Can Green Credit Interest Subsidy Policy Promote Corporate Green Innovation?—From the Perspective of Fiscal and Financial Policy Coordination

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

2.1. Literature Review

2.2. Hypotheses Development

2.2.1. GCISP and Corporate Green Innovation

2.2.2. GCISP, Liquidity Constraints and Corporate Green Innovation

2.2.3. GCISP, Agency Costs and Corporate Green Innovation

2.2.4. GCISP, “Greenwashing” Behavior and Corporate Green Innovation

2.2.5. GCISP, “Rent-Seeking” Behavior and Corporate Green Innovation

3. Research Design

3.1. Data Sources

3.2. Model Design

3.3. Main Variables

3.3.1. Corporate Green Innovation

3.3.2. GCISP

3.3.3. Control Variables

4. Main Results

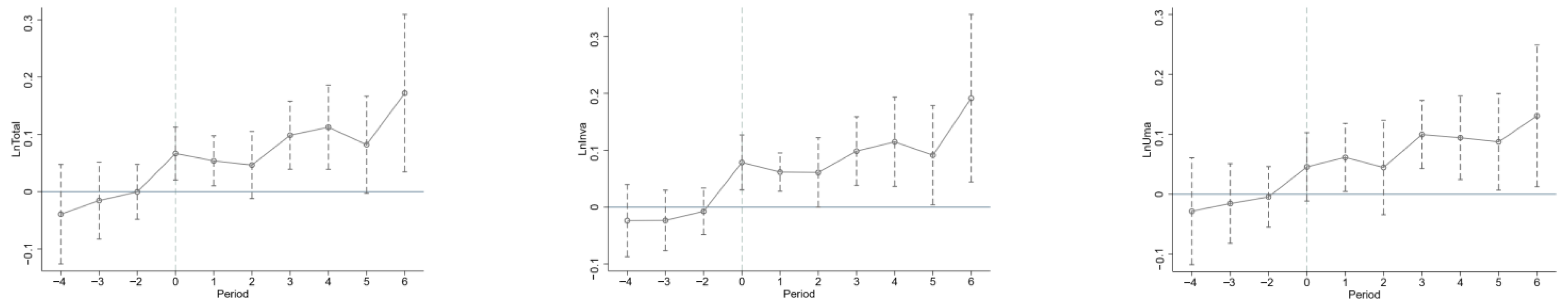

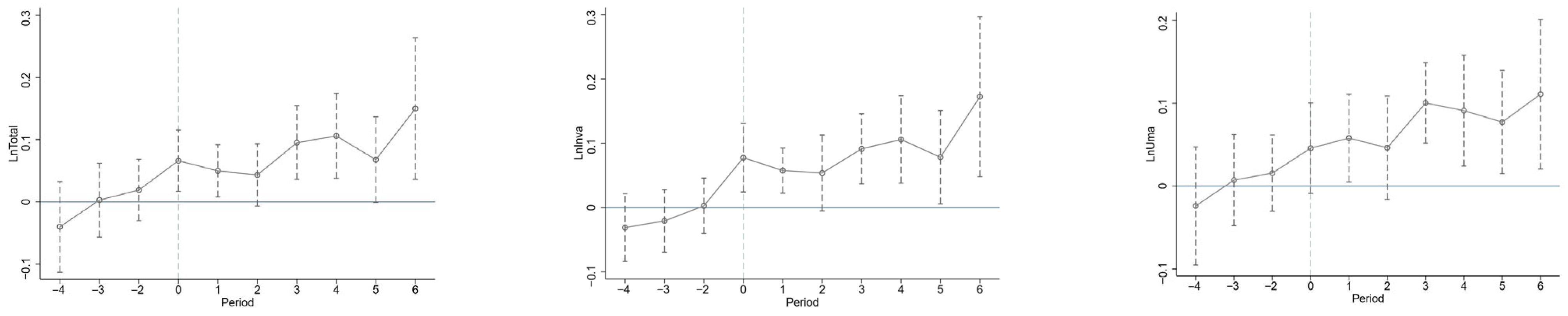

4.1. Parallel Trends Assumption Test

4.2. Baseline Regression Results

4.3. Robustness Tests

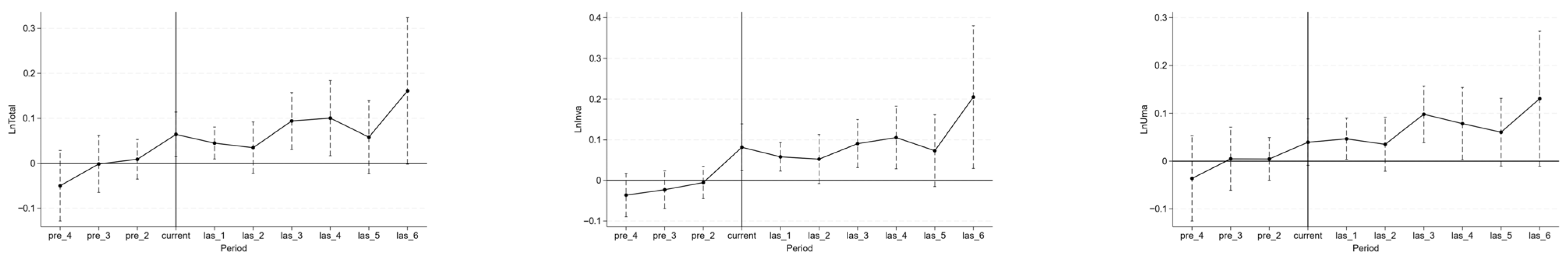

4.3.1. Parallel Trends Sensitivity Analysis

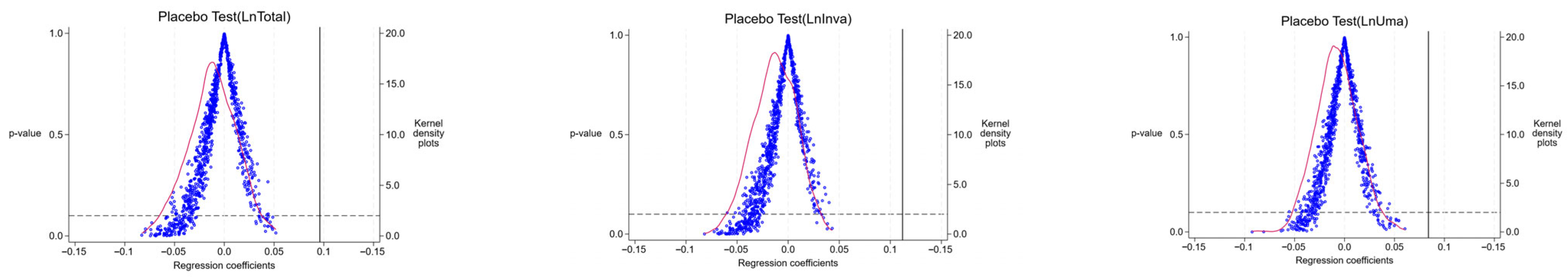

4.3.2. Placebo Test

4.3.3. Propensity Score Matching

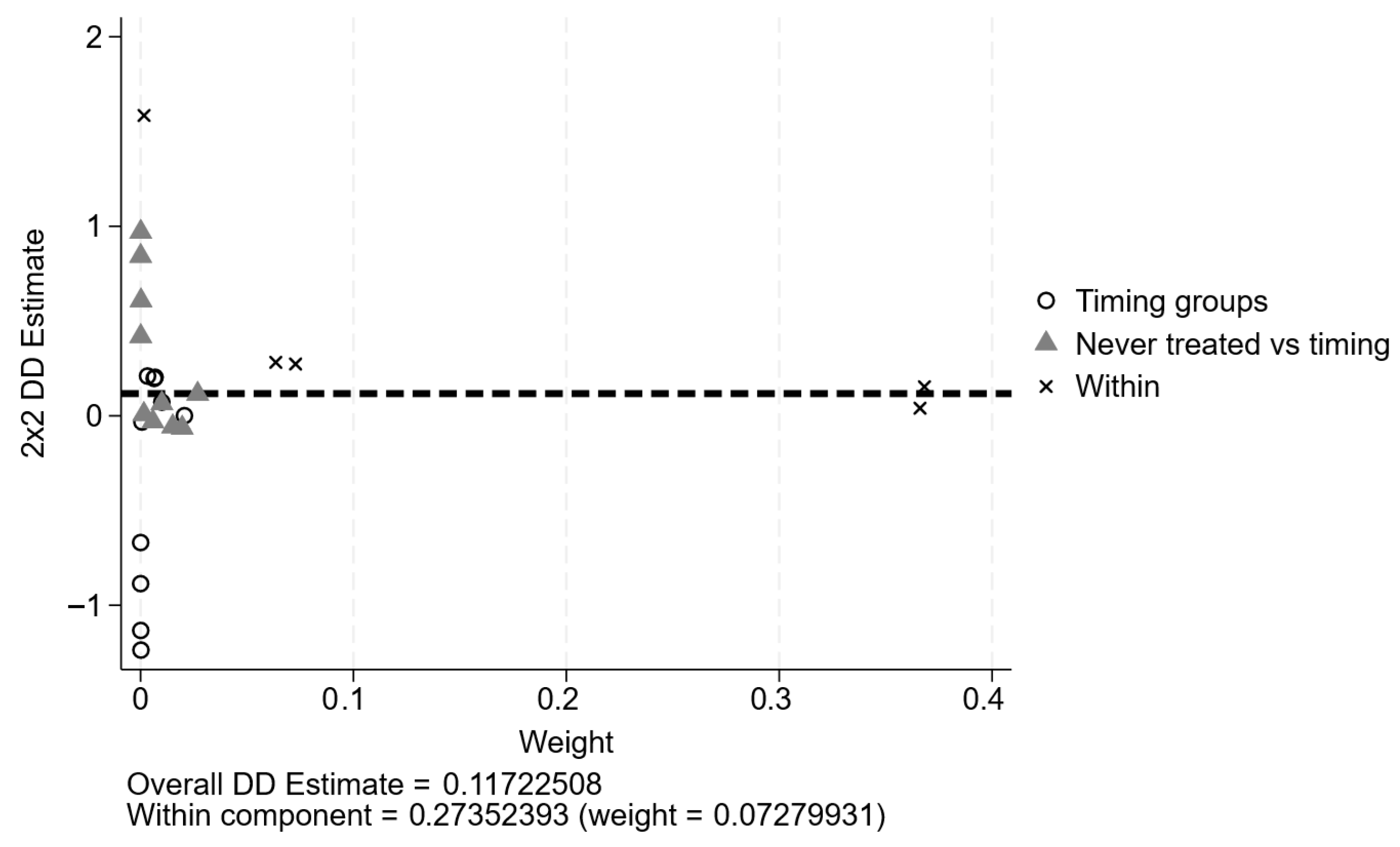

4.3.4. Treatment Effect Heterogeneity Test and Analysis

4.3.5. Replacing the Dependent Variable

4.3.6. Replacing the Explanatory Variable

4.3.7. Alternative Regression Models

4.3.8. Instrumental Variable Regression

4.3.9. Excluding Patent Standard Changes and Direct-Controlled Municipalities

4.3.10. Excluding Competing Policy Interferences

5. Mechanism and Heterogeneity Analysis

5.1. Analysis of the Mechanism Through Which GCISP Promotes Green Innovation

5.1.1. Examination of the Mediation Effect Based on Corporate Liquidity Constraints

5.1.2. Examination of the Mediation Effect Based on Corporate Agency Costs

5.1.3. Analysis of the Moderating Effect Based on Corporate Greenwashing Behavior

5.1.4. Analysis of the Moderating Effect Based on Corporate Rent-Seeking Behavior

5.2. Heterogeneity Analysis of the Green Innovation-Enhancing Effects of GCISP

5.2.1. Heterogeneity Analysis Based on Environmental Regulation Intensity

