Evolution of the Spatial Network Structure of the Global Service Value Chain and Its Influencing Factors—An Empirical Study Based on the TERGM

Abstract

1. Introduction

2. Data and Methodology

2.1. Data Description

2.2. Network Construction and Analysis Methods

2.2.1. Network Construction Model

2.2.2. Network Characteristic Analysis Methods

2.3. Network Influencing Factors Analysis Methods

3. Results

3.1. Evolution of Trade Patterns in Typical Industries of the Global Service Value Chain

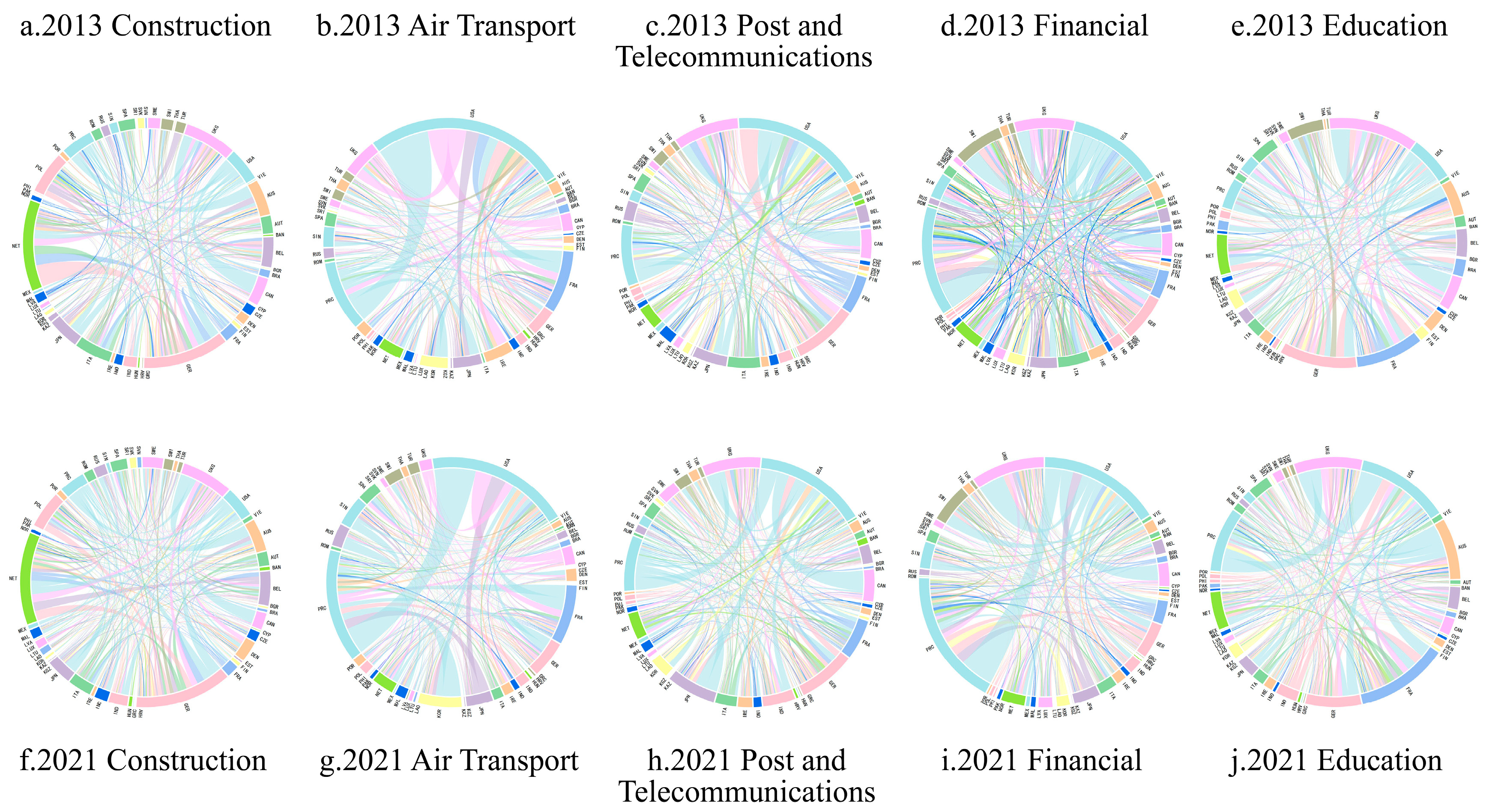

3.1.1. Evolution of the Spatial Pattern of Typical Industries in the Global Service Value Chain

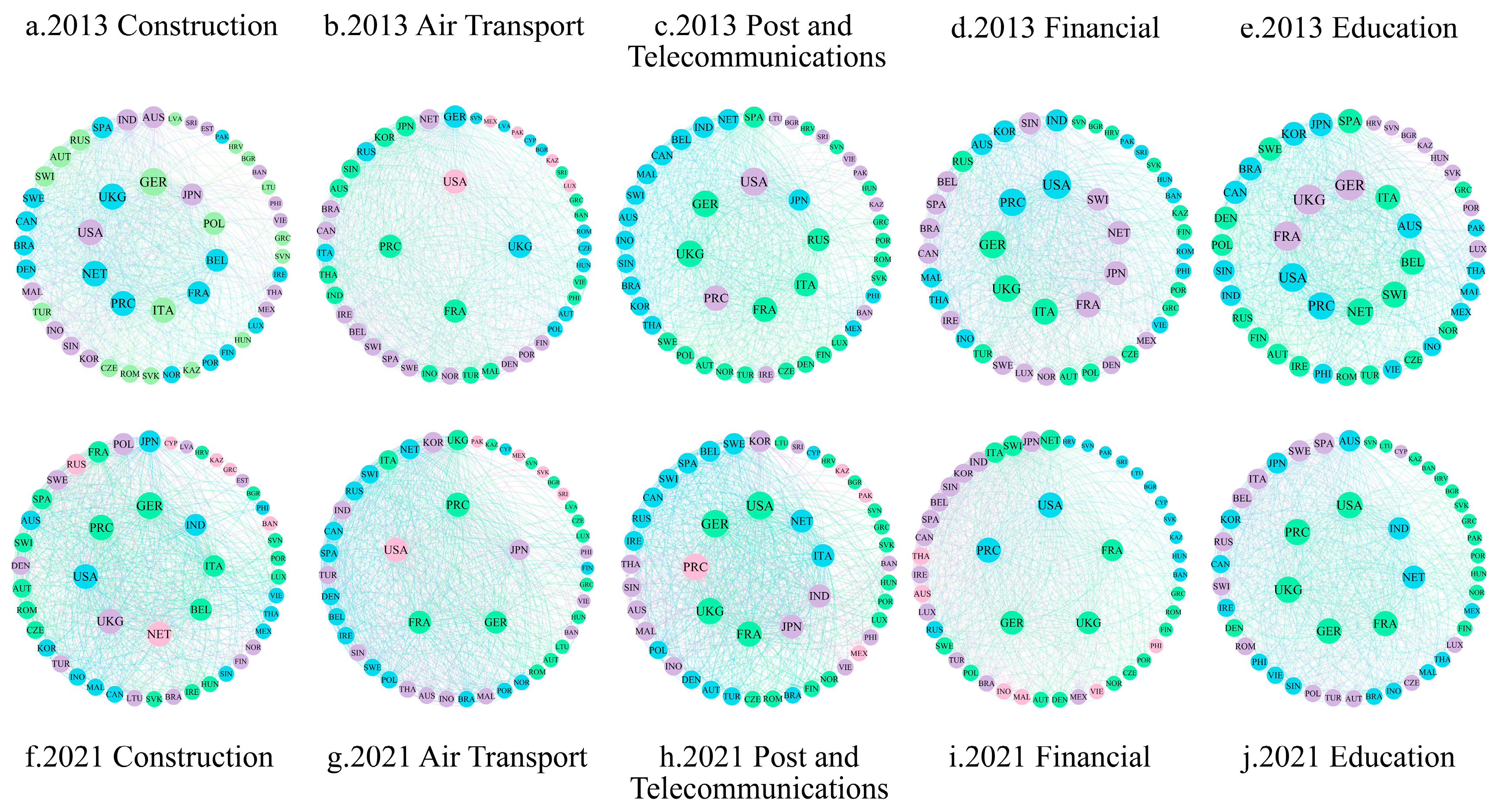

3.1.2. Evolution of the Network Structure of Typical Industries in the Global Service Value Chain

- Overall network characteristics

- 2.

