Abstract

This study selects Chinese A-listed non-financial and non-insurance enterprises covering the period from 2009 to 2023 as the research sample. Utilizing the green credit interest subsidy policy (GCISP) as a quasi-natural experiment, it employs a multi-period difference-in-differences (DID) model to examine the policy effect and micro-level mechanisms through which GCISP—by coordinating fiscal subsidies with green finance—impacts corporate green innovation. The findings reveal that GCISP significantly promotes corporate green innovation. This enhancing effect is achieved through two pathways: alleviating financing constraints and reducing agency costs. The conclusions of this study provide valuable insights for refining green economic policies that harmonize green finance with fiscal subsidies, and offer reliable empirical evidence and policy implications to support corporate green transformation.

1. Introduction

The global imperative for a low-carbon transition has positioned green innovation as a critical engine for sustainable development worldwide [1]. However, this engine is often stifled by a fundamental market failure: green innovation is characterized by significantly higher R&D costs, longer payback periods, and greater technological uncertainty compared to conventional alternatives [2]. This creates a pervasive “green innovation dilemma,” where firms, as rational economic actors, are often unwilling due to insufficient short-term returns and hesitant due to prohibitive risks and costs [3], leading to a critical gap between societal environmental goals and corporate investment. While governments have deployed various tools—from fiscal subsidies to green finance—their isolated application often yields suboptimal outcomes, struggling with issues like greenwashing under standalone subsidies and insufficient lending incentives under unilateral financial policies. This raises a pivotal question with universal relevance: How can economic policies be strategically designed to overcome these parallel challenges? We argue that the answer lies not in isolated interventions, but in policy synergy.

Since China proposed its “Carbon Peaking and Neutrality Goals”, the country has continuously refined its green financial system, gradually establishing a synergistic mechanism that combines policy incentives with technological innovation. By the end of 2024, China’s outstanding total green credit (in both local and foreign currencies) exceeded 36 trillion yuan, up 21.7% year-on-year—14.5 percentage points higher than the average loan growth rate across all sectors, with a net annual increase of 6.52 trillion yuan. Nevertheless, the transformation of policy effects into tangible innovation momentum still faces bottlenecks. On one hand, standalone fiscal subsidy policies lack effective information screening capabilities, making it difficult to prevent “greenwashing” enterprises from fraudulently claiming subsidies [4]. On the other hand, standalone financial policies suffer from negative issues such as insufficient incentives for financial institutions (leading to reluctance to lend) and the development of subsidy dependency among micro-level enterprises [5]. As a key instrument for enhancing the green financial system, GCISP—by integrating central-level design with regional pilot programs—offers distinct advantages over solely implementing fiscal subsidies or financial policies in addressing these challenges [6,7].

GCISP establishes a synergistic mechanism between government fiscal departments and financial institutions (e.g., banks), thereby enabling the effective integration of economic policies. Its subsidy recipients generally fall into two categories: (1) enterprises that obtain financing from local financial institutions to implement projects certified as officially green; and (2) projects involving environmental governance (e.g., pollution prevention and control, ecological restoration) or green transformation initiatives (e.g., industrial decarbonization upgrades, clean energy substitution), where local governments provide tiered interest subsidies on green credit to qualifying enterprises or projects. Compared to traditional fiscal subsidy policies, GCISP offers two breakthrough advantages. First, by leveraging pre-existing bank credit review procedures, it fully utilizes the professional expertise of financial institutions in areas like environmental risk assessment and project feasibility analysis, thereby effectively curbing fraudulent loan applications and subsidy claims by “greenwashing” enterprises. Second, by creating a credit interest compensation mechanism [8], it simultaneously ensures commercial banks’ sustainability and reduces corporate financing costs, offering an innovative solution to the persistent dual challenges of financing constraints and incentive misalignment in green finance. By establishing a market-based screening mechanism and a sustainable incentive mechanism, it not only improves targeting precision but also cultivates endogenous growth drivers for the green finance market. Based on the above background, this paper empirically examines the impact of GCISP on corporate green innovation, aiming to address the following two questions: (1) Does GCISP augment corporate green innovation? (2) What are the specific pathways through which GCISP influences corporate green innovation?

Building on the preceding background, this paper employs GCISP as a quasi-natural experiment and utilizes a sample of China’s A-share listed companies from 2009 to 2023. This paper examines the micro-level mechanisms and policy effects of this coordinated economic policy—integrating fiscal subsidies with green finance—on corporate green innovation. The study finds that GCISP significantly augments corporate green innovation. This positive effect is achieved through two primary pathways: reducing liquidity constraints and lowering agency costs. Notably, the policy exerts a stronger augmentation effect on green innovation for firms exhibiting higher degrees of “greenwashing” and greater engagement in “rent-seeking behavior”. Heterogeneity analysis further reveals asymmetric effects across different contexts: environmental regulation stringency, digital transformation levels, intellectual property protection regimes, and supply chain bargaining power. These findings carry important theoretical and policy implications for designing effective green innovation incentives and facilitating corporate sustainability transitions.

The potential marginal contributions of this study are threefold. First, it enriches the analytical framework for GCISP. While existing literature has examined the economic effects of such policies through perspectives such as environmental governance and moderate financialization [9], research on their innovation-enhancing effects remains scarce. By focusing on corporate green innovation as a key metric to assess the micro-level impact of these subsidies, this study provides novel insights into the coordinated economic effects of green finance and fiscal incentives. Second, it advances the research paradigm on economic policy incentives for corporate green innovation. Prior studies have predominantly analyzed green finance or fiscal subsidies in isolation [10,11,12,13], while investigations into policy instruments that integrate both approaches remain limited. This research concretizes such coordination through a specific policy mechanism, offering new pathways to enhance corporate green innovation and drive high-quality sustainable transformation. Third, through rigorous empirical analysis, it comprehensively examines the transmission mechanisms and impact channels through which green credit subsidies influence corporate green innovation. These findings provide actionable decision-making references for enterprises pursuing substantive eco-innovation and green transition, ultimately facilitating economy-wide sustainable transformation and optimizing green development trajectories.

2. Literature Review and Hypotheses Development

2.1. Literature Review

This study examines the impact and pathways of GCISP on corporate green innovation. The existing literature relevant to this research primarily unfolds along two dimensions: the determinants of corporate green innovation and the micro-level effects of green economic policies.

Regarding the determinants and pathways of green innovation, extant literature primarily adopts institutional theory and market-driven perspectives for analysis. From an institutional theory perspective, studies demonstrate that environmental regulations [14] and tax policies [15] can promote corporate green innovation by alleviating financing constraints and shaping managerial environmental awareness. However, excessive policy layering may yield diminishing marginal returns and could even inhibit the corporate green innovation process [16]. From a market-driven perspective, research suggests that multiple factors, including consumer environmental preferences [17], institutional investors’ green preferences [18], corporate digital empowerment [19], and environmental, social, and governance (ESG) ratings [20], collectively promote green innovation by influencing managerial innovation decisions and reshaping corporate resource allocation. Moderate market competition fosters corporate green innovation to some extent [21], but intensifying competition may induce firms to engage in pseudo-innovation behaviors, such as strategic innovation [22].

Research on green economic policy outcomes primarily focuses on two aspects. One strand examines the environmental incentives of green finance policies, demonstrating their efficacy in driving the corporate sustainability transitions [23] while noting their limited capacity to stimulate substantive green innovation [24]. The other stream examines the innovation incentives of fiscal subsidies, which significantly boost corporate R&D investment in green technologies. Nevertheless, these policies exhibit shortcomings in preventing corporate “greenwashing” and “rent-seeking” behavior [4]. GCISP innovatively bridges these policy gaps by establishing a synergistic government-financial institution mechanism. Compared to traditional green finance or fiscal subsidy policies, it offers two breakthrough advantages: First, by leveraging pre-existing bank credit review procedures, it fully utilizes the professional expertise of financial institutions in environmental risk assessment and project feasibility analysis, effectively curbing fraudulent loan applications and subsidy claims by “greenwashing” enterprises [9]. Second, through the creation of a credit interest compensation mechanism, it simultaneously ensures the sustainability of commercial banks and reduces corporate financing costs, thereby innovatively resolving the long-standing dual challenges of financing difficulties and incentive misalignment in the green finance market. By establishing a market-based screening mechanism and a sustainable incentive mechanism, this policy not only enhances the precision of policy implementation but also fosters the endogenous growth drivers of the green finance market.

Through a systematic review of research on green innovation and green economic policies, existing literature has established a multi-dimensional theoretical framework that provides a solid theoretical groundwork for this study. The core contributions of prior research manifest in two aspects: (1) Multi-dimensional Theoretical Framework for Green Innovation. Existing studies have elucidated the mechanisms influencing green innovation from diverse perspectives, including institutional pressures, market drivers, and policy instruments. The institutional theory perspective focuses on the “double-edged sword” effect of environmental regulations and tax policies, while the market perspective further emphasizes the guiding role of market factors—such as consumer preferences and ESG ratings—on innovation decisions. These collectively demonstrate that green innovation results from the synergistic interplay of policy push and market pull forces, providing a multi-dimensional theoretical foundation for subsequent research. (2) Refined Breakthroughs in Policy Consequence Evaluation: Research on green finance and fiscal subsidy policies has not only verified their transformation incentives but also uncovered implementation drawbacks. The key findings include: Policy standard deficiencies leading firms to focus on end-of-pipe treatment while avoiding substantive innovation; Regulatory loopholes enabling subsidy funds to be diverted towards “greenwashing” activities, such as environmental image packaging; Collusion between government and enterprises facilitating corporate “rent-seeking” behavior for arbitrage; Large-scale tax and fee reductions exacerbate pressures on fiscal sustainability.

