Reducing Waste in Retail: A Mixed Strategy, Cost Optimization Model for Sustainable Dead Stock Management

Abstract

1. Introduction

2. Literature Review

2.1. The Presence of Dead Stock in the Retail Industry

2.2. General Dead Stock Inventory Management Strategies

2.2.1. Disposal Strategy

2.2.2. Price Discount Strategy

2.2.3. Product Bundling Strategy

2.2.4. Lateral Transshipment Strategy

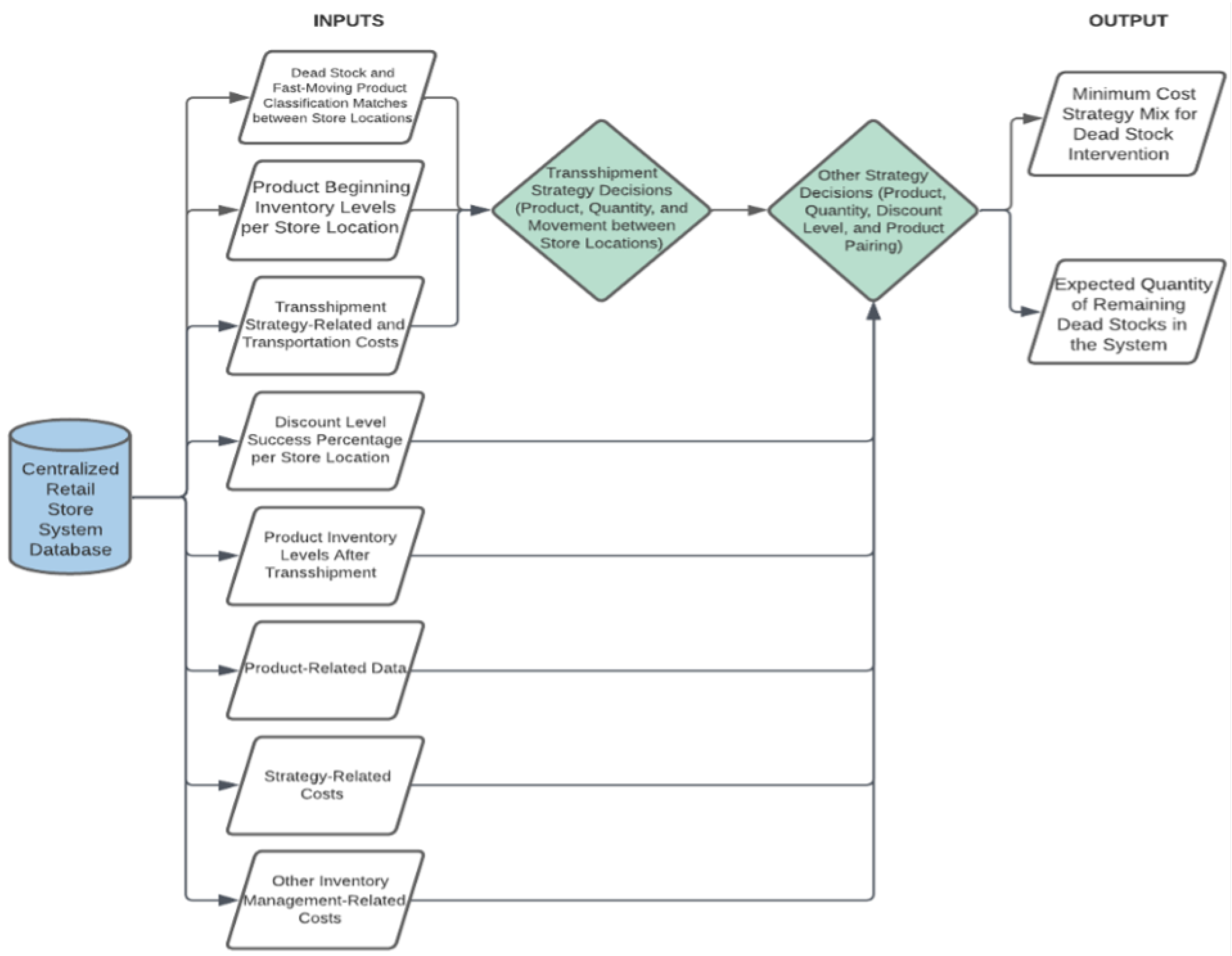

3. Methodology

4. Mathematical Model

- Fast-moving items may not be transshipped to other stores in the chain store system. Only slow-moving (potential dead stock) and non-moving items (unexpired dead stock) are allowed to be transshipped from one store to another store if these items belong to the fast-moving product classification in the store that they will be transshipped to.

- There are dedicated trucks for dead stock management. The number of trucks in the retail chain store system and the capacity per truck are enough to transport products from one store to another as needed.

- Transportation cost is a function of a product’s store-to-store distance. It does not consider travel time, vehicle speed, and vehicle routing.

- All fast-moving products for the given period are equally desirable for bundling. The success in selling the bundles is not dependent on the fast-moving product that a dead stock or potential dead stock is bundled with.

- Product bundling strategy success is a function of bundle discount % level and sales throughput of the store.

- Unlimited additional warehouse space is maintained for potential dead stock and unexpired dead stock.

- Stockout costs of fast-moving products are not considered in the total inventory cost.

