Abstract

With the impact of globalization, logistics has evolved beyond mere goods transportation to become an indispensable component of international trade and a strategic force that provides a competitive advantage. Through logistics companies with strong financial performance, the sector plays a decisive role in enhancing industry efficiency and supporting global economic sustainability. In this context, measuring and improving the financial performance of logistics companies has become critically important. This study introduces an innovative approach to evaluating the financial performance of logistics companies listed on the Borsa Istanbul (BIST) Transportation Index by integrating four distinct Multi-Criteria Decision-Making (MCDM) methods. The SIWEC, MEREC, and LODECI methods, recognized for objective weighting, were used to assign weights to financial criteria for logistics companies. The obtained criteria weights were combined for each research period using the Heron mean, and then the performance rankings of logistics companies were determined using the CoCoSo method. The consistency of the results obtained was also evaluated through sensitivity analysis, and the reliability of the model was tested. It has been determined that the methods used are moderately to highly sensitive to changes in parameters.

Keywords:

logistics; financial performance; multi-criteria decision making; SIWEC; MEREC; LODECI; CoCoSo 1. Introduction

Currently, the expansion of free foreign trade and the facilitation of customs clearance between countries have subjected numerous sectors to an environment characterized by intense international competition. This development compels businesses to confront competitive pressures in both production and distribution processes, necessitating a reassessment of their existing strategies. Within this context, one of the most essential approaches to attaining and maintaining a competitive advantage is the development of cost-effective, high-performance production and distribution models.

Logistics activities—encompassing both internal logistics (such as procurement, in-production transportation, and warehouse management) and external logistics (including distribution, international transportation, and customs clearance)—are essential for delivering final products and services to the market at competitive prices. Consequently, optimizing costs solely in raw material procurement and production processes is insufficient; logistics costs must also be managed through a comprehensive approach. For businesses that prioritize production processes, logistics companies specializing in these services play a crucial role as key stakeholders in ensuring the efficient execution of logistics activities and providing these services more cost-effectively. These companies are commonly referred to as logistics outsourcing service providers.

Logistics is defined as the strategic planning and management of the entire process encompassing the procurement, transportation, and storage of materials, components, finished products, and associated information flows across organizations and distribution channels [1] (p. 2). It also includes additional activities essential to the global supply chain, such as purchasing, handling, inventory management, distribution, customs clearance, insurance, and customer service management [2] (p. 19). Moreover, businesses may manage these processes either internally through their own logistics departments or externally by outsourcing to specialized logistics service providers. The types of logistics companies offering outsourcing services vary according to the specific services they provide [3] (pp. 6–7).

- Second-Party Logistics (2PL) refers to companies that primarily provide commodity capacity and engage in fundamental logistics functions, including transportation, warehousing, and transshipment.

- Third-Party Logistics (3PL) refers to companies that offer comprehensive logistics services, including transportation, warehousing, cross-docking, inventory management, packaging, and labeling. These services are more complex than those provided by Second-Party Logistics (2PL) providers, incorporate advanced information technology, and are frequently delivered under long-term contractual agreements.

- Fourth-Party Logistics (4PL) represents one of the most comprehensive outsourcing models within logistics and supply chain management. Providers of 4PL services extend beyond operational functions such as transportation and warehousing; they assume responsibility for the integration, coordination, and strategic management of these services. Additionally, they frequently deliver more extensive services to companies across various sectors by employing virtual planning and optimization processes.

The classification of these companies depends on their level of specialization within the logistics sector and their capacity to incorporate information technologies into their operations. In response to globalization, logistics firms have adopted more comprehensive and strategic roles, evolving into increasingly sophisticated entities over the past three decades to address the growing demands of the global supply chain. Although logistics companies are often favored for their service quality and process expertise, particularly when other firms concentrate on specialization or lack sufficient expertise, two critical factors for achieving competitive advantage in this sector are operational performance and financial performance. Financial performance is essential for all companies, as it directly influences profitability, operational efficiency, sustainable growth, and overall competitiveness. Sustainable financial performance within the logistics sector is essential for businesses to sustain long-term competitive advantage. Effective sustainable financial management extends beyond merely minimizing short-term costs; it also involves the efficient allocation of resources, the consideration of environmental and social impacts in investment decisions, and the strategic management of associated risks. Consequently, maintaining robust financial performance is a priority for logistics companies, as it is across all industries.

Consequently, maintaining robust financial performance is a priority for logistics companies, as it is across all industries. Conversely, the robust financial performance observed today is attributable not only to operational profitability but also to the enhancement of investor confidence through stock market listings. Within this framework, corporate financial strategies should align with objectives aimed at augmenting market value and obtaining additional resources from capital markets. Numerous logistics companies globally are publicly traded on stock exchanges across different countries, thereby improving their financial profitability and broadening both their operational diversity and scale.

BIST, a fundamental component of Turkey’s capital markets, serves as a critical mechanism for the growth and institutionalization of companies within the logistics sector, which is characterized by high capital intensity. Presently, the BIST Transportation (XULAS) Index comprises 12 companies primarily engaged in transportation and warehousing services.

Financial performance of logistics companies is a complex process that requires evaluating multiple financial criteria directly related to the company’s financial condition and operational efficiency. Due to the presence of multiple financial criteria that must be considered, financial performance evaluations in the literature are often conducted using Multi-Criteria Decision-Making (MCDM) methodologies. These methodologies enable the simultaneous analysis of various financial indicators, offering a more comprehensive and objective evaluation process.

The primary objective of this study is to evaluate the financial performance of nine of the twelve companies listed on the BIST XULAS index over the past three years, conduct a comparative analysis, and identify trends and changes during this period. In this context, MCDM models have been applied; however, a novel model combining four different MCDM methods—an approach not previously reported in the literature—has been proposed. For each method (Simple Weight of Criteria (SIWEC) Method), Method Based on the Removal Effects of Criteria (MEREC), (Logarithmic Objective Decomposition Index (LODECI) method), criteria weights were calculated separately for each research period, and weighted values were obtained using the Heron mean. Subsequently, these weighted values were used to derive annual performance rankings of the alternatives with the Combined Compromise Solution (CoCoSo) method. Additionally, to assess the consistency and reliability of the results obtained from the novel model methodology, the impact of changes in the criteria weights on the rankings was analyzed, and the rankings were compared with those derived from different MCDM methods. These evaluations were conducted through sensitivity analyses.

This study is expected to contribute not only by offering a novel methodological example in literature but also by providing additional contribution through the application of relatively newer methods compared to the MCDM models commonly used in research on the financial performance of logistics companies.

This study comprises five sections. Section 2 reviews research on the financial evaluation of logistics companies using MCDM methods, emphasizing the necessity of this study and its potential contributions in light of gaps in existing literature. Section 3 offers a comprehensive discussion of the MCDM techniques employed in this research. Section 4 analyzes the financial performance of logistics service providers listed on the BIST XULAS index by applying the established MCDM methods. Section 5 presents sensitivity analyses to evaluate the robustness of the proposed model.

2. Theoretical Framework

It is important to note that MCDM methods are extensively employed in research assessing the financial performance of logistics companies in both national and international contexts.

Feng and Wang [4] assessed the financial performance of five transportation companies operating in Taiwan by employing a combined model integrating Grey Relational Analysis (GRA) and the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS). Wong et al. [5] examined the performance of logistics companies in Singapore and Malaysia utilizing Data Envelopment Analysis (DEA) alongside Tobit Regression. Lee et al. [6] evaluated the financial performance of container shipping companies operating between Korea and Taiwan through the Entropy-GRA model, with particular consideration of the global financial crisis period from 1999 to 2009. Pineda et al. [7] assessed firms within the U.S. transportation sector employing multiple methodologies, including the Dominance-based Rough Set Approach (DRSA), Decision-Making Trial and Evaluation Laboratory (DEMATEL) method, DEMATEL-based analytic network process (DANP) method, and VIseKriterijumska Optimizacija I Kompromisno Resenje (VIKOR). Rosini and Gunavan [8] examined the financial conditions of twenty transportation companies in Indonesia utilizing TOPSIS and DEA techniques. Periokaitė and Dobrovolskienė [9] investigated the financial performance of transportation firms in Lithuania in the context of the COVID-19 pandemic, ranking their performance through a relative weighting approach informed by expert judgments.