However, the existing literature exhibits three significant theoretical limitations: First, there exists a theoretical disjointedness in prevailing research approaches. Most studies examine green finance or fiscal subsidies in isolation, treating them as independent instruments rather than components of an integrated policy framework. This siloed perspective fails to capture the complex reality of environmental governance, where policy instruments increasingly interact within coordinated ecosystems. This limitation becomes particularly evident through international comparison: while China’s GCISP represents a top-down, administratively driven model of policy coordination, the European Union’s approach relies more heavily on market-based mechanisms and standardization (e.g., the EU Taxonomy regulation) to harmonize cross-border green finance initiatives amidst fiscal fragmentation. Similarly, developing economies often employ blended finance models that depend critically on international climate funds—a context fundamentally different from China’s domestically financed fiscal capacity. Second, the literature demonstrates a pronounced contextual bias toward single-country studies, particularly China, without sufficient comparative analysis to distinguish universal mechanisms from context-dependent effects. This limitation restricts the transferability of policy insights across different institutional environments. For instance, while Chinese policies leverage strong state capacity for rapid implementation, policy effectiveness in federal systems like the United States or Germany depends heavily on sub-national implementation and multi-level governance arrangements that existing literature rarely addresses. Third, an analytical disconnect persists between macro-level policy announcements and firm-level behavioral changes. While numerous studies correlate policy interventions with innovation outputs, few successfully unpack the causal mechanisms through which policy signals translate into corporate investment decisions. This problem is particularly acute in cross-border contexts, where the same policy instrument (e.g., green credit) may operate through different channels in bank-based financial systems (prevalent in China and the EU) versus market-based systems (like the US).

In summary, the existing literature provides a solid foundation by establishing the individual roles of fiscal subsidies and green finance in promoting corporate environmental behavior, and by diagnosing their respective limitations, such as risks of greenwashing and insufficient incentives. However, a significant gap remains in empirically examining coordinated policy instruments that integrate both fiscal and financial mechanisms. Furthermore, there is a lack of robust, micro-level evidence on the causal pathways—specifically, how such synergistic policies alleviate financing constraints and reduce agency costs to drive innovation. This study aims to fill these gaps by investigating GCISP as a quintessential example of fiscal-financial coordination, utilizing a quasi-experimental design to identify its causal effect on corporate green innovation and the underlying micro-level mechanisms.

2.2. Hypotheses Development

2.2.1. GCISP and Corporate Green Innovation

GCISP guides enterprises towards green innovation by integrating green finance with fiscal policy, simultaneously harnessing the dual advantages of green credit and fiscal subsidies. The core stakeholders are primarily the government, banks, and enterprises [25]. Although their objectives differ, they signal cooperative intentions through policy signals (from the government), credit allocation behavior (from banks), and innovation investment (from enterprises), forming a dynamic game equilibrium and achieving win-win outcomes through policy synergy. First, the government and banks form a synergy in policy transmission and risk sharing. The government shares the potential risks of banks’ green lending through fiscal interest subsidies, enhancing banks’ willingness to lend. Concurrently, local regions establish certification systems for green enterprises and projects, standardizing environmental benefit assessment criteria. Third-party agencies conduct green evaluations of subsidy recipients to ensure they possess substantive environmental protection projects, reducing banks’ information screening risks and costs. Second, banks and enterprises form a synergy in credit incentives and supervisory constraints. GCISP leverages banks to provide more credit funds, directing capital precisely towards “genuinely green” enterprises. Banks conduct due diligence on enterprises before loan approval, strengthening external supervision and compelling enterprises to allocate more funds towards green innovation [26]. Finally, the government and enterprises form a synergy in financial incentives [27] and reputational bonding. Through this policy, the government channels fiscal subsidies to “genuinely green” enterprises, providing them with implicit guarantees [28]. This helps shape a green corporate image for external investors, facilitating enterprises’ access to more financing from financial institutions and social capital [29].

The innovation incentive effect of GCISP primarily materializes through two pathways. The first is the financial incentive mechanism. When enterprises demonstrate strong performance in environmental disclosure and green governance, they gain access to low-interest loans and fiscal subsidies through GCISP. This reduces the financing costs for green projects and shares the innovation risks, thereby increasing these enterprises’ willingness to innovate [30]. After obtaining low-cost funds, enterprises can invest more resources in green innovation activities such as technology R&D and equipment upgrades, creating a virtuous cycle. Simultaneously, during the audit phase, the green credit interest subsidy policy screens out genuinely green enterprises for subsidies, generating an “income effect” and a “certification effect” [31]. This signals their green technological advantages and commitment to environmental responsibility to the market, attracting more green investors or green supply chain partners [32], which further incentivizes innovation investment.

The second is the policy’s pressure mechanism. GCISP signals the government’s institutional commitment to promoting green transition. To comply with policy requirements and secure more low-interest loans, enterprises must proactively engage in green innovation to achieve green transformation. If an enterprise fails to meet the policy’s green standards, it risks being labeled “non-green”, thus sending negative signals to the market that damage corporate reputation and stock prices [33]. This compels enterprises to repair their image through green innovation and regain investor trust [34]. Furthermore, the application conditions for GCISP stipulate that enterprises must obtain green assessment certification from government-appointed third-party agencies. Financial institutions such as banks will also strengthen the approval oversight of green credit to prevent funds from flowing into “greenwashing” enterprises or environmentally high-risk projects due to credit approval oversights, thereby mitigating potential regulatory accountability risks. This significantly intensifies external green supervision on enterprises, effectively curbs non-green corporate behavior, and drives enterprises to undertake green innovation in pursuit of green development opportunities [35]. Our first hypothesis then is:

Hypothesis (H1).

GCISP can augment corporate green innovation.

2.2.2. GCISP, Liquidity Constraints and Corporate Green Innovation

GCISP, as a crucial component of the green financial system, guides financial institutions in adjusting their credit resource allocation strategies by reducing/exempting interest on green loans. From a risk-bearing perspective, green innovation is characterized by high risk and long payback periods. In the absence of interest subsidy support, commercial banks must independently bear the credit risk when extending loans to enterprises for green projects. Driven by the profit-maximization objective, commercial banks lack the incentive to provide low-interest loans for corporate environmental projects. GCISP addresses this by using fiscal funds to partially or fully subsidize loan interest. This sends an explicit signal of government support for green credit, effectively sharing the costs and risks of environmental governance, internalizing the externalities of environmental projects [36]. Consequently, it incentivizes financial institutions to reallocate credit resources, encourages banks to scale up green credit, and enhances their willingness to lend [37]. From a reputational incentive perspective, the reputational capital of financial institutions influences their relationships with key stakeholders, including governments, investors, and clients. GCISP carries public policy attributes; participation in such initiatives can elevate a bank’s social responsibility reputation premium, bolstering its political legitimacy and social trust [38]. Furthermore, bank management often faces the dilemma between short-term performance and long-term strategic goals. GCISP incorporates social responsibility objectives into management performance metrics through external reputational incentives, prompting them to prioritize long-term reputation accumulation over short-term profit maximization. Finally, from a market competition perspective, financial institutions located in policy pilot zones exhibit a stronger tendency to signal their commitment to sustainable development by issuing green credit. This allows them to gain a competitive edge, expand their market advantage [39], and capture greater market share [40]. Thus, these arguments lead to our second hypothesis:

Hypothesis (H2).

GCISP effectively enhances the accessibility of green credit, alleviating corporate liquidity constraints and thereby stimulating corporate green innovation.

2.2.3. GCISP, Agency Costs and Corporate Green Innovation

As an incentive-based environmental regulation tool, GCISP raises the cost of environmental compliance for firms, making them substantially exceed the benefits of extensive development models. Within the theoretical framework of the “Porter Hypothesis” forcing effect, shareholders as principals become more proactive in incentivizing managers to pursue green innovation activities, urging enterprises to develop green technologies to reduce environmental costs; managers as agents are motivated to actively seek green transformation and increase investments in green innovation [41]. On the other hand, GCISP promotes the scale of green credit issuance by banks. Similarly to conventional bank credit, green credit also possesses monitoring functions. As creditors of green credit, financial institutions such as banks can acquire and process corporate information at lower costs, thereby effectively supervising corporate managers [42]. Unlike conventional bank credit, green credit exerts stronger monitoring effects. GCISP explicitly requires banks to scrutinize corporate qualifications or engage third-party institutions for evaluation during the lending process. Simultaneously, driven by fiscal risk compensation mechanisms, commercial banks will restructure green credit approval frameworks, establishing intelligent risk assessment systems through methods such as introducing artificial intelligence and specialized talent, thereby forming stronger monitoring effects and significantly reducing information asymmetry [43]. This leads us to set forth the following hypothesis:

Hypothesis (H3).

GCISP effectively reduces corporate agency costs, thereby promoting green innovation.

2.2.4. GCISP, “Greenwashing” Behavior and Corporate Green Innovation

By coordinating fiscal subsidies with green finance policies, GCISP enhances the screening capacity of financial institutions, incentivizing banks to generate information and identify “authentically green” firms, thus achieving targeted credit allocation. According to financial intermediary theory, under pressure from “Dual Carbon” goals, firms lacking transformation may package themselves as environmentally friendly enterprises through various means, including self-serving false environmental declarations, to gain stakeholder support or project a green image [44]. Information actively disclosed by such firms in capital markets is not necessarily effective or credible; instead, it tends to be information favorable to the firm [45]. Beneficial information for investors needs to be obtained through due diligence by financial intermediaries. To prevent “greenwashing” by borrowing enterprises, GCISP requires financial institutions like banks to engage third-party agencies to audit corporate green projects during green credit issuance. When approving green credit interest subsidies, the government can leverage environmental information assessment systems based on artificial intelligence and operated by commercial banks and other financial institutions to effectively identify corporate “greenwashing” risks and reduce fraudulent subsidy claims [46]. “Greenwashing” firms find it difficult to continue obtaining subsidies through superficial measures, forcing them to adjust development strategies and rebuild their differentiated advantages in green product markets through innovation, thereby shifting toward substantive innovation. Simultaneously, “greenwashing” firms may possess certain pre-existing environmental technology reserves or management experience before the policy. After the introduction of GCISP, their latent reserves can be rapidly converted into innovation outputs to qualify for green credit and fiscal interest subsidies. To test the above statement, we set forth our fourth hypothesis as follows:

Hypothesis (H4).

