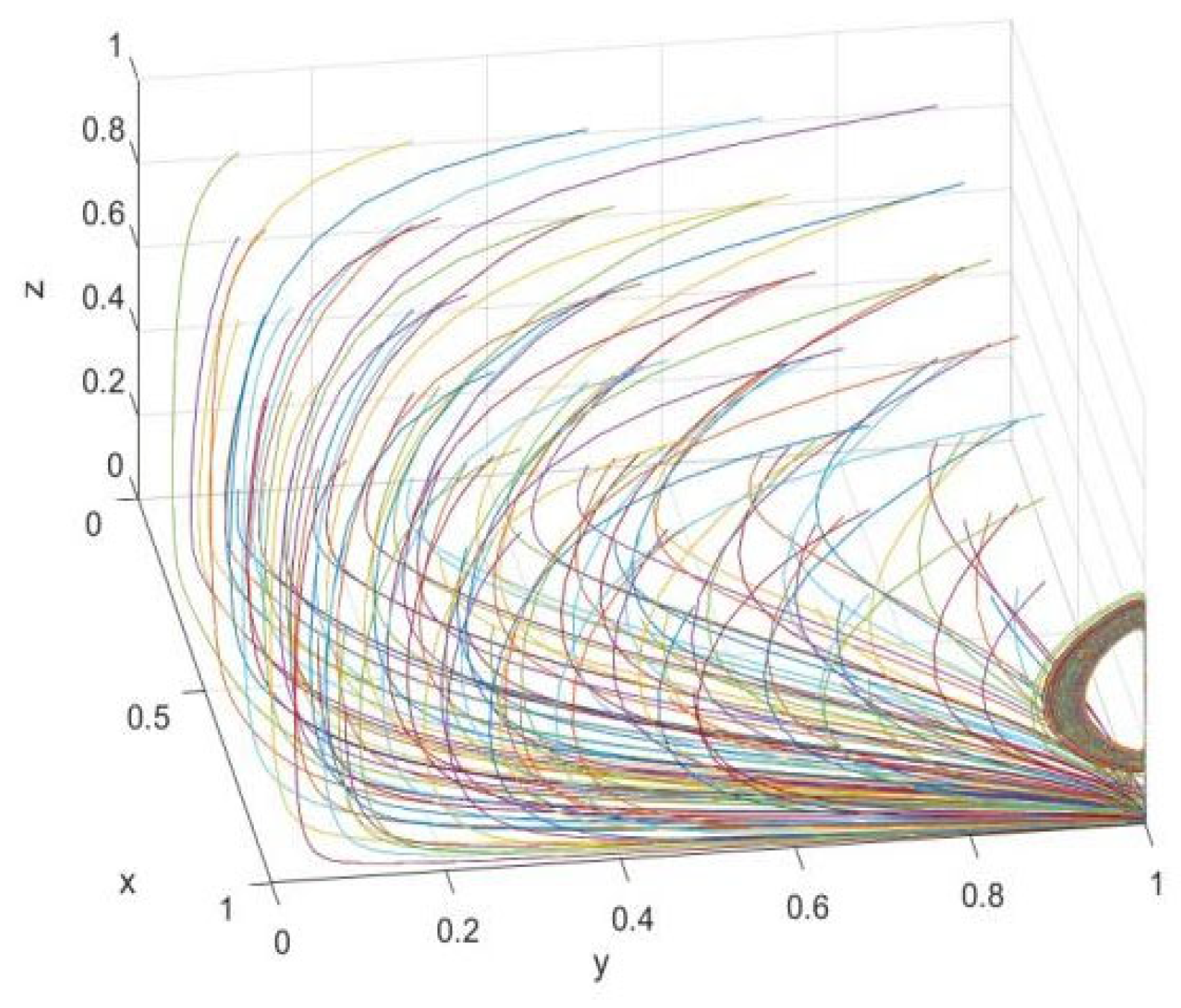

4.2. Initial Evolution Dynamics Analysis

4.3. Sensitivity Analysis

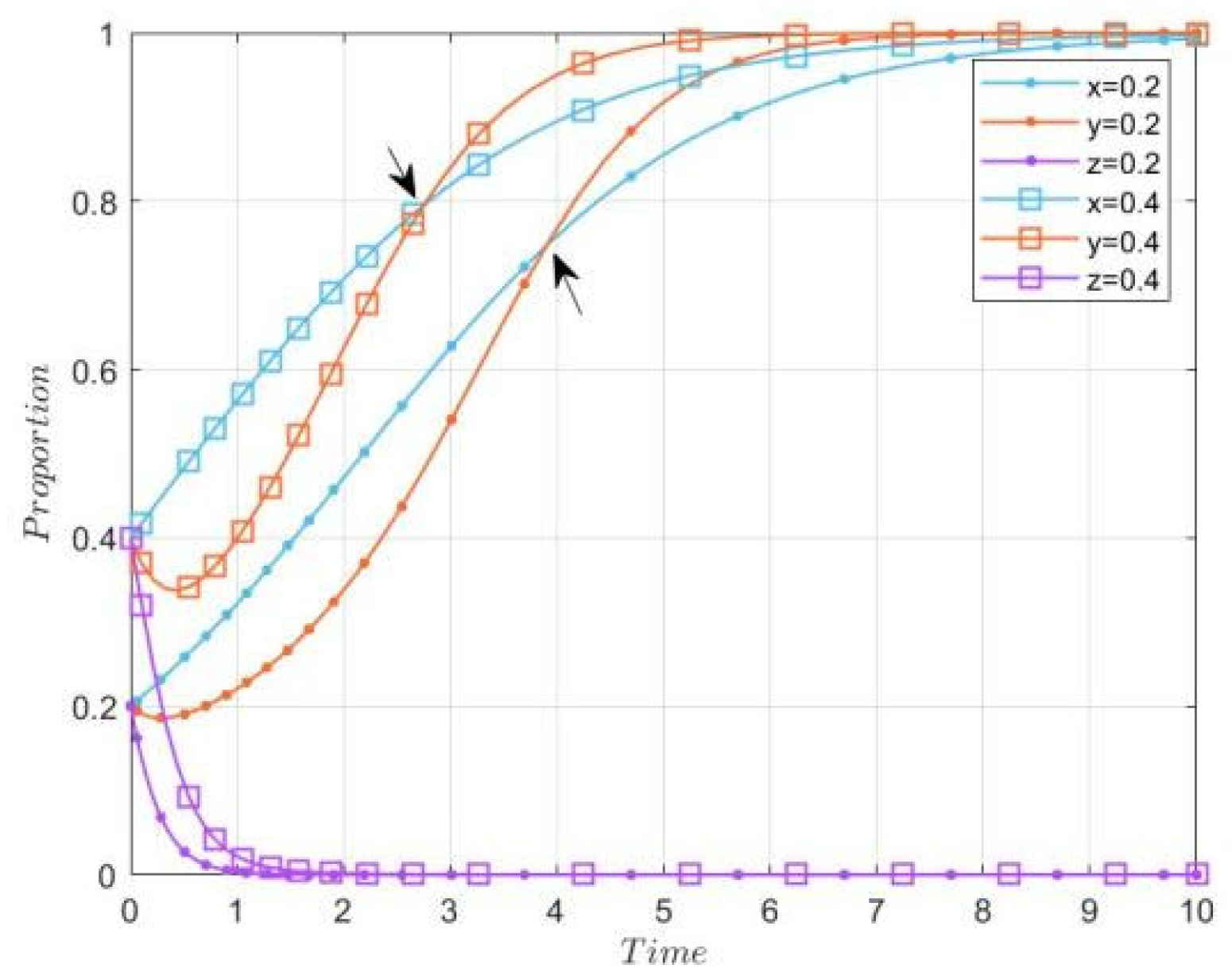

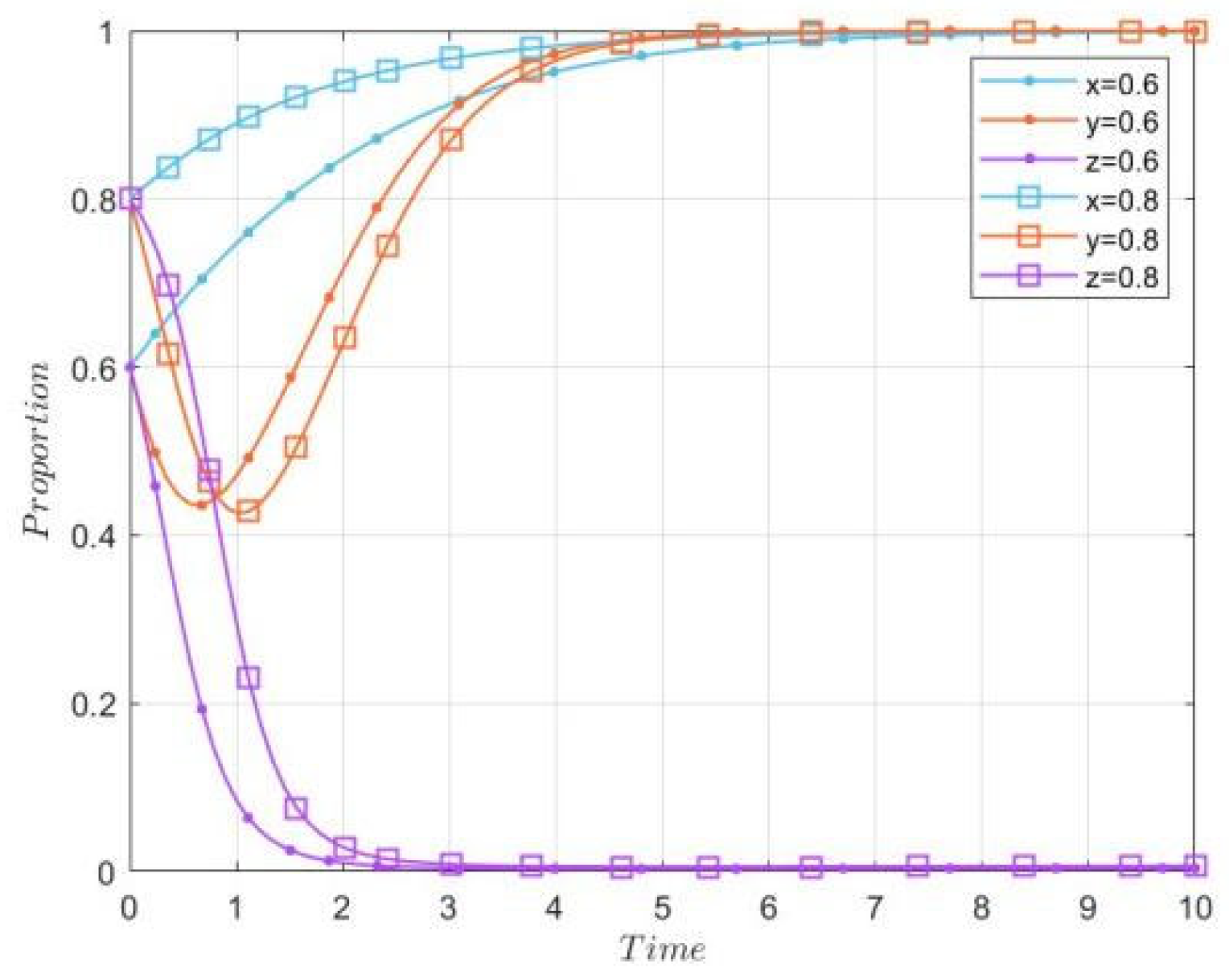

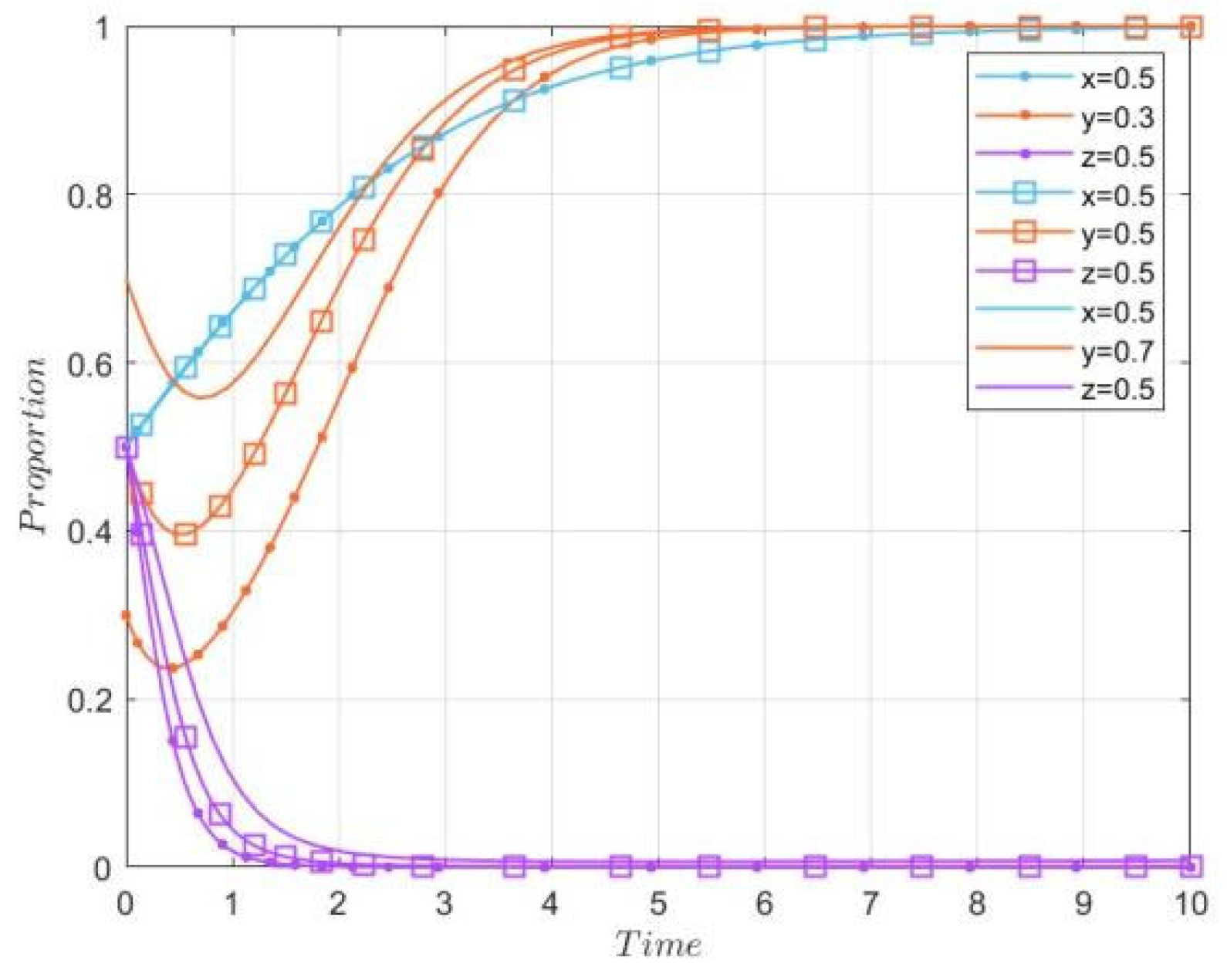

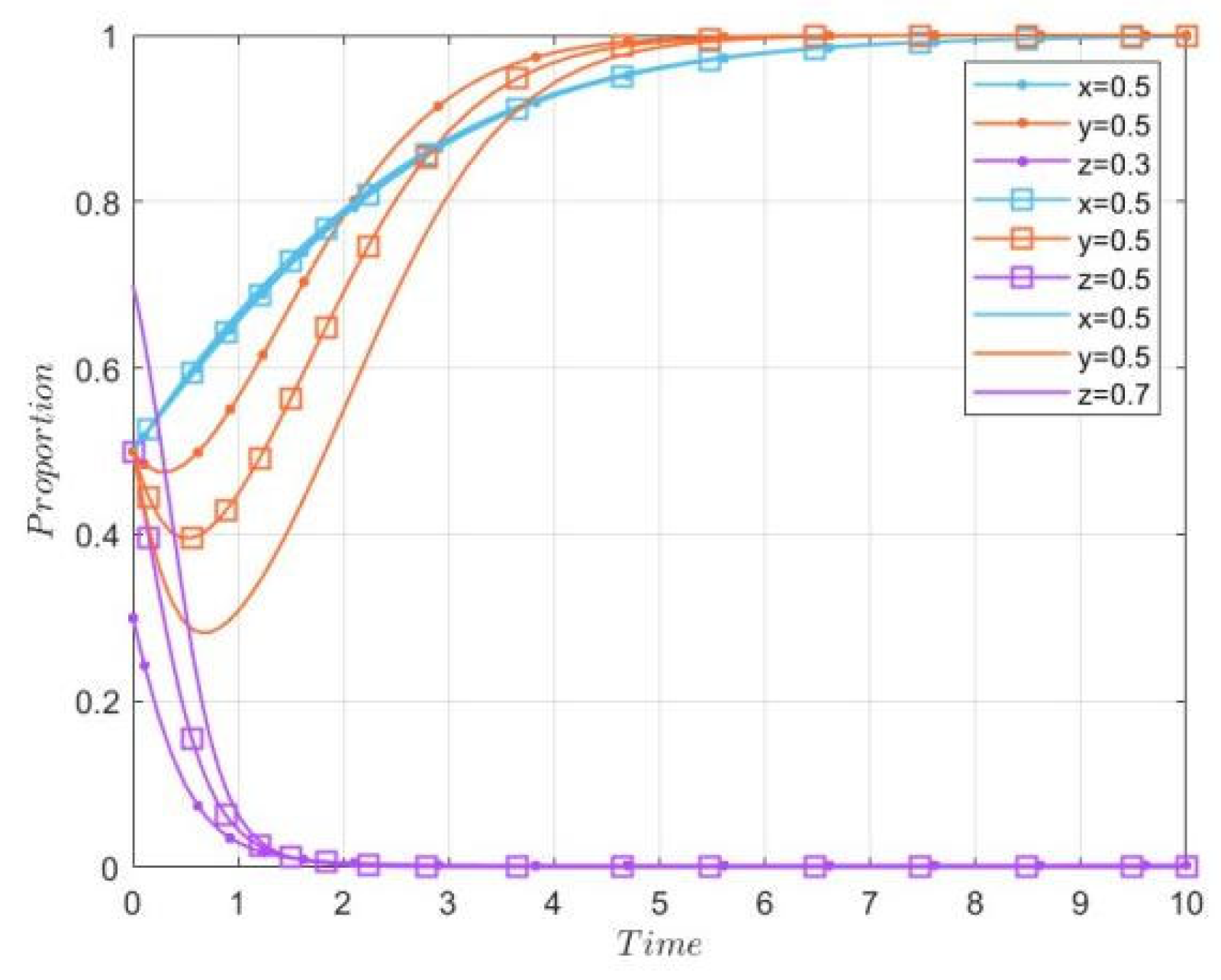

4.3.1. Impact of Initial Strategy Preferences on the Evolutionary Dynamics of the System

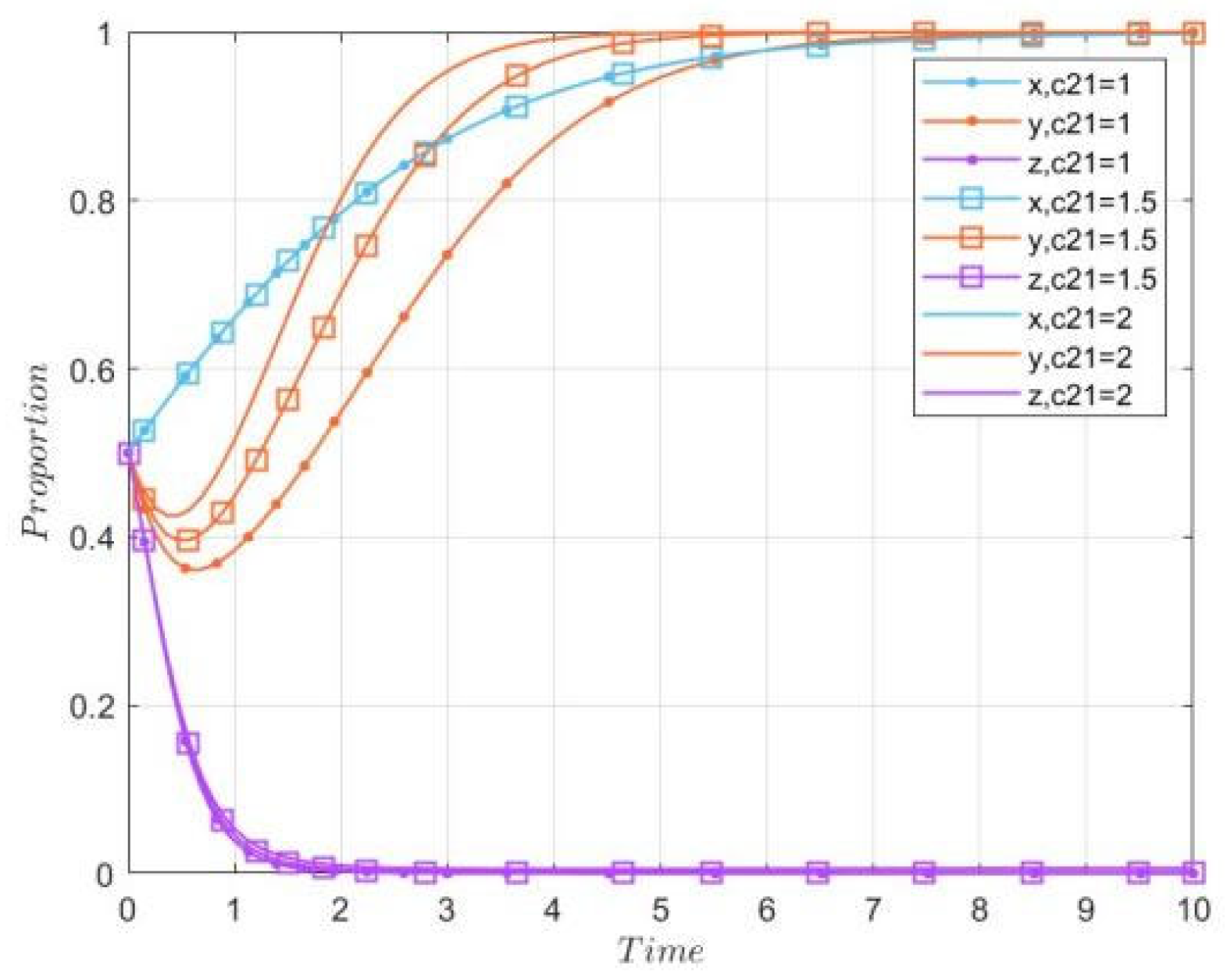

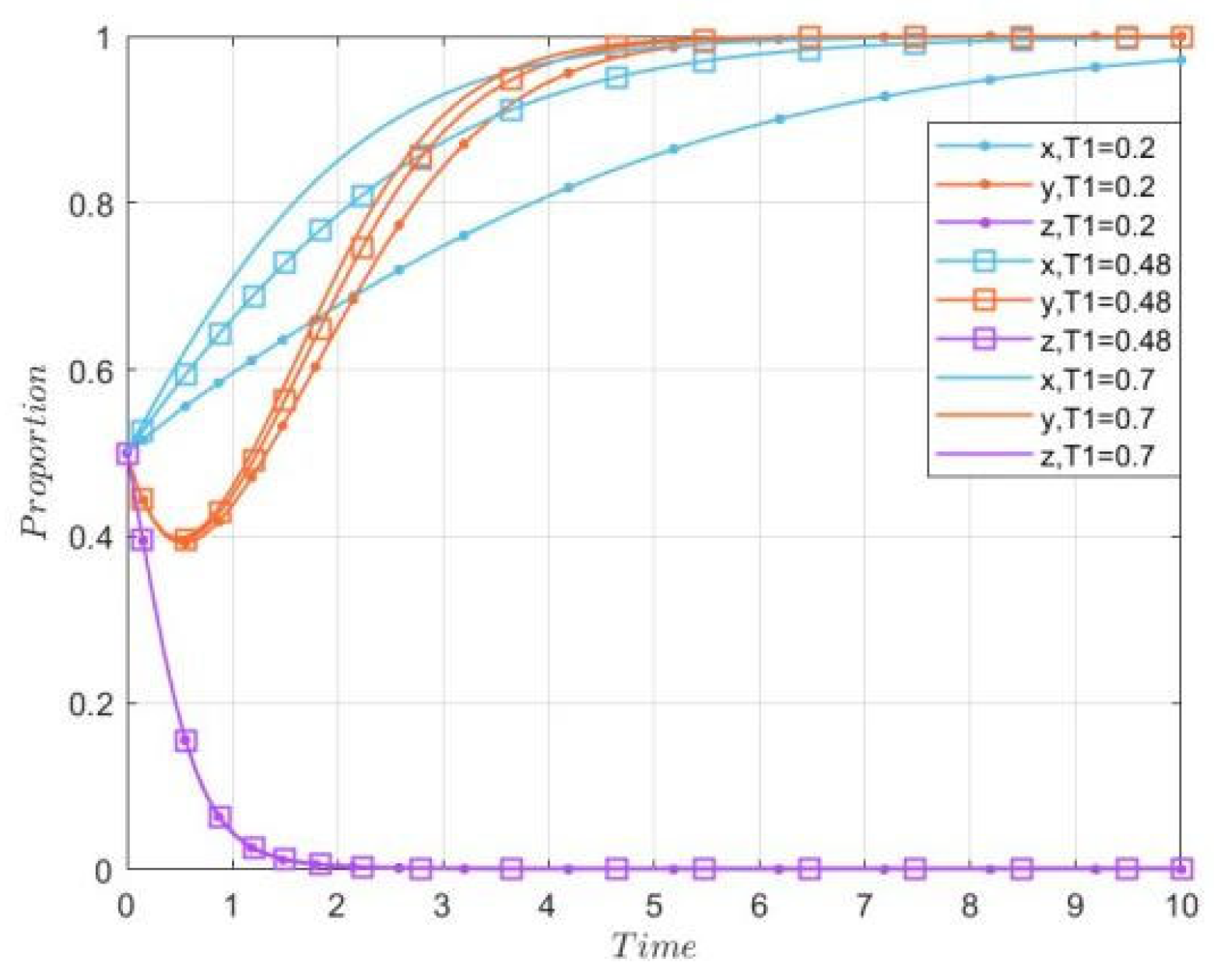

4.3.2. Impact of Parameter Changes on the Evolutionary Dynamics of the System

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| ESS | Evolutionarily Stable Strategy |

Appendix A

- Survey Questionnaire on Agricultural Industry Chain Financing

- Farmers’ Financing Needs

- What is your main crop? ______

- Planting scale: Total ______ mu (Note: 1 mu ≈ 0.0667 hectares) (_____ greenhouses, _____ mu/greenhouse, _____ sticks/greenhouse)

- Your cost and revenue information:

Year Scale/mu Yield/jin (Note: 1 jin = 0.5 Kg) Price (Yuan/jin) Cost (Yuan/mu) 2022 2023 - Did you experience a shortage of funds during the planting period? ( )A. Yes B. No

