1. Introduction

Under global economy integration, the manufacturing industry, as the core of the real economy, not only assumes the important task of promoting economic growth, providing employment and improving production efficiency, but also plays an irreplaceable role in the reconstruction of the global value chain. Especially in developing countries, manufacturing industry is widely regarded as the cornerstone of industrialization and modernization, and its strategic significance in driving technology diffusion, promoting industrial upgrading, and optimizing economic structure has become increasingly prominent [

1]. With the wide application of artificial intelligence, automation, 5G, and other emerging technologies, the global manufacturing competition pattern has undergone profound changes, and more and more countries rely on foreign direct investment (FDI) and foreign trade to obtain advanced technologies, expand markets, and enhance the global competitiveness of their industries.

As the largest manufacturing country in the world, China’s manufacturing industry occupies a core position in national economy. In 2023, China’s total industrial added value reached CNY 3.9103 trillion, accounting for 31.7% of GDP, and manufacturing added value accounted for 26.2% of GDP, accounting for about 30% of world and proving the fundamental role of manufacturing in the national economy. Although China’s manufacturing industry has made remarkable achievements, it is currently facing strategic challenges from the transformation from “quantitative expansion” to “qualitative improvement” [

2]. In this context, how to promote the manufacturing industry’s high-quality development with the help of economic forces has become the focus of policy and academic circles.

FDI and foreign trade, as important driving factors for global manufacturing industry development, have also played an important role in China’s manufacturing industry development. FDI brings a “spillover effect” through capital input, technology transfer, and management experience and improves local enterprises’ technological level and production efficiency [

3,

4]. Meanwhile, foreign trade, especially the export-oriented strategy, has significantly enhanced China’s manufacturing industry competitiveness by expanding the market scale and encouraging enterprises to upgrade technology and internationalization [

5,

6]. Imports help absorb advanced technologies and optimize resource allocation, becoming an important channel for improving productivity.

Although many studies have been carried out around FDI or foreign trade, the existing literature mostly starts from a static or univariate perspective, ignoring the dynamic interaction mechanism between FDI and trade and its joint impact on the manufacturing industry [

7]. In addition, the role of technological innovation (such as R&D investment) and human capital as supplementary variables in the mechanism path is often weakened or ignored, which limits the in-depth understanding of the mechanism of the manufacturing industry’s high-quality development [

8,

9].

Recent studies have increasingly emphasized the complex and often indirect mechanisms through which FDI and foreign trade contribute to industrial upgrading, particularly within the evolving context of global value chains (GVCs). First, vertical and horizontal linkages play a critical role. For instance, the downstream agglomeration of multinational enterprises (MNEs) enhances the product quality of non-exporting local firms in Indonesia, illustrating the importance of vertical spillovers [

10]. In Kenya, the productivity spillovers from FDI vary across transmission channels, with labor mobility and demonstration effects being more stable than backward linkages [

11]. Second, regional and structural factors shape these effects. China’s FDI and trade positively affect Africa’s GVC participation and upgrading, although the marginal effects differ under changing global trade dynamics [

12]. Regional agglomeration economies such as urbanization and specialization significantly influence the attraction of manufacturing-related FDI across EU subnational regions [

13]. Third, broader enabling conditions also matter. Dual GVC participation promotes both manufacturing upgrading and green development through factor endowments and market expansion [

14]. Likewise, improvements in air transport infrastructure can facilitate industrial technology upgrading in developing countries by reducing logistical constraints, although these effects are moderated by firms’ R&D capacity and institutional conditions [

15]. Collectively, these findings highlight the dynamic, indirect, and context-specific linkages among FDI, trade, innovation, and industrial development, underscoring the need for deeper analysis in the context of post-pandemic GVC restructuring. Since the outbreak of the COVID-19 pandemic in 2020, the global industrial chain has been restructured, trade barriers have risen, and the trend of “technological decoupling” has intensified. Especially against the backdrop of the competition between China and the United States, China’s manufacturing industry is facing greater uncertainty in its open environment. Therefore, re-examining FDI, foreign trade, and their mechanisms of linkage with innovation and human capital is of great practical significance for achieving high-quality development of the manufacturing industry.

In recent years, the external environment surrounding China’s manufacturing industry has become increasingly complex. The trend of “de-risking” in global supply chains, the rise of green trade barriers, and intensified geopolitical competition have reshaped the openness and competitiveness of China’s manufacturing sector. While globalization has long provided opportunities for technological spillovers and market expansion, the current environment highlights the risks of over-reliance on foreign markets and imported intermediate goods. Against this backdrop, the “dual circulation” strategy emphasizes the need to balance domestic demand expansion with continued external openness. On the one hand, securing the resilience and security of domestic industrial and supply chains has become a national priority; on the other hand, deepening international cooperation remains indispensable for technological upgrading and value chain integration. These challenges underscore the urgency of re-evaluating the dynamic roles of FDI, trade, innovation, and human capital in sustaining manufacturing growth. By addressing these issues, this study contributes to the elucidation of how China can transition from “scale-driven” growth toward high-quality, innovation-led industrial development in the evolving global economic landscape.