4.1. Decision Variables

| Decision Variable | Definition | Factors Considered by the Model in Deciding |

| Qpi(ts) | quantity of product p in store location i to manage using transshipment (ts) strategy | Inventory Classification: Only slow (PDS) or non-moving (UDS) items in a store are allowed to be transshipped. There should be at least one receiving store where the same product to be transshipped is classified as fast-moving (NDS). |

| QTSpij | quantity of product p transshipped from store location i to store location j | Inventory level (IL) of NDS in the receiving store must not exceed its UMIL after transshipment. Inventory classification of the product (PDS or UDS) to be transshipped from the sending store should be considered. The cost profile of the sending store should be considered. |

| Qpi(pd) | quantity of product p in store location i to manage using price discount (pd) strategy | IL, Discount %, Expected Sales Success %

Inventory Classification: Unsold PDS are kept in the warehouse for another period, while unsold UDS are automatically disposed of. The realizable salvage value factor of a product should be considered. |

| Qpi(pb) | quantity of product p from store location i to manage using product bundling (pb) strategy | IL, Discount %, Expected Sales Success % Inventory Classification: Unsold PDS are kept in the warehouse for another period, while unsold UDS are automatically disposed of. The realizable salvage value factor of a product should be considered. |

| PBQpp’i,pfi PBQpdni,pfi | quantity of product p from set p’i to bundle with product p from set fi quantity of product p from set dni to bundle with product p from set fi | IL of NDS should be higher than its EMIL. The max. qty. of NDS that can be assigned for pairing is IL-EMIL. Priority is given to the NDS with the highest % excess over its EMIL. |

4.2. Objective Function

4.3. Model Constraints

4.4. Non-Negativity, Integer and Binary Constraints

5. Results

6. Discussion

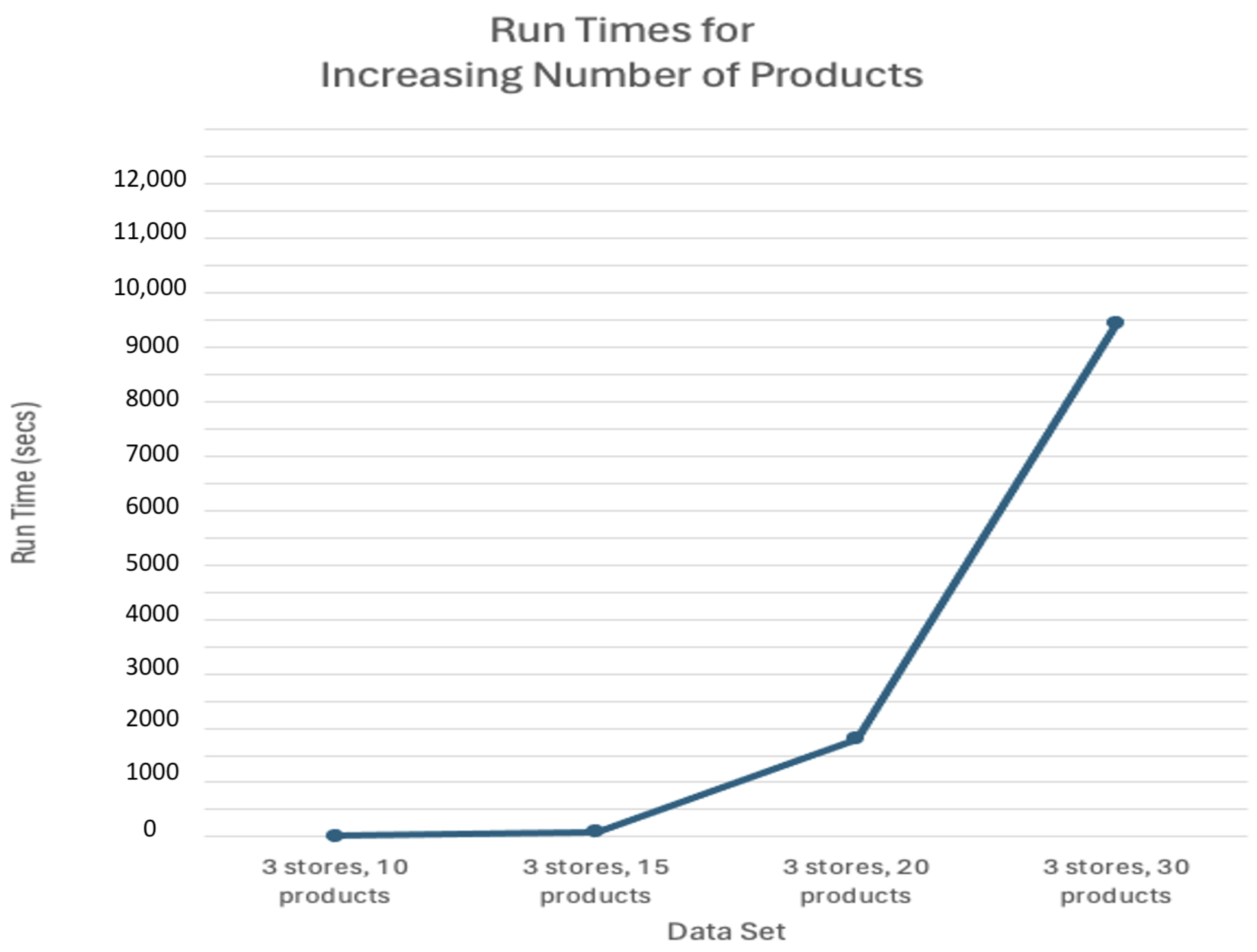

6.1. Scalability of the Model

6.2. Practical Application

- Run the Inventory Classification Module of the ERP system and generate Inventory Classification Report per store.

- Consolidate all store-level product classification results, product-related, and sales-strategy-related data into an Excel file with specific data formatting (i.e., separate sheet per parameter where rows represent products and columns represent stores) that an optimization software will read.

- Run the mixed strategy cost optimization model code and generate the dead stock management decision report for each dead stock per store.

- Examine the transshipment, price discount, and product bundling results per store and check for sudden operational, logistical, and resource constraints that need to be considered. Discount percentage levels selected by the model for each dead stock should also be checked against the most recent product demand patterns and forecasts, if available.

- Finalize the dead stock management decision report per store.

- Prepare the labor, material, marketing, logistical, and other operational resources needed per store in carrying out the dead stock management strategies prescribed by the optimization model.

- Prepare a transshipment routing plan and perform the prescribed transshipment decisions in the final dead stock management decision report first.

- Update and verify the inventory level of each product after transshipment to see if it matches the inventory level used by the model in making the sales strategy decisions.

- Execute the sales strategy decisions in the final dead stock management decision report.

- Monitor the sales performance of each dead stock during the period and adjust strategies to reduce dead stock management costs if necessary.

- If possible, and with the help of people from the finance and accounting department, record and monitor actual costs and benefits of strategy implementation.

- Prepare the labor, material, logistical, and other operational resources needed per store to collect the unsold unexpired dead stock (UDS) from the store and return them to the warehouse.