- “Core–periphery” structural characteristics

3.2. Analysis of Factors Affecting the Evolution of the Spatial Network Structure of Global Service Value Chain

3.2.1. Endogenous Structural Variables

3.2.2. Exogenous Node Attribute Variables

3.2.3. Exogenous Network Variables

3.2.4. Time-Dependent Variables

3.2.5. Estimation Results of the TERGM

3.2.6. Robustness Test

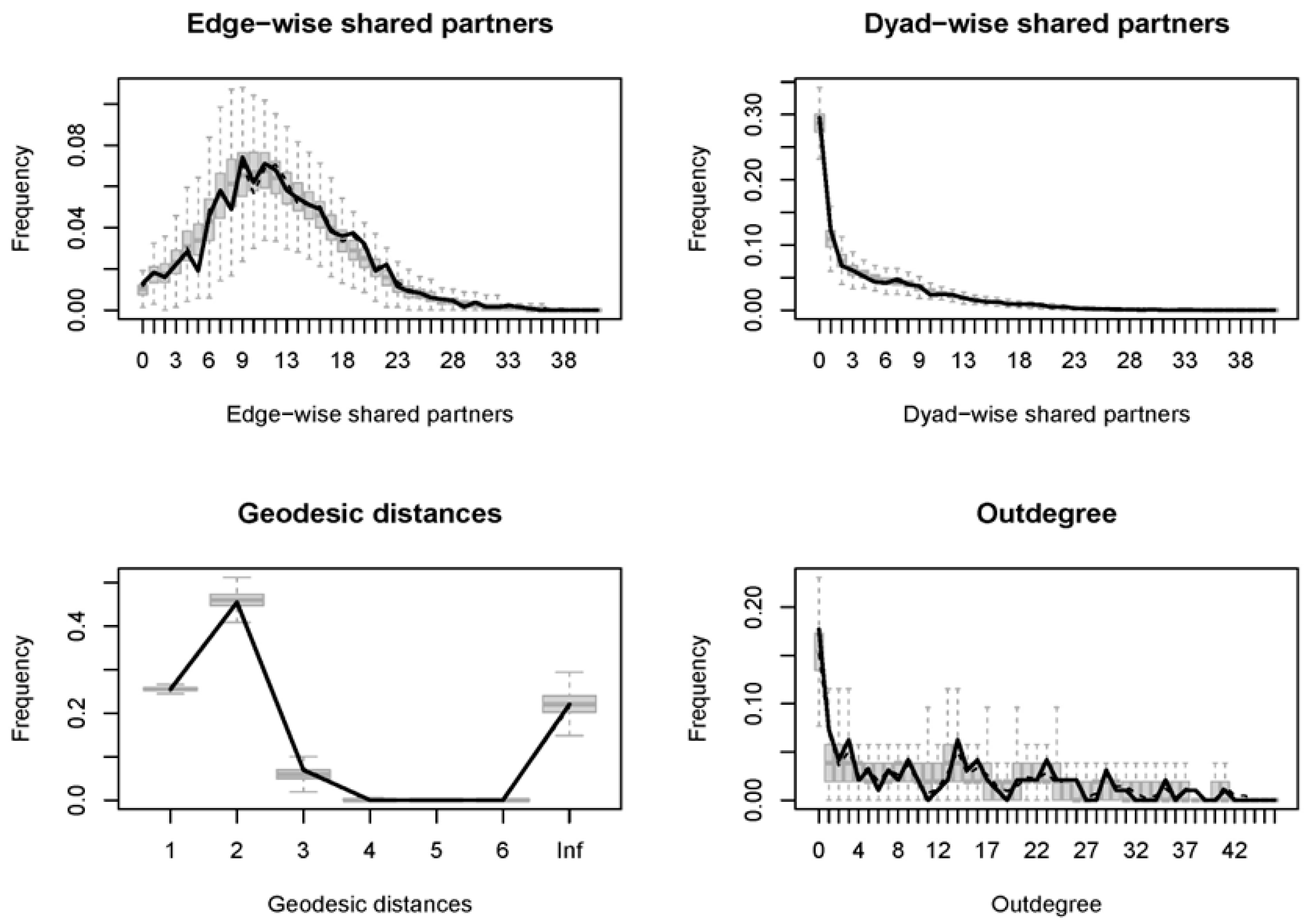

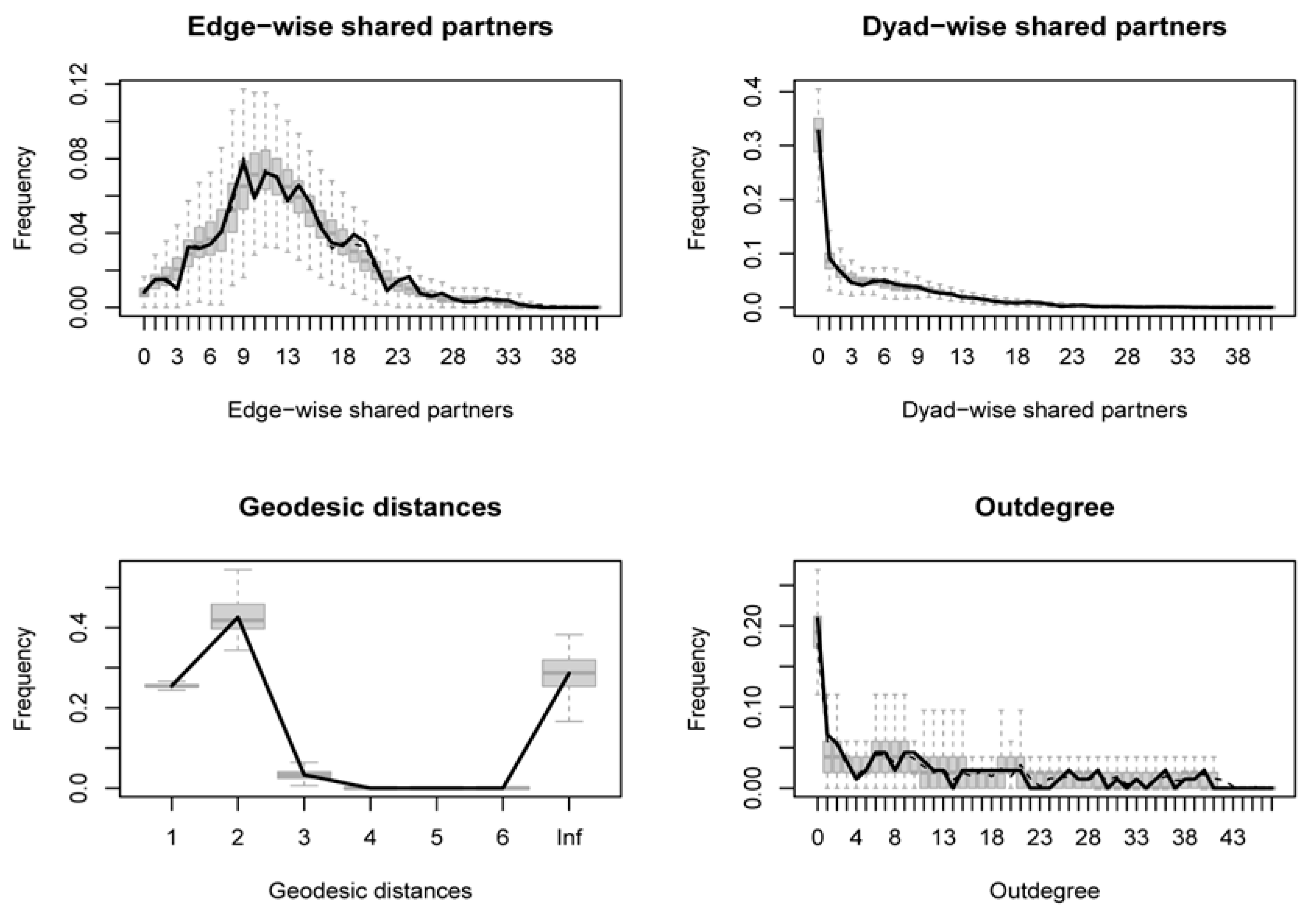

3.2.7. Goodness-of-Fit Test

4. Discussion, Conclusions, and Policy Implications

4.1. Discussion

4.2. Conclusions

4.3. Policy Implications

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The governance of global value chains. Rev. Int. Political Econ. 2005, 12, 78–104. [Google Scholar] [CrossRef]