The main contributions of this paper include the following: First, it constructs a dynamic multivariate framework linking FDI, foreign trade, technological innovation, and human capital, addressing a gap in the literature regarding the interaction among these factors in the manufacturing sector. Second, it identifies the indirect transmission effect of FDI and the lagged positive influence of exports and human capital, advancing the understanding of the investment–innovation–growth nexus. Third, by applying a PVAR model, the study captures both short-term shocks and long-term causality, enhancing empirical identification of the proposed mechanisms.

The structure of this paper is organized as follows:

Section 2 reviews the theoretical foundations and the relevant literature, providing the conceptual framework and research hypotheses.

Section 3 introduces the data, variable construction, and methodological design.

Section 4 presents the empirical analysis and results, including GMM regression, Granger causality tests, impulse response analysis, and variance decomposition.

Section 5 discusses the findings in the context of the existing literature along with international comparisons.

Section 6 concludes with the main research implications and offers policy recommendations.

2. Theoretical Framework and Literature Review

In this paper, some relevant theoretical foundations provide important support for variable setting and mechanism explanation. The eclectic theory of international production proposed by Dunning (1981) [

16] explains why multinational companies choose FDI, emphasizing that host countries need to have ownership advantages, location advantages, and internalization advantages. In the context of China’s manufacturing industry, FDI not only brings advanced technology and management experience, but it also makes full use of China’s labor force-, market-, and industrial-supporting advantages, thus promoting the efficiency improvement and industrial upgrading of local enterprises. The study of Blomstrom and Kokko (1998) [

4] on technology spillover effect showed that FDI and foreign trade often benefit local enterprises through the “learning effect”, especially in the manufacturing industry. Comparative advantage theory purports that countries should focus on industries with relative cost advantages [

17], while the new trade theory further emphasizes the role of scale economies and product differences in international trade [

18]. In addition, endogenous growth theory emphasizes that technological progress comes from within the economic system, for example, R&D investment and human capital accumulation [

19,

20]. The theory shows that the manufacturing industry’s sustainable development depends on external resources such as FDI and foreign trade, enterprises, and governments’ investment in technological innovation and education, which provides a theoretical basis for incorporating technological innovation and human capital into the PVAR model. This paper builds a theoretical framework based on FDI theory, foreign trade theory, and endogenous growth theory, aiming to deeply analyze how FDI, foreign trade, technological innovation (R&D investment), and human capital dynamically affect China’s manufacturing industry development.

2.1. Impact of FDI on Manufacturing Industry

The role of foreign direct investment (FDI) in the manufacturing industry has long been a central topic of academic discussion. FDI not only provides crucial capital for the host country’s manufacturing sector but also enhances industrial competitiveness through the transfer of advanced technologies and the introduction of modern management practices. Empirical evidence indicates that trade agreements can significantly influence the inflow of FDI, thereby fostering productivity growth and strengthening export capacity in host economies [

21]. However, the magnitude of these effects varies considerably across industries. For instance, in Indonesia, trade agreements have shown a strong positive impact on attracting FDI to the services and primary sectors, whereas their influence on manufacturing remains relatively limited. This underscores the need for host countries to optimize policy frameworks to improve the attractiveness of their manufacturing sectors and maximize the economic benefits of FDI.

FDI can also elevate the quality of manufacturing export products while stimulating local enterprises to upgrade their technologies and production efficiency through competition and demonstration effects [

22]. Such competitive dynamics are particularly pronounced in high technology manufacturing, where foreign invested firms exert a notable productivity-enhancing influence on nearby domestic enterprises [

23]. These cross-firm spillover effects are especially evident in industries such as electrical machinery manufacturing, which have played a pivotal role in driving technological progress in China’s manufacturing sector. In line with the objectives of the 14th Five Year Plan, which emphasizes accelerating the formation of a new development pattern centered on the domestic cycle while fostering mutual reinforcement between domestic and international cycles, FDI has increasingly shifted towards technology-intensive and innovation-driven manufacturing industries, thereby supporting the sector’s long term sustainable growth.

2.2. Impact of Foreign Trade on Manufacturing Industry

The influence of foreign trade on the manufacturing industry is manifested in the expansion of export markets and the knowledge spillover effects from technological imports. Exports can enhance enterprises’ production efficiency and international competitiveness through economies of scale, while imports offer opportunities for the manufacturing sector to acquire advanced production equipment and technologies. It has been shown that the vertical linkages between foreign enterprises and domestic firms can strengthen participation in the global value chain, thereby improving export capacity and industrial competitiveness [

24]. In addition, trade itself can exhibit heterogeneous effects, promoting environmental sustainability while producing mixed impacts on productivity [

25]. Evidence from the Malaysian manufacturing industry indicates that FDI can enhance productivity by facilitating exports and technology spillovers, a mechanism that is also relevant to China [

26].

