Enhancing Sustainable Fisheries Trade and Food Security Through CPEC in Pakistan

Abstract

1. Introduction

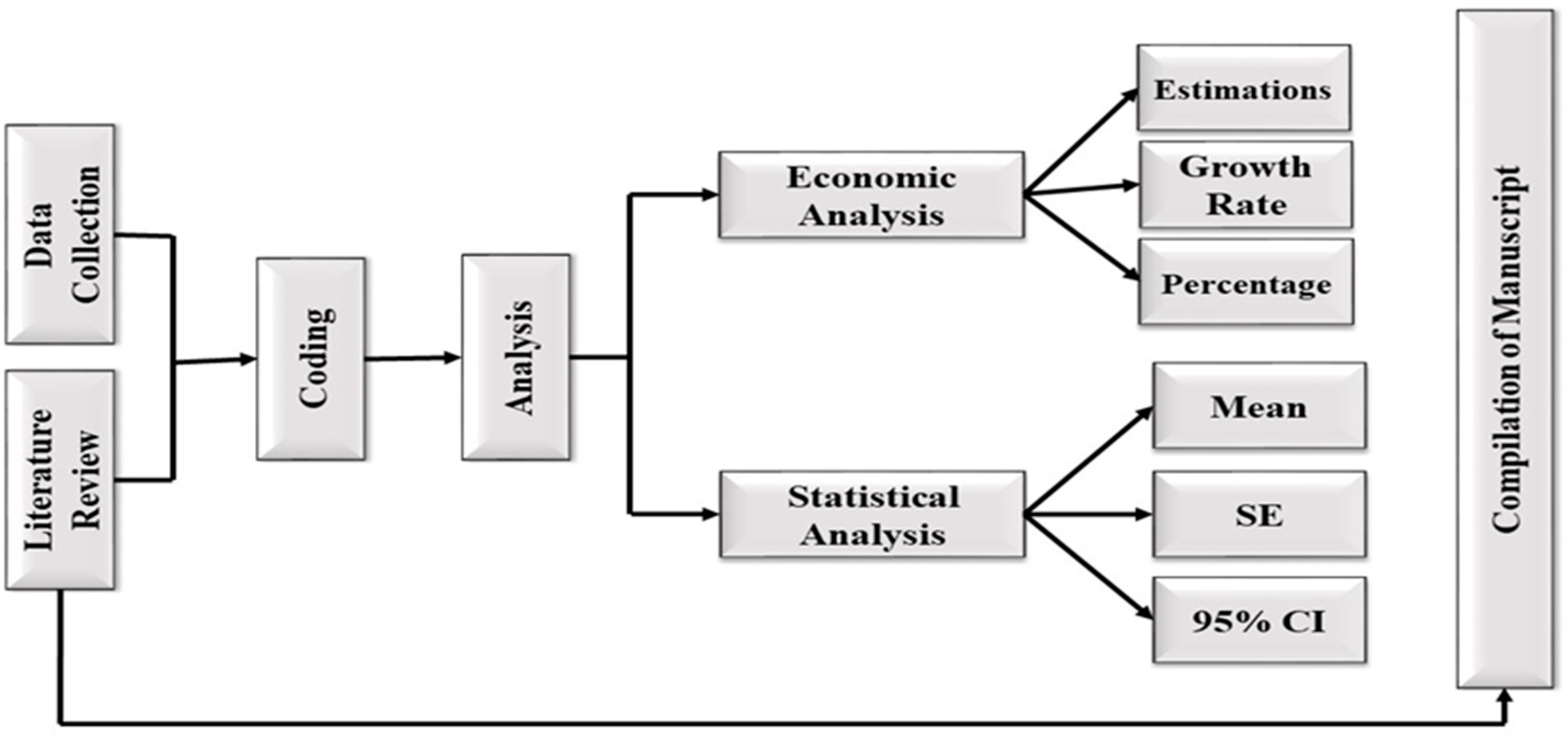

2. Materials and Methods

2.1. Data Collection

2.2. Hypothesis

2.3. Analytical Framework

- Descriptive statistics (growth rates, percentages, and variability measures) were computed using Microsoft Excel and Python 3.13.5 to provide baseline trends.