Numerous studies have been conducted in the literature focusing specifically on Turkey. Akgün and Temür [10] analyzed the logistics performance of two airline companies listed on the BIST XULAS index by employing the TOPSIS method. Kendirli and Kaya [11] assessed the financial performance of logistics companies traded on the BIST XULAS index between 2010 and 2013, without differentiating between transportation modes, using the TOPSIS method. Ayaydın et al. [12] evaluated the 2011 financial performance of ten logistics companies included in the Fortune 500 Turkey list through GRA and ranked the companies according to their success. Ozbek [13] examined the 2016 financial performance of companies within the same sample group by applying hybrid models comprising GRA, Step-wise Weight Assessment Ratio Analysis (SWARA), the Complex Proportional Assessment (COPRAS) method, and TOPSIS. Tufan and Kılıç [14] comparatively analyzed the financial performance of logistics companies traded on the BIST XULAS index from 2014 to 2018 using TOPSIS and VIKOR methods, identifying return on equity, return on assets, and asset turnover as the most significant criteria. Oral and Kırkıp [15] investigated the financial performance of eight transportation companies listed on the BIST during the period 2014–2018, employing TOPSIS and the Preference Ranking Organization Method for Enrichment Evaluations (PROMETHEE). Elmas and Özkan [16] analyzed the financial performance of logistics companies traded on the BIST XULAS index between 2015 and 2019, utilizing the SWARA and Operational Competitiveness Rating (OCRA) methods to rank the best-performing companies annually. Alnıpak and Kale [17] examined the sector’s financial development by applying the OCRA method to consolidated financial ratios of companies listed on the BIST XULAS index from 2008 to 2020, also assessing the impact of COVID-19. Işık [18] evaluated the financial performance of logistics companies included in the 2018 Fortune 500 Turkey list using two integrated models comprising Gray Entropy, the Full Consistency Method (FUCOM) and Evaluation based on Distance from Average Solution in the Minkowski space (EDAS-M). Kurt and Kablan [19] analyzed the financial performance of airline companies listed on the BIST XULAS index through an integrated model combining the TOPSIS and Multi-Attributive Border Approximation Area Comparison (MABAC) methods, with particular attention to the effects of the COVID-19 pandemic. Table 1 presents a summary of the literature on financial performance measurement in the logistics sector, highlighting the methods and criteria employed.

Table 1.

Financial Ratios Utilized in Assessing the Financial Performance of Companies in the Logistics Sector.

Contributions of the Research to the Literature

In the literature, methods such as TOPSIS, GRA, VIKOR, PROMETHEE, and OCRA are commonly used to analyze the financial performance of companies in the logistics sector. These companies’ performances are evaluated based on quantitative criteria over specific time periods. Given that BIST is frequently used as a data source in these studies, it is evident that reliable and standardized data are accessible for the financial evaluation of logistics firms. This availability enhances the objectivity and comparability of the analyses, thereby facilitating more robust and consistent conclusions regarding the sector.

However, the number of firms evaluated fluctuates over time due to the varying number of new firms listed on or withdrawn from the BIST each year. Utilizing the most recent data available in this study offers one of the most current analyses in the field and contributes a dynamic perspective to existing literature.

Conversely, logistics companies typically employ either a single MCDM method or, at most, a hybrid approach in their evaluations of financial performance. Although the analyses conducted in these studies are generally adequate, integrating multiple methodologies comparatively can improve the reliability and depth of the results, thereby yielding more precise and comprehensive insights.

This study seeks to address a gap in the existing literature by employing the SIWEC, MEREC, LODECI, and CoCoSo methods in combination. The integrated model proposed herein represents the first instance of these methods being utilized collectively in the literature, thereby providing a novel perspective for future research. Notably, the criteria weighting techniques applied are relatively recent developments, and the dynamic evaluation of the financial performance of logistics companies underscores the significance of this study.

3. Materials and Methods

This section provides a detailed examination of the SIWEC, MEREC, LODECI, and CoCoSo methodologies employed to evaluate the financial performance of logistics service providers listed on the BIST XULAS index during the 2022–2024 period. For each research interval, the weights of the financial criteria influencing the companies’ financial performance were determined using the SIWEC, MEREC, and LODECI methods, respectively. Additionally, the CoCoSo method was utilized to rank the companies’ financial performance for each period, offering an annual comparative analysis.

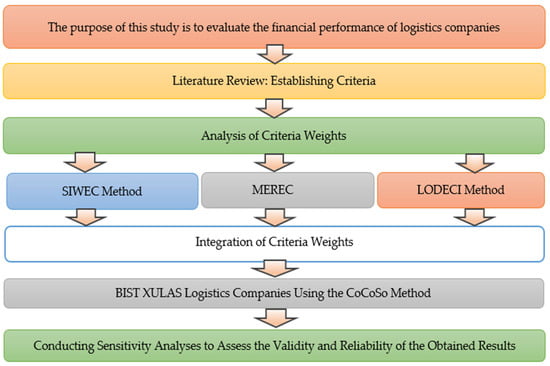

To facilitate a clearer and more systematic understanding of the research methodology employed in the study, the process flow diagram is presented in Figure 1.

Figure 1.

Flow Diagram of the Methodology.

During the analysis phase of the studies, the decision matrix standardization process is initially applied to enable the comparison and evaluation of criteria that possess different units and dimensions. Because zero or negative values in decision matrices of MCDM methods are excluded from the normalized matrix, these values must be transformed into positive values [21] (p. 1006). If the decision matrix utilized in MCDM methods includes zero or negative values, the Z-Score Standardization Method proposed by [22] (p. 3) is employed to transform it into a matrix with exclusively positive values. The initial step of this method is represented by Equation (1).

Here, represents the standardized value corresponding to the ith observation in the jth variable. The elements of the decision matrix are denoted by . The mean value of the ith index is represented by and its standard deviation is denoted by .

In Equation (2), the term denotes the standardized value following translation. The parameter signifies the translation amplitude, under the condition that . Specifically, satisfies the inequality . Notably, as the value of approaches , the evaluation outcome becomes increasingly significant.

3.1. Simple Weight of Criteria (SIWEC) Method

Among the methods developed to enhance the effectiveness of decision-making processes, SIWEC method, proposed by [23] provides decision-makers with a straightforward, comprehensible, and practical alternative. Although it is a relatively recent approach in the literature, its applications, while currently limited, are increasing. The SIWEC method has been employed in a range of decision-making problems across multiple sectors. In this context, the method has been applied in various studies, including channel selection for agricultural products [23] analysis of trade performance dynamics [24], material selection in mechanical production processes [25], evaluation of transportation policies [26], sustainable smart city planning within the framework of digital twin technologies [27], selection of social network platforms for consumer communication [28], assessment of solar energy investment projects [29], and selection of waste disposal technologies [30].

The SIWEC model provides a framework comprising six steps designed to systematically organize the decision-making process [23] (pp. 2–3); [31] (p. 756).

- Step 1: Constructing the Initial Decision Matrix

In the initial phase of the SIWEC method, the decision matrix is constructed. Mathematically, this decision matrix is represented by Equation (3):

: Performance value of the ith alternative with respect to the jth criterion

m: Denotes the number of alternatives.

n: Denotes the number of criteria.

- Step 2: Normalization of the Initial Decision Matrix

The normalization procedure employed in the SIWEC method diverges from that of traditional MCDM methods. While in classical approaches normalize each criterion according to its individual maximum value, the SIWEC method normalizes based on the highest score shared across all criteria. This process is mathematically represented by Equation (4) below.

: The maximum value across all criteria.

