1. Introduction

Lack of financial knowledge directly affects individuals’ ability to make informed economic decisions, thereby damaging their financial well-being in the short and long term. This limitation is especially evident in retirement, when accumulated mistakes in financial management become more difficult to correct. Studies highlight that low financial literacy is associated with inadequate economic choices, such as excessive indebtedness, lack of planning, and greater exposure to financial fraud, negatively impacting individual and collective economic stability [

1,

2].

Socioeconomic factors, especially low schooling, further exacerbate financial vulnerability, which makes it increasingly important to develop intersectional interventions that reach groups of women, black individuals, and people with low schooling, who have greater difficulty in accessing good financial information and services, taking into account the particularities of each one [

3,

4].

It is important to note that financial literacy refers to a set of skills, going beyond just knowledge about finance. This is confirmed when we analyze traditional interventions that focus only on educational methods, thereby neglecting behavioral factors. Interventions such as these have low efficiency, which reveals the need to develop public policies that consider the behavioral biases of individuals, as well as financial literacy.

Especially in the Brazilian context, research into financial literacy as a multifaceted element is even more necessary. The Brazilian Central Bank and the Credit Guarantee Fund point out that on a scale of 0 to 100, the average level of financial literacy in Brazil is 59.6, with about 75% of survey participants obtaining a maximum score of 70 points, being those with higher levels of education. The same study shows that 44.8% of Brazilians in the sample said they never or rarely had money left over at the end of the month, and 36% were concerned about whether they would have enough money to cover their expenses. Furthermore, the Central Bank points out that 64% of Brazilians face financial instability and around 49.1% report that experiencing financial worries affects their mental health on a personal and family level [

5]. These data reveal Brazilians’ exposure to financial vulnerability, which shows that there are still significant gaps to be filled in terms of financial literacy in Brazil, especially for minority groups such as people with less access to education and formal financial services.

In this context, investigating the elements related to financial literacy can help in the development of interventions and public policies that contribute to individuals’ financial autonomy and well-being. Financial education has a positive and significant influence on financial inclusion and the attainment of sustainable livelihoods [

6], and is considered a path to sustainability. It is also key to ensuring the financial sustainability of individuals, families, businesses, and national economies [

7], since economic growth and sustainability depend on the financial education of individuals.

Financial literacy is a pillar for the achievement of several Sustainable Development Goals of the 2030 Agenda of the United Nations, related to poverty reduction (SDG 1), increased well-being (SDG 3), higher-quality education (SDG 4), gender equality (SDG 5), economic growth (SDG 8), reducing inequalities (SDG 10), and more responsible consumption and production (SDG 12) [

8]. This reinforces the indispensability of broad and multifaceted research into financial literacy, as it is a driving force for individual and collective economic development, in addition to contributing significantly to poverty reduction [

9].

Objective measures of financial literacy are important for reducing inequalities between people, as without financial literacy, they can face a series of problems, such as difficulties in making informed investments or incurring losses on assets, which can harm their financial well-being. Nevertheless, financial literacy as a concept should be further developed in terms of also covering financial planning attitudes and using new digital assets as investment products, such as cryptocurrencies. Of equal importance is measuring knowledge and attitude impacts across desired outcome indicators, such as financial fraud prevalence or financial vulnerabilities. The latter, defined as financial precariousness or a lack of financial well-being, hinders the attainment of Sustainable Development Goal 1, aimed at achieving a world without poverty, and at the same time hinders SDG 10, aimed at reducing inequalities. Both impacts are significant and inhibit long-term sustainable development of a country.

The primary objective of this work is to develop an instrument that comprehensively measures financial literacy, encompassing aspects such as crypto literacy and financial planning, and assess how these factors influence financial vulnerability and susceptibility to financial fraud among individuals, ultimately impacting their financial well-being. The scope of our instrument may help fill gaps in the literature, since it can be related to aspects such as cognitive biases, financial fraud, and financial vulnerability. To the best of our knowledge, these dimensions have not been analyzed in an integrated manner to date.

The structure of our paper is organized into interconnected sections. Initially, the literature review presents the fundamental concepts of financial literacy, financial planning, and susceptibility to fraud and financial vulnerability. Next, in

Section 3 used to develop and validate the proposed instrument are detailed, as well as the experimental application. Finally, in

Section 4 and

Section 5 provide insights into how financial literacy can be increased and financial vulnerabilities reduced, with practical implications for public policies and educational programs in Brazil.

2. Literature Review

There is a relatively large body of literature on how individuals deal with their finances. Knowledge on this subject is essential because it provides conceptual inputs that help people avoid putting themselves in a situation of financial vulnerability, especially in scenarios of socioeconomic instability [

1]. A better financial perception contributes to more assertive decision-making based on information, thereby reducing the risk of indebtedness, as well as promoting conditions for more sustainable economic growth, financial inclusion, and positive financial behavior [

7,

10].

Financial literacy is understood as an individual’s ability to understand and apply financial concepts to make well-informed and more rational decisions [

11,

12,

13]. In the literature, several factors are identified as variables that influence financial literacy. These include demographic and socioeconomic variations, with an emphasis on educational attainment, age, and gender [

11,

14]. Another factor highlighted in recent studies is the lack of access or limited access to formal financial technologies and services [

9].

Financial literacy has a strong economic and social impact, as it enables individuals to improve their financial well-being and deal with situations of financial vulnerability [

11]. The literature shows that people with greater financial literacy have greater autonomy and ability to make prudent and beneficial decisions about their financial lives, such as financial planning, increasing savings, and managing risks [

15]. In addition to domestic benefits, financial literacy is also associated with greater chances of business success, since more literate entrepreneurs have higher incomes and savings [

13]. Furthermore, in rural contexts, financial literacy is also essential for encouraging entrepreneurial activities, which contribute to the empowerment of rural communities and sustainable development [

9].

Financial literacy contributes to people’s autonomy, enabling them to understand economic scenarios and strategic resources and take more effective actions based on planning, managing resources, calculating interest rates, diversifying investments, and interacting with financial institutions. This contributes to making informed economic decisions [

1,

16,

17,

18,

19,

20,

21,

22,

23,

24].

Understanding individuals’ attitudes towards the use of money, financial decisions, risk management capacity, and financial uncertainties is the object of study of financial literacy [

25,

26]. Greater financial literacy contributes to healthier financial behaviors, such as greater savings, lower propensity to debt, greater financial planning capacity, and better participation in the stock market [

2,

20,

27,

28,

29]. The importance of this knowledge is demonstrated by the number of people unable to answer simple questions on the subject, as shown by an experiment carried out in the United States, in which only half of the respondents over the age of 50 were able to get two simple questions about compound interest and inflation right [

30]. It is worth mentioning that low financial literacy is a global issue that includes countries such as Germany, Sweden, Italy, Japan, and New Zealand [

26].

Important aspects of economic life are impacted by financial knowledge, as is the case with saving for retirement. A study carried out in the Netherlands found that getting more questions right about financial literacy contributes to a 10 percentage point increase in the ability to plan for retirement [

26]. The number of social security programs, aimed at the most diverse groups of individuals such as women, low-income families, and minorities [

31], reveals the gulf in the level of financial literacy, as can be seen among whites and Asians, who are more knowledgeable in this area than African-Americans or Hispanics [

26].

Financial literacy also helps to reduce financial vulnerability, a phenomenon characterized by the inability to pay unforeseen bills, high levels of debt, and frequent exposure to fraud. This issue is very worrying because it reveals a structural problem that exposes economic inequalities, financial exclusion, and a lack of financial knowledge. This financial vulnerability can also affect the health of individuals, which can have an impact on physical and mental health, interpersonal relationships, and work performance [

32,

33]. The training generated by financial literacy contributes to better management of savings and investments; this capacity reduces financial vulnerability and thus provides economic well-being [

4,

27,

28,

29].

Actions such as inadequate financial planning and impulsiveness, especially in the short term, are factors present in the behavior of people exposed to financial vulnerability, which makes them more susceptible to fraud, especially in a scenario of low digital inclusion [

34]. This is the case in Brazil, for example, where the low-income population has no access to formal financial products such as credit and insurance [

3,

4]. And this financial exclusion leads to dependence on informal and predatory financial services, which makes the situation of vulnerability even worse [

26].

The low level of knowledge about basic financial issues such as budgeting, savings, and credit as a result of a lack of financial literacy exposes individuals to vulnerability, as recent studies have shown. This lack of knowledge makes it difficult to deal with unforeseen events, which contributes to excessive indebtedness. The consequence of this behavior is the exclusion of low-income populations from the formal financial system, increasing their exposure to fraud and unsustainable financial behavior [

4].

Financial literacy is an important tool for promoting financial stability; understanding the costs associated with credit and avoiding unsustainable financing decisions [

35] contributes to this result. This knowledge contributes to better financial planning, resulting in the establishment of emergency reserves, which reduces default and also helps to strengthen individual and collective economic security.

Understanding cryptocurrencies is of paramount importance for assessing financial knowledge. The 1st National Cryptocurrency Survey in Brazil indicates that crypto assets have already surpassed stocks in investor preference, showing that investing in cryptocurrencies is now among the five most popular forms of investment among Brazilians. Despite this, the survey shows that Brazilians’ knowledge of other aspects related to this market is still limited and there is a long way to go in terms of financial education [

36].

The effectiveness of financial literacy is clear in its role in contributing to good financial behavior and reducing the risk of vulnerability. The literature shows that more financially literate individuals develop more resilient behavior in times of crisis, reducing their exposure to impulsive behavior and financial fraud. Financial literacy also contributes to financial inclusion and sustainable economic development [

7,

37]. In scenarios characterized by exclusion and economic instability, financial literacy highlights its importance as a tool for change. This reinforces the importance of initiatives that support the expansion and better dissemination of financial literacy at different levels of society.