5.2.2. Heterogeneity Analysis Based on Digitalization Level

5.2.3. Heterogeneity Analysis Based on the Strength of Intellectual Property Rights Protection

5.2.4. Heterogeneity Analysis Based on the Supply Chain Bargaining Power

6. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhao, L.; Zhang, L.; Sun, J.; He, P. Can public participation constraints promote green technological innovation of Chinese enterprises? The moderating role of government environmental regulatory enforcement. Technol. Forecast. Soc. Chang. 2022, 174, 121198. [Google Scholar] [CrossRef]

- Du, Y.; Guo, Q. Green credit policy and green innovation in green industries: Does climate policy uncertainty matter? Financ. Res. Lett. 2023, 58, 104512. [Google Scholar] [CrossRef]

- Deng, F.; Mao, Z. The asymmetric impact of ambidextrous innovation on labor income share. East China Econ. Manag. 2024, 38, 83–95. [Google Scholar] [CrossRef]

- Liu, G.; Fang, Y.; Qian, H.; Ding, Z.; Zhang, A.; Zhang, S. Incentive or catering effect of environmental subsidies? Evidence from ESG reports on greenwashing. Int. Rev. Financ. Anal. 2025, 103, 104242. [Google Scholar] [CrossRef]

- Yang, W.; Lin, J. Can green credit promote green innovation quality of heavily polluting industries? Appl. Econ. 2025, 1–16. [Google Scholar] [CrossRef]

- Cao, H.; Zhang, S.; Ouyang, Y. Innovation policy and the innovation quality of specialized and sophisticated SMEs that produce novel and unique products. China Ind. Econ. 2022, 11, 135–154. Available online: https://www.chndoi.org/Resolution/Handler?doi=10.19581/j.cnki.ciejournal.2022.11.012 (accessed on 31 October 2024).

- Daga, S.; Yadav, K.; Singh, D.; Pamucar, D.; Simic, V. Unveiling greenwashing: Analyzing the interaction of factors discouraging ESG greenwashing through TISM and MICMAC. J. Environ. Manag. 2025, 380, 124850. [Google Scholar] [CrossRef]

- Huang, Z.; Gao, N.; Jia, M. Green credit and its obstacles: Evidence from China’s green credit guidelines. J. Corp. Finance. 2023, 82, 102441. [Google Scholar] [CrossRef]