Normalized values.

- Step 3: Calculation of the Standard Deviation for Normalized Values

In this step, the standard deviation for each alternative is calculated based on the normalized values.

- Step 4: Multiplying normalized values by their corresponding standard deviation values

In this step, each element of the Normalized Decision Matrix is multiplied by its corresponding standard deviation value. This procedure is expressed mathematically in Equation (5):

- Step 5: Calculating the Sum of Weighted Values for the Criteria

In this stage of the SIWEC method, the aggregate of the weighted and normalized scores for each criterion is computed. This procedure is intended to quantify the overall influence of each relevant criterion on the decision-making process. Specifically, by summing the scores weighted by their respective standard deviations, the degree to which each criterion contributes to the decision-making process is quantitatively represented. The process is formalized by Equation (6) as follows:

- Step 6: Calculation of the Final Criteria Weights

In the final step, the importance weights for each criterion are calculated in accordance with the SIWEC method. Utilizing the total weighted scores () of the criteria obtained in the preceding steps, the relative importance levels of the criteria are determined by applying Equation (7) as follows:

3.2. Method Based on the Removal Effects of Criteria (MEREC)

The MEREC approach was introduced into the MCDM literature by [32] (pp. 7–9) as an objective method for determining criterion weights. This method involves excluding the criterion under consideration from the calculation of its importance weight, thereby emphasizing the impact of its removal on the overall criterion weights. Additionally, the MEREC method is characterized by a robust mathematical foundation and straightforward, comprehensible procedural steps, which are among its notable advantages [33] (p. 78).

In the literature, this method has been proposed as a solution to various decision-making problems, such as analyzing the carbon emission profiles of countries [34], evaluating airline performance [35], selecting autonomous vehicles in logistics systems [36], and network selection for Industry 5.0 [37].

The calculation of criterion weights using the MEREC method comprises six steps, which are detailed below [32] (pp. 7–9).

- Step 1: Developing the Decision Matrix

In the initial step, a decision matrix comprising elements is constructed, where represents the alternatives and denotes the criteria. The resulting decision matrix is presented in Equation (8):

- Step 2: Normalization of the Decision Matrix

In this step, the decision matrix is normalized using Equation (9), and the elements of the normalized matrix are denoted as . Here, represents the set of benefit criteria, whereas denotes the set of cost criteria.

- Step 3: Calculation of the Total Performance Value

The total performance value of the decision alternatives is determined as illustrated in Equation (10).

- Step 4: Determination of the Performance Values of the Alternatives

Each criterion is evaluated independently, and the performance values of the alternatives are determined using Equation (11).

- Step 5: Calculation of the Sum of Absolute Deviations

The impact level of the jth criterion is determined using Equation (12), which incorporates the values obtained from Equations (10) and (11).

- Step 6: Determination of Criteria Importance Weights.

In this final step, the weight values for the criteria are calculated using the values obtained from Equation (13). The value w j MEREC presented below denotes the importance of the jth criterion.

3.3. Logarithmic Objective Decomposition Index (LODECI) Method

The LODECI method, introduced to the literature by Pala [38], represents an approach that integrates the features of both the Entropy and MEREC methods. This method is grounded in the principle of maximum decomposition for criterion weighting. Additionally, the incorporation of a logarithmic function within the method constrains the weight range to an appropriate scale, thereby mitigating the issue of overestimating certain criteria observed in the Entropy and MEREC methods [38] (p. 3). LODECI assesses each alternative by measuring its maximum difference from other alternatives across each criterion.

Recently, the number of applications utilizing the new methodology, LODECI, has begun to increase. Studies have demonstrated its effectiveness in addressing various decision-making problems, including supplier selection [39], financial performance evaluation [40,41], assessment of social progress levels in countries [42], and sustainable agricultural practices [43].

The weighting of criteria using the LODECI method follows a systematic approach comprising five fundamental steps [38] (pp. 2–3).

- Step 1: Construction of the Initial Decision Matrix

The initial phase of the LODECI method entails structuring the data pertinent to the decision-making process into a well-organized matrix format. During this phase, an initial decision matrix , comprising alternatives and criteria, is derived as shown in Equation (14) below.

- Step 2: Maximum Normalization Approach

This approach has been identified as the most appropriate normalization technique for the LODECI method when compared to alternative normalization approaches. It facilitates the separation of numerical values and enables a more consistent and reliable transformation of the normalized matrix. Specifically, the decision matrix X is normalized using Equations (15) and (16), depending on whether the criterion is classified as a benefit or a cost criterion.

- Step 3: Calculation of the Decomposition Value for Elements of the Normalized Decision Matrix.

The Decomposition Value (DV) for each element of the decision matrix is computed using the normalized decision matrix elements according to the equation presented in Equation (17):

- Step 4: Determining the Logarithmic Decomposition Values for the Criteria

The Logarithmic Decomposition Value (LDV) for each criterion is calculated using the following Equation (18):

- Step 5: Determination of Criteria Importance Levels

Finally, the importance levels of the criteria are determined using Equation (19).

The results obtained from three different criteria weighting methods were integrated into a single value by computing the Heron mean, as outlined by [44] (p. 764), using Equation (20).

3.4. Combined Compromise Solution (CoCoSo) Method

The CoCoSo method, introduced by [45] (pp. 2507–2508), is a ranking technique that has been incorporated into the academic literature. This method has been applied in various decision-making problems, including logistics center selection [46], rare earth industry security [47], circular economy practices [48], spray painting robot selection [49], airport performance evaluation [35], and autonomous vehicle selection [36].

- Step 1: Constructing the Decision Matrix

The decision matrix is defined as shown in Equation (21), where and

- Step 2: Construction of the Normalized Decision Matrix

In this step, a normalized decision matrix is constructed using Equation (22) for benefit criteria and Equation (23) for cost criteria.

- Step 3: Calculation of the Weighted Comparability Values and .

In this step, the weighted comparability sum is computed according to Equation (24), whereas the power weight sum of the comparability sets for each alternative is determined using Equation (25).

- Step 4: Calculation of the Relative Weights of the Alternatives

In this step, the relative weights of the alternatives are determined using Equations (26)–(28). Typically, the value of in Equation (25) is set to 0.5.

- Step 5: Determining the Rank Values of the Alternatives

In the final step, the alternatives are ranked such that the alternative with the highest value, as determined by Equation (29), is assigned the first rank.

4. Analysis and Findings

4.1. Dataset

The data utilized in this study were derived from the financial reports of companies included in the BIST XULAS index for the period 2022–2024. These reports were accessed via the Public Disclosure Platform [50] (KAP, 2025). As of March 2025, twelve companies were listed in the relevant index; however, only nine companies with complete data for the years 2022–2024 were incorporated into the analysis. While the sample provides a significant representation of the Turkish logistics sector, it should be noted that this limited selection, based on a specific index, does not offer a comprehensive assessment of all logistics companies within the sector. However, the BIST XULAS index, which includes large, active companies directly involved in the Turkish logistics sector, effectively reflects general trends and financial performance in the sector.

Eight financial ratios—namely, Current Ratio, Asset Turnover, Financial Leverage Ratio, Receivables Turnover, Operating Profit Margin, Net Profit Margin, Return on Assets, and Return on Equity—were employed to assess the financial performance of companies within the BIST XULAS Index. These ratios were categorized under four primary groups: Liquidity Ratios, Financial Structure Ratios, Activity Ratios, and Profitability Ratios. The selection of financial ratios was informed by analogous studies in the transportation sector literature. The study’s dataset comprises nine firms as alternatives and eight financial ratios as criteria, which are detailed in Table 2 and Table 3, respectively.

In the analysis conducted in this study, a decision matrix was constructed utilizing financial data from the 2022–2024 period for companies within the sector represented in the BIST Transportation Index. The alternatives within the decision matrix correspond to the companies listed in Table 2, while the criteria comprise the financial ratios detailed in Table 3. These ratios were selected based on a comprehensive literature review to most accurately represent company performance within the sector. The resulting decision matrix, developed from the collected data, is presented in Table 4.