The positive impact of technological imports on the manufacturing sector is particularly notable. By importing high-end equipment and technology, Chinese manufacturing enterprises have significantly upgraded their technological capabilities and product quality, especially in high technology and capital-intensive industries. Moreover, there is a positive interaction between imported technology and the quality of export products [

22]. Since China’s accession to the WTO in 2001, the strategy of technology importation has replaced the traditional import substitution approach, which has greatly improved the quality and competitiveness of export products. In the 14th Five Year Plan, the government explicitly proposed optimizing the structure of imports and exports, accelerating technology introduction, and promoting domestic innovation to achieve the goal of advancing high-end, intelligent, and green development in both emerging and traditional industries. These measures have injected new momentum into the dynamic growth of the manufacturing sector.

2.3. The Role of Technological Innovation and Human Capital in Manufacturing Industry Development

Technological innovation and human capital are essential drivers of manufacturing growth. Foreign direct investment (FDI) and foreign trade indirectly contribute to the upgrading and transformation of the manufacturing sector by enhancing technological innovation capacity and fostering the accumulation of human capital. Empirical evidence shows that the liberalization of FDI in China has accelerated the accumulation of human capital, particularly during the transition from labor-intensive to technology-intensive industries [

27]. In this process, foreign invested enterprises have attracted higher-quality labor by offering skills training and competitive salaries, thereby significantly improving the overall technological level and productivity of the manufacturing sector.

With regard to technological innovation, the capacity of high technology manufacturing to attract FDI is closely linked to the host country’s level of participation in the global value chain [

28]. The attraction of FDI in advanced manufacturing has been shown to stimulate technological innovation and help countries in Eastern Europe strengthen their competitive position in the international market, a conclusion that offers valuable implications for China. Further evidence indicates that technological innovation and product upgrading enable Chinese manufacturing enterprises to continuously improve their competitiveness in the international arena [

22].

In the 14th Five Year Plan, the Chinese government explicitly proposed measures to support manufacturing enterprises in increasing research and development investment and to deepen collaborative innovation among industry, universities, and research institutions, with the aim of enhancing the sector’s capacity for independent innovation. These policies not only reinforce the critical role of technological innovation in manufacturing development but also create more opportunities for domestic enterprises to engage in international competition.

In summary, FDI and foreign trade have jointly driven the dynamic growth and structural transformation of China’s manufacturing industry through multiple channels, including capital inflows, technology spillovers, market expansion, and human capital accumulation. The 14th Five Year Plan emphasizes the advancement of the manufacturing sector towards the medium and high end of the value chain, the deepening of international cooperation, and the improvement of domestic enterprises’ independent innovation capabilities. This provides both a policy context and a valuable perspective for further research into the interaction effects of FDI and foreign trade as well as their long-term impact on the sustainable development of the manufacturing sector.