Substantial amounts of literature confirm the importance of individual-level financial literacy to personal as well as macroeconomic well-being. However, scholarly investigation has progressed mainly in a compartmentalized and unconnected manner. The past literature can broadly be categorized into a few different camps: (1) studies focusing on basic knowledge of finance where often interest compounding, inflation, or risk diversification (e.g., [

26,

30]) are tested, among other factors; (2) behavioral finance studies that investigate how specific cognitive biases (e.g., overconfidence bias or loss aversion) impact individual-level financial decision-making (e.g., [

38,

39]); (3) socioeconomic examinations that assess drivers of financial insecurity often linking it to variables such as race, gender, or income; or (4) recent scholarship where awareness regarding new financial instruments such as cryptocurrencies is explored but often found to be unrelated to more traditional literacy testing. While these represent worthwhile endeavors individually, they collectively present an incomplete picture.

The key research gap, then, is the absence of a unifying, multidimensional framework that simultaneously examines these components. Current scholarship falls short of adequately examining interdependencies among financial literacy (both traditional and novel), behavioral inclinations (e.g., planning), cognitive traits (e.g., biases and reflective thinking), and real-world results (related to being vulnerable or being a fraud target) within a single framework. Accordingly, an ambiguous understanding remains regarding how these forces interact to impact one’s individual financial resilience. Additionally, a crucial consideration missing from this fragmented landscape is an explicit connection to sustainable development. While financial inclusion is often aligned with the United Nations Sustainable Development Goals (SDGs), existing scholarship has failed to adequately explore how the quality of financial literacy—encompassing behaviors, cognitive resilience, and vulnerability—facilitates social and economic sustainability. For instance, variations in financial literacy and vulnerability by race and gender transcend economic issues and embody the causes of social injustices that undermine social sustainability, especially with respect to SDG 5: Gender Equality and SDG 10: Reduced Inequalities. Similarly, household finance volatility has a direct impact on a nation’s economic resilience, delineating a core component of SDG 8 (Decent Work and Economic Growth).

Our work aims to address these broad deficits through three key avenues. First, we move beyond the individualistic methodology by positing and testing an integrated framework that simultaneously considers basic financial literacy, knowledge about cryptocurrency, financial planning, reflective thinking, and cognitive bias. Secondly, as a necessary methodological innovation, we design and validate a new, omnibus instrument specially developed for the Brazilian setting, which simultaneously measures these diverse constructs. We establish the reliability and validity of such an instrument through Confirmatory Factor Analysis and thus provide a sturdy tool for future research applications. Finally, by including socioeconomic and demographic variables (such as race and gender) alongside coveted outcome measures (such as financial vulnerability and fraud experience), our exploratory work establishes a direct empirical link between the multifaceted dimensions of financial literacy and the overall goals of social and economic sustainability. In doing so, we reconceptualize financial literacy as a critical component for building fairer, more resilient, sustainable societies, beyond a mere concern for individual wealth.

3. Materials and Methods

3.1. Sampling

This research received approval from the Ethics Committee on Research Involving Human Subjects of the Getulio Vargas Foundation—CEPH/FGV (P.214.2024). Data collection commenced upon the acquisition of ethical permission. All study participants provided informed consent. The given details encompassed the study’s aim, confidentiality, participant autonomy, voluntary participation, the right to withdraw at any time, and the guarantee that all acquired data would be anonymized to safeguard participant identity.

Although our analysis sheds light on the relevant determinants of vulnerability and impropriety in financial dealings in Brazil, it is important to consider the special characteristics of our sample in interpreting the findings.

We conducted our data collection through direct contact at urban focal points, including shopping centers, bus and subway terminal stations, and public spaces in the Federal District. Specifically, our convenience sampling was employed to achieve a representative coverage of the population by their socioeconomic levels, educational levels, and occupation. The total size of the sample was 256 participants.

Despite this, however, we are aware of the following limitations associated with the coverage of the sample. First, our focus on an urban population means that the sample does not capture the views of populations in rural or other remote locations, and may face some pecuniary issues, as well as disparate access to infrastructure for finances and information technology. Secondly, the survey covered mostly the Federal District. This territory is characterized by high internal mobility and demographic diversity, which increases the diversity of the sample. However, given its unique economic features as the administrative seat of the government, it may not be representative of other Brazilian states.

As such, it is critical to be cautious in extrapolating these findings to the broader Brazilian population. The combination of planning, literacy, and vulnerability may be likely influenced by local economic factors and cultural norms, which are addressed by this study in limited ways. Although the population in the Federal District is very diverse, with most residents coming from different parts of the country, large-scale migration may result in some states in Brazil becoming more homogeneous, and these factors may work in different ways. Nonetheless, this study adds to the creation of a sound framework in understanding nuanced relations of finances within a heterogeneous urban environment in Brazil. We show how it is important to expand financial education programs by incorporating key elements, like planning finances, to inform intensive public policy actions.

Data were collected through the SurveyMonkey platform version 4.5.7, using electronic devices. The data was kept in Survey Monkey’s cloud-based database, which keeps the data encrypted according to the SOC 2 standard.

3.2. Instrument

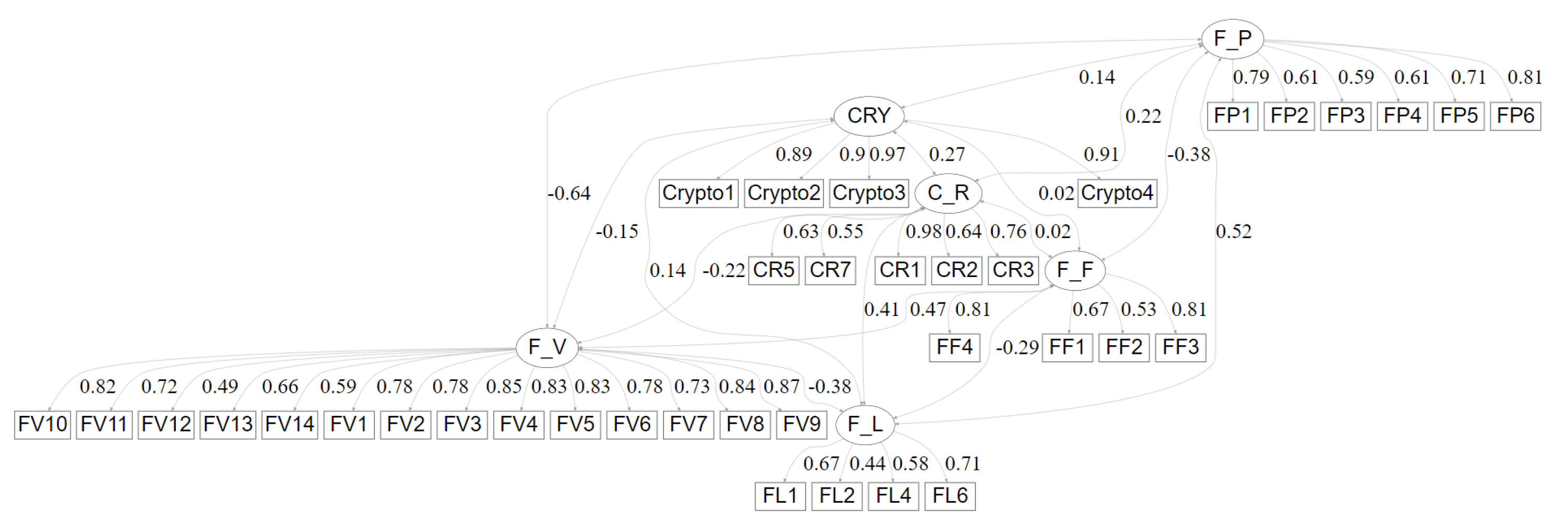

In addition to socioeconomic questions, our instruments comprise items adapted to Brazilian reality, ensuring good consistency and reliability (we used Confirmatory Factor Analysis to evaluate the instruments and reduce the number of items to obtain reliable and valid instruments, which we used for the econometric and machine learning analysis). We developed a comprehensive financial literacy instrument, which comprises core financial literacy items (FL). We also included financial planning (FP) and knowledge on cryptocurrency (Crypto). This instrument has two knowledge dimensions (FL and crypto) and an attitude dimension, which is financial planning.

We evaluated the impact of the Broad FL instrument on financial vulnerability (VF) or financial fraud (FV). These two variables capture an outcome dimension, where respondents have suffered from financial vulnerability (i.e., several bills past due) or financial fraud (i.e., suffered losses from FF). We also measured the reflective and analytical thinking of respondents using the Cognitive Reflection Test (CRT). In addition, we measured four cognitive biases and control variables, including gender, race, age, and income. It is important to highlight that the final instrument follows the results from the Confirmatory Factor Analysis, regarding the goodness of the model fit and the reliability and validity of the latent factors.

3.3. Financial Literacy—Core Knowledge

Financial knowledge was measured using the main instrument (the Big Five) developed by Lusardi and Mitchell [

26]. This is a widely used instrument for measuring financial literacy, which provides a standardized and comparable measure of financial knowledge between different countries and groups. The main objective of the “Big Five”, which is an expanded version of the “Big Three” [

25], is to provide a consistent measure of financial knowledge. Consisting of questions on simple interest rates, inflation, bond prices, mortgages, and risk diversification, the questionnaire provides an expanded view of respondents’ financial knowledge [

25]. To adapt it to the Brazilian context, we translated the instrument by replacing “mortgage” with “financing”. We also included one question from financial knowledge from the Financial Literacy Survey [

40] which measures investment knowledge focusing on return on investment.

Next, we selected two self-perception questions on financial knowledge from the Financial Literacy Survey [

40]. These questions allowed us to analyze whether people who have had access to financial education manage their finances better and how confident they are in their financial knowledge.