- Prepare the unsold UDS for disposal. Judgement should be exercised in deciding whether to dispose of the unsold UDS or not based on the actual sales strategy’s success during the period.

- Consolidate the unsold UDS for disposal from each store and prepare a truck routing plan to transport these to the centralized disposal facility.

- Prepare the labor and other operational resources needed per store to transfer the unsold PDS back to the warehouse.

- If possible, and with the help of people from the finance and accounting department, record the actual disposal and warehouse costs for the period. Compute the total actual dead stock management costs and benefits incurred for the period, and compare this cost against the total cost computed by the optimization model.

- The cycle repeats itself in the following period.

7. Conclusions

Limitations of the Proposed Integrated Mixed Strategy Model and Future Research

- Discount levels are not treated as decision variables in the model. Hence, the selection of discount % is limited to only four possible values in all store locations.

- Stockout cost of fast-moving products was not considered in the optimization model. The consideration of stockout cost can alter the product bundling decisions and total inventory management cost.

- The single-period model formulated in this research was unable to show the effect of changes in product classifications on dead stock management. Consequently, it was unable to determine the degree of accumulation or elimination of dead stock over time.

- The formulated model is limited to only three dead stock management strategies. Consideration of other strategies, such as return to vendor and donation of dead stock, provides an opportunity for management to consider tradeoffs between social and environmental costs.

- The use of hypothetical data in determining the effectiveness of the results limited the realism and strength of validity of the stated results.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Matlab Code for Mixed Strategy Model

References

- Kumar, P.; Shivabharathi, P. Dead stock reduction using association rule mining. In Proceedings of the 2022 7th International Conference on Communication and Electronics Systems (ICCES), Coimbatore, India, 22–24 June 2022. [Google Scholar] [CrossRef]

- Bazrafshan, F.; Emami, S.; Mashreghi, H. Inventory control and price discount policies for perishable products with age and price-dependent demand. Sci. Iran. 2022. [Google Scholar] [CrossRef]

- Lestari, N.F. Analysis of inventory management in order to reduce overstock (Case study of TVF footwear). Int. J. Curr. Sci. Res. Rev. 2022, 5. [Google Scholar] [CrossRef]

- Tariq Afridi, M.; Nieto-Isaza, S.; Ehm, H.; Ponsignon, T.; Hamed, A. A deep reinforcement learning approach for optimal replenishment policy in a Vendor Managed Inventory setting for semiconductors. In Proceedings of the 2020 Winter Simulation Conference (WSC), Orlando, FL, USA, 14–18 December 2020. [Google Scholar] [CrossRef]

- Saprudin, S.; Dewi, S.; Pratiwi, T.H. Analysis of sales return and economic order quantity to assess turn of goods inventory. Int. J. Inform. Econ. Manag. Sci. (IJIEMS) 2022, 1, 63–77. [Google Scholar] [CrossRef]

- Zighan, S. Managing the great bullwhip effects caused by COVID-19. J. Glob. Oper. Strateg. Sourc. 2021, 15, 28–47. [Google Scholar] [CrossRef]

- van de Hurk, L. An Inventory Model for Slow Moving Items Subject to Obsolescence with Limited Customer Patience. Bachelor’s Thesis, Erasmus University Rotterdam, Rotterdam, The Netherlands, 2019. [Google Scholar]

- Jauhar, S.K.; Jani, S.M.; Kamble, S.S.; Pratap, S.; Belhadi, A.; Gupta, S. How to use no-code artificial intelligence to predict and minimize the inventory distortions for resilient supply chains. Int. J. Prod. Res. 2023, 62, 5510–5534. [Google Scholar] [CrossRef]

- Yan, H.; Yano, C.A.; Zhang, H. Inventory management under periodic profit targets. Prod. Oper. Manag. 2019, 28, 1387–1406. [Google Scholar] [CrossRef]

- Zhou, L.; Gupta, S.M. Marketing research and life cycle pricing strategies for new and remanufactured products. J. Remanuf. 2018, 9, 29–50. [Google Scholar] [CrossRef]

- Ibrahim, A. Optimal customized bundle pricing. Int. J. Model. Optim. 2019, 9, 234–237. [Google Scholar] [CrossRef]

- Li, Q.; Yu, P. Reducing Waste of Perishables in Retailing Through Transshipment. 2018. Available online: http://www.bm.ust.hk/isom/files/OM/FacultyPublications/LiQing/Rotation_Clearance_Dec2018.pdf (accessed on 1 August 2022).

- Prasad, M.N.V.; Vithanage, M.; Kapley, A. (Eds.) Pharmaceuticals and Personal Care Products: Waste Management and Treatment Technology: Emerging Contaminants and Micro Pollutants; Heinemann: Butterworth, Malaysia, 2019. [Google Scholar]

- Sugumaran, P.; Sukumaran, V. Recommendations to improve dead stock management in garment industry using data analytics. Math. Biosci. Eng. 2019, 16, 8121–8133. [Google Scholar] [CrossRef]

- Yıldız, S.C.; Hekimoğlu, M. Markdown optimization in apparel retail sector. In Advances in National Brand and Private Label Marketing: Seventh International Conference; Springer International Publishing: Berlin/Heidelberg, Germany, 2020; pp. 50–57. [Google Scholar]

- Avci, M.G. Lateral transshipment and expedited shipping in disruption recovery: A mean-CVaR approach. Comput. Ind. Eng. 2019, 130, 35–49. [Google Scholar] [CrossRef]

- Teplická, K.; Čulková, K. Using of optimizing methods in inventory management of the company. Acta Logist. 2020, 7, 9–16. [Google Scholar] [CrossRef]

- López-Soto, D.; Yacout, S.; Ángel-Bello, F. Root cause analysis of familiarity biases in classification of inventory items based on logical patterns recognition. Comput. Ind. Eng. 2016, 93, 121–130. [Google Scholar] [CrossRef]

- Emar, W. Al-dulaime, W. Analysis of inventory management of laptops spare parts by using XYZ techniques and EOQ model—A case study. J. Electron. Syst. 2021, 10, 1. [Google Scholar]