2.4. Conceptual Framework and Research Hypotheses

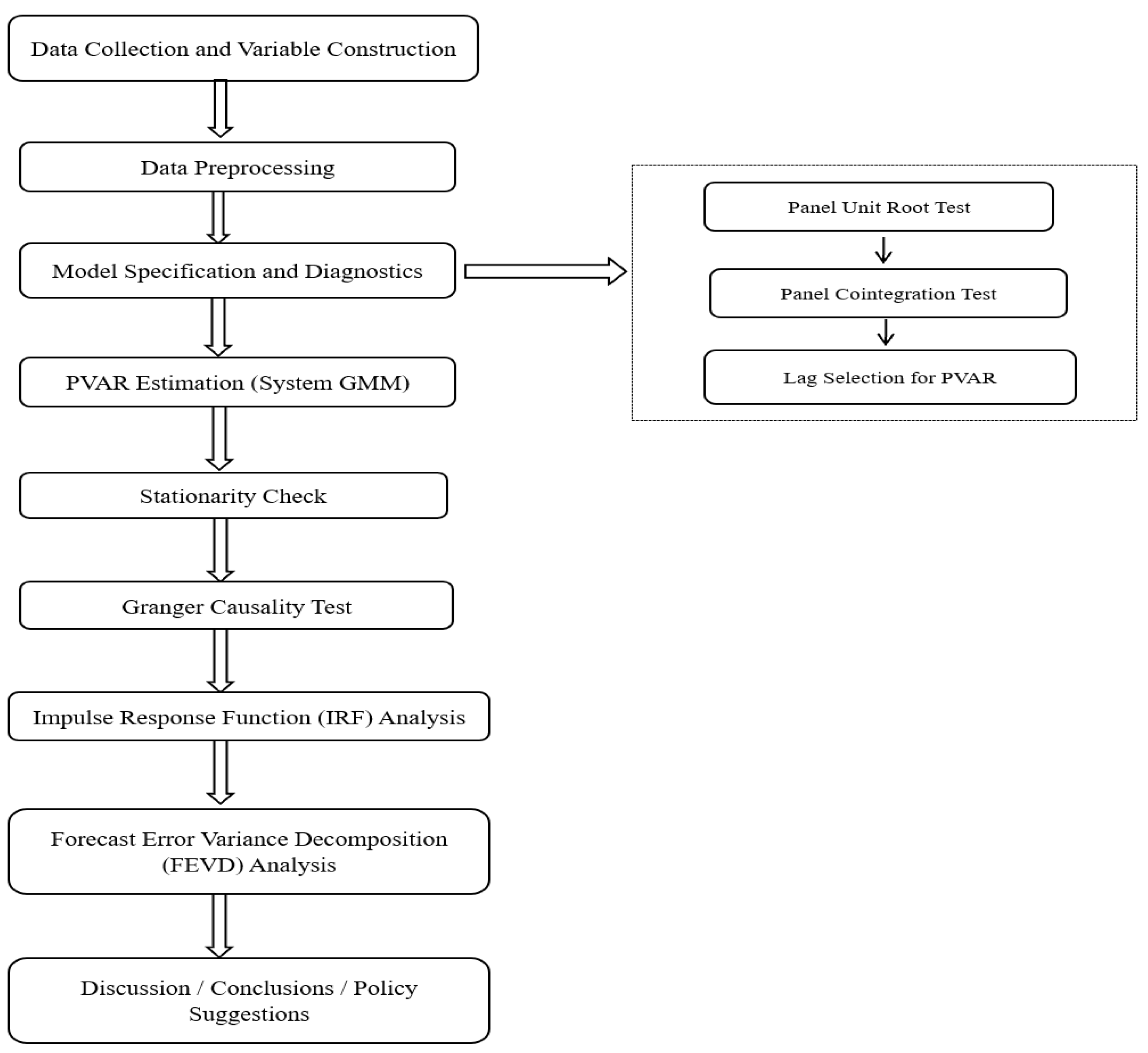

Based on the theoretical foundation of the OLI paradigm and endogenous growth theory as well as insights from the existing literature, this study aims to explore the dynamic mechanism pathways through which FDI, foreign trade (exports and imports), technological innovation, and human capital influence industrial output in China’s manufacturing sector. Particular attention is paid to the interaction patterns across different types of manufacturing sub-sectors. To better illustrate the hypothesized relationships, a conceptual model is presented (see

Figure 1) that captures both the direct and indirect channels among six core variables: FDI, export, import, technological innovation, human capital, and industrial output. Dynamic interactions among all variables are also recognized, reflecting feedback loops and adjustment mechanisms in China’s evolving manufacturing economy. Export and human capital are hypothesized to have lagged positive effects on output, in line with endogenous growth theory. FDI is expected to influence output primarily through innovation and human capital, reflecting the indirect effect mechanism emphasized by the OLI paradigm. This framework also accommodates recent challenges such as post-pandemic supply chain restructuring, technological decoupling, and shifting labor market dynamics. Accordingly, the following research hypotheses are proposed:

H1: There exist dynamic interactions among foreign direct investment (FDI), exports, imports, technological innovation, and human capital, which jointly influence industrial output in China’s manufacturing sector.

H2: Exports and human capital have significant lagged positive effects on industrial output, with their impact becoming more pronounced in the medium to long term.

H3: The effect of FDI on industrial output is primarily indirect, transmitted through channels such as technological innovation and human capital, rather than through direct short-term impact.

4. Core Results Analysis

4.1. GMM Regression

After determining the optimal lag order, this study uses the generalized estimation of moments (GMM) method for regression analysis. Because the baseline specification with five lags is just-identified, the Hansen J statistic is not defined and is therefore not reported. This is a standard feature of system-GMM estimation when the number of moment conditions equals the number of estimated parameters. The results are shown in

Table 6. Through GMM regression, this study can accurately estimate the dynamic impact of variables and analyze their long-term and short-term effects.

Industrial output has a significant periodicity, and its one-period lag and two-period lag both show a significant negative impact, which is reasonably explained by factors such as overcapacity or weak market demand at the significance level of 1% and 10%, respectively. The four-period lag of imports has a negative impact on industrial output, which is significant at the 5% level, indicating that the long-term dependence on intermediate imports may weaken local manufacturing industry’s development. On the contrary, the five-period lag of human capital has a positive impact on industrial output, which is significant at the 10% level, highlighting the long-term effect of labor quality in improving output; this finding is consistent with H2. In contrast, the lagged terms of FDI and R&D investment have insignificant effects on industrial output, which indirectly support H3.