We covered different aspects of financial literacy, and to assess this aspect, we used three questions from the Financial Literacy Quiz [

40]. This is a tool based on the recommendations of the Financial Literacy Map, a Japanese framework created by the Committee for the Promotion of Financial Education. In order to cover different characteristics of financial literacy, we included questions on family budget, financial knowledge, understanding of financial/economic circumstances, appropriate selection/use of financial products, and appropriate use of external expertise.

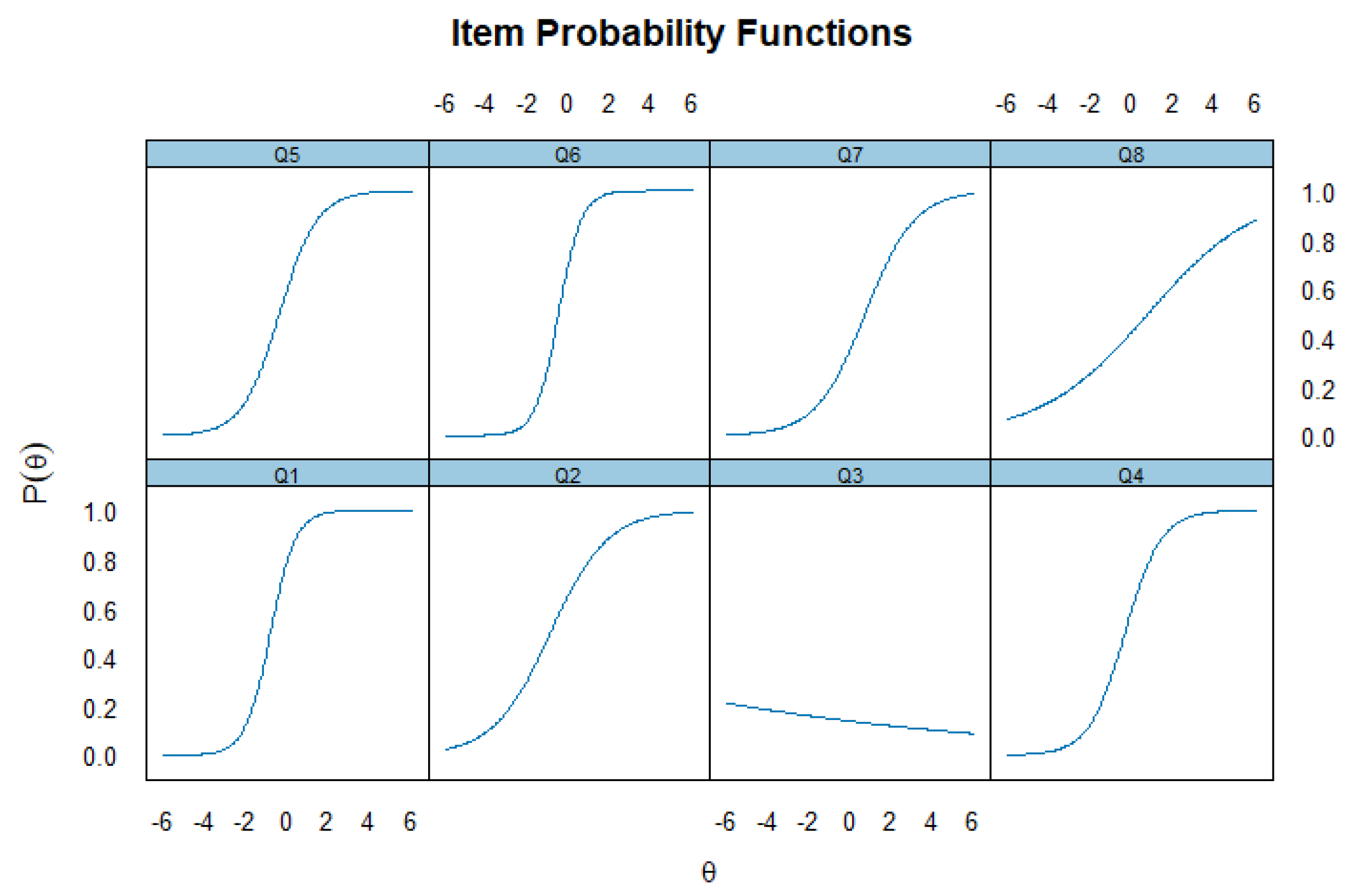

To ensure that the score of financial knowledge reflected the real result, we used the method of Item Response Theory (IRT). IRT models analyze individual item performance in relation to overall ability, allowing for more precise measurement of financial literacy and providing insights into the difficulty and discriminating power of each question. Each item in a test has constraints, such as difficulty, discrimination (ability to differentiate between people with different skill levels), and the probability of getting it right by chance.

We utilized a multidimensional Item Response Theory named mirt. The mirt software was developed to estimate multidimensional item response theory parameters for both exploratory and confirmatory models with maximum-likelihood approaches [

41]. We use R Software version 4.5.1 whit Mirt package version 1.45.1.

After analyzing the eight questions in the instrument, the IRT method identified one question (three) that participants had difficulty answering, even those with high literacy, while some with low literacy also answered correctly. We have decided to disregard this question in the scoring (

Figure 1).

We also employed Confirmatory Factor Analysis, retained only four items that had high loadings, and improved the psychometric properties of these instruments. The final instruments are provided in

Appendix C.

3.4. Financial Planning

Financial planning was based on research by Anderloni et al. [

42]. Six questions were selected, focusing on personal behavior and attitudes, such as critical thinking before buying something, setting financial goals, personal vigilance in financial matters, paying bills on time, and people with divergent thinking, such as living for today and letting tomorrow take care of itself. We opted to adopt a scale of only two response options for the instrument’s items, attributing one if the respondent agreed to some extent with the text. It should be noted that there are no correct or incorrect answers, and the score obtained is a direct measure of the respondents’ level of financial planning. Hence, a lower score reflects a lower level of financial planning.

3.5. Cryptocurrency Literacy

For knowledge of cryptocurrencies, four items were selected from an instrument initially developed by Al-Omoush et al. [

43], based on an empirical study and items taken from relevant studies in the literature on financial literacy. The original instrument contains 24 items, divided into six scales with 4 items each. In addition, three experts in cryptocurrencies, financial technology, and investments in financial assets reviewed this instrument to evaluate the measures and refine the items, ensuring the instrument’s accuracy and robustness. As far as the answers are concerned, respondents must score each item according to a Likert scale, ranging from 1 (strongly disagree) to 5 (strongly agree).

The original instrument consists of six scales, developed and validated based on the relevant literature, namely (i) financial literacy, which assesses the knowledge and ability to deal with fundamental concepts of cryptocurrencies [

44,

45]; (ii) perceived value, which emphasizes the perceived benefits of using cryptocurrencies, such as security and efficiency [

46]; (iii) optimism, which measures users’ positive outlook on the future of cryptocurrencies [

47,

48]; (iv) cryptocurrency dependence, based on the scales proposed by Sonkurt and Altınöz [

49] and Kiatsakared and Chen [

50], which evaluates compulsive behaviors and negative impacts related to excessive use; (v) trust, addressing the perceived security and reliability of cryptocurrency transactions [

51,

52]; and, finally, (vi) intention to continue using, which examines the long-term behavioral intention to continue using cryptocurrencies [

53,

54].

To develop the instrument used in this study, only the items related to the financial literacy scale were selected to gauge the participants’ self-perception of their knowledge about the cryptocurrency market and risk assessment. Unlike the original study, we opted to adopt a scale of only four response options for the instrument’s items, 1 (“strongly disagree”), 2 (“disagree”), 3 (“agree”), and 4 (“strongly agree”). It should be noted that there are no correct or incorrect answers, and the score obtained is a direct measure of the respondents’ level of knowledge and perception. Hence, a lower score reflects a lower level of knowledge about cryptocurrencies.

3.6. Financial Vulnerability

The questionnaire developed in this study was based on research by Anderloni et al. [

42], whose main objective is to propose a financial vulnerability indicator (Financial Vulnerability Index) that summarizes different aspects of the financial stress faced by families, such as excessive indebtedness, inability to cover monthly expenses, late payments and other conditions of financial instability, as well as analyzing how the characteristics of families are related to the level of financial vulnerability.

The study questionnaire covers five main areas to measure the degree of financial vulnerability of families: (i) sociodemographic characteristics; (ii) economic and financial profile, which investigates the level of income, financial wealth and assets, types of debt (secured or unsecured), employment status, and use of risk management instruments, such as insurance; (iii) financial literacy; and (iv) economic and financial situation, which explores difficulties in balancing monthly expenses and dealing with unexpected expenses. The items included in our questionnaire essentially concern secure access to credit lines, financial well-being, household expenses, and access to health services.

3.7. Financial Fraud

To compose this dimension, we used questions on financial fraud (FF) from the Assessment of Financial Consumer Survey Report (2018) and two questions on secure financial behavior from the Financial Literacy Survey [

40]. The items were selected to investigate the vulnerability of individuals to economic crime and financial fraud. These questions are based on studies examining exposure to economic crime and the role of financial literacy in preventing it [

55], as well as reports such as the Assessment of Financial Consumer Survey Report (2018), which analyzes the impact of financial fraud in various contexts.

3.8. Cognitive Reflection Test

We used the 7-item Cognitive Reflection Test [

56]. The Cognitive Reflection Test is a psychological tool widely used to measure an individual’s propensity to resort to reflective and analytical thinking rather than relying on intuitive and rapid responses. Developed by Shane Frederick, the CRT was initially developed with just three questions, but has evolved to include more comprehensive versions, such as the seven-item version. This expansion aimed to increase the test’s accuracy and ability to capture nuances in participants’ cognitive style.