GCISP exert a stronger innovation-promoting effect on green innovation in firms with high levels of “greenwashing”.

2.2.5. GCISP, “Rent-Seeking” Behavior and Corporate Green Innovation

Against the backdrop of the “Dual Carbon” strategic goals and global green competition, governments and the public typically impose stringent environmental regulations, along with supportive policies, or public opinion pressure on firms. When facing stringent environmental pressures, firms may resort to non-market competition means such as rent-seeking to evade costs or gain benefits. GCISP involves not only bank qualification reviews but also supervision by relevant government departments and audits by third-party institutions—measures that significantly increase the difficulty of rent-seeking and enhance supervision over such activities. This makes it practically impossible for firms originally willing to pay rent-seeking costs to proceed. The relationship between rent-seeking behavior and corporate innovation is complex: Some scholars argue that firms obtain information on the latest policy changes through rent-seeking and similar activities, allowing them to increase investment in government-supported projects in advance to capture emerging markets, thereby indirectly boosting R&D investment. Other scholars contend that rent-seeking wastes entrepreneurial talent, distorts the optimal allocation of innovation resources, reduces firms’ willingness to invest in productive activities like R&D, and hinders innovation efforts [47]. Yet another group of scholars posits an inverted U-shaped relationship between rent-seeking and corporate innovation, suggesting that moderate rent-seeking may promote innovation investment to some extent; however, when firms divert resources from productive activities to rent-seeking, the funds consumed significantly encroach on R&D budgets. Regardless of the nature of this relationship, the funds required for such activities invariably increase corporate financing and operational costs to varying degrees, crowding out capital allocated to innovation, particularly in the case of credit-related rent-seeking. GCISP effectively coordinates relationships among enterprises, banks, and governments. By enhancing mutual supervision among these three parties, it reduces rent-seeking behavior in the credit process, thereby minimizing the diversion of capital from innovation projects. These arguments lead to our fifth hypothesis:

Hypothesis (H5).

GCISP exert a stronger innovation-promoting effect on green innovation in firms with high levels of “rent-seeking” behavior.

3. Research Design

3.1. Data Sources

This study examines the impact of GCISP on corporate green innovation by selecting China’s A-share listed non-financial and non-insurance enterprises from 2009 to 2023 as the research sample, and treating the policies as a quasi-natural experiment. Following the approach of prior studies [48,49], data on GCISP were collected from the official websites of provincial and municipal authorities in China, focusing specifically on disclosed policy documents that contained substantive incentive measures for green finance. Additional data comprise two main components: (1) Corporate innovation data sourced from the Chinese Research Data Services Platform (CNRDS database) [50]; (2) Corporate financial data and provincial/municipal characteristic data, obtained from the China Stock Market & Accounting Research Database (CSMAR database) unless otherwise specified [50]. After merging these datasets, this study applied: (1) Exclusion of enterprises under special treatment status (ST, *ST, PT) during the sample period; (2) Elimination of enterprises with abnormal data, severe missing values, or less than three years of observations; (3) Winsorization of continuous variables at the 1% and 99% levels to mitigate the influence of outliers. The final processed sample contains 27,999 valid observations.

3.2. Model Design

Given the staggered implementation of GCISP across different regions—primarily between 2016 and 2020—this study adopts a multi-period staggered Difference-in-Differences (DID) model following conventional literature [51,52]. The policy enactment year in each province/municipality serves as the treatment timing. The baseline specification is constructed as follows:

where the subscripts , , and denote firm, region (prefecture-level city or province), and year, respectively. The dependent variable captures firm’s green innovation level, measured through three dimensions: overall green innovation (LnTotal), green innovation quality (LnInva), and green innovation quantity (LnUma), all quantified by the firm’s green patent applications. The explanatory variable is a binary indicator reflecting the implementation status of GCISP. The vector incorporates firm-level and province-level covariates, while and denote firm fixed effects and year fixed effects, respectively. The idiosyncratic error term is addressed by clustering standard errors at the provincial level.

3.3. Main Variables

3.3.1. Corporate Green Innovation

Following Wang and Wang (2021) [53], this study employs green patent applications to measure corporate green innovation for three key reasons: First, technological innovation represents the ultimate manifestation of resource allocation and utilization efficiency. Therefore, patent application data, which reflects innovation output, better captures corporate innovation capability. Second, China implements selective industrial policies where government support for corporate innovation tends to be backward-looking, making innovation output more closely correlated with fiscal incentives. Third, patent application data provides a more accurate reflection of innovation levels than grant data. The patent granting process involves examination and maintenance fee requirements, introducing greater uncertainty and potential bureaucratic influences, whereas patent technologies often impact corporate performance during the application process itself. Thus, patent application data proves more stable, reliable, and timely than grant data. To ensure the robustness of our findings, we subsequently re-estimated our models using green patent grants as an alternative dependent variable in robustness checks.

After compiling data on corporate green patent applications, we classify them into green invention patent applications and green utility model patent applications. Three indicators are constructed to measure corporate green innovation: (1) Total: Overall green innovation level, measured by the sum of green invention and utility model patent applications; (2) Inva: Quality of green innovation. Since invention patents better reflect original innovative activities, this is measured by green invention patent applications; (3) Uma: Quantity of green innovation, measured by green utility model patent applications. This study applies a natural logarithmic transformation after adding one to each of the three indicators. This transformation is motivated by two key reasons. First, patent count data is typically characterized by a highly right-skewed distribution, with a majority of firms having zero or a few patents and a long tail of a few firms with very high counts. The log transformation helps to mitigate this skewness, making the distribution more symmetric and conforming better to the normality assumptions of many statistical models. Second, and more critically, the addition of one (+1) is essential to retain observations with zero patent applications in the sample, as the logarithm of zero is undefined. Without this adjustment, firms with no innovation output would be dropped from the regression, leading to a sample selection bias that would severely misrepresent the innovation landscape. The resulting coefficients can be interpreted approximately as the percentage change in green patent applications associated with a one-unit change in the explanatory variable. This yields the final dependent variables: LnTotal, LnInva, and LnUma.

3.3.2. GCISP

The interaction term CreditSubsidy is defined as: CreditSubsidy = treat × post. Variable Construction: (1) treat = 1 if the firm is located in a region implementing green credit interest subsidy policy; =0 otherwise. (2) post = 1 for years after policy implementation in the respective province/municipality; =0 for years prior to policy implementation.

3.3.3. Control Variables

Following Wang and Wang (2021) [53] and Hong et al. (2023) [9], we control for a set of firm-level and macroeconomic variables that are known to influence corporate green innovation. Firm-level control variables include: Tobin’s Q (TobinQ), leverage ratio (Lev), shareholding ratio of the largest shareholder (Top1), CEO duality (Dual), firm size (Size), operating revenue growth (Growth), workforce size (Size2), and asset turnover ratio (Turnover). Province-level control variables include: local government fiscal capacity (Dovmon), per capita gross regional product (PGDP), and industrial value-added rate (IS). Variable definitions and descriptive statistics are presented in Table 1.

Table 1.

Variable definitions and descriptive statistics.

4. Main Results

4.1. Parallel Trends Assumption Test

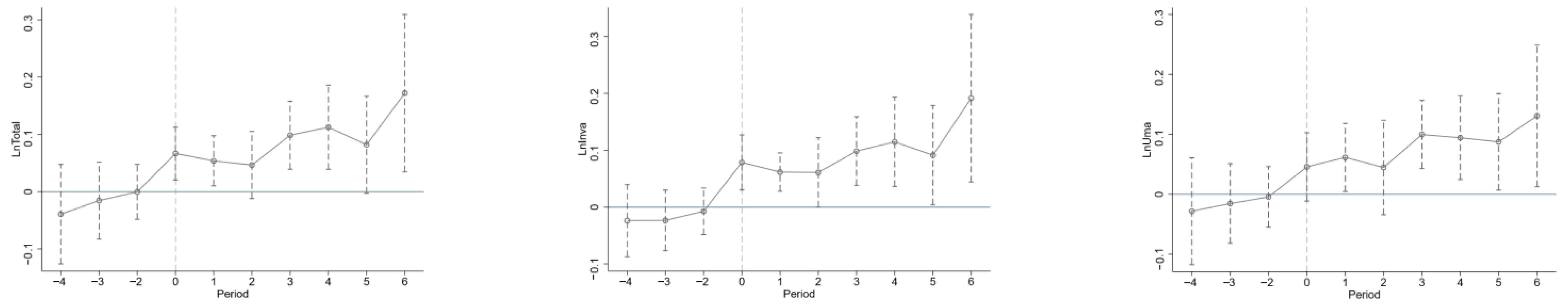

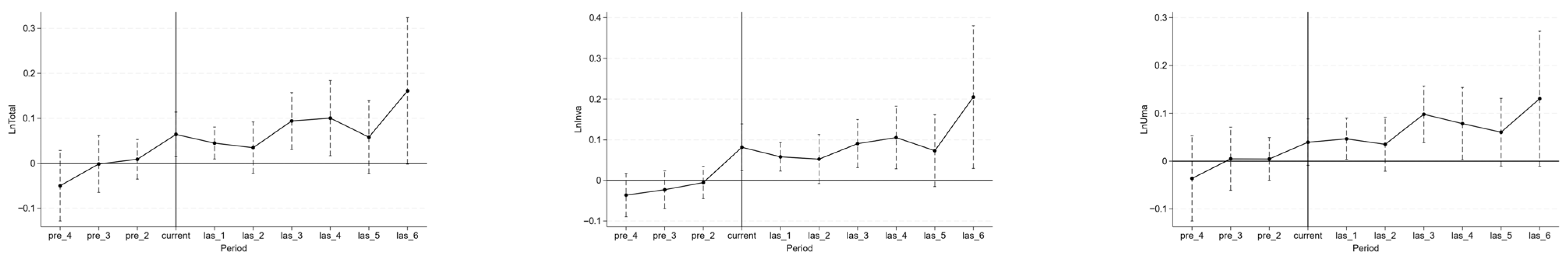

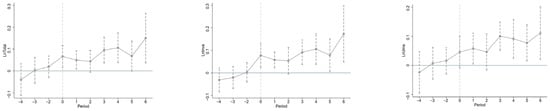

A prerequisite for applying the Difference-in-Differences (DID) method is that the treatment and control groups exhibit parallel trends prior to the intervention. Following common practice in the literature [54,55], this paper employs an event study approach, examining four periods before and six periods after the policy shock, with the period immediately preceding the treatment serving as the baseline. The test results, presented in Figure 1, indicate that the estimated coefficients are statistically insignificant across all pre-treatment periods. This suggests no systematic difference in green innovation trends between the treatment and control groups before policy implementation, thereby satisfying the parallel trends assumption.