- Hong, X.; Lin, X.; Chen, L. Incentive effect of green loan interest subsidies policy: From the perspective of coordination of fiscal and financial policies. China Ind. Econ. 2023, 9, 80–97. Available online: https://www.chndoi.org/Resolution/Handler?doi=10.19581/j.cnki.ciejournal.2023.09.005 (accessed on 31 October 2024).

- Li, X.; Wang, S.; Lu, X.; Guo, F. Quantity or quality? The effect of green finance on enterprise green technology innovation. Eur. J. Innov. Manag. 2025, 28, 1114–1140. [Google Scholar] [CrossRef]

- Yu, C.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy. 2021, 153, 112255. [Google Scholar] [CrossRef]

- Irfan, M.; Razzaq, A.; Sharif, A.; Yang, X. Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol. Forecast. Soc. Chang. 2022, 182, 121882. [Google Scholar] [CrossRef]

- Liu, J.; Long, F.; Chen, L.; Li, L.; Zheng, L.; Mi, Z. Exploratory or exploitative green innovation? The role of different green fiscal policies in motivating innovation. Technovation 2025, 143, 103207. [Google Scholar] [CrossRef]

- Wang, G. Research on the Influence of Environmental Regulation on Enterprise Green Innovation Performance. Earth Environ. Sci. 2021, 647, 012179. Available online: https://iopscience.iop.org/article/10.1088/1755-1315/647/1/012179 (accessed on 31 October 2024). [CrossRef]

- Yin, H.; Zhang, L.; Cai, C.; Zhang, Z.; Zhu, Q. Fiscal & tax incentives, ESG responsibility fulfillments, and corporate green innovation performance. Int. Rev. Econ. Financ. 2025, 98, 103838. [Google Scholar] [CrossRef]

- Wang, X.; Wang, C.; Xue, L. Co-evolution of regional integration and green innovation under two-layer network. Energy Environ. 2025, 36, 565–591. Available online: https://EconPapers.repec.org/RePEc:sae:engenv:v:36:y:2025:i:2:p:565-591 (accessed on 31 October 2024). [CrossRef]

- Yu, P.; Zeng, L. The impact of consumer environmental preferences on the green technological innovation of chinese listed companies. Sustainability 2024, 16, 2951. [Google Scholar] [CrossRef]