- Chadee, D.; Raman, R. International outsourcing of information technology services: Review and future directions. Int. Mark. Rev. 2009, 26, 411–438. [Google Scholar] [CrossRef]

- Könning, M.; Westner, M.; Strahringer, S. A systematic review of recent developments in IT outsourcing research. Inf. Syst. Manag. 2019, 36, 78–96. [Google Scholar] [CrossRef]

- Gerbl, M.; McIvor, R.; Loane, S. A multi-theory approach to understanding the business process outsourcing decision. J. World Bus. 2015, 50, 505–518. [Google Scholar] [CrossRef]

- Heuser, C.; Mattoo, A. Services trade and global value chains. World Bank Policy Res. Work. Pap. 2017, 8126, 141–159. [Google Scholar]

- Saliola, F.; Zanfei, A. Multinational firms, global value chains and the organization of knowledge transfer. Res. Policy 2009, 38, 369–381. [Google Scholar] [CrossRef]

- Keijser, C.; Belderbos, R.; Goedhuys, M. Governance and learning in global, regional, and local value chains: The IT enabled services industry in South Africa. World Dev. 2021, 141, 105398. [Google Scholar] [CrossRef]

- Chen, Q.; Shen, Y. The impacts of offshore and onshore outsourcing on China’s upgrading in global value chains: Evidence from its manufacturing and service sectors. Struct. Change Econ. Dyn. 2021, 59, 263–280. [Google Scholar] [CrossRef]

- Rodriguez, C.; Ciravegna, L.; Petersen, B. Geographical reconfiguration in global value chains: Search within limited space? Glob. Strategy J. 2023, 13, 440–482. [Google Scholar] [CrossRef]

- Arnold, J.M.; Javorcik, B.; Lipscomb, M. Services reform and manufacturing performance: Evidence from India. Econ. J. 2016, 126, 1–39. [Google Scholar] [CrossRef]

- Arnold, J.M.; Javorcik, B.S.; Mattoo, A. Does services liberalization benefit manufacturing firms?: Evidence from the Czech Republic. J. Int. Econ. 2011, 85, 136–146. [Google Scholar] [CrossRef]

- Bas, M. Does services liberalization affect manufacturing firms’ export performance? Evidence from India. J. Comp. Econ. 2014, 42, 569–589. [Google Scholar] [CrossRef]

- Hallward-Driemeier, M.; Nayyar, G. Trouble in the Making?: The Future of Manufacturing-Led Development; World Bank Publications: Washington, DC, USA, 2017. [Google Scholar]

- Ehab, M.; Zaki, C.R. Global value chains and service liberalization: Do they matter for skill-upgrading? Appl. Econ. 2021, 53, 1342–1360. [Google Scholar] [CrossRef]

- Baldwin, R.; Forslid, R. Globotics and development: When manufacturing is jobless and services are tradeable. World Trade Rev. 2023, 22, 302–311. [Google Scholar] [CrossRef]

- Di Pietro, F.; Lecca, P.; Salotti, S. Regional economic resilience in the European Union: A numerical general equilibrium analysis. Spat. Econ. Anal. 2021, 16, 287–312. [Google Scholar] [CrossRef]

- Elston, T.; Bel, G. Does inter-municipal collaboration improve public service resilience? Evidence from local authorities in England. Public Manag. Rev. 2023, 25, 734–761. [Google Scholar] [CrossRef]

- Ando, M.; Hayakawa, K. Impact of COVID-19 on trade in services. Jpn. World Econ. 2022, 62, 101131. [Google Scholar] [CrossRef]

- Novak, D.C.; Wu, Z.; Dooley, K.J. Whose resilience matters? Addressing issues of scale in supply chain resilience. J. Bus. Logist. 2021, 42, 323–335. [Google Scholar] [CrossRef]

- Huang, A.; Farboudi Jahromi, M. Resilience building in service firms during and post COVID-19. Serv. Ind. J. 2021, 41, 138–167. [Google Scholar] [CrossRef]

- Senbeto, D.L.; Hon, A.H.Y. Market turbulence and service innovation in hospitality: Examining the underlying mechanisms of employee and organizational resilience. Serv. Ind. J. 2020, 40, 1119–1139. [Google Scholar] [CrossRef]

- Wang, K.; Hu, C.; Shan, C. Defining and measuring the resilience of network services. Comput. Netw. 2025, 258, 111036. [Google Scholar] [CrossRef]

- Baldwin, R.; Venables, A.J. Spiders and snakes: Offshoring and agglomeration in the global economy. J. Int. Econ. 2013, 90, 245–254. [Google Scholar] [CrossRef]

- Dollar, D.R.; Inomata, S.; Degain, C. Global Value Chain Development Report 2017: Measuring and Analyzing the Impact of GVCs on Economic Development; World Bank Group: Washington, DC, USA, 2017. [Google Scholar]

- Sanguinet, E.R.; Alvim, A.M.; Atienza, M. Trade agreements and participation in global value chains: Empirical evidence from Latin America. World Econ. 2022, 45, 702–738. [Google Scholar] [CrossRef]

- Ganapati, S.; Wong, W.F. How far goods travel: Global transport and supply chains from 1965–2020. J. Econ. Perspect. 2023, 37, 3–30. [Google Scholar] [CrossRef]

- Lee, N. Global production networks meets evolutionary economic geography. Reg. Stud. 2024, 58, 1477–1479. [Google Scholar] [CrossRef]