Figure 1.

Parallel Trends Assumption Test.

4.2. Baseline Regression Results

Table 2 presents the baseline regression results. As shown, the explanatory variable CreditSubsidy is consistently positive and statistically significant at least at the 5% level. After controlling for other influencing factors, the coefficients of the interaction term are 0.100, 0.109, and 0.091, respectively. Both the significance levels and magnitude remain largely unchanged. This indicates that following the implementation of GCISP, enterprises in policy-treated cities experienced increases of approximately 10.0%, 10.9%, and 9.1% in their total green patent applications, green invention patent applications, and green utility model patent applications, respectively. The policy enhanced overall corporate green innovation levels, green innovation quality, and green innovation quantity to varying degrees, with a more pronounced effect on the improvement of green innovation quality. These findings provide preliminary support for H1 proposed earlier.

Table 2.

Main results.

These results carry significant practical implications beyond their statistical significance. First, at the corporate level, the observed increase in green patent applications signifies a substantial acceleration in green technology development. This enhances firms’ competitiveness in emerging low-carbon markets while directly reducing their environmental footprint through improved resource efficiency and lower emissions. Second, at the industrial level, the policy’s success in directing capital toward authentic green projects through rigorous screening helps correct market failures commonly associated with environmental innovation. This creates a more robust and credible ecosystem for green technology development. Third, at the national and international levels, the results demonstrate GCISP as a cost-effective, scalable model for achieving synergistic economic and environmental goals. This provides a transferable policy blueprint for other economies seeking to accelerate their green transition through coordinated fiscal-financial instruments.

4.3. Robustness Tests

4.3.1. Parallel Trends Sensitivity Analysis

Kahn-Lang and Lang (2018) [56] note that a growing number of researchers rely on statistically insignificant pre-treatment trend tests to validate the parallel trends assumption. While pre-treatment trend tests are important for verifying this assumption, failure to reject parallel trends before treatment does not guarantee their validity after treatment. Simply put, failure to reject the null hypothesis does not equate to confirming it. Roth et al. (2023) [57] further demonstrate that pre-treatment parallel trend tests have low statistical power—even when the parallel trends assumption is violated, insignificant pre-treatment coefficients may still be observed. Moreover, the DID estimator’s dependence on pre-treatment parallel trend testing is inherently problematic and may exacerbate bias in post-treatment effect estimates. In essence, pre-treatment parallel trend tests are neither necessary nor sufficient for causal identification in DID designs.

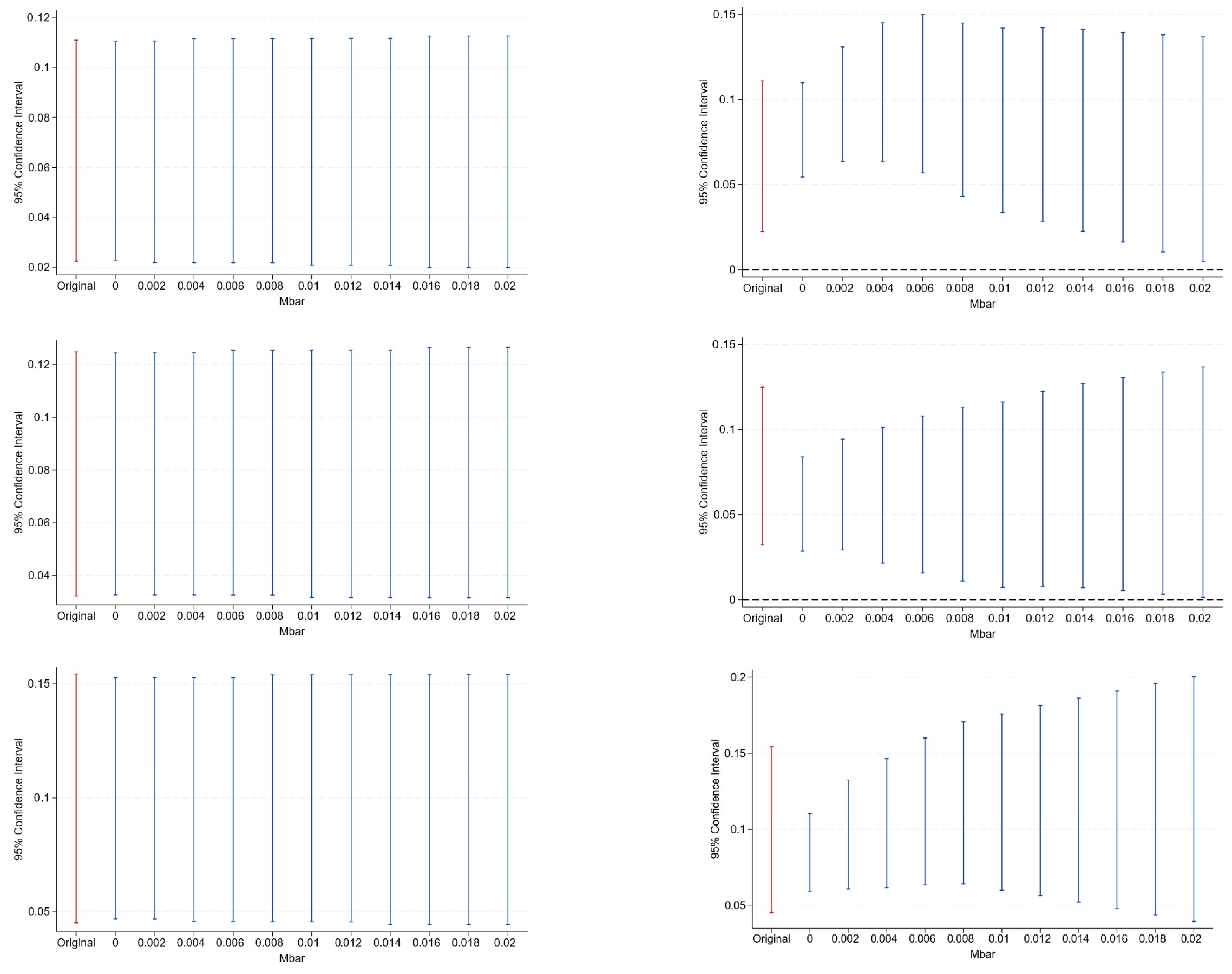

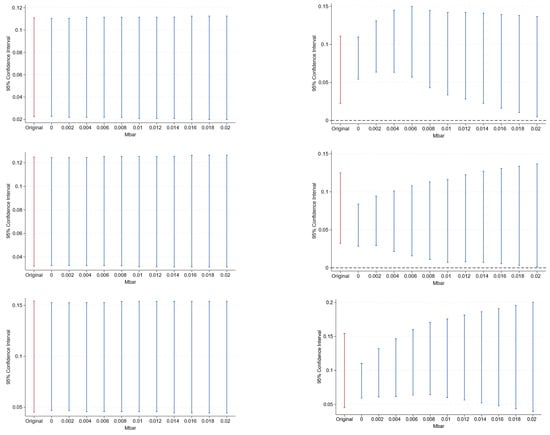

Accordingly, this study adopts the sensitivity analysis framework proposed by Roth et al. (2023) [57], which does not require the parallel trends assumption to hold exactly but quantifies how robust the treatment effect is to potential violations. The method proceeds in two steps: (1) specifying the maximum allowable deviation (Mbar) from the parallel trends assumption, and (2) constructing a confidence interval for the post-treatment point estimate that is valid under this degree of deviation. Following the convention in this literature [58,59], we set Mbar = 1 × standard error of the baseline estimates to represent a moderate and economically meaningful deviation. This threshold tests whether the treatment effect remains statistically significant even if the post-treatment trends between the treatment and control groups were to diverge by an amount equivalent to the precision of our original estimate. Figure 2 sequentially displays the sensitivity results for overall green innovation levels (implementation period: the implementation period in the parallel trends test), green innovation quality (implementation period: the implementation period in the parallel trends test), and green innovation quantity (the third period after the treatment: the third period after the policy implementation in the parallel trends test). The left and right columns present results under the relative deviation restriction and smoothing restriction, respectively. The horizontal axis shows the degree of deviation from parallel trends (Mbar), while the vertical axis displays the confidence intervals for the treatment effect estimate under different sensitivity assumptions. For “Original” on the horizontal axis, it represents the estimated treatment effect from the original DID model, serving as the primary reference benchmark for the entire sensitivity analysis. As Mbar increases, we observe how the estimate and its confidence interval (the vertical lines) would change if the parallel trends assumption were violated to that extent. The analysis reveals that the green innovation enhancement effects remain highly robust—statistically significant even under a one-standard-error deviation from parallel trends—across both restriction frameworks.