The one-period lag and the five-period lag of FDI have a significantly negative impact on itself, with the significance level at 1%, which may reflect the decline in investment returns or the market becoming saturated. The second-, third-, fourth-, and fifth-period lags of industrial output all have a significant positive impact on FDI at the levels of 5%, 10%, 10%, and 10%, respectively, indicating that output expansion helps to attract foreign capital; this result supports H1. The first-, fourth-, and fifth-period lags of export also have a significant positive impact on FDI, which is significant at the 10% level, indicating that export growth is attractive to foreign capital; this finding is consistent with H1. The first-, second-, and fourth-period lags of import have a significantly negative impact on FDI at the levels of 1%, 5%, and 10%, respectively, indicating that import expansion may inhibit foreign capital inflow. In addition, the two-period lag of human capital has a negative impact on FDI, while the fifth-lagged human capital has a positive impact, which is significant at the level of 5%, indicating that its impact on FDI has an obvious time lag; this result aligns with H3.

In terms of export, the third-, fourth-, and fifth-period lags of FDI have a significantly negative impact on export at the levels of 10%, 1%, and 5%, respectively. The one-period lag and two-period lag of import also have a significant negative impact on export at the levels of 1% and 5%, respectively, which may be due to the lag of cost rise, domestic demand priority, or technology spillover effect. The second- and third-period lags of R&D investment also have a negative impact on export, which is significant at the levels of 1% and 5%, indicating that its promotion effect has obvious characteristics of delay; this finding is consistent with H2. In terms of imports, the three-period lag of industrial output, one-period lag of FDI, and three-period lag of export all have a positive impact on imports, which are significant at the levels of 10%, 5%, and 10%, respectively. However, the three-period lag of FDI and three-period lag of R&D investment have a negative impact on imports, which is significant at the 5% level. The three-period lag and four-period lag of human capital have a positive impact on imports and are significant at the 5% and 10% levels, respectively.

R&D investment is affected by the complex interaction of industrial output, FDI itself, and human capital and other factors, and many of its lag period items are significantly negative, reflecting its long adjustment cycle and lagging reaction mechanism, but import has a certain positive role in promoting it. Human capital is significantly positively affected by industrial output and export and significantly negatively affected by import and its own lag period, indicating that there may be a decreasing marginal trend or resource allocation bottleneck in its accumulation process.

In summary, the interaction of FDI, export, import, R&D investment, and human capital jointly drives China’s manufacturing industry development, which supports H1. Import plays a positive role in improving production efficiency and promoting technological innovation; FDI, R&D investment, and human capital accumulation promote technological progress and reduce dependence on imports, especially in low-tech industries. Export growth increases the demand for imports, and it also promotes the manufacturing industry’s technological upgrading and production capacity improvement.

4.2. Stability Test of the PVAR Model

Next, the PVAR model is tested for stability, and model stability is verified by calculating the eigenvalue stability condition to see whether all of them fall within the unit circle (less than 1). It can be seen from

Table 7 and

Figure 3 that the eigenvalues of the PVAR model are all less than 1, and six estimated points all fall within the unit circle, indicating that the constructed PVAR model is stable. There is a long-term stable relationship among variables.

4.3. Granger Causality Test

Through the Granger causality test, this study reveals the complex dynamic causality among variables, further deepening the understanding of the mechanism of these factors in China’s manufacturing industry’s development [

30].

Table 8 shows the results. FDI, exports, imports, R&D investment, and human capital do not show Granger causality toward industrial output, indicating that past values of these variables do not significantly predict future changes in industrial output. Industrial output, import, and human capital are the Granger causes of FDI, indicating that the historical changes of these variables can significantly predict the future changes of FDI, reflecting the endogenous characteristics of FDI in manufacturing industry’s development, and validating the mechanism of the eclectic theory of international production concerning the influence of development stage on FDI inflow [

31]. This supports H1 by revealing dynamic interactions among key variables. FDI, import, and R&D investment are the Granger causes of export, indicating that the past values of these variables can significantly predict export, which supports the theory of technology-driven export growth and emphasizes the promotion effect of technology input and foreign economic ties on export performance [

32]. This provides empirical support for H3, suggesting that FDI affects output indirectly via its influence on export performance.

Industrial output, FDI, and R&D investment show Granger causality toward imports, indicating that manufacturing capacity, capital inflow, and technological innovation have a significant guiding effect on import changes [

33]. This is consistent with H1, as it reflects multi-directional causal interactions among key factors. Industrial output, FDI, and import show Granger causality toward R&D investment, indicating that industrial expansion, capital inflow, and trade activities have a positive impact on technology investment, which confirms the interaction mechanism between capital accumulation and knowledge production in the endogenous growth theory [

19]. This supports H3, highlighting that FDI’s effect on output may operate through its influence on innovation. Industrial output, FDI, and import are the Granger causes of human capital, indicating that the expansion of the real economy and the inflow of external resources can significantly predict the change of human capital, reflecting the fundamental role of human capital in the sustainable development of manufacturing industry [

3]. This also supports H3, as human capital acts as a transmission channel through which other variables influence manufacturing dynamics.