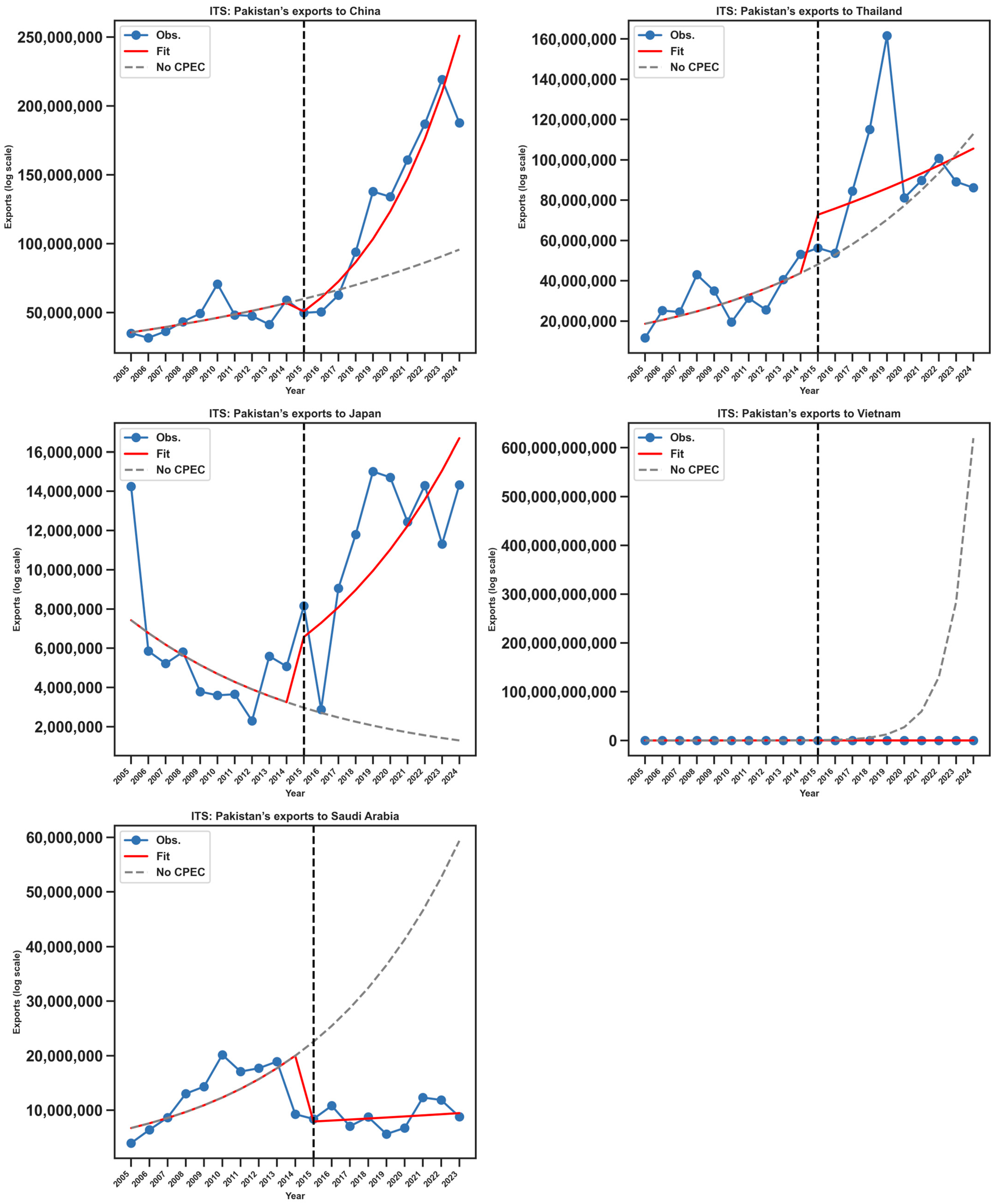

- Interrupted Time Series (ITS) models were applied to detect structural breaks in export trajectories around 2015. The specification included time trends, a post-2015 intervention dummy, and their interaction to test for changes in level and slope.