- Zhang, Y.; Xu, J.; Yang, W. Analysis of the evolution characteristics of international ICT services trade based on complex network. Telecommun. Policy 2024, 48, 102697. [Google Scholar] [CrossRef]

- Wang, L.; Xiang, Y.; Zhang, N.; Lau, Y.Y.; Kanrak, M.; Ling, X. Analysis of the global shipping finance industry in 2006 and 2019: A spatial distribution perspective and its factors. Int. J. Shipp. Transp. Logist. 2024, 19, 253–277. [Google Scholar] [CrossRef]

- Hu, Y.; Ma, J.; Chen, F. Research on Ecological Innovation Connection and Network Structure of Beijing-Tianjin-Hebei Urban Agglomeration. Urban Probl. 2020, 12, 4–13. [Google Scholar] [CrossRef]

- De Benedictis, L.; Tajoli, L. The world trade network. World Econ. 2011, 34, 1417–1454. [Google Scholar] [CrossRef]

- Chong, Z.; Qin, C.; Pan, S. The evolution of the belt and road trade network and its determinant factors. Emerg. Mark. Financ. Trade 2019, 55, 3166–3177. [Google Scholar] [CrossRef]

- Herman, P.R. Modeling complex network patterns in international trade. Rev. World Econ. 2022, 158, 127–179. [Google Scholar] [CrossRef]

- Leifeld, P.; Cranmer, S.J.; Desmarais, B.A. Temporal exponential random graph models with btergm: Estimation and bootstrap confidence intervals. J. Stat. Softw. 2018, 83, 1–36. [Google Scholar] [CrossRef]

- Serrano, M.Á.; Boguná, M.; Vespignani, A. Extracting the multiscale backbone of complex weighted networks. Proc. Natl. Acad. Sci. USA 2009, 106, 6483–6488. [Google Scholar] [CrossRef]

- Shore, J.C. Market formation as transitive closure: The evolving pattern of trade in music. Netw. Sci. 2016, 4, 164–187. [Google Scholar] [CrossRef]

- Smith, M.; Gorgoni, S.; Cronin, B. International production and trade in a high-tech industry: A multilevel network analysis. Soc. Netw. 2019, 59, 50–60. [Google Scholar] [CrossRef]

- Barrat, A.; Barthelemy, M.; Pastor-Satorras, R. The architecture of complex weighted networks. Proc. Natl. Acad. Sci. USA 2004, 101, 3747–3752. [Google Scholar] [CrossRef]

- Feng, L.; Xu, H.; Wu, G. Service trade network structure and its determinants in the Belt and Road based on the temporal exponential random graph model. Pac. Econ. Rev. 2021, 26, 617–650. [Google Scholar] [CrossRef]

- Ou, S.; Yang, Q.; Liu, J. The global production pattern of the semiconductor industry: An empirical research based on trade network. Humanit. Soc. Sci. Commun. 2024, 11, 750. [Google Scholar] [CrossRef]

- Lusher, D.; Koskinen, J.; Robins, G. Exponential Random Graph Models for Social Networks: Theory, Methods and Applications; Cambridge University Press: Cambridge, UK, 2013. [Google Scholar]

- Robins, G.; Pattison, P.; Kalish, Y. An introduction to exponential random graph (p*) models for social networks. Soc. Netw. 2007, 29, 173–191. [Google Scholar] [CrossRef]

- Hanneke, S.; Fu, W.; Xing, E.P. Discrete temporal models of social networks. Electron. J. Stat. 2010, 4, 585–605. [Google Scholar] [CrossRef]

- Yao, X.; Du, Y.; Pu, Y.; Wang, B. Structural Evolution and Its Determinants of Domestic Value-Added Network of Digital Service Exports Based on Temporal Exponential Random Graph Model. Emerg. Mark. Financ. Trade 2024, 60, 3387–3401. [Google Scholar] [CrossRef]

- Bramoullé, Y.; Djebbari, H.; Fortin, B. Peer effects in networks: A survey. Annu. Rev. Econ. 2020, 12, 603–629. [Google Scholar] [CrossRef]

- Azmeh, S.; Foster, C.; Echavarri, J. The international trade regime and the quest for free digital trade. Int. Stud. Rev. 2020, 22, 671–692. [Google Scholar] [CrossRef]

- Caselli, F.; Koren, M.; Lisicky, M. Diversification through trade. Q. J. Econ. 2020, 135, 449–502. [Google Scholar] [CrossRef]

- Sultana, N.; Turkina, E. Foreign direct investment, technological advancement, and absorptive capacity: A network analysis. Int. Bus. Rev. 2020, 29, 101668. [Google Scholar] [CrossRef]

- Wang, X.Y.; Chen, B.; Hou, N. Evolution of structural properties of the global strategic emerging industries’ trade network and its determinants: An TERGM analysis. Ind. Mark. Manag. 2024, 118, 78–92. [Google Scholar] [CrossRef]

- Dobbelaere, S.; Wiersma, Q. The impact of trade liberalization on firms’ product and labor market power. Ind. Corp. Change 2024, 34, 210–233. [Google Scholar] [CrossRef]

- Werker, C.; Korzinov, V.; Cunningham, S. Formation and output of collaborations: The role of proximity in German nanotechnology. J. Evol. Econ. 2019, 29, 697–719. [Google Scholar] [CrossRef]

- Guo, M.; Yang, N.; Wang, J. Multi-dimensional proximity and network stability: The moderating role of network cohesion. Scientometrics 2021, 126, 3471–3499. [Google Scholar] [CrossRef]

