Synergizing Halal Compliance with Balanced Scorecard Approach: Implications for Supply Chain Performance in Indonesian Fried Chicken MSMEs

Abstract

1. Introduction

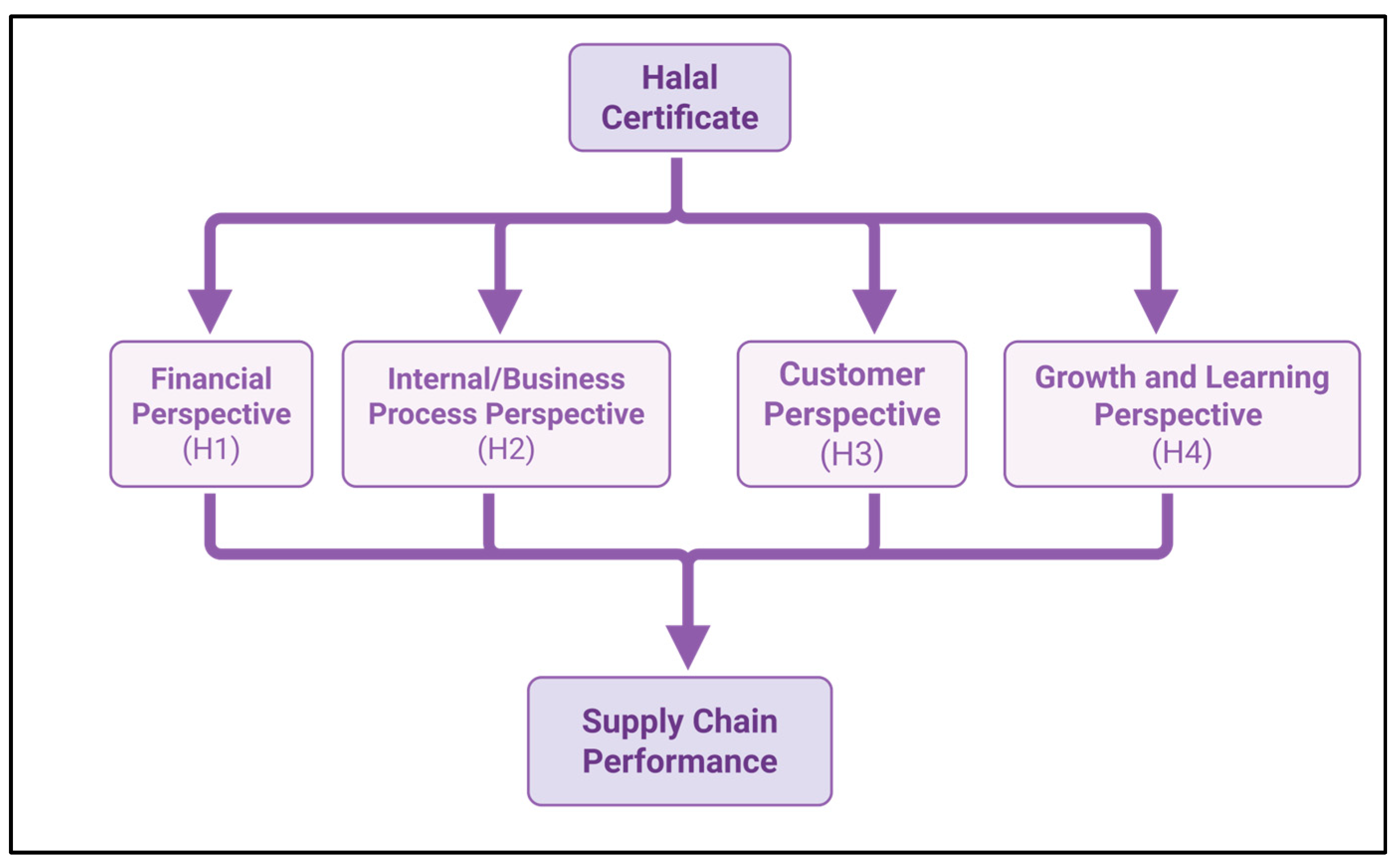

- RQ1: How can the BSC framework be adapted to incorporate halal compliance indicators in MSME supply chains?

- RQ2: Which BSC perspectives (financial, customer, internal business process, and growth) exert the most significant influence on SC performance in halal food MSMEs?

- RQ3: What are the practical implications of integrating halal compliance into the BSC framework for improving competitiveness and sustainability in MSMEs?