The CRT is based on the dual thought process model, which distinguishes between two cognitive systems: System 1, which is intuitive, fast, and automatic, being responsible for impulsive responses that often lead to error due to high susceptibility to optical illusions, and System 2, which is reflective, slow, and deliberate, requiring greater cognitive effort to suppress intuitive responses and reach more reasoned solutions [

39,

57,

58,

59,

60]. CRT questions are designed to exploit this dynamic, presenting problems that appear simple at first glance but contain cognitive traps designed to induce incorrect answers.

The expanded version of the CRT, with seven items, maintains the logic of the original version, but incorporates a greater number of questions to diversify the challenges presented and improve the reliability of the results. These questions are carefully formulated to provoke intuitive errors and challenge the participant to resort to analytical thinking. For example, one of the classic questions in the three-item version asks: “A bat and a ball together cost $1.10. The bat costs $1 more than the ball. How much does the ball cost?” The intuitive and wrong answer would be USD 0.10, while the correct answer, USD 0.05, requires more in-depth reasoning. In the seven-item version, similar problems are presented, covering a wider spectrum of mathematical and logical reasoning.

Scoring on the CRT is simple and straightforward, with each correct answer worth one point, resulting in a total score ranging from 0 to 7. Interpreting the results provides insight into the participant’s cognitive style: lower scores indicate a strong reliance on intuitive thinking, while higher scores reflect a greater capacity for analytical reasoning. In addition, it is possible to analyze intuitive wrong answers, which offer insights into how often automatic thinking dominates deliberative thinking.

We employed Confirmatory Factor Analysis for the Cognitive Reflection Test, retained only five items that had high loadings, and improved the psychometric properties of these instruments. The final instruments are provided in

Appendix C.

3.9. Cognitive Biases

We also included four cognitive biases to test if they are related to financial literacy (core competencies), financial vulnerability, and financial fraud. Our hypothesis is that if respondents are prone to cognitive biases then they may have lower financial literacy or be more likely to have financial vulnerability or financial fraud problems [

40]. Taking cognitive biases into consideration may help us to understand why so many people may have difficulties in avoiding financial troubles or financial fraud. Cognitive biases are related to behaviors that deviate from rationality and therefore may explain these financial outcomes.

The items were developed based on the premises of behavioral economics and explore the general characteristics of behavior in addition to specific biases that are fundamental to financial decisions, such as loss aversion, herd behavior, myopic behavior, and hyperbolic discounting.

Aversion to loss:

Loss aversion is the cognitive bias that explains why individuals feel the pain of loss twice as intensely as the satisfaction generated by a gain of equal value [

38]. This bias directly affects individuals’ financial decisions, from their investment choices to the choice of which groceries to buy at the supermarket [

61]. This is because people affected by this bias will focus more on potential costs and failures than on potential gains and benefits [

62,

63].

Herd behavior:

Herd behavior refers to the tendency of individuals to follow the actions or decisions of a group, even though these choices may be irrational or inconsistent with their own preferences. This behavior is influenced by the belief that the actions of the majority reflect superior information or decisions, leading individuals to ignore their own judgments, something reinforced by factors such as social pressure and the search for validation [

64,

65]. In the financial context, its implications are significant: collective decisions, such as mass asset sales or purchases, can create economic bubbles or crises [

66]. Thus, herd behavior not only reduces the diversity of decisions but also contributes to volatility and systemic risks in financial markets.

Short-sighted behavior:

Short-sighted behavior is marked by an exaggerated focus on immediate rewards, which can lead to impulsive decisions, such as impulse purchases and procrastination, prioritizing momentary satisfactions that can cause future regrets [

67]. People affected by this bias tend to see only isolated parts of a situation, which makes them ignore the situation as a whole, leading them to decisions that lead to reduced gains at the expense of greater opportunities [

68].

Hyperbolic discount:

Hyperbolic discounting refers to the tendency to undervalue future rewards to the detriment of immediate ones [

69]. Behavior like this has a significant impact on financial decisions, causing people to opt for immediate benefits, such as impulse purchases, rather than long-term beneficial choices, such as saving for retirement or investments [

70,

71]. This type of behavior can lead to financial problems, such as debt and lack of planning [

72]. Understanding hyperbolic discounting and looking for ways to overcome it is key to improving personal and social financial stability.

3.10. Multiple Linear Regression

We used Ordinary Least Squares (OLS) to investigate the relationship between variables. This is a widely used statistical method to estimate the coefficients of a linear regression model [

73]. The multiple linear regression model was applied to explain the following dependent variables: financial literacy (FL), financial vulnerability (FV), and financial fraud (FF). All regressions were estimated with robust standard errors for heteroskedasticity, and the results are displayed in

Appendix A.

In our modeling strategy, we first assessed the predictors of financial literacy (FL), which includes the Cognitive Reflection Test (CRT). Subsequently, we used the resulting FL score, alongside other variables, to predict both financial vulnerability (FV) and financial fraud (FF).

One of our key objectives here is to assess whether knowledge-based or behavior-based dimensions of financial literacy have a more substantial impact. As such, we deliberately looked at these factors individually. We frame our methodology with the following reasoning:

Hypothesis 1: We hoped to determine if the behavioral dimension (financial planning) would be a better predictor than the knowledge dimension for financial results (fraud and vulnerability).

To distinguish this effect, we examined the dimensions individually.

Our general multiple linear regression model can be represented mathematically as:

The independent variables used in the models are defined as follows:

FL—Latent variable for financial literacy measured by four observed indicators;

FP—Latent variable for financial planning measured by six observed indicators;

Crypto—Latent variable for cryptocurrency knowledge measured by four observed indicators;

CRT—Refers to the Cognitive Reflection Test, which measures the respondent’s ability to override intuitive but incorrect answers with reflective and accurate reasoning;

Female—Represents the gender of the respondent, is a dummy variable equal to 1 if the respondent identifies as female;

NonBinary—Represents the gender of the respondent, is a dummy variable equal to 1 if the respondent identifies as nonbinary;

Black—Is a dummy variable equal to 1 if the respondent identifies as Black. For our analysis, we combined black and mixed-race groups, consistent with previous studies [

74,

75,

76];

Other Race—Is a dummy variable equal to 1 if the respondent identifies as being of Asian descent or Indigenous;

Young—Is a dummy variable equal to 1 if the respondent is between 18 and 30 years old;

Old—Is a dummy variable equal to 1 if the respondent is 56 years old or older;

LowIncome—Is a dummy variable that represents individuals earning up to three times the minimum wage;

HighIncome—Is a dummy variable representing individuals earning more than ten times the minimum wage;

LossAversion—Indicates the respondent’s tendency to avoid financial losses;

Myopic—Captures the preference for immediate rewards over long-term benefits, indicating short-term financial behavior;

Discount—Reflects a preference for consumption rather than saving, indicating a present-biased preference;

Herding—Measures the tendency to follow the behavior of the majority in financial decision-making.

3.11. Machine Learning

Machine learning is a subset of artificial intelligence that enables computers to acquire knowledge and enhance their performance through data. Machine learning models are algorithms trained on data to identify specific patterns or generate changes in previously unobserved datasets. A multitude of classification methods have been presented in the machine learning literature and data science [

73].

In this section, we utilize supervised learning techniques [

77] to forecast the key attributes that are important for assessing FL, FV, and FF indices. Initially, we evaluate many classic machine learning approaches to identify the most appropriate one for our dataset. This is significant as machine learning models are often employed to make judgments with tangible real-world implications, particularly in sectors such as healthcare, banking, criminal justice, and energy [

78].

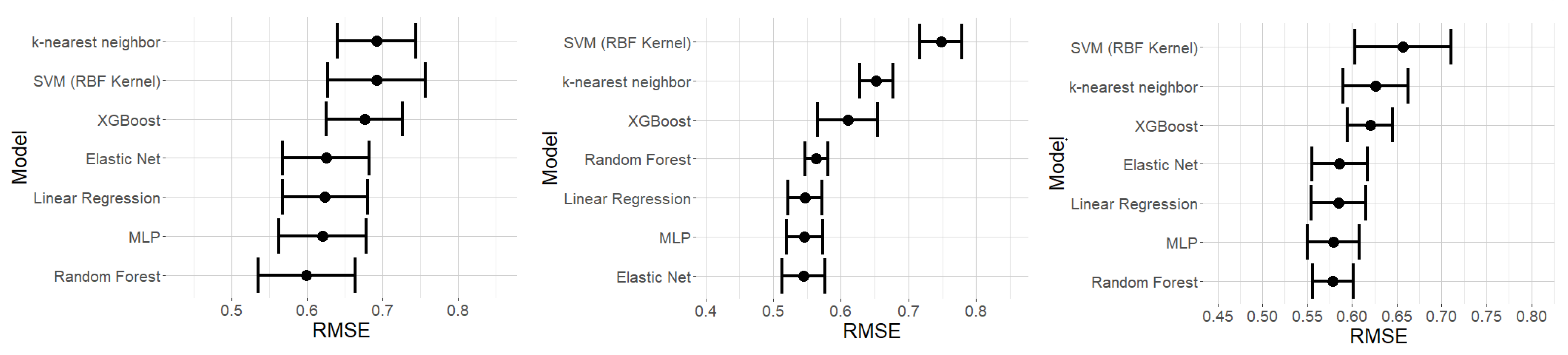

3.11.1. Horse Race

We conducted a competitive evaluation of supervised regressors to identify the optimal machine learning technique that enhances model performance to explain the average financial literacy (FL), financial vulnerability (FV), and financial fraud (FF). For modeling we used the tidymodels framework for R Version 1.4.1, the results are presented in (

Figure 2).