- Pencheva, D. Fast Moving Consumer Goods Retail: Business Intelligence Approach in Retail Information Systems. Egypt. Comput. Sci. J. 2021, 45, 47–57. [Google Scholar]

- Chaowai, K.; Chutima, P. Demand Forecasting and Ordering Policy of Fast-Moving Consumer Goods with Promotional Sales in a Small Trading Firm. Eng. J. 2024, 28, 21–40. [Google Scholar] [CrossRef]

- Li, R.; Chiu, A.; Seva, R. A Process-Based Dead Stock Management Framework for Retail Chain Store Systems. RSF Conf. Ser. Bus. Manag. Soc. Sci. 2022, 2, 122–128. [Google Scholar]

- Kakarlamudi, S. Deadstock Inventory Identification and Disposition. Master’s Thesis, Pennsylvania State University, University Park, PA, USA, 2018. [Google Scholar]

- Borden, N.H. The concept of the marketing mix. J. Advert. Res. 1964, 4, 2–7. [Google Scholar]

- Buisman, M.E. Reduce and Re-Use: Studying Retailers’ Food Waste from an Operations Research Perspective. Doctoral Dissertation, Wageningen University and Research, Wageningen, The Netherlands, 2019. [Google Scholar]

- Zhang, M.; Yang, X.; Cheng, T.E.; Chang, C. Inventory management of perishable goods with Overconfident retailers. Mathematics 2022, 10, 1716. [Google Scholar] [CrossRef]

- Collart, A.J.; Interis, M.G.; Maples, J. The impacts of food waste information on consumer preferences for blemished produce and implications for food retailers. J. Agric. Appl. Econ. 2022, 54, 440–460. [Google Scholar] [CrossRef]

- Franco, C.; López-Santana, E.R.; Figueroa-García, J.C. Solving the interval green inventory routing problem using optimization and genetic algorithms. In Applied Computer Sciences in Engineering: 4th Workshop on Engineering Applications, WEA 2017, Cartagena, Colombia, 27–29 September 2017; Proceedings 4; Springer International Publishing: Berlin/Heidelberg, Germany, 2017; pp. 556–564. [Google Scholar]

- Bachman, T.C.; Williams, P.J.; Cheman, K.M.; Curtis, J.; Carroll, R. PNG: Effective inventory control for items with highly variable demand. Interfaces 2016, 46, 18–32. [Google Scholar] [CrossRef]

- Martins, P.; Rodrigues, P.; Martins, C.; Barros, T.; Duarte, N.; Dong, R.K.; Yue, X. Preference between individual products and bundles: Effects of complementary, price, and discount level in Portugal. J. Risk Financ. Manag. 2021, 14, 192. [Google Scholar] [CrossRef]

- Fang, Y.; Jiang, Y.; Han, X. Bundle pricing decisions for fresh products with quality deterioration. J. Food Qual. 2018, 2018, 1595807. [Google Scholar] [CrossRef]

- Barrios, P.S.C.; Cruz, D.E. A mixed integer programming optimization of bundling and pricing strategies for multiple product components with inventory allocation considerations. In Proceedings of the 2017 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Singapore, 10–13 December 2017; pp. 16–20. [Google Scholar] [CrossRef]

- Bucarey, V.; Elloumi, S.; Labbé, M.; Plein, F. Models and algorithms for the product pricing with single-minded customers requesting bundles. Comput. Oper. Res. 2021, 127, 105139. [Google Scholar] [CrossRef]

- Naderi, S.; Kilic, K.; Dasci, A. A Deterministic Model for the Transshipment Problem of a Fast Fashion Retailer under Capacity Constraints. SSRN Electron. J. 2020, 227, 107687. [Google Scholar] [CrossRef]

- Nakandala, D.; Lau, H.; Zhang, J. Strategic hybrid lateral transshipment for cost-optimized inventory management. Ind. Manag. Data Syst. 2017, 117, 1632–1649. [Google Scholar] [CrossRef]

- Li, R.; Seva, R.; Chiu, A. A System-Based Classification and Prioritization Model to Prevent Dead Stock Occurrence in Retail Store Systems. In Industrial Engineering and Applications; IOS Press: Manila, Philippines, 2023; pp. 87–98. [Google Scholar]

- Li, R.; Chiu, A.S.; Seva, R. Reducing carbon footprint and promoting resource sustainability in the retail industry through the prevention of dead stocks. Clean. Responsible Consum. 2023, 11, 100150. [Google Scholar] [CrossRef]

- Sebatjane, M.; Adetunji, O. Optimal lot-sizing and shipment decisions in a three-Echelon supply chain for growing items with inventory level- and expiration date-dependent demand. Appl. Math. Model. 2021, 90, 1204–1225. [Google Scholar] [CrossRef]

- Yan, J.; Gong, M.; Sun, C.; Huang, J.; Chu, S.M. Sales pipeline win propensity prediction: A regression approach. In Proceedings of the 2015 IFIP/IEEE International Symposium on Integrated Network Management (IM), Ottawa, ON, Canada, 11–15 May 2015; pp. 854–857. [Google Scholar]

- Jonsson, P.; Mattsson, S.A. Inventory management practices and their implications on perceived planning performance. Int. J. Prod. Res. 2008, 46, 1787–1812. [Google Scholar] [CrossRef]