2. Theoretical Framework and Literature Review

2.1. Relationship Between Financial Perspective and Supply Chain Performance

2.2. Relationships Between Customer Perspective and Supply Chain Performance

2.3. Relationship Between Business/Internal Process Perspective and Supply Chain Performance

2.4. Relationship Between Growth Perspective and Supply Chain Performance

3. Materials and Methods

3.1. Research Design

3.2. Sampling

3.3. Measurement Scales

3.4. Instrumentation

4. Results

4.1. Financial Perspective (FP)

4.2. Customer Perspective (CP)

4.3. Business Process

4.4. Learning and Growth Perspective

4.5. Supply Chain

4.6. Common Method Variance (CMV)

4.7. Confirmatory Factor Analysis (CFA)

4.8. Structural Equation Modeling (SEM) Path Analysis

4.9. Connecting Customer Perspective (CP) to Supply Chain

4.10. Relationship Between Growth Perspective (GP) and Supply Chain

4.11. Relationship Between Business/Internal Process and Supply Chain

4.12. Relationship Between Financial Perspective (FP) and Supply Chain

4.13. Qualitative Insights

5. Discussion

6. Limitation

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Idris, P.S.R.P.H. Navigating Halal Certification Challenges in Japanese Restaurants: Insights and Strategies for Success. J. Halal Sci. Ind. Bus. 2024, 2, 1–14. [Google Scholar] [CrossRef]

- Oemar, H.; Prasetyaningsih, E.; Bakar, S.Z.A.; Djamaludin, D.; Septiani, A. Awareness and Intention to Register Halal Certification of Micro and Small-Scale Food Enterprises. F1000Research 2022, 11, 170. [Google Scholar] [CrossRef]

- Linh, N.T.; Trang, N.T. Using the Balanced Scorecard in the Vietnam Bank for Agriculture and Rural Development. Int. J. Innov. Res. Multidiscip. Educ. 2023, 2, 500–504. [Google Scholar] [CrossRef]

- Salindal, N.A. Halal Certification Compliance and Its Effects on Companies’ Innovative and Market Performance. J. Islam. Mark. 2019, 10, 589–605. [Google Scholar] [CrossRef]

- Nahidloh, S.; Qadariyah, L. Sharia Compliance as the Potential Factor for Halal Tourism Destination Development. Nusant. Halal J. 2021, 2, 16–23. [Google Scholar] [CrossRef]

- Samsi, S.Z.M.; Tasnim, R.; Ibrahim, O. Stakeholders’ Role for an Efficient Traceability System in Halal Industry Supply Chain. In Proceedings of the ERP-SCM Conference, Cebu, Philippines, 14–15 March 2011; pp. 14–15. Available online: https://www.researchgate.net/publication/269136432_Stakeholders’_Role_for_an_Efficient_Traceability_System_in_Halal_Industry_Supply_Chain (accessed on 13 October 2025). [CrossRef]

- Rahayu, E.S.; Mardiyani, S.A. Mapping the Halal, Safety, and Quality Food Industry for Micro and Small Enterprises in Pasuruan Regency. Glob. J. Al-Thaqafah 2023, 2023, 77–89. Available online: https://search.emarefa.net/en/detail/BIM-1618237-mapping-the-halal-safety-and-quality-food-industry-for-micro (accessed on 13 October 2025). [CrossRef]

- Haleem, A.; Khan, M.I.; Khan, S. Understanding the Adoption of Halal Logistics through Critical Success Factors and Stakeholder Objectives. Logistics 2021, 5, 38. [Google Scholar] [CrossRef]

- Giyanti, I.; Indrasari, A.; Sutopo, W.; Liquiddanu, E. Halal Standard Implementation in Food Manufacturing SMEs: Its Drivers and Impact on Performance. J. Islam. Mark. 2021, 12, 1577–1602. [Google Scholar] [CrossRef]

- Duong, N.H.; Ha, Q. The Links between Supply Chain Risk Management Practices, Supply Chain Integration and Supply Chain Performance in Southern Vietnam: A Moderation Effect of Supply Chain Social Sustainability. Cogent Bus. Manag. 2021, 8, 1999556. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 5th ed.; Free Press: New York, NY, USA, 2003; Available online: https://books.google.co.id/books?id=9U1K5LjUOwEC&printsec=frontcover&redir_esc=y#v=onepage&q&f=false (accessed on 1 November 2025).