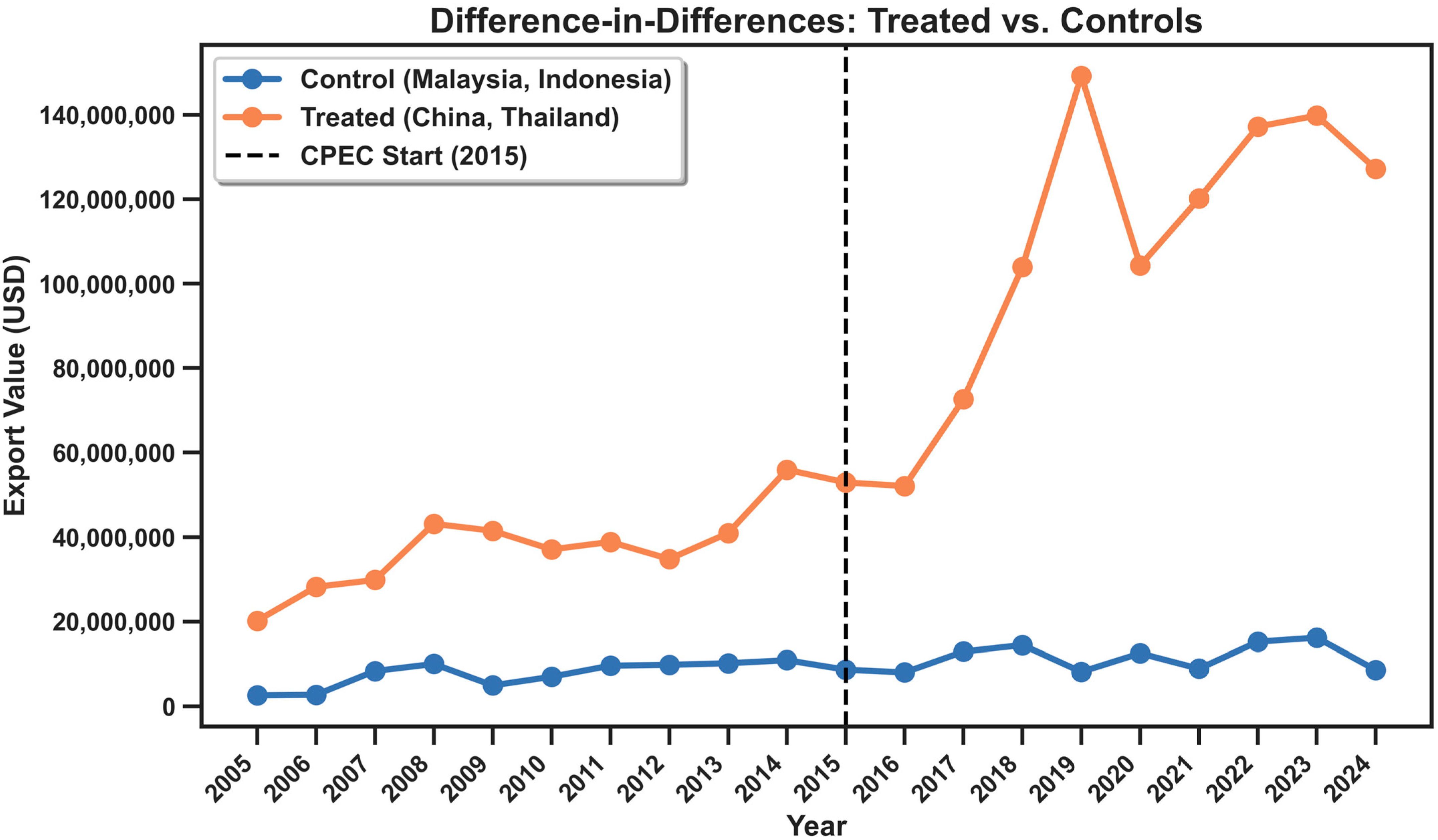

- Difference-in-Difference (DiD) models compared exports to treatment countries (China and Thailand, which are directly connected through CPEC routes) with control countries (e.g., Malaysia and Indonesia, which trade with Pakistan but are not directly affected by CPEC). The interaction term captured the differential post-2015 effect attributable to CPEC. Robust standard errors were used to address heteroscedasticity.