- Tripathi, V.; Kochhar, P. Determinants of Effective Inventory Management A Study of Consumer Durable Retailers. Bonfring Int. J. Ind. Eng. Manag. Sci. 2016, 6, 53. [Google Scholar] [CrossRef]

| P | set of all products or item codes |

| p’i | set of all potential dead stock (slow-moving items) in store location i |

| dni | set of all unexpired dead stock (non-moving items) in store location i |

| fi | set of all fast-moving stocks in store location i, where p’i ⊆ P; dni⊆ P; fi⊆ P |

| p’i ⋀ fj | set of all products classified as potential dead stock (slow-moving items) in store location i but classified as fast-moving stocks in store location j |

| dni ⋀ fj | set of all products classified as unexpired dead stock (non-moving items) in store location i but classified as fast-moving stocks in store location j |

| fi ⋀ fj | set of all products classified as fast-moving stocks in store location i and also classified as fast-moving stocks in store location j |

| i,j | indices of retail store location i, j = 0, 1, 2, …, M |

| p | index of retail store products p = 1, 2, …, N |

| s | index of retail store strategy s = 1, 2, …, S |

| o | index of product discount levels for p’ o = 1, 2, …, O |

| o’ | index of product discount levels for dn o’ = 1, 2, …, O’ |

| o" | index of product bundle discount levels for p’ and f bundle o” = 1, 2, …, O” |

| o’” | index of product bundle discount levels for dn and f bundle o” ’ = 1, 2, …, O” ’ |

| copi | fixed product ordering cost (paperwork and communications) in store location i |

| dcoi | discount factor level o of product p (belonging to product category set p’i) in store location i |

| dc’o’i | discount factor level o’ of product p (belonging to product category set dni) in store location i |

| disppi | disposal cost (variable labor cost of collecting, unbundling and loading the unsold product into the truck for disposal) per unit of product p (belonging to product category set dni) in store location i |

| E(pbs%o”) | expected product bundle discount success % based on discount level o” for product p (belonging to product category set p’i) |

| E(pbs%’o” ’) | expected product bundle discount success % based on discount level o” ’ for product p (belonging to product category set dni) |

| E(pds%o) | expected price discount success % based on discount level o for product p (belonging to product category set p’i) |

| E(pds%’o’) | expected price discount success % based on discount level o’ for product p (belonging to product category set dni) |

| pbdco”i | product bundle discount factor level o” of product p (belonging to product category set p’i) in store location i |

| pbdc’o” ’i | product bundle discount factor level o” ’ of product p (belonging to product category set dni) in store location i |

| pbci | variable product bundling strategy cost (variable labor and supplies cost to bundle and reprice the bundled products) per bundled unit of product (belonging to product category sets p’i and dni) in store location i |

| pbcfi | fixed product bundling strategy cost (fixed cost of visual or print collaterals placed in both primary and secondary shelves plus system registration cost) per product (belonging to product category sets p’i and dni) in store location i |

| pdcfi | cost (fixed cost of visual or print collaterals placed in both primary and secondary shelves plus system registration cost) of discount offer strategy per product belonging to product category sets p’i and dni in store location i |

| tp,i,j | transportation cost (truck operations and fuel cost) per unit of product p (belonging to product category sets p’i and dni) transshipped from store location i to store location j |

| tpi | transportation cost (logistics provider cost) per unit of product p (belonging to product category set dni) from store location i to centralized disposal facility location |

| tspi | transshipment cost (labor, material and overhead cost to retrieve and handle products from the warehouse, inspect and load them into the truck, and process necessary paperwork) per unit of product p (belonging to product category sets p’i and dni) in store location i |

| wpi | warehouse cost (labor cost and holding cost) per unit of product p in the warehouse of store location i |

| cp | total cost of purchasing and making each unit of product p available for sale in the retail store |

| spp | original selling price per unit of product p |

| BIpi | beginning inventory of product p (belonging to product category sets p’i, dni and fi) in store location i |

| LMILpi | lower maintaining inventory level for product p in store location i |

| EMILpi | expected maintaining inventory level for product p in store location i |

| UMILpi | upper maintaining inventory level for product p in store location i |

| ILpi | inventory level of product p (belonging to product category sets p’i, dni and fi) in store location i after transshipment to or from the store has been carried out at the beginning of the single period |

| Qpis | quantity of product p from store location i to manage using strategy s · Qpi(ts)—quantity of product p from store location i to manage using transshipment (ts) strategy · Qpi(pd)—quantity of product p from store location i to manage using price discount (pd) strategy · Qpi(pb)—quantity of product p from store location i to manage using product bundling (pb) strategy |

| QTSpij | quantity of product p transshipped from store location i to store location j |

| PBQpp’i,pfi | quantity of product p from set p’i to bundle with product p from set fi |

| PBQpdni,pfi | quantity of product p from set dni to bundle with product p from set fi |

| STpis | =1 if strategy s is selected for product p in store location i =0 otherwise · STpi(ts) = 1 if transshipment strategy is selected for product p in store location i where p{p’i, dni} =0 otherwise · STpi(pd) = 1 if price discount strategy is selected for product p in store location i where p{p’i, dni} =0 otherwise · STpi(pb) = 1 if product bundling strategy is selected for product p in store location i where p{p’i, dni, fi} =0 otherwise |

| TQpij | =1 if product p where p{p’i, dni} is transshipped from store location i to store location j =0 otherwise |

| DLopi | =1 if price discount level o is applied to product p in store location i where pp’i =0 otherwise |

| DLo=1,p,i | =1 if price discount level o = 1 is applied to product p in store location i where pp’i (i.e., ILpi-LMILpi ≤ 0) =0 otherwise |

| DLo=2,p,i | =1 if price discount level o = 2 is applied to product p in store location i where pp’i (i.e., LMILpi< ILpi ≤ EMILpi) =0 otherwise |

| DLo=3,p,i | =1 if price discount level o = 3 is applied to product p in store location i where pp’i (i.e., EMILpi< ILpi ≤ UMILpi) =0 otherwise |

| DLo=4,p,i | =1 if price discount level o = 4 is applied to product p in store location i where pp’i (i.e., ILpi-UMILpi > 0) =0 otherwise |

| DL’o’pi | =1 if price discount level o’ is applied to product p in store location i where pdni =0 otherwise |

| DL’o’=1,p,i | =1 if price discount level o’ = 1 is applied to product p in store location i where pdni (i.e., ILpi-LMILpi ≤ 0) =0 otherwise |

| DL’o’=2,p,i | =1 if price discount level o’ = 2 is applied to product p in store location i where pdni (i.e., LMILpi< ILpi ≤ EMILpi) =0 otherwise |

| DL’o’=3,p,i | =1 if price discount level o’ = 3 is applied to product p in store location i where pdni (i.e., EMILpi< ILpi ≤ UMILpi) =0 otherwise |

| DL’o’=4,p,i | =1 if price discount level o’ = 4 is applied to product p in store location i where pdni (i.e., ILpi-UMILpi > 0) =0 otherwise |