- Darku, A.B. International trade and income convergence: Sorting out the nature of bilateral trade. Int. J. Financ. Econ. 2021, 26, 5337–5348. [Google Scholar] [CrossRef]

- Damásio, S.; Afonso, Ó.; Neves, P.C.; Sochirca, E. International trade and income convergence: Meta—Analysis. World Econ. 2024, 47, 3998–4018. [Google Scholar] [CrossRef]

| Year | Number of Economies | Average Degree | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Con | Air | Pos | Fin | Edu | Con | Air | Pos | Fin | Edu | |

| 2013 | 49 | 46 | 47 | 46 | 44 | 13.796 | 14.696 | 14.383 | 14.696 | 15.364 |

| 2014 | 49 | 46 | 48 | 47 | 44 | 13.796 | 14.696 | 14.083 | 14.383 | 15.364 |

| 2015 | 49 | 47 | 48 | 47 | 47 | 13.796 | 14.383 | 14.083 | 14.383 | 14.383 |

| 2016 | 49 | 47 | 50 | 47 | 44 | 13.796 | 14.383 | 13.52 | 14.383 | 15.364 |

| 2017 | 49 | 47 | 49 | 48 | 44 | 13.796 | 14.383 | 13.796 | 14.083 | 15.364 |

| 2018 | 48 | 49 | 46 | 48 | 46 | 14.083 | 13.796 | 14.696 | 14.083 | 14.696 |

| 2019 | 49 | 49 | 47 | 46 | 48 | 13.796 | 13.796 | 14.383 | 14.696 | 14.083 |

| 2020 | 48 | 50 | 47 | 48 | 49 | 14.083 | 13.52 | 14.383 | 14.083 | 13.796 |

| 2021 | 48 | 48 | 48 | 48 | 47 | 14.083 | 14.083 | 14.083 | 14.083 | 14.383 |

| Year | Network Density | Average Cluster Coefficient | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Con | Air | Pos | Fin | Edu | Con | Air | Pos | Fin | Edu | |

| 2013 | 0.287 | 0.327 | 0.313 | 0.327 | 0.357 | 0.715 | 0.686 | 0.772 | 0.744 | 0.686 |

| 2014 | 0.287 | 0.327 | 0.300 | 0.313 | 0.357 | 0.722 | 0.660 | 0.729 | 0.721 | 0.691 |

| 2015 | 0.287 | 0.313 | 0.300 | 0.313 | 0.313 | 0.697 | 0.647 | 0.731 | 0.737 | 0.674 |

| 2016 | 0.287 | 0.313 | 0.276 | 0.313 | 0.357 | 0.706 | 0.647 | 0.700 | 0.722 | 0.725 |

| 2017 | 0.287 | 0.313 | 0.287 | 0.300 | 0.357 | 0.724 | 0.646 | 0.718 | 0.711 | 0.734 |

| 2018 | 0.300 | 0.287 | 0.327 | 0.300 | 0.327 | 0.709 | 0.695 | 0.780 | 0.721 | 0.744 |

| 2019 | 0.287 | 0.287 | 0.313 | 0.327 | 0.300 | 0.687 | 0.650 | 0.754 | 0.740 | 0.709 |

| 2020 | 0.300 | 0.276 | 0.313 | 0.300 | 0.287 | 0.730 | 0.636 | 0.731 | 0.731 | 0.708 |

| 2021 | 0.300 | 0.300 | 0.300 | 0.300 | 0.313 | 0.733 | 0.666 | 0.712 | 0.752 | 0.700 |

| Categories | Variables | Variable Meaning | Description and Data Sources |

|---|---|---|---|

| Exogenous node attribute covariates | Nodecov (logdt) | Countries with stronger attributes (level of digital technology, economic freedom, foreign direct investment, size of labour force and structure of manufacturing sector) have more expansive trade networks | Using the digital technology section of the TIMG2023 report prepared by the Institute of Finance, Chinese Academy of Social Sciences, reported in logarithmic form. |

| Nodecov (dof) | Adoption of the Indicators of Global Economic Freedom report issued by the Heritage Foundation of the United States of America | ||

| Nodecov (logfdi) | Expressed in logarithmic terms using the stock of foreign direct investment (World Bank database). | ||

| Nodecov (peo) | Measured using services employment as a percentage of total employment as estimated by the International Labour Organization model. | ||

| Nodecov (logm) | Measured using industrial value added as a share of GDP (World Bank database) | ||

| Nodematch (continent) | Whether countries belonging to the same continent are more likely to have trade relations. | Whether belonging to the same continent (CEPII database) | |

| Endogenous network structural variables | edges | The effect of network density on the formation of network relationships is similar to the intercept term in the regression model. | Network Graphic Variables |

| mutual | Whether economies in the network favour reciprocal trade. | ||

| gwodeg | Trends in the distribution of export services of economies in the network | ||

| Exogenous network covariates | Edgecov (distcap) | The effect of other network relationships (distance, language) on trade network relationships. | Geographical distance expressed as the actual distance between national (regional) capitals (CEPII database) |

| Edgecov (comlang_off) | If two economies share a common official language, the value is 1; otherwise, it is 0 (CEPII database). | ||

| Time-dependent variables | stability | It reflects whether the dependency relationship connection status at time t remains unchanged at time t + 1. | |

| variability | To examine whether trade dependency relationships change over time, specifically in terms of the disappearance or emergence of dependencies. | ||