2.4. Analytical Rationale

2.5. Data Limitations and Assumptions

3. Results

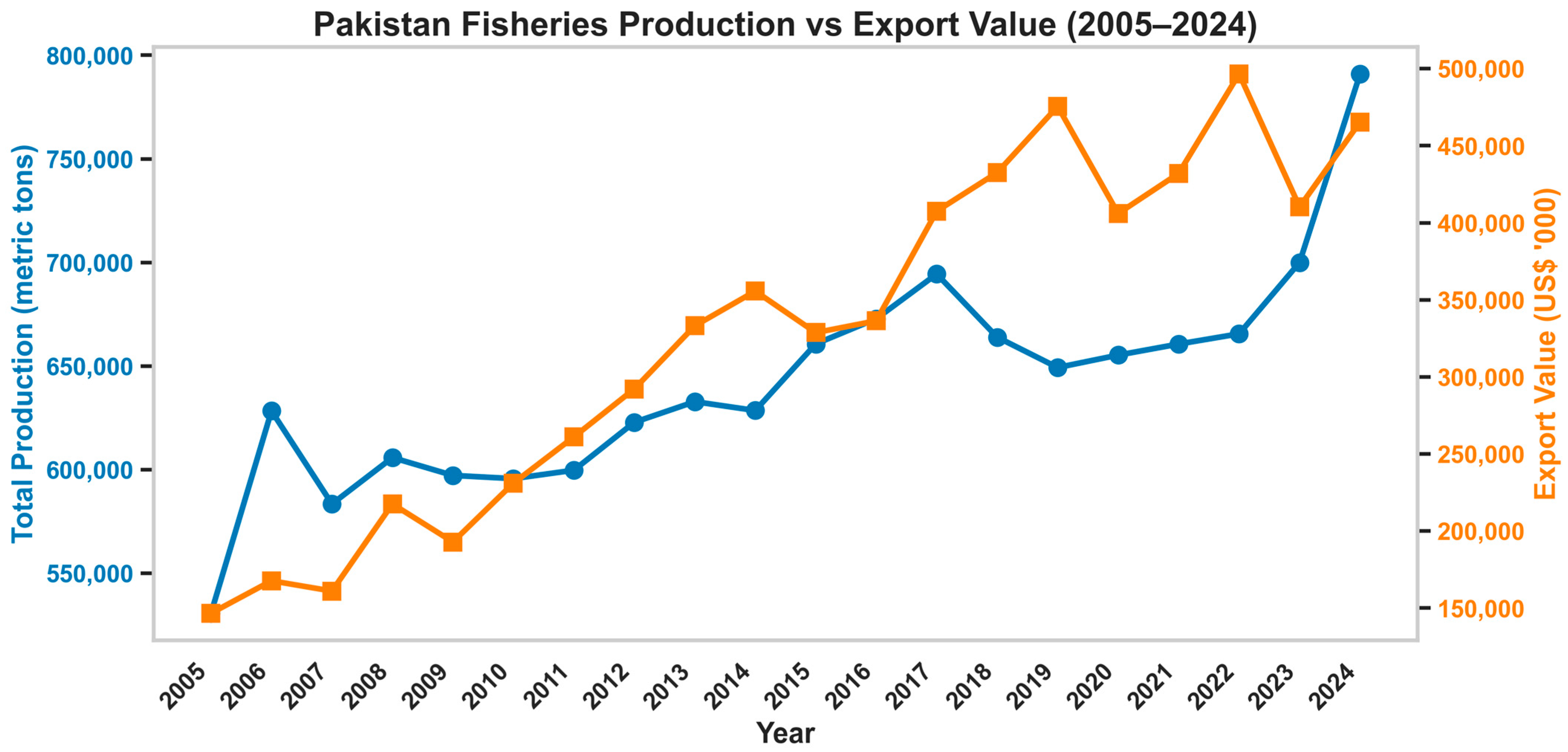

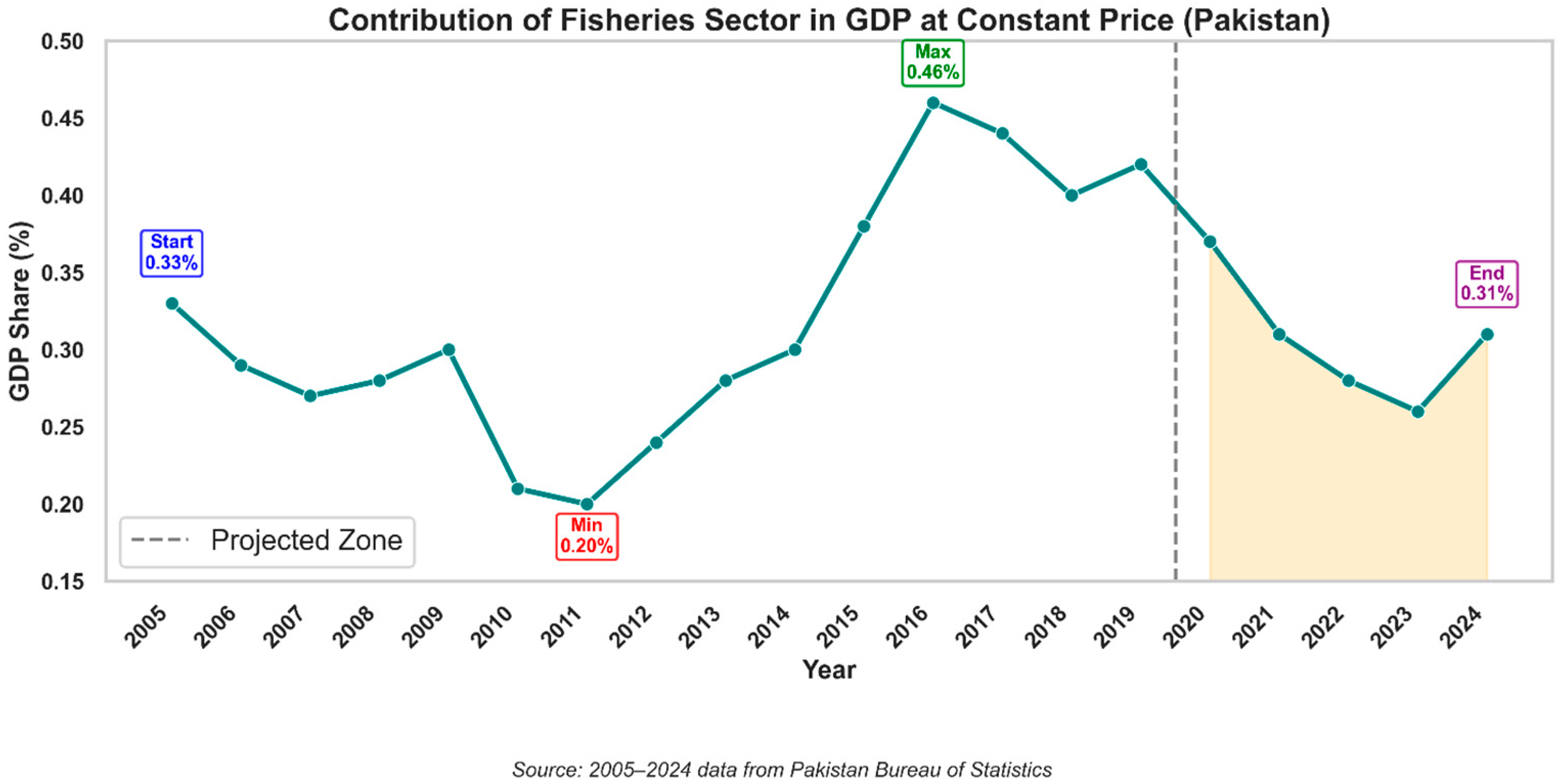

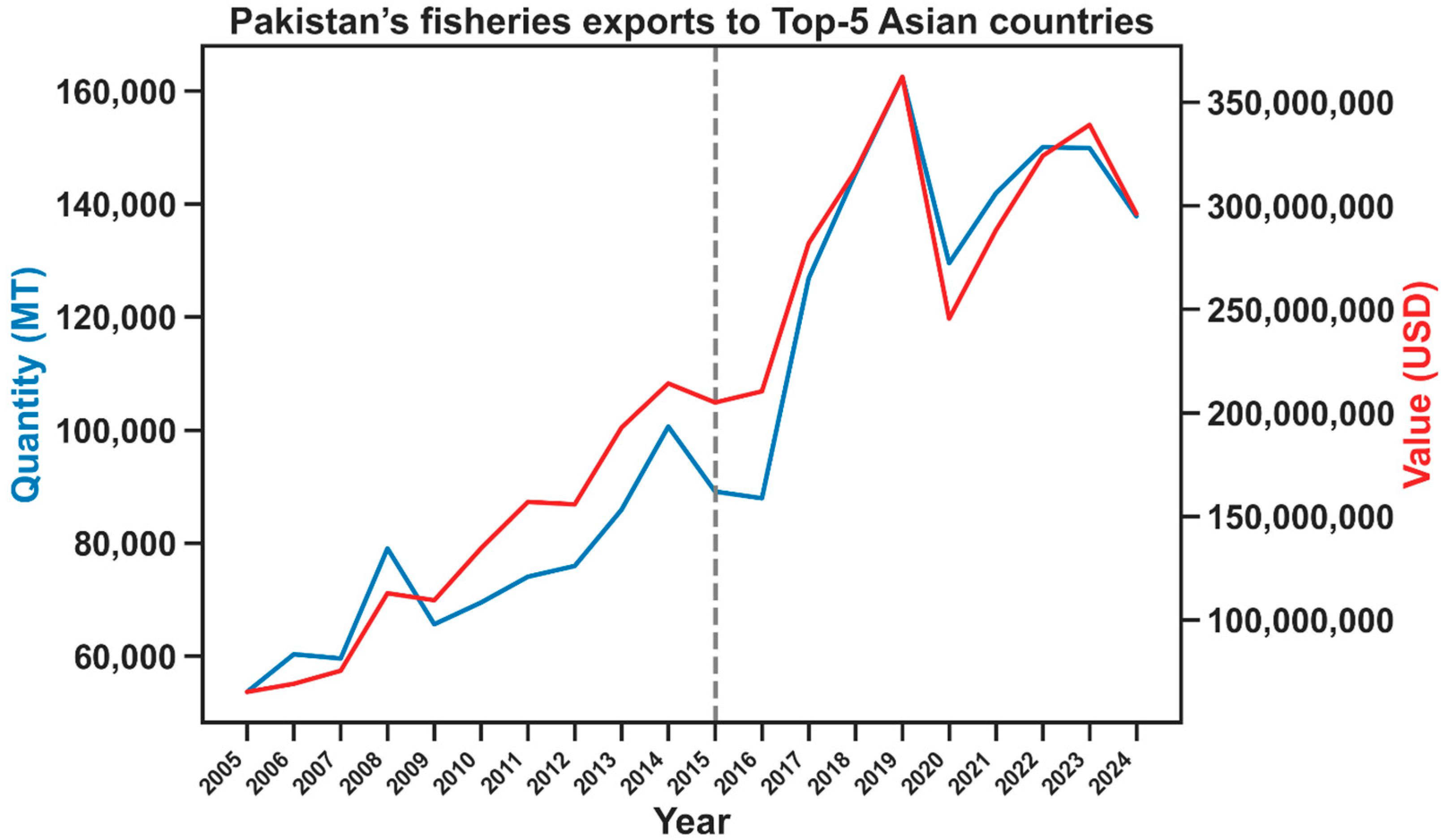

3.1. Statistical Analysis of Fish Export to Top Five Asian Countries from 2005 to 2024

3.1.1. Descriptive Trends

3.1.2. Country-Specific Trends

3.2. Interrupted Time Series (ITS) Analysis

3.3. Difference-in-Difference Analysis

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. OLS Regression Results

| Dep. Variable: | ln_val | R-squared: | 0.747 | |||

| Model: | OLS | Adj. R-squared: | 0.737 | |||

| Method: | Least Squares | F-statistic: | 84.04 | |||

| Date: | Sun, 17 August 2025 | Prob (F-statistic): | 4.50 × 10−24 | |||

| Time: | 19:18:01 | Log-Likelihood: | −73.693 | |||

| No. Observations: | 80 | AIC: | 155.4 | |||

| Df Residuals: | 76 | BIC: | 164.9 | |||

| Df Model: | 3 | |||||

| Covariance Type: | HC1 | |||||