- Chen, Z.; Zuo, W.; Xie, G. How does institutional investor preference influence corporate green innovation in China? Eur. J. Finance. 2023, 30, 1239–1269. [Google Scholar] [CrossRef]

- Zhang, D. Can digital finance empowerment reduce extreme ESG hypocrisy resistance to improve green innovation? Energy Econ. 2023, 125, 106756. [Google Scholar] [CrossRef]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- Ji, H.; Yu, Z.; Tian, G.; Wang, H. Market competition, environmental, social and corporate governance investment, and enterprise green innovation performance. Financ. Res. Lett. 2025, 77, 107057. [Google Scholar] [CrossRef]

- Guo, Y.; Fan, L.; Yuan, X. Market competition, financialization, and green innovation: Evidence from China’s manufacturing industries. Front. Environ. Sci. 2022, 10, 836019. [Google Scholar] [CrossRef]

- Hu, M.; Sima, Z.; Chen, S.; Huang, M. Does green finance promote low-carbon economic transition? J. Clean. Prod. 2023, 427, 139231. [Google Scholar] [CrossRef]

- Li, L.; Gan, Y.; Bi, S.; Fu, H. Substantive or strategic? Unveiling the green innovation effects of pilot policy promoting the integration of technology and finance. Int. Rev. Financ. Anal. 2025, 97, 103781. [Google Scholar] [CrossRef]

- Zhou, K.; Wang, Q.; Tang, J. Evolutionary game and simulation analysis of enterprise’s green technology innovation under green credit policy: Evidence from China. Technol. Anal. Strateg. Manag. 2024, 36, 1551–1570. [Google Scholar] [CrossRef]

- Huang, H.; Qi, B. Green innovation effects of corporate information disclosure: Environmental, social, and governance perspectives. Ind. Econ. Res. 2024, 1, 71–84. [Google Scholar] [CrossRef]

- Huang, Z.; Liao, G.; Li, Z. Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Chang. 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Wu, X.; Fan, Z.; Cao, B. Cost-Sharing strategy for carbon emission reduction and sales effort: A nash game with government subsidy. J. Ind. Manag. Optim. 2020, 16, 1999–2027. Available online: https://www.aimsciences.org/article/doi/10.3934/jimo.2019040 (accessed on 31 October 2024). [CrossRef]

- Li, X.; Wu, M.; Shi, C.; Chen, Y. Impacts of green credit policies and information asymmetry: From market perspective. Resour. Policy. 2023, 81, 103395. [Google Scholar] [CrossRef]

- He, J.; Xue, H.; Yang, W.; Zhong, Y.; Fan, B. Green credit policy and corporate green innovation. Int. Rev. Econ. Financ. 2025, 99, 104031. [Google Scholar] [CrossRef]

- Feldman, M.; Kelley, M. The ex ante assessment of knowledge spillovers: Government R&D policy, economic incentives and private firm behavior. Res. Policy. 2006, 35, 1509–1521. [Google Scholar] [CrossRef]

- Li, G.; Shi, X.; Yang, Y.; Lee, P. Green co-creation strategies among supply chain partners: A value co-creation perspective. Sustainability 2020, 12, 4305. [Google Scholar] [CrossRef]

- Jiang, G.; Lu, J.; Li, W. Do green investors play a role? Empirical research on firms’ participation in green governance. J. Financ. Res. 2021, 5, 117–134. Available online: http://www.jryj.org.cn/EN/Y2021/V491/I5/117 (accessed on 31 October 2024).

- Lu, L.; Wang, M.; Xu, J. How to keep investors’ confidence after being labeled as polluting firms: The role of external political ties and internal green innovation capabilities. Sustainability 2023, 15, 13167. [Google Scholar] [CrossRef]

- Liu, S.; Qian, J.; Wen, H.; Wang, Y. The impact of green finance pilot cities on enterprises’ green innovation performance: An empirical study in china. Sustainability 2025, 17, 948. [Google Scholar] [CrossRef]

- Ehigiamusoe, K.U.; Lee, C.C.; Lean, H.H. Analysis of the economic and environmental imperatives of the service sector: The role of government in promoting sustainable development. J. Environ. Manag. 2023, 376, 124470. [Google Scholar] [CrossRef]

- Shi, J.; Li, J.; Jiang, S.; Liu, Y.; Yin, X. Does green finance facilitate the upgrading of green export quality? Evidence from china’s green loan interest subsidies policy. Sustainability 2025, 17, 4375. [Google Scholar] [CrossRef]

- Xi, B.; Wang, Y.; Yang, M. Green credit, green reputation, and corporate financial performance: Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 2401–2419. [Google Scholar] [CrossRef]

- Luo, S.; Yu, S.; Zhou, G. Does green credit improve the core competence of commercial banks? Based on quasi-natural experiments in China. Energy Econ. 2021, 100, 105335. [Google Scholar] [CrossRef]

- Chen, X.; Xu, H.; Anwar, S. Bank Competition, Government interest in green initiatives and carbon emissions reduction: An empirical analysis using city-level data from China. N. Am. J. Econ. Financ. 2024, 72, 102144. [Google Scholar] [CrossRef]

- Liu, Y.; Huang, H.; Mbanyele, W.; Wei, Z.; Li, X. How does green industrial policy affect corporate green innovation? Evidence from the green factory identification in China. Energy Econ. 2025, 141, 108047. [Google Scholar] [CrossRef]