K-Nearest Neighbors—The fundamental concept of nearest neighbor methods is to identify a certain number of training samples that are closest in proximity to a new point and to predict its label based on those samples. The quantity of samples may be a user-defined constant (k-nearest neighbor learning) or fluctuate according to the local density of the points (radius-based neighbor learning). The distance can often be any metric measurement, with the conventional Euclidean distance being the most prevalent option. Neighbor-based approaches are classified as non-generalizing machine learning techniques, as they utilize all available training data, potentially organized into an efficient indexing structure, such as a ball tree or a KD tree [

79].

SVMs—These are learning machines for classifying two groups. They map input vectors nonlinearly to a high-dimensional feature space, where a linear decision surface is constructed with properties that ensure high generalization capacity. Only the support vectors, which define the maximum margin of separation between classes, are used to construct this surface. SVMs use the “kernel trick” to efficiently create nonlinear decision surfaces in high-dimensional spaces. For non-separable data, they apply soft margins to allow for controlled errors, increasing robustness [

80].

Random Forests—They consist of collections of classifiers that are tree-based, in which each tree is grown independently by using a random vector. The forests vote by output, and the generalization error converges without overfitting. Random Forests are also robust against noise and yield high accuracy with numerous weak and correlated inputs [

81].

XGBoost is a type of ensemble learning that uses the Gradient Boosting algorithm. It is a common choice for many machine learning tasks, especially when it comes to classifying and regressing structured data. It also lets you use more than one processor to speed up the training of the model. It boasts considerable speed, precision, and room for growth [

80].

A multilayer perceptron (MLP) is a type of neural network that has three layers: input units, hidden (or internal) units, and output units. The hidden units’ principal job is to make internal representations of the input patterns. This enables the network to solve issues that are more complex than those that two-layer networks can handle. The MLP’s purpose is to learn how to match the input patterns to the output patterns that are wanted, which will help it make good generalizations [

82].

Elastic Net is a penalized regression that outperforms Lasso when more predictors exist than observations (

p >

n) or in situations of correlation of predictors. The model involves both L1 (Lasso) and L2 (Ridge) penalties. For stability and model precision, Elastic Net chooses more variables and ranks those that exhibit interrelationships among them [

83].

Linear regression, being one of the fundamental methods under supervised machine learning, makes use of one or multiple independent variables to predict a continuously valued response (the dependent variable). A common method to estimate this model is the Ordinary Lest Squares (OLS) regression [

84].

The executed model selection approach sought to accurately optimize the distinct hyperparameter for each utilized machine learning algorithm. The primary criterion for identifying the optimal hyperparameter configuration was reduction in the Root Mean Squared Error (RMSE). To achieve this, cross-validation using 5 different folds was used. The resultant objects encompass the requisite information to iterate over these folds, utilizing 4 for model training and the remaining 1 for performance assessment, repeating this process 5 times to ensure each fold serves as an evaluation set once. In general, tree-based ensemble models exhibit improved performance on the dataset. Given our selection of RMSE as the performance indicator, we deemed Random Forest the victor of the competition, due to it achieving the best or similar RMSE to the best-performing methods, but with a lower standard deviation.

3.11.2. Interpretability Methods

Machine learning interpretability refers to methodologies for elucidating and comprehending the mechanisms by which machine learning models generate predictions. As models increase in complexity, elucidating their internal logic and acquiring insights into their behavior become paramount [

85]. In the absence of interpretability, it becomes challenging to determine whether a machine learning model is making sound decisions or exhibiting bias. Explainable Artificial Intelligence (XAI) has been revealed as a viable solution to the difficulty of interpretability by clarifying the rationale behind the model predictions [

86].

Among the diverse XAI methodologies, Shapley Additive Explanation (SHAP) and Local Interpretable Model-Agnostic Explanation (LIME) have attained recognition for providing global and local interpretability. SHAP provides consistent and precise importance values for the characteristics. In contrast, LIME builds local substitute models that emulate complex classifier behavior, thereby improving the understanding of specific predictions [

87,

88]. To elucidate the model’s judgments, we employed two prevalent XAI methodologies: LIME, which generates local substitute explanations, and SHAP, which assigns feature attributions based on game theory principles. These elements ensure a clearer understanding and important predictive potential, essential for transparent results.

4. Results

4.1. Characteristics of the Respondents

Of the 256 respondents, 123 were women (48%), 128 men (50%), and 5 nonbinary (1.95%). With regard to race/color, based on the principle of self-declaration, the sample is made up of 100 white people (39.1%), 149 black people (58.2%), 5 yellow people (1.95%) and 2 indigenous people (0.78%). In terms of income distribution, 100 respondents (39.1%) earned up to 1 minimum wage (BRL 1320), 79 (30.9%) had an income between 1 and 3 minimum wages (BRL 1320 to 3960), 40 (15.6%) between 3 and 6 minimum wages (R

$ 3960 to R

$ 7920), 22 (8.59%) between 6 and 9 minimum wages (BRL 7920 to 11,880), 8 (3.12%) between 10 and 20 minimum wages (BRL 13,200 to R

$ 26,400) and 7 (2.73%) earned more than 20 minimum wages (above BRL 26,400) (

Table 1 and

Table 2).

4.2. Multiple Linear Regression

We used the following as dependent variables: financial literacy (FL), financial vulnerability (FV), and financial fraud (FF). The results are displayed in

Appendix A.

In the financial literacy analysis, the Cognitive Reflection Test showed a strong positive relationship (coef. 0.502; p < 0.01), with higher scores reflecting greater knowledge in financial literacy, demonstrating that more thoughtful people tend to have more knowledge in this field. Women had lower levels of financial literacy (coef. −0.140; p < 0.1), which reflects social barriers in access to financial literacy. Individuals with a high income had higher levels of financial literacy (coef. 0.348; p < 0.1) which can be explained by several structural, social, and behavioral factors. In the analysis of race, individuals who self-declared themselves as black or as an other race did not show significant results. Behavioral characteristics such as loss aversion, myopic behavior, hyperbolic discounting, and herding, although some showed a positive or negative coefficient, were not statistically significant.

In the analysis of financial vulnerability, individuals with better financial planning exhibited a strong inverse relationship (coef. −0.797; p < 0.01), indicating that those with effective financial planning, such as controlling and projecting their finances, are less financially vulnerable. Individuals who self-identified as black were more financially vulnerable (coef. 0.156; p < 0.05), showing that race is an important characteristic and that black people are more financially vulnerable.

For financial fraud outcomes, financial literacy showed a significant negative relationship (coefficient −0.139; p < 0.1), demonstrating that higher levels of financial knowledge are correlated with a lower susceptibility to financial fraud. Financial planning is shown to be important for financial vulnerability (coefficient −0.366; p < 0.01), showing that financial planning is an effective tool in reducing fraud.

The results show that financial literacy and financial planning play a crucial role in shaping better financial habits, reducing financial vulnerabilities, and preventing fraud.