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| edges | −15.19 *** | −21.89 *** | −25.38 *** | −27.95 *** | −23.45 *** |

| (1.77) | (1.67) | (1.84) | (2.27) | (1.80) | |

| nodeicov.logdt | 2.41 ** | 3.45 *** | 1.75 * | 0.57 | 2.12 ** |

| (0.75) | (0.64) | (0.75) | (0.88) | (0.72) | |

| nodeocov.logdt | 2.62 *** | 4.19 *** | 4.75 *** | 4.72 *** | 2.50 *** |

| (0.73) | (0.65) | (0.74) | (0.88) | (0.70) | |

| nodecov.dof | −0.12 | −0.31 *** | −0.09 | −0.26 * | −0.23 ** |

| (0.10) | (0.08) | (0.09) | (0.11) | (0.09) | |

| nodeicov.logfdi | 0.41 * | 0.51 *** | 0.51 ** | 0.64 *** | 0.40 * |

| (0.16) | (0.13) | (0.16) | (0.18) | (0.15) | |

| nodeocov.logfdi | 0.22 | 0.49 *** | 0.63 *** | 1.90 *** | 1.13 *** |

| (0.15) | (0.13) | (0.15) | (0.17) | (0.14) | |

| nodeicov.peo | −0.43 | −0.94 | −0.41 | 0.01 | 0.55 |

| (0.69) | (0.57) | (0.63) | (0.77) | (0.62) | |

| nodeocov.peo | −2.85 *** | −1.07 | −2.45 *** | −0.83 | −1.09 |

| (0.67) | (0.59) | (0.65) | (0.76) | (0.58) | |

| nodeicov.logm | 1.52 *** | 1.15 *** | 1.61 *** | 1.65 *** | 1.57 *** |

| (0.19) | (0.15) | (0.18) | (0.20) | (0.18) | |

| nodeocov.logm | 0.81 *** | 0.74 *** | 1.00 *** | 0.39 * | 0.73 *** |

| (0.20) | (0.16) | (0.19) | (0.18) | (0.16) | |

| nodeifactor.income lower middle income | 0.83 ** | 0.57 * | 0.69 * | 0.67 * | 1.19 *** |

| (0.30) | (0.23) | (0.27) | (0.31) | (0.24) | |

| nodeifactor.income Upper-middle income | 0.49 ** | −0.27 | 0.35 * | −0.02 | 0.06 |

| (0.19) | (0.15) | (0.17) | (0.20) | (0.18) | |

| nodeofactor.income lower middle income | −0.84 ** | −0.50 * | 0.27 | 0.82 * | 0.05 |

| (0.29) | (0.24) | (0.26) | (0.32) | (0.25) | |

| nodeofactor.income Upper-middle income | −0.77 *** | 0.03 | −0.56 ** | −0.13 | −0.90 *** |

| (0.19) | (0.15) | (0.18) | (0.20) | (0.18) | |

| nodematch.income | 0.05 | −0.00 | −0.01 | −0.01 | −0.26 * |

| (0.13) | (0.10) | (0.12) | (0.14) | (0.13) | |

| nodematch.continent | −0.04 | 0.40 ** | 0.38 * | 0.68 *** | 0.55 *** |

| (0.15) | (0.13) | (0.15) | (0.18) | (0.15) | |

| edgecov.comlang_off | 0.43 * | 0.06 | 0.32 | 0.24 | 0.21 |

| (0.20) | (0.16) | (0.18) | (0.22) | (0.17) | |

| edgecov.logdistcap | −1.63 *** | −0.43 ** | −1.06 *** | −0.67 *** | −0.50 ** |

| (0.18) | (0.15) | (0.17) | (0.20) | (0.17) | |

| mutual | 0.53 *** | 0.48 *** | 1.16 *** | 0.83 *** | 0.65 *** |

| (0.12) | (0.10) | (0.11) | (0.14) | (0.11) | |

| gwodeg.fixed.0.1 | −2.19 *** | −2.00 *** | −1.22 ** | −0.59 | −1.26 *** |

| (0.35) | (0.32) | (0.38) | (0.35) | (0.32) | |

| edgecov. stability | 2.70 *** | 2.31 *** | 2.43 *** | 2.73 *** | 2.44 *** |

| (0.05) | (0.04) | (0.04) | (0.05) | (0.04) | |

| edgecov. variability | −0.07 *** | −0.09 *** | −0.09 *** | −0.13 *** | −0.10 *** |

| (0.02) | (0.02) | (0.02) | (0.02) | (0.02) |

| Variable | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 |

|---|---|---|---|---|---|

| edges | −15.16 * | −22.64 * | −26.00 * | −28.59 * | −23.52 * |

| [−21.71; −8.01] | [−29.09; −18.07] | [−34.24; −20.05] | [−35.30; −23.31] | [−30.26; −19.42] | |

| nodeicov.logdt | 2.50 * | 3.75 * | 1.84 | 0.76 | 2.24 |

| [0.00; 4.87] | [1.49; 5.57] | [−0.02; 3.80] | [−1.70; 3.53] | [−0.03; 4.25] | |

| nodeocov.logdt | 2.58 * | 4.68 * | 4.84 * | 4.81 * | 2.48 * |

| [0.06; 4.49] | [2.81; 7.43] | [2.47; 7.14] | [2.17; 7.29] | [1.51; 3.83] | |

| nodecov.dof | −0.15 * | −0.33 * | −0.09 | −0.27 | −0.23 |

| [−0.26; −0.03] | [−0.60; −0.02] | [−0.29; 0.06] | [−0.61; 0.03] | [−0.58; 0.19] | |