- Mohammed, A.; Wang, Q.; Li, X. A Cost-Effective Decision-Making Algorithm for Integrity of HMSCs: A Multi-Objective Approach. In Proceedings of the 2015 IEEE 10th International Conference on Industrial and Information Systems (ICIIS 2015), Peradeniya, Sri Lanka, 18–20 December 2015; IEEE: Piscataway, NJ, USA, 2016; pp. 106–110. [Google Scholar] [CrossRef]

- Kurniawati, D.A. Balance Halal Food Supply Chain: A Mathematical Model Approach for Halal Food Supply Chain Sustainability. J. Sains Teknol. Ind. 2018, 16, 83–92. [Google Scholar] [CrossRef]

- Prihatmoko, C.; Kusbaryanto, K.; Hidayah, N. Cost Control Strategy in COVID-19 Pandemic Using Balanced Scorecard at Yogyakarta Islamic Hospital PDHI. Contagion 2023, 5, 1581–1592. [Google Scholar] [CrossRef]

- Tieman, M.; Van Der Vorst, J.G.A.J.; Ghazali, C.; Ghazali, M.C. Principles in Halal Supply Chain Management. J. Islam. Mark. 2012, 3, 217–243. [Google Scholar] [CrossRef]

- Widiarty, W.S. Legal Effectiveness in the Application of Halal Product Assurance Certification to MSME Business Actors According to Law Number 33 of 2014 Concerning Halal Product Assurance. J. Islamic Sci. Technol. 2024, 5, 2886–2895. [Google Scholar] [CrossRef]

- Mena, C.; Humphries, A.; Choi, T.Y. Toward a Theory of Multi-Tier Supply Chain Management. J. Supply Chain Manag. 2013, 49, 58–77. [Google Scholar] [CrossRef]

- Hashemi, S.M.; Handayanto, E.; Masudin, I.; Zulfikarijah, F.; Jihadi, M. The Effect of Supply Chain Integration, Management Commitment and Supply Chain Challenges on Non-Profit Organizations’ Performance: Empirical Evidence from Afghanistan. Cogent Bus. Manag. 2022, 9, 2143008. [Google Scholar] [CrossRef]

- Wetzel, P.; Hofmann, E. Supply Chain Finance, Financial Constraints and Corporate Performance: An Explorative Network Analysis and Future Research Agenda. Int. J. Prod. Econ. 2019, 216, 364–383. [Google Scholar] [CrossRef]

- Md Nawi, N.H.; Megat Ahmad, P.H.; Ibrahim, H.; Mohd Suki, N. Firms’ Commitment to Halal Standard Practices in the Food Sector: Impact of Knowledge and Attitude. J. Islam. Mark. 2023, 14, 1260–1275. [Google Scholar] [CrossRef]

- Mukhsin, M.; Najmudin, N. Effect on the Performance of Supply Chain Integration. In Proceedings of the 2nd International Seminar on Business, Economics, Social Science and Technology (ISBEST 2019), Tangerang Selatan, Indonesia, 23–24 October 2019; pp. 109–112. Available online: https://eprints.untirta.ac.id/13793/1/Effect%20on%20the%20Performance%20of%20Supply%20Chain.pdf (accessed on 1 November 2025).

- Mursid, A.; Wu, C.H.J. Halal Company Identity and Halal Restaurant Loyalty: The Role of Customer Satisfaction, Customer Trust and Customer-Company Identification. J. Islam. Mark. 2022, 13, 2521–2541. [Google Scholar] [CrossRef]

- Sadiyah, S.; Erawati, E. Effectiveness of Halal Traceability and Self-Declared Certification on Indonesian MSMEs Performance. Indones. J. Islam. Econ. Law 2024, 1, 72–90. [Google Scholar] [CrossRef]

- Jacobs, M.A.; Yu, W.; Chavez, R. The Effect of Internal Communication and Employee Satisfaction on Supply Chain Integration. Int. J. Prod. Econ. 2016, 171, 60–70. [Google Scholar] [CrossRef]

- Habtemariyam, T.N.; Kero, C.A. The Effect of Supply Chain Management on Competitive Advantage: Mediating Role of Supply Chain Responsiveness in Ethiopian Food Processing Industry. Int. J. Bus. Manag. 2022, 1, 1–33. [Google Scholar] [CrossRef]

- Zaid, M.; Farooqi, R.; Azmi, S.N. Driving Sustainable Supply Chain Performance through Digital Transformation: The Role of Information Exchange and Responsiveness. Cogent Bus. Manag. 2025, 12, 2443047. [Google Scholar] [CrossRef]

- Epoh, R.L.; Langton, I.; Mafini, C. A Model for Green Supply Chain Management in the South African Manufacturing Sector. Cogent Bus. Manag. 2024, 11, 2390213. [Google Scholar] [CrossRef]

- Oladele Ayodeji, P.I.; Emmanuel, O.O.; Olajiire, E.O. Impact of Total Quality Management on Organisational Performance. Int. J. Res. Commer. Manag. Stud. 2021, 3, 21–32. [Google Scholar] [CrossRef]

- Voak, A. Fake: The Rise of Food Fraud in the Halal Supply Chain. Nusant. Halal J. 2021, 2, 82–88. [Google Scholar] [CrossRef]