- If yes, how did you solve it? ( )A. Borrowed from relatives/friends B. Bank loan C. Personal savings D. Other

- If you chose bank loan, the main reasons were (choose up to 2):A. Low interest rate B. Large loan amount C. Simple procedure D. High efficiency

- Your loan method from the bank: ( )A. Mortgage loan, collateral: ______ B. Guaranteed loan, guarantor: ______ C. Credit loan

- If you did not apply for a bank loan, what were the main reasons? (choose up to 2)A. Did not meet bank standards B. Loan amount too small C. Lack of collateralD. Complicated procedure, long approval time E. Other

- Purpose of the loan: (choose up to 2)A. Expand production (build greenhouses, rent land, etc.) B. Purchase seedlingsC. Buy fertilizer/pesticides D. Purchase machinery E. Introduce new planting techniquesF. Infrastructure (storage, water, electricity) G. Other________

- Do you think it’s easy to get funding from banks? ( )A. Very difficult B. Difficult C. Average D. Relatively easy E. Easy

- From the perspective of future farm operations, do you anticipate a need for loans? ( )A. Yes B. No C. Uncertain

- Participation in Agricultural Industry Chain Financing

- Are you aware of the “Mushroom Loan” agricultural industry chain financing product offered by banks? ( )A. Completely unaware B. Heard of it but not used C. Currently using

- How did you learn about the “Mushroom Loan”? (choose up to 3)A. Never learned about it B. Through relatives/friends C. TV, newspapers, internetD. Government promotion E. Bank staff F. Enterprise promotion

- If you participated in the “Mushroom Loan”, what were your reasons? (choose up to 3)A. Enterprise provides guarantee, no collateral requiredB. High loan efficiency and quick disbursementC. Simple loan process D. Low interest rateE. Meets different loan needs (large/small amounts)

- How did you participate in the “Mushroom Loan”? ( )A. Guarantee from leading enterprise B. Credit loan C. Mortgage loan D. Other

- If guaranteed by a leading enterprise, what other support did the enterprise provide? (select all that apply)A. None B. Cash C. Agricultural inputs (seedlings, fertilizers, etc.)D. Technical training E. Other

- Your loan application details:

Year Own Funds (Yuan) Loan Applied (Yuan) Bank Approved (Yuan) Repayment Period (Years) Interest Rate (%) 2022 2023 - What is your repayment source when participating in chain financing? ( )A. Income used directly for repayment B. Borrowing C. Other

- Have you ever failed to repay on time and in full? ( )A. Yes B. No

- If yes, what were the reasons? (select all that apply)A. Natural disasters reduced production B. Pests/diseases reduced productionC. Improper operations reduced production D. Significant price dropsE. Poor sales F. Enterprise default caused poor sales

- If unable to repay on time/in full, what measures did you take? ( )A. Defaulted B. Applied for extensionC. Partial repayment with collateral for remainder D. Other

- Does the bank monitor the usage of your loan funds? ( )A. Yes B. No

- Are you satisfied with this loan product? ( )A. Satisfied B. Quite satisfied C. Neutral D. Somewhat dissatisfied E. Dissatisfied

- Has your planting scale expanded due to the loan? ( )A. Yes B. No

- Has the loan helped increase your income? ( )A. Yes B. No

- If you have not participated in industry chain financing, what are the reasons? (select all that apply)A. Unfamiliar with it B. No need C. Process too complexD. Obtained funding from other sources E. High financing costsF. Ineligible for industry chain financing

- Risks in Agricultural Industry Chain Financing

- Please rank the following sources of loan risk from highest to lowest:A. Leading enterprises default and buy from other farmersB. Natural disasters reducing outputC. Technical problems leading to lower yields and inability to repayD. Market price fluctuations reducing incomeE. Losses due to poor storage/transport technologyF. Unstable policies or lack of protection of rights

- Impact of different risk types on financing (check the appropriate box):

Risk Type Very High High Medium Low No Impact Moral Risk Natural Risk Technical Risk Price Risk Storage Risk Legal/Policy Risk - At what level of loss would you be unable to bear it? (check the appropriate box):

Risk Type 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Moral Risk Natural Risk Technical Risk Price Risk Storage Risk Legal/Policy Risk

- Data Collection for Evolutionary Game SimulationNote: For yes/no questions, mark “√” for Yes and “×” for No.