- Li, B.; Tang, K. Green credit policy and bankruptcy risk of heavily polluting enterprises. Financ. Res. Lett. 2024, 67, 105897. [Google Scholar] [CrossRef]

- Zhang, G.; Song, F.; Liu, X. The impact and mechanism analysis of bank digital transformation on green credit. Financ. Res. Lett. 2025, 85, 108113. [Google Scholar] [CrossRef]

- Fang, C.; Wang, Z.; Zhao, L. Environmental regulations and the greenwashing of corporate ESG reports. Econ. Anal. Policy. 2025, 87, 1469–1481. [Google Scholar] [CrossRef]

- Cremers, M.; Pareek, A.; Sautner, Z. Short-Term investors, long-term investments, and firm value: Evidence from Russell 2000 index inclusions. Manag. Sci. 2020, 66, 4535–4551. [Google Scholar] [CrossRef]

- Qian, S.; Yang, Z.; Fang, X. Bank fintech and corporate green transformation quality improvement: Based on greenwashing governance perspective. Econ. Anal. Policy. 2025, 87, 401–423. [Google Scholar] [CrossRef]

- Quan, X.; Zhang, K.; Zhong, R.; Zhu, Y. Political corruption and green innovation. Pac.-Bas. Finance J. 2023, 82, 102169. [Google Scholar] [CrossRef]

- Nie, S. Does intellectual property rights protection matter for low-carbon transition? The role of institutional incentives. Econ. Model. 2024, 140, 106842. [Google Scholar] [CrossRef]

- Liu, C.; Song, Y.; Zhang, M.; Chen, S. Enterprise carbon emission reduction effects of the green loan interest subsidy policy: Evidence of city-level spatial spillovers. Environ. Impact Assess. Rev. 2025, 114, 107954. [Google Scholar] [CrossRef]

- Zhang, S.; Jin, R.; Xie, M.; Xu, L. Environmental policy and corporate green innovation: The role of penalties, taxes, and subsidies in China. J. Environ. Manag. 2025, 392, 126730. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Bertrand, M.; Mullainathan, S. Enjoying the Quiet Life? Corporate Governance and Managerial Preferences. J. Polit. Econ. 2003, 111, 1043–1075. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Y. Research on green credit policy promoting green innovation. J. Manag. World 2021, 37, 173–188. [Google Scholar] [CrossRef]

- Duchin, R.; Ozbas, O.; Sensoy, B.A. Costly external finance, corporate investment, and the subprime mortgage credit crisis. J. Financ. Econ. 2010, 97, 418–435. [Google Scholar] [CrossRef]

- Jacobson, L.S.; Lalonde, R.J.; Sullivan, D.G. Earnings Losses of Displaced Workers. Am. Econ. Rev. 1993, 83, 685–709. Available online: http://www.jstor.org/stable/2117574 (accessed on 31 October 2024).

- Kahn-Lang, A.; Lang, K. The promise and pitfalls of differences-in-differences: Reflections on 16 and pregnant and other applications. J. Bus. Econ. Stat. 2019, 38, 613–620. [Google Scholar] [CrossRef]

- Roth, J.; Sant’Anna, P.H.; Bilinski, A.; Poe, J. What’s trending in difference-In-differences? a synthesis of the recent econometrics literature. J. Econom. 2023, 235, 2218–2244. [Google Scholar] [CrossRef]

- Xu, W.; Sun, L. Market-Incentive Environmental Regulation and Energy Consumption Structure Transformation: Evidence from China’s Carbon Emission Trading Pilot. J. Quant. Tech. Econ. 2023, 40, 133–155. [Google Scholar]

- Biasi, B.; Sarsons, H. Flexible Wages, Bargaining, and the Gender Gap. Q. J. Econ. 2022, 137, 215–266. [Google Scholar] [CrossRef]

- Goodman-Bacon, A. Difference-in-differences with variation in treatment timing. J. Econom. 2021, 225, 254–277. [Google Scholar] [CrossRef]

- de Chaisemartin, C.; D’Haultfoeuille, X. Two-Way fixed effects estimators with heterogeneous treatment effects. Am. Econ. Rev. 2020, 110, 2964–2996. Available online: https://www.aeaweb.org/articles?id=10.1257/aer.20181169 (accessed on 31 October 2024). [CrossRef]

- Sun, L.; Abraham, S. Estimating dynamic treatment effects in event studies with heterogeneous treatment effects. J. Econom. 2021, 225, 175–199. [Google Scholar] [CrossRef]

- Liu, L.; Wang, Y.; Xu, Y. A practical guide to counterfactual estimators for causal inference with time-series cross-sectional data. Am. J. Polit. Sci. 2024, 68, 160–176. [Google Scholar] [CrossRef]

- Cengiz, D.; Dube, A.; Lindner, A.; Zipperer, B. The effect of minimum wages on low-wage Jobs. Q. J. Econ. 2019, 134, 1405–1454. [Google Scholar] [CrossRef]

- Tao, A.; Wong, C.; Zhong, S.; Kuo, P. Does enterprise digital transformation contribute to green innovation? Micro-level evidence from China. J. Environ. Manage. 2024, 370, 122609. [Google Scholar] [CrossRef]

- Fan, X.; Wang, Z.; Wu, S.; Li, K. Environmental investment and green innovation in polluting enterprises: Evidence from heavily polluting listed firms in China. J. Environ. Manage. 2025, 393, 127177. [Google Scholar] [CrossRef]

- Dai, K.; Wang, S.; Huang, Z. Does the Construction of Green Factory Induce Green Innovation? J. Quant. Tech. Econ. 2024, 41, 177–199. [Google Scholar]