| Ypi | =1 if UMILpi –BIpi> 0 where pfi in store location i where product transshipment will be received =0 if UMILpi –BIpi ≤ 0 where pfi in store location i where product transshipment will be received |

| PBpp’i,pfi | =1 if product pp’i is bundled with product pfi =0 otherwise |

| PBpdni,pfi | =1 if product pdni is bundled with product pfi =0 otherwise |

| PBSp1fi,p2fi | =1 if p1 fi is to be bundled ahead of p2 fi in store location i where p1 ≠ p2 =0 if p2 fi is to be bundled ahead of p1 fi in store location i where p1 ≠ p2 |

| BDLo”,p,i | =1 if product bundle discount level o” is applied to product p bundle in store location i where pp’i =0 otherwise |

| BDLo”=1,p,i | =1 if product bundle discount level o” = 1 is applied to product p bundle in store location i where pp’i (i.e., ILpi-LMILpi ≤ 0) =0 otherwise |

| BDLo”=2,p,i | =1 if product bundle discount level o” = 2 is applied to product p bundle in store location i where pp’i (i.e., LMILpi< ILpi ≤ EMILpi) =0 otherwise |

| BDLo”=3,p,i | =1 if product bundle discount level o” = 3 is applied to product p bundle in store location i where pp’i (i.e., EMILpi< ILpi ≤ UMILpi) =0 otherwise |

| BDLo”=4,p,i | =1 if product bundle discount level o” = 4 is applied to product p bundle in store location i where pp’i (i.e., ILpi-UMILpi > 0) =0 otherwise |

| BDL’o” ’, p,i | =1 if product bundle discount level o” ’ is applied to product p bundle in store location i where pdni =0 otherwise |

| BDL’o” ’=1,p,i | =1 if product bundle discount level o” ’ = 1 is applied to product p bundle in store location i where pdni (i.e., ILpi-LMILpi ≤ 0) |

| BDL’o” ’=2,p,i | =1 if product bundle discount level o” ’ = 2 is applied to product p bundle in store location i where pdni (i.e., LMILpi< ILpi ≤ EMILpi) |

| BDL’o” ’=3,p,i | =1 if product bundle discount level o” ’ = 3 is applied to product p bundle in store location i where pdni (i.e., EMILpi< ILpi ≤ UMILpi) |

| BDL’o” ’=4,p,i | =1 if product bundle discount level o” ’ = 4 is applied to product p bundle in store location i where pdni (i.e., ILpi-UMILpi > 0) |

| Dead Stock Management Strategy | Objective Function Component | Definition |

|---|---|---|

| Product Bundling/Price Discount | A1/A2—Strategy Related Cost (SRC) | Semi-fixed and variable costs that are incurred in carrying out the strategy |

| Product Bundling/Price Discount | B1/B2—Unrecovered Product Purchase Cost (UPC) | Difference between the product cost and discounted selling price of successfully sold dead stock |

| Product Bundling/Price Discount | C1/C2—Disposal Cost (DC) | Labor and other operational costs associated with product disposal |

| Product Bundling/Price Discount | C1/C2—Disposed Product Cost (PC) | Totally unrecovered purchase cost of a disposed product |

| Product Bundling/Price Discount | D1/D2—Transport Cost (TC) | Variable cost of transporting a disposed product to the disposal facility |

| Product Bundling/Price Discount | E1/E2—Warehouse Cost (WC) | Cost of holding inventory for one full period including risk of obsolescence |

| Product Bundling/Price Discount | F1/F2—Salvage Value (SV) | Revenue derived from the sale of discounted products |

| Lateral Transshipment | A3—Strategy Related Transportation Cost (SRT) | Variable cost of transporting a product from one store to another store |

| Lateral Transshipment | B3—Strategy Related Operations Cost (SRO) | Labor and other operational costs associated with product transshipment |

| Lateral Transshipment | C3—Savings in Purchase Cost (SPC) | Purchase cost savings realized by the chain store system because the product requirement of the receiving store was internally supplied through transshipment |

| Lateral Transshipment | D3—Savings in Ordering Cost (SOC) | Savings arising from not having to order the product with an external supplier |

| Lateral Transshipment | E3—Savings in Warehouse Cost (SWC) | Savings in holding and obsolescence risk cost arising from the transshipment of the dead stock |

| Dead Stock Management Strategy | Constraints | Description |

|---|---|---|

| General constraints | Involve the selection/activation of a strategy and the determination of inventory quantities in each store to be managed using a specific strategy | |

| Binary and integer constraints | Specify which decision variables are 0–1 variables and which variables are integers | |

| Lateral Transshipment | Post-transshipment inventory level calculation constraints | Calculate the IL of all products in the sending and receiving stores after transshipment |

| Lateral Transshipment | Allowable outbound and inbound transshipment quantity constraints | Ensure that the quantities transshipped from the sending stores do not exceed the requirement of products in the receiving stores |

| Product Bundling | Product bundle pairing constraints | Determine which NDS and how much of each NDS should be bundled with each dead stock |

| Product Bundling | Bundling strategy discount level determination constraints | Determine the bundle discount % to offer based on the IL of the dead stock |

| Product Bundling | NDS sequencing constraints | Determine which among many NDS should be prioritized for bundle pairing based on the % by which an NDS exceeds its expected maintaining inventory level (EMIL) |

| Price Discount | Price discount strategy discount level determination constraints | Determine the price discount % to offer based on the IL of the dead stock |

| Inventory Classification | Store 1 Qty. | % of Store 1 Invty. | Store 2 Qty. | % of Store 2 Invty. | Store 3 Qty. | % of Store 3 Invty. | System Total Qty. | % of System Invty. |

|---|---|---|---|---|---|---|---|---|

| PDS | 94 | 13 | 375 | 41.1 | 282 | 40.6 | 751 | 32.2 |

| UDS | 96 | 13.3 | 154 | 16.9 | 324 | 46.7 | 574 | 24.6 |

| NDS | 534 | 73.7 | 384 | 42 | 88 | 12.7 | 1006 | 43.2 |

| Store Total Qty. | 724 | 100 | 913 | 100 | 694 | 100 | 2331 | 100 |

| Total Dead Stock (PDS + UDS) | 190 | 26.3 | 529 | 58 | 606 | 87.3 | 1325 | 56.8 |