- Company Name: _________________________

- Main Business: ____________________, Types of Crops: ____________________

- Number of cooperating farmers: ________ households; Does the enterprise purchase agricultural products from these farmers? ( ); Is a purchase order signed? ( ); Does the order include a guaranteed minimum price? ( )

- How is the purchase price in the order determined? ( )A. Slightly above market price B. Average market price C. Slightly below market price

- Total planting area by all farmers: ______ mu; Yield per mu: ______ jin; Purchase price: ______ Yuan/jin; Cost per mu: ______ Yuan; Net profit per mu: ______ Yuan

- Do farmers need to have some initial capital? ( ); If yes, how much? ______ Yuan;Typical loan amount: ______ Yuan; Loan interest rate: ______; This loan amount can cover ______ mu of planting.

- Processing, storage, and transportation costs per jin: ______ Yuan; Selling price per jin: ______ Yuan; Net profit per jin: ______ Yuan

- Does the enterprise require farmers to deposit funds in advance as a condition for providing a loan guarantee? ( ); If yes, amount: ______ Yuan; Is this amount deducted in case of default? ( ); Cooperative benefit: ______ Yuan/mu (includes seedlings, fertilizer, technology support, etc.)

- Cost incurred by farmers to find another guarantor after default: ______ Yuan; Cost to find a new bank: ______ Yuan (due to stricter terms)

- Bank assessment and review cost: ______ Yuan; If the bank lends to a lower-risk project, what is the interest rate? ______

- Does the enterprise provide rewards or additional penalties for farmer compliance or default? ( ); If yes, please describe:__________________________________________________________________________

- Does the enterprise charge a guarantee fee? ( ); If yes, please specify:__________________________________________________________________________

- Do farmers have counter-guarantee mechanisms? ( ); If yes, please specify:__________________________________________________________________________

- Default situation of farmers: _____________; Reason for default: ______________; Consequences of default: _________________ (to banks and enterprises)

- Does the government provide rewards or penalties to banks for participating in industry chain financing? ( ); If yes, please describe:__________________________________________________________________________

- Compared with the situation before using industry chain financing products, has the number of cooperating farmers increased significantly? ( )

- Has the implementation of the industry chain loan product increased the number of borrowing farmers? ( ); If yes, please describe:__________________________________________________________________________

Has it encouraged the bank to develop other industry chain loan products? ( ); If yes, what products?__________________________________________________________________________

References

- Feder, G.; Lau, L.J.; Lin, J.Y.; Luo, X. The relationship between credit and productivity in Chinese agriculture: A microeconomic model of disequilibrium. Am. J. Agric. Econ. 1990, 72, 1151–1157. [Google Scholar] [CrossRef]

- Lin, Q.; Shan, Z.J.; Fu, W.H.; Lin, X.G. Interplay between the agriculture firm’s guarantee strategy and the e-commerce platform’s loan strategy with risk averse farmers. Omega 2024, 127, 103108. [Google Scholar] [CrossRef]

- Villalba, R.; Venus, T.E.; Sauer, J. The ecosystem approach to agricultural value chain finance: A framework for rural credit. World Dev. 2023, 164, 106177. [Google Scholar] [CrossRef]

- Miller, C.; Da Silva, C. Value chain financing in agriculture. Enterp. Dev. Microfinance 2007, 18, 95–108. [Google Scholar] [CrossRef]

- Zhang, X.; Jin, H. Financing constraints of listed agricultural companies, agricultural product processing output value, and supply chain finance. Finance Res. Lett. 2025, 86, 108455. [Google Scholar] [CrossRef]

- Komarek, A.M.; De Pinto, A.; Smith, V.H. A review of types of risks in agriculture: What we know and what we need to know. Agric. Syst. 2020, 178, 102738. [Google Scholar] [CrossRef]

- Miller, C.; Jones, L. Agricultural Value Chain Finance, 1st ed.; FAO and Practical Action Publishing: Rugby, UK, 2010; pp. 42–57. Available online: https://openknowledge.fao.org/handle/20.500.14283/i0846e (accessed on 1 November 2025).

- Wang, J.; Peng, X.; Du, Y.; Zhang, L. A tripartite evolutionary game research on information sharing of the subjects of agricultural product supply chain with a farmer cooperative as the core enterprise. Manag. Decis. Econ. 2022, 43, 159–177. [Google Scholar] [CrossRef]

- Yi, Z.; Wang, Y.; Chen, Y.J. Financing an agricultural supply chain with a capital-constrained smallholder farmer in developing economies. Prod. Oper. Manag. 2021, 30, 2102–2121. [Google Scholar] [CrossRef]

- Oberholster, C.; Adendorff, C.; Jonker, K. Financing agricultural production from a value chain perspective: Recent evidence from South Africa. Outlook Agric. 2015, 44, 49–60. [Google Scholar] [CrossRef]

- Swamy, V.; Dharani, M. Analyzing the agricultural value chain financing: Approaches and tools in India. Agric. Finance Rev. 2016, 76, 211–232. [Google Scholar] [CrossRef]

- Song, Y.N.; Zhao, W.; Yu, M.M. Agricultural industry chain growth and supply chain financial service innovation: Mechanism and case. Rural. Financ. Res. 2012, 3, 11–18. [Google Scholar] [CrossRef]

- Mou, W.M.; Wong, W.K.; McAleer, M. Financial credit risk evaluation based on core enterprise supply chains. Sustainability 2018, 10, 3699. [Google Scholar] [CrossRef]

- Froot, K.A.; Stein, J.C. Risk management, capital budgeting, and capital structure policy for financial institutions: An integrated approach. J. Financ. Econ. 1998, 47, 55–82. [Google Scholar] [CrossRef]

- Qiao, R.; Zhao, L. Reduce supply chain financing risks through supply chain integration: Dual approaches of alleviating information asymmetry and mitigating supply chain risks. J. Enterp. Inf. Manag. 2023, 36, 1533–1555. [Google Scholar] [CrossRef]

- Wu, C.F.; Fathi, M.; Chiang, D.M.; Pardalos, P.M. Credit guarantee mechanism with information asymmetry: A single sourcing model. Int. J. Prod. Res. 2020, 58, 4877–4893. [Google Scholar] [CrossRef]

- Yi, Z.; Chen, Y.; Luo, S.; Huang, H. Agricultural supply chain finance considering interest or direct subsidy by government. Transp. Res. Part E Logist. Transp. Rev. 2025, 195, 103992. [Google Scholar] [CrossRef]