In general, the Granger causality tests reveal strong interdependencies among industrial output, FDI, trade, technology innovation, and human capital, which confirms H1 regarding dynamic interactions, provides indirect support for H3 through observed transmission paths, and supports the applicability of several classical economic theories in China’s development stage, also providing theoretical support and empirical basis for relevant policy making.

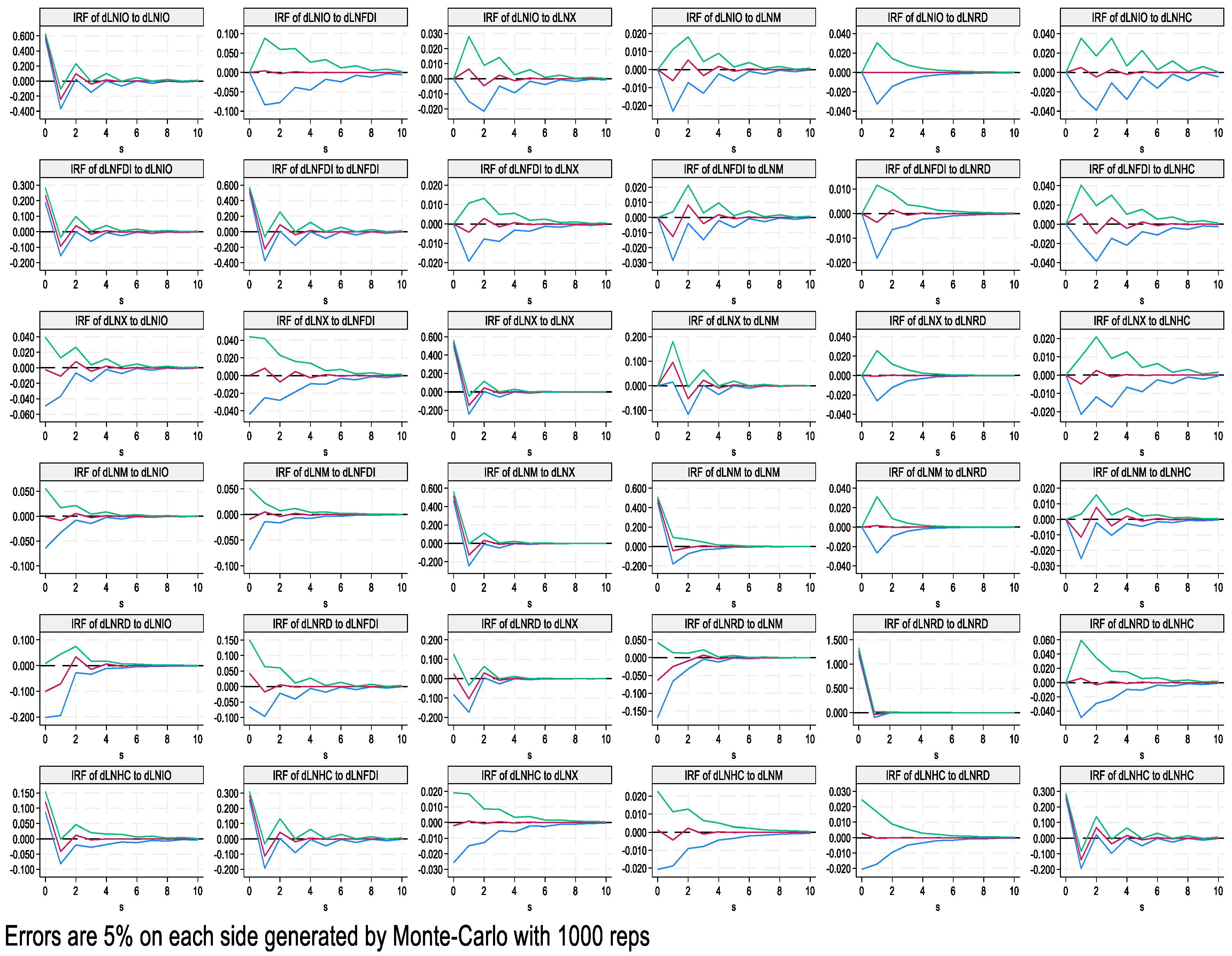

4.4. Impulse Response Analysis

Impulse response analysis reveals the dynamic response path of variables to other variables after external shocks, which provides an intuitive perspective for understanding the short-term and long-term interaction among factors. The impulse response results are shown in

Figure 4.