Figure 2.

Parallel Trends Sensitivity Analysis.

4.3.2. Placebo Test

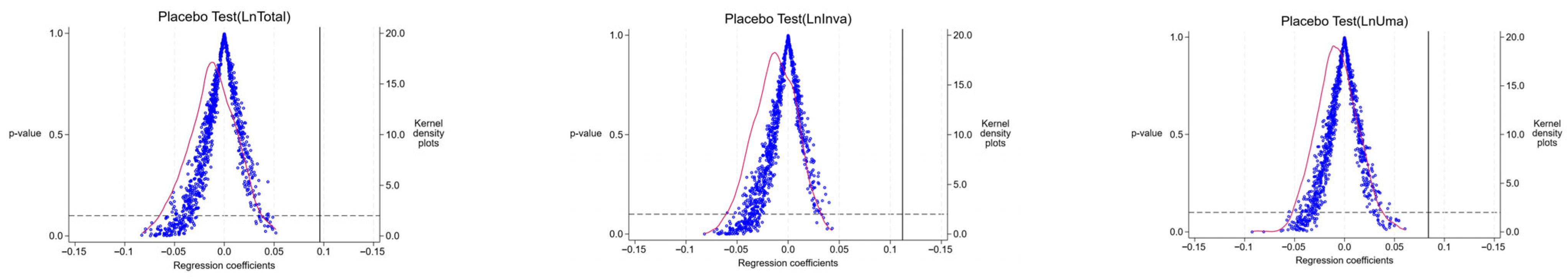

To address potential unobserved factors affecting the estimation results, despite controlling for multiple firm- and province-level characteristics in the baseline regression, this study conducts a placebo test by randomly assigning treatment firms and policy implementation years. Following standard practice, we randomly select a pseudo-treatment group of firms matching the size of the actual treatment group from the full sample and assign them random policy implementation years. The pseudo-core explanatory variable constructed from this process replaces the original variable in regression analysis. To mitigate the influence of rare unobserved factors, this procedure is repeated 1000 times. Figure 3 shows that the estimated coefficients follow an approximately normal distribution centered near zero, significantly smaller than the true estimated coefficients. This largely rules out the possibility that baseline results are driven by unobserved confounders.

Figure 3.

Placebo Test.

4.3.3. Propensity Score Matching

While the DID approach estimates the average treatment effect of GCISP, non-random selection of implementation areas and systematic differences between treatment and control firms may introduce sample selection bias. To address this, we employ PSM-DID for robustness checks. Existing literature addresses the panel-data limitation of PSM through two approaches: pooled matching (treating panel data as cross-sectional) and period-by-period matching. Given limitations in both methods, we apply both techniques using 1:1 nearest-neighbor matching to construct matched control groups. Regression results based on matched samples (Table 3) remain consistent with baseline estimates after controlling for selection bias through both matching strategies.

Table 3.

Propensity Score Matching.