- Kinoti, W.; Barasa, P. Influence of Circular Supply Chain Practices on the Performance of Manufacturing Firms in Nairobi County, Kenya. Int. J. Supply Chain Manag. 2022, 7, 34–59. [Google Scholar] [CrossRef]

- Iyer, K.N.S. Demand Chain Collaboration and Operational Performance: Role of IT Analytic Capability and Environmental Uncertainty. J. Bus. Ind. Mark. 2011, 26, 81–91. [Google Scholar] [CrossRef]

- Mintah, B.O.; Owusu-Darko, I.; Apoenchir, H. The Perception of Teachers on Integration of Information and Communication Technology (ICT) into Mathematics Teaching and Learning. Eur. J. Educ. Pedagog. 2023, 4, 65–77. [Google Scholar] [CrossRef]

- Guetterman, T.C.; Babchuk, W.A.; Howell Smith, M.C.; Stevens, J. Contemporary Approaches to Mixed Methods–Grounded Theory Research: A Field-Based Analysis. J. Mix Methods Res. 2019, 13, 179–195. [Google Scholar] [CrossRef]

- Badan Pusat Statistik. Batu City in Figures 2023; BPS: Batu, Indonesia, 2023; Available online: https://batukota.bps.go.id/id/publication/2023/02/28/1308eb3612af549495d305fc/kota-batu-dalam-angka-2023.html (accessed on 1 November 2025).

- Guetterman, T.C.; Fetters, M.D.; Creswell, J.W. Integrating Quantitative and Qualitative Results in Health Science Mixed Methods Research through Joint Displays. Ann. Fam. Med. 2015, 13, 554–561. [Google Scholar] [CrossRef]

- Zailani, S.; Iranmanesh, M.; Jafarzadeh, S.; Foroughi, B. The Influence of Halal Orientation Strategy on Financial Performance of Halal Food Firms: Halal Culture as a Moderator. J. Islam. Mark. 2020, 11, 31–49. [Google Scholar] [CrossRef]

- Rubiyatno, R.; Theodorus, S. The Role of Operational Performance as a Mediator in the Influence of Supply Chain Management Practices on the Financial Performance of MSMEs. J. Bus. Appl. Manag. 2024, 17, 23–40. [Google Scholar] [CrossRef]

- Baabaker, L.M.; Ibrahim, N.; Saadallah, H.A.; Juma, M.A. The Impact of Supply Chain Strategy on the Financial Performance: A Case Study of a Manufacturing Company at Khartoum State. Arab J. Sci. Res. 2021, 5, 39–58. [Google Scholar] [CrossRef]

- Al-Ansi, A.; Olya, H.G.T.; Han, H. Effect of General Risk on Trust, Satisfaction, and Recommendation Intention for Halal Food. Int. J. Hosp. Manag. 2019, 83, 210–219. [Google Scholar] [CrossRef]

- Khawka, Z.M.H.; Rahman, A.A.; Sidek, S.B.; Ahmed, S.A.B.; Al-Hadeethi, R.H.F.; Al-Dabbagh, T. Effect of Lean Supply Chain on Competitive Advantage: A Systematic Literature Review. Cogent Bus. Manag. 2024, 11, 2370445. [Google Scholar] [CrossRef]

- Ademi, B.; Klungseth, N.J. Addressing Sustainability: Setting and Governing Sustainability Goals and Targets. In IOP Conference Series: Earth and Environmental Science; IOP Publishing Ltd.: Bristol, UK, 2023; Volume 1176, p. 012038. [Google Scholar] [CrossRef]

- Buhaya, M.I.; Metwally, A.B.M. Green Intellectual Capital and Green Supply Chain Performance: Do External Pressures Matter? Cogent Bus. Manag. 2024, 11, 2349276. [Google Scholar] [CrossRef]

- Khattak, M.N.; Zolin, R.; Muhammad, N. Linking Transformational Leadership and Continuous Improvement: The Mediating Role of Trust. Manag. Res. Rev. 2020, 43, 931–950. [Google Scholar] [CrossRef]

- Mutmainnah, D.; Yuniarsih, T.; Sojanah, J.; Rahayu, M.; Nusannas, I.S. The Impact of Directive Leadership on Innovative Work Behavior: The Mediation Role of Continuance Commitment. J. Indones. Econ. Bus. 2022, 37, 268–286. [Google Scholar] [CrossRef]

- Wang, L.; Zhang, D.; Liu, J.; Tang, Y.; Zhou, Q.; Lai, X.; Zheng, F.; Wang, Q.; Zhang, X.; Cheng, J. The Mediating Role of Incentives in Association between Leadership Attention and Self-Perceived Continuous Improvement in Infection Prevention and Control among Medical Staff: A Cross-Sectional Survey. Front. Public Health 2023, 11, 984847. [Google Scholar] [CrossRef]