- Zhang, D. Does green finance really inhibit extreme hypocritical ESG risk? A greenwashing perspective exploration. Energy Econ. 2023, 121, 106688. [Google Scholar] [CrossRef]

- Hu, X.; Hua, R.; Liu, Q.; Wang, C. The green fog: Environmental rating disagreement and corporate greenwashing. Pac.-Bas. Finance J. 2023, 35, 1509–1521. [Google Scholar] [CrossRef]

- Hoberg, G.; Lewis, C. Do fraudulent firms produce abnormal disclosure? J. Corp. Finance. 2017, 43, 58–85. [Google Scholar] [CrossRef]

- Wang, Z.; Liu, X.; Kong, X.; Zhou, J. Corporate political connection, rent seeking and government procurement order. Int. Rev. Econ. Financ. 2025, 103, 104354. [Google Scholar] [CrossRef]

- Yang, B.; Yue, L. Green finance reform, environmental regulation, and regional green and low-carbon development. Financ. Res. Lett. 2025, 85, 108104. [Google Scholar] [CrossRef]

- Hoque, M.; Sang-Joon, L. How digital transformation drives green innovation: An empirical study. J. Clean. Prod. 2025, 522, 146236. [Google Scholar] [CrossRef]

- Zhu, X.; Chen, H.; Xiang, E.; Qi, Y. Digital transformation and corporate green technology transfer: The moderating effect of executive green cognition. Financ. Res. Lett. 2025, 76, 107035. [Google Scholar] [CrossRef]

- Tu, Y.; Hu, L.; Hua, X. Supply chain stability and corporate green technology innovation. Int. Rev. Econ. Financ. 2025, 97, 103769. [Google Scholar] [CrossRef]

- Liu, M.; Xu, K.; Zhai, L. Bank-firm common ownership, green credit and enterprise green technology innovation: Evidence from Chinese credit markets. Energy Econ. 2024, 140, 108014. [Google Scholar] [CrossRef]

- Song, Y.; Gao, W.; Lee, C.-C. Does China’s green credit interest subsidies policy promote enterprises’ green technology innovation quality? Based on the perspective of financial and fiscal coordination. J. Environ. Manag. 2025, 390, 126366. [Google Scholar] [CrossRef]

| Variables | Definition | Mean | S.D. | Min | Max |

|---|---|---|---|---|---|

| LnTotal | Green patent applications are log-transformed after adding 1 | 0.902 | 1.257 | 0.000 | 7.659 |

| LnInva | Green invention patent applications are log-transformed after adding 1 | 0.609 | 1.046 | 0.000 | 7.168 |

| LnUma | Green utility model patent applications are log-transformed after adding 1 | 0.614 | 1.010 | 0.000 | 6.714 |

| TobinQ | Total market value divided by total assets | 2.026 | 1.370 | 0.611 | 31.400 |

| Lev | Total liabilities divided by total assets | 0.422 | 0.194 | 0.008 | 0.994 |

| Top1 | Shareholding percentage of the largest shareholder | 34.091 | 14.832 | 1.840 | 89.990 |

| Dual | Equals 1 if chairman serves concurrently as general manager | 0.281 | 0.450 | 0.000 | 1.000 |

| Size | Log-transformed total assets | 22.366 | 1.316 | 18.902 | 28.697 |

| Growth | Current year revenue divided by prior year revenue minus 1 | 0.443 | 6.977 | −11.683 | 922.348 |

| Size2 | Log-transformed number of employees | 7.794 | 1.250 | 2.197 | 13.464 |

| Turnover | Revenue divided by total assets | 0.633 | 0.519 | −0.058 | 12.105 |

| Dovmon | Log-transformed subnational fiscal revenue | 17.654 | 0.753 | 12.615 | 18.765 |

| PGDP | Log-transformed regional GDP | 10.673 | 0.755 | 6.090 | 11.818 |

| IS | Secondary industry share of GDP | 40.250 | 9.374 | 14.900 | 59.000 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.096 ** | 0.112 *** | 0.084 ** | 0.100 ** | 0.109 *** | 0.091 ** |

| (0.043) | (0.037) | (0.040) | (0.036) | (0.031) | (0.036) | |

| TobinQ | 0.006 | 0.009 | 0.002 | |||

| (0.007) | (0.006) | (0.005) | ||||

| Lev | −0.147 | −0.164 | −0.108 | |||

| (0.097) | (0.099) | (0.080) | ||||

| Top1 | −0.002 | −0.001 | −0.001 | |||

| (0.001) | (0.001) | (0.001) | ||||

| Dual | −0.002 | 0.024 | −0.034 * | |||

| (0.018) | (0.020) | (0.017) | ||||

| Size1 | 0.293 *** | 0.255 *** | 0.193 *** | |||

| (0.030) | (0.030) | (0.024) | ||||

| Growth | −0.001 | −0.001 | −0.001 | |||

| (0.001) | (0.001) | (0.001) | ||||

| Size2 | 0.106 *** | 0.070 *** | 0.084 *** | |||

| (0.026) | (0.019) | (0.019) | ||||

| Turnover | −0.003 | −0.009 | −0.007 | |||

| (0.033) | (0.031) | (0.023) | ||||

| Dovmon | 0.291 *** | 0.171 ** | 0.248 *** | |||

| (0.090) | (0.074) | (0.088) | ||||

| PGDP | −0.164 | 0.003 | −0.238 ** | |||

| (0.123) | (0.107) | (0.114) | ||||

| IS | −0.008 * | −0.008 ** | −0.004 | |||

| (0.005) | (0.004) | (0.004) | ||||

| Constant | 0.872 *** | 0.573 *** | 0.588 *** | −9.451 *** | −8.307 *** | −5.990 *** |