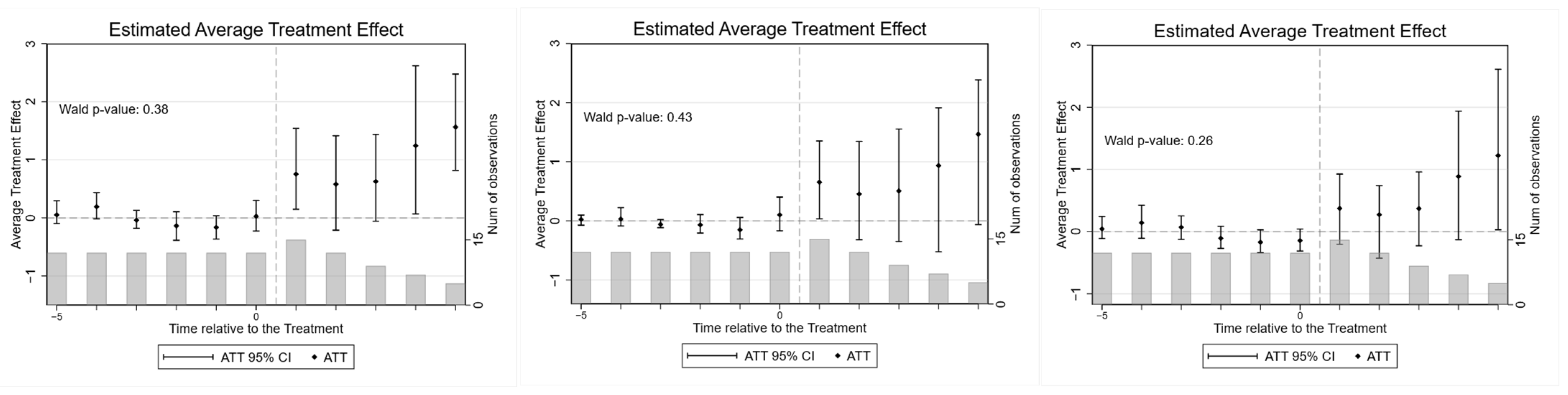

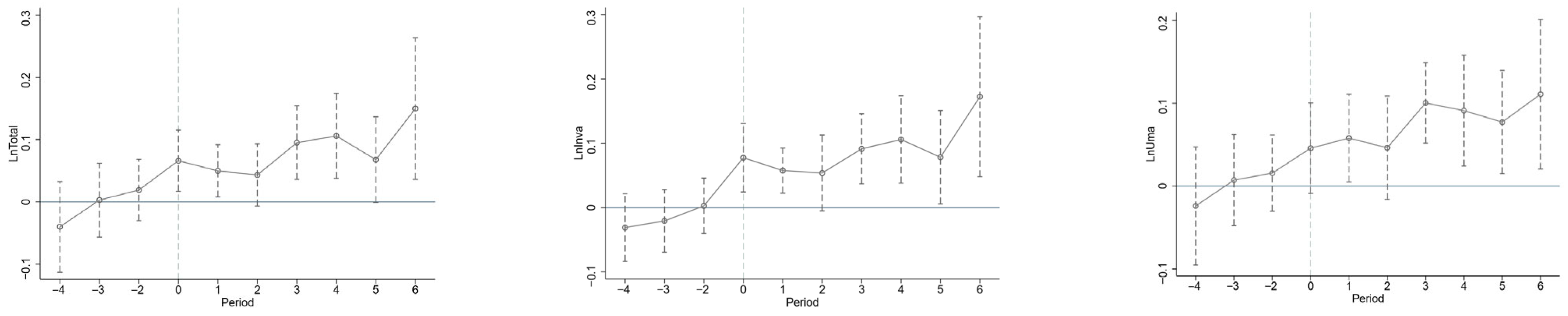

4.3.4. Treatment Effect Heterogeneity Test and Analysis

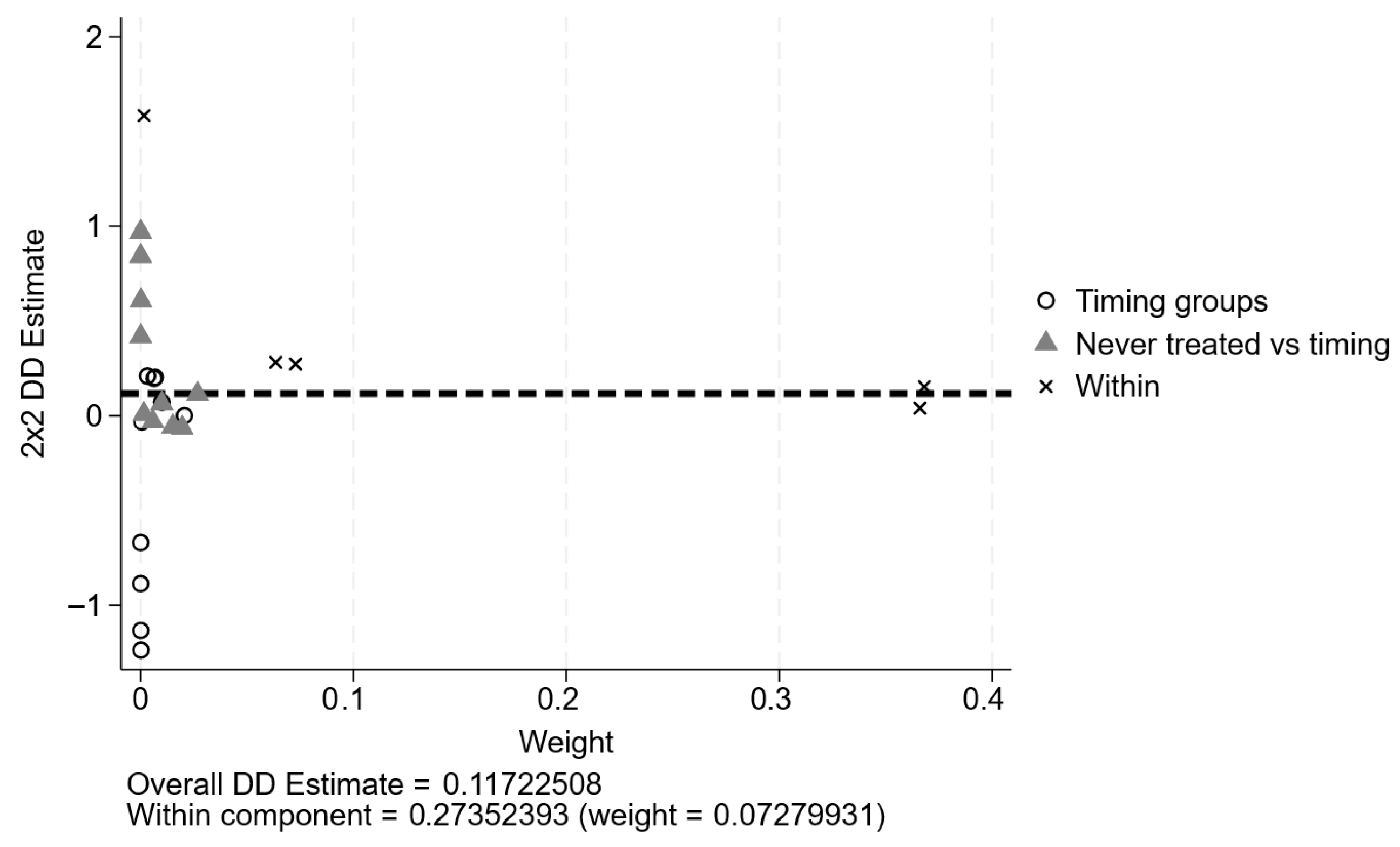

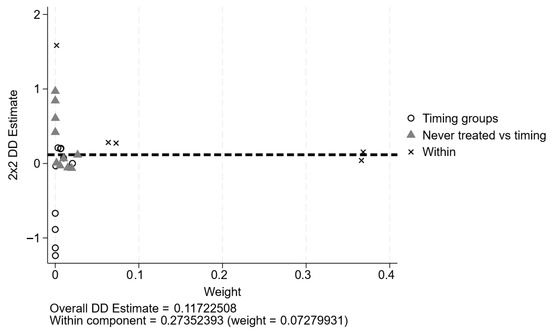

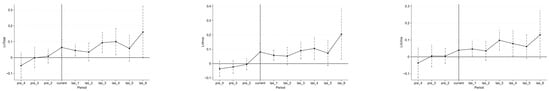

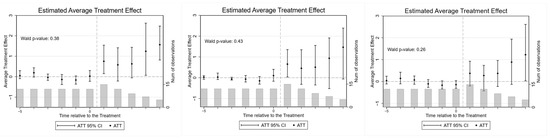

Heterogeneous responses to multi-period DID policies may bias baseline estimates. We first implement the Bacon decomposition method [60]. Results (Table 4 and Figure 4) show minimal contamination (weight: 0.047) from comparisons between late-treated and early-treated units. However, the forced balanced panel requirement in Bacon decomposition causes significant sample loss. We employ the methodology proposed by de Chaisemartin and D’Haultfoeuille (2020) [61], revealing a substantial negative weight proportion (20.44%), indicating potential bias. To address this, we estimate average treatment effects using alternative methods: (1) Following Sun and Abraham (2021) [62], we compute cohort-specific treatment effects. The event study plot (Figure 5) shows no significant pre-trend differences. Post-treatment, positive effects emerge for overall green innovation (0.117), quality (0.142), and quantity (0.110), all significant at 1%—consistent with baseline results. (2) To handle treatment group attrition, we implement the imputation estimator [63]. Figure 6 displays results from 100 resamples to bound counterfactuals, with Wald tests for pre-trend fit (p-values: 0.38, 0.43, 0.26), failing to reject parallel trends. Estimated effects align with baseline findings. (3) Applying the stacked regression estimator [64]. Figure 7 confirms parallel trends, yielding significant effects (0.060, 0.070, 0.094, all p < 0.05). Collectively, these approaches confirm that GCISP enhances corporate green innovation levels, quality, and quantity despite treatment effect heterogeneity.

Table 4.

Bacon Decomposition.

Figure 4.

Bacon Decomposition.

Figure 5.

Sun & Abraham.

Figure 6.

Liu.

Figure 7.

Cengiz.

4.3.5. Replacing the Dependent Variable

Given that the measurement of the dependent variable may affect regression results and the prevalence of zero-value observations in corporate patent applications, we re-estimate models using the logarithm of green patent grants [50] and green patent applications adjusted via the inverse hyperbolic sine function [65] as alternative dependent variables. Results in Table 5 show significantly positive coefficients (all p < 0.10) for both specifications—columns 1–3 for patent grants and columns 4–6 for adjusted patent applications—consistent with baseline findings.

Table 5.

Replacing the Dependent Variable.

4.3.6. Replacing the Explanatory Variable

To examine potential differential effects of GCISP on green and low-pollution firms, Following Hong et al. (2023) [9], we redefine the treatment group as “green or low-pollution enterprises within policy-implementing cities”. Green firms are classified using two criteria: (1) GreenCor1: firms with environmental performance exceeding the sample median; (2) GreenCor2: firms with Huazheng ESG ratings above the median. Low-pollution firms (LowPolluted = 1) are identified according to the China Securities Regulatory Commission’s (2012) industry classifications and the Ministry of Ecology and Environment’s Environmental Verification Guidelines, excluding heavily polluting industries. Regression results in Table 6 demonstrate significantly positive coefficients (all p < 0.05), confirming that the policy enhances green innovation for these redefined treatment groups. This alignment with baseline results persists when the treatment group is modified.

Table 6.

Replacing the Explanatory Variable.

4.3.7. Alternative Regression Models

To address the specific data characteristics of corporate patent applications and ensure the robustness of our findings, we supplement our baseline linear model with two alternative estimators: the Probit model and the Tobit model.

First, we construct binary variables indicating whether a firm has any positive patent count (Du_LnTotal, Du_LnInva, Du_LnUma) and estimate a double probit model. This approach is employed because the decision to engage in any green innovation is inherently a binary choice—a firm must first have the “willingness to innovate” before the scale or quantity of innovation is determined. The Probit model is specifically designed to model such binary outcomes, allowing us to examine whether the GCISP significantly influences the extensive margin of corporate green innovation, i.e., the probability of a firm becoming a green innovator.

Second, following Fan et al. (2025) [66], we replace the baseline specification with a double Tobit model. This is motivated by the distribution of our patent data, which is characterized by a substantial fraction of zero observations (non-innovating firms) and a continuous, positive distribution among innovating firms. In such a scenario, standard OLS estimates can be biased and inconsistent. The Tobit model is explicitly formulated for this type of corner solution outcome or censored data, where the latent willingness to innovate translates into a positive outcome only after crossing a certain threshold. It provides consistent estimates by simultaneously accounting for the probability of having positive patents (extensive margin) and the level of patents conditional on being positive (intensive margin).

The significantly positive coefficients from both the Probit and Tobit models, as presented in Table 7, confirm that our baseline results are not an artifact of model misspecification.

Table 7.

Alternative Regression Models.

4.3.8. Instrumental Variable Regression

Following Dai et al. (2024) [67], to mitigate potential omitted variable bias and reverse causality, we employ a two-stage instrumental variable approach. The instrument—the interaction between the post-period dummy and the frequency of green terminology in 2009 municipal government work reports—satisfies relevance (reflecting local governments’ environmental governance commitment) and exogeneity (no direct correlation with firm innovation behavior). Results in Table 8 show significantly positive coefficients (all p < 0.05), consistent with baseline estimates.

Table 8.

Instrumental Variable Regression.

4.3.9. Excluding Patent Standard Changes and Direct-Controlled Municipalities

We conduct additional robustness checks by sequentially excluding: (1) 2017 observations (year of patent reporting standard revisions); (2) direct-controlled municipalities (Beijing, Shanghai, Tianjin, Chongqing) due to their distinctive development levels. Results in Table 9 remain significantly positive (all p < 0.10), indicating that baseline findings are not driven by these factors.

Table 9.

Excluding Patent Standard Changes and Direct-Controlled Municipalities.

4.3.10. Excluding Competing Policy Interferences

Given concurrent implementation of multiple environmental policies during 2016–2020, we control for three major initiatives: Green Finance Reform Pilot Zones (GreenFinance), Low-Carbon City Pilots (LowCarbon), and Carbon Trading Pilots (CarbonTrade). Additionally, we replace fixed effects with industry–year and province–year interactions to account for impacts of the Environmental Protection Law. Results in Table 10 and Table 11 confirm that baseline estimates remain robust after accounting for these competing policies.

Table 10.

Excluding Competing Policy Interferences (a).

Table 11.

Excluding Competing Policy Interferences (b).

5. Mechanism and Heterogeneity Analysis

5.1. Analysis of the Mechanism Through Which GCISP Promotes Green Innovation

5.1.1. Examination of the Mediation Effect Based on Corporate Liquidity Constraints

As postulated in Research Hypothesis 2, GCISP effectively enhances the accessibility of green credit, alleviates firms’ liquidity constraints, and thereby promotes corporate green innovation. First, our analysis examines both the supply and demand sides of green credit. For the supply side, we employ two indicators to measure green credit provision: (1) Prefecture-level City Green Credit Ratio: Measured as the ratio of total credit allocated to environmental protection projects versus total credit within the prefecture-level city. (2) Commercial Banks’ Green Credit Balance: Data are manually collected from bank annual reports and integrated with the CSMAR database on commercial banks’ green credit. Given the large scale (in trillions of RMB), values are expressed in units of 100 billion RMB. Recognizing that commercial banks may concentrate lending activities and establish more branches in their registration locations, we classify banks into treatment and control groups based on policy implementation status in their registration cities. The impact of the policy on green credit suppliers is analyzed using Models (2) and (3):

In Equations (2) and (3), the dependent variables and represent the proportion of green credit at the prefecture-city level and the outstanding green credit balance of commercial banks, respectively. The explanatory variable is a dummy variable indicating the period before and after the implementation of GCISP. denotes city-level control variables, while represents a set of bank-level control variables. The terms , , and denote city fixed effects, time fixed effects, and bank individual fixed effects, respectively. includes human capital (Human), measured as the number of college students per 10,000 people), per capita GDP (PGDP), and local government fiscal capacity (DOVMON). includes CEO duality (Dual), bank size (Size), total loans (Loan), total deposits (Deposit), the non-performing loan ratio (NPL), the liquidity ratio (Liquidity), and the equity multiplier (ETA). The regression results, presented in the first two columns of Table 12, show that following the introduction of GCISP, the overall green credit level in policy-implementing cities and the green credit balances of commercial banks in those cities increased significantly. This indicates that GCISP substantially boosted the supply of green credit from financial institutions.