- Haque, M.Z.; Islam, M.S.; Deb, S.K.; Islam, M.R. Strategic Value of Online Social Networks (OSNs) in Supply Chain Networks during COVID-19. Cogent Bus. Manag. 2022, 9, 2148336. [Google Scholar] [CrossRef]

- Pratikto, H.; Agustina, Y.; Kiranawati, T.M. The Influence of Various Factors on MSME Halal Certification Behavior: An Analysis with Intention as an Intervening Variable. Int. J. Prof. Bus. Rev. 2023, 8, 9. [Google Scholar] [CrossRef]

- Baumgartner, H.; Weijters, B. Dealing with Common Method Variance in International Marketing Research. J. Int. Mark. Res. 2021, 29, 215–230. [Google Scholar] [CrossRef]

- Heizer, J.; Render, B.; Munson, C. Operations Management: Sustainability and Supply Chain Management, 13th ed.; Pearson Education: Boston, MA, USA, 2023; Available online: https://9afi.com/storage/daftar/K2yp6Qajgf6cwQzvuzXoCG0WMhwlrSeNEKhbZClX.pdf (accessed on 1 November 2025).

- Alhuraish, I.; Robledo, C.; Kobi, A. The Key Success Factors for Lean Manufacturing versus Six Sigma. Res. J. Appl. Sci. Eng. Technol. 2016, 12, 169–182. [Google Scholar] [CrossRef]

- Kotler, P.; Keller, K.L. Marketing Management, 15th ed.; Pearson Education: London, UK, 2016; Available online: https://books.google.co.id/books/about/Marketing_Management.html?hl=id&id=UbfwtwEACAAJ&redir_esc=y (accessed on 1 November 2025).

- Jumeri, J.; Khosyani, M.A.F. Analysis of Halal Certification Renewal Service Quality and Their Effect on the Customer’s Satisfaction and Loyalty in Yogyakarta (Case Study in Meatball Stall). J. Food Pharm. Sci. 2021, 9, 372–383. [Google Scholar] [CrossRef]

- Herindar, E. Maqoshid Sharia and the Importance of Consuming Halal Food Products for Z Muslim Generation. Halal Res. J. 2022, 2, 77–95. [Google Scholar] [CrossRef]

- Jaiyeoba, H.B.; Abdullah, M.A.; Dzuljastri, A.R. Halal Certification Mark, Brand Quality, and Awareness: Do They Influence Buying Decisions of Nigerian Consumers? J. Islam. Mark. 2020, 11, 1657–1670. [Google Scholar] [CrossRef]

- Angela, I.; Triwijayati, A.; Adriana, E. The Influence of Customer Orientation on New Product Development with Moderating Environmental Factors on MSME in Tulungrejo Village, Batu City. J. Ekon. Bisnis Digit. 2023, 2, 981–996. Available online: https://pdfs.semanticscholar.org/9aeb/e1a543d356c1e37bbd4620a8a04bfff5e56f.pdf (accessed on 1 November 2025). [CrossRef]

- Marissa, S.; Fitriyah, F. The Influence of Financial Knowledge, Financial Attitude, Financial Behavior on the Growth of MSMEs with Financial Literacy as a Mediation Variable. MEC-J Manag. Econ. J. 2023, 7, 233–244. [Google Scholar] [CrossRef]

- Parast, M.M.; Subramanian, N. An Examination of the Effect of Supply Chain Disruption Risk Drivers on Organizational Performance: Evidence from Chinese Supply Chains. Supply Chain Manag. 2021, 26, 548–562. [Google Scholar] [CrossRef]

- Cui, L.; Wu, H.; Wu, L.; Kumar, A.; Tan, K.H. Investigating the Relationship between Digital Technologies, Supply Chain Integration and Firm Resilience in the Context of COVID-19. Ann. Oper. Res. 2023, 327, 825–853. [Google Scholar] [CrossRef]

- Riley, J.M.; Klein, R.; Miller, J.; Sridharan, V. How Internal Integration, Information Sharing, and Training Affect Supply Chain Risk Management Capabilities. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 953–980. [Google Scholar] [CrossRef]

- Yuzgenc, I.U.; Aydemir, E. Sustainable ERP Systems: A Green Perspective. In Proceedings of the International Conference on Pioneer and Innovative Studies, Konya, Turkey, 5–7 June 2023; Volume 1, pp. 533–538. [Google Scholar] [CrossRef]

- Lei, M.Q.; Ming, C.W. The Integration of Supply Chain and Digitalization: The Influence on SME’s Business Performance in Chengdu, Sichuan Province, China. J. Digit. Realism Mastery (DREAM) 2023, 2, 21–31. [Google Scholar] [CrossRef]

- Reynolds, S. Consumer Perceptions of Ethical Supply Chains and Their Effect on Brand Loyalty. Preprints 2024. Available online: https://www.preprints.org/manuscript/202406.1074 (accessed on 1 November 2025).