| Obj. Function Component | Store 1 | Store 2 | Store 3 | Total |

|---|---|---|---|---|

| Strategy Related Cost (SRC) | - | 651.50 | 111.00 | 762.50 |

| Unrecovered Product Cost (UPC) | - | 6062.76 | - | 6062.76 |

| Disposal Cost (DC) | - | - | 68.73 | 68.73 |

| Product Cost (PC) | - | - | 309.06 | 309.06 |

| Transportation Cost (TC) | - | - | 46.24 | 46.24 |

| Warehouse Cost (WC) | - | 563.83 | - | 563.83 |

| Salvage Value (SV) | - | 42,965.72 | 296.94 | 43,262.66 |

| Total Net Product Bundling Strategy Cost | - | −35,687.63 | 238.10 | −35,449.54 |

| Strategy Related Cost (SRC) | 60.00 | 120.00 | 120.00 | 300.00 |

| Unrecovered Product Cost (UPC) | 73,570.56 | 147,810.30 | 47,526.89 | 268,907.75 |

| Disposal Cost (DC) | 426.95 | 707.73 | - | 1134.69 |

| Product Cost (PC) | 73,920.00 | 83,545.00 | - | 157,465.00 |

| Transportation Cost (TC) | 320.09 | 378.10 | - | 698.20 |

| Warehouse Cost (WC) | 643.17 | 2,481.43 | 1504.18 | 4628.77 |

| Salvage Value (SV) | 24,299.52 | 47,353.14 | 103,549.74 | 175,202.40 |

| Total Net Price Discount Strategy Cost | 124,641.25 | 187,689.42 | −54,398.68 | 257,932.00 |

| Strategy Related—Transpo (SRT) | - | 2646.50 | 10,861.00 | 13,507.50 |

| Strategy Related—Operations (SRO) | - | 163.90 | 461.73 | 625.63 |

| Savings in Purchase Cost (SPC) | 50,289.75 | 33,804.55 | - | 84,094.30 |

| Savings in Ordering Cost (SOC) | 360.00 | 400.00 | - | 760.00 |

| Savings in Warehouse Cost (SWC) | - | 1817.99 | 5445.26 | 7263.25 |

| Total Net Transshipment Strategy Cost | −50,649.75 | −33,212.14 | 5877.47 | −77,984.42 |

| Total System Dead Stock Management Cost | 73,991.50 | 118,789.65 | −48,283.11 | 144,498.04 |

| Total Remaining Qty. of Dead Stock | 49.00 | 133.00 | 138.00 | 320.00 |

| Dead Stock as a % of Total Inventory | 6.77 | 14.57 | 19.88 | 13.73 |

| Integrated Model Decision | Store 1 | Store 2 | Store 3 | System Total Qty. |

|---|---|---|---|---|

| Qty. of PDS Transshipped | 0 | 67 | 21 | 88 |

| Qty. of UDS Transshipped | 0 | 0 | 309 | 309 |

| Total PDS + UDS Qty. Transshipped | 0 | 67 | 330 | 397 |

| Qty. of PDS Discounted | 94 | 217 | 261 | 572 |

| Qty. of UDS Discounted | 96 | 154 | 0 | 250 |

| Total PDS + UDS Qty. Discounted | 190 | 371 | 261 | 822 |

| Qty. of PDS Sold as a Bundle | 0 | 91 | 0 | 91 |

| Qty. of UDS Sold as a Bundle | 0 | 0 | 15 | 15 |

| Total PDS + UDS Qty. Sold as a Bundle | 0 | 91 | 15 | 106 |

| Total Qty. of PDS + UDS Managed | 190 | 529 | 606 | 1325 |

| Relationship Item Number | Cost of UDS | Discount Offer % | Selling Price of UDS | % of Unsold UDS | Selling Price of Dead Stock | % of Unsold Dead Stock | PC | UPC |

|---|---|---|---|---|---|---|---|---|

| 1 | ↑ | ↑ | ||||||

| 2 | ↑ | ↑ | ||||||

| 3 | ↑ | ↓ | ↓ | |||||

| 4 | ↓ | ↑ | ↑ | |||||

| 5 | ↑ | ↓ | ||||||

| 6 | ↑ | ↓ | ↑ | |||||

| 7 | ↓ | ↑ | ↑ | |||||

| 8 | ↓ | ↑ | ↓ |

| Inventory Cost Component | Product Bundling Model | Price Discount Model |

|---|---|---|

| Strategy Related (SR) | 1512.70 | 480.00 |

| Unrecovered Product Cost (UPC) | 150,904.44 | 284,518.44 |

| Disposal Cost (DC) | 5571.24 | 3168.55 |

| Product Cost (PC) | 321,515.70 | 166,948.55 |

| Transportation Cost (TC) | 3448.74 | 2066.60 |

| Warehouse Cost (WC) | 12,775.47 | 6157.38 |

| Salvage Value (SV) | 42,317.56 | 234,763.81 |

| Grand Total Cost for all Stores | 453,410.73 | 228,575.70 |

| Total Qty. of Remaining Potential Dead Stock for all Stores | 651.00 | 375.00 |

| Integrated Model | Product Bundling Only | Price Discount Only | ||||

|---|---|---|---|---|---|---|

| Store | Cost (Php) | Qty. of Remaining Dead Stock (Units) | Cost (Php) | Qty. of Remaining Dead Stock (Units) | >Cost (Php) | Qty. of Remaining Dead Stock (Units) |

| 1 | 73,991.50 | 48.88 | 166,279.17 | 30.08 | 124,641.25 | 48.88 |

| 2 | 118,789.65 | 133.02 | 276,757.99 | 363.78 | 151,159.71 | 173.65 |

| 3 | −48,283.11 | 137.69 | 10,373.58 | 255.12 | −47,225.27 | 151.98 |

| Total System Cost (Php) | 144,498.04 | 319.59 | 453,410.74 | 648.98 | 228,575.69 | 374.51 |

| Total Dead Stock Management Cost | Qty. of Remaining Dead Stock | % of Unresolved Dead Stock | |

