1. Introduction

Environmental change is a major challenge faced globally. There is a broad consensus that advancing sustainable, green, and low-carbon development represents a collective pathway forward. China prioritizes green growth as a national objective, aiming to limit carbon emissions by 2030 and achieve carbon neutrality by 2060. The Chinese government has systematically institutionalized environmental governance through a tripartite policy framework that integrates pollution control, regulatory enhancement, and green innovation incentives [

1]. Sustainable innovation plays a crucial role in advancing the goal of carbon neutrality. Under environmental regulatory pressure, companies are motivated to adopt green innovations as a strategic measure to boost shareholder returns [

2]; mitigate compliance costs [

3]; and ultimately improve financial performance [

4], corporate reputation [

5], and market valuation [

6].

Prior studies have explored the diverse determinants of corporate green innovation, including the impact of sustainable fiscal measures [

7], environmental regulations [

8], and the institutional environment [

9]. This study primarily examines the external influences and operational aspects that shape corporate green innovation. The role of executives’ local social capital at the internal micro-level remains a critical yet overlooked area in current scholarship.

This study examines internal corporate evidence while advancing the literature on green innovation. Specifically, we examine how the chairperson’s local social capital shapes corporate green innovation and investigate the underlying mediating mechanisms. We consider the chairperson’s social capital as the existing literature shows that it plays a critical role in corporate operations. For instance, research has shown that executives’ hometown ties represent a form of identity attachment and foster emotional embeddedness, serving as a source of social capital [

10]. These connections can effectively stabilize and facilitate corporate business ties [

11].

Our analysis empirically examines the hypotheses using extensive Chinese firm data from 2013 to 2023. The results indicate that there is a detrimental impact of local board chairpersons on corporate green innovation. In this study, three moderated models are constructed to integrate institutional pressures stemming from environmental, social, and governance (ESG) factors; the legal environment (LE); and senior management team stability (STMT). We further conduct heterogeneity tests based on relational networks, tenure, ownership, and industry regulation.

Our study significantly advances two key strands of the literature. First, it elucidates key drivers behind corporate environmental innovation. Prior studies have focused on external institutional forces (e.g., environmental regulations, government subsidies) [

8,

12,

13], while our study addresses a critical gap by exploring how local chairpersons impact green innovation outcomes. We contribute to the green innovation literature by empirically demonstrating that firms with a local board chairperson exhibit significantly lower levels of green innovation. Second, our study expands the body of research on social capital, highlighting its variable impacts on corporate green innovation. Moreover, we reveal that senior executives leverage social capital strategically to minimize corporate green innovation costs. While the existing literature predominantly emphasizes the positive effects of hometown ties on corporate performance, our empirical evidence suggests that such social capital may engender negative externalities for environmental protection mechanisms.

3. Research Hypotheses

Prior research shows that locally born chairpersons tend to access broader local social networks and accumulate more social capital than their foreign counterparts. In addition to this, the strong local social capital within a community plays a pivotal role in driving business expansion and professional development. According to Schutjens & Völker (2010), local social capital provides entrepreneurs with a significant advantage when launching new ventures [

50]. Social capital can significantly influence a company’s business model [

40]. Venture capitalists (VCs) located within five miles of a company’s headquarters are twice as likely to appoint board members to investee companies [

51]. Zhu et al. (2018) found that a higher degree of connection between board members and the chairperson reduces the likelihood that the chairperson will be removed [

42]. Moreover, familial ties embedded in a firm’s local networks (“home ties”) may weaken internal governance and increase favoritism toward chairpersons [

52].

This study demonstrates that local chairpersons can acquire social capital more cost-effectively through kinship and friendship networks. Emotionally grounded trust in local connections typically fosters stronger relational bonds [

52], and such ties enhance reputational capital [

53], leading local partners to view corporate behavior more favorably [

54].

China has implemented a tax-sharing fiscal system, in which the disparity between fiscal authority and financial resources results in distinctive regional characteristics within local economic structures. Local governments often function as both policymakers and policy implementers. Their revenue reliance on local firms exacerbates the tension between growth and environmental goals. Existing research indicates that local social connections often encourage opportunistic behavior.

Corporate misconduct has been explored in numerous studies regarding its connection with the social ties of top management [

55]. For instance, hometown ties within executive teams significantly increase corporate tax avoidance [

25]. Local chairpersons’ social capital mitigates green innovation pressure under environmental regulation through enhanced government communication channels. However, this regulatory leniency ultimately results in weaker green innovation performance.

H1. Local chairpersons have a negative impact on corporate green innovation.