- Sahoo, S.; Yadav, S. Entrepreneurial Orientation of SMEs, Total Quality Management and Firm Performance. J. Manuf. Technol. Manag. 2017, 28, 892–912. [Google Scholar] [CrossRef]

- Rupilu, W.; Tanan, E.H.P.; Gah, T.N.P. Strengthening the Financial Aspects, Characteristics and Competencies of Entrepreneurship to Improve the Performance of MSMEs Managed by Women. In Proceedings of the International Conference on Applied Science and Technology on Social Science 2021 (iCAST-SS 2021), Samarinda, Indonesia, 23–24 October 2021; Atlantis Press: Dordrecht, The Netherlands, 2022; pp. 338–346. Available online: https://www.atlantis-press.com/proceedings/icast-ss-21/125971022 (accessed on 1 November 2025).

- Sulastri, H.; Disman, M.; Hendrayati, H. SMEs Resilience During the COVID-19 Pandemic: A Case Study in Indonesia. In Proceedings of the 5th Global Conference on Business, Management and Entrepreneurship (GCBME 2020), Bandung, Indonesia, 5 August 2020; pp. 727–731. [Google Scholar] [CrossRef]

- Hussain, K.; Wahab, E.; Zeb, A.; Khan, M.A.; Javaid, M.; Khan, M.A. Examining the Relationship between Learning Capabilities and Organizational Performance: The Mediating Role of Organizational Innovativeness. In Proceedings of the MUCET 2017—Malaysian Technical Universities Conference on Engineering and Technology, Penang, Malaysia, 6–7 December 2017. [Google Scholar]

- Ismail, R. Role and Challenges of Halal Supervisor on SMEs Halal Food Certification: A Case in Indonesia. Halal Food Stud. 2024, 1, 1. [Google Scholar] [CrossRef]

- Ismail, S.; Nazarudin, N.; Muhamad, M.Z. Governance of Halal Logistics Compliance. J. Contemp. Islam. Stud. 2022, 8, 1–20. Available online: https://www.researchgate.net/publication/366536558_Governance_of_Halal_Logistics_Compliance (accessed on 1 November 2025). [CrossRef]

- Najmi, A.; Ahmed, W.; Jahangir, S. Firm’s Readiness for Halal Food Standard Adoption: Assessing the Importance of Traceability System. J. Islam. Account. Bus. Res. 2023, 14, 1451–1473. [Google Scholar] [CrossRef]

- Santoso, S.; Alfarisah, S.; Fatmawati, A.A.; Ubaidillah, R. Correlation Analysis of the Halal Certification Process and Perceptions of the Cost of Halal Certification with the Intentions of Food and Beverage SMEs Actors. Relig. J. Stud. Agama-Agama Lintas Budaya 2021, 5, 297–308. [Google Scholar] [CrossRef]

- Ngah, A.H.; Zainuddin, Y.; Thurasamy, R. Barriers and Enablers in Adopting of Halal Warehousing. J. Islam. Mark. 2015, 6, 354–376. [Google Scholar] [CrossRef]

- Sarasi, V.; Yunizar; Satmoko, N.D. Evaluation of Halal Supply Chain Management’s Performance in Culinary Enterprises. Cogent Bus. Manag. 2025, 12, 2440128. [Google Scholar] [CrossRef]

- Al-Mahmood, O.A.; Fraser, A.M. Perceived Challenges in Implementing Halal Standards by Halal Certifying Bodies in the United States. PLoS ONE 2023, 18, e0290774. [Google Scholar] [CrossRef]

- Hew, J.J.; Wong, L.W.; Tan, G.W.H.; Ooi, K.B.; Lin, B. The Blockchain-Based Halal Traceability Systems: A Hype or Reality? Supply Chain Manag. 2020, 25, 863–879. [Google Scholar] [CrossRef]

- Setik, R.; Marjudi, S.; Raja Lope Ahmad, R.M.T.; Wan Hassan, W.A.; Kassim, A.A.M. Deriving Halal Transaction Compliance Using Weighted Compliance Scorecard (WCS). Int. J. Comput. Digit. Syst. 2023, 13, 1. [Google Scholar] [CrossRef] [PubMed]

- Khan, G.; Khan, F. “Is This Restaurant Halal?” Surrogate Indicators and Muslim Behaviour. J. Islam. Mark. 2020, 11, 1105–1123. [Google Scholar] [CrossRef]