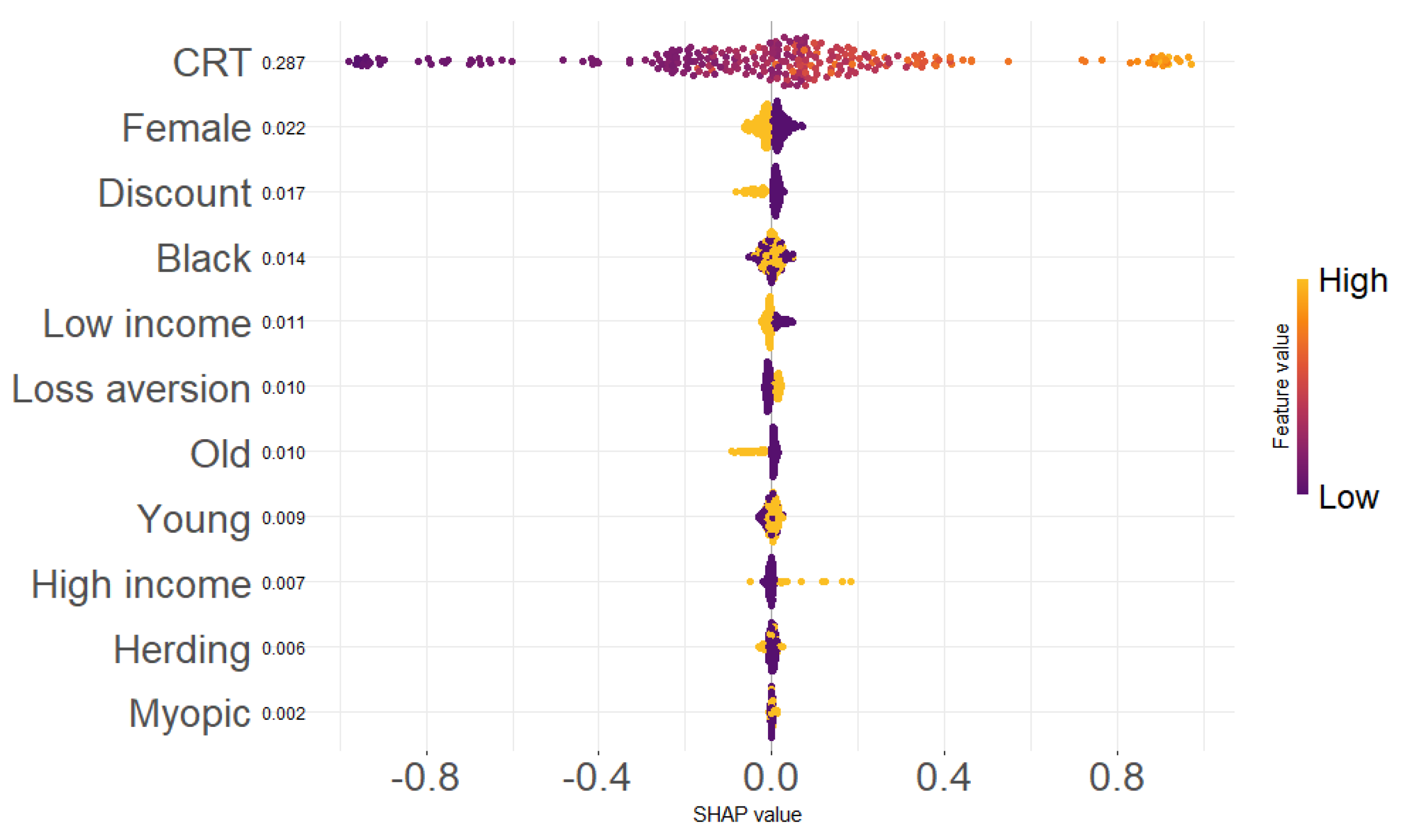

4.3. Results of the Machine Learning Approach

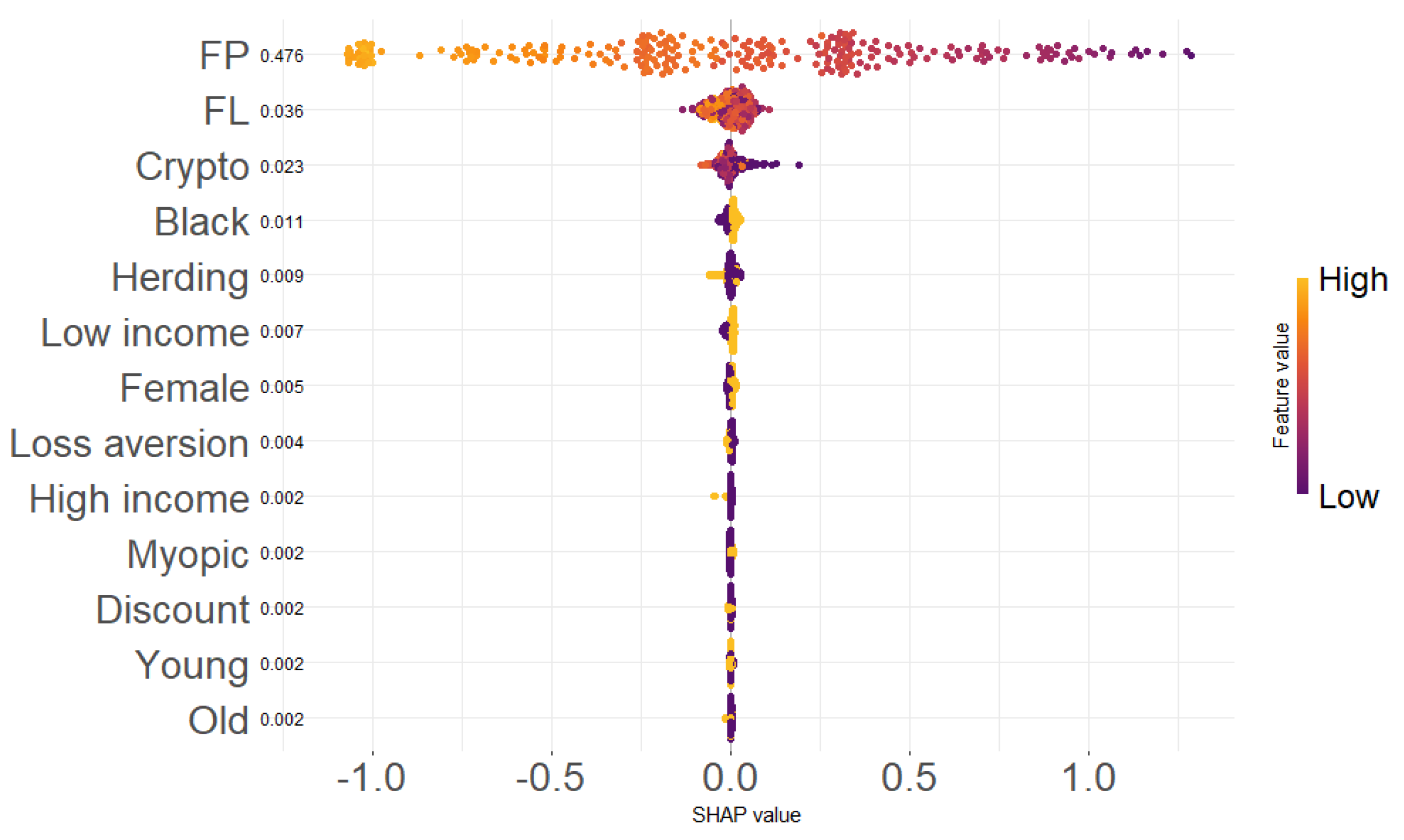

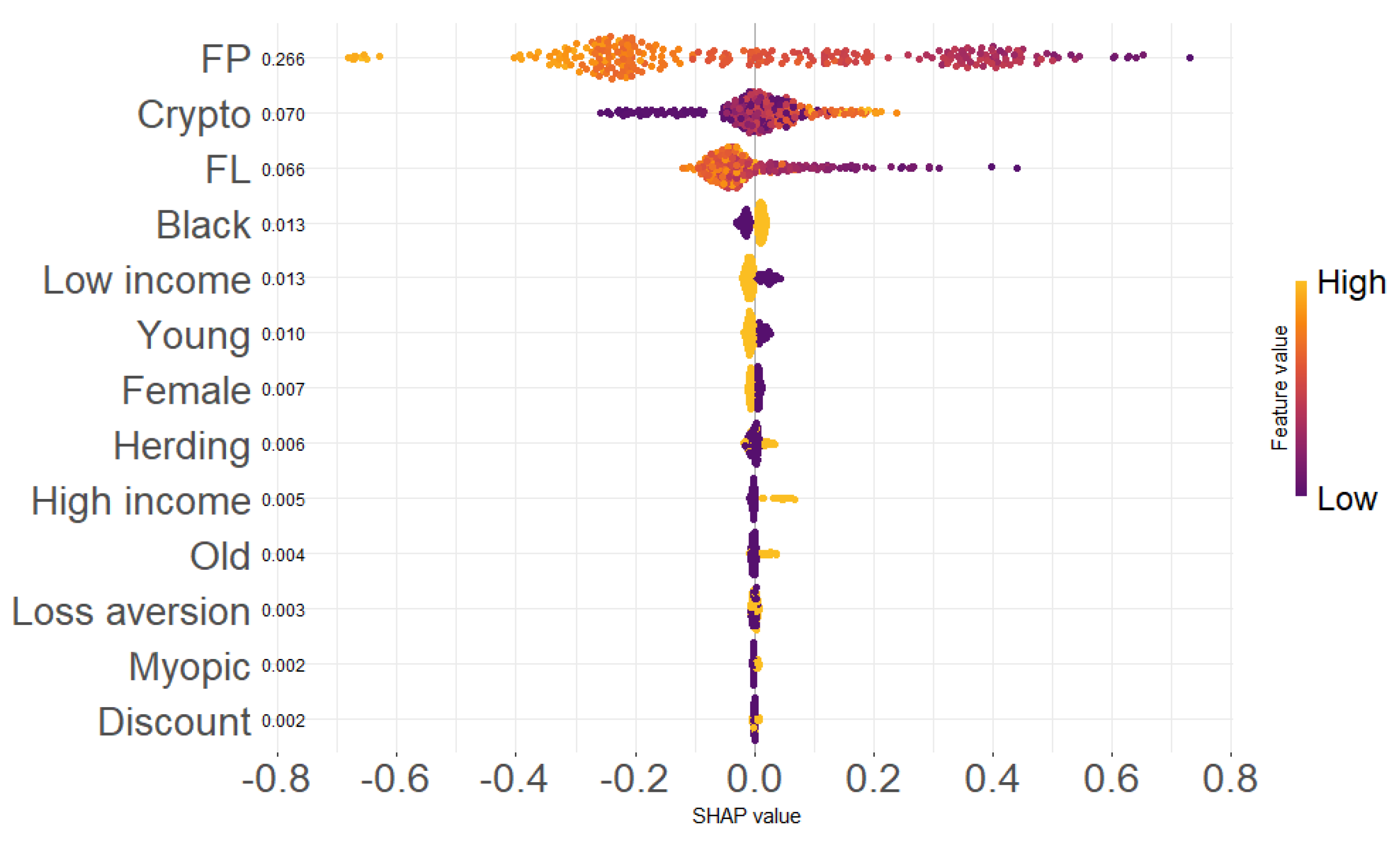

The importance of SHAP measures the influence of each variable on the individual model prediction. The absolute mean value shows the strength of this influence, regardless of the sign (positive or negative). The higher the importance value, the more relevant the variable is to the model’s decisions. The beeswarm plot presents the results for the dependent variables FL (

Figure 3), FV (

Figure 4), and FF (

Figure 5). The horizontal axis denotes the SHAP value, while the vertical axis comprises the predictive features. Positive (negative) SHAP values signify that the feature enhances (diminishes) the target variable. Each represents a dot for every attribute, which signifies the SHAP value for a particular instance, indicating the contribution of that attribute to the overall prediction for that instance. The color of the dot corresponds to the value of the feature, with lighter hues signifying greater values.