As shown in Table 4, the decision matrices for the years 2023 and 2024 contain negative values. However, to implement the criteria weighting methods, it is necessary to first transform these matrices into positive-valued decision matrices. Consequently, the Z-score standardization method proposed by [22] (p. 3) was applied to all values in the 2023 and 2024 decision matrices presented in Table 4. The application of Z-score standardization directly influences the interpretation of analysis results. This method rescales each variable based on its mean and standard deviation, so the data reflect the relative performance levels of companies compared to the industry average, rather than their absolute financial performance ([51,52]). In other words, the values obtained from the Z-score represent not the actual magnitude of a company’s performance in the relevant variables, but the extent to which they deviate from the industry average [53]. This approach eliminates the scale effects among performance indicators of varying magnitudes, enabling a more balanced and comparable analysis. Using this procedure, matrices containing only positive values were obtained, allowing the analysis to proceed to the second step.

Table 2.

Companies Included in the Study Registered on the BIST Transportation Index.

Table 2.

Companies Included in the Study Registered on the BIST Transportation Index.

| Alternative Code | BIST Code | Company Name |

|---|---|---|

| A1 | BEYAZ | Beyaz Fleet Car Rental Inc. |

| A2 | CLEBI | Çelebi Air Service Inc. |

| A3 | GSDDE | GSD Maritime Real Estate Construction Industry and Trade Inc. |

| A4 | GRSEL | Gür-Sel Tourism Transportation and Service Trade Inc. |

| A5 | PGSUS | Pegasus Air Transportation Inc. |

| A6 | RYSAS | Reysaş Transportation and Logistics Trade Inc. |

| A7 | TLMAN | Trabzon Port Management Inc. |

| A8 | TUREX | Tureks Tourism Transportation Inc. |

| A9 | THYAO | Turkish Airlines Inc. |

Source: https://www.kap.org.tr/tr/Endeksler (accessed 2 April 2025).

Table 3.

Financial Ratios Employed in the Study.

Table 3.

Financial Ratios Employed in the Study.

| Criterion Code | Ratio | Direction * | Sources |

|---|---|---|---|

| C1 | Current Ratio | B | [10,11,15,16,20,38,54] |

| C2 | Asset Turnover | B | [10,15,16,20,38,54,55] |

| C3 | Financial Leverage Ratio | C | [10,11,15,16,38,54] |

| C4 | Receivables Turnover Ratio | B | [11,20,54] |

| C5 | Operating Profit Margin | B | [54,56] |

| C6 | Net Profit Margin | B | [11,20,38,54,55] |

| C7 | Asset Return Ratio | B | [10,11,15,16,20,38,54,55,56] |

| C8 | Return on Equity | B | [10,11,15,16,20,38,54,55,56] |

* B: Benefit, C: Cost.

Table 4.

Decision Matrices for the Years 2022 to 2024.

Table 4.

Decision Matrices for the Years 2022 to 2024.

| Year | Alternative/ Criteria | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 |

|---|---|---|---|---|---|---|---|---|---|

| 2022 | A1 | 1.164 | 3.234 | 0.780 | 8.049 | 2.607 | 2.962 | 0.096 | 0.347 |

| A2 | 1.492 | 0.899 | 0.596 | 13.011 | 25.939 | 19.005 | 0.171 | 0.469 | |

| A3 | 5.381 | 0.272 | 0.257 | 419.018 | 61.127 | 69.168 | 0.188 | 0.409 | |

| A4 | 1.175 | 0.997 | 0.407 | 5.605 | 14.381 | 14.672 | 0.146 | 0.260 | |

| A5 | 0.998 | 0.574 | 0.812 | 56.516 | 22.642 | 16.615 | 0.095 | 0.570 | |

| A6 | 0.946 | 0.447 | 0.627 | 9.293 | 40.245 | 18.059 | 0.081 | 0.223 | |

| A7 | 3.423 | 0.741 | 0.224 | 24.779 | 54.931 | 93.922 | 0.696 | 0.910 | |

| A8 | 1.056 | 1.606 | 0.410 | 7.183 | 11.088 | 8.869 | 0.142 | 0.229 | |

| A9 | 0.877 | 0.668 | 0.686 | 20.114 | 15.686 | 15.243 | 0.102 | 0.349 | |

| 2023 | A1 | 1.372 | 4.685 | 0.661 | 13.133 | 2.730 | 0.747 | 0.035 | 0.120 |

| A2 | 1.258 | 0.932 | 0.658 | 11.382 | 25.415 | 16.807 | 0.157 | 0.431 | |

| A3 | 2.730 | 0.115 | 0.229 | 168.455 | 15.010 | −117.565 | −0.135 | −0.363 | |

| A4 | 1.539 | 0.993 | 0.383 | 5.302 | 22.816 | 24.715 | 0.245 | 0.423 | |

| A5 | 1.291 | 0.474 | 0.729 | 49.601 | 18.555 | 29.643 | 0.140 | 0.575 | |

| A6 | 0.986 | 0.804 | 0.563 | 10.903 | 41.116 | 16.977 | 0.136 | 0.415 | |

| A7 | 5.261 | 0.473 | 0.219 | 17.892 | 50.632 | 36.067 | 0.171 | 0.218 | |

| A8 | 1.201 | 0.882 | 0.297 | 7.169 | 16.933 | 14.129 | 0.125 | 0.182 | |

| A9 | 0.944 | 0.619 | 0.565 | 23.027 | 14.160 | 32.315 | 0.200 | 0.511 | |

| 2024 | A1 | 1.234 | 5.570 | 0.636 | 21.885 | 0.007 | −0.250 | −0.014 | −0.040 |

| A2 | 1.312 | 1.101 | 0.608 | 11.488 | 22.209 | 18.711 | 0.206 | 0.557 | |

| A3 | 3.108 | 0.177 | 0.276 | 186.341 | 44.936 | −6.285 | −0.011 | −0.015 | |

| A4 | 1.690 | 0.989 | 0.341 | 4.442 | 26.916 | 20.943 | 0.207 | 0.324 | |

| A5 | 1.276 | 0.461 | 0.736 | 51.197 | 18.607 | 11.881 | 0.055 | 0.205 | |

| A6 | 1.132 | 0.657 | 0.500 | 10.094 | 46.509 | 22.629 | 0.149 | 0.314 | |

| A7 | 4.232 | 0.389 | 0.177 | 14.449 | 19.292 | 19.815 | 0.077 | 0.096 | |

| A8 | 1.174 | 0.703 | 0.336 | 5.857 | 10.132 | 4.022 | 0.028 | 0.041 | |

| A9 | 1.007 | 0.609 | 0.514 | 26.110 | 10.785 | 15.207 | 0.093 | 0.199 |

4.2. Weighting of Criteria

The determination of criteria weights constitutes a critical step in MCDM problems. In the literature, both subjective and objective methods are commonly employed for this purpose. Subjective weighting approaches are typically utilized when secondary data are unavailable or when expert judgment is deemed more appropriate due to the nature of the criteria. Conversely, objective weighting methods yield valuable results in studies relying on secondary data analysis and are generally preferred when such data are accessible. It is important to note that the application of different objective weighting techniques to the same dataset may produce varying results, primarily due to the distinct normalization procedures inherent to each method. This variation significantly influences the assigned importance weights of the criteria. To mitigate this issue, the present study integrates the outcomes derived from three distinct weighting methods by employing the Heron mean, as shown in Equation (20). Table 5 presents the weights obtained from the MEREC, SIWEC, and LODECI methods for each year, alongside their aggregated values computed using the Heron mean.

Table 5.

Weight Values of Criteria by Year.

The results presented in Table 5 indicate that the importance levels of the criteria exhibited fluctuations across different years and methods. Specifically, within the MEREC method, criteria C5 and C6 received higher weights in 2022, whereas the weights were more evenly distributed in 2023 and 2024.