- Talib, M.S.A.; Hamid, A.B.A. Motivations and Limitations in Implementing Halal Food Certification: A Pareto Analysis. Br. Food J. 2015, 117, 2664–2705. [Google Scholar] [CrossRef]

| Variables | Description |

|---|---|

| FP (Financial Perspective) | |

| FP 1: Break-Even Point (BEP) | Helps determine the minimum sales volume needed to cover total costs Useful for assessing financial feasibility and pricing strategies |

| FP 2: Revenue/Cost (R/C) | Measures profitability by comparing revenue against costs Indicates how efficiently business activity converts costs into revenue |

| FP 3: Return on Investment (ROI) | Evaluates the efficiency of an investment or compares the efficiency of multiple investments Often used to make informed decisions on capital allocation and resource optimization |

| FP 4: Profit Margin | Represents the percentage of profit a company earns from its sales A key metric for gauging financial health and operational efficiency |

| CP (Customer Perspective) | |

| CP1: Level of Market Share | Indicates competitive position and brand acceptance in the marketplace A higher market share typically correlates with stronger bargaining power and economies of scale |

| CP2: Value-Added Perception | Reflects how customers perceive the additional benefits or unique features of a product/service Directly influences willingness to pay and brand loyalty |

| CP3: Level of Customer Interaction on Processes | Captures how actively customers participate in or influence service/product design and delivery Greater customer involvement can lead to higher satisfaction and co-created value |

| CP4: Level of Customer Satisfaction | Measures how well a product/service meets or exceeds customer expectations Strongly influences customer loyalty, word-of-mouth, and repeat business |

| CP5: Customer Retention Strategies | Focuses on maintaining long-term relationships with existing customers, often more cost-effective than acquiring new ones Retention strategies (e.g., loyalty programs) directly impact profitability and brand reputation |

| BP (Business Perspective) | |

| BP1: Process Efficiency | Ensures resources (time, labor, materials) are used optimally, reducing waste and costs Drives operational excellence and consistent output quality |

| BP2: Response Time | Measures speed in addressing customer orders, market changes, or production issues Faster response times can lead to improved customer satisfaction and competitive advantage |

| BP3: Level of Flexibility | The ability to adapt to changes in demand, customization, or market conditions. High flexibility can mitigate risks and improve customer responsiveness |

| BP4: Level and Extension of Transparency | Involves open communication about processes, data, and performance across the supply chain Greater transparency builds trust among stakeholders and supports agile decision making |

| BP5: Level of Collaboration | Collaboration among SC partners leads to shared knowledge, reduced costs, and innovative solutions Cross-functional and cross-organizational teamwork is essential for synergy and alignment |

| BP6: Level of Waste Reduction | Reducing material, time, and energy waste contributes to lean operations and cost savings Essential for sustainable practices and process optimization |

| BP 7: Level and Extension of Proses Integration | Integration can streamline workflows, reduce duplication, and enable end-to-end visibility |

| GP (Growth Process) | |

| GP1: Adequacy and Extension of Technologies | Adopting advanced technologies (e.g., Industry 4.0, IoT) is crucial for productivity and competitiveness Reflects the organization’s capability to innovate and modernize |

| GP2: Adequacy of Infrastructure to New Technologies | Ensures existing physical and digital infrastructure can support modern systems and processes Reduces bottlenecks, downtimes, and ensures smooth integration of emerging technologies |

| GP3: Level of Integration (Information and Technologies) | Focuses on combining data, systems, and tech to streamline workflow and decision making High integration fosters real-time collaboration and agility in responding to market changes |

| GP4: Level of People Competencies | Human capital (skills, training, expertise) is key to implementing and sustaining growth initiatives Competent workforce ensures smooth adoption of new processes and tools |

| GP5: Level of Leadership Engagement | Leadership commitment drives cultural change, resource allocation, and continuous improvement Engaged leaders champion strategic objectives and influence organizational direction |

| Variables | Description |

|---|---|

| Raw Material Quality (SC1) | High-quality raw materials reduce defects and prevent downstream process failures Effective supplier selection and strict quality control minimize production costs and improve overall SC performance |

| Production Process (SC2) | An efficient and timely production process directly enhances overall SC efficiency Continuous improvement efforts help reduce costs, shorten production cycles, and maintain consistent product quality |

| Distribution and Storage (SC3) | Reliable distribution and storage ensure on-time delivery and product preservation Effective inventory management lowers logistics costs and reduces damage or spoilage risks |

| Improvement and Adaptation (SC4) | The ability to innovate and adapt (e.g., to changes in market demand or technology) enhance SC resilience Continuous process innovation and improved SC efficiency foster long-term competitive advantage |

| Quality and Customer Satisfaction (SC5) | Service quality and customer satisfaction are key indicators of SC success Measuring customer perceptions (e.g., using SERVQUAL) provides a benchmark for ongoing improvements in the supply chain |