Unlike conventional corporate innovation, green innovation aims to achieve both economic growth and ecological sustainability at the same time. As part of a non-market approach, strong ESG (environmental, social, and governance) performance encourages companies to focus more on environmental conservation, strengthen their social commitments, and improve governance. Robust ESG performance strengthens external confidence in corporate operations, thereby significantly enhancing green innovation [

56,

57]. However, research demonstrates that ESG divergence exacerbates managerial myopia, thereby creating green innovation bubbles and reducing innovation quality [

58]. Under rigorous regulatory frameworks, positive ESG performance exerts an inverse moderating effect on the relationship between stringent environmental policies and progress in green innovation [

59]. Firms with low ESG ratings exhibit greater green innovation engagement than higher-rated counterparts [

60]. For companies already leading in ESG rankings, the marginal improvement from additional green innovation investment diminishes significantly. In this context, local chairpersons are more likely to utilize their social capital to prioritize local projects with immediate political or private benefits over highly uncertain, long-term green frontier research. This strategic choice exacerbates the detrimental effect of local ties on green innovation. In institutionally robust contexts where formal rules are flexibly implemented, firms leverage relational networks to manage institutional pressures [

61]. In such institutionally robust contexts, local chairpersons’ social resources attain enhanced strategic value. High-ESG-rated firms are compelled to concurrently meet multi-dimensional environmental and social requirements, which already impose substantial resources. Under these circumstances, local chairpersons are more likely to leverage their social capital to redirect the company’s allocable resources to local government and business projects. Such reallocations displace green innovation investments, resulting in a more significant decline in innovative output.