The SIWEC method prioritized C4, C5, and C6 in 2022, whereas C3, C6, C7, and C8 were assigned greater weights in 2023 and 2024. In contrast, the weights derived using the LODECI method exhibited a more balanced distribution across the three years.

An analysis of the aggregated weights, derived by averaging the Heron results from the three methods, indicates that criteria C5 (net profit margin) and C6 (operating profit margin), both categorized under the primary profitability criterion, exhibited higher weights in the final two years. This finding implies that these criteria were pivotal in influencing firm performance throughout the period under study.

The net profit margin, identified as the primary criterion for profitability, holds the greatest weight in both 2023 and 2024. Additionally, the operating profit margin and return on assets ratio are recognized as significant factors in performance evaluation relative to other criteria.

When Table 5 is examined, the use of combined weight values (Heron mean) is generally regarded as a more balanced and reliable approach. Moreover, an analysis of each method individually reveals significant variations in the criteria weights across methods. In this context, the weights derived using the Heron means are considered to yield more reliable results by achieving a consensus that mitigates discrepancies among the methods.

4.3. Firm Rankings

This section provides a detailed explanation of the application stages of the CoCoSo method employed to rank the financial performance of nine companies listed in the BIST XULAS Index, utilizing fully accessible data from the 2023–2024 period, with a focus on 2024 data. During the analysis, criteria weights were calculated using the Heron mean method and incorporated into the CoCoSo method. Subsequently, the decision matrix was normalized using Equations (22) and (23), with the results presented in Table 6.

Table 6.

Normalized Decision Matrix for the Year 2024.

The weighted comparability sum () was computed by applying Equation (24) to the values presented in Table 6, while the power-weighted sum of the comparability arrays (Pᵢ) was determined using Equation (25). These results are displayed in Table 7 and Table 8, respectively.

Table 7.

Weighted Normalized Decision Matrix and Values of Alternatives in 2024.

Table 8.

The 2024 Exponentially Weighted Matrix and the Corresponding Values for Alternatives.

By applying Equations (26)–(29) to the Sᵢ and Pᵢ values presented in Table 7 and Table 8, the relative weights and final rankings of the alternatives were calculated. The results are summarized in Table 9.

Table 9.

Relative Weights and Ranking Values of Alternatives in 2024.

An analysis of Table 9 indicates that the leading three companies in terms of financial performance in 2024 are RYSAS, CLEBI, and TLMAN, respectively. Conversely, the companies exhibiting the lowest financial performance are BEYAZ, TUREX, and PGSUS. The computed values and the corresponding ranking outcomes for all years encompassed by the study are presented in Table 10.

Table 10.

Values of and Ranking Results for the Period 2022–2024.

An analysis of Table 10 indicates notable shifts in the financial performance rankings of companies from 2022 to 2024. In 2022, the top three companies with the highest financial performance were TLMAN, GSDDE, and CLEBI; however, in 2023, this ranking changed to TLMAN, RYSAS, and GRSEL. By 2024, the leading position was held by RYSAS, followed by CLEBI and TLMAN.

The data indicate that TLMAN’s consecutive leadership in 2022 and 2023 reflects the company’s sustained financial stability during this period. Its continued presence among the top three in 2024 further demonstrates consistent performance with respect to the financial ratios analyzed. A comparable level of stability is observed for CLEBI. Notably, RYSAS exhibited a marked improvement in performance, particularly over the last two years within the period under review. Overall, these findings underscore the rapid variability of market dynamics and firm performance.

One of the primary limitations of this study pertains to the temporal scope of the analysis and the criteria employed to assess financial performance. It is important to acknowledge that the notions of “good” or “bad” performance are inherently relative. Therefore, the selection of evaluation criteria and the review period must be rigorously examined to ensure the reliability and validity of performance assessments. The findings underscore the necessity for investors and industry analysts to carefully consider both the breadth of the criteria and seasonal variations when appraising companies’ financial conditions. For instance, although RYSAS exhibited lower financial performance in 2022, its substantial improvement over the subsequent two years clearly illustrates the relative nature of these evaluations.

4.4. Sensitivity and Comparative Analysis

Sensitivity analyses are essential for evaluating the consistency and reliability of results derived from MCDM processes. Specifically, investigating the effects of minor variations in criterion weights on model outcomes serves to validate the robustness of the proposed model and informs decision-makers about the sensitivity of the results.

To this end, a two-stage process was employed in this section to demonstrate the validity and reliability of the model proposed in this study. In the first stage, the impact of variations in criterion weights on the ranking outcomes was examined. In the second stage, the rankings derived from the proposed model were compared with those obtained using alternative MCDM techniques.

The final criterion weights were established by computing the Heron mean of the weights derived from the MEREC, SIWEC, and LODECI methods. The sensitivity of the proposed model to these weights was examined by varying the weight of the criterion identified as most significant among the obtained weights. The procedural steps are outlined as follows [33] (p. 20):

Step 1. Determine the weight sensitivity coefficient. The weight sensitivity coefficient denoted as quantifies the relative balance of other weights in relation to changes in the weight of the most important criterion. It is calculated using Equation (24). Notably, is always assigned a value of 1 for the most important criterion.

: initial value of the modified weight

: weight assigned to the most important criterion.

Step 2. Determine the value of . This value represents the magnitude of change to be applied to the weight of the most important criterion. The boundaries for this value are defined in Equation (25).

Step 3 involves calculating the new weights using Equations (26) and (27). It is essential that the sum of these new weights equals one.

initial value of the primary criterion

: initial value of the modified weight.

As a result of the conducted sensitivity analysis, Table 11 presents the weight elasticity coefficients, while Table 12 displays the updated criteria weights.

Table 11.

Coefficients of Weight Elasticity.

Table 12.

Weights of the New Criteria.

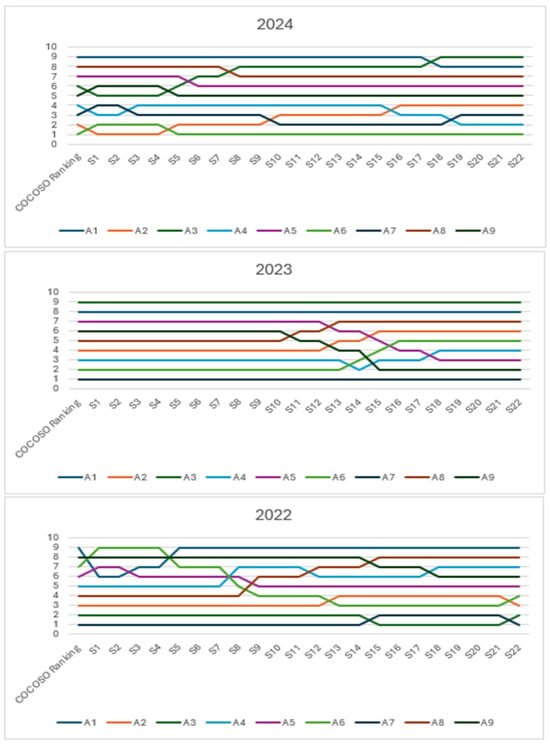

In this study, twenty-two distinct scenarios were constructed to assess the influence of variations in criterion weight coefficients on the resulting rankings. Examination of the effects of differing criterion weights across each scenario revealed substantial differences in the rankings. Figure 2 shows the effect of twenty-two different weighting scenarios on the rankings. These findings indicate the sensitivity of the proposed model to changes in criterion weights.

Figure 2.

Rankings Derived from Various MCDM Method.

According to the comparative results obtained from 22 scenarios over three years, the rankings in 2022 exhibited greater fluctuations than those in 2023 and 2024. In 2023, three companies (A9, A1, and A7) consistently maintained the same rankings across all scenarios, while the remaining companies continued to show noticeable variations in their positions. By 2024, ranking fluctuations had become relatively minor; most companies shifted only one position up or down, except for A3, which deviated from this general pattern. These findings indicate that the CoCoSo method has become more robust over time, yielding increasingly stable and reliable ranking outcomes.