- Ghadge, A.; Wurtmann, H.; Seuring, S. Managing climate change risks in global supply chains: A review and research agenda. Int. J. Prod. Res. 2020, 58, 44–64. [Google Scholar] [CrossRef]

- Wan, X.; Li, C. Asymmetric price volatility transmission in agricultural supply chains: Evidence from the Chinese pork market. Math. Probl. Eng. 2022, 2022, 4801898. [Google Scholar] [CrossRef]

- Ray, P. Agricultural supply chain risk management under price and demand uncertainty. Int. J. Syst. Dyn. Appl. 2021, 10, 17–32. [Google Scholar] [CrossRef]

- Kouvelis, P. OM forum—Supply chain finance redefined: A supply chain-centric viewpoint of working capital, hedging, and risk management. Manuf. Serv. Oper. Manag. 2023, 25, 2074–2084. [Google Scholar] [CrossRef]

- Boufounou, P.; Lathiras, N.; Toudas, K.; Kourkoumelis, N. Value-chain finance in Greek agriculture. Sustainability 2024, 16, 2922. [Google Scholar] [CrossRef]

- Xie, W.; He, J.; Huang, F.; Zhou, L. Operational risk assessment of commercial banks’ supply chain finance. Systems 2025, 13, 76. [Google Scholar] [CrossRef]

- Wuttke, D.A.; Blome, C.; Heese, H.S.; Henke, M. Supply chain finance: Optimal introduction and adoption decisions. Int. J. Prod. Econ. 2016, 178, 72–81. [Google Scholar] [CrossRef]

- Guo, S.; Niu, R.; Zhao, Y. Credit evaluation and rating system for farmers’ loans in the context of agricultural supply chain financing based on AHP-ELECTRE III. Agric. Econ. 2024, 70, 541–555. [Google Scholar] [CrossRef]

- Miller, T.; Cao, S.; Foth, M.; Thomas, M. An asset-backed decentralised finance instrument for food supply chains–A case study from the livestock export industry. Comput. Ind. 2023, 147, 103863. [Google Scholar] [CrossRef]

- Diamond, D.W.; Rajan, R.G. Liquidity risk, liquidity creation, and financial fragility: A theory of banking. J. Polit. Econ. 2001, 109, 287–327. [Google Scholar] [CrossRef]

- Balana, B.B.; Oyeyemi, M.A. Agricultural credit constraints in smallholder farming in developing countries: Evidence from Nigeria. World Dev. Sustain. 2022, 1, 100012. [Google Scholar] [CrossRef]

- Mayovets, Y.; Vdovenko, N.; Shevchuk, H.; Melnyk, I. Simulation modeling of the financial risk of bankruptcy of agricultural enterprises in the context of COVID-19. J. Hyg. Eng. Des. 2021, 36, 192–198. Available online: http://socrates.vsau.org/repository/getfile.php/30390.pdf (accessed on 2 November 2025).

- Bechtel, A.; Ranaldo, A.; Wrampelmeyer, J. Liquidity risk and funding cost. Rev. Finance 2023, 27, 399–422. [Google Scholar] [CrossRef]

- Risman, A.; Mulyana, B.; Silvatika, B.; Hapsari, D. The effect of digital finance on financial stability. Manag. Sci. Lett. 2021, 11, 1979–1984. [Google Scholar] [CrossRef]

- Acharya, V.V.; Bhadury, S.; Surti, J. Financial vulnerability and risks to growth in emerging markets. Indian Econ. J. 2025, 73, 18–56. [Google Scholar] [CrossRef]

- Pellegrino, R.; Costantino, N.; Tauro, D. Supply Chain Finance: A supply chain-oriented perspective to mitigate commodity risk and pricing volatility. J. Purch. Supply Manag. 2019, 25, 118–133. [Google Scholar] [CrossRef]

- Er Kara, M.; Ghadge, A. Bititci U S. Modelling the impact of climate change risk on supply chain performance. Int. J. Prod. Res. 2021, 59, 7317–7335. [Google Scholar] [CrossRef]

- Rezaei, E.E.; Webber, H.; Asseng, S.; Boote, K.; Durand, J.L.; Ewert, F.; Martre, P.; MacCarthy, D.S. Climate change impacts on crop yields. Nat. Rev. Earth Environ. 2023, 4, 831–846. [Google Scholar] [CrossRef]

- Paudel, D.; Neupane, R.C.; Sigdel, S.; Poudel, P.; Khanal, A.R. COVID-19 pandemic, climate change, and conflicts on agriculture: A trio of challenges to global food security. Sustainability 2023, 15, 8280. [Google Scholar] [CrossRef]

- Lumingkewas, C.F. The relationship effect of digital finance on financial stability. YUME J. Manag. 2024, 7, 158–166. [Google Scholar]

- Acemoglu, D.; Ozdaglar, A.; Tahbaz-Salehi, A. Systemic risk and stability in financial networks. Am. Econ. Rev. 2015, 105, 564–608. [Google Scholar] [CrossRef]

- Atanasova, C. How do firms choose between intermediary and supplier finance? Financ. Manag. 2012, 41, 207–228. [Google Scholar] [CrossRef]

- Burkart, M.; Ellingsen, T. In-kind Finance: A Theory of Trade Credit. Am. Econ. Rev. 2004, 94, 569–590. [Google Scholar] [CrossRef]

- Chen, F.Y.; Yano, C.A. Improving supply chain performance and managing risk under weather-related demand uncertainty. Manag. Sci. 2010, 56, 1380–1397. [Google Scholar] [CrossRef]

- Zhou, Y.S.; Da, Y.J.; Yu, Y. Analysis on the creative mode of “Internet + Agricultural Industry Chain”finance: An example of Nxin pig industry chain. Agric. Econ. Issues 2020, 01, 94–103. [Google Scholar] [CrossRef]

- Dev, N.K.; Shankar, R.; Swami, S. Diffusion of green products in Industry 4.0: Reverse logistics issues during design of inventory and production planning system. Int. J. Prod. Econ. 2020, 223, 107519. [Google Scholar] [CrossRef]

- Rodríguez-Espíndola, O.; Chowdhury, S.; Dey, P.K.; Bhattacharya, S. Analysis of the adoption of emergent technologies for risk management in the era of digital manufacturing. Technol. Forecast. Soc. Change 2022, 178, 121562. [Google Scholar] [CrossRef]