| coef | std err | z | P > |z| | [0.025] | [0.975] | |

| const | 15.7361 | 0.208 | 75.564 | 0.000 | 15.328 | 16.14 |

| treat | 1.6583 | 0.228 | 7.271 | 0.000 | 1.211 | 2.105 |

| post2015 | 0.4742 | 0.242 | 1.962 | 0.050 | 0.001 | 0.948 |

| treat_post | 0.5468 | 0.279 | 1.960 | 0.050 | 0.000 | 1.093 |

| Omnibus: | 32.146 | Durbin–Watson: | 0.952 | |||

| Prob(Omnibus): | 0.000 | Jarque–Bera (JB): | 65.841 | |||

| Skew: | −1.457 | Prob(JB): | 5.04 × 10−15 | |||

| Kurtosis: | 6.356 | Cond. No. | 6.85 | |||

| Note: Standard Errors are heteroscedasticity robust (HC1). | ||||||

Appendix A.2. Supplementary Equations and Model Specifications

Appendix A.2.1. Descriptive Statistics

- µx = Estimation,

- n = Total Number,

- I = Frequency of observation and

- N = Total

- Percentage calculation:

- Percentages ( were calculated as:

- x = Given Quantity,

- n = Total amount, and

- p = percentage of the quantity compared to the total.