In the second phase, the consistency and reliability of the firm rankings were evaluated using the CoCoSo [45] model. The rankings generated by the CoCoSo model were compared with those derived from the COPRAS [57], TOPSIS [58], Multi-Objective Optimization on The Basis of Simple Ratio Analysis (MOOSRA) [59], Weighted Aggregated Sum Product Assessment (WASPAS) method [60] and Additive Ratio Assessment (ARAS) method [61] methods. The relationships among these rankings were examined through Spearman’s Rank Correlation Coefficients (rs) between the primary model and the rankings obtained from the other MCDM approaches. As shown in Table 13, a general examination of the ranking results reveals that in 2024, the WASPAS and ARAS methods; in 2023, the WASPAS method; and in 2022, the MOOSRA method exhibited strong correlations with the CoCoSo method. Conversely, the model with the lowest correlation to the CoCoSo method across all periods was the TOPSIS method applied to the 2022 data. This discrepancy is attributed not to the presence of negative criteria but to the mathematical structural differences between the methods, such as the distinction between proportional evaluation and distance-based evaluation. Furthermore, aside from the 2022 TOPSIS results, Table 13 shows that the CoCoSo method demonstrated medium to high correlations with the other models across all years. This suggests that most models produced consistent results with the CoCoSo method, thereby supporting the reliability of the proposed model.

Table 13.

Comparative Analysis of Ranking Results.

5. Discussion

Competence in logistics operations and the resulting efficiency directly impact a company’s competitive advantage. Furthermore, these factors substantially enhance the company’s appeal to downstream stakeholders within the supply chain. Considering the opportunities afforded by international markets, logistics functions can play a strategic role in facilitating market entry and competition. Many companies, conversely, concentrate on their core business areas to enhance production cost efficiency and ensure quality production processes. Instead of managing logistics activities internally, they may outsource all logistics operations related to the delivery of their final product or service to the subsequent buyer to specialized logistics service providers. In this context, the operational development of companies within the logistics sector and the quality of service they provide are critically important for the overall efficiency of both the logistics industry and the other sector companies they support.

Like all for-profit enterprises, the primary objective of logistics companies is to sustain a robust and sustainable financial structure. The monitoring of this goal is accomplished through financial performance measurements conducted on a monthly, quarterly, or annual basis. These measurements furnish managers and stakeholders with essential information regarding the current financial status and future planning, thereby informing strategic decisions related to efficient resource allocation, cost control, profitability enhancement, and risk management. Moreover, the early identification of potential deviations enables the implementation of timely preventive measures. All these processes play a critical role in both achieving short-term operational goals and successfully implementing long-term sustainable growth strategies.

Conversely, a company may require additional financial support to augment its profitability while maintaining its operations. In this regard, firms can integrate strategies such as capital increases through public offerings, leveraging liquidity opportunities, expanding credit access, and enhancing their reputation and credibility into their strategic frameworks to secure more robust financial resources post-commencement of operations. Within this context, the BIST XULAS Index in Turkey functions as a platform for monitoring the financial performance of logistics companies, particularly those engaged in transportation and warehousing sectors. This platform enables companies to achieve financial transparency for prospective investors, attract stakeholders, and provide clear information regarding their financial structures to existing stakeholders.

Numerous studies within the literature examine the financial performance of logistics companies by utilizing publicly available data from firms included in this index [10,11,13,14,15,16,17,19]. Multi-criteria decision-making methods are commonly employed in most of these studies, as evidenced by the international literature [4,5,6,7,8,9]. The studies are generally structured by initially assigning weights to criteria that are prominent in terms of financial performance, employing either objective or subjective MCDM methods. These methods are selected based on the specific research period, sector, or sample under investigation. Subsequently, alternatives within the sample are ranked using a same or different MCDM method. This approach facilitates both the systematic determination of the relative importance of criteria and the comparative evaluation of alternatives based on their performance. Although this study primarily aims to serve this purpose, calculating the criteria weights using three different methods from the existing literature—SIWEC, MEREC and LODECI—and subsequently combining these weights through the Heron mean can be regarded as a more balanced and reliable approach. The alternatives were then ranked using the CoCoSo method with Heronian mean weights. The research findings of the proposed model for each period were compared with results obtained from other MCDM methods, including COPRAS, TOPSIS, MOORA, WASPAS, and ARAS. The relationships between the rankings were assessed using Spearman’s Rank Correlation Coefficients, comparing the main model with the rankings derived from these alternative MCDM approaches. The results indicate a moderate to high level of consistency and similarity among the ranking outcomes across the relevant years, thereby supporting the CoCoSo method’s ability to produce stable and reliable results. This demonstrates the model’s sensitivity in the measurement and evaluation process. Furthermore, a notable distinction of this study compared to similar research in the literature is the inclusion of relatively new and less frequently used MCDM methods, such as SIWEC and LODECI. These methods have not been utilized in prior studies conducted under the keywords ‘logistics companies’ and ‘financial performance’.

This study focused on a sample of nine companies selected from the twelve firms listed under the XULAS (Transportation) index on Borsa Istanbul between 2022 and 2024, for which complete financial data were available for the specified period. The companies included in the sample encompass a diverse array of sectors within the Turkish transportation industry, operating across multiple subcomponents. These firms are international enterprises engaged in activities such as new and used vehicle sales, airport ground handling services, maritime transport, road transport, air transport, port management, and fleet leasing. Consequently, these companies are recognized as leading and strategically significant entities within the sector, exemplifying the dynamic characteristics of the Turkish transportation industry. These companies were selected because they exemplify prominent entities within the Turkish logistics sector. The BIST XULAS index effectively reflects overall trends and financial performance within the sector.

The study examined the three-year period from 2022 to 2024, employing financial ratio criteria commonly utilized in the literature. The analyses indicated that profitability-related sub-criteria—specifically ratios such as net profit margin, operating profitability, and return on assets (ROA)—were assigned relatively greater weights compared to other criteria across all three years. This result underscores the pivotal and primary role of profitability indicators in assessing the financial performance of companies within the logistics sector. In the literature, analyses employing a single MCDM method [10,11,12,15,20] typically assign equal importance to financial criteria. Conversely, studies that adopt hybrid models [9,13,14,16,54] apply more systematic and realistic weightings to criteria, leading to results that closely align with the findings of the present study.

The greater importance placed on profitability compared to other criteria indicates that the logistics firms in the sample adopt a profitability-focused strategy, prioritizing financial success. This focus enables firms to optimize their resources and strategic decisions to enhance profitability, which in turn supports sustainable long-term growth and strengthens their competitive advantage within the sector. Moreover, profitability not only reflects the firms’ financial health but also helps build a strong market reputation by earning investors’ trust. Since investors are more likely to establish solid business relationships with profitable companies, profitability serves as a crucial indicator of the firms’ financial sustainability and growth potential.

According to the study’s results, the lower performance of the BEYAZ and TUREX firms listed on the BIST XULAS and, conversely, the higher and improving performance of the CELEBI and REYSAS firms are significantly related to changes in profitability ratios. BEYAZ consistently reported the lowest profitability ratios across all years based on the Operating Profit Margin (C5) and Net Profit Margin (C6) criteria, while TUREX’s Net Profit Margin (C6) declined over time. In contrast, CELEBI, which demonstrated strong performance, maintained stable ratios across all criteria, particularly profitability, throughout the years. REYSAS, which had one of the highest operating profit margins, also outperformed its 2022 results in the recent period despite fluctuations in its net profit margin. Consequently, profitability, as the most significant criterion in financial performance rankings, plays a crucial role in determining the firms’ success rankings.

This study uses the SIWEC, MEREC, LODECI and COCOSO methods together to present a reliable and useful model for measuring companies’ financial performance. Future studies may integrate different MCDM models and compare the results. The study primarily focuses on the BIST Transportation Index, and the results obtained in different sectors may reveal inter-sectoral relationships. However, the study is limited to the financial ratios used, and different financial or non-financial criteria (e.g., sustainability, innovation, and customer satisfaction) may be employed.