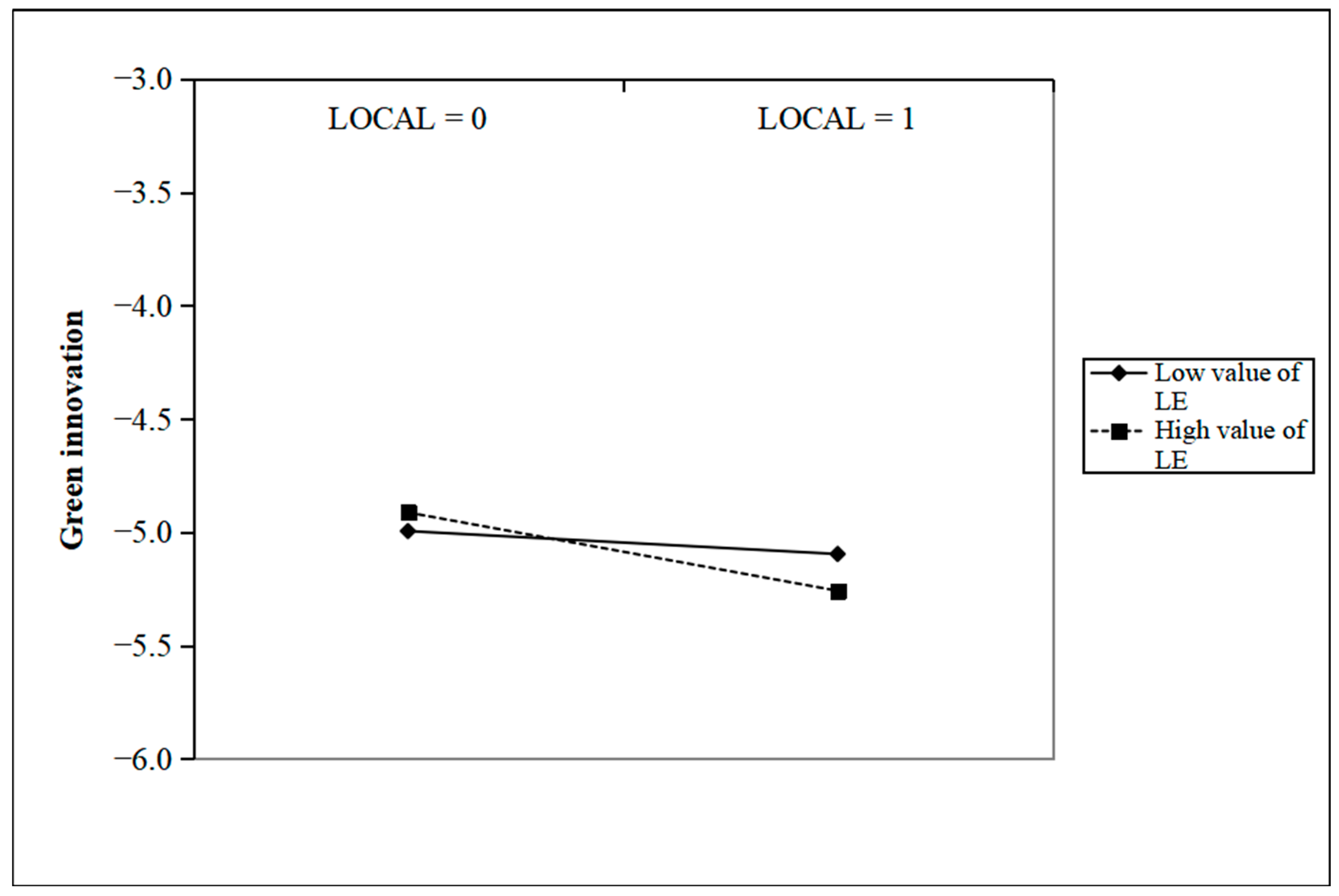

H2. ESG performance can mitigate the negative impact of local chairpersons on corporate green innovation.

In contexts where property rights frameworks are underdeveloped and political governance mechanisms exhibit relative instability during institutional transitions, businesses are exposed to increased operational costs and heightened uncertainty. This situation is particularly pronounced for companies situated in regions with stronger legal environments, where regulations are more comprehensive and the enforcement of judicial and administrative laws is more stringent [

62]. However, a strong property rights-based legal environment (LE) does not preclude the role of informal relationships. A local CEO’s social connections create “obligations and expectations” within the network, which incentivize heightened corporate social responsibility engagement. This engagement, however, is instrumentally motivated by reciprocity rather than genuine altruism [

63]. Under a stringent legal environment where environmental compliance costs are significantly high, local chairpersons may leverage their influence to resist or circumvent strict regulations. Although such measures might safeguard regional economic interests in the near-term by delaying sustainable transitions, they essentially serve as a means of reciprocating social capital among involved actors. In these situations, existing social resources are leveraged to oppose environmental innovation initiatives, thereby reinforcing disincentives for the adoption of green technologies. Furthermore, in regions with high legal effectiveness, companies do not reduce their relational reliance but strategically utilize local resources to seek operational flexibility and secure scarce resources within the robust legal framework [

64]. In a strong legal environment, the judiciary is highly credible, and the consequences of non-compliance are severe. Under these circumstances, the value of a local chairperson lies precisely in their ability to convert social capital into regulatory leniency. Consequently, companies exhibit greater reliance on these individuals rather than engage in costly green innovation.

H3. Legal Environment (LE) can effectively enhance the negative relationship between local chairpersons and corporate green innovation.

Drawing on upper echelons theory, existing research demonstrates that the demographic characteristics and cognitive bases of top management teams significantly influence strategic decision-making processes and overall organizational performance. A stable top management team exerts significant influence on a company’s sustainable innovation [

65] and can mitigate agency costs between the chairperson and shareholders while ensuring the implementation of long-term strategies. The social connections of a local chairperson represent a “double-edged sword.”

High stability within the top management team (TMT) is positively associated with extended member tenure and enhanced strategic commitment to organizational objectives. This phenomenon stems from the cumulative effect of shared experiences and cognitive alignment among TMT members, which fosters institutional memory and reinforces strategic consistency over time. This, in turn, fosters a robust capacity to monitor [

66] and counterbalance high-level decision-making [

67]. A stable management team demonstrates a stronger commitment to executing a company’s long-term strategies (green innovation). Such a team can effectively channel the chairperson’s local social capital to support—rather than supplant—green innovation activities. For instance, this involves leveraging hometown ties to secure critical green technology information or policy support instead of seeking regulatory exemptions. In contrast, an unstable team lacks the requisite cohesion and long-term orientation. It is more likely to acquiesce to—or fail to constrain—the chairperson’s use of social connections for short-term rent-seeking behaviors.