Figure 4 presents the results of impulse response functions, revealing the dynamic adjustment paths of variables following a one standard deviation shock. The response of all variables to shocks shows different degrees of positive and negative changes in the short term and presents periodic fluctuations but tends to be stable in the medium–long term, reflecting the self-regulation ability of the economic system and the return to equilibrium mechanism. Specifically, when the industrial output is affected by its own impact, the response is negative in the short term, then gradually turns to positive and fluctuates, and finally tends to be stable, indicating that the industrial system has the ability to respond and adjust with a lag to the self-fluctuations. The impact of FDI, export, import, R&D investment, and human capital on industrial output also shows the typical characteristics of “first negative and then positive”, with fluctuations alternating in the first three to four periods and gradually converging after the fourth period, indicating that the short-term disturbance effect of these factors on output is absorbed by the economic structure in the medium and long terms. This validates H2 and H3 by showing that the positive effects of exports and human capital emerge after several periods, while FDI exhibits a delayed positive influence.

Similarly, when FDI, export, import, R&D investment, and human capital are used as shock variables, their response paths to other variables show asymmetric and time-lag effects. For example, the positive and negative effects of FDI alternate, and the shocks of export and import reflect the sensitive adjustment of the externally dependent economy, while the shock effects of technology input and human capital have a gradual impact on the industrial system.

The shock response fluctuates violently in the early stage, reflecting the disturbance effect of external shocks on the system, and it gradually becomes stable after the fourth to the sixth period, showing the internal buffer mechanism and structural adjustment ability of the system. The overall results verify the short-term dynamic correlation among variables and the medium-long term equilibrium trend, which is helpful to understand the time series effect and adjustment path of FDI and foreign trade and other factors on the economic system. There are significant dynamic interactions among industry output, FDI, import and export, R&D investment, and human capital. This confirms H1 regarding the dynamic interplay among variables. The response of industrial output to the shock shows alternating positive and negative changes in the short term and tends to be stable in the long term. FDI shows a short-term negative adjustment and gradually turns positive, showing a lagged effect. Exports and imports show dynamic fluctuations after the shock and tend to be stable in the long run, indicating a multi-level transmission mechanism. The economic effects of R&D investment and human capital take time to manifest and eventually become stable. This is consistent with H2, highlighting the lagged nature of their contribution to industrial growth. Overall, the impulse response analysis provides dynamic evidence for the hypothesized relationships. The observed interactions among FDI, exports, innovation, and human capital confirm H1. The lagged and gradually increasing effects of exports and human capital on output support H2. Moreover, the delayed positive effect of FDI, along with its impact on other variables, suggests an indirect influence mechanism, in line with H3.

4.5. Variance Decomposition

To evaluate the contribution of each variable to the manufacturing industry’s growth fluctuation, this paper conducts variance decomposition analysis, and the results are shown in

Table 9. In period 10, changes in industrial output are almost entirely led by its own factors, contributing 99.9% to itself. The fluctuations of FDI and export are also mainly driven by their own factors, and the self-explanatory degree is still maintained at about 84.2% and 96%, indicating that the influence of external variables is limited. The change of import is mainly affected by export, with the long-term contribution rate of export reaching 54.6% and the contribution rate of import to itself reaching 45.3%, indicating a strong linkage between export and import. The change of R&D investment is almost completely determined by its own factors, with a contribution rate of 97.8%, and the influence of external variables is extremely weak. At the 10th periods, the explanatory degree of FDI to the variation of human capital remains at 44.6%, while the contribution of its own factors is 47.5%. To sum up, FDI and foreign trade have a significant impact on the manufacturing industry growth in the long term, while technological innovation and human capital have a weak impact in the short term.

5. Discussion

Through GMM regression, Granger causality test, impulse response analysis, and variance decomposition, this paper deeply explores the dynamic effect of FDI and foreign trade on China’s manufacturing industry growth. The results reveal the important role of key variables such as FDI, export, import, R&D investment, and human capital in driving China’s manufacturing industry growth and their interrelations.

GMM regression results show that FDI has a significant positive impact on China’s manufacturing growth [

26]. Especially in the context of export growth and industrial output expansion, FDI increases significantly, which indicates the positive role of an open economy on FDI attraction. However, excessive dependence on imports may weaken FDI, which is reflected in the negative impact of imports on FDI. The Granger causality test further confirms the significant causal relationship between FDI and export and industrial output, highlighting the key role of export growth and industrial output expansion in attracting FDI.

The driving effect of export growth on China’s manufacturing industry cannot be ignored. Both GMM regression and Granger causality test show that export growth can effectively attract FDI, reflecting the positive effect of an open economy on FDI attraction. However, export growth may also be affected by dependence on imported intermediate goods, which is reflected in the negative effect of imports on exports. Impulse response analysis further reveals the short-term and long-term effects of export growth on manufacturing industry, indicating that export growth may be restrained by the rise of import costs in the short term. However, in the long term, export growth still plays a significant role in promoting manufacturing industry.