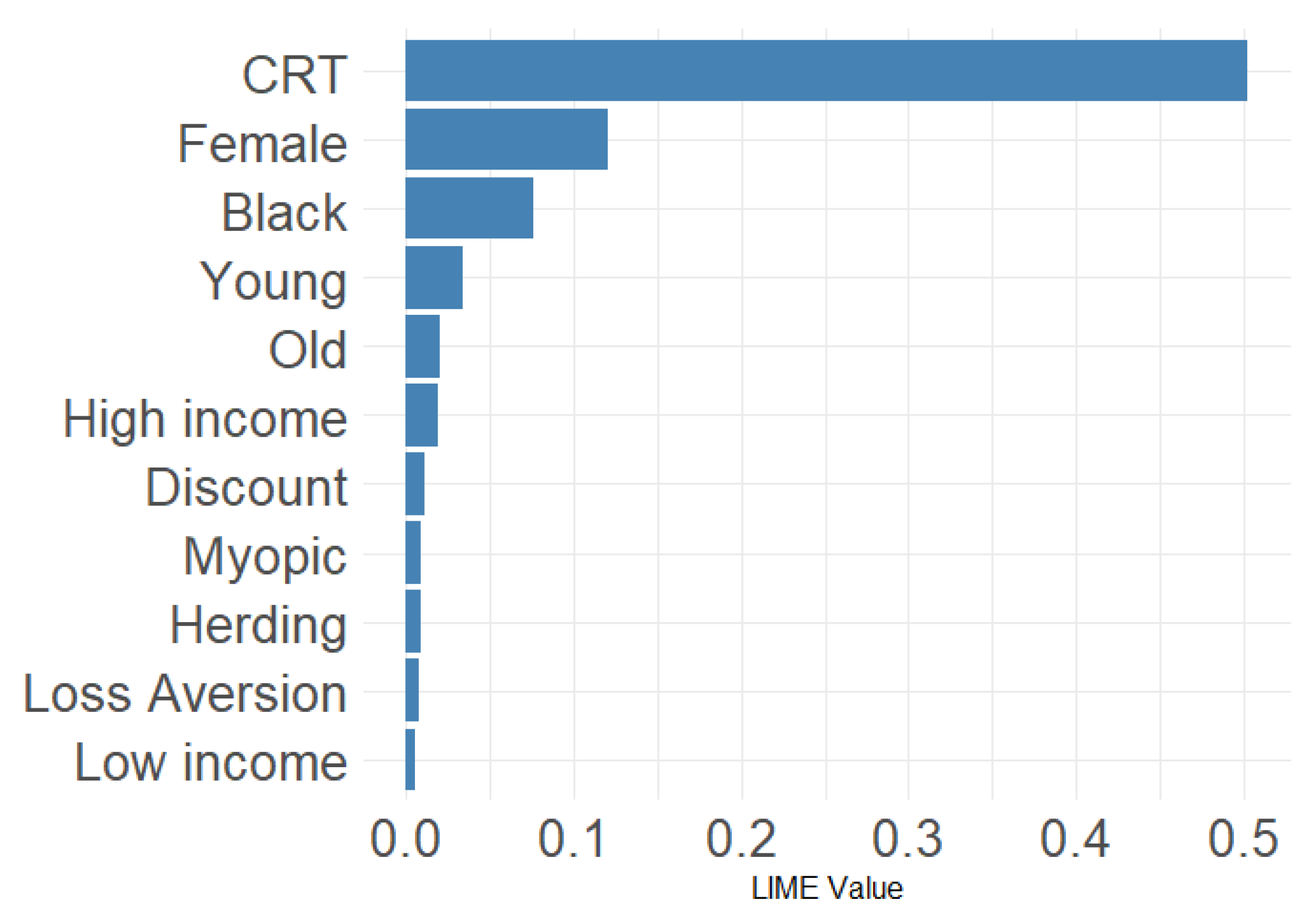

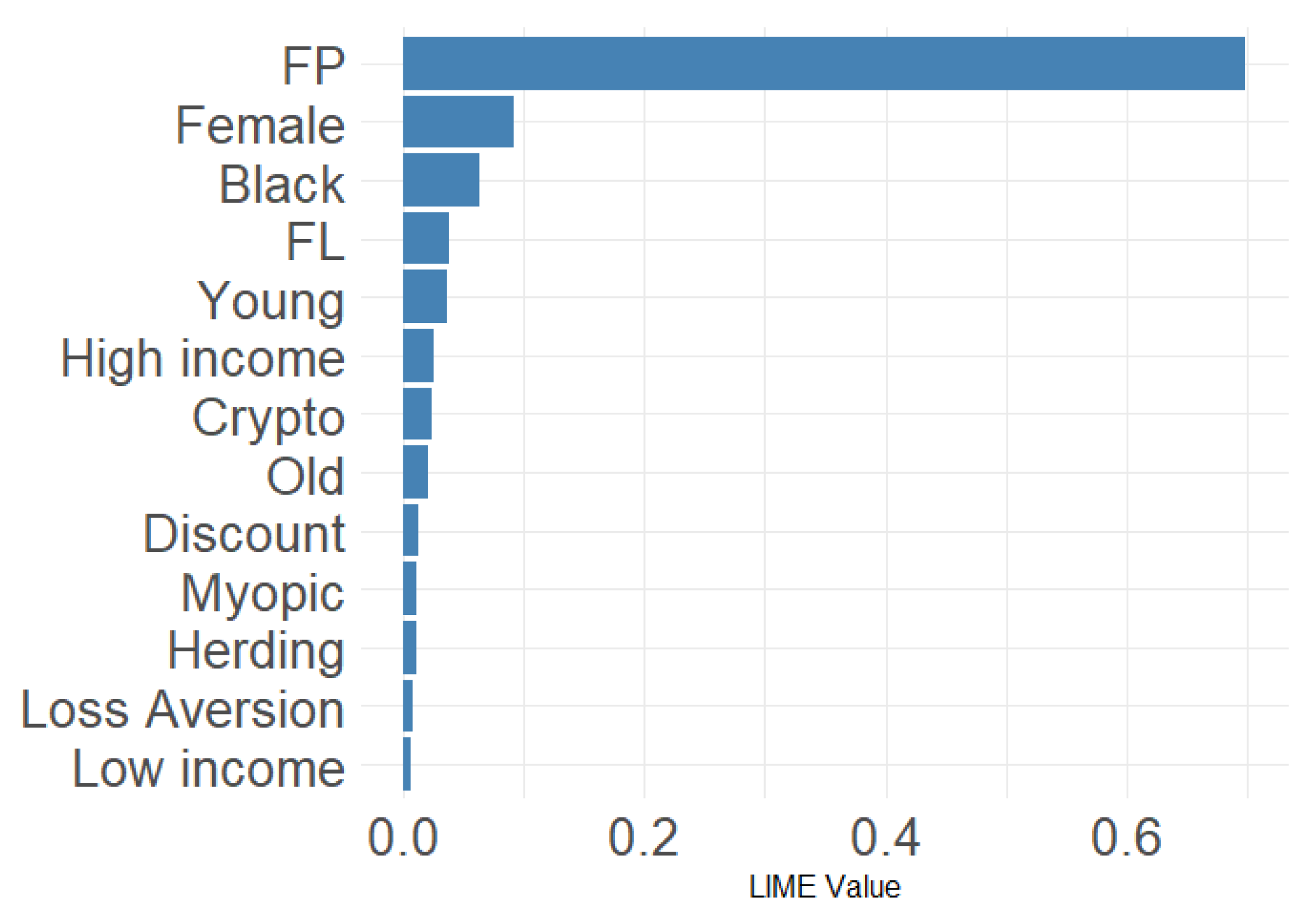

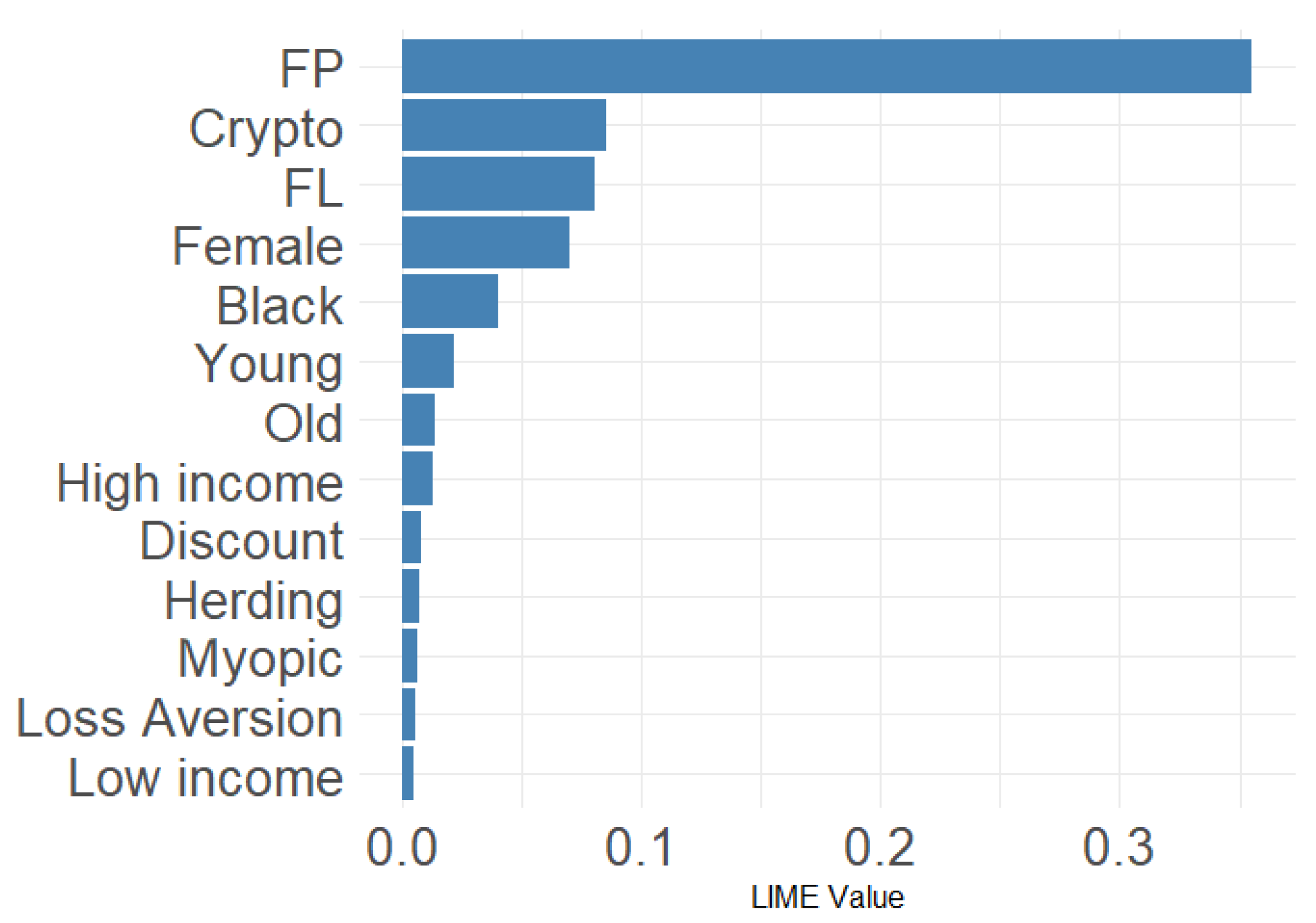

The importance of LIME measures the influence of each variable on the individual model prediction. The absolute mean strength shows the influence of each feature. The higher the importance value, the more relevant the variable is to the model’s decisions. The LIME plot presents the results for the dependent variables FL (

Figure 6), FV (

Figure 7), and FF (

Figure 8). Local Interpretable Model-Agnostic Explanation (LIME) represents the average importance of the variables in the local explanation of the predictions made by the best model (Random Forest). The X-axis (horizontal): names of the variables (or features), ordered from most important to least important, and the Y-axis (vertical): average of the absolute values of the weights attributed to the variables (mean_weight) by LIME in the explanations. This represents the average contribution of that variable to the predictions.

Financial planning (FP) is the variable that most influences the model, presenting a strong prediction for financial education, financial vulnerability, and financial fraud. The significance is very high for both the SHAP and LIME methods. In an analysis of financial literacy the Cognitive Reflection Test (CRT) is the feature that most influences both the SHAP and LIME models, confirming the results of the regressions. Being a woman significantly impacts the predicted result, showing a positive prediction for financial vulnerability and financial fraud, especially for the prediction of financial literacy, mainly when we look at the LIME results compared to the SHAP results; these values are a consequence of the different methodologies behind SHAP and LIME. The LIME method provides information on specific local specifications, while the SHAP method aims at a more comprehensive and global understanding of resource contributions. Both are valuable, but we answer different proposed questions about the importance of features. We can highlight the variables FL, Crypto and Black, which, despite not having great predictive power, always rank among the top for financial vulnerability and financial fraud modeling. The other characteristics did not show great significance in our models. It is important to note that the values for the Nonbinary and Other Race variables are not shown in the results, due to the small number of samples. When cross-validation is performed on training and test sets, these groups may end up in only one of these sets, or even in none of the test sets in certain folds, which is what occurred for the values in question.

These results confirm the regression results, especially when we look at the results of the SHAP methodology, since this methodology aims at a more comprehensive and global understanding of the contributions of resources. Both are valuable, but we answer different proposed questions about the importance of features.

5. Discussion

In recent years, Brazil has seen a rise in indebtedness, with 32% of Brazilians having been in arrears for more than three months, as well as the recurrence of financial scams, which affect more than 40 million Brazilians [

89]. At the same time, research points to the growing popularity of online sports betting, called “bets”, which is predominantly aimed at people earning up to two minimum salaries [

89]. From this context, and based on the results of this article, we infer that financial literacy is something that deserves the full attention of public policymakers.

The recent literature on financial literacy mainly investigates financial literacy and retirement planning; the intersection of financial risk management; and the impact of behavioral finance and psychological factors [

90]. In line with the discussion in the international literature, our results showed that people with greater financial literacy have better financial habits, which lead them to practices that reduce their level of debt, motivating an increase in financial reserves and, consequently, the ability to deal with unexpected expenses and even economic instability. Financial literacy combined with appropriate financial behavior contributes to individual and family financial security and favors economic growth and stability [

91].

Emerging economies like Brazil are more vulnerable to economic instability and shocks. The Getulio Vargas Foundation’s Economic Uncertainty Indicator (IIE-Br) rose by 4.6 points in April 2025, totaling 115.5 points [

92], which reinforces the need for a population capable of dealing with economic instability, something that is only feasible through a good degree of literacy and positive financial habits. The literature shows that people with greater financial literacy have greater access to formal financial systems and use them sparingly, reducing the likelihood of being exposed to any degree of financial vulnerability [

93].

The development of new, innovative instruments that assess financial literacy, financial planning, and cryptocurrency literacy is intended to address substantive gaps in the prevailing literature. Policymakers will now be able to measure financial literacy and related concepts in a more efficient and comprehensive manner, while being in a position to design and deliver interventions that are empirically grounded. The imperative of developing this tool arises due to the complicated nature of the construct and financial literacy’s central role in personal as well as communal economic stability, whereby there must be intermixing of basic financial competency with attitudes, behaviors, and contextual factors, such as exposure to socioeconomic vulnerability, that have a direct influence upon individuals’ health, well-being, and financial stability [

91]. In hypothesizing and crafting our approach, not only has there been a step up in scholarly work in academia, but financial literacy’s status as a complicated construct has also been acknowledged. This facilitates the evidence-based promotion of effective interventions, as well as a decrease in vulnerability [