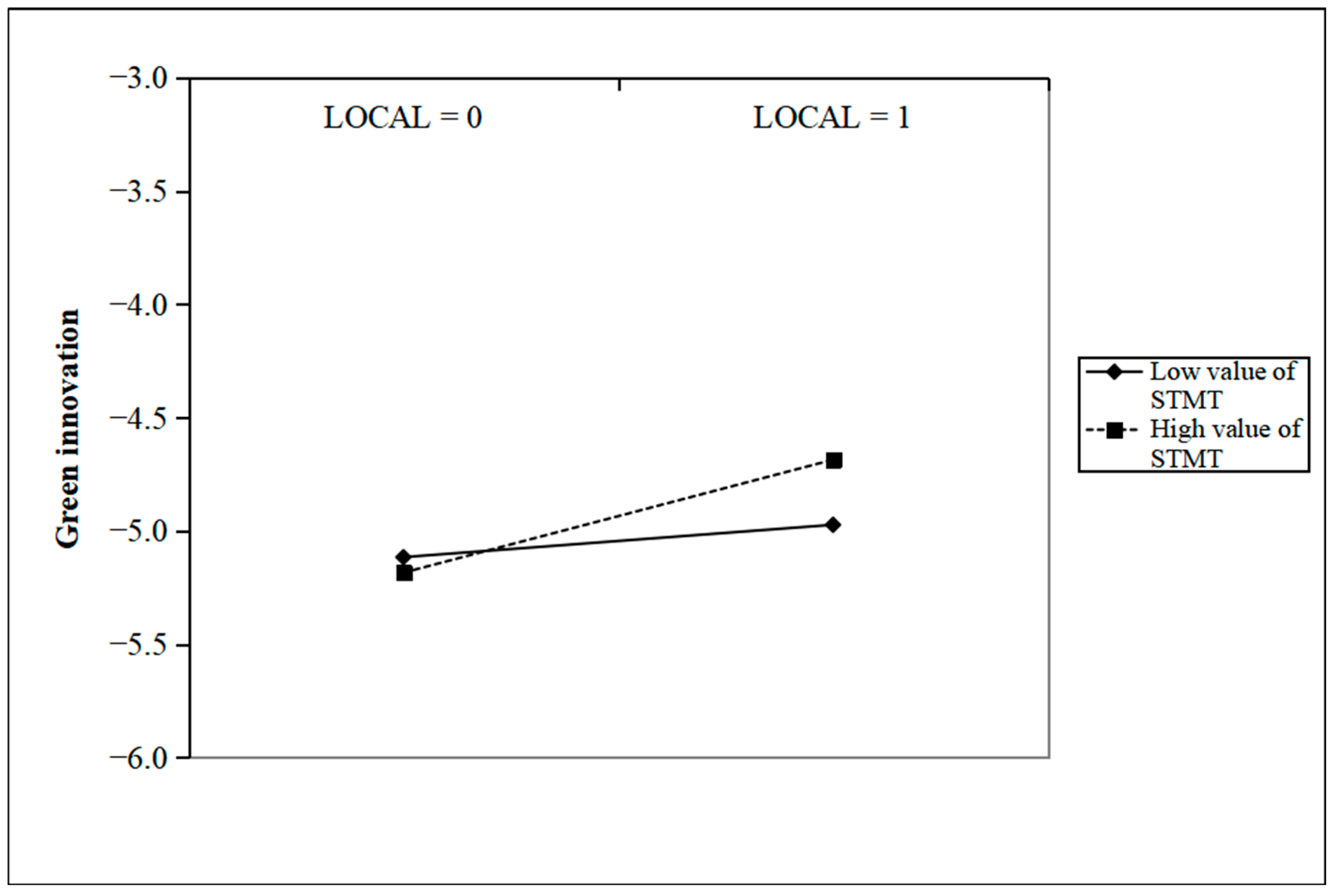

H4. The stability of the executive team can mitigate the negative impact of local chairpersons on corporate green innovation.