- Du, Y.; Xu, H.; Chen, Y. Digital empowerment and innovation in risk control strategies for fishery supply chain finance—A case study of Puhui Agriculture and Animal Husbandry Financing Guarantee Company Limited. Mar. Dev. 2024, 2, 1. [Google Scholar] [CrossRef]

- Yan, G.; Li, W.; Guo, T. Research on the evolutionary game path of three parties in technology finance from the perspective of project risk. In Applied Mathematics, Modeling and Computer Simulation; IOS Press: Amsterdam, The Netherlands, 2022; pp. 1005–1020. [Google Scholar] [CrossRef]

- Lin, Q.; Peng, Y. Incentive mechanism to prevent moral hazard in online supply chain finance. Electron. Commer. Res. 2021, 21, 571–598. [Google Scholar] [CrossRef]

- Zhang, S.; Fu, J.; Zhu, W.; Zhao, G.X.; Xu, S.W.; Zhang, B.Q. How does strategic deviation affect firm performance? The roles of financing constraints and institutional investors. Bus. Process Manag. J. 2024, 30, 1266–1296. [Google Scholar] [CrossRef]

- Zhang, J.; Mei, Z.; Zhang, F.; Li, H. An evolutionary game study on the cooperation behavior of the “government, banks, and guarantee institutions” in financing guarantee for China’s new agricultural entities. Front. Phys. 2023, 11, 1121374. [Google Scholar] [CrossRef]

- Jin, Q.; Dang, H.; Wang, H.; Liu, X. Exploring cooperative mechanisms in the Chinese agricultural value chain: A game model analysis based on leading enterprises and small farmers. Agriculture 2024, 14, 437. [Google Scholar] [CrossRef]

- Zhao, N.; Lv, D. Can joining the agricultural supply chain alleviate the problem of credit rationing for farmers? Agriculture 2023, 13, 1382. [Google Scholar] [CrossRef]

- Wang, J.; Liu, T.; Liu, Q.; Zhang, Y. Does trade credit facilitate high-quality development in agricultural enterprises? Insights from Chinese enterprises. Front. Sustain. Food Syst. 2024, 8, 1396739. [Google Scholar] [CrossRef]

- Simmons, P.; Winters, P.; Patrick, I. An analysis of contract farming in East Java, Bali, and Lombok, Indonesia. Agric. Econ. 2005, 33, 513–525. [Google Scholar] [CrossRef]

- Mpeku, F.N.; Urassa, J.K. Access to bank loans and smallholder farmers’ paddy productivity: A case of Mvomero District, Tanzania. Int. J. 2022, 15, 65–78. [Google Scholar] [CrossRef]

- Cao, W.; Tao, X. A study on the evolutionary game of the four-party agricultural product supply chain based on collaborative governance and sustainability. Sustainability 2025, 17, 1762. [Google Scholar] [CrossRef]

- Onyiriuba, L.; Okoro, E.U.O.; Ibe, G.I. Strategic government policies on agricultural financing in African emerging markets. Agric. Finance Rev. 2020, 80, 563–588. [Google Scholar] [CrossRef]

- Kong, R.; Turvey, C.G.; Channa, H.; Peng, Y.L. Factors affecting farmers’ participation in China’s group guarantee lending program. China Agric. Econ. Rev. 2015, 7, 45–64. [Google Scholar] [CrossRef]

- Zheng, T.; Zhao, G. The impact of policy-oriented agricultural insurance on China’s grain production resilience. Front. Sustain. Food Syst. 2025, 8, 1510953. [Google Scholar] [CrossRef]

| Variables | Meaning |

|---|---|

| Cooperative benefits earned by agricultural enterprises when providing loan guarantees | |

| Net operating income of agricultural enterprises when banks issue loan | |

| Net operating income of agricultural enterprises when banks do not issue loans | |

| Net operating income of farmers when banks issue loans | |

| Net operating income of farmers when banks do not issue loans | |

| Interest income of banks from lending to other low-risk projects | |

| Search cost incurred by agricultural enterprises when not providing guarantees | |

| Cost incurred by farmers to obtain loans without guarantees from agricultural enterprises | |

| Operational costs incurred by farmers due to default under guaranteed loan contracts | |

| Screening costs incurred by banks when enterprises do not provide guarantees and banks issue loans | |

| Penalty income received by agricultural enterprises when providing guarantees, banks issue loans, and farmers breach | |

| Initial funds owned by farmers | |

| Loan demand of farmers | |

| Interest rate on agricultural supply chain loan products |

| Agricultural Enterprises | Farmer | Bank | |

|---|---|---|---|

| Guarantee | Loan issuance | ||

| Non-loan issuance | |||

| Non-guarantee | Loan issuance | ||

| Non-loan issuance | |||

| Equilibrium Point | Eigenvalue | Signs of Real Parts | Stability Conclusion | ||

|---|---|---|---|---|---|

| (+, 0, −) | Instability | ||||

| (+, 0, ×) | Instability | ||||

| (+, −, +) | Instability | ||||

| (−, +, −) | Instability | ||||

| (−, −, +) | Instability | ||||

| (−, ×, +) | Instability | ||||

| (+, +, ×) | Instability | ||||

| (−, ×, −) | Undetermined | ||||

| Variable | ||||||||

|---|---|---|---|---|---|---|---|---|

| Value | 5 | 3.55 | 0.3 | 0.15 | 1.5 | 0.001 | 0.48 | 0.14 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, X.; Qiao, L.; Zhao, T.; Kou, C. Exploring Sustainable Agricultural Supply Chain Financing: Risk Sharing in Three-Party Game Theory. Sustainability 2025, 17, 10003. https://doi.org/10.3390/su172210003

Li X, Qiao L, Zhao T, Kou C. Exploring Sustainable Agricultural Supply Chain Financing: Risk Sharing in Three-Party Game Theory. Sustainability. 2025; 17(22):10003. https://doi.org/10.3390/su172210003

Chicago/Turabian StyleLi, Xiaoxuan, Lijuan Qiao, Tian Zhao, and Chunyu Kou. 2025. "Exploring Sustainable Agricultural Supply Chain Financing: Risk Sharing in Three-Party Game Theory" Sustainability 17, no. 22: 10003. https://doi.org/10.3390/su172210003

APA StyleLi, X., Qiao, L., Zhao, T., & Kou, C. (2025). Exploring Sustainable Agricultural Supply Chain Financing: Risk Sharing in Three-Party Game Theory. Sustainability, 17(22), 10003. https://doi.org/10.3390/su172210003