Author Contributions

Conceptualization, methodology, software development, formal analysis, investigation, resource provision, data curation, original draft preparation, review and editing of the manuscript, and visualization were conducted by H.H.O., K.V. and T.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Christopher, M. Logistics & Supply Chain Management, 6th ed.; FT Publishing: Santa Rosa, CA, USA, 2016. [Google Scholar]

- Ozguner, Z. Uretim İsletmelerinin Lojistik Faaliyetlerinde Süreçsel Etkinliğinin Başarı Dinamikleri; Hiperyayın: Istanbul, Turkey, 2019. [Google Scholar]

- Hanus, P. The business profile shaping and the logistics information systems of 2PL, 3PL, 4PL operators. J. Econ. Manag. 2013, 12, 5–21. [Google Scholar]

- Feng, C.M.; Wang, R.T. Performance evaluation for airlines including the consideration of financial ratios. J. Air Transp. Manag. 2000, 6, 133–142. [Google Scholar] [CrossRef]

- Wong, W.P.; Soh, K.L.; Chong, C.L.; Karia, N. Logistics firms performance: Efficiency and effectiveness perspectives. Int. J. Product. Perform. Manag. 2015, 64, 686–701. [Google Scholar] [CrossRef]

- Lee, T.W.; Lin, C.W.; Shin, S.H. A Comparative Study on Financial Positions of Shipping Companies in Taiwan and Korea Using Entropy and Grey Relation Analysis. Expert Syst. Appl. 2017, 39, 5649–5657. [Google Scholar] [CrossRef]

- Pineda, P.J.G.; Liou, J.J.H.; Hsu, C.-C.; Chuang, Y.-C. An integrated MCDM model for improving airline operational and financial performance. J. Air Transp. Manag. 2018, 68, 103–117. [Google Scholar] [CrossRef]

- Rosini, I.; Gunawan, J. Financial ratio and performance airlines industry with DEA and TOPSIS model. Int. J. Pure Appl. Math. 2018, 119, 367–374. Available online: https://acadpubl.eu/jsi/2018-119-10/articles/10a/34.pdf (accessed on 14 October 2025).

- Periokaitė, P.; Dobrovolskienė, N. The impact of COVID-19 on the financial performance: A case study of the Lithuanian transport sector. Insights Reg. Dev. 2021, 3, 34–50. [Google Scholar] [CrossRef] [PubMed]

- Akgün, M.; Temür, A.S. BIST ulaştirma endeksine kayitli şirketlerin finansal performanslarinin TOPSIS yöntemi ile değerlendirilmesi. Int. J. Manag. Econ. Bus. 2016, 12, 173–186. [Google Scholar] [CrossRef]

- Kendirli, S.; Kaya, A. BIST-Ulaştırma endeksinde yer alan firmaların mali performanslarının ölçülmesi ve TOPSIS yönteminin uygulanması. MANAS J. Soc. Stud. 2016, 5, 34–63. [Google Scholar]

- Ayaydın, H.; Durmuş, S.; Pala, F. Gri İlişkisel Analiz Yöntemiyle Türk Lojistik Firmalarında Performans Ölçümü. Gümüshane Univ. Electron. J. Inst. Soc. Sci. 2017, 8, 76–94. [Google Scholar]

- Ozbek, A. Fortune 500 listesinde yer alan lojistik firmaların değerlendirilmesi. Afyon Kocatepe Univ. J. Econ. Adm. Sci. 2018, 20, 13–26. [Google Scholar] [CrossRef]

- Tufan, C.; Kılıç, Y. Borsa İstanbul’da İşlem Gören Lojistik İşletmelerinin Finansal Performanslarinin Topsis ve Vikor Yöntemleriyle Değerlendirilmesi. Cumhur. Univ. J. Econ. Adm. Sci. 2019, 20, 119–137. [Google Scholar]

- Oral, C.; Kıpkıp, E. Ulaştırma sektörünün finansal performans ölçümü için TOPSIS ve PROMETHEE yöntemlerinin kullanılması: BIST üzerine bir uygulama. Mehmet Akif Ersoy Univ. J. Soc. Sci. Inst. 2019, 11, 1005–1015. [Google Scholar] [CrossRef]

- Elmas, B.; Özkan, T. Ulaştırma ve depolama sektörü işletmelerinin finansal performanslarının SWARA-OCRA modeli ile değerlendirilmesi. J. Bus. Acad. 2021, 2, 240–253. [Google Scholar] [CrossRef]

- Alnıpak, S.; Kale, S. COVID-19 sürecinin ulaştırma sektörü finansal performansına etkileri. J. Res. Econ. Politics Financ. 2021, 6, 139–156. [Google Scholar] [CrossRef]

- Işık, Ö. Gri entropi, FUCOM ve EDAS-M yöntemleriyle Türk lojistik firmalarının çok kriterli performans analizi. J. Yasar Univesity 2022, 17, 472–489. [Google Scholar] [CrossRef]

- Kurt, G.; Kablan, A. COVID-19’un, BİST ulaştırma endeksinde faaliyet gösteren havayolu işletmelerinin finansal performansı üzerindeki etkilerinin, çok kriterli karar verme yöntemleri ile analizi. J. Bus. Acad. 2022, 3, 16–33. [Google Scholar] [CrossRef]

- Ersoy, N. Finansal performansın gri ilişkisel analiz yöntemi ile değerlendirilmesi: Borsa İstanbul Ulaştırma Endeksi’ndeki şirketler üzerine bir araştırma. J. Account. Financ. 2020, 86, 223–246. [Google Scholar] [CrossRef]

- Ersoy, N. Türk inşaat firmalarının finansal performansının SECA yöntemi ile değerlendirilmesi. Izmir J. Econ. 2022, 37, 1003–1021. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, C.; Li, E.; Xu, C. Assessment model of eco environmental vulnerability based on ımproved entropy weight method. Sci. World J. 2014, 797814. [Google Scholar] [CrossRef]

- Puška, A.; Nedeljković, M.; Pamučar, D.; Božanić, D.; Simić, V. Application of the new simple weight calculation (SIWEC) method in the case study in the sales channels of agricultural products. MethodsX 2024, 13, 102930. [Google Scholar] [CrossRef]

- Lukic, R. Application of Fuzzy SIWEC and Rough MABAC Methods in the Evaluation of Trade Performance Dynamics in Serbia. Manag. Econ. Rev. 2025, 10, 448–456. [Google Scholar] [CrossRef]

- Dung, H.T.; Bao, N.C.; Van Duc, D. A novel approach for determining criteria weights: Application in ranking materials for mechanical manufacturing processes. Manuf. Rev. 2025, 12, 16. [Google Scholar] [CrossRef]

- Yalçın, G.C.; Limon, E.G.; Kara, K.; Limon, O.; Gürol, P.; Deveci, M.; Demirayak, Ö.; Tomášková, H. A hybrid decision support system for transport policy selection: A case study on Russia’s Northern Sea route in Artic region. Socio-Econ. Plan. Sci. 2025, 98, 102171. [Google Scholar] [CrossRef]

- Cao, J.; Spulbar, C.; Eti, S.; Horobet, A.; Yüksel, S.; Dinçer, H. Innovative approaches to green digital twin technologies of sustainable smart cities using a novel hybrid decision-making system. J. Innov. Knowl. 2025, 10, 100651. [Google Scholar] [CrossRef]

- Puška, A.; Bosna, J. Selecting Social Network for Direct Consumer Communication Using Multi-criteria Analysis: The Case of Company Iceled. In Proceedings of the ICFE-BD, The Brcko, Bosnia and Herzegovina, 10–11 November 2024; Volume 10/2025, pp. 47–56. Available online: https://konferencija.efb.ues.rs.ba/documents/Zbornik%20Radova%20-%20Konferencija%2010%202025.pdf (accessed on 10 October 2025).