7. Conclusions and Implications

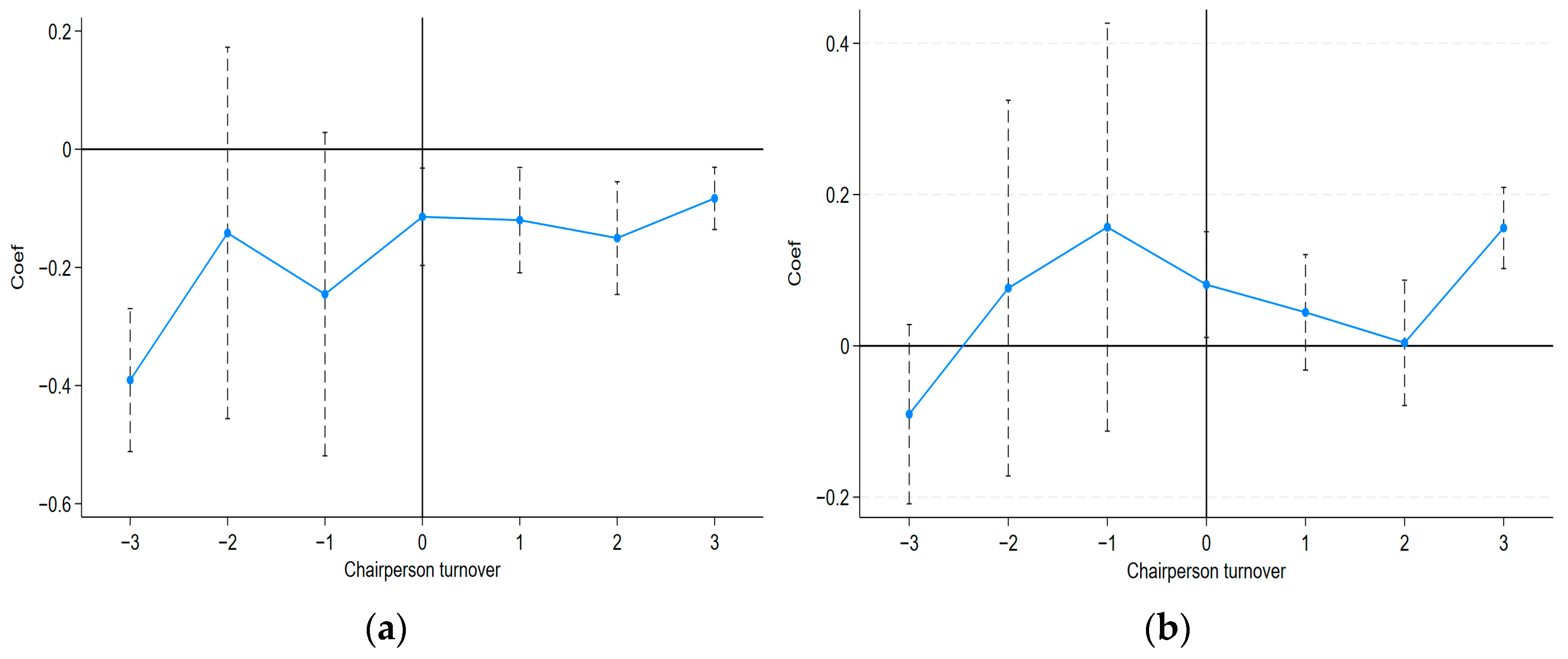

This study examined corporate green innovation as a critical approach to environmental pollution governance. It analyzed the influence of local chairpersons on green innovation in publicly listed companies, emphasizing how these chairpersons leverage their regional social capital to gain preferential treatment. Based on micro-level data from Chinese listed companies between 2013 and 2023, this study conducted robust empirical tests to examine this relationship. The findings show that local chairpersons negatively affect the level of corporate green innovation. Specifically, companies with local chairpersons engage in significantly fewer green innovation activities than those with non-local chairpersons. This conclusion remains robust after comprehensive sensitivity analyses, including instrumental variable approaches and difference-in-differences tests.

Based on the moderation effect analysis of ESG performance, this study observed that local chairpersons utilize local resources to buffer formal institutional pressures. They redirect remaining allocable resources toward local government–business projects, thereby crowding out green innovation investment. This result indicates that stronger ESG performance reinforces the negative relationship between local chairpersons and green innovation. The moderating effect of the legal environment (LE) reveals that in regions with more developed legal systems, local chairpersons more strategically leverage relationships to seek flexibility within the robust legal framework and obtain scarce resources. In such contexts, their social resources are transformed into “resistance” to green innovation policies, thus creating a stronger disincentive for green innovation. Furthermore, STMT demonstrates a stronger commitment to organizational strategy and develops a robust capacity to monitor and balance top-level decision-making. Such teams are more committed to implementing the company’s long-term strategies and curbing the chairperson’s myopic behaviors, thus mitigating the negative relationship between local chairpersons and green innovation.

Based on empirical research findings, targeted policy recommendations in two key domains are proposed. First, by understanding how the chairperson’s background influences corporate green innovation, a firm can make more targeted decisions. Long-term performance assessments and stable tenure arrangements are thus recommended. Specifically, the long-term benefits of green innovation should be integrated into core key performance indicators (KPIs). Simultaneously, a chairperson’s tenure should be extended to foster their sense of long-term commitment to corporate green transformation and their willingness to undertake strategic risks. Second, for policymakers, this study reveals that chairpersons may leverage their social connections to influence the supervision of their enterprises under environmental regulation policies, thereby concealing their enterprises’ deficiencies in green innovation. This finding underscores the need for local governments to attach greater importance to supervision, with the aim of preventing interference by corporate executives.