- Growth rate:

- Growth Rate (GR) was computed through:

- GR = Growth Rate

- cy = Current year,

- py = Previous year. These metrics provided a descriptive basis for understanding the scale and pace of export changes.

Appendix A.2.2. Statistical Analysis

- Sample mean:

- = mean,

- f = Frequency of each Class,

- = mid-interval value of each class

- N = Total frequency

- = sum of the products of mid–interval Values and their corresponding frequency

- Standard error:

- = Standard Error of the Sample,

- σ = Sample Standard Deviation,

- n = Sample of Samples

- Confidence Interval (95%)

- CI = Confidence interval,

- = sample mean,

- s = sample standard deviation,

- n = Sample Size, and

- z = 1.96 for a 95% level of significance.

Appendix A.2.3. Interrupted Time Series (ITS) Analysis

Appendix A.2.4. Difference in Difference (DiD) Model

References

- Trade Development Authority of Pakistan. Fisheries Potential of Pakistan. 2022. Available online: https://tdap.gov.pk/wp-content/uploads/2022/03/Fisheries-Potential-of-Pakistan-Salma-Nusrat.pdf (accessed on 1 September 2025).

- Shah, S.B.H.; Mu, Y.; Abbas, G.; Pavase, T.R.; Mohsin, M.; Malik, A.; Ali, M.; Noman, M.; Soomro, M.A. An economic analysis of the fisheries sector of Pakistan (1950–2017): Challenges, opportunities and development strategies. Int. J. Fish. Aquat. Stud. 2018, 6, 515–524. [Google Scholar]

- Mohsin, M.; Yongtong, M.; Hussain, K.; Mahmood, A.; Zhaoqun, S.; Nazir, K.; Wei, W. Contribution of Fish Production and Trade to the Economy of Pakistan. Int. J. Mar. Sci. 2015, 5, 1–7. [Google Scholar] [CrossRef][Green Version]

- Shah, S.B.H.; Mu, Y.; Mohsin, M.; Pavase, T.R.; Jattak, Z.; Hydar, S.S.; Soomro, M.A. An economic analysis of the fisheries sector in Pakistan (1950–2013). Indian J. Geo-Mar. Sci. 2018, 47, 903–909. [Google Scholar][Green Version]

- VLIZ. Maritime Boundaries Geodatabase. Retrieved 22 February 2019, from Flanders Marine Institute. 2019. Available online: http://www.marineregions.org/downloads.php (accessed on 22 February 2019).[Green Version]

- Siddiqi, A.H. Fishery resources and development policy in Pakistan. GeoJournal 1992, 26, 395–411. [Google Scholar] [CrossRef]

- FAOSTAT. Inland Waters in Pakistan. Retrieved 22 February 2019, from FAO. 2016. Available online: http://www.fao.org/faostat/en/#data/RL (accessed on 22 February 2019).

- Shah, S.B.H.; Mu, Y.; Pavase, T.R.; Abbas, G.; Soomro, M.A.; Kalhoro, M.T.; Muhammad, M.; Muhammad, N.; Mumtaz, A.; Abdul, M. Current status of shrimp fishery in Pakistan: Economic role, challenges, opportunities and strategies for aquaculture development. Indian J. Mar. Sci. 2019, 48, 1743. [Google Scholar]

- FAO. National Aquaculture Sector Overview Pakistan. 2020. Available online: http://www.fao.org/fishery/countrysector/naso_pakistan/en (accessed on 26 December 2020).

- MFD. Handbookof Fisheries Statistics of Pakistan; Marine Fisheries Department, Government of Pakistan: Karachi, Pakistan, 2018; Volume 21.

- FAO. Fisheries and Aquaculture; Hayat, M., Ed.; FAO: Rome, Italy, 2025; Available online: https://www.fao.org/fishery/en/countrysector/naso_pakistan (accessed on 15 July 2025).

- Internation Trade Centre (ITC). Trade Map: Trade Statistics for International Business Development. 2025. Available online: https://www.trademap.org/Product_SelCountry_TS.aspx (accessed on 9 August 2025).

- Mohsin, M.; Yin, H.; Mehak, A. Sustainable solutions: Exploring risks and strategies in Pakistan’s seafood trade for marine conservation. Front. Mar. Sci. 2024, 11, 1420755. [Google Scholar] [CrossRef]

- Ali, M.; Yongtong, M.; Oad, S.; Shah, S.; Kalhoro, M.; Kalhoro, M.; Lahbar, G. A comparative analysis on expansion of Pakistan Sfisheries trade: World & China. Indian J. Geo-Mar. Sci. 2020, 49, 1643–1650. [Google Scholar]

- Malik, A.R. The China–Pakistan Economic Corridor (CPEC): A Game Changer for Pakistan’s Economy China’s Global Rebalancing and the New Silk Road; Springer: Berlin/Heidelberg, Germany, 2018; pp. 69–83. [Google Scholar]

- Editorial. EU ‘Ban’ on Fish Import, The Express Tribune. 2019. Available online: https://tribune.com.pk/story/1967816/eu-ban-fish-import (accessed on 10 July 2025).