Moreover, technological innovation and human capital have played an important role in driving manufacturing growth. The GMM regression results show that human capital has a significant positive impact on industrial output, especially in the long term. The variance decomposition results also show that human capital toward manufacturing industry growth gradually emerges in the long run, which emphasizes the importance of education and skills training in enhancing manufacturing industry competitiveness. At the same time, although the direct impact of R&D investment on manufacturing growth is small in the short term, its long-term effect cannot be ignored, which is reflected in the negative impact of R&D investment on exports.

This study focuses on the core economic variables that are commonly emphasized in the FDI–trade–growth literature. A limitation of this study is that operating income may contain non-production revenues. Future work will re-estimate the model using industrial value added or physical output once sufficiently long and complete series become available. This paper also acknowledges that institutional quality, environmental regulation, and policy factors may play important roles in manufacturing development. Due to the structure of the panel VAR model and the sample size constraint, this study does not incorporate sector-specific heterogeneity within the model. Rather, it focuses on capturing the aggregate dynamic relationships across China’s manufacturing sector. Recognizing potential heterogeneity, future work will extend the analysis by estimating sub-sample or heterogeneous-coefficient PVAR models by technology classification once longer time series or richer data become available. Future studies also may consider sub-group PVAR or switching VAR models, provided sufficient data are available. Their inclusion is a promising direction for future empirical work. Moreover, although the current model does not account for sectoral or regional heterogeneity, the dynamic framework developed here provides a foundation for future research to examine how such interactions may differ across technological levels or geographic regions.

6. Conclusions and Policy Suggestions

6.1. Conclusions

This paper explores the impact of foreign direct investment and foreign trade on China’s manufacturing industry growth through GMM-PVAR model analysis and draws the following main conclusions. This paper found that FDI has significantly promotes China’s manufacturing industry growth, improving production efficiency and optimizing industrial structure through technology spillovers, capital accumulation, and industrial upgrading. Exports enhance the production capacity and international competitiveness of export-oriented industries and play a positive role in manufacturing industry growth. Still, the effect has a certain lag, which indicates the importance of continuous foreign-trade-promotion policies. In addition, imports provide key support for manufacturing industry upgrading, driving technological progress and industrial structure optimization. This paper also found that R&D investment and human capital have a significant role in promoting manufacturing industry growth. R&D investment directly promotes technological innovation and production efficiency improvement, while human capital provides important support for the manufacturing industry’s long-term development. In general, FDI, exports, and imports play a complementary role in China’s manufacturing industry’s sustainable growth and are of key significance in promoting industrial modernization, optimizing structure, and enhancing international competitiveness. Unlike most existing studies based on overall data, this paper provides the identification of dynamic mechanisms at the sub-industry level of manufacturing, offering more specific empirical evidence for understanding the synergy between FDI and foreign trade under the background of high-quality development and also providing a reference for other developing countries to formulate industrial policies. Moreover, given the volatile global supply chain situation in the post-pandemic era, the path of how FDI and trade influence manufacturing growth through technological innovation and human capital revealed in this article can help governments optimize their industrial opening-up strategies, enhance the resilience of manufacturing, and promote the transformation from “foreign-driven” to “innovation-led”. While this study focuses on China’s manufacturing sector, the identified interaction mechanisms, particularly the indirect and lagged roles of FDI and human capital, may offer valuable implications for other emerging economies with similar structural challenges.

6.2. Policy Suggestions

Based on the results of this study, policy makers should take the following measures to promote China’s manufacturing industry’s sustained growth: The first is to optimize FDI-introduction policies, focus on attracting foreign investment in high-tech industries, simplify access procedures, encourage foreign enterprises to cooperate with local enterprises, promote technology transfer and innovation, and provide tax incentives to support high-tech investment. The second is to enhance the export competitiveness of domestic enterprises, reduce the cost of small- and medium-sized enterprises through tax cuts and export tax rebates and other measures, encourage brand building and product innovation, and support cross-border e-commerce to expand the international market. The third is to accelerate the intelligent and digital transformation of the manufacturing industry, provide intelligent equipment and technical support, promote the application of artificial intelligence and the Internet of Things and big data in the manufacturing industry, and build intelligent manufacturing industrial parks. The fourth is to strengthen personnel training, promote skilled workers’ skill training and academic education, and encourage colleges and universities to cooperate with enterprises to cultivate highly skilled talents that meet industry’s needs so as to enhance the manufacturing industry’s technical strength and international competitiveness. These policies can promote China’s manufacturing industry’s high-quality development and enhance its global competitiveness while also offering references to other developing countries.