1,

23].

In line with the international literature, our results show that in the Federal District, financial literacy plays an important role in developing better financial habits among the population. However, for the sample analyzed, the data show that theoretical knowledge alone does not guarantee the mitigation of financial vulnerabilities, nor even the prevention of fraud. This type of finding converges with other studies that highlight the importance of an integrated approach that considers not only knowledge, but also the practices and social context of individuals [

18,

19,

35]. Accordingly, financial behavior emerged as the most consistent dimension in explaining the positive outcomes of the sample. This dimension, therefore, shows that skills such as spending control, financial planning, and behavioral resilience are essential for reducing vulnerability and strengthening financial security [

20,

68].

The analysis also revealed significant inequalities in the levels of financial literacy between the different groups in the sample. Individuals with high income, for example, had higher levels of financial literacy, reflecting structural and cultural barriers to accessing financial literacy and other formal economic resources. This type of inequality, which has already been demonstrated in other studies [

25,

29], is even more critical in Brazil, a country characterized by high income inequality and financial exclusion, especially among the low-income population [

3,

4]. These results highlight the need for intersectional public policies, that is, policies that take into account the socioeconomic and cultural particularities of the most vulnerable groups.

Our findings confirm our hypothesis: planning has much stronger predictive ability. As a matter of theoretical interest but also because such a composite aggregated index would suppress an important difference, we performed such an exercise as a robustness check. The results, which we document in

Appendix B, confirm our major results and support our initial hypothesis. We carried out an assessment with a composite index to confirm our methodology. The results procured were consistent with our main findings and available in

Appendix B.

5.1. Implications for Sustainable Development

We found lower financial literacy for women, compared to male respondents, and greater vulnerability among black individuals. These results demonstrate not only important economic issues, but also issues of social injustice that undermine social sustainability. In Brazil, there are already racial quota policies for black people to access public universities. Public policies that address racial injustices are important to tackle issues of vulnerability and financial fraud. Future research could assess whether algorithms may be being used to defraud people of specific races due to greater vulnerability.

Greater financial vulnerability leads to families experiencing greater instability in their savings. It causes them to seek access to credit that can be predatory, with high interest rates. It can also lead to difficulty in withstanding adverse economic shocks. These weaknesses should be addressed at the macroeconomic level, which underscores the importance of enhancing financial planning, as well as household resilience, in order to build a more stable and sustainable national economy (this point is closely related to SDG 8: Decent Work and Economic Growth).

Our main finding is that financial planning and behaviors are more critical than knowledge (as measured by the financial literacy instrument, which encompasses only basic knowledge). Similarly, environmental knowledge does not necessarily lead people to behave in a pro-environmental way. Thus, financial knowledge does not guarantee the financial well-being of families. Thus, a key finding of our study is that sustainable outcomes depend on fostering or stimulating long-term thinking and behavioral changes. Our results suggest important avenues for developing public policies that are more inclusive and aim to foster behavioral change. Future research could investigate this relationship by evaluating the impact of nudges on increasing people’s financial well-being, reducing vulnerabilities, and promoting more sustainable behaviors.

5.2. Machine Learning Discussion

Machine learning systems help people and institutions better understand data and identify important patterns within it. This information is crucial for decision-making and planning. Therefore, it is important to understand the principles of machine learning algorithms and their applicability in various real-world application areas, such as security services, healthcare, economic data, context-aware systems, sustainable agriculture, and many others [

94]. Choosing the best machine learning model can be quite a daunting task. Typically, when creating a model, we choose the algorithm that performs best for the data in question. To support this, we use a methodology that is becoming widespread when comparing machine learning models in a horse race to choose which model is best [

95]. The best model evaluated was Random Forest, a highly effective machine learning algorithm that excels at modeling nonlinear relationships and providing the importance of each variable [

96].

Ease of interpreting results is paramount, as social researchers are primarily concerned with understanding complex social specificity, testing theories, and drawing explanatory conclusions from their data. Their expertise lies in their respective fields, not necessarily in advanced computer programming or algorithm development, to have a better interpretation of the results using SHAP and LIME, which are two prominent techniques in the field of Explainable AI (XAI), addressing the “black box” problem of complex machine learning models, helping researchers understand why a certain discovery was made.