| (0.014) | (0.012) | (0.013) | (1.206) | (1.040) | (0.943) | |

| Firm FEs | YES | YES | YES | YES | YES | YES |

| Year FEs | YES | YES | YES | YES | YES | YES |

| Obs. | 27,999 | 27,999 | 27,999 | 27,999 | 27,999 | 27,999 |

| R2 | 0.731 | 0.706 | 0.693 | 0.742 | 0.716 | 0.701 |

| Variables | Pooled Matching | Period-by-Period Matching | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.100 ** | 0.109 *** | 0.092 ** | 0.092 ** | 0.097 *** | 0.085 ** |

| (0.036) | (0.031) | (0.036) | (0.034) | (0.028) | (0.035) | |

| Controls | YES | YES | YES | YES | YES | YES |

| Firm FEs | YES | YES | YES | YES | YES | YES |

| Year FEs | YES | YES | YES | YES | YES | YES |

| Obs. | 27,990 | 27,990 | 27,990 | 27,282 | 27,282 | 27,282 |

| R2 | 0.742 | 0.716 | 0.701 | 0.743 | 0.717 | 0.701 |

| Comparison Type | Weight | Subgroup Estimate |

|---|---|---|

| Treated vs. Never-treated Groups | 0.874 | 0.152 |

| Early-treated vs. Late-treated Groups | 0.080 | 0.040 |

| Late-treated vs. Early-treated Groups | 0.047 | 0.054 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| LnAuTotal | LnAuInva | LnAuUma | Total_arsinh | Inva_arsinh | Uma_arsinh | |

| CreditSubsidy | 0.090 ** | 0.087 *** | 0.078 ** | 0.100 ** | 0.120 *** | 0.098 ** |

| (0.040) | (0.026) | (0.035) | (0.040) | (0.035) | (0.043) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 27,999 | 27,999 | 27,999 | 27,142 | 27,142 | 27,142 |

| R2 | 0.739 | 0.666 | 0.699 | 0.741 | 0.716 | 0.701 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| GreenCor1 * CreditSubsidy | 0.171 *** (0.037) | 0.179 *** (0.035) | 0.152 *** (0.035) | ||||||

| GreenCor2 * CreIntSubsidy | 0.173 *** (0.042) | 0.185 *** (0.036) | 0.157 *** (0.042) | ||||||

| LowPolluted * CreIntSubsidy | 0.116 ** (0.045) | 0.136 *** (0.033) | 0.081 *** (0.016) | ||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 27,999 | 27,999 | 27,999 | 27,999 | 27,999 | 27,999 | 27,997 | 27,997 | 27,997 |

| R2 | 0.742 | 0.717 | 0.701 | 0.742 | 0.717 | 0.701 | 0.742 | 0.716 | 0.701 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Du_LnTotal | Du_LnInva | Du_LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.075 ** | 0.144 *** | 0.153 *** | 0.108 *** | 0.116 *** | 0.087 *** |

| (0.038) | (0.038) | (0.037) | (0.016) | (0.014) | (0.014) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 27,999 | 27,999 | 27,999 | 27,999 | 27,999 | 27,999 |

| Variables | First-Stage Regression | Second-Stage Regression | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| CreditSubsidy | LnTotal | LnInva | LnUma | |

| IV | 0.008 *** | |||

| (0.001) | ||||

| CreditSubsidy | 0.137 *** | 0.139 *** | 0.122 ** | |

| (0.048) | (0.047) | (0.046) | ||

| Controls | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes |

| Obs. | 24,974 | 24,974 | 24,974 | 24,974 |

| R2 | 0.954 | 0.043 | 0.039 | 0.029 |

| Kleibergen-Paap Wald rk F statistic | 118.02 | 118.02 | 118.02 | |

| Kleibergen-Paap rk LM statistic | 9.53 *** | 9.53 *** | 9.53 *** | |

| Variables | 2017 Observations | Direct-Controlled Municipalities | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.107 ** | 0.118 *** | 0.099 ** | 0.057 * | 0.080 ** | 0.052 * |

| (0.042) | (0.034) | (0.044) | (0.030) | (0.030) | (0.031) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 26,213 | 26,213 | 26,213 | 22,333 | 22,333 | 22,315 |

| R2 | 0.743 | 0.715 | 0.702 | 0.715 | 0.687 | 0.667 |

| Variables | Green Finance Reform Pilot Zones | Low-Carbon City Pilots | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.099 ** | 0.110 *** | 0.092 ** | 0.094 ** | 0.101 *** | 0.087 ** |

| (0.037) | (0.031) | (0.036) | (0.036) | (0.031) | (0.036) | |

| GreenFinance | 0.026 | −0.021 | −0.010 | |||

| (0.036) | (0.061) | (0.050) | ||||

| LowCarbon | 0.049 | 0.069 * | 0.038 | |||

| (0.032) | (0.038) | (0.025) | ||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 27,999 | 27,999 | 27,999 | 27,999 | 27,999 | 27,999 |

| R2 | 0.742 | 0.716 | 0.701 | 0.742 | 0.716 | 0.701 |

| Variables | Carbon Trading Pilots | The Environmental Protection Law | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.100 *** | 0.109 *** | 0.092 ** | 0.197 ** | 0.156 * | 0.141 ** |