| Product Competitiveness (SC6) | Product competitiveness reflects the ability to compete globally in terms of quality, cost, and innovation A well-integrated SC enables rapid and efficient response to market demand, thereby enhancing competitive advantage |

| Variable | Likert Score | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| FP2: R/C | 15 | 56 | 59 | 0 |

| FP3: ROI | 43 | 48 | 25 | 14 |

| FP4: Profit Margin | 94 | 29 | 6 | 1 |

| Variable | Likert Score | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| CP1: Level of Market Share | 0 | 14 | 74 | 42 |

| CP3: Level of Customer Interaction on Processes | 2 | 13 | 69 | 46 |

| CP4: Level of Customer Satisfaction | 2 | 26 | 80 | 22 |

| Variable | Likert Score | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| BP 1: Process Efficiency | 0 | 1 | 95 | 34 |

| BP 4: Level of Extension and Transparency | 25 | 15 | 51 | 39 |

| BP 5: Level of Collaboration | 1 | 23 | 78 | 28 |

| BP 7: Level Extension of Process Integration | 1 | 7 | 93 | 29 |

| Variable | Likert Score | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| LGP1: Adequacy and Extension of Technologies | 1 | 9 | 89 | 32 |

| LGP2: Adequacy of Infrastructure to the new technologies | 9 | 39 | 49 | 33 |

| LGP4: Level of People Competence | 5 | 28 | 64 | 33 |

| LGP5: Level of Leadership Engagement | 1 | 8 | 74 | 48 |

| Variable | Likert Score | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| CP1: Level of Market Share | 1 | 11 | 84 | 34 |

| CP2: Value-Added Perception | 2 | 15 | 82 | 31 |

| CP3: Level of Customer Interaction on Processes | 7 | 12 | 76 | 35 |

| CP4: Level of Customer Satisfaction | 2 | 14 | 74 | 40 |

| CP5: Customer Retention Strategies | 6 | 13 | 83 | 28 |

| Index | Observed Value | Threshold Criteria | Interpretation |

|---|---|---|---|

| GFI | 0.613 | ≥0.80 | Below threshold, poor fit |

| TLI | 0.800 | ≥0.90 | Below threshold, marginal fit |

| CFI | 0.821 | ≥0.90 | Below threshold, marginal fit |

| CMIN/df | 3.781 | ≤3.00 | Above threshold, poor fit |

| RMSEA | 0.147 | ≤0.08 | Above threshold, poor fit |

| Index | Initial Model | Threshold | Revised Model |

|---|---|---|---|

| GFI | 0.613 | ≥0.80 | 0.855 |

| TLI | 0.800 | ≥0.90 | 0.918 |

| CFI | 0.821 | ≥0.90 | 0.934 |

| CMIN/df | 3.781 | ≤3.00 | 1.535 |

| RMSEA | 0.147 | ≤0.08 | 0.064 |

| Path | Coeff. | p-Value | Interpretation |

|---|---|---|---|

| SC ← CP | 0.496 | p < 0.001 | Significant |

| SC ← GP | 0.803 | 0.417 | Large coefficient but not sig. (p > 0.05) |

| SC ← BP | −0.511 | 0.608 | Negative, non-significant |

| SC ← FP | 0.114 | 0.365 | Positive, non-significant |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Akhiroh, P.; Utami, H.D.; Al Awwaly, K.U.; Febrianto, N.; Hartono, B. Synergizing Halal Compliance with Balanced Scorecard Approach: Implications for Supply Chain Performance in Indonesian Fried Chicken MSMEs. Sustainability 2025, 17, 9814. https://doi.org/10.3390/su17219814

Akhiroh P, Utami HD, Al Awwaly KU, Febrianto N, Hartono B. Synergizing Halal Compliance with Balanced Scorecard Approach: Implications for Supply Chain Performance in Indonesian Fried Chicken MSMEs. Sustainability. 2025; 17(21):9814. https://doi.org/10.3390/su17219814

Chicago/Turabian StyleAkhiroh, Puji, Hari Dwi Utami, Khothibul Umam Al Awwaly, Nanang Febrianto, and Budi Hartono. 2025. "Synergizing Halal Compliance with Balanced Scorecard Approach: Implications for Supply Chain Performance in Indonesian Fried Chicken MSMEs" Sustainability 17, no. 21: 9814. https://doi.org/10.3390/su17219814

APA StyleAkhiroh, P., Utami, H. D., Al Awwaly, K. U., Febrianto, N., & Hartono, B. (2025). Synergizing Halal Compliance with Balanced Scorecard Approach: Implications for Supply Chain Performance in Indonesian Fried Chicken MSMEs. Sustainability, 17(21), 9814. https://doi.org/10.3390/su17219814