- Adnan, M.; Xiao, B.; Bibi, S.; Xiao, P.; Zhao, P.; Wang, H.; Ali, M.U.; An, X. Known and unknown environmental impacts related to climate changes in Pakistan: An under-recognized risk to local communities. Sustainability 2024, 16, 6108. [Google Scholar] [CrossRef]

- Marine Fisheries Department. Annual Export Progress Report FY 2024–25. Ministry of Maritime Affairs, Government of Pakistan. 2025. Available online: https://moma.gov.pk/Detail/Mzg0M2I4NzctMjE1ZS00ZGM0LTkyNmItMDViODFhZjE4Njhk (accessed on 10 July 2025).

- Food and Agriculture Organization. Globefish Highlights: Seafood Trade Trends in Asia. FAO Fisheries Division. 2024. Available online: https://www.fao.org/in-action/globefish/publications/en/ (accessed on 10 July 2025).

- International Trade Centre. Trade Map: Trade Statistics for International Business Development. 2025. Available online: https://www.trademap.org (accessed on 30 September 2025).

- Ali Khan, E.; Rizwan, M.; Wang, Y.; Munir, F.; Hua, J. Challenges and Future Prospects of Pakistan’s Animal Industry: Economic Potential, Emerging Trends, and Strategic Directions. Vet. Sci. 2025, 12, 733. [Google Scholar] [CrossRef]

- FAO. The State of World Fisheries and Aquaculture 2024—Blue Transformation in Action; FAO: Rome, Italy, 2024. [Google Scholar]

- FAO. The State of World Fisheries and Aquaculture 2020. Sustainability in Action; FAO: Rome, Italy, 2020. [Google Scholar]

- Pakistan Bureau of Statistics. 2024. Sectoral Shares in GDP (at Current Basic Prices): Table 7b. Government of Pakistan. Available online: https://www.pbs.gov.pk/sites/default/files/tables/national_accounts/2023-24/Table_7b.pdf (accessed on 11 July 2025).

- Banomyong, R. Supply chain dynamics in Asia. SSRN 2010. Available online: https://publications.iadb.org/en/supply-chain-dynamics-asia-0 (accessed on 11 July 2025).[Green Version]

- Eegunjobi, R.; Ngepah, N. The determinants of global value chain participation in developing seafood-exporting countries. Fishes 2022, 7, 186. [Google Scholar] [CrossRef]

- Rahman, F. Pakistan’s Evolving Relations with China, Russia and Central Asia. In Russia and Its Neighbors in Crisis; Slavic Eurasian Research Center; Hokkaido University: Sapporo, Japan, 2007; pp. 211–229. Available online: http://src-h.slav.hokudai.ac.jp/coe21/publish/no16_1_ses/11_rahman.pdf (accessed on 11 July 2025).

- China-Pakistan Economic Corridor Secretariat. New Gwadar International Airport. Ministry of Planning, Development & Special Initiatives, Government of Pakistan. Available online: https://cpec.gov.pk/project-details/33 (accessed on 14 October 2024).

- Yii, K.-J.; Bee, K.-Y.; Cheam, W.-Y.; Chong, Y.-L.; Lee, C.-M. Is transportation infrastructure important to the One Belt One Road (OBOR) Initiative? Empirical evidence from the selected Asian countries. Sustainability 2018, 10, 4131. [Google Scholar] [CrossRef]

- Xia, Y.; Yin, H.; Mohsin, M.; Mehak, A.; Yan, C. Exploring FTAs, seafood exports, and SDGs: A gravity model analysis of Pakistan’s seafood trade with China and regional partners. Front. Mar. Sci. 2025, 12, 1553780. [Google Scholar] [CrossRef]

- World Bank. Connecting to Compete: Trade Logistics Performance Index. 2020. Available online: https://lpi.worldbank.org (accessed on 11 July 2025).

- United Nations Conference on Trade and Development. Harmonizing Trade Policies in Africa: Lessons from ECCAS and COMESA. 2021, UNCTAD. Available online: http://unctad.org/system/files/official-document/webditc2017d1_en.pdf (accessed on 11 July 2025).

- Food and Agriculture Organization. Fishery and Aquaculture Country Profiles – Central Africa Region. 2020, Retrieved from FAO Website. Available online: http://www.fao.org/fishery/en/facp/search (accessed on 11 July 2025).

- Garba, D.; Wancelous, A. The challenges of regional integration and effective implementation of African Continental Free Trade Area (AfCFTA) policy in Africa. Afr. J. Politics Adm. Stud. 2023, 16, 712–734. [Google Scholar] [CrossRef]

- Chemonics International. Indo-Pacific Economic Corridor (IPEC) Phase I: Coordinated Regional Trade Analysis. 2015, United States Agency for International Development (USAID). Retrieved from Banyan Global’s IPEC Report. Available online: https://banyanglobal.com/wp-content/uploads/2017/06/Indo-Pacific-Economic-Economic-Corridor.pdf (accessed on 11 July 2025).