Table 12.

Examination of the Mediation Effect.

For the demand side of green credit, Following Liu et al. (2025) [49], we measure it using the amount of green credit obtained by firms. This is calculated by screening the text of all loan announcements obtained by firms. Loans are classified as green credit if their announcements contain keywords related to energy-saving and environmental protection projects. The total amount of green credit obtained by each firm in a given year is then summed. To analyze the impact of GCISP on the demand side, we estimate the following firm-level model (4):

In Equation (4), the dependent variable represents the amount of green credit obtained by firm . The explanatory variable is a dummy variable indicating the period before and after the implementation of GCISP in city . denotes a set of firm-level and city-level control variables consistent with those used in the baseline regressions. The terms and represent firm fixed effects and time fixed effects, respectively. The regression results, presented in the third column of Table 12, show that following the policy introduction, the amount of green credit obtained by firms in policy-implementing cities increased significantly. This indicates that GCISP substantially enhanced green credit accessibility for the demand side, thereby alleviating firms’ liquidity constraints.

Furthermore, this paper analyzes the impact from the perspective of firms’ internal operating cash flow. The regression results, presented in the fourth column of Table 12, show that the coefficient of the explanatory variable is significantly positive at the 5% level. Following the implementation of GCISP, the operating cash flow of firms in cities adopting the policy experienced a significant increase, consequently promoting corporate green innovation.

In summary, GCISP enhances firms’ green innovation by improving their access to green credit and boosting operating cash flow, which mitigates liquidity constraints. These findings provide fundamental support for Research Hypothesis H2.

5.1.2. Examination of the Mediation Effect Based on Corporate Agency Costs

As posited in Hypothesis 3, GCISP can enhance corporate green innovation by reducing agency costs within firms. To analyze the impact of GCISP on both overall agency costs and “green” agency costs, we estimate the following model:

In the model, the dependent variable represents agency costs, measured by total agency costs (TAC) and “green” agency costs (GAC), respectively. Following Wang and Wang (2021) [53], for total agency costs, we use the management expense ratio as the proxy. A higher value indicates more severe agency problems. For “green” agency costs, we aggregate expenses related to greening fees, emission fees, sanitation fees, and other environmental governance costs listed under the “Management Expenses” item in corporate income statements. This sum constitutes the firm’s environmental management expenses. The “green” agency cost variable is then measured as the ratio of environmental management expenses to total operating revenue.

The regression results, presented in the last two columns of Table 12, show that the coefficients on total agency costs and “green” agency costs are −0.003 and −0.073, respectively, both statistically significant and negative. This indicates that following the introduction of GCISP, both the total agency costs and “green” agency costs of firms decreased. This reduction in agency costs facilitated the corporate green innovation process. These findings provide fundamental support for Research Hypothesis H3.

5.1.3. Analysis of the Moderating Effect Based on Corporate Greenwashing Behavior

Regarding the measurement of corporate “greenwashing” intensity, this study adopts a dual approach. First, Following Zhang (2023) [68], based on textual analysis of corporate environmental reports and social responsibility reports, a scoring system encompassing 16 indicators across three dimensions is applied to each enterprise. Subsequently, corporate greenwashing behavior is defined as comprising two tactics: selective disclosure and expressive manipulation. Scores for selective disclosure and expressive manipulation are calculated separately, and their geometric mean is computed to derive a composite indicator measuring the degree of corporate greenwashing. Finally, the greenwashing indicator for each firm from the year preceding the introduction of GCISP (2016) is selected for comparison. A dummy variable, Gwl_dum, is assigned a value of 1 if a firm’s greenwashing degree ranks within the top 50% of all firms, and 0 otherwise.

Second, drawing on the methodology of Hu et al. (2023) [69], this study constructs a dummy variable for corporate verbal green promotion (Oral). This involves textual analysis of environmental and social responsibility reports using a predefined lexicon of green and environmental terms (including words like “green”, “environmental protection”, “low-carbon”, “environment”, etc.) to calculate the frequency of these terms [70]. If a firm’s term frequency exceeds the industry median for the same period, Oral is set to 1; otherwise, it is 0. Another dummy variable, Actual, captures corporate environmental performance, set to 1 if the firm incurred environmental penalties in a given year, and 0 otherwise. The greenwashing dummy variable GW_dum is then constructed as the product of Oral and Actual (GW_dum = Oral × Actual). The GW_dum value from 2016 is selected as the second proxy for the greenwashing moderating variable in this study.

The regression results presented in Table 13 indicate that firms exhibiting higher levels of greenwashing prior to the policy introduction demonstrate a greater tendency to undertake substantive green actions following the implementation of GCISP. Specifically, these firms increase their investments in green innovation to accelerate their green innovation processes. This strategic shift enables them to qualify for more policy discounts, thereby alleviating potential liquidity constraints. These findings provide substantial support for Research Hypothesis H4.

Table 13.

The Moderating Effect Based on Corporate Greenwashing Behavior.

5.1.4. Analysis of the Moderating Effect Based on Corporate Rent-Seeking Behavior

To measure corporate “rent-seeking” behavior, Following Wang et al. (2025) [71], this study employs abnormal administrative expenses as the proxy. The rent-seeking indicator for each firm from the year preceding the introduction of GCISP (2016) is selected for comparison. A dummy variable, Rent_dum, is assigned a value of 1 if a firm’s rent-seeking indicator ranks within the top 50% of all sample firms, and 0 otherwise.

As shown in Table 14, the interaction terms between the rent-seeking dummy variable and GCISP variable are all significantly positive at the 1% level. This indicates that firms exhibiting higher levels of rent-seeking behavior prior to the policy introduction experience a significantly greater increase in their green innovation levels following the implementation of GCISP. These findings provide preliminary support for Research Hypothesis H5.

Table 14.

The Moderating Effect Based on Corporate Rent-Seeking Behavior.

5.2. Heterogeneity Analysis of the Green Innovation-Enhancing Effects of GCISP

To further explore the boundary conditions of our baseline regression results, this study conducts a heterogeneity analysis examining the relationship between GCISP and corporate green innovation across four dimensions: environmental regulation intensity, digitalization level, intellectual property rights (IPR) protection strength, and supply chain bargaining power.

5.2.1. Heterogeneity Analysis Based on Environmental Regulation Intensity

Green innovation is characterized by high upfront investment and uncertain long-term returns, requiring substantial human, financial, and time resources during both the R&D and application diffusion stages. As profit-maximizing entities, firms typically prioritize projects with shorter payback periods and lower risks, often leading to reduced investment in green innovation. Consequently, government agencies frequently employ environmental regulation instruments to compel firms towards green innovation. Firms located in regions with high environmental regulation intensity may have already undertaken initial green technology innovations due to policy pressure [72]. For these firms, GCISP, acting as an incremental incentive, likely offers diminishing marginal utility. Conversely, for firms in regions with low regulation intensity, this policy may address a pre-existing incentive gap, providing a significant impetus for innovation. To proxy for environmental regulation intensity, this study employs the ratio of the word count of sentences containing environmental protection keywords within a city’s government work report to the report’s total word count. Sample firms are divided into high- and low-intensity groups based on the median value of this proxy, and separate regressions are performed for each group. As presented in Table 15, the regression results are broadly consistent with our expectations.

Table 15.

Environmental Regulation Intensity.

5.2.2. Heterogeneity Analysis Based on Digitalization Level

Green innovations, such as clean production technologies and carbon emission monitoring systems, often rely on digital technologies like the Internet of Things (IoT), big data analytics, and artificial intelligence (AI) [73]. These technologies optimize R&D processes, shorten the cycle from laboratory development to market deployment for green technologies, and enhance the utilization efficiency of policy funds [74]. Furthermore, digital technologies significantly influence external supervision, internal governance, financing constraints, and environmental information transparency—all critical factors that inevitably accelerate corporate green innovation processes. Consequently, it can be inferred that the impact of GCISP on corporate green innovation is likely to vary depending on the firm’s digital infrastructure and capabilities. This study classifies sample firms into high- and low-digitalization groups based on whether their registered location falls within a “Broadband China” pilot city. Separate regressions are then conducted for each group. As evidenced by the results in Table 16, the green innovation-enhancing effect of GCISP is primarily concentrated among firms in high-digitalization environments, demonstrating a more pronounced effect for these firms. This finding aligns with our initial expectations.

Table 16.

Digitalization Level.

5.2.3. Heterogeneity Analysis Based on the Strength of Intellectual Property Rights Protection

High intellectual property protection reduces the risk of imitation of corporate green technologies through legal instruments, thereby strengthening firms’ expectations of innovation returns [48]. Second, regions with robust IPR protection typically feature mature technology trading markets, enabling enterprises to swiftly recoup R&D costs by selling or licensing green patents. Simultaneously, such regions often foster closer collaboration networks among enterprises, universities, and research institutions, where well-defined property rights facilitate joint green technology innovation. Consequently, it can be inferred that the impact of GCISP on corporate green innovation varies with the degree of IPR protection, exhibiting stronger effects in regions with higher IPR safeguards. This study categorizes sample firms into high- and low-IPR protection groups based on whether their registered locations are within “IPR demonstration” pilot cities. Regression results (Table 17) indicate significantly positive coefficients in the high-IPR protection group, consistent with our hypothesis.

Table 17.

Strength of Intellectual Property Rights Protection.

5.2.4. Heterogeneity Analysis Based on the Supply Chain Bargaining Power

In terms of resource integration and risk transfer capabilities, firms with strong supply chain bargaining power typically compel upstream suppliers to adopt eco-friendly technologies through procurement contract terms, thereby reducing complementary costs for their own green innovation [75]. Concurrently, they leverage market pricing power to transfer green innovation costs to consumers, mitigating their innovation risks and expenses. Furthermore, regarding the policy’s “siphoning effect,” local governments prioritize allocating green credit interest subsidies to leading enterprises that significantly contribute to regional GDP and employment, ensuring policy demonstration outcomes. Local commercial banks also exhibit stronger preference for extending green loans to core supply chain enterprises. Therefore, it can be inferred that GCISP exert a stronger impact on green innovation for firms with higher supply chain bargaining power. This study employs supply chain concentration as a proxy for bargaining power, dividing the sample into high- and low-bargaining-power groups based on median values. Regression results (Table 18) show significantly positive coefficients in the high-bargaining-power group, consistent with our hypothesis.