- Şimşek, E.; Eti, S.; Yüksel, S.; Dinçer, H. Evaluation of Purchasing Process in Solar Energy Investment Projects via SIWEC Methodology. Spectr. Oper. Res. 2026, 3, 81–86. [Google Scholar] [CrossRef]

- Katrancı, A.; Kundakcı, N.; Arman, K. Fuzzy SIWEC and Fuzzy RAWEC methods for sustainable waste disposal technology selection. Spectr. Oper. Res. 2026, 3, 87–102. [Google Scholar] [CrossRef]

- Yürüyen, A.A.; Altay, H. Evaluating the Logistics Performance of One Belt One Road Project Countries with Multi Criteria Decision Making Methods. J. Mehmet Akif Ersoy Univ. Econ. Adm. Sci. Fac. 2025, 12, 750–774. [Google Scholar] [CrossRef]

- Keshavarz-Ghorabaee, M.; Amiri, M.; Zavadskas, E.K.; Turskis, Z.; Antucheviciene, J. Determination of objective weights using a new method based on the removal effects of criteria (MEREC). Symmetry 2021, 13, 525. [Google Scholar] [CrossRef]

- Ayçin, E.; Arsu, T. Sosyal gelişme endeksine göre ülkelerin değerlendirilmesi: MEREC ve MARCOS yöntemleri ile bir uygulama. Izmir J. Manag. 2021, 2, 75–88. [Google Scholar] [CrossRef]

- Pelit, İ.; Avşar, İ.İ. Turkiye’s Carbon Emission Profile: A Global Analysis with the MEREC-PROMETHEE Hybrid Method. Sustainability 2025, 17, 6527. [Google Scholar] [CrossRef]

- Ertuğrul, M.; Özdarak, E. Measuring Airline Performance: An Integrated Balanced Scorecard-Based MEREC-CoCoSo Model. Sustainability 2025, 17, 5826. [Google Scholar] [CrossRef]

- Gamal, A.; Abdel-Basset, M.; Hezam, I.M.; Sallam, K.M.; Hameed, I.A. An interactive multi-criteria decision-making approach for autonomous vehicles and distributed resources based on logistic systems: Challenges for a sustainable future. Sustainability 2023, 15, 12844. [Google Scholar] [CrossRef]

- Yadav, A.K.; Singh, K.; Srivastava, P.K.; Pandey, P.S. I-MEREC-T: Improved MEREC-TOPSIS scheme for optimal network selection in 5G heterogeneous network for IoT. Internet Things 2023, 22, 100748. [Google Scholar] [CrossRef]

- Pala, O. IDOCRIW ve MARCOS Temelli BIST Ulaştirma İşletmelerinin Finansal Performans Analizi. Kafkas Univ. J. Econ. Adm. Sci. Fac. 2021, 12, 263–294. [Google Scholar] [CrossRef]

- Tufan, D.; Ulutaş, A. Supplier Selection in the Food Sector: An Integrated Approach Using LODECI and CORASO Methods. Spectr. Decis. Mak. Appl. 2026, 3, 40–51. [Google Scholar] [CrossRef]

- Pala, O.; Atçeken, Ö.; Omurtak, H.; Şimşir, B. BİST çimento sektöründe LODECI ve CRADIS ile finansal performans analizi. Alanya Akad. Bakış 2024, 8, 956–970. [Google Scholar] [CrossRef]

- Demirhan, A.; Ulutaş, A.; Pala, O. BİST’te İşlem Gören Seçili Ticari Bankaların LODECI ve ARLON Yöntemleriyle Perfor-mansının Değerlendirilmesi. İzmir İktisat Derg. 2025, 40, 918–941. [Google Scholar] [CrossRef]

- Pala, O. Assessment of the social progress on European Union by logarithmic decomposition of criteria importance. Expert Syst. Appl. 2024, 238, 121846. [Google Scholar] [CrossRef]

- Tatar, V. Assessment of Ergonomic Risk Factors for Sustainable Agricultural Practices Based on Picture Fuzzy Lodeci-Artasi Approach. Bitlis Eren Üniversitesi Fen Bilim. Derg. 2025, 14, 1891–1920. [Google Scholar] [CrossRef]

- Ito, M. Estimations of the Lehmer mean by the Heron mean and their generalizations involving refined Heinz operator inequalities. Adv. Oper. Theory. 2018, 3, 763–780. [Google Scholar] [CrossRef]

- Yazdani, M.; Zarate, P.; Kazimieras Zavadskas, E.; Turskis, Z. A combined compromise solution (CoCoSo) method for multi-criteria decision-making problems. Manag. Decis. 2019, 57, 2501–2519. [Google Scholar] [CrossRef]

- Ulutaş, A.; Karakuş, C.B.; Topal, A. Location selection for logistics center with fuzzy SWARA and CoCoSo methods. J. Intell. Fuzzy Syst. 2020, 38, 4693–4709. [Google Scholar] [CrossRef]

- Peng, X.; Smarandache, F. A decision-making framework for China’s rare earth industry security evaluation by neutrosophic soft CoCoSo method. J. Intell. Fuzzy Syst. 2020, 39, 7571–7585. [Google Scholar] [CrossRef]

- Khan, S.; Haleem, A. Investigation of circular economy practices in the context of emerging economies: A CoCoSo approach. Int. J. Sustain. Eng. 2021, 14, 357–367. [Google Scholar] [CrossRef]

- Kumar, V.; Kalita, K.; Chatterjee, P.; Zavadskas, E.K.; Chakraborty, S. A SWARA-CoCoSo-based approach for spray painting robot selection. Informatica 2022, 33, 35–54. [Google Scholar] [CrossRef]

- KAP. 2025. Available online: https://kap.org.tr/tr/Endeksler (accessed on 2 April 2025).

- Field, A. Discovering Statistics Using IBM SPSS Statistics, 4th ed.; Sage Publications: Thousand Oaks, CA, USA, 2013. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson Education Limited: London, UK, 2014. [Google Scholar]

- Kalaycı, Ş. SPSS Uygulamalı Çok Değişkenli Istatistik Teknikleri, 5. baskı; Asil Yayın Dağıtım: Ankara, Turkey, 2010. [Google Scholar]

- Durmuş, C.N. BIST ulaştırma endeksindeki firmaların finansal performanslarının ENTROPİ ve WASPAS tabanlı entegre model ile değerlendirilmesi. Muhasebe Denetime Bakış 2025, 24, 369–390. [Google Scholar] [CrossRef]

- Koç Özşahin, F. BIST ulaştırma ve depolama firmalarının finansal performansının DuPont analizi yöntemiyle değerlendirilmesi. Hitit J. Soc. Sci. 2024, 17, 225–242. [Google Scholar] [CrossRef]

- İyigün, İ. Borsa İstanbul XULAS endeksindeki firmaların finansal performanslarının değerlendirilmesi. Mali Çözüm Derg. 2014, 34, 1349–1372. [Google Scholar]

- Zavadskas, E.K.; Kaklauskas, A.; Šarka, V. The new method of multicriteria complex proportional assessment of projects. Technol. Econ. Dev. Econ. 1994, 1, 131–139. [Google Scholar]

- Hwang, C.L.; Yoon, K. Multiple Attribute Decision Making: Methods and Applications; Springer: New York, NY, USA, 1981. [Google Scholar] [CrossRef]

- Das, M.C.; Sarkar, B.; Ray, S. Decision making under conflicting environment: A new MCDM method. Int. J. Appl. Decis. Sci. 2012, 5, 142–162. [Google Scholar] [CrossRef]

- Chakraborty, S.; Zavadskas, E.K. Applications of WASPAS method in manufacturing decision making. Informatica 2014, 25, 1–20. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Turskis, Z. A new additive ratio assessment (ARAS) method in multicriteria decision-making. Technol. Econ. Dev. Econ. 2010, 16, 159–172. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).