|---|---|---|---|

| 3 stores 10 products | 144,498.04 | 320.00 | 24% |

| 4 stores 15 products | 125,702.02 | 427.00 | 24% |

| 5 stores 20 products | (472,046.94) | 782.00 | 25% |

| 7 stores 30 products | (1,109,978.52) | 1448.00 | 19% |

| Scenario | Data Set | Run Time (s) | Number of Variables | Number of Constraints |

|---|---|---|---|---|

| Increasing Number of Products | 3 stores 10 products | 20.70 | 14,479 | 66,919 |

| 3 stores 15 products | 95.03 | 44,854 | 214,414 | |

| 3 stores 20 products | 1803.37 | 102,679 | 497,959 | |

| 3 stores 30 products | 9453.62 | 336,679 | 1,653,199 | |

| Increasing Number of Stores | 3 stores 10 products | 20.70 | 14,479 | 66,919 |

| 4 stores 10 products | 37.54 | 19,378 | 89,338 | |

| 5 stores 10 products | 119.59 | 24,317 | 111,817 | |

| 7 stores 10 products | 270.87 | 34,315 | 156,955 | |

| Increasing Number of Stores and Number of Products | 3 stores 10 products | 20.70 | 14,479 | 66,919 |

| 4 stores 15 products | 161.30 | 59,918 | 286,058 | |

| 5 stores 20 products | 7826.55 | 171,517 | 830,517 | |

| 7 stores 30 products | 12,968.29 | 787,235 | 3,859,955 |

| Total Net Dead Stock Management Cost | Total Net Dead Stock Management Cost | Total Net Dead Stock Management Cost | Total Net Dead Stock Management Cost | |

|---|---|---|---|---|

| Objective Function Components | 3 stores 10 products | 4 stores 15 products | 5 stores 20 products | 7 stores 30 products |

| Bundling Strategy Related Cost (BSRC) | 762.50 | 1879.00 | 3494.00 | 4785.00 |

| Unrecovered Product Purchase Cost (UPC) | 6062.76 | 33,244.87 | 172,443.04 | 28,307.48 |

| Disposal Cost (DC) | 68.73 | 616.64 | 1427.17 | 239.07 |

| Disposed Product Purchase Cost (PC) | 309.06 | 37,119.04 | 140,277.48 | 5189.00 |

| Transportation Cost TC) | 46.24 | 365.12 | 848.45 | 135.39 |

| Warehouse Cost (WC) | 563.83 | 874.28 | 995.25 | 4288.68 |

| Salvage Value (SV) | 43,262.66 | 78,022.65 | 202,689.24 | 82,013.03 |

| Total Bundling Management Cost | (35,449.54) | (3923.70) | 116,796.15 | (39,067.91) |

| Discount Strategy Related Cost (DSRC) | 300.00 | 450.00 | 630.00 | 1470.00 |

| Unrecovered Product Purchase Cost (UPC) | 268,907.75 | 293,260.76 | 88,229.60 | 284,505.24 |

| Disposal Cost (DC) | 1134.69 | 1211.34 | 238.80 | 3555.33 |

| Disposed Product Purchase Cost (PC) | 157,465.00 | 157,652.46 | 2144.68 | 351,919.70 |

| Transportation Cost TC) | 698.20 | 743.58 | 141.40 | 2157.02 |

| Warehouse Cost (WC) | 4628.77 | 4798.11 | 10,057.89 | 22,139.92 |

| Salvage Value (SV) | 175,202.40 | 210,498.25 | 213,891.86 | 388,660.52 |

| Total Discount Management Cost | 257,932.00 | 247,617.99 | (112,449.51) | 277,086.68 |

| Strategy Related-Transpo (SRT) | 13,507.50 | 20,382.00 | 36,329.50 | 168,123.00 |

| Strategy Related-Operations (SRO) | 625.63 | 1575.59 | 3126.26 | 12,183.18 |

| Savings in Purchase Cost (SPC) | 84,094.30 | 126,819.90 | 490,828.65 | 1,430,113.70 |

| Savings in Ordering Cost (SOC) | 760.00 | 1920.00 | 3170.00 | 7490.00 |

| Savings in Warehouse Cost (SWC) | 7263.25 | 11,209.96 | 21,850.70 | 90,699.78 |

| Total Transshipment Management Cost | (77,984.42) | (117,992.28) | (476,393.58) | (1,347,997.30) |

| Net Total Dead Stock Management Cost | 144,498.04 | 125,702.02 | (472,046.94) | (1,109,978.52) |

| Total Qty. of Potential Dead Stocks | 751.00 | 1354.00 | 2328.00 | 5589.00 |

| Total Qty. of Unexpired Dead Stocks | 574.00 | 437.00 | 787.00 | 1891.00 |

| Total Qty. of Dead Stocks | 1325.00 | 1791.00 | 3115.00 | 7480.00 |

| Qty. of Remaining Potential Dead Stocks | 320.00 | 427.00 | 782.00 | 1448.00 |

| Percentage of Unresolved Dead Stocks | 24% | 24% | 25% | 19% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, R.; Seva, R.; Chiu, A. Reducing Waste in Retail: A Mixed Strategy, Cost Optimization Model for Sustainable Dead Stock Management. Sustainability 2025, 17, 9242. https://doi.org/10.3390/su17209242

Li R, Seva R, Chiu A. Reducing Waste in Retail: A Mixed Strategy, Cost Optimization Model for Sustainable Dead Stock Management. Sustainability. 2025; 17(20):9242. https://doi.org/10.3390/su17209242

Chicago/Turabian StyleLi, Richard, Rosemary Seva, and Anthony Chiu. 2025. "Reducing Waste in Retail: A Mixed Strategy, Cost Optimization Model for Sustainable Dead Stock Management" Sustainability 17, no. 20: 9242. https://doi.org/10.3390/su17209242

APA StyleLi, R., Seva, R., & Chiu, A. (2025). Reducing Waste in Retail: A Mixed Strategy, Cost Optimization Model for Sustainable Dead Stock Management. Sustainability, 17(20), 9242. https://doi.org/10.3390/su17209242