Table 18.

The Supply Chain Bargaining Power.

6. Conclusions and Discussion

As the global community intensifies its efforts toward a low-carbon future, the transition of enterprises to substantive green innovation and low-carbon models has emerged as a universal driver of sustainable economic development. The Chinese pathway, with its distinctive policy approach, offers a compelling paradigm for how this transition can be effectively facilitated, providing generalizable insights for policymakers worldwide. This study examines the impact of GCISP on corporate green innovation using a sample of China’s A-share non-financial listed firms from 2009 to 2023. Key findings include: (1) The implementation of GCISP significantly enhances corporate green innovation and facilitates green transformation—a conclusion that remains robust across multiple sensitivity tests; (2) This innovation-enhancing effect operates through improved access to green credit and reduced agency costs, with the policy exerting a stronger innovation stimulus on firms with higher levels of greenwashing and rent-seeking activities; (3) Asymmetric impacts emerge across varying regulatory intensities, digitalization levels, intellectual property protection, and supply chain bargaining power.

The results of this study confirm that GCISP has a significant positive impact on the total volume, quality, and quantity of green innovation. These findings are consistent with previous research which demonstrated that green credit policies effectively promote corporate green innovation [30,76], particularly highlighting how green credit subsidy policies significantly enhance the quality of corporate green innovation [77]. Diverging from prior studies, this research employs patent counts to measure the total volume, quality, and quantity of corporate green innovation, respectively, and constructs a multi-period difference-in-differences model to explore the mechanism through which the coordination of green finance and fiscal subsidy policies influences corporate green innovation, thereby providing a theoretical basis for policymakers at the macro level. The study further reveals that the enhancing effect of GCISP on corporate green innovation is primarily realized through two pathways: alleviating Corporate Liquidity Constraints and reducing Corporate Agency Costs. This offers a more comprehensive perspective for understanding the practical role of GCISP and provides valuable guidance for future policy design. Specifically, the alleviation of Corporate Liquidity Constraints aligns with the findings of Hong et al. (2023) [9], while the reduction in Corporate Agency Costs is consistent with the conclusions of Wang and Wang (2021) [53]. In terms of heterogeneity, this study confirms that the impact of GCISP on corporate green innovation varies depending on Environmental Regulation Intensity, Digitalization Level, Strength of Intellectual Property Rights Protection, and Supply Chain Bargaining Power, providing a theoretical foundation for future location-specific and corporate policies. These findings not only validate the overall effectiveness of GCISP but also significantly refine its theoretical and practical application. Consequently, while supporting the existing literature on green finance, this study provides more precise measurement methods, mechanistic evidence, and critical boundary conditions essential for formulating targeted and effective policies.

This study carries significant theoretical implications. First, it constructs a theoretical framework for analyzing the synergistic effects of green credit subsidy policies, revealing the micro-level mechanisms through which fiscal-financial coordination promotes green innovation. Second, it breaks through the traditional research paradigm that treats green finance and fiscal subsidies as separate domains, establishing a new theoretical foundation for understanding how policy synergy drives high-quality green transformation. Third, it systematically identifies and verifies the theoretical transmission mechanisms through which credit subsidies influence corporate green innovation.

This study carries significant policy implications. Our findings provide robust empirical support for the policy direction outlined in China’s key documents, including the 2016 Guidelines for Establishing a Green Financial System and the 2022 Opinions on Fiscal Support for Carbon Peaking and Carbon Neutrality. The evidence justifies implementing more precise tiered subsidy rates and strengthening coordination mechanisms between bank reviews and fiscal subsidies. This approach helps maximize policy effectiveness while addressing critical shortcomings such as greenwashing arbitrage under standalone subsidies and insufficient incentives under unilateral financial policies. Beyond China’s context, our research offers suggestive insights for other governance systems, though these represent logical extensions rather than direct empirical findings. For multi-level governance systems like the European Union, the GCISP model could potentially inform a strategy of centralized coordination with decentralized implementation. This might involve establishing a dedicated EU Green Credit Enhancement Facility to pool fiscal resources, enforcing the mandatory EU Green Taxonomy as a common standard, and implementing differentiated subsidy rates to address regional disparities. Similarly, for developing economies with constrained fiscal space, the model suggests a practical pathway through targeted pilot programs, blended finance arrangements with national development banks, and parallel investment in regulatory systems. The broader lesson underscores the superior efficacy of strategically coordinated fiscal and financial interventions over isolated policy measures. The GCISP experience confirms that intelligent integration of fiscal incentives with financial mechanisms can create a powerful, market-based engine for green innovation, with China’s case providing the empirical foundation for this conclusion.

There are some research deficiencies in this paper, which are worthy of further discussion in the future. First, the primary focus on listed companies, while justified by data availability, limits the generalizability of our findings. The impact of GCISP on the more dynamic and often more financially constrained Small- and Medium-sized Enterprises (SMEs) remains an open and critical question. Future studies should therefore extend this line of inquiry to the SME sector. Second, while we have identified and tested two crucial mediating pathways, other potential channels, such as shifts in managerial cognition or pressure from green supply chains, may also be at play. Third, constrained by data availability, our analysis focuses on the policy’s existence rather than its intensity. The subsidy magnitude could exhibit non-linear or even an inverted U-shaped relationship with innovation outcomes, where moderate amounts stimulate innovation while excessive subsidies might crowd out intrinsic motivation. Future research should investigate this “subsidy intensity effect” once more granular data becomes available. Fourth, our analysis captures the policy’s medium-term effects, but its long-term consequences for corporate financial performance and environmental impact remain to be evaluated through longitudinal tracking.

Author Contributions

All authors contributed to the study conception and design. Conceptualization, methodology and Supervision were performed by F.L. Data collection, analysis and format revision were performed by Z.W. The first draft of the manuscript was written by F.L. and Z.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the General Program of the National Social Science Fund of China grant number 23BJY112.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets used or analyzed during this study are available from the corresponding author on reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Zhao, L.; Zhang, L.; Sun, J.; He, P. Can public participation constraints promote green technological innovation of Chinese enterprises? The moderating role of government environmental regulatory enforcement. Technol. Forecast. Soc. Chang. 2022, 174, 121198. [Google Scholar] [CrossRef]

- Du, Y.; Guo, Q. Green credit policy and green innovation in green industries: Does climate policy uncertainty matter? Financ. Res. Lett. 2023, 58, 104512. [Google Scholar] [CrossRef]

- Deng, F.; Mao, Z. The asymmetric impact of ambidextrous innovation on labor income share. East China Econ. Manag. 2024, 38, 83–95. [Google Scholar] [CrossRef]

- Liu, G.; Fang, Y.; Qian, H.; Ding, Z.; Zhang, A.; Zhang, S. Incentive or catering effect of environmental subsidies? Evidence from ESG reports on greenwashing. Int. Rev. Financ. Anal. 2025, 103, 104242. [Google Scholar] [CrossRef]

- Yang, W.; Lin, J. Can green credit promote green innovation quality of heavily polluting industries? Appl. Econ. 2025, 1–16. [Google Scholar] [CrossRef]

- Cao, H.; Zhang, S.; Ouyang, Y. Innovation policy and the innovation quality of specialized and sophisticated SMEs that produce novel and unique products. China Ind. Econ. 2022, 11, 135–154. Available online: https://www.chndoi.org/Resolution/Handler?doi=10.19581/j.cnki.ciejournal.2022.11.012 (accessed on 31 October 2024).

- Daga, S.; Yadav, K.; Singh, D.; Pamucar, D.; Simic, V. Unveiling greenwashing: Analyzing the interaction of factors discouraging ESG greenwashing through TISM and MICMAC. J. Environ. Manag. 2025, 380, 124850. [Google Scholar] [CrossRef]

- Huang, Z.; Gao, N.; Jia, M. Green credit and its obstacles: Evidence from China’s green credit guidelines. J. Corp. Finance. 2023, 82, 102441. [Google Scholar] [CrossRef]

- Hong, X.; Lin, X.; Chen, L. Incentive effect of green loan interest subsidies policy: From the perspective of coordination of fiscal and financial policies. China Ind. Econ. 2023, 9, 80–97. Available online: https://www.chndoi.org/Resolution/Handler?doi=10.19581/j.cnki.ciejournal.2023.09.005 (accessed on 31 October 2024).

- Li, X.; Wang, S.; Lu, X.; Guo, F. Quantity or quality? The effect of green finance on enterprise green technology innovation. Eur. J. Innov. Manag. 2025, 28, 1114–1140. [Google Scholar] [CrossRef]

- Yu, C.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy. 2021, 153, 112255. [Google Scholar] [CrossRef]

- Irfan, M.; Razzaq, A.; Sharif, A.; Yang, X. Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol. Forecast. Soc. Chang. 2022, 182, 121882. [Google Scholar] [CrossRef]

- Liu, J.; Long, F.; Chen, L.; Li, L.; Zheng, L.; Mi, Z. Exploratory or exploitative green innovation? The role of different green fiscal policies in motivating innovation. Technovation 2025, 143, 103207. [Google Scholar] [CrossRef]

- Wang, G. Research on the Influence of Environmental Regulation on Enterprise Green Innovation Performance. Earth Environ. Sci. 2021, 647, 012179. Available online: https://iopscience.iop.org/article/10.1088/1755-1315/647/1/012179 (accessed on 31 October 2024). [CrossRef]