| (0.035) | (0.031) | (0.035) | (0.093) | (0.078) | (0.065) | |

| CarbonTrade | −0.051 | −0.013 | −0.046 | |||

| (0.077) | (0.071) | (0.064) | ||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Province-year FEs | NO | NO | NO | Yes | Yes | Yes |

| Industry-year FEs | NO | NO | NO | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | NO | NO | NO |

| Year FEs | Yes | Yes | Yes | NO | NO | NO |

| Obs. | 27,999 | 27,999 | 27,999 | 28,496 | 28,496 | 28,496 |

| R2 | 0.742 | 0.716 | 0.701 | 0.342 | 0.300 | 0.320 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| CityCredit | BankCredit | CorporCredit | CashFlow | TAC | GAC | |

| CreditSubsidy | 0.002 ** | 1.148 * | 0.256 ** | 0.074 ** | −0.003 * | −0.073 ** |

| (0.001) | (0.553) | (0.108) | (0.029) | (0.002) | (0.035) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Bank FEs | No | Yes | No | No | No | No |

| Firm FEs | No | No | Yes | Yes | Yes | Yes |

| City FEs | Yes | No | No | No | No | No |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 4 378 | 486 | 17,269 | 22,999 | 28,029 | 28,029 |

| R2 | 0.700 | 0.732 | 0.756 | 0.787 | 0.540 | 0.698 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| Gwl_dum * CreditSubsidy | 0.220 *** | 0.184 *** | 0.183 *** | |||

| (0.058) | (0.049) | (0.051) | ||||

| GW_dum * CreditSubsidy | 0.270 ** | 0.213 * | 0.344 *** | |||

| (0.112) | (0.107) | (0.110) | ||||

| CreditSubsidy | 0.030 | 0.050 | 0.033 | 0.062 * | 0.079 ** | 0.042 |

| (0.040) | (0.033) | (0.040) | (0.035) | (0.029) | (0.036) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 27,999 | 27,999 | 27,999 | 24,566 | 24,566 | 24,566 |

| R2 | 0.743 | 0.717 | 0.701 | 0.733 | 0.705 | 0.690 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| LnTotal | LnInva | LnUma | |

| Rent_dum * CreditSubsidy | 0.305 *** | 0.323 *** | 0.190 ** |

| (0.076) | (0.066) | (0.075) | |

| CreditSubsidy | −0.043 | −0.042 | 0.003 |

| (0.038) | (0.038) | (0.031) | |

| Controls | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes |

| Obs. | 23,070 | 23,070 | 23,070 |

| R2 | 0.734 | 0.707 | 0.689 |

| Variables | High | Low | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.049 | 0.054 | 0.049 | 0.125 ** | 0.131 *** | 0.114 ** |

| (0.033) | (0.045) | (0.033) | (0.046) | (0.029) | (0.049) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 10,788 | 10,788 | 10,788 | 11,329 | 11,329 | 11,329 |

| R2 | 0.762 | 0.735 | 0.721 | 0.714 | 0.685 | 0.667 |

| Variables | High | Low | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.124 *** | 0.108 ** | 0.125 *** | 0.005 | 0.041 | 0.014 |

| (0.044) | (0.042) | (0.041) | (0.054) | (0.052) | (0.046) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 18,816 | 18,816 | 18,816 | 9 172 | 9 172 | 9 172 |

| R2 | 0.754 | 0.727 | 0.714 | 0.707 | 0.680 | 0.669 |

| Variables | High | Low | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.091 * | 0.087 ** | 0.090 * | 0.059 | 0.067 | 0.063 |

| (0.050) | (0.042) | (0.050) | (0.047) | (0.042) | (0.043) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 18926 | 18926 | 18,926 | 9 068 | 9 068 | 9 068 |

| R2 | 0.765 | 0.738 | 0.728 | 0.665 | 0.630 | 0.608 |

| Variables | High | Low | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| LnTotal | LnInva | LnUma | LnTotal | LnInva | LnUma | |

| CreditSubsidy | 0.128 *** | 0.141 *** | 0.106 *** | 0.070 | 0.072 | 0.082 |

| (0.041) | (0.041) | (0.037) | (0.056) | (0.051) | (0.052) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FEs | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 11,475 | 11,475 | 11,475 | 11,922 | 11,922 | 11,922 |

| R2 | 0.695 | 0.667 | 0.643 | 0.748 | 0.714 | 0.711 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, F.; Wang, Z. Can Green Credit Interest Subsidy Policy Promote Corporate Green Innovation?—From the Perspective of Fiscal and Financial Policy Coordination. Sustainability 2025, 17, 9750. https://doi.org/10.3390/su17219750

Liu F, Wang Z. Can Green Credit Interest Subsidy Policy Promote Corporate Green Innovation?—From the Perspective of Fiscal and Financial Policy Coordination. Sustainability. 2025; 17(21):9750. https://doi.org/10.3390/su17219750

Chicago/Turabian StyleLiu, Fei, and Zhenxiang Wang. 2025. "Can Green Credit Interest Subsidy Policy Promote Corporate Green Innovation?—From the Perspective of Fiscal and Financial Policy Coordination" Sustainability 17, no. 21: 9750. https://doi.org/10.3390/su17219750

APA StyleLiu, F., & Wang, Z. (2025). Can Green Credit Interest Subsidy Policy Promote Corporate Green Innovation?—From the Perspective of Fiscal and Financial Policy Coordination. Sustainability, 17(21), 9750. https://doi.org/10.3390/su17219750