| nodeicov.logfdi | 0.44 * | 0.59 * | 0.54 * | 0.71 * | 0.40 |

| [0.20; 0.60] | [0.35; 0.91] | [0.17; 0.92] | [0.17; 1.20] | [−0.20; 0.91] | |

| nodeocov.logfdi | 0.30 | 0.47 * | 0.65 * | 1.93 * | 1.13 * |

| [−0.09; 0.65] | [0.22; 0.78] | [0.22; 1.00] | [1.60; 2.31] | [0.71; 1.47] | |

| nodeicov.peo | −0.46 | −1.14 | −0.41 | −0.05 | 0.50 |

| [−1.54; 0.67] | [−2.15; 0.03] | [−1.45; 0.69] | [−1.39; 1.53] | [−1.04; 2.57] | |

| nodeocov.peo | −2.95 * | −1.32 | −2.47 * | −0.88 | −1.06 |

| [−4.18; −1.44] | [−2.32; 0.04] | [−3.44; −1.68] | [−2.10; 0.40] | [−2.50; 0.45] | |

| nodeicov.logm | 1.54 * | 1.17 * | 1.64 * | 1.64 * | 1.58 * |

| [1.14; 1.98] | [0.95; 1.54] | [1.16; 2.19] | [1.32; 1.98] | [1.24; 2.27] | |

| nodeocov.logm | 0.76 * | 0.72 * | 1.05 * | 0.40 * | 0.71 * |

| [0.52; 1.18] | [0.33; 1.20] | [0.61; 1.60] | [0.08; 0.76] | [0.29; 1.13] | |

| nodeifactor.income lower middle income | 0.83 * | 0.54 * | 0.72 * | 0.69 | 1.21 * |

| [0.38; 1.24] | [0.09; 1.08] | [0.15; 1.06] | [−0.15; 1.75] | [0.38; 2.26] | |

| nodeifactor.income Upper-middle income | 0.48 * | −0.29 | 0.35 | −0.03 | 0.06 |

| [0.12; 0.85] | [−0.60; 0.03] | [−0.25; 0.73] | [−0.62; 0.57] | [−0.46; 0.63] | |

| nodeofactor.income lower middle income | −0.89 * | −0.58 | 0.26 | 0.80 * | 0.06 |

| [−1.63; −0.35] | [−1.67; 0.56] | [−0.32; 0.76] | [0.14; 1.65] | [−0.90; 1.26] | |

| nodeofactor.income Upper-middle income | −0.78 * | 0.01 | −0.53 * | −0.12 | −0.86 * |

| [−1.07; −0.54] | [−0.53; 0.62] | [−0.90; −0.18] | [−0.75; 0.52] | [−1.48; −0.17] | |

| nodematch.income | 0.07 | −0.02 | 0.00 | −0.00 | −0.25 * |

| [−0.24; 0.36] | [−0.15; 0.11] | [−0.24; 0.25] | [−0.36; 0.32] | [−0.42; 0.02] | |

| nodematch.continent | −0.00 | 0.40 * | 0.38 * | 0.70 * | 0.55 * |

| [−0.19; 0.22] | [0.07; 0.83] | [0.19; 0.59] | [0.55; 0.94] | [0.26; 0.92] | |

| edgecov.comlang_off | 0.46 * | 0.08 | 0.37 * | 0.26 | 0.20 |

| [0.15; 0.84] | [−0.14; 0.27] | [0.15; 0.66] | [−0.25; 0.64] | [−0.12; 0.46] | |

| edgecov.logdistcap | −1.63 * | −0.50 | −1.12 * | −0.69 * | −0.50 * |

| [−2.17; −1.14] | [−1.05; 0.00] | [−1.53; −0.81] | [−1.14; −0.20] | [−0.75; −0.26] | |

| mutual | 0.54 * | 0.37 * | 1.05 * | 0.72 * | 0.61 * |

| [0.26; 0.74] | [0.11; 0.63] | [0.84; 1.27] | [0.42; 1.03] | [0.34; 0.94] | |

| gwodeg.fixed.0.1 | −2.34 * | −2.77 * | −1.31 * | −0.64 * | −1.91 * |

| [−3.18; −1.52] | [−4.23; −1.17] | [−2.49; −0.15] | [−1.00; −0.31] | [−2.89; −1.01] | |

| edgecov. stability | 2.69 * | 2.32 * | 2.42 * | 2.73 * | 2.45 * |

| [2.49; 2.92] | [1.96; 2.81] | [1.99; 2.87] | [2.51; 3.01] | [2.06; 2.91] | |

| edgecov. variability | −0.07 * | −0.07 * | −0.10 * | −0.14 * | −0.10 * |

| [−0.13; −0.03] | [−0.12; −0.04] | [−0.15; −0.06] | [−0.21; −0.09] | [−0.17; −0.04] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, X.; Zeng, S. Evolution of the Spatial Network Structure of the Global Service Value Chain and Its Influencing Factors—An Empirical Study Based on the TERGM. Sustainability 2025, 17, 9130. https://doi.org/10.3390/su17209130

Yu X, Zeng S. Evolution of the Spatial Network Structure of the Global Service Value Chain and Its Influencing Factors—An Empirical Study Based on the TERGM. Sustainability. 2025; 17(20):9130. https://doi.org/10.3390/su17209130

Chicago/Turabian StyleYu, Xingyan, and Shihong Zeng. 2025. "Evolution of the Spatial Network Structure of the Global Service Value Chain and Its Influencing Factors—An Empirical Study Based on the TERGM" Sustainability 17, no. 20: 9130. https://doi.org/10.3390/su17209130

APA StyleYu, X., & Zeng, S. (2025). Evolution of the Spatial Network Structure of the Global Service Value Chain and Its Influencing Factors—An Empirical Study Based on the TERGM. Sustainability, 17(20), 9130. https://doi.org/10.3390/su17209130