- Asian Development Bank. Greater Mekong Subregion: Twenty-Five Years of Partnership. 2018. Available online: https://www.adb.org/publications/greater-mekong-subregion-25-years-partnership (accessed on 11 July 2025).

- Tenório Gouveia de Melo, M.; Barros, J.M.S.; Ribeiro, A.R.B.; Lima, T.L.A.; Sobral, M.F.F. The role of certifications and eco-labels in fisheries: A systematic literature review of their benefits and challenges. Environ. Sci. Eur. 2024, 36, 200. [Google Scholar] [CrossRef]

- Banomyong, R. Benchmarking Economic Corridors logistics performance: A GMS border crossing observation. World Cust. J. 2010, 4, 29–38. [Google Scholar] [CrossRef]

- Srivastava, P. Regional corridors development: A framework. J. Int. Commer. Econ. Policy 2013, 4, 1350012. [Google Scholar] [CrossRef]

- NEPAD. Central African Corridor Cross-Border Trade in Fish; African Union Development Agency (AUDA-NEPAD): Johannesburg, South Africa, 2016. [Google Scholar]

- WorldFish. Opening Avenues for Cross-Border Fish Trade in Africa. FishTrade for a Better Future Project. 2016. Available online: https://worldfishcenter.org/pages/opening-avenues-for-cross-border-fish-trade-in-africa/ (accessed on 15 July 2025).

- USAID. Indo-Pacific Economic Corridor (Ipec) Coordinated Regional Trade Analysis; U.S. Agency for International Development: Washington, DC, USA, 2015.

- Burki, S.J. The State of the Economy China Pakistan Economic Corridor Review and Analysis. 2017, p. 196. Available online: https://www.academia.edu/41208681/The_State_of_the_Economy_China_Pakistan_Economic_Corridor_Review_and_Analysis (accessed on 15 July 2025).

- Ali, M.R. Small-scale fisheries in Pakistan. In Small-Scale Fisheries in South Asia; National Agriculture Research Centre: Islamabad, Pakistan, 2018; p. 81. [Google Scholar]

- Ali, S. Identifying and Mitigating the Factors Causing Post-Harvest Losses in Supply Chain of Inland Fish Industry: A Study of Badin Fish Industrial Cluster. Int. J. Sci. Res. Eng. Dev. 2021, 4. Available online: https://ijsred.com/volume4/issue2/29-identifying-and-mitigating-the%20-factors-causing-post-harvest-losses-in-supply-chain-of-in-land-fish-industry-a-study-of-badin-fish-industrial-cluster.html (accessed on 15 July 2025).

- Abbas, G.; Khan, M.W.; Ahmed, M. Coastal and Marine Fisheries Management in. Coast. Mar. Fish. Manag. SAARC Ctries. 2013, 245. Available online: https://www.researchgate.net/publication/274251322_Coastal_and_Marine_Fisheries_Management_in_SAARC_Countries (accessed on 15 July 2025).

- Khan, S.R.; Ali, F.; Tanveer, A. A Supply Chain Analysis from Pakistan; International Institute for Sustainable Development: Winnipeg, MB, Canada, 2005. [Google Scholar]

- Kausar, R. Best management practices in aquaculture in pakistan. In Best Management Practices in Aquaculture; Aquaculture and Fisheries Program; National Agriculture Research Centre: Islamabad, Pakistan, 2017; p. 69. [Google Scholar]

- Javed, M.; Abbas, K. Inland fisheries and aquaculture in Pakistan. In Developing Sustainable Agriculture in Pakistan; CRC Press: Boca Raton, FL, USA, 2018; pp. 543–559. [Google Scholar]

| Countries | µ (y−1) | Confidence Interval | |

|---|---|---|---|

| China | 87,239.65 * | 13,478.63 | 59,028.55–115,450.75 |

| Thailand | 61,364.60 * | 8630.39 | 43,300.99–79,428.21 |

| Vietnam | 40,277.45 * | 8875.83 | 21,700.11–58,854.79 |

| Saudi Arabia | 11,045.21 * | 1087.73 | 8759.98–13,330.44 |

| Japan | 8454.00 * | 1027.52 | 6303.37–10,604.63 |

| Total Exports | 208,380.91 * | 33,100.10 | 139,093.00–277,668.82 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dahri, A.M.; Yongtong, M. Enhancing Sustainable Fisheries Trade and Food Security Through CPEC in Pakistan. Sustainability 2025, 17, 9121. https://doi.org/10.3390/su17209121

Dahri AM, Yongtong M. Enhancing Sustainable Fisheries Trade and Food Security Through CPEC in Pakistan. Sustainability. 2025; 17(20):9121. https://doi.org/10.3390/su17209121

Chicago/Turabian StyleDahri, Ali Mumtaz, and Mu Yongtong. 2025. "Enhancing Sustainable Fisheries Trade and Food Security Through CPEC in Pakistan" Sustainability 17, no. 20: 9121. https://doi.org/10.3390/su17209121

APA StyleDahri, A. M., & Yongtong, M. (2025). Enhancing Sustainable Fisheries Trade and Food Security Through CPEC in Pakistan. Sustainability, 17(20), 9121. https://doi.org